WORK

8 - 9 November 2023

QEII Centre, London

SPONSORSHIPS GET YOUR PASS

LOUIS THOMPSETT CHIEF CONTENT OFFICER

SCOTT BIRCH MANAGING EDITOR

NEIL PERRY

CHIEF DESIGN OFFICER

MATT JOHNSON HEAD OF DESIGN

LEAD DESIGNER

SAM HUBBARD

FEATURE DESIGNERS

REBEKAH BIRLESON

MIMI GUNN

SOPHIE-ANN PINNELL

HECTOR PENROSE

JULIA WAINRIGHT

ADVERT DESIGNERS

JORDAN WOOD

CALLUM HOOD

DANILO CARDOSO

VIDEO PRODUCTION MANAGER

KIERAN WAITE

SENIOR VIDEOGRAPHER

HUDSON MELDRUM

DIGITAL VIDEO PRODUCERS

ERNEST DE NEVE

THOMAS EASTERFORD

DREW HARDMAN

SALLY MOUSTAFA

PRODUCTION DIRECTORS

GEORGIA ALLEN

DANIELA KIANICKOVÁ

PRODUCTION MANAGERS

JANE ARNETA

MARIA GONZALEZ

YEVHENIIA SUBBOTINA

MARKETING MANAGER

EVELYN HOWAT

PROJECT DIRECTORS

JAKE MEGEARY JACK MITCHELL MANAGING DIRECTOR LEWIS VAUGHAN CEO GLEN WHITE

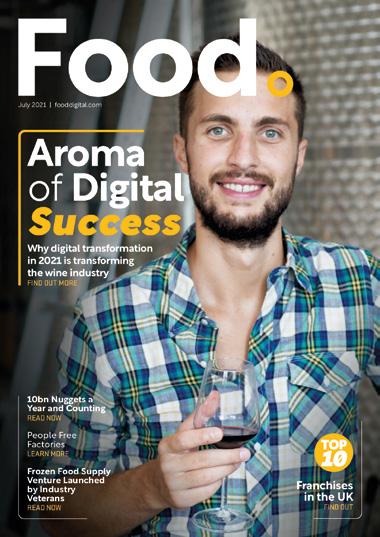

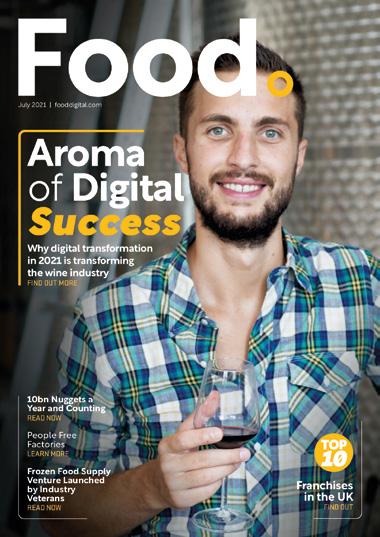

I’m delighted to welcome back the Top 100 FinTech Companies – our annual supplement that picks out the brightest stars in the fintech galaxy.

At a time of much-hyped volatility and tumult in verticals like banking and cryptocurrencies, it’s especially rewarding to be casting a light on the industry’s triumphs and victories.

All the businesses featured in this list are revolutionising the delivery of financial services and disrupting the future of money. But what stands out to me this year is the diversity of the companies featured. We have Wall Street institutions and plucky upstarts alike. There are inductees headquartered in every continent (apart from Antarctica, of course – better luck next time PenguinPay!). Companies that are five years old to some that are incredibly more than 300 years old!

So sit back, pour yourself something bubbly (especially if you’re included in this list), and join me in congratulating all of our Top 100!

Alex ClereThe Global FinTech Awards 2024 will be celebrating the very best in Fintech with the following categories:

Digital Banking Award

–PayTech Award

–

Digital Currency Award

–

FinTech Award

–InsurTech Award

–

Sustainable FinTech

–

FinTech Technology Award

–

FinTech Consultancy Award

–

Future Leader Award

–

Executive of the Year Award

–

Project of the Year Award

–

Lifetime Achievement Award

Founded in 2007

CEO: Andy Jassy

https://pay.amazon.co.uk/ https://www.linkedin. com/ showcase/ amazon-pay/

Amazon Pay is an online payment processing service owned by Amazon. First launched in 2007 to the company’s consumer base, Amazon Pay gives users the option to pay with their accounts or through external merchant websites. The service was expanded in 2021, becoming available in Austria, Belgium, France, the UK, India, Ireland and Japan. The payments arm of Amazon announced a partnership with Worldpay in 2019, allowing clients of Worldpay to enable Amazon Pay as part of the same integration.

Payments

United States

Founded in 2011

CEO: Sundar Pichai

https://pay.google.com/about/ https://www.linkedin. com/ showcase/ google-pay/about/

Google Pay is a mobile payment service for in-app, online, and in-person contactless purchases. Consumers with Google Pay are able to complete payment transactions with Android phones, tablets and watches. Leveraging near-field communication, Google Pay is able to transmit card information facilitating funds transfer to retailers. The service is similar to contactless payments with the added security of two-factor authentication. With its digital wallet, users can add multiple cards to its service by taking a photo of a bank card or by entering card information manually.

Payments

United States

Founded in 2016

CEO: Kris Marszalek

https://Crypto.com https://www.linkedin. com/ company/ cryptocom/

Crypto.com is one of the world’s leading cryptocurrency platforms. With over 80 million users worldwide, the crypto trading platform counts itself as a leader in regulatory compliance and security certifications. It also offers comprehensive insurance coverage and a verified pool of reserves. Founded in 2016, Crypto. com’s vision is for cryptocurrency to be in every wallet. As such, the company is committed to accelerating cryptocurrency adoption through innovation and empowering a new generation of creators and entrepreneurs to develop more fair and equitable digital ecosystems.

Singapore

Founded in 2005

CEO: Scott Galit

https://www.payoneer. com/uk/ https://www.linkedin. com/ company/

Payoneer is a pioneer in the borderless payments space. Providing businesses with the technology and connection to participate and flourish in new global economies, Payoneer’s mission is to make operating an easier experience for SMEs across the globe. While the fintech does partner with a range of entrepreneurs from across the globe, it also serves cross-border payments for some of the world’s leading brands, including Airbnb, Amazon, Google, Upwork, and Walmart. Payoneer has raised US$570m across 15 rounds since its funding, most recently generating US$300m in Post-IPO equity, with lead funding from Wellington Management.

Payments

United States

Founded in 2014

CEO: Prajit Nanu

https://www. nium.com/ https://www.linkedin. com/ company/ nium-global/

Nium is a leader modern money movement. The fintech provides payment providers, businesses and banks access to global payment and card issuance services. Utilising a modular platform, Nium powers seamless commerce globally with its pay-out, pay-in and card issuance services. The fintech also has a banking-as-a-service (BaaS) solution for its customers. Today, the fintech offers payout in over 100 currencies across 190 countries. Using Nium’s platform, clients can receive funds in 27 different markets, including the UK, Hong Kong, Australia, India, Singapore, Southeast Asia and the US among others.

Financial Services

Singapore

Founded in 2012

CEO: Daniel Kjellén

http://www.tink.com/ https://www.linkedin. com/ company/tink-ab/

Tink is one of Europe’s leading open banking platforms, enabling fintechs and startups to develop data-driven financial services for their clients. With its single API, Tink makes access to aggregated financial data easy for its customers, as well as providing the tools to initiate payments, enrich transactions, build personal finance management tools and verify account ownership. With partnerships at over 3,400 banks across Europe, Tink is a wholly-owned subsidiary of Visa as of an acquisition in 2022. The company was founded in Stockholm in 2012.

Financial Services

Sweden

Founded in 2014

CEO: John Mountain (Interim)

https://starlingbank.com https://www.linkedin. com/ company/ starlingbank/

London-based Starling Bank is one of Britain’s first digital financial institutions. Founded by Anne Boden in 2014, who has since stepped back as CEO to focus on her role as a shareholder, Starling Bank has received over £500m ($635.5m) in total funding. Without a single in-person branch, Starling Bank has established itself as a challenger to traditional banking institutions, offering personal, joint, business, and Euro accounts through its mobile app. Now with over three million accounts and thousands of employees, Starling can count itself among the established digital players in the UK banking sphere. Today, the neobank leverages Wise for its international payments.

