BERNARD ARNAULT’S INVESTMENTS SHIFTING PRIVATE WEALTH MIGRATION

5 RICHEST BILLIONAIRE FAMILIES

20 SMARTEST CITIES IN THE WORLD GLOBAL BUSINESSES FOUNDED BY FAMILIES

AUGUST 2023 ISSUE 131

TAREK HOSNI

CEO of Jamjoom Pharma

“RAISING MONEY WAS NOT EVEN 20-30% OF OUR OBJECTIVE. THE KEY WAS GOVERNANCE AND SUSTAINABILITY.”

4TH ANNUAL

AUGUST 2023 ISSUE 131

TOP 100 ARAB FAMILY BUSINESSES

LEGACY BUSINESSES ARE STILL THRIVING THROUGH GENERATIONS, AND INCREASINGLY HITTING THE STOCK MARKETS. MEET THE LEADERS EMBRACING A NEW ERA IN SUCCESSION.

Stay connected with our latest business news. UAE......................................................... AED 15 SAUDI ARABIA.....................................SAR 15 BAHRAIN............................................ BHD 1.5 KUWAIT............................................ KWD 1.25 OMAN...................................................OMR 1.5 QATAR....................................................QAR 15 OTHERS..........................................................$4

71

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

6 I Sidelines Succession Continues By Claudine Coletti

24

LEADERBOARDS

WORLD’S BILLIONAIRES

10 I Notable Investments Of Bernard Arnault

1 CONTENTS

At the heart of the world’s second richest family is a prolific investor. Bernard Arnault was the richest person in the world when Forbes released its 2023 list of the World’s Billionaires in April. Here are some of his biggest backings. By Jamila Gandhi

12 I The World’s 5 Richest Billionaire Families From the Walton family to the candy conglomerate Mars Inc., these families have built their fortunes through strategic investments, business acumen, and inheritance. Here are the top five richest billionaire families as of July 12, 2023, according to Forbes.

By Amr Abdelhamid WEALTH

14 I Moving Millionaires: The Shifting Trend In

Private Wealth Migration

More than 122,000 millionaires are estimated to be looking to move countries in 2023, but where are they heading, and why? By Cherry Aisne Trinidad FOUNDERS

16 I Enduring Legacies: 5 Renowned Global

Businesses That Were Founded By Families Family businesses have long been an important part of the global business landscape. Here are five renowned businesses founded by families, rising from humble beginnings to global prestige.

By Malika Kaloo INVESTMENT

18 I In Numbers: Global Asset Allocation Shifts

For Family Offices

As economic conditions and geopolitical landscapes change, family offices are planning their most significant shift in strategic asset allocation in several years to ensure long-term growth and success. By Rawan Hassan SUSTAINABILITY

20 I 20 Smartest Cities In The World Here are the top 20 cities improving energy efficiency, reducing CO2 emissions, and increasing the well-being of citizens, according to the Institute for Management and Development in partnership with the World Smart Sustainable Organization. By Joyce Abaño WORLD’S BILLIONAIRES

22 I Musk Vs Zuckerberg: Who’s Winning The

Tech Billionaires’ Brawl?

Whether Musk and Zuckerberg will ever make it to the boxing ring remains to be seen, but their rivalry continues to make headlines. Here are some highlights and key stats. By Joyce Abaño

F O R B E S M I D D L E E A S T.C O M

62 CONTRARIAN

24 I Inflection AI, The Year-Old Startup Behind

Chatbot Pi, Raises $1.3 Billion

Backed by Microsoft, Nvidia and billionaires Reid Hoffman, Bill Gates and Eric Schmidt, the startup led by ex-DeepMind leader Mustafa Suleyman is valued at $4 billion—and claims to have the world’s best AI hardware setup.. By Alex Konrad

62 I Overclocking AMD LISA SU orchestrated one of the great turnarounds in Silicon Valley history, driving the dying semiconductor maker's stock price up nearly 30-fold in less than a decade. Now, she's preparing for battle in the coming AI revolution—and she expects to keep winning. BY IAIN MARTIN AND RICHARD NIEVA

68 I Thoughts On Legacy AUGUST 2023

CONTENTS

2

TOP 100 ARAB FAMILY BUSINESSES 2023

32 I Going Strong Hassan Allam Holding’s third-generation leaders, Hassan Allam and Amr Allam, the Co-CEOs of the group, have been overseeing their family business since 2009 and 2010, respectively. They are now focused on expanding the company’s operations, leveraging hitting $5.5 billion in backlog in 2022. By Hagar Omran

38 I Seeding Sustainable Agriculture Morocco’s agribusiness is under mounting pressure amid soaring inflation and climate-driven weather variations. Rita Maria Zniber, Chairman and CEO of agribusiness group Diana Holding, is taking the lead in transitioning to a more sustainable ecosystem. By Samar Khouri

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

3

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

August 2023

•

4 CONTENTS

Issue 131

COVER STORY

26

Executing An Evolution

INSIDE •

Tarek Hosni, CEO of family-owned Saudi pharmaceuticals giant Jamjoom Pharma, led the company through an IPO in June 2023—the largest the kingdom has seen so far this year. Now he’s looking at new product growth to make the company an international name. By Jason Lasrado

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

5

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

SIDELINES

FORBES MIDDLE EAST

6

Succession Continues Family businesses have been the lifeblood of Middle East economies for decades, ever since the Arab world first began forming its metropolises in the desert. But today, many of these have evolved well beyond what those early founders could have imagined, handed down through generations, diversified across multiple sectors, expanded across continents, and listed on regional stock exchanges. In the U.A.E. alone, family-owned businesses reportedly account for 60% of the GDP and 80% of the workforce, according to a 2022 report by KPMG. But will they continue to grow? And will new generations continue to be the ones taking the businesses into the next era? PwC’s 2023 family business report forecasts positive results as long as they continue to build and capitalize on consumer trust. According to the report, 65% of the family businesses surveyed in the Middle East reported growth in their most recent financial year, indicating a recovery from the pandemic slump, and 74% believe they will grow further in the next two years. But trust is paramount, and while family businesses are traditionally trusted more by consumers, as the consumer demographic changes and Gen-Z release their spending power, issues such as ESG, diversity, and sustainability are coming to the forefront. In short, a brand’s reputation for good behavior can make or break its future. Changing demographics will also determine whether a family business remains a family affair. According to a 2019 survey from Deloitte, more than 70% of family businesses fail before reaching the third generation. This shows a natural evolution. The founder establishes the nascent business and commits to building their vision, the second generation is born into a growing enterprise and is inspired to take it further, but the third generation is born into a wealthy legacy and seeks their own success. However, handing the batten to one or more of your children is not the only way to grow. Going public and taking a step back can also secure a prosperous future. In our 2023 list of the Top 100 Arab Family Businesses, over 60% are major shareholders in a company listed on a regional stock exchange, with most being the founding shareholders. While family members remain on the boards, the management and operations can be entrusted to senior executives, allowing new generations to follow their own path while keeping a foot in the door of their birthright legacies. The path of succession can deviate for those families willing to broaden company ownership. This month we speak to second and third-generation leaders, as well as one that is safeguarding a listed business on behalf of its family founders. Rita Maria Zniber, Chairman and CEO of Moroccan agribusiness group Diana Holding, is leading the business first established by her late husband, side-byside with their daughter, Diana. Hassan Allam and Amr Allam, the Co-CEOs of Egyptian construction company Hassam Allam Holding, are continuing their grandfather’s vision, heading a family business that has been growing for nearly 90 years. And Tarek Hosni, CEO of Saudi pharmaceuticals giant Jamjoom Pharma, has just led the Jamjoon family’s thriving business through an IPO, the largest on Tadawul this year so far. I hope you enjoy the issue. —Claudine Coletti, Managing Editor

