Spring 2023

www.globalinvestorgroup.com

CUSTODY

PICTET ASSET SERVICES HEAD

MARC BRIOL EYES

EUROPEAN GROWTH

Securities finance

Experts in London and New York consider key securities finance themes

ASSET MANAGEMENT

Persefoni Chief Executive

Kawamori takes stock of ESG trends

LOH BOON CHYE

SGX Group Chief Executive discusses opportunities

Unlock your portfolio’s full potential, enhance returns and finance efficiently with customizable lending solutions linked to J.P. Morgan’s global equity, fixed income and cash management capabilities. We offer full-service agency securities financing backed by over four decades of expertise, proprietary technology and advanced analytics and insights. Contact your representative to learn how we can help or visit www.jpmorgan.com/securities-services © 2022 JPMorgan Chase & Co. and its subsidiaries. All rights reserved. This advert is for institutional and professional investors only and subject to the important disclosures and disclaimers at www.jpmorgan.com/pages/disclosures. Agency Securities Finance | Performance | Analytics | Governance

The Art of Sustainable Growth

This quarter issue of Global Investor celebrates sustainable growth, featuring several exponents of carefully crafted and executed multi-year strategies.

A great example is Loh Boon Chye, who appears on our cover just two months before he celebrates his eighth anniversary as chief executive of SGX Group.

In his time, Loh has focused largely on building out the exchange group’s asset class coverage so it now has a full suite of equity, equity derivatives, fixed income, commodities and foreign exchange instruments available to traders.

The strategy has largely been organic but Loh has not ignored the M&A market, rather he has engaged in bolt-on acquisitions to expedite the diversification strategy, including the 2016 purchase of freight market the Baltic Exchange and the more recent acquisitions of FX platforms MaxxTrader (July 2021) and BidFX (July 2022).

A recent interesting move is SGX Group’s partnership with the National Stock Exchange of India to connect the NSE’s Nifty 50 Index futures contract with SGX’s international Nifty 50 product.

Loh said: “The partnership that we have with the NSE for the Nifty…will extend and expand the process of investing in India.”

If this partnership is successful, it is a fair assumption that Loh will look to replicate this model in other markets as he looks to the next phase of his strategy.

Similarly, Daniel Maguire has been chief executive of LCH for almost six years, having joined the LSEG-owned clearing house in 2008. His rise has been meteoric. He became head of SwapClear in 2014, then global head of rates and FX derivatives in 2016 and then group chief operating officer in early 2017 before becoming CEO in October that year.

Like SGX, LCH is also thriving in the current environment, having deployed a multi-year strategy that marries targeted acquisitions with organic growth.

LSEG reported on April 27 its financial results for the first three months of this year and its post-trade arm led by Maguire was the fastest growing business in the group, with revenue up 21% to £289m.

An interesting move by LCH in recent years has been its build-out in the un-cleared swaps markets. As Maguire himself says, it’s unusual for a clearing house to support an area that does not involve clearing but LCH has moved to diversify its book by offering new services in this more esoteric end of the OTC derivatives industry.

LCH’s business is truly diverse now. From SwapClear to the uncleared swaps businesses, RepoClear, CDSClear and ForexClear, Maguire and his team have constructed a formidable business.

Another strong advocate of sustainable growth is March Biol, the chief executive of Pictet Asset Services. The Swiss-based custodian is part of the Pictet Group, one of the most trusted financial services brands on the planet, which is no small claim in a time of volatility and concerns about bank liquidity.

Pictet Asset Services is looking to grow its business in the UK but Briol stresses the priority for his firm is and always will be the quality of the service over assets under custody.

On the topic of sustainability, Kentaro Kawamori, the founder and chief executive of Persefoni, is one to watch. The entrepreneur has developed a series of technology services that enable financial firms to meet their stakeholder and regulatory climate disclosure obligations.

The Arizona-based firm, backed by Bain & Co., already has a strong list of investment bank and asset management clients, and is set to grow rapidly as ESG regulation continues to evolve globally.

Separately, Derek Sammann, the senior managing director and global head of commodities, options and international markets at CME Group, discusses opportunities for the Merc in options, the Libor transition and energy.

Lastly, this issue features two roundtables focused on beneficial owners who are looking to explore further securities finance while protecting the interests of their stakeholders.

EDITORIAL

Managing editor

Luke Jeffs

Tel: +44 (0) 20 7779 8728 luke.jeffs@globalinvestorgroup.com

Derivatives editor

Radi Khasawneh

Tel: +44 (0) 20 7779 7210 radi.khasawneh@delinian.com

Securities Finance Reporter

Sophia Thomson

Tel: +44 20 7779 8586 sophia.thomson@delinian.com

Special projects manager

Anshula Kumar

Tel: +44 (0) 20 7779 7927 anshula.kumar@delinian.com

Design and production

Antony Parselle aparselledesign@me.com

BUSINESS DEVELOPMENT

Business development executive

Jamie McKay

Tel: +44 (0) 207 779 8248 jamie.mckay@globalinvestorgroup.com

Sales manager

Federico Mancini federico.mancini@delinian.com

Chief Executive Officer Andrew Pinder

Chairman Henry Elkington

© Delinian Limited London 2023

SUBSCRIPTIONS

UK hotline (UK/ROW)

Tel: +44 (0)20 7779 8999 hotline@globalinvestorgroup.com

RENEWALS

Tel: +44 (0)20 7779 8938 renewals@globalinvestorgroup.com

CUSTOMER SERVICES

Tel: +44 (0)20 7779 8610 customerservices@globalinvestorgroup.com

GLOBAL INVESTOR

8 Bouverie Street, London, EC4Y 8AX, UK globalinvestorgroup.com

Next publication

Summer 2023

Luke

Jeffs, Managing Editor, Global Investor Group

Global Investor (USPS No 001-182) is a full service business website and e-news facility with supplementary printed magazines, published by Delinian Limited.

