WEDGEHUT FOODS LTD

CEO Wanjiru Mambo highlights how the company is capitallizing on opportunities in Kenya’s potato value chain

UNLOCKING VALUE OF INFORMAL DAIRY

MITIGATING INFLATION IN AFRICA SOFT DRINKS MARKET

SOFT BEVERAGE INDUSTRY IN TANZANIA

NUTRITION FOR SLEEP

Discover Fi Africa

Where the tastemakers of the world create a world of taste

28-30 May 2023

Egypt International Exhibition Center

figlobal.com/africa

JOIN US

JOIN US

32 New Product Innovations:

African Originals: Apple & lime Cider | Copia

Global: Pulses | Tanzania Distilleries: Konyagi

Fusion | Zangibrands: Trail Mix & Breakfast Cereal | Highland Drinks: Club Lemonade | TruFoods

Limited: No-Added sugar Jams

DAIRY BUSINESS AFRICA

42 How Zaidi uses technology to improve incomes of smallholder dairy farmers in Kenya

BEVERAGE TECH AFRICA

45 Manufacturer strategies to mitigate inflation in African soft drinks market

FOOD NUTRITION & HEALTH

55 How the food industry is innovating to create foods that help consumers sleep better

REGULARS

4 Editorial

6 Events Calendar

30 Appointments Update

10 News Updates:

• Uganda Alcohol Industry Association launches alcohol sale and drinking code of conduct

• Traditional recipes will propel food and beverage innovations in 2023: Kerry Taste and Nutrition charts

• Duck Donuts opens Africa’s first outlet in Egypt

• Lancet report terms infant formula milk marketing techniques as exploitative and misleading

• The UK govt invests US$18.5M in Kenya’s first processing facility for Irish and sweet potatoes

• Atlantis Foods acquires fish and seafood distributor Snoek Wholesalers

• Saudi dairy giant Almarai buys out PepsiCo from dairy and juice venture

• Study questions the suitability of cartons as primary packages for milk

• Bill Gates snaps up 3.7% stake in Dutch brewing giant Heineken for US$939m

• No- and low-alcohol category value exceeds US$11bn in 2022, projected to have 7% growth by 2026: IWSR

60 Supplier News & Innovations:

• ADM invests in new US$30 facility in Spain to meet growing demand for probiotics

• Tate & Lyle PLC rebrands business to become purpose-led and growth-focused

• Ingredients specialist Loryma launches Wheat-based binder to optimize meat processing

• Döhler taps DKSH to distribute its texturant solutions in Swizerland and Austria

• Palsgaard pumps US$19.2m in expanding Dutch specialty ingredient facility

• Kerry forges new partnerships with Azelis, Caldic to bolster distribution in Europe

• Alland & Robert unveils acacia gum-based ingredient to replace gelatin and pectins

• Azelis adds smoke ingredients to its portfolio with Smoky Light acquisition

• Chr. Hansen operationalizes South Africa office to enhance service delivery to customers

Food Africa Business

FOUNDER & PUBLISHER

Francis Juma

SENIOR EDITOR

Paul Ongeto

EDITOR

Abel Ndeda

ASSOCIATE EDITOR

Queen Mwasere

BUSINESS DEVELOPMENT DIRECTOR

Virginia Nyoro

BUSINESS DEVELOPMENT ASSOCIATE

Hellen Mucheru

HEAD OF DESIGN

Clare Ngode

VIDEO & DESIGN ASSISTANT

Newton Lemein

ACCOUNTS

Jonah Sambai

PUBLISHED BY: FW Africa

P.O. Box 1874-00621, Nairobi Kenya

Tel: +254 20 8155022, +254725 343932

Email: info@fwafrica.net

Company Website: www.fwafrica.net

Food industry makes progress in gender diversity, but challenges still abound

The food industry globally has made progressive changes in recent years, particularly when it comes to promoting gender splits in the workforce. According to GlobalData, Mondelez, General Mills, Hershey, Kraft Heinz, and Danone were among the food companies with “significant women representation” in their workforce in 2021. Closer home in Africa, leading companies from East African Breweries to Coca-Cola Beverages Africa have all made deliberate efforts towards increasing women participation in the food industry.

EABL has several successful diversity and inclusion programs, including the Spirited Women program for female employees' career development, a STEM Apprentice program to increase gender representation in the manufacturing sector, and a Commercial Graduate program that provides handson experience in commerce fields for female professionals. The efforts are paying off. In 2022, represented 66% of the EABL Group’s Management Team.

women empowerment initiative. In 2022 alone, CCBA empowered more than 17,000 women with foundational business skills, coaching, and support, according to Tshidi Ramogase, CCBA Director Public Affairs, Communications, & Sustainability.

As a way to celebrate the progress made by the food industry, the 56th issue of Food Business Africa features Wedgehut Foods Limited, a fast-rising food processing company in Kenya’s capital Nairobi that is led by a woman by the name Wanjiru Mambo. Starting at the height of the pandemic, the company has defied all odds to establish a name for itself in Kenya’s potato value chain. Read the full story on page 38.

Elsewhere in the magazine, we highlight how technology can be use to maximise the potential of Kenya’s informal diary industry. With sleep becoming a major issue globally, this issue also explores how the food industry is innovating products to help consumers snooze better.

Food Business Africa (ISSN 2307-3535) is published 6 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

CCBA takes a more wholistic approach to gender diversty. while it has a significant proportion of women in its workforce, the company has invested heavily in empowerment programs that are aimed at supporting women to establish and expand businesses in the food value chain. About 2 million women in Africa have so far been equipped to succeed as entrepreneurs through Coca-Cola System’s 5by20

With these and many more articles on the latest news and trends in the food industry, this issue like its predecessors is definitely a must read

We wish you nothing but an insightful, inspirational and enjoyable reading journey.

Paul Ongeto, Senior Editor FW Africa

Foodex Manufacturing Solutions

24 - 26 April 2023

NEC, Birmingham, UK www.foodex.co.uk

Global Dubai Tea Forum

25 - 27 April 2023

Dubai Marina, Dubai, UAE

https://www.globaldubaiteaforum.ae/

The Future of Food Europe

03 - 04 May 2023

Hotel Casa Amsterdam, Amsterdam, Netherlands

www.eitfood.eu/projects/future-offood-conference

Contract Manufacturing & Private Label Expo

04 - 05 May 2023

Jio World Convention Centre, Mumbai, India www.cmplexpo.com

IFU Juice Conference 2023

08 - 11 May 2023

Lord Charles Hotel, Cape Town, South Africa

www.ifu-fruitjuice.com

Sugar Summit

08 - 10 May 2023

Le Meridien Dubai Hotel & Conference Center, Dubai, UAE www.sugarsummit.in

Food For Future Summit & Expo

10 - 12 May 2023

Dubai World Trade Centre, Dubai, UAE

www.foodforfuturesummit.com

Nigeria International Meat Tech Expo

16 - 18 May 2023

International conference center, Ibadan, Nigeria

https://nipoliexpo.com.ng/nimeatech/

Cold Chain Show

19 - 21 May 2023

Sector 34 Fair Ground, Chandigarh,

India

https://coldchianshows.com/

FNB Ingredients Expo

25 - 27 May 2023

Dussehra Maidan, Indore, India

www.fnbexpo.biz

Africa Food Manufacturing

28 - 30 May 2023

Egypt International Exhibition Center, Cairo, Egypt

www.africa-foodmanufacturing.com/

ProPak MENA

28 - 30 May 2023

Egypt International Exhibition Center, Cairo, Egypt

www.propakmena.com

Saudi Food Expo

05 - 08 June 2023

Riyadh front expo, Riyadh, Saudi Arabia

www.saudifoodexpo.com

World Conference on Food and Beverages

05 - 06 June 2023

London, UK

www.foodandbeverages. foodtechconferences.com

Agrofood Ethiopia

08 - 10 June 2023

Millennium Hall, Addis Ababa, Ethiopia

www.agrofood-ethiopia.com

Food & Beverage West Africa

13 - 15 June 2023

Landmark Centre, Lagos, Nigeria

www.fab-westafrica.com

Foodpack East Africa

15 - 17 June 2023

UMA Show Ground, Kampala, Uganda

www.mxmexhibitions.com/foodpackuganda/

Africa's Big 7

18 - 20 June 2023

Gallagher Convention Centre, Johannesburg, South Africa

www.africabig7.com

Africa Sustainability Symposium

June 13-14, 2023

Safari Park Hotel, Nairobi, Kenya

www.africasustainabilitysymposium. com

AFMASS Food Expo:

June 15-17, 2023

Sarit Expo Centre, Nairobi, Kenya

www.afmass.com/

Africa Food Safety & Nutrition Summit

June 15-17, 2023

Sarit Expo Centre, Nairobi, Kenya

www.summit.foodsafetyafrica.net

Grainstech Africa - International Exhibition & Conference

15 - 17 June 2023

Kenyatta International Convention Centre, Nairobi, Kenya.

