The Middle East and Africa (MEA) is a truly exciting region as it is the backdrop to some of the world's fastest-growing economies and countries undergoing significant transformation: fintech is playing a part in this.

It is such an honour to write a report for a region that, to be frank, I knew little about until recent times, but I – like a quarter of the world’s population – am now proud to call it my current base and home. I’ve loved the opportunity to help spearhead and architect the 2022 edition of this report, following the success of our pilot study in 2021. I hope it helps readers grasp various aspects of MEA, its economic development and, most importantly, the growth in importance of fintech in the region.

It is narrow-minded to think that the MEA is not contributing to the global success of fintech even in comparison to more 'valuable' regions. Yes, it may be delivering less per venture capitalist (VC) funding or have fewer fintechs, but from my experiences while living here, there’s so much worth talking about when you hear the stories behind the initial figures.

This region has not only grown in its contribution to the fintech sector but has even exported its know-how to much of the world while impacting on the wider narratives of financial inclusion and economic development.

I would like to thank my family and friends who have supported me and given moral support while I have compiled this year’s report. Plus, of course The Fintech Times family. Thank you to Kaitlyn King, as well as Claire, Chris, Jason, Raf and last but definitely not least Mark... we did it! I'd like to thank our sponsors as well for making this report possible

For those who are reading this – whether you live in the Middle East and Africa, follow fintech regularly, work within the sector, or are just simply curious about it – we all hope the Fintech: Middle East and Africa Report 2022 will prove useful for you. Despite its complexities, our aim is to make topics as simple as possible to be accessible to all levels.

For those of you who are more ‘in-tune’ with fintech and goings-on in MEA, we hope you will learn new things not only about others but also your own contributions to the wider global community.

Now come with us as we take you on a journey through the exceptionally diverse region of the Middle East and Africa.

IIt is a pleasure for us to participate in The Fintech Times MEA Report 2022, a report which examines the fintech ecosystem in the MEA region and sheds the light on how the latter is creating a suitable environment for all types of financial technology services to synergise, while identifying progress, challenges and opportunities.

In line with Qatar’s fintech strategy, Qatar Development Bank (QDB) announced the launch of the FinTech Incubator and Accelerator programmes in 2020, a main milestone and key strategic initiative of the strategy. Their launch constitutes a breakthrough for the financial system in the State of Qatar and the region as the programmes are achieving a paradigm shift for fintechs and their ability to compete and grow in the light of a healthy business environment. Since its launch, the Qatar FinTech Hub has been striving to create a sound ecosystem for incubating domestic fintechs, while building up an enabling environment for foreign ones to invest and grow in the region. Both programmes are working on supporting the Qatari financial system to meet the needs of local and global fintech entrepreneurs who are looking for a launch pad and a hub to accelerate their growth.

The Incubator programme is designed for budding entrepreneurs and early-stage fintechs with a minimum viable product (MVP) who want to transform their prototype into a sellable product; whereas the Accelerator programme targets mature fintechs looking for global expansion with a proven product market fit by demonstrating their project’s proof of concept.

QFTH runs the FinTech Incubator and Accelerator programmes twice a year; both programmes provide fintechs with access to financial and in-kind support as well as access to wider investors and global mentor network. Our mentors come from more than 14 countries with different areas of expertise within the fintech sector. The programmes offer a series of high-level masterclasses as well, conducted by QFTH partners and renowned speakers from across the world, in addition to a range of proof of concept (PoC) and collaboration opportunities with over 25 local and global financial institutions, payment technology partners and large corporations. Moreover, as part of our ecosystem development initiative, we also organise fintech hackathons; an innovative

competition through which participants present their solutions for pressing challenges that financial institutions and stakeholders face regularly. The winners of the hackathon are awarded with fast-track access to the Incubator programme. In our most recent hackathon, we onboarded Visa as a challenge partner, offering participants a chance to access Visa’s Fintech Fast Track programme.

Since its launch, QFTH has rolled out four waves of the Incubator and Accelerator programmes in Qatar, drawing in over 2,300 applications from more than 76 countries. Each wave was designed with a different focus area, to tackle and address specific challenges faced by financial institutions. The four waves covered were payment solutions, emerging technologies, embedded finance and next-gen banking.

To date, we have invested up to $7million in 64 fintechs with a total valuation of $484million+. Moreover, QFTH has been ranked as MENA’s second largest investor in fintech during Q1 2021.

In 2021, we released our first ever whitepaper, titled From Qatar to the World: A report on the state of FinTech in Qatar. The whitepaper offered a deep dive into Qatar’s fintech ecosystem and the programmes that it has put in place to stimulate growth, build calibre and talent, provide access to capital and opportunities, and design regulatory initiatives to attract fintechs and foster their development.

Moreover, our last milestone for 2022 was the Demo Day event that took place in October, and that was under the patronage of Qatar Central Bank, with which we concluded Wave 4. The Demo Day was one of the biggest fintech events in the region and a platform where fintechs had the opportunity to showcase their solution for the key players in the financial services ecosystem as well as startups and scale-ups, investors, partners, sponsors, advisors, consultants and enthusiasts.

Finally, we believe that our success can only be achieved through synergy and meaningful cooperation. We continuously collaborate with strategic stakeholders within the fintech community including financial institutions, technology providers, payment networks, regional and global fintech hubs, academia and regulators from around the world to ensure we are bringing programme participants an unparalleled expertise and wider opportunities across the globe.

We would like to conclude by reiterating that QFTH is on a committed mission to transform the fintech ecosystem not just in Qatar but across the entire MEA region. With access to adjacent underserved markets, favourable business environment, and access to capital, Qatar will continue to be a home for regional fintech development and will emerge as a key global player on that front.

Hilal Ali Al Kuwari – acting head of incubation and manufacturing projects, Qatar Development Bank

" Reltime is very pleased to take part in the Fintech: Middle East & Africa 2022 Report and to partner with The Fintech Times. The region is very close to my heart, since I grew up as a child in Burundi and Zambia in the 1970s. My father was working for the Norwegian government and the United Nations back then and my formative years in Africa have shaped and positively influenced my life. I am fond of planting trees and also passionate about helping empower people and businesses to take back control of their finances, privacy, identity and assets worldwide. I have planted olive trees in Dubai and in South Africa, as a gesture of peace, reconciliation and friendship in the Middle East, Africa and beyond, and a sign of alliance between nature and mankind.

Without a doubt, fintech is making a huge difference in and positive impact on the MEA region – significantly improving the livelihoods of people, communities and businesses. Reltime has very ambitious plans for the region and we are open to collaboration with both financial and non-financial institutions. Reltime is a B2B2C company on a mission to empower people and businesses to thrive and be free in the New World. We are revolutionising and transforming the way business and finance are done, payments and financial transactions are made, and trade is conducted in the region and worldwide.

As a fintech for good doing business all around the world, Reltime entered the Southern African markets in September 2022. The group managing partner of our business partners in the region, Peterson Khumalo, who runs a proudly pro pan-African financial services firm, believes that ‘a business is not about making money, it is about creating value. Money will follow. With Reltime, we have found our perfect second half’. Peterson’s perspective is Africa first, and the world after. This is because Africa has over many centuries given so much to the world in labour, minerals, humanity and so much more. Our trailblazing and inclusive strategic partnership aims at empowering people and businesses, while accelerating and leading the region’s Web3 and Metaverse fintech eruption.

We are seeking strategic and B2B2C partners throughout the MEA region, since we firmly believe

that Reltime’s global Web3 financial services platform and Decentralised Exchange (DEX) are unique. Web3 means power to the people. Power to entrepreneurs. Power to local businesses and communities!

Our Reltime DEX could, for example, be used as a truly easy-totrade platform for local fair trade and premium cocoa growers to trade their quality beans directly with buyers on the other side of the planet, without the interference of any intermediaries. A smart contract inside the DEX enabling the transaction is automatically created. This instant smart contract could be between the seller (e.g. the farmer or producer in Africa or the Middle East), transporter (e.g. a logistics or shipping company) and buyer (e.g. an end user or merchant in Cape Town, Tel Aviv or anywhere in the world).

Reltime is determined to be at the forefront of the Web3 and Metaverse revolution in the MEA region. Through Reltime’s best-inclass FastTrack to Embedded Finance, game-changing financial services can be provided to your customer base under your own brand, providing attractive new revenue streams, while reducing your customer churn. This is single, decentralised, agile and Web3 financial platform is especially interesting for telecom operators, financial service providers focusing on specific target groups, neobanks, gaming and virtual sports Metaverse companies, supermarket chains, shopping malls, e-commerce firms and others with a large customer base.