ISSN 0951-3604

EDITORIAL Spring 2023 3 www.globalinvestorgroup.com

CONTENTS

REGULAR FEATURES

6 Trading Places: BlackRock promotes Orr to run equity trading; State Street expands Tahiri’s Middle East role; ICMA hires Patterson in regulatory policy; LME appoints Williamson as new chairman

8 Highlights from GlobalInvestorGroup.com: FCA updates standards after LDI crisis; Hedge fund performance rebounds in first quarter; Firms outline concerns with SEC Treasuries clearing plan; CME eyes new rates products amid options spike

COVER STORY:

10 SGX Group chief executive Loh Boon Chye tracks the Asian exchange group’s progress in diversifying its product mix to cover equities, fixed income, foreign exchange and commodities

DERIVATIVES:

16 LSE Group’s head of post-trade and chief executive of LCH Daniel Maguire discusses opportunities for the UK-based firm across the clearing industry

24 CME Group’s head of commodities, options and international markets Derek Sammann talks options, Libor transition and energy trends

27 Euronext has raised serious concerns about the review of the Markets in Financial Instruments Regulation as the European Commission, Parliament and Council try to find a compromise

29 Eurex hosted in March its annual conference in Frankfurt where its senior managers and other experts discussed the key issues in Europe and across asset classes

ASSET MANAGEMENT:

34 Kentaro Kawamori, the chief executive and founder of ESG fintech Persefoni, considers the main challenges facing sustainable investors in a period of turmoil

38 Asset management expert Ian Hunt discusses the short history of the Investment Book of Record and takes stock of where that initiative is today

42 AXA Investment Managers’ Hans Stoter tackles the difficult issue of asset managers’ credibility when it comes to responsible investing

16 10

Spring 2023 4 www.globalinvestorgroup.com

CUSTODY:

44 Pictet Asset Services chief executive Marc Briol details the attributes that make the Swiss custodian different to its larger, bulge-bracket rivals

SECURITIES FINANCE:

49 European Union Beneficial Owners Roundtable: Some of Europe’s top securities finance experts gathered in London to discuss the key issues facing the industry

62 BNY Mellon’s head of securities finance client relationship management and business development in EMEA Steve Kiely shares his thoughts on volatility in the lending market

65 US Beneficial Owners Roundtable: Asset owners met in New York to talk through the current challenges facing beneficial owners when lending assets

76 CACEIS’ Securities Finance desk takes a look at the current lending market and the key topics that might drive change in the industry

78 Day in the Life: Sunil Daswani, global head of agency lending at Standard Chartered Bank, reflects on his experiences, drawing on 25 years in securities finance

80 S&P Global Market Intelligence’s Monica Damas-Shaw discusses the role of securities finance markets in a time of volatility and uncertainty

62 76 80 76 76 78 38 42 34 44 CONTENTS Spring 2023 5 www.globalinvestorgroup.com

Trading Places

ASSET MANAGEMENT:

BlackRock promotes Orr to lead international equity trading BlackRock has promoted Andy Orr as the new head of international equity trading within the firm’s securities lending business.

Having been at the New Yorkheadquartered investment company for over 16 years, Orr first joined BlackRock in 2006 as a systems developer. He then took on various positions within the firm, which include roles as an equity finance trader and the head of the EMEA securities lending trading desk.

Based in London, Orr will take on a broader regional management role for securities lending trading for the EMEA region. Orr will continue to report to Yoshi Aoyama, managing director and co-head of global trading at BlackRock.

Citigroup promotes two women to senior roles in Asia Citigroup has promoted Vandana Bhatter and Anoushka Dua to senior roles in the US bank’s Markets, Treasury and Trade Solutions (TTS) business, underlining the firm’s commitment to grow its presence in Asia Pacific.

Bhatter has been promoted to head of markets for ASEAN. She will be responsible for leading a fully integrated business strategy, monetising Citi’s local market network, strengthening connectivity both within Asia markets and leveraging Citi’s global footprint and extensive product offering, the firm said.

She reports to Julia Raiskin, the Asia Pacific head of markets, and Amol Gupte, head of South Asia & ASEAN. Additionally, Anoushka Dua has been appointed as the head of TTS for ASEAN.

In her most recent role as head of trade for ASEAN, Dua was responsible for leading the growth of Citi, delivering innovative working capital solutions and focusing on digitising the business and maintaining a robust risk and control environment. She will report to Rajesh Mehta, head of TTS Asia Pacific and Amol Gupte, head of South Asia & ASEAN.

CUSTODY:

State Street widens

Tahiri’s scope to lead Middle East business

State Street has expanded the scope of Asia Pacific (APAC) chief executive Mostapha Tahiri’s role to lead the firm’s Middle East business.

He will serve as head of the Middle East in addition to his current responsibilities for the APAC region. Based in Singapore, he will continue to report to Andrew Erickson, chief productivity officer and head of International Business, and Lou Maiuri, president and chief operating officer and head of Investment Services.

As State Streets head for both regions, Tahiri will be responsible for: all business activities; driving strategy; increasing client engagement; pursuing growth opportunities and managing diverse stakeholders such as local officials and regulators.

Citi hires ex-JPM exec Hughes in custody product development

Citi Securities Services has hired Mike Hughes, formerly of JP Morgan, as global head of custody product development at the US banking group. Based in London, Hughes will be responsible for leading Citi’s custody business and strategy across all its proprietary markets and global models, the firm said.

Reporting to Matthew Bax, global head of custody, he will work with the client, technology and operations teams to meet Citi’s product suite and client acquisition goals.

Hughes has more than two decades worth of experience in the financial industry: primarily in securities, cash and trade.

In his previous role at Ocorian, Hughes was an independent administrator, where he was the global head of services lines and a member of the board.

SECURITIES FINANCE:

Tony Smith departs

BNY Mellon in Hong Kong

Tony Smith has left BNY Mellon in Hong Kong after more than 15 years in securities finance.

Smith served as the director of governance and control within BNY Mellon’s Clearance and Collateral Management division since August 2022.

Just over a decade ago, Smith joined the Hong Kong branch of BNY Mellon, where he was appointed head of collateral management product for Asia Pacific (APAC).

Smith first joined the firm in 2007 within its Global Clearing and Collateral Client Management division. With almost 35 years of experience within the securities lending industry, Smith has worked at a number of financial institutions including AXA Investment Managers and Skandinaviska Enskilda Banken (SEB).

BNP Paribas hires Mashru from Societe Generale

BNP Paribas has hired Namrata Mashru from Societe Generale as a vice president of securities lending at the French international banking group. Previously, Mashru was the vice president at Societe Generale in Hong Kong for eight months.

In a 20 year career, she has held roles at UBS, Morgan Stanley and Deutsche Bank, including a time as vice president

TRADING PLACES REVIEW OF THE YEAR Spring 2023 6 www.globalinvestorgroup.com

Post-Bonus is always a busy time for People Moves

of prime finance in both London and Hong Kong.

BNP Paribas recently upgraded the technology it supplies to hedge fund clients by launching a digital offering which the French bank claims will enable alternative investment clients to respond to trading opportunities in real-time.

ICMA hires regulation expert from Thomson Reuters

The International Capital Market Association (ICMA) has appointed Miriam Patterson into the role as senior director of Market Practice and Regulatory Policy.

In her new role, she will work alongside Ruari Ewing, with a focus on ICMA’s Legal & Documentation Committee and related groups and picking up in due course on supporting the association’s broader EU and UK regulatory engagement.

Based in London, she will report directly to Paul Richards, managing director, Head of Market Practice and Regulatory Policy.

Patterson joins from Thomson Reuters, where she has worked since 2008, most recently as a senior editor of Practical Law Global Capital Markets.