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

The First Initiative

to teach

7 FORBES MIDDLE EAST

Children The art of investment

In F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

INNOVATING SINCE 2010 AUGUST 2023 ISSUE 131

Dr. Nasser Bin Aqeel Al Tayyar President & Publisher nasser@forbesmiddleeast.com

8

Khuloud Al Omian

FORBES MIDDLE EAST

Editor-in-Chief Forbes Middle East, CEO - Arab Publisher House

khuloud@forbesmiddleeast.com

Editorial

Business Development

Claudine Coletti Managing Editor claudine@forbesmiddleeast.com

Ruth Pulkury Senior Vice President - Business Development

Laurice Constantine Digital Managing Editor laurice@forbesmiddleeast.com

ruth@forbesmiddleeast.com

Fouzia Azzab Deputy Managing Editor fouzia@forbesmiddleeast.com

Fiona Pereira fiona@forbesmiddleeast.com

Amany Zaher Senior Quality Editor amany@forbesmiddleeast.com

Karl Noujaim karl@forbesmiddleeast.com

Jamila Gandhi Senior Editor jamila@forbesmiddleeast.com

Sarine Nemchehirlian sarine@forbesmiddleeast.com

Rawan Hassan Senior Translator rawan@forbesmiddleeast.com Samar Khouri Reporter samar@forbesmiddleeast.com Cherry Aisne Trinidad Senior Online Editor aisne@forbesmiddleeast.com

Sarah Gadallah Hassan sarah.g@forbesmiddleeast.com Upeksha Udayangani Client Relations Executive upeksha@forbesmiddleeast.com Tayyab Riaz Mohammed Financial Controller riaz@forbesmiddleeast.com

Research

Jason Lasrado Head of Research jason@forbesmiddleeast.com Nermeen Abbas Senior Researcher nermeen@forbesmiddleeast.com Elena Hayek Researcher elena@forbesmiddleeast.com Layan Abo Shkier Research Reporter layan@forbesmiddleeast.com Soumer Al Daas Head of Creative soumer@forbesmiddleeast.com Julie Gemini Marquez Brand & Creative Content Executive julie@forbesmiddleeast.com Mohammed Ashkar IT Manager ashkar@forbesmiddleeast.com Muhammad Saim Aziz Web Developer saim@forbesmiddleeast.com Habibullah Qadir Senior Operations Manager habib@forbesmiddleeast.com

FORBES US Chairman and Editor-In-Chief Steve Forbes CEO and President Michael Federle

Copyright© 2019 Arab Publisher House Copyright @ 2019 Forbes IP (HK) Limited. All rights reserved. This title is protected through a trademark registered with the US Patent & Trademark Office Forbes Middle East is published by Arab Publisher House under a license agreement with Forbes IP (HK) Limited. 499 Washington Blvd, 10th floor, Jersey City, NJ, 07310 Founded in 1917 B.C. Forbes, Editor-in-Chief (1917-54); Malcolm S. Forbes, Editor-in-Chief (1954-90); James W. Michaels, Editor (1961-99) William Baldwin, Editor (1999-2010) ABU Dhabi Office Office 216, Podium 2, Yas Creative Hub, Yas Island, Abu Dhabi, U.A.E. - P.O. Box 502105, info@forbesmiddleeast.com Dubai Office Office 309, Building 4, Emaar Business Park, Dubai, U.A.E. - P.O. Box 502105, Tel: +9714 3995559, Qatar 14-DD2, Commercial Bank Plaza, West Bay, Doha, Qatar readers@forbesmiddleeast.com subscription@forbesmiddleeast.com Queries: editorial@forbesmiddleeast.com For Production Queries: production@forbesmiddleeast.com

Forbes Middle East is legally represented by Abdullah AlHaithami Advocate & Legal Consultants

Check our Sustainability Policy F O R B E S M I D D L E E A S T.C O M

P.O.Box 95561 Dubai • UAE Tel: +971 4 886 8535

www.intlawfirm.com AUGUST 2023

9

YOUR JOURNEY TO

Happy Places

STARTS HERE

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

World’s Billionaires

Notable Investments Of Bernard Arnault LEADERBOARD

Pachama Aglaé Ventures invested in Pachama’s $5 million seed round in September 2020 and then again in its $55 million series B in May 2022. The tech company uses satellite imagery, remote sensing, and machine learning to measure and monitor the carbon stored in rainforests and ecosystems globally.

Slack

Bernard Arnault

LVMH’s Bernard Arnault and family stand as one of the world’s wealthiest families, overseeing an empire of 75 fashion and cosmetics brands, including Louis Vuitton and Sephora. Forbes estimates the 74-year-old’s fortune at $231 billion as of July 12, 2023. Arnault’s five children all work at LVMH. In July 2022, the billionaire proposed a reorganization of his holding company Agache to give them equal stakes. Agache—formerly Groupe Arnault—including its 100%-owned subsidiary Financière Agache, forms the principal investment vehicle of Arnault. The Frenchman’s holding F O R B E S M I D D L E E A S T.C O M

company Agache backs venture capital firm Aglaé Ventures, which primarily executes technologyfocused investments. In the first half of 2023, the venture capital firm backed seven companies. Here’s a look into the notable companies backed by Paris-headquartered global investment platform Aglaé Ventures and Agache, according to Crunchbase.

Airbnb In June 2015, Agache invested in Airbnb’s $1.5 billion Series E funding round. The peer-to-peer apartment rental platform had 6.6 million active global

listings and $180 billion in all-time host earnings as of the end of December 2022. As per Dealroom, the group has now exited Airbnb.

Netflix Among the streaming platform’s investors was Arnault’s holding company which led the $30.3 million Series D round for Netflix in July 1999. The backing made Arnault Netflix’s largest investor at that time just as the company was about to run out of money, according to a statement by Alex Morris, founder of TSOH Investment Research. The group has now exited Netflix.

In April 2015, Arnault’s Agache participated in Slack’s $172.7 million Series E fundraising round. The productivity platform was acquired by CRM leader Salesforce in July 2021. As per Slack, the company has over 200,000 paid customers.

SpaceX In July 2017, Aglaé Ventures invested in the $351 million Series H round for SpaceX. In total, the spacecraft exploration company has executed 245 launches and 206 landings as of July 12, 2023.

viagogo In August 2006, the French holding company invested in viagogo’s $20 million Series B funding round. The entertainment booking platform claims to have nearly five million tickets on its network, with users in over 160 countries. AUGUST 2023

BY JAMILA GANDHI; PHOTOGRAPHY BY JAMEL TOPPIN FOR FORBES

10

At the heart of the world’s second richest family is a prolific investor. Bernard Arnault was the richest person in the world when Forbes released its 2023 list of the World’s Billionaires in April. Here are some of his biggest backings.

LEADERBOARD

11

Huawei Cloud New Intelligence for Saudi Arabia Saudi Region Coming Live Soon!

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

World’s Billionaires

The World’s 5 Richest Billionaire Families

Members of the Walton family (L-R) Rob, Alice and Jim.

1. The Walton Family Combined net worth: $241.1 billion Source of wealth: Walmart Citizenship: U.S. The Waltons are the richest family in the world thanks to their stake in Walmart, the world’s largest retailer by sales. Nearly half of Walmart’s stock is held by seven heirs of founders Sam Walton, who died in 1992, and his brother James “Bud,” who died in 1995. Heirs include Sam’s three living children—Rob, Jim, and Alice—his daughter-in-law Christy and her son Lukas, in addition to Bud’s two daughters, Ann and Nancy. Walmart’s total revenues reached $611.3 billion in the 2023 fiscal year that ended in January.

2. Bernard Arnault & family Net worth: $231 billion Source of wealth: LVMH Citizenship: France Bernard Arnault is the founder, chairman, and CEO of the LVMH empire—the world’s biggest luxury conglomerate—which owns 75 fashion and cosmetics brands, including Louis Vuitton and Sephora. In July 2022, Arnault proposed a reorganization of his holding company Agache to give his five children equal stakes. In a historical milestone, in April 2023, LVMH became Europe’s most valuable company ever, F O R B E S M I D D L E E A S T.C O M

with a market value exceeding $500 billion. Arnault and LVMH also own a 40% stake in private equity firm L Catterton, which has $33 billion in assets under management, including investments in Birkenstock and Equinox.

3. The Koch Family Combined net worth: $116 billion Source of wealth: Koch Industries Citizenship: U.S. Charles owns a 42% stake in Koch Industries, as did his brother David, who died in August 2019 aged 79. Julia Koch and her three children inherited her husband David’s stake. Charles became chairman and CEO of Koch Industries in 1967. In 2023, he became co-CEO. While Julia oversees the David H. Koch Foundation, through which she and her late husband have donated approximately $1.8 billion to causes like poverty, addiction-related issues, criminal justice, and education.

