Dedicated coverage of gaming in the Americas May/Jun 2023 THE WORLD CUP OF NEW YORK BIG APPLE: Michael Hershman joins us as the race for the first NYC casino license heats up FROM THE TOP: We review March Madness as US sports betting continues to surge ON THE CASINO FLOOR: GamingAmerica speaks to companies across the supply chain

2 | GAMINGAMERICA GLOBAL GAMING

AWARDS

AMERICA | 3 | GAMING AMERICA

COO, EDITOR IN CHIEF

Julian Perry

STAFF WRITERS

Stephanie Feeley

Stephanie.Feeley@gamingamerica.com

Laura Mack

Laura.Mack@gamingamerica.com

LEAD DESIGNER

Brendan Morrell DESIGNERS

Olesya Adamska, Christian Quiling

DESIGN ASSISTANTS

Radostina Mihaylova, Svetlana Stoyanova, Gabriela Baleva

MARKETING & EVENTS MANAGER

Mariya Savova

FINANCE AND ADMINISTRATION ASSISTANT

Julia Olivan

PRODUCTION CONTROLLER

Oleksandra Myronova

IT MANAGER

Tom Powling

COMMERCIAL DIRECTOR

Deepak Malkani

Deepak.Malkani@gamblinginsider.com

Tel: +44 (0)20 7729 6279

US BUSINESS DEVELOPMENT MANAGER

Aaron Harvey

Aaron.Harvey@playerspublishing.com

Tel: +1 702 425 7818

ADVERTISING SALES EXECUTIVE

Ariel Greenberg

Ariel.Greenberg@playerspublishing.com

Tel: +1.702 833 9581

SENIOR ACCOUNT MANAGER

Michael Juqula

Michael.Juqula@gamblinginsider.com

Tel: +44 (0)20 3487 0498

ACCOUNT MANAGERS

William Aderele

William.Aderele@gamblinginsider.com

Tel: +44 (0)20 7739 2062

Irina Litvinova

Irina.Litvinova@gamblinginsider.com

Tel: +44 207 613 5863

Martin O'Shea

Martin.Oshea@gamblinginsider.com

Tel: +44 (0) 207 729 0643

Serena Kwong

Serena.Kwong@gamblinginsider.com

Tel: +44 (0)20 3435 5628

BUSINESS DEVELOPMENT MANAGER

Michelle Pugh

Michelle.Pugh@gamblinginsider.com

Tel: +44 (0)20 7739 5768

CREDIT MANAGER

Rachel Voit

WITH THANKS TO:

Chris Wieners, Je Baldi, Steve Bright, Cleve Tzung, E. Sequoyah Simermeyer, Jeannie Hovland, Michael Hershman, Derik Mooberry, Bill Pascrell III, Oliver Lovat, Shivan Patel, Yugo Kinoshita, Declain Raines, Bill Yucatonis, Mike Salvaris, Ambus Hunter, Epom, Travis Geiger, Mandi Hart, Anne Hay, John Skorick, Victor Newsom, Chris Justice Gaming America magazine ISSN 2632-766X

EDITOR’S LETTER

JULIAN PERRY, COO, Editor-in-Chief

Does it get bigger than the Big Apple? With the race for an NYC casino license heating up, the city is certainly getting plenty of attention for gaming right now. Accordingly, our magnificent team has produced an in-depth exploration of the race in this issue's cover feature (pages 26-31), dubbed "the World Cup of New York" by our exclusive interviewee Michael Hershman. Hershman is CEO of the Soloviev Group, partnered with Mohegan as one of the bidders for a downstate New York casino license. Other bidders are plentiful – and formidable. Just look at Las Vegas Sands: with several properties across Asia and now none in actual Las Vegas, the operator is also bidding for a license in New York. Make it make sense!

While New York is our hot topic, though, it undoubtedly isn't our only major talking point this issue. We have interviews with CasinoTrac (page 16), OPTX (page 18), Passport Technology (page 22), Zitro USA (page 32) and Aruze Gaming (page 40) for all kinds of different perspectives on the casino floor. Elsewhere, our storied columnist Oliver Lovat returns this issue with a typically detailed feature on the history of The Dunes (page 36), and we have an interview with Ambus Hunter (page 48), a recovered problem gambler-turned-financial advisor.

It's a pretty action-packed issue, overall, with several returning contributors (including the National Indian Gaming Commission), our Viewpoints feature on the topical issue of payments, and reviews of several hot new products on the casino floor. We also look back on the IGA tradeshow, during what has been an especially busy time for the industry at large. There's plenty to get stuck into, so we hope you enjoy the magazine!

Editor-in-Chief Julian Perry

FEATURED IN THIS ISSUE

and published

Publishing Ltd All material is strictly copyrighted and all rights reserved. Reproduction without permission is forbidden. Every care is taken in compiling the contents of Gambling Insider but we assume no responsibility for the e ects arising therefrom. The views expressed are not necessarily those of the publisher.

Produced

by Players

CHECK OUT GAMINGAMERICA.COM FOR THE BEST IN BREAKING NEWS

MICHAEL HERSHMAN Soloviev Group CEO

OLIVER LOVAT Denstone Group CEO

08

FROM THE TOP: BETTORS AND BALLERS

Was this year's NCAA March Madness tournament a slam dunk for the US sports betting industry?

12

14

RG IN THE USA

Which states have taken the most tangible actions toward achieving responsible gaming (RG)?

IGA 2023 SAN DIEGO – AN EXHIBITOR’S POV

Chris Wieners, Velvix MD, reviews April’s Indian Gaming Association (IGA) tradeshow in California.

16

THE IDEAL STATE: PLAYING THE GAME

Jeff Baldi, SVP of Commercial Strategy at CasinoTrac, spoke to Gaming America about the elegance of software, the importance of customer experience and plans for growth.

18

THE FUTURE BEFORE THE FUTURE

Speaking to Gaming America, VP of OPTX Data Science, Steve Bright, assures us humans are still at the core of the economic premise behind understanding behavior.

22

ARCHITECTS OF DATA

Passport Technology CEO Cleve Tzung spoke to Gaming America about streamlining payments and data with the casino floor in mind.

24

MODERNIZING NIGC REGULATIONS

Chairman E. Sequoyah Simermeyer and Vice Chair Jeannie Hovland discuss proposed changes for key employees and primary management officials.

26

THE WORLD CUP OF NEW YORK

Gaming America closely examines the bidding process to add a casino to the New York City cultural and entertainment landscape. Michael Hershman, CEO of the Soloviev Group, is also on hand to provide exclusive insight into his company’s bid.

6 | GAMINGAMERICA GAMING AMERICA | CONTENTS

39 Shivan Patel

40

24 Jeannie Hovland

32

GREAT GAMES TRANSCEND

Derik Mooberry, CEO of Zitro USA, speaks about innovation in the US market vs global success.

34 HOW OPERATORS SHOULD PROMOTE RESPONSIBLE GAMBLING

William J. Pascrell, III, Esq. speaks to Gaming America about how the gaming industry can research, educate and collaborate to promote better gaming habits.

36

THE CURSE OF THE SULTAN

Gaming America regular contributor Oliver Lovat is back! Here, he discusses The Dunes, the Las Vegas Strip’s 10th resort to be built...

39

40

PARIPLAY OP-ED

Shivan Patel talks aggregation.

NEW APPROACHES ON OLD CLASSICS

Yugo Kinoshita, Global CEO of Aruze Gaming Group, speaks to Gaming America about innovation and trends on the casino floor.

42

DIFFICULT BUT CRITICAL

Gaming America contributor Declan Raines, Head of US Gaming at TransUnion, discusses why reducing abandonment during onboarding is hard but vitally important.

44

NICHE SPORTS GO PRO

Gaming America sits down with Pro League Network’s Co-Founders Mike Salvaris and Bill Yucatonis to discuss the advent of niche sports betting.

48 TRIGGERS, BOUNDARIES & A BALANCED REALITY

Accredited Financial Counselor Ambus Hunter speaks with Gaming America, sharing his story of recovering from problem gambling addiction and working toward financial recovery.

50 HOW'S YOUR SOCIAL LIFE?

Research looks into which forms of social media are most effective for gaming operators.

56 BECOMING A BETTER BETTOR

Travis Geiger of WagerWire speaks to Gaming America about the brand’s attempts to launch a new concept, a social media community and a Bet Value Calculator, through the ethos of ‘being a good hang.’

58 VIEWPOINTS

Five payments industry experts discuss their opinions on customer loyalty, alternative payments and more.

63 PRODUCT REVIEWS

Gaming America looks at four suppliers' newest land-based slots, available across the country.

GAMINGAMERICA | 7 CONTENTS | GAMING AMERICA

48 Ambus Hunter

58 Mandi Hart

FROM THE TOP: BETTORS AND BALLERS

Was this year’s March Madness NCAA tournament a slam dunk for the US sports betting industry?

