PUBLISHED BY

SOUTH AFRICAN TABLE GRAPES 2024

PUBLISHED BY

SOUTH AFRICAN TABLE GRAPES 2024

Fresh Produce India is back in person to spotlight opportunities in one of the world’s most exciting markets for fresh fruit and vegetables

SINCE 1995

India has long been recognised for its massive market potential. Now, there is a genuine sense that it is beginning to deliver

We’re delighted to be back in person with Fresh Produce India on 21-22 March in Mumbai. Launched by Fruitnet some 17 years ago, India’s premier business event for fresh fruit and vegetables has long been the annual meeting point for leading players in the local and international trade. Now, we’re back in Mumbai with a brand-new format that maximises business and information opportunities. Fresh Produce India is centred on a non-stop networking expo, paired with a lively programme of talks, interviews and tastings. And there’s so much to discuss and catch up on. India has witnessed enormous change and development since our last in-person edition in 2019. It’s a market that has long been recognised for its massive potential. Now, there is a genuine sense that India is beginning to deliver. Liam O’Callaghan’s in-depth India report (p22-46) captures the sense of purpose in the business. The fruit market is expanding, driven by rapidly evolving domestic production as well as imports. And consumption is shifting with the introduction of new products and varieties. India’s young population provides a receptive consumer market, while social media and healthy eating trends are propelling the trend. India is renowned as a pricesensitive market, but the premium segment displays clear signs of growth – witness the investments key food retailers are now making to cater to the high-end demographic. India’s rapid digitisation is also a driving force, and it is spurring development throughout the supply chain, from new solutions for farmers to the rise of quick commerce. On top of all this, the nation's huge transport infrastructure upgrade, combined with cold chain investments among fresh produce companies, is helping to address the supply chain issues that have long held the industry back. Of course, big challenges remain. We look forward to discussing those, and the potential solutions, as well as exploring the myriad market opportunities, at Fresh Produce India A

John Hey, Editor

fruitnet.com/berrycongress

Fruitnet's Global Berry Congress brought the international berry business together in Rotterdam on 28 November. View the photo gallery online.

instagram.com/fruitnet

Follow Fruitnet's Instagram page for regular photos and updates from the Fruitnet team.

fruitnet.com/asiafruit Asiafruit's news website provides regular updates on all the top stories from Asia's fresh fruit and vegetable business.

asiafruitchina.net

Visit Asiafruit's Chinese-language portal for all the latest news in Mandarin. Sign up to our newsletter, Asiafruit News and find us on WeChat. Our WeChat ID is asiafruit.

Expand your network of professional contacts and join the fresh produce conversation by visiting the Asiafruit LinkedIn account. LinkedIn

linkedin.com/showcase/asiafruitmagazine

desktop.asiafruitmagazine.com

Download the new Asiafruit app onto your smartphone or tablet from the App Store or Google Play. Stay informed on the latest fresh produce industry developments, and enjoy our magazines in new user-friendly digital formats.

x.com/asiafruit

Keep up to date with news, opinions and developments from around the Asia's fresh produce trade by following our dedicated X account. X

https://bit.ly/3eHjlS0

Download Fruitnet's podcast series hosted by managing director Chris White in London. The Fruitbox podcast features conversations and interviews with leading industry experts.

EDITORIAL

editor John Hey

+61 3 9040 1602 john@fruitnet.com

digital editor

Liam O'Callaghan +61 3 9040 1605 liam@fruitnet.com

staff journalist

Bree Caggiati

+61 3 9040 1606 bree@fruitnet.com

china editor

Yuxin Yang +61 3 9040 1604 yuxin@fruitnet.com

DESIGN & PRODUCTION

design manager

Simon Spreckley

+44 20 7501 3713 simon@fruitnet.com

senior designer

Qiong Wu

+61 3 9040 1603 wobo@fruitnet.com

senior designer Mai Luong

+44 20 7501 3713 mai@fruitnet.com

graphic designer

Asma Kapoor

+44 20 7501 3713 asma@fruitnet.com

EVENTS & MARKETING

head of events and marketing

Laura Martín Nuñez

+44 20 7501 3720 laura@fruitnet.com

events executive

Poppy Bowe

+44 20 7501 3719 poppy@fruitnet.com

ADMINISTRATION

finance director

Elvan Gul

+44 20 7501 3711 elvan@fruitnet.com

accounts receivable

Tracey Haines

+44 20 7501 3717 tracey@fruitnet.com

finance manager

Günal Yildiz

+44 20 7501 3714 gunal@fruitnet.com

subscriptions

+44 20 7501 0311 subscriptions@fruitnet.com

ADVERTISING

asia pacific

Kate Riches

+61 3 9040 1601 kate@fruitnet.com

europe & middle east

Artur Wiselka

+44 20 7501 0309 artur@fruitnet.com

china, taiwan & philippines

Jennifer Zhang +86 21 6136 6010 jennifer@fruitnet.com

uk, ireland, belgium, greece, turkey & south-east europe

Giorgio Mancino

+44 20 7501 3716 giorgio@fruitnet.com

us & canada

Jeff Long +1 805 966 0815 jeff@fruitnet.com

south africa

Fred Meintjes +27 28 754 1418 fredmeintjes@fruitnet.com

italy

Giordano Giardi +39 059 786 3839 giordano@fruitnet.com

commercial director

Ulrike Niggemann

+49 211 99 10 425 ulrike@fruitnet.com

managing director

Chris White +44 20 7501 3710 chris@fruitnet.com

Jeff Long asiafruit

Jeff provides an update on the Washington apple and Northwest pear deals. With apple production bouncing back this year, the industry is seeing a recovery in exports. apples & pears–p48-49

Mike Knowles fruitnet

Mike talks to agritech firm Innoterra about the potential solution it has found to one of the banana industry's biggest challenges as well as its new method of crop protection. dispatches–p74-75

Fred Meintjes fruitnet

Fred has prepared Fresh Focus South African Table Grapes 2024, which looks at how the industry's push into Asia is being fuelled by a strong crop and proprietary varieties. rsa table grapes–p53

Colin Fain agronometrics

Market analyst Colin speaks to key players in China's blueberry industry to find out what the future holds for its rapidly expanding production, and what challenges lie ahead dispatches–p76-77

Unifrutti has acquired South American grower-exporter Verfrut as part of its strategy to build a globally diversified premium fruit platform.

Verfrut is a leading supplier of fresh fruit with over 7,500ha of production in Chile and Peru. It exports more than 15m cartons of

table grapes, cherries, stonefruit, apples, blueberries and other products each year.

Unifrutti said the deal marks an important step in expanding its integrated and sustainable global multi-fruit platform.

It gives the group a major presence in Chile and extends its

Salix Fruits has opened its newest office in Singapore, enhancing its presence in Asia. Sales manager Javier Orti said: “Having a local office is the most effective way to stay close to our customers in the Asian markets and unleash our full potential in this region”. The company said a local presence will enable it to address customer requirements promptly and efficiently as Singapore’s strategic location as a regional hub allows quick access to key markets. The Singapore office will be headed by Raed Kazi, who Salix said has a proven track record as a country manager in India and prior experience in Latin America.

reach into Peru, a key hub in the fresh produce sector.

Completion of the acquisition is subject to satisfaction of closing conditions, including regulatory approvals. Once completed, Unifrutti will maintain Verfrut’s global operations, ensuring business continuity.

“This expansion not only enhances our current operations but also paves the way for future growth, as we aim to become the preeminent and most sustainably driven global multi-fruit company, setting new standards in the industry,” said Mohamed Elsarky, group CEO of Unifrutti.

Romano Vercellino, founder and president of Verfrut, added: “After many years of hard work together with our great team, we look forward to the next stage of our successful journey”.

Apple & Pear Australia (Apal) has announced its latest venture, Twenty Degrees, a new commercial entity partnering with clients to transform their produce IP into global fresh produce brands. The move will see Apal’s strengths in licensing and IP management integrate with the expertise of Coregeo, Apal’s whollyowned UK subsidiary responsible for marketing Pink Lady and other fresh produce brands. Phil Turnbull, group CEO, said: “This new entity will provide a wonderful opportunity for our international teams and existing clients to work together to build global FMCG brands, delivering enhanced value to partners around the world”.