www.graintechafrica.com/

International Food Show Africa

20 - 23 June 2023

Le Kram - Exhibition and International Trade Center of Tunis, Carthage, Tunisia

www.ifsaafrica.com/

World Congress on Nutrition and Food Chemistry

05 - 06 Jun 2023

Park Inn by Radisson London Heathrow, London, UK

www.nutrition-foodchemistry. insightconferences.com

Food & Drink Trends & Innovations Conference

07 Jun 2023

London, UK

www.foodanddrinkconference.com/

Safari Park Hotel, Nairobi, Kenya

AFRICA’S MOST INFLUENTIAL FOOD INDUSTRY AWARDS

The Future of Food in Africa

www.afmass.com

JUNE 15-17, 2023

Sarit Expo Centre, Nairobi, Kenya

SIGN UP TO ATTEND EASTERN AFRICA'S LARGEST FOOD, BEVERAGE & MILLING INDUSTRY TRADE SHOW

Co-located with:

Sign up today to Sponsor, Exhibit, Speak or Attend AFMASS Food Expo

Hosted at the Sarit Expo Centre in Nairobi, Kenya on June 15-17, 2023, AFMASS Food Expo has over the last 7 years grown into the most influential trade show for the food, beverage and milling industry in Eastern Africa.

This year, look forward to a larger Expo Hall with more exhibitors, a larger variety of exhibitors from more than 20 countries and more food companies showcasing their latest products

And to cap it all, join us as we debut the AFMASS Baking Championship at the Expo. See you in June!!

AFMASS BakingChampionship

• The AFMASS Baking Championship is a new initiative by the organisers of the AFMASS Food Expo that is focused on promoting excellence in the bakery industry in Africa.

• The Championship’s main goal is the advancement of the baking and baking profession in Africa and to create vibe and celebration at this pan-African Expo.

• In the first edition, the Championship will focus on the cake making and decoration – where creativity, science and art converge, thereby enabling attendees to experience the wonderful art of baking.

The competitors will be judged by a Panel of Judges with vast experience in the field of pastry, cake making and baking, with each entry evaluated on originality and creativity in the use of ingredients, decoration and the use of technical skills. They will also be judged on cleanliness and overall presentation of the final cake.

FOUR PAVILLIONS THAT COVER THE FOOD INDUSTRY FROM A-Z

FOOD

FOOD AFMASS DRINKS

MARKET

Duck Donuts opens Africa’s first outlet in Egypt

EGYPT – American coffee and donut distribution chain, Duck Donuts has opened its first outlet in Cairo, Egypt as part of its international expansion drive.

Based at the Cairo Festival City Mall, the new store is going to be managed by Master Foods, a local operator in the catering sector.

The nearly 1,100 sq. ft. store also offers a viewing area where children and adults can watch their donuts being made and photo opportunities throughout with the brand’s iconic

Delta Corporation outlines US$50m

ZIMBABWE – Delta Corporation, Zimbabwe’s largest beverage company, is planning to invest up to US$50 million to strengthen its operations, Group chief executive officer Valela Matlhogonolo has revealed in an interview with businessdigest.

“The current focus of the business is to invest in capacity in the existing

and lovable duck mascot, Ollie.

In addition to donuts, the Cairo location also serves high-end coffee, espresso, donut sundaes, breakfast sandwiches, milkshakes, frozen beverages, select retail items, and more.

The chain further plans to expand in the country by opening 24 additional outlets by 2027, including a new one to be launched in the second half of 2023.

annual investment strategy

businesses, at an average of US$40 million to US$50 million a year,” Matlhogonolo said.

“This includes plant replacements, delivery fleet, information communication technology upgrades, and returnable containers.”

The CEO further noted that regional expansion of the business will be guided by the performance of

the already acquired businesses in the last three years. “We will assess opportunities as they arise.”

The new investments will also touch on supporting farmers contracted to produce raw materials like barley, sorghum, and maize to build reserves to self-sustain the business.

Atlantis Foods acquires fish and seafood distributor Snoek Wholesalers

distribution company has acquired Snoek Wholesalers a major player in the distribution of fish and seafood products to the wholesale and retail trade in the country.

The deal is part of Atlantis Foods’ strategy to grow its business operations and considerably increase its revenue.

Snoek Wholesalers was founded in 1964, as a smoked snoek processing company but currently, processes and markets a wide variety of seafood

products either fresh, dried, smoked or frozen.

Neil Pascall, Managing Director at Atlantis Foods said, “The acquisition of Snoek Wholesales is the next step in our expansion plan and complements our business perfectly.”

Atlantis was founded in 2003 and has amassed immense growth over the years as it currently supplies a broad range of seafood to wholesalers, food service customers and other major stakeholders in the retail industry.

TWO-STEP MOLDING CAN HELP YOU ACHIEVE:

up to 20% Lower package part cost up to 20% Minimized package weight up to 9% Improved uptime Reduce initial CAPEX

Saudi dairy giant Almarai buys out PepsiCo from dairy and juice venture

SAUDI ARABIA – Almarai, a Saudi manufacturer and distributor of food and beverages, has become the sole owner of International Dairy and Juice Limited (IDJ) after buying out its joint venture partner PepsiCo.

Almarai bought PepsiCo’s 48% stake in IDJ for SAR255 million (US$68M) to allow it to “further expand strategically in the wider region”

Riyadh-headquartered Almarai said the deal, announced in a stock exchange filing on Friday (17 February), would allow it to “further expand strategically in the wider region”.

IDJ manufactures and distributes food and beverages in Egypt and Jordan, as well as exports outside those two markets.

New KCC requests state for US$23M to implement milk powder reserve fund

KENYA – The New Kenya Cooperative Creameries (NKCC) has asked the Kenyan parliament to allocate KES3 billion (US$23.9M) for the implementation of a milk powder reserve fund for the stabilization of prices during glut and deficit.

dairy processors in the country and has a range of dairy products including milk, yoghurt, butter, cheese, ghee and cream milk powder.

NKCC said the Strategic Milk Powder Fund was established in law in 2016 and will be used for mopping up excess milk when there is glut, converting excess into milk powder and for release into the market when there is a shortage.

The company further communicated to the National Assembly’s Trade, Industry and Cooperatives that it would need KES500 million as initial seed capital to complete the modernization and upgrade of milk processing equipment.

Its JV with PepsiCo was formed in 2009 to focus on opportunities in south-east Asia, Africa and the Middle East, excluding the Gulf Cooperation Council countries where Almarai already had a strong presence.

Later that year, IDJ bought a 75% stake in Jordanian dairy producer Teeba and in 2010 acquired Egypt milk, juice and yoghurt producer Beyti.

New KCC is state-owned milk processor engaged in the processing and marketing of milk and milk products in the country.

The company is one of the largest

The government had recently spent KES 2 billion to modernize some of the New Kenya Cooperative Creameries factories in seven counties to build capacity for dairy farmers.

The factories situated in Uasin Gishu, Bomet, Nyahururu, Nyeri, Trans Nzoia, Meru and Mombasa have been revamped to build capacity for dairy farmers.

KCC HAS FURTHER REQUESTED FOR KES500 MILLION AS INITIAL SEED CAPITAL TO COMPLETE THE MODERNIZATION AND UPGRADE OF MILK PROCESSING EQUIPMENT.

BGI Ethiopia invests US$9.3m in expanding Meto Abo Brewery

ETHIOPIA – Brasseries et Glacières Internationales (BGI), a subsidiary of the French beverages firm Castel Group, has pumped Birr 500 million (US$9.3 million) into its Meto Abo Brewery to remodel and expand the brewery.

Until last year, Meta Abo brewery was under the ownership of British drinks giant Diageo which had acquired it in 2012 from the Ethiopian government for US$225 million.

While under the ownership of Diageo, the brewery got a boost of US$119 million in investment to expand its bottling line.

The investments by BGI will see the brewery fitted with new types of machinery and generators, which are expected to increase production capacity and strengthen BGI’s position in the market.

Uganda Alcohol Industry Association launches alcohol sale and drinking code of conduct

BGI, has a significant market share in the Ethiopian beer market, and also exports products across Africa, Europe, Asia, Australia, and North America.

Apart from Meto Abo Brewery, the group also owns other breweries in the area including St. George Brewery; Zebidar Brewery; Hawassa Brewery; Kombolcha Brewery, and Maychew Northern Brewery.

UGANDA – Alcoholic beverage players under their umbrella body, the Uganda Alcohol Industry Association (UAIA), have launched the code of conduct that will guide the sale and consumption of alcohol all over the country.

The UAIA chairman, Onapito Ekomoloit, said the code will help address social issues such as drinking and driving, underage drinking, and heavy episodic drinking all aimed at promoting the responsible use of alcoholic beverages.

