Reduce Repetition to Combat

By: James E. Powers, Senior Underwriting Counsel

In sports, it has been said, “repetition makes perfect.”1 On a title commitment or policy, repetition can make for a bewildering mess. Consider a commitment with the following exceptions:

Special assessments, outstanding and contemplated, if any.

Special taxes and assessments, if any, payable with the taxes levied or to be levied for the current and subsequent years.

The lien of any special assessments, special taxes or special charges. We have witnessed similar multiple exceptions in relation to easements, deferred water and sewer charges, and general property taxes. One can imagine how a loan officer, consumer, or buyer’s counsel may respond to multiple exceptions that essentially refer to the same matter. Lenders may demand all the similar exceptions be removed. Buyer’s counsel will request striking the broadest exceptions. Unrepresented buyers or borrowers will simply be vexed.

The remedy is to carefully proofread all title work product and edit out exceptions already addressed in the boilerplate exceptions. Be especially careful when borrowing exceptions from prior policies; they may have already been addressed in your current form.

If our commitments and policies are clear and uncluttered, we can spend less time dealing with objections and ultimate revisions. Clarity, not repetition, is closer to perfect in our industry.

IN THIS ISSUE 1 Reduce Repetition to Combat Confusion 2 Wisconsin Agency Contacts 3 Get to Know Ben Smaglick 4 Upcoming Teleseminars Appointments and Terminations Reminder 5 Statutes Barring Interests in Land and the Government Current Assessments vs. Assessments Priority 6 Agent Print Pro® 7 Warranties of Title: Some Deeds Give Them, Some Do Not 8 Restrictive Covenants and Just Plain Restrictions 9 News Brief ©2022 First American Financial Corporation and/or its affiliates. All rights reserved. NYSE: FAF The information contained in this document was prepared by First American Title Insurance Company (“FATICO”) for informational purposes only and does not constitute legal advice. FATICO is not a law firm and this information is not intended to be legal advice. Readers should not act upon this without seeking advice from professional advisers. First American Title Insurance Company makes no express or implied warranty respecting the information presented and assumes no responsibility for errors or omissions. First American, the eagle logo, First American Title, and firstam.com are registered trademarks or trademarks of First American Financial Corporation and/or its affiliates.

1 DeAndre Hopkins, wide receiver for the Arizona Cardinals

– State Agency Office Will Be Closed –A WISCONSIN AGENCY NEWSLETTER NOVEMBER 24 TH - 25 TH THANKSGIVING DECEMBER 26TH CHRISTMAS THE EAGLE’S NEST

2022 SEPTEMBER OCTOBER

Wisconsin Agency Team Learn more about our Agency Representatives www.firstam.com/title/agency/wi FIRST AMERICAN TITLE 3330 University Avenue, Suite 310, Madison, WI 53705 TF: 800.362.8205 wisconsinagency@firstam.com| | We are here to provide you with the best possible support to grow your business. While our team has evolved, one thing continues to remain the same: your First American Wisconsin Agency Team is here to help. Meet the key players committed to providing the necessary resources and underwriting guidance you need, and the service solutions that give you an edge. Product, Service, and Administrative Support Underwriting Support Marv Ripp VP, State Counsel D: 608.286.3202 mripp@firstam.com jipowers@firstam.com szablocki@firstam.com WI) C: 248.880.858 dmartyn@firstam.com Joanne M. Zech Midwest Agency Technology Consultant D: 608.345.5044 jzech@firstam.com Matthew D. Ballard SVP, Agency Division – Midwest Region C: 617.721.9702 mballard@firstam.com Age stant D: 608.286.3213 jessobrien@firstam.com GET TO KNOW YOUR LOCAL WISCONSIN AGENCY TEAM DOWNLOAD CONTACT LIST Page 2First American Title | The Eagle’s Nest | September/October 2022

Get to Know Ben Smaglick

A customer-focused professional and Wisconsin native with over 21 years of industry experience, Ben is focused on ensuring his local title partners have the tools and services necessary for growth and continued success.

