EMBEDDED FINANCE

How alternative payments can help checkouts become financially inclusive page 16

BANKING

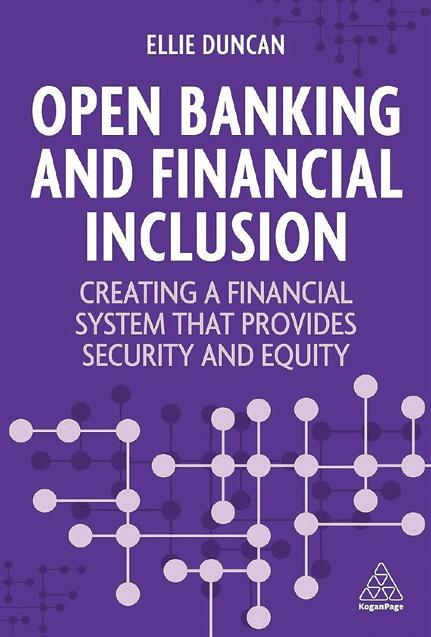

BOOK REVIEW

Open Banking and Financial Inclusion by Ellie Duncan page 22

EMBEDDED FINANCE

How alternative payments can help checkouts become financially inclusive page 16

BANKING

BOOK REVIEW

Open Banking and Financial Inclusion by Ellie Duncan page 22

How to effectively implement diversity, equity and inclusion practices in fintech

Profits vs purpose

How fintechs can remain ‘good’ while still making money page 6

power of data

Behavioural science can transform consumer habits to combat climate change, writes Emma Kisby at Cogo page 8

words, more action

Inclusivity requires effort and it is time fintechs pay attention, says YouLend‘s Jessica O’Hare page 9

Nadia Edwards-Dashti shares insights into fintech recruitment and enhancing DEI page 10

Stuart Rimmer, Open Banking Excellence on the importance of prioritising mental health page 13

More inclusive and accessible

Project Nemo’s Joanne Dewar shares 10 steps to starting your disability inclusion journey page 20

Chantal Swainston, founder of The Heard, on bringing more women in fintech and financial services into the spotlight page 21

info@matoukbassiouny.com Matouk Bassiouny comprises 33 partners and over 200 lawyers across seven jurisdictions – trained locally and internationally in common and civil law systems – fully conversant in Arabic, English, French and Korean.

Editorial

Editorial

Mark

Editor

Art

Features

Marketing

Business

AJournalists

s fintechs strive to innovate and disrupt traditional financial systems, they hold a unique position to also drive significant social impact. In this edition of The Fintech Times, we delve into two topics that are not only timely but also critical for the sustainable and ethical growth of the fintech industry: ‘fintech for good’ and ‘diversity, equity and inclusion (DEI)’.

We take a look at how DEI within fintech organisations can lead to greater innovation, better decision-making and products that cater to a wider and more diverse audience. By prioritising DEI, fintech companies can ensure that their services and opportunities are accessible to all, promoting economic empowerment and reducing financial disparities.

Fintech for good encapsulates the idea that technology can be harnessed to create positive societal change. Throughout our pages, we explore how fintech can make financial services more accessible to underserved communities and learn of fintech platforms promoting sustainable and ethical investing, directing capital towards companies that prioritise environmental, social and governance (ESG) principles. Starting with practical advice, Polly Jean Harrison in her piece ‘The Dos and Don’ts of DEI’ addresses the steps fintech companies can take to implement effective DEI practices. She outlines a guide for fintech leaders to follow, stressing the importance of assessing current DEI standings, committing across all levels, and avoiding tokenism. Meanwhile, Joanne Dewar from Project Nemo provides valuable tips for integrating

inclusion from the ground up. From conducting accessibility testing on websites to creating inclusive social media content and forming employee resource groups, her advice is grounded in useful steps that fintechs can start implementing today.

Highlighting the benefits of inclusive cultures, Jessica O’Hare at YouLend shares the fintech’s success in boosting female-led business applications through supportive policies and flexible work environments. This serves as a timely reminder to address the gender diversity gap, with women representing just 28 per cent of the fintech workforce.

informed discussions, showcasing the value of varied voices.

Addressing the pressing need for mental health awareness in fintech, Stuart Rimmer at Open Banking Excellence discusses the role of leaders in fostering mental wellbeing. There are practical strategies for companies to implement, highlighting that a focus on mental health is both a moral imperative and a driver of business success.

Exploring the intersection of technology and sustainability, Emma Kisby, CEO of Cogo EMEA, discusses how big data and behavioural science can transform consumer habits to drive sustainable consumption and combat climate change. She illustrates how Cogo uses spend-based data to reveal the carbon footprint of consumer spending, improving carbon literacy and motivating climate action.

The conversation continues with Nadia Edwards-Dashti from Harrington Starr Group, who shares insights from her nearly two-decade career in fintech recruitment and her passionate commitment to enhancing DEI. Her journey reveals the transformative impact of inclusive recruitment and effective strategies for driving diversity in the fintech sector.

Adding to the discussion, Chantal Swainston, founder of The Heard, focuses on bringing more women and non-binary individuals into the fintech spotlight. She emphasises how diverse representation at events can foster more dynamic and

Finally, Tom Bleach explores how fintechs and banks can play a critical role in addressing the climate crisis. We touch on the importance of the financial sector in driving decarbonisation efforts, the potential of carbon credits as a new currency of climate action, and the moral responsibility banks have in helping their customers understand and reduce their carbon footprints.

Despite the challenges, there’s no excuse for the industry, known for its agility and innovation, not to advance inclusivity. We hope this issue inspires you to champion inclusivity and leverage fintech for good in your own ventures! Claire Woffenden, editor in chief, The Fintech Times

a more welcoming, and inclusive fintech industry.

A very good place to start

The concept of DEI and putting it into practice within an organisation is not as easy a task as it should be. Knowing where to start can be tricky to figure out, especially if you’re struggling to find a ‘business

“The first thing for any fintech business to do when tackling DEI issues is to assess where you are. Everyone will be starting from a different place, so focus on identifying your unique gaps and opportunities first. After you’ve determined what your main priorities will be, you need to make an active commitment across the entire executive team with a plan in place that regularly measures and communicates progress and setbacks.

“When we hire, we have a crucial opportunity to represent voices that are not in the room. Working collaboratively is key to identifying candidates we might otherwise overlook. It involves taking a critical look at assessment criteria and processes to ensure they are genuinely inclusive.”

However, despite this, it’s also important not to focus too hard on gender-blind or colour-blind hiring – as much as that sounds

Diversity, equity and inclusion (DEI) have been the words on everyone’s lips lately, and 2024 feels like a year for change. Something is stirring in the fintech world, and I truly believe in the next 12 months we’re going to see some major transformation on a global scale when we think about representation.

But before that wonderful, inclusive industry can bloom, a lot of work needs to be done by its leaders and organisations to bring the DEI values up to scratch. Navigating that can be a challenge, but there is really no excuse for anyone within fintech, one of the most agile and innovative industries in the world, to not be considering how they can make things more inclusive.

So, for anyone looking for a reason to get started – this is your definitive guide on how to show up for DEI and start making real changes. Simply follow these ‘dos’ and ‘don’ts’ and you’ll be on the right path to

case’ for implementing new practices (other than it just being the right thing to).

So, where do you start when it comes to tackling DEI? Jane Reddin, partner, platform and talent at investor Albion VC suggests you need to take it back to basics.