Banking

United Kingdom

Founded in 2010

CEO: Simon Khalaf

https://marqeta.com https://www.linkedin. com/ company/ marqeta/

With its open API platform, Marqeta brings speed and efficiency to card issuing and payment processing. Today, Marqeta operates globally in the US, UK, EU, Canada, and throughout the APAC region. Its API is in use at multiple financial institutions, the likes of Visa and Mastercard both included. A multipurpose open API, Marqeta’s solutions are used by businesses in digital banking, lending, e-commerce, and on-demand services among other sectors of the financial industry. Founded in Oakland, California, Marqeta says it is proud of its roots and plans to build a team as diverse as North California’s Oakland region.

Financial Services

United States

Founded in 2012

CEO: Dave Girouard

https://www.upstart. com/ https://www.linkedin. com/ company/ upstart-network/

AI lending marketplace Upstart provides an innovative offering in the fintech space, partnering with banks and credit unions to expand consumer access to affordable credit. Leveraging Upstart’s AI marketplace, partner banks can gain higher approval rates and lower loss rates across all consumer demographics. Furthermore, Upstart says the banks that it powers typically see more than two-thirds of its loan offers approved immediately, made possible by its fully automated service. Founded in 2012 by Google’s former President of Enterprise Dave Girouard and Anna Counselman, Google Enterprise’s former Head of Premium Services & Customer Programs, alongside Thiel Fellow Paul Gu, Upstart has generated US$144m in its 11 operational years.

Financial Services

United States

Founded in 2011

CEO: Denis Globa

https://tradingview.com linkedin.com/company/ tradingview/

TradingView is a social network and charting platform for traders and investors and is today used by over 50 million users across 200 different countries. TradingView’s open-source charts and commercial libraries are used by tens of thousands of financial sites, the likes of CME, Investopedia, Crunchbase and Binance all included. With a mission to help its customers achieve success with its trading and crypto information, TradingView’s goal is to always inform how to make the best decisions. Backed by American venture capital, the company has teams in over 40 countries, speaking over 20 different languages.

Wealth and Investing

United Kingdom

Founded in 2013 CEO: Valentin Stalf

https://n26.com/en-eu https://www.linkedin. com/ company/ n26/

German challenger bank N26 is one of the most highly valued in continental Europe. At a valuation of US$9bn, N26 raised €775m (US$852.4m) in Series E funding in 2021, with lead investment coming from Coatue and Third Point Ventures. The fintech’s app-based banking system enables users to open an account within minutes and manage their finances in a secure and user-friendly way. N26’s features include instant transactions, no foreign currency fees and budgeting tools that help customers track their spending. The company has over seven million customers worldwide and a presence in 25 markets. The neobank offers free current accounts and debit cards, as well as investment products and premium accounts available for a monthly fee.

Banking

Germany

Founded in 2016 CEO: Lalit Keshre

Another fintech hailing from India, Groww is an investment app targeted to millennials, offering stockbroking options and direct mutual funds. With over 40 million customers worldwide and a growing team of over 1,000 members, the company favours a customer-centric approach, with easy-to-use front-end services. The fintech says its mission is to democratise access to financial services for Indians, leveraging first-principle thinking and technology to solve problems at scale. Since its founding, the fintech has raised US$393.3m in total funding across six rounds. Its last bout of investment came in October 2021, when it generated US$251m in a Series E round led by ICONIQ Growth.

India

Founded in 2006

CEO: Sashi Narahari

https://highradius.com https://www.linkedin. com/ company/ highradius/

HighRadius offers cloud-based autonomous software for CFOs. Its innovative software has helped transform record-to-report processes at a series of leading companies by continuously morphing its behaviour to underlying domain transactional data. HighRadius’ clients include the likes of Unilever, Kellogg Company, Danone and Hershey’s. Leveraging HighRadius’ cloudbased software, these organisations are able to utilise the capabilities of AI, robotic process automation, natural language processing, and connected workspaces as out-of-the-box features for both financing and accounting.

Software Development

United States

Founded in 1998

CEO: B Amrish Rau

https://www. pinelabs.com/ linkedin.com/company/ pinelabs/

Indian fintech Pine Labs provides financing and retail transaction technology through its Androidbased point-of-sale machines. Founded in 1998, Pine Labs can count itself as one of India’s unicorn startups, with a valuation of over US$5bn. Today, the fintech employs its machines at over 70,000 retailers across India, notably at retailers including Spencer’s Retail, Pantaloons and Westside. In 2022, the company filed an IPO with the US Securities and Exchange Commission (SEC) in the hopes of raising US$500m to further boost its valuation. The company has already raised US$1.2bn in total funding, with lead investment from the likes of PayPal, Actis Capital and Sequoia Capital.

Software Development

India

Founded in 2008

CEO: Mike Massaro

https://flywire.com https://www.linkedin. com/ company/flywire/

Flywire is a global payments and software company. By combining a series of solutions, including its global payments network, platform, and verticalspecific software, Flywire aims to deliver significant and complex payments solutions to its clients and its customers. Helping businesses complete the financial transactions they need to, Flywire also gives its clients the tools to optimise the payments experience for their own customers.

The fintech offers 24-hour multilingual support to its 3,300 clients. Headquartered in Boston, Flywire has offices in Chicago, Palo Alto, London and Shanghai among other worldwide destinations.

Payments

United States

Founded in 2009

CEO: Ravi Kumar

https://upstox.com/

Online trading app Upstox serves demat account holders, share market, MF, and IPO trading services among others. Founded in India, the online trader’s mission is to help every Indian confidently up their wealth. Promoting accessibility, affordability, and simplicity, Upstox has grown significantly from its beginnings in a small Delhi apartment. Initially expanding to Mumbai, Upstox took advantage of the Indian Government’s ‘financial superhighway’ initiative, expanding its services into Bharat. And, Upstox reached even greater heights in 2021, partnering with the Indian Premier League (IPL) of cricket.

Founded in 2016

CEO: Sebastián Kanovich

https://dlocal.com/ https://www.linkedin. com/ company/dlocal/

Uruguayan fintech dLocal provides cross-border payments services to connect global enterprise merchants with consumers in emerging markets. With a focus on APAC, LatAm, and African jurisdictions, dLocal facilitates payments for global companies otherwise unable to reach the billions of potential customers in emerging markets, enabling enterprises to send payouts and settle funds globally, without the need to manage separate pay-in and payout processors, establish local entities, or integrate acquirers and payment methods in each market. Established in 2016, dLocal was Uruguay’s first unicorn and now operates in all of Montevideo, São Paulo, Tel Aviv, Shenzhen, San Francisco, and London. It went public in 2021 at a valuation of US$9.5bn.

Payments

Uruguay

Founded in 2007

CEO: Yoni Assia

https://www.etoro. com/ https://www.linkedin. com/ company/etoro/

Social investment platform eToro has a mission to open the world’s markets to everyone, everywhere. Founded in 2007, eToro today boasts a global community of over 20m users, who exchange investment strategies, connect, and share thoughts about the market across social feeds. A multi-asset platform, eToro offers both stock investment and digital asset investment opportunities, as well as contract for difference (CFD) trading. In the US, eToro offers cryptoasset trading and plans to expand its offering to cover wider verticals in the near future. Empowering investors to grow wealth and knowledge, eToro hopes investors can become more by integrating with the wider financial ecosystem.

Wealth and Investing

Israel

Founded in 2016

CEO: Eynat Guez

https://www. papayaglobal.com/ https://www.linkedin. com/ company/ papaya-global/

Papaya Global is a SaaS fintech company enabling enterprises to master the complexities of workforce management. Its comprehensive technology, Papaya OS, is the only global platform that offers payroll and payments as a unified process. Papaya provides an embedded, end-to-end solution for the entire payroll journey, from onboarding to payroll processing to cross-border payment delivery, giving finance teams the visibility and control to master workforce spending and payments. Papaya’s integrated approach connects the dots between workforce management tools from HCM to ERP to create a single source of truth. Its team currently spans the globe, with locations including Tel Aviv, New York, London, Kiev, Singapore, and Melbourne.

Software Development

United States

Founded in 2015

CEO: TS Anil

https://monzo.com

Founded in 2015 as a mobile app and prepaid debit card, Monzo was able to offer its first full current account in 2017, when its UK banking licence restrictions were lifted. Fast-forward to 2023, and today Monzo has over 7.4 million customers, and is valued at US$4.5bn. With sustained growth in the UK, the fintech has released a string of products since its launch – one of its latest being Monzo Flex, a buy-now-pay-later product to help consumers spread costs. Today, Monzo is one of the most popular and feature-rich digital banks in Europe, enabling customers to launch a fullyfledged UK bank account from the comfort of their smartphones. Users can choose between a wide variety of free and premium accounts.

