26 minute read

Industry Update

ARA WINS ANSI MEMORANDUM FIGHT FOR MEWPS

The American Rental Association (ARA) has won two separate appeals before the American National Standards Institute (ANSI) Board of Standards Review, ultimately forcing the A92 committee to remove all reference and requirements for a Manual of Responsibility (MoR) to be placed on mobile elevating work platforms (MEWPs).

This means that owners of MEWPs do not have to maintain any MoR past or present on any MEWP going forward.

“This is a huge victory for the equipment and event rental industry,” says John McClelland, ARA vice president for government affairs and chief economist, as well as the ARA’s main representative on the A92 committee. “Eliminating the MoR requirement will save our industry millions of dollars going forward. In addition, our appeals have established a precedent making it clear that no ANSI committee can make such a requirement without running afoul of ANSI’s commercial terms.”

The ANSI A92 Committee published its standards for MEWPs on Aug. 12, 2020. The suite of standards has been in development since 2010, but they have been delayed due to appeals filed by ARA over the inclusion of an MoR that was initially required to be placed and maintained on each machine.

ARA successfully argued that the MoR was a violation of ANSI’s commercial terms because it was a copyrighted document that was only available from the Scaffolding Access Industry Association (SAIA), which also is the secretariat of the A92 committee. For more, visit forconstructionpros.com/21627325.

UNITED RENTALS CREATES LEARNING PLATFORM FOR SALES DEVELOPMENT

United Rentals has created an innovative learning platform to roll out sales training consistently throughout North America that has led to reduced onboarding time, decreased turnover, and increased sales rep effectiveness.

United Rentals created a custom sales development initiative using the Brainshark sales readiness platform, United Rentals’ Sales Development Program. The program is focused on not only the equipment United Rental offers, but also the importance of the key messages associated with the company and its offerings.

“United Rentals provides a comprehensive Sales Development Program to help new sales reps learn the construction and equipment rental business. We teach and mentor on the best ways to sell and provide solutions for customers, as well as about our product advantages and differentiating features. We’re passionate about helping our people grow professionally and embrace teamwork in everything they do,” said Jeff Cummings, director of sales development at United Rentals.

The United Rentals Sales Development Program trains sales reps on four main pillars: • Equipment industry knowledge • Sales methodology and how the company goes to market • Sales strategy and how it competes • Sales tools, both internal and external

Cummings and his team found that having all the training and content available in digestible pieces – nothing was too long or in-depth – was critical to the program’s success. Within Brainshark, United Rentals broke larger concepts into micro training to make it easier for sales reps to review and retain. To read more, visit forconstructionpros.com/21627975.

HERC HOLDINGS ACQUIRES TEXAS-BASED CBS RENTALS

Herc Holdings Inc., a North American equipment rental supplier operating as Herc Rentals Inc., has entered a purchase agreement to acquire all the assets of Texas-based CBS Rentals.

CBS is a full-service general equipment rental company comprised of approximately 190 employees and 12 locations serving construction and industrial customers throughout Texas, as well as locations in Carlsbad, New Mexico, and Kingsport, Tennessee. The addition of CBS expands Herc Rentals’ presence in Texas — one of the largest equipment rental markets in North America — to 38 physical locations, which provide general and specialty equipment rental solutions and related services.

“I look forward to welcoming CBS Rentals to Team Herc,” said Larry Silber, president and CEO, Herc Rentals. “Like Herc Rentals, CBS has more than 56 years of history, substantial equipment rental experience, and a strong reputation for exceptional customer service, topquality equipment, and operational excellence.”

He continued, “Our combined teams and resources position Herc Rentals to be a preeminent equipment rental partner across Texas serving a diverse mix of construction, industrial, and government customers.

The transaction, which is subject to customary closing conditions and regulatory approvals, is expected to close prior to the end of 2021 To read more, visit forconstructionpros.com/21615012.

Compressed Air That Means Business

The M55PE portable compressor delivers 185 cfm at 100 psig and delivers superior fuel economy and reliability with the combination of the Sigma Profile™ airend and Tier 4 Final diesel engine.

And it’s your business on the line.