He, however, noted that the code does not serve to summarize or substitute national laws and policies, which must always be upheld but rather explains UAIA’s approach to self-regulation.

According to the code of conduct by alcohol manufacturers, all members of UAIA must only portray drinking in safe and appropriate circumstances.

In addition, those marketing alcohol should not imply that drinking enhances virility, mental ability or performance, skills, or strength and neither should they use suggesting drink names that imply energizing, stimulating, or invigorating properties.

In the case of co-promoting alcoholic brands with energy drinks,

the mixer must be treated neutrally just like any other mixer, no energy claims should be made, and particular care must be taken with the imagery used.

With this code, penal sanctions have been put in place for noncompliant members and there will be a committee constituted to monitor and oversee the implementation.

ACCORDING TO THE CODE, THE

According to the code, the committee may issue the offer with a caution or impose a fine not exceeding shs10 million (US$2,715).

COMMITTEE MAY ISSUE THE OFFENDER WITH A CAUTION OR IMPOSE A FINE NOT EXCEEDING UGX10 MILLION TO NON COMPLIANT MEMBERS.

USA - Scientists from the North Carolina State University carried out a test analysis that offers insights into how some packaging materials impact the sensory and chemical properties of milk, which was published in the Journal of Dairy Science.

The varieties of packages were glass, LDPE (low-density polyethylene), HDPE (high-density polyethylene), PET (polyethylene terephthalate), LLDPE (linear lowdensity polyethylene) and paperboard carton.

According to the study report, glass bottles are the most advisable package as they retain the milk flavour, are more environmentally friendly and are considered more hygienic.

Milk packaged in paperboard cartons and LLDPE packages was found to have ‘lower cooked and sweet aromatic flavours with storage time and distinct stale flavours’ compared to milk stored in PET, HDPE and LDPE containers.

The paperboard-packaged milk was also reported to have a stronger ‘paper taste’ within hours of storage.

As for chemical transfer, milk packaged in paperboard and plastic bags also had higher amounts of chemical compounds after days of storage.

The UK govt invests US$18.5M in Kenya’s first processing facility for Irish and sweet potatoes

KENYA-The UK government has launched the construction of a KES2.3 billion (US$18.5M) production facility for Irish and sweet potato processing in Iten town of Elgeyo Marakwet county, Kenya.

The factory is a partnership between the UK government and Select Fresh Produce Kenya Limited which is implemented through the UK’s Sustainable Urban Economic Development Programme (SUED) in collaboration with the Iten municipality.

The processing factory will have a capacity of 60,000 tonnes, anticipated to process fresh and frozen Irish and sweet potatoes.

If completed, the factory will be the first in the country and the third in

INVESTMENT SUSTAINABILITY

Africa after Egypt and South Africa to process Irish and sweet potatoes for the European market.

Speaking at its launch, Jane Marriot, the British high commissioner to Kenya said that the factory will guarantee steady farm prices to over 10,000 smallholder potato farmers in the county and the region.

She also added that the facility will create at least 5,000 direct jobs in its first year of operation which will increase to 10,000 jobs within five years.

In addition, the program also intends to be producing a new highyielding seed variety to boost farmers’ yield and income.

PepsiCo Egypt subsidiary opens US$20M chips production line in expansion strategy move

Founded in 1982, Chipsy for Food Industries holds approximately 60% market share in the snack segment in Egypt and exports its products to 11 countries in Africa, Asia, and the Middle East including Saudi Arabia, Kuwait, and Lebanon.

The 110,000 sqm Chipsy Company for Food Industries plant includes nine production lines producing potato chips, tortilla chips, and corn-derived products.

EGYPT – Chipsy Food Industries, a subsidiary of PepsiCo Egypt Group, has opened a new US$20 million production line inside the Chipsy factory with a production capacity of 25,000 tonnes as part of its expansion strategy in the Sixth of October City, Egypt.

According to Mohamed Shelbaya, president of PepsiCo North Africa region, the new investment will facilitate the company’s goal of diversifying in particular into corn and potato-based snacks.

In addition, the investment will contribute to the Egyptian economic drive by employing 45 full-time employees and 145 temporary workers seven days a week.

Study questions the suitability of cartons as primary packages for milk

Planet-first nutrition will dominate consumer habits in 2023: FrieslandCampina consumer trend projections

ageing are among the prominent trends to be expected in the industry.

According to the magazine, consumers are ‘building trust for planet-first nutrition’ with concern for the planet expected to be observed in consumer habits for the foreseeable future.

Consumers are also becoming increasingly skeptical towards sustainability claims made by companies, the report noted.

In its projection, FrieslandCampina highlighted positive nutrition as the second most popular trend for 2023.

unique formats like teas, shots and fortified gummies that contain gutfriendly ingredients like prebiotics.

NETHERLANDS – FrieslandCampina has released its third annual consumer trend magazine, ‘Shaping the future of nutrition’ which highlights current consumer drivers in the food, beverage and supplements industries in 2023.

The ingredient supplier points out that planet-first nutrition and active

Plant-based and alternative proteins take third position in the ranking driven by a desire for highquality and nutritious products that do more than just replace animal proteins.

On fourth position is gut health driven by growing consumer awareness concerning gut health and gut microbes which support mental health and reduce stress. The company predicts the emergence of

Friesland’s fifth trend for 2023 is a shift from the emphasis on “healthy ageing” to “active ageing” which will offer opportunities for brands to develop products that support mobility and balance targeting emerging markets in adult nutrition.

Inyange Industries readies US$45M milk processing plant for commissioning

RWANDA – Inyange Industries

Limited, Rwanda’s leading agroprocessing firm has announced plans to commission a US$45 million milk processing unit in the Nyangatare district.

The new factory is anticipated to begin operations in May 2023 and will have the capacity to process 650,000 litres of milk in liquid form into 50,000 kilogrammes of milk powder a day.

The site intends to supply the produced 50 tonnes of milk powder along with 150,000 litres of UHTtreated milk every day, according to James Biseruka, Inyange Industries

According to information from the Ministry of Agriculture and Animal Resources, the plant’s marketing plan includes securing an off-take contract from Africa Improved Foods (AIF), a local major food manufacturer, for 2,000 tonnes of milk annually.

However, only 20% of the factory’s production will be domestically supplied while the remaining 80% is intended for exportation to the countries of the East African Community (EAC), the East African Common Market and Southern (COMESA) and the Middle East.

THERE IS A SHIFT FROM THE EMPHASIS ON HEALTHY AGEING TO ACTIVE AGEING WHICH OFFERS OPPORTUNITIES FOR BRANDS TO DEVELOP PRODUCTS THAT SUPPORT MOBILITY.

YEMISI IRANLOYE Founder/CEO, Psaltry International

MICHAEL CHORSKE Operating Partner, Pegasus Capital Advisors / Sustainable African Foods, Mali

JOHN MWENDWA Public Affairs & Communications Director, Coca-Cola Beverages Africa

DAVID KAMAU Managing Director, Fortified Whole Grain Alliance

NDIDI NWUNELI Executive Chairman, Sahel Consulting & Co-Founder, AACE Foods

DAVE OKECH OKECH Founder & Chief Imagination Officer, Aquarech

MATTHIAS GRABE Managing Director, Buhler East Africa

HARRISON JUMA General Manager, Tunga Nutrition (Unga Group)

TUMISANG MATSHEKA Vice President, Supply Chain, PepsiCo South Africa

STANLEY MWORIA CEO, Aquaculture Association of Kenya

PAUL BARTELS CEO, Mogale Meat

CAROL KOECH Country President, Schneider Electric East Africa

CLAIRE VAN ENK CEO, Farm to Feed

JIT BHATTACHARYA Co-founder & CEO – BasiGo

MICHAEL ORANGI Country Director, Kenya & Tanzania, Rainforest Alliance

WILLIAM KAPFUPI Managing Executive, CCB, National Foods

TALASH HUIJBERS CEO & Founder, Insectipro

JOACHIM WESTERWELD Executive Chairman, Bio Food Products

VAISHALI MALDE Sales & Marketing & Sustainability Manager, PIL

CAESAR ASIYO Chief Development Officer, Victory Farms

DR. KEN MUMA CEO, AAR Hospital

YEMISI IRANLOYE Founder/CEO, Psaltry International

MICHAEL CHORSKE Operating Partner, Pegasus Capital Advisors / Sustainable African Foods, Mali

JOHN MWENDWA Public Affairs & Communications Director, Coca-Cola Beverages Africa

DAVID KAMAU Managing Director, Fortified Whole Grain Alliance

NDIDI NWUNELI Executive Chairman, Sahel Consulting & Co-Founder, AACE Foods

DAVE OKECH OKECH Founder & Chief Imagination Officer, Aquarech

MATTHIAS GRABE Managing Director, Buhler East Africa

HARRISON JUMA General Manager, Tunga Nutrition (Unga Group)

TUMISANG MATSHEKA Vice President, Supply Chain, PepsiCo South Africa

STANLEY MWORIA CEO, Aquaculture Association of Kenya

PAUL BARTELS CEO, Mogale Meat

CAROL KOECH Country President, Schneider Electric East Africa

CLAIRE VAN ENK CEO, Farm to Feed

JIT BHATTACHARYA Co-founder & CEO – BasiGo

MICHAEL ORANGI Country Director, Kenya & Tanzania, Rainforest Alliance

WILLIAM KAPFUPI Managing Executive, CCB, National Foods

TALASH HUIJBERS CEO & Founder, Insectipro

JOACHIM WESTERWELD Executive Chairman, Bio Food Products

VAISHALI MALDE Sales & Marketing & Sustainability Manager, PIL

CAESAR ASIYO Chief Development Officer, Victory Farms

DR. KEN MUMA CEO, AAR Hospital

Bill Gates snaps up 3.7% stake in Dutch brewing giant Heineken for US$939m

NETHERLANDS – Billionaire entrepreneur and Microsoft cofounder, Bill Gates, has purchased a 3.7% stake (10.8 million shares) worth about US$939.87 million in the Dutch brewing group, Heineken.