“Understand the current composition of your team to see where the gaps and opportunities are,” she said. “Commit to DEI as a central part of your mission and consider how it maps onto your business goals and the next stage of company scaling. Critically, you must explain why it matters to your company and how your own DEI manifesto will have a positive impact on both the team and results.”

Reviewing where your organisation is as a whole when it comes to DEI is a crucial beginning step. What are you doing well, what do you need to improve? Without making these assessments you’ll be hopelessly lost in no time, as Carrie Freeman, executive lead at gender equality champion GET Cities, explains:

“Accountability is key; without it, you risk your DEI efforts being perceived as a performative exercise, which can be worse than not taking on the work in the first place.”

Another great way to start improving your organisation is to review your hiring policies to ensure they are as inclusive as possible.

Yael Malek, chief people officer at Bluevine, a digital banking platform, said: “In tackling DEI issues within our staffing, we must prioritise inclusive hiring to welcome a more diverse candidate pool. Today, it’s essential to move beyond hiring practices that can inadvertently limit opportunities for capable, underrepresented individuals. We should be challenging ourselves to think creatively and not merely hold to the existing mould, which might seem easier but ultimately stifles diversity efforts and thus decreases the potential for more creativity and innovation, stronger financial outcomes, and overall customer value.

counterintuitive. Companies should always aim for a team of diverse backgrounds and experiences for the best outcome, but ultimately they need to hire the best person for the job rather than trying to hit targets or quotas.

Jennifer Preston, senior HR consultant for Flex HR said: “I don’t believe in DEI in fintech or any industry. I believe in hiring the most qualified candidate for the job regardless of age, gender, race, religion, political affiliation, etc. Hiring to achieve a DEI target is expensive, unproductive, and affects employee morale, engagement, and the bottom line.

“Companies should focus on hiring the best candidates for the job – hands down – and coach them to be highly contributing and highly effective players in the workplace. A person’s gender, age, and race do not dictate a person’s future performance.

A person’s prior experiences, qualifications, skills, and abilities will help to dictate future contributions and performance.”

Not just a token DON’T fall into the trap of the ‘tick box exercise’. Tokenism has no place in the industry and hiring one representative from a certain background does not diversity make.

Gabby Kusz, COO of TCSblockchain and also a board member of the Association for Women in Cryptocurrency, said: “DEI should not be a ‘tick the box’ exercise – but rather a thoughtful and engaging process that begins during the design of products, services and corporate roles. For those in the fintech and digital asset industry – there are some amazing resources out there including from the Inclusive Design Institute, the Black Women in Blockchain Council, as well as the Association for Women in Cryptocurrency. One of my favourite resources is the recent State of Inclusion Report 2024 which outlines both the status as well as insights into how to advance DEI within the industry.”

Diversity in your offering Internal hiring processes are only one part of the story. Yes, fintech needs to look within and understand where they’re falling down on their own team’s diversity. However, something just as important is providing products and services that are accessible to all from every background.

Don’t forget about the consumer! The people you’re trying to attract to your business come from so many different worlds and their access to financial services products is just as important.

Suneera Madhani, founder of billion-dollar tech startup

Stax, said: “Externally, fintechs need to develop products and services with customer inclusivity in mind. This involves thorough market research to understand diverse user needs, providing accessible solutions, and addressing biases in algorithms and decision-making processes.

more women in the industry, as staff and as leaders. This is absolutely the case, however, there are so many other considerations to think about when tackling inclusion, and gender only just scratches the surface.

Those who are disabled or neurodivergent are often left behind in so many areas, especially when it comes to the workplace, and there’s no better time than now to start recognising their unique skills and talents.

“Embracing neurodiversity is crucial as it provides a tangible benefit to an organisation in the form of increased productivity and creative problem solving,” said Ed Thompson, founder and CEO of Uptimize, neurodiversity consultants that have worked with the likes of JP Morgan to create more inclusive workplaces.

“When all types of thinkers can flourish in a work environment, a company’s performance will naturally improve. But although every team is by definition neurodiverse – no two

tactics for ensuring that every type of brain can thrive.

“Most of this is helpful for everybody, and flexibility is key. Some examples include allowing for flexible scheduling or the ability to hash out a work-from-home arrangement. For instance, I spoke with a talented autistic banker whose modified work schedule allows him to avoid rush hours, which can cause sensory discomfort. The end result was he was able to do better work and avoid burnout. There is a measurable improvement when teams can embrace neurodiversity.”

There’s no question that diversity and inclusion are a complex topic that need specific actions. And now more than ever, fintech companies need to prioritise improving equality in everything they do.

Aside from anything else, the main thing you should be doing

“GENUINE COMMITMENT REQUIRES ONGOING EVALUATION, TRANSPARENCY, AND ACCOUNTABILITY. FINTECHS NEED TO ACTIVELY LISTEN TO DIVERSE VOICES, ENGAGE IN MEANINGFUL DIALOGUE, AND ADAPT STRATEGIES”

Another way to avoid ‘performative allyship’ in DEI is to make sure you lead with humility, Freeman added. “Know what you don’t know and where you need support or expertise, and make sure that all those involved have that same commitment and approach. This is hard work and you will be challenged. So, you need to make sure you’re prepared not only in your planning and resourcing but how you’re showing up as people in the first place.”

“Fintechs need to prioritise financial literacy and accessibility for underserved communities. We can achieve this through initiatives like offering educational resources in multiple languages, partnering with community organisations to provide localised financial literacy workshops, and designing userfriendly interfaces tailored to the needs of underserved populations.

“Genuine commitment requires ongoing evaluation, transparency, and accountability. Fintechs need to actively listen to diverse voices, engage in meaningful dialogue, and adapt strategies based on customer and community feedback. Prioritising authenticity over optics enables fintechs to build inclusivity and make a meaningful impact in addressing DEI issues!”

A question of gender

Another thing that is crucial to consider on the DEI journey is to make sure you don’t get stuck on just gender issues. Oftentimes when we think about diversity, we immediately think we need to get

brains are alike – most people are still unaware of how to include and leverage different thinkers for optimal effect.

“This can change when teams appreciate the reality of neurodiversity, and colleagues and leaders are equipped with both greater empathy and effective

in the push for better diversity, equality and inclusion… is actually doing. Commit to making your business as inclusive and accessible as possible on all fronts and be the change we need to see in this industry.

Commit: The whole organisation from the top - down needs to commit to DEI efforts Execs need to lead by example

Educate: Training should be provided for all team members, including leadership, and resources should be available

Assess: Take stock of your company and your policies to promote inclusion from the get- go

Adapt: Things change all the time

Constantly assess your efforts and make improvements via feedback from staff and stakeholders

...and t he DON’TS

Tokenism: Don’t get caught in the trap of performative allyship – ensure you’re rotting for representation, not just ticking a box

Just gender: Diversity goes so much further than gender

Remember your consumers: Accessibility of services is just as important in this conversation

Do nothing: There’s no room for inaction, only by doing can we see real change

The term ‘fintech for good’ is associated with individuals and companies striving to aid the less fortunate or enact positive environmental change. However, acting on these goals can be costly and put a strain on resources.

We set out to understand the fine line that businesses must walk to ensure they are meeting and exceeding ESG standards (something many Gen Zers look for in businesses they shop from) while still being able to make a profit.

Emmanuel ‘Manu’ Smadja, co -founder and CEO at MPOWER Financing, the educational loans and scholarships provider

“Let me start off with a perhaps controversial claim: there is no balancing act, or fine line to walk, between profitability and purpose. Those ascribing to this notion often think of trade-offs between short-term profitability (e.g, cutting service quality to save money) and impact.