Banking

United Kingdom

Founded in 2010

CEO: Vijay Shekhar Sharma

https://paytm.com/ https://www.linkedin. com/ company/ paytm/

Founded in India, Paytm is a multinational fintech specialising in digital payments and financial services. Founded in 2010, the fintech offers mobile payment services for consumers, giving retailers the option to receive payment via QR codes, online payment gateways and point of sale. Using its digital wallet, consumers can make payments at over 21 million stores, websites and apps partnered with Paytm. Financial services offered by Paytm include microloans and buy now pay later solutions. The fintech also offers ticketing services, online games and retail brokerage services.

Payments

India

Founded in 2014

CEO: Tim Cook https://www.

Apple Pay is the mobile payments service by Apple. It allows users to make quick, seamless payments using mobile for purchases in iOS apps, in brick-and-mortar stores and on the web. Not only is it supported by iPhone, but Apple Pay users can complete payment using their Apple Watch, iPad and Mac. Allowing users to store multiple cards and eTickets in its digital wallet service, Apple Pay transactions can also be used on public transport networks. Using the EMV Payment Tokenisation Specification, Apple Pay keeps consumers’ payment details private from the retailers by replacing credit or debit card funding primary account numbers (FPANs) with tokenised device primary account numbers (DPANs).

Payments

United States

Founded in 2014

CEO: Michael Katchen

https://www.wealthsimple. com/en-ca https://www.linkedin. com/ company/ wealthsimple/

Wealthsimple is a Canadian online investment management service. Founded in 2014, the investment platform has since grown rapidly, and as of 2021 had over CA$15bn (US$11.3bn) in assets under management. Merging with Canadian ShareOwner Investments in 2015, Wealthsimple became the owner of a discount brokerage, resulting in it having CA$400m in assets under management across 10,000 customer accounts. Launching Wealthsimple Trade in 2018, the fintech had a zero-commission stock and exchange-traded fund (ETF) trading mobile app, expanding both its proposition and customer reach. Recently, in 2022, Wealthsimple announced it had become Canada’s first non-bank to be approved for a direct settlement account.

Wealth and Investing

Canada

Founded in 2012

CEO: Max Levchin

https://www.affirm. com/ https://www.linkedin. com/ company/affirm/

Affirm is a buy now, pay later financial provider, offering consumer loans at the point of sale. Born in Silicon Valley’s tech haven, Affirm was founded in 2012 as part of HVF, a fintech startup studio. Partnering with Walmart in 2019, Affirm has since gone on to offer buy now, pay later payment services at BigCommerce, Zen-Cart and Shopify. In the US, it is the exclusive installment loans provider for Amazon and its adaptive checkout service has been available to US Stripe users since 2022. Generating US$1.5bn in total funding since its founding by Max Levchin, a former founder of PayPal, Affirm is now a world leader in the buy now, pay later market.

Financial Services

United States

Founded in 2014

CEO: Eric Demuth and Paul Klanschek

https://bitpanda.com https://www.linkedin. com/ company/ bitpanda/

Bitpanda is a centralised crypto exchange offering users access to digital assets. Raising US$554m across seven rounds, Bitpanda achieved its highest valuation of over US$4bn in 2021, and today has over two million customers. Founded in 2014, the company was first called Coinimal before rebranding to Bitpanda in 2016. Aside from crypto, the exchange offers trading options in precious metals as well as securities. In 2021, Bitpanda partnered with Visa to offer customers a debit card enabling users to pay for online and in-story purchases with cryptocurrency or other assets, all backed by Visa security and fraud prevention.

Crypto and Blockchain

Austria

Founded in 2017

CEO: Changpeng Zhao

https://binance.com https://www.linkedin. com/ company/ binance/

Founded by Changpeng Zhao in 2017, Binance is a cryptocurrency exchange that allows customers to buy, trade and hold over 350 different cryptocurrencies on its platform. Today, the exchange is the world’s largest in terms of daily trading volume. As of its founding, Binance launched two of its own cryptocurrencies, Binance Coin (BNB) and BinanceUSD (BUSD). Initially starting as an Ethereum token, BNB later moved to Binance’s proprietary blockchain, Binance Smart Chain (BSC). This later merged with the older Binance Chain, creating the BNB chain. BNB Chain operates a unique “Proof of Staked Authority” model, a combination of proof of stake and proof of authority.

Crypto and Blockchain

China

Founded in 2015

CEO: Jeppe Rindom

https://pleo.io

Danish fintech Pleo has raised a total of US$428.1m in funding over 6 rounds since its founding, with its latest investment of US$200m in December 2021 taking the company’s valuation to US$4.7bn. Offering smart company payment cards and expense management solutions for businesses, Pleo automatically categorises its clients’ expenditures, reducing the administrative burden of expense management. The fintech integrates its services with accounting software such as Xero and allows companies to set spending limits and control employee expenses. In 2022, the fintech expanded into 10 new countries in Europe: France, Italy, the Netherlands, Portugal, Belgium, Austria, Norway, Finland, Estonia and Luxembourg.

Financial Services

Denmark

Founded in 2017 CEO: Simon Paris

UK-based Finastra is one of the world’s leading banking technology companies. The fintech offers a portfolio of products and solutions for retail banking, transaction banking, lending and treasury capital markets. Formed in 2017 in the combination of financial operations software Misys and payments technology provider D+H, Finastra is now a wholly-owned brand of Vista Equity Partners. With the purpose to unlock finance for its clients, Finastra offers open finance services including its Fusion software architecture and cloud ecosystem. Today, Finastra has over 9,000 customers, including 90 of the world’s top 100 banks.

Financial Services

United Kingdom

Founded in 2012

CEO: Sergio Furio

https://www.creditas.com/ https://www.linkedin. com/ company/creditasbr/

Creditas is a consumer loaning startup operating a digital platform providing secure loans and low-interest rates. The fintech has raised a total of US$1.1bn over 12 rounds of funding. Notable rounds include a US$260m Series F round in January 2022 with lead investment from Fidelity Management and Research company, as well as a US$255m Series E round led by Lightrock in 2020. Based in São Paulo, Brazil, Creditas has a mission to enable people to do what they want by unleashing the power of their assets. Working with home equity, auto equity, private payrolldeducted personal loans, and vehicle financing, Creditas is always researching innovative ways to help its users reach new heights.

Financial Services

Brazil

Founded in 1990

CEO: Stanley Middleman

https://www.

Freedom Mortgage helps millions of Americans buy and refinance homes on its mission to help its customers achieve financial stability and success. One of the US’ top mortgage lenders, Freedom Mortgage is dedicated to expanding homeownership, particularly for first-time homebuyers, army veterans, and service members. Offering a unique, streamlined lending process, Freedom Mortgage has generated US$1bn in total funding since its founding. Based in New Jersey, the lender is family-founded and has been in operation since 1990. The mortgage provider is known for its support and national and local charities that directly impact the communities Freedom Mortgage serves.

Financial Services

United States

Founded in 2011

CEO: Fernando Zandona

https://mambu. com https://www.linkedin.com/ company/ mambu/

Mambu offers a cloud-native software-as-aservice (SaaS) platform, helping banks, fintechs, retailers and corporates build a variety of loan offerings tailored to customer needs. Mambu says its platform is designed to power financial innovation and bring solutions to market faster, drive down cost barriers and allow ecosystems to expand. Helping clients achieve a 50% reduction in processing costs, Mambu’s platform includes a process orchestrator, which directs interactions between different components, connecting banking engines to third-party services. The software provider has generated US$428.64m in total funding since its founding in 2011, and in 2021 it reached a valuation of US$5.3bn, making it one of Germany’s unicorns.

Founded in 2015

CEO: Christian Hecker

https://traderepublic.com/ https://www.linkedin. com/ company/

Trade Republic supports access to wealth creation by providing secure and free access to financial markets. Based in Berlin, the online broker has raised US$1.3bn in total funding since its founding, and today offers shares, derivatives, and cryptocurrency trading options through its mobile app. Founded in 2015, Trade Republic has grown its customer base to over one million, offering commission-free investing in crypto and equities, as well as free fractional stock and ETF savings plans. It offers trading on 50 cryptocurrencies, premium derivative partner options including Citi, HSBC, and UBS, as well as stock investment options in 10,400 companies, alongside 4,900 free saving plans.