Prior to Thomson Reuters, she held roles at law firms Latham & Watkins and Allen & Overy.

DERIVATIVES:

LME hires new chairman ahead of Nickel reforms

The London Metal Exchange (LME) has appointed a new chairman, promoting an existing non-executive director to take over when the incumbent steps down at the end of April.

John Williamson takes over as interim chairman on April 28, after Gay Huey Evans leaves the role. The Hong Kong Exchanges and Clearing (HKEX)-owned venue started the process of identifying a replacement earlier this year, as it announced Evans’ departure. The move comes as

it implements a series of changes after suspending its nickel market last year.

“This is a particularly important time for the LME as we look to the future and seek to support the market and our customers in a dynamic and evolving landscape,” Matthew Chamberlain, chief executive of the LME said in a release. “John’s deep knowledge of our business and his extensive international experience will be invaluable to us as we look to drive forward our two-year programme to strengthen and enhance our markets.”

Prior to taking up his current role, Williamson was a longstanding nonexecutive director on the board at HKEX. He had been in that post since 2008.

LSE Group appoints data, analytics head

London Stock Exchange Group (LSEG) has appointed a group head of data and analytics, a role the chief executive was doing on an interim basis last year.

LSEG said Satvinder Singh will take up the role on July 3. This position was left vacant by Andrea Remyn Stone, whose intention to depart was announced at the end of June 2022. Singh joins from Mastercard, where he was co-head for advisors in its data and services business.

“Satvinder brings strong leadership experience in financial services, in many parts of the trade lifecycle, and a proven track record of building high performing global teams,” David Schwimmer, chief executive of LSEG said in a release. “His expertise will be invaluable as LSEG transforms how the financial markets discover, manage and analyse data. We look forward to welcoming him to the team.”

Mako and Liquid Capital complete merger with Asian deal Mako and Liquid Capital, two of the last remaining London-based marketmakers, have completed their merger after Mako acquired the last two Liquid Capital units it did not already own.

Mako, which took over Liquid Capital’s European arm early last year, said it completed on April 5 the acquisition of Liquid Capital’s AsiaPacific business which comprises the firm’s trading hubs in Australia and China.

The market-maker said in a statement the acquisition of the Liquid Capital Asia Pacific business was a natural step following the European deal last year, and one that significantly expands Mako’s presence in Asia.

David Segel, the founder of Mako, said: “We are thrilled to welcome the experienced team from Liquid to the Mako Group. Their proven track record and commitment to excellence align with our own values, and we look forward to collaborating and growing together.”

Marex hires ex-IFAD head

Oulhadj to run US clearing

Marex has hired the former head of ICE’s Middle East exchange Jamal Oulhadj to run clearing in North America as the British broker moves to expand its clearing business in the US.

Oulhadj, who was most recently the first president of the Intercontinental Exchange’s (ICE) Abu Dhabi-based derivatives venue, became head of clearing for North America on April 3, Marex has said. Oulhadj is based in the broking group’s Chicago office.

“The creation of this new role is an important step in strengthening our clearing franchise in North America,” a spokesperson for the London-based broker said in an emailed statement.

Oulhadj ran ICE Futures Abu Dhabi (IFAD) for nearly two years from January 2020. He was previously the chief executive officer of RJ O’Brien (MENA) Capital Limited based in Dubai. He spent 14 years at the Chicago-based broker in various roles including chief risk officer and chief operating officer before moving to Abu Dhabi. He started his career in 1996 at CME Group, before joining broker Refco where he eventually led the market risk team.

TRADING PLACES REVIEW OF THE YEAR Spring 2023 7 www.globalinvestorgroup.com

Breaking stories from Global Investor Group

Here are some of the top stories you may have missed at GlobalInvestorGroup.com

ASSET MANAGEMENT: EU money market grew almost a fifth in 2022 - ECB

The European money market including repo and reverse repo grew by nearly a fifth last year to €1.3tn (£1.14tn), according to the European Central Bank.

The ECB published its 2022 Euro money market study that found the Euro money market grew in 2022 by €200bn or 18.2%, up from €1.1tn at the end of 2021.

The study covers five segments of euro money market activity: secured transactions - repos and reverse repos; unsecured cash transactions; issuance of short-term securities; FX swaps; and overnight index swaps.

The report describes developments in these five segments between January 2021 and December 2022 based on actual daily money market transactions executed by the 47 largest euro area banks and reported to the ECB through the Eurosystem’s money market statistical reporting (MMSR) dataset.

FCA updates standards after LDI crisis

The UK Financial Conduct Authority (FCA) has released new guidance for pension funds and asset managers using Liability Driven Investment (LDI) strategies after the volatilitydriven crisis at stresses in September last year.

The FCA published new rules to bolster risk standards and transparency at firms after the September 23 “mini budget” presented by then chancellor Kwasi Kwarteng caused severe market volatility. The Bank

of England was forced to step in and support liquidity at the funds that had been caught by severe moves in Gilt markets, affecting the value of positions held by the funds.

“This guidance sets out what we expect in terms of risk management, stress testing and client communication, so that the necessary lessons are learned from last September’s extreme events,” Sarah Pritchard, executive director for markets at the FCA said in a release. “Many of these lessons will be relevant to firms beyond the LDI sector.”

Venues hail EU crypto milestone as MiCA passes

The European Parliament passed in April its wide-ranging regulations on markets in crypto-assets (MiCA), marking a significant moment for the market according to exchanges active in the region.

The plenary session approved the law by 517 votes to 38 against, with 18 abstentions. The rules will have phased implementation starting in July and extending for 18 months. They will mean changes to the transparency, disclosure and supervision of those issuing and trading cryptoassets in the region. Trading venues have welcomed the move as a step forward in efforts to build trust in the regional market.

“As a major operator of financial markets venues within the European Union, news that European lawmakers have passed MiCA legislation is welcome, and marks a significant event in the evolution of the cryptoassets market,” Duncan Trenholme, co-global head of digital assets at TP ICAP said in an emailed statement.

“We believe strongly in the value that regulation can bring to markets, and we look forward to working within this framework to ensure investors can enter the cryptoassets market within Europe with confidence.”

CUSTODY:

ASX lays out next steps in CHESS upgrade project

The Australian Securities Exchange (ASX) has agreed the terms of its A$70 million (£37m) incentive scheme to garner support for the upgrade to its CHESS settlement system, as group moves to reboot the project.

The distributed ledger-based back office upgrade has been beset by delays and spiralling costs, prompting the announcement of a regulatory investigation in March. The Sydneybased exchange has been in the process of initiating a reset of its plans to replace the system, and started seeking vendors for the project in March, its chief executive said in late April.

“Good progress is being made on the CHESS Replacement solution design,” Helen Lofthouse said in a release. “Request for proposals were issued to potential vendors earlier this week. In addition, we’ve had constructive engagement through our newly formed Technical Committee and we will begin scope refinement sessions in May. We have also begun preliminary discussions on the industry testing approach, as well as potential implementation options.”

