Food Africa Business

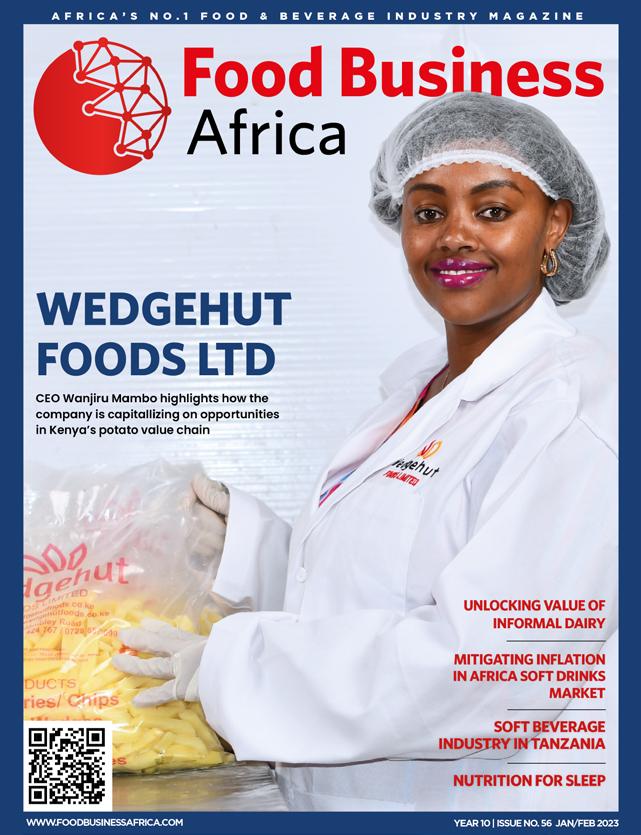

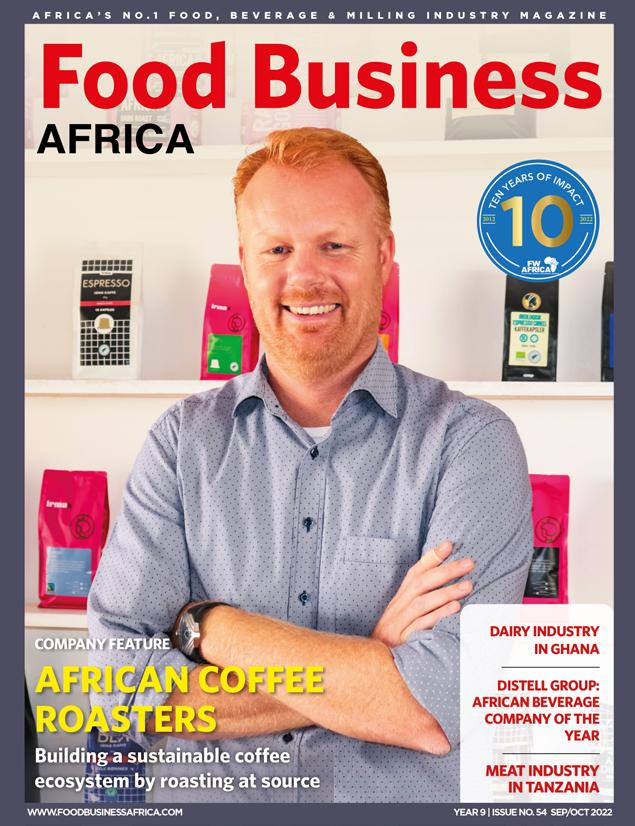

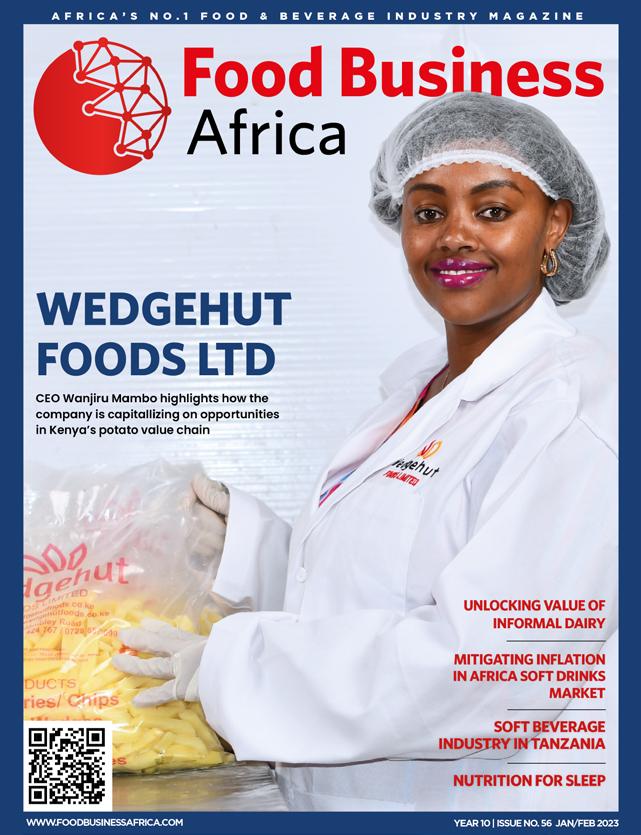

HIGHLANDS DRINKS LTD

CEO Joachim Westerveld on how to build on legacy to create a modern and successful soft beverage company

AFRICA INFANT FORMULA MARKET

TRENDS IN MALT DRINKS

PROCESSING

INVESTMENTS IN AFRICA RETAIL INDUSTRY

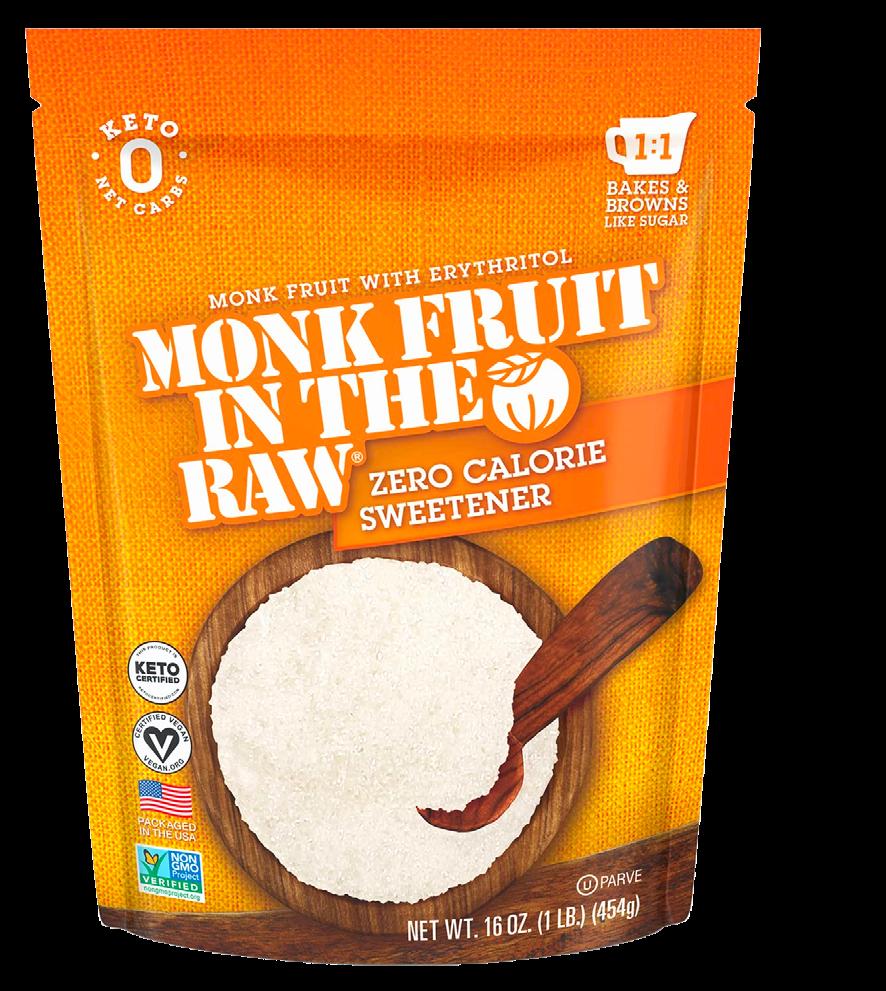

MONK FRUIT AS A SUGAR ALTERNATIVE

WWW.FOODBUSINESSAFRICA.COM YEAR 10 | ISSUE NO. 57 MAY/JUNE 2023 AFRICA’S NO.1 FOOD & BEVERAGE INDUSTRY MAGAZINE

SCAN ME

OBIPEKTIN from APECX is a natural fibre, which is mainly obtained from apples and citrus fruits. It offers natural gelling, thickening and stabilising properties. OBIPEKTIN can complement or even replace other texturising ingredients in many applications – highly functional and very versatile.

Advantages of OBIPEKTIN from APECX

Flexible pectin with versatile use

Perfect texture and mouthfeel for food and beverage products

Plant-based, suitable for vegetarians and vegans

Halal, kosher, non GMO, FSSC 22000 certified

V E R S A T I L E P E C T I N F O R N A T U R A L G E L L I N G , T H I C K E N I N G A N D S T A B I L I S A T I O N

www.apecx.ag

Pearl Dairy: Lato Instant Porridge | Brookside

Dairy: Plant based milk | Jetlak Foods Limited:

