Beneficial Owners

When traditional investment returns come under pressure, the ability to generate supplemental revenue from your existing portfolio can help maintain performance. We provide tools to source liquidity, borrow securities (as needed) and lend securities to help enhance portfolio returns.

Our solutions include: Agency Securities Lending, Principal Lending, Sponsored Member Program, Secured Loans and Agency Investment Product.

To learn more about all of our Securities Finance Services, scan the QR code.

50

EDITORIAL

Managing editor

Luke Jeffs

Tel: +44 (0) 20 7779 8728 luke.jeffs@globalinvestorgroup.com

Derivatives editor

Radi Khasawneh

Tel: +44 (0) 20 7779 7210 radi.khasawneh@delinian.com

Securities Finance Reporter

Sophia Thomson

Tel: +44 20 7779 8586 sophia.thomson@delinian.com

Special projects manager

Anshula Kumar

Tel: +44 (0) 20 7779 7927 anshula.kumar@delinian.com

Design and production

Antony Parselle aparselledesign@me.com

BUSINESS DEVELOPMENT

Business development executive

Jamie McKay

Tel: +44 (0) 207 779 8248 jamie.mckay@globalinvestorgroup.com

Sales manager

Federico Mancini federico.mancini@delinian.com

Chief Executive Officer

Andrew Pinder

Chairman Henry Elkington

© Delinian Limited London 2023

SUBSCRIPTIONS

UK hotline (UK/ROW)

Tel: +44 (0)20 7779 8999 hotline@globalinvestorgroup.com

RENEWALS

Tel: +44 (0)20 7779 8938 renewals@globalinvestorgroup.com

CUSTOMER SERVICES

Tel: +44 (0)20 7779 8610 customerservices@globalinvestorgroup.com

GLOBAL INVESTOR

8 Bouverie Street, London, EC4Y 8AX, UK globalinvestorgroup.com

Next publication

Spring 2024

Global Investor (USPS No 001-182) is a full service business website and e-news facility with supplementary printed magazines, published by Delinian Limited. ISSN 0951-3604

Global Investor/ISF’s Beneficial Owners Survey 2023 edition recognised the leading custodial lenders and third-party agent lenders globally. The survey asked beneficial owners from around the world to rate the performance of their agent lenders across areas such as collateral management, market coverage, reporting transparency and programme customisation. Only three firms qualified in the lender categories this year.

Global bank J.P. Morgan returned again this year to win the global weighted and unweighted categories, winning the top prize in two of the three regions: Europe, the Middle East and Africa (EMEA) and the Americas.

While RBC Investor & Treasury Services’ scores in the global categories were down on last year’s totals, the Canada-headquartered lender made the top three in this year’s rankings.

State Street took the final spot in the top three global lender lists and came out top in the Asia Pacific region.

One respondent to the survey noted that the US lender ‘continues to be a leader in navigating the ever-changing market environment’, setting the backdrop for J.P. Morgan’s win across multiple categories again this year.

It scooped up the top prize again this year in the weighted category, scoring the highest global totals in Americas (7.07) and EMEA (6.98), both down slightly on 2022’s figures. The bank scored 6.13 in the Asia Pacific weighted list, also lower

This year’s survey saw nearly two-thirds (62%) of respondents originate from the asset manager or mutual fund space, up on last year’s representation (54%). Respondents also comprised public and private pension funds (22%), insurance companies (14%) as well as trust banks and corporations.

Nearly half the respondent firms reported assets under management (AuM) valued at more than $100bn, with the remainder spread out quite evenly over the $1bn to $90bn brackets. The remainder had AuM under $10bn.

Three-quarters of respondents said they use only one single provider, while the remainder used two or more.

than last year, but making it the second best-rated lender in that region behind State Street. The firm’s global average rating across the three regions, at 6.40, also continued a slight downward trend.

In the unweighted category, J.P. Morgan had the highest unweighted scores in EMEA (6.98), an improvement on last year, and in the Americas (6.72). Again, in Asia Pacific, it was only one of two lenders to quality, and ranked in second place. On an average basis, a score of 6.79, though down in 2022 meant it returned to levels seen in 2020 and 2021 (6.69 and 6.8 respectively).

As a custodial lender, J.P. Morgan secured the top spots on both an unweighted (20.56) as a global total) and weighted (19.59) basis. Again, it achieved the highest scores in EMEA and Americas.

It scored top marks with respondents in all 12 service categories outlined the unweighted category. In the weighted part of the survey, it was recognised for its Programme Customisation, the Provision of Market and Regulatory Updates and its Relationship Management capabilities.

J.P. Morgan also received recognition as top agent lender

Like previous year results, respondents showed a differing appetite for lending. The number of firms lending up to $1bn was similar to making available between $2bn and $3bn and between $5bn and $7bn.

Of the key challenges outlined, a few respondents singled out the upcoming regulatory challenges lying ahead including the SEC’s US settlement cycle moving to T+1 in May 2024 and the impact on security recalls, and the new proxy and loan disclosure requirements. Ongoing market turbulences were also highlighted as an issue.

in the EMEA and Americas regions, in the weighted and unweighted categories, which also enabled it to get the best global total score. It was the only agent lender to qualify in all three regions.

Rated ‘excellent’ by one survey respondent, the lender qualified in the Americas and Asia Pacific regions in the All Lenders part of the survey, in the weighted and unweighted groups, winning in APAC with an unweighted score of 6.75 and a weighted total of 6.25. It also won the average weighted score category, with a figure of 6.58.

In the Americas market, it came third behind J.P. Morgan and RBC Investor & Treasury Services, with an unweighted score of 5.75. In the weighted space, a score of 6.91 placed it second behind J.P. Morgan only.

The situation was similar when only top custodial lenders were considered, with State Street returning to place top in Asia Pacific. When it comes to the agent lenders, it was only one of two firms – alongside J.P. Morgan – to qualify, and also win in the Asia Pacific market.

State Street achieved second or third place when service categories in the unweighted category were taken into account. However, in the weighted space, it won across multiple categories including Collateral Management, Engagement on

Parameter Management, Risk Management, Market Coverage in Emerging and Developed Markets.

Canada-based lender RBC Investor & Treasury Services (RBC I&TS) was only one of two lenders to qualify in the EMEA and Americas regions, alongside J.P. Morgan. An unweighted score of 5.36 in EMEA was down on the 2022 figure, while a result of 6.50 for the Americas was higher (6.44 last year).

In the weighted space, it placed at the same levels. It scored a global weighted average of 4.96, down on 2022’s numbers (5.22), and a global total of 9.92, also slightly down on the prior year’s levels.

In the unweighted custodial lenders lists, RBC I&TS also qualified in EMEA and Americas, and took second place in these regions.

Looking specifically at service categories, the Canadian lender won second place in the unweighted Programme Customisation, Provision of Market and Regulatory Updates and Relationship Management lists.

One survey respondent highlighted: ‘RBC I&TS continues to have great reporting tools, risk management and overall client experience.’

Beneficial owners are asked to rate the performance of their agent lenders. Respondents are asked to rate their agent lenders across 12 service categories (see below) from one (unacceptable) to seven (excellent).

There are two methodologies: unweighted and weighted.

Unweighted methodology

All valid responses for each agent lender are averaged to populate unweighted tables. All beneficial owners’ responses are given an equal weight, regardless of the size of their lendable portfolio. All categories are given equal weight regardless of how important they are considered to be by respondents. No allowances are made for regional variations.

Weighted methodology

The weighted table methodology makes allowances for both the size of the respondent’s lendable portfolio and how important the respondents, on average, consider each category to be. An allowance is also made for differences between average scores in each region to make meaningful global averages.