“My 10 years as the founder and CEO of MPOWER Financing, a B-Corp fintech specialising in international student financing for the US and Canada, suggests that companies ought to focus on building a life-changing product for customers (purpose), sell this product at the highest premium the market will bear (maximise profit), and reinvest those healthy profits into a virtuous cycle of improving the product and increasing its reach to ever more customers. This approach has allowed MPOWER to raise close to $1billion in equity and loan capital since inception, while positively distorting the lives of more than 10,000 students this year alone.”

Nicole Valentine, fintech director at Milken Institute, the nonprofit think tank

“At every stage of innovation, the phrase ‘for good’ could have been included in the tagline to reflect the immense value that was and continues to be derived from transformational technologies. We could have written - automobiles

for good, as mobility is a driving force for equality and opportunity. Railroads for good, as interstate commerce is foundational for trade and business. Mobile phones for good, as connectivity is essential for information sharing and instant communication. Over time, these innovations evolved into utilities, and are thought of as essential services for all of us. Fintech for good is also an appropriate way to describe financial services that meet the needs of end-users while offering options that are more affordable, accessible, and faster.

“Fintech solutions are inherently inclusive, and inclusivity is inherently good. Fintech is an enabler and a tool for financial inclusion and access. As the industry evolves and new technologies like artificial intelligence are integrated and leveraged, fintechs can create even more opportunities to solve the financial pain points of individuals, entrepreneurs, and businesses in the areas of insurance, real estate, student loans, remittances, and investing, to name a few. Fintech also has an opportunity to be an

answer to the biggest challenges around the world. There are many markets where the gap between rich and poor is too wide and not enough occupy the middle. When fintechs can be the great economic mobiliser at scale, profits will follow the impact.”

Mike De Vere, CEO of Zest AI, the AI lender

Mike De Vere, CEO of Zest AI, the AI lender

“Today’s fintechs can be a force for good if their technology is built with purpose. If building their technology in-house, that means they must make a concerted effort to mitigate bias that often crops up in algorithms when the people building the technology aren’t representative of the population the fintech is looking to serve, and they aren’t inspecting the impact of their technology across diverse populations.

'If your strategy is to buy the technology, that means being thoughtful about who you’re partnering with. Scrutinise the organisation and determine if they’re truly purpose-led.

Unfortunately, there’s a lot of performative fairness out there,

so it’s crucial to make sure the people in the organisation are practising what they preach.

“When you align business strategy with technology that creates real change and long-term value for customers, ‘fintech for good’ extends beyond not-for-profit models. At Zest AI, we live and breathe fintech for good. We’ve built our AI-automated technology purposely to broaden access to equitable lending. We work with banks and credit unions to tailor our models for diverse communities, ensuring the data we use represents the people they serve. Fintechs can use technology to address bias in the system and reach those who might otherwise be overlooked, like women, minorities, or folks in underserved communities. By creating purposeful technology that is mission-driven, fintechs can help make the world a more equitable place.”

Aparna Gupta, codirector, centre for research toward advancing financial technologies at Rensselaer Polytechnic Institute

“Technology-enabled financial innovations that define fintech can do good beyond charity or serving the less fortunate by serving conscious capitalism objectives towards sustainable development goals. A circular economy rests on the paradigm that all products and

for sustainable resource utilisation outcomes. Fintech innovations using advanced natural language processing techniques, machine learning and artificial intelligence applications combined with blockchain technology can support these imperatives for a transition to a sustainable circular economy.”

Steve Round, president and co -founder at SaaScada, the cloud - native core banking engine

“ESG can’t be an ‘add-on’ to existing services. It’s a way to do business! ESG-focused products must be central to business models across financial services. Fintechs must create innovative, ESG-focused business models that generate consumer demand and demonstrate a solid business case. For example, Ecology Building Society was created with sustainable mortgages at the heart of its business.

“All products should be developed across an ESG framework. It’s not good enough to provide one product in an array of others that deliver no ESG value. In addition, fintechs should

– as we’ve been doing at Enfuce since day one – fosters innovation and outside-the-box thinking, which is key to future proofing your company.

“The truth is that genuine interest in levelling up your sustainability game can be good for business too, with consumers, shareholders, and employees all paying more attention to ESG issues and rewarding those companies who stand out.

“Let’s also not forget that success today, aside from the bottom line, is also measured by the positive impact left on society. Indeed, at Enfuce, we believe that fintech is not only a driving force for innovation, but also has the potential to create a more inclusive and equitable society.”

Karen Emmett , transformation officer and ESG lead at Aryza, the end-to - end, mission- critical automation software provider

“The phrase ‘fintech for good’ evokes the idea of leveraging technology within the finance sector for societal betterment. One area often overlooked is taking action beyond the solutions

Fintech solutions are inherently inclusive, and inclusivity is inherently good.

Fintech is an enabler and a tool for financial inclusion and access

services in the economy undergo the scrutiny of ‘circularity’, which means resources and energy used for the products and services are responsive to the trade-off of burden versus value they create.

“There is a need to develop financing mechanisms and investment choices that support capital formation, financial resource allocation and risk management to support a sustainable circular economy. Similarly, strategic decisions for supply chain optimisation and resilience are critical to ensuring robust circularity in a range of industries

consider the ‘S’ in ESG with their solutions. Fintechs need the right information to deliver real impact, one transaction at a time, supported by granular data to measure the success of their ESG policies.

To achieve this, fintechs must re-architect their core banking infrastructure, improving access to sustainability and social impact data and ensure all offerings are benefitting ESG programmes.”

By Monika Liikamaa

By Monika Liikamaa

and Denise Johansson, co -founders and co - CEOs of Enfuce “Fintechs can thrive while contributing meaningfully to a world in need of solutions. But balancing purpose with profit is no walk in the park.

“A true integration of ESG principles means really challenging the old way of doing things to make sustainability a key part of every business operation. From transparent reporting to emission reduction, thinking ESG first

and services offered, such as charity initiatives that exemplify how businesses can drive positive change.

“Transitioning from these initiatives to the broader discussion of ESG practices, it’s crucial to recognise the growing emphasis on sustainability and social responsibility alongside profitability. Adopting robust ESG practices can drive long-term profitability by enhancing brand reputation, reducing risk, and attracting socially conscious investors.

“Integrating ESG considerations into business strategies fosters innovation and resilience. Instead of viewing ESG compliance as a hindrance to profitability, businesses should see it as an opportunity for sustainable growth and competitive advantage. By carefully navigating this fine line, businesses can not only meet but exceed ESG standards while still achieving profitability and long-term success.”

data and behavioural science can transform consumer habits to drive sustainable consumption and combat climate change by

Emma Kisby, Cogo CEO, EMEAIspent many years of my career analysing people’s shopping habits, leveraging data insights and behavioural science to nudge people into buying more stuff – from washing detergents to frozen pizzas. Companies invest heavily in this type of work due to its significant opportunity to drive value to the bottom line. From supermarkets to airlines, they are all using these strategies to boost spending. Just think about those timely emails you receive shortly after searching for something online – they are not coincidences but well-orchestrated efforts to drive consumer behaviour.

Now imagine the transformative power of using these insights to help people to be more sustainable. The IPCC’s recent report highlights that 70 per cent of greenhouse gas emissions are linked to household consumption, demonstrating a clear relationship between our spending habits and our carbon footprint. There is a significant opportunity for corporations to use big data technology, underpinned by AI and behavioural science, to drive more sustainable consumption.