Frosti Fruit Drink | Bakhresa Group: Azam O’cream

Icecream | Bounty Kenya Limited: Non-Alcoholic

wine & Energy Drink | Kitui Flour Mills: Dola

Vegetable Cooking Oil

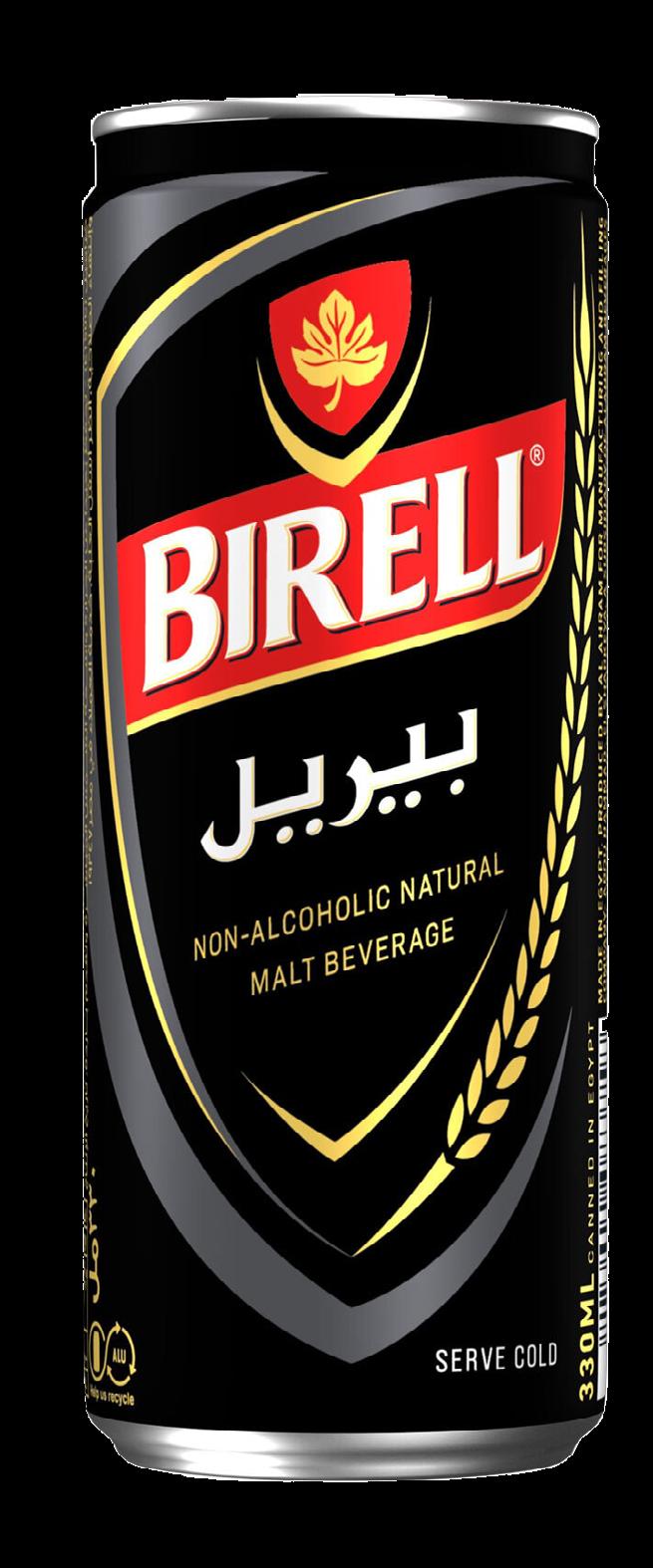

45 Beverage makers expand malt drink options as African consumers rediscover their lost passion

51 Monk fruit presents itself as a viable natural alternative to sugar

56 Retail in Africa is a bag full of opportunities steeped in immense challenges

FOODBUSINESSAFRICA.COM MAY/JUNE 2023 | FOOD BUSINESS AFRICA 1 CONTENTS DAIRY BUSINESS AFRICA 39 Infant milk formula popularity is on the rise in Africa despite sustained efforts to limit its use

TECH AFRICA

BEVERAGE

FOOD INGREDIENTS AFRICA

MARKET TRENDS

REGULARS 4 Editorial 10 News Update 26 Appointments Update 62 Supplier News & Innovations

Innovations:

32 New Product

YEAR 10 | ISSUE NO. 57 MAY/JUNE 2023

30

My Company Profile: Highlands Drinks Ltd

Highlands is a Kenyan company manufacurting and marketing non-alcoholic beverages, with a history spanning 69 years. Provides

8 Events Calendar

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 2 ON THE COVER -

you a highlight of the key food industry events in Africa and the Middle East

CONTENTS YEAR 10 | ISSUE NO. 57 MAY/JUNE 2023

Joachim Westerveld, CEO, Highlands Drinks Ltd

Yes! Now everyone can enjoy delicious yoghurts PALSGAARD ® ACIDMILK SERIES Shelf-stable ambient yoghurts are the future of the category. Bring the joys of creamy, fruity yoghurts to consumers all over your market. Find out more at www.palsgaard.com/ambientyoghurt BRINGING GOOD THINGS TOGETHER By using the Palsgaard ® AcidMilk series of emulsifier and stabiliser blends in your yoghurt production, you can produce shelf-stable products that are easier to distribute and not reliant on a stable cold-chain. The Palsgaard ® AcidMilk series works for set, stirred and drinkable yoghurts. Simplify your distribution chain No UHT process required Maximise your products’ shelf-life

FOUNDER & PUBLISHER

Francis Juma

SENIOR EDITOR

Paul Ongeto

EDITOR

Abel Ndeda

ASSOCIATE EDITOR

Alphonce Okoth | Martha Kuria | Mary Wanjira

BUSINESS DEVELOPMENT DIRECTOR

Virginia Nyoro

BUSINESS DEVELOPMENT ASSOCIATE

Hellen Mucheru

HEAD OF DESIGN

Clare Ngode

VIDEO & DESIGN ASSISTANT

Newton Lemein

ACCOUNTS

Jonah Sambai

PUBLISHED BY: FW Africa

P.O. Box 1874-00621, Nairobi Kenya

Tel: +254 20 8155022, +254725 343932

Email: info@fwafrica.net

Company Website: www.fwafrica.net

Food Africa Business Food Africa Business

Be inspired to do more at Africa’s inaugural food industry week

Welcome to our 57th issue of Food Business Africa Magazine. This issue launches shortly before the inaugural Africa food industry week that promises to offer stakeholders inspiration to take food manufacturing in Africa to even greater heights.

The Africa Sustainability Symposium kicks off the week with top decision-makers in the Industry converging at the Safari Park Hotel on June 13th to discuss the progress on sustainability and the latest innovations and technologies that mainstream sustainability in Africa and globally.

From the symposium, all focus will switch to the Sarit Center where the longest-running pure-play food, beverage, and milling industry trade show in the Eastern Africa region will be happening as from June 15th to 17th.

The expo will be co-located with Africa Food Safety & Nutrition Summit which will focus on shedding light on the opportunities, challenges, and market trends in Africa’s food safety, quality, and food systems landscape.

We hope to see you at either one or all of the above events.

Inside this edition, you will find a detailed overview of the retail industry in Africa and what trends will inform its transformation in future.

Elsewhere in the magazine, we highlight the story of Highlands Drinks Limited as it celebrates its 69 years of refreshing Kenyans with best-tasting drinks at affordable prices.

We also take a deep dive into the infant nutrition market in Africa as well as bring you the latest trends in the African malt drink industry.

Food Business Africa (ISSN 2307-3535) is published 6 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

On the evening of Friday, June 16, we shall go back to the iconic Safari Park Hotel to celebrate the people, new product innovations, sustainability initiatives, and leading companies in Africa’s food industry at the Africa Food Awards.

With a host of other insightful articles and the latest news from the food industry, we hope that you enjoy your read.

Paul Ongeto, Senior Editor FW Africa

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 4

Year 10 | Issue 2 | No.57 • ISSN2307-3535 EDITORIAL WWW.FOODSAFETYAFRICA.NET CEO BUSINESS AFRICA WWW.HEALTHCAREMEA.COM WWW.SUSTAINABLEPACKAGINGAFRICA.COM WWW.CEOBUSINESSAFRICA.COM OUR PUBLICATIONS

MILLING MIDDLE EAST & AFRICA AFRICA Packag ng SUSTAINABLE

WWW.FOODBUSINESSAFRICA.COM WWW.MILLINGMEA.COM

HealthCare MIDDLE EAST & AFRICA

Agrofood Ethiopia is Ethiopia’s leading trade show & conference on agriculture, food & beverage technology, food ingredients and food. Products like agricultural machines, farming tractors, harvesting equipment, analytical equipment, poultry equipment, milling and mixing installations/equipment, fish farming equipment, irrigation systems as well as food ingredients and finished food will be featured.

DATE: 08 - 10 June 2023

VENUE: Millennium Hall, Addis Ababa, Ethiopia

WEBSITE: www.agrofood-ethiopia. com

AFRICA

The Africa Sustainability Symposium is the first conference dedicated to the sustainability agenda across Africa. It brings together the key stakeholders in the private sector, government ministries and agencies; NGOs and development organisations; academic and research institutions; suppliers of various technologies and the general public to define the sustainability agenda in Africa.

DATE: 13 June 2023

VENUE: Safari Park Hotel, Nairobi, Kenya

WEBSITE: www. africasustainabilitysymposium.com

The Food & Beverage West Africa is the premier exhibition dedicated to West Africa's food and beverage industry. The event provides the attendees with a fantastic opportunity to exhibit new food and drink products and to build better business connections across the grocery, catering and wider F&B industry in Nigeria and beyond.

DATE: 13 - 15 Jun 2023

VENUE: Landmark Centre, Lagos, Nigeria

WEBSITE: www.fab-westafrica.com

The Summit is focused on shedding light into the opportunities, challenges and market trends in Africa’s food safety, quality and food systems landscape, with attendees expected from more than 60 countries in Africa and the World, virtually and in person.

DATE: 15 - 17 June 2023

VENUE: Sarit Expo, Nairobi, Kenya

WEBSITE: summit.foodsafetyafrica. net

AFMASS Food Expo showcases the latest products from small, medium and large food companies and an array of equipment, packaging, ingredients, laboratory technology and other supply chain solutions from Africa and the World. With a mix of food manufacturers, retailers, distributors, importers and exporters plus some of the leading suppliers of new technologies to the food industry, this is the perfect trade show to discover the present and future of the food industry in Africa.

DATE: 15 - 17 June 2023

VENUE: Sarit Expo, Nairobi, Kenya

WEBSITE: www.afmass.com

Grains Africa is undeniably eminent for an international trade fair which brings together Processors, growers, Sellers & Buyers in considering to indulge in the latest in the industry including the bright aspects of Flour, Silos, Cereals, Beans, Legumes, Rice, Graders & Sorters, Processing Machinery, Weighing Equipment & Machinery, Sugar, Milling & Packaging, etc.

DATE: 15 - 17 June 2023

VENUE: UMA Show Ground, Kampala, Uganda

WEBSITE: mxmexhibitions.com/ grainsafrica_uganda

FOOD & BEVERAGE WEST AFRICA AGROFOOD ETHIOPIA AFRICA FOOD SAFETY SUMMIT

AFMASS FOOD EXPO

SUSTAINABILITY SYMPOSIUM

GRAINS AFRICA - INTERNATIONAL TRADE SHOW ON GRAINS & TECHNOLOGY

EVENTS CALENDAR MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 6

AFRICA FOOD AWARDS

5TH GLOBAL DAIRY CONGRESS AFRICA 2023

GCCA SOUTH AFRICAN COLD CHAIN CONFERENCE

The Africa Food Awards have become sub-Saharan Africa’s most respected food industry Awards process and ceremony – since the first edition in 2017. The awards celebrate the people, new product innovations, sustainability initiatives and leading companies in Africa’s food industry.

DATE: 16 June 2023

VENUE: Safari Park Hotel, Nairobi, Kenya

WEBSITE: www.agrikexpo.com

The 5th Global Dairy Congress Africa 2023 aims to promote African milk production and technology upgrading through international cooperation and communications. The conference will share the first-hand information on World and African latest dairy status and trends, accelerate African dairy technologies upgrading, and enhance African dairy availability and affordability.