Step one – weighting for lendable portfolio: A weighting is generated to reflect to the size of the respondent’s lendable portfolio. Each respondent is put into a quartile depending on its total lendable portfolio. The scores of the respondent are then given a weighting based on this quartile. As the boundaries of each quartile are determined by all the responses received in this year’s survey, the boundaries are unknown until the survey closes. For the purposes of the 2023 survey all Asian responses will be given a weighting of 1. Asian responses will not be included in determining the quartile boundaries. However all Asian responses will be subject to step two – see step 2 below.

three in Asia Pacific. To qualify globally, a lender must qualify in at least two regions.

Custodial and third-party agent lender tables Ratings of lenders acting in a custodial or third-party agent lender capacity are recorded in separate tables. The respondent is asked to define their relationship with the lender: custodial, agent or both. If the relationship involves both forms of arrangement, the response counts for both the custodial and agent lender tables. Therefore, some responses will be included in both the custodial and third-party agent lender tables. All the scores calculated for overall lenders will be replicated for custodial and third-party agent lenders separately.

The qualification criteria are lower for the custodial and agent lender tables compared with overall. To qualify for either the overall custodial and third-party agent lender tables, lenders need four responses in the Americas, four in Emea and three in Asia Pacific.

Most improved

The agent lender that improved its score by the greatest margin over its equivalent 2022 score is the most improved firm. Agent lenders are ineligible if they did not qualify for the 2022 survey.

Service categories

Respondents are asked to rate each of their providers from one to seven across 12 service categories. The ratings of respondents for each service category are averaged to produce the final score for each provider. The service categories are:

Income generated versus expectation

• Risk management

Reporting and transparency

• Settlement and responsiveness to recalls

Engagement on corporate action opportunities

• Collateral management

Relationship management/client service

• Market coverage (developed markets)

Market coverage (emerging markets)

• Programme customisation

Lending programme parameter management

Step two – weighting for importance: An additional allowance is made for how important beneficial owners consider each category to be. This is done to acknowledge the fact that beneficial owners consider some categories to be more important than others.

Respondents are asked to rank each service category in order of how important the function is to them. An average ranking is then calculated for each of the 12 categories (11= highest ranking, 0 = lowest). This number is then divided by 5.5 to give a weighting within a theoretical band between 0 and 2, with an average of one. Again, basing weights around one is done to preserve comparability with unweighted scores.

To illustrate, if every respondent considers category X to be the most important it would get an average rank of 11. This is then divided by 5.5 to provide the weighting for category X, i.e. 11 / 5.5 = 2.

Overall tables

The overall table contains all responses for a lender regardless of its relationship with the beneficial owner, whether custodial or agent. The following scores are calculated: separately for each region, a global total, a global average and for each service category.

Regional scores are the average of all responses from beneficial owners based in that region (it is the location of the beneficial owner, not the lender, that is the relevant). There are three regions. A lender must receive a different minimum number of responses to qualify in each: five in the Americas, four responses in Europe, the Middle East and Africa (Emea) and

• Provision of market and regulatory updates

To qualify for each service category table, the lender needs the same number of responses to qualify for the corresponding main table; i.e., to qualify for an overall, custodian or agent lender service category the lender must qualify in two of the three regions (for example, four responses for that category in the Americas and three in Emea). A lender can qualify in some categories and not others – it does not have to qualify globally for all service categories to be any particular service category.

VALID RESPONSES

For a response to count for the purposes of qualification, the beneficial owner must rate the lender in no fewer than eight of the 12 service categories (i.e. it can tick n/a in no more than four service categories).

It is possible for a lender to qualify globally or regionally without qualifying for all service category tables, if it receives n/a responses for certain categories. For example, it may not offer emerging market coverage and therefore receive a string of n/a ratings in that category but qualify for all other categories, regionally and globally.

If a lender receives two or more responses in the same region from the same beneficial owner, an average of the ratings will be taken and it is considered to be one response for qualification purposes. If a lender receives two or more responses from the same client in different regions (e.g. pension scheme X rates lender Y in Emea and the Americas) the responses are not averaged and are counted as separate responses for qualification purposes.

2022 was a stellar year for Beneficial Owners who participate in Securities Lending. The unique blend of macro-economic factors which defined last year; the War in Ukraine, the resulting energy crisis, high inflation and aggressive rate cuts across the world provided significant market volatility and a fertile market environment for strong revenue growth. $9.89 billion was earned by Beneficial Owners in 2022, 0.7% short of the 2018 record: a post financial crisis figure of $9.96 billion. So, was 2022 a great year for all Beneficial Owners and how do they know if they have performed as well as they should have?

The Securities Lending market has evolved significantly since 2008, driven by increased regulation and a better understanding of risk and reward by the beneficial owner community. What was once thought of as a back-office tool, is now considered complex enough by some Beneficial Owners to move this function into the front office. A few have gone a step further and decided to lend securities themselves rather than outsourcing this to agent lenders. Others are now looking at the broader financing world and thinking about the best and most efficient way to utilise their portfolios taking all of their financing and collateral requirements into account. At the centre of this evolution is technology and data.

Pre-2001, the data available to beneficial owners was limited to each agent lender’s own reporting tool and these varied greatly in terms of what they were able to show. Many reporting tools only showed which securities were out on loan and how much they were earning and up till 2008, few demanded more. Benchmarking and Performance Measurement were in their infancy and underutilised by many market participants. Post 2008, suddenly transparency was on everyone’s mind and would soon become a key consideration when implementing a lending programme.

Although transparency has historically been driven by market participants, industry bodies and regulators are now picking up the baton and leading the charge. The International Securities Lending Association (ISLA) has a Performance Measurement Working Group, Securities Financing Transactions Regulation (SFTR) which came into effect in 2020 and in the U.S, the Securities and Exchange Commission (SEC) is on the cusp of implementing Rule 10c-1, all of which are aimed at increasing transparency in the Securities Lending Market.

Technology has played a big role in helping improve transparency and it will continue to do so going forward. For example, the proposed SEC 10c-1 Rule as it stands today has a reporting window of 15 minutes. Without technological investment, this proposed regulatory requirement will be difficult to achieve. EquiLend has been producing Real-Time data which is published within 5 minutes of trade execution for over a year now meaning compliance with the proposed SEC regulation will be simple for firms in the EquiLend ecosystem.

Today there are more tools and more providers to help measure and benchmark performance than ever before and this number continues to grow however DataLend’s anonymised data modelling and benchmarking captures the largest selection of data, market wide. When

The Securities Lending market has evolved significantly since 2008, driven by increased regulation and a better understanding of risk and reward by the beneficial owner community.

navigating these options and searching for appropriate partners there are two key components that Beneficial Owners should consider – attribution and relative performance. Performance measurement should always start with attribution, ensuring a good understanding of what’s behind the numbers. Analysis should determine: is it a particular stock, asset class, market or sector or, a combination of these driving revenue? For example, in 2022, the top 5 revenue generating securities were all US Equities - Lucid Group (LCID), followed by GameStop Corporation (GME), Beyond Meat Inc. (BYND), Sirius XM Holdings (SIRI) and lastly, Cassava Sciences Inc. (SAVA). These 5 securities alone generated $769 million for lenders in 2022. Fixed Income assets were also strong contributors to revenue in 2022. US, UK and German Government Bonds and High Yield Corporate Bonds all performed well. Beneficial Owners who didn’t hold these securities in their portfolios are likely to have not had as stellar a year in revenue terms as those that did.

This brings us to the other key component – relative performance. Holding or not holding those securities in your portfolio is down to the investment framework for each Beneficial Owner. Portfolio managers rarely make investment decisions based on securities lending revenue which is why relative performance becomes important. At its simplest, relative performance looks at other institutions who are similar in terms of geographical location, legal construct, Risk Weighted Asset rating and who holds the same securities as you to give you something to compare against where most things are equal – benchmarking against your peers.