Kaeser’s Mobilair™ portable compressors have been powering the toughest jobs for more than 35 years. Construction, demolition, and rental use are all in a day’s work for Mobilair. The one your Cold start batteries give reliable operation customers ask for. even when the temperature drops. Oversized fuel tanks and energy efficient operation mean there’s no stopping mid-job to refuel. Galvanized steel chassis take the hits from even your roughest customers. Visit us.kaeser.com/rental to get the best for your business.

Kaeser Compressors, Inc. • (866) 516-6888 • us.kaeser.com/rental

Mobilair and Sigma Profile are trademarks of Kaeser Compressors, Inc. ©2021 Kaeser Compressors, Inc. customer.us@kaeser.com

Compact equipment?

Meet compact HMI.

Just because the equipment is smaller doesn’t mean the work is. The Murphy PowerView 700 delivers rich infotainment and powerful control to help operators get the job done. Designed for rugged, all-weather environments, the PV700 has superior sunlight-visibility, a glove-friendly touchscreen and an IP69K-protected enclosure.

Learn more at EnovationControls.com/PV700

BOOTH #2209

BOOTH #5014 DEERE, HITACHI DISSOLVE 30-YEAR EXCAVATOR JOINT VENTURE

Hitachi Construction Machinery (HCM) and Deere have announced plans to dissolve their longstanding joint venture in the Americas.

The move comes as Hitachi moves to “determine its own destiny in the Americas,” according to HCMA CEO Alan Quinn, with plans for new equipment, technologies, and an expanded dealer presence in the Americas.

The dissolution of the joint venture will be completed Feb. 28, 2022. At the same time, HCM is announcing that HCMA will assume all product and service operations for the Americas in spring 2022. HCMA will continue to be a whollyowned subsidiary of the Hitachi Construction Machinery Group.

HCMA is planning to add more than 60 new local positions to strengthen its North American headquarters in Newnan, Ga.

Details from Deere The origins of Deere and Hitachi’s joint venture reach all the way back to an original supply relationship established in the early 1960s. After nearly three decades of working together, the two companies entered the joint venture in 1988, with plans to produce excavators in Kernersville, N.C.

In 1998, Deere-Hitachi expanded the relationship to include the production of forestry swing machines at Deere-Hitachi Specialty Products in Langley, British Columbia, Canada. In 2001, John Deere and Hitachi combined their marketing and distribution efforts in the Americas. In 2011, excavator manufacturing was expanded with the addition of the Deere-Hitachi Brazil factory in Indaiatuba, Brazil.

According to Deere: • John Deere will acquire the Deere-Hitachi joint-venture factories in Kernersville, NC; Indaiatuba, Brazil; and Langley, B.C. • John Deere will continue to manufacture Deere-branded construction and forestry excavators currently produced at the three Deere-Hitachi factories. These locations will discontinue production of Hitachi-branded excavators. John Deere will continue to offer a full portfolio of excavators through a supply agreement with Hitachi. • John Deere’s marketing arrangement for Hitachi-branded construction excavators and mining equipment in the Americas will end; Hitachi will assume distribution and support for these products.

“For many years, John Deere and Hitachi enjoyed a mutually successful partnership in the Americas,” says John Stone, president, John Deere Construction & Forestry Division and Power Systems. “As we turn the page to a new chapter of Deere-designed excavators, we remain committed to supporting our customers of today and tomorrow.” To read the full article and see what Hitachi’s plans are, visit forconstructionpros.com/21615312.