DATE: 20-21 June, 2023

VENUE: Nairobi, Kenya

WEBSITE: www.szwgroup.com/ global-dairy-congress-africa

The South African Cold Chain Conference is South Africa’s one and only venue bringing together cold store operators, distributors, manufacturers, producers, retailers, controlled-environment builders, equipment suppliers and service providers to discuss opportunities and innovations of this essential sector.

DATE: 02-04 Aug, 2023

VENUE: Century City Hotel, Cape Town, South Africa

WEBSITE: www.coldchainconference. org/gcca-south-africa-0

Africa's Big 7 brings together the best in the food & beverage business to identify growth opportunities and to close deals. It allows you to connect directly with buyers from across the African continent. Buyers attend to source products, develop new partnerships, and conclude export and import deals.

DATE: 18 - 20 Jun 2023

VENUE: Gallagher Convention Centre, Johannesburg, South Africa

WEBSITE: www.africabig7.com

The East Africa Bakery and Pastry Expo is a chance to learn about, make connections with, find, and trade the widest range of high-quality, cost-effective bakery ingredients, equipment, and related goods and services.

DATE: June 28 - 30 2023

VENUE: Sarit Expo, Nairobi, Kenya

WEBSITE: eastafricachef.com/eastafrica-bakery-and-pastry-expo-2021

EAST AFRICA BAKERY & PASTRY EXPO

CONNECT WITH US!

Follow Us Foodbizafrica Follow Us Foodbizafrica Like Food Business Africa Magazine Connect with us Food Business Africa Magazine

FOODBUSINESSAFRICA.COM MAY/JUNE 2023 | FOOD BUSINESS AFRICA 7

AFRICA'S BIG 7

by www.FoodBusinessAfrica.com

Kenya’s Agriculture and Food Authority introduces controversial sugarcane zoning in bid to stem off shortage

KENYA – The Agricultural and Food Authority of Kenya (AFA) has reintroduced the controversial zoning policy that restricts millers to only buy cane from their demarcated zones in an attempt to address the current acute shortage of the sweetener.

According to the AFA, restricting

millers to harvest of sugarcane in their select regions will help fight cane poaching which has been growing in the recent past and leading to conflicts.

The authority has since announced the delineation of the sugar belt into six regions to limit conflicts and

Coca-Cola rebrands Minute Maid for the first time in juice brand’s 75-year history

GLOBAL – The Coca-Cola Company, the world’s largest marketer of fruit juices and drinks, has made the firstever global rebrand for Minute Maid in more than 75 years of the juice brand being in the market.

Minute Maid debuted in 1946 as a year-round seasonal orange juice and grew to more than 100 countries, offering a diverse portfolio under different brand names.

While the names and the products will remain intact, the beverage giant said the full Minute Maid portfolio will sport a newly harmonized look for consistency and a refreshed visual identity for the global campaign.

The new visual identity is anchored

by a warm, lively color palette inspired by the bright tones of fresh, ripe fruit.

The rebranding has also brought about a softer, more natural typeface that breathes new energy into the

MAY/JUNE 2023 | FOOD BUSINESS AFRICA 8

NEWS UPDATES

STRATEGY REGULATORY FOODBUSINESSAFRICA.COM

JUNE 15-17, 2023 | Sarit Expo Centre, Nairobi, Kenya SIGN UP TO ATTEND EASTERN AFRICA'S LARGEST FOOD, BEVERAGE & MILLING INDUSTRY TRADE SHOW FOOD Afmass EXPO The Future of Food in Africa www.afmass.com 5000+ ATTENDEES 100+ EXHIBITORS AFRICA Food Safety SUMMIT Co-located with:

Tea management review to save Kenyan farmers US$5.8m yearly

1.5pc, a move that could give back the 8 million tea farmers over KES800 million (US$5.8m) charged by the MS every year.

The term for services offered by the KTDA-MS such as production, transportation, marketing, and management of accounts, among others has also been reduced from the current 10 years to 5 years, which is expected to enhance the accountability of the management agency.

In addition, there will be enhanced respect for farmers during and after the collection of their tea leaves and improved services in the collection of the produce from buying centers.

factories for the benefit of tea farmers.

Their spokesperson, John Mithamo, noted that the agency pays dividends to factories, and farmers will lose and may be subjected to unnecessary procedural management of their money if one percent of their sales went to other parties.

KENYA – Tea farmers in Kenya anticipate earning more from the sector following the completion of negotiations to review management agreements between smallholder tea factories and KTDA Management Service LTD.

Under the new management agreement, charges have been reduced from the current 2.5pc to

According to KTDA chairman David Ichoho, tea farmers are significant economic pillars, and as such, more efforts are being put towards supporting the empowerment and improved returns for the farmers.

He noted that the review of the management agreements hopes to remedy the relationship between the parties involved in the tea sector and improve the management of tea

Nestle appoints new Chief Financial Officer as François-Xavier Roger steps down

USA – Nestlé has appointed Anna Manz as the company’s new Chief Financial Officer (CFO) after FrançoisXavier Roger stepped down from the position.

In the company’s press release, François-Xavier Roger, Executive Vice President, and Chief Financial Officer, who has served in the company for 8 years decided to step down and pursue new professional line .

According to the CEO Mark Schneider, François has played a great role in shaping and implementing the company’s value creation

strategy enabling it to steer through a very turbulent macroeconomic environment.

Anna Manz, who is currently the Chief Financial Officer and a member of the Board for the London Stock Exchange Group (LSEG), will join Nestlé as CFO as soon as she is released from her present duties.

To ensure a smooth transition François-Xavier Roger will remain in his role until Anna Manz arrives where she will also become a member of the Executive Board of Nestlé S.A. as an Executive Vice President.

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 10

POLICY APPOINTMENT

NEWS UPDATES

UNDER THE NEW AGREEMENT, CHARGES HAVE BEEN REDUCED FROM THE CURRENT 2.5PC TO 1.5PC, A MOVE THAT COULD GIVE FARMERS OVER US$5.8M CHARGED BY THE MS EVERY YEAR.

TWO-STEP MOLDING CAN HELP YOU ACHIEVE:

up to 20% Lower package part cost up to 20% Minimized package weight up to 9% Improved uptime Reduce initial CAPEX

Campaigns.Husky.ca/TwoStepMolding

LEARN MORE »

WHO, FAO settle for “cell-based food” as universal name for meat grown in the lab

INVESTMENT

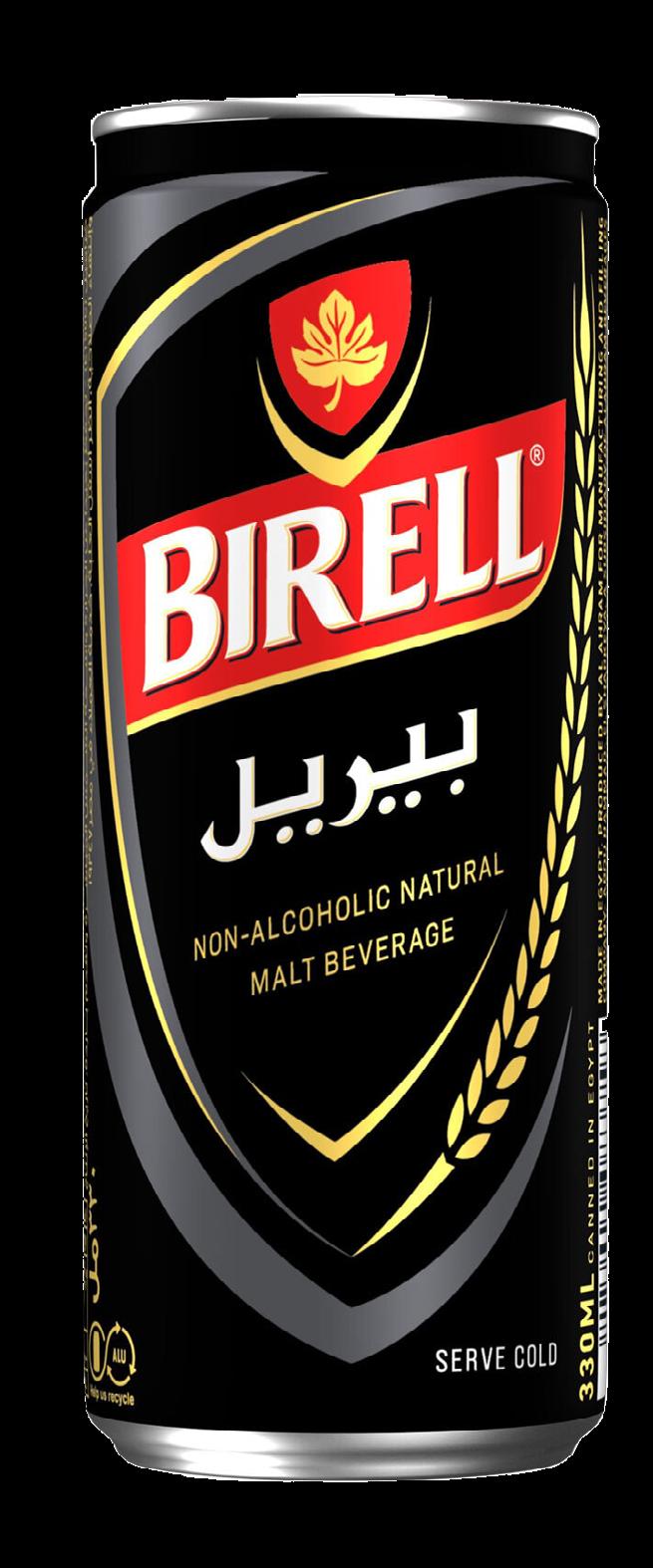

Ayman Shahin Export invests US$20m in new Moussy malt beverage factory in Egypt

EGYPT – Ayman Shahin Export, an export management and manufacturing company, has invested US$20 million in a new Moussy malt beverage factory in Egypt.

The factory was established with technical assistance from the Danish beverage company Carlsberg, which owns the Moussy brand.

The new plant, spanning an area of 8,000 square meters, has a production capacity of about 30,000 bottles/hour.

Group chairman Ayman Shaheen

NUTRITION

GLOBAL – The World Health Organization (WHO) and the Food and Agriculture Organization of the United nations (FAO) have settled for “Cellbased food” as the term to describe meat that has been produced in the lab.

Defending their preferred name, the two organizations noted that cell-based food was “less confusing, conveniently overarching and generally well-accepted by consumers”, and accurately reflects the science of the product.

In their report, they noted that other popular terms such as “cultured” and “cultivated” can be confusing as they are often used in the aquaculture sector to indicate farmed fish and fisheries.

The term “cellular agriculture” can be considered too general as it may include the topic of plant cell culturing or fermentation, the report noted.

WHO and FAO also deliberately drop the term “meat” in favor of “food” to make the product easily acceptable across geographies regardless of cultural and religious convictions.

“The use of the term “meat” to refer to a cell-based food product might not be acceptable in all regions and may also complicate halal or kosher labeling,” the report indicated.

told Zawya Projects that the factory supports the Egyptian government’s goal of local manufacturing and will operate sustainably by rationalizing energy and water consumption and avoiding environmentally harmful chemicals.