3. The Mars Family Combined net worth: $116 billion Source of wealth: Mars Inc. Citizenship: U.S. The Mars family owns Mars Inc., one of the world’s largest candy and pet food companies, which was founded in 1911

From the Walton family to the candy conglomerate Mars Inc., these families have built their fortunes through strategic investments, business acumen, and inheritance. Here are the top five richest billionaire families as of July 12, 2023, according to Forbes. when Frank Mars started selling candy out of his kitchen in Washington. John and his siblings Jacqueline and Forrest Jr., who died in July 2016, inherited stakes in the candy firm Mars when their father died in 1999. John and Jacqueline each own an estimated one-third of the company. His late brother Forrest Jr.’s four daughters own the rest. In July 2023, Marc Inc. signed an agreement to acquire Kevin’s Natural Foods.

5. Carlos Slim Helu & family Net worth: $102.5 billion Source of wealth: Telecom Citizenship: Mexico Mexico’s richest person, Carlos Slim Helu, and his family control América Móvil, Latin America’s biggest mobile telecom firm with operations in at least 15 countries. In 1990, Slim and foreign telecom partners acquired a stake in Telmex, Mexico’s only phone company, which is now part of América Móvil. The self-made businessman also owns stakes in Mexican construction, consumer goods, mining, and real estate companies. Slim and his family also own 79% of Grupo Carso, one of Latin America’s largest conglomerates. In February 2023, he listed his historic Manhattan mansion for $80 million, almost twice what he paid for it in 2010.

AUGUST 2023

BY AMR ABDELHAMID; PHOTO BY RICK T. WILKING / GETTY IMAGES NORTH AMERICA / GETTY IMAGES VIA AFP

LEADERBOARD

12

13

A fully integrated town nestled along the Red Sea in Egypt, where coastal living is not a mere concept; it is an immersive experience that rejuvenates, inspires, and ignites the soul. It offers unparalleled opportunities for residents, discerning travelers, and the community to fully embrace.

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

LEADERBOARD

14

Moving Millionaires: The Shifting Trend In Private Wealth Migration More than 122,000 millionaires are estimated to be looking to move countries in 2023, but where are they heading, and why? Private wealth migration is back to an upward growth trajectory after two years of minimal movement during the pandemic, according to Henley & Partners’ latest Private Wealth Migration Report, which estimates that 122,000 millionaires around the world are looking to relocate in 2023 and another 128,000 in 2024 in pursuit of wealth preservation and protection. The report suggests that the movement of high networth individuals (HNWIs)— defined by Henley & Partners as those with $1 million or more investable wealth— could be an early indication of a country’s economic and

social state. The clear-cut threat of instability brought about by social and political unrest, transatlantic tension between the East and West, and even climate change is one of the underlying motivations for millionaires to find a safer, more secure environment. This was evident in Russia in 2022, when the nation lost the second-highest number of millionaires, or net outflows of 8,500 HNWIs, due to its conflict with Ukraine. This year, that number is expected to hit 3,000 net departures. But no country has seen a steadier or larger exodus of

Top 5 Countries Witnessing An Exodus Of Millionaires Countries

Net HNWI Outflows 2023

Net HNWI Outflows 2022

• China

13,500

10,800

• India

6,500

7,500

• U.K.

3,200

1,600

• Russian Federation

3,000

8,500

• Brazil

1,200

1,800

Top 5 Countries Witnessing An Influx Of Millionaires Net HNWI Inflows 2023

Net HNWI Inflows 2022

• Australia

5,200

3,800

• U.A.E.

4,500

5,200

• Singapore

3,200

2,900

• U.S.

2,100

1,500

• Switzerland

1,800

2,200

Countries

Source: Henley Private Wealth Migration Report 2023 Note: 2023 figures are forecast based on year-to-date HNWI movements to June 2023 F O R B E S M I D D L E E A S T.C O M

millionaires each year over the past decade than China. The world’s second-largest economy is projected to witness the highest number of net HNWI departures again in 2023, with 13,500 choosing to leave. The report reveals that China’s future growth plan has been centered around its high-tech sector, and the banning of Huawei 5G by major markets and Beijing’s crackdown on the nation’s biggest tech companies have greatly contributed to deteriorating confidence in the country. Meanwhile, India moved up in the forecast ranks and will see this year’s secondhighest number of HNWI net outflows at 6,500, with prohibitive tax legislation and complex rules for outbound remittances among a few key issues prompting wealth migration. The U.K., which for decades (1980 to 2010) has consistently welcomed affluent families from various regions, continues to witness a depleting number of HNWIs that began in 2017. It stands to lose 3,200 millionaires in 2023. According to the report, the persistent exit could be a result of Brexit’s impact, the country’s high capital gains tax, and the weakening healthcare systems, among other reasons. So, where will the departing millionaires migrate? This year, Australia is expected to steal the top spot as the most attractive destination for the wealthy, with 5,200 net HNWI inflows, beating out the U.A.E., which is forecast to host an additional 4,500 millionaires. Ranking third is Singapore—Asia’s biggest wealth hub—with 3,200, followed by the U.S. (2,100) and Switzerland (1,800). In terms of commonality, the top five countries with the highest net HNWIs inflows offer residency or citizenship

to other nationalities through investment programs. Particularly in the Middle East, investors can gain residency through the U.A.E.’s investment program, with a minimum capital of about $544,588, while Jordan provides citizenship, with the right to live, work and study to those with a minimum capital of $750,000. In 2022, the U.A.E. experienced the largest influx of millionaires, with 5,200 new arrivals. While that number will be slightly decreased this year, the country is still proving to be a safe haven for most migrating millionaires from India, the U.K., Russia, Lebanon, and Pakistan, to name a few. The Arab state’s low tax rates, its first-class healthcare system, and its highly-diversified economy have helped the U.A.E. become one of the world’s wealth magnets. In August 2022, the Dubai International Financial Centre unveiled the world’s first Global Family Business and Private Wealth Centre to provide wealth management solutions, such as investment migration options to family-owned businesses, HNWIs, and ultraHNWIs. What makes a good destination for wealth migration? The report reveals that extremely mobile HNWIs are on the lookout for host countries with clear policies and attractive legislation like low taxation in addition to political stability and personal freedom. Yet, on the back of ongoing global uncertainties, these priorities have now added some intangible influences impacting the wealthy’s children’s prospects, quality of life, and legacies. In short, HNWIs are opting for countries that can guarantee a safe and secure environment for both their riches and their families. AUGUST 2023

BY CHERRY AISNE TRINIDAD

Wealth

LEADERBOARD

15

Under the theme “Sea Change,” the 21st edition of the Forbes Global CEO Conference will examine the economic transformation that is underway. The world is in reverse: deleveraging, decelerating and deglobalizing. It’s more than a pivot, it’s a global grinding of the gears as the world shifts to a new normal— or a new abnormal? The conference will gather insights from leading CEOs, thought leaders, entrepreneurs and investors as they chart new courses to ride the waves of sea change. For more information, please visit forbesglobalceoconference.com or email info@forbesasia.com.sg

PRINCIPAL SPONSORS

Global Private Banking CORPORATE SPONSORS

CORPORATE SPONSOR

F O R B E S M I D D L E E A S T.C O M

SUPPORTING SPONSOR

AUGUST 2023

LEADERBOARD

16

Enduring Legacies: 5 Renowned Global Businesses That Were Founded By Families Family businesses have long been an important part of the global business landscape. Here are five renowned businesses founded by families, rising from humble beginnings to global prestige.

Yoovidhya died in 2012, and today his son Chalerm heads the family’s 51% share in the company, 2% of which is held directly by him. Chalerm Yoovidhya and family ranked second on Forbes Thailand’s 50 Richest list 2023 with a net worth of $33.4 billion. Mark Mateschitz had a net worth of $41.1 billion as of July 12, 2023, according to Forbes.

