presentations, Q&A sessions to 1-2-1 networking, the 2-day hybrid show is an essential deep dive into issues impacting the future of each industry today.

Global giants and innovative startups will all find the perfect platform with direct access to an engaged and active audience. You can’t afford to miss this opportunity.

See you on:

Recently, the crypto space was rocked by a brand new disruption that threatens to destabilise an already challenged space. Ethereum, the second largest cryptocurrency, did a ‘thing’.

That thing, called The Merge, saw the open source currency swap from its original ‘proof-of-work’ blockchain to the more sustainable ‘proof-of-stake’ blockchain.

The move was described by the team as being so complicated, that it was like swapping out the engine of a moving car. Even after years of research, they were not sure it would work - and even now, after a seemingly successful manoeuvre, the fallout is yet to be realised.

One thing is for sure though, by bypassing the mining process, Ethereum is now almost entirely net zero, having cut its energy consumption by the equivalent of Finland’s power grid.

Will this signal a new start for digital currencies? Will the SEC crack down on Ethereum now it is considered fair game? And how will other digital currencies react?

It’s an exciting time in fintech, despite all the unanswered questions. Check out our selection of digital currency features in this month’s issue to find out more. Let us know your thoughts, and of course, enjoy the issue.

“Ethereum is now almost entirely net zero, having cut its energy consumption by the equivalent of Finland’s power grid”

Digital disruption in financial services is already a reality for retail customers but it hadn’t happened yet for SMEs and entrepreneurs, who were still seeing their needs and demands pretty much uncovered. SMEs across the globe are seeking beyondbanking ecosystems, integrating third-party services, that cover their needs in a single, easy-to-use service, allowing them to focus on their core activities.

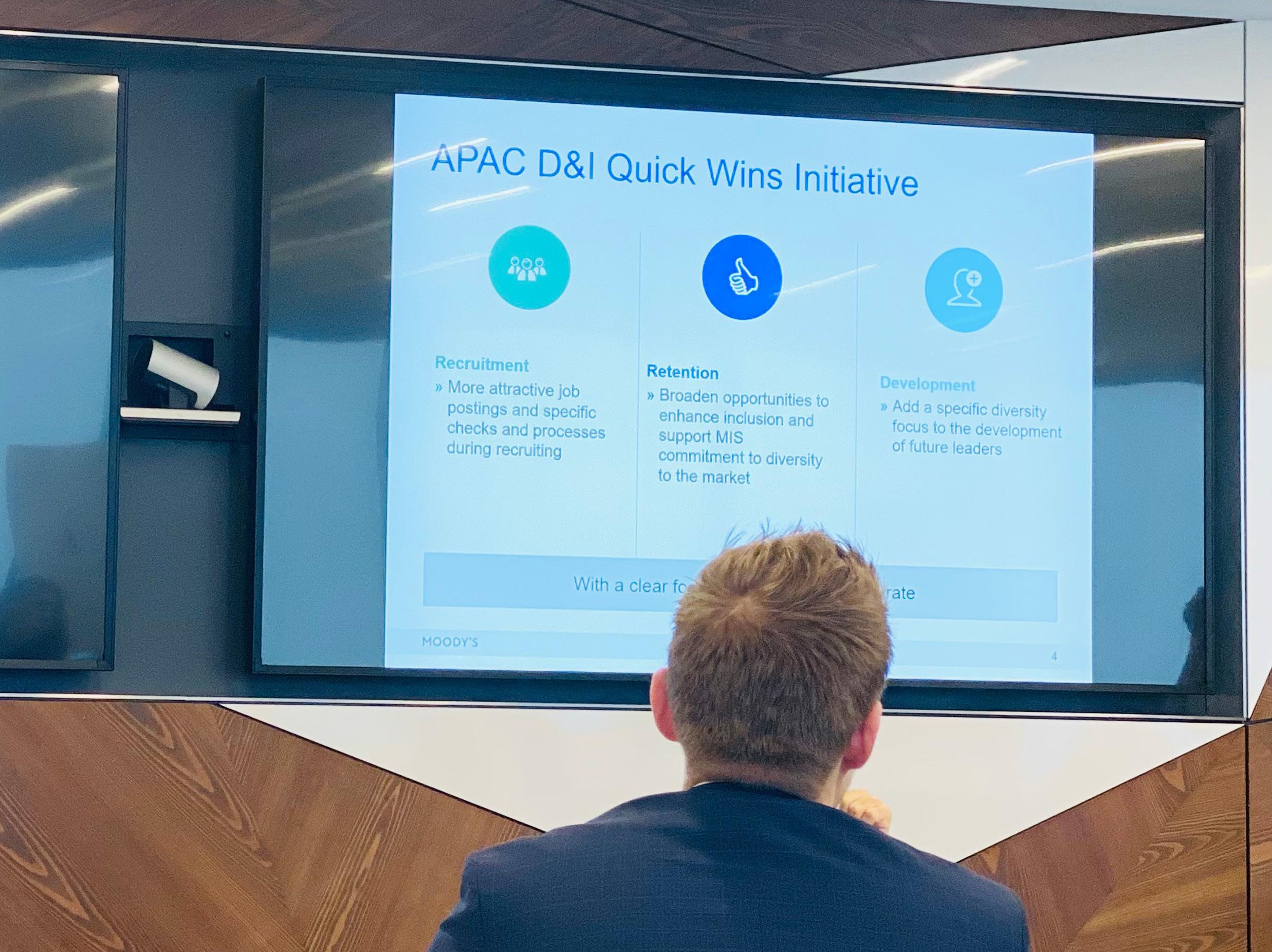

With this landscape in mind, STEP, a global marketplace for financial products for SMEs with the mission of delivering a fullyfledged Customer-Centric digital solution, used CRIF Group’s solutions, among which Strands’ BFM and Engager, enriched by CRIF account aggregation, in order to deliver excellence in every product/service to SME and corporate customers.

Structuring a customized insight driven experience tailored to SMEs, using CRIF’s open banking capabilities and Strands’ advanced analytics, STEP was able to create a competitive advantage in a very simple way, by enabling:

• Account aggregation – first platform to offer it for free to SMEs on European scale

• Invoice reconciliation - retrieve invoices from third party providers such as Quickbooks and many others

• Strands BFM + Engager - for cash flow management and forecasting; business insights to trigger relevant information for a personalized experience.

• Third party products - integrated that allow SMEs to apply for an instant loan, discount their invoices, manage their international payments and FX transactions, acquire payments from customers, ask for an ESG rating, subsidized finance, insurances among others

The solution provided by Strands and CRIF has enabled STEP to achieve unbelievable results since its market launch in October 2021 with more than 4,000 SMEs having chosen the STEP platform in two countries (Italy and Spain) in order to always keep their financial position under control and seek for an innovative fully-fledged financial solution. This customer loyalty has led to a 22,6% cross selling ratio and a pipeline of more than 450 million euros loan and working capital operations already requested.

CRIF is a global company specializing in credit & business information systems, analytics, outsourcing and processing services, as well as advanced digital solutions for business development and open banking.

CRIF is currently the leading credit information banking group in continental Europe and a major player in the global market for integrated business & commercial information and credit & marketing management services. Through continuous innovation, the use of state-of-the-art technology and a strong information management culture, CRIF supports 10,500 banks and financial institutions, more than 600 insurance companies, 82,000 business clients and 1,000,000 consumers in more than 50 countries of 4 continents. For more information: www.crif.com

A young man sends messages at the base of Jabal Alfil - a famous ancient landmark in Saudi Arabia. According to data reports, Saudi is ranking 10th globally for widespread 5G access, just slightly behind the UK, Germany and Italy. 5G is already transforming the transactional space, contributing to faster services, lower prices and better customer servicing. Rami Aboukhair, CEO of Santander Spain, says: “New technology will enable us to gain connectivity and response speed in transactions and offer our customers… the best possible experience.”

“THIS CONSTANT OVERLOAD OF UNREGULATED CRYPTO LEADS TO DAILY NEGATIVE HEADLINES ABOUT CRYPTOCURRENCY SCAMS, RESULTING IN INVESTORS BEING PUT OFF FROM BUYING AND SELLING CRYPTO”

Dan DA ROSA Co-Founder and CEO, ETHAX

READ MORE

Paul RANDALL CEO, Creditinfo

READ MORE

“FOR THE INDUSTRY TO CONTINUE TO GROW AND BECOME MAINSTREAM, CUSTOMERS MUST HAVE TRUST IN THE INFRASTRUCTURE AND FRAMEWORK UNDERPINNING IT AND IT STARTS WITH REGULATION”

Tom CROSLAND CEO, CoinZoom

READ MORE

With inflation at an all-time high and following several months that saw stocks plummet, along with valuations, it seems that there may yet be a glimmer of hope on the horizon for fintech companies seeking investment.

While the space won’t recover to 2021 levels - an artificially induced bubble that led to unprecedented funding due to the demands for digital transformation and online financial services - things do appear to be returning to where they were in 2020.