The future of the MEA region is bright. Leading by example, the region can show to the world what fintech for good can do, how it works in the New World, and how it can positively impact people’s lives, entrepreneurs’ profitability and merchants’ capability to open up new markets and pay little or no settlement and transaction fees. Fintech can contribute immensely to solving the challenges and frustrations people, communities and businesses in the region are facing every single today. That is why Reltime is your local, regional and global partner for anything related to embedded finance, Web3 and decentralised fintech for good solutions. We are here for the long term!”

Peter Michel Heilmann, CEO, Reltime

AIM OF THE REPORT

The report gives a comprehensive overview of the MEA fintech landscape, from a wider macro-level overview and then narrowing down to specific aspects of the industry.

REPORT OVERVIEW Divided into four chapters, the report covers economic development in the region and how its relationship – both market demand and government support – have been impacting the growth and development of the fintech industry in MEA. It tells a story of a region where many are financial excluded and fintech has truly brought inclusion across the region. Later, the report delves into fintech directly and goes through key subsectors of it. Afterwards, the report then ranks 23 different fintech hubs and categorises them in a three-tier system through analysis of various economic, digital and fintech-specific factors – giving in addition a country overview of all 23. Finally, the report concludes with a summary, predictions and future framework for the future vision of the sector and its contributions to wider economic development.

Overall, the report gives the reader – including those who would not be familiar with the region nor even fintech as well as those more in-tune with either or both – a comprehensive overview via the presentation of this report as a solid reference point.

A region that is home to a quarter of the world’s population, MEA presents a diverse region that is home to a mix range of cultures and socio-economic backgrounds but nonetheless share similarities – it needs digitalisation, financial services can be improved and fintech could be the answer to much of it. The following will be the baseline of the report:

Before jumping in on fintech, the report gives an overview of the MEA region – from its economic development at present to economic situation to its financial services sector and tech sector and government intervention – culminating with its relation to financial technologies or fintech.

With a region as diverse as MEA, which is home to some of the world’s richest, poorest and fastest growing economies, it is hard to summarise quickly or easily. Nonetheless, there are similar traits – for instance much of them rely on natural resources fuelling their economic growth as well as having traditional mindset financial services institutions. This culminates in today’s needs globally with the rise of digitalisation and economic diversification whereby much of MEA isn’t prepared to do so; however they admit and are willing to change via economic development strategies to prepare them for the future via 'visions' or economic diversification strategies. To note, economic integration among neighbours can play a key role in collaboration and innovation as well.

In addition, consumers in MEA, whom are mainly young, internet deprived but mobile friendly, diverse and also unbanked and financially excluded or underserved, have had to adapt to the challenges the pandemic have brought in recent memory.

From economic development, Chapter Two then focuses on its relation to financial technologies and its impact in MEA. The sector is first given a comprehensive overview, in particular in terms of who does what and where it is. In other words, how many fintech solutions are there in the MEA region as well as what specifically they do.

Later, much of the section focuses on breaking down the subsectors of fintech in relation to MEA. It is true, and even to this day, that much of the region’s fintech is centred around payments, money transfer and remittances. However, this is not completely accurate anymore, as the region is also boasting other fintech subsectors beyond payments such as gametech, wealthtech and investing, digital currencies (including cryptocurrencies), lending, open and embedded finance, regtech and insurtech. This chapter gives an overview of each of them and their impact on the region.

As a first, the report gives a visual overview of a sample of fintechs that are part of this ecosystem as well as other relevant graphics that pertain to the fintech ecosytems. After giving an overview, the report

showcases excerpts of a sample of key ecosystem players that are relevant to the MEA fintech environment.

The question arises – so which ones are fintech hubs? And why? It is easy to say X country is a fintech hub and Y country is not but it needs evidence and justification at the end of the day. This is why this report also adds more value than others because it also factors in various aspects of a fintech ecosystem. Looking at the wider MEA region, coupled with known information, 23 countries were chosen to be evaluated among themselves on what level of fintech hub 'ness' they were. This was done based on simple three-level criteria:

■ Wider economic development criteria – for any sector such as fintech to thrive it needs an ecosystem that promotes economic growth and prosperity. In this case, six different criteria on this topic were chosen to evaluate the 23 countries.

■ Tech and digital – what have been the benefits of tech and digital? Three different criteria were chosen to evaluate the 23 countries.

■ Fintech-specific – there are four fintech-specific criteria that can we have used to evaluate the 23 countries .

Factoring in these indicators, the results shouldn't come as a surprise in terms of which countries in MEA got what. For instance, the highest Tier-One hubs were Israel and the United Arab Emirates (UAE). Also in the second tier, the two highest were Saudi Arabia and Turkey; the 'Big Four' in Africa (Egypt, Nigeria, Kenya and South Africa) all scored well and are solidly in Tier-Two hubs. If anything, it further solidifies which categories received what score. Economic development prosperity coupled with digital and fintech specific indicators help propel the ‘fintech hub’ of those that have been ranked as they have been done.

This chapter addresses the question first of partnerships – do it on your own or via mergers and acquisitions (M&As) with respect to the relationship of fintech and financial services and other third parties like telecommunications companies. Later, a top 10 predictions of the region is given – addressing topics like the current ongoing challenges of the global economy, the further diversification of the region’s fintech sectors beyond just payments, and afterwards a future framework for the vision of fintech’s further growth and contributions to MEA is done.

The overall theme of financial inclusion through fintech will continue to be important for MEA. The report then concludes with a final summary.

Chapter One gives an overview of the Middle East and Africa (MEA) region, with the region’s current economies and wider economic development the main focus. Later, the chapter gives an overview of the MEA consumer before delving into the region’s financial services ecosystem. The chapter concludes

with government support via national economic development strategies, the rise of economic integration and finally, financial technologies (fintech), and its growing role in the region.

Before going into the region’s economic development, one must understand its geography first.

The MEA region is vast – spanning mainly across Africa and Western Asia (with parts of Turkey in Europe too). Including Israel and Turkey, MEA has a population of approximately 1.8 billion people, with Africa alone home to 1.35 billion. Essentially, almost one out of four people in the world’s population of almost eight billion live in MEA. Given that the territory of MEA is so huge, each region and country have their own respective cultures, languages and histories.

When including North African nations, it is common practice to say Middle East and North Africa (MENA) with respect to the Middle East. The MENA region is often categorised together due to its shared history, culture, religion and language. It includes:

■ The Gulf Cooperation Council (GCC) – with members including Kingdom of Saudi Arabia, Kingdom of Bahrain, Sultanate of Oman, State of Qatar, State of Kuwait and the United Arab Emirates (UAE)

– is a political and economic union in the Arabian Gulf region

■ The Levant Region –Jordan, Syria, Lebanon, Israel and the Palestinian Territories

■ Gulf region non-GCC – Yemen, Iran, Iraq

■ Turkey

■ North Africa – Algeria, Egypt, Libya, Mauritania, Morocco, Tunisia, Sudan and Western Sahara

Africa is home to 54 countries, according to the United Nations (UN) – not including Western Sahara. Africa is really big – spanning from the Indian Ocean to the Atlantic from east to west, all the way from the Mediterranean in the north to the tip of South Africa.

It has a land area of more than 30 million sq. km meaning it can easily accommodate the US, China, India, Japan, Mexico and several European nations combined.1 The African Union, which has 55 African member states, divides the continent into five regions:

■ North: Algeria, Egypt, Libya, Mauritania, Morocco, Tunisia, Western Sahara and Sudan

■ South: Angola, Botswana, Lesotho, Malawi, Mozambique, Namibia, South Africa, Swaziland, Zambia and Zimbabwe

■ West: Benin, Burkina Faso, Cabo Verde, Cote d’Ivoire, Gambia, Ghana, Guinea-Bissau, Guinea, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone and Togo

■ East: Comoros, Djibouti, Ethiopia, Eritrea, Kenya, Madagascar, South Sudan, Mauritius, Rwanda, Seychelles, Somalia, Tanzania and Uganda.