In 2022, $3.1bn was projected to be wagered on the March Madness tournament by 45 million American basketball fans. Fast forward to 2023 and the same American Gaming Association (AGA) research shows that number has meteorically risen to $15.5bn for the tournament, bet by 68 million fans.

In total, $16bn was wagered on Super Bowl LVII only a month earlier, but a comparatively small $1.8bn was bet by American soccer fans on the World Cup in the fall of 2022, making March Madness stand out. Perhaps the biggest surprise, and what may be bolstering basketball bettors, is the rebound in popularity of bracket competitions – which the AGA said 56.3 million Americans took part in this March. This increase in fans’ madness for sports betting could also be due to the number of legal markets now available. There were 33+ legal live sports betting states including Washington DC, in which 57% of American adults happen to live in these states – and potentially watch basketball. AGA President and CEO, Bill Miller, said of the tournament, “March Madness is one of the best traditions in American sports – and America’s most wagered-on competition. Critically, the expansion of regulated sports betting over the past five years has brought safeguards to more than half of American adults who can now bet legally in their home market.”

A bracket of 68 hopeful college teams represented a total of 37 states and Washington DC, but only 22 states with a

team in the tournament had legalized sports betting. Newcomers Massachusetts, Ohio and Kansas have only recently legalized and launched legal sports betting for their residents, while other states have introduced mobile betting options. Maryland Lottery and Gaming Director John Martin said, “This was the first time mobile wagering on March Madness was available in Maryland, and as our market continues to mature, we’re pleased to see it generate a strong contribution to education funding.”

WHO’S GOING ALL IN?

Millions of hopeful basketball fans engage by taking part in March Madness competitions meant for bettors rather than ballers. Incentive Games and bet365 offered perhaps the largest grand prize: a $10m jackpot for anyone who bet a perfectly accurate list of winning teams in their Mega March Bracket Challenge. The game was free to play in New Jersey, Virginia, Colorado, Ohio, Mexico and New Zealand; a leaderboard and other prizes were available based on points earned for any correct prediction. The odds of filling out a perfect bracket, though, were a staggering 1 in 9.2 quintillion.

BetRivers launched bonus payouts in a new NCAA version of its Squares game. A winning standard square earned $20 in bonus money for that bettor, while the potential payout for winning “boosted” squares was worth designated amounts ranging from $25 to $10,000. Betr also expanded from its usual offerings, from microbetting

to a core sports betting market. Bettors could wager on an outright winner, the margin of win and an over/under on total points. Other gaming providers that sought to offer more options included: Meridianbet, a European sports betting operator, which announced more than 200 odds per game and Low6, an iGaming freeplay provider that created a customizable bracket game suite with Clutchbet, from Australian bookmaker, Bluebet.

Tipico Sportsbook’s in-app competition announced a winner, and started at a modest $20 minimum wager. Bettors could place unlimited bets throughout the duration of the tournament, rank on state leaderboards, earn exclusive rewards and potentially win a grand prize. Tipico’s competition winner, who placed over 110 winning betslips with a total of $10,000 in handle, won a full year of bet credits.

GUARDING THE POINTS

These contests and operators did not see any advertisement air time during March Madness games, though. 2023’s Super Bowl saw an uptick in sports betting advertising deals, including a DraftKings and Molson Coors “High Stakes Beer Ad,” but the NCAA bans networks from selling air time to sportsbook ads. The organization’s website contains an official statement saying, “Sports competition should be appreciated for the inherent benefits related to participation of student

8 | GAMINGAMERICA GAMING AMERICA | FROM THE TOP

-athletes, coaches and institutions in fair contests, not the amount of money wagered on the outcome of the competition.”

College football games, however, have not seen the same blanket ban on sportsbook advertising. The New York Times called relationships between popular sportsbooks and several universities the ‘Caesarization’ of campuses. Caesars Sportsbook and Michigan State University struck the first deal in 2021.

As of November 2022, at least eight universities had partnered with sportsbooks. However, the AGA marketing code now prohibits new “college partnerships that promote, market or advertise sports wagering activity.” The University of Colorado ended its “controversial” partnership with PointsBet only a day after the AGA’s announcement of the new code, and other schools may soon follow that lead. Michigan State faculty members have already started a petition to end its athletic department’s $9m Caesars partnership. Conversely, the AGA has also reported that Americans under 35-years-old are both more likely to remember viewing a responsible gaming message and more likely to advocate the importance of wagering legally.

Historically, no matter how much money is bet during the course of the action, neither the schools nor the players see a cent of that handle. The Supreme Court ruled in 2021 that players can receive sponsorships and negotiate endorsement deals, but even the schools and players with the most favorable odds can’t make any revenue from the overs, point spreads, or totals that bettors predict.

NOTHING BUT NET (PROFIT)?

Overall US tax revenue from sports wagers in 2022 reached a combined $1.4bn, across 27 legal states. With more states legalizing the ability to wager on a win for the home team, more states have benefitted from increased revenue during the mad rush to bet this March. The American Action Forum has already reported a disparity between tax revenue structure in each state where sports betting is legal. In New York alone the rules differ greatly; mobile betting

revenue is taxed at 51%, while land-based revenue is taxed 10%. The Empire State brought in a total of $1.8bn in bets during March 2023.

Texas, which hosted the Final Four games, has yet to legalize sports betting. However, bettors didn’t have to look very hard for websites posting lists of sportsbooks that still accept bets from the Lone Star State. Unregulated and offshore betting was still easily accessible to those hoping to make a backdoor cut around state laws. Wagers with unlicensed sportsbooks took nearly $4bn in revenue from legal operators in 2022, also taking $700m in taxes and fees away from the states.

Critics of sports betting’s sweep of the nation have focused on potential rises in gambling addiction rather than rises in tax revenue. This quick and thorough expansion of legal gambling creates a duality between excitement and responsibility. Michigan’s ‘Don’t Regret the Bet’ campaign urges players to: “think of gambling as “entertainment, not a side job.” The Massachusetts Gaming Commission (MGC), in its newly legal gambling market, has also already introduced PlayMyWay, a free budgeting tool to track player spending.

According to the AGA, three quarters of this year’s March Madness bettors using popular online sportsbooks were brand new to placing sports bets online. While March Madness wasn't expected to quite reach the $16bn handle heights of Super Bowl Sunday, sportsbooks like DraftKings are already predicting the odds for the 2024 tournament, and states’ reported gaming revenues for March are on the rise due to the madness. No matter which schools do well, odds are that sportsbooks will see even more legal sports bets placed around 2024’s Big Dance.

10 | GAMINGAMERICA

AMERICA | FROM THE TOP

GAMING

RG IN THE USA

Which states have taken the most tangible actions toward achieving responsible gaming (RG)?

MINNESOTA

A Minnesota Court of Appeals ruled that the ‘open-all’ feature on electronic pull-tab casino games was improperly allowed and would be illegalized in the future. It made this decision due to Tribal protest, who complained this feature was too similar to the mechanics of a slot machine, over which they have a monopoly in the Gopher State. It was argued these pull-tab casino games broke RG guidelines due to their highly addictive nature.

NEVADA, MICHIGAN AND WEST VIRGINIA

All of these states failed to meet National Council on Problem Gambling (NCPG) standards relating to iGaming specifically. The NCPG reported that these states fell drastically short of meeting its Internet Responsible Gaming Standards, which are meant to provide players with sufficient RG gambling protections. This report came out at the end of January 2023.

12 | GAMINGAMERICA GAMING AMERICA | RESPONSIBLE GAMING

MT WA OR UT CO AZ NM AK HI WY ID

NV

NEW YORK

Senator Joseph P. Addabbo Jr. stepped up to promote Problem Gambling Awareness Month in March 2023. Indeed, Addabbo announced in October 2022 that NY would be implementing responsible gaming training for all lottery vendors. This training will focus on underage gambling, teaching operators how to properly verify gamblers' ages and recognize fake IDs.

MAINE

Maine launched a virtual self-exclusion program, which will allow people to voluntarily exclude themselves from casino gambling, in March 2023. The state’s Gambling Control Board says that, before this virtual option was made available, people would have to go out to designated locations to fill out a form. With the virtual form, the process is made far more convenient.

MASSACHUSETTS

The Bay State launched a program formulated by regulators to prevent problem gambling, called ‘GameSense,’ in February 2023, ahead of the state’s launch of online sports betting on March 10. The RG program aims to inform gamblers about the realities of betting, including the low likelihood of winning money. It also educates them on practices such as self-exclusion.

The Delaware Council on Gaming Problems (DCGP) received a Best in Show award at the Healthcare Advertising Awards in August 2022, for its innovative ad campaign on problem gaming. The DCPG teamed up with the AB&C advertising agency to create ad spots in an attempt to educate and inform bettors.