Whether it’s AgentNet®, Clear2Go®, SAFEvalidation®, Agent Print Pro®, PRISM™, or any of the other First American resources, Ben leverages his problem-solving skills and technical know-how to help Wisconsin title agents streamline their processes and protect their customers.

Ben began his industry career as a loan officer in Oak Brook, Illinois. He joined First American in 2002 and has held positions of increasing responsibility throughout his career. Ben is knowledgeable in all aspects of title and settlement services, has a comprehensive understanding of industry technology and products, and is skilled at developing and maintaining long-standing relationships. His professionalism and focus on agency initiatives, including technology to save time and create efficiencies, will be a tremendous asset to our valued agents in Wisconsin.

Ben graduated from the University of Wisconsin – Whitewater with a Bachelor of Arts in communications and marketing. He was one of two applicants selected to participate in the Overseas Studies Program at Umea University in Sweden. Ben is a member of the Wisconsin REALTORS® Association, Wisconsin Mortgage Bankers Association, and the Wisconsin Land Title Association. Please contact Ben today to find out how First American’s nationwide strength, local expertise, and friendly service can work for you. He may be reached at 608.345.3902 or bsmaglick@firstam.com

WISCONSIN AGENCY REPRESENTATIVE Page 3First American Title | The Eagle’s Nest | September/October 2022

Contact First American Title to report new or departing employees. All licensed agent employees are required to be appointed to the Wisconsin Office of the Commissioner of Insurance by First American Title. Departing employees must have their appointment terminated, and any AgentNet ® accounts for departed employees must be deactivated as soon as possible. Send employee updates to: Ben Smaglick: bsmaglick@firstam.com Jessie O’Brien: jessobrien@firstam.com Employee Updates Reminder ISSUING POLICIES | Wednesday, November 9 th Presented by: James E. Powers, State Underwriting Counsel CONSTRUCTION DISBURSING | Wednesday, December 7th Presented by: Steve Zablocki, Underwriting Counsel NOTE: Seminar-specific phone numbers and passcodes will be sent out with registration reminders and materials for each seminar. Please contact Jessie O’Brien at jessobrien@firstam.com if you have any questions. UPCOMING TELESEMINARS Seminars will be presented from 9:00am – 10:00am (CST) Page 4First American Title | The Eagle’s Nest | September/October 2022

By: Steven Zablocki, Underwriting Counsel

Whether we know it or not, we are burdened by the old Latin expression: Nullum tempus occurrit regi. Translated, it means, No time runs against the king. This old common law doctrine governs land use to this day.

Simply put, the doctrine states that towns, villages, and cities, as subdivisions of the State, the State of Wisconsin and the Federal Government and their sub entities, are exempt from most statutes of limitations. That generally means a mortgage or other interest in favor of one of these entities is not subject to the 30-year statute of limitation for enforcement.1

For our purposes, if you see an old interest to a subdivision of the State or the United States, pause and look closer. Do not simply write over the matter. For example, old USDA mortgages or improvement mortgages in favor of city development are fair game. Recently, we’ve had situations where old improvement mortgages, older than 30 years, have come up as due and owing. While it might be the entity never acted to recover on these interests, if we are insuring a new

Current Assessments

Assessments Priority

By: James E. Powers, Senior Underwriting Counsel

With the release of the new 2021 ALTA Forms, you may have noticed some policy and endorsement forms feature additional language in their titles.

There is the:

• ALTA Short Form Residential Loan Policy - A.P. (7-1-21) (Assessments Priority) coupled with the ALTA Short Form Residential Loan Policy - C.A. (7-1-21) (Current Assessments).

The same title variances pop up with other policy forms, such as the:

• ALTA Short Form Residential Loan Policy and the ALTA Short Form Expanded Coverage Residential Loan Policy.

Among endorsements, there are the:

• ALTA 4 Condominium - Assessments Priority (7-1-21) and the ALTA 4.1 Condominium - Current Assessments (7-1-21).