For most Beneficial Owners, attribution and relative performance measurement is sufficient and should be the minimum standards in terms of good practice. For others, those who have evolved, measuring performance is becoming more complex. For Beneficial Owners who are now either lending their own assets, either partially in a hybrid structure with an agent or directly on their own, the increasing customisation is making relative performance measurement more difficult. In these instances, Beneficial Owners are looking for additional data points from their data partners to not only measure performance but to also provide actionable insights to

help make lending decisions and deploy their assets most efficiently. Revenue is not necessarily the primary objective.

With the turbulent macro-economic environment set to continue for the rest of 2023 (Q1 revenue came in at $2.7 billion v Q4 2022 $2.2 billion), it’s important that Beneficial Owners who participate in Securities Lending continue to focus on performance measurement to ensure that the governance of their programmes is adhering to best practice. Those that are lending themselves or deploying the assets in their portfolios in a variety of ways should also utilise data and technology solutions, a wide range of which are available through EquiLend, to help make more informed decisions.

Dimitri Arlando is the Head of Data and Analytics Solutions EMEA & APAC, EquiLend. He has over 20 years of experience in securities lending, having started his career with Deutsche Bank in 2001. He has held a number of sales and relationship management roles at some of the largest agent lenders, including State Street, BNY Mellon and Northern Trust. Dimitri holds a Bachelor of Science degree in Banking and Finance from Loughborough University in the UK.

For most Beneficial Owners, attribution and relative performance measurement is sufficient and should be the minimum standards in terms of good practice.

The 2023 EU Beneficial Owners’ Roundtable was moderated by Andy Dyson, the Chief Executive of ISLA with EquiLend as the lead sponsor. The roundtable was held in late March with a panel of industry experts discussing topics from the data, ESG, collateral and the change from 2022 to 2023.

Chair: Andy Dyson, Chief Executive Officer, ISLA

Stephen Kiely, Head of the BNY Mellon Securities Finance Client Relationship Management and Business Development Teams in EMEA

Olivier Zemb, Head of Equity Finance and Collateral Trading, Caceis Bank

Andrew Geggus, Global Head of Agency Lending, BNP Paribas

Cassie Jones, Managing Director, EMEA Head of Financing Solutions Client Management, State Street

Nick Davis, Executive Director, EMEA Head of Relationship Management, J.P. Morgan

Dimitri Arlando, Head of EquiLend Data and Analytics EMEA & APAC, Equilend

Maurice Leo, Client Solutions, Agency Securities Lending, Deutsche Bank

Ernst Dolce, CEO & Co-Founder, Biben Capital Markets

Dimitri Arlando, Head of EquiLend Data and Analytics

EMEA & APAC: A look back in history shows us that during extreme macro-economic turmoil, the resulting volatility usually means it’s good for security lending in terms of revenue generation, and 2022 has been no different really.

We’ve been collecting data since 2013. We all know that 2008 was a record in terms of revenue generated for the industry. 2022 came in at $9.89 billion revenue generated for security lending participants, slightly shy of DataLend’s 2018 high of $9.96 billion. 2022 revenue was 7% higher than 2021 and 30% higher than 2020.

We had a lot of aggressive rate hikes in 2022. The war in Ukraine, and the resulting energy crisis, high inflation, and more recently, the regional bank issues in the US and Credit Suisse, here in EMEA as well.

Focusing on EMEA, 2022 revenue came in at $2.18 billion broken out as $1.4 billion for equities and $800 million for fixed income. As you can see, the fixed income market performed exceptionally well in 2022 with a 25% increase over 2021.

$700 million of revenue was generated from corporate bonds globally in 2022 and $250 million of that came from EMEA. The driver behind the strong performance was on the balance and the fee side with both increasing significantly in the year.

US equities contributed the most to revenue overall led by electric vehicle companies and meme stocks. EMEA and

APAC didn’t perform as well, and revenue was actually down for both regions compared to 2021.

For EMEA, Equity revenue is dominated by German and French names as you can see, and in Asia, Korean names dominated the top three. However, Korea was actually the fourth best performing market after Taiwan, Japan and Hong Kong. The top four markets in Asia actually accounted for 85% of the revenue.

In lendable terms this number averaged $26 trillion for 2022 but fluctuates between $26 and $30 trillion across the year. Collective Investment Schemes dominate the lendable inventory with 53% of that the total, however, when it comes to on loan, pension funds and government entities have more out on loan, and you’d expect that because collective investment vehicles have very strict guidelines on what they can or can’t do, and that’s not the same for pension plans and government entities.

Andy Dyson, Chief Executive Officer, ISLA: Cassie, when you talk to your clients, is what we see there in the data recognisable in their experience in terms of your programs?

Cassie Jones, Managing Director, EMEA Head of Financing Solutions Client Management, State Street: I think in particular, the fixed income trades are definitely reemerging off the back of the crises that we’ve been seeing in the markets, and it’s worth just spending a few moments on what’s happening in the markets as well.

Of course, this market environment produces volatility, and in turn is generally good for securities lending revenue for the beneficial owners, but you have to also be thinking about the risk that you’re taking in these programs, and of course, your agent lender should be taking care of this on your behalf.

Andy Dyson: Ernst, what are your thoughts on what you see there in terms of market footprint when it comes to performance and where performance is coming from?

Ernst Dolce, CEO & Co-Founder, Biben Capital Markets: What we observed is that the trend in corporate bonds will continue. I remember noticing this trend eighteen months ago, even though corporate bonds are not currently dominating performance; equities still account for 60% of total revenue.

“A look back in history shows us that during extreme macro-economic turmoil, the resulting volatility usually means it’s good for security lending in terms of revenue generation, and

EMEADespite the shift in results for securities lending, the market continues to beat records year after year, with only 10% utilisation rate of total lendable assets. The utilisation rate has not increased meaning that the market participants managed to generate more revenue from their assets on loan.

Andrew Geggus, Global Head of Agency Lending, BNP Paribas: I would refer to the fixed income businesses as rockstars and I don’t think that’s ever happened before, but that is definitely a trend that I think we’ve seen for the last 18 months and that we see carrying on as well.

2022 has been no different really.”

Dimitri Arlando, Head of Data and Analytics

& APAC, EquiLend

You need to make sure your clients are comfortable with their risk parameters and the whole point of having strong risk parameters in place is that during times of volatility it’s there to protect you. I do think we will see some clients maybe start to review their risk parameters on the reverse side, so maybe pulling back a little bit – which is not what we want, we want to push so we can optimise revenues.

Andy Dyson: Maurice, where do you see the performance in the markets in terms of what we’re seeing there?

Maurice Leo, Client Solutions, Agency Securities Lending, Deutsche Bank: The headline numbers I agree with in terms of growth overall at an industry level. I think there’s certain clients that have benefited much more and part of that is also the story Dimitri mentioned around concentration, particularly to take US equity revenues in the top 10 names, it’s typically about 50% of total revenues year to date.

Andy Dyson: Is that latitude more to do with the credit they’ll take, the duration their take on the reinvest, what is it that they’re buying that gives them that yield?

Maurice Leo: Yeah, I don’t think it’s always actually buying. I think it can be through reverse repo, which is a different risk construct and one that a lot of them like. The government, sovereign entities that lend, the pension

funds that can lend, can typically do duration, they can do collateral transformation. All the things that UCITS and mutual funds struggle with, because of the regulatory perimeter they have to work within. And that’s for understood reasons but I think that’s why our business is increasingly segmented, and clients are not in a homogenous offering anymore. I think regulation is probably the primary driver but its own their own risk profile [driving performance] as well.