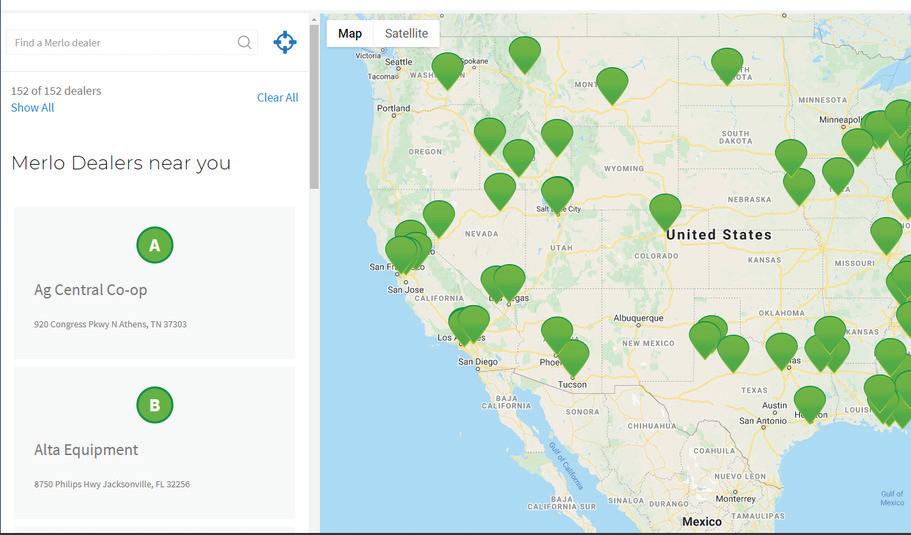

AMS-MERLO WEBSITE UPDATES ENHANCE USER EXPERIENCE

Applied Machinery Sales, the official importer and distributor of Merlo telehandlers and the DBM mini cement mixer for the U.S., added a few customer centric upgrades to its ams-merlo. com website.

“We added quick access links to find a dealer, created a document library for more in-depth information on each product line, and to find information on available used equipment here at the Rock Hill, South Carolina, site and from select dealers,” says Austin Bailey, AMS sales manager.

He continued, saying, “We are seeing a significant increase in demand for Merlo telehandlers across many industries.” Bailey says. “As we increase our dealer base to meet this demand, their contact and web information will be quickly added to our dealer finder.”

The Dealer Locator, located on the top navigation bar, lists over 100 dealer addresses across the United States. Just add in a state or zip code and a list with map will pop-up. If there is no dealer available for the chosen location, the link on the bottom of the page sends a direct inquiry to AMS. To read about the other updated features, visit forconstructionpros. com/21659875.

DEUTZ CORPORATION OPENS NEW LAS VEGAS POWER CENTER

DEUTZ Corporation will be adding another DEUTZ Power Center in Las Vegas. The new location will be called DEUTZ Power Center West. “Since we launched the DEUTZ Power Center concept back in 2014, our OEM partners and end user customers have really embraced it and made it a big success,” said Dominick A. “Nick” Vermet, vice president, Power Center Operations for DEUTZ Corporation. “The addition of DEUTZ Power Center West in Las Vegas will help us not only serve the large number of rental companies in southern Nevada, but it will also help us provide much-needed DEUTZ service and parts to our customers in San Francisco, Los Angeles, and all across California.” To read more, visit forconstructionpros.com/21615082.

COME VISIT US

LAS VEGAS, NV // OCT. 18-20, 2021 BOOTH #3617

The sale of Doosan Infracore to Hyundai Heavy Industries Holdings Co. (HHIH) has officially closed. Doosan Infracore now becomes a subsidiary of the newly created Hyundai Genuine (HG) group alongside Hyundai Construction Equipment (HCE), as two independent construction equipment companies under HHIH. HG will act as the intermediary company of HHIH Group’s construction equipment businesses and will be leading both DI and HCE to maximize the company’s efforts and focus on the construction equipment industry. Together the two brands will combine as a global top 5 player.

It was first announced in 2020 that Doosan Group was looking to sell its shares of the company to help improve its finances and repay debts held by Doosan Heavy Industries & Construction, and that Hyundai was a top contender early on. In December 2020, it was announced that Hyundai was the preferred bidder.

Hyundai signed a deal in February 2021 to acquire a 35%

TM

It’s Not Just for Rocks!

stake in Doosan Infracore; its subsidiary Hyundai Genuine Co. took over that stake in April. Per The Korea Herald, regulators’ approval of the deal will also aid Doosan Heavy with its corporate restructuring. The deal will also help Hyundai Genuine to increase its market presence in Korea as well as the global construction market.

The combination of Hyundai Construction Equipment and Doosan Infracore will reportedly create a new construction equipment powerhouse. The two entities currently stand at No. 20 and No. 9 in the global construction equipment market, according to a Pulse News report. The joining of the two companies is set to create the world’s fifth-largest construction equipment player, and No. 1 in South Korea.