He added that the project targets a sales volume of up to US$13 million and an export volume equivalent to 25 percent of the factory’s production capacity in the first 12 months.

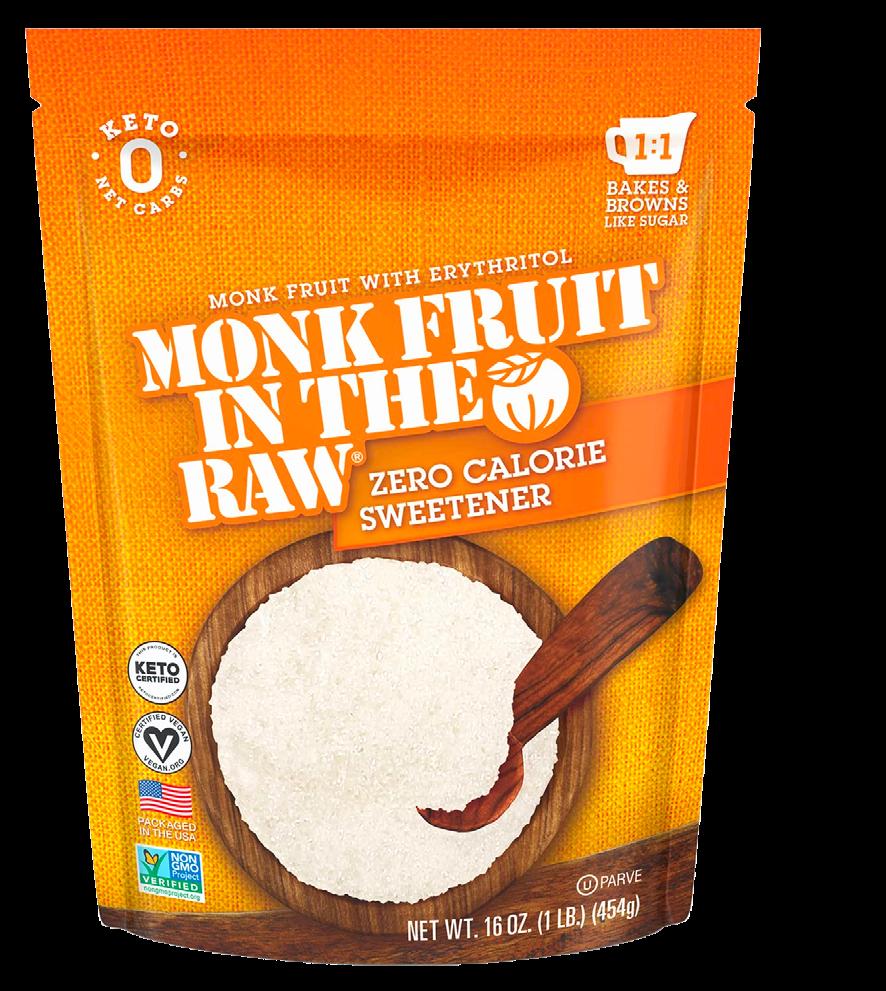

WHO recommends against use of non-sugar sweeteners to control body weight or reduce the risk of NCDs

GLOBAL – The WHO has recommended against the use of non-sugar sweeteners to control body weight or reduce the risk of noncommunicable diseases (NCDs).

According to the world health body, the recommendation is based on the findings of a systematic review of the available evidence which suggests that the use of NSS does not confer any long-term benefit in reducing body fat in adults or children.

Results of the review also suggest that there may be potential undesirable effects from long-term use of NSS, such as an increased risk of type 2 diabetes, cardiovascular diseases, and mortality in adults.

“Replacing free sugars with NSS does not help with weight control in the long term. People need to consider other ways to reduce free sugars intakes, such as consuming food with naturally occurring sugars, like fruit, or unsweetened food and beverages,” said Francesco Branca, WHO Director for Nutrition and Food Safety.

The recommendation however does not apply to low-calorie sugars and sugar alcohols (polyols), which are sugars or sugar derivatives containing calories and are therefore not considered NSS.

Common NSS include acesulfame K, aspartame, advantame, cyclamates, neotame, saccharin, sucralose, stevia, and stevia derivatives.

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 12 NEWS UPDATES

FOOD JUNE 16, 2023 Safari Park Hotel, Nairobi, Kenya AFRICA’S MOST INFLUENTIAL FOOD INDUSTRY AWARDS CEREMONY www.awards.foodbusinessafrica.com SCAN ME Join industry leaders, investors, managers and professionals from Africa and the World at the region’s most-respected Awards Ceremony and Gala Dinner, as we review the year and celebrate the industry’s leading companies, innovations, achievements and impact on the community. Sponsored By:

AFEX seeks to raise US$65M to drive expansion into 7 new African countries

NIGERIA – AFEX, Nigeria’s first private agricultural commodities exchange player, has announced plans to raise US$65 million to fund its expansion plan into seven new African countries in a bid to capitalize on the growth in intra-African trade.

According to Eficon Agency, the funding will enable AFEX to take advantage of growing trade across the continent resulting from the entry into force of the Zone Continental

Free Trade Association (Zlecaf).

Founded in 2014, AFEX already operates in Nigeria, Kenya, and Uganda, where it trades nine agricultural commodities, including maize, wheat, sorghum, and cocoa.

Since it first appeared on the inaugural list last year, AFEX has doubled in revenue and expanded operations into East Africa, having financed over 450,000 farmers and traded 526,850 metric tonnes of

commodities in Nigeria, Kenya, and Uganda.

According to the company executives, AFEX plans to expand to 9 African countries within the next 10 years to create regional markets that balance demand and supply through intra-Africa trade.

Markets considered for expansion include Benin, Togo, Ghana, Côte d’Ivoire, Tanzania, Ethiopia, and Zambia.

Tea Company suspends operations in Bomet, Kericho counties over insecurity

Ekaterra

business premises and the deliberate destruction of crucial assets including some of the tea plucking machines.

“The value of compromised assets as a result of these security challenges is estimated at approximately Sh50 million and an additional Sh120 million in 4.5 million kilos of green leaf,” he said.

KENYA – Ekaterra Tea Company has suspended its operations in two Rift Valley counties in Kenya due to insecurity following the heightened invasion and destruction of property by residents.

The multinational tea firm, which owns vast tea estates in Bomet and Kericho counties, took the drastic action to put the safety of its employees at the forefront.

“The safety of their people is of paramount importance to them. So, they have suspended their operations until the law enforcement agencies can confirm that it is safe to resume their activities,” a statement issued

by Kenya Tea Growers Association (KTGA) chair Silas Njibwakale read.

KTGA said that large-scale tea producers in Kericho and Bomet counties are deeply alarmed by the increasing insecurity plaguing Kericho, Bomet, Nyamira, and Nandi Counties. Demonstrations have been going on in Kericho against the introduction of mechanized tea-picking machines by large-scale tea companies. The machines, according to the residents, have reduced the number of workers in the tea estates.

Njibwakale noted that the escalation of insecurity in the farms has led to organized assaults on

“What began as daytime raids and thefts of tea leaves and machinery in October 2022 has now escalated into organized assaults on business premises and the deliberate destruction of crucial assets.”

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 14 NEWS UPDATES

STRATEGY

THE VALUE OF COMPROMISED ASSETS AS A RESULT OF THE SECURITY CHALLENGES IS ESTIMATED AT APPROXIMATELY KES50M

WHATS ON SHOW? SCAN ME AFRICA Fresh Produce EXPO AFRICA’S NO.1 FRESH PRODUCE INDUSTRY TRADE SHOW MARCH 22-24, 2024 Sarit Expo Centre, Nairobi, Kenya www.africafreshproduceexpo.com

www.africasustainabilitysymposium.com

JUNE 13, 2023

Safari Park Hotel, Nairobi, Kenya

Confirmed Sponsor: RESET & TRANSFORM – Mainstreaming Sustainability in Africa in Uncertain Times, Impacted by Covid-19 & Supply Chain

Disruptions

CONFIRMED SPEAKERS

WILLIAM BRENT Chief Marketing Officer at Husk Power Systems

ASHISH PANDE Country Head, Olam Agri, Nigeria

ESSAM EL-MADDAH HR & General Secretary Director, Danone Egypt & North East Africa

KEVIN SHAH Managing Director, ACEteK Software

CLAUDIA CASTELLANOS Managing Director, Black Mamba

MARGARET KIBOGY Managing Director, Kenya Dairy Board

GAURAV VJ CEO, 260 Brands

MATTHIAS GRABE Managing Director, Buhler East Africa

PALOMA FERNANDES, OGW CEO, Cereal Millers Association, Kenya

DR. KEN MUMA CEO, AAR Hospital

WILLIAM BRENT Chief Marketing Officer at Husk Power Systems

ASHISH PANDE Country Head, Olam Agri, Nigeria

ESSAM EL-MADDAH HR & General Secretary Director, Danone Egypt & North East Africa

KEVIN SHAH Managing Director, ACEteK Software

CLAUDIA CASTELLANOS Managing Director, Black Mamba

MARGARET KIBOGY Managing Director, Kenya Dairy Board

GAURAV VJ CEO, 260 Brands

MATTHIAS GRABE Managing Director, Buhler East Africa

PALOMA FERNANDES, OGW CEO, Cereal Millers Association, Kenya

DR. KEN MUMA CEO, AAR Hospital

info@fwafrica.net +254 725 343 932 www.africasustainabilitysymposium.com SCAN ME

STEFFANY BERMUDEZ Policy Analyst, Sustainability Standards International Institute for Sustainable Development (IISD)

CLAIRE VAN ENK Founder & CEO, Farm to Feed

YEMISI IRANLOYE Founder/CEO, Psaltry International

JOHN MWENDWA Public Affairs & Communications Director, Coca-Cola Beverages Africa

CHUKWUEMEKA IDAM Sustainability Advocate and CEO, Zen Ideas

TUMISANG MATSHEKA Vice President, Supply Chain, PepsiCo South Africa

Jit Bhattacharya Co-founder & CEO – BasiGo

VINOD GUPTAN CEO, MedSource Group & Vice Chairman, Kenya Association of Pharmaceutical Industry

JOACHIM WESTERWELD Executive Chairman, Bio Food Products

CAESAR ASIYO Chief Development Officer, Victory Farms

ROZY RANA Managing Director, Dormans Coffee

DAVID KAMAU Managing Director, Fortified Whole Grain Alliance

NASRA NANDA CEO & ESG Lead, Kenya Green Building Society

DAVE OKECH OKECH Founder & Chief Imagination Officer, Aquarech

HARRISON JUMA General Manager, Tunga Nutrition (Unga Group)

Carol Koech Country President, Schneider Electric East Africa

CLAIRE VAN ENK CEO, Farm to Feed

MICHAEL ORANGI Country Director, Kenya & Tanzania, Rainforest Alliance

TALASH HUIJBERS CEO & Founder, Insectipro

WAMBUI MBARIRE CEO, Retail Traders Association of Kenya

STANLEY MWORIA CEO, Aquaculture Association of Kenya

VAISHALI MALDE Sales & Marketing & Sustainability Manager, PIL

MILLICENT A. ADOBOE Co-Founder, Achiever Foods Ghana

Nestle extends majority ownership of Nestle Nigeria with additional share acquisition

NIGERIA - Nestle S. A., the majority shareholder of Nestle Nigeria Plc, has bought an additional 40, 894 units of the shares of the consumer goods manufacturer at a cost of N44 million (US$95,000).