Founded in 2016

CEO: Alexandre Prot

https://qonto.com/en https://www.linkedin. com/ company/ qonto/

Parisian fintech Qonto is a neobank with services specialises for freelancers and SMEs. Launched in 2017, Qonto has since expanded its offering in Spain, Germany and Italy, where it has operated since 2019. Raising US$115m in January 2020, Qonto soon went on to pass the 100,000 customer mark later that year. Generating a significant US$530.5m in January 2022, Qonto became the most valued Unicorn in France at a valuation of US$4.8bn. The fintech made its first acquisition in 2022 too, buying its German competitor Penta. After its acquisition, Qonto’s customer base grew to 300,000, with almost 1,0000 employees on the books.

Financial Services

France

Founded in 1993

CEO: Andreas Andreades

http://www. temenos.com/ https://www.linkedin. com/ company/ temenos/

Banking platform Temenos is among the world’s largest. Serving a range of players in the industry, from different-sized banks to non-banks and fintechs, Temenos has a mission to be Everyone’s Banking Platform. Headquartered in Geneva, Switzerland, the fintech is used by 41 of the world’s top 50 banks worldwide. Founded in 1993, Temenos went public in 2001, acquiring a mainframe core banking application aimed at high-end banks – later known as Temenos Corebanking. More recently, in 2021, the company launched its new collaborative marketplace, Temenos Exchange. The provider has completed 18 acquisitions in total, most notably mobile application development platform provider Kony, which it acquired for US$559m in 2019.

Software Development

Switzerland

Founded in 2003

CEO: Philip Fayer

https://nuvei.com https://www.linkedin. com/ company/ nuvei/

Nuvei is a Canadian fintech company accelerating the business of clients around the world. Nuvei’s modular, flexible, and scalable technology allows leading companies to accept next-gen payments, offer all payout options, and benefit from card issuing, banking, risk, and fraud management services. Connecting businesses to their customers in more than 200 markets, with local acquiring in 47+ markets, 150 currencies, and more than 600 alternative payment methods, Nuvei provides the technology and insights for customers and partners to succeed locally and globally with one integration. The payments provider has generated US$830m in total funding since its founding, including US$369.4m at IPO since going public in 2021.

Financial Services

Canada

Founded in 2015

CEO: Jack Zhang

https://airwallex.com https://www.linkedin. com/ company/airwallex/

Raising US$902m across 12 rounds, Airwallex is one of the most well-funded cross-border payment fintechs. The company’s platform offers businesses a seamless and cost-effective way to send and receive payments globally, simplifying the processes of completing international transactions. Airwallex provides access to multi-currency accounts, realtime exchange rates, and competitive foreign exchange services. The fintech employs robust compliance measures, ensuring secure and efficient cross-border payments for business clients. The company saw its greatest stint of expansion after 2019 when it generated US$100m in funds from investors, including DST Global, Sequoia Capital China, and Hillhouse Capital.

Payments

Australia

In this Global SAP webinar, Etosha Thurman (Chief Marketing and Solutions Officer, SAP) and guest speaker Patrick Reymann (Research Director, IDC) will share various perspectives such as how Machine Learning (ML) and Artificial Intelligence (AI) will help procurement solve problems. Anyone who registers will receive a complimentary copy of IDC MarketScape: Worldwide SaaS and Cloud-Enabled Procurement Applications 2023 Vendor Assessment.

Speakers

Etosha Thurman Chief Marketing and Solutions Officer - SAP

Overview

Looking Forward: Deciding on the Next Cloud Procurement Solution for Your Organization

Wednesday, September 27, 2023

4 pm BST | 11 am EST | 8 am PST

Patrick Reymann Research Director - IDC

Founded in 1973

CEO: Javier Pérez-Tasso

https://www.swift.com/ https://www.linkedin. com/ company/swift/

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) is a vast messaging network used by banks and other financial services institutions to securely and accurately send and receive information. Formed in Brussels in 1973, SWIFT leverages digital technology to enable the global financial services industry to move value in a swift and frictionless way. A memberowned cooperative, SWIFT allows individuals and businesses to take electronic or card payments even if the customer or vendor uses a different bank than the payee. Using a unique code system, each of SWIFT’s member institutions or financial organisations is assigned a unique code that identifies a bank’s name, country, city, and branch.

Financial Services

Belgium

Founded in 2011 CEO: Kristo Käärmann

https://wise.com https://www.linkedin. com/ company/ wiseaccount/

UK-based fintech Wise has helped revolutionise the way money can be transferred globally. Formerly known as TransferWise, Wise has developed an innovative platform that allows funds to be transferred internationally at speed, and at low costs. Implementing a peerto-peer model, Wise negates the need for traditional banking intermediaries, resulting in fair exchange rates as well as lower fees. The fintech has already processed billions of dollars in cross-border transactions, receiving a total investment of US$1.7bn to date. Recently, Wise partnered with Frontier to advance its market commitments to accelerate its use of permanent carbon removal technologies.

Payments

United Kingdom

Founded in 2018

CEO: Kunal Shah

Indian fintech CRED is a members-only credit card bill payment platform. Rewarding members for clearing credit card bills on time, CRED offers its members exclusive rewards and experiences from premier brands when they clear their credit card bills using its platform. Gamifying the credit experience, CRED offers Coin rewards when customers pay using its card, and for every rupee cleared, which can be used for rewards. Gems are awarded for every person referred to CRED that goes through to make a bill payment. The fintech has raised US$801.5m in total funding and made a series of acquisitions since its founding, including Spenny, CreditVidya, Happay, and HipBar.

Financial Services

India

Founded in 2004

CEO: Koen Koppen

One of Europe’s fastest-growing fintechs, Mollie creates products to simplify financial services, offering effortless payments, flexible financing, and effective integration models. Founded in Amsterdam in 2004, Mollie has raised US$928m in total funding across three rounds, with its most significant funding coming in 2021 when it generated US$665m in a round led by Blackstone Group. Today, the fintech’s solutions are in use at over 130,000 businesses and its offices extend to all of France, Germany, the UK, and Belgium. With a portfolio of over 10 products, Mollie serves a range of financial needs for companies of all sizes.

Financial Services

Netherlands

Founded in 2005

CEO: Sebastian Siemiatkowski

https://klarna.com https://www.linkedin. com/ company/ klarna/

Swedish fintech Klarna provides online financial services including payment solutions for online stores, as well as direct and post-payment solutions. In 2021 alone, the fintech handled over US$80bn in online transactions. In its native Sweden, around 40% of online e-commerce sales were handled by Klarna. Its significant share in the country has given it a valuation of US$6.7bn. Today, the company is known for its buy now pay later services, providing credit options to customers during the checkout process. Most recently, Klarna launched its Klarna Creator app, allowing retailers to collaborate with influencers on marketing campaigns as well as track earnings and sales.

Sweden

Founded in 2014

CEO: Joseph Lubin

Leading Ethereum software company ConsenSys enables developers, enterprises, and individuals worldwide to create next-generation applications, access the decentralised web and launch modern financial infrastructures. With a product suite composed of MetaMask, Quorum, Truffle, and Diligence, ConsenSys serves millions of users worldwide while supporting billions of its clients’ blockchain queries. Today, Ethereum is the latest programmable blockchain in the world, leading in developer communities, business adoption, and DeFi activity. It is through Ethereum that ConsenSys says it is building the digital economy of tomorrow.

United States

Founded in 2014

CEO: Tyler Winklevoss

https://gemini.com https://www.linkedin. com/ company/ geminitrust/

Gemini is an American cryptocurrency exchange founded by brothers Cameron and Tyler Winklevoss in 2014. Now operating in all of the US, Canada, Hong Kong, Singapore, South Korea and the UK, Gemini was the first licensed Ethereum exchange in the US. The company began offering block trading in 2018, enabling its users to buy and sell large quantities of digital assets outside its continuous order books. It also leverages NASDAQ’s SMARTS technology to monitor trade and combat fraudulent activity, making its platform a safe trading place for customers. Gemini purchased Nifty Gateway in 2019, acquiring its marketplace for NFTs.

Crypto and Blockchain

United States

Founded in 2007 CEO: Kenneth Lin https://creditkarma.com

Focusing on championing financial progress for its 110 million members across the US, Canada and the UK, Credit Karma is known for pioneering free credit scores, and offering resources for members to work towards their financial goals. Tools provided by Credit Karma include credit and identity monitoring, credit card recommendations, savings growth and loans shopping. Adding 70 million new members in the last five years alone, Credit Karma has offices spread across San Francisco, Charlotte, Los Angeles, Leeds, London and one soon to be opening in Oakland. Valuing helpfulness, ownership and progression, Credit Karma aims to push financial progress forward for its members.