Similar Assessments Priority/Current Assessments language appears for the ALTA 5 (Planned Unit Development) endorsement.

mortgage or new owner, we have to show the interests and clear them from title.

Additionally, a private individual claiming adverse possession is barred if it is an exempted entity.2 Example: if there is a road running through US Forest Service land, rights of prescription would be barred. As a result, an easement or license in such a scenario is necessary. We can never rely on same rules of prescription or persistent use.

Ultimately, if you aren’t sure if the interest is resolved, show it on the commitment and policy. Maybe the owner has documentation to prove the mortgage or interest was paid. Maybe they do not. Whatever the case, don’t go it alone. If you find such an interest or issue, contact your First American Underwriter. We may have to show it or we may have tools that permit us to resolve the matter.

1Wis. Stat. §893.33(5)

2Wis. Stat. §893.29

So, which one should you use? We recommend the Current Assessment version of each of the above policies and endorsements. They reduce our liability for undisclosed assessments for tax specials and HOA or condominium fees, as applicable. If, however, your customer insists on the Assessments Priority version of a policy or endorsement, you may accommodate them if you follow our underwriting guidelines, which are the same regardless of the form.1 In each case, you must obtain a statement from the municipality or the Homeowners’/Condominium Association all assessments are paid or are not yet due or payable, and any rights of first refusal are waived.

The above policies and endorsements have many more features, and we are happy to explain them if you receive questions about them.

1Note: The ALTA 4 and ALTA 5 may not be issued with Owner’s Policies; you should only use the ALTA 4.1 or ALTA 5.1 for these policies.