This is the second time in 2023 that the Switzerland-based multinational food company is acquiring more shares of its Nigerian subsidiary.

In March, Nestle S.A. bought 77, 967 units of shares of the Nigerian arm for over N84m (about US$0.18 million).

As of December 31, 2022, Nestle Switzerland (Societe Des Products), the ultimate holding company owned 66.18 per cent (2021: 66.18 per cent) of the issued share capital of Nestlé Nigeria Plc.

Kenya to import 180,000 more metric tons of sugar to curb surging prices

Meanwhile, the shareholders of the fast-moving consumer goods manufacturer had approved the proposed final dividend of N36.50 for the 2022 financial year.

The board of directors had recommended the payment of a final dividend of N36.50 (2021: N25.50) per share having earlier declared an interim dividend of N25 for 2022. The total dividend paid for the year amounts to N61.50.

KENYA – Kenya is set to import 180,000 more metric tons of sugar to cushion consumers against the skyrocketing prices of the products after the recent duty-free sugar failed to curb soaring prices.

“We are going to authorize the importation of 180,000 metric tons of sugar to cushion the consumers against skyrocketing prices, which is unfortunate because we are supposed to be crushing sugar we need to sustain ourselves,” said Agriculture CS Mithika Linturi.

Linturi said Kenya has been forced to outsource from other markets as regional markets are experiencing similar shortages because of drought and short rains.

The government opened an import window in December that would see traders ship in 100,000 tonnes of sugar outside of the COMESA region to curb an imminent shortage in the country.

In the most recent market review, a 2kg of sugar ranges between Kes 430 – Kes 480 at retail price, more than three times the normal price in the previous years, when the prices were high.

The shortage has been attributed to an acute sugarcane shortage that has forced many millers to operate at

less than 30 percent of their installed capacity.

The National Assembly Departmental Committee on Agriculture and Livestock, led by committee chairperson John Mutunga, recently said the shortage is a result of poaching, lack of policy framework, and unhealthy competition from importers of cheap sugar.

THE GOVERNMENT OPENED AN IMPORT WINDOW IN DECEMBER

Dr. Mutunga pointed out there is a need to amend policies that will regulate the importation of sugarcane to protect local farmers who invest their resources and time on the farm.

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 18 NEWS UPDATES

FOOD SECURITY

THAT WOULD SEE TRADERS SHIP IN 100,000 TONNES OF SUGAR OUTSIDE OF THE COMESA REGION TO CURB AN IMMINENT SHORTAGE IN THE COUNTRY.

UGANDA’S MOST INFLUENTIAL FOOD, BEVERAGE & MILLING INDUSTRY CONFERENCE & EXPO SCAN ME MARCH 6-8, 2024 Kampala, Uganda www.afmass.com/ug Afmass UGANDA EXPO FOOD

Coca-Cola Beverages Botswana inaugurates new US$24.4m production line

More than a third of Gen Z and younger millennials sceptical about sugar replacersnew study finds

GLOBAL – Gen Z and younger Millennials are ‘breaking the norm’ when it comes to sweetener preferences among different generations, a new study by taste and nutrition company Kerry has revealed.

across the globe, with 75% of global consumers saying they prefer a natural sweetener (such as honey, sugar, or stevia).

BOTSWANA – Coca-Cola Beverages

Botswana (CCBB), a unit of CocaCola Beverages Africa (CCBA), has launched a new state-of-the-art production line and water treatment plant to significantly increase the factory’s production capacity.

CCBB invested P310 million (US$24.4m) into the new production line with a capacity of 13,500 bottles per hour and equipped with the latest industry technology.

The installation of the new PET line allows for faster and more efficient production of PET products, increasing productivity, while also producing bottles with higher clarity and strength, CCBB said.

CCBB MD David Chait pointed out that the company would be partnering with the Botswana University of Agriculture and Natural Resources to provide it with clean water as well.

In a water-scarce country such as Botswana, Chait explained that CCBB needs to use water as efficiently as possible and its investment in the water treatment plant, ensures the water going back into the environment is clean.

“This investment is a clear demonstration of our continued belief in the future of Botswana and a signal of our confidence in Botswana as an investment destination,” CocaCola Beverages Africa (CCBA) CEO, Jacques Vermeulen.

According to the study, younger consumers are placing greater importance on sugar in food and drinks, with 36% of these consumers skeptical of ingredients used to replace sugar in food and drinks.

The survey also revealed that natural sweeteners rank highest

On preferences, most consumers globally preferred honey, sucrose/ sugar, stevia, coconut sugar, and fructose more than any other sweetener.

Kerry’s consumer research and insights experts conducted the quantitative survey that saw the input of 12,784 people across 24 countries and six continents.

Famous brands reports 15% jump in full year revenue driven by robust sales growth in Africa

SOUTH AFRICA – Famous Brands, Africa’s leading branded food services franchisor, has reported a 15% increase in revenue to R6.5-billion for the year ended February 28.

The double digit growth in sales was driven by a vibrant Africa where system-wide sales increased has 31% during the year.

Operating profits in Africa decreased by R10-million in the period. This however did not prevent the company from reporting a rise in companywide operating profit to R861-million, from R630-million in the prior year.

Famous Brands said its revenues have now exceeding pre-pandemic levels, after the group focused on improving cash generation from operations and controlling its cost base tightly, despite high inflation, input cost increases, and loadshedding.

“While the marketplace remains

highly competitive as brands fight to retain market share, we continue to experience good brand growth, revamp activity, and demand for our brands from potential franchise partners,” CEO Darren Hele said.

She noted that trading conditions in South Africa remain challenging, with the restaurant industry being highly exposed to loadshedding.

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 20 NEWS UPDATES

NUTRITION

FINANCIALS

Bio Foods becomes first Kenyan dairy processor to acquire B Corp certification

B Corp’s high standards of social and environmental performance, accountability, and transparency.

In addition, the dairy processor noted that as Certified B Corp, it could be a force for good in the world and is committed to making a positive impact now and in the future industry.

KENYA – Bio Foods Ltd, a leading processor and marketer of premium dairy products, has become the first and only Food & Beverage company in Kenya to receive a B Corp certification after undergoing a rigorous 2-year impact assessment with B Lab Africa.

According to the company’s statement on a LinkedIn post, acquiring the certification indicates that the company has maintained a high standard of verified, overall social and

environmental performance, public transparency, and legal accountability.

“At Bio Foods, we strongly believe in sustainability as a core pillar for our Business and as an organization, we operate within and commit to the triple bottom-line framework, of people, planet, and profit,” the company added.

With the certification, Bio joins an international movement of 6,000 purpose-led businesses that meet

Uganda to hold talks with Kenya over powdered milk importation restrictions

UGANDA – Ugandan government has proposed to hold talks with the Kenyan government, over restrictions on the importation of its powdered milk.

This comes after Benson Mwangi, the general manager at Brookside Uganda, a firm owned by the family of former President Uhuru Kenyatta, said Nairobi is denying the milk processor export permits and that those given are often delayed.

The statements were confirmed by Uganda’s Dairy Development Authority (DDA) with the authority’s

executive director Samson Akankiza revealing that Nairobi was only issuing about 20 percent of entry papers to

exporters of its powdered milk.

Speaking in parliament, David Bahati, the country’s Minister of State for Trade, said that if the trend was not dealt with It would lead to the crippled livelihood of cattle farmers in the country.

“We are aware of this situation of not only milk but also other products. The head of state has been informed about this situation, and is going to engage the President of Kenya, to see how we can resolve this matter,” he revealed.

FOODBUSINESSAFRICA.COM MAY/JUNE 2023 | FOOD BUSINESS AFRICA 21 SUSTAINABILITY

THE CERTIFICATION INDICATES THAT THE COMPANY HAS MAINTAINED A HIGH STANDARD OF VERIFIED, OVERALL SOCIAL AND ENVIRONMENTAL PERFORMANCE, PUBLIC TRANSPARENCY, AND LEGAL ACCOUNTABILITY

www.summit.foodsafetyafrica.net

JUNE 15-17, 2023

Sarit Expo Centre, Nairobi, Kenya

KEY ISSUES

The Africa Food Safety Summit covers the following issues in the food and agriculture value chain in Africa

Regulation & Policy

Leadership, Culture & Communication

Human & Infrastructure Capacity

Trade & Market Access

Innovation & Technology

Coordination & Cooperation

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 22

IN PARTNERSHIP WITH:

DISCOVER THE FUTURE OF FOOD SAFETY, QUALITY & FOOD SYSTEMS IN AFRICA

FOODBUSINESSAFRICA.COM MAY/JUNE 2023 | FOOD BUSINESS AFRICA 23 info@fwafrica.net +254 725 343 932 www.summit.foodsafetyafrica.net Sign up to Sponsor, Attend & Speak SCAN ME NETWORK BE INSPIRED DISCOVER

Carrefour Kenya opens 20th branch at Business Bay Square Mall in Eastleigh

exceptional services to our customers as we strategically expand our footprint in the Kenyan market,” East Africa Carrefour Regional Director Christophe Orcet said.

“Our goal is to offer the best affordable products in all our stores to benefit every household and offer real value and solutions to the rising cost of living in Kenya.”

KENYA – French multinational retail and wholesaling corporation, Carrefour, has expanded its retail chain in Nairobi city with the latest being at the Business Bay Square Mall in Eastleigh.

Located along General Waruinge Street, the 3,000-square-meter store will be one of the largest opened by retailers in the country in 2019.

The new outlet seeks to tap

the area’s growing population and businesses with a major focus on the high footfall of customers who visit Eastleigh to shop for clothes and household items.

In total, Carrefour now operates 20 stores countrywide: 16 are located in Nairobi with Kisumu and Mombasa hosting two stores each.

“The opening of our new store today is a true testament to our commitment to continue providing

Arla Foods inaugurates state-of-the-art dairy Farm in Nigeria

NIGERIA – Arla Foods has stepped up its efforts to boost sustainable milk production in Nigeria with the inauguration of its state-of-the-art dairy farm in Kaduna which cost the Danish dairy giant over US$10 million.

The farm – a state-of the-art Danish designed dairy farm and the first of its kind in Nigeria- is located in Damau village, Kubau Local Government Area, Kaduna State.

Designed to ensure optimum animal welfare and productivity, the Farm covers 400 Ha of land, with the capacity to house 400 milking cows and 1000 animals in total.