“Of the 10.83 million shares, Bill Gates bought 6.65 million as a private individual and another 4.18 million through the non-profit Bill & Melinda Gates Investment Trust, a foundation owned by the American business

magnate and his ex-wife,” Inside Beer reported.

Gates purchased the shares from

the Mexican Coca-Cola bottler and convenience store operator Fomento Economico Mexicano SAB(FEMSA), which is exiting the brewing business to focus on core business verticals.

According to Bloomberg, FEMSA plans on selling all its shares in Heineken within two to three years.

In a separate filing, Heineken said it bought €1 billion (US$1 billion) worth of shares from the exiting shareholder, FEMSA.

No- and low-alcohol category value exceeds US$11bn in 2022, projected to have 7% growth by 2026: IWSR

stages and have a small volume base.

IWSR expects no-alcohol volumes to grow at a compound annual growth rate (CAGR) of +9% between 2022 and 2026. The growth is attributed to improved taste, production techniques, and diversification of consumption occasions.

GLOBAL – Sales of no- and lowalcohol drinks globally surpassed US$11 billion in 2022, up from $8 billion in 2018, according to new data from global alcoholic market research firm IWSR.

The category grew by more than 7% in volume across 10 key global markets in 2022, driven by increasing consumer demand.

The global alcoholic market research firm highlights that the pace of growth is further expected to surpass that of the last 4 years, with a forecast volume CAGR of +7%, 2022-

2026, compared to +5%, 2018-2022.

The No-alcohol drinks will lead the growth, accounting for over 90% of the forecast total category volume growth.

In 2022, No-alcohol volumes grew 9%, increasing their share of the overall no/low-alcohol space in the world’s 10 leading no/low markets to 70% up from 65% in 2018.

The subcategory is said to be growing faster than low alcohol in most markets, with the exemption of countries like Japan and Brazil, where low-alcohol markets are at early

The market research firm further forecasts consumption of no/lowalcohol beverages to grow by a third by 2026, spearheaded by the growth of no-alcohol products.

IN 2022, NO-ALCOHOL VOLUMES GREW 9%, INCREASING THEIR SHARE OF THE NO/ LOW-ALCOHOL SPACE IN THE WORLD'S 10 LEADING NO/LOW MARKETS TO 70% UP FROM 65% IN 2018.

Brewdog ties up with Budweiser to launch iconic craft beer brands in China

CHINA - UK-based craft beer maker Brewdog is expanding in China after partnering with brewing giant Budweiser.

The joint venture with Budweiser China will see the Scottish firm's Punk IPA and other beers brewed in China.

Brewdog also says it plans to open more bars in the world's second largest economy.

It comes after the company has faced controversies in recent years and has flagged it may pursue a stock market listing.

In a statement, Brewdog founder James Watt described the Budweiser partnership as "transformational" and said it would bring the craft brewery to "every corner of the world's biggest beer market".

REGULATORY

Pause on sugar tax increment a welcome relief to South

African sugar producers

SOUTH AFRICA – South Africa has paused further on the Health Promotion Levy (HPL), otherwise known as the sugar tax for two years in an effort to shield the industry from collapse.

The announcement from the Minister of Finance, Enoch Godongwana, during the presentation of the 2023 national budget is a muchwelcome relief to players in the sector.

In making this decision, the government took into account challenges stemming from greater regional competitiveness, the damage incurred from the floods in April 2022 and civil unrest in July 2021.

It follows persistent requests from players in the sugar industry such as the Sugar Association of South Africa and the South African Cane Crowers’ Association, who said that an increase in the levy would prove detrimental to the already struggling industry.

According to the South Africa Sugar Association, the increase in the sugar tax would have led to the loss of

more than 6000 jobs and jeopardized nearly 3000 small-scale grower businesses.

SA growers also compiled some data whose findings revealed that farmers already expect to lose about R700 million (US$ 38M) in 2023 owing to the implementation of loadshedding at stages 4 to 6.

Kenya’s leading coffee chain Java House Africa refutes claims that it is being sold

Under the deal, Brewdog said it expects its beers would begin to be produced at Budweiser China's Putian craft brewery, in the southeastern province of Fujian, by the end of next month.

The company said it also plans to open several bars in the country in the next three years.

China, which is the world's biggest market for beer, currently accounts for less than 1% of Brewdog's overall sales.

KENYA – Java House Africa, one of the leading coffee houses in East Africa, has refuted claims that its owner, UK-based private equity fund Actis is looking for potential buyers for the business estimated to be worth between Sh2.5 billion (US$18.4m) and Sh3 billion (US$24m).

The speculations into the sale have been going on for weeks now with many media houses quoting persons familiar with the transactions.

Mauritius-based private equity firm Adenia Partners had been identified as one of the potential buyers with

“sources familiar with the matter” intimating that talks were at an advanced stage.

In a LinkedIn Post, Java House Africa, which operates over 80 stores in 3 countries and across 12 East African cities, distanced itself from the said reports.

“There have been a number of misleading articles in the press recently speculating that Java might be for sale. These are absolutely incorrect. There is no sale process and there are no offers on the table,” read the LinkedIn post.

Zimbabwe cuts reliance on dairy imports as local production surpasses

91M litres

ZIMBABWE – Efforts towards dairy self-sufficiency in Zimbabwe have started bearing fruits with local production rising to 91.4 million litres in 2022 from 79.6 million in the year prior.

The higher milk output comes from a growing national herd population which has grown to 39,000 heads of cattle.

This growth has been attributed to the government’s multiple

ZIMBABWE NOW WANTS TO INCREASE THE UPTAKE OF RAW MILY BY PROCESSING COMPANIES FROM THE CURRENT LEVEL OF 70M LITRES TO 130 MILLION LITRES PER ANNUM BY 2025.

initiatives as revealed by the Lands, Agriculture, Fisheries, Water and Rural Development permanent secretary Dr John Basera.

The spike in local production has caused a 17% drop in milk powder imports from 8.9 million kgs in 2021 to 7.4 million kgs in 2022, according to Dr Basera.

With increased production, Zimbabwe now wants to increase the uptake of raw milk by processing companies from the current level of 70 million litres to 130 million per annum by 2025, according to Finance and

economic development Minister Prof. Mthuli Ncube.

To achieve this goal, Prof Mthuli urged dairy processors to increase their uptake of raw milk from smallholder farmers and increase their support to out-grower schemes so as to help build the stock of the dairy herd.

In line with that, the government has also proposed to gradually reduce milk powder and cheese imports in a sliding scale manner starting at 75% in 2023 to 50% in 2024 and 25% in 2025.

Tanzania partners with Spanish fishing company to build US$10M fish processing factory

TANZANIA – The Deep-Sea Fishing Authority (DFSA) of Tanzania in collaboration with a Spain deep sea fishing company anticipates building a TZS23.4 billion (US$10 M) fish processing factory in Tanga.

The Spain fishing company in question is called Pacific Star and it was recently granted a license for its vessels to practice deep-sea fishing in the Indian Ocean using the Tanzanian flag.

According to the DFSA’s Managing director Dr Emmanuel Sweke, once

fully operational, the factory will have the capacity to process 100-200 tonnes of fish per day and create about 100 job opportunities for the

citizens of Tanzania.

“This Spain fishing company also has been registered in Zanzibar Marine Authority and practicing fishing activities in our Exclusive Economic Zone (EEZ),” Dr. Sweke revealed.