Call your citrus sales representative at 661.778.1458 or email Amanda.Meneses@wonderful.com

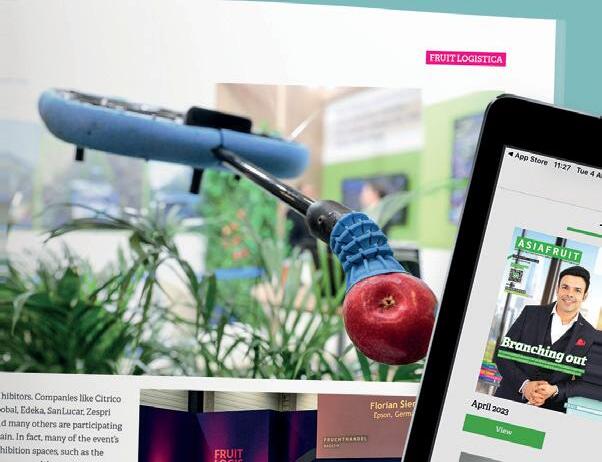

Asia’s premier fresh fruit and vegetable trade show returns to AsiaWorld-Expo in Hong Kong on 4-6 September 2024.

ASIA FRUIT LOGISTICA takes place on 4-6 September 2024 at AsiaWorld-Expo, bringing together leading players from across the global fresh fruit and vegetable business and throughout the value chain. It is held together with ASIAFRUIT CONGRESS, Asia’s longestrunning fresh produce business conference, where expert speakers share high-level insights on the key topics and trends in the trade.

ASIA FRUIT LOGISTICA made a highly impressive return to Hong Kong in 2023, as record visitor numbers contributed to excellent business meetings and outcomes for exhibitors at the sell-out show. More than 13,000 trade visitors from over 70 different countries attended ASIA FRUIT LOGISTICA 2023 to meet and do business with over 700 exhibitors from some 43 countries and regions.

“It was great to be back at full scale with ASIA FRUIT LOGISTICA in 2023,” said David Axiotis, Managing Director of Global Produce Events, the organiser of ASIA FRUIT LOGISTICA.

“ With the huge success of the event and the positive feedback from exhibitors and visitors,

platform for Asia’s fresh produce business at ASIA FRUIT LOGISTICA 2024.”

Further increasing its footprint across the region, ASIA FRUIT LOGISTICA is launching a series of content-backed regional networking events, the AFL Business Meet-Ups. The MeetUps will take place in key markets across Asia to connect with leading players and build momentum for the show’s return to Hong Kong

on 4-6 September

Save the dates below:

• Indonesia Station: Jakarta, 27 February 2024

• India Station: Mumbai, 21 -22 March 2024

• Thailand Station: Bangkok, 3 April 2024

• China Station: Shanghai, 27-28 May 2024

“ASIA FRUIT LOGISTICA is delighted to introduce the Meet-Ups to bring existing and future partners together and deepen our connections in these key markets,” said Axiotis.

“By engaging directly with these diverse markets, we believe we can create even more opportunities and value for all ASIA FRUIT LOGISTICA visitors and exhibitors.”

Exhibitors can register online to book their stand at ASIA FRUIT LOGISTICA 2024. Applications received by 29 February 2024 are

For exhibiting / Business Meet-Ups enquiries, feel free to contact us at info@gp-events.com.

Please visit us in Booth No. 16

Three major markets join forces with Asia Fruit Logistica on new China Business Meet-Up event in Shanghai on 27-28 May, and become official partners to 2024 edition of trade show in Hong Kong.

by John Hey @johnfruitnet

Asia Fruit Logistica has announced a new strategic partnership with three of China’s leading wholesale markets – Guangzhou Jiangnan Market, Shanghai Huizhan Market and Hebei Sunhola Market.

Asia Fruit Logistica and the three market partners signed an official cooperation agreement on 25 January during a signing event at The Peninsula Shanghai Hotel.

The cooperation agreement was signed by David Axiotis, managing director of Global Produce Events, which organises Asia Fruit Logistica; Ye Canjiang, chairman of Guangzhou Jiangnan Agricultural Development Co; Liu Xiongjie, general manager of Shanghai Huizhan Fruit and Vegetable Management Co; and Mi Yalin, chairman of Sunhola Group Gaobeidian Agricultural and Sideline Products Trading Center.

Ye Canjiang hailed the cooperation between Asia Fruit Logistica and the leading wholesale markets as a win-win partnership.

“This direct cooperation between the exhibition and the wholesale markets will play a key role to further grow the industry in China and enable us to create even more business at Asia Fruit Logistica,” he said. “We’re excited to partner with Asia Fruit Logistica to deepen its connections in China while at the same time boosting our presence on the international stage at the ever-expanding trade show in Hong Kong.”

Under the agreement, the leading wholesale markets are partnering with Asia Fruit Logistica on the launch of its China Business MeetUp event in Shanghai on 27-28 May 2024. The event, which takes place at Shanghai World Expo Exhibition & Convention Center, is the final station on Asia Fruit Logistica’s new Asia roadshow of Business Meet-Ups.

Asia Fruit Logistica has launched the series of contentbacked networking events to deepen its connections in key markets across Asia and build

even greater momentum for the show’s return to Hong Kong on 4-6 September 2024.

The Business Meet-Up series kicks off in Jakarta, Indonesia on 27 February. The roadshow then heads to Mumbai, India, where Asia Fruit Logistica is the Official Partner of Fresh Produce India on 21-22 March, organised by Fruitnet. Thailand is the next stop, with a Business Meet-Up in Bangkok to be held on 3 April.

Asia Fruit Logistica’s China Business Meet-Up on 27-28 May marks the culmination of the roadshow and the largest-scale event in the series. The Business

Mumbai, 21-22 March

Jakarta, 27 February

Meet-Up in Shanghai brings together leading buyers and suppliers from across the industry to network and explore in-depth the trends and opportunities in the fast-expanding China market.

The two-day event includes an information-packed programme of expert talks and discussions organised by Asia Fruit Logistica’s

“Together these three markets cover the entire China market, from the south through central to north China”

knowledge partner and leading business conference organiser, Asiafruit Magazine. It also features a B2B expo and various business networking formats, including a large-scale networking dinner to be held on the evening of 27 May.

As part of the cooperation agreement, the three leading wholesale markets were also announced as the Official Wholesale Market Partners to Asia Fruit Logistica 2024. The market partners will lead an extensive delegation of exhibitors and buyers to attend and do business at Asia’s

Shanghai, 27-28 May

Bangkok, 3 April

premier fresh produce trade show on 4-6 September in Hong Kong.

“Asia Fruit Logistica is delighted to form this landmark partnership with these three leading wholesale markets – Guangzhou Jiangnan, Shanghai Huizhan and Hebei Sunhola,” said Axiotis. “Together, these three markets cover the entire China market, from the south through central to north China.

“Partnerships like this are key for Asia Fruit Logistica as the leading continental trade show as we deepen our connections and widen our reach across Asia. It’s a combination that makes a lot of sense: our overall continental business platform each September in Hong Kong together with local in-depth activities with strategic partners in key markets such as China.” A

OPPOSITE—Pictured (l-r): Mi Yalin of Hebei Sunhola Market; Liu Xiongjie of Shanghai Huizhan Market; David Axiotis of Global Produce Events; and Guangzhou Jiangnan’s Ye Canjiang

ABOVE TOP—The three wholesale markets are joining forces with Asia Fruit Logistica on the launch of its China Business Meet-Up event

ABOVE BOTTOM—China is the largest single-exhibiting country at Asia Fruit Logistica

Breeder to support licensees and act against nurseries and growers who illegitimately use proprietary varieties and trademarks.

by Liam O’Callaghan @liamfruitnet

Bloom Fresh International has announced it will license its protected plant varieties to Chinese growers, providing ongoing support for their success. In support of this move, Bloom Fresh says it will also take legal action against nurseries and growers who illegitimately use its proprietary varieties and trademarks.