In addition, the acquisition will further expand Hyundai

Construction’s global presence. Doosan Infracore’s excavator operations will also help to enhance Hyundai’s excavator engine business.

To read the full article, visit forconstructionpros. com/21195935.

SAVE TIME! SAVE MONEY! SAVE YOUR BACK! THE POSSIBILITIES ARE ENDLESS!

Offer your rental customers a cost effective solution for their landscaping and construction projects with the RockVac. The self-powered machine will vacuum rocks, wood chips and shavings, sand, gravel, leaves, compost, mud, sludge, glass and debris. Fill a wheelbarrow in less than 3 minutes!

20421 - 15th Street SE Blomkest, MN 56216 800-328-8896

www.rockvac.com sales@christianson.com

PLAN FOR WORK TRUCK SHORTAGES TO LINGER DUE TO TIGHT MICROCHIP SUPPLY

If you are struggling to find new work vehicles, you are not alone. There is currently limited availability coupled with elevated prices.

As the supply chain continues to recover, we may have already seen the worst of the shortage. “Availability has made a slight improvement,” says Pannemann. But don’t expect major improvements for a while. “As far as when we will see availability improve, it will take at least a year.”

If you will be needing to add trucks to your fleet, procrastination is not a viable strategy. You will need to be proactive and order well in advance. In certain situations, you may need to get creative about alternative ways to source your work truck fleet until some form of normalcy returns. To read the full article by Curt Bennink, visit forconstructionpros.com/21615110.

FELLING TRAILERS’ 2021 TRAILER FOR A CAUSE BENEFITS FIREFIGHTERS

Felling Trailers conducted its ninth annual online auction of an FT-3 drop deck utility trailer to benefit a non-profit organization, which for 2021, was the Minnesota Fire Fighters Foundation.

Felling Trailers wanted to help generate awareness about the hidden health dangers and cancer risks firefighters face while serving and beyond. So, Felling manufactured and painted one of its most popular trailers the signature fire engine red with custom fire engine gold pinstriping, bearing the Minnesota Fire Fighters Foundation emblem.

The online auction of the trailer ran for seven days, from Sep. 5 through Sep. 11. Several Felling Trailers’ suppliers have joined to support MNFFF by sponsoring the trailer build.

MNFFF’s mission is to provide funding and resources for fire departments to obtain the best available equipment, technology, and training. They are dedicated to maintaining the highest level of public safety in their communities. The State of Minnesota has 774 fire departments. MNFFF’s Hoods 4 Heroes campaign goal is to provide 500 particulate hoods to those departments who cannot afford this type of PPE or have applied for grants and been denied. To read more, visit forconstructionpros.com/21615174.

Chain Saw barS & Chain

• saw bars • saw chain • sprockets • springs • starters • carburetors • cylinder assemblies • tools & accessories

1.800.841.3989 for more info!

Scan with Smartphone to view Copperhead chain saw video series. LAS VEGAS 2021

VISIT US IN BOOTH #8314 BOOTH #8314

PowerPusher’s E-750 Electric Wheelbarrow

safely & easily transports up to 1,000 lbs. • Push-button powered dump capability • Silent motor with zero emissions Silent motor with zero emissions • Standard & custom attachments Standard & custom attachments • Demos available

800.800.9274

OSHA CALLS ON INDUSTRY TO COMBAT UNIQUE KILLER OF CONSTRUCTION WORKERS

Hazards often associated with workplace deaths in the U.S. construction industry—including falling, being struck-by or crushed by equipment or other objects, or suffering electrocution—are well known. But a recent study finds that another potential killer is taking lives in the industry at an alarming rate.

In 2020, the Centers for Disease Control and Prevention found that men working in construction have one of the highest suicide rates compared to other industries. Their rate of suicide is about four times higher than the general population.