Stephen Kiely, Head of the BNY Mellon Securities Finance Client Relationship Management and Business Development Teams in EMEA: One thing I’ll just say on the performance aspects is that, we’ve seen momentum, we’ve seen many of the trends that have already been discussed by Cassie, Andrew, etc and trends in asset classes, but what we’re also seeing is it’s not just about the revenue.

We saw in September last year during the volatility caused by the mini budget action when there was a lot of volatility, and we’ve seen it again now with SVB and with Credit Suisse, etc., that clients are looking to us to help them with liquidity management, not just increase revenue, especially in September last year. Requests such as, “Can you help us transform collateral? Can you help us raise cash? Can you help us deploy cash? So we’re seeing that as a trend. It’s a driver of volume and the entry of some new participants into the program. It’s not just about the revenue.

Andy Dyson: One of the things that I see and I think we’ve got to recognise is that one of the unintended consequences of the regulatory agenda over the last 10 years is how business has flowed into larger names. What are you seeing from a performance and opportunity perspective?

Olivier Zemb, Head of Equity Finance and Collateral Trading, Caceis Bank: I agree with everyone else’s comments but I will be a bit cautious when it comes to US equities. As Maurice said, revenues are highly concentrated on a few names. This could then have a significant impact on programmes’ performances. Other than that, I think it’s going to be a very good year, especially on the govies side.

Regarding credit, 2023 should also be an excellent year for corporate and convertible bonds, probably even better than 2022 which was the best year ever in terms of returns, as commercial property and the retail sector remain sought after. Finally, revenues generated on ETFs should keep on increasing. I think the correlation between stocks, industries and countries is higher now than before.

Nick Davis, Executive Director, EMEA Head of Relationship Management, J.P. Morgan: We have certainly seen a convergence for both the client and trading businesses. The occurring theme is maximising performance, capital, and efficiency which includes, but not limited to, the lending of assets while mobilising collateral.

Mobilisation has been key to help facilitate the financing of both long and short cash trades. Risk taking is also being

reviewed by clients following a shift in some programs out of operations and into a Treasury function.

Clients see additional value in moving away from the traditional indemnified program and approving more non vanilla type trades, esoteric forms of collateral or increasing general utilisation in specific markets. These examples would see additional value being added to their lending program.

Andy Dyson: I think a couple of you mentioned the idea of, is it collateral transformation, or is it the provision of liquidity? Other drivers there were the arrival of margin rules for uncleared derivatives, and as they’ve gone down into the lower waves of those investment management clients. Surprise, surprise, many of those clients don’t have a trading desk to actually manage their own liquidity.

Stephen Kiely: We’re seeing clients starting to put their treasury financing and maybe their securities lending together to realise the efficiencies within their own organisations. I think that’s changing the dynamic somewhat, and we’re seeing clients tweak their programs here and there.

Nick Davis: It’s about managing an efficient book. Should assets be better utilised under a lending transaction or through synthetics?

Andy Dyson: The point you may say is spot on and it is one of the conversations we’re having a lot of is Total Return Swaps. What does that look like? How is that business evolving? It’s always been a part of the broker-to-broker world and it’s always been a feature of certain very large clients. What should we expect to see from a regulatory perspective?

Nick Davis: There are two key regulatory points I would like to raise, US T+1, and 10c-1. Addressing US T+1 first. If you want to be transacting in the US market, you need to be able to support this new timeframe. If clients can offer a pre-notification on sales, you are not going to see any real change to your day to day with this new time frame being implemented.

Fund Managers as we know tend to trade right up to the market close, therefore from an industry best practice perspective, what is a realistic time frame that sales can be accepted by market participants?

The second regulation is 10c-1, and I see two main challenges. First point is the reporting every 15 minutes. The current model certainly doesn’t allow for a 15-minute turnaround.

The second point is around reporting from an inventory perspective. The regulation asks that you report on the total inventory. Will beneficial owners want to disclose their total inventory? In addition, some beneficial owners may want to hold back a certain percentage of their lendable. Therefore, will that disrupt liquidity? Could we see incorrect data being supplied? There are still challenges that need to be addressed.

“Fund Managers as we know tend to trade right up to the market close, therefore from an industry best practice perspective, what is a realistic time frame that sales can be accepted by market participants?”Nick Davis, Executive

Director,EMEA Head of Relationship Management, J.P. Morgan

Andy Dyson: I think you’re right that one of the challenges with increasing your settlement rate or reducing your time is that if you’ve got endemic issues embedded in your market, its just going to make things worse, certainly in the short term.

Cassie Jones: I think we’ve all seen that on CSDR. Even the regulators have said the fines are much larger than they expected and they’re not seeing an improvement in the fail rate. Something’s got to give in the markets to be able to improve that. Do they need higher fines, or is it just something that’s an investment in technology and continuing to automate things?

Ernst Dolce: The market should not push for higher fines or encourage the regulator to do so! The penalty is computed as a basis point times a notional, depending on the size of the trade - the fines are already large enough. For some markets, such as credit and emerging markets, increasing the size of the penalty could kill the liquidity. Therefore, we all need to be careful.

Andy Dyson: We had a conversation at the Bank of England somebody said that when you look at going to the insurance market to buy an indemnity, it’s very expensive. So, my comment was, it’s probably the right price and what you’ve been charging for the last 30 years has been the wrong price. I don’t know if anybody agrees.

“Even the regulators have said the fines are much larger than they expected and they’re not seeing an improvement in the fail rate. Something’s got to give in the markets to be able to improve that.”

Ernst Dolce: Indemnity is very expensive, but the clients are not paying the right price to be honest. Even though the indemnity could be replaced by an insurance, the insurance cost remains high.

Olivier Zemb: About indemnity, I think we need to distinguish two types of trade. On the one hand, GC trades that are too cheap and probably not profitable. If you add the cost of indemnity with a potential CSDR penalty if you don’t deliver on time, you may work at a loss. On the other hand, if you look at specials, you’re on the safe side. The question then is do we need to split the indemnification between the type of trade, type of counterpart and provide indemnity on specific situations, and not on others. It’s a major subject.

Cassie Jones: But also it’s an education point as well with clients. There’s a huge mismatch between the cost of the indemnification and the economic benefit that the client receives.

Stephen Kiely: Olivier made an excellent point. There is no other insurance which is so binary as agent lender indemnity. With agent lender indemnification, it’s really black and white, you’re indemnified or you’re not, every trade, every borrower.

Olivier Zemb: The market is always right. There will always be someone who will be tempted to lower the fees to capture more business and will reduce the levels for the whole business.

Andrew Geggus: It’s been a race to zero for the last 20 years.

Andy Dyson: What we’re seeing in the technology space, what you’d like to see and what we expect to happen next?

Andrew Geggus: I just wanted to have a look back at what we discussed last time around and what has actually happened over the last 12 months, we made some predictions at the time, some have panned out, some haven’t. Firstly, we spoke about distributed ledger technology at length last time around. There is a divergence of views between some people saying it’s more of a pipe dream / longer term, and some people saying there are real use cases shorter term. What we have seen over the last 12 months have been a select number of use cases, I think there has been progress made by HQLAx, as well as JP Morgan’s Onyx business unit – I think they’ve publicly announced different use cases. It’s not going to be rapid in terms of its development, however each use case is a step in the right direction from my point of view and we can probably touch

on the potential benefits of distributed ledger technologies further down the line.

Secondly, we also spoke about AI, this is something I think firms are using much more internally. I think a lot of firms are using robotics and AI in their internal systems but I haven’t seen a sort of “mass-adoption” within the Securities Finance market of a single product.

Lastly, we spoke about standardisation. We spoke quite at length about how to really benefit from technology and all the capabilities it has. We needed much more standardisation across the market, we spoke quite at length about the CDM work, the Common Domain Model that ISLA is doing, and that has actually progressed quite significantly over the last 12 months in conjunction with ISDA and ICMA.