Many of us want to live more sustainably and recognise that we need to change our habits to move closer to a net-zero society. However, our actions often do not align with our intentions or values. One of the biggest challenges is the invisible nature of climate change – we can’t see the immediate impact of our actions, making it difficult to keep sustainability top of mind. It is also a complex subject, with

conflicting advice and a lack of personalised information. This can lead to low carbon literacy, where many prioritise low-impact but visible actions, like recycling, over high-impact actions, such as reducing fast fashion consumption.

At Cogo, we use spend-based data to make the invisible visible, showing individuals and businesses the carbon footprint of their spending. Our user research has shown that engaging with carbon insights significantly improves carbon literacy, which in turn increases motivation to take climate action. This highlights the power of data to drive change.

70 PER CENT OF GREENHOUSE GAS EMISSIONS ARE LINKED TO HOUSEHOLD CONSUMPTION, DEMONSTRATING A CLEAR RELATIONSHIP BETWEEN OUR SPENDING HABITS AND OUR CARBON

There’s also growing demand for this type of information. Research conducted with the Behavioural Insights Team found that 62 per cent want their banks to help them understand the environmental impact of their spend – this figure rises to 71 per cent among those under 25. Clearly, the demand is there, and we predict it will only increase as awareness of climate change grows. This presents a real opportunity for banks to engage customers.

However, knowledge alone is often not enough to change engrained habits. We all have habits, biases and mental shortcuts that guide our daily decisions, keeping us stuck in our ways. By providing timely carbon insights and leveraging behavioural science techniques, we can nudge customers to make different choices. Corporations can also offer embedded, low-carbon finance products, such as EV loans, green mortgages or home energy retrofit propositions, at the point of need. These tailored and timely offers remove barriers to sustainability and mobilise people to take more effective action.

In recent years, banks have increasingly supported customers with home retrofits, running mass marketing campaigns to promote energy efficiency upgrades. We’ve seen generous offers and great partnerships, but they often struggle with uptake due to their broad targeting. There’s a massive opportunity here, but businesses need data to connect the dots.

At Cogo, we can leverage customer data to identify energy expenditures and where customers can save money, and then suggest recommendations like switching to green energy providers. From there, we encourage users to provide more data about their energy bill (either manually or through a smart meter automation). This allows us to tailor recommendations to individual needs and where they are in their personal sustainability journey. Banks can then embed more relevant green financial

products at the point of purchase, increasing engagement and uptake. This strategic use of data not only demonstrates the power of data to decarbonise and help customers save money, but it also shows how banks can align purpose with profit. By engaging customers on sustainability and effectively promoting green financial products, banks can drive effective climate action while enhancing their customer experience and value. In fact, one of our key banking clients saw a 14+ NPS lift for customers using the carbon insights feature.

By reimagining the use of data from promoting consumption to encouraging sustainable practices, we at Cogo are not just envisioning a more sustainable world – we are actively creating it. Collaboration is key; we specialise in data and impact measurements, but we need the scale that businesses and banks provide. Together, we can create real impact.

About Cogo Cogo is a carbon footprint management product that helps individuals and businesses to measure, understand and reduce their impact on the climate. Cogo does this through partnerships with some of the world’s largest banks to integrate leading carbon-tracking functionality into their banking apps. To find out more information about Cogo, please visit cogo.co

It is no secret that the fintech sector is male-dominated. Last year, EY found that UK fintechs are less gender-diverse than the broader financial services sector, with women comprising just 28 per cent of the fintech workforce, compared to 44 per cent in financial services at large.

These figures need to change. Countless studies prove that having a more diverse and inclusive workforce leads to better business outcomes and performance – so why is fintech still so far behind?

From a product perspective, fintech is leading the way towards inclusivity and innovation. Over the years, the fintech industry has generated digital solutions that promise to bridge the financial gap and improve financial inclusion for millions of people and businesses worldwide. Fintech needs to achieve the same goal in the workplace.

Building an inclusive, high-performance culture

Building an inclusive, highperformance culture in fintech requires a deliberate and sustained effort. My two-decade journey in financial services has reinforced the importance of such a culture. Forward-thinking businesses view inclusion as a critical business strategy.

A tangible example of this is the composition of YouLend’s global product team. Today, over 70 per cent of my product team is female. Focusing on building a collaborative, supportive and high performance team, delivering customer-centric outcomes, while actively providing opportunities that encourage flexibility, have led to this outcome.

Too often in my career I have been the only woman in the room, often with a differing view or approach. I don’t want this to continue, women should have an equal voice instead of being the odd one out. We have an important viewpoint that businesses too often overlook. Too often the room of people making a decision does not represent those who we are making decisions for. Business leaders need to ensure they are providing an environment where women want to work, where they are supported, and where their unique skills and capabilities are appreciated. This can come in the form of encouraging women to put themselves forward and help them to focus on the reasons they can instead of focusing on reasons they can’t. It can also be creating a flexible work environment where both mothers and fathers feel confident they can achieve great results without sacrificing family priorities.

Inclusivity requires effort and it is time fintechs pay attention, says Jessica O’Hare , VP of Product at YouLend

I think too often women are expected to ‘fit in’ and think more like men. Instead we must motivate women to lean into the capabilities that make them great, and provide a different perspective. This inclusive approach boosts individual performance and catalyses innovative thinking, resulting in superior business outcomes and enhanced customer experiences.

However, building an inclusive, high-performance culture is an ongoing journey that demands intentional strategies and commitment.

Balancing career and family

One crucial lesson fintech businesses can learn to build an inclusive, high-performance culture is the importance of supporting individuals to balance career and family life. The challenges of managing a demanding career while fulfilling family responsibilities are significant. Promoting a supportive work

Bank shows that female-owned businesses are as ambitious as their male counterparts, but are more likely to be deterred by the complexity and uncertainty of the financing process.

At YouLend we have addressed the issue by streamlining and designing our application and decision processes so that it caters to female business customers, who are supported adequately through the application process.

The results have been significant. Currently, 30 per cent of our applications come from female-led businesses, compared to the UK average of 17 per cent. Also, we are twice as likely to approve financing for female-led businesses compared to the national average. These statistics highlight the effectiveness of our AI-driven model and our commitment to financial inclusion.

Looking ahead: driving change

environment for working parents and carers with flexible work schedules can be key to achieving this balance. For example, focusing on measuring outcomes and not hours in the office.

As a working mother, I understand the challenges of balancing a demanding career with family responsibilities. You have to be focused on where you spend your time and what your priorities are. Delivering impactful results is very important for me and so is putting my kids to bed at night. I am lucky that I have the flexibility to achieve both, by often leaving the office before 5pm but then logging back on at 7pm when they are in bed.

Creating a culture that supports work-life balance within my team and wider company is very important to me. It directly impacts engagement, retention and output.

Key business outcomes

Developing a diverse and inclusive workplace can unlock hidden business ideas and opportunities that might otherwise remain elusive.

For instance, we noticed that female entrepreneurs often face significant barriers in accessing funding, because traditional credit applications may feel out of reach. Research from the British Business

The journey towards inclusivity and performance in the fintech sector necessitates a concerted effort to bridge the gender gap and create diverse, high-performing teams. As evidenced by the statistics revealing the underrepresentation of women in fintech, there is a clear imperative to enact change. By embracing inclusivity as a cornerstone of business strategy, leaders can propel their organisations toward success. This means achieving gender balance, but also nurturing talent through mentorship programmes and fostering a supportive work environment that accommodates the demands of family life.