Consumer Services

United States

Founded in 2013

CEO: Lee Seung-gun

https://toss.im/en https://www.linkedin. com/ company/ viva-republica/

South Korean financial services company Toss began by offering a remittance service that allows easy and fast remittance without the need for a public certificate. Today, the fintech offers over 40 different financial services, with a goal to end uncomfortable and complex financial problems for all. Toss says its financial services are designed to make common sense for everyone, offering an enhanced user experience. With solutions for all of insurance, payments, banking and securities, Toss is one of the fastest growing fintech in South Korea.

Financial Services

South Korea

Founded in 2014 CEO: Harshil Mathur

https://razorpay.com/ https://www.linkedin. com/ company/ razorpay/

Razorpay is an Indian financial services company on a mission to enhance the payment experience of over 300 million consumers. The company was founded in 2014 by Harshil Mathur and Shashank Kumar with the goal of enabling frictionless transactions and overhauling money management for online businesses with its developer-friendly APIs. As such, Razorpay aims to offer a fast and secure way for merchants, e-commerce companies and public institutions to accept and disburse payments online with services ranging from payments and banking to credit and payroll. Today, Razorpay boasts a workforce of roughly 800 employees and is backed by the likes of Sequoia, Ribbit Capital, Tiger Global and Y Combinator. Its headquarters are in Bengaluru, India.

Payments

India

Founded in 2011

CEO: Anthony Noto

https://www.sofi.com/ https://www.linkedin. com/ company/sofi/

Online personal finance company and bank, SoFi, leverages modern financial products and services to help its customers invest, borrow, and save their money in innovative new ways. With a mission to help its clients achieve financial independence, the San Francisco-based SoFi was launched to offer more affordable loans to students taking on debt for college studies. Receiving US$3bn in total funding across its lifespan, the finance company has struck deals with Barclays and Morgan Stanley to create a bond backed by peer-to-peer student loans, resulting in the first securitisation of these loans to receive a credit rating. SoFi’s services now extend to saving for home ownership, retirement plans, and more.

Financial Services

United States

Founded in 2018

CEO: Roham Gharegozlou

https://www.

Founded in 2018, Dapper Labs brings NFTs into the gaming and entertainment industries, helping open up a whole new frontier in the digital asset space. The company, which is based in Vancouver, aims to bring consumers “closer to the brands they love, building engaged and exciting communities for them to contribute to, and producing new pathways for them to become creators themselves”. Notably, Dapper Labs is best known for being the company behind CryptoKitties – a series of unique virtual cats that users collect, trade and use to play games in the so-called ‘KittyVerse’. The team behind CryptoKitties claim it’s one of the first blockchain games but insists they’re not trying to build the future but just “trying to have fun with it”.

Crypto and Blockchain Canada

Founded in 1919

CEO: Jeffrey J. Brown

https://ally.com https://www.linkedin. com/ company/ally/

Detroit-based Ally Financial has become one of the US’ top digital financial holdings companies, offering financial services to businesses, consumers, corporate clients, and car dealerships. With roots stretching back to 1919, Ally redesigned its offering to be digital-first in 2009, promoting customer-centricity to its core. Renowned for its auto finance operations, for which it has an associated insurance business, Ally has sold over five million vehicles through multiple channels. This includes its SmartAuction online marketplace, where it sold 336,000 automobiles in 2022 alone. Renamed from General Motors Acceptance Corporation (GMAC), Ally was at first a subsidiary of General Motors, offering finance options to automotive customers.

Financial Services

United States

Founded in 2018

CEO: Raghu Yarlagadda

https://falconx.io/

FalconX is a large prime brokerage for institutional crypto investors. Its investment platform, FalconX 360, provides clients with a central place to manage their decentralised assets – including turnkey access to global spot and derivative liquidity, comprehensive cross-margin risk tools, as well as reporting and operations tools. The business was founded in 2018 and is led by CEO and Co-Founder Raghu Yarlagadda, an engineer who previously worked in various product leadership roles at tech giants like Google and Eightfold. FalconX’s diverse team is a mixture of Silicon Valley and Wall Street alike, boasting prior experience at familiar fintech as well as leading venture capital firms.

United States

Founded in 2018

CEO: Michael Shaulovhttps://www.fireblocks.com/ https://www.linkedin. com/ company/fireblocks/

Fireblocks helps thousands of organisations securely mint, transfer and store crypto with a secure digital asset infrastructure. The New York firm offers an enterprise-grade platform that empowers exchanges, custodians, banks, trading desks and hedge funds to scale their digital asset operations – something which is becoming increasingly desirable among institutional crypto investors. The founders of Fireblocks know how important it is to protect the integrity of your crypto investments: in 2017, they were part of the task force charged with investigating and the fallout from the infamous Lazarus Group hack of four South Korean crypto exchanges, which resulted in the theft of US$200m’s worth of bitcoin. A year later, they started Fireblocks.

Crypto and Blockchain

United States

Founded in 2019

CEO: Eric Glymanhttps://ramp.com/ https://www.linkedin. com/ company/ ramp/ US-based fintech Ramp is building a platform for finance teams that incorporates a suite of financial tools – including corporate cards, expense management, bill payments, and integrations with popular accounting software. It is already used by over 15,000 finance teams, who, according to the company, spend on average 3.5% less and close their books eight times faster compared to other platforms. Founded in 2019, the fintech supports billions of dollars’ worth of capacity every year and is currently enjoying tenfold year-on-year growth. It numbers clients ranging from startups to software unicorns and large enterprises among its ranks, and was recently named Fast Company’s Most Innovative Company in North America.

Financial Services

United States

Founded in 2013

CEO: Markus Villig

https://bolt.eu https://www.linkedin. com/ company/ bolt-eu/

Bolt describes itself as “the all-in-one mobility app”, allowing users to hail a ride, find a car share, or hire a scooter or e-bike. Like many mobility apps, it has also branched out into food delivery in recent times. The company has 3.1m drivers and couriers in over 45 countries, helping more than 100m customers move around 500 different cities worldwide. As their apps have ballooned into a holistic offering – a sort of super-app for mobility – delivery and ride-sharing firms have found themselves having to ‘fintechify’ in order to meet volume and demand. Bolt is no exception. The app processes payments on the customer side and ensures couriers are paid on the driver side, earning the company its place on this list.

Founded in 2012

CEO: Daniel Klein

https://sumup.com https://www.linkedin. com/ company/ sumup/

A financial services provider for small businesses founded in 2012, SumUp is now the financial partner for over four million SMEs in more than 35 markets worldwide. Giving SMEs the tools to start, run, and grow their businesses, SumUp is committed to leveraging its success for the betterment of the planet, pledging a 1% donation of net revenue to support environmental, educational, and entrepreneurial causes. Raising US$2bn in funding since its founding, the fintech now has 18 offices worldwide. With a mission to continue developing intuitive ways to financially support SMEs, the fintech has been recognised as a top global employer for LGBTQ+ inclusion, receiving a Bronze Award from Stonewall Workplace Equality Index 2022.

Financial Services

United Kingdom

Founded in 2012

CEO: Henry Ward

https://carta.com https://www.linkedin. com/ company/carta--/

Carta is a fintech equity management platform. With a mission to unlock equity ownership for more people, Carta has amassed an equity management portfolio of over US$2tn, covering two million people worldwide. The equity platform manages funds for over 30,000 businesses and over 5,000 investment funds too. Formally called eShares, Inc., Carta’s valuation software digitises paper stock certificates along with derivatives, warrants and stock options, allowing individual investors and companies to manage their own equity and track company ownership. Raising US$1.2bn in total funding, Carta has risen to the top of capital asset management after acquiring its competitor Silicon Valley Bank Analytics in 2017.

Wealth and Investing

United States

Founded in 2014 CEO: Michael Gronager

https://chainalysis.com https://www.linkedin.

Offering cryptocurrency compliance and investigation solutions to global law enforcement agencies, businesses, and regulators, Chainalysis helps global partners work together to combat illicit cryptocurrency activity. With venture capital backing from the likes of Benchmark, Chainalysis was first set up as a Bitcoin tracing organisation. Since its 2014 founding, the fintech’s clientele has stretched to the US FBI, DEA, and IRS, as well as the UK’s National Crime Agency. Notably, Chainalysis helped law enforcement agencies retrieve over US$1bn from the shutdown of the dark web marketplace Silk Road, while assisting in the 2021 crypto theft investigation, identifying North Korea’s Lazarus Group as the culprit.