The announcement follows the leading fruit breeder’s string of successful enforcement cases in Yunnan, Jiangsu, Shaanxi, and Guangdong. Bloom Fresh says the results were significant for both the company’s rights and the rights of its Chinese licensees and consumers.

“Infringers create unfair competition for Bloom Fresh licensees, who pay for rights, while infringers illicitly gain advantages through stolen intellectual property,” the company notes.

“Poor-quality infringing fruit negatively affects the market for high-quality, licensed fruit, as infringers do not receive authorised plant material or the benefit of Bloom Fresh’s technical support and quality assurance systems. Infringing fruit also deceives consumers, as the quality does not align with Bloom Fresh’s specifications for licensed fruit.”

Chief executive Kenneth Avery says Bloom Fresh wants to improve the market for all involved.

“Bloom Fresh aims to establish a win-win-win environment for itself, its licensees, and local communities. Creating such an environment relies on a healthy market that protects plant breeder rights and encourages the development of robust new varieties,” says Avery.

“Despite being a long and challenging process, Bloom Fresh is committed to supporting the industry in fostering a positive and healthy intellectual property environment.”

The breeder has secured plant variety rights for 16 table grape varietals and registered trademarks for some of its bestknown offerings such as Cotton Candy, Sweet Sapphire, and Sweet Globe.

Bloom Fresh says it has received support from Chinese authorities, including the Local Agriculture and Rural Affairs Bureau and Administration for Market Regulation in its efforts to enforce intellectual property rights and it anticipates further cooperation with local authorities, communities, and licensees to protect its intellectual property. A

Rubyglow unveiled in China in time for Chinese New Year, as part of the company’s debut in the market.

by Carl Collen @carlfruitnet

Fresh Del Monte Produce has announced the launch of its latest innovation, the Rubyglow pineapple, a red-shelled variety.

According to the company, Rubyglow has a red outer skin, bright yellow flesh, and a “new, sweet flavour similar to Del Monte pineapples.”

The Rubyglow pineapple has been launched in China, in time for Chinese New Year as part of the company’s grand debut in the Chinese market, while a waitlist is

available for consumers in other countries.

“We are proud to unveil our latest pineapple innovation to the world, the Rubyglow pineapple,” says Mohammad Abu-Ghazaleh, chairman and chief executive of Fresh Del Monte.

“Our scientists continue to elevate the bar by creating new pineapple varieties, with varied tastes and colours, that cater to more and more consumers worldwide.”

With around 5,000 pineapples

available worldwide in 2024 and 3,000 in 2025, the pineapple’s rarity and limited inventory make Rubyglow a ”highly coveted item”, Del Monte notes.

This holds particularly true in the Chinese market, where consumers wield significant spending power and value luxury novelty items.

“We believe that the Rubyglow pineapple is the perfect product to build our market presence in China,” Abu-Ghazaleh says.

Grown in Costa Rica, the Rubyglow pineapple has been in development for more than 15 years and has a registered plant patent in the US.

According to Del Monte, Rubyglow is a cross between a traditional pineapple and a Morada pineapple – which is typically inedible – making the Rubyglow pineapple a hybrid fruit produced through traditional crossbreeding techniques.

Rubyglow pineapples are naturally ripened in Costa Rica on the plant and sold crownless.

“Fresh Del Monte has been leading pineapple innovation since the 1990s with the debut of the Del Monte Gold Extra Sweet pineapple, the first of its kind,” the group adds. “The pineapple has a golden colour and, at that time, was much sweeter than any other pineapple on the market.

“Since then, the company’s robust pineapple programme has released the Pinkglow pineapple, the Honeyglow pineapple, the Del Monte Zero pineapple, and now the Rubyglow pineapple.” A

Mathieson ends 21-year stint at Zespri to join berry giant Driscoll’s.

by Carl Collen @carlfruitnet

Zespri has announced its chief executive Dan Mathieson is to leave the kiwifruit leader and take up a new position as president of the Americas for global berry company Driscoll’s.

Mathieson has been at Zespri for 21 years, almost seven of those

as chief executive, and will remain at the New Zealand-based group to oversee the 2024 harvest and start of the sales season and until a new chief executive is appointed.

Zespri chairman Bruce Cameron said Mathieson leaves as “a worldclass CEO”, who has helped turn Zespri into a leading sales and

marketing company and with the industry well positioned to continue to succeed.

“Under Dan’s exceptional leadership Zespri grew sales from almost NZ$2.3bn in 2016/17 to a peak just over NZ$4bn in 2021/22 prior to the Covid-19 pandemic, with that growth set to continue in the coming years,” said Cameron.

“Through that time, he demonstrated his ability to bring talented people together, to set and execute strategy and ultimately to deliver great outcomes for the industry.”

Looking ahead, Cameron remains excited for the future of Zespri and its team. “[I] know we have the right people to continue to create value for our growers and partners and we know Dan will have great success in his new role,” he said.

Mathieson said it was a “difficult decision” to leave, but he is confident the industry is well positioned and is excited by the personal challenge ahead.

“I’m so passionate about this industry,” he said. “It’s filled with incredible, deeply committed people providing a world-class product and its future is so bright.”

As the industry continues to address the quality challenges imposed by Covid restrictions, Mathieson noted the positive results from Zespri this season.

“We know demand is growing strongly,” he said. “And with what has so far been a good growing season, we’re focused on delivering a large, great-tasting and high-quality crop to our customers and consumers and delivering great value back to our growers and partners.”

With this in mind, Mathieson believes the Zespri team will continue to achieve success in the sector.

“There will be new challenges ahead, but with an outstanding team of people, a clear strategy, and strong investment in innovation, I know Zespri will continue to be an increasingly strong force in the healthy food space.”

Zespri said its board will carry out an executive search for Mathieson’s replacement to “take Zespri and the industry forward.” A

Montague has announced the passing of its founder, William (Bill) Montague on 6 February, aged 97. Bill Montague founded the Australian company in 1948, planting its first orchard in Narre Warren North, Victoria in 1950 and supplying fruit to hospitals in and around Melbourne “Bill had an unwavering passion for quality fruit production,” the company said.”He will be dearly missed.”

APPOINTMENTS

Salix Fruits has made two key appointments to its leadership teams in Chile and Egypt.

Pascuala Vergara Sabaini becomes country manager for Chile, while Haydy Shahin has been named country manager for Egypt. Both executives have extensive experience in the fruit industry. Salix Fruits said both appointments emphasised its dedication to diversity and equal opportunities in top leadership.

The Australian Fresh Produce Alliance (AFPA) has elected Gavin Scurr, managing director of Piñata Farms, as AFPA chair for the 2024 term. With over 30 years of experience in the fresh produce industry, Scurr (pictured) will take over the role from Scott Montague. “I am looking forward to continuing to lead the AFPA’s agenda in improving outcomes for the industry,” he said.

The fresh produce trade has reacted with shock and sadness to the news that Heath Wilkins, founder and managing director of New Zealand cooperative Golden Bay Fruit, has died unexpectedly at the age of 54. Wilkins (pictured) started Golden Bay Fruit following the deregulation of New Zealand’s apple and pear industry in 2000.

From that moment on, and with support from other apple-producing families, Wilkins managed to grow the Golden Bay brand and to build an impressive export business – not just to traditional destinations in Europe, but also in emerging Asian and Middle

Eastern markets.

In April 2022, the company refreshed its brand to underline the spirit of partnership and empowerment among growers, something that remained at its core during those first two decades.

“Heath’s loss is deeply felt across Golden Bay Fruit, the industry and the community, affecting us not only as a dedicated leader but also as a close friend and colleague,” the company said in a statement.

“Our thoughts and heartfelt condolences go out to his wife Lisa, his kids Tasmyn, Sydnee and Connor, and his entire family during this incredibly difficult time. At Golden Bay Fruit, we are a close-knit family, and now, more than ever, we stand united to navigate through this challenging period.”

Ben Bardsley, head of climate tech business Bx, described Wilkins as “a legend of the global fresh produce industry.”

IBO names Mario Steta as new chairman

The International Blueberry Organisation (IBO) has appointed Mario Steta as its new chairman. Steta (pictured), who is operations director for Driscoll’s in EMEA and formerly served as president of Mexican berry association Aneberries, brings extensive experience and knowledge to the role.