LG Corp. Founded by: Koo family Headquarters: Korea

John Willard Marriott and his wife Alice Reviewing a Model of the Twin Bridges Motor Hotel, CA (1955)

Marriott International Founded by: Marriott family Headquarters: U.S. In May 1927, armed with just $6,000, John Willard Marriott and his wife Alice opened a nine-stool A&W Root Beer franchise in Washington D.C. As the menu expanded, the business was named Hot Shoppes, and in 1957, J.W. Marriott entered the hotel industry by opening the Twin Bridges Motor Hotel in Arlington, Virginia. Today, Marriott International has a presence in 138 countries, with over 8,500 properties, including luxury brands such as Ritz-Carlton and St. Regis. In 2022, Marriott International’s global headquarters opened in Marland, with a cafeteria called The Hot Shoppe. Davis F O R B E S M I D D L E E A S T.C O M

S. Marriott, J.W. Marriott Jr.’s son, is the current chairman of the board.

Red Bull Founded by: Dietrich Mateschitz and Chaleo Yoovidhya Headquarters: Austria Red Bull Energy Drink was launched in Austria in 1987 by former marketing executive Dietrich Mateschitz and energy-drink tycoon Chaleo Yoovidhya. Mateschitz died in October 2022, leaving his 49% stake in Red Bull to his son Mark Mateschitz. Chaleo

Koo In-Hwoi co-founded Lucky Chemical Co. Ltd in 1947. The company produced injection molding machines, plastic combs, soaps, and toothpaste, under different trademarks. Lucky Industry (now LG International) was established in 1953, and the corporation gradually entered the electronics market. Today, its subsidiaries include LG Electronics, LG Sports, LG Energy Solution, LG Chem, and LG CNS. In 1994, the chairman of LG, Koo BonMoo, adopted his nephew Koo Kwang Mo who now serves as the chairman and CEO of LG Corp. Mo had an estimated net worth of $1.8 billion as of July 12, 2023, according to Forbes.

Comcast Founded by: Roberts family Headquarters: U.S. Ralph Roberts bought a community-antenna TV system in Tupelo, Mississippi, in 1963 for $500,000 and established American Cable Systems. In 1969, the company was renamed

Comcast Corporation. It began trading on Nasdaq in 1972. As the company marked its 50th anniversary in 2013, Comcast announced its acquisition of GE’s 49% common equity ownership interest in NBCUniversal. Ralph Roberts passed away in 2015, and his son Brian Roberts became the CEO and chairman of Comcast. As of July 12, 2023, Brian Roberts’ net worth was $2 billion, according to Forbes, and he has exclusive voting rights over approximately one-third of the company’s stock.

Hallmark Founded by: Hall family Headquarters: U.S. Joyce C. Hall and his two elder brothers Rollie and William first established the Norfolk Post Card Company before setting up Hall Brothers in 1923. The name of the company was officially changed to Hallmark in 1954. Today, J.C. Hall’s grandsons lead the company’s board of directors, with Donald J. Hall Jr., executive chairman, and David E. Hall, executive vice chairman. The company has since diversified through the Hallmark Hall of Fame, the Hallmark Channel, Hallmark Movies, and Mysteries cable television networks. Today, Hallmark publishes in 30 languages, and its products are available in over 100 countries. AUGUST 2023

BY MALIKA KALOO; PHOTOS FROM COMPANIES WEBISTES , DIETRICH MATESCHITZ PHOTO BY ROBERT MICHAEL / AFP

Founders

Healthcare SUMMIT

Innovate, Collaborate, Heal

PIONEERING THE FUTURE OF HEALTHCARE This premier event brings together leading experts, visionaries, and influencers in the healthcare industry to share insights and take action, leaving a lasting impact on healthcare in the Middle East. Through innovative discussions, thought-provoking panels, and interactive sessions, the summit pioneers the future of longevity, promoting collaboration, innovation, and healing.

For general inquiries: event@forbesmiddleeast.com

F O R B E S M I D D L E E A S T.C O M

For sponsorship opportunities: AUGUST 2023 advertising@forbesmiddleeast.com

LEADERBOARD

17

Investment

In Numbers: Global Asset Allocation Shifts For Family Offices As economic conditions and geopolitical landscapes change, family offices are planning their most significant shift in strategic asset allocation in several years to ensure long-term growth and success. The UBS Global Family Office Report 2023 reveals that family offices are refocusing their private market exposure, with potential inflection points in inflation, interest rates, and economic growth. In light of the ongoing Russia-Ukraine conflict and the U.S.-China cold trade war, geopolitics overtook inflation as the top concern among family offices globally, followed by a recession and inflation. The report surveyed 230 single-family offices worldwide, with a total net worth of $495.8 billion and individual families’ net worth averaging $2.2 billion. One notable shift in the increased interest in developed market fixed income. After reducing bond investments for three years, nearly 38% of family offices plan to increase their holdings over the next five years. Fixed income is now regarded as a popular source of diversification, with 37% moving to high-quality, shortduration bonds offering potential wealth protection, yield, and capital appreciation. The surveyed family offices anticipate a more significant allocation to risk assets, with 34%

planning to increase their investments in emerging market equities as USD reaches its peak and the Chinese economy reopens. Despite short-term market and geopolitical trends leading to increased liquid, short-term fixed-income exposure, 66% of family offices still believe that illiquidity boosts returns in the long term. Alternative investments are therefore gaining momentum for diversification, reducing direct private equity allocations (from 13% in 2021 to 6% in 2023) while increasing hedge fund allocations (from 4% to 6%), private debt (from 2% to 3%), and infrastructure (0% to 1%) to diversify portfolios. Real estate, which served as a key inflation hedge in 2021 and 2022, is expected to see reduced allocations by family offices in 2023. However, European, Latin American, and U.S. family offices foresee bigger allocations in real estate over the next five years, while fewer Asia-Pacific investors see themselves increasing allocations. Regarding value opportunities, 45% of family offices with private equity investments plan to overallocate their portfolios towards the

• Changes In Asset Allocation In The Next Five Years • Increase

Stay the same

Decrease

Don’t plan on investing

• Fixed income (developed markets)

38%

37%

16%

8%

• Fixed income (emerging markets)

20%

53%

9%

18%

• Equities (developed markets)

44%

43%

12%

2%

• Equities (emerging markets)

34%

42%

16%

8%

• Private equity (direct investments)

41%

39%

13%

7%

• Private equity (funds / funds of funds)

35%

42%

14%

10%

• Private debt

26%

46%

11%

18%

• Hedge funds

21%

48%

17%

13%

• Real estate

33%

48%

11%

7%

• Infrastructure

20%

54%

3%

23%

Source: UBS Global Family Office Report 2023.

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

BY RAWAN HASSAN

LEADERBOARD

18

secondary private equity market, as they outperformed public markets in 2022, and exits remain challenging to achieve through IPOs. The private equity market, in general, is seeing noticeable growth, with its total assets under management reaching $11.7 trillion as of June 30, 2022. It has grown at an annual rate of 20% since 2017, according to McKinsey’s 2023 Global Private Markets Review. Around 35% of family offices rely more on active management and investment manager selection to enhance diversification. They exhibit confidence in hedge funds’ ability to generate investment returns, with 73% believing they will meet or exceed performance targets in the next 12 months. Overall, 41% plan to raise private equity direct investments over the next five years, noting that 56% of family offices with private equity investments prefer to invest using funds. Although family offices currently allocate nearly half of their assets to North America, more than a quarter of them intend to increase their investments in Western Europe within the next five years. Nearly a third of these offices plan to expand and diversify their allocations in the broader Asia-Pacific region. Family offices remain on the fence for digital assets, staying cryptocurious rather than crypto-committed since 2022, despite 56% of the family offices investing in cryptocurrencies and distributed ledger technologies in 2023, 38% invested less than 1% of portfolio assets.

SUSTAINABILITY

LEADERS

LEADERBOARD

19

SUMMIT

UNITE INNOVATE SUSTAIN Driving Economic Growth For A Greener World

NOVEMBER 1ST, 2ND & 3RD, 2023

THE RITZ-CARLTON GRAND CANAL • ABU DHABI, U.A.E.

For general inquiries: event@forbesmiddleeast.com For sponsorship opportunities: advertising@forbesmiddleeast.com F O R B E S M I D D L E E A S T.C O M

forbesmiddleeast.com AUGUST 2023

Sustainability

20 Smartest Cities In The World Here are the top 20 cities improving energy efficiency, reducing CO2 emissions, and increasing the well-being of citizens, according to the Institute for Management and Development in partnership with the World Smart Sustainable Organization. 1

Zurich

Helsinki

Zurich has embraced a circular economy, introduced eco-friendly waste management, and digitized its infrastructure. Zurich Airport has reduced its CO2 emissions by about 50% over the last 25 years, and it plans to be net zero by 2040. The Swiss Federal Railway runs on 90% hydropower and plans to be powered by 100% renewable energy sources by 2025. 2

3

8

Canberra

Canberra has a sustainable network of public transport options and is the first Australian city to encourage ride-sharing services so people can travel as groups and cut back on solo driving. Canberra is powered by 100% renewable electricity generated by wind and photovoltaic power. F O R B E S M I D D L E E A S T.C O M

Helsinki

According to the city’s pocket statistics, the emissions of greenhouse gases have been cut down by 33% since 1990. The city has 3,470 city bikes with 347 bike stations. Air quality was good or satisfactory 95% of the time in the city in 2022.