According to the latest reports on fintech startups, 2022 hasn’t been the disaster zone it could have been. There were more than 130 funding rounds in January alone and a further 26 fintech seed deals across Latin America in the second quarter of the year with Brazilian companies taking the biggest share with nine deals, or 35% all deals at that stage.

Indeed Neon raised $300mn in its Series D round, while Creditas closed a Series F round for $260mn. While these rounds are yet to reach the dizzying heights of 2021, they are in all other respects megarounds in their own right. 2023 may yet signal further optimism for the fintech market as economies begin to stablise.

Our results show that trust in the virtual world is still scant - with investors preferring to place their bets on real-world investment opportunities

We examine The Merge and how the event will affect the cryptocurrency market moving forward

As these two leading regional hubs forge new strategic alliances, we discuss what the future will hold for them

We caught up with Annelyse Fournier, COO of PDX Global, to find out what inspires her in fintech today

Ratio, a fintech that combines payments, predictive pricing, financing and a quote-to-cash process into one platform, has raised $411mn across venture funding and a credit facility

Power launched a full-stack credit card issuance platform and has raised $316.1mn after a $300mn credit facility and $16.1mn in seed funding

PayPal’s market capitalisation is currently sitting at $101.37bn, down from a peak of more than $360bn in July 2021

Block, the recently re-branded Square, owned by Jack Dorsey, posted a net loss of $208mn, or 36c a share

5G technology is revolutionising the financial services space through its super-fast, low latency and real-time delivery applications. The global rollout is well underway - we track the technology’s history

1G IS BORN Japan was the first country in the world to launch 1G wireless technology - an innovation that was to lead to connectivity so advanced that it would literally change the world

By the mid 80s, the Nippon Telegraph and telephone network had rolled out 1G countrywide. The world was taking notes, and the US had also launched its own 1G network using the Motorola DynaTAC mobile phone

-

Today, 5G is available across Europe, APAC, the US and beyond. In May 2022, an Ofcom report also estimated with “high to very high confidence” that 5G reached around half of all outdoor premises in the UK. The service promises to fundamentally transform data collection and delivery on a global scale

3G introduced the concept of wireless connections. Japan was the first country to sign up, with services available from October 2001. 3G users were introduced to the joys of location-based services, mobile TV, video conferencing and videos on demand

A decade on, 4G brought faster download and upload speeds, provided the innovation for video streaming platforms within the home and on the go (in anticipation, Netflix launched its first mobile responsive app in 2011)

South Korea, as the birthplace of Samsung, experimented with the very first 5G towers and receivers, rolling it out across its major towns and cities

Although the technology had been in the pipeline for some time, Google announced in 2016 that it was developing a 5G network called SkyBender. In December 2016, a 5G emulator was opened in Basingstoke, UK to enable local businesses to access 5G as an experimental pilot scheme

Estonian-born Kristo Käärmann is the dynamic CEO and Co-founder of Wise (formerly Transferwise) - a fintech that has completely disrupted the peer-to-peer money transfer space.

But despite heading up all the major industry leadership lists, this savvy businessman did not get a golden foothold in the industry as a result of his background.

Rather, he describes himself as a typical ‘Soviet kid’, who grew up under the shadow of the former Soviet Union’s draconian and backward-thinking business environment.

Describing that experience, he has told interviewers: “For the first 10 years, I was growing up like all the Soviet kids did at the time. It wasn’t until 1991 when the country became independent again that it went to a pretty incredible growth story from nothing to then becoming part of the European Union, joined NATO, and now, generally, is doing pretty well.”

But despite the lack of technology influencing those early years, Käärmann soon caught up, and in the early 90s, had his first taste of personal computing. His first computer was a ZX Spectrum, which then graduated to a Commodore 2001 - a 1970s model on which Käärmann wrote his first piece of code.

Once bitten by the technology bug, there was no turning back, and by the time Käärmann was 19, he’d launched his first business. It was an online investment tracking portal called Investor.ee.

Though Investor.ee was never profitable, it was nevertheless a popular product, and a few years later, Käärmann sold it for an undisclosed amount.

By now, technology and mathematics were what interested him most, and in 2002, be gained a BSc, followed by an MSc in Mathematics and Computer Science from Tartu University.

He then applied for a number of jobs - and was accepted by PwC, where his role was to assist banks in Estonia as well as

Kristo Käärmann is the Co-founder and CEO of Wise – a leading peer-to-peer international money transfer fintech based in London

Telcos to get a better grasp on their data. It was an eye opening experience because Estonia’s new commerce community was still in its infancy because just 15 years had passed since the birth of democracy and western-style commerce in the region.

Käärmann saw that legacy systems were not a problem to be dealt with, because Estonian companies were simply not old enough to have them. He said of the experience: “If you look at what consultants usually do in the old world, in Europe or in the US, they usually go to really old companies and help them deal with legacy and help them with change, either new processes or better ways to run the company. Back in the day in Estonia, all the companies were very young.” This experience saw him concentrate on innovation and organisation of data, rather than upgrades, deepening his interest in the space.

By 2007, Käärmann had joined Deloitte as a manager. It was here that he honed his skills in implementations and delivering systems, actuarial modelling, tools and data environments for customer finance, actuarial departments, and risk. He also supervised Deloitte’s technology strategy to support customers with management information and systems architecture challenges as a reaction to Solvency II regulatory requirements.

It was this experience that put Käärmann in the path of insurers and western banks. He realised their systems were archaic and gave poor value to customers. The epiphany saw him form a business partnership with Taavet Hinrikus, who was, at that time,

Skype’s director of strategy. The pair decided to create a new system geared towards cross-border money transfers.

TransferWise was launched in London in 2010 and swiftly established offices in Tallinn, New York and Singapore. The business took off - with much demand generated from migrant Estonians working in the UK and sending money back to their families abroad.

“If you look at what consultants usually do in the old world, in Europe or in the US, they usually go to really old companies and help them deal with legacy”

By 2017, the business had skyrocketed - and TransferWise launched a new service called the Borderless account, which opened up their services to freelancers and businesses, and essentially provided customers with a borderless account that could operate using multiple currencies - and still save customers substantial fees in comparison to offerings from traditional banks.

By 2021, TransferWise rebranded and became known simply as Wise. To date, the fintech has seen 12 investment funding rounds and has raised US$1.3bn in capital to develop and scale its operations. The company’s most recent valuation saw it hit US$11bn.

Käärmann continues to be a keen technologist in his spare time, and recently, during the pandemic, saw his 1,000-strong staff hold an open tech school in the Estonian language for children being homeschooled.

“For the first 10 years, I was growing up like all the Soviet kids did at the time”

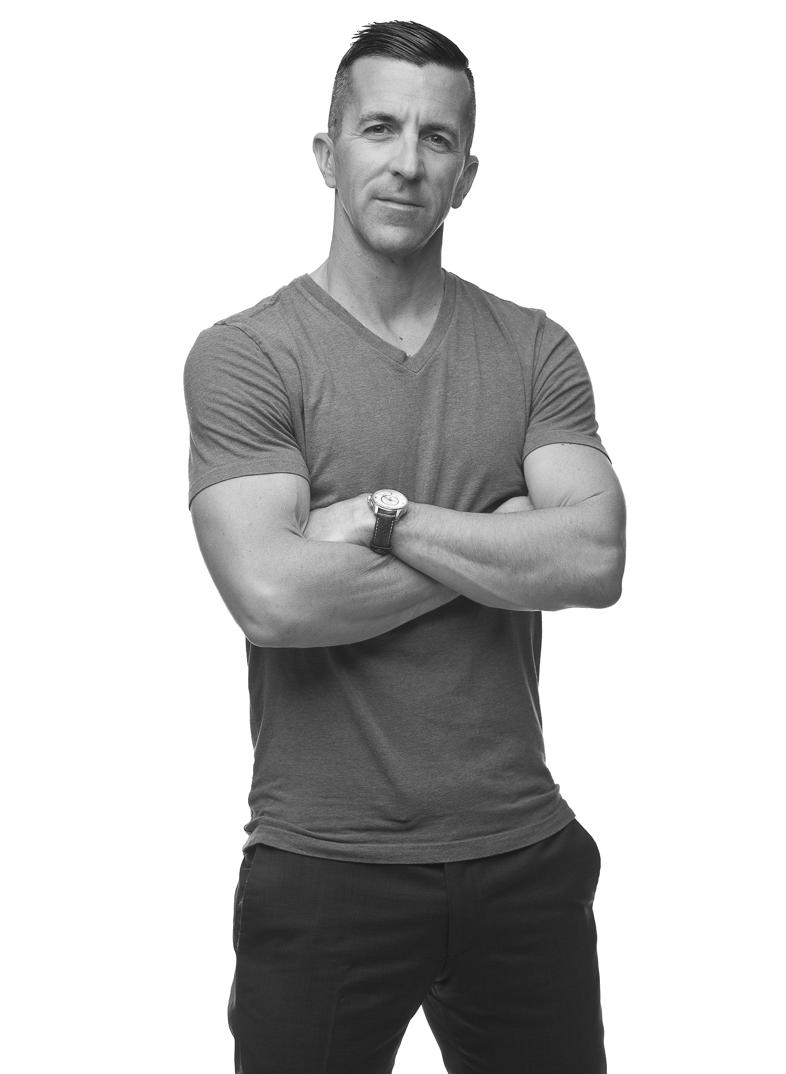

The co-founder of brand consultancy Rival and ex-CMO at 11:FS talks inspiration, differentiation, and the grind of starting a business.