Despite speaking about all these fantastic future technologies, I think in 2023 the key things that we need to address with the help of technology are trade matching and settlement, onboarding, KYC, and operations exception management.

I think with that, one of the key points, for me, is that, luckily, technology providers in our industry are coming up with solutions. I think this is absolutely key – is interoperability.

Ernst Dolce: I think there’s another impact – if the regulator finds that the market participants did not play the game –i.e. they did not increase the “interoperability” – probably, as Cassie mentioned, it will become more expensive. The fintech that are not playing the game of “interoperability”

“Despite speaking about all these fantastic future technologies, I think in 2023 the key things that we need to address with the help of technology are trade matching and settlement, onboarding, KYC, and operations exception management.”Andrew Geggus, Global Head of Agency Lending, BNP Paribas

“We need to have some kind of harmonisation across the industry but at the same time you need to deliver tailor-made solutions for your clients. We need to provide more and more granular details. There are two things to look at, the big picture and also the clients’ view.”

will disappear because you will have the big firms that will go after that market. Currently, in Europe, I know at some firms that are doing their own platform and looking to emulate Blackrock Aladdin’s model, because they don’t believe that the fintech are taking seriously the lack of interoperability.

Olivier Zemb: I agree with you. We need to have some kind of harmonisation across the industry but at the same time you need to deliver tailor-made solutions for your clients. We need to provide more and more granular details. There are two things to look at, the big picture and also the clients’ view.

Nick Davis: If we go back to the start of the year and what occurred across the financial sector, proves that transparency into a client’s lending program remains a key requirement. Clients want to be able to see their risk profiles, collateral, counterparty exposure and revenue performance. Having that in-house technology is key to meet those requests from your clients.

Dimitri Arlando: Trading desks are now actually saying, show me the settlement rates because that’s important to us. That’s really driven by the search for efficiency. As desks are being squeezed from a fee perspective and everything is becoming more expensive in general, people try and find ways to be more efficient and our data can help you do that.

Andy Dyson: For us, ICMA and ISDA, the CDM is a digital standard that they can use to define which fields, which transaction types they want to pull out of your systems on the premise that you’re all describing those trades in the same way. ISLA doesn’t want to be in the process of products and services. What we want is to create that level playing field that gives the regulators the opportunity to pull the information they want, which means from a regulatory perspective, one of their big challenges is they think we need to do something, and it takes them years to figure it out because the process, the consultations, the implementation.

Andrew Geggus: One difficulty for firms within the market is the cost element of it, because resources are limited.

Typically, agent lenders are custodians, custodians don’t have bottomless pots of money to spend on development. When we do have limited resources, we’re also seeing things like SFTR come along, or CSDR. I think when we move through the regulatory roadmap for the year ahead, it’s pretty thick still.

Stephen Kiely: I agree with Andrew’s point that fundamentally as an industry, we need to spend more technology dollars on some of the things that are unseen. Let’s just think about this, BNY Mellon does around 18,000 securities lending trades a day and uses a lot of technology. NGT being some of it. If I go back 10 years, that number will be less than half.

And yet if I go back 10 years, the way we do KYC is the same. The way we onboard clients is the same. The way trades are settled is the same. That needs to catch up and if we’re talking costs, we need to cut down the expenses there.

Andy Dyson: Another factor that I recognise is that you have businesses to run and therefore it’s quite hard to be the person that says: “I’m going to spend a lot of money on sorting out KYC because that’s going to have benefit now and over the next 10 years. But it means that we’re going to make less money this year.” It’s not a good conversation with your boss.

Stephen Kiely: That’s the challenge because people are judged in the short term. Every single person on this table has a short-term annualised budget. What are you going to make? And if you move away from that because you want to invest in the industry, that’s a hard conversation.

Nick Davis: We should also remember how far the industry has come and how robust we are in times of extreme volatility. More clients are taking advantage of APIs, tokenisation will improve the timings when it comes

to settling and returning loans, increased transparency for all market participants, and an ongoing focus on sustainability.

Olivier Zemb: Risk management as well. Ten to fifteen years ago, risk management was less present. Now we have loads of limits in terms of trading and so on. The system is more robust as a whole. We can absorb shocks.

Andy Dyson: We sort of morphed into that world of data. Dimitri is there anything else you would add in terms of how you see the changing role of data in the businesses that these guys run.

Dimitri Arlando: There are two key areas to focus on from a performance measurement perspective. Firstly, attribution. Essentially getting a good understanding of why your

“It’s really important to make sure that you are truly comparing like-for-like, tools like ours allow you to do just that and compare your performance with portfolios that have the same securities as you.”

Dimitri Arlando, Head of Data and Analytics EMEA & APAC, EquiLend

programme is performing better or worse than previously, and really trying to identify if it’s a specific market or a specific security.

The second aspect is relative performance: how are you doing in comparison to your peers and to the industry? Now, that’s the interesting one.

And I think that’s where the evolution is really happening right now, because it was the case and it still is the case for most part, that people look at their performance numbers and they use tools from providers like us that allow them to look at their performance and compare it to a peer group.

It’s really important to make sure that you are truly comparing like-for-like, tools like ours allow you to do just that and compare your performance with portfolios that have the same securities as you. But the problem then becomes when you’re looking at peer groups and you look at sovereign wealth funds, for example, who are very different across the world and have varying levels of appetite for risk, and they have varying investment guidelines as well.

It becomes tricky to benchmark because now you’ve got a whole world of things you can do with that portfolio and a lot of different options. And you don’t necessarily have all the tools to be able to benchmark your performance properly.

A number of beneficial owners are now saying: no, we

“ I think that money is not going to be transitory. Some of its going to stay there because of the interest rate environment.”

Maurice Leo, Client Solutions, Agency Securities Lending, Deutsche Bank

don’t want to see that, we’re more interested in looking at the same data that trading desks use to do their trades. So they’ve moved away from saying, how’s my performance compared to my peers to now saying, am I getting the best out of my assets?

Cassie Jones: I think that granularity and performance is really important because if you can then extrapolate that and understand the drivers of performance moving forward, clients can come back to those opportunistic trades.

Maurice Leo: In a way, beneficial owners have been a catalyst for change particularly around data. The whole ISLA securities lending performance measurement group was borne out of, or championed, very heavily by a beneficial owner in particular, who chaired that group. That’s led to guidance notes that I think will accelerate in adoption this year, which will deliver more consistency, understanding around that data. And I think it’ll make it more valuable and as a result.

Dimitri Arlando: I think it is a really important point. So obviously, we’ve done a lot of work on the performance measurement working group to try and drive those standards. However, we still have some way to go.

Andy Dyson: I think also that what SFTR delivered was a clear understanding of what’s a trade and what’s not a trade, and that rigor has fed through into the way people define things like inputs for performance benchmarking, it’s gone into standards around the CDM. So in that sense, SFTR was a great catalyst for the creation of standards and digital standards.

Olivier Zemb: You need to have some metrics in place. Data providers have done a great job, but I think more granularity is needed for good benchmarking. For liquid assets such as large/mid cap, benchmarking works well and is very easy. For small caps, corporate bonds, not so much…

Nick Davis: I break data down into four points.

• Descriptive and Diagnostic

– This includes the benchmark providers that the industry utilises, with the addition of your prop overlay (performance of your book vs the industry), backward looking and your current footprint.

• Predictive

– This is where diagnostics play an important part in conjunction with quantitative research and AI, to establish your value add and how you can achieve outperformance.

• Prescriptive

– How you achieve the above.

Andy Dyson: So how much of a particular asset do we have in a collateral pool? How many days would it take to sell it? What could be that price movement over those days? So, in addition to sort of haircuts, people looking at almost liquidity stress buffers, etc. On collateral, where are you guys seeing in terms of what your clients are asking you more generally?