Oslo

The capital of Norway has a strong innovation culture. The city promotes ecodesign and architecture and is also highly digitalized, from its healthcare to shipping ports. Norway is accelerating its adoption of electric vehicles (EVs). According to data from the Norwegian Electric Vehicle Association, 2022 was another record for EV sales in the country, which showed 79.3% of all new cars sold during the period were fully electric, up from 64.5% in 2021.

underground car parks, and outdoor green spaces exist to complement the citizen-patient experience. Singapore’s Housing Development Board offers citizens access to affordable, quality homes.

9

4

Copenhagen

The Danish capital has invested in intelligent transportation systems (ITS) and intelligent traffic management to control traffic and optimize signals in real-time, resulting in more efficient flows of bikes and buses and reduced accidents. According to a Mckinsey & Company report, ITS will help Copenhagen achieve its vision to have 75% of all the trips in the city be by bike, public transport, or on foot by 2025. 5

Lausanne

This Swiss city is working toward being diesel-free by 2030. Hydropower accounts for roughly 57%

of Switzerland’s domestic electricity production, making it the country’s most important domestic source of renewable energy. 6

London

Most sectors in London have seen a significant reduction in emissions over the last few decades, mainly due to the nationwide decarbonization of electricity, government data showed. The city’s CO2 emissions were 28.1 million tonnes in 2020, down from 31.5 million tonnes in 2019. 7

Singapore

Singapore has a master plan for community-focused health where infrastructure like pedestrian walkways,

Geneva

Geneva’s energy policy is designed to be 100% renewable in 2050. The Swiss city has a range of public transportation options taking advantage of its topography, as it offers public excursion boats. It also encourages carpooling and car sharing and provides free-to-use bikes. 10

Stockholm

The Swedish capital launched Openlab, a creative center for solving societal challenges. The city’s leaders believe that in order to continue to grow sustainably and offer high quality in Stockholm’s city operations, new thinking and innovation are needed. The center was established to create the conditions for innovative solutions

AUGUST 2023

BY JOYCE ABAÑO ; MISTERVLAD/ SHUTTERSTOCK.COM

LEADERBOARD

20

with the aim of raising the quality of life of the city’s residents. 11

Abu Dhabi

Hamburg

One of the strengths of this German city is mobility. It has put importance on smart traffic management and smart parking, as well as offering comprehensive car sharing. The city plans to reduce CO2 emissions by 55% in 2030 compared to 1990 levels and by 95% in 2050 to achieve climate neutrality. 12

SALEH AL TAMIMI/ SHUTTERSTOCK.

LEADERBOARD

Beijing

Beijing’s government subsidizes the cost of public travel to boost the attractiveness of public transport and reduce the number of private trips, according to Statista. Major cities in China are also adopting advanced technologies and innovative approaches to minimize carbon emissions and improve urban living. According to the International Energy Agency (IEA), the country’s growing energy needs are increasingly met by renewables. 13

21

Abu Dhabi

Abu Dhabi has increasingly been focusing on digital innovation and sustainability to build a smart economy. The emirate’s Economic Vision 2030 aims to shift the base of its economy from natural resources to knowledge, innovation, and the export of cuttingedge technologies. Masdar City is its first sustainable city. It also houses the headquarters of the International Renewable Energy Agency, an intergovernmental organization that supports countries in transitioning to sustainable energy. F O R B E S M I D D L E E A S T.C O M

14

Prague

The capital of the Czech Republic has focused on traffic, lighting, and waste management to improve the lives of its citizens, according to PwC. It is aiming to make its transport system smoother, and with the latest technologies, it plans to create a better living space. 15

Amsterdam

Amsterdam combines multiple renewable energy sources, storage technologies, electric vehicles, and energy consumption optimization into a single, innovative smart energy management system. Its intelligent Energy Management System is expected to dramatically lower CO2 emissions and increase renewable energy’s economic value. 16

Seoul

Seoul’s e-governance system is believed to be the world’s most advanced, according to Sustainable, Smart, and Solidary Seoul. This includes expansive online government

services, free access to vast databases, and opportunities for electronic citizen engagement. The city’s Gangnam Resource Recovery Facility transforms waste into energy and helps reduce landfill and power neighborhood heating. 17

Dubai

The Dubai Plan 2021 called for the transformation of about 1,000 government services, implementing initiatives on open and easy access to data, smart transport, optimizing energy resources, smart parks, and beaches, police smartphone apps, and a new master control room. Dubai’s police force has a smart robocop that can find offenders through facial recognition technology. As of 2023, the city’s digitization rate of government services stands at 99.5%, achieving the objective of a paperless government. 18

Sydney

Sydney has implemented a strategy to cultivate vibrant,

livable places with the use of data and technology to help optimize street space allocation and prioritize active transport. Data is used to understand the community’s needs and preferences, providing efficient services to the community. 19

Hong Kong

Hong Kong has established a real-time arrival information system for green minibuses and continues to encourage public transport operators to open up their data. It also plans to set up a $1 billion Smart Traffic Fund to promote research and application of vehicle-related innovation and technology. 20

Munich

Munich introduced a project to promote a sharing economy, the reuse of resources, innovative business models, and the focused, socially compatible use of modern technology, including e-mobility, energyefficient street lighting, and energy consumption. AUGUST 2023

World’s Billionaires

Whether Musk and Zuckerberg will ever make it to the boxing ring remains to be seen, but their rivalry continues to make headlines. Here are some highlights and key stats.

F O R B E S M I D D L E E A S T.C O M

While the rivalry between centibillionaire media moguls Elon Musk, co-founder of Tesla and SpaceX and owner of Twitter, and Mark Zuckerberg, founder, chairman, and CEO of Meta, the parent company of Facebook, Instagram, WhatsApp, and Messenger, has recently intensified, the pair have been sniping at each other for years. Highlighting just a few examples, in 2016, an unmanned SpaceX Falcon 9 rocket blew up on its launchpad in Cape Canaveral, Florida during a test, also destroying a satellite that Facebook had planned to use, leading to Zuckerberg expressing his disappointment in a Facebook post. A year later, Zuckerberg shared his optimism about AI via a live video. Musk, unimpressed, said in a tweet: “I’ve talked to Mark about this. His understanding of the subject is limited.” Then, in 2018, Musk joined a campaign that urged users to delete Facebook over privacy concerns. Musk’s SpaceX and Tesla left the site. Their bickering escalated last month when Zuckerberg launched Threads on July 5, a new social media app linked to Meta’s Instagram to rival Twitter. It only took five days for Threads to hit 100 million users, according to online data service Quiver Quantitative, dethroning ChatGPT’s record as the fastest-growing consumer app in history. It took ChatGPT two months to reach 100 million users. AUGUST 2023

BY JOYCE ABAÑO; ELON MUSK; PHOTO BY DIMITRIOS KAIMAGE BY NORTH AMERICA / GETTY IMAGES VIA AFP MARK ZUCKERBERG; PHOTO BY JOSH EDELSON / AFP

LEADERBOARD

22

Musk Vs Zuckerberg: Who’s Winning The Tech Billionaires’ Brawl?

Threads, designed for real-time public conversations, allows users to post comments up to 500 characters long, compared to Twitter’s 280-character threshold. Links can be added to posts that could also include images and videos up to five minutes in length. A user can easily share a Threads post through an Instagram story or share it as a link on other platforms. On the day of the Threads launch, Twitter lawyer Alex Spiro sent a letter to Zuckerberg accusing him of poaching former Twitter employees to create a “copycat” platform. In the letter, Spiro accused Zuckerberg of hiring dozens of ex-Twitter employees who “had and continue to have access to Twitter’s trade secrets and other highly confidential information.” Andy Stone, Communications Director at Meta, responded in a post saying, “No one on the Threads engineering team is a former Twitter employee— that’s just not a thing.”