Page 5First American Title | The Eagle’s Nest | September/October 2022

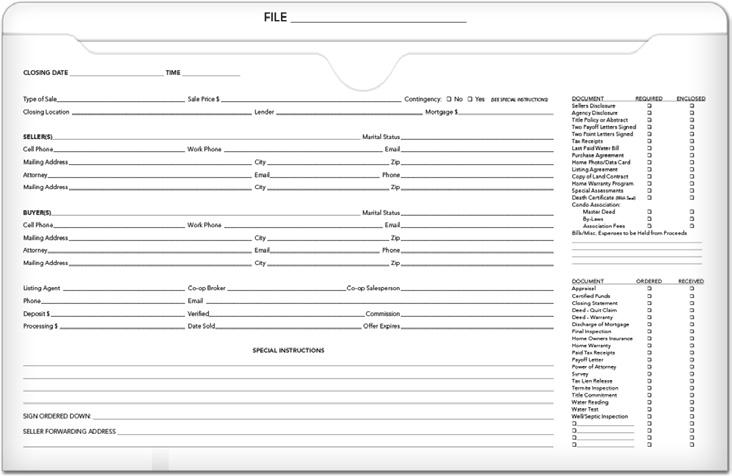

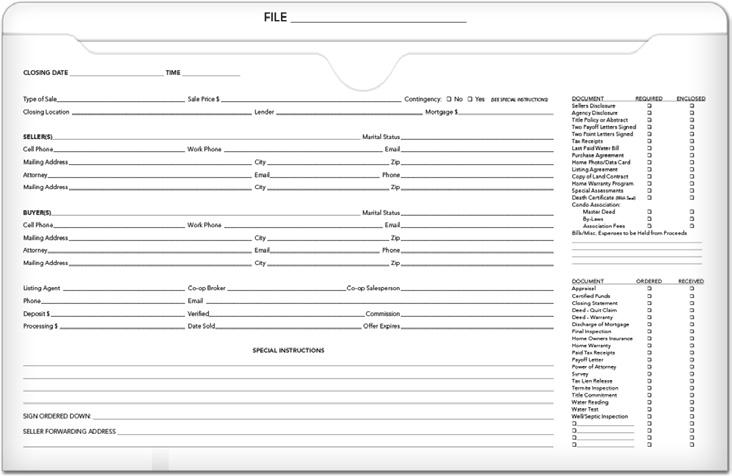

Agent Print Pro Real estate professionals know effective marketing is crucial to their business. Agent Print Pro provides First American policy-issuing agents and their invited* real estate agents access to top-quality marketing resources and competitively priced print services to help you stand out from the competition. AMD: 03/2021 Marketing And Print Solution COMPETITIVE PRINT PRICING • Postcards as low as 10¢ each • Flyers as low as 14¢ each FLEXIBLE OPTIONS • Direct Mail, FedEx ® and UPS® Shipping Options • USPS® Every Door Direct Mail® Compatible Designs • Personalized Branding and Messaging • Print or Download Customized Content VARIETY OF CONTENT • Flyers • Postcards • Greeting Cards • Pocket Folders • Rack Cards • Yard Signs • File Jackets • Business Cards • Notepads • Brochures • Calendars • And more! Your Company Name Your Text Here C: xxx.xxx.xxxx O: xxx.xxx.xxxx DemoRealEstate@agentprintpro.com www.examplewebsite.com you have a brokerage relationship with another agency, this is not intended as solicitation. 2021 Calendar CUSTOM TEXT Why should buy instead of rent? When you rent, you write monthly check and that money is gone forever. A home an investment which can grow in value over time and when you own home, you may be able to deduct the cost of your mortgage loan interest and property tax from your federal and/or state income taxes. How do know if am ready to buy a home? You can find out by asking yourself few questions: Do have steady source of income? Have been employed on regular basis for the last 2-3 years? my current income reliable? Do have good record of paying my bills? Do have few outstanding long-term debts, like car payments? Do have money saved for down payment? Do If you can answer “yes” to these questions, you are probably ready to buy your own home. maintenance costs are a few of the expenses to be considered. Additionally, there may be homeowner association or condo How are pre-qualifying and pre-approval different? Pre-qualification an informal way to see how much you may be able to borrow. A pre-approval is the lender’s commitment Should use real estate agent? How do find a good one? good real estate professional can guide you through the entire process and make the experience much easier. All of the details involved in home buying, particularly the financial ones, can be mind-boggling. Start by asking your family and friends they can recommend an agent. Look for an agent who listens well and understands your needs. The ideal agent knows the local area well and has resources and contacts to help you in your search. FIRST-TIME FAQ HOMEBUYER Buying home for the first time can be overwhelming. Our knowledgeable professionals can answer your title and closing questions and we are committed to making the home-buying experience satisfying one for you. To help you begin your journey, here are some answers to a few of the questions that first-time homebuyers may ask as they begin their quest to purchase their slice of the American dream. decision. Once you have found the home of your dreams, contact our office so we can provide the protection you need and $589,000 123 Main Street Bitio. Itaquis dolor res que autate sitis acerferupta e poreium et ut reperspeIcae explab id quod maximi, andicilic to corrum ipis et expla dolectatur alit quis nusamus modicim odigniatur, occuscieniam dia volora aut a quunt velibus voluptaeptas enite pereper oribus nobis acitia quasita vellaut asi utatuscipsum con rest, nosa qui consequi re necturecti omnimodia volupta ssequi quisqui dusa comnis ncianihiciis mo et et derehenis deliquodit magnis Priced Below Market Just Listed! www.examplewebsite.com ACCEPTABLE IDENTIFICATION DOCUMENTS REQUIREMENTS MAY VARY FROM STATE TO STATE. CONTACT One or more of the following may be requested to verify identification. The document must be current and contain the document signer’s photograph, physical description, signature, and bear serial or other identifying number. 