Stephen Kiely: I think a positive trend in terms of the questions we’re asked by clients is, they are starting to be more concerned with liquidity and credit. And I think that’s absolutely the right way to go. The only true value of whether something is liquid or not, is: is it being bought and sold? And so we’re seeing clients put greater emphasis on the liquidity of their collateral and not too concerned about whether it’s single or double A.

Olivier Zemb: We have to bear in mind that in terms of risk, collateral has to be seen as secondary or derivative. The

“I’ve observed a shift in the buy-side’s approach to pricing collateral, as they are now considering not only risk and diversification, but also the potential uses (reuse) for the assets.”

Ernst Dolce, CEO & Co-Founder, Biben Capital Markets

primary risk is counterparty risk. Collateral is certainly key but you need to check what you are receiving from which counterpart and then you can adapt your collateral profile and haircuts. Right now, haircuts are pretty much standard but this is an area where we need to be flexible.

Ernst Dolce: I’ve observed a shift in the buy-side’s approach to pricing collateral, as they are now considering not only risk and diversification, but also the potential uses for the assets. For instance, some firms are looking to reuse the collateral for intra-group trades. While some firms previously avoided such transactions, they are now recognizing the value of the assets they receive as collateral and seeking to leverage them. Other firms are focused on finding the most cost-effective way to deliver the collateral, which involves comparing the value of different assets, such as government bonds and credit, for various types of transactions like derivatives, repos, securities lending, and collateral. However, implementing

these strategies is challenging and requires building new pricing models.

Cassie Jones: The buy-side need to consider their specific funding and opportunity cost, so that’s where it takes a step up from just general triparty optimisation to asset optimisation. If you can have a view of your entire inventory as the buy-side, and you can actually identify when securities are trading special, for example, you don’t want to tie that up as collateral in a repo trade. You want to lend that on the market. But having just a more real time view of your inventory sources and uses of collateral goes a long way.

Andy Dyson: ESG, does that change the client’s dynamic?

Cassie Jones: We just have to find the balance. There is a cost and benefit trade-off of limiting your collateral schedules so that it reflects your ESG parameters, but then you’ll never get anything out on loan. So there’s that trade off.

Nick Davis: Collateral is secondary. When clients are looking to restrict asset classes due to their own ESG mandate, it is on the lendable and not necessarily on the collateral.

Maurice Leo: A slightly different angle on collateral: HQLA. So if you think the other angle is there is a lot of money moving out of deposits at the moment in Europe because interest rates are rising and in the US because of concerns with bank risk. So you’re seeing that money move. I think that money is not going to be transitory. Some of its going to stay there because of the interest rate environment.

And I think you’ve also got a lot of government agency money parked at the ECB which has been parked there on favourable terms for a long time. And the ECB is anxious that that money gradually and orderly moves off balance sheet, that’s all going to flood into money markets, into repo, into the products that we all operate in.

And arguably a lot of it is conservative and is going to gravitate towards government collateral. So government collateral is likely to become more expensive as you see more of that money coming in. So for those clients that probably ringfence and depend heavily on that, that’s going to be a difficulty. If you’re lending it [government debt], I think potentially you’re going to see enhanced spreads.

Andy Dyson: Can I just get your closing thoughts on what you expect the market to look like as we go into the remainder of this year or any other closing thoughts.

Nick Davis: Continue to support funding requirements for our clients which will enhance asset optimisation, taking

“I’d like ‘23 to be a year where more beneficial owners come to the realisation that securities lending can do more for them than just be a source of revenue.”

Stephen Kiely, Head of the BNY Mellon Securities Finance Client Relationship Management and Business Development Teams in EMEA

additional risk through non indemnified style trades, accessibility to other liquidity sources, and continued efficiency both at the front end and operationally.

Olivier Zemb: As a whole, I think we need greater harmonisation together with tailor-made solutions for clients. For trading, govies will be a major element this year, like previous years, but I don’t think we have seen the ‘flight to quality effect’ yet, even if the markets are quite jittery. Repo markets are not moving a lot in terms of spreads between peripheral and core govies.

Maurice Leo: Focus on the [US] debt ceiling, unfortunately, it’s going to be there in the second half of the year. There’s no getting away from that – we have had dress rehearsals before so we’ll deal with that.

Ernst Dolce: I expect an increase in liquidity solutions and a shift in the debate from securities financing/collateral management to liquidity solutions. For instance, in securities lending transactions, we may see more General Collateral (GC) trades with shorter durations, and longerterm evergreen trades, which last for more than one year, may become bullet trades with proper risk management. For unsecured transactions, evergreen trades may also transition to bullet trades, especially if the cost of singlename Credit Default Swaps (CDS) is reasonable for covering specific banking risk exposure.

Dimitri Arlando: I think the use of data and performance will continue to evolve. Transparency will continue to increase and we’ve seen that play out already but the regulations that are coming down the pipe like 10c-1, will push that along even further. From a performance perspective, I think we’re going to have another strong year in revenue terms. I think there’s still a lot of turbulence from a macroeconomic perspective to ensure that there will continue to be opportunities for revenue in the lending markets.

Cassie Jones: On the back of that I think we should put more power in the hands of the buy-side so they can take advantage of the market volatility in those opportunistic trades in partnership with your lender. But one thing I want everyone to keep an eye on as well,is the balance sheet constraints remerging.

Andrew Geggus: Long periods of volatility for this year. I think we saw it recently with banks, but I do think we’ll see more episodes occur. I think this will help drive the fixed income area of securities lending to remain as the rockstar. I do think that we also will see some developments in the interoperability space which is really hopeful for me.

Stephen Kiely: I’d like ‘23 to be a year where more beneficial owners come to the realisation that securities lending can do more for them than just be a source of revenue.

What measures did your organisation take to manage risk during the recent market volatility in the Securities Lending market, and what was the outcome of those measures?

We always try to put ourselves in the place of our clients, understanding their concerns and giving them confidence in the safety of their programme. Collateral is often the focus in times of market volatility; therefore, we directed clients to their collateral adequacy reports and emphasised the daily collateral stress tests that we perform. We regularly re-evaluate the risks and act in the interests of clients and the overall lending programme, and from a relationship perspective, we were proactive in

increasing client communication, which reassured our clients in the market conditions.

The programme did not experience a loss of liquidity for clients as the recall process was very robust. Clients did not restrict highly liquid assets, e.g., government bonds, from lending programmes, to have access to liquidity if required, and borrowers experienced stability of supply as a result. The experience of the UK’s September 2022 Mini-Budget volatility helped all parties to have faith in securities lending programmes.

In terms of outcome, the main period of volatility passed without any serious incident and with the reputation of the programme enhanced.

How has the recent market volatility impacted your organisation’s Securities Lending business?

The effect has been minimal, in that we haven’t seen significant changes to clients’ programme parameters, and simultaneously clients have benefited from the increased revenue that acts as a hedge against volatility. Increased volatility and/ or market events always bring us closer to our clients due to the raised level of client contact, and we believe that results in deeper levels of trust, through pro-active, twoway communication.

How have your clients responded to the recent market volatility in the Securities Lending market, and what

communication,

We regularly re-evaluate the risks and act in the interests of clients and the overall lending programme, and from a relationship perspective, we were proactive in increasing client

which reassured our clients in the market conditions.

actions have you taken to reassure them?

Success in this environment depends on preparation beforehand. Market trends come and go with such frequency, that we work to ensure that clients and their programmes are as equipped as they can be to weather unusual conditions and take advantage of opportunities as they present themselves. As already mentioned, volatility often leads to questions from clients and opens opportunities for dialogue and greater education. As a result, clients often gain a greater understanding of the securities lending market when it goes through periods of volatility.