Free speech vs hate speech Both billionaire founders have faced criticism outside of their spat. Facebook became the bad guy in 2016 as it was revealed how unprepared the platform was to police fake news. As the year unfurled, the company had to deal with a series of controversies that included the spread of disinformation about candidates in the lead-up to presidential elections, reaching the platform’s then 1.79 billion monthly active users. In 2019, Zuckerberg was called to appear before the US Congress. Zuckerberg told lawmakers he was open to regulation as long as it didn’t impact its business model and users’ ability to communicate freely. In October 2021, former Facebook product manager and whistleblower Frances Haugen alleged that company executives, including Zuckerberg, had misled investors for years and that the platform

had allowed hate speech and misinformation to go unchecked, putting profits before its users. FTC imposed a $5 billion penalty and sweeping new privacy restrictions on Meta in 2019, prompting the social media firm to introduce stricter privacy settings on all its social media platforms—Facebook, WhatsApp, Instagram, and Messenger. Online safety was also emphasized. For businesses, Meta introduced new advertising solutions on Facebook, like AR ads and Facebook stories ads. On July 11, 2023, Musk tweeted on his official account, “you are free to be your true self here.” But while Musk gives importance to free speech, the platform is often accused of allowing hate speech, violence, or harassment, things that Musk says he will not tolerate as owner. Twitter’s rules were highlighted as the billionaire continued in his quest to make the company more profitable. The social media firm stated it will “ensure all

ELON MUSK PHOTO BY JOËL SAGET / AFP, MARK ZUCKERBERG ALAIN JOCARD / AFP

Elon Musk

people can participate in the public conversation freely and safely.” In 2022, Twitter reinstated accounts that were previously suspended or banned. Over 60,000 accounts were restored, which included former U.S. President Donald Trump’s. In early December 2022, Musk started releasing internal Twitter communications, which he called “Twitter Files,” claiming that they disclosed the platform’s previous efforts to suppress free speech, especially from conservative voices. He also revamped Twitter’s verification system, introducing the “Twitter Blue” paid premium subscription service, adding a blue checkmark to a user account, a gold checkmark for companies and brands, and a gray checkmark for government and multilateral accounts. In February 2023, Zuckerberg introduced Meta Verified, adding a blue checkmark to profiles or pages confirming authenticity.

Mark Zuckerberg

52

Age

39

$248.1 billion

Net worth as of July 13, 2023

$111 billion

2

Rank on Forbes’ billionaires list 2023

16

24: Musk co-founded online bank X.com in 1999, which merged with Confinity in 2000 to form PayPal.

Years active

19: Zuckerberg cofounded

Musk has co-founded six companies, including Tesla, SpaceX, and the Boring Company. He acquired Twitter for $44 billion in April 2022.

Companies

Zuckerberg owns around 13% of Meta Platforms, which owns and operates Facebook, Instagram, Threads, Messenger, and WhatsApp.

Approximate number of platform users as of July 2023

Facebook: 2.99 billion

Twitter: 353.9 million

Source: BankMyCell F O R B E S M I D D L E E A S T.C O M

Facebook in 2004.

Meta: 3.81 billion Threads: 105 million Source: Meta AUGUST 2023

23 LEADERBOARD

See you in court

By Alex Konrad

Inflection AI, The Year-Old Startup Behind Chatbot Pi, Raises $1.3 Billion Backed by Microsoft, Nvidia and billionaires Reid Hoffman, Bill Gates and Eric Schmidt, the startup led by ex-DeepMind leader MUSTAFA SULEYMAN is valued at $4 billion—and claims to have the world’s best AI hardware setup.

L

Less than two months after the launch of their first chatbot Pi, artificial intelligence startup Inflection AI and CEO Mustafa Suleyman have raised $1.3 billion in new funding. Microsoft, Nvidia and three of tech’s most influential billionaires led the investment in the Palo Altobased startup launched in early 2022. LinkedIn cofounder Reid Hoffman, Microsoft cofounder Bill Gates and former Google CEO Eric Schmidt all personally invested, with Nvidia the sole new investor among the group. The new funding values Inflection at $4 billion, according to a source with knowledge of the transaction. Inflection said the company and Suleyman remained majority shareholders and declined further comment. In an interview, Suleyman said that the group of mostly insiders proposed the additional investment after Inflection was “overwhelmed with offers” following the launch of Pi, its conversational chatbot launched in May. “I think people can see that it’s

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

COURTESY OF INFLECTION AI

CONTRARIAN • TECHNOLOGY

24

CONTRARIAN • TECHNOLOGY

“Microsoft has been amazing, they’re turbo-charging us, they are our anchor,” Suleyman said. “And as a result of our collaboration with Nvidia, we’ve been able to tune our cluster to get it to be the absolute best in the world. We can objectively say now that we have the very best hardware in the world.” Microsoft CTO and AI lead Kevin Scott and Nvidia CEO Jensen Huang declared their support for Inflection in statements, with Huang saying that “the world-class team” at Inflection would help usher in “amazing personal digital assistants.” With this latest funding, Inflection plans to continue expanding its computing capabilities further developing Pi, a bot trained to engage in a conversational back-and-forth with users to tease out more valuable questions and answers. That chatbot, which Forbes previewed in early May, is “seeing huge engagement” as it adds new features, according to Suleyman. Inflection declined to provide user numbers to corroborate that claim. The model used for Pi, which Inflection announced earlier in June and said had similar computing capabilities to OpenAI’s ChatGPT, is one of the smaller ones it’s had in the works, Suleyman claimed, with much bigger to come. Also in the short-term pipeline: an API for selected partners to train their own conversational AIs. (Inflection doesn’t plan to make that generally available as it focuses on its own consumer products, Suleyman said.) All of that means more funding is imminent — “I expect we will continue to raise at an accelerated rate” — but don’t expect Inflection to raise it from venture capital firms. “Our network and reach isn’t something that regular VCs can help accelerate,” Suleyman said. “What I’m personally looking for as a CEO is just advice, to benefit from the wisdom of their experience.” (The large sums of cash help, too.) For skeptics raising their eyebrows at the dollar amounts involved, both for the cost of training large language models and for the rounds their creators are raising, Suleyman offered a couple of explanations. While the cost of training AI models has decreased over time, Inflection and its rivals’ desire to train ever-bigger ones means that their absolute spend continues to grow, he said. Then there’s the “tidal wave” of investor and consumer interest in such technologies — one that Suleyman is happily “surfing.” “It’s totally nuts,” he admitted. Facing a potentially historic growth opportunity, Suleyman added, Inflection’s best bet is to “blitz-scale” and raise funding voraciously to grow as fast as possible, risks be damned. “There is, you know, ‘small is beautiful,’ we have demonstrated that in under a year,” Suleyman said. “This is the beginning of a journey, really just the starting line.”

Largest AI fundraising rounds*

Argo AI

OpenAI Amount Raised ($) Date

Cruise

Inflection AI

SenseTime

10B

2.6B

2B

1.3B

1B

1/23/23

7/12/19

1/19/21

6/29/23

9/10/18

*Additional rounds per company excluded • Source: Crunchbase F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

25 CONTRARIAN • TECHNOLOGY

just the tip of the iceberg,” Suleyman told Forbes. “There’s so much further to go after [Pi] validates the core thesis, which is that conversation is the new interface.” Some details of Inflection’s new deal with Microsoft and Nvidia are, like Suleyman’s iceberg, still largely out of view. He declined to provide a breakdown of how much of the $1.3 billion raised included cash equivalents (such as computing credits) but said that a “very, very large chunk” was in dollars. “We have all the cash we need to run and operate,” he added. Inflection also declined to comment on how much equity Microsoft and Nvidia now held in the business. But Suleyman said neither company commands ownership-like control over it, or other preferential rights. “In practice, it was a very traditional round,” he said. “There’s no IP movement, and we still are entirely independent and at liberty to do whatever we want on the commercial front, and partner with whomever we want. So there are no real restrictions,” he said. What is clear: the round significantly deepens Inflection’s ties with Microsoft and Nvidia, two key partners in the AI race. Microsoft, also a major investor in OpenAI, is Inflection’s cloud computing partner; Nvidia, meanwhile, has been working closely with Inflection on the deployment of its flagship H100 graphics processing unit (GPU), the current gold standard for AI training and powering large language models like OpenAI’s GPT-3. Nvidia worked closely with Inflection and service provider CoreWeave to co-develop Inflection’s current H100 cluster; Inflection paused its own work for Nvidia to run a recent test that Nvidia announced this week had set records on eight tests of current AI model training benchmarks, completing a benchmark based on GPT-3 in less than 11 minutes. That test, which matched the computational power of training a model that took an estimated three to six months to develop, ran on Inflection’s 3,584 H100 GPUs already in service, Suleyman noted. But in the wake of this funding round and partnership, Inflection’s growing horsepower is about to get a turbo-charge. Nvidia and CoreWeave (which helps physically deploy the GPUs) are now in the process of helping Inflection install many thousands more. Once fully operational, Inflection’s new cluster will run 22,000 H100s. Inflection believes that to be the largest GPU cluster for AI applications in the world, ahead of Meta’s 16,000 GPU cluster announced in May. (Just how many OpenAI is using is currently unknown; Nvidia announced last November it planned to incorporate “tens of thousands” of GPUs into Microsoft’s Azure cloud service.) Against the world’s largest clusters overall, Inflection said it estimated that it would trail only Frontier, the supercomputer maintained by the Oak Ridge National Laboratory in Tennessee.