Arla which produces Dano Milk, a popular milk brand in Nigeria, notes that its farm will be a showcase for sustainable milk production in Nigeria

The Managing Director, Arla Nigeria, Peder Pedersen, noted that the farm is currently home to 216 Danish Holstein cows, which arrived a few days ago and are settling well into their new environment.

Once fully operational, the farm will directly employ 40 people and is expected to produce 5 million kg of milk per year.

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 24 NEWS UPDATES RETAIL

IN TOTAL, CARREFOUR NOW OPERATES 20 STORES COUNTRYWIDE: 16 ARE LOCATED IN NAIROBI WITH KISUMU AND MOMBASA HOSTING TWO STORES EACH.

FOODBUSINESSAFRICA.COM MAY/JUNE 2023 | FOOD BUSINESS AFRICA 25 Robots have become a reliable way to accomplish the monotous and dangerous chores of palletizing bags. NOVEMBER 23-24, 2023 | DAR ES SALAAM, TANZANIA TANZANIA’S MOST INFLUENTIAL FOOD, BEVERAGE & MILLING INDUSTRY CONFERENCE & EXPO info@fwafrica.net +254 725 343 932 www.afmass.com/tz SIGN UP CO-LOCATED WITH www.afmass.com/tz www.dairybevafrica.com AN FW AFRICA EVENT Dairy Drink AFRICA SUMMIT & & EXPO Afmass TANZANIA EXPO FOOD

APPOINTMENTS Update

KFC appoints first black female General Manager for Africa region

PepsiCo appoints Riaan Heyl as new CEO for South African unit

SOUTH AFRICA – Multinational food and beverage corporation, PepsiCo, has named Riaan Heyl as the new Chief Executive Officer of its South African unit effective 1 May 2023.

Heyl, a Chartered Accountant by training with a rewarding career that included senior leadership roles in finance and general management, replaces Tertius Carstens, who retired after 29 years with the company.

He steps into the new position after serving as PepsiCo’s Chief Operating Officer in South Africa since January 2023.

Nigerian Breweries appoints Asue Ighodalo as new Non-Executive Chairman

AFRICA – American fast food restaurant chain KFC has appointed Akhona Qengqe as its very first black female General Manager for Africa, effective April 1st, 2023.

Akhona, who was the then Chief Development Officer of KFC Africa, has vast experience spanning multiple industries including petroleum, property, marketing, operations, and convenience retail. She will replace the outgoing GM – Dhruv Kaul, who is moving into a GM role for KFC Pan Europe.

Sabir Sami, KFC Global Chief Executive Officer, noted that Akhona has spent the better part of her eight years at KFC as an intrinsic part of the KFC leadership team in Africa and has worked closely with Dhruv and the team to ensure the sustainability of the business but also, the growth of local female talent.

She has helped the business navigate a disruptive pandemic that impacted not only business but also staff from a wellness and workplace perspective – a job she managed with humility, empathy, and efficiency; the quick service restaurant highlighted.

In his career portfolio, Heyl led the Essential Foods portfolio within Pioneer Foods from 2017, and following PepsiCo’s acquisition of Pioneer Foods, in 2020, took on the

NIGERIA – Nigerian Breweries Plc (NB), the largest brewing company in Nigeria, has appointed Mr. Asue Ighodalo to be the new Non-Executive Chairman effective from May 1st, 2023, after the retirement of its Chairman, Chief Kolawole B. Jamodu, CFR.

Mr. Ighodalo joined the Board on January 1st, 2022. He is a highly experienced lawyer with over 35 years of experience and a leading figure in corporate Nigeria.

role of Vice President Go to Market and Commercial Integration across the South African portfolio.

With the appointment, Heyl said he is ready to build on what has already been achieved and is passionate about the company’s trajectory for growth where shared value, sustainability, people, and consumers are at the center.

He currently serves as the chairperson of Sterling Bank Plc and Levene Energy Group and sits on the Board of Okomu Oil Palm Plc. He is the immediate past chairperson of the Nigerian Economic Summit Group.

Meanwhile, Chief Jamodu, who joined the Board on March 1st, 2006, and became Chairman on January 1st, 2008, played a significant role in the Company’s growth and transformation, which included various acquisitions and mergers between 2011 and 2014.

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 26 JAN/FEB 2023 | FOOD BUSINESS AFRICA 26

Danone SA appoints first female Head of Manufacturing

SOUTH AFRICA – Tsholofelo

Ngobeni has become the first woman to hold the head of manufacturing position at South Africa’s largest dairy producer, Danone.

According to the company, Tsholofelo is a seasoned operations leader, with experience in operations, safety, quality & food safety, supply chain, and engineering in the FMCG sector locally and internationally.

Kid Nkantsu, Danone Southern Africa operations director, described Tsholofelo as a calm and objectiveorientated individual who will be most valuable with the implementation of a modern and innovative manufacturing strategy, as well as solid strategic operational goals that aim to result in even higher product quality, integrity, and customer satisfaction.

UACN taps Kerry Group executive Oluyemi Oloyede to head food and beverage division

South African wine and spirit producer KWV appoints John Loomes as CEO

SOUTH AFRICA – KWV, a leading wine and spirit producer in South Africa, has named John Loomes to replace Boyce Lloyd as CEO effective 1 June 2023.

Loomes has been serving as the CEO incumbent in a temporary COO role since September 2022, taking on responsibility for most functions and reporting lines.

Since January 2023, Loomes’ responsibilities further expanded, and has effectively been managing the business for the past 5 months.

NIGERIA – U.A.C of Nigeria, an investment holding company with a wide range of interests in food and beverages, real estate, paint, and logistics sectors, has appointed Oluyemi Oloyede as CEO of UAC Foods Limited, its food and beverages subsidiary.

Oloyede joins UAC Foods from the Irish taste and nutrition firm, Kerry, where he served as the General Manager for West Africa since 2018.

At Kerry Group, he led a team of colleagues in commercial, finance, research, development and applications, supply chain, and operations to support Kerry’s customers in West Africa.

With an extensive background in the beverage, FMCG, and CPG sectors, Loomes, an MBA degree holder from Bond University, brings a wealth of experience and a proven

Tsholofelo holds a qualification in Chemical Engineering and an MBA. She also completed the Certified Supply Chain Professional (CSCP) program and Certification in Planning & Inventory Management (CPIM) with APICS.

In his over 16 years of experience leading multinational teams, Oloyede has also held various executive positions in leading fast-moving consumer goods companies in Nigeria, including L’Oreal where he served as National Sales Manager for Nigeria and Ghana, and Procter and Gamble where he served as Regional Sales Manager.

He holds a First-Class Honours degree in Mathematics from Obafemi Awolowo University, Ile Ife, Nigeria, and an MBA from the same institution.

track record of success to lead the business into an exciting new chapter.

Loomes has over 25 years of experience working in commercial, business development, and general management roles in South Africa, Africa, and the Middle East.

KWV said his appointment was part of a “carefully orchestrated leadership transition.”

FOODBUSINESSAFRICA.COM MAY/JUNE 2023 | FOOD BUSINESS AFRICA 27 JAN/FEB 2023 | FOOD BUSINESS AFRICA

PEARL DAIRY

Lato Instant Porridge

Pearl Dairy, the producer of popular Ugandan milk brand Lato, has diversified its portfolio to include Instant porridge. Trading under the Lato brand name, the Instant Porridge is a composite flour made up of maize and sorghum. The flour also contains milk and sugar for a truly all-in-one breakfast cereal experience. Available in 30g sachets, the porridge is also fortified with Iron, Zinc, and vitamins A & E for a healthy start to the day.

www.latomilk.com

BROOKSIDE DAIRY

Plant based milk

Brookside Dairy Limited, Eastern Africa’s largest dairy processing company, has dipped its toes into the plant-based milk category with the launch of 100% Almond Milk and 100% Soy Milk products. Launched under the company’s flagship brand Brookside, the products come packaged in 1000ml laminated carton boxes.

www.brookside.co.ke

JETLAK FOODS LIMITED

Frosti Fruit Drink

Jetlak Foods Limited, a leading beverage company in Kenya, has introduced a new fruit drink under the brand Frosti. The fruit drinks are made from 10% real fruit and are rich in Vitamin C, according to the company. The drinks come in 1000ml laminated carton boxes and are available in a variety of fruity flavors like Mango, Apple, Tropical, and Guava.

www.jetlack.com

MAY/JUNE 2023 | FOOD BUSINESS AFRICA 28 NEW FOOD PRODUCT INNOVATIONS

BAKHRESA GROUP

Azam O’cream Icecream

Bakhresa group, one of Tanzania’s most diversified food companies, has launched a new ice cream flavor under its Azam brand. Trading as Azam O’cream Ice cream, the new product is vanilla flavored and contains chocolate biscuits. Like others in the range, the product is available in 1-litre plastic bowls.

www.bakhresa.com

KITUI FLOUR MILLS

Dola Vegetable Cooking Oil

Kitui Flour Mills, the maker of one of the leading wheat flour brands in Kenya Dola, has diversified its strong brand name into the vegetable cooking oil category with the launch of Dola Vegetable Cooking Oil. The cooking oil is available in all leading stores in Kenya in a wide variety of sizes from 20ltrs to 500ml.

www.kituiflourmills.co.ke

BOUNTY KENYA LIMITED

Non-Alcoholic wine & Energy Drink

Bounty Kenya Limited, the makers of popular soft drink Lemonade, has launched a new energy drink dubbed Safari Energy Booster. The drink is available country wide in 350ml PET bottles. The Kenya-based company has added Mohito flavour to its Rendezvous line of non-alcoholic sparkling drinks. According to the company, the new product is “a delicious blend of zesty lime, fresh mint, and bubbly carbonation that will transport your taste buds to a tropical paradise.”

www.bounty.co.ke

FOODBUSINESSAFRICA.COM

HIGHLANDS DRINKS LTD

Refreshing Kenyans with joy since 1954

By Paul Ongeto

Ahousehold name in Kenya, Highland Drinks Limited has been refreshing Kenyans with great-tasting, refreshing, and affordable products since 1954. "I think everybody in this room and outside has grown up with a product of Highlands, whether it's water or cordials," says Joachim Westerveld, CEO of Highlands Drinks Limited.

Putting dates to figures, Joachim tells us the company was founded in 1954 by the Padia family. However, Highland's history stretches back eight years before that to 1947 when Mr. Tribhovan Padia opened a shop in Nyeri.

Production of the Highlands cordials did not start until 1986 when Highlands Orange cordial was released to the market. Before striking the sweet spot with the cordials, Highlands Drinks had experimented with a number of soft drinks. Softa, Mirinda, and Babito were soda brands produced by Highland Drinks that were wellknown in the late 70s, in the 80s, and early 90s. When people from this period remember the good old days, these brands certainly

come to mind.

Now in production for the 37th year running, Highlands Drinks Cordials have expanded to include four other flavors, namely lemon, mango, pineapples, and tropical. Mineral water, which was first introduced in 1990, is also thriving and is today available in various packs from the tiny 500ml PET back to the jumbo 20-liter non-returnable plastic bottle.