9 Drivers License or Non-Driver ID Card United States Passport 9 Foreign Passport Stamped by the U.S. Citizenship and Immigration Services (USCIS) 9 United States Military ID 9 Valid Canadian or Mexican Drivers License Issued by the Official Agency UNACCEPTABLE IDENTIFICATION DOCUMENTS Temporary Driver’s License 8 Drivers License without Photograph 8 Social Security Card Employee ID Badge 8 Permanent Resident ID Card Closing document signatures must match the name that appears on the identification presented. An abbreviated form (John D. Smith instead of John David Smith, for example) may be acceptable. However, deviation is only allowed the individual is signing with less than and not more than what is on the identification document. If your name has changed, or will change, prior to the closing, supporting documentation must be provided. IDENTIFICATION REQUIREMENTS FOR CLOSING First DemoAgent Title Agency Representative ABC Title Insurance Company First American Title Insurance Company makes express or implied warranty respecting the information present Anytown, ST 00000 O: 555.555.5555 C: 222.222.2222 demoagent@agentprintpro.com 123 Main Street, Suite Title Agency Representative Anytown, ST 00000 O: 555.555.5555 C: 222.222.2222 demoagent@agentprintpro.com 123 Main Street, Suite Title Agency Representative Anytown, ST 00000 O: 555.555.5555 C: 222.222.2222 demoagent@agentprintpro.com 123 Main Street, Suite Title Agency Representative Anytown, ST 00000 O: 555.555.5555 C: 222.222.2222 demoagent@agentprintpro.com 123 Main Street, Suite Title Agency Representative Anytown, ST 00000 O: 555.555.5555 C: 222.222.2222 demoagent@agentprintpro.com 123 Main Street, Suite Title Agency Representative Anytown, ST 00000 O: 555.555.5555 C: 222.222.2222 demoagent@agentprintpro.com 123 Main Street, Suite Title Agency Representative Anytown, ST 00000 O: 555.555.5555 C: 222.222.2222 demoagent@agentprintpro.com 123 Main Street, Suite Title Agency Representative Anytown, ST 00000 O: 555.555.5555 C: 222.222.2222 demoagent@agentprintpro.com 123 Main Street, Suite Title Agency Representative Anytown, ST 00000 O: 555.555.5555 C: 222.222.2222 demoagent@agentprintpro.com 123 Main Street, Suite Title Agency Representative Anytown, ST 00000 O: 555.555.5555 C: 222.222.2222 demoagent@agentprintpro.com 123 Main Street, Suite Title Agency Representative www.examplewebsite.com just listed your dream home! LOOKING FOR A CHANGE OF SCENERY? Your Local Real Estate Expert Let's Find The Right One! Sample Real Estate Agent Your Company Name O: xxx.xxx.xxxx pro.com www.examplewebsite.com 123 Main Street Priced Below Market! Welcome Home! Itaquis dolor res que autate sitis acerferupta essin poreium et ut reperspeIcae explab id quod maximi, andicilic to corrum ipis et expla dolectatur alit quis nusamus modicim odigniatur, occuscieniam dia volora aut a quunt velibusdani Agent Print Pro® For complete details, login to your AgentNet account or contact your First American Title representative. *Unique Invitation Codes created per Title Agency brand and subject to annual fee. Invitation Codes not approved for use in California and Washington. Program and print pricing subject to change without notice. First American Title Insurance Company makes no express or implied warranty respecting the information presented and assumes no responsibility for errors or omissions. First American, the eagle logo, First American Title, and firstam.com are registered trademarks or trademarks of First American Financial Corporation and/or its affiliates. ©2022 First American Financial Corporation and/or its affiliates. All rights reserved. NYSE: FAF *Ask your First American representative for details. Invitation Codes not approved for use in California and Washington. Program and print pricing subject to change without notice. First American Title Insurance Company makes no express or implied warranty respecting the information presented and assumes no responsibility for errors or omissions. First American, the eagle logo, First American Title, and firstam. com are registered trademarks or trademarks of First American Financial Corporation and/or its affiliates. Page 6First American Title | The Eagle’s Nest | September/October 2022