“It is also providing about TZS920million (US$393,667) to the government every year as an economic compensation and it has agreed to employ 10 Tanzanians in their vessel as well as train two Tanzanians in the level of vessel Captains.”

www.summit.foodsafetyafrica.net

JUNE 15-17, 2023

Nairobi, Kenya

DISCOVER THE FUTURE OF FOOD SAFETY, NUTRITION & FOOD SECURITY IN AFRICA

REASONS TO ATTEND THE SUMMIT

Provide a platform to exchange the latest knowledge, experience and expertise in food safety, food nutrition, food processing and new technologies within the food and agro value chains in Africa

Improve local, regional and global collaboration initiatives on food nutrition, food security and food safety initiatives;

Provide a platform where technology and service providers can showcase their latest products and services to the industry, Goverment/NGOs and other stakeholders, hence improving the adoption of the latest technologies in Africa’s food and agro sector;

Improve the quality and food safety aspects of the food, agricultural and processed food and feed products in Africa, hence boosting trade and market access to local, regional and overseas markets;

Amplify the awareness of consumers on food safety, regulatory and public health issues and how each stakeholder can contribute to a safer food environment in the Continent.

Lancet report terms infant formula milk marketing techniques as exploitative and misleading

USA – A recently published report by Lancet has noted that the infant formula industry is using exploitative and “underhand” marketing strategies that are influencing millions of mothers not to breastfeed.

According to the report, misleading marketing tactics used in the infant nutrition industry have created a reality where fewer than half of infants globally are currently being breastfed contrary to WHO recommendations.

Some of the uncanny tactics include the use of influencers, industry-sponsored applications, and use of poor science to suggest that infant products offer solutions to common infant behaviour such as disrupted sleep and persistent crying.

According to the report, uncanny marketing behaviors have propped commercial milk formula market into a US$55 billion market.

Traditional recipes will propel food and beverage innovations in 2023: Kerry Taste and Nutrition charts

According to a global infant formula market report, the market is projected to grow at a CAGR of 4.04% to reach a market size of US$62.066 billion by 2027.

The experts are calling for an urgent strengthening of regulations and an international legal treaty to end irresponsible formula milk marketing and political lobbying.

APMEA – Kerry has released its APMEA 2023 annual Taste and Nutrition Charts highlighting the upcoming and emerging flavors for the coming year, as well as top mainstream and key tastes.

According to the charts, flavors inspired by global cuisines and heirloom recipes will propel food and beverage innovations in 2023.

Old cooking practices are also anticipated to resurface as consumers are seen to place more importance in tradition and provenance.

As a result, Kerry notes that ingredients such as nutmeg, ashwagandha, Indian gooseberry and ancient grains will find a new home across snack and beverage applications.

Soumya Nair, Global Consumer Research and Insights Director at Kerry, said: “Flavours have a powerful way to convey a story – particularly when it comes to consumer trends and preferences.

This year we will witness the resurgence of time-honoured traditions and heirloom recipes as consumers crave traditional tastes with new and emerging flavours.”

Consumers will also be on the look out for unconventional combinations of traditional ingredients and emerging taste profiles from other regions, such as black sesame crusted meats, sriracha-spiced cocktails, green tahini, saffron and curry aioli.

A thirst for healthier beverages with functional ingredients is also expected to reach new heights as more and more consumers move towards functionality and simplicity.

KERRY NOTES THAT INGREDIENTS SUCH AS NUTMEG, ASHWAGANDHA, INDIAN GOOSEBERRY AND ANCIENT GRAINS WILL FIND A NEW HOME ACROSS SNACK AND BEVERAGE APPLICATIONS.

Egypt shuts down facility believed to be producing counterfeit Nescafe coffee products

EGYPT – A company producing counterfeit copies of Nescafe coffee products under the name of food and beverage giant Nestlé has been shut down by law enforcement authorities.

The facility was based in North Cairo and was producing fake nescafe coffee along with other brands while failing to adhere to the appropriate regulations and operating without

a license, according to local media reports.

Along with commercial fraud, rumours have it that the fake coffee packs were filled with ceramic powder which led to the matter being discussed in the national parliament according to a government official.

The rumours were however later debunked by the head of the internal trade sector at the Ministry of Supply, Abdel Moneim Khalil, who said that the factory was seized due to counterfeiting an international brand.

From a raid in the factory, 5 million fake packs branded Nescafe were found together with three tonnes of raw materials.

Coffee has been a common target for food and beverage fraudsters where low-quality coffee beans are ground and adulterated with filler ingredients like corn, wheat, barley, soybeans, and rice among others.

CCBA expands production capacity in Africa, steps up youth and women empowerment

AFRICA – Coca-Cola Beverages

Africa (CCBA) is investing in expanding its production capabilities by installing a new production line at Coca-Cola Beverages Botswana’s (CCBB) Gaborone factory which will help reduce energy consumption, improve productivity, and open up export opportunities to neighboring countries.

According to CCBA, the factory will have state-of-the-art technology that allows for faster and more efficient production of polyethylene phthalate (PET) bottled products, increasing productivity and producing bottles with higher clarity and strength.

Uganda Breweries Limited commissions US$10.73M production line

UGANDA – Uganda Breweries

Limited, a subsidiary of East African Breweries Limited, has commissioned a UGX 39.9 billion (US$10.73 million) production line in an effort to improve capacity and efficiency.

The new line will increase the brewer’s production capacity to 30,000 330ml Bottles Per Hour and 25,000 500ml Bottlers per hour averaging Best – in Class efficiency of 94%, UBL said in a statement.

“The new line which is manned by atleast 65% women will supplement a UGX 44.4 billion state-of-the-art bottling line that was launched in 2010 that doubled the production capacity of the beer bottling plant,” UBL said.

The commissioning was presided over by a delegation from the Ministry of Finance led by the State Minister

The investment follows a US$4 million investment in a new polyethylene phthalate (PET) plastic bottle production line at CCBA’s Nampula factory in Mozambique.

The Nampula plant produces approximately 14,400 bottles of 200ml PET bottles per hour, cutting down on transport costs and CO2 emissions, CCBA said.

10,000 youth in 10 higher education institutions will be enrolled in a digital coaching and mentorship program called Boundless Minds in partnership with CCBA through CocaCola Beverages Uganda (CCBU).

of Finance for General Duties

–Hon. Henry Musasizi assisted by the Kampala Capital City Authority (KCCA) ED Dorothy Kisaka and UBL Board Member Jimmy D. Mugerwa.

“As a 76-year business, this milestone stands as a testament to the fact that our quality Ugandan products – made from quality Ugandan inputs – are well-received in the country and the region,” said Andrew Itambo Kilonzo – UBL’s Managing Director.

WHAT’S ON SHOW AT THE EVENT

Africa & Care Hospitals

Expo

Africa

Medilab

& Expo Diagnostics

Animal

Health & Care

Africa

Expo Devices Medical

Africa

& Health Nutrition

Expo

Wellness

Africa Health

Supply Chain

Africa & Expo Logistics

Expo

Africa Health

Financing & Insurance

Expo

Africa

HealthTech

Expo

Africa

Expo Pharma

APPOINTMENTS Update

Zambeef names Ezekiel Sekele new Executive, Corporate Affairs and Sustainability

Danone South Africa appoints Hervé Barrere as Managing Director

SOUTH AFRICA – Danone South Africa, the country’s largest manufacturer and distributor of yoghurt, has appointed Hervé Orama Barrere as its new Managing Director.

According to Danone, Barrere is no stranger to the African market noting that he possesses rich insights, experience, and on-the-ground knowledge of building brands in Africa.

Tongaat Hullet appoints Dan Marokane as acting CEO

ZAMBIA – Zambeef Products PLC, the largest beef-producing company in Zambia, has appointed Ezekiel Sekele as its Executive of Corporate Affairs and Sustainability.

Sekele brings to Zambeef a wealth of experience gained from over 20 years of expertise in senior management positions across several sectors.

Prior to this appointment, Mr. Sekele served as the Director of Corporate Affairs of Zambian Breweries, which is part of Belgium-based multination brewing giant AB InBev Group.

He was also the immediate past President of the Zambia Association of Manufacturers (ZAM) and has sat on the Zambia Chamber of Commerce and Industry (ZACCI) board.

He has had successful careers in several multinational organizations such as Deloitte & Touche, the Commonwealth Development Company (CDC) at Mpongwe Development Company, and SABMiller Mozambique (CDM).

Mr. Sekele is an associate of the Chartered Governance Professional with a post-qualifying diploma in Corporate Governance.

Barrere previously led Danone Nigeria as Managing Director in 2017 as well as in Algeria in 2019. He has also worked with the Swiss multinational food and drink processing conglomerate corporation Nestlé for 10 years in various positions including managing director in the Congo and Central Africa regions.

SOUTH AFRICA – Tongaat Hulett, South Africa’s biggest sugar group, has appointed Dan Marakone, as acting CEO, following the resignation of Gavin Hudson.

Hudson was appointed four years ago to help lead Tongaat’s turnaround after years of business turmoil where the company was riddled with debt that threatened its survival.

Marakone took office on March 1st and is required to steward the sugar giant through the difficult period by working in hand with the business rescue practitioners who are currently working on a highly anticipated business rescue plan.