While the CDC continues its research to understand the disparity, the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) has formed a task force of industry partners, unions, and educators to raise awareness of the types of stress that can push construction workers into depression and toward suicide. In addition to alerting stakeholders, the task force encourages industry employers to share and discuss available resources with their workers. The task force called on the industry to take part in a weeklong Suicide Prevention Safety Stand-Down, September 6-10, to raise awareness about the unique challenges construction workers face. The stand-down coincided with National Suicide Prevention Month in September. “Work-related stress can have severe impacts on mental health and without proper support may lead to substance abuse and even suicide,” stated Acting Assistant Secretary of Labor for Occupational Safety and Health Jim Frederick. “Workers in construction face many work-related stressors that may increase their risk factors for suicide, such as the uncertainty of seasonal work, demanding schedules and workplace injuries that are sometimes treated with opioids.”

“Like many workplace fatalities, suicides can be prevented,” said OSHA Acting Regional Administrator Billie Kizer in Kansas City, Missouri. “We encourage employers to use all available resources, familiarize themselves with the problem and learn to recognize the warning signs of depression. We also urge workers to seek help if they feel overwhelmed or overcome by a loss of hope.” To read the full article and view additional resources, visit forconstructionpros.com/21627381.

EQUIPMENTSHARE RECEIVES $1.2 BILLION LINE OF CREDIT FROM CAPITAL ONE BANK

Capital One has served as administrative agent for a $1.2 billion senior secured asset-based revolving line of credit for EquipmentShare, a full-service equipment rental supplier for the construction industry. The revolver has a $800 million accordion option, and Capital One also arranged a $500 million private term loan as part of the deal.

“Our ability to take on a transaction of this size and complexity underscores the strength of our balance sheet and the expertise of the team we have assembled,” said Bob McCarrick, executive vice president and head of middle market relationships at Capital One.

“This is a key step in our evolution as we continue to grow,” said Jabbok Schlacks, CEO and co-founder of EquipmentShare. “In conjunction with our recent $230 million investment round, it is helping us expand our suite of technology solutions and build out our national footprint to better serve the needs of our customers.”

In addition to offering next-generation equipment rentals and sales and providing such services including maintenance and repair, the privately held EquipmentShare has developed a proprietary telematicspowered and cloud-based technology operating system for construction called T3. It enables contractors to connect data and workflows and better manage assets, materials, and team members from a single platform, helping them improve productivity and efficiency as well as experience significant time and cost savings. To read more, visit forconstructionpros.com/21648133.

Magni Telescopic Handlers, a provider of rotating and heavy lift telehandlers, announces that Pinnacle Cranes has become the first Magni authorized dealer in the Carolinas.

Jim Mackinson, president of Pinnacle Cranes, says, “Pinnacle is pleased to join the Magni family of North American dealers ... This addition allows Pinnacle Cranes to continue to be the number one lifting equipment source in the Carolinas.”

In addition to Magni, Pinnacle, headquartered in Midland, North Carolina, is the authorized dealer for LinkBelt Cranes and Manitex boom trucks in North and South Carolina. For more information, visit forconstructionpros. com/21627604.

HY-BRID LIFTS SEES INCREASED DEMAND, 68 PERCENT SALES GROWTH

Hy-Brid Lifts has released record sales in the first half of 2021, with projections for the second half of the year on track to continue in a positive trend.

Global sales rose 68 percent compared to the previous year, spurred by a 110-percent growth in Push-Around Series sales. The Pro Series category reported a growth of 41 percent, driven by the company’s lightweight entry into the 19-foot scissor lift market with the PS-1930. Demand for the ZT-1630 boosted Zero-Turn Series sales by nearly 200 percent. “We have seen a tremendous increase in demand for our products globally as our customers and end users see the value of our innovative product portfolio,” said Marshall Shaver, vice president of sales and marketing, who attributes the company’s six-month sales to being uniquely positioned in the access market. “Our ability to navigate through challenging supply chain issues, steel cost increases, and labor shortages allows us to continue to provide equipment with little disruption.” To read more, visit forconstructionpros.com/21602918.