RESPONSIBLE GAMING | GAMING AMERICA GAMINGAMERICA | 13

ND MN WI IA NE TX OK MO IL IN OH WV VA NC SC GA FL AL MS LA AR TN KY VT ME NH MI MA NY PA

DELAWARE

KS

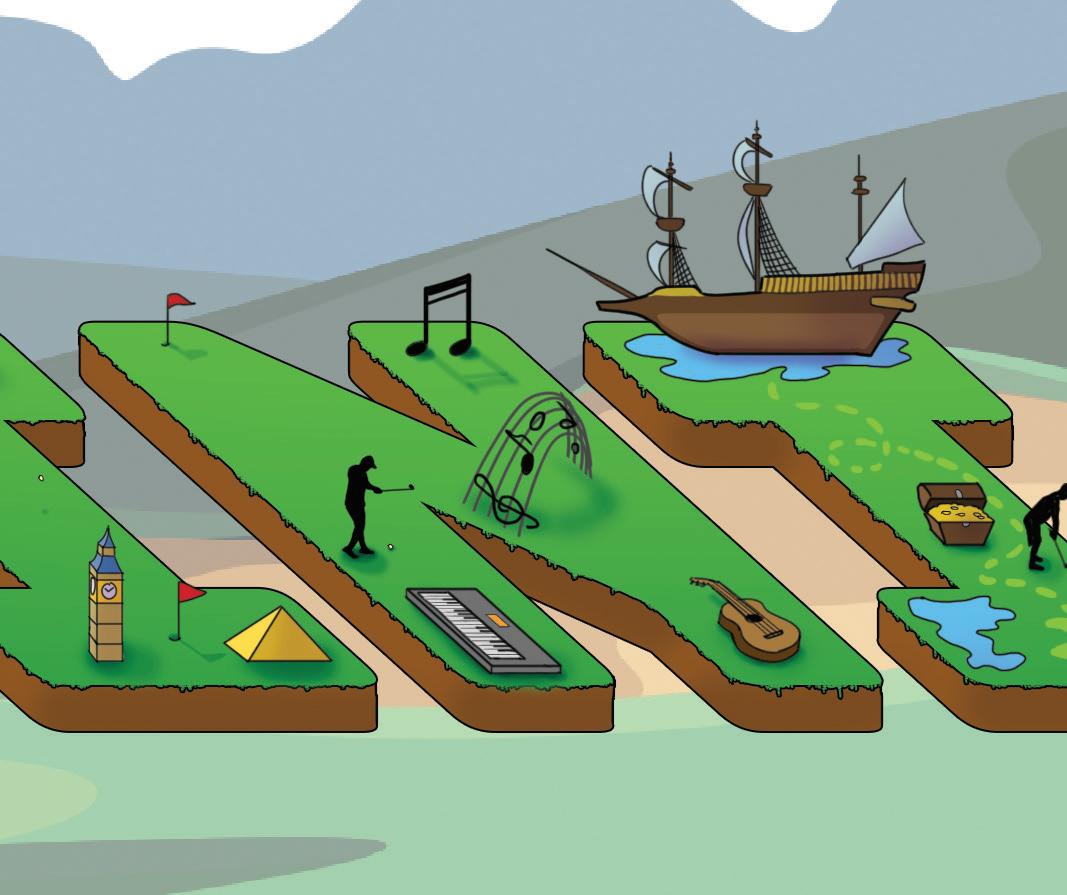

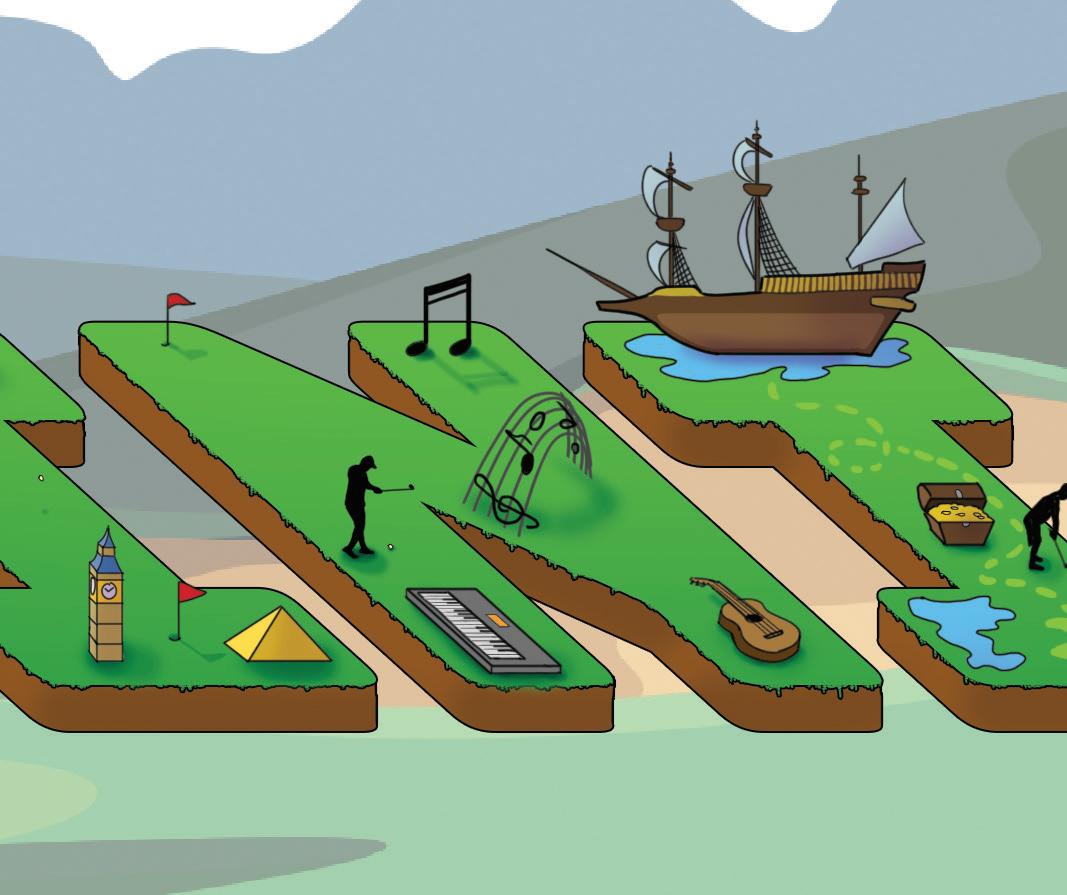

IGA 2023 SAN DIEGO: AN EXHIBITOR’S POV

Chris Wieners, Velvix MD, reviews April’s Indian Gaming Association (IGA) tradeshow in California.

The recent IGA 2023 show held in San Diego, California, was another example of the post-Covid world returning to normal: a busy tradeshow floor, Tribal representation from across the US and excited operators ready to purchase – I think one can truly say “we’re back!” With all of the excitement that came with the show's return to San Diego, there were definitely some unique aspects worth pointing out, which showcase both the current state of affairs for Tribal gaming operators and a glimpse into what the future may hold – good and bad. Here are some of my observations as an exhibitor who walked the floor and connected with clients, industry partners and competitors.

CHANGING TIDES – THE MOVE TO STRAIGHT PURCHASE OF GAMING EQUIPMENT

While this may not be specific to Tribal gaming, the reliance on daily fees and revenue share is definitely shifting. With the majority of operators experiencing an amazing two-year run, we are witnessing a shift from interest in long-term lease and rev-share deals to more straight purchase requests. To be candid, this makes it significantly harder for both newer and smaller manufacturers, who must truly prove their worth (and their longevity) to be rightfully considered for placement. It's not an impossible task, but definitely more difficult if you’re new to the market.

INNOVATION – MORE CAN BE DONE FOR TRIBAL OPERATORS

Something that could further liven up IGA, and interest in it, are the innovations showcased across the tradeshow floor. It’s no secret that most major manufacturers

CHRIS WEINERS

Velvix Managing Director

Velvix Managing Director

are ‘saving up’ for their big product launches at G2E. While not true for all, there is definitely a lot to be said for scale (not only in regard to size) of the booths. Understandably it makes more financial sense for operators to go all out for G2E. However, I think there is something to be said for additional, unique innovations, offerings and on-floor events at IGA.

SAN DIEGO VS. ANAHEIM – WHO DOES IT BETTER?

One of the most contested announcements was that of the movement back to Anaheim for IGA 2024. I heard considerably mixed messages from both operators and manufacturers. In some cases, Anaheim is an easier location to get to. It does offer a considerable infrastructure when it comes to tourism and conferences. However, I believe the general feeling was that San Diego,

when available, makes for a much better conference. Regardless of your preference in baseball teams, San Diego's location, proximity to the airport and hotels, as well as overall vibe, seem to put the city ahead.