■ Central: Burundi, Cameroon, Central African Republic, Chad, Congo, Democratic Republic of Congo, Equatorial Guinea, Gabon and Sao Tomo-and-Principe

In this report, Sub-Saharan Africa (SSA) will also be used, which refers to the area south of the Sahara – essentially minus North Africa. In addition, due to the importance of the Arab culture in MEA, the Arab world will be referenced in this report, which mainly refers to the countries in MEA that not only speak Arabic but are members of the League of Arab States (Arab League) – the association of independent MEA countries whose peoples are mainly Arabic speaking: Algeria, Bahrain, Comoros, Djibouti, Egypt, Iraq, Jordan, Kuwait, Lebanon, Libya, Mauritania, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Somalia, Sudan, Syria, Tunisia, the United Arab Emirates and Yemen. (Note, Syria’s membership to the Arab League has been suspended)2

The diversity of MEA can be seen across its different economies – home to some of the most advanced ones as well as some of the poorest regions in the world. With respect to gross domestic product (GDP), for instance, it is home to some of the world’s highest GDPs per capita, particularly in the Gulf Cooperation Council (GCC) region and Israel. It is also home to much of the world’s lowest per capita. Of the bottom 10 gross national income (GNI) per capita globally, all were in Africa with the exception of Afghanistan.3 4

The region is very much reliant on its own natural resources. Much of the global spotlight tends to focus on oil and gas and specifically on the Middle East, specifically in the GCC region – Saudi Arabia, UAE, Qatar, Bahrain, Oman and Kuwait, as well as others such as Iran and Iraq. It’s important to note, several African nations are also oil producing nations. These include Angola, Algeria, Nigeria, Libya, Republic of the Congo, Ghana, Gabon and Equatorial Guinea.5 In fact, in 2021, out of the top 15 exports of crude oil (by dollar value), over half were MEA countries – Saudi Arabia (first place), Iraq (fourth), UAE (fifth), Kuwait (eighth), Nigeria (ninth), Libya (11th), Angola (12th), and Oman (13th).6 In terms of natural gas, two MEA countries, Iran (second) and Qatar (third) hold the world’s biggest natural gas reserves behind the US in fifth, Turkmenistan in fourth and Russia in first place.7 Out of the current 13 Organisation of the Petroleum Exporting Countries (OPEC) members, all but one (Venezuela) are MEA countries. Despite its diverse landscape, it presents tremendous development and growth. During pre-Covid times, from 2014 to 2019, Africa had a decadal average of five per cent to around three per cent growth. In 2019, East Africa was the fastest growing region while North Africa continued to make the largest contribution to Africa’s overall GDP growth, thanks in part to Egypt’s growth. In fact, six African countries were among the world’s 10 fastest-growing economies: Rwanda at 8.7 per cent, Ethiopia at 7.4 per cent, Côte d’Ivoire at 7.4 per cent, Ghana at 7.1 per cent, Tanzania at 6.8 per cent and Benin at 6.7 per cent.8

The well-developed and wealthy parts of the region comprise the GCC and Israel. With the former, the discovery of oil last century transformed this region drastically. Previously, it was mostly a nomadic society 9 in comparison to today, whereby it now has some of the world’s highest standards of living – Qatar has the highest GDP per capita in MEA (and one of the highest in the world), for example. Israel, despite not having many resources compared to its oil-rich neighbours, has been able to transform itself into a leading economy focused mainly on services. In particular, its high tech industry has produced and contributed many advancements leading the country to earn the nickname ‘Startup Nation’, as it boasts the most startups per capita in the world.10 Much of its success can be attributed from the 1960s (and later again in the 1980s and 90s) when it began economic reforms to liberalise its economy.11 Also, the arrival of up to a million of former Union of Soviet Socialist Republics (USSR) citizens during its fall, many of whom were from technical backgrounds, further drove entrepreneurship and a high-knowledge economy.12

Not all economies in the GCC have been solely reliant on oil, however. Dubai, the largest city and commercial hub of the UAE, and the Kingdom of Bahrain have both used wealth from their oil reserves to transform their economies through diversification via non-oil sectors. With the latter, it was the first in the GCC from as early as the 1960s to diversify its economy via non-oil sectors such as finance, tourism, logistics and wider services industry13. In Dubai, oil – which at one point was over half – now only contributes less than one per cent of Dubai’s GDP.14 This has been attributed to its investments as well and prioritisation of sectors notably logistics and transportation, tourism, financial services tourism and wider services. For instance, in pre-pandemic 2019, Dubai was the fourth most visited city in the world behind London, Paris and Bangkok.15 This and the city’s wider economic development can be attributed to the success of Emirates Airlines.

Several countries in MEA have relatively mid-advanced economies – ranging from the higher end to the border between the lower end of the mid-range. They are either economies that, similar to their more advanced countries in particular the GCC, have an abundance of natural resources, in particular oil and gas, or economies like Israel, where they have had to rely more on a services economy due to a lack of those resources, or a hybrid of both resources and services.

Many of these economies are reliant on the likes of oil and gas, or other commodities such as gold or agriculture. As mentioned earlier, countries like Nigeria are abundant in resources – in their case oil, where over three-fourths of their export goods by value are generated by this.16 With large populations, the revenues of oil presented wealth to the country but these haven’t benefited everyone.

Turkey, which is a high-middle income economy, has a strong economy historically. It has a mixed range of goods that includes agriculture, manufacturing and the services sector.17 Kenya, similarly, has a wide range of its economy that include not only agriculture but also the services sector.18 In fact, Nairobi has become not only a regional hub for East Africa but has also increased its technology environment to the point it has also earned its own nickname 'Silicon Savannah'.19 Other examples include South Africa, which historically has a developed economy in its services sector and a mixed economy where natural resources, in particular gold and platinum, also play a strong part in its income.20 This also includes much of North Africa – in particular Morocco, Tunisia and Egypt – which has relied on both a mix of resources like gas for Egypt but coupled with other sectors notably tourism for all three. There are countries like Jordan, with little natural resources compared to the others, who nonetheless have achieved their status with a strong services sector and manufacturing.21

Despite having relatively advanced economies, the challenge remains that wealth is not as enjoyed by all – huge numbers in some countries still live below or at the poverty line and inequality is high. For instance, it was estimated that almost half of South Africans pre-pandemic were living at or below the poverty line.22

MIDDLE EAST Bahrain, Qatar, UAE, Oman, Yemen, Saudi Arabia, Jordan, Iran, Iraq, Syria, Lebanon, Isreal and Palestine

NORTH Algeria, Egypt, Libya, Mauritania, Morocco, Tunisia and Western Sahara

SOUTH Angola, Botswana, Lesotho, Malawi, Mozambique, Namibia, South Africa, Zambia Swaziland and Zimbabwe

WEST Benin, Burkina Faso, Cape Verde, Côte d’Ivoire, Gambia, Ghana, Guinea-Bissau, Guinea, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone and Togo

EAST Comoros, Djibouti, Ethiopia, Eritrea, Kenya, Madagascar, Mauritius, Rwanda, Seychelles, Somalia, South Sudan, Sudan, Tanzania and Uganda

CENTRAL Burundi, Cameroon, Central African Republic, Chad, Congo, Democratic Republic of Congo, Equatorial Guinea, Gabon and Sao Tome-and-Principe

Compared to the well-advanced high-income countries and the mid-level ones, the low-income economies are noticeably not as economically advanced for their own reasons – political, economic, social. In addition, a lot of these countries depend on development aids and subsidised loans from multilateral lenders to survive.23

Based on the 2020 gross national income (GNI) per capita in current USD, the bottom 10 countries in the world were Burundi in first place at $270, Somalia in second at $310, Mozambique in third at $460, Madagascar in fourth at $480, Sierra Leone in fifth at $490, Afghanistan in sixth at $00, Central African Republic at $410 in seventh place, Liberia in eighth at $530, Niger in ninth place at $540 and the Democratic Republic of the Congo at $550.24

It doesn’t help that much of Africa is poor and consequently doesn’t help with its own economic development. As highlighted in the first edition of this report last year, Africa has the highest rates of child mortality (one in six) and malnutrition (36 per cent) in the world in children up to five years of age. The continent has the worst schooling outcomes in the world (51 per cent out of school) in the age group from six to 14 years.25

While some might have resources, their own political, economic development and social factors have prevented them to further rank higher. Unfortunately, which isn’t much common knowledge, much of Africa remains to be in this case.

Like the rest of the world, 2020 until present has brought significant challenges to MEA. From the affluent regions to the middle and the lower income, the global pandemic was not an easy challenge and recovery from it is still ongoing. Shipping and logistics crises, partially due to Covid, closures and delays in major Chinese ports as well as other factors like the Suez Canal blockage and the 2022 Ukraine and Russia war, have not helped. The current resurgence of travel and tourism and, related, the overall challenges of inflation have made this worse.