OF TITLE: Some Deeds Give Them, Some Do Not

My last television had a three-year warranty. Naturally, on year 3, sensing the end of coverage, the picture failed and failed dramatically. Halfexpected but disappointing, lucky it was only a TV.

What about bigger ticket items in our lives like real estate? What does a buyer have that protects them when things “go wrong”? Warranties of title.

What is a warranty of title? A warranty of title is an assurance in a deed that:

» the grantor owns the property interest being conveyed and has the power to convey.1

» the property is free from encumbrances, other than those disclosed or excepted from the deed

» the grantor will defend forever title against claims prior to the deed.2

You will see warranties expressed in a warranty deed or in a condominium deed. The grantor is specifically stepping up and agreeing to defend forever if there is an issue.

What is a special warranty deed? There may be times where the grantor ends up in title reluctantly.

Think of a lender in a foreclosure where the lender foreclosed their mortgage and were the successful bidder at sale. In that case, they have no idea about the status of title. They have no idea what the prior owner might have done to title. As such, they end up conveying by a special warranty deed.

The special warranty insures against defects or items created or suffered by the grantor while

By: Steven Zablocki, Underwriting Counsel

By: Steven Zablocki, Underwriting Counsel

in title. They are not insuring against anything a predecessor in title might have created.

What is a quit claim deed? The quit claim deed conveys what the grantor has and grants no assurances. The quit claim deed conveys all of the interest in land described which the grantor could lawfully convey but does not warrant title.3

A quit claim deed is mirrored in a trustee’s deed or personal representative’s deed. A trustee or a personal representative, will likely have no knowledge of the existence, quantity or quality of the real estate interest. They will decline to step up and defend since their existence is temporary.

So why does it matter? Whether there is a warranty affects whether recourse against a former seller is feasible. Short of misrepresentation, if someone conveys by quit claim deed or special warranty deed, their liability for items in the chain of title is eliminated or severely limited. What if the former owner is needed to assist in resolving an old interest? If they deeded by quit claim deed, they can and will likely ignore any inquiry.

Also, when a seller conveys by quit claim deed, they may also refuse to sign an owner’s affidavit. This may create a problem by not allowing certain standard exceptions to be removed from the policy.

Whatever the case, if the seller isn’t warranting title, you should pay close attention. Why is it they refuse? Is there a logical reason? If there isn’t, and an acceptable owner’s affidavit cannot be obtained, contact underwriting.

1Wis. Stat. §706.10(5) 2Id. 3Wis. Stat. §706.10(4)

Page 7First American Title | The Eagle’s Nest | September/October 2022

Restrictive Covenants Just Plain Restrictions

Covenants, Conditions, and Restrictions (CC&Rs) are a set of rules governing the use of land, usually in reference to any improvements, but they may also impose obligations for maintenance of road easements. CC&Rs are commonly recorded as a separate document by developers with the intention of applying them to multiple parcels within a subdivision. They may also be included in a deed to a single buyer. Once a CC&R instrument is recorded, it binds all purchasers of lands described therein. Unlike zoning, CC&Rs are private rules, governed by the laws of contract.

Here are the basic rules governing CC&Rs:

1. CC&Rs must be recorded at the Register of Deeds in the county where the affected land is located in order to bind purchasers.

2. CC&Rs cannot be applied retroactively to landowners who purchased before the CCRs were recorded.

3. Lands added to a subdivision governed by CC&Rs are not bound by the CC&Rs unless a new instrument that includes the added parcels is recorded.

Because CC&Rs do not grant property rights, they cannot be insured. They are only excepted from title insurance coverage. The exception may be deleted if any of the following occur:

By: James E. Powers, Senior Underwriting Counsel

1. The CC&Rs have not appeared in the record for more than forty (40) years.1 Let Underwriting know if you become aware of unrecorded CC&Rs.

2. An instrument terminating the CC&Rs is recorded at the Register of Deeds. Who may sign the termination may be stated in the CC&R text; it may be the developer or a specified majority of owners. Both the CC&R and the termination instrument must be reviewed by underwriting to determine if the CC&R rules were followed.

3. The CC&R instrument has expired under its own terms. Caution should be used since neighboring landowners may have purchased in reliance upon the CC&Rs despite their having expired, or if the CC&Rs are part of a “pattern of development” that includes nearby parcels. Underwriting counsel should review all transactions involving expired CC&Rs.