» It’s been a long and winding road. I fell into marketing; I never had an ambition to be a marketer and, in many ways, I still don’t! I originally worked in the nonprofit world with HIV/AIDS programmes in Latin America. New York City was my home at the time, and I ended up meeting the CEO of Forbes.com – back when it was a separate business from the magazine. He was looking for someone to “figure out this social media thing”, and I decided to give it a shot. It was the start of Web 2.0 in New York, and I met some of the people building the early days of social media, digital marketing and adtech, including a guy named Gary Vaynerchuk, who was starting an advertising agency. I worked in digital ad agencies for 10 years, then spent two-and-a-half years as the CMO of 11:FS until co-founding Rival late last year.

» Weirdly, I don’t think I had one. I had people I looked up to, of course, including my mom, but I wouldn’t say I had a hero. That’s not to say I had it all figured out (and I definitely still don’t) – it’s more that I take inspiration and motivation in smaller doses from many people rather than a big dose from one big hero.

» “Always try to bring 51% of the value”. This piece of advice is the one that’s had the most profound impact on almost every aspect of my life. ‘Bring 51%’ means that you are always trying to add more value than you’re receiving. If it’s a conversation, you’re trying to listen and respond in a helpful way. If it's a relationship, you’re trying to find ways to empathise and help someone out. If it’s a client or business opportunity, you are trying to understand their needs and try to help them solve them, whether you get the credit or not.

» Just how much opportunity there is. When I jumped into the deep-end of fintech by joining 11:FS three years ago, it blew my mind how many smart people were working on big ideas. Financial services are the lifeblood of our world in many ways, yet so much of it is outdated and broken. Even now, 20 years into fintech, we’re still just scratching the surface. There is so much of this industry where more value can be delivered faster and cheaper, which is what innovation is all about. For those of us on the inside, it might feel like the white space is filling up, but all you need to do is look around you at the inefficiencies that still exist and you realise how much opportunity there is.

» There’s no balance. Brands should be doing the minimum they think is needed to conform. The rest – the vast majority of time, budget and focus – should be put on doing something different. Of course, I’m exaggerating slightly to make a point. You can’t just design something completely foreign and expect people to accept it. Make sure you understand and are anchored in some kind of acceptable norm. But the biggest risk by far for most brands is not being rejected, but being ignored entirely. The market is so crowded. There is so much noise being pumped out at the modern consumer. Lack of differentiation is a much bigger risk to your business than being rejected for not conforming to design norms.

“

» Wise. As an expat, I’ve been a Wise user for years for FX between the US and UK, but we also use Wise as our business account at Rival.

» Grateful. Hungry. WIP.

» Starting Rival! I’ve always worked in startups, but this is the first that I’ve co-founded. And, man, it’s hard! I don’t think we talk enough about how hard entrepreneurship is – particularly being a founder or co-founder. We love to talk about the wins and headlines, but 99% of being an entrepreneur is about grinding, stressing, failing, learning – things that don’t get likes on Instagram and LinkedIn. We need to have a more balanced, honest conversation about it, because I believe a lot of people think they’re not good at what they do or they’re doing it wrong because all they see are people making it look easy. It’s not! And it’s a feature, not a bug, of trying to start your own company.

» I read a lot – about a book a week. The last book I read was A Gentleman in Moscow. My wife is trying to get me to read more fiction, so I promised I’d give it a shot. But the last ‘best book’ I read was The Changing World Order by Ray Dalio.

Accelerate growth and create wholistic business value with pioneering technology-fuelled digital solutions tailored to the realities of your enterprise and the financial services industry. Inspire customer loyalty and success.

Gautam Samanta, Coforge EVP and Global Head of Banking and Financial Services, stresses that digital transformation is all about delivering value.

Coforge is a global digital services and solutions provider, and helps its clients embrace emerging and new technologies to achieve real-world business impact.

The company’s proprietary platforms power critical business processes across a select number of sectors, and it has a presence in 21 countries, with 25 delivery centres across nine nations.

One of the sectors in which Coforge is a key player is banking and financial services (BFS), where it is helping its BFS clients on the digital transformation journey by making the road as straight and smooth as possible.

“Digital transformation is an evolutionary process, not a revolutionary one,” says Samanta. “So we do not see it as disruptive.”

He adds that having a clear vision of what digital transformation is - and isn’t - is what shapes the solutions that help Coforge’s clients achieve their goals.

“For us, digital transformation is not just a marketing phrase to wrap around software services. It is not about the technology.

It is about delivering business value for stakeholders, including shareholders, customers and employees.”

Samanta adds that Coforge’s approach is effective because its solutions also “absorb the realities of our customers’ enterprises” - the reality being that “the old and the new often coexist in business processes that can sometimes be decades old”.

“One of the things that differentiates us is that we are pragmatic in our approach to helping clients,” Samanta adds. “Yes, we transform with the new, but not at the expense of the old, which often has value.”

It helps, too, that Coforge has a deep understanding of what value looks like in BFS, because the company has chosen to focus its attention on this sector, as well as a small number of other verticals.

“We focus on very select industries, and have a deep understanding of the underlying processes of those industries, which provide us with a distinct perspective,” says Samanta.

Learn more ›

PRODUCED BY: JOE PALLISER WRITTEN BY: GEORGE HOPKIN

PRODUCED BY: JOE PALLISER WRITTEN BY: GEORGE HOPKIN

Anew bank arrived in the Philippines this year. But don’t expect to see brick-andmortar branches appear on the streets of Manila, because the new brand, GoTyme Bank, has a unique approach for a new kind of consumer.

Instead of opening the doors of physical branches, GoTyme Bank’s launch was marked by the appearance of special digital kiosks that will be deployed throughout the retail ecosystem of the Gokongwei Group. From supermarkets, department stores and even convenience stores, this approach will help Filipinos make the move to mobile banking and financial services offered by the new venture.

A partnership between the Gokongwei Group and Singapore-based digital banking group Tyme – which operates across Asia and South Africa – GoTyme Bank is to be led by Nate Clarke, President and CEO, and one of the founding members of the Tyme Group.

Prior to joining the business in 2012 to start its first operations in South Africa, Clarke worked in senior management consulting roles with high-profile names including Deloitte.

Together, President and CEO Nate Clarke along with co-CEO and Chief Commercial Officer Albert Tinio explain how GoTyme Bank is bringing digital banking to the Philippines

LOCATION: PHILIPPINES

Nate Clarke is a founding member of Singapore-based digital banking group Tyme where he dedicated the last ten years to designing, building, and operating digital banks in emerging markets. Now, Nate is looking to make high quality banking accessible to all Filipinos as President and CEO of GoTyme Bank, a joint venture between the Gokongwei group and Tyme.

Nate’s experience spans general management, product, and strategy to include leading the rollout of Tyme’s digital proposition in Indonesia, growing the MTN Mobile Money in South Africa to a customer base of 4 million, and most recently heading product and strategy for Tyme in the creation of Africa’s fastest growing bank.

Before Tyme, Nate spent six years in Deloitte Consulting US’s Strategy & Operations practice where he fostered a passion for financial inclusion while on a project in Tanzania. Nate holds a BA in Political Science with a minor in Economics from James Madison University.

LOCATION: PHILIPPINES

Albert has several years' experience in the fields of fintech, banking, telecommunications, and logistics. He started his career in logistics having worked for American President Lines and Federal Express. He broadened his knowledge and experience by then moving into telecommunications with two major Philippine telco players, Globe Telecom and Smart Communications. While at Globe, Albert earned Globe’s Leadership Award for significant gains made in growing and expanding broadband services nationwide. He transitioned from telco to fintech after being chosen to lead GCash as President and CEO. During this period, Albert became the founding president of the Philippine E-Money Association.

Immediately prior to joining GoTyme, he was SVP, Digital Payments and Agency Banking for Robinsons Bank. Albert has a Bachelor of Science degree in Hotel and Restaurant Administration from the University of the Philippines and completed the Oxford FinTech Program of the University of Oxford Saïd Business School. He is also a certified coach from the International Coaching Federation.

Clarke says he was compelled to join the fintech industry when he found himself ready for new career and life challenges. “I was at a conference in Washington, DC, where I was based more than 10 years ago, and saw a presentation about a very successful digital wallet in Kenya,” says Clarke. “I heard about this phenomenon in East Africa where digital wallets and digital banking were transforming a country. And I said, ‘This is what I want to do with my life’.”

Before the pandemic, Filipinos had already become used to the convenience of conducting business and social tasks on mobile phones, explains Albert Tinio, co-CEO, and Chief Commercial Officer at GoTyme Bank, who also points out that Filipinos make up the largest percentage of Facebook users in 2022.