• COVER STORY •

JAMJOOM PHARMA

26

EXECUTING AN EVOLUTION Tarek Hosni, CEO of family-owned Saudi pharmaceuticals giant Jamjoom Pharma, led the company through an IPO in June 2023—the largest the kingdom has seen so far this year. Now he’s looking at new product growth to make the company an international name.

BY JASON LASRADO F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

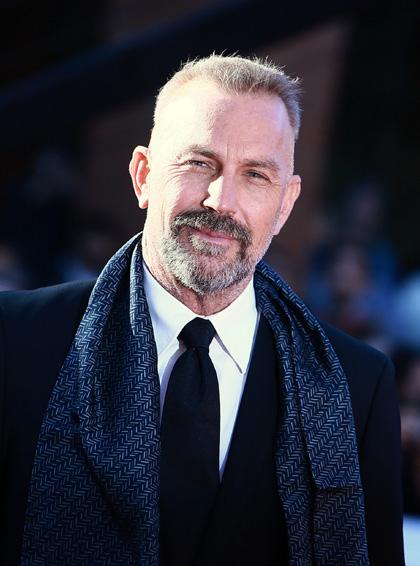

Tarek Hosni, CEO of family-owned Saudi pharmaceuticals giant Jamjoom Pharma.

IMAGE FROM SOURCE

27

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

JAMJOOM PHARMA

28

O

On June 20, 2023, Jamjoom Pharmaceuticals Factory (Jamjoom Pharma) debuted on the Saudi exchange, selling 21 million shares, or 30% of its issued share capital. With an offer price of $16, on the first day of trading the company’s share price rose by 30%, closing the day at $20.8. As of July 17, the stock was trading at $33.9, making the offering the Saudi exchange’s largest IPO so far this year and one of its most successful debuts ever. It was an understandably proud moment for Tarek Hosni, CEO of Jamjoom Pharma. The company was valued at $2.4 billion as of July 19. When Jamjoom Pharma applied for the IPO in February 2022, the Saudi Markets were booming. In April 2022, the Tadawul All Share Index (TASI) was above 13,700 points, more than doubling in the two years since March 2020. However, between the application and approval of the IPO in December 2022, the Saudi markets reversed sharply, with the TASI falling to just under 10,100 points. The market then trended sideways over the following three months as the world faced a war in Europe, high inflation, and fears of a global recession. All in all, it was not the best time for an IPO, but Hosni brought in the Saudi Economic and Development Holding Company (SEDCO) and the Al Faisaliah Group Holding Company as cornerstone investors. Together, the companies subscribed to 5,166,666 shares at the offer price, representing 24.6% of the offer shares and 7.4% of the company’s issued share capital. In the end, Jamjoon Pharma’s IPO was oversubscribed 88.8 times (excluding the shares that were allocated to cornerstone investors) and received great interest among institutional investors in Saudi Arabia and internationally. “The Jamjoom Pharma IPO was a consequential IPO for the Saudi equity capital markets. The IPO has set many precedents for the Saudi main market, being the largest IPO of 2023 following a six-month drought, the largest IPO of a F O R B E S M I D D L E E A S T.C O M

pharmaceutical company, and the first IPO to include cornerstone investor tranche,” says Amir Riad, Head Of Investment Banking at Saudi Fransi Capital, who advised on the deal. Fadi AlAwami, Financial Advisor and Founder of The Consultation Center, explains that IPOs go a long way in making a country attractive for business. “IPOs are an important factor to measure a country’s economy in terms of creating investment opportunities and to help companies to increase their capital,” he adds. But while Jamjoom Pharma went public to raise capital, the more vital goal was to instill best practices to become a global player. “Raising money was not even 20-30% of our objective. The key was governance,” explains the CEO. Hosni was the right person for the task. Before joining Jamjoon Pharma in 2021, he spent his entire career with two big pharma global players, spending over 30 years working at GlaxoSmithKline and Pfizer. A pharmacist by training, Hosni started his career with SmithKline & French (now GSK) as a medical representative in Saudi Arabia. He then moved to the U.K. with the company, where he lived for five years and moved into management roles. By 1998, he was head of marketing and commercial for GSK in the Middle East, Africa, Pakistan, and Turkey. In 2001, he moved back to his home country of Egypt as the commercial director of Egypt and Sudan until 2004, when he moved to the U.A.E. to become regional head of marketing for Wyeth (now Pfizer).

“You don’t get an opportunity like this to transform, perform, change the structure, go for IPO, and we have done this in a very short time.” In 2006, Hosni moved to Saudi Arabia as general manager of the Jeddah governorate for Wyeth and nearly tripled its revenue from $60 million in 2006 to $170 million in 2009. When Pfizer acquired Wyeth that year, he moved again, this time to the U.A.E. as regional president for nutrition in Africa and the Middle East, where he increased revenues from $150 million in 2009 to $271 million in 2017. By the time Hosni left Pfizer in 2018, he was leading a billion-dollar business, making it the best-performing big pharma company in the region. While heading Pfizer’s middle eastern business, Hosni was looking to strike partnerships and alliances in the two biggest markets in the Middle East and

AUGUST 2023

IMAGE FROM SOURCE

F O R B E S M I D D L E E A S T.C O M

began exporting products outside Saudi Arabia to Bahrain. Since then, the company has focused on international expansion and innovation. By 2010, Jamjoom products were available in more than 15 countries. By 2015, the company’s annual manufacturing capacity had reached 90 million units, and the following year it established the largest pharma R&D capacity facility in Saudi Arabia. In 2022, Jamjoon Pharma recorded sales of $244 million, making it a market leader in Saudi Arabia, Egypt, Iraq, and the U.A.E. Today, its primary operating production facility is a 46,500-square-meter state-ofthe-art manufacturing plant in Jeddah, with a production capacity of 113 million units per year. It has a direct and indirect presence in 36 countries in the Middle East and Africa.

The company’s main markets are poised to grow. With over 500 hospitals and 75,000 beds, Saudi Arabia’s public expenditure on healthcare grew to an estimated $50 billion in 2022. This, combined with mandatory health insurance for all private sector employees and their families, is encouraging growth in consumer expenditure on health products and medical services, which hit $7.2 billion last year. Saudi Arabia currently imports the majority of its pharmaceutical products from the U.S., Europe, China, and India, but as part of its Vision 2030, it aims to achieve 40% of total pharma consumption to come from local

AUGUST 2023

29 JAMJOOM PHARMA

Africa, namely South Africa and Saudi Arabia. It was through this that he first met the Jamjoom family. In 2020, he was contacted about taking the role of CEO at Jamjoom Pharma, but he was initially reluctant to join, having spent over three decades in big pharma. However, once the owners shared their vision for the company, it piqued his interest. “I always admired some of the other examples where domestic companies became strong regional players and then became international,” he explains. Hosni joined Jamjoom Pharma in April 2021. His task right from the beginning was to make changes with the intention of going public. He set about putting the right people and processes in place and increasing transparency, reviewing the strategy of the company in order for it to be more appealing to shareholders. “I really enjoyed every moment, you don’t get an opportunity like this to transform, perform, change the structure, go for IPO, and we have done this in a very short time,” he adds, recalling the journey. Jamjoom Pharma’s history goes back to 1957 when a group of brothers from the Jamjoom family entered the pharmaceutical distribution sector through an acquisition led by Yousuf Mohammed Salah Jamjoom. At that time, the company was known as Jamjoom Medical Store, which evolved into one of the country’s largest pharmaceutical distributors under a holding company called Abdullatif Mohammed Salah Jamjoom and Brothers, with partnerships with pharmaceutical giants like Pfizer and Allergan. As the pharmaceutical market in Saudi Arabia started to expand in the early 1990s, Yousuf Jamjoom identified an opportunity to localize pharmaceutical manufacturing capabilities. Yousuf, together with his son Mahmoud, decided to create a state-of-theart manufacturing facility using the latest technology. This led to the establishment of Jamjoom Pharmaceuticals Factory Company. The company started production and commercial operations in 2000. In 2002, it