Nonetheless, according to the World Bank, the MENA region is expected to grow by 5.2 per cent,26 which is the fastest rate since 2016. In sub-Saharan Africa, where growth initially was predicted to be at four per cent, the forecast is 3.6 per cent by end of 2022.27 For both regions, this will be pending on the ongoing conflicts of Ukraine and Russia, food crisis, other health issues relating to the pandemic – to name just a few. Even though many in MEA are abundant with commodities, such as oil, they are also mainly reliant on imports of food, which can impact any significant predications on economic growth.

The following will look specifically at key sectors in the economy, including the financial services sector as well as wider tech and entrepreneurship – all of which have brought opportunities to the rise of financial technologies (fintech).

Financial services encompass a wide range of offerings including payments and insurance – to name a few – and this is no different in the MEA region.

Globally, the financial services sector plays a large part in our economy. Its total assets last year globally were estimated be around $468trillion.28 As with the wider disparity across the vast MEA region, the financial services industry is also varied. The GCC in the Middle East and countries like South Africa or Mauritius (located in the Indian Ocean) in Africa have a well-developed banking sector.

However, in other parts of MEA the banking sector is less well developed. In addition, there are many parts of MEA dominated by public sector banks, with government intervention in credit allocation, losses and liquidity issues.29 The African banking sector has seen significant changes overall.

According to a report from the African Development Bank Group (AfDB) these reforms, to a large extent, were aimed at restructuring and privatising state-controlled banks, part of structural adjustment policies (SAP) by the World Bank and IMF. These reforms had also included auxiliary policies that helped ease entry and exit restrictions, interest and capital controls, and the overhaul of supervisory and regulatory frameworks within the banking sector.30

Overall, the Middle East is oversaturated with banks. For instance, in 2019 there were around 120 private and public banks across the GCC (minus Qatar), serving more than 50 million people. In the UAE, for example, there were around 47 lenders for a population of around 10 million people, whereas in Saudi Arabia there were 18 banks serving a population of 36 million.31

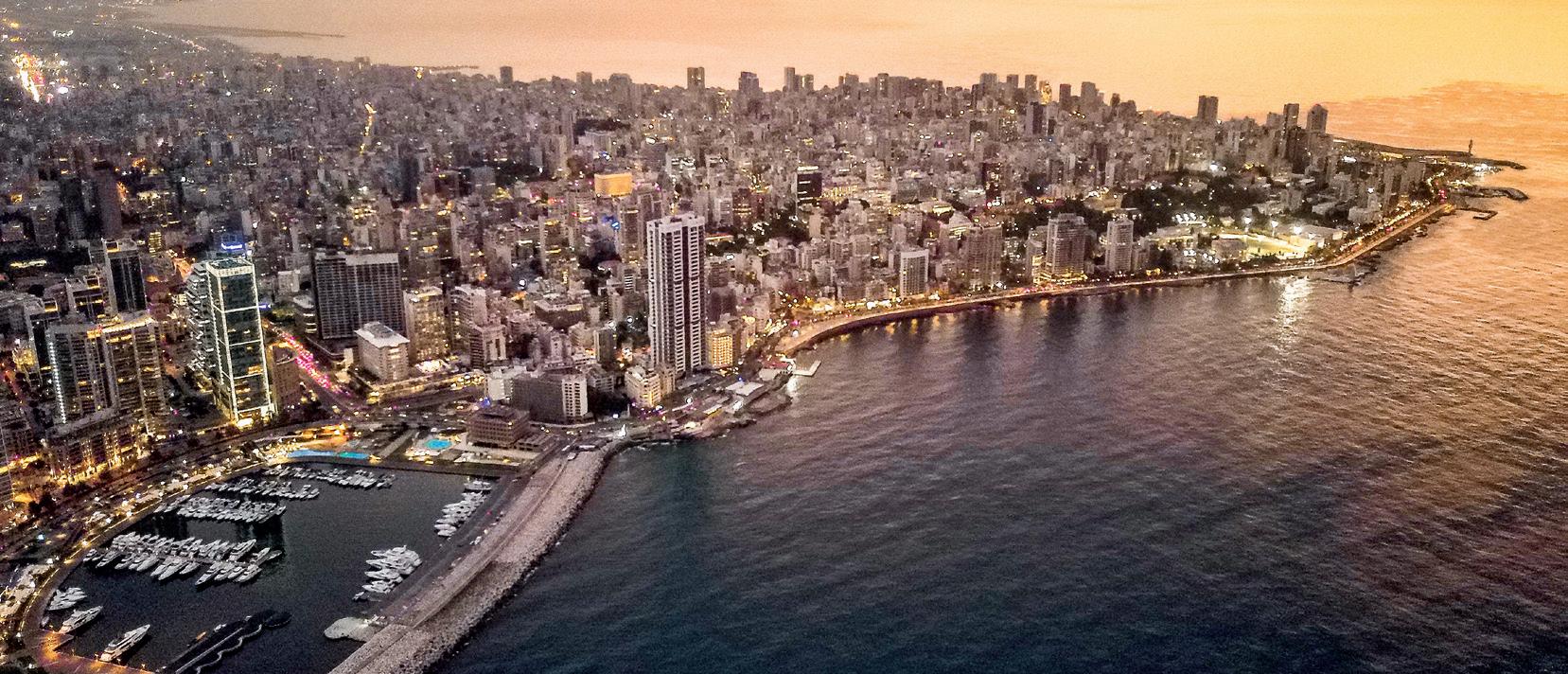

There are notable financial centres that have/are contributing significantly not only to their own economies but that of the region. Beirut, often known as the ‘Paris of the East’ up until the Lebanese Civil War in 1975, saw its capital and largest city of Lebanon as a major financial centre in the Middle East.32 Its success was attributed to its embracement of Western culture and sophisticated banking regulations and one of few banking secrecy regimes that would not collapse to the political insecurities at the time like communism; its geographical location and lifestyle also helped attract investment.33

After the challenges of the Civil War, other financial hubs in MEA came about such as Kuwait or Bahrain. As of today, more than 400 licensed financial institutions, representing a rich mix of international, regional and local names, are based in Bahrain. Those companies and institutions cover the full range of financial services, with concentrations in wholesale banking, insurance, and funds/asset management. The financial sector in Bahrain now represents its most important sector of the economy, representing over 27 per cent of GDP. This sector is also the largest single employer in Bahrain, with Bahrainis representing more than 80 per cent of the workforce, according to the Bahrain Economic Development Board (Bahrain EDB).34

In Africa, there’s Mauritius. According to the Mauritius Economic Development Board, the financial services sector contributes 13 per cent to the total GDP in the country and employs over 8,600 people. The ICT/ business process outsourcing (BPO) industry represents a key driver of the Mauritian economy with a GDP contribution of 7.4 per cent for last year and employing around 30,000 people with over 850 companies in the sector.35 At present, MEA has a large diverse number of strong financial centres. As well as those previously mentioned, there’s Casablanca in Morocco, Johannesburg and Cape Town in South Africa, Istanbul in Turkey, Nairobi in Kenya, Doha in Qatar, Tel Aviv in Israel and the UAE capital of Abu Dhabi. However, based on various metrics,

the undisputed leader at present is Dubai, the commercial hub and largest city of the UAE. Last year, Dubai was among the world’s top 20 vibrant financial centres ranking at 17th place in the Global Financial Centres Index (GFCI) – the only Middle East, Africa and South Asian city to do so, joining the likes of London, New York City, Singapore and Hong Kong.36 The centrepiece of Dubai’s financial hub status can be seen with its Dubai International Financial Centre (DIFC), a special economic zone. Dubai is also home to regional offices of two-thirds of Fortune 500 companies with a MEA operation. These include large international banks, such as HSBC and Standard Chartered as well as payment giants Visa and Mastercard, plus technology companies such as Microsoft and Oracle. It is said that DIFC contributes at least 12 per cent to Dubai’s GDP.37

There are also emerging players – notably Abu Dhabi, which on the same GFI ranking was the only other city in MEA to crack the top 50 with a 31st place. In the top 100, other MEA cities included South Africa’s Cape Town (55th place) and Johannesburg (56th), Tel Aviv (57th), Istanbul (64), Doha (65th), Bahrain (84th), Riyadh (86th), Mauritius (87th) and Kigali (99th).