“The experience I’ve gained working for one of the leading berry companies makes me feel ready to embrace this role and the significant opportunities and challenges that face the global blueberry industry,” Steta said. “Under the leadership of the outgoing president, Peter McPherson, the IBO has established a strong spirit of industry collaboration, strongly focused on furthering the development and promotion of blueberries worldwide.”

McPherson, formerly general manager of Australian company Costa Group’s berry business, held the IBO president position for eight years.

Top local and international players to discuss rapid market evolution as India’s premier fresh produce event returns to Mumbai.

by John Hey

@johnfruitnet

Ahigh-profile lineup of leading names in the business is set to speak at Fresh Produce India as the event makes its much-anticipated in-person return on 21-22 March 2024.

Organised by Fruitnet with Official Partner Asia Fruit Logistica, India’s premier event for fresh produce business professionals is back with a brand-new format.

Taking place at Mumbai’s Trident Nariman Point Hotel on 21 March, Fresh Produce India is centred on a non-stop business networking expo, paired with a new-look

OPPOSITE LEFT— Fresh Produce India is back for its first in-person edition since 2019

OPPOSITE RIGHT & TOP LEFT— Speakers (pictured clockwise) include Reliance Retail’s Saurabh Raina, Siddharth Tata of Amazon Fresh, Tarun Arora of IG International and Peter McPherson, consulting advisor to Costa Group

ABOVE LEFT—Fresh Produce India is centred on a non-stop business networking expo

content programme.

With a packed one-day programme of talks, presentations, interviews and tastings all taking place in the bustling expo, Fresh Produce India brings together key players from across the local and international business to discuss the big trends and opportunities in India’s fast-moving fresh produce business.

The programme opens with a high-powered panel discussion looking at the major shifts in the Indian market since the last in-person edition of Fresh Produce India took place in 2019. Reliance Retail’s Saurabh Raina, Siddharth Tata of Amazon Fresh, IG International’s Tarun Arora and Sumit Saran of SS Associates share their expert insights on India’s changing consumer, retail and distribution landscape. The discussion touches on a wide range of developments, from large-scale investments in infrastructure to the rise of quick commerce.

Avocados and berries, two fast emerging categories in India, are the focus of the second session.

Multinational avocado supplier Westfalia Fruit is playing a pioneering role to develop the market through its joint venture with Sam Agri, Westfalia Fruit India. The group’s global business development executive Zac Bard is joined by Westfalia Fruit India general manager Ajay TG to talk about India’s journey

in avocados. The pair discuss the impact of the opening of the market to key African supply origins such as Tanzania and Kenya as well as moves to develop domestic production among other topics.

India also recently opened its doors to Australian avocados, and Flora Zhang of Avocados Australia outlines the industry’s plans to develop the market, including an exciting marketing campaign featuring cricket celebrity, Brett Lee.

Turning the spotlight on berries, Yupaa Group’s Ambrish Karvat and Peter McPherson, consulting advisor to Australia’s Costa Group, explain why India is emerging as ‘the next frontier’ for the global berry business. As leading global breeders and marketers move in on the Indian market, they discuss some of the keys to success in developing domestic production ventures, plus they analyse India’s consumer market potential.

India’s fresh fruit and vegetable producers are moving to capitalise on opportunities in their domestic market for branded and premium products. In a session focused on building India’s domestic fresh produce offering, Ajit Bisoi of leading seed company Rijk Zwaan discusses its efforts to develop Snibs, a range of snacking vegetables catering to trends towards healthy snacking.

India’s rapidly developing fruit import market is the focus of the final session at Fresh Produce India. An expert panel featuring leading global brands and suppliers discusses some of the key market trends and opportunities, from efforts to introduce new club apple varieties to building consumption in lower-tier cities.

Speakers include Jitender Lohani, CEO of leading importer DJ Exports, Anton Kruger, CEO of South Africa’s Fresh Produce Exporters’ Forum; Jason Morris, global general manager of Pink Lady; and Laurent de Smedt, head of the pomefruit division at Belgian cooperative BelOrta.

Fresh Produce India’s content programme takes place alongside the bustling business networking expo. The mix of lively sessions in a shared conference and expo area enables delegates to connect with customers, buyers and service providers and tap into a wealth of established expertise and new talent.

Day Two of Fresh Produce India (22 March) offers a programme of organised tours for delegates. The first stop on the tour is IG International’s cold storage facility at the second Mumbai International Cargo Terminal (MICT II). The state-of-the-art facility is strategically located next to Jawaharlal Nehru, just 18km from Nhava Sheva Port. The tour then heads to Vashi wholesale market, before visiting a selection of Mumbai’s leading modern food retail stores. A

Fresh shopping and eating habits are driving change in India’s consumer market, and leading importer IG International is adding new capabilities to stay ahead.

by Liam O’Callaghan @liamfruitnet

It’s a positive trajectory for fruit in India, according to Shubha Rawal, IG International’s head of procurement. While the imported fruit market faced a slight downturn in 2023, the overall fruit market in India is expanding, helped by rapidly evolving domestic production.

Rawal says fruit preferences in India have undergone a transformative shift as new fruits and varieties are added to both the domestic and imported offerings.

Apples, India’s top import category, lead the way with increasing consumer income levels and health benefits helping to fuel demand.

“Notably, the market expansion is not confined to urban areas, as the penetration of imported fruits has significantly increased in smaller towns and cities across India, amplifying the overall demand,” says Rawal.

Another driver of growth for the imported fruit market is a convergence of a set of key trends: culinary evolution, social media and healthy eating.

“Fruits that serve as essential ingredients in cuisines have found fertile ground, owing in part to the surge in fine dining establishments and the transformative influence of the internet revolution,” notes Rawal.

“Platforms like Facebook, Instagram, and other social media channels have facilitated

a virtual kitchen space for chefs, enabling them to share and access innovative recipes and cooking techniques. This has contributed significantly to the increased incorporation of exotic fruits into diverse culinary creations.”

The pandemic also acted as an accelerant, fostering home cooking and a focus on healthenhancing and immunityboosting ingredients, and fruit has benefitted.

“Fruits such as berries, cherries, and avocados (are) transitioning into mainstream staples. This change is primarily driven by the country's millennials, a significant portion of whom reside in urban areas,” says Rawal.

“This demographic is wellinformed about the nutritional benefits of these superfoods, and their willingness to adapt their dietary habits and pay premium prices has spurred an ever-growing demand.”

Effectively catering to these consumers is not a simple task in a vibrant and diverse market like India. Rawal says the Indian market presents immense opportunities but success requires a nuanced understanding of its complexity and investment in infrastructure and supply chain, particularly in cold storage and cold chain logistics.

“Successful brands have taken time to understand the intricacies of the Indian market, recognising

the mix of organised and unorganised segments. They often have strategies that cater to both the upscale superstores and the less organised markets in smaller towns,” Rawal says.

“Recognising the diversity within India, successful brands tailor their marketing strategies to different regions. They acknowledge the cultural diversity, preferences, and consumption patterns, allowing them to compete effectively with local and regional varieties.”

Determined to stay at the cutting edge of the market, IG continues to invest across the value chain. It has partnerships with Hortifrut for berries, Engin Tarim for apples and SNFL for grapes, bringing new varieties in for domestic production. Its efforts are further enhanced by controlled environment agriculture, plant biotics, and other modern technological solutions.

IG is also expanding its efforts beyond cultivation, venturing into post-harvest solutions with a focus on circular economy practices including a new strategic partnership with Europe-based perishable logistics service provider Foodcareplus Logistics. A

Market for premium imported fruits shows signs of recovery in India as suppliers jostle for opportunity.

by Liam O’Callaghan @liamfruitnet

After a challenging few years for the premium end of the Indian import market, conditions are improving with top-end consumers returning to branded favourites and continuing to explore newer categories.

While this return in demand will be welcomed by some suppliers,

importers note a level of price sensitivity still remains for the majority of the consumer market, particularly in large categories such as apples.

“With the revival of the economy post-Covid, it has helped consumers in first-tier cities to enjoy premium fruits. Still, the majority of consumers in India

remain price conscious due to increasing inflation,” notes Naufil Kalam operations director of CR Fruits International.