DISRUPTING KENYA’S SOFT DRINK MARKET

Highland Drinks' fame in the soft drinks market caught the attention of a group of Dutch investors, led by the TBL Group, who in the late 2000s invested in the company with a mission to take it to even greater heights. "We said this is a great company with a great legacy, good history, a beautiful production plant, and it's a great platform," Joachim says. "Together with the Padia family, who founded the company back in 1954, we said we were going to disrupt the Kenyan soft drink market."

The disruption took the form of a re-entry into the carbonated soft drinks category. Highland's exit from the scene in the early 1990s

MY COMPANY PROFILE: HIGHLANDS DRINKS LTD JAN/FEB 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 32

ABOVE: Staff manning the carbonated soft drink line to ensure each product is up to standard.

left only one dominant player in the market. Left with very little choice, consumers became accustomed to this reality until Highlands under the patronage of new investors decided to shake up the market a little bit. "Kenyans deserve a better alternative and Kenyans deserve an affordable alternative," the vibrant CEO says. "So that informed our decision."

A return to carbonated soft drinks required significant investment in machinery and research and development. The process began in 2009 when the company conducted a factory upgrade to its facilities and commenced R&D on three new Carbonated Soft Drinks. The whole process culminated in 2014 when Club Soda Drink (CSD), a new carbonated soft drink brand from Highlands hit the market with three flavors.

To meet customer demand for a variety of flavors, Highlands added three flavors: Blackcurrant, Pineapple, and Passion to its range of Club Soda drinks in 2016. A brand refresh occurred in 2018 with the CSD name dropped in favor of CLUB, a simple yet memorable brand to reflect the brand's growth into a household name. Three new flavors, Apple, Mango, and Pina Colada were also

added to mark this new milestone. The big packs in the form of 1.25-liter bottles were introduced two years later in response to market demand for family-size packs. Joachim is happy with the progress the company has made thus far. "We've been hacking ladders for the last couple of years, and we're slowly but surely disrupting the markets with a bettertasting product that's more affordable," he says.

FRESH WATER, FRESH DRINKS

Padia had a strategic reason for locating the factory in Nyeri. Although the town was considerably smaller compared to Nairobi, Kenya’s capital, it had an abundant supply of fresh spring water that flowed into the town from the nearby Aberdare ranges.

Naman Kimathi, Head of Operations at Highlands Drinks, says that this unfettered access to fresh spring water gives Highlands a competitive advantage in that it is able to maintain a certain consistency in the quality of its mineral water and, by extension, its drinks which also use the water as their main raw material. He notes that other beverage and water bottlers using groundwater may not

KEY NUMBERS

1954

THE YEAR

HIGHLANDS DRINKS LIMITED WAS INCORPORATED AS A BEVERAGE COMPANY

BELOW: Cordials have been part of the highlands range since 1986 and water since 1991

FOODBUSINESSAFRICA.COM JAN/FEB 2023 | FOOD BUSINESS AFRICA 33

enjoy this kind of advantage as its mineral composition keeps varying and treating it to a level that matches spring water Highlands receives from the Nyeri Water and Sewerage Company is almost impossible.

Although the water is usually subjected to some level of treatment, Kimathi notes that Highlands subjects its water to further treatment checks to bring it to desired quality levels before it's bottled or used to make other soft drinks. “Just out of an abundance of caution, our water is first passed through sand filters to trap any debris that may have escaped initial treatment stages by Nyewasco,” he explains.

The next treatment stages include chlorination to inactivate any present microorganisms and a second stage filtration with cartridges that can filter up to 0.45 microns to remove chlorine and bacteria. The dechlorinated water is then passed through a chamber that contains a UV lamp. As the water flows through the chamber, the UV light targets and kills any microorganisms present, including bacteria, viruses, and protozoa. “That's how we guarantee the quality of our water,” a proud Kimathi concludes after taking us through the entire water treatment process at the facility.

A team of qualified quality assurance officials is always at hand to check on the effectiveness of the treatment procedures before water is directed to a nearby line for bottling or held at a temporary storage tank for use in the production of cordials and carbonated soft drinks. A fully furnished lab is nearby where tests such as pH, electrical conductivity, total dissolved solids, and chlorine are conducted on water samples to assure quality and safety.

“If we are doing cordial or carbonated soft drinks, the water is directed to another compounding tank where other ingredients will be added depending on the formulation,” Kimathi explains. “It’s mixed for a minimum of 45 minutes to achieve a homogeneous drink after which it is released to go to the filling lines.” A team of professional quality assurance officials monitors the entire process to ensure each and every bottle contains a safe and high-quality drink. “They take samples every 30 minutes for quality assurance checks,” Kimathi explains. Just like water, these drinks are subjected to a number of tests including brix and pH.

A

SUSTAINABILITY MINDSET

Sustainability is one thing that Joachim is passionate about. "We can see that global warming and climate change are real, and I think the only right thing to do as a business is to bring sustainability to the core of your strategy because otherwise, you're robbing yourself, your children, and the families of your workers of their future."

Under his guidance, Team Highlands has implemented a number of initiatives to reduce the company’s carbon footprint. In 2021, the company installed a 385 KWp solar PV plant that currently generates about 18% of the company's total electric energy needs. "We have also continuously undertaken several small energy efficiency initiatives in our manufacturing sites that have reduced our energy intensity from 0.9 Kwh per liter in 2019 to 0.78 kwh per liter in 2022," he adds.

Like many CPG companies, plastic packaging contributes the largest share of its carbon footprint. Highlands is, however, proactively seeking ways to lessen the impact of its packaging on the environment. An industry first, the company recently removed

34

IN 2021, THE COMPANY INSTALLED A 385 KWP SOLAR PV PLANT THAT CURRENTLY GENERATES ABOUT 18% OF THE COMPANY'S TOTAL ELECTRIC ENERGY NEEDS.

JAN/FEB 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM MY COMPANY PROFILE: HIGHLANDS DRINKS LTD

Joachim Westerveld, CEO, Highlands Drinks Ltd

plastic bottle cap sleeves from its water and cordials packaging to minimize plastic waste. Plastic will, however, continue to be an important part of its packaging profile. "We will always go for the solution that is most sustainable," Joachim says. "But at this point in time, plastic is the most economical and also potentially sustainable solution globally. But it has to be made sustainable, and that's why we, as Highlands, have been very much at the forefront of recycling." The CEO reveals that Highlands pays a considerable amount of money to PETCO to have its plastic recycled. "This means that for each gram of PET that we produce and bring to the market, a gram is collected and recycled," he explains, adding that he looks forward to the introduction of recycled PET, which is currently unavailable in Kenya. "We will be the first ones to buy that product because we believe that's the solution for the future."

At Highlands, sustainability extends beyond the environment and involves building a business that can thrive even in tough market conditions. "We have a lot of initiatives ongoing in our production to make sure that we become

BELOW: The key staff behind the quality products that Highlands is known for.

35 FOODBUSINESSAFRICA.COM JAN/FEB 2023 | FOOD BUSINESS AFRICA

BELOW: Quality assurance checks ensure all drinks from Highlands are safe and of high quality.

as efficient as possible," he reveals. "We're even looking at CO2 leakage and electricity consumption and driving to be a world-class efficient operation." This, according to the CEO, takes little from the environment and also lowers the cost of its product, enabling Highlands to remain affordable despite runaway inflation that is currently pushing up prices in Kenya and eroding consumer purchasing power."

STAYING AHEAD WITH INNOVATION

One thing that sets Highlands apart from its peers is its innovative spirit. Time and time again, the company has not failed to impress consumers with unique flavored products. Its Club soft drink range alone is comprised of 10 different flavors, some of which are only unique to Highlands. Its recent product innovations such as Bazuu Energy drink and Club Lemonade are shaking the various categories they are in to the delight of consumers.

With so many successful new products, one wonders how the company always gets it right. “Our secret is to be very close to our consumers, understand what they want, develop a prototype, fine-tune it based on their feedback, and then bring it to the market,” Joachim reveals.

Understanding their market is also one

thing that Highlands seems to have mastered. “Our target market needs that diversity,” Kaari reveals. “They want to taste everything. They want to be unique. They want to be special. So we have to make them feel special by giving them what they ask for.”

BELOW: A team from Highlands celebrating an award recognizing the quality of their beverages.

OUR SECRET IS TO BE VERY CLOSE TO OUR CONSUMERS, UNDERSTAND WHAT THEY WANT, DEVELOP A PROTOTYPE, FINETUNE IT BASED ON THEIR FEEDBACK, AND THEN BRING IT TO THE MARKET.

MY COMPANY PROFILE: HIGHLANDS DRINKS LTD MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 36

Joachim Westerveld, CEO, Highlands Drinks Ltd

Highlands customers will certainly continue feeling special as the company has more products lined up for launch in the near future. “We have always been trendsetters, so we'll soon be launching some very good flavors,” Joachim confides. Cordials which have for a long time stagnated at just 5 flavors will see more new flavors added under this new plan. Energy drinks and even the already diverse range of CSD will also see new flavor additions, according to Joachim.

A WINNING MARKETING STRATEGY

Highlands’ market success has a lot to do with the taste of its products. Joachim tells us the company goes to great lengths including conducting regular blind tastes with consumers to come up with a taste profile that truly aligns with the Kenyan consumer. “That means that once you put the product on the market, we are sure that at least from a taste profile, people would prefer it. And then our job is fairly easy,” Joachim says. His statements are echoed by Kaari, the person in charge of sales. “If the customer loves the taste of our products, they will come back,” she says. Charles Momanyi, the Route to Market Manager, adds that Highlands also actively seeks partnerships with beverage players in other categories to deliver an even superior taste experience to consumers. A good example is the recent successful experiment between East Africa Breweries’ Chome Gin & Chrome Vodka products with Highlands’ own Club Lemonade mixer.

Taste is one part of the marketing equation, the other is competitive pricing whose role has risen in prominence as consumers, battered by inflation, actively seek out quality but affordable products. “We understand that our consumers’ budgets are tight, so we are actually looking to remain a little bit more affordable,” Joachim says. Highlands goes beyond offering customers competitive prices. It also regularly conducts sales offers and promotions where customers either get huge discounts or prizes, which according to Kaari, not only eases the cost-of-living burden but also improves brand loyalty.

Of course, the traditional ingredients to successful marketing including having an extensive distribution network and having the right people on the ground have also played their rightful role in the success of the Highlands brand. “Our strategy is that we deliver directly to the customer wherever they want the product, be it at the branch level or central warehousing. Then we have a team on the ground, to ensure that that it has been placed on the shelf,” Kaari reveals adding that delivery is also prompt, mostly the same day the order is made or the next.