Software Development

United States

Founded in 2013 CEO: Jeremy Allaire

https://circle.com https://www.linkedin. com/ company/circle-internet-financial/

Fintech Circle enables businesses of all sizes to access digital currencies and public blockchains for payments, financial applications, and commerce. It also operates USD Coin (USDC), a fully regulated and reserved dollar digital currency. Over the past year, USDC has supported around US$1.4tn in transactions, giving rise to a new generation of financial services and commerce applications. Circle believes its transaction and treasury services hold the promise of raising global economic prosperity through the frictionless exchange of financial value. Raising US$1.1bn in total funding since its founding, Circle is committed to transparency and stability as it looks to continuously champion compliance.

Crypto and Blockchain

United States

Founded in 1981 CEO: Steve Hare

https://www. sage.com/en-gb/ https://www.linkedin. com/ company/ sage-software/

Sage is a UK-based enterprise software company known for its suite of financial tools for small-tomedium-sized businesses – including solutions for payroll, HR and finance. Sage was founded in Newcastle-upon-Tyne, England, in 1981 when local businessman David Goldman wanted to automate some of the basic accounting functions of his own company. After almost a decade of growth, it floated on the London Stock Exchange in 1989 before expanding to the US two years later. It became part of the FTSE 100 in 1999 and has remained there ever since, welcoming its five-millionth customer in 2007. Today, the business employs more than 11,000 people and supports millions of entrepreneurs in over 20 countries on a daily basis.

Software Development

United Kingdom

Founded in 2013 CEO: Vladimir Tenev

https://robinhood.com/ https://www.linkedin. com/ company/ robinhood/

Robinhood is an investing platform that aims to bring to the masses participation in the stock market – once the preserve of the wealthy, who could rely on investment managers and brokers. The company is aptly named after the figure from English folklore who took from the rich to give to the poor. “We’re levelling the playing field by making trading more intuitive, affordable and inclusive,” the firm says. Since being founded in 2013, the company has forged a name for itself as one of the most significant players in the retail investment space – but it courted controversy in 2021 when it temporarily halted trading of shares in US game retailer Gamestop after social media users caused a rush on an otherwise untrendy and oft-shorted stock.

United States

Founded in 2017 CEO: Johnny Lyu

https://www. kucoin.com/ https://www.linkedin. com/ company/ kucoin/

Launched in 2017, KuCoin is an international cryptocurrency exchange with headquarters in Seychelles. The platform offers over 700 digital assets to buy, trade and sell. Users can engage in futures trading, spot trading, margin trading, P2P fiat trading, futures trading, staking, and lending –and there are 27 million of them on the platform. In 2022, KuCoin raised over US$150m through a pre-Series B funding round, meaning the company has raised over US$170m to date at a valuation of US$10bn – not bad for a company that will only turn seven years old in September. The runaway success enjoyed by KuCoin is also a testament to its resilient growth in spite of general volatility in the crypto market that has seen other players struggle.

Seychelles

Founded in 2011

CEO: Joshua Reeves

https://gusto.com https://www.linkedin. com/ company/ gustohq/

San Francisco-based Gusto delivers payroll, HR, benefits and hiring tools to businesses of all sizes – a product suite that it refers to as its ‘people platform’. Launched in 2012 as ZenPayroll, Gusto serves more than 300,000 businesses across the US and processes tens of billions of dollars in payroll, all while providing employee benefits like health insurance and 401(k). It also offers a modern accounting platform called Gusto Pro and helps facilitate workers’ compensation insurance through insurtech partner NEXT Insurance. The aim, Gusto says, is to empower clients to make workplaces where employees want to come. Backed by the likes of General Catalyst, T. Rowe Price and Capital G, the business is led by Founder-CEO Joshua Reeves.

Software Development

United States

Founded in 2012

CEO: Chris Britt

https://www. chime.com/ https://www.linkedin. com/ company/ chime-card/

Fintech Chime partners with regional banks to provide their members with customer-focused financial products. With a mission to make financial peace of mind a reality for millions of Americans, Chime offers access to bank accounts with feefree overdrafts, early access to paychecks, and credit-boosting initiatives. Raising over US$1.7bn in total funds to date, with backing from VC firms Sequoia Capital Global Equities, General Atlantic, and Tiger Global, among others, Chime was most recently valued at US$25.5bn, making it one of the US’ fastest growing fintech. Founded by Chris Britt and Ryan King in 2012, Chime was named in Fortune’s list of Best Places to Work in 2022.

United States

Founded in 2011

CEO: Dave Ripley

https://kraken.com https://www.linkedin. com/ company/ krakenfx/

Digital asset exchange Kraken has fast become one of the world’s largest cryptocurrency platforms. Operating in over 70 countries, Kraken says its aim is to accelerate cryptocurrency adoption worldwide and proliferate knowledge around blockchain technology. A fully remote company, Kraken has launched a string of blockchain-related products since its launch, including Kraken NFT, on-andoff-chain staking and instant Bitcoin transfers using its Lightning Network. Most recently valued at US$10.8bn, Kraken has generated US$130.1m in total investment over 15 rounds. The crypto exchange launched an app in 2021 before the release of its NFT marketplace in Q4 2022.

United States

Founded in 2009

CEO: Guillaume Pousaz

https://checkout.com https://www.linkedin. com/ company/ checkout/

Global payments provider Checkout.com offers solutions that help businesses and their communities thrive in the digital economy. Founded in 2012, Checkout.com has grown to over 1,700 employees, operating out of 19 offices worldwide. Offering businesses of all sizes a full stack of payment solutions, the fintech provides adaptive offerings to help companies thrive and scale to their individual needs. Based in London, Checkout.com was valued at US$40bn ten years on from its founding (2022), making it the most valuable fintech startup in Europe at the time. Its current pool of clients extends to streaming giants Netflix, fast-food chain Pizza Hut and the digital asset exchange Coinbase.

Payments

United Kingdom

8 - 9 November 2023

QEII Centre, London

SPONSORSHIPS GET YOUR PASS

Founded in 2018

CEO: Marcelo Kalim

https://www. c6bank.com.br/ https://www.linkedin. com/ company/ c6-bank/

Brazilian neo bank C6 Bank has enjoyed astronomical success over the course of just five years, inspired in part by the legacy nature of Brazil’s fast-moving banking ecosystem. The app is one of the most popular digital banking apps in the world, according to Apptopia, the market leader in mobile app competitive intelligence, registering nearly 18m downloads in the space of 12 months. The challenger offers more than 90 different products and services, including a current account, investment platform and foreign exchange account, reaching consumers in every corner of this large South American nation. Its breakneck growth has been reflected in terms of recruitment, too; C6 Bank’s parent company has amassed almost 4,000 employees combined so far.

Founded in 2011 CEO: Chris Comparato

https://toasttab.com

Toast is an all-in-one restaurant point of sale and management system. Based in Massachusetts, toast powers restaurants using the Android operating system. Leveraging cloud-based software, Toast’s platform facilitates point of sale, guest marketing, digital ordering, and delivery, as well as payroll and HR capabilities. With US$962m in total funding, Toast now serves over 79,000 restaurants in the US alone. Going public in 2021 with a market capitalisation of US$20bn, Toast became one of the US’ largest IPOs. In 2023, the fintech acquired Delphi Display Systems, the producer of drive-thru technology and digital display solutions for quick-service restaurants.

United States

Founded in 2015

CEO: Sameer Nigam

https://www. phonepe. com/ https://www.linkedin. com/ company/ phonepe-internet/

PhonePe is a mobile payments app that allows users to transfer money easily and instantly using just their mobile phone number. The Bengalurubased firm wants to give every Indian “equal opportunity” to access the financial system and move money, in a country where nearly 200m people (one seventh of the population) remain unbanked. PhonePe was founded in 2015 by Flipkart alums Sameer Nigam and Rahul Chari; as well as experienced software industry executive Burzin Engineer. On top of the central payment functionality, PhonePe has expanded over the years into other financial products, including a range of insurance lines, investments, and solutions for business. It has 470m registered users (one in four Indians) and several thousand employees.

Founded in 2017

CEO: Henrique Dubugras

https://www.