“ Our kiosks are capable of capturing personal data and identification documents, including biometrics, fingerprints, and other key data”

NATE CLARKE PRESIDENT AND CEO, GOTYME BANK AND CO-FOUNDER OF TYME GROUP, GOTYME BANK CORPORATION

“After they became comfortable with mobile phones, they started looking for things that are more practical, more every day and meaningful,” says Tinio. “And from there, they saw more financial services being offered. At the same time, banks and regulators in the Philippines now have a mandate to increase financial inclusion, so those two elements are driving the industry right now.”

When the new GoTyme Bank brand went live in October it immediately appealed to consumers with an awareness of, and appetite for, world-class banking products, according to Clarke. “This will start with payments and savings, but there will be a

move to investments and credit. The second phase that follows is actually more about serving all Filipinos, including those outside the cities.

“The main reason people are going to join the first phase is for the customer service and experience, as this is quite different from what we call the ‘traditional digital banks’,” says Clarke. “GoTyme Bank is a twist on digital banks, through a combination of a human and digital touch.”

The Gokongwei Group represents one of the largest and most diversified collections of

ALBERT TINIO CO-CEO, CO-FOUNDER AND CHIEF COMMERCIAL OFFICER, GOTYME BANK CORPORATION

“

It's very different recruiting people for something you're building from scratch, compared to recruiting for something that is already running”

Filipino companies. The group is composed of JG Summit Holdings Inc., which has business interests in food manufacturing, air transport, real estate and property development, banking, and petrochemicals; Robinsons Retail Holdings Inc.(RRHI), which includes supermarket, department store, and speciality retail brand operations; the Summit Media Group; and other privately held companies.

Working from headquarters in Singapore as well as offices in Hong Kong and Vietnam, Tyme designs, builds, and commercialises digital banks for the mass market, with particular expertise in serving underserved and underbanked populations.

The new GoTyme Bank venture combines the trusted Gokongwei Group brand, along with its reputation and multi-industry operations, with Tyme’s globally proven digital banking technology and hands-on experience to add an exciting new player to the Philippines’ banking community.

GoTyme Bank will leverage the Gokongwei Group’s extensive ecosystem, which is highly integrated into the daily lives of Filipinos – where they already shop, eat and spend family time. This distribution strategy will assist in the democratisation of financial services, addressing the needs of all Filipinos regardless of age, income, or geography.

The kiosks are to be deployed in Robinsons Retails’ network across the country. New customers will have the opportunity to meet with human bank ambassadors who will handle the entire onboarding process there and then.

“Our kiosks are capable of capturing personal data and identification documents, including biometrics, fingerprints, and other data,” explains Clarke. “It can then print and release a debit card there in the store – and this entire process happens in five minutes or less.”

Another example of the GoTyme Bank human touch includes the opportunity for customers to call, chat or email the company 24 hours a day, seven days a week. Customers can also benefit from the new digital bank’s unique rewards programme that turns ‘points into pesos’, which can instantly be credited to an account.

GoTyme Bank will provide secure and easy onboarding through both an app and digital kiosks that are conveniently located throughout the mall and retail footprint of the Gokongwei Group.

“In South Africa, 3 million of our 3.5 million customers joined TymeBank through our digital kiosks deployed in retail environments,” explains Clarke. “We believe the combination of this technology and the Gokongwei Group’s nationwide retail footprint provides GoTyme a clear path to rapid growth.”

As well as utilising the existing partner ecosystems of Gokongwei Group and Tyme, GoTyme Bank is creating its own ecosystem of partners and service providers.

“

We come from a wide range of industries, and I think that what brought us together is a genuine desire to build something – to build and leave a legacy”

NATE CLARKE PRESIDENT AND CEO, GOTYME BANK AND CO-FOUNDER OF TYME GROUP, GOTYME BANK CORPORATION

These include Daon, the Digital Identity Trust company that helps businesses mitigate fraud, reduce friction, ensure regulatory compliance, and deliver a seamless customer experience. Daon enables clients to easily and accurately proof, verify, authenticate and secure customer identities at every trust point across the entire customer lifecycle. With industry-leading biometric authentication technologies at its core, Daon’s technology ensures customer identities are accurately verified, easily asserted and safely recovered.

Also working with GoTyme Bank is GDS Link and WSO2, the former being a global leader in credit data and analytics, combining powerful artificial intelligence technology with credit and fraud risk management software and data. WSO2, meanwhile, provides GoTyme Bank with API management, integration, and customer identity and access management (CIAM) services playing a key role in enabling the bank to deliver its multichannel offering and seamless customer experience across those channels.

“As we grew from a startup, using WSO2 frameworks allowed us to focus more on building new customer experiences and less on integration and digital identity challenges. This is certainly something that could benefit many companies,” says GoTyme Bank CTO Chris Bennett.

WSO2 handles more than 60 trillion transactions and manages over a billion identities each year through its services, provided by over 900 employees worldwide working from offices in Australia, Brazil, Germany, India, Sri Lanka, the UAE, the UK, and the US.

“Both WSO2 and GoTyme Bank want our teams to focus on what they are best at,” says Bennett. “We share this in our cultures. Over time, we’ve moved to use more of WSO2’s managed services so we can each concentrate on our best work for clients.”

People powering the process of financial inclusion in the Philippines GoTyme Bank will employ 362 bank ambassadors at 226 kiosk locations by year-end. Both Clarke and Tinio say that the eclectic mix of professionals will play a crucial role in bringing new financial services to an increasingly sophisticated customer base in the Philippines.

“We come from a wide range of industries, and I think what brought us together is a genuine desire to build something – to build and leave a legacy,” says Tinio. “We come from banking, and there are also fintech people, there are FMCG people, there are telco people, there are logistics people, and all of these people are freely, organically sharing their experience and contributing to building a new service.”

Clarke agrees with this, emphasising that the new team is having fun working on the

venture – and this has a lot to do with the approach taken to recruit the new team.

“We were quite deliberate regarding recruitment,” says Clarke. “Because it's very different recruiting people for something you're building from scratch compared to recruiting for something that is already running.

“We wanted to build a diverse group, as Abet has said, but on top of that, we wanted to attract people with a few scars and some unfinished business,” explains Clarke with a smile. “We’re looking for people who have had success in our careers, but who have also had some near big misses where we felt

like we didn't quite make it, but know now that we can do it better.”

This approach has led to a shared belief within the new team, emerging from the combination of rock-solid experience and “scar tissue” from previous projects.

“We want people who are used to being in the trenches, doing the hands-on work, but we believe that personal growth and stretching yourself is good for the culture and good for motivation,” says Clarke.

“ The main reason people are going to join the first phase is the customer service, which is quite different from traditional digital banks”

ALBERT TINIO CO-CEO, CO-FOUNDER AND CHIEF COMMERCIAL OFFICER, GOTYME BANK CORPORATION

The world of cryptocurrency seems more volatile than ever before. But what new trends are emerging from the fray?

WRITTEN BY: JOANNA ENGLANDCrypto investing was once the forte of experimental risk-takers seeking a wild west approach to fortune hunting. As the space evolved, it has garnered increasing interest from established investors and incumbents. Though a lack of regulation within the industry is still a factor in preventing its complete transition to the mainstream, progress is being made.

The process has been hampered by several crypto winters over the past few months that have seen the value of investments crash and armchair investors wringing their hands. But now is not the time to turn our backs on the heady crypto space, as new developments and trends look set to stabilise and energise digital currencies.

Today, more hobby investors than ever before are dipping their toes into the crypto space through well-established crypto exchanges that offer advice and navigation through the tricky DeFi landscape.

Data shows there are as many as 20,268 digital currencies in existence, though currently, less than 500 of them are considered tradeable via an exchange. Crypto exchanges only trade certain types of crypto, but the spectrum is widening, which opens up a more diverse market for investors.

Sunrise strives to provide innovative solutions that empower financial wellness and advance financial equity. We partner with mission-minded fintechs that want to create positive change.

The biggest names in crypto exchange usually provide the most choice. For example, Kraken and Coinbase are known for their wide spectrum of coin trades, with Coinbase currently trading over 450 different cryptocurrencies, while Kraken will trade 160. Robinhood, meanwhile, focuses on the few, prominent currencies, but does offer commission-free trading on some coins.

According to Tom Crosland, CEO of CoinZoom – the crypto-to-cash conversion fintech – regulation will be the mainstream driving force. “Some in the crypto space virulently oppose regulation, arguing that it would hinder innovation and contradict the very decentralised foundations upon which cryptocurrencies were built. In this scenario, financial task-forces would take a hands-off approach, leaving the industry to self-regulate.”

Crosland argues that the implementation of a clear and well-developed set of

regulations will be critical for integrating cryptocurrencies into the global financial system. “For the industry to continue to grow and become mainstream, customers must have trust in the infrastructure and framework underpinning it – and it starts with regulation.”