We have seen increased interest from clients in using their securities lending programme, not just as a tool for generating incremental revenue, but as a tool for accessing financing and liquidity management. When volatility and market events squeezed liquidity, clients looked to their lending programmes for answers, and we have developed the apparatus to provide those answers. We can offer solutions to raise cash and deploy cash, as required through our Securities Finance product suite.

Looking ahead, what steps is your organisation taking to prepare for potential future market volatility in the Securities Lending market, and what lessons have been learned from the recent experience?

To continue a theme, we are expanding our efforts to enhance

and align clients’ programmes when markets are calm, in order to lean on this progress during periods of increased volatility. For example, our clients are well educated in how we manage risk and we will increase this to ensure even higher levels of comfort. BNY Mellon has a set of solutions to not only protect and enhance securities lending revenue streams, but to also manage the programme to our clients’ benefit.

For the most part, we have learned two things: clients trust us to manage risk pursuant to their direction; and they are looking for Securities Lending to provide liquidity management tools – not just revenue generation. This changing view of Securities Lending is an industry trend, and it is the responsibility of industry leaders to facilitate these solutions as markets move with greater speed and clients become more sophisticated.

Steve is a securities finance professional with over 20 years’ experience in the securities industry, mostly in securities lending and repo. Steve is the head of the BNY Mellon Securities Finance Client Relationship Management and Business Development Teams in EMEA, where he is responsible for sales, market visibility and client management across the whole securities finance suite of products. Before he began working at BNY Mellon, Steve was responsible for securities finance sales and relationship management at Citigroup in London for seven years focusing on Luxembourg, Nordics and the Middle East. Prior to this, Steve was Head of Capital Markets Operations at HVB London, specialising in fixed income and derivative structures. Steve has extensive experience with both the buy and sell side of the market, vendors and industry bodies, and is a regular contributor to industry press and event panels.

When volatility and market events squeezed liquidity, clients looked to their lending programmes for answers, and we have developed the apparatus to provide those answers. We can offer solutions to raise cash and deploy cash, as required through our Securities Finance product suite.Steve Kiely, Head of the BNY Mellon Securities Finance Client Relationship Management and Business Development Teams in EMEA , BNY Mellon

CACEIS’ Securities Finance desk takes a look at the current lending market, the hot topics that might drive change, and the opportunities this year for clients looking for extra performance.

Off to a good start: a very positive Q1 for lending revenues

The industry had doubts about how it would top the exceptional year 2022 but we are doing well so far. Total securities lending industry revenues for Q1-2023 are up 24.5% on the same period in 2022, reaching $3.414bn according to S&P Global. This makes Q1-2023 one of the best performing quarters in recent history, with an average lending fee of 53bps - up 39% on the same period in 2022. DataLend confirmed this, revealing a year-onyear worldwide increase across all asset classes of 27%, even with a 5% fall in loan balances.

How do we explain these excellent

figures? Firstly activity on US equity specials continues to heat up, and in the EMEA equities space, Swiss equities have pulled ahead. The only notable decline has been on ETF activity. On the fixed income side, corporate bonds fees are on the rise but with the liquidity that will become less abundant, especially with the end of TLTROs and various ECB programs, we all anticipate a rising demand for HQLA assets as well. The second semester will be very interesting indeed.

What are the industry hot topics in 2023

Regulation is the first topic for the lending industry. The main focus now being on the incoming Basel CRR3 and CRD6 putting pressure on balance sheets, which shall push for more client selectivity from agent lenders based on capital requirements and RWA consumption. Regarding CSDR’s settlement disciple regime, we observed that it is now well established but questions around a mandatory buy-in process scheduled for 2025 remain, although it seems SFTs will be exempt. Another theme is coming from the level 1 review of UCITS and AIFMD which might constrain buy side players acting as agent lender for their own funds to justify on the split of the revenues they take.

A second key topic is indemnification, as it is still a dilemma for agent lenders that haven’t yet stepped up to solve it. Indeed, these clauses are somehow still offered to

clients despite the high cost of it. That is why, for instance, some agents now favour special transactions, stating indemnified GC transactions lack profitability, but clients are not ready to give up this clause and agents are struggling to stop providing it, aware of the fierce competition.

The third topic we can identify is obviously the challenges of technology. Similar to any industry, we need more data and granularity to answer clients’ and market players’ needs. For example, we need finetuning benchmark data especially for less liquid small capitalisation or corporate bond type assets to ensure clients have benchmarks aligning with best execution standards. Another example would be on the

2022 was an exceptional year for revenues and the trend continues into 2023. There remains a great deal of uncertainty which makes forecasting more challenging, but active markets nevertheless mean favourable lending opportunities for our clients.

Julien Berge, Head of Fixed Income and Repo

Innovating and keeping pace with changing financial markets is essential in combination with streamlined processes that meet regulatory constraints but leave a degree of flexibility for individualised customisation.

Olivier Zemb, Head of Equity Finance and Collateral Management

Make idle assets work harder with Securities Lending. Behind the scenes, we generate low-risk additional revenues on your securities. The only impact on your business is enhanced performance figures, and today, every basis point counts.

We offer tailor-made agency, principal and lending solutions with remote access to suit your precise needs.

CACEIS, your comprehensive asset servicing partner.

Contact: seclending@caceis.com

dynamic collateral selection required by ESG-oriented clients, which is heavily dependent on IT and costly data like ESG indexes. Automating AGM data collection and management to ensure timely securities recalls is also major a challenge that only technology will help address.

Why securities lending is still a great opportunity for beneficial owners in 2023

Three main themes are emerging for beneficial owners this year: ESG, cash reinvestment and collateral pledge.

Regarding ESG, regulators had been clear about the important role securities lending plays in financial market efficiency. So, the consensus we are seeing amongst ESG/SRI lenders that lending can be compatible with their portfolio strategy is very important. The difficulty comes from the variations in the approach. To resolve this, the International Securities Lending Association (ISLA) has drafted a set of good practices for ESG matters which establish a comprehensive framework for action. This will certainly help beneficial owners fine tune their lending programme.

Regarding cash reinvestment, the positive interest rate environment has changed the perception of the asset owners on the possibility of reinvesting the cash received as collateral. Nevertheless, the investment supports remain an essential choice for the client. It must be sufficiently secure not to increase portfolio risk, that is why so far, most reinvestment is currently performed via money market funds.

The third theme concerns pledge structures which can allow agent lenders to maintain an aggressive profit split or even offer a better one.

Data providers note that pledge (as opposed to transfer title) structured transactions doubled last year so there is clearly a trend here and clients willing to accept this type of collateral have an excellent opportunity to

enhance the profitability of their lending programme.

Donia Rouigueb - Head of Sales Securities Finance and Repo: “Regulation-driven transparency and ESG-focused best practices is good news for lenders as it gives them confidence to lend their securities, they are enhancing the value for their investors and playing a key role in maintaining market liquidity.”

Securities lending is safer than ever and remains a legitimate source of additional revenues for beneficial owners into 2023, and as long as the constraints service providers face are not too restrictive, clients and their end-investors will continue enjoy the performance enhancement possibilities in this promising market.

Donia Rouigueb, Head of Sales Securities Finance and RepoCACEIS is an asset servicing banking group dedicated to institutional and corporate clients and one of the world’s market leaders in asset servicing. CACEIS’ Securities Finance desk designs bespoke securities lending, borrowing, liquidity and collateral management services for its clients, leveraging its group’s core asset servicing activity as well as a broad regulatory expertise to meet its clients’ specific risk/return requirements.

Julien Berge and Olivier Zemb both joined CACEIS in 2019 respectively as Head of Fixed income & repo in Luxembourg and Head of Equity Finance & Collateral Trading in Luxembourg.