Brex provides an all-in-one platform for corporate cards, reimbursements, expense management, business accounts, and travel. Hailing from San Francisco’s Silicon Valley, Brex’s offering is exclusive to business charge cards. Founded by Brazilians Henrique Dubugras and Pedro Franceschi, Brex was initially intended as a virtual reality start-up before Duburgras and Franceschi pivoted their outlook three weeks into the fintech’s Y Combinator accelerator programme. Generating US$1.5bn in total funding, Brex recently launched a financial software platform to help people comply with their employers’ expense policies, Brex Empower.

Financial Services

United States

Founded in 2017

CEO: Devin Finzerhttps://opensea.io/ https://www.linkedin. com/ company/ opensea-io/

OpenSea operates a peer-to-peer NFT marketplace. Consumers can access its marketplace for minting, purchasing, and selling NFTs frictionlessly. Offering multi-chain options for creators and collectors to shape their NFT journeys individually, OpenSea’s leadership team combines experience from the likes of Google, Lyft, Palantir, Uber, Stanford University, and UC Berkeley. Generating US$427.2m in total funding across eight rounds, OpenSea has become one of the industry’s leading NFT marketplaces since its founding in 2017. Based in New York, OpenSea hopes to leverage open protocols like Ethereum and interoperable standards like ERC-721 and ERC-1155 to build a new world digital economy that allows consumers to trade their items freely.

Crypto and Blockchain

United States

Founded in 2013

CEO: Zach Perrethttps://plaid.com https://www.linkedin. com/ company/plaid-/

Financial services company Plaid operates a technology platform that enables applications to directly connect with a user’s bank account. Its proprietary technology allows consumers and businesses to connect with their bank accounts, check balances, and make payments through different channels. With a network covering more than 12,000 financial institutions across North America and Europe, significant Plaid partnerships include Venmo, SoFi, and Betterment. Once the subject of a proposed acquisition by Visa, Plaid has achieved marked success on its own footing, generating US$734.3m in funding across seven rounds.

Software Development

United States

Founded in 2011

CEO: Peter Smith

https://blockchain.com https://www.linkedin. com/ company/ blockchain/

Blockchain.com provides a crypto wallet that allows individuals and institutional investors alike to buy, sell and store cryptocurrencies safely.

Founded in 2011, the company has always been at the vanguard of digital assets: on top of its crypto wallet, it has also previously launched a ‘Blockchain Explorer’ that allows anyone to examine transactions on the blockchain, as well as an API that let companies build on bitcoin. The company was founded by Peter Smith and Nic Carey, and in the 12 intervening years since launch has facilitated the creation of 87m wallets, transacted over US$1tn in volume, and verified 37m users in more than 200 countries. Today, a third of Bitcoin network transactions are through Blockchain.com.

Crypto and Blockchain

United Kingdom

Founded in 2015

CEO: Arik Shtilman

https://www.rapyd.net/ https://www.linkedin.com/company/ rapydpayments/

Rapyd sees itself as a liberator of global commerce. Using Rapyd’s platform, partner companies can accept and send payments anywhere –faster, cheaper, and easier. And according to Rapyd, its clients see an average 196% return on investment and spend 70% less time managing payments. The company says it launched its Global Payments Network and Fintech Platform to provide a full stack of integrated payments, commerce, and other financial capabilities that can be embedded into any application. It was then, after building these solutions, that Rapyd says it was able to scale its operations globally, helping the rest of the fintech community partner with its global payments infrastructure in a move it hopes will liberate commerce globally.

Software Development

United Kingdom

Founded in 2012

CEO: Brad Garlinghouse

https://ripple.com https://www.linkedin. com/company/rippleofficial/

Ripple was founded in 2012 with a vision to create a world where value moves as seamlessly as information. Over a decade on, its customers use the firm’s enterprise-grade blockchain solutions to source crypto, facilitate instant payments, empower their treasury and drive new revenue in a faster, more transparent and more cost-effective way than traditional financial services. With a decade of crypto and blockchain experience, Ripple today boasts a payments network with over 300 customers across 40 countries and jurisdictions. But it has had its challenges along the way; Ripple was previously accused by the SEC of breaking federal securities rules by selling its XRP token on public exchanges but recorded a victory in that case in July.

United States

Founded in 2006

CEO: Sukhinder Singh Cassidy

https://xero.com https://www.linkedin. com/ company/ xero/

Founded in 2006 in New Zealand, Xero is a small business platform with 3.5m subscribers, who rely on the company to cater to all of their day-to-day financial needs. This is particularly useful to smaller firms, who, despite representing a vast majority of most economies, often lack the resources and capacity of their larger counterparts. Xero offers a core accounting solution coupled with payroll, workforce management, expenses and projects. It also has an extensive range of apps and integrations that can be brought into its ecosystem to bolster the product offering further, and give even greater value to its small business clients. It has been included on the Dow Jones Sustainability Index, as well as the Bloomberg Gender Equality Index.

Software Development

New Zealand

Founded in 2012

CEO: Brian Armstrong

https://coinbase.com https://www.linkedin. com/ company/ coinbase/

Founded in 2012, Coinbase offers a cryptocurrency exchange platform and digital wallet that gives merchants and consumers a way into cryptocurrencies – allowing them to transact with new digital currencies such as Bitcoin, Ethereum and Litecoin. The company is based in the San Francisco Bay Area and is led by CEO and Co-Founder Brian Armstrong, who is no stranger to exciting startups; he was previously Technical Product Manager at Airbnb during the short-stay rental site’s growth years and also had a short stint at Deloitte. At Coinbase, Armstrong guided the company through a direct listing two years ago that gave it an initial market cap of around US$85bn; at the time of writing, that figure is more like US$23bn.

Crypto and Blockchain

United States

Founded in 2015

CEO: Nikolay Storonsky

https://revolut.com https://www.linkedin. com/ company/revolut/

UK-based financial super-app Revolut brings a plethora of financial services into one place, inspired by the success of Chinese super-apps like WeChat, which lets consumers do everything from ordering a taxi to paying for goods. Since launching in 2015, Revolut has amassed 25m customers who initiate over 250m transactions a month. Recent product launches include a crypto ‘staking’ feature, as well as trip cancellation insurance. The business is led by Nik Storonsky, the former champion swimmer and keen kitesurfer who moved to London 20 years ago to pursue a career in financial services. Alongside fellow co-founder Vlad Yatsenko, he ultimately built a fintech giant that was valued at US$33bn at its most recent series funding round in 2021.

Banking

United Kingdom

Founded in 2014

https://afterpay.com https://www.linkedin. com/ company/ afterpay-com-au/

Australian buy now, pay later provider Afterpay was founded in 2014 by Nick Molnar and Anthony Eisen. Now operating in all of Australia, New Zealand, the UK, Canada, and the US, Afterpay offers six and 12-month buy now, pay later plans and four-month interest-free plans. With no fees for payments made on time, Afterpay has established partnerships with retailers Anthropologie, Revolve, Levi’s, and Ray-Ban, among others. Empowering customers to access the things they want and need, Afterpay says it is committed to delivering positive outcomes for customers while helping them maintain financial wellness and control. Afterpay has since expanded its payments service to subscriptions, such as gym memberships and entertainment subscriptions.

Payments

Australia

Founded in 1690

CEO: C. S. Venkatakrishnan

https://barclays.com https://www.linkedin. com/ company/ barclays-bank/

Barclays is one of the world’s largest banking groups. It has over 325 years of history, tracing its roots back to late-17th Century London when two goldsmith bankers set the ball rolling on what is now a financial juggernaut. The son of one of the bankers hired a certain James Barclay, after whom the modern-day organisation is named, and today Barclays boasts 83,500 people in more than 40 countries. From multiple bases around the world, Barclays moves, lends, invests and protects consumers’ money and helps them save for the important milestones in their lives or in their businesses. Areas of activity include consumer banking and payment operations, as well as top-tier, full-service, global corporate and investment banking.

Founded in 2009

CEO: Jack Dorsey

https://block.xyz/

Formerly known as Square, Block is a fintech conglomerate that provides a payments platform aimed at SMEs, allowing them to accept credit card payments through smartphones and tablet computers, which act as point-of-sale (POS) systems. Its flagship product, still known as Square, has had 210 million buyer profiles, making up a vast ecosystem of customers. Acquiring Tidal in 2021, Block now has its toe in the subscription-based music, podcast and video streaming service. The fintech also manages Cash App, a mobile app that facilitates money transfers between individuals and between consumers and businesses.