US T+1 highlights importance of tech investments – Clear Street, Sharegain

T+1 migration in the US is less daunting if your firm has invested in new technology, two US securities lending companies have said.

Speaking to Global Investor, Andy Volz, chief operation officer of Clear Street, said he welcomed the switch to next-day settlement as the migration should make his firm more capital efficient.

EXCLUSIVES FROM GLOBAL INVESTOR GROUP Spring 2023 8 www.globalinvestorgroup.com

The Clear Street senior executive said: “We’re a new technology stack and we modify our systems quickly to deal with T+1. Clear Street does quite a bit of equity and option business, and with options being T+1 and equities being T+2, there are capital-intensive things that happen within the broker-dealer. So Clear Street expects to benefit a lot from T+1.”

And the extra capital should help Clear Street’s plans for expansion outside the US. Volz said: “I believe it will make us more capital efficient as we expand globally. Obviously, we need to move capital into those markets and every new market you move into and where you open another broker-dealer, whether that’s Canada, Europe or the UK, will require us to capitalise on it. Hopefully it means that we can run our US business more capital efficient and free up capital for global expansion.”

Hedge fund performance rebounds with better average in Q1 Hedge funds continued to bounce back with a better weighted average returns in Q1 2023 compared to Q4 2022, with multi-strategy and equities funds continuing as the best performers, said asset servicer Citco.

Tortola-headquartered Citco reported an overall weighted average return of 4.49% in Q1 2023, up from 4.11% in Q4.

All fund strategies produced positive returns, apart for commodities at -2.2% and Global Macro at -1.14%. Multi-strategy and equities funds improved their fourth quarter performance with first quarter weighted average returns of 5.78% and 5.42% respectively.

SECURITIES FINANCE:

Firms concerned about SEC US treasuries clearing plan - report

Buy and sell-side firms are concerned about the US proposal to introduce clearing in the US treasuries market, according to a new report from re-

search firm Coalition Greenwich

The report ‘Market Views on the SEC’s US Treasury Clearing Proposal’ examines trends in the treasury and repo markets, outlines the main points of the SEC plan and discusses the potential implications of the proposed rules.

The US regulator proposed a set of rule amendments on September 14 2022 requiring direct market users to clear all eligible secondary market transactions (ESMTs) in US treasury Securities.

NY Fed limits firms’ access to reverse repo facility

The Federal Reserve Bank of New York said it is limiting some firms’ access to its reverse repo facility (RRF), a tool used to manage short-term interest rates.

The bank amended the ‘Policy on Counterparties for Market Operations’, stating firms that wish to use its RRF should only apply for access if its use is consistent with the existing business model of the company.

The RRF is one of two tools the bank uses to maintain its overnight federal funds rate, which is the main instrument of monetary policy. The bank said the move aims to cut off access to investment entities set up specifically to take advantage of the RRF tool.

Accessing the reverse repo facility “should be a natural extension of an existing business model, and the counterparty should not be organised for the purpose of accessing operations,” said the bank.

Sharegain plans

to

‘democratise’ stock lending

Sharegain has said its new partnership with JP Morgan is the latest success in a broader push to “democratise” securities lending by making that market more easily accessible to new groups such as wealth managers and retail brokers.

London-headquartered securities lending fintech Sharegain in April partnered with JP Morgan’s Securities

Services business to improve accessibility to wealth managers and online brokers.

Sharegain’s Securities Lending Technology (SLTech) solution aims to enhance JP Morgan’s securities agency lending offering, said the fintech. The collaboration also adds a new global custodian to its growing roster of clients in Asia Pacific, Europe and the Middle East.

DERIVATIVES:

FSB warns of ‘pile up’ around US Libor switch

The Financial Stability Board (FSB) has warned firms to avoid a ‘pile up’ as they prepare to transition US dollar Libor positions ahead of mandatory cessation for new contracts at the end of June.

The Basel-based body, which coordinates oversight of national regulators, said in April firms should transition their legacy positions ahead of the mothballing of the Libor rate.

“The FSB encourages market participants to complete the transition of any remaining USD Libor-linked contracts now, in order to avoid a ‘pile-up’ towards end-June 2023 that could introduce operational risks and wider market disruption,” it said in a statement.

Deutsche Boerse quarterly revenue jumps 16% on strong trading

Deutsche Boerse has reported a 16% year-on-year increase in first quarter revenue, driven partly by increased trading activity around the bank funding squeeze in March.

The Frankfurt-based exchange giant reported in late April net revenue of €1.2 billion (£1bn) for the first three months due to a combination of interest rate gains in securities services and heightened trading on market uncertainty. The firm said it will deliver full year figures at the high end of its €4.5 billion to €4.7 billion guidance.

EXCLUSIVES FROM GLOBAL INVESTOR GROUP Spring 2023 9 www.globalinvestorgroup.com

LOH BOON CHYE, SGX

SGX Group chief Loh discusses evolving Asian opportunities

Loh Boon Chye will celebrate in July 2023 eight years as the chief executive of SGX Group and he can be rightly pleased with the progress the Singapore exchange has made in that time.

By Luke Jeffs

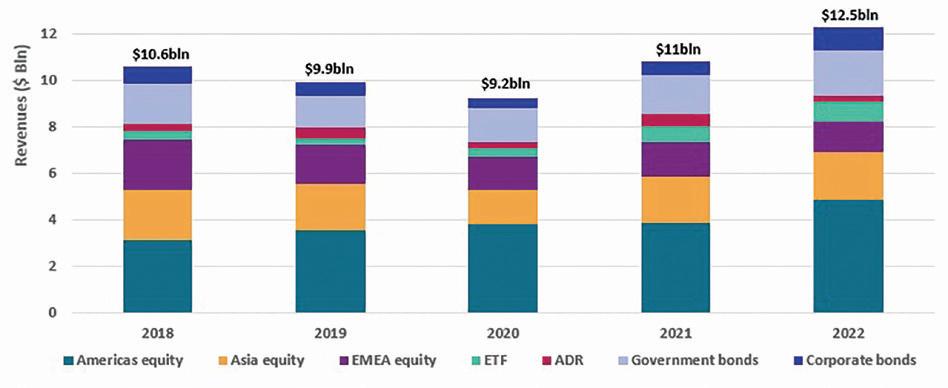

SGX Group reported in its 2022 financial year (which ran to the end of June last year) record operating revenue of S$1.1bn (£659m), up 4% on S$1.06bn in the previous 12 months, driven largely by higher earnings in equities, currencies and commodities.

The first half of the current financial year has continued this theme with revenue in the latter half of last year up a tenth on the same period of 2022 to S$571m, driven partly by a 28% spike in derivatives revenue.