“This year saw an increase in the number of customers who were willing to buy high priced premium products like Hass avocados and cherries.”

Prashant Gidwani of Fresh Fruit Alliances says many of the changes in long-standing consumer habits caused by the pandemic remain, and the suppliers that have responded best have seen results.

“The adage ‘availability creates demand’ rings true even today. By bringing in fruits from other countries, India has been able to help its fruit industry grow and give its consumers the best of both worlds. The overall imported fruit market in India over the past 12 months has seen increasing consumption, demand and volumes compared to previous years,” says Gidwani.

“In the past few years countries like Turkey, Iran and Poland have understood and appreciated the market dynamics of India and with their competitive pricing they continue to be the leading suppliers of imported apples in the country.”

Apples reign supreme when it comes to imported fruits in India however other fruits continue to gain momentum as consumption grows.

Jitender Lohani, chief executive of DJ Exports, notes the progress made by key categories citrus and kiwifruit.

“Kiwifruit remains the second largest category of imports and demand and acceptance of fruit is consistent. Yellow sweet kiwifruit, especially Zespri SunGold, is gaining more acceptance in tier-one cities,” says Lohani.

“In citrus, consumption of Valencia oranges continues to grow, and we also see growth in the consumption of low-seeded mandarins. Australian citrus received a recent tariff reduction and we have seen good growth in volumes.”

Gidwani says overall citrus demand is expanding and Egypt and South Africa are two of the top suppliers benefitting. Supply is shifting in kiwifruit.

“Recent geo-political developments have restrained the Iranian kiwifruit with limited arrivals, creating an opportunity for Greek and Italian kiwifruit to fill the gap,” he explains.

The exponential growth shown by some of the smaller lines such as blueberries, avocados and cherries is also continuing. Lohani says the key to sustaining this success is maintaining consistent effort and product, pointing to suppliers like Zespri,

blueberries from Peru and cherries from Chile.

Gidwani notes cherries and blueberries still only represent a tiny percentage of total imports as high cost and limited shelf-life remain major challenges.

“The avocado, on the other hand, has become a regularly consumed fruit,” he says. “Through Tanzania's opening to our market, Indian consumers have had consistent and price-friendly access almost yearround.”

Kalam says the demand for new varieties of fruit is helping to fuel this growth, but the key to future success does not necessarily lie in the premium end of the market.

“We can see newer varieties of apples entering India. Consumers in first tier cities are open to trying new varieties of fruits to give a change to their taste buds. This has allowed importers to confidently import new varieties and run marketing programmes to support their imports,” he says.

“The question now is, how do

OPPOSITE—Lower cost suppliers dominate the apple market

LEFT—New varieties and brands are helping to grow the fruit import market

DJ Exports continues to invest in infrastructure development, recently completing a new distribution centre. The company has expanded its digital presence, increasing its B2B profile with major online retailers and establishing its own e-commerce start-up Froovella, which offers domestic and imported fruit to consumers in the Delhi NCR. DJ Exports has also partnered with Agrovision to grow blueberries in India, marking its first joint venture in this area.

brands that grow these fruits market their products in India? They already have the rich population as their customers and the poor population of the country cannot be targeted as they won’t be able to afford these.

“The perfect consumers that can stimulate growth in consumption of fruits would be the upper middle class. They constitute »

a major part of the population and are growing significantly. The companies importing and marketing these fruits must appeal to the health needs of the upper middle class.”

One trend that has maintained momentum on the other side of the pandemic is the growing popularity of e-commerce, particularly the quick commerce segment which offers short delivery times. As the supply chains that support e-commerce platforms continue to develop, so does the viability of fresh produce sales via this channel.

“Consumers increasingly have begun using virtual or online methods of shopping for groceries and fresh produce. Food delivery apps and e-commerce platforms continue to be on the rise and are

here to stay,” says Gidwani.

“At Fresh Fruit Alliances, we continue to invest in new technology and digitalisation to make our suppliers more efficient. Fresh Fruit Alliances with our in-house brand Fruitamins has been reaching consumers from both online and offline channels.”

One current barrier to capturing the opportunities available in India is ongoing logistics disruption, most notably in the Red Sea.

“With (the) Red Sea issue we expect disruptions of supplies from Europe and Egypt which would give impetus to supplies from South Africa, New Zealand and the US,” notes Lohani.

Gidwani says the transit time for vessels coming from Europe to India is extended by 15-20 days as

CR Fruits International has launched two new fruit brands to differentiate its offering and deliver consumers a premium product. Grapescape is the company’s new premium table grape brand while Dreamberry is a fresh look for GI-certified strawberries grown in Mahabaleshwar.

For Grapescape, CR Fruits collaborates with growers from across the country, providing expertise and the latest technology to ensure a high quality product. The result is fruit that can achieve a premium in domestic and export markets.

“We provide growers with our packaging expertise at our own packhouses where these premium quality grapes are packed in our very own Grapescape brand and made available to consumers via our retail outlet as well as our partnered retail outlets,” says Naufil Kalam, operations director of CR Fruits International.

CR Fruits has also helped growers in Mahabaleshwar access new varieties of strawberries via a partnership with nurseries in Italy.

“We have also provided growers access to new ways of farming which has helped them to increase their yield while reducing their cost. With Dreamberry we aim to distribute Mahabaleshwar strawberries to every corner of the world,” explains Kalam.

In an effort to service consumers directly, CR Fruits has also opened its very first retail outlet in Mangalore. With a focus on fruits and vegetables, the store channels the interior design of major supermarket to give consumers a premium experience.

“We have ensured with our retail outlet that fruit shopping is different from the traditional way. It is something that you could do as a leisure (activity) with families coming together, shopping for premium quality fruits while enjoying fresh pressed juices and culinary fruit-based dishes developed by our in-house chefs,” says Kalam.

“With positive feedback to our first outlet from our customers, we aim to open more outlets, with plans for three outlets in the city of Bangalore already falling into place.”

ships re-route around southern Africa.

“This has seen seafreight rates skyrocket and has immensely affected the supply chain. It’s leaving the market short supplied, resulting in high price levels,” he says. A

First consignment of South African blueberries could be shipped to India at the start of the next season.

by Fred Meintjes

South Africa’s efforts to gain access to India for blueberries are at an advanced stage. The industry is currently awaiting final feedback from Indian authorities and there are hopes matters will progress during Fresh Produce India held in Mumbai in March.

South Africa has a growing blueberry industry and has recorded substantial production increases in recent years.

“Our 2023 crop has been somewhat below expectations, but our long-term forecast is still for

“We are also in a phase of introducing new varieties which positions us for long-term growth”

considerable growth,” says Brent Walsh, chief executive of Berries ZA. “That is why we are keen to get access to the consumer markets of the East and India is one example.”

South Africa exported just over

22,000 tonnes of blueberries in 2023, short of initial forecasts of 25,000 tonnes.

“We had some difficult conditions during the harvest which slowed down picking and packing. We are also in a phase of introducing new varieties which positions us for long-term growth,” says Walsh,

The lower crop was particularly disappointing given there was strong demand and good prices to be had in traditional markets.

“Our competitors in Peru were also affected and this was reflected in the strong market,” notes Walsh.

There is optimism South Africa will be able to conduct its first shipments to India as the new season picks up steam in July if access is confirmed.

“We can service the Indian market both by air and by sea, with some of our producers in the north of the country being able to ship their fruit from the east coast ports,” says Walsh.

“This is assuming that the final agreements are in place.”

It is not just the South African blueberry industry that has its sights set on India, as securing access for stonefruit is also a priority. Both sectors are eager to meet the requirements of the Indian market according to Walsh.

“We hope that the access for South African stonefruit will be finalised soon and that our blueberry industry can then also move forward. Naturally, we must finalise the final processes of the intended protocols and we are happy that we have responded to everything the Indian authorities have asked of us,” he concludes. A

BelOrta is a Belgian cooperative, owned and led by more than 1.250 local growers. Because of this, we can confidently call ourselves your one stop shop partner for the complete apple and pear range.

Ultra modern handling process. From field over sorting to fork.

