New! GreenPath Financial Wellness Resources

Does achieving your financial goals feel out of reach? Help is available! Fox is partnering with GreenPath, a non-profit organization with over 60 years of experience helping people get on the path to financial well-being. Their National Foundation for Credit Counseling and Housing and Urban Development (HUD)certified counselors can help you navigate everything from credit card debt to home ownership. As a Fox member you will also have access to debt management services, housing services, credit report review and student loan counseling.

Start your financial wellness journey at foxcu.org/greenpath or call 877-337-3399.*

*GreenPath™

Mark Your Calendars

Money Smart Week

Monday, April 15th - Friday, April 19th

Loads of financial education including seminars.

Virtual Annual Meeting: Monday, May 6th

Paper Shredding and Electronic Recycling

• Saturday, May 18th: Two Rivers

• Saturday, June 1st: Oshkosh & Green Bay

• Saturday, June 15th: Appleton

Did You Know You Have Multiple Loan Payment Options?

Fox has multiple ways to pay your loan. It’s easy to make a payment through Online and Mobile Banking* with a Fox checking or savings account. Don’t have a Fox checking account? You can use a non-Fox debit card to pay too. Pay now at foxcu.org/payments.

*Message and data rates may apply.

Financial Makeover Challenge

Our first Ripple Effect* selection process is underway! Stay tuned for updates from our participants as they tackle saving, create better budgeting practices, reduce debt and boost their financial confidence – all while competing to win the first place cash prize of $5,000. We’re excited to share the Ripple Effect’s participant journeys with you at foxcu.org/ripple-effect.

Federally Insured by NCUA.

From Accepted Offer to the Big Move – In 30 Days or Less*

*Loan closing within 30 days is subject to approved loan documentation and receipt of all supporting closing documentations. Loan is subject to program terms and conditions. Membership required. ** Downpayment Plus ® is a program of Federal Home Loan Bank of Chicago. Restrictions apply. Please see the Federal Home Loan Bank of Chicago’s website at fhtbc.com for full requirements. Downpayment Plus® is a registered trademark of the Federal Home Loan Bank of Chicago. Funds for the program are limited and will be awarded on a first come, first served basis until all funds have been used for the calendar year. Additional eligibility requirements apply.

financial wellness is a third-party partner

Fox

In order to receive free financial services, you must be a member

Fox. These services are optional and are not an obligation or guarantee by Fox or its a liates. GreenPath Financial Wellness is a trademark of GreenPath, Inc.

to

Communities Credit Union (Fox).

of

Pay Now

*The Ripple Effect Financial Makeover Challenge is an exciting opportunity for four teams of Fox members to build a stronger financial future all while competing for $10,000 in prize money. During Ripple Effect, each team will be working with their own Financial Coach assigned through Fox Communities Credit Union’s partnership with Goodwill Financial and Debt Solutions Services. The challenge begins in April and ends in October, with one team winning a grand prize of $5,000!

Financing Options for High School Graduates

There are many ways new graduates can start to establish credit and build a strong financial foundation. There are a variety of scholarships available for high school seniors; applications for 2024-2025 are now being accepted at foxcu.org/scholarships.

Brand new for 2024 is the Fox First Reward Credit Card,* which is great for those who are looking to build credit.

There’s no annual fee and cardholder’s earn 1 uChoose rewards point per every $1 spent. Apply today!

*Fox First Rewards rate is variable and based on the Prime Rate (currently 8.50% as of 2/7/2024), plus a margin of 7.49% for purchases; and 9.49% for cash advances and balance transfers. The APR may increase or decrease as identified by the Wall Street Journal ‘Prime Rate’. The interest rate can change monthly on the first day of each month following a change in the Prime Rate. The APR will never be more than 20%. Any increase will lengthen the

it

to pay

your

APR is based on creditworthiness at the time the account is established. No annual membership fee, cash

A foreign transaction fee is 1% of each transaction in US dollars. For additional information, see a Fox team member

Not Federally Insured by NCUA.