He points out that trust cannot be founded in an environment that “permits bad actors to roam freely”. Indeed, the UK’s Financial Conduct Authority (FCA) recently reported a 100% increase in alleged crypto-related scams in 2021 compared to 2020. The cost of cryptocurrency fraud also amounts to US$19.2bn worldwide.

Such eye-opening data, he believes, is a clear driver for change. “Clear accounting rules are critical to achieving this, not only helping companies shape their crypto strategies, but also providing them with the tools they need to make crypto a safe and orderly marketplace for investors.”

More and more insurance providers are recognising the need to provide protection options when it comes to digital assets.

Breach Insurance is an insurtech startup that provides insurance technology and

regulated insurance products for the crypto market. The company’s Crypto Shield product is available for more than 20 cryptocurrencies and for consumers using Binance US, Coinbase, CoinList, and Gemini. It is also backed by a premier insurance carrier and reinsured by a global crypto insurance industry leader.

Co-founder Eyhab Aejaz explains: “We don't opine on whether crypto is a security, a currency, something more like gold, or whether it's property. Our position is that it's a thing that people choose to buy and own. It's not illegal because governments tax you on it. Last time I checked, they don't tax you on drugs or something more illicit. So, it's undefined, but it's something that people have an appreciation for – so much so that they choose to put part of their wealth into it.”

There are still lots of countries globally that don’t tolerate the use of cryptocurrency. But this is slowly changing. For example, according to the Thomson Reuters Cryptos Report Compendium of 2022 , crypto is now far more widely

accepted globally than it once was. Only a smattering of nations remain closed to it. For example, the Bolivian government banned cryptocurrencies in 2014, believing it would instigate economic instability and tax evasion. “It is illegal to use any kind of currency that is not issued and controlled by a government or an authorised entity,” Bolivia’s central bank (BCB) said.

MANISH PATNI LEAD PRODUCT MANAGER EUROPE, FINACLE

But El Salvador adopted Bitcoin as legal tender in 2021, Brazil has embraced the digital currency market in response to fiat currency instability, and, in December 2022, a new cryptocurrency law was introduced in Peru, which will define crypto assets and regulate crypto transactions. Called the ‘Cryptoasset Marketing Framework’, the law is, according to the report, “seen as a first step to establish regulatory clarity for virtual asset service providers and others involved in blockchain and cryptography”.

The metaverse is the perfect home for crypto Meanwhile, in the Western Hemisphere, digital currency is here to stay and is forging new innovations in gamification, online retail and through opportunities in the metaverse.

As Manish Patni, Lead Product Manager of Europe for Finacle, points out: “A recent report by JP Morgan has estimated the market and business opportunities for companies in the metaverse at over US$1tn in annual revenues, while the Zion Market Research study claimed that the metaverse market is expected to grow at 39.5% CAGR to touch $400.5bn by 2028.”

He says that digital platforms and tech giants are preparing for the metaverse, which it is predicted will have an economy worth $13tn and five billion users by 2030.

With so much transition taking place, cryptocurrency adoption globally will continue to increase. “Banks and fintechs have the potential to lead, as the world has shifted to digital interactions and the adoption of digital fintech solutions due to the pandemic and subsequent lockdowns. The trend is likely to continue in the metaverse, where fintechs will drive most financial transactions.”

TOM CROSLAND CEO, COINZOOM PRODUCED BY: MICHAEL BANYARD WRITTEN BY: ALEX CLERE

PRODUCED BY: MICHAEL BANYARD WRITTEN BY: ALEX CLERE

When Mark Foulsham joined Kensington Mortgages nearly three-and-a-half years ago, it wasn’t just a new employer – it was a completely new industry. Although he has nearly 20 years of experience in financial services, he had not worked directly in the mortgage sector before, but says the appeal was there from the very beginning. “As an outsider, I thought it was a great opportunity to come in and work with an organisation that was pioneering innovation in the industry,” he recalls.

Foulsham has a superb track record of over 25 years of driving digital transformation within senior operations, IT and project delivery roles primarily within financial services. He spent 12 years as CIO at insurance provider Esure Group, including Gocompare, where his remit was broadly similar to his current position, and enjoyed a nearly three-year tenure as Chief Digital Officer for the disability charity Scope. In parallel with that role, he also worked with fintechs on their digital transformation journeys. The cross-fertilisation between sectors provides valuable opportunities for challenge and innovation, he says.

“I've worked across a broad range of industries and that's intentional,” he explains. “I think a variety in your career adds a lot of value for comparing opportunities and looking at how things are done differently.

At the heart of Kensington Mortgages' digital transformation strategy is the customer – in particular, understanding their unique circumstances and needs

“Sometimes automation is seen as a panacea. We see it as one of a number of solutions, not a silver bullet”

MARK FOULSHAM CHIEF OPERATING OFFICER, KENSINGTON MORTGAGES

Example of an image caption

Example of an image caption

So, my background is quite varied – but deliberately so.”

At Kensington Mortgages, he oversees a full spectrum of operational, digital, data and technology-related functions that make up about two-thirds of the organisation’s headcount and budget. It’s a sizeable undertaking that also includes partnerships and business change – but a role that actually didn’t exist until Foulsham took it up in June 2019. He wasn’t the only new face in the business, either. When Foulsham joined, Chief Executive Mark Arnold was little more than a year into the job. Together with the wider executive team, they have “turbocharged” Kensington’s strategy, reinforcing its position as the UK’s leading specialist provider of mortgages that operates where big-bank lenders struggle to reach.

“The company has been going for 27 years but we’ve changed quite a

lot over that period,” Foulsham says. “We are essentially providing mortgages for people who don't necessarily have the right fit of products provided to them by high-street lenders.

“We are actively pioneering in our approach within an industry that continues to be ripe for transformation and disruption; society and customers’ needs continue to evolve to demand more tailored solutions and we are constantly adapting to meet this growing demand. We've led a number of firsttime initiatives, including a real focus on ESG – Kensington were the first to complete a green bond securitisation in the UK mortgage market, for instance.

At the heart of Kensington’s strategy of specialism is tailoring

products to their customers’ individual circumstances. The company prides itself on offering mortgages for those on variable incomes, like sole traders or the selfemployed, who have specific lending needs. In particular, it offers a ‘Flexi Fixed For Term mortgage’ that provides certainty of rates to customers in an increasing interest rate environment.

Kensington understands that mortgages are not the sort of product that fit everybody equally. Instead of a one-size-fits-all approach, it invests a great deal of time, analysis and engagement to understand its customers. It’s something that requires empathy – but thankfully, Foulsham can rely on his three adult children, who are of an age to be taking their first steps onto the property ladder. “They provide a great source for challenging my thinking about a generation that’s our future customer base,” he says.

“The large banks are not as nuanced when it comes to connecting the needs of customers with the services and products that they provide,” Foulsham continues. “At Kensington, we have a ‘head-and-heart lending’ mentality, where we use data to provide insight and information but we still make sure that customers’ payment arrangements are at the right level of affordability, or that the right products are tailored for customers. It’s

LOCATION: UNITED KINGDOM

Mark has more than 30 years’ experience in driving transformative change and digital innovation within various sectors, most recently Financial Services. He has primarily worked with Fintechs, start-ups and digitally led organisations, in particular those aiming to pioneer market-leading initiatives. He joined Kensington in 2019 taking on the role of Chief Operation Officer, responsible for Lending Operations, Servicing, Technology, Change and Procurement. His prior roles have included leading similar functions for esure, GoCompare, Macquarie Bank and Bouygues. Mark sits on advisory Boards for Winmark and CIONET, has authored books on data protection and has been a Non-Executive Director for cloud-solutions business, Cobweb.

not just about whether the computer says yes or no. It's about really understanding the background and the circumstances of those customers.

“I think if you overplay technology and digital too much in your strategy, you can end up being perceived as a faceless organisation. By combining both tech and the human touch, we try to be highly informed, apply strong diligence and deliver market-leading customer service and solutions. You can only

do that by having a real blend of expertise in an organisation. Over the last three years, we've grown significantly year on year. Clearly within that time, we've also had the pandemic to navigate. Despite the challenges COVID19 brought, it really allowed us to focus on customers’ needs (such as managing payment holidays) and how our colleagues work (replatforming our infrastructure) – and very much acted as a catalyst to what we were doing.

“We essentially provide mortgages for people who don't necessarily have the right fit of products provided to them by high-street lenders”

MARK FOULSHAM CHIEF OPERATING OFFICER, KENSINGTON MORTGAGES

Many businesses and organisations are going through a period of digital transforma tion. Supporting such initiatives is Sopra Banking Software (SBS), which is working with Kensington Mortgages (KMC) to digitally overhaul its services.

“SBS is a global software and services or ganisation,” explains Richard Broadbent, Managing Director.

“We cover everything from origination pro ducts to the operation and maintenance of those, as well as savings, lending and transactional banking. From a customer perspective, we again support a very bro ad range of organisations, including high -street banks, specialist lenders, and buil ding societies.”