This report lists the top 20 largest banks in the entire region, which were ranked by total assets in US dollars. These figures were compiled from the banks’ individual investor relations reports, using their annual data from this year. Note, only MEA headquartered banks were included and not non-MEA banks with regional offices in the region.

Qatar National Bank takes first place, with total assets of $298.8billion. Close behind it is United Arab Emirates' First Abu Dhabi Bank, with total assets of $272.25billion. In third place is Saudi Arabia’s National Commercial Bank (NBC) with total assets of $246billion. Rounding out the top five are Israel’s Bank Leumi with $191.1billion and UAE’s Emirates NBD with $189billion.

The 20 largest banks in MEA are concentrated in a few specific countries – Israel, Turkey, South Africa, the GCC (mainly the UAE, Saudi Arabia, Qatar and Kuwait) and Egypt. It is worth noting that others that did not make the top 20 list, such as Nigeria and Bahrain, also have sizeable numbers of local banks. Nevertheless, it shows that much of the region’s financial services industry is concentrated in specific countries, the largest financial institutions in the region.

When it comes to insurance companies in the MEA region, there is strong competition in the industry. With property, health, life and non-life insurances, as well as a host of other financial services (including pensions and asset management), insurance offerings in the region are vast, with options for consumers and businesses. Home to 1.8 billion people, the MEA region represents a significant population yet many are uninsured. According to Atlas, the insurance premiums market in MENA stood at $57billion in 2018. The affluent GCC region38, according to research from management consulting firm Kearney, is one of the world’s fastest-growing markets, with registered growth of nearly seven per cent each year in gross written premiums over the previous few years. The GCC countries collectively accounted for less than half (44.3 per cent) of the region’s premium market share. Much of the Middle East still is uninsured, with less affluent regions specifically beyond the GCC region.

According to a report by Zurich, “despite the ability of insurance to mitigate some key challenges for the sustainable development of emerging economies, its potential remains largely untapped. This is particularly true for MENA countries where insurance penetration – i.e., the ratio between insurance premiums written and GDP – is the lowest

in the world. Insurance penetration varies considerably between MENA countries, ranging from very low ratios in Algeria, Egypt, Yemen and several GCC countries, to ratios above 1.5 per cent in Jordan, Lebanon and Morocco. Whereas the non-life sector in the MENA region is roughly comparable to those of other emerging economies, the region’s life sector is conspicuously underdeveloped relative to other regions.”39

In Africa, the rate of uninsured is even lower. Nigeria, with a population of more than 200 million people and the largest country in the continent by population, has a penetration insurance rate of merely 0.4 per cent. A different trajectory generally in that rule is South Africa, where the nation has one of the world’s highest penetration rates of insurance, accounting for an estimated 80 per cent of the continent’s total gross premiums.

MEA has a combination of large global insurance brands offering various products and services across the region, such as MetLife, Zurich, AXA, Cigna, Munich RE, Aetna, Bupa – to name a few. MEA also has a wide range of its own native-born and headquartered insurance firms, such as Turkey’s ERGO Sigorta A.S¸, Insurance Association of Turkey, and Anadolu Hayat Emeklilik, Saudi Arabia’s Walaa, Salama, Malath and Al-Rajhi Bank, Takaful, Israel’s Harel Insurance Investments & Finance Services, Migdal Holdings, Clal Insurance Enterprises Holdings Ltd, and Menora Mivtachim, the UAE’s Daman Health, Orient Insurance, Oman Insurance Company, and Takaful Emarat, Egypt’s Misr Insurance, South Africa’s Old Mutual, Liberty Holdings, Momentum Metropolitan Holdings, and Discovery Health, Qatar’s Qatar Insurance Company, Bahrain’s Bahrain Kuwait Insurance, Morocco’s RMA and Wafa Assurance and Kuwait’s Gulf Insurance Group. The next page showcases the top 15 insurance companies in the MEA region.

Healt h is a shared value insurance company covering over 5.1 million clients. It mainly serves small to large sized employers, as well as individual clients, also operating in UK, US and Chinese markets

Interestingly, when looking at the top 15, the entries are led by South Africa and Israel as well as Turkey, with Morocco, Qatar and Saudi Arabia having representation. Like the banks, the largest ones in the MEA region are focused on those areas.

Spotlighting back to Africa, the continent has a potential insurance market value of $68billion in terms of gross written premiums, which would put it at the eighth largest in the world. This was originally researched from a report from McKinsey.40

With even mentioning digital transformation and the rise of insurance technologies, or insurtech, there remains much opportunity for insurance to further grow. As with everywhere else in the world, the financial services industry is not much different in the region in terms of what it offers. It still, after all, is providing financial services to people and corporations. The ecosystem is made up of banks, as well as other international banks who have a presence in the region, investment houses, lenders finance companies, real estate brokers and insurance companies.

Nonetheless, MEA has its own unique approaches compared to the rest of the world. These include for instance:

■ State owned or partially state owned financial institutions For those of you reading in the West, considering state ownership of banks might conjure up memories of the 2008 Global Financial Crisis, with American and British governments forced to bail out banks – buying their bad debts in exchange for stakes in said bank.

However, in MEA, state ownership of banks is common and isn’t associated with a financial crisis. For instance, in Angola there are 195 state-owned companies (some of which are financial services institutions).41 This is also prevalent as well in the Middle East, where at one point it was estimated by The Financial Times, that GCC governments – including their sovereign wealth funds, state pensions and social funds – had interests in 80 per cent of the 50 biggest lenders by assets. These include the likes of First Abu Dhabi Bank (FAB), Emirates NBD, Saudi Arabia’s NCB and Qatar National Bank (QNB).42

■ Lending more conservative It is hard to summarise all the banks in MEA, but it seems to be generally conservative in terms of its lending. This could be seen with the 2008 Global Financial Crisis, in comparison to the West, the financial services sector across MEA fared much better. Of course, there was a global recession that did impact the world, including MEA, but this speaks purely on the financial sector. MENA banks, and in particular the GCC ones, hold high levels of capital, generally comfortably above minimum capital requirements and standards set under the Basel III agreements.43 Basel III is an internationally agreed set of measures developed by the Basel Committee on Banking Supervision in response to the financial crisis of 2007 to 2009.44

■ Growth of Islamic finance Being the birthplace of Islam and home to much of the world’s two billion Muslims, Islamic finance plays a growing role in the wider financial services ecosystem. Even though Islamic finance existed in the seventh century, its formalisation began gradually since the 1960s. Islamic finance refers to how businesses and individuals raise capital in accordance with Sharia, or Islamic law. This also includes the types of investments that are permissible under this form of law. Islamic finance can be seen as a unique form of socially responsible investment.

Islamic finance is one of the fastest growing financial industries, even though it is still a small share of global finance. Its total assets have exceeded $2trillion, and it is expected to reach $3.8trillion by 2023. According to the Union of Arab Banks, 10 countries accounted for 95 per cent of the world’s Sharia-compliant assets with Iran at 30 per cent of the global total, followed by Saudi Arabia at 24 per cent, Malaysia at 11 per cent, the United Arab Emirates (UAE) at 10 per cent, Qatar at six per cent, Kuwait at five per cent, Bahrain at four per cent, Bangladesh at 1.8 per cent, Indonesia at 1.6 per cent and Pakistan at one per cent.45

With regards to insurance, part of why there is still a low penetration could be the lack of Sharia compliant offerings. Saying that, with Takaful, which is Sharia compliant, this can help boost the uninsured rate in the Arab World.46

■ Less advanced infrastructure Compared to the West, much of MEA overall has various levels of its advanced infrastructure with regards to financial services. These infrastructures of course are important for lenders, especially as data and information are needed to help offer potential services to end users. For instance, while credit bureaus are important and perhaps taken for granted, this isn’t the case in MEA. As recently as 2007, only four countries in Africa, according to the IFC-World Bank Doing Business 2007 Report, had effective credit bureaus: Botswana, Namibia, South Africa and Swaziland.47 Since then much has changed.