Payments

United States

Founded in 2017

CEO: Marc Boiron

Fintech Polygon focuses on providing alternative finance and services to unbanked populations by leveraging technology. A blockchain platform with aims to create a multi-chain blockchain system compatible with Ethereum, Polygon uses the energy-efficient proof-of-stake consensus mechanism for processing on-chain transactions. Formerly known as Matic Network, Polygon’s native cryptocurrency is named MATIC, which, as an ERC-20 token, is compatible with other Ethereum cryptocurrencies. In 2022, Polygon raised US$450m by selling tokens to leading VC firms. Later in the year, Donald Trump launched a series of NFTs minted on the Polygon network.

India

Founded in 2012

CEO: Anthony Tan

https://www. grab.com/ https://www.linkedin. com/ company/ grabapp/

Grab is a Southeast Asian super-app that allows users to order food deliveries, hail a ride, pay for daily purchases, invest in the stock market, take out insurance for life’s necessities, and even book a hotel room. No wonder, then, that the all-encompassing fintech describes itself as ‘the everyday everything app’. But while some tech entrepreneurs can merely dream of building a successful super-app, Grab has done it already; the platform is used by millions of consumers every day with a presence in 13 different markets, mostly in South and Southeast Asia. Grab is headquartered in Singapore and is led by former Harvard Business School graduate Anthony Tan as Co-Founder and CEO.

Software Development

Singapore

Founded in 1994

CEO: Richard Fairbank

https://www. capitalone.com/ https://www.linkedin. com/ company/capital-one

Sometimes described as the original fintech owing to the fact it was founded in 1994, Capital One says of itself, “We’re a bank, but we don’t think like one”. More than 25 years ago, Capital One revolutionised the credit card industry with data and technology and today it is one of the largest retail banks in the US, serving more than 100m customers and employing around 50,000 people globally. It claims to have been “founded on the belief that no one should be locked out of the financial system”, so ESG remains an important component of what it does. It continues to evolve, too, in June announcing the acquisition of digital concierge company Velocity Black to better serve customers in the travel, entertainment, shopping and dining verticals. Banking United States

Founded in 2013

CEO: David Vélez Osorno

https://nubank.com.br/en/ https://www.linkedin. com/ company/ nubank/

Nubank is one of the most significant players in Brazil’s sizeable and emerging fintech ecosystem – in fact, it’s the second Brazilian neo bank on this list, such is the success of Brazilian neo banks more broadly. Founded in 2013 by a trio of banking entrepreneurs – David Vélez, Cristina Junqueira and Edward Wible – the challenger is on a mission to improve access to financial services for ordinary Brazilians. To this end, the unicorn has already secured a base of more than 70m customers. As well as its home market of Brazil, Nubank is also active in Colombia and Mexico, where it launched in 2020 and 2023, respectively. Earlier this year, Junqueira was recognised for her contribution by being named in FinTech Magazine’s Top 100 Women series.

Banking Brazil

Founded in 2007

CEO: David Schwimmer

London Stock Exchange Group brings together nearly 2,000 companies from over 100 countries with a combined value of £4.8tn (US$6.1tn). At the heart of LSEG mission is giving customers extensive access to capital markets and liquidity across multiple asset classes. It operates a broad range of international equity, fixed income and exchange-traded products. LSEG owns the London Stock Exchange (LSE), which began. in a coffee shop in London when a man named John Castaing published a list of currency, stock and commodity prices – including gold and pieces of eight. A major focus of LSEG is providing market infrastructure and data – and to this end, in 2021, it completed the acquisition of data and analytics company Refinitiv.

Financial Services

United Kingdom

Founded in 2006

CEO: Pieter van der Does

https://adyen.com https://www.linkedin. com/ company/ adyen/

Adyen is a financial technology platform that provides end-to-end payments capabilities, data-driven insights, and financial products to institutional clients, including Facebook, Uber, H&M and Microsoft. Since launching in 2006, the company’s ascent has made co-founders Pieter van der Does and Arnout Schuijff (who stepped away from the business a couple of years ago) two of the richest people in the Netherlands, just behind the heir to the Heineken beer fortune and the founder of temping agency Randstad. In February, CFO Ingo Uytdehaage was promoted to the role of co-CEO to allow van der Does more time to focus on his health. Though based in Amsterdam, Adyen has offices in 26 cities from Stockholm to Sydney and employs over 3,000 people.

Financial Services

Netherlands

Founded in 1857

CEO: José Antonio Alvarez

https://santander.co.uk https://www.linkedin. com/ company/ banco-santander/

Banco Santander is a commercial bank which has, for almost 150 years, been helping individuals and businesses reach their financial potential. Based in Spain and named after the city where it started, Santander’s presence in 10 core markets throughout Europe, North America and South America makes it one of the largest banks based on market capitalisation. It serves private individuals as well as SMEs, corporates, other financial institutions and governments. As part of its transition for the future, the bank has committed to raising more than €120bn (US$132bn) in green financing by 2025, as well as financially empowering over 10m people. The bank has €1.2tn in total funds, 157m customers, over 9,000 branches, and 200,000 employees.

Founded in 1984 CEO: Frank Bisignano

Founded in 2014 CEO:

https://www.antgroup. com/en https://www.linkedin. com/ company/ antgroup/

Ant Group emerged out of China’s Alibaba Group and is the parent company of Alipay, one of the world’s most-used mobile payment platforms. Alipay helps to connect consumers and merchants, supporting both ecommerce and physical transactions. As well as supporting over 2,000 financial institutions in China to provide inclusive financial services – ranging from consumer finance, wealth management and insurance –it has collaborated with local governments in over 1,000 counties, more than 500 brands, and 1,000 financial institutions. Ant Group was split out of the Alibaba Group in 2011 and earlier this year, the founder of both, Jack Ma, gave up overall control of Ant Group amid continuing regulatory scrutiny.

https://fiserv.com https://www.linkedin. com/ company/fiserv/

Fiserv is a provider of financial technology, helping clients – including fintechs and many of the largest global brands – to unlock new revenue streams using the power of open finance. Fiserv products or services reach nearly 100% of US households, either directly or indirectly through a financial institution, fintech, merchant or biller. The company has 40,000 associates globally and does business in more than 100 countries, processing 12,000 financial transactions a second. Fiserv was created by a merger in 1984, going public on the Nasdaq Stock Market just two years later. Today, it is helping to drive innovation in payments, processing services, risk and compliance, customer and channel management, and business insights and optimisation.

Financial Services

United States

Founded in 1998

CEO: Dan Schulmanhttps://paypal.com https://www.linkedin. com/ company/ paypal/

PayPal is one of those instantly recognisable fintech brands, an early pioneer of technology that revolutionised the money movement. PayPal created a global real-time payments network using people’s email addresses. It began life under the name Confinity, founded by Peter Thiel (later to co-found data analytics firm Palantir) and Max Levchin (who would go on to set up BNPL company Affirm). In 2000, Confinity merged with x.com. Its CEO, Elon Musk (who is now trying to revive the X brand) was replaced as CEO by Thiel, the new entity was rebranded PayPal and listed, and then it was acquired by eBay for US$1.5bn in stock. The success netted its founders a fortune, and today they’re some of the wealthiest men in Silicon Valley.

Payments

United States

Founded in 1812 CEO: Jane Fraser

https://citigroup.com

Citi Group is an investment bank and financial services business that connects millions of clients throughout hundreds of different cities and countries. It offers a wide range of financial products and services, which contribute to it being an important partner to the businesses, institutions and individuals that bank with Citi. Core activities include safeguarding assets, lending money, making payments and accessing capital markets on behalf of the group’s clients. Citi has financial flows in excess of US4tn, helping to move the equivalent of Germany’s GDP every day. In addition, it has over 13,000 institutional clients – including 90% of Fortune 500 firms – and has pledged more than US$1bn as part of its commitment to ESG.

Banking

United States

26 - 27 September 2023

Business Design Centre, London

SPONSORSHIPS GET YOUR PASS

Founded in 2010

CEO: Patrick Collisonhttps://stripe.com https://www.linkedin.com/company/stripe/

Stripe is a provider of financial infrastructure which says it’s on a mission “to increase the GDP of the internet”.

With dual headquarters in San Francisco and Dublin, the company’s software is used by startups and large enterprises alike to accept payments and manage their finances online. It was conceived by brothers and co-founders Patrick and John Collison – today CEO and President respectively – who have come a long way from their roots in rural Ireland to building this tech success story.

Patrick and John showed signs of promise from an early age, despite their disadvantages. The former was