TEAMWORK MAKES THE DREAM WORK

Joachim is not just the CEO of Highlands. He is also the Chief Executive Office of Bio Foods, one of Kenya’s leading dairy companies. Managing one company can be a hell of a task, but Joachim seemingly has no problem heading

WHY ADVERTISE IN FOOD BUSINESS AFRICA MAGAZINE

• Reach the food, beverage and milling industry in sub-Saharan Africa (East, West, South and Central Africa) and beyond using one publication and website

• Use the first magazine of its kind in the region available in a digital format, providing our advertisers with a worldwide audience

• Advertizing with us opens the door to key decision makers in the food industry

• Gain access to the best read and visited food industry website in sub-Saharan Africa.

AFRICA’S

FOOD

YOUR

ADVERTISE IN

NO.1

& BEVERAGE INDUSTRY MAGAZINE GROW

BUSINESS FASTER, MORE SUSTAINABLY

AVAILABLE IN PRINT & FOR FREE ONLINE AT:

WWW.FOODBUSINESSAFRICA.COM

FOODBUSINESSAFRICA.COM

two companies that are located more than 150 kilometers away from each other. “As you can see, I'm really enjoying myself,” he proudly says.

How is he able to one effectively manage two given the demands that each one presents? The answer lies in building a very independent and proactive team, Joachim reveals. He tells us that he spent a good time with his key staff early on, coaching them to become better professionals, so that later he does not have to spend a lot of time checking, controlling, and interfering with work he has entrusted to do. “I trust their abilities to deliver,” he says.

Despite having trust on his team, Joachim is however not detached from Highlands. He is ,in fact, part and parcel of that very independent and proactive team that he described above. “We have very structured meetings where we make sure that we're aligned,” he reveals. “It gives me and everyone at Highlands a good picture of how we are doing as a company and that allows me to only get involved in the places where I should get involved.”

The spirit of teamwork has permeated through the entire workforce and from our observation, everyone, regardless of their position at the company was working towards making Highlands and Club brands successful. During weekly town hall meetings, employees are encouraged to speak freely and give ideas on how the brand or operations can be improved even further. “In this business, everyone is a CEO and will query work

processes, sales achievement, and market engagement based on personal ownership,” Joachim reveals. “This has been key in getting us to the top.”

A PIPELINE OF NEW INVESTMENTS

Being the fastest-growing beverage company in Kenya has its drawbacks; quickly running out of capacity. Norman admits that the current warehouse is not able to hold as much stock as needed to match the demand in the market. Joachim, however, promises that this would not be the reality three years from now. “We have a master plan for this factory,” he says. The plan involves acquiring new machinery and setting up new production and warehouse spaces that can handle bigger production volumes. “We are at the starting point of our investments and are investing in some machinery as we speak,” he says. “In three years' time, this place will be totally different.”

With more capacity planned, the company is now exploring exports with Uganda and Rwanda being the first in mind. Exports haven’t started yet, but Kaari reveals that great progress has been made on the research front on both markets. “And we've already got partners,” she reveals. “However, we are very cautious about how we're going to handle it. We are working on a marketing plan, and once we are clear on the products we want to launch and the region, only then will we commence exports.” FBA

COUNTRY SECTOR KENYA SOFT BEVERAGE WEBSITE hdl.highlandske.com EMAIL highlands@highlandske.com MY COMPANY PROFILE: HIGHLANDS DRINKS LTD

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 38

one of the most modern production line with capacity to produe up to 20,000 bottles an hour.

TRENDS IN FORMULATING, PROCESSING, PACKAGING & CONSUMPTION OF DAIRY PRODUCTS

Infant milk formula popularity is on the rise in Africa despite sustained efforts to limit its use

By Mary Wanjira

By Mary Wanjira

roper infant nutrition is fundamental to a child’s continued health, from birth through adulthood. Correct feeding in the first three years of life is particularly important due to its role in lowering morbidity and mortality, reducing the risk of chronic disease throughout their lifespan, and promoting

regular mental and physical development.

Breastfeeding is considered the best source of nutrition for the healthy growth and development of infants. A 2016 study by Lancet found that scaling up breastfeeding to nearuniversal levels could prevent the deaths of over 820,000 children under five. It is for this reason that WHO recommends

FOODBUSINESSAFRICA.COM MAY/JUNE 2023 | FOOD BUSINESS AFRICA 39

Dairy BUSINESS P

that babies everywhere be breastfed exclusively for the first six months, at which point safe, appropriate complementary foods (CF) should be introduced to meet children’s evolving nutritional requirements. WHO also notes that CF should not be used as breast milk substitutes (BMS), and infants and young children should continue to be breastfed until they are two or older.

perceptions and misinformation. Women’s perceptions of insufficient breast milk, beliefs about infant thirst and the need for water, and the cultural and family norms that support the early introduction of food and liquid are a few examples of barriers that prevent the universal adoption of EBF in Africa.

A BOOMING MARKET FOR INFANT FORMULA

Previously, the early introduction of water and porridge to infants inhibited exclusive breastfeeding practices. Today, it is the introduction of infant milk formula. Infant formula is a breast milk substitute designed to meet the full nutritional needs of babies under 12 months of age. Internationally, the required components for formulas are set by the Codex Alimentarius, a joint food standards program overseen by the Food and Agriculture Organization of the United Nations and the World Health Organization. Individual countries can also set additional guidelines. In total, the Codex lists more than 30 required nutritional ingredients for infant formula, including vitamins and minerals, but the three major constituents are fats, proteins, and carbohydrates –the primary building blocks that little humans need to grow and develop.

Despite these advantages, exclusive breastfeeding (EBF) in Africa remains rare. Only 37% of infants under 6 months of age in Africa were exclusively breastfed in 2017, according to a study published in the Nature Medicine Journal. Many of EBF’s primary barriers involve cultural

The shift towards infant milk formula has been accelerated by urbanization and more women entering employment, leaving them with little time to breastfeed their babies. With Africa lacking sufficient infant formula production capacities, the rising demand for these products is satisfied by imports. According to a new report by the International Trade Centre, titled "Made by Africa: Creating

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 40

DAIRY BUSINESS AFRICA: INFANT FORMULA

ONLY 37% OF INFANTS UNDER 6 MONTHS OF AGE IN AFRICA WERE EXCLUSIVELY BREASTFED IN 2017, ACCORDING TO A STUDY PUBLISHED IN THE NATURE MEDICINE JOURNAL.

Value through Integration," Africa imports US$627.2 million of food preparations for infant use every year, and this figure is projected to exceed US$1.21 billion by 2026. Leading brands in the region include Nan by Switzerland-based food giant Nestle, Aptamil, which is produced by French food company Danone, Similac, which is owned by USbased Abbott Industries, and Enfamil, which is produced by UK-based consumer goods company Reckitt & Benckiser. Aspen Pharmaceutical, which was the only major infant formula producer on the continent, sold the business to Lactalis for US$860.1 million in 2018, giving the Francebased dairy company ownership of the Alula, Infacare, and S-26 brands.

Regionally, South Africa stands out as the most important infant milk formula market. South Africa's baby food market value was estimated to be US$618.999 million in 2020 and is expected to grow at a compound annual growth rate of 4.89% to reach a market size of US$864.499 million in 2027. West Africa as a region comes in second. According to Data Bridge Market Research, the market is growing with a CAGR of 6.4% in the forecast period of 2021 to 2028 and is expected to reach US$1.088 billion by 2028. Nigeria, West Africa’s largest market, imported infant foods worth US$36.6 million in 2021, a 25% increase from the previous year, according to data from Statista. In North Africa, Egypt is an important formula market. In the first nine months of 2022, data from the Central Agency for Public Mobilization

and Statistics revealed that baby formula imports increased by 2.5% in the first eight months of 2022 to US$73.9 million. In Egypt, infant formula prices are sensitive, and the government, through the military, has previously intervened by directly importing the products in an effort to reduce the retail prices.

OF US$864.499 MILLION IN 2027.

The key distribution channels in the African infant formula market are drugstores & pharmacies and hypermarkets & supermarkets. Drugstores & pharmacies are the primary distribution channel in the sector in 2021, creating the impression that the formula is physician-approved. Being a business of mostly perception and less science, UNICEF in its report also observed that women thought expensive formula products - sometimes containing specific ingredients such as human milk oligosaccharides (HMOs) or polyunsaturated fatty acids (PUFA) - were better than cheaper alternatives. This, despite systematic reviews reporting no health or brain development benefits from the addition of specific ingredients such as HMOs or PUFA, the report highlighted. When they can afford it, women also reported that they would go for expensive products out of the desire to give their child 'the best,' sometimes as a result of feeling guilty about not being able to breastfeed.

WORKING MOMS DRIVE GROWTH

Growth is mainly fueled by more women in Africa joining the workforce, which gives them high disposable incomes necessary to buy infant milk formula and less time to exclusively breastfeed their babies. A good example is in South Africa where the participation of women in wage employment has more than doubled from 23% in 1970 to about 49.54% in 2021, according to data from Statista. This can be directly associated with the high uptake of infant milk formula products when compared to other regions. Overall,

FOODBUSINESSAFRICA.COM MAY/JUNE 2023 | FOOD BUSINESS AFRICA 41

SOUTH AFRICA'S BABY FOOD MARKET VALUE WAS ESTIMATED TO BE US$618.999 MILLION IN 2020 AND IS EXPECTED TO GROW AT A COMPOUND ANNUAL GROWTH RATE OF 4.89% TO REACH A MARKET SIZE

2021 World Bank data shows that Africa has seen women's participation in wage employment rise to 39.2% and 46.2% when the total labor force is considered. Faced with limited time with their kids, these women are more open to the idea of substituting breast milk with infant milk formula than

to go back to work." Others, according to the report, start giving their babies formula because they will be going back to work say in two months' time, and they worry that their babies might not want formula if they are only introduced to it once they go back to work.

High birth rates and rising numbers of women of reproductive age in Africa are also expected to drive the infant formula milk market in the future. UNICEF, in 2015, projected that almost two billion babies would be born in Africa over the next 35 years. If the current trends remain, more children will mean a higher demand for infant milk formula, further increasing Africa's share of the market. With growth slowing in China, a major importer of infant milk formula, manufacturers are certainly expected to increase their focus on Africa to offset lost sales in the largest economy in Asia.

they would have if they had sufficient time to nurse their children to adulthood. A 2022 report by WHO and UNICEF validates this argument. According to the report, more than three-quarters (76%) of women agreed with the statement "formula feeding is the better choice if the mother plans

Perception of formula as a more desirable or modern option compared to breastfeeding is also one of the factors behind the growth being witnessed in Africa. Marketing by the major infant formula providers in the region, including Nestle, Danone, Lactalis, and FrieslandCampina, has been cited by many reports as the major reason behind this perception change. A 2022 report by UNICEF titled "How the marketing of formula milk influences our decisions on infant feeding" noted that formula companies used sophisticated techniques and misleading messaging to market their products, including scientific language and imagery, pain points, emotional and aspirational appeals, influenced South African women's perception towards breast milk.

When it comes to marketing, formula producers stop

MAY/JUNE 2023 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 42