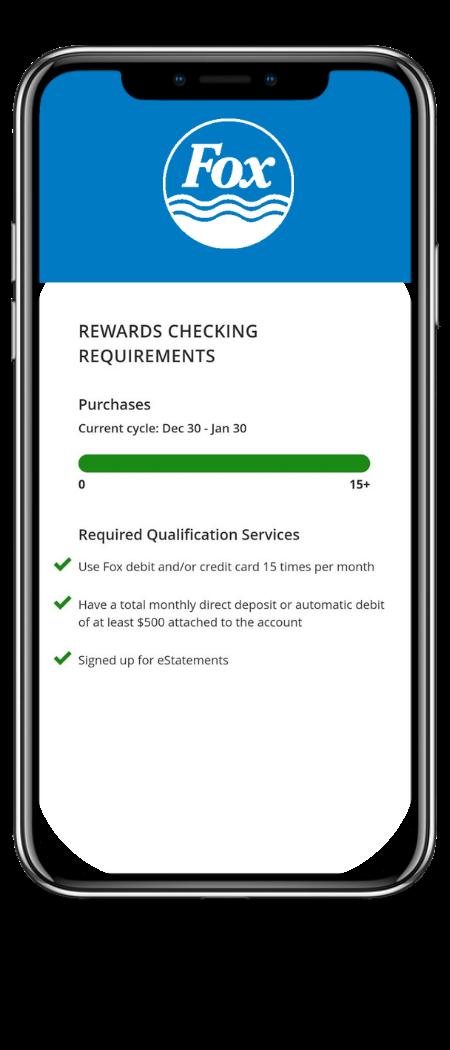

Fox Rewards Checking Tracker Now Available within Online & Mobile Banking*

It’s easy to monitor your Fox Rewards Checking with our new Rewards Tracker. The tracker lets you know how close you are to earning your monthly 5.00% Annual Percentage Yield on balances up to $5,000, with 0.50% APY** on everything beyond that, and other Fox Rewards Checking benefits. Get in on the rewards at foxcu.org/foxrewards.

1. File on time for the April 15, 2024, deadline: If you need more time, you can ask for an extension until October 15, 2024, but you’ll be charged interest on what you owe starting April 15, 2024.

2. File free if you can: Taxpayers who electronically prepare and file online will likely have fewer mistakes on their tax return.

3. Double check your deductions: Make sure you’ve claimed all the deductions you’re eligible for. Common deductions are charitable contributions, mortgage interest and student loan interest.

4. Consider last-minute financial moves: You have until April 15th to make contributions to your IRA or Health Savings Account for 2023.

5. Don’t forget to claim unemployment benefits: If you received unemployment benefits in 2023, you’ll need to report them on your tax return.

6. Check on simple mistakes: Double-check your tax return for simple mistakes like typos, incorrect Social Security Numbers and math errors.

7. E-file for the fastest return: E-filing is the fastest way to get your refund. The IRS issues most refunds within 21 days of receiving your tax return.

8. Mail your return to the right address: If you’re mailing your tax return, make sure you send it to the correct address. The address you need to send your tax return to depends on where you live and whether you are enclosing a payment.

resulting in a range from 0.50% to 5.00% APY, depending on daily balance and meeting monthly qualifications. Dividends are calculated and accrued daily based on Fox Rewards Checking balance tier and if Monthly Qualifications requirements are met. Monthly Qualifications requirements: (a) make 15 Fox Communities Credit Union (Fox) debit/credit card qualifying purchase transactions that post

a $500 or

during each Monthly Qualification Cycle; (c) enroll in Online Banking and elect to receive eStatments with a valid email address. When qualifications are not met, the rate earned on the entire daily balance in the account will be 0.01% APY, and domestic ATM fee refunds will not apply. Limit of one Fox Rewards Checking per tax reported owner. For additional details, contact Fox.

9. Track your return and refund online: You can track the status of your tax return and refund online using the IRS “Where’s My Refund?” tool.

These tips were provided by Fox Communities Investment Services – foxcu.org/investments.

Visit Us: foxcu.org/locations Find Us: instagram.com/foxccu Call Us: 920-993-9000 Fox Communities Credit Union (Fox) provides referrals to financial professionals of LPL Financial LLC (LPL) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services. Please visit www.lpl.com/disclosures/is-lplrelationship-disclosure.html for more information. Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed a liates. Fox Communities Credit Union and Fox Communities Investment Services are not registered as broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Fox Communities Investment Services and may also be employees of Fox Communities Credit Union. These products and services are being offered through LPL or its a liates, of which are separate entities from, and not a liates of Fox Communities Credit Union or Fox Communities Investment Services. Securities and Insurance offered through LPL or its a liates are: NOT INSURED BY NCUA OR ANY OTHER GOVERNMENT AGENCY NOT CREDIT UNION GUARANTEED NOT CREDIT UNION DEPOSITS OR OBLIGATIONS MAY LOSE VALUE

Federally Insured by NCUA. Last-Minute Tax Filing Tips

Whether you have federal or private loans, we can help! We offer fixed and variable interest rates, in-school deferment, borrower benefits and more.* Give your student loan a refresh at foxcu.org/student-loans. *Fox Communities Credit Union (Fox) private student loan program is offered through a partnership with CURevl and is not a Federal student loan program. You may qualify for Federal student financial assistance, please visit studentaid.gov for additional information. Fox's private student loans are subject to credit qualifications, loan amount, student enrollment in a participating school, and underwriting criteria. Not Federally Insured by NCUA.

Have You Thought About Refinancing Your Student Loan?

*Message and data rates may apply. Apple, the Apple logo, and App Store are registered trademarks of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC. **APY=Annual Percentage Yield, accurate as of 2/7/2024. Rates are subject to change at any time. 1: Fox Rewards Checking account daily balance up to and including $5,000 earns a dividend rate of 4.89%, resulting in an APY of 5.00%; and daily balances over $5,000 earn a rate of 0.50% APY on the portion of the daily balance over $5,000

more direct deposit

automatic

IT ON

and settle during each Monthly Qualification Cycle; restrictions apply, (b) have

or

payment

GET

balance

fee.

refer to

Apply for Your First Credit Card

time

takes

off

loan.

advance or

transfer

or

your Credit Card Account disclosure for complete details and applicable fees.