Extensive range (+ 20 variaties), constantly evolving and improving thanks to constant trend and quality research.

World class sustainability.

Tailor made products, packaging etc. available on demand.

More info about our our apples and pears and other produce?

Contact +32 (0)12 670 200 or fruit@belorta.be

A short domestic crop, tariff changes and logistics challenges have created a fluid market for apple imports in India.

by Liam O’Callaghan @liamfruitnet

India’s apple import market has been short on stability in recent times as a host of factors influence across the value chain.

At one end, suppliers are contending with logistics disruption and tariff changes. At the other end, while consumers are still eager for apples following an underwhelming domestic season, the increasing cost of living is being felt. The result is a fluid market that is ripe for opportunity for the suppliers that can effectively service it.

Three suppliers currently making the most of their opportunities are Turkey, Poland and Iran, according to Prashant Gidwani of Fresh Fruit Alliances.

“India continues to be one of the biggest markets for apple imports. At the same time, it is also a price sensitive market. Hence Turkey, Poland and Iran remain the leading suppliers of imported apples,” says Gidwani.

A weather-affected domestic crop saw apple prices rise in 2023 for both local product and imported

fruit that sought to fill the gap, according to Naufil Kalam, operations director of CR Fruits International.

“The apple market went a little aggressive in pricing due to flooding in Himachal which caused a delay and damage to the apple crop of India. This forced Indian consumers to pay a high premium to the roaring imported apple market,” says Kalam.

“The Kashmiri apples also opened at a high premium due to shortage in Himachal apples, this did not help consumers as they still had to pay a premium for apples, but the prices stabilised at the end of the year.”

Jitender Lohani, chief executive of DJ Exports, says the short supply also saw a surge of Afghan apples being imported via land border in North India.

Turkey has been able to secure a sizeable market share in the Indian apple market, capitalising as competitors navigated challenges.

“The Turkish Red Delicious apples found a way to increase their market share in India due to

weakness in the supply of Red Delicious apples from Europe. Consumers in India love Turkish Red Delicious apples for their taste and texture as well as attractive price,” notes Kalam.

Aysel Oguz of Turkish exporter Anadolu Etap says Indian consumers have come to gain an appreciation of the Turkish product.

“When we are talking about the place of Turkish apples in the Indian market we can say for sure that for the last couple of years, demand and reputation have (gotten) better and better. Indian consumers like the fact that the fruit is not waxed as well as the sweet taste of the fruit,” says Oguz.

Oguz acknowledges that the increased tariff on US apples provided the impetus for the growth but as the tariff is reduced, she remains optimistic that progress can be maintained.

“In general, Turkish Red Delicious apples from Isparta look very similar to US Washington apples, and after the increase in the tariff, Turkish apples got the market share,” says Oguz.

“This season the crop in the US is quite good and the tariff went down which created a lot of question marks in the heads of exporters as well as the customers. Well now the season has started and is moving on and it looks like Turkish apples are very steady in their spot.”

One of the biggest uncertainties in the market is what kind of market share US apple imports recover now the tariff has been reduced. Kalam says only small volumes of Washington apples entered the Indian market in the initial months following the change.

“It was obviously a lot higher than what entered last year but US apples found it difficult to compete with the Turkish apples, which had gained popularity and market share in India due to low prices and high quality,” he says. “The Turkish Red Delicious apples also enjoyed a better position compared to the European apples since there was very little Red Delicious in Europe. Gala

OPPOSITE TOP—Indian consumers remain fairly price-sensitive when it comes to the apple category

OPPOSITE BELOW—A short domestic crop provided opportunities for imported fruit

LEFT—The removal of a supplementary tariff on US apples is set to shake up the market again

BELOW—Turkey is one of the suppliers that has capitalised on a downturn in US apple imports

from European countries especially struggled with poor quality. This gave an upper hand to Gala from the US and Turkey.”

A new factor set to influence this dynamic is the current logistics disruption in the Red Sea, according to Kalam, as it may present an opening that US exporters can exploit.

“With seafreight costs soaring for European and Turkish companies as their goods have to divert to avoid the Red Sea, they have had to increase their price in turn. This would be a perfect welcome back for US apples to recover the market share lost in previous years,” says Kalam.

“It will be very interesting to see how well US apples will be able to compete with the much fresher apples from Southern Hemisphere suppliers, which include the likes of Chile, South Africa and New Zealand, in the coming months.”

India has also been on the radar for South African apple exporters looking for growth, and the situation in the Red Sea may also play into their hands. However, Riaan Ferreira of GF Marketing says it can be a fine balance between opportunity and challenge.

“The Red Sea shipping problems are creating some advantages as those that have fruit get good prices when the shipping is delayed. Then the market drops when all the fruit arrives together,” he says

“Northern Hemisphere apples are still getting to the markets, but the feeling is that there will be less volume, which gives South Africa an advantage when the South African apple season starts. The Red Sea also makes it more complex for countries like Brazil to get their apples to India.” A

Encouraging signs of growth for Bigbucks and its brand Flash Gala.

by Fred Meintjes

Bigbucks, the wine-red coloured apple, branded as Flash Gala, has made an exciting debut across Asia –especially in India and China –and is likely to be the driving force behind increased sales in the region this year.

South African apple and pear grower, and one of the holders of Bigbucks and Flash Gala Plant Breeder’s Rights (PBR), Anthony Rawbone-Viljoen, says there has been a flurry of interest in both the variety and the brand in India since the fruit was first exported.

“The Far East and India have proven to be shining lights to date. In these markets the overwhelming consumer preference is for sweet and red apples and in this respect Bigbucks and Flash Gala fit the billing perfectly,” says RawboneViljoen.

He says it takes many years to develop brand acceptance, but the initial signs are very encouraging.

According to industry statistics there are now almost 2.5m Bigbucks trees planted in South Africa.

“This equates to around 1,474ha of orchard capacity,” RawboneViljoen says. “In 2023 we saw an increase of 53 per cent in production, despite damage from hail in some regions.”

The rapid growth in the variety has helped to propel the Gala

category into South Africa’s single biggest apple category, overtaking Golden Delicious.

Globally, the Gala category represents over 20 per cent of current plantings, so it is firmly entrenched as an apple of choice among consumers.

“For the 2023 season, in terms of average pricing recorded from one marketer, the price premium achieved between Flash Gala and Bigbucks was around R34 (US$1.79) per carton,” says Rawbone-Viljoen.

“It is early days yet for the variety, and the premium can be expected to grow as the various markets build confidence in the variety and the brand.”

Future price performance will depend on the quality of fruit put into the carton and producers are encouraged not to be tempted to take short cuts. The premium will have to be earned, but if the offering is of a consistently high quality, the industry is confident the reward will be there.

“As volumes of the variety grow, more resources will become available to promote the Flash Gala brand in key target markets around the world,” says Rawbone-Viljoen.

“Given budget constraints, much of the current marketing activity is social media-driven.”

Calla du Toit, chairman of the Flash Gala Association, says growers are reporting a good crop

and volumes are expected to grow rapidly this season.

“This year we are again paying particular attention to the maturity of the fruit to ensure that consumers derive a consistent eating experience,” he says. A

ABOVE TOP—Growers report a strong crop of Bigbucks this season

ABOVE BOTTOM—The Flash Gala brand is gaining recognition in key export markets

In an exclusive interview with Asiafruit, Amazon’s vice president, machine learning, Rajeev Rastogi explains how technology is revolutionising quality assurance in India.

by Liam O’Callaghan @liamfruitnet

Amazon has developed a shelf monitoring solution called Johari. Can you please provide an overview of what the technology is and how it is used?

Rajeev Rastogi: Amazon’s shelf monitoring solution is a cuttingedge machine learning-powered system designed for farm-to-fridge quality assurance of fresh produce. The solution utilises advanced deep neural networks and rulebased grading to set a new standard in maintaining the quality of fresh produce.

The shelf monitoring solution offers both manual and automated

monitoring capabilities. In the manual monitoring approach, operators use the Johari mobile app to submit images of produce crates taken with their smartphones. The solution assesses the image for quality, detects defects, and applies grading logic to identify items that do not meet quality standards. Operators can then remove the defective produce, updating the app with their actions. The app provides detailed information on defect types, and the entire manual monitoring process takes an average of around six seconds per crate.