In recent memory, it is estimated that the MENA region in terms of private credit bureau coverage (by percentage of adults) was only over 20 per cent. It’s important to note the disproportion of this, with Israel scoring at 100 per cent and most of the GCC scoring at least over 50 per cent like in Saudi Arabia and the UAE. Interestingly, Iran was more than 60 per cent.48

Another example has been the relatively lack of data centres across the region. Much of the data, such as in Africa, is stored abroad. Nonetheless, the region has witnessed a growth in building its own data centres.49

This even includes the gap of what many might see as basic financial services infrastructure, such as ATMs. In Africa, especially in the rural areas, ATMs are not readily available – further exasperating the gap of financial exclusion.50 Even IDs are still lacking – according to the World Bank, of the estimated one billion people globally without a registered ID, Sub-Saharan Africa takes over half of this share, making digital transformation and fintech developments difficult to advance. So, forget even considering know your customer (KYC) when even just knowing someone is difficult. Not even factoring digital experiences, which much of this report will highlight, infrastructure improvements are still needed.

■ Financially excluded for individuals Much of MEA remains to be underserviced or excluded completely. In more advanced financial sector ecosystems, such as in South Africa, Mauritius and Kenya, there have been improvements in banking penetration and overall financial infrastructure. Banking penetration in those three countries are 69 per cent, 90 per cent and 82 per cent respectively. Compared to much of the rest of Africa, in South Africa and Mauritius, there are 10 bank branches per 100,000 adults – far higher than the Sub-Saharan African average of only five.51

Saying that, most Africans – 57 per cent – do not have any kind of bank account (even including mobile money accounts). It is also estimated that 360 million adults do not have access to any form of a bank account at all. Additionally, Sub-Saharan Africa has a low credit and debit card penetration – at three per cent and 18 per

cent respectively.52 One challenge in the African continent is that it is still not mostly urbanised – and much of its already limited financial services institutions often caters mainly in these urban areas – thereby excluding a significant proportion of the rural population. This doesn’t factor poverty levels which also made the situation of financially excluded worse.

The Arab World is even worse. According to a World Bank study, almost 92 per cent of the Arab World population are in immediate need for adequate financial inclusion – more choices, greater access and resilience. While 69 per cent of the Arab World remains to be unbanked.53

■ Financial exclusion for small and medium enterprises For the MEA region, in terms of small and medium enterprises and micro businesses, access to finance remains to be a challenge. For instance, in the Middle East and Central Asia, SMEs are the majority (96 per cent) of all registered companies in the region. Nonetheless, the region lags most with SME access to finance via the banking system. The average share of SMEs in total bank lending in Middle East, North Africa and Pakistan (MENAP) is around seven per cent (it is even lower in parts of the GCC at two per cent). This is also shown in a survey from the World Bank Enterprise Survey where 32 per cent of firms in the MENAP region say access to credit is a major constraint (higher than the global average of 26 per cent); it is estimated that SMEs in the Middle East have the highest rate of lack of financial access in the world.54 Africa doesn’t fare better either. SMEs in Sub-Saharan Africa have a finance gap of $330billion, according to the World Bank. SMEs across the continent struggle to secure loans due to various factors, one of which is they are unable to provide information needed about their businesses to lenders (as highlighted earlier with the infrastructure bullet point).55

It is no surprise that tech plays a major part in not only the global economy but also in day-to-day lives. Just this year, for example, global VC funding reached $160billion in the first quarter of this year, seven per cent higher than compared to the same period last year.58 In terms of a sector, the tech industry globally is estimated to be worth at least $5.2trillion now. Yet most of that is divided between North America (35 per cent), Asia (32 per cent) and Europe (22 per cent) – therefore the remaining 10 per cent goes to the rest of the world, including MEA.59

It may seem like MEA might not have much going for it when looking at figures like these with uncertainty of where VC funding goes – at one point it was as low as a mere one per cent – but to see the day-to-day changes and the opportunities for fintech, the story becomes clearer. Related to its economic development, and like the financial services industry, the region’s wider tech ecosystem presents varied amounts of disparity in development. Israel has an environment that is not only leading in MEA but also the world while in other parts of the region the tech ecosystem still remains to be infant.

The following is a summary from StartupBlink on MEA countries that are ranked among tech hubs.

Of the estimated one billion people globally without a registered ID, Sub-Saharan Africa takes over half of this share

Startup Nation Israel has ranked as the highest in the region and this is no surprise with its own nickname demonstrating how it has produced the most startups per capita in the world. In addition, the country has produced some of the world’s most prominent tech unicorns (companies that are valued at $1billion or more) – including the likes of eToro, Rapyd, TripActions, Moon Active, Compass, Next Insurance and Melio. There are at least 77 Israeli-founded startups that have achieved this status – one of the highest numbers in the world.60 Many of them such as the first two and last two mentioned, are fintechs.

The highly innovative Israeli tech ecosystem has strong support from the government and its ecosystem has a tight-knit network of entrepreneurs. The country is second in the world in research and development (R&D) expenditure per capita, which is around 4.1 per cent of its GDP in R&D. Also, the country has the highest percentage of engineers and scientists per capita in the world. Israel also boasts one of the highest ratios of university degrees and academic publications per capita.61

The country had a record of over $25billion raised last year and this year so far looks promising too. During the first three months of this year, Israeli companies raised close to $5.6billion.

These were raised over 212 deals (including 14 megadeals of over $100million each); the $5.58billion is on par with fundraising in Q1 2021, which amounted to $5.4billion.62

Turkey has a large population of over 86 million people as well as an educated population. Despite its own recent challenges with the Turkish Lira, the country has been able to continue developing a strong tech ecosystem.

Between 2010 and 2020, the amount invested in Turkish startups annually was around $50milion to $100million. However, last year, that was over $1.5billion, which is more than the last decade combined. Having failed to produce any unicorns until 2020, the country has now seen six unicorns.63 One of them is Dream Games, a gametech company. During the first quarter of this year, Turkey saw an investment volume of $1.3billion with 42 deals, a figure similar to the same period last year.64

As a breakdown of the startups from Q1 this year, fintechs had the most of the 44 deals at nine deals, followed by gaming with a close eight and delivery & logistics with six. By deal volume it was delivery & logistics that took the most of the $1.3billion at $776.795million followed by gaming at $425.563million and software as a service (SaaS) in third at 131.471million.65

Focusing on the rest of MENA, not counting Israel and Turkey, last year saw the region achieve $2.6billion in VC funding – a record high – according to MAGNiTT’s 2022 Middle East and North Africa Venture Report. That included three mega deals which included Saudi Arabia’s Unifonic, a customer engagement platform. The $2.6billion value represented 590 deals. The UAE accounted for over a quarter of those deals at 26 per cent, and nearly half (45 per cent) of all funding raised in MENA last year. A third of this funding went to fintech.66 67

This year, Africa enjoyed a record 150 per cent increase in VC funding with $1.8billion during the first quarter of this year (compared to $730million the same period last year). The key regional hubs in the region, due to their sizes and relative advanced ecosystems, took the lion’s share – Nigeria ($600million), Kenya ($482million), South Africa ($228million) and Egypt ($202million). The rest of Africa enjoyed $306milion.

More than half (54 per cent) of the venture funding last year in Africa went to fintechs and this year included some of the continent’s biggest deals, such as Flutterwave’s $250million Series D raise.68

Besides Israel and Turkey, other noticeable tech hubs exist. For instance, the second highest ranked tech hub, the UAE, presents an ecosystem that is maturing and has attracted some of the best and brightest to the country’s key cities of Dubai and Abu Dhabi. In addition, there is also Kenya, with its capital and largest city Nairobi even dubbed ‘Silicon Savannah’ due to its stature as a regional hub in East Africa and its concentration and growing tech community.

Another one to highlight is South Africa, in particular Cape Town. This has seen the likes of Amazon and Panasonic setting up base there and a growing amount of foreign direct investment (FDI) and local based startups. According to a fDi Intelligence report last year, South Africa took first place in Africa for economic potential, startup status and business friendliness. It received the largest number of FDI projects in the software and IT services sector, as well as having the second-highest number of startups in the continent behind Nigeria.