Looking ahead, the journey towards inclusivity and high performance in the fintech sector is ongoing. We need fewer words, more action. By championing diversity, equity, and inclusion, fintech businesses can lead by example, driving meaningful change within their organisations and across the broader industry.

Together, we can build a future where businesses no longer see inclusivity and performance as mutually exclusive, but rather mutually reinforcing pillars of success.

About Jessica O’Hare

Jessica is the VP of product at YouLend, the global embedded finance provider for e-commerce platforms, tech companies and payment service providers. She is the recipient of Team Leader of the Year at Women in Credit 2022. Web: https://youlend.com

Nadia Edwards-Dashti , co-founder and chief customer officer at Harrington Starr Group, shares insights from her nearly two-decade career in fintech recruitment and her commitment to enhancing DEI in the industry

Fintech recruitment is much more than merely filling roles; it’s a strategic effort that propels innovation and sustainability within financial technology. With the global expansion of fintech, there’s a heightened demand for diverse talent capable of introducing new perspectives and solutions. A workforce rich in diversity not only fuels creativity but is essential for developing strategies that effectively cater to a variety of markets and demographics.

Leading the way is Nadia Edwards-Dashti, co-founder of Harrington Starr Group and a staunch advocate for diversity, equity and inclusion. Her forwardthinking recruitment strategies and influential podcast series have significantly shaped a more diverse fintech environment.

The Fintech Times sat down with Edwards-Dashti to delve into her career, her perspectives on the transformative impact of inclusive recruitment and her aspirations for the future of the sector.

THE FINTECH TIMES: Tell us a little bit about yourself and your career to date?

NADIA EDWARDS-DASHTI: I’ve worked for nearly 20 years in the recruitment space. I’ve always found jobs for sales or tech people within the financial services space. I have spent the past 14 years helping build out the Harrington Star Group from just four of us in a room in 2010 to a team of 70 people across Belfast, London and New York. I’m a recruiter – I’m all about helping people forge great careers, and I think when you look beyond the scope of talent being solely a CV function, you open your eyes to the real work that I do and the value that I can bring. I question job specs, I scope out growth projects, I help businesses reduce churn, and I increase efficiencies around the hiring process. I talk about talent being an experience and help companies see that if that is a poor experience, people simply won’t want to apply, accept offers, or stay in businesses. Diversity, equity and inclusion must be central to

every staffing, colleague, managerial, leadership, executive or peer conversation. Without understanding people and what they need to thrive, you will never be able to attract the right talent or retain that talent, let alone grow that talent and build a productive business.

TFT: What inspired you to co-found Harrington Starr Group, and how has this company evolved?

NED: No one was really innovating in the recruitment space, and it was very transactional back in 2010. You were supposed to be wedded to the sales cycle rather than the people’s lives you were affecting. No one spoke about building careers, and certainly didn’t consider supporting businesses in building better brands and employee value propositions. We wanted to change that and introduce a different recruitment experience. We wanted to guide relationships through communityled engagement and set out to add value to potential candidates and potential customers in new and innovative ways. We were one of the first to host events and round tables and certainly the first to produce magazines featuring business leaders talking about industry trends. Our video blogs and podcasts are now the most established in the industry with Fintech Focus TV boasting 300 episodes and Fintech’s DEI Discussions at over 400.

TFT: Could you share some highlights or lessons learned in your career in recruiting for the financial services technology sector?

NED: Everything always changes in the financial services technology sector. Whether that is the recession, the pandemic, a downturn or a flood of funding, the talent space always goes through cycles and depending on where we are in that cycle, there will always be more opportunity to advocate for your candidate and their careers, or there will be less. I’ve learned that however limited vacancies are, our job is always to advocate for our people and support customers in their long-term people plans.

Highlights for me have included winning the Investing in Talent award in 2019 – it was super meaningful to win because, at that time, I was in the first trimester of my first baby and having a very hard time being heard as a female leader in the workplace. Another big win was the Recruitment Agency Leader of the Year 2022: The Recruiter Awards for all my work in gender equality and inclusion across the sector, which was something the recruitment space hadn’t seen before in this way.

TFT: Your podcast, ‘Fintech’s DEI Discussions’, puts the focus on equitable change in the industry. Can you tell us more about your podcast and what you’ve enjoyed most about doing it?

NED: We have produced over 400 episodes with multiple chapter specials, series, and spin-offs. From ‘Women of fintech’, ‘Families of fintech’, ‘Artificial discrimination: can AI be trusted with Inclusion?’, the ‘Advocate Series’, and the upcoming ‘Confidence Series’, I love how each episode is truly unique. Everyone has their own journey experiences, and their own version of what inclusion means to them. That’s the point of all my series and expansions; we are all included in inclusion and everyone has felt excluded at some point – it’s been about disarming the conversation and showing the power of inclusion in the workplace for us all.

My advice to anyone in the industry has always been to strive to be your best, don’t be afraid to put your hand up and be curious and always have that drive to solve a problem

This has been such a driver for me to showcase careers and also challenges overcome by individuals. After all, I want to attract people to the industry, increase representation and give those in this space who are having a hard time the confidence to know that there are better environments out there. Also, these pods are super useful as a library of case studies of how to build better, more successful workplaces where inclusion and, therefore, engagement and productivity are at the core.

TFT: What motivated your ‘FinTech Women Walk the Talk’ podcast and book and what did you learn from this?

NED: I wrote it because I wanted more people to listen to the amazing women who recorded my first 100 podcasts with me. I will always be grateful for these original podcasters; they opened their hearts to me on a recording, their experiences and obstacles, and how,

through determination, resilience and grit, made it to these powerful positions in financial services. I learned from them and they supported me through my pregnancies and return to work with babies in slings – it was never just a podcast for a business – it’s been a personal journey more than anything. My personal growth in confidence is down to this tribe of people I have spoken with on podcasts. That confidence has enabled me to drive the change so desperately needed. The book was a result of an idea I had: that if every citation in a book was a quote from a podcast of a woman in fintech, then how could anyone say women don’t exist in this sector?

That’s where it began, with those original ‘Women of Fintech’ podcast series. 15 months later, I submitted the manuscript when my second child was two weeks old.

TFT: What advice would you give to aspiring professionals looking to make a mark in the fintech industry?

NED: Go the extra mile for a manager and business that will go the extra mile for you. Align yourself to the company’s values, in a company that values you. Always prepare to present a list of your accomplishments to a manager who is willing to hear. Ask for that seat at the table where your seat is as an equal. Commit to being agile and learning new skills in a business that will invest in your learning. Know exactly what you need to do to progress in your team, in a team that will encourage and sponsor you to do so. These things are baseline expectations for some people. Others have to fight for that. My advice to anyone in the industry has always been to strive to be your best, don’t be afraid to put your hand up and be curious and always have that drive to solve a problem. My advice more recently is to do so in the right place for you where you are recognised, heard and valued.

TFT: Could you share some strategies or initiatives that have been particularly effective in driving diversity and inclusion in the fintech sector?

NED: My most successful strategy was to turn the current recruitment system on its head. Rather than ‘catching people out,’ I wanted the industry to help ‘catch people in.’

The Talent Equity List gives leading firms visibility of exceptional female or non-binary talent looking to make their next career move. The goal is to give these recipients confidence that women and non-binary people

exist in technology and sales and are looking for work.