GAME DESIGN – TIMES ARE CHANGING

Anecdotally, there were some interesting changes happening in game design, which were present at various slot manufacturers across the board. Our team checked out various competitors during the event and noticed a few key trends including: Significantly more multi-feature games; Cash on reels (i.e. hold and re-spin) is still hot; Significantly more randomized triggers vs. the previous 3 Scatter (landing) trigger features.

Representing an operator that is 100% focused on Tribal gaming operators in the USA, I can safely say that IGA is our group’s most important show of the year. While it may not have the scale of G2E, its pure focus on Tribal gaming allows manufacturers and service providers the ability to connect with Tribal operators in a way that's not really possible at some of the larger shows. The integration of the IGA board meeting, the attendance by national Tribal councils and a complete focus on the issues facing the Tribal gaming industry make this a show that only has room to grow. I believe it's imperative for IGA (as an association) to focus on growth and representation, as well as to leverage the resources of its partners (think, non-native organizations) to help further build the strength of the organization, and ultimately, the annual trade show at large. I, for one, am excited about what the next five years hold in store for Tribal properties across the US and to be part of it myself.

14 | GAMINGAMERICA GAMING AMERICA | CHRIS WIENERS

THE IDEAL STATE: PLAYING THE GAME

Jeff Baldi , SVP of Commercial Strategy at CasinoTrac, spoke to Gaming America about the elegance of software, the importance of customer experience and the supplier's plans for growth.

Since Table Trac’s and DataTrac’s introductions in 2020, are there are any other new programs you’re working on now?

Our primary focus continues to be CasinoTrac, the enhancement and expansion of our wide-ranging casino management system. We expect v5, our next major release, to be in the submission phase by G2E 2023. With that said, we are proud of new features, apps and modules that have been released. For example, KioskTrac Mobile is an absolute killer app. KTM is an all-inclusive, integrated app that

room access, plus all loyalty balances and status. It’s exciting. And it’s a monumental effort from Chad Hoehne, President & CEO/CTO and our development, QA, support and training teams.

With CasinoTrac, Table Trac, AlertTrac, KioskTrac, DataTrac, many functions have now been automated. Can you tell us how that helps casino staff and what they’re free to focus on in person now?

Simply put, these features help our casino partners focus on service and

strategies, and enforce their internal policies and procedures, without the ‘tech’ getting in the way. Elegant software should support the business, not force organizational change, the need to add an army of staff to monitor and operate or constantly require vendor intervention.

Tell us more about your slogan ‘known players of known value,’ and how the CasinoTrac software spots and tracks the right players at the right time.

This brings us full circle back to our focus: helping our partners deliver their best customer experience. The real-time nature of our operational components puts the important data in the hands of our partners when they need it. To give just one example: consider the service opportunities created when a slot supervisor or casino host is notified that a VIP receives one of our Reflexive Rewards or is dynamically re-tiered, in real-time. That player’s experience goes to the next level when the emotional and social components are layered on top of the feelings of winning or unlocking a higher tier.

will provide our casino partners with an unprecedented customer experience. It’s an all-inclusive ‘out of the box’ cashless & credit, PMS & POS experience, offering

delivering the apex guest experience. Table Trac is focused on providing an ecosystem that enables our partners to deliver their customer experience

What capability have clients asked you to include in your software the most over the years? Or what feature have clients praised the most?

The client requests can be seen in our most recent updates and enhancements. We

16 | GAMINGAMERICA GAMING AMERICA | JEFF BALDI

"THERE ARE DIFFERENT TACTICS, BUT THEY COMPRISE THE STRATEGY. THE CASINOTRAC TECH STACK FACILITATES EFFICIENT AND SECURE TRANSACTIONS, SO THE ‘SYSTEM’ DOESN’T INTERFERE OR SLOW THINGS DOWN."

have been asked for features like enhanced notifications and communications, which we’ve delivered via the CasinoTrac 6.2 touchscreen player interface, like hot seat winners. Integrating third parties, like Marker Trax and Koin into the KTM Cashless function, has created a lot of excitement. Casino players are excited about options we have created with hand pays and w2glevel jackpots being handled at the credit meter, significantly reducing wait times and increasing play time.

How does your software keep players at the tables and at the machines?

There are different tactics, but they comprize the strategy. The CasinoTrac tech stack facilitates efficient and secure transactions, so the ‘system’ doesn’t interfere or slow things down. For table games, this means the player isn’t forced to use special chips or hardware and can move spots with ease, when they want – the dealer and pit staff can also use the system easily without being inconvenienced. With the slot floor, the in-action player, is the ideal state. We strive to enable speedy jackpots and fast alerts for errors or tilts – anything & everything to get the game back in service and the player back to the ideal state: playing the game of their choice.

millions of transactions 24-7, 365. I think everyone would agree that data security is ‘top of mind’ for every IT boss, General Manager, etc. Our intranet, browser-based strategy, built on Linux COBOL, delivers highly secure systems, using the same programming language trusted by governments, banks and business systems for decades. It has yet to be penetrated, even when ‘racked’ next to systems that have been.

You are currently in 13 countries. Do you plan to expand to any others?

business into ‘new’ traditional markets, like Florida, Mississippi and Louisiana, and expanding our existing footprint.

Is there anything else happening at CasinoTrac that you’d like to discuss now?

We are running into 2023, following a record in 2022. We broke a revenue milestone and are eager to continue breaking records. We are implementing internal changes to prepare for that continued, responsible growth; investing in our co-workers, working to increase brand awareness, and of course software development and support.

can move spots with ease, when they strive to enable speedy jackpots and in service and the player back to the ideal dynamic, high-traffic

Absolutely, yes. We are hyper-focused on expansion in the US, currently. But we constantly evaluate further international penetration and make those evaluations are in the process of implementing a careful, yet aggressive, approach to drive new

How does CasinoTrac eliminate data errors and security issues?

…Speaking of ‘ideal states!’ The elimination of errors is tough, but we get pretty darn close. CasinoTrac is the backbone, the database of record. We are running a 13-game tavern or 3,000 games, fintech equipment, POS & PMS systems across our 280+ casino sites. All of these are third party connections in dynamic, high-traffic environments that handle

Jeff Baldi, CasinoTrac, SVP of Commercial Strategy

Our most important asset and investment is us, the crew. The commitment to support and shared success from the Table Trac team is a big part of what separates us from the pack. It’s an exciting time to be here, and I am very grateful to be part of it.

and success from the Table an and

JEFF BALDI | GAMING AMERICA

cautiously. We GAMINGAMERICA | 17

THE FUTURE BEFORE THE FUTURE

Speaking to Gaming America, VP of OPTX Data Science, Steve Bright, assures us humans are still at the core of the economic premise behind understanding behavior.

Thanks for joining us Steve! To start off with, we wanted to ask what made you switch from physics and data science to AI and machine learning?

I got into physics because of my interest in mathematics. I think physics, when you get to a deep enough level, really is just mathematics under the hood. And mathematics really is the ultimate source code and operating system for everything in the entire universe. That interest carried over into pursuing an undergraduate degree and eventually a PhD in particle physics. It was great because I got to play with cutting-edge technology. My thesis was on a previously unobserved particle decay process. That was really a fun, formative, intellectual experience. I always just enjoyed problem solving, using math, science, data and the scientific method to approach problems of all kinds.

That’s really what drove all my career choices: problems that are intellectually interesting and fun. So, I suppose I’ve been working as a data scientist, but since before people were calling themselves Data Scientists on LinkedIn. The transition to machine learning and AI is very, very natural. There’s nothing I know like AI. Machine learning gets very much mystified in

the popular press and in culture, but it’s just programs; it’s just computers. Computers will do whatever you tell them to do. I’m pretty skeptical of the notion that any sort of AI could really be considered to be self-aware in any sentient, meaningful way.

18 | GAMINGAMERICA GAMING AMERICA | STEVE BRIGHT

Steve Bright, VP, OPTX Data

Can you explain why you believe AI won’t take jobs away from humans?

What I’ve noticed, at least in the gaming industry, is that the stuff we’re looking for AI to do will not. It’s not, “we want to build this AI thing to make decisions that the person will no longer be responsible for.” That’s not what we’re doing at all. An analyst at a casino property spends hours of their time manipulating data, cleansing data, moving data from one place to another, dragging and dropping spreadsheets and so forth. What we’re doing is a way to present them with data so they can absorb it in a holistic way, and make some decisions and recommendations. Those are things a computer can be trained to do very easily. When the person is spending their time hunched over an Excel sheet, it’s not that they don’t have other things they would rather be doing, or that would be more valuable; it’s that they’re stuck doing this boring stuff we just haven’t been clever enough to automate yet.

So, my thinking is that once these things are automated, that will free up the person to do actual, valuable work.

In the casino industry, for example, it’s about creating a fun, recreational experience for the visitor and that’s a very human-on-human interaction. The real value of a casino is it’s a fun place where they can go and hang out with their friends, have a couple of drinks and play some games. It’s fun; that’s something you still need people for. You need the machine to do the non-fun stuff.