SBS’s rich variety of solutions mean it’s able to support organisations throughout the journey of onboarding customers to the closure of accounts or collection of funds.

“KMC specialise in certain segments of the mortgage market in the UK; the software and services that we provide effectively un derpin their business operations right the way through the full engagement cycle that they have with their customers.

When SBS started working in partnership with KMC, the process followed two core strands: digital product innovation and customer experience. “On the digital side, we’ve helped KMC automate the origina

tion of mortgage products, as well as fo cusing quite heavily with them on how to integrate other third parties into that origi nation process.

“We’ve also spent quite a lot of time working with them around the optimisation of the broker journey, making sure that the service is fine-tuned to meet the very spe cific needs of the brokers that are helping originate mortgages on customers’ behalf,” Broadbent says.

In terms of core banking, SBS has also supported much of KMC’s innovation around the new products it has launched in the mortgage market. One that KMC has focused quite heavily on is its green mortgage – essential in a more socially and environmentally-aware age – which brings together financial services and so cial responsibility under a single product type.

“It’s a really exciting time for Kensing ton Mortgages at the moment, and we’re looking forward to the continuation of our partnership optimisation programme, su pporting KMC with its aspirational growth.”

MARK FOULSHAM CHIEF OPERATING OFFICER, KENSINGTON MORTGAGES

MARK FOULSHAM CHIEF OPERATING OFFICER, KENSINGTON MORTGAGES

“We are actively pioneering in our approach within an industry that continues to be ripe for transformation and disruption”

“We put a number of digital solutions in place during the pandemic that we've now continued to use, grown and scaled – but also ways of working as well, whether that comes down to automating some of our activities, greater sophistication around affordability checks or providing a new portal for customers. These are things that not only helped address the specific demands brought by the pandemic, but have now been extended to provide benefits to our customers, brokers and colleagues as we continue to develop further and grow.”

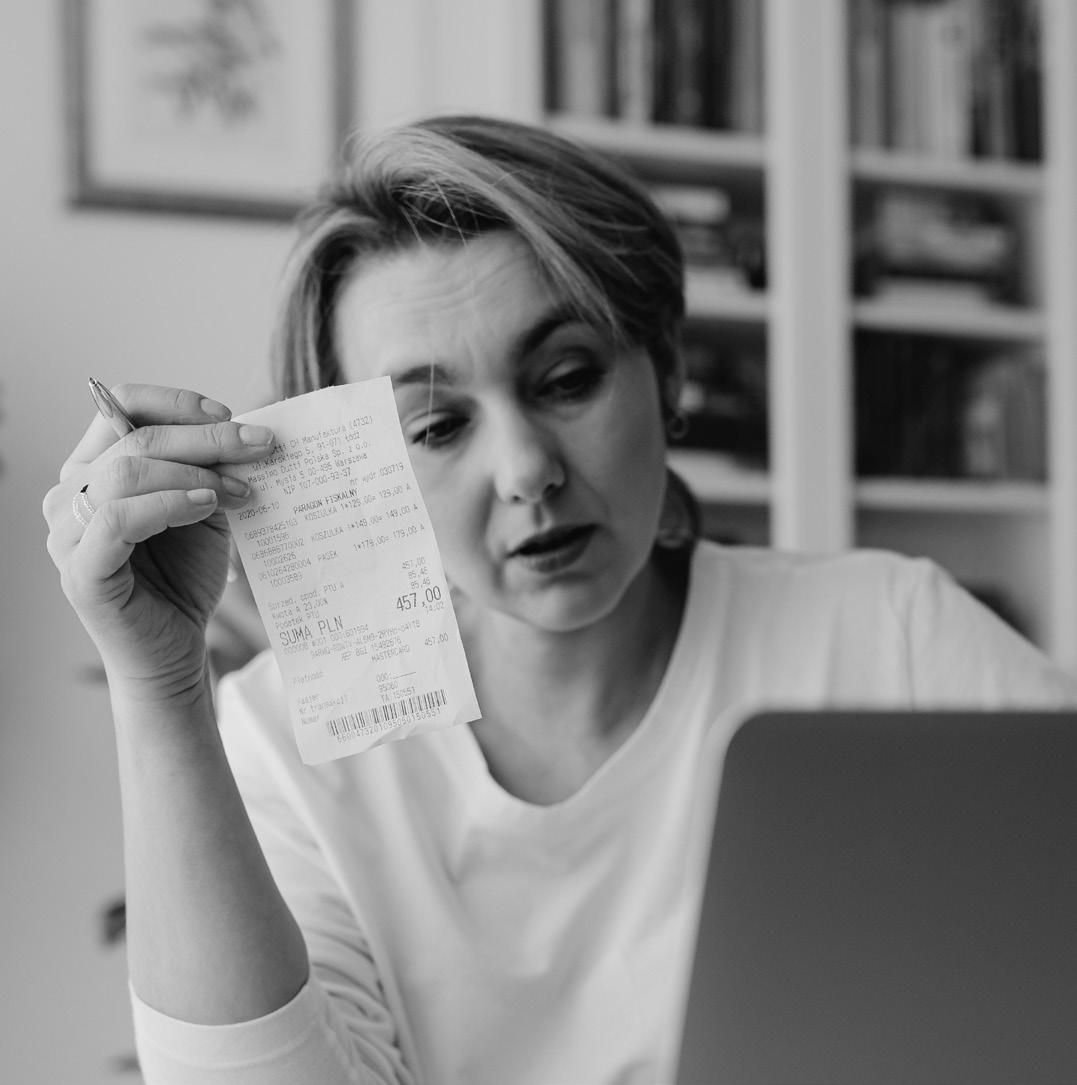

This human touch has built a tangible rapport between Kensington, its broker community and its customers. It will prove enduringly vital as the world faces up to some of its gravest economic realities: consumers are facing a cost-of-living crisis and many homeowners will struggle to pay for everything during the next few months. Foulsham points out that Kensington is well-placed and has proven adaptable in helping them respond to these looming cost pressures.

“People want to have the right service and the right product provided to them,

but they also need flexibility and optionality as well. One of the things that we've done is put in a solution that allows customers at the end of their fixed term to choose another product. And we've created that in a digital form, so that when customers move off their fixed rate, we've got clarity on how that can happen and how that can be achieved in the most affordable way for their circumstances.”

Of course, accepting customers that other lenders turn away means a careful understanding of risk is needed – something which Kensington mitigates by utilising the data and technology it has to hand. “Risk is our business,” Foulsham explains wryly. “That's what we manage. Obviously it's the

same for high-street lenders. What I would say is, rather than taking a fairly heavyhanded approach, we take a more precise and tailored approach. It's our job to really understand risk, both for our customers and how we underwrite.

“We have a model called VECTOR, which contains mortgage loan level performance data over a period of 30 years and includes 32 million data points through several macroeconomic cycles. The wealth of data allows us to deploy a broad variety of model uses. That ranges from assessing our underwriting accuracy to the effectiveness of pricing for new products.

“Individually, we look at customer circumstances, and I think it's a different type of risk management and risk assessment when customers come to us rather than larger high-street lenders. Because we have the data and the human touch, we can blend those into a better understanding of what risk means to the customer in terms of payment plans, for example, but also risk to us in terms of making sure the loan period is appropriate. In many respects, being more tailored and more personalised in our product set allows us to have greater insight not only into the customer's needs, but also the risks around that.”

Providing a tailored approach also has the potential to create extra work across all areas of business activity. Like many lenders, Kensington has turned to automation to help ease the pain points that this would usually create – but Mark Foulsham is keen to stress

that automation needs to be targeted, rather than being a cure-all that can be thrown at any problem.

“I think sometimes automation is seen as a panacea,” he says. “We see it as one of a number of solutions, not a silver bullet.”

“The first question when one deals with automation is ‘are we automating something that is inefficient that needs fixing first?’ So, is the process correct? Is it optimised? Is it effective in terms of providing the right information to customers or the right information back into the organisation? Only when we feel that the process and procedures are correct do we look to automate it to make it slicker. Particularly in areas where there’s no value-add, where you're passing information from one place to another, or when there’s a procedure that you can improve timeliness or accuracy… that's when we look to put in automation.

When you have a mortgage book that’s worth £5bn, as Kensington does, it becomes much more complex for a lender to achieve complexity at scale. New technology and new platforms become mammoth undertakings. Part of the reason that incumbent banks and lenders struggle so much with legacy technology is that, as an organisation scales, it becomes much easier for those at the top of the hierarchy to dismiss large digital transformation projects as too costly, too complex, too time-consuming and too risky.

But, of course, the success that you derive from digital transformation projects relies on the approach you take from the outset, and the partners with whom you choose to align yourself.

“I've always been very keen that you don't continue to just bolt on new things after new,”

MARK FOULSHAM CHIEF OPERATING OFFICER, KENSINGTON MORTGAGESFoulsham says. “That way, you're just building up technical debt and building up complexity.