For automated monitoring, cameras are installed on top

of produce shelves to capture images at specified intervals. This approach mirrors the manual process, with the solution using the images to assess and identify defects. The automated monitoring solution employs state-of-the-art computer vision models and Wi-Fi-enabled IoT cameras. Two types of models are developed: one for item detection and counting, and another for identifying defect classes in each item.

What produce is it trained to monitor currently, and do you have plans to expand this range?

RR: Currently, the monitoring system is specifically tailored for fruits and vegetables. The AI model has been meticulously trained to recognise and assess the quality, freshness, and overall condition. However, our commitment to innovation and continuous improvement means that we are actively exploring plans to expand the range of products monitored by this advanced system.

As this technology is powered by machine learning (ML), it should improve the longer it is implemented. What kind of improvements do you think we will see to this technology?

RR: As the ML-based approach is implemented over an extended period, its capability to analyse and produce images for defect detection, including cuts, cracks, and pressure damage, will continuously improve. The ML model enables it to refine its assessments with each iteration, resulting in an increasingly accurate and efficient system. The grade and pack machine will reduce grading costs by 78 per cent as compared to manual grading. This in-house capability will provide Amazon Fresh with increased information, flexibility, and control, ultimately establishing a competitive advantage in terms of produce quality.

Where can this technology be deployed? Is it just for retail shelves or are there opportunities to use this in other areas along the supply chain?

RR: Amazon initially introduced the shelf monitoring solution at Amazon Fresh with the primary goal of enhancing the quality of fruits and vegetables delivered to customers. However, the deployment of this technology is not limited to retail shelves; rather, there are plans to expand the deployment of this solution gradually. We will continue to invest in technological advancements, and strengthen our supply chain to seamlessly deliver fresh, quality fruits and vegetables to our customers.

How widespread is it used at the moment in the Indian market and what plans do you have for expansion domestically and internationally?

RR: Currently, shelf monitoring solutions are employed for Amazon Fresh sites. As part of our strategic plans, we are committed to further expanding the deployment of this technology across geographies. Our focus is on investing in continuous technological advancements and fortifying the supply chain to ensure the seamless and timely delivery of fresh, high-quality fruits, and vegetables to our customers.

Can this technology be a key tool in growing online fresh produce sales as it can help give consumers more confidence in the product?

RR: Yes, the shelf monitoring solution holds significant potential as a key tool in boosting online fresh produce sales. As the grocery category continues to be one of our fastest-growing segments, the shelf monitoring solution becomes particularly valuable in addressing the challenge of customers being unable to physically inspect the produce before purchase. By leveraging this technology, we aim to instil greater confidence in consumers regarding the quality of the products they will receive. This becomes crucial as we observe a shifting consumer trend towards purchasing more organic and cleanlabel products across different geographical regions.

What is Amazon Fresh’s footprint now in India and how has it grown recently? What plans do you have for further growth?

RR: Amazon Fresh has established a robust presence in India, aligning

with the rapidly growing online grocery retail market, especially in metropolitan areas and emerging smart cities. The footprint of Amazon Fresh has expanded significantly, covering over 60 cities.

This recent growth reflects the increasing demand for online grocery shopping in India. Amazon Fresh aims to continue this momentum and further expand its reach across the country. The focus is on penetrating deeper into smaller cities to offer our full basket selection of (wet and dry grocery) quality products to a wider consumer base.

How have online fresh fruit and vegetable sales developed for Amazon Fresh? How do you plan to continue to develop this category?

RR: The trajectory of online fresh fruit and vegetable sales for Amazon Fresh has undergone a significant evolution, particularly accelerated by the changes in consumer behaviour during the pandemic. Traditionally, customers shopped for groceries offline, but

the pandemic-induced shift towards online platforms has become a lasting trend.

At Amazon Fresh, our paramount focus is on providing customers with an online shopping experience that feels familiar yet caters to their evolving preferences. We recognise that consumers prioritise quality products, especially when it comes to fresh fruits and vegetables, along with the convenience of delivery slots aligned with their preferred time slots.

One of the recent pan-India studies by LocalCircles revealed that 67 per cent of online grocery shoppers consider quality and value for money as top criteria for purchasing groceries online and over 50 per cent of consumers pre-plan their online grocery purchase and prefer a delivery slot as per their convenience. In response to these insights, we are committed to continuing the growth of online fresh fruit and vegetable sales for Amazon Fresh.

Our strategy involves actively listening to customer feedback and preferences to refine our offerings. This includes providing convenient delivery slots, an unmatched selection of products, and an unwavering commitment to delivering the best quality products to our customers. A

OPPOSITE—Amazon’s vice president, machine learning, Rajeev Rastogi

BELOW—The growth of online fresh fruit and vegetable sales has become a lasting trend post-pandemic

Agreement establishes direct farm-to-retail partnership which will see Indian Cavendish bananas supplied to stores in the Middle East.

by Liam O’Callaghan @liamfruitnet

INI Farms, part of the AgroStar group, has entered into a Memorandum of Understanding (MoU) with LuLu Group International, establishing a direct farm-to-retail partnership for Indian Cavendish bananas.

The new deal is an extension to a long-term partnership between the two groups – already working on pomegranates and guavas – to bring Indian fruits to the supermarkets and hypermarkets of the LuLu Group in the Middle East.

Purnima Khandelwal, chief executive of INI Farms says, this partnership marked one of the first instances of Indian bananas being directly supplied to a large, reputed global retailer like LuLu Group.

“This MoU is a significant

milestone not just in the journey of INI Farms, but also for banana and guava farmers across the country,” says Khandelwal.

“We are excited about the prospect of directly servicing a highly reputed global retailer like LuLu and ensuring the highest quality of Indian bananas and guavas from our farms to their retail shelves. We are grateful for the faith and trust shown by LuLu Group and excited about the opportunities this collaboration can bring for Indian farmers."

LuLu Group director Salim M A says the MoU is not just a trade deal, it is also about supporting Indian growers.

“LuLu Group International aims to be the pioneer in sustainable

agriculture and set new standards in quality and innovation. We have been working with INI Farms for close to a decade and this MoU further strengthens our collaboration,” he says.

“Together, in collaboration with our farmers and partners we will explore new markets and contribute to the growth of the agriculture sector. This MoU is a milestone and I’m confident that our partnership will be marked by success.”

Under this strategic partnership INI Farms will work with the AgroStar network of farmers in Maharashtra and Andhra Pradesh to deliver yearround supply and meet the high quality standards required by an international retail like LuLu Group and its consumers.

Co-founder and chief executive of AgroStar Shardul Sheth says the partnership highlights the group’s ability to serve Indian farmers across the value chain and fulfil the expectations of customers across the world.

"INI Farms has gone from strength to strength over the past few years. Last year, we witnessed landmark developments like the first Indian consignment of our ‘Kimaye’ branded bananas being shipped to the Netherlands and becoming a pioneer in the industry to successfully ship great quality pomegranates to the US among other achievements,” says Sheth.

“Our collaboration with LuLu Group International is yet another important milestone and a testament to our capability to be able to supply fruit and vegetable products of global quality standards to marquee retailers and end customers around the globe and our passion to continue to build deep and meaningful relationships servicing the seed to market linkage needs of our farmers.” A

ABOVE—INI Farms signs the MoU with LuLu Group BELOW—The deal marks one of the first instances of Indian bananas being supplied to a large global retailer

Fresh produce B2B marketplace will use new capital to drive its reach across India and fortify its global network.

by Bree Caggiati @breefruitnet

Vegrow has secured US$46m in a Series C funding round led by GIC, Singapore’s sovereign wealth fund, with significant participation from existing investor Prosus Ventures, and continued support from Matrix Partners India, Elevation Capital, and Lightspeed.

Vegrow established its presence in the Indian fruit sector by aggregating multiple channels (wholesalers/semi-wholesalers, modern trade and general trade) and using technology to match supply and demand.