His career in Tongaat Hullet started back in 2018 as chief of business transformation officer, part of Hudson’s turnaround team, and then appointed as executive director in 2019.

The company intends to leverage his longevity in the field as well as his wealth of operational and leadership expertise.

With this new appointment, Barrere is tasked with the responsibility to ensure the continued success and growth of Danone South Africa and its full brand portfolio.

He has had a valuable contribution to Tongaat Hulett, notably his impact on the internal cashflow optimization programmes and the management of the company’s asset disposals.

Marakone holds a BSc in Chemical Engineering, an MSc in Petroleum Engineering, and an MBA degree and has worked in various executive roles across mining and manufacturing industries over the past 20 years.

Nile Breweries picks Adu Rando to succeed David Valencia as Country Director

UGANDA – Nile Breweries, the Ugandan subsidiary of alcohol manufacturing giant AB InBev, has appointed Mr. Adu Rando as its new Country Director, replacing David Valencia who takes on the role of Commercial Strategy Director, Africa Zone for AB InBev.

Rando has had over 20 years of service to the Company’s parent company AB InBev in different capacities in Brazil, China, and Tanzania.

In Tanzania based in Dar es Salaam, he served as the Route To Market Director, Greater Africa Tanzania from 2021. He will leave Tanzania for new roles in Uganda.

Appolinaire Djikengm becomes first African to lead the International Livestock Research Institute

Serengeti Breweries Boss Martin Ocitti takes helm at Kenya Breweries Limited

KENYA – East African Breweries Limited (EABL), a subsidiary of alcoholic beverage giant Diageo, has appointed Martin Ocitti to the role of Managing Director of Kenya Breweries Limited (KBL), from 1st March 2023.

Ocitti joined EABL in 2014 as MD for EABL International (EABLI), then moved to Uganda Breweries Limited as its MD in 2016, and later in 2019, he took up the role of MD for Serengeti Breweries, Tanzania.

Martin succeeds John Musunga who left KBL last October to take up a new assignment as the new Managing Director for Guinness Nigeria.

KENYA – Appolinaire Djikengm, A Cameroonian biologist and researcher at the University of Edinburg in Scotland, has become the first African to lead the International Livestock Research Institute (ILRI) following his recent appointment as Director General of the organisation.

The new director will take office in April 2023. The appointment also includes him being the Senior Director of livestock systems of the Consortium of International Agricultural Research Centers (CGIAR).

Martin’s position in Tanzania will be filled by Dr. Obinna Anyalebechi, a seasoned executive with an expansive

His proven track record span across sales, operations, digital sales systems platforms, e-commerce, sales structure, and process optimization.

According to Onapito Ekomoloit, the Legal and Corporate Affairs Director, Rando’s long sales and operations experience in different channels on three large and diverse continents and his unique expertise in driving technological change across markets have provided him with a solid base for his role.

In his new role, Professor Djikengm is expected to expand ILRI’s proven track record of impact, developing livestock sustainable systems that will help nourish and sustain millions of people in low- and middle-income countries. He will also provide leadership and coordination of activities related to livestock systems across CGIAR.

Professor Djikengm is a globally renowned biologist who earned his respect from various scientific research including his piloted multidisciplinary and multi-institutional research and development programs focused on the development of agriculture and livestock health.

experience in commercial, consumer marketing, and customer marketing spanning over 16 years.

Mark has an honours degree in Statistics from Makerere University and an MBA from Herriot Watt University in Scotland. He also has an Executive MBA from London Business School.

AFRICAN ORIGINALS

Apple & lime Cider

Kenya-based craft beverage producer African Originals has just released a new cider: the apple and lime Cider! According to the company, the new KO Coffee Cider is an “authentic Kenyan fruit cider carefully handcrafted with a coffee kick.” The drink is 4.5%ABV and comes packaged in a stylish 330ml bottle unique to the KO range of ciders. Consumers can purchase the cider directly from the company’s website or at select retail stores in Kenya.

www.kenyanoriginals.co.ke

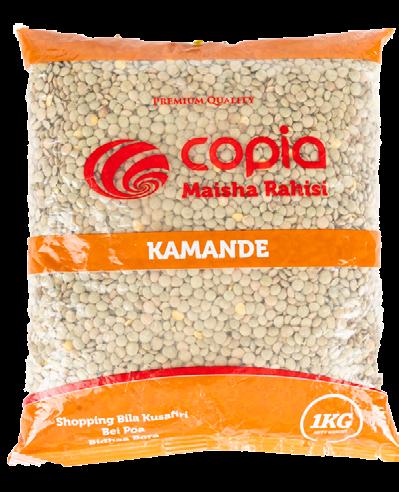

COPIA GLOBAL

Pulses

Copia, a leading online retail platform in Kenya, has added pulses namely green grams, lentils, and black beans to its portfolio of own-label food products. “We are excited to introduce you to our very own Copia Ndengu (green grams), Copia Njahi (black beans) and Copia Kamande (lentils)!,” Copia said. Copia says that its pulses are sourced from Kenyan farmers and has promised to offer buyers “a fantastic launch discount” adding that it will continue to offer free deliveries countrywide through Copia Agents.

www.copiaglobal.com

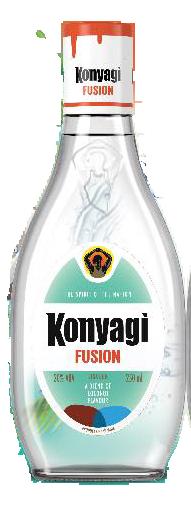

TANZANIA DISTILLERIES

Konyagi Fusion

Tanzania Distilleries Limited has added two new flavor variants, Ginger & Lemon and Coconut, to its flagship spirit brand Konyagi. Launched under a new brand name Konyagi Fusion, the new flavours were specially tailored to appeal to the modern youth. Konyagi fusion has 20 percent alcohol and is available in 250 milliliters glass packaging that still maintains the classic shape that the Konyagi brand is known for.

www.tanzaniabreweries.co.tz

ZANGIBRANDS Trail Mix & Breakfast Cereal

Zangi Brands has launched Trail Mix (R'eino Notten), a mixture of premium selected nuts and seeds that have been sweetened and roasted to meet a healthy-diet needs. The brand is available in three varieties namely Unflavored, BBQ, Caramel, and Cashew.

The company has also unveiled a ready-to-eat cereal that “comes with the concept of fulfilling customer needs: no artificial sugar, rich & nutritious.” The breakfast cereal is available in different varietie including zangigranolla; Nutty, Tropical, Muesli and Zero % Sugar.

www.zangibrands.com

HIGHLAND DRINKS Club Lemonade

Highlands Drinks Limited, a Kenyan-based beverage manufacturer, has added Club Lemonade to its diverse portfolio of soft beverages. According to the company, the new Club Lemonade is “a perfect blend of sweet and tangy.” Packaged in a 350Ml PET bottle, the drink is available at all leading stores in Kenya.

www.highlandske.com

TRU FOODS LIMITED

No added sugar Jams

Tru Foods Limited, a leading food processor in Kenya, has introduced No added sugar jams and marmalades to its portfolio. Launched under the Zesta brand, the new jams: strawberry, red plum jam, and mixed fruit jams, and the orange mamalades are said to be high in nutrition & fibre, low in calories, and suitable for consumers who are diabetic.

www.trufoods.biz

We all love chips! Whether as a once-in-a-while guilty indulgence or a perfect lunch date, these long slices of potato that are lightly fried golden always find a way of gracing our meals. The journey to our plate is, however, a long one and involves some not-so-clean steps that most consumers- and increasingly today, processors- would rather avoid. Nobody wants to go through the tedious and dirty process of peeling potatoes. Even the workers at your favorite food service restaurant don’t, or why else would they have you peeling them if, for whatever reason, you fail to pay your bills?

While most of us see this critical step as an inconvenience, Wanjiru Mambo, the Founder and CEO of Wedgehut Foods saw it

as an opportunity and has today built an entire business that not only generates income for her but is also a source of employment for 30 other staff. “We are in the value addition of potatoes where we get potatoes as they are from the farmer, do the sorting, the cleaning, the peeling and finally packing,” she says. “The end product is fresh, ready-to-cook potato.”

A PANDEMIC BABY

Before the Pandemic, if you asked Wanjiru, a marketing graduate and certified public accountant, whether she would see herself doing what she does today, the most probable answer would have been an emphatic No. But Covid created a “new normal” which completely disrupted life as we knew it. For Wanjiru, Covid meant a complete halt to her previous business venture. “I had a restaurant

in Upper Hill that shut down,” she reveals. The restaurant could no longer operate as the Ministry of Health had given an order for all outlets and eateries to close down in an effort to curb the spread of the pandemic.