“I'm a big believer in reusing your previous investments as well as modularisation of solutions and technology. So, trying to make sure that platforms and systems are coupled in a way that are effective in terms of data transfer and functional cohesion, but aren't too tightly bound in a monolithic sense. That means that every time you make a change, it has a ripple effect and takes a long time to deploy. I think, when we look at scalability and complexity, it comes down to making sure the solutions are as elegant as possible, as simple as possible and no more complicated than they have to be. The market is changing so quickly that if you over-engineer something, you'll find that by the time you've deployed it, the solution isn't actually fit for purpose in the way it was originally.”

Kensington has turned to Paris-based Sopra as its long-time primary technology partner. In recent times, Sopra has deployed a new frontend platform that has allowed Kensington to realise better and more agile working. For example, before that platform came in, it would

“Being more tailored and more personalised in our product set allows us to have greater insight into the customer's needs and the risks around that”

take many days if not weeks for the lender to effect a pricing change – but Kensington can now do that in minutes or hours.

“We have a very strong relationship with Sopra,” Foulsham says. “We share business strategies, we have good engagement at an executive level, and we deal with making sure that there's a good alignment between their product evolution and our business strategy. So, if we are looking to go into new segments or we're looking to release a new product, the functionality behind that and the way in which their product is going to operate is very much a conversation we have at an early stage with Sopra, so if appropriate they can build that into their core platform.

“In particular, one of the big differences from a few years ago when we were introducing these new platforms is the level of

configuration. We are able to configure over 90% of some of the changes that we've put into place, where some of our competitors using other systems have nowhere near that sort of flexibility. Again, it gives us a real advantage in the market using this type of system, a more contemporary system than others. In a dynamic market that requires a quick response to changing circumstances, such as rapidly rising interest rates, having slick and adaptable technology is a real competitive differentiator.”

It’s this steadfast determination to keep pace with change and move with their customers that underlines much of Kensington’s thinking. Data and technology have taken on renewed

importance, allowing the company to tailor products to customers’ individual needs and rapidly transform its technology stack.

“We know that customer circumstances are going to continue to change over the next 12-18 months,” Foulsham says, looking ahead to the next couple of years. “In particular, when it comes to the cost of living, we know that customers are going to want flexibility in the products and services that we provide, so it's really important that we continue to understand what those needs are and be dynamic in the choices we offer.

“As an organisation, it's really important that we continue to look at the changing picture when it comes to our customers’ needs and how we can make sure, as an organisation, we adapt to that evolving position and ultimately provide customers with the value and service that they demand.”

“Large banks are not as nuanced when it comes to connecting the needs of customers with the products they provide”

MARK FOULSHAM CHIEF OPERATING OFFICER, KENSINGTON MORTGAGES

The launch of new cryptocurrencies has created a fractious and, arguably, oversaturated marketplace for investors –more than 20,000 different tokens are currently in existence. With each new cryptocurrency, calls for the industry to face greater regulation are amplified. What’s more, with the global economic outlook looking bleaker by the day, how will new cryptocurrencies stand out and thrive?

“The market is leaning towards becoming crowded and now presents somewhat of an impossible task for investors to distinguish which cryptocurrencies are the ones to be trusted and where best to invest their money,” says Dan Da Rosa, Co-Founder and CEO of recently released cryptocurrency token ETHAX. “This constant overload of unregulated crypto leads to daily negative headlines about cryptocurrency scams, resulting in investors being put off from buying and selling crypto. Albeit small, this contributes towards the crypto market's unpredictable behaviour.

Learn what open source vulnerabilities are commonly found in financial services organizations.

“It is important that the entire community is aware enough to steer clear of adopting the stereotype that all cryptocurrencies are untrustworthy scams, as it would damage the reputation of tokens and coins that are actually legitimately safe.”

How can crypto tokens stand out in a crowded market?

ETHAX was launched in May 2022, intended to lower access barriers into cryptocurrency and make the process of investing safer and easier. With so many rival tokens on the market, Da Rosa says that new cryptocurrencies “should always aim to stand out but not at the risk of compromising your mission”. He explains that ETHAX’s differentiation is partly built on its design, brand message and its entire proposition –including introducing safety, loyalty and trust into the crypto market.

“In short, it’s very difficult to secure buy-in, particularly if you have no track record,” Da Rosa says. “Being an unknown in the cryptocurrency market presents difficulties with general market adoption.

DAN DA ROSA CEO AND CO-FOUNDER, ETHAX“You can use classic marketing methods to grow awareness, and we’re seeing a lot of cryptocurrencies leaning on digital innovation and social media growth to expand their market share. But you walk a fine line by anchoring yourself early on to a message that doesn’t represent you and can ultimately ruin your reputation.”

On top of the challenge of standing out against other currencies, new entrants also have to wrestle with a general lack of understanding from everyday investors. According to a recent survey from Cardify, one in three crypto investors say they

BEN REEVE PARTNER, OLIVER WYMAN“We would like to see a complete shift in the cryptocurrency industry that encourages companies to be licensed and self-regulated”

“Crypto illiteracy poses a challenge for on-chain growth as investors have become wary of more advanced functionalities such as staking”BEN REEVE PARTNER, OLIVER WYMAN

have little or no understanding of what they’re investing in.

Ben Reeve, a partner in Oliver Wyman’s Global Financial Services practice, says: “Emerging cryptocurrencies enhance the risk of information asymmetries across the ecosystem, which is driven by opaque and concentrated ownership structures, varying scope and quality of investor materials, and complex multi-platform market structures. Uninformed investors may lock capital into protocols that observe complex yet flawed mechanics for vesting, lockups, and overall security.

“Crypto illiteracy poses a challenge for on-chain growth as investors have become wary of more advanced functionalities such as staking, which is indicative of the depletion from DeFi totally value locked, falling from US$173bn to US$60bn since January.”

With global macroeconomic challenges, further questions will be asked about crypto’s future – particularly new and emerging

tokens.

After a slump in the crypto market, inflation has hit double figures in some countries, while economic growth in advanced economies like the US and the Eurozone is projected to slow to just 1.4% next year.

“Many people are rightfully looking inward for ways to save money and alleviate pressures, finding little comfort in a volatile market,” Dan Da Rosa says. “Naturally, fewer people are finding a reason to trust emerging currencies that they may never have heard of or know what the outcome will be. It’s a challenge, as we want to do what we can to educate people on what investing in cryptocurrency could mean for their investments on a long-term basis. But, for some, it’s just not a priority right now.

“On the flip side, for regular investors who have experience with volatile markets and the value of investing, they may be more inclined to choose a cryptocurrency that has an established overview of trends, dips and peaks to evaluate.”

“The explosive growth of cryptocurrencies has led to nations urging their financial regulators to introduce frameworks for digital assets, but approaches have varied significantly”

Oliver Wyman’s Ben Reeve believes that regulation will be the largest near-term driver for development in the digital asset landscape, but argues that the current crypto winter is unlike others that have happened before.

“Different from past crypto winters, there’s a significant amount of infrastructure that’s been built and many crypto natives have accumulated healthy funds to last through the winter and continue innovating. While there might still be a slowdown, this could also be an opportunity for traditional finance players to catch up.”

Dan Da Rosa believes the unregulated state of crypto could potentially undermine investor confidence, with just 0.01% of currency projects currently licensed and regulated. “The more unregulated cryptocurrencies that enter the crypto space, the more likely it is that we will see potential investors invest elsewhere and the market will become a more volatile space.”

He takes pride in the fact that ETHAX is among the minority of cryptocurrencies that are licensed and regulated for the services they provide, but would like to see more being done to crack down on the remaining majority. “We reduce the risk and ensure that we provide a safe platform for investors to learn on and develop their investing and cryptocurrency trading skills,” he says.

“We would like to see a complete shift in the cryptocurrency industry that encourages companies to be licensed and self-regulate. The crypto industry needs to unite on regulation, however, that proves a difficult task when so many cryptocurrencies are free to flood the industry with no or very low regulation standards.”

This is a sentiment echoed by Ben Reeve, who points to the disparate nature of regulation around the world: “The explosive growth of cryptocurrencies has led to nations urging their financial regulators to introduce frameworks for digital assets, but approaches have varied significantly on a global level, from some economies that embrace crypto technologies – such as Switzerland, Singapore and Hong Kong – to others with outright bans on crypto trading and mining activity.”

“The market presents somewhat of an impossible task for investors to distinguish which cryptocurrencies are the ones to be trusted”

DAN DA ROSA CEO AND CO-FOUNDER, ETHAX

When Dean Leavitt talks to us from his base in New York, it’s a characteristically warm and humid summer day in the city. His expansive corner office affords a view right down East 48th Street in Midtown Manhattan. These sunlit streets are lined by some of the largest and most prestigious companies in the world, with more than one in 10 S&P 500 firms based in New York and a city-wide economy that tops US$1.5tn in GDP every year.

These are the companies that Boost Payment Solutions, which Leavitt founded in 2009, are targeting: large, complex organisations wherever they are located in the world. Boost is active in 47 different regions globally and has been focused since day one on enterprise-level B2B spending, building financial tools that help companies to bridge the gap between accounts receivable (AR) and accounts payable (AP).