The half year earnings were the exchange group’s best since SGX started financial reporting after listing in 2000.

Speaking to Global Investor in April, Loh Boon Chye said the group’s recent record financial performance reflects partly the diversification strategy implemented by the firm over recent years.

“We had a strong 2022 and we have had a good start to this year. As an exchange group, we have now

transformed ourselves into a multiasset platform that, as an international exchange, offers unrivalled access to Asian economies and Asian markets through equity index derivatives, currencies and commodities.”

The breadth of the group is obvious in its latest full-year results (see Chart One): 23% from fixed income, currencies and commodities, 29% from equity derivatives, 35% from cash equities and 13% from data, connectivity and indices.

Another of Loh’s strategies is to establish SGX as the international gateway to Asia’s fast-growing economies including China, offering investors from outside Asia a secure platform for investing across the bloc.

Loh said: “Asia is not a homogenous region, it is made up of many countries that have grown in the last 15 to 20 years relatively faster than the global economy. Having been able to position SGX Group as the trusted platform for accessing the Asian markets, we have also been able to broaden and deepen our asset-class offering.”

He added: “We, as an exchange group, essentially simplify Asia for international investors who are seeking investment opportunities in this part of the world or are actively managing their portfolio that includes Asia.”

And the two strategies are complementary because of the way that international traders increasingly manage their Asian exposure, moving between correlated instruments to maximise their return.

“If you trade the Asian markets, you might be moving in and out between foreign exchange, commodities or equity derivatives. So for every one dollar of risk capital posted with SGX, the correlation of the different asset classes allows us to stretch that further, so that is why FX has grown alongside some of our other asset classes such as equity index derivatives,” said Loh.

Foreign Exchange

The SGX chief executive officer is especially pleased with the progress the group has made in foreign exchange (FX) derivatives, a vast over-thecounter market where international exchanges have historically struggled.

He said: “In foreign exchange, we are the world’s leading exchange for listed FX derivatives in Asian currencies and we have broadened the value chain to include over-thecounter FX.”

COVER FEATURE: LOH BOON CHYE, SGX GROUP Spring 2023 11 www.globalinvestorgroup.com DERIVATIVES

Asia is not a homogenous region, it is made up of many countries that have grown in the last 15 to 20 years relatively faster than the global economy

And this is potentially only the beginning for SGX in what is a dynamic asset class.

“The opportunities in FX are enormous. We have been able to grow our listed FX derivatives business in the last ten years through the zerointerest-rate regime, so the relative movements of currencies were predicated on the expected movement between two currencies based on the fundamentals,” Loh said.

“With interest rates at their current level, FX has become an asset class in its own right because it does offer a yield. In the Asian equity markets, FX movements can accentuate positively or negatively your equity market return.” The chief executive also said the exchange is looking at options on some currencies to accelerate the growth in its FX segment.

Equity Derivatives

By volume, SGX’s most popular product remains the FTSE China A50 Index future which last year traded over 100 million lots in a single year for the first time when 103 million contracts were traded. This was up 5.6% on 2021, meaning that the A50 made up last year 40% of SGX’s futures trading book by volume, according to the exchange.

Loh said: “When we look at our A50 futures, the contract has really grown in relevance for international investors to invest in the Chinese economy and the Chinese equity market. In terms of China exposure, we offer not just A50 futures but also our market-leading CNH FX futures and pioneering iron ore derivatives.”

The increase in trading volume last year can be attributed to ongoing

concerns about the future of the Chinese economy given its protracted Covid restrictions but the outlook is more positive now.

The SGX chief executive said: “When we think about China’s reopening, market participants are optimistic that the reopening is a catalyst for growth. Singapore and SGX Group are wellpositioned in that regard. That said, Asia is more than China. China is a critical part of the region’s future, given the size and the growth of the economy, but we also have India where the economy has proved to be resilient and GDP has been growing at near 6%.”

The Singapore Exchange is bullish on India where the group will commence full-scale operation of the NSE IFSCSGX Connect in July with the transition of its Nifty 50 futures contract to GIFT City.

COVER FEATURE: LOH BOON CHYE, SGX GROUP Spring 2023 12 www.globalinvestorgroup.com CUSTODY DERIVATIVES

Loh: “With interest rates at their current level, FX has become an asset class in its own right because it does offer a yield. In the Asian equity markets, FX movements can accentuate positively or negatively your equity market return.”

Loh said: “We have also broadened our equity index derivatives through the upcoming launch of our GIFT Connect platform with our partner the National Stock Exchange of India that will bring together the international liquidity that we offer on the Nifty contract with the domestic liquidity.”

The SGX Nifty 50 Index future traded almost 30 million lots last year, making it the exchange’s second most popular listed derivative behind the A50.

Cross-border partnerships

SGX’s Indian agreement is also interesting because it could serve as a template to similar deals with other national markets in the region.

Loh said: “The partnership that we have with the NSE for the Nifty, that will extend and expand the process of investing into India. We also have markets like Taiwan and Japan, and also the ASEAN collection of ten economies that have over 600 million people and growing at 5% a year so that potential is huge. As a bloc, it is going to be the fourth-largest economy in a few years’ time.”

He added: “Depending on client needs, SGX Group will continue to work with other exchanges to further broaden the ecosystem. Collaborations and partnerships aren’t new to us. We have a history of partnerships with other exchanges. Besides NSE, we have a partnership with New Zealand’s Exchange where we jointly work on the New Zealand milk contracts so the New Zealand dairy derivatives are now listed on SGX.”

SGX and New Zealand’s Exchange signed in October 2020 an agreement to make NZX’s milk futures contracts available on SGX, something that happened in November 2021.

Loh said: “We have been able to work with them to expand the number of members and have increased open interest by 50%, as well as increasing the liquidity and trading volume.”

He continued on the theme: “We have listing partnerships with

Performance Review

Revenue EBITDA

Net profit Dividend per Share

$1,099m $634m 42.2¢ 4% 1%

$451m 32.0¢ 1% 1% Unchanged

SGX recorded EBITDA of $634.1 million ($625.2 million) and net profit attributable to SGX of $451.4 million ($445.4 million) FY2022. Earnings per share was 42.2 cents (41.6 cents). Adjusted EBITDA was $637.8 million ($623.9 million) and adjusted profit was $456.4 million ($446.9 million). Adjusted earnings per share was 42.7 cents (41.8 cents).