The closure left Wanjiru with a huge consignment of potatoes that she and her household could not consume. “I started selling them in the estate where I live and that's the same time people were doing panic buying,” she narrates. No sooner had she started than her stock ended. “I went ahead to get some more from Limuru and sold. But then in the process, I was just thinking, what else can you do with potatoes? So that's where the idea of processing and adding value came about.”

BABY STEPS GIVE WAY TO BIG CLIENTS

Enthused with the new business prospect,

she approached a friend who had experience processing potatoes for some insights. She got more from the conversation than initially planned. “They were willing to allow me to purchase some of the equipment they had and even set up the company at their space.” With manufacturing sorted, the next challenge was to find clients willing to buy her products. “I was lucky to land one a big client in the name of Naivas,” she reveals. Naivas Supermarkets is one of the largest retail chains in East Africa with over 91 stores as of December 2022. Wanjiru however reveals to us that in the industry where she operates, “people just trust you with small quantities,” at first as they gauge your ability to deliver. In the Naivas case, she reveals that only three branches were assigned to her at first. More were added later as the relationship developed, and she was able to demonstrate the ability to deliver on larger orders. A proud Wanjiru notes that the fact that Naivas is still one of her major clients 2 years after she got her first order from the supermarket chain is proof Wedgehut’s ability to consistently meet customer needs.

Today, Naivas is not the only major brand in Wedgehut’s portfolio. The client list has expanded to include other major brands in the food service industry in Kenya. The clients are categorized into retail, restaurant chains, and institutional clients. Joining Naivas in the retail chain is Quickmart, the second largest supermarket in Kenya. Wanjiru explains to us that Wedgehut products don’t end up on the shelves of these supermarkets. Instead, they are delivered directly to the deli section of the supermarket where they are used to make fries and other potato-based ready-to-eat products for the on-the-go consumer.

If you have enjoyed fried chicken at Chicken Inn or Galitos, chances are that the chips that accompanied them were from Wedgehut foods as Simbisa Brands, the restaurant chain’s parent company is one of Wanjiru’s biggest clients. Simbisa together with Java House Africa form part of the notable brands in WedgeHut Food’s restaurant chains category. The institution’s list includes various prestigious schools like Strathmore and Braeside alongside major hotels including Safari Park, Ole Sereni, and Crowne Plaza.

When it comes to dealing with large clients, Wanjiru tells us the only secret is consistency in the quality of delivered products. She confesses that when setting

WE ARE IN THE POTATOE VALUE ADDITION BUSINESS WHERE WE GET POTATOES FROM THE FARMER AND PROCESS. THE END PRODUCT IS A FRESH, READYTO-COOK POTATO.

Wanjiru Mambo, Founder & CEO, Wedgehut FoodsWanjiru Mambo, Founder & CEO Wedgehut Foods Limited

up, there were challenges, particularly with the packaging, but she made sure that her team did not compromise on what was inside the packaging. “We made sure the quality was good,” She says. Having fewer players also played to Wanjiru’s advantage. “We are not so many processors in the industry and that has worked to our advantage thus far.”

SOURCING THE RIGHT POTATO

The search for the right quality of potatoes had Wanjiru scouting Kenya’s country sides where potatoes are known to be available in abundance. In her scouting escapades, she quickly realized that in the abundance of potato supply lay a scarcity in the availability of potato that was of processing quality. Reason for this market anomaly according to Wanjiru was an information gap. ‘Farmers simply don't understand what a potato for processing is and that has been quite a challenge,” she says. What makes a potato to be of processing quality? I ask. “For us, number one is the size, then the variety,” She answers succinctly. Size is important for WedgeHut as potato chips are the most highly sought after by its clients and these need to be “very good and long enough,” Wanjiru explains. When it comes to variety WedgeHut’s order of preference is Shangi, unica, and Markies. “Shangi and Unica, they are very sweet. Most companies or eateries prefer them because of their sweetness.” Though not her number one choice, Wanjiru describes Markies as a potato variety that is of exceptional processing quality. “It doesn't have deep eyes and thus produces minimal waste during processing.”

Most farmers however don’t always get it right during farming so they end with very small-sized potatoes that are of little use to WedgeHut and most processors. The ugly face of this anomaly showed itself when it was revealed to the media that KFC, an American multinational fast food restaurant chain with a sizeable share of the Kenyan fast food market, was importing potatoes while potatoes were rotting away in Kinangop, one of Kenya’s leading potato producing regions.

Wedgehut, although a small player in the potato value chain, is currently doing its best to try and correct the situation. Wanjiru tells us that her company is one of the members of the Mavuno Zaidi program which seeks to improve the quality of potatoes produced at the farm. The program is led by Sygenta East

Africa which educates farmers on the good agricultural practices required to produce processing quality potatoes. Equity Bank, one of the largest financial institutions is also part of the program as a financial partner. “Farmers say the challenge they have when it comes to doing proper farming is money and that is why Equity has come in as the financier,” Wanjiru explains. Other players include Fresh Crop which provides farmers with certified seeds and Yara which supplies fertilizer.

The impact of the program has been phenomenal, both to farmers and processors like Wedge Hut. Wanjiru reveals that the ones who have attended the program now approach farming from an agribusiness point of view. They know the importance of soil testing before farming and the value of crop rotation particularly in maximizing land potential. Access to certified seeds and required fertilizer coupled with financing solutions has also ensured that farmers produce the right quality of potatoes that WedgeHut can use to make its range of products that is not only comprised of potato chips but also Wedges,

CONSISTENT ADHERENCE TO QUALITY AND SAFETY IS WHAT HAS OPENED BUSINESS FOR US BECAUSE WHEN PEOPLE COME TO DO AUDITS WE ALWAYS MEET EXPECTATIONS

Cubes, and peeled whole potatoes. Wanjiru reveals to us that about 265 farmers with a combined hectarage of about 3000 hectares are part of her company’s sourcing program. When it comes to sourcing, location is not of importance. “We work with farmers from across the country,” she says. “It just depends on where we are able to get a perfect potato.”

MAKING FOOD QUALITY AND SAFETY A PRIORITY

Wanjiru’s biggest achievement is ensuring consistent adherence to quality and safety. “It has given us mileage and that's what has opened up business for us because when people come and do the vetting or the audits, we always consistently met expectations,” she says. In areas where improvement has been required, she notes that the company has always been open “to learn and evolve and adopt best processing practices.” To achieve this, Wanjiru, a marketer and certified public accountant by profession, has had a lot of learning to do. “It's been quite a learning experience every day,” she says. “I didn't know food is such a huge thing. How you do your

KEY NUMBERS

10,000

KILOGRAMS OF POTATOES THAT WEDGEHUT CAN PROCESSES IN A DAYprocessing, how you set up is such a big deal!”

She also admits that bringing on board people who have the knowledge on food processing has really helped her get everything right. At Wedgehut, those people include two production managers and one quality assurance officer. She notes that having trained and experienced people in her production and quality department has ensured that each process batch meets the necessary quality and safety specifications. Her team also come in handy particularly in enabling the business to adopt and implement food quality and safety recommendations

given by clients. Wanjiru is also glad to have such an impressive team of food technologists as it relieves her of the responsibility to handle customer complaints while also giving her the reassurance that it will be handled in the most competent way. “I don’t respond directly to customer complaints,” she says. “The person in charge of quality assurance writes back to clients from a quality perspective complete with recommendations.” Clients will always say they are right, but Wanjiru reveals that at times they could be the ones having issues, and with a competent team, Wedghut is always in a position to give recommendations on possible corrective actions to take.

A FOCUS ON CASH CLIENTS

In any business, cash is King. But in the market where Wedgehut operates, the Queen in form of credit runs the streets. Wanjiru reveals that while farmers expect prompt payment for their produce, Wedgehut customers operate in a credit system where payment is made between 30 and 45 days. This greatly creates cashflow issues for the upstart company. A shrewd business lady, Wanjiru is turning her focus to a new category of clients: Cash clients. She explains to us that this category is comprised of smaller restaurants that are coming up, especially in the upmarket which normally take a shorter credit cycle of between 7 and 14 days. She sees a lot of potential in this avenue as most of these businesses are opening up in spaces such as top floors of buildings where space is very limited. “Because of how potatoes are processed, the peeling is a bit hectic and it's a very dirty process,” Wanjiru explains. “So the best thing is to just get ready to cook potatoes” and that’s where Wedgehut comes in.

The company has also opened up a directto-consumer channel that delivers small orders from as low as 3 kilograms per order. These ones pay in cash and are particularly critical in balancing the cash flow. Digital has been the main channel for reaching these clients with the company already having a significant following across its social media channels including Facebook and Instagram. These clients have also turned out to be very valuable when it comes to referrals. “Sometimes a customer samples our product and its works very well for them and they end up recommending you to a hotel or hotel owner. Other times it’s a chef who sampled for his own personal use but

ends up recommending us at their workplace because they liked the product we offered.”