I have been working hard to give them fair representation and shaking off that old phrase of ‘women don’t exist in xyz roles (dev ops, dev, testing, app support etc)’. I speak confidentially to hundreds of people a month about their experience in this industry and what they would have needed to have stayed and thrived in their current firm. I share that data; I consult on the environmental changes we need to make to drive real inclusion and belonging in our sector. I ask questions people don’t like, “How much would it cost to erase the gender pay gap in your business?” or “Who haven’t you given a pay rise because they didn’t ask for it even though you know they are deserving?” I share data on hiring trends and decisions on who to promote, hire, or make redundant. I open eyes to who we as an industry back, excuse and vouch for and sadly who we don’t.

TFT: What are your interests and passions outside of ‘work’?

NED: If my kids are awake and I’m not working I spend every second I have with them which is never enough.

Harrington Starr is a multi-award winning financial technology recruitment business based in London, Belfast and New York City. Founded in 2010, it specialises in technology, change and transformation, and sales recruitment and has helped clients and candidates across five continents. Its diverse range of clients include banks, hedge funds, vendors, service providers, payment providers, asset managers, startups, disruptors and more. The one thing these have in common though is that they trust Harrington Starr with their most important asset: people. The company is passionate about helping its customers grow their teams, their brands, their networks and their careers.

Website: www.harringtonstarr.com

LinkedIn: www.linkedin.com/ company/harrington-starr

Twitter: @HarringtonStarr

Total business travel in the modern-day accounts for three to four per cent of all carbon emissions, but in-person meetings remain the gold standard of client interactions, especially financial services and other high-value industries. For example, dinners and golf days are still a vital part of many financial services companies’ outreach and where deals get done and many feel it is very unlikely that they will be replaced by digital alternatives.

Despite the advent of digital hospitality (the art of providing a seamless and personalised experience for audiences across all digital touchpoints), traditional client engagement methods persist as pillars of relationship-building. However, the convergence of environmental, social, and governance (ESG) principles with technological innovation presents a compelling opportunity for financial institutions (FIs) to reconcile these seemingly conflicting priorities.

Moreover, digital hospitality aligns seamlessly with broader ESG objectives beyond environmental sustainability. By embracing virtual platforms, companies can promote social inclusivity and diversity, ensuring that client engagement initiatives are accessible to individuals from all backgrounds. Virtual events democratise participation, transcending geographical barriers and empowering stakeholders to contribute irrespective of physical location. This commitment to inclusivity not only fosters stronger client relationships but also enhances the company’s reputation as a socially responsible entity.

Digital hospitality in a digital age Digital hospitality has emerged as a strategic imperative for companies seeking to align their operational practices with sustainability goals. While face-to-face meetings undoubtedly remain important, the integration of digital solutions offers a pathway to reduce carbon emissions without sacrificing the essence of personalised service. By leveraging virtual platforms, FIs can curate personalised digital experiences that transcend geographical barriers, fostering meaningful connections while minimising environmental impact. With the advent of bespoke online environments to host your meetings and updates, it is now much easier to bridge the gap, and create a space that is representative of the brand – while building familiarity and giving access and awareness to your hero assets and key messaging. What’s more, while your guests and attendees spend time in your digital real-estate, the data captured helps you to better understand them ahead of your next engagement – be it physical or digital. This encompasses a spectrum of innovative approaches, ranging from virtual events and webinars to interactive online workshops. It is essential that FIs give audiences the freedom to explore content on their own terms. Rather than using rigid, predefined marketing funnels, they should put users at the centre of the experience. They may visit an FI’s platform because of an interest in a specific article or video, but then they should be free to dig deeper. Allow them to decide what content they want to

Matt

consume, as well as where, when and how.

These virtual platforms not only facilitate engagement but also afford greater accessibility and inclusivity, enabling broader participation from diverse stakeholders. Moreover, digital channels enable real-time data analytics that offer the ability to track user behaviour across all digital touchpoints to gather rich intent data. This means FIs can answer questions, such as, what can you learn about what interests them from their engagement with your content? How can you use this data to personalise their experiences and build trust and loyalty going forward? This data is empowering companies to glean actionable insights into client preferences and behaviour, thereby enhancing the efficacy of their outreach efforts, and ensuring they return.

Boosting ESG credentials ESG is far more than ‘greenwashing’ or performative philanthropy. The ESG framework was developed specifically to hold companies to real standards that make a measurable difference in the world, covering everything from a company’s carbon emissions to whether their supply chain involves slavery. It has been demonstrated that this is an

important factor in consumer behaviour: a report by McKinsey shows that ‘products making ESG-related claims accounted for 56 per cent of all growth’.

However, embracing digital hospitality is not merely a matter of environmental stewardship; it also serves as a cornerstone of comprehensive ESG strategies. By implementing technology-enabled solutions, financial institutions can demonstrate their commitment to environmental responsibility while simultaneously delivering value to clients. Integrating digital hospitality into ESG frameworks underscores a company’s dedication to sustainability, bolstering its reputation as a socially conscious organisation.

Furthermore, digital platforms offer unprecedented opportunities for transparency and accountability, enabling stakeholders to track and evaluate the environmental impact of business operations in real-time. By providing visibility into carbon emissions associated with travel and events, companies can proactively identify areas for optimisation and implement targeted mitigation measures. This proactive approach not only mitigates environmental risk but also enhances operational efficiency, yielding tangible cost savings over the long term.

The role of digital hospitality for a firm’s ESG strategy In financial services, the imperative to balance client engagement with environmental responsibility has never been more pressing. Digital hospitality offers a compelling solution, enabling companies to reimagine traditional client interactions through innovative digital platforms. By embracing technology-enabled solutions, financial institutions can navigate the tension between face-to-face engagement and sustainability imperatives, delivering value to clients while minimising environmental impact.

Moreover, digital hospitality serves as a linchpin of comprehensive ESG strategies, enhancing an FI’s credentials across environmental, social, and governance dimensions. By leveraging virtual platforms, FIs can demonstrate their commitment to sustainability, transparency, and inclusivity, thereby bolstering stakeholder trust and long-term resilience. As the financial services industry continues to evolve, embracing digital hospitality will be essential not only for mitigating environmental risk but also for driving innovation and fostering sustainable growth in a rapidly changing world.

About Reef, powered by Totem Totem has supported some of the world’s biggest financial brands and delivered the sector’s most prestigious international events for over 20 years. Its technology arm (Reef) is an extension of a large team of highly experienced professionals across event planning, management, and creative on and off-site services, including design, video, streaming, broadcasting and AV. Reef is an award-winning audience engagement platform designed for events, webinars, communities and courses. www.wearetotem.io/platform

Between high-pressure environments, fierce competition and the threat of burnout, those who work in fintech need to start prioritising their mental health

To learn more about the need for frank conversations about wellbeing, The Fintech Times chatted to Stuart Rimmer MBE, who joined Open Banking Excellence in February 2024 as the interim director of strategy and knowledge transfer. In his professional life, Rimmer has led large scale national mental health projects as well as undertaking a PhD in Organisational Psychology and Performance Coaching and is currently researching leadership distress in fintech. Here he shares his thoughts on the mental health concerns within the fintech world, and how wellness can be addressed on an industry-wide level.

Q How would you characterise the current level of mental health awareness within the fintech industry?

It is a topic that isn’t currently talked widely about in a public and open way. Yet behind closed doors and through coaching senior executives I understand that the pressures are acute and have a huge detrimental impact in fintech.

Q

Are there any unique challenges and pressures faced by those working in fintech that can impact their mental health?