You’ve previously said, “AI is the co-pilot, not the autopilot.”

Can you tell us more here?

The idea is that the AI is doing all the automated Excel-type stuff, all the numerical manipulation. It can make some predictions — some cross correlations that a person could do eventually, but it’ll take them a long time. The person ultimately, especially in the casino setting right now, is

always going to have context that the machines will not. When faced with the dilemma of, “why is this certain machine not being played?” Well, is that machine by any chance by a stinky open sewer line? AI probably doesn’t know that, but the person walking the floor will. They can make judgments. That’s what we mean when we say the AI is the co-pilot, because the person can always grab the stick. Take off, landing, when there’s turbulence, when there’s stuff that you have to make decisions about — grab the stick and takeover.

Can you expand on the differences between your traditional offerings and your AI ones? You have a program called ‘Slots,’ but then you also have ‘Slots AI.’ What are the differences and how do they work?

Very broadly, most of what Slots is doing is reporting on numbers. Before you can report the numbers, you have to gather data from all these disparate sources. There are the slot games, table games, hotel, food and beverage, and all these various places that are run by their own different systems, which don’t really talk to each other. The data is in different formats. The player at your property doesn’t know or care about that; they want to walk in the door and have a good time. You can tell your visitor, “Hey, we would have liked to make this experience better for you,” but they don’t want to hear that, right? What we’re fundamentally doing is taking all these disparate sources and different data formats, combining them into this grand, unified framework that should be the same for every property, for every system. Once you have that, and you can give these reports in a very unified way, that’s where the AI can be added on top of that.

Everywhere you are reporting a number, in almost every case, that number can

also be a prediction. I’m telling you how well this machine did last week, but with a little bit of machine learning and some clever mathematics, you can now say what will happen next week – or what will happen if this popular machine that you only have two copies of will do with a third copy. Is it going to generate some incremental value, or is it just going to reshuffle players on the floor? Is that going to enhance

the player experience or detract from the experience in some way?

It’s really about enhancing the guest experience by taking these reports and findings, and translating them into predictions and recommendations so you can tell the operator something useful. You learn about these humans who are coming to your property

GAMINGAMERICA | 19 STEVE BRIGHT | GAMING AMERICA

to have fun and you can understand what’s really motivating them. What sort of player are they? What sort of things are they going to find more fun or less fun? You can adjust your operations accordingly. It’ll be about what’s happening for them, but also what will happen for you.

slot machines on your property only. Machine learning,without data sharing, is inherently customizable because the customization is part of the machine. Learning is part of training them outright.

Can you tell us about your Future Player Value product?

We have a fairly sophisticated machine-learning model that looks at the player’s gaming activity, some demographic variables and makes a prediction about what we think this player’s short-term activity in slot and table games is going to be. We update that on a cadence and we push those results to the client instantly. So when the operator pulls up the profile of a given player, it’s right there. Here’s what we think those players are going to do next month in terms of theirtotal activity.

And when operators are building campaigns rather than, or in addition to, segmenting the playerbase based on recent activity, we can now allow these properties to segment the playerbase based on who is going to do what in the next month. It’s about letting the property make decisions about the future – before the future gets here.

What is next for OPTX?

And what do you think going to happen to the casino industry at large?

Right now, all the data is very much siloed from property to property.

How customizable is your software?

We’re always generating new stuff, but the great thing about a machinelearning model is that the customization is built into the product. When we write a predictive model, we train it for your property, on your players and only your players. When we look at your slot machine floor and make recommendations, it’s based on

We’re also looking at a program where we would combine data for multiple properties. This is especially relevant for our Slots AI product. You may want to know: how is my property comparing relative to my peer group? Are players having to traverse the casino from one game to another or overlapping and playing various games? Are other games doing well at another property I may not have just yet?

That sort of data sharing provides

a big opportunity for additional, better, deeper learnings. We’re moving into that cautiously; if we’re talking about sharing data, we have to make sure we’re going to ensure data controls remain very vigorous. It’s something we only do with explicit permission and with a very well-defined and certain scope; we’re going to use this specific data for this specific purpose. I think having that informed consent of the operator is critical. These operators are trusting us with that data and that’s something we want to treat with the utmost care.

Is there one package or software from OPTX you think people have really benefited from the most over the years?

Probably not the AI stuff...

Not yet?

That’s right. What I hear from properties is they love the ability to mass communicate with players. It’s something that sounds like it should be super easy, but it’s something that always takes a village. It takes a lot of careful coding and careful programming. That’s why we have a great team of developers working on that.

So, whether AI or not, is the focus just on the players?

I really think it is. If you think of the two broad categories of what you can do to the property, it’s messing around with the game content and how you incentivize, reward and enhance the player experience. I think the players’ side is much more important, which is difficult. Slot machines are like computers; they all behave in a very predictable, well-defined way, whereas human beings do not. If you really understand the incentives and motivation for people, you have a good chance of understanding how a population of players will behave. That’s fundamental: the economic premise of understanding behavior.

20 | GAMINGAMERICA GAMING AMERICA | STEVE BRIGHT

ARCHITECTS OF DATA

Passport Technology CEO, Cleve Tzung, spoke to Gaming America about streamlining payments and data with the casino floor in mind.

You are currently operating in the US, the UK and Canada. We wanted to know what the biggest challenges have been within the US market, and if you found any particular states more challenging to work in than others.

The biggest challenge of working in the US for us, because we’re a relatively smaller company, is our presence and our name aren’t really well known. We built a base of business in certain jurisdictions and certain states. The biggest hurdle right now, is just more name recognition than anything else. What we found is when we bring customers in to see us, and we show them the story and where we’re going on our road map, they tend to get very excited. We tend to win a lot of business that way. It’s really just the fact that what we stand for in the in the eyes of the customers isn’t quite as well known. Now that we have a national salesforce, we’re starting to get the word out.

Is one of those things that customers are getting excited about the DataStream offering? Can you tell us how that works?

The DataStream is essentially a switch processor that powers our ATM and our debit POS services. It’s something that John Steely (COO/CIO) and Kent Cain (SVP Platform Operations) have spent many, many years developing and building. We’ve been powering retail ATMs for a number of years. We got it registered in the gaming environment, so now we can use it with our casino customers. It’s cloud-based, so it offers greater redundancy, just from an architecture standpoint. It also allows greater redundancy on the floor, so the reliability factor is much improved. We can add specific products through the software just for the gaming applications. We’re going to be introducing some fairly exciting new products through DataStream, only available in the DataStream, and those will be available to our casino customers. It offers greater reliability, greater redundancy, full control within our own stack and some exciting new products and features.

One of the features we wanted to ask about is your loyalty products and how those work.

The Lush Loyalty product is a kiosk-based product, but it offers web HTML5. It offers a full suite of promotions, player enrollment, points management and the ability for patrons to earn rewards points through games that either we can develop or the casino can develop. We’ve set up a template and we’ve made it very easy for the casino to go in and modify their promotions as they need to. Because marketing groups like to constantly refresh their promotions, and like to keep things exciting, our service really allows them to do that. On top of that, we’re also building this out to a mobile environment. We have an API that sits behind us, allowing us to integrate with all of the casinos’ functions, be it food and beverage, the retail function, or hotel management. This API is very powerful because you can integrate everything within one app. Lush is one of our products that, when we do get in front of customers, and demonstrate it to them and show them what it does, they can really see the capabilities and really get excited about it.

Has there been either one industry advancement, or an advancement within Passport, that’s really furthered your company’s success, like API or the cloud?

I think it’s actually both the DataStream and the Lush Loyalty, and the way we

22 | GAMINGAMERICA GAMING AMERICA | PASSPORT TECHNOLOGY

architected both of those. With a lot of cloud-based and HTML5-based services, we’ve been able to architect these products so that they are much, much more flexible. We’ve been able to create a DataStream and build it in a way that’s not built up of legacy systems. And what that means is, we’re able to kind of manipulate the data; we’re able to manipulate the products and introduce products much, much more rapidly than our competitors. On the loyalty side of things, we built it in a way that really puts a lot more flexibility in the hands of the customers. We think that’s a feature that casinos will appreciate. We can certainly do it for them, but it just allows them a level of customization when they’re running their marketing programmes, that we think is very, very powerful. It’s the ability to create these things in a way that it is much more palatable now, much faster and much more flexible for our casino customers.

and a casino kind of cash-on-the-floor improvement. The way we’ve done that is, we’ve built something with a mobile application so that a jackpot attendant can essentially fulfil a jackpot right on the spot with the customer. Whereas, right now it’s a process that involves a jackpot attendant going to the customer’s slot, shutting down the slot, going back to the hardware machine on the floor, doing a bunch of paperwork and then going back to customer. It’s really a very long and tedious process, and we’ve shortened that, so that’s another product that we are finding to be very popular.