Covering The Rental World With

Call now for custom graphics at 800.829.3021

HEAVY EQUIPMENT & FENCENCE RENTALRENTAL

WWW.MYMEDIANRENTSMYMEDIANRENTS

NOTICE

EQ-1077 Customer Is Responsible Fo Fo u Respon r NOTICE Customer Is

Flat Flat Tires Responsible For ScreenTech Imaging 1.800.829.3021ech Imaging 1.800.829.3021 Flat Tires

EQ-1003 DANGER HIGH VOLTAGE

ScreenTech Imaging 1.800.829.3021 ScreenTech Imaging 1.800.829.3021eenTech Imaging 1.800.82

Shop thousands of stock at

WARNING ARNING

Do Not Pump Flammables

store.roeda.COM

roeda.com | info@roeda.com | 20530 Stoney Island Ave. Lynwood, IL 60411

Would you pump 13 gallons of water into your tools?

Neither would we.

The Solution to Your Portable Compressor Moisture Problems

Find us at the ARA show Booth #212

1-800-287-1538

getdryair.com

7. Complete Mailing Address of Known Office of Publication (Street, City, County, State, and Zip+4)

AC Business Media 201 North Main St., 5th Floor Fort Atkinson, WI 53538-1807

8. Complete Mailing Address of Headquarters or General Business Office of Publisher

AC Business Media, 201 North Main St., 5th Floor, Fort Atkinson, WI 53538-1807

9. Full Names and Complete Mailing Addresses of Publisher and Editor Publisher (Name and Complete Mailing Address)

Sean Dunphy, Group Publisher 201 North Main St., 5th Floor Fort Atkinson, WI 53538-1807

Editor (Name and Complete Mailing Address)

Alexis Sheprak, Editor 201 North Main St., 5th Floor Fort Atkinson, WI 53538-1807

Contact Person Angela Franks

Telephone

(920) 542-1259

10. Owner (Do not leave blank. If the publication is owned by a corporation, give the name and address of the corporation immediately followed by the names and addresses of all stockholders owning or holding 1 percent or more of the total amount of stock . If not owned by a corporation, give the names and addresses of the individual owners. If owned by a partnership or other unincorporated firm, give its name and address as well as those of each individual owner. If the publication is published by a nonprofit organization, give its name and address.)

Full Name Complete Mailing Address

ACBM, LLC, Ron Spink, CEO 201 North Main St., 5th Floor, Fort Atkinson WI 53538-1807

11. Known Bondholders, Mortgagees, and Other Security Holders Owning or Holding 1 Percent

or more of Total Amount of Bonds, Mortgages or Other Securities. If none, check here. None

Full Name Complete Mailing Address

12. Tax Status (For completion by nonprofit organizations authorized to mail at nonprofit rates) . (Check One) The purpose, function, and nonprofit status of this organization and the exempt status for federal income

tax purposes: Has Not Changed During Preceding 12 Months Has Changed During Preceding 12 Months

PS Form 3526-R Facsimile, July 2014

13. Publication Title 14. Issue Date for Circulation Data Below

Rental Oct/Nov 2021

15. Extent and Nature of Circulation

a. Total Number of Copies (net press run) Outside County Paid/Requested Mail Subscriptions stated on

(1) PS Form 3541. (Include direct written request from recipient, telemarketing and

b. Legitimate

Internet requests from recipient, paid subscriptions including nominal rate subscriptions,

Paid and/or

employer requests, advertiser's proof copies, and exchange copies.) Requested (2) In-County Paid/Requested Mail Subscriptions stated on PS

Distribution Form 3451. (Include direct written request from recipient, telemarketing and internet (By Mail and Outside

requests from recipient, paid subscriptions including nominal rate subscriptions, employer requests, advertiser's proof copies, and exchange copies.) the Mail) (3) Sales Through Dealers & Carriers, Street Vendors, Counter

Sales, and Other Paid or Requested distribution Outside USPS. (4) Requested Copies Distributed by Other Mail Classes

Through the USPS. (e.g. first-Class Mail)

c. Total Paid and/or Requested Circulation [Sum of 15b(1), (2), (3), (4)] (1) Outside County Nonrequested Copies stated on PS form 3541.