SGX Group Financial Overview July 2021 - June 2022

Source: SGX Group Annual Report, July 2021 – June 2022

Acquisitions

contributed 5% to group revenue, 2%-points , total revenue grew $68.1 million or 7% to $1,049.5 million ($981.4 million). FICC revenue increased $41.0 million or 19% to $252.7 million ($211.8 million) and accounted for 23% (20%) of total revenue. There were 1,179 bond listings raising $429.6 billion, compared to 795 bond listings raising $389.1 billion a year earlier. Fixed Income revenue decreased $2.7 million or 18% to $12.2 million ($14.9 million). FICC – Fixed Income $8.7m $3.5m Listing revenue Corporate actions and other revenue 24% from $11.5m 2% from $3.4m

Loh Boon Chye has in the past three years boosted SGX’s growth strategy with the $153m (£122m) acquisition of FX trading platform MaxxTrader in July 2021 and the July 2020, $128m takeover of cloud-based currency trading platform BidFX.

“The acquisitions that would be useful to look at would be to broaden our reach into the ecosystem, expand our market share or serve our customers better around the asset classes that we already offer.

SGX also invested in November 2021 about $200m in a consortium acquisition of Chicago-based fintech Trading Technologies.

Speaking in April, Loh said the company will look at further acquisitions that are consistent with its strategic goals: “We have done a few acquisitions over the last few years. As we look to this year, next year or beyond, we are seeking opportunities to deepen the value chain or broaden our reach in various asset classes.

“There are areas where we can create a better platform overall in the transport of commodities around the link between freight and commodities, such as iron ore, where the ecosystem relies on workflow, so there are opportunities to make that more efficient. If that is something that serves customers better, why not?

All figures are for the year except for figures in brackets, which are for the year earlier unless otherwise stated. Figures may be subject to rounding. 1 OTC FX comprised only BidFX in FY2021; BidFX, MaxxTrader and Electronic Communication Network (ECN) in FY2022. 2 Treasury income on cash and non-cash collateral balances including associated currency hedging impact.

“In FX, we have acquired two companies so we now have the full spectrum in OTC and listed derivatives, as well as an ECN, so we think that pulling all that together may better serve the customer.”

COVER FEATURE: LOH BOON CHYE, SGX GROUP Spring 2023 13 www.globalinvestorgroup.com DERIVATIVES

Earnings per Share (EPS)

The Board of Directors has proposed a final quarterly dividend of 8.0 cents (8.0 cents) per share, payable on 21 October for approval at the forthcoming annual general meeting. If approved, this brings total dividends in FY2022 to 32.0 cents

Financial Overview

SGX Group is positioning itself as a regional market-leader in environmental, social and governance investing. The firm has launched ESG and net-zero versions of its flagship equity indices, and announced in October an agreement to license the MSCI Climate Action Index.

Looking ahead, Loh said: “The climate-related theme in equity benchmark indices is in our view a medium-term opportunity that is beginning to take shape. The pathway for the transition to net-zero is not a straightforward, straight-line process. Whether we look at ESG or sustainability, it is an enormous collectiveaction problem. There may be bumps along the road, but the transition will involve trade-offs and frankly a leap of faith.

“Notwithstanding the unfortunate situation of the invasion of Ukraine, this will require a collective effort through commitments and longterm solutions which can only be built over time through trust.

“What is important to assist the transition to net-zero is to be able to mobilise capital at scale. As exchanges and market infrastructure, we also have a

role to play. We have recently launched the Nikkei 225 Climate Paris-aligned benchmark futures, and we will also look to launch passive capital products linked to benchmarks that will help the transition by mobilising capital to companies that are helping with the transition.

“I would like to reiterate three points. As the international exchange group that operates an institutional platform that offers access to Asia around the clock for international investors, that is an important hallmark of SGX Group.

“If one takes the view that Asia continues to have promise and will continue to grow rapidly and faster than the rest of the world, Asia is not homogenous – and we can simplify Asia for investors.

“Lastly, we look at markets and asset classes with a holistic lens so whether it’s China or other Asian economies, you can invest in them through the equity markets, FX or commodities. Going forward, there will clearly be requirements for ESG versions of benchmarks, so constant and continuous creating and innovating solutions is what makes SGX Group unique.”

Nasdaq and NYSE, and in the next quarter we will launch a depositoryreceipt link with the Stock Exchange of Thailand. So collaborations are there and we will continue to look at collaborations that will benefit the ecosystem.”

Virtual Steel Mill

Another key strategy for SGX this year is the virtual steel mill, a neat idea that leverages the complementary nature of the exchange’s coking coal, freight and iron ore contracts.

Loh said: “We also offer the global benchmark for iron ore, which has evolved from an OTC-traded and exchange-cleared market into one that offers equal liquidity on screen, which obviously brings in a broader set of financial participants.

“Iron ore is a very reliable proxy for the urbanisation of countries, particularly China, and it is also a good proxy for the macro-economic outlook of China,” Loh added.

SGX is pleased with the progress it has made building screen liquidity in iron ore, particularly its iron ore 62% futures and options, which the exchange sees as a key pillar for the commodity’s eventual inclusion in broader commodity indices.

Loh said: “We will continue to broaden the screen adoption of iron ore, which will lead to eventually its inclusion in commodity indices, bringing us into the investor market, who would then take on iron ore in structured products.”

He continued: “In the commodities complex, for us, it’s not just iron ore. We look at this in two ways, one is the “virtual steel mill” that includes a whole series of ferrous metals including different grades of iron ore; the iron ore also has to be transported so that requires freight, which, while it has come down in price, it clearly went through a very volatile period.”

International Strategy

While SGX has made in Loh’s time massive strides in diversifying its

COVER FEATURE: LOH BOON CHYE, SGX GROUP Spring 2023 14 www.globalinvestorgroup.com CUSTODY DERIVATIVES

product offering to allow international traders and investors the opportunity to trade different Asian asset classes, that is only part of the challenge.

The chief executive said: “We have a long track record with participants from Europe and the US trading into our markets. Our contracts are CFTCcertified so they are available to US investors. At the same time, while capital is global and borderless, and we have been able to attract many international firms as our trading members, getting close to them on the ground is clearly a better way to further engage with them – and this explains our presence in Europe and the US, which also helps us attract new customers like the buy-side.”

SGX was a pioneer in 2010 when it extended for the first time its trading day so the Asian market was open in European and US hours, a move that has since been emulated by many of its Asian counterparts.

The SGX chief said this longer trading day remains a key feature of the exchange’s global strategy.

Loh said: “Also interesting for US and European participants is that their day starts when most of the Asian markets are closed or closing, so we offer the T+1 sessions which cover the European and US time zones, allowing them to participate in the Asian markets. In the A50, for example, our T+1 volume is 1516% while the impressive growth in our iron ore screen volume has come largely from clients in Europe and Asia, and the growth has been higher in the T+1 session.”

Interestingly, Loh said SGX is also seeing growing flows from fastgrowing Asian economies that are starting to look beyond their national market for trading opportunities.