The ALTA 9 series of endorsements provide some coverage for loan policies against CC&Rs “that may divest, extinguish, or otherwise result in the invalidity or unenforceability of the Insured Mortgage.”2 If no such CC&Rs exist, or if existing CC&Rs have no reversion clause, you may issue the ALTA 9 or 9.10.

Whether to further delete the CC&R exception depends on whether the guidance above applies.

1Wis. Stat. §893.33(8) 2First American Endorsement and Issuing Standards Manual, January 2022, pp. 107-108

Page 8First American Title | The Eagle’s Nest | September/October 2022

Residential Commercial

The Average Homeowner Gained $60k in Equity YoY

Home equity hit a new high in the second quarter, as homeowners with mortgages gained a collective $3.6 billion year-over-year over the course of a single quarter.

By: Kyle G. Horst, MReport, September 9, 2022

Read more: https://firstam.us/3Ef05L0

How To Buy a Home When You Have Student Loan Debt

If you’re one of the many Americans preparing to enter the homebuying sphere with student loan debt, here are some tips and expert-approved recommendations for navigating the process.

By: Kathleen Willcox, REALTOR®.com, September 28, 2022

Read more: https://firstam.us/3Vb9OrZ

Homebuyers Challenged By Mortgage Rate ‘Whiplash’

A house hunter looking for a $500,000 home saw their potential total mortgage payment decrease $64,000 from July to August, but jump up $118,000 from August to September.

By: Sarah Wolak, National Mortgage Professional, September 29, 2022

Read more: https://firstam.us/3SA2TGP

Home Purchase Cancellations Are Above 15% for the Second Straight Month

Amid higher interest rates and a softening housing market, home buyers are continuing to back out of purchase contracts at an elevated rate.

By: Sarah O’Brien, CNBC, September 26, 2022

Read more: https://firstam.us/3ybBYt0

FSBOs Usually Soar in a Hot Market. Not This Time.

Housing volatility is pushing more sellers to work with real estate pros rather than go it alone; here’s how to capitalize on higher interest in your real estate services.

By: Melissa Dittmann Tracey, REALTOR® Magazine, August 30, 2022

Read more: https://firstam.us/3EeFPJt

Night At The Museum: Ghost Town General Store Turned-Home Lists At $1M

For the Wild West-obsessed buyer, a rare opportunity to own a 127-year-old ghost town general store known as the Arizona Ghost Town Museum.

By: Kate Hinsche, The Real Deal, September 24, 2022

Read more: https://firstam.us/3SBVVkI

Amazon and Walmart Want the FAA to Let Them Use Part of Your Property

One of the largest government-assisted property grabs in U.S. history is quietly unfolding above America’s cities and towns; here’s how drone delivery companies are coming for your airspace.

By: Troy A. Rule, contributor Fortune.com, September 2, 2022

Read more: https://firstam.us/3ftivgE

Real Estate Developer Buys First-Ever Real-Life Office Building as NFT NFTs are not new. 3D scans of buildings are not new…what’s new is the merging of these technologies with blockchain utility, enabling building owner’s to create, own, transact, and monetize their digital assets—similar to how we do so with our physical assets.

By: Jordan Major, Finbold Finance in Bold, September 22, 2022

Read more: https://firstam.us/3fF1yzP

A CRE Executive’s Outlook On Market Optimism

A variety of unprecedented events over the last few years have impacted markets around the world; one element that still worries industry participants is the rise and uncertainty of interest rates.

By: Shawn Clark, Forbes Councils Member, September 30, 2022

Read more: https://firstam.us/3rqn3qK

Vacant Stores Will Become Homes More Easily Under New California Laws

They’ve become a familiar sight along the wide commercial corridors of America — empty buildings once filled by big retailers who have closed their doors, in part because many of their customers shop online.

By: National Public Radio, September 29, 2022

Read more: https://firstam.us/3fBZQ2j

NewsBrief

Page 9First American Title | The Eagle’s Nest | September/October 2022