Like all sectors executive distress is widespread but I think that open banking has a unique set of pressure mostly derived out of being still a fairly new industry that has a combination of lots of fast-moving technology, fierce competition and speedy pressure in go to market, combined with fragile venture capital and commercial funding, and a regulatory landscape still establishing the rules. These are accelerating factors.

Q

Why is it important for the fintech industry to be addressing mental health in its members? For me, there is a twin imperative. The first is a moral position, to look after the mental health of colleagues is the right thing to do. The second is commercial sense. To have a well and highly functioning workforce

and executive will outperform those who are struggling and unsupported. With nearly half of the workforce reporting their mental health has declined since 2022 and 60 per cent reporting they feel detached at work it makes strategic sense to step into this space.

Q Is there still a stigma around discussing mental health in the workplace, how can company culture be cultivated to encourage open conversations and support?

Nationally, 13 per cent of employees feel comfortable discussing

While one in six people experience mental health problems in the workplace, 100 per cent of people have mental health. We all have fluctuations in levels of anxiety, distress and happiness

mental health. Leadership must come from the top. It is now at a stage of maturity that we can still support mental health awareness but actually implementing practical solutions to support teams is

more important. This means that culture, which is complex, needs to prioritise wellbeing, with leaders asking questions and seeking their own support.

QHow do issues of diversity and inclusion intersect with mental health in the fintech industry?

Seventeen per cent of employees will struggle with mental health conditions this year. We are becoming increasingly aware of issues of inclusion where different groups will experience the same condition differently.

One of the most

Q What can fintech companies do to help support mental health and wellbeing in the industry and their staff?

There is a range of interventions from policy review such as wellbeing policy but also family friendly policies, through to training in awareness, self care and mental health first aid, one-to-one coaching, employee assistance programmes and leadership development. There are numerous opportunities for companies and individuals to utilise the capabilities of apps. Wellness and mental health apps leverage open data to provide tailored support such as money management, fitness tracking and guided meditation. Caring for the mental health of your team can often require a bespoke approach, building a culture of trust will enable your team to start honest and open conversations.

QWhat role do you believe leaders within the fintech industry should play in promoting mental health and wellbeing among their teams?

The old saying people don’t leave bad companies they leave bad leaders has never been more true. Leaders don’t have to wait for corporate responses but can immediately introduce three interventions. One for themselves which impacts how they show up to lead, second developing team support, and finally in one-to-one interactions with staff around matters such as workload or just simply checking in.

common issues that companies would benefit from reviewing and understanding more is neurodiversity. It’s vital that companies support through policy and considered practices tailored around different groups. For example, women who work full time are almost twice as likely to experience mental health challenges than their male counterparts. Similarly, young people consider their mental health more than older workers and LGBTQ+ employees experience distress at higher rates comparatively.

Q What are your hopes for the future?

While one in six people experience mental health problems in the workplace, 100 per cent of people have mental health. We all have fluctuations in levels of anxiety, distress and happiness. If a sector leads with compassion and proper consideration with adequate support mechanisms then it will be more productive and thrive. Fintech is known for a culture of innovation and collaboration – what better topic to work collectively on than wellbeing?

2023 broke countless temperature records across the globe, and 2024 looks as though it will follow suit. As our planet gets hotter than ever, and as

the climate crisis worsens, where can we look to

reverse the damage?

While many believe that the damage being done to our planet will only cause serious issues for our children’s children, or beyond, the truth is that rising temperatures are already a cause for concern –with climate change directly contributing to heatwaves, wildfires, floods, tropical storms and hurricanes in recent years.

The World Health Organisation predicts that between 2030 and 2050, climate change could cause approximately 250,000 additional deaths per year. Yet while this presents a very real challenge to hundreds of thousands of lives today, the progress currently being made feels negligible at best.

Hoping to change this, world leaders came together in 2015 at the UN Climate Change Conference (COP21) to adopt the Paris Agreement: the international treaty hoping to keep global warming to no more than 1.5 degrees celsius, to reduce emissions by 45 per cent by 2030, and achieve net zero by 2050.

However, not all countries have necessarily done enough to make progress in reducing the risk of climate change. In fact, in the UK, the High Court recently ruled that the government has not done enough to meet its targets for cutting greenhouse gas emissions.

With this in mind, the all important role of the financial sector in driving change has never been clearer. But how can fintechs and banks practically make a difference?

Banking sector could ‘make or break’ climate targets

Banks have a uniquely powerful position to make a positive impact, according to Jeff Waller, head of sustainable finance at US-based ENGIE Impact, a sustainability consulting firm helping corporations accelerate their decarbonisation efforts.

By Tom Bleach, journalist at The Fintech Times“Banking plays a central role in the wider economy as their lending activity touches almost every facet of economic activity. The emissions associated with this activity dwarf any direct emissions stemming from a bank’s operations or energy use.

“As a result, any effort from big banking institutions to reduce these financed emissions will have a profound impact on the economy at large and must be considered a vital aspect of any broader societal decarbonisation strategy.”

Waller also explains how firms can leverage technology to help achieve climate targets.

“Banks must first develop a methodology to assess the impact of financed emissions in those industries that emit the most, such as oil and gas, transportation, and power. Once identified, there are several approaches they can take to facilitate rapid decarbonisation across their range of clients.

“This could include incorporating emissions information into credit decisions, offering financing for decarbonisation projects or engaging with their clients to encourage more sustainable operations. Because of the influence and impact that the banking sector has, these efforts could either make or break our ability to reach net-zero targets.”

Investigating investment: Are banks doing their due diligence?

Anna Roberts, head of market development at iov42, a technology firm specialising in digital identity, trust and data integrity, breaks down new regulations that are hoping to make an impact – but outlines the issues that will remain.

“Deforestation accounts for around 12 per cent of global carbon emissions. Although deforestation as an issue is on financial institutions’ radars, they are not taking swift enough action to reduce their exposure to risk both within their own businesses and in their portfolios.

“The EU’s imminent Deforestation Regulation (EUDR), which comes into force on 31 December 2024, makes clear that goods placed on the European market shall not result from recent deforestation, meaning that the land has not been cleared or degraded after 31 December 2020.

“One of the key components of the EUDR is an obligation for due diligence, mandating that every company ensures traceability back to specific plots of land. Failure to do so risks fines (up to four per cent of company turnover within the EU), temporary exclusion from public procurement/access to public funding, and confiscation of goods. It also risks significant reputational damage and a potential negative impact on share price.

“THE WORLD HEALTH ORGANISATION PREDICTS THAT BETWEEN 2030 AND 2050, CLIMATE CHANGE COULD CAUSE APPROXIMATELY 250,000 ADDITIONAL DEATHS PER YEAR. YET WHILE THIS PRESENTS A VERY REAL CHALLENGE TO HUNDREDS OF THOUSANDS OF LIVES TODAY, THE PROGRESS CURRENTLY BEING MADE FEELS NEGLIGIBLE AT BEST”

“Our own research indicates that 18 per cent of European timber importers say they are unaware of the legislation. For those claiming to not be aware there is clearly a danger that they will not be ready.

“The biggest risk for banks and investment firms lies in whether the companies they invest in and/or lend to are found to be in breach of EUDR. Banks should be asking these companies questions around

how they obtain and analyse supply chain information given the scale of data. How are they incentivising and equipping their suppliers? How are they building their teams to handle the incoming legislative changes?”

Banking’s moral responsibility

Aside from making careful investments and introducing measures to directly reduce their own emissions, banks are also obligated to help their own customers, explains Kim Jenkins, MD of APIs at Moneyhub.