With Cape Town, it is said that the Stellenbosch corridor has 450 tech firms alone that employ over 40,000 people – a bigger ecosystem than Nairobi and Lagos combined. The Western Cape has the highest number of VC firms in Africa with over 30 co-working spaces and almost 40 per cent of total devops in South Africa, the highest concentration in the nation. It is also home to some of the country’s (and Africa’s) prestigious universities, such as the University of Cape Town and Stellenbosch University.69

Although MEA (minus Israel) trails much of the world in producing unicorns there are signs that the tech ecosystem is maturing, and that the region can deliver. Until six years ago, the continent had zero unicorns and now accounts for seven (all except one are fintechs) including Fawry from Egypt, Nigeria based/founded Opay, Andela (the only non-fintech), Flutterwave, Interswitch, Jumia) and West-African Senegalese-headquartered Wave.70 There’s also Chippers Cash, although with African founders (Ugandan and Ghanaian), its main business operates on the continent and is headquartered in the US.71

The Middle East only has two fintech unicorns – Fawry from Egypt and stcpay from Saudi Arabia. In terms of tech, the MENA region has four others – the first in the Middle East to hit was hail-riding app Careem (later to be acquired by Uber), as well as Swvl (app for booking buses), Kitopi (cloud-kitchen platform), Emerging Markets Property Group (EMGP) (mainly proptech) – all four headquartered in the UAE.72

Israel has produced 92 unicorns, the most per capita in the world.73. In Israel, their home-grown players (many of which have moved operations or at least their headquarters to the US, UK or Asia) have become household fintech names74

Globally, it is estimated there are at least 1,068 unicorns with the US boasting half of them at 554 and China in second place with 180.75 In terms of fintechs, globally it is estimated to be 241 as of June this year.76

Startupbootcamp and PlugAndPlay as well as local-born players like Flat6Labs and Misk500. Globally, there are at least 7,000 incubators, with the USA alone having 1,400 of them.77 In Israel, there are at least 90 accelerator programmes78 and Turkey has 65.79

Another challenge historically has been the lack of VCs, mentors and wider ecosystem to support startups, but this is changing as well. Interesting to note, especially in the GCC which houses various sovereign wealth funds, they are not only investing in tech but even from non-MEA. For example, Mubadala from Abu Dhabi has invested globally in the likes of Klarna.80 VCs also include Pan-African Launch African Ventures or Middle East Venture Partners or Aramco’s Saudi Aramco Entrepreneurship Centre (Wa’ed)’s VC arm, Wa’ed Ventures or Jabbar Internet Group from the UAE. Others from non-MEA that have been active in the region include 500 startups from Silicon Valley.81 Israel has 205 VC firms, around 70 foreign firms and 60 corporate VCs.82 Another challenge for MEA is attracting and retaining talent. Given the nature of tech and wider entrepreneurship, it is a challenge to churn out those with the skill sets to not only work in high-knowledge industries like tech, but, for the bravest, to go out on one’s own and create a business.

Many countries in MEA have natural resources as a main part of their economies, so the wider services industry, including financial services and tech, presents an opportunity for these economies to diversify and embrace new innovations such as fintech

With the UAE’s strong business-friendly environment and push to attract FDI it has allowed for Dubai to become a financial hub. It is also building up its tech ecosystem.

Accelerators and incubators, which play an important part for startups, sees potential in the MEA region. In 2019, it was estimated that there were 643 hubs in Africa – with 41 per cent of those facilities to be incubators, 24 per cent innovation hubs, 14 per cent accelerators and 39 per cent co-working spaces; Nigeria (90 hubs), South Africa (78), Egypt (56) and Kenya were the top four. In the Middle East, a similar story can be told as well but that is also changing. There have been a growth of both international firms entering the market like

In the GCC, where historically much of the local population works in the public sector (for instance the percentage of Kuwaitis working in the government sector has reached 80 per cent of the total employees in this sector)83, instilling a mindset of entrepreneurship and a desire to either create your own startup or work for a startup might seem daunting.

To top it off, due to the nature of the low-income, middle and even the high-income economies, such as Israel, often the best and brightest leave MEA, flocking to the tech epicentres of Silicon Valley in California or London and Singapore. It is a challenge to keep the best and brightest to stay in their country to inspire and give them assurance that there is a strong ecosystem in place for their future business or work.

As highlighted in the StartupBlink report, there remains gaps and in MEA, minus Israel and the UAE and Turkey, there are opportunities for their tech ecosystems to grow. Many countries in MEA have natural resources as a main part of their economies, so the wider services industry, including financial services and tech, presents an opportunity for these economies to diversify and embrace new innovations such as fintech.

Due to the diversity of the region, MEA represents a wide range of ethnicities and cultures. In fact, much of this diversity can be felt across country borders. It is estimated that Nigeria alone has over 500 languages spoken84 and more than 250 ethnic groups.85

The birthplace of the three largest monotheistic religions –Judaism, Christianity and Islam – has also not only shaped the MEA region but globally too. In particularly, the latter has even brought the rise of Islamic finance, which will be discussed later in this report.

As much of MEA has been colonised, as a protectorate or as trading routes to outside of MEA, much of that also has shaped the region – from legal structure, linguistic lingua francas to wider international trade and investment and consequently their wider economic development. From the British to the French to the Portuguese to the Belgians to the Ottomans to the Dutch to the Spanish – this is also something that plays a role in the way the region is to this day. Saying that, they have similar traits that can be summarised below:

The informal economy – which of course plays much of a significant role in the developing and emerging economies but also in advanced economies (i.e., gig economies and domestic workers) – sees 60 per cent of the world’s population participating in it. According to the

International Labour Organisation (ILO), 60 per cent, or around two billion workers, participate in the informal economy at least part time.86

The gig or informal economy plays a role in much of the world and that resonates in practice with Africa, where 85.8 per cent of employment, and 95 per cent of youth employment is informal. MEA plays a large part of that with some of the world’s highest levels of informality.87 For instance, from 2004 to 2010 the informal employment as a percentage of non-agricultural employment showed South Asia at 82 per cent, followed by Sub-Saharan Africa at 66 per cent, East and Southeast Asia at 65 per cent, Latin America at over 50 per cent, and the MENA region at 45 per cent.88

With regards to the Middle East and North Africa, middle-income Arab nations (Lebanon, Egypt, Jordan, Morocco, Tunisia and Libya) have significant populations of workers that would be classified as informal. Lebanon has 55 per cent of their workers in this category and neighbouring Jordan has a similar landscape. In Egypt, 40 per cent of the country’s GDP is estimated to derive from the informal economy, while in Morocco in 2014 almost 2.4 million were working in the gig economy.89

Like the rest of the world, during the height of the pandemic with various lockdowns, much of MEA and its informal economy suffered heavily, as many were forced to go online and digital.

Generally, as younger populations adapt and are more flexible to changes, MEA is in a unique position as it has a young population. In MENA, children and young people (0 to 24-year-olds) currently account for nearly half of the region’s population. The population looks to continue growing rapidly so that by 2050, half of the countries in MENA are projected to experience population increases of at least 50 per cent from their 2015 levels with 271 million children and young people. Except Lebanon, every country in MENA looks to grow through various degrees population wise.90

When looking at Africa, it is not only young but also growing fast. For instance, 70 per cent of Sub-Saharan Africa’s population is under 30 years old.91 The African continent is the world’s second largest population behind Asia; it is also the fastest growing population in the world and from its estimated +1.3 billion people will jump to 4.3 billion by 2100. With a median age of 19.7 in 2020, Africa is the youngest population in the world where 60 per cent of its population is younger than 25 years old and over a third are from 15-34 years old. By 2100, Africa is still expected to have the world’s youngest population worldwide with a 35-year-old median age.92

As highlighted with the first edition of this report, youth unemployment overall in the MENA region is very high, coupled with Africa’s youth working in the informal sector due to necessity, presents a lack of opportunities for many whereby a significant proportion immigrate to better pastures. While the global average (pre-Covid) is around 12.6 per cent, in MENA it is over 25 per cent.93 This results in many of them to leave to the wealthy Gulf region.

The rich regions, in particularly the GCC, have attracted people from across the world – both from other MEA countries and non-MEA countries – to help develop their country over the past century. This uniqueness of having the world’s richest and poorest countries in the world means that the movement of people – both to seek and to give economic opportunities – is busy in the MEA region. As a result, the remittances corridor for both sending money and receiving money is some of the world’s busiest and there is an MEA country in each of the top five.

Data shows the top five source countries for remittance outflows in 2021 as the US with over $69billion, second-place UAE at $43billion, Saudi Arabia in third place at over $34billlion, Switzerland in fourth at over $29billion, and China in fifth at over $18billion.