Through its multi-channel demand stack, the company aims

to maximise grower income by accurately grading produce and efficiently matching it with the most suitable demand channel. According to Vegrow, this creates a virtuous cycle, attracting more growers through competitive pricing as well as more buyers, who seek consistency in both price and quality.

“Vegrow is the fastest agritech company to build a national presence, having done this within three years of its inception. Typically, it takes double the time to achieve this scale of operations,” says Vegrow co-founder, Praneeth Kumar.

LEFT—Vegrow aggregrates multiple distribution channels and uses technology to match supply and demand

Co-founder Mrudhukar Batchu says over the past year, Vegrow has experienced a fivefold increase in revenue and achieved operational profitability.

“Through the extensive utilisation of data and technology, we provide valuable insights and optimise supply chain challenges, such as reducing perishable inventory wastage to only one-fourth of industry average, and consistently achieving industry-leading profit margins,” Batchu says.

Vegrow is the first agritech and B2B investment in India for GIC, and it says the founders’ extensive experience in the sector and demonstrated execution differentiated Vegrow.

Vegrow co-founder Shobhit Jain adds the company is also committed to making a positive impact for both farmers and the planet.

“Our ambition is to establish ourselves as the undisputed leader in every fruit category, ensuring transparency and higher income for farmers, while also reducing carbon consumption through supply chain optimisation,” says Jain.

“We are excited to work with GIC, whose long-term vision and reputed global network can contribute to building a company that will last generations. We are also grateful for the continued support from our existing investors. As we focus on long-term institutional development and enhancing value for all stakeholders, we are excited for what the future holds.”

As the first backers of Vegrow, Matrix Partners India, says it has witnessed the company's evolution from concept to category leadership. Matrix Partners is optimistic about Vegrow scaling to greater heights following a strategy that has seen the company not only establish a sustainable economic model, but increase income for every participant in the supply chain. A

Leading marketer welcomes first commercial shipment following opening of market to Australian Hass avocados.

by Bree Caggiati @breefruitnet

India approved market access for Australian Hass avocados in November 2023, subject to Australia completing ten successful trial shipments.

“Sea shipments from Western Australia will play a key role in fulfilling the growing demand for avocados”

end of January 2024.

Following these trial shipments, multinational avocado growersupplier Westfalia Fruit confirmed its first commercial seafreight shipment of Australian avocados landed successfully in India at the

Westfalia Fruit is working with Western Australia’s Delroy Orchards to bring the fruit into the Indian market. According to Westfalia, Western Australia fits well into India’s avocado imports calendar with fruit available from

November to March, complementing African import programmes from April to November.

Westfalia Fruit commenced commercial imports and distribution of avocados through its Indian subsidiary in 2022 and has since seen its first commercial harvest of Indian-grown Hass avocados. The company also works closely with major national retail chains and e-commerce companies to develop awareness for avocados across the country. These marketing efforts include an avocado ripening centre which allows the company to tackle ripeness challenges by supplying avocados to consumers that are ready to eat.

Zac Bard, Westfalia Fruit group business development executive, says Westfalia Fruit has established itself as the market leader in India and the country’s largest importer of avocados.

Ajay TG, general manager at Westfalia Fruit India, adds that Australian avocados will play a key part in offering year-round availability to the Indian market.

“Westfalia Fruit has well established working relations with all major retailers and wholesalers across the country,” he says.

“Sea shipments from Western Australia will play a key role in fulfilling the growing demand for avocados over the next three months.”

Looking ahead, Westfalia Fruit is working to continue market expansion across Asia in the latter half of the decade as it caps off a year of growth across India, China and Japan. A

Expanded access into Asia bodes well for South African avocado export growth.

by Fred Meintjes

Following recent announcements granting South African avocados access to in China and Japan, India has taken clear steps to follow suit. Indian authorities have published a notice with the World Trade Organisation indicating their intention to extend access to South Africa, with comments set to close in March. Meanwhile, South African growers and exporters are preparing their registrations for the Indian market and Subtrop, South Africa’s subtropical growers’ association, says it is hopeful the first shipments will start in April.

Subtrop chief executive Derek Donkin welcomes these latest developments, saying

the breakthrough in Japan is a significant step for the South African industry.

“Widening access to Eastern markets allows for market diversification, providing opportunities other than the EU and UK, which currently absorb 95 per cent of South African avocado exports. These traditional markets, however, will remain important markets for South Africa,” Donkin says.

“Tapping into growing markets in the Far East will allow for further expansion in the South African avocado industry, which has grown at a rate of 800ha to 1,000ha per annum over the last five years. (With) current plantings

standing at 20,000ha, access to China and Japan has come at a critical time when these new plantings are coming into production.”

Early indications for the year reflect this growth, with forecasts widely predicting an increase on last year’s export crop which will augur well for the expansion into Asia.

The first shipments to Japan are still on the cards for June or July when the industry expects to harvest Hass varieties which are more suitable for the shipping protocol.

Westfalia Fruit has previously stated it anticipates the first shipment of fruit to arrive in southern Chinese ports at the end of March, reaffirming it sees the opening of the Chinese market to South African avocados as an exciting development.

“South Africa is strategically well positioned to supply the growing Chinese market with Hass, with transit times from Durban ports to southern ports in China, such as Hong Kong and Shanghai, being only 18-22 days,” the company says.

Clive Garret, marketing executive at avocado grower-exporter ZZ2 Afrikaido, says the Hass crop is being given special attention for shipments to Asia.

“We will also do trial shipments with Maluma to see if our partners can ripen them on arrival,” he adds.

According to Garret, ZZ2 has a close association with Mission Produce in the US and Mr Avocado in China.

“Both are avocado experts, and we hope to build our business with them in future,” Garret says.

“The team from Mr Avocado has already been here in our orchards and we are all keen to start.” A

Washington apples produce bumper crop after ideal preseason conditions, and exports recover in turn.

by Jeff Long

Pacific Northwest apple and pear growers have welcomed ideal growing conditions this season, with the apple industry reporting the best crop in a number of years.

For the previous three seasons, annual production of Washington apples has only been moderate at best, averaging around 116m cartons (18kg), including the meagre 104.3m cartons last year. This was hardly representative of the industry’s potential, given the steady conversion of its orchards from traditional to high-yielding varietals over the last couple of decades. It’s no shock then to see the well-rested trees that thrived under nearly ideal pre-season growing conditions respond with a bumper crop currently estimated at just under 140m cartons. If the prognostication holds, the 2023 yield will trail only the record 2014 season which produced 142m cartons.

“This year’s crop is up in volume from the original 134m (cartons) but that could slip back or even increase somewhat as we get deeper into the season,” says Steve Reinholt of CMI Orchards.

“Although projections are still for about 140m cartons, just how much fruit ends up getting packed is the question,” his CMI colleague

Marc Pflugrath agrees. “It depends on the variety and the grade as well as condition once it comes out of controlled atmosphere (CA) storage.”

Fruit quality does not seem to be an issue this season, however.

“The strongest-quality fruit always goes into CA anyway,” says Pflugrath.

Large-volume seasons often result in depressed prices and so far that has been the case, as reports have FOBs down across all varieties including the popular Honeycrisp. Adding to the industry’s profitability woes are rising costs of production including labour, fertiliser, energy and transportation.

“It will be difficult for growers to make any money this year,” predicts Randy Eckert of River Valley Fruit, adding he believes the market for Washington apples has fundamentally changed in recent years.

“There has been a flood of new proprietaries introduced to the point where I feel the consumer is getting confused. At the very least, these new varietals are cannibalising demand for some of the major ones such as Gala and Fuji,” Eckert says.

Exports have traditionally been relied on to divert significant volume from the domestic supply market. However, with trade wars,

the economic downturn from the pandemic and lowercost fruit from competing sources, international demand for Washington apples has been in decline.

The relatively light crops of recent seasons had eased supply pressures, but this was never a longterm solution. Fortunately, international sales have rebounded alongside supply increases this year.

“Exports have actually been pretty good so far,” says Reinholt. “India is up substantially thanks to the retaliatory duty getting lifted, Vietnam is churning right along, and Fujis to Taiwan have been steady. However, the China market continues to disappoint; we’ve shipped some large Red Delicious there, but the Lunar New Year demand just isn’t what it used to be.”