(include sample copies, requests over 3 years old, requests induced by a premium, d. Nonrequested bulk sales and requests including association requests, names obtained from Distribution

business directories, lists, and other sources) (By Mail (2) In-County Nonrequested Copies stated on PS form 3541. and Outside (include sample copies, requests over 3 years old, requests induced by a premium, the Mail)

bulk sales and requests including association requests, names obtained from business directories, lists, and other sources)

(3) Nonrequested Copies Distributed Through the USPS by

Other Classes of Mail.(e.g. First-Class Mail, nonrequestor copies mailed in excess of 10% Limit mailed at Standard Mail or Package Services Rates)

(4) Nonrequested Copies Distributed Outside the Mail

(include pickup stands, trade shows, showrooms, and other sources)

e. Total Nonrequested Distribution (Sum of 15d (1), (2), and (3))

f. Total Distribution (Sum of 15c and e)

g. Copies Not Distributed

Average No. Copies No. Copies of Single Each Issue During Issue Published Preceding 12 Months Nearest to Filing Date

20,714 14,484

0

0

0

14,484

5,545

0

0

43

5,588

20,072

642

h. Total (Sum of 15f and g)

20,714

i. Percent Paid and/or Requested Circulation

72.2%

(15c / 15f x 100) *if you are claiming electronic copies, go to line 16 on page 3. If you are not claiming electronic copies, skip to line 17 on page 3.

PS Form 3526 -R Facsimile, July 2014

16. Electronic Copy Circulation Statement of Ownership, Management, and Circulation

(Requester Publications Only)

Average No. Copies No. Copies of Single Each Issue During Issue Published

Preceding 12 Months Nearest to Filing Date

a. Requested Electronic and Paid Electronic Copies b. Total Requested and Paid Print Copies (Line 15C) + Requested/Paid Electronic Copies (Line 16a) c. Total Copy Distribution (Line 15F) + Requested/Paid Electronic Copies (Line 16a) d. Percent Paid and/or Requested Circulation (Both Print & Electronic Copies) (16b divided by 16c X 100) x I certify that 50% of all my distributed copies (electronic & print) are legitimate requests or paid copies

17. Publication of Statement of Ownership for a Requester Publication is required and will be printed in the October/November issue of this publication. 18. Signature and Title of Editor, Publisher, Business Manager, or Owner

1,934 16,418 22,006 72.8%

Ron Spink, CEO September 15, 2021

I certify that all information furnished on this form is true and complete. I understand that anyone who furnishes false or misleading information on this form or who omits material or information requested on the form may be subject to criminal sanctions (including fines and imprisonment) and/or civil sanctions (including civil penalties).