Speaking of that casino floor and the flow of cash, do you think fully cashless

operation will ultimately be the future?

Do you plan to work with any US-based responsible gaming organizations? We know that you do within Canada and the UK. It’s part of our DNA to always be working with the regulators and always have a focus on responsible gaming. To the extent that we have opportunities to work with them, we certainly explore those opportunities, and are always looking for those opportunities. Like I said, it’s part of our DNA; it’s part of how we were founded in the UK and Canada. We’re certainly bringing that perspective to the US.

Has there been one payment solution that’s become your most popular over the years?

I don’t necessarily think that there’s any specific payment solution that’s the most popular. I think in terms of the payment types, we sort of follow the industry, in terms of what customers tend to gravitate toward. But in terms of the popularity of what people see when they come see us for a demonstration, the Lush is very popular. We have a jackpot device that is also proving to be very, very popular. The jackpot is essentially not really a payment device, but allows the casino to pay out their jackpots much more quickly and efficiently, which we think is really a customer satisfaction

I don’t necessarily think that casino floors will be completely cashless. I do think digital wallets and cashless operations will become more popular, but I think cash is a pretty frictionless operation on the floor. The customer is ultimately going to drive what’s on the floor. I think that there is a certain set of customers, be they of the older set that’s comfortable with cash, or whether there is a group that tends to like to play anonymously, simply because they don’t necessarily want to be tracked. There’s always going to be a set of customers that are going to want to use cash – whether that set of customers is 50%, 20%, 80% – it could be any of the above. It’ll follow a growth curve, but I don’t think cash will completely disappear off the floor.

GAMINGAMERICA | 23 PASSPORT TECHNOLOGY | GAMING AMERICA

Cleve Tzung CEO, Passport Technology

"THE BIGGEST HURDLE RIGHT NOW, IS JUST MORE NAME RECOGNITION THAN ANYTHING ELSE."

MODERNIZING NIGC REGULATIONS

Chairman E. Sequoyah Simermeyer and Vice Chair Jeannie Hovland discuss proposed changes for key employees and primary management officials.

During Tribal Consultations that took place from July 2021 through February 2022, the National Indian Gaming Commission (NIGC) solicited input on proposed rules updating, changing or clarifying NIGC regulations to support Tribal self-sufficiency and the integrity of Indian gaming.

The Indian Gaming Regulatory Act (IGRA) requires that “background investigations are conducted on the primary management officials, and key employees of the gaming enterprise and that oversight of such officials and their management is conducted on an ongoing basis…”

25 U.S.C. § 2710(b)(2)(F)(i) (emphasis added). NIGC has defined “key employee” and “primary management official” at 25 § C.F.R. 502.14 and

502.19, respectively. Additionally, NIGC describes the application, investigation, determination, reporting and licensing processes at 25 C.F.R. § 556 & § 558. As part of this investigation and eligibility determination process, Tribes and NIGC use fingerprint-based FBI criminal history records information (FBI CHRI).

Because the NIGC (1) receives FBI CHRI for the purpose of licensing primary management officials and key employees, and (2) the FBI determines when it is and is not appropriate to share FBI CHRI for such purpose, NIGC took FBI’s views into consideration. FBI is charged under federal law, regulations and policy to ensure FBI CHRI is only used for specific purposes provided for by

law. NIGC’s goal is to define KE and PMO with enough specification to satisfy FBI CHRI requirements and at the same time provide tribes with enough flexibility to background and license the individuals working in, and managing, their gaming operations as they deem appropriate.

NIGC considered all comments and feedback stakeholders. Based on the diversity of responses, the agency issued a second Notice of Potential Rulemaking (NPRM) on April 14 to receive and consider any additional comments until May 30. Such comments are instrumental in this rulemaking process and the Commission thanks you in advance for any submissions.

PROPOSED CHANGES TO 25 C.F.R. § 502

Based on comments received to date, the Commission’s proposed amendments focus on licensing of primary management officials and key employees instead of their employment. Below are a few of the proposed changes to 25 § C.F.R. 502:

• Adding general managers and similar positions to the primary management official definition

• Limiting the definition of primary management official to those with duties similar to those of a CFO rather than persons who have financial

24 | GAMINGAMERICA GAMING AMERICA | NIGC

"AGAIN, WE STRONGLY BELIEVE IN ONGOING CONSULTATIONS, AND SINCERELY THANK TRIBAL LEADERS AND TRIBAL GAMING REGULATORS AND PROFRESSIONALS FOR THEIR INPUT."

management responsibility

• Limiting primary management officials to employed management officials designated by Tribes instead of “any person” so designated

• Consolidating certain subsections of the key employee definition

• Modifying the definition of key employee to include any gaming operation employee authorized by the gaming operation for unescorted access to secured areas

• Removing compensation as determinative factor in the key employee definition and replacing it with the four most highly compensated persons in the gaming operation

• Allowing Tribes to designate any other employees of the gaming enterprise as a key employee

instead of “any other person”

• Adding definitions for Gaming Enterprise and Tribal Gaming Regulatory Authority

PROPOSED CHANGES TO 25 C.F.R. § 556 AND § 558

Below are a few of the proposed changes for 25 C.F.R. § 556 & § 558 from the current NPRM:

• Clarifying licensing application and background investigation retention periods

• Adding NIGC notification for all licensing revocation decisions

• Specifying retention requirements of information and documentation post KE/PMO termination

• Changing the vesting of a right to a hearing to reflect Tribal law and policy

WHAT’S NEXT?

As indicated in the most recent Dear Tribal Leader Letter, the Commission will consider and adjudicate all comments and expects to publish a final rule soon after. Again, we strongly believe in ongoing consultations, and sincerely thank Tribal leaders and Tribal gaming regulators and professionals for their input. For more information or to leave a comment on proposed rule changes, contact the NIGC Legislative and Intergovernmental Affairs office at info@nigc.gov.

E. Sequoyah Simermeyer (Coharie Tribe) is NIGC Chairman and oversees the federal regulatory agency’s national operations. Jeannie C. Hovland (Flandreau Santee Sioux) is NIGC Vice Chair and Director of the Office of Self-Regulation.

GAMINGAMERICA | 25 NIGC | GAMING AMERICA

Jeannie Hovland, Vice Chair

E. Sequoyah Simermeyer, Chairman

THE WORLD CUP OF NEW YORK

Gaming America closely examines the bidding process to add a casino to the New York City cultural and entertainment landscape. Michael Hershman, CEO of the Soloviev Group, is also on hand to provide exclusive insight into his company’s bid.

26 | GAMINGAMERICA GAMING AMERICA | NEW YORK

New York City calls to tourists from many iconic destinations. Times Square, Broadway, Central Park and the Statue of Liberty all welcome visitors with open arms. The New York City skyline is one of the world’s most recognizable architectural triumphs, but is the Big Apple missing something at its core? Though the Empire State currently houses two ‘racinos,’ in Queens and Yonkers, New York City has yet to add a world-class gambling establishment to its list of famed landmarks and attractions. Something to rival neighboring Atlantic City – or even Las Vegas.

But start spreading the news: there’s been an approval of three downstate casino licenses. Now property developers and casino operators have a creative, economic and surprisingly political challenge as they submit their $500m bid proposals. Many may enter, but three will win, in this casino battle royale.

WHO WANTS TO BE A PART OF IT?

In early January, the process began. A 10-year prohibition on Downstate gaming expired and at least a dozen companies are bidding for the chance to put their individual properties – and casinos – on the map. The initial casino licenses will run from 10 years to 30 years, based on the investment of the winning bidder. To find out more, Gaming America spoke to Michael Hershman, CEO of the Soloviev Group, who is partnering with the Mohegan Tribe – with a view to scoring one of the coveted casino licenses for a property that’s ready to go in Midtown East.

Hershman began, “We own a piece of property on 1st Avenue between 38th and 41st Streets. It’s right on the East River, two blocks from the United Nations. It’s the largest piece of undeveloped land in Manhattan, and it is currently zoned for both residential and commercial. It’s shovel-ready, if you will. We can begin building as soon as we’re awarded the license.”

Only three licenses will be granted, of course, and several large gaming industry players have already thrown their hats

into the ring. So Hershman’s confidence is commendable but the process is far from a foregone conclusion. Wynn Resorts and Related Companies have bid to develop an up-and-coming plot of Hudson Yards land, also located in Midtown. Las Vegas Sands is hoping for a casino at the site of the Nassau Veterans Memorial Coliseum on Long Island, though this will mean potential visitors will have to leave the bright lights of Manhattan. Billionaire and New York Mets owner, Steve Cohen, plans to work with MGM to put a casino in Queens next to the Mets' Cifi Field. Thor Equities Group Founder Joseph Sitt has also partnered with Saratoga Casino Holdings and the Chickasaw Nation to build a casino even further afield, amid Coney Island’s vintage amusements.