Leavitt, who himself is a veteran of the finance industry, started a company in 1989 that was focused on the consumer card acceptance industry before running a public company, also in the credit card processing space. He then founded Boost 13 years ago after seeing many failed attempts, by companies big and small, at pursuing B2B payments.

For the first five or six years, they were, by his own admission, an exclusively serviceled operation that drew upon third-party technology to help clients. It wasn’t until

With its bespoke approach, Boost Payment Solutions is helping large enterprises bridge the gap between accounts receivable (AR) and accounts payable (AP)

six or seven years ago that Boost Payment Solutions began to hear from customers who had specific requirements, and so Boost brought on board developers to help build bespoke software solutions internally. Today, the fintech is laser-focused on creating custom solutions that enable large enterprises to overcome whatever challenges they may face within B2B payments – and that can vary wildly from one client to the next.

Bespoke solutions tailored to each client “Historically, the credit card processing industry has been bifurcated into two worlds,” Leavitt explains. “Those that support the accounts payable side, and those that support the accounts receivable side. Even if they're under a single roof, there's anywhere between a brook and an ocean between the two. It was very important when we started Boost to serve as that bridge and uniquely join those two groups together.”

Much like the Queensboro Bridge, a stone’s throw from Boost’s offices, the traffic that traverses that bridge is diverse. Although Boost focuses on enterprises, there are still variations in terms of industry and geography. “Our buyers tend to be very large organisations,” Leavitt continues. “We have more than 50% of the Fortune 100 that either make payments through us or receive payments from us. So the entities that we work with tend to be very large.

Bridging the gap between AR and AP

“Our ears are our most powerful asset. The first thing we do with a client is always to listen”

DEAN M. LEAVITT FOUNDER & CEO, BOOST PAYMENT SOLUTIONS

“Our focus is on optimising the way in which enterprise-level businesses pay their vendors and suppliers by utilising proprietary technology and procedures that we've developed over a 14-year period.”

As such, the level of bespoke technology that is required depends on the client and the nature of their business. As an example, Boost Payment Solutions works with some of the largest telecommunications companies in the world. The industry is more account-based, rather than invoice-based, and that calls for Boost to create more bespoke solutions for telco customers.

Often, the telco and their buyer will have different account numbers stored in their ERP systems to refer to the same transaction – either a result of character limits, or sometimes just clerical error. Boost has built a bespoke bridging tool that translates both versions of the same account number so that it’s in the right format for whichever ERP it’s being sent to.

It’s not just telecommunications, though. Boost has clients spanning healthcare, freight and logistics, manufacturing, media and more. All of these companies have pain points that are unique to their industry – even unique within their industry, in some cases – as well as specific requirements for their local market.

For many of the companies that Boost works with, the challenges they face are as old as the corporate card itself. “Since the credit card industry was invented 70 years ago, there were never any specific types of solutions that served B2B transactions,” Leavitt says. “Because of that, most of the processes required to accept a commercial card product now are manual and very HR-intensive. If you're a large organisation that’s accepting

LOCATION: NEW YORK, USA

Dean M. Leavitt is a wellrespected veteran of the electronic payments industry with over 30 years of experience in leadership roles at both public and private companies.

Dean founded Boost Payment Solutions in 2009 to meet the untapped needs of the B2B payments industry with technology solutions that seamlessly serve the needs of today's commercial trading partners. Today, Boost is operating in 47 countries and is widely recognised as an industry leader in

a high velocity of these transactions, it becomes a huge burden to your accounts receivable team.

“The industry has caused a lot of that market confusion because there are so many different products and technologies that are being thrown at them, but they’re not a payments business. Their business is doing whatever their business does, so they get confused.”

As a result, Boost Payment Solutions has been dedicating a large part of its time towards educating customers about the various options available to them, helping them to separate the important things from the noise. With more payment solutions constantly coming online – both within B2B and B2C – that noise can become deafening without the right guidance.

“Our ears are our most powerful asset,” Leavitt says. The process of onboarding any new client begins by listening to their story.

In any new customer conversation, Boost Payment Solutions is trying to unearth the problems that a prospective customer is facing, as well as where they are going as a business and what problems they are likely to encounter in the future. All of those considerations affect the solution that Boost will eventually build.

“The first thing we do is listen. We listen, we ask questions, we pay attention very carefully to those answers and we dig deeper to make sure that, before we're in a position to make any recommendations, we understand what's truly going on in that organisation.”

What Boost hears in that initial conversation has the potential to set the direction for an entire customer relationship for years to come. In many ways, it’s like technological

counselling. Some of the challenges that enterprises present are unique to their business, but other problems are universal.

Of course, enterprises today have reason to transfer money across borders, whether it’s to pay a supplier or refund a customer. But incumbent payment methods present barriers and costs, including issues related to currency conversion and FX.

To solve those challenges, Boost is building hybrid solutions that rely on one payment modality for part of the payment experience but then switch to a different modality for another part. The result is a seamless experience that reduces cost and improves efficiency for the customer.

In enterprise-level B2B remittances, you often have larger payments, say in the tens of millions of dollars, that incorporate thousands of invoices and their associated details together. Considering that each invoice will have multiple line items and specific details relating to that transaction, it highlights the scale of the problem for Boost to bridge that gap between AR and AP. Leavitt says: “It's imperative that you spend as much time making sure that the remittance detail associated with each transaction is delivered to the stakeholders in a format and a delivery protocol that they can seamlessly ingest into their ERP platform.”

With each new geography comes a fresh set of obstacles, unlike anything that consumers will be familiar with from the world of B2C payments. Leavitt likens it to buying a pair of shoes. It doesn’t matter whether you walk into a store in New York, Rio de Janeiro or Sydney, the process of paying for those shoes with a credit card will be the same for the consumer wherever they are. They tap their card, walk out of the shop with some new shoes, and the merchant will be assured of the money within the next 48 hours. That’s B2C.

Yet in B2B payments, every region has dramatically different circumstances that need to be accounted for. Boost’s customer base covers a broad mix of markets – markets like Western Europe, that are less mature than the US in terms of adopting commercial card use and acceptance; then there are countries like Brazil, which have their own ways of delivering funds that lead to merchants and suppliers waiting up to 30 days for a card transaction in some cases. Other regions are entirely embryonic with respect to utilising a card product to make or receive a commercial payment.

DEAN M. LEAVITT FOUNDER & CEO, BOOST PAYMENT SOLUTIONSIn order to understand these local requirements and differences in culture, Boost Payment Solutions has ‘boots on the ground’ in many of the regions where it is active – including the US and Canada, Mexico, Brazil, Australia, the UK, France and Belgium. It’s something that Leavitt says he wouldn’t go without: “It's really important to understand those idiosyncrasies between regions, and have people locally so you can truly understand what the issues are, what the pain points are, what the friction is, and what the needs are of the businesses in that region.”

Boost focusing on acceleration and expansion Looking forward to the future, Leavitt says: “I think if you fast forward several years from now, you're going to see a very different

“We have more than 50% of the Fortune 100 that either make payments through us or receive payments from us”

landscape in terms of how companies are making payments across borders. I suspect that some of the existing payment modalities are not going to go away, but they're no longer going to be the primary ways to move money. So I think you're going to see increased efficiency, increased speed and reduced cost – because that's what the market is demanding right now – as well as reliability and more reporting capabilities.

“The way in which the data is exchanged among the parties is incredibly important, and certain rails that exist now don't have the capability to carry that data alongside the transaction. Some of the new technologies that are evolving allow you to do that, and it's a very exciting time for cross-border transactions. It's still young, it’s very early days, but it's a very exciting moment.”

One of the areas where Boost will pay particular attention is on crypto and blockchain, where it expects to be extremely active in the next couple of years. The company has an alliance with a blockchain platform, where the initial focus is on using blockchain technology to manage freight and logistics contracts and trigger payments associated therewith. When a payment is due for customers in the freight industry, the blockchain will trigger a request within Boost’s platform and Boost will process that transaction on a commercial card and report the results back to the blockchain.

As the industry realises more use-cases for blockchain, we can expect to see Boost become even more active, but Dean Leavitt warns that its involvement will be targeted and specific. “We’re doing a lot on blockchain and we’ll be doing more in future where the blockchain, itself is used to manage contracts and do all of the amazing things that technology offers. But the enterprise-level B2B community

has not yet screamed out for the ability to utilise cryptocurrency for payments. We believe there will be a very appropriate need for it, especially as it relates to cross-border transactions, but for our part the focus will be on governmentbacked cryptocurrencies rather than cryptocurrencies that are primarily an asset class for investment purposes.”

Boost Payment Solutions is currently in the process of establishing cryptocurrency acceptance capabilities across multiple partners. It expects to be accepting cryptocurrency payments by some point next year. More broadly, the business will

continue to focus on accelerating its impressive growth curve and get back to normality following the COVID-19 pandemic. Prior to 2020, Boost had been going live in a couple of new regions every quarter, and Leavitt is hopeful that they can now return to that sort of rhythm.