Donia Rouigueb joined CACEIS in 2015 and is currently Head of Sales for Securities Finance and Repo services, developing tailormade products for institutional, asset manager and corporate clients of the custodian franchise.

Regulationdriven transparency and ESG-focused best practices is good news for lenders as it gives them confidence to lend their securities, they are enhancing the value for their investors and playing a key role in maintaining market liquidity.Julien Berge, Head of Fixed Income and Repo Olivier Zemb, Head of Equity Finance and Collateral Management Donia Rouigueb, Head of Sales Securities Finance and Repo

During March 2023, Global Investor/ISF held the annual US Beneficial Owners’ Roundtable in New York with the help of EquiLend as the lead sponsor. The roundtable was moderated by Global Investor’s Managing Director Amelie LabbeThomson who was joined by an esteemed group of speakers to discuss recent trends, developments and challenges in the securities finance space.

Chair: Amélie Labbé, Managing director, News & Insight, Global Investor Group

Brooke Gillman, Global Head of Client Relationship Management, eSeclending

John Templeton, Global Head of Sales and Relationship Management for Securities Finance, BNY Mellon

Amy A. Dunn, Executive Director, Americas Head of Relationship Management, J.P. Morgan

Mike Saunders, Head of Agency Lending, Americas, BNP Paribas

Nancy Allen, Head of Data and Analytics Solutions, EquiLend

Francesco Squillacioti, Senior Managing Director, Global Head of Client Management, State Street

Cherie Jefferies, Director of Fixed Income Trading, State Board of Administration of Florida

Michael Stamm, Director of Financing & Collateral Management, State of Wisconsin Investment Board

Amélie Labbé: The global securities finance industry has generated an increasing amount of revenue for lenders since 2020, with the Americas region specifically spearheading that growth in multiple areas. We are gathered here to analyse the situation and see how recent events and potential future developments will impact this situation, which brings me to my first point today looking at current market drivers and challenges.

I would like to hand over to Nancy Allen from EquiLend to take us through some key metrics to set the scene for our discussion today.

Nancy Allen, Head of Data and Analytics Solutions, EquiLend: I have a high-level overview here to set the scene for our discussion today. Looking at revenue in 2022, we were up 7% over 2021, with lender to broker revenue of about $9.9 billion.

When you look at that 7% increase, global equities increased by 2%. Overall, global fixed income was up 25% and we’ll talk a little bit about the drivers behind that significant increase in fixed income. Looking regionally, the Americas was up 10%. Equities were up 7% in the Americas and fixed income up 19%. In EMEA, we were

up 6% with equities and fixed income up 22%. In Asia, primarily dominated by equities, we were down 2%.

Jumping into a couple of highlights into some drivers of revenue. We had seven interest rate hikes in 2022 worth 425bps; that’s the highest since 2005, where we had eight interest rates. The rate hikes were key drivers behind the increase in revenue for fixed income.

What we have here is the revenue by quarter and overlaying the revenue we have the average basis points. You can definitely see an increase in the average fee going from Q1 of 2020 - of 31 basis points - up to a high of 39 in Q3. So far in Q1 2023, we’re coming in at about $2.2 billion and that’s up until March 17th.

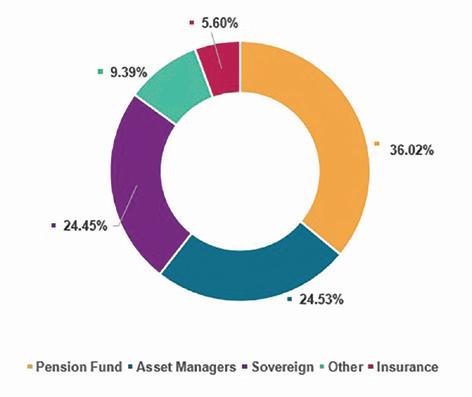

Amy Dunn, Executive Director, Americas Head of Relationship Management, J.P. Morgan: In terms of borrower behaviour, counterparties have become acutely focused on RWA and actively targeting RWA friendly client types which are associated with the lowest capital requirements. This has led to providers smart bucketing whereby client types are grouped by their risk weighting which will dictate trade flow. For example, sovereigns and central banks are associated with the lowest RWA and highest demand whereas pensions, insurance companies and ‘40 Act Funds are associated with the highest RWA and lowest demand. This will clearly have an impact on performance based on what bucket a lender falls into.

Francesco Squillacioti, Senior Managing Director, Global Head of Client Management, State Street: I think [Amy] hit it right on the head and that’s certainly a concern for our counterparties as well as for agent lenders looking at RWA usage: trying to make sure that we’re getting out the most efficient high value trades that we can. Certainly, looking at the different types of clients in the program, we’re seeing those sorts of patterns turn out in terms of sovereign wealth funds, etc., at a zero riskweighting, looking a bit more attractive than a 40-Act. So, that’s certainly a consideration where you are having discussions with clients – making them aware of RWA impact, both from where we sit as agent lender, as well as where from where our counterparties sit, and showing what those impacts are.

“We had seven interest rate hikes in 2022 worth 425bps; that’s the highest since 2005, where we had eight interest rates. The rate hikes were key drivers behind the increase in revenue for fixed income.”

Nancy Allen, Head of Data and Analytics Solutions, EquiLendAs Nancy points out, it was still a pretty good year. I think our performance echoed a lot of what she presented earlier. The other part is that lender participation has grown, as well. When we think about going forward and bringing new clients onto the program, we’re just trying to make sure that the types of assets that we’re bringing on are as accretive as they can be to the program as we look at what clients are looking to enrol.

Amélie Labbé: Amy, I’m just going to ask you to share what your thoughts are on what the drivers are going to be

that will impact lender and borrower behaviour in the near future, but also if you can give a bit of a flavour as well on types of collateral that we’re going to be looking at as well.

Amy Dunn: On the back of Francesco’s point, I would agree that client interaction is key. As it relates to the impact of RWA or any headwind facing our industry, in order to remain relevant and competitive, strong consideration of program changes that allow for greater flexibility will be beneficial. We have a limited number of levers at our disposal but the more levers approved, the better positioned a lender is to capture the next revenue opportunity. Common considerations are: collateral flexibility, counterparty or market expansion, conducting a cost/benefit analysis ahead of recalling for proxy, increased participation in trade opportunities and review of cash collateral guidelines.

Cherie Jefferies, Director of Fixed Income Trading, State Board of Administration of Florida: When it comes to borrowers, we depend on our securities lenders to evaluate the borrowers that we use. When we look at the alternative for different collateral between the regulation and the tax harmonisation that’s transpired over the past several years, for us, that’s always evolving. We’re always looking at different types of collateral. Currently we’re looking at adding some non-cash

“I think there will always be a need for the traditional securities lending model, but as we contend with a smaller universe of specials, rising interest rates, market volatility, evolving UMR and seg IM rules, lenders are faced with new challenges that require different solutions.”

Amy A. Dunn, Executive Director, Americas, Head of Relationship Management, J.P. Morgan

Amy A. Dunn, Executive Director, Americas, Head of Relationship Management, J.P. Morgan

collateral availability to our program. We’re in the process of doing that now, so that has not been finalised, but we always are looking to keep our program abreast of the changing regulations and environment.

Brooke Gillman, Global Head of Client Relationship Management, eSeclending: I think when you talk about flexibility around guidelines, what is starting to transpire now in the industry is not just the things that Cherie and Amy and Cesco were speaking about in terms of collateral types and different sort of transaction components to what the economics are of the trade but it’s also about structural flexibility. I think that will be an ongoing theme and so there are a lot of new ways that people are approaching what are the same types of and results in terms of exposure on transactions but done through either a different legal structure or a different mechanism. We have spent time as agent around this table educating the client beneficial owner community on what they can be comfortable with on collateral and things like that.