THERE IS MONEY TO BE MADE FROM POTATO

The potato business, despite its various challenges, has proved to be very lucrative for Wanjiru. With the performance so far, She believes that there is more money to be made in from potatoes as demand for chips and other potato products expands. She forecasts that with the current trends, potato is well on its way to overtaking Maize as Kenya’s mostconsumed food product. “Look at our kids,” she poses. “Not so many will go and ask for Ugali in a restaurant, but you find people asking for potatoes.”

Given its potential, Wanjiru would love to see more farmers give potato farming the attention it deserves. Already, a crop is emerging of young, well-educated farmers going back to the rural areas to do potato farming. Given their exposure, Wanjiru notes that this group of farmers is opting to adopt proper farming methods right from the start which has helped improve their revenues. More farmers need to join to ensure that the country has an adequate supply of good-quality potatoes. She notes that if done right,”you can actually make more than just enough to feed your family. You can even make money for school fees and other things.”

HUNT FOR A STRATEGIC PARTNER IS ON

As the market for potatoes continues to rapidly expand, Wanjiru wants her company to continue playing an increasingly important role in the value chain. So far the company has been taking an organic approach when it comes to growth. “We have been upgrading as we go,” she says. “When operating at full capacity, we can do even ten tonnes in a day.” The goal is to however be in the big leagues. She tells us that getting in that arena involves bringing on board technologies like automation for consistency, efficiency, and food safety. “We're looking at also doing the frozen line which is in demand right now,” she reveals. “The government has taxed heavily people who are importing, so if we can do it locally, we are at an advantage.” Wedgehut also has plans to enter into the potato flour business. The flour not only brings in revenue but also “sorts out some of the waste.” Starch, one of her biggest headaches “because its forms a gummy thing that blocks waste stream pipes,” could also be turned into a revenue generating product. Finding a way to process that would actually be of great benefit to her zero-waste strategy. “So that's where we are looking forward to and we hope we can get strategic investors to help us get there.”

TRENDS IN FORMULATING, PROCESSING, PACKAGING & CONSUMPTION OF DAIRY PRODUCTS

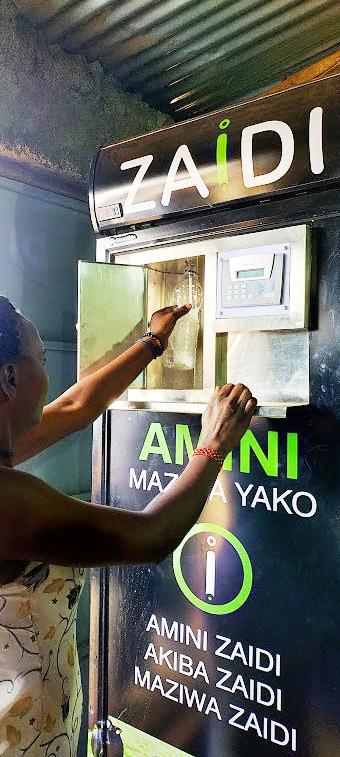

How Zaidi uses technology to improve incomes of smallholder dairy farmers in Kenya

By Paul Ongeto

By Paul Ongeto

Smallholder dairy farmers account for 56% of the 5 billion liters of milk produced in Kenya. Despite heavy investments by milk processors, a significant portion of this milk (over half) is still handled by the informal dairy value chain. Graham Benton, who founded and ran Zaidi Technologies,

believes that for this value chain to thrive despite the onslaught from formal trade, "it must be doing something right. Something that works for everybody in that value chain which the formal market can't or is unwilling to serve.”

What makes the informal sector thrive, according to Benton, is its value proposition for the farmer. Unlike formal

trade where smallholder farmers deliver milk only to be paid in a 30 to 45 days cycle, in the informal trade, payment for milk delivered is prompt, often on a daily or weekly basis. The farmgate price in the informal sector is also often higher (up to half of the final price) when compared to the formal where it can go as low as 25%. Benton says this makes informal trade immensely popular among farmers that if they were asked to choose between a cooperative or a formal business or a guy with a motorcycle, the guy on a motorcycle is preferred almost every time.

A HIGHLY INEFFICIENT SYSTEM

Despite its immense popularity, inefficiencies within the system mean that farmers do not always get a fair value for their milk. To avoid complex maths associated with recording the true quantity of milk each farmer delivers, Benton says that most middlemen often round off the quantities to the nearest liter. The loss in uncaptured quantities (which ends up not being paid) can be as high as 20% per delivery, which is significant given that the average milk delivery per farmer is 4 liters.

keep their records manually on books, and in the event the famous "black book" is unavailable, a piece of paper is used in the hope that information will be transferred to the main records book. Where even a piece of paper is unavailable, farmers have to rely on their middleman's memory which is an even worse method of keeping records. Whenever deliveries are not accurately captured, which is common, disputes always arise and most often end up with the farmers not receiving payment for milk delivered.

ENHANCING FAIRNESS THROUGH TECHNOLOGY

With technology, however, Zaidi helped transform the informal dairy value chain in Kenya to make it more lucrative, inclusive, and fair to farmers and all other players in the sector. The startup developed an app that solved two of the biggest pain points for farmers, accurate measurement and proper record keeping. “If the little digital scale says 2.37 Kgs, then it's 2.37Kgs that will be recorded in the app which then does all the math,” Benton says.

Digitizing the entire milk purchasing process has brought a level of transparency to the value chain that never existed before. Benton notes that with the app, “the farmer knows that they're not just giving milk to this guy who's taking records on the back of a piece of paper,” but rather his milk is going into a system that is doing meticulous calculations and keeping records. Farmer incomes have also improved as the amount previously lost to rounding off is captured fully and paid for.

Even with digitalization, Zaidi does not veer off from the value chain’s main selling point: prompt payment. “We did a seven-day cycle,” Benton reveals, adding that “with some very affordable tricks,” the company could bring the payment cycle down to daily. Like other aspects of the system, payment is digitalized. Farmers receive their payment through the mobile money transfer platform M-Pesa which creates “bankable records" that farmers could use to improve their credit scores. Although weekly is

WITH TECHNOLOGY, ZAIDI HELPED TRANSFORM THE INFORMAL DAIRY VALUE CHAIN IN KENYA INTO MORE LUCRATIVE, INCLUSIVE, AND FAIR TO FARMERS AND ALL OTHER PLAYERS IN THE SECTOR.A guy on a motorcycle is the most preferred milk trader by farmers.

the preferred payment cycle, Benton reveals that with digital, farmers are allowed to choose whichever cycle fits them, be it twice a week or twice a month.

THE ROLE OF MILK ATMS IN INFORMAL TRADE

Milk ATMs played a critical role in realizing Zaidi’s goal to modernize the informal milk value chain in Kenya. According to Benton, ATMs allows companies to sell milk at a much more affordable price. If you go to a supermarket, a 500ml packet of pasteurized milk retails for KES50 while UHT milk sells for KES60 or KES70, depending on location, Benton observes. In comparison, 500 ml of milk from an ATM retails at between KES35 and KES45. Moreover at the ATM, consumers are not restricted to buying milk in particular quantities, they can always buy whichever amount they need from as low as KES10. This makes the milk sold through informal trade channels immensely popular among low-income areas where consumer purchasing power is limited. Benton adds that consumers prefer the taste of ATM milk when compared to packaged milk as it closely resembles the original taste of raw milk.

Before Milk is delivered to the

ATMs, it must, however, pass through a contracted processing facility where it is pasteurized for safety purposes. Benton further assures that tests are conducted on the milk post-processing

to ensure it meets the minimum quality standards. The process of delivery is also optimized to ensure that ATMs only receive the amount of milk that they are likely to sell based on their historic performance. This reduces

KEY NUMBERS

NUMBER OF FARMERS THAT HAVE BEEN IMPACTED BY ZAIDI TECHNOLOGIES

waste which is a key problem in most fresh food value chains in Kenya.

Despite its critical role in the informal milk trade, Benton admits that the current milk ATMs are not optimized for the function of dispensing milk to customers. “Nothing is built for each other,” Benton reckons. He notes that the “containers are not built for the refrigeration unit, which is not built for the dispenser,” and this greatly diminishes the effectiveness of the machine. Another big challenge, according to Benton, is that the machines are very inaccurate which at times leads to them either underdispensing or over-dispensing milk. This he reckons was Zaidi’s biggest obstacle to scaling up its technology despite it having a direct impact on more than 700 farmers in Kenya’s central highlands and having the potential to onboard even more. "What really needs to happen is that somebody needs to come in and develop from the ground up, a fully functional and working milk ATM.”

Today, Benton is continuing his work of improving the dairy value chain and is looking at developing new ways to ensure that quality milk reaches customers at a fair price, while ensuring an equitable value chain for farmers

BeverageTECH

TRENDS IN FORMULATING, PROCESSING, PACKAGING & CONSUMPTION OF BEVERAGE PRODUCTS

Manufacturers strategise to mitigate inflation in Africa's soft drinks market