Bally’s Corporation, however, has revealed plans to turn a golf clubhouse owned by the Trump Organization into a casino in the Bronx. A deal occurred in December that gave Bally’s control of 17 acres of the 192-acre Trump Golf Links and Ferry Point. The project is valued at around $2.5bn and will include the removal of the large ‘Trump Links’ sign on the course, but only if it wins a license. An official with Bally’s told the New York Times that “any company’s association with the Trump name is likely to kill an

otherwise viable casino bid.”

Another contentious proposal comes from SL Green Realty Corp, which currently owns an office building at 1515 Broadway – in an area better known as Times Square. The company plans to turn eight floors in an existing 54-story tower into a casino with Caesars Entertainment. Times Square is often seen as the center of the New York City universe, with approximately 330,000 people passing through daily; to some this could be the obvious spot for a new casino.

The existing racinos could, though, be considered frontrunners in this exciting process, as granting licenses to them would simply raise their existing gambling options, rather than require the city to go all in on a new locale. Hershman said of the competing bids already on the table, “We’re up against some of the most powerful and some of the most formidable people in the state. So I call it the World Cup of New York, this process. I very much respect our competitors.”

MAKING A BRAND NEW START

Hershman has already spoken highly of the Soloviev Group’s partnership with Mohegan. “We like their style, frankly. We like their success,” he said. “They are the largest casino owners in the Northeast with many of their players coming New York, Connecticut, New Jersey, Pennsylvania and elsewhere. But what we particularly like about them, and what sold us on them, is their commitment to social responsibility and giving back to the community, which is very much in line with our thinking. We want to make this an entertainment district for the local community, not only for visitors, but for those that live in the area.”

The Soloviev Group has plans for not only a casino, but for an entire project it is calling Freedom Plaza. Reportedly, the casino itself would be less than 20% of overall land usage. “We have right now approved zoning to build 2.8 million square feet of space. We would dedicate part of that space to the casino hotel. About four acres would be dedicated to a park for use by the community. We would also build a museum that would be dedicated to the promotion of democracy,

GAMINGAMERICA | 27 NEW YORK | GAMING AMERICA

MICHAEL HERSHMAN

Soloviev Group CEO

freedom of the press, human rights and freedom of religion.” As the Soloviev Group is approved for both commercial and residential buildings, two residential buildings will also be in the works as Freedom Plaza’s new neighbours. Hershman added, “Part of those buildings would be for affordable housing, which is in very short supply here in this city.”

Though the Soloviev Group does have a hospitality and retail division within the company, this would be its first diversification into the gaming industry. Hershman said of the transition to potential casino ownership, “We own hotels, restaurants, a winery and other entertainment sorts of businesses. And we just thought a casino would be a natural extension for our entertainment division.” Hershman also stated that the area where the incipient property lies is “not overly populated” by retail, restaurants or other amusement, which a casino on Freedom Plaza aims to deliver. “We’d bring some retail and restaurants to an area that sorely needs it and also hotel rooms. Because of the proximity to the United Nations, there is always a need for more hotel rooms in that area.”

Hershman was resolute in the project’s

community-building approach. He clarified a previous comment about how the development could create 2,000 new jobs. “Now we’re estimating, as we get a little bit more involved in responding to the request for applications, we believe we will create between 4,000-5,000 full-time positions.”

IF A CASINO CAN MAKE IT THERE…

However, any casino looking to win one of the three licenses will need approval not only from New York City officials and state regulators, but also local committees, institutes and residents near the proposed locale. There is a balancing act between attracting tourists and coexisting with established communities, and the new casinos will need public support to truly be successful. Vocal opposition by local committees could stop a casino bid in its tracks.

The application procedure has been designed so that for each casino bid, a local Community Advisory Committee must be formed. Committees will have six members, including the Governor, Mayor and local State Senator. The casinos must pass a two-third vote in favor of their bid before moving onto regulatory consideration. Several casinos

have seen both great shows of support as well as opposition – often within the same communities.

The New York State Latino Restaurant, Bar & Lounge Association (NYSLRBLA) is enthusiastic for the proposed SL Green and Caesars casino in Times Square. NYSLRBLA President Jeff Garcia said, “Times Square is the right place for New York’s next gaming destination, hands down. It’s great not only for the Times Square area but for the city as a whole. We believe the increased tourism is going to directly benefit small, minorityowned businesses across the five boroughs.”

However, the impact of a Times Square casino has not been positively perceived by the theater district. A new organization, started by the Broadway League, aptly titled the “No Times Square Casino Community Coalition,” includes a local church, a bus association, a tenants’ association and businesses that have previously been dedicated to serving the area’s patrons of the arts. Max Klimavicius, owner of iconic, 100-year-old Broadway-linked restaurant Sardis, has said, “A casino in Times Square has the potential to jeopardize the character of the theater district and ultimately the fate of its restaurants.”

28 | GAMINGAMERICA GAMING AMERICA | NEW YORK

Before the Covid-19 pandemic, Broadway and off-Broadway theaters in New York provided a historic, stable boost to both the city’s economy and culture. Charlotte St. Martin, President of the Broadway League, added, “We are just coming back and getting healthy, and we believe that a casino will damage that character and damage [theater] attendance.”

City & State New York reported that a coalition has formed to petition for Coney Island to win one of the potential licenses. The petition in question includes a line saying, “As a Southern Brooklyn resident, I support creating good jobs and new economic growth by establishing a new casino and entertainment district in Coney Island.” By April 2023, it had received over 3,000 signatures. Yet Coney Island residents, part of Community Board 13, held a meeting

where all present were in opposition. One member commented that they had not heard from a single person who had signed the petition in favor.

And the list goes on... Hofstra University has also greatly clashed with the idea that a new casino could improve its setting. A letter from the university trustees explained that 40,000 students, from preschool age to graduate studies, attend schools in the Nassau Hub, and that a casino would be ‘inappropriate’ for the demographic. The letter said neither the students nor suburban communities should be “exposed to the increased traffic congestion, crime, economic harm to local businesses and other negative impacts that a casino development would likely bring.” Long Island University and Nassau Community College would rather work together with its potential new

casino neighbor, Las Vegas Sands, to create a new hospitality management program for interested students.

Opposition also comes from casino operators in New Jersey (although this is rather predictable). The East Coast Gaming Congress discussed the potential adverse effects of New York casinos, including a loss of up to 30% of Atlantic City casino revenue due to competition with the allure of the Empire State. Upstate New Jersey and Downstate New York may find their residents wanting to gamble under the bright lights of New York City rather than Jersey’s premier gambling destination. This has made Hard Rock International’s Chairman Jim Allen nervous about the brand’s Atlantic City casino, even though Hard Rock is expected to announce an application for a New York City casino license as well.

30 | GAMINGAMERICA GAMING AMERICA | NEW YORK

Looking to the cultural benefits of the process – perhaps acknowledging some of the anti-casino sentiment – Mohegan and Soloviev have worked with The New York State Restaurant Association (NYSRA) to create the Mohegan Momentum Partnership Program for the surrounding local businesses in Midtown East. The program will support hospitality members by offering gaming-based rewards to future guests of the proposed Freedom Plaza when they patronize local shops, restaurants and businesses in the city.

Melissa Fleischut, President and CEO of NYSRA, said, “This program goes beyond traditional incentives and investments. Local restaurants will have unprecedented access to a larger customer base, prosperous partnerships and brand awareness exceeding what many owners would be able to achieve

independently.” Hershman stated in a press release about the program that its mission is to “address vital community needs, which are being communicated in meaningful conversations with local stakeholders.”

IT’S UP TO YOU, NEW YORK, NEW YORK

Each potential developer has listed the creation of revenue, jobs and exciting attractions as reasons to let their casinos take root and flourish, but the surrounding communities must be convinced. The Gaming Facility Location Board has released a document stating that the organization “expects to hear a variety of viewpoints from communities potentially impacted by proposed projects.” The 70-page document, published in January this year, also says that the board “welcomes” local and community

input, and “will consider all public comments received during the process.”

Hershman’s time with Gaming America ended with the CEO full of confidence and hope for Soloviev and Mohegan’s Freedom Plaza. “We, like everyone else bidding on this project, are in the process of working with building architects, landscape architects, and land use attorneys to finalize the designs and plans. And we look forward to what will hopefully be a fair process of judging by the state authorities and the city authorities. But I do believe that, if the license is awarded on merit, we have the best site and the best plan.”

Just like the World Cup, the new Empire State casino must play the game, advance from the group stage and win outright before it can truly call itself the best.

GAMINGAMERICA | 31 NEW YORK | GAMING AMERICA

GREAT GAMES TRANSCEND

Derik Mooberry, CEO of Zitro USA, speaks about innovation in the US market vs global success.

Thanks for joining us! How has your first year gone as CEO? And what has your proudest achievement been so far?