PS Form 3526 -R Facsimile, July 2014

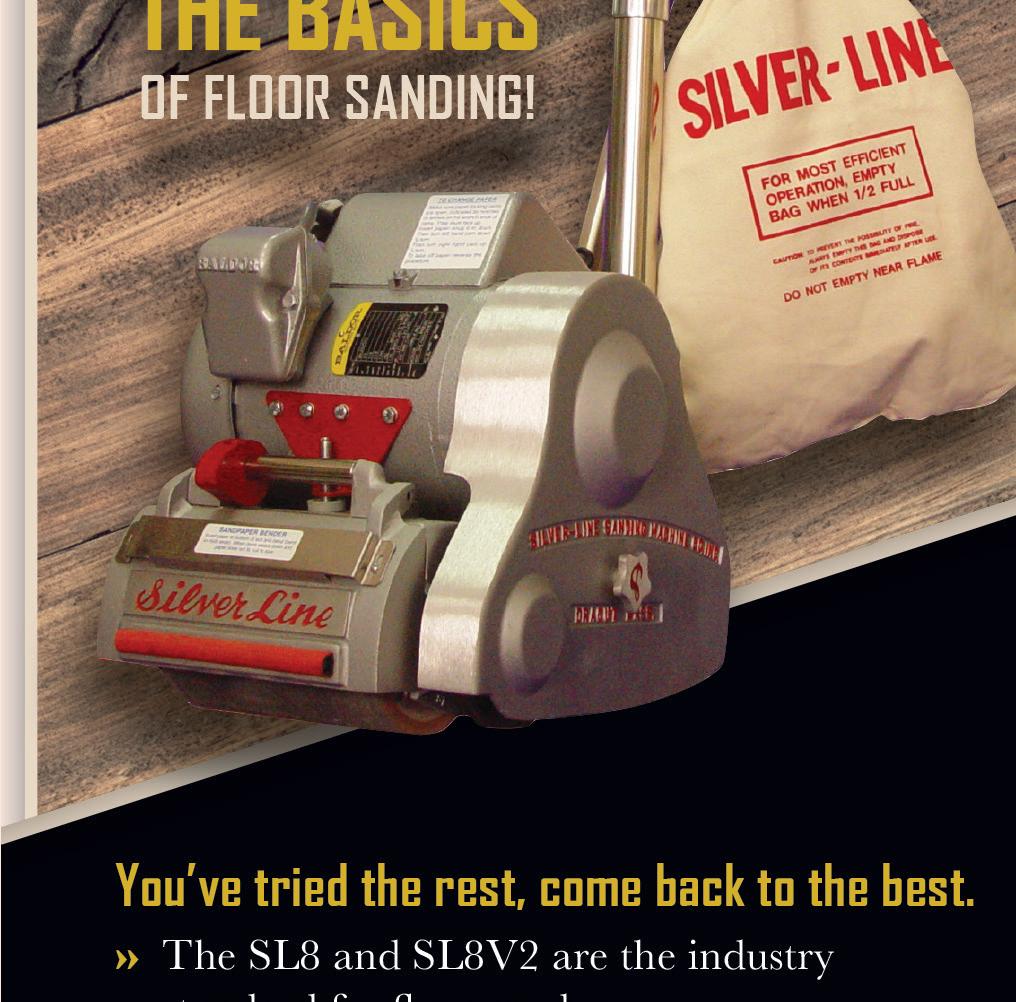

ADVERTISER PAGE Abbott Rubber Company ........................................81 Allen Engineering Corporation ...............................75 Alliance North America (ANA) ..................................5 Allmand ....................................................................25 Ammann America ....................................................67 Boss Industries, LLC ..................................................36 Briggs & Stratton .....................................................43 Christianson Systems Inc. ........................................76 Compact Excavator Sales .........................................47 Cummins Engine Company Inc. ...............................84 Ditch Witch ...............................................................35 Doosan Infracore ......................................................31 EDCO Equipment Development Co. .......................83 Enovation Controls ..................................................74 Essex Silverline .........................................................79 Fecon LLC. .................................................................23 Generac Power Systems ..........................................17 General Pipe Cleaners ................................................9 Haulotte US Inc. .......................................................66 IPAF - Int’l. Powered Access Federation.................58 Jenny Products, Inc ..................................................55 JLG Industries Inc ....................................................2-3 Kaeser Compressors .................................................73 Kohler Company ........................................................7 Kubota Tractor ........................................................13 LBX Company LLC ....................................................65 Lind Equipment ........................................................40 Manitou North America, LLC ...................................63 MERLO - Applied Machinery Sales ..........................71 Mi-T-M Corporation .................................................27 Orion Software ........................................................53 Oztec Industries Inc. ...........................................15, 37 Power Pusher, Division of Nu-Star, Inc. ..................77 Rammer .....................................................................59 ROEDA ......................................................................80 Rotary Corp. .............................................................77 RoyPow Technology Co., Ltd. ..................................51 Snorkel ......................................................................57 Stellar Industries ......................................................61 Sullair ........................................................................41 Takeuchi Manufacturing Co. ..............................44-45 Terex USA .................................................................39 The Toro Company ...................................................19 Trask-Decrow Machinery .........................................80 TVH Parts Co. ............................................................60 Uline ..........................................................................49 Windy Ridge Corporation ........................................81

The Original.

Breaking up concrete, boulders, and bedrock — mix with water and pour into holes.

| One product for all temperatures | Wholesale pricing includes shipping Wholesale pricing includes shipping

800.639.2021

www.betonamit.net

CONTRACTOR’S HOSE & ASSEMBLIES & ASSEMBLIES

• Air Hose • Water Hose • Suction Hose • Discharge Hose • Hydraulic Hose • Pressure Washer Hose Pressure Washer Hose • Plaster/Grout Hose • Sand Blast Hose

NEW! WEBSITE

ORDER ONLINE24/7

NOW AVAILABLE AT www.abbottrubber.com