“Banks have a dual responsibility when it comes to the fight against climate change; reducing their own impact but also helping their customers to understand their own footprint. The latter can often be overlooked, but could hold the key to helping every customer across the UK make sustainable changes.

“The consumer spending data that banks have access to has the potential to both inform and change behaviours. By using this spending data, it is possible to show consumers their true carbon footprint, and from here provide the insights needed to make real steps that make a tangible difference to our impact on the environment.

“However, accessing this data can be challenging for banks, particularly established high street banks with legacy systems. And once accessed, banks need credible partners in order to analyse this data, and transform findings into actionable insights. This can often be too steep a barrier for organisations that already have other competing priorities within their data teams. But there are solutions available; using open banking, banks can easily access the connections and provide the

insights to customers to help influence their buying decisions and live more sustainably.”

A technological solution: Climate credits

In a recent PwC Middle East report, the accountancy firm highlights the rapidly increasing importance of carbon credits, and the role of banks in the emerging carbon credit tokenisation market.

The carbon credits market is set to grow to $100billion by 2030,

according to Morgan Stanley, and PwC believes that carbon credits are primed to become the ‘new currency’ of climate action.

Within the report, PwC highlights how Fils, an enterprise-grade digital infrastructure provider enabling businesses to embed sustainable and climate action into their business model and customer journeys across industries, is enabling its banking clientele to do their part.

Fils’ method of incorporating climate action into business models, contributing to a sustainable future in finance and ensuring that Fils becomes one of the firms leading the way in building a global community of sustainability-minded businesses.

Nameer Khan, CEO of Fils, told The Fintech Times: “Organisations currently face a challenging task in tracking and offsetting emissions, due to the complexity of the fragmented voluntary carbon market.

“Our ambition is to foster a lasting, worldwide shift towards sustainability. Our strategy spans all 17 UN Sustainable Development Goals, with a particular focus on combating climate change and its effects on society, including humanitarian aid, wildlife conservation, and disaster response, without inhibiting the normal operations of businesses.

“At Fils, our strategy is clear: to build a scalable infrastructure as a foundation for climate-positive growth. With phase one focused on establishing robust connectivity, we’re now embarking on phase two, ready to expand our infrastructure and continue our journey towards enabling sustainable transformation globally.”

Enacting meaningful change

Whether the entire financial and banking sector will adopt technological means of tracking and reducing their carbon footprint, is another question entirely. While it is undeniable that there has been a slow uptake when it comes to implementing sustainable practices across all aspects of operations, it is increasingly clear that consumers are becoming more climate conscious.

Fils’ software has enabled fintechs, including UAE-based Magnati and Saudi Arabia-based Geidea, as well as banks such as Mashreq, to process payments that offset carbon emissions, simplifying eco-friendly transactions and ensuring business transparency.

Fils also uses advanced analytics for carbon emission calculations in corporate spending, to offer a clearer view of environmental impact. This approach exemplifies

As more and more people attempt to live their lives sustainably, the pressure is increasingly on firms, financial or otherwise, to do their part – or risk losing customers completely. This threat may be more influential than any global targets or regulatory demands, and could mean a genuinely meaningful change in favour of the planet’s health.

The technology and other means to enact this change already exist through firms like Fils, so only time will tell whether it can be used to its fullest potential.

intechs are in a prime position to make the e-commerce and checkout experience easy and accessible, streamlining transactions and offering customers a seamless and convenient way to pay for goods and services.

However, despite these advancements, certain groups of people have historically been excluded when they reach the final point in a transaction. This exclusion can be due to various factors, such as a lack of access to traditional banking services, limited credit history, or socioeconomic barriers that prevent the use of standard payment methods.

Embedded finance – integrating financial services seamlessly into non-financial platforms – has the potential to address these issues directly. By embedding financial solutions into the very fabric of e-commerce platforms, fintech companies can ensure that all users, regardless of their financial background, can complete transactions effortlessly and securely.

Local situations require local solutions

Embedded finance can be adapted to serve in specific situations that can ensure those without access to traditional finance, can still get involved, suggests Arthur Ribakovs, head of financial partnerships at Ecommpay, the online payments solution provider.

“A simple way to ensure financial inclusion is being considered is to provide an extensive array of payment alternatives beyond conventional credit and debit cards, such as digital wallets, BNPL options, and alternative payment methods, like PayPal. Doing so accommodates individuals who may not be able to access traditional banking services, or those who prefer to use alternative payment methods.

“Taking this a step further would be customising financial offerings to meet the unique requirements of various sectors. This may involve personalised pricing, credit assessment methods, or providing financial education materials to

empower businesses to make informed decisions. Adapting embedded finance solutions to local frameworks and regulations ensures greater accessibility across different regions and demographics.”

All about APMs

Marius Galdikas, CEO of ConnectPay, the all-in-one financial platform for online businesses, highlights the importance of alternative payment methods (APMs).

“In terms of financial inclusivity, the checkout experience centres around the integration of APMs. Good examples would be local APMs like PIX in Brazil or Yape in Peru, which cater to 80 per cent of customers in emerging markets without card access. To enhance accessibility and tailor experiences for diverse customer segments, AI is being employed as well, to better evaluate customer integrity and issuer risk appetite, as well as to automate payment testing. These strategies bridge gaps for the underbanked and those new to digital payments.”

Everyone is a winner

For Peter Galvin, chief growth officer at NMI, the embedded payments solutions provider, embedded lending allows every member in the checkout experience to be a winner.

“In most cases by embedding finance into their applications, merchants make it easier for them or their consumers to interact with financial products. One advantage of this model is that the financial products that merchants or consumers might want to use already have much of the information needed to easily decide on creditworthiness.

“One example is embedded lending for merchants. By providing access to their credit card payment volumes, merchants can more easily get a small loan for working capital and in many cases, they have flexible payment terms as the payment is based on the percentage of daily revenue the merchant receives. Because of this, more of the loan is paid back when the merchant is earning more money but less during slow times as the percentage stays the same.”

Growth must be centred around equity and innovation

Sophie Flynn, CFO and co-founder of Nucleus365, the payment service provider, believes firms must equally prioritise equity and innovation in their roadmaps.

“Currently, fintech providers are making progress in ensuring financial inclusivity by creating solutions that have the population of their target market at the core of their propositions. For example, focusing on mobile-first designs that cater to underbanked populations who may lack access to traditional banking services. Additionally, embedded finance is being leveraged to include solutions within payment processes that provide unbanked populations with more flexible payment options. Promoting financial literacy and transparency is crucial. This empowers consumers to make informed decisions about the financial services they use and how they use them. It ensures that individuals understand the terms, fees, and implications of financial products.

“When embedded finance solutions are seamlessly integrated into digital platforms (such as e-commerce, accounting software, or mobile apps), transparency becomes essential. Users need clear information about the financial services available to them. This benefits both parties as transparent communication builds trust. Users are more likely to engage with financial products when they feel informed and confident. Ultimately, the most successful embedded finance strategies will be those that proactively address financial inclusion from the ground up. By supporting local financial institutions and centring equity alongside innovation, the checkout experience can be reimagined to work for all consumers, not just the privileged few.”

Ensuring there is an avenue to engage Michael Pierce, VP of sales at Toqio, an embedded finance platform, explains how the more

alternative payment methods a firm offers, the more inclusive they will be as consumers have more choice.

“Financial inclusion has the primary goal of making financial services accessible and affordable to everyone. Throughout this year, we can expect to see corporate-embedded finance platforms focus more on the topic. This will involve developing new products and services that are specifically designed to reach the people who need it most.