Source: SGX Group Annual Report, July 2021 – June 2022

He said: “We have the big economies covered so that is China, India, Japan, Taiwan, Singapore and some of the ASEAN markets. Our equity derivatives cover close to 99% of Asia’s GDP. We see the ecosystem broadening – for instance, we see flows from Thailand into our cash

equity market and we have Taiwanese financial institutions launching ETFs related to our contracts. Also interesting are flows from the other economies like Indonesia, which has a large and growing economy and we have contracts for investors to access opportunities there.”

COVER FEATURE: LOH BOON CHYE, SGX GROUP Spring 2023 15 www.globalinvestorgroup.com DERIVATIVES

Chart 1. SGX Group at a glance

We have the big economies covered so that is China, India, Japan, Taiwan, Singapore and some of the ASEAN markets. Our equity derivatives cover close to 99% of Asia’s GDP.

LSE Group’s post-trade strategy moves to the fore

The LSE Group is now unrecogniseable from the firm that David Schwimmer took over in 2018, largely due to the $27bn (£21.6bn) acquisition of Refinitiv in early 2021. While much of the British group’s efforts in the past two years have focused on digesting the vast data firm, a quieter success story has been the performance of LSEG’s posttrade business, led by Daniel Maguire.

By Luke Jeffs

This success was underlined in the LSE Group’s first quarter 2023 financial results on April 27 when post-trade was the fastest growing of any LSEG business, up 21.4% to £289m.

Schwimmer said about those results: “In Post Trade, our leading franchise attracted a surge in volumes as clients looked to manage risk effectively during a period of heightened volatility.”

The LSEG chief is right that clearing houses tend to do well in periods of heightened activity, given they charge fees on individual trades, but Schwimmer equally knows the success of the post-trade business is largely attributable to a carefully crafted multiyear strategy to develop that business.

Most recently, the LSEG post-trade arm has been exploring the murkier end of the vast over-the-counter (OTC) derivatives market by building out its services for uncleared swaps.

Uncleared OTC Derivatives

Speaking to Global Investor in late April, Maguire, the Group Head of Post Trade at London Stock Exchange Group and Chief Executive Officer of LCH Group, explained the rationale.

“If you go back to 2009, post the global financial crisis (GFC), G20 leaders wanted banks to collateralise their OTC derivatives, mandating the clearing of the more standardised derivatives contracts through central

DANIEL MAGUIRE, LSE GROUP Spring 2023 16 www.globalinvestorgroup.com CUSTODY DERIVATIVES

As a firm, we have historically focused on clearing but we recognised five or six years ago that centralised clearing for OTC derivatives isn’t always the answer

counterparties (CCPs), and they also introduced higher capital requirements and minimum margining requirements for uncleared OTC derivatives.”

Maguire added: “Whilst sizable, the cleared space was straightforward - across G20 nations, certain types of institutions doing certain sizes and types of trades were mandated to clear and there was then a natural evolution by market participants, beyond the original mandates, to clear nonmandated trades too.”

Once the authorities had tackled the larger, standardised market, it was inevitable they would turn their attention to the smaller and more complex business of complex swaps with the Uncleared Margin Rules, the implementation of which was completed in September last year.

“As a firm, we have historically focused on clearing but we recognised five or six years ago that centralised clearing for OTC derivatives isn’t always the answer.

“So, we started thinking how to bring our infrastructure and expertise to address the more idiosyncratic and esoteric uncleared products that are going to be subject to margin rules. That was when SwapAgent was born.”

LCH SwapAgent, launched in 2017 with the backing of 14 of the world’s top investment banks, offers a rulebook, standardised and transparent Credit Support Annex (CSA), valuations and calculations of risk numbers.

This sounds very “clearing-like”, Maguire suggests, but importantly, SwapAgent is not acting as CCP in the case of a default. “It is a clearing house but not a CCP,” he said.

Maguire continued: “Going back to the regulatory environment, we had Dodd-Frank, the European Markets Infrastructure Regulation (EMIR) and UMR but the other big vector was the Basel III capital rules. If you don’t get caught by the collateralisation, you may well get caught by the capital side of things, or perhaps both. Whichever way you look at it, post-GFC there has been a combination of rules,

regulations and capital requirements that have made OTC derivatives safer but also more expensive.”

“We came to the realisation that this uncleared space will persist and needs to thrive, and whilst there are a lot of good niche businesses in the space making parts of the process more efficient, every time we talked to our customers, whether sell- or buy-side, it was clear that this is a pain point, and a more holistic solution would be preferable. Whenever we speak to one

Euronext is a long-standing client of LCH SA which uses the Paris-based division to clear its European equities and derivatives markets. But this is set to change.

In April 2021, Euronext bought Borsa Italiana from LSE Group for e4.4bn. As part of the deal, Euronext acquired Borsa Italiana’s Milan-based clearing house CC&G and Euronext chief Stephane Boujnah announced in November 2021 that he was committing to invest in CC&G with a view to moving his clearing to his own clearing house and away from LCH.

Asked about the implications of this development, Maguire said: “LCH SA is strategically important for LSEG. Currently, the majority of the Eurozone repo market and the Euro CDS market is cleared in Paris, whereas six years ago that wasn’t the case. As a result of the diversification and business growth, and the continued expansion of connectivity

of the investment banks or their buyside clients they ask: “How can you make this whole process more efficient, like clearing?”

Using SwapAgent as the platform, the clearing provider set about building out its services in this historically underserved market and, rather uncharacteristically for LCH, sought to turbocharge its progress through acquisitions.

Maguire said: “Quantile has a capital, XVA and resource management

of LCH SA’s equity clearing business to additional venues and MTFs, LCH SA has, over time, become less reliant on Euronext originated trades and business.”

He added: “The relationship with Euronext and our mutual customers is a long one and we are the primary clearer for their cash equity business and secondly, we are the primary clearer for their derivatives business. On cash equities, under MIFIR (the Markets in Financial Instruments Regulation) there is the legislation and the principle of open access so, from an equity standpoint, we will continue to offer seamless clearing of Euronext stocks to all of our existing customers under the ‘Preferred Clearing’ model.”

Maguire concluded: “Whilst we may no longer be the primary CCP for Euronext stocks, we are in regular and positive dialogue with our customers to make sure they know they have the option to continue to clear with us.”

DANIEL MAGUIRE, LSE GROUP Spring 2023 17 www.globalinvestorgroup.com DERIVATIVES

We started thinking how to bring our infrastructure and expertise to address the more idiosyncratic and esoteric uncleared products that are going to be subject to margin rules. That was when SwapAgent was born

background and they have had a lot of success connecting to the major dealers to offer compression and optimisation in different flavours, bringing to bear their technology and expertise to really harvest portfolios and make them less capital and collateral intensive and more risk efficient.

“In clearing we always have been open access and have worked, and continue to work, with other optimisation providers as well as Quantile, but we came to the view that this skillset and capability is becoming more core to our overall mission, and we felt the need to have this additional capital and optimisation expertise in-house.”