A year just zips by pretty quickly. It’s been an exciting year and it’s been a time of growth for us. I think there were four employees when I started, and we’re about 20 now, so we’ve had quite a bit of growth here in the US. In all honesty, that’s probably our biggest achievement. Before you can have great success, it really starts with the foundation of building a team. We’ve assembled a great group of people that have joined us here in the US, and we’re starting to get our products out into a large number of different locations and casinos throughout the US. We think we have just a tremendous future in front of us.

I think casino operators love choices. They love having lots of opportunities to buy from different people. They love the fact that people are innovating and that’s exactly what we’re doing here at Zitro. We’re coming out with a lot of exciting new products. We’re different from a lot of what I would call smaller vendors – and I say ‘smaller’ because we’re small here in the US, but we’re really not small globally. Around the world, we’ve got over 1,000 people. We operate in over 60 jurisdictions around the world, and in the US people are just getting to know who we are. But I think people are saying, “This is a company who can innovate. This is a company who has exciting products.”

What do you think the most successful game has been in the US market so far? And do you know what makes it so popular?

For us it’s pretty simple. We’ve got a standout game. It’s called 88 Link Lucky Charms. It’s been our best game and it’s performed extremely well – in some cases up to two times house average at casinos, – which is just exceptional. It’s usually the game we lead with. Every time we go to a new customer they say, “what game should we take from yours, because you have a vast library of products?” We like to go with one we think is shown to be a proven winner – and the 88 Link Lucky

Charms has been exactly that. I think it combines a lot of features players like. A lot of popular games now obviously have the Asian graphics that it does. It also comes as a multi-game with four games built into it, usually in the US.

We choose just one of the four to launch with, but the four games are slightly different graphically; similar mathematically but a little different. Graphically, it’s got a Bet Up feature on it where the more you bet you acquire more of the symbols, giving you more chances for bigger and better bonuses. So when the player’s on that lucky winning streak and they feel like betting a little more money, it gives them the opportunity for that as well. It’s got the ever-popular – what we call – Bonus Link feature, which is the bonus round that creates all the excitement for them. We think it’s got a lot of common things players like and I think that’s why it’s resonated. Here in in the US, literally almost everywhere we’ve done great.

Do you think there are gaming trends in the US that differ from markets in other countries? You mentioned Asian graphics being popular. Is that a general 2023 trend rather than US?

DERIK MOOBERRY Zitro USA CEO

I’m going to answer this in two different ways. I think great games transcend the world – I really do. I think a game that’s great can be popular almost anywhere in the world. I think if you’ve found that great combination of math and graphics, and found a really intriguing way to entertain

32 | GAMINGAMERICA GAMING AMERICA | DERIK MOOBERRY

the player; I think that can transcend regardless of where you are in the world. However, the flipside to that is there are certainly little differences you see around the world, in terms of player characteristics. The average consumer can vary differently, even here within the US, forgetting the rest of the world. The gambler on the Las Vegas Strip is slightly different, obviously, than the gambler who might play at one of the Native American casinos. The person who’s coming to the Las Vegas Strip is coming for a three-to-four-day experience.

They’ve got a budget they’re trying to maintain over those three to four days. They’re trying to maximize their time on a device during those play periods. The person who’s coming to more of what I would call a localized casino has probably a smaller, finite amount of time, right? They’re coming in for maybe an hour or two – maybe with some friends – looking to have some enjoyment. Ideally, in those kinds of situations, the player probably either wants to win big or go home. Because their time is a little different: it isn’t a one size fits all. But I do find that there are some trends, though. Great games do seem to be great almost regardless of where they are. That could be throughout places here in the US or it could be internationally. We’re very popular in Mexico and a lot of the Latin America markets. Obviously, Spain is a fantastic market for us as well. So we’ve found great games work all over.

Which states are you live in right now? Have you seen any differences between those states?

We’re live in four states: California, Oklahoma, Florida and Wisconsin. The gambler profile is different, even among those states, because there’s different products in those states. You have different demographics, different regulations and different regulations on how the products work. You do see some slight differences there, but not anything tremendous so far. This is really kind of just the beginning for us.

We hope to be in probably anywhere from 10 to 15 states by the end of the year.

We have approvals to enter a bunch more very soon. You’re going to start to see Zitro products in a lot more locations around the world or around the US in particular.

We saw a recent partnership with KGM, which will put you into Connecticut, Ohio and New York. Is that correct?

Yeah, we will. They’re our distributor partner on the East Coast. When you’re a small manufacturer like us in the US, sometimes you need partners to help leverage your success. KGM is one we just recently announced a partnership with and they have deep roots in sales force already in place in a lot of those East Coast locations. We look to leverage their infrastructure, including their service technicians and their sales personnel to help launch Zitro products in a large number of states on the East Coast.

Do you know when that will be?

We intend to launch our first games with them as early as May (at press time).

We’ve seen a lot of focus on video bingo and video slots. Is that your primary focus in general in the US?

Obviously, video bingo is our roots. That’s how the company started; that’s what got us going years ago. We’ve transitioned to video slots as well; traditional, as we call them, Class III gaming devices . The third segment we’re also in is the digital space: online gaming. We’re a player in that segment as well, in terms of what we’re focusing on. Though, here in the US, we’re really focusing just on traditional Class III slots. The video bingo products we leave for more of the

Mexico market and some of the other Latin American markets. But what we’re really focusing on is trying to grow our land-based slot business here in the US. Then there’ll be a point in the future, once we get the land-based slot segment established, when we’ll look to focus on a digital push as well. That way we can give the player that omnichannel experience where they could play the best of Zitro games, both online and in a land-based casino.

We’ve seen your slogan for Zitro saying, “Winning is not about luck.” Can you explain a little bit about that and how you keep people engaged with games beyond just that lucky feeling? The message there is two-fold, in my opinion. It’s about the consumer, them picking a machine they find enjoyable and us providing the right entertainment experience for them, which keeps them coming back again and again. I think, “winning is not about luck” is also about Zitro the company, too. Success comes through a lot of hard work, a lot of dedication, a lot of focus on customers, casino operators and ultimately the end consumer as well. If you do the right things, you will ultimately end up winning. It takes a lot of hard work and dedication to do that. That’s the message for us and we think it resonates well for both us as a company, and also the consumer as well.

It’s a customer service ethos as well as a way to play the games? Absolutely. And that’s the message we want to tell. If we execute on those fronts, I think the growth story here in the US is going to be something we’ll be talking about for some time.

GAMINGAMERICA | 33 DERIK MOOBERRY | GAMING AMERICA

"I THINK CASINO OPERATORS LOVE CHOICES. THEY LOVE HAVING LOTS OF OPPORTUNITIES TO BUY FROM DIFFERENT PEOPLE."

HOW OPERATORS SHOULD PROMOTE RESPONSIBLE GAMING

William (Bill) J. Pascrell, III, Esq. writes about how the gaming industry can research, educate and collaborate to promote better gaming habits.

New opportunities for gambling arise daily as new states legalize fixed-odds horseracing, esports, brick-and-mortar casino gaming, online casino gaming and sports betting. With these opportunities expanding throughout the country, it’s more important than ever that gambling companies educate their customers on best practices for responsible gambling. Regulatory boards, federal and state governments, and even consumers themselves, have a role to play in ensuring the safety of gamblers. However, no group bears a greater responsibility than the operators themselves.

Operators have full control over their platforms and, as such, countless adjustments can be made to reduce the likelihood and impact of problematic gambling behavior, from player safeguards to incentive limitations. Here are some of the best ways that operators can promote RG to their customers:

FUND MEANINGFUL RG INITIATIVES

Operators should fund responsible gambling initiatives that are exploring new ways to reach gamblers and those in high-risk groups, like college athletes. For example, Entain Foundation US, for which I serve as a Trustee alongside Martin Lycka, SVP for

American Regulatory Affairs and Responsible Gambling at Entain, and former New York Giants wide receiver Amani Toomer, sponsors or partners with a range of responsible gambling organizations. These include Epic Risk Management, which facilitates “lived experience” responsible gambling classes across the country; Kindbridge, an independent virtual clinic that provides mental health services to people suffering difficulties related to gambling and gaming; and the NFLPA Professional Athletes Foundation, a provider of financial assistance and counseling for former NFL players, to create, market, and launch live and virtual educational programs for NFLPA members.

SUPPORT ACADEMIC RESEARCH

Academic research must play a central role in addressing problem gambling, ensuring comprehensive self-regulation on the part of gambling companies and effective gambling regulations. To that end, Entain Foundation US invested $5m in a multi-year partnership with the Harvard Medical School Faculty at the Division on Addiction, providing Harvard with access to anonymized player data across a range of our brands. We also partner with the UNLV International Gaming Institute to provide information to legislators and

regulators about sports integrity, youth gambling impact, illegal marketplacee and Americans’ perception of gambling.

INDUSTRY COLLABORATION