JAMJOOM PHARMA

30

production. The kingdom has been actively facilitating new products approved, with a bioequivalence success technology and research-driven partnerships with rate of 94%. It launched 17 new products in 2021 and global manufacturers such as AstraZeneca, Pfizer and has 72 new products in the pipeline, 64% of which an MoU with GlaxoSmithKline. This, combined with have either been submitted for approval to the SFDA portfolio expansion by existing local manufacturers, or are close to submission. New products contributed resulted in the contribution of local products to the 4%, 8%, and 18% to the company’s total revenues in overall pharmaceutical market growing from 30% in 2019, 2020 and 2021, respectively. 2018 to 36% in 2021. This has encouraged companies “Being able to participate in the healthcare like Jamjoom to actively capitalize on the push for revolution that is expanding across the globe is localization in expanding its portfolio in both existing essential for counties that aim to provide top-notch and new product lines. therapies,” emphasizes John D. Philips, Director For example, in 2015 and 2019, it launched two of Research & Innovation at the Abu Dhabi new consumer health products, JP Vitamin D3 and Stem Cells Center. “Capitalizing on this locally Prima D3, after research showed that 80% of Saudi’s gives universities, healthcare organizations, and adult population was suffering from some form of businesses a platform from which to make exciting vitamin D deficiency and over 45% of the market was discoveries that lead to treatments, drugs, and dominated by liquid products, which are less effective devices that will be used globally.” than solid-dose alternatives. The company created Looking ahead, and Hosni now plans to make a formula for an alternative soft-gel product Jamjoon Pharma the leading pharma Stay with a better absorption and stability rate and manufacturer in the Middle East and Africa connected launched a full suite of vitamin D products, by 2026. “Many of the names you define as big with our latest business news. helping it to capture a 40% market share in pharma started off as family businesses; some of this category by 2021. them still are,” he says. “I would like to see this Jamjoom Pharma has over 90 scientists and company evolving in its journey to become a real Ph.D. graduates in its R&D team. Between significant regional player and then evolve to a January 2019 and May 2023, it had over 400 multinational international player.”

Saudi IPOs 2023 While Saudi’s IPO market was not as vibrant in 2023 as global factors dampened investors’ interest, the Saudi exchange has seen a few large IPOs. Here are the top five from the first half of 2023. Company

IPO size

• Jamjoom Pharma

$336 million

Jamjoom Pharma is a manufacturer and marketer of pharmaceutical products in the MENA region. The company has a wide range of products in its portfolio, including generic drugs, over-the-counter medications, and specialized treatments.

• First Mills

$266 million

Founded in 2017, First Mills produces flour, feed, bran, and wheat derivatives. It covers all major regions of Saudi Arabia through four largecapacity mills.

• Morabaha Marina Financing Company (MRNA)

$83.4 million

MRNA is an independent non-bank finance institution, offering a range of flexible Shari’ah-compliant financing solutions to individuals and SMEs. It has 16 branches across 13 cities in Saudi, in addition to its head office in Riyadh.

• AlMawarid Manpower

$76.8 million

Established in 2012, AlMawarid offers a variety of services to provide domestic and other professional staff to both private and public sectors. The company extends professional support services for the accurate management of the human resources recruitment process from all countries.

• Tam Development Company

$20.3 million

Established in 2012 and listed on the Nomu Parallel Market in June 2023, Tam Development Company is a management consultancy firm with digital business solutions. It has partnered with over 50 government entities.

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

31

The Under 30 Summit serves as a platform to showcase the exceptional talents featured in

the 2023 Forbes Middle East 30 Under 30 list. Attendees can expect thought-provoking discussions, where these budding visionaries engage with industry experts and share their insights on innovation, entrepreneurship, and the future of business.

NOVEMBER 23rd , 24th, 25th & 26th

2023 EGYPT EL GOUNA

F O R B E S M I D D L E E A S T.C O M

www.forbesmiddleeast.com

For general inquiries: event@forbesmiddleeast.com For sponsorship opportunities: advertising@forbesmiddleeast.com AUGUST 2023

• TOP 100 ARAB FAMILY BUSINESSES •

HASSAN ALLAM HOLDING

32

GOING STRONG

Hassan Allam Holding’s third-generation leaders, Hassan Allam and Amr Allam, the Co-CEOs of the group, have been overseeing their family business since 2009 and 2010, respectively. They are now focused on expanding the company’s operations, leveraging hitting $5.5 billion in backlog in 2022.

BY HAGAR OMRAN F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

Hassan Allam and Amr Allam, the Co-CEOs of Hassan Allam Holding.

IMAGE FROM SOURCE

33

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

HASSAN ALLAM HOLDING

34

W

While being lucky enough to be born into a thriving family business may seem like a guaranteed path to success, the truth is that there are no guarantees. According to Deloitte, more than 70% of family businesses fail before reaching the third generation. That is not the case for Hassam Allam Holding, an Egyptian construction, engineering, and utilities company. Now under the leadership of two of the founder’s grandchildren, it has been growing at a rapid rate for over 87 years. The group’s backlog has grown over tenfold in the last 13 years alone, from $500 million in 2009 to $5.5 billion in 2022. Hassan Allam and Amr Allam, the group’s Co-CEOs, attribute the success of the family business to institutionalization and sound governance. “Any family business that isn’t institutionalized will be restricted in terms of growth and success,” explains Hassan. “The right governance and organizational structure help businesses succeed and operate as an institution rather than a family affair.” The group’s founder, Hassan Allam, started the family enterprise as Hassan Mohammed Allam & Co. in 1936 after quitting school to join his father’s small shop selling construction materials. The construction of El Kassaseen Hospital on the Cairo-to-Ismailia agricultural road was Hassan Allam’s first major contract. In 1964, the company was fully nationalized and became Nasr General Contracting. However, in 1975, the investment and legislative climate in Egypt changed, allowing the private sector to re-emerge, and the founder established a new entity, which is what is known today as Hassan Allam Holding. Today, the group employs 45,000 people and operates across 18 subsidiaries in several countries, including Egypt, Saudi Arabia, Oman, Jordan, Libya, DRC, Algeria, Germany, and Iraq, focusing on engineering, construction, investment, and development. Hassan joined the construction arm of Hassan Allam Holding in 2002 and held several positions in the construction division, including Operations F O R B E S M I D D L E E A S T.C O M

Director and Managing Director, before becoming the CEO in 2009. Amr Allam started his career in 2004 by joining the Consolidated Contractors Company as a project engineer. In 2007, he joined Hassan Allam Construction as head of new businesses. He became co-CEO of Hassan Allam Holding in 2010. The brothers divide their responsibilities. While Hassan oversees construction and engineering in addition to supervising strategic plans, business growth, and international expansion, Amr is more engaged in spearheading the evolution of the group’s corporate strategy and expansion through new investments, including launching Hassan Allam Utilities, Hassan Allam Holding’s investment and development arm, in 2017.

“Local blue chips, including Hassan Allam Holding, will benefit from Egypt moving in the right direction.” “The most successful families have struck the right balance for prioritization across the areas of succession, in-house governance, board composition, cyber, and tax, and they have taken action accordingly,” says Scott Whalan, Partner at Deloitte Middle East. “Throughout the ongoing transformation journey many Middle East family enterprises are experiencing, communication remains a core element proven to be essential in helping minimize obstacles along the way. Open and honest communication amongst the family; amongst the board, management and independent directors; and amongst advisors supporting the transformation.” According to Hassan, favorable market conditions in Egypt have also helped Hassan Allam Holding’s growth trajectory as it capitalizes on emerging prospects to enhance its market position. During the 2009-2010 financial year, Egypt’s GDP grew by 5.1%. The International Monetary Fund expects growth of 3.7% for the 2022-2023 financial year, followed by 5% growth in 2023-2024. This is still a slowdown from the 6.6% growth rate achieved in 2021–2022. Hassan Allam Holding has been engaged in a wide range of local and regional diversified projects that have supported its long journey. The group’s current project portfolio includes the first phase of the Cairo Metro Line 4, which the company is undertaking in partnership with Arab Contractors and PETROJET as part of an Egyptian consortium. The Ministry of Transportation

AUGUST 2023

IMAGE FROM SOURCE

F O R B E S M I D D L E E A S T.C O M

AUGUST 2023

35 HASSAN ALLAM HOLDING