For inflow of remittances, Egypt (in fourth) was the top MEA country on the list with India in first place at $83billion, Mexico in second place at $42billion, Philippines in third place at over $34billion, Egypt in fourth place at over $29billion, and Pakistan in fifth at more than $26billion.94

For remittances as a share of GDP, a MEA country led the list at 54 per cent followed by Tonga at 44 per cent, Tajikistan at 34 per cent, the Kyrgyz Republic at 33 per cent and Samoa at fifth at 32 per cent.95 The other rankers, such as the Philippines, India, Pakistan and Egypt, have significant numbers of their compatriots overseas in the MEA region notably in the GCC region.96

Remittances are not only a blue-collar worker concept as middle and upper class citizens who reside abroad will generally send money back to their home countries and/or their loved ones.

Despite being a developed economy, it doesn’t necessarily mean that a country would have its own fair share of emigrants due to various reasons.

This was highlighted in first edition of this report with Israel. The ‘Leaving the Promised Land – A Look at Israel’s Emigration Challenge’ report, released by the Shoresh Institution for Socioeconomic Research, revealed that for every Israeli with an academic degree who returned to the country in 2017, 4.5 Israeli academics emigrated. The Startup Nation has often seen much of that talent and innovation go to the US, specifically.97, 98

With regards to the internet, last year save MENA surpass 300 million subscribers and by this year’s end, over half of the population will have internet. 4G is the region’s leading mobile technology, with almost 270 million connections at the end of last year; this has more than doubled in the past five years because of investments by telecommunication companies to upgrade infrastructure and pursue more network expansions. Saying that, 5G still is one per cent of the market but expected to be 17 per cent by 2025 – all according to the Global System for Mobile Communications (GSMA).99

MOBILE

IN

The dispersion of this development generally falls in favour of the developed economies of MENA, with the likes of the UAE and other GCC nations capturing much of this market than its less affluent MENA peers. In Africa, as the previous report highlighted, around 800 million Africans do not have access to the internet (which is the lowest in the world). Other sources put sub-Saharan African with 28 per cent internet penetration, which despite low is growing.100 Aligned to its economic prosperity overall, generally much of the more developed economies have the higher rates – with Egypt (at 71.9 per cent), Seychelles (in second at 79 per cent) and Morocco (in first place at 84.1 per cent). In comparison, the lowest on record is the Central African Republic at a 7.1 per cent followed in second last of Eritrea at eight per cent.101

Back to MENA, in 2019 the SIM card penetration rate exceeded 105 per cent and by 2025 it is expected that the region will have a smartphone adoption rate of over 80 per cent.102 The GCC region (Saudi Arabia, Kuwait, Bahrain, Oman, Qatar and the UAE), has the highest and most advanced mobile and smartphone usage and infrastructure. For instance, in the UAE the smartphone penetration rate has reached 99 per cent and UAE smartphone users spend 6.5 hours daily using them on average.103, 104

In Sub-Saharan Africa, almost 500 million (495) were subscribed to mobile services in 2020, a 20 per cent increase from the previous year and representing 46 per cent of the region’s population. It is estimated that 4G adoption in the region to double to 28 per cent by 2025, whereby 5G, still very infant there, will be around three per cent of total mobile connections.105

Despite this, the expansion of mobile coverage is still outnumbering mobile internet – around one in five people live in an area without

mobile broadband coverage. Also, 53 per cent of people is not using mobile internet, even though their area has mobile broadband coverage.106 Despite that, much of it is dispersed as in East Africa. Kenya has a very high rate of mobile penetration among adults at 98 per cent. Later in this report, the solutions for financial inclusion will be highlighted mainly with the popularity of M-Pesa and mobile money.107

In addition, at least one in nine transactions at the point of sale (POS) are now contactless. Mastercard for instance increased its contactless payment total by more than 66 per cent to $136million across MEA last year. Before the pandemic, in 2019 Mastercard saw a 200 per cent increase in contactless payment in MEA. Globally, contactless by 2025 is expected to grow to $18billion, which is almost double what it is now from 2020.113

Back in 2020, payment firm Checkout.com polled more than 5,000 consumers in the UAE, Saudi Arabia, Egypt, Jordan, Qatar, Kuwait, Bahrain and Pakistan and found 47 per cent of consumers expect to shop online more frequently over the next year. Only 15 per cent expect their online shopping frequency to decline while the remaining 38 per cent expect it to remain about the same as now.114

THE MEA CONSUMER – DIRECT & INDIRECT RESULT OF COVID-19 69%

Payments will be cashless in the Middle East by 2023 64%

In Middle East only started using online payments during pandemic 53%

In Middle East are shopping more on their smartphones than pre-Covid

~40% Increase usage of online banking in Africa

~40% Increase usage of digital channels post-pandemic In Africa

73% MEA consumers shopping more online since Covid-19 30%

In Africa will visit a bank branch less post-pandemic

Image: Richie Santosdiaz and The Fintech Times

Sources: Various including The Fintech Times, Mastercard, MENA Fintech Association. Kaspersky, Economist, McKinsey

With an economy, culture, socio-economic as diverse as MEA, they all have one thing in common – economic development priorities. This is not really a MEA phenomenon but rather a public sector priority that all countries across the world focus on for the betterment of their citizens. At the end of the day, any jurisdiction cares that their country has economic growth and job creation.

Although not a MEA exclusive thing, the region as whole – from the rich lands of the GCC to the not so wealthy ones – have some of the most visible changes and clearest economic development and diversification happening in one’s lifetime that it presents an exciting time for those in the space such as this author. However, for the majority who probably do not even know what economic development and diversification are it will appear in many ways when one either visits MEA or for those reading this that are living there. It is the reason why this report exists and the growth of fintech as we know it today – both direct and indirect.

This subsection will look at it from economic development strategies, economic integration and financial technologies relating to economic development:

It is good to understand what economic development strategies are in the first place. They are essentially a national outlook of a nation (or

could be even cities – within one’s borders) that aims to improve existing sectors it might have but also foster new ones. The overall aim of them is to boost economic growth, job creation and aim to improve the lives of those in one’s jurisdiction.

Why is it important in MEA? Many countries in MEA have developed their own various economic development and diversification strategies and are also implementing them. Remember earlier with regards to much of the region’s economies being reliant on commodities and other natural resources (such as oil from the GCC to parts of Africa like Nigeria)? With the volatility of oil prices seen this past century so far – coupled with the fact that natural resources are finite – countries in MEA more than anywhere else need visions that will strategically give them focus with clear roadmaps that can channel them.

All six GCC countries have variants of their own wider strategies of some sort (e.g., Bahrain Economic Vision 2030, Kuwait Vision 2035, Qatar National Vision 2030, Oman Vision 2040 and Saudi Vision 2030). The UAE, for instance, not only has other national initiatives, such as UAE Centennial 2071 and UAE Vision 2021, but also variants in the respective Emirates, such as Abu Dhabi Vision 2030. The GCC countries are historically reliant on oil and gas and are using economic development strategies to diversify their sectors so in the future they can keep and grow their standard of living, but it would be newer sectors such as tech and financial services and other ones (including tourism for instance) that would drive much of the growth.

Also, many in MEA, in particular those who are low income, low-middle, middle-income and high-middle income, are using economic development strategies to raise the standard of living in their respective jurisdictions that can help them in the long-term to be more prosperous through building on what they are good at but also expanding on new sectors to fuel economic growth – such as with the tech sector and also boosting their financial services sector. Many in Africa and parts of the Middle East are using them, such as in Egypt (Egypt Vision 2030) or Mauritius (Mauritius Vision or Rwanda (Rwanda Vision 205) or Jordan (Jordan 2025) or Uganda (Uganda Vision 2040) or Kenya (Kenya Vision 2030) or Ghana (Ghana Vision 2020), where they have created their own economic development strategies for the wider future that will hopefully uplift their nation’s income and standard of living through diversifying their sectors.

Also, countries are using them to boost entrepreneurship and home-grown startups. This goes across the board generally in MEA but in places like the GCC this is most evident, as historically most of the local population often works in public-sector jobs and starting a new business and/or working in startups or even in the private sector is still a relatively new concept. The implementation of this can be felt across the region the advent of incentives that governments have launched to hire locals in the private sector, catalysts to build and promote priority sectors, such as fintech (like in Saudi Arabia with the birth of Fintech Saudi back in 2018 which was launched by the Saudi Central Bank (SAMA), the rise of accelerator and incubation programmes and VCs that are being supported by government and/or creating a business entrepreneurship ecosystem to attract them, and prioritising education through sector training and boosting incentives for those looking to start businesses. A recent headline was in the UAE, which looks to be something unique, whereby locals now can take a year off from their government jobs that would allow them to start their own businesses.115