Maguire said Quantile, which the LSE Group acquired late last year in deal worth about £270m, also has a high integrity, self-reinforcing database of trades.

“They operate both in the uncleared and cleared space across multiple asset classes and hopefully, as we get more traction with SwapAgent and a resultant high integrity database

of uncleared trades, we will be able to harvest, both within, and across, cleared and uncleared to help customers optimise their funding, capital and collateral and enhance risk management.”

More recently, in early April, LSEG also acquired US margin processing firm Acadia without disclosing terms.

Maguire said: “Acadia is a fundamentally important piece of the jigsaw. Customers are looking for more ways to optimise their financial resources, and Acadia’s services enable significant efficiencies in risk management, margining and collateral. It connects the sell- and buy-side across various asset classes – rates, credit, FX and equity and we intend to cover the same asset classes with SwapAgent too.”

He added: “Both Quantile and Acadia are businesses that are connected to customers now, they are real. There are a lot of great ideas out there, but people only have a certain amount of bandwidth and capital to spend on connectivity and the

like, so we put a high importance on businesses that are connected, credible, and already tangibly delivering value to customers.”

Libor Transition

As the world’s largest clearer of interest rate swaps, LCH has been integral to the industry’s slow migration away from the toxic Libor reference rate to a new breed of so-called risk-free rates.

LCH has worked on all the major switches (sterling, Euro, Yen etc) that have taken place until now but started in late April the conversion of its US dollar-denominated book, by far its largest by notional.

The clearing house plans to phase-out its US dollar Libor contracts over two weekends: April 22-23 and May 20-21.

At the time of writing, the first weekend went smoothly as LCH moved across about $1.5 trillion of variable notional swaps and zero coupon swaps. Philip Whitehurst, head of service development for rates at LCH, told Global Investor in late April the second

DANIEL MAGUIRE, LSE GROUP Spring 2023 18 www.globalinvestorgroup.com CUSTODY DERIVATIVES

Maguire: “Customers are looking for more ways to optimise their financial resources, and Acadia’s services enable significant efficiencies in risk management, margining and collateral..”

weekend would see a far larger notional moving across, estimating that as much as $43 trillion could convert in May.

Maguire said: “The transition of IBORs to Risk-Free Rates is one of the most existential things that has happened in the industry in a generation. There is the whole Libor transition but the US Dollar one this year is the most significant. We have placed a huge amount of importance on supporting the industry in the two conversion events and we are hopeful they will both take place with no issues.”

The LCH chief said the experience of working on the earlier conversions is valuable as the clearing house prepares for the second, larger migration at the end of May.

“We’ve successfully converted Swiss, Yen, Sterling and Euro indices, as well as a first tranche of USD IBOR linked products, so we have a great amount of expertise and track record in this but really it is a co-ordinated choreography with the dealers, their clients, trade associations, and the other clearing houses.”

But Maguire is not complacent as he looks ahead to May 20.

“The total size of this year’s conversion events is two or three times bigger than the others that we have done in prior years, to give some context around number of trades. It’s a bit of a moving target because trades are expiring and some firms are managing some components of the conversion themselves, but we have seen a shift over the last 12-18 months where the volume of new trades coming in to LCH, be it by DV01 or any other measure, has flipped from 90-10 Libor/SOFR to 10-90 Libor/SOFR.”

He added: “By the end of Q2, Libor, at least in LCH, will be gone.”

Margin Discipline

The frenetic trading that Schwimmer mentioned was focused around the near-collapse of Credit Suisse in midMarch this year, leading to the Swiss bank’s ad hoc takeover by its main rival UBS.

At the time, clearing experts speculated that firms had generally dealt better with the volatility and margin pressure than they had in the febrile trading three years earlier as markets reacted to the onset of the COVID epidemic.

Maguire said: “COVID and the recent volatility around SVB and Credit Suisse were very different events. When we look at COVID we are quietly proud that we weren’t seen as pro-cyclical in terms of our margins jumping around. We were able to protect our members while ensuring the safety and stability of the marketplace – we were predictable.”

In 2020, trading firms were quick to blame clearing houses for contributing to volatility by imposing large intraday margin calls, which forced clients to liquidate positions to free up the collateral to meet the calls, thereby increasing the volatility, a phenomenon known as pro-cyclicality.

Maguire continued: “With Credit Suisse, there were some big margin calls given the scale and size of the risk positions, but everyone paid on

time, and everyone was well-drilled –which is testament to the huge public and private sector effort since the GFC in 2008.

“While these events may have been different to past ones, people have got much more muscle memory around pre-funding and putting a buffer into the margin account. We’re not in the business of predicting volatility but customers normally sense when it’s coming and proactively prepare for it, which helps the eco-system.”

Maguire concluded: “I am comfortable where we are with our risk methodology, but we continue to scrutinise and back-test every event to test the model – we will never rest on our laurels here. Of course, you must strike the right balance, so the models don’t over-react or under-react and equally they don’t over-hang or underhang post-events as well.”

Euro Clearing

While clearing is meat-and-drink to a trade rag such as Global Investor, LCH found itself on some unfamiliar front pages after Brexit as European

DANIEL MAGUIRE, LSE GROUP Spring 2023 19 www.globalinvestorgroup.com DERIVATIVES

Chart One. LCH SwapClear Performance 2022

921 2180 2684 +26% +18% 1091

Source: LCH Ltd Annual Report 2022

Client Trades (‘000)

Interest rate Swap Notional (US$ Trillion)

2021

2021 2022 2022

politicians started demanding the repatriation of Euro-denominated swaps clearing.

The European stance has softened over the intervening years, but the European authorities are still uncomfortable with the fact that most Euro-denominated swaps sit in a clearing house based outside of Europe and, therefore, beyond their control.

The latest proposal from the European Commission in December is that firms have an active account with a European Union-based clearing house, though no-one is really sure at this stage what is meant by “active account”.

Maguire (for his sins) has been at the heart of this debate for years now.

“If you look at where we started in 2016 after Brexit, there were a lot of hard statements around a potential ‘location policy’. If you look at where

we are now, the narrative has evolved significantly. I think it’s reasonable to say that there isn’t a desire to ‘cut-off’ EU firms from the supply of services from UK CCPs but there is still a desire from the EU to have more capability closer to home.”

He added: “The EMIR proposals are now focused on active accounts, which means that EU firms are likely to be asked or encouraged to have an active account at an EU CCP as well as nonEU CCPs. The European Securities and Markets Authority (ESMA) would be given the task of trying to define that in their rule-making.”

Maguire said he welcomes the more nuanced approach from the European Union but he is mindful of the unintended consequences of requiring firms to clear more of their interest rates swaps in a different clearing house.

“We are supportive of the move

away from a location policy, but the real issue is what does this mean for EU firms, such as real-money accounts, pension funds, asset managers and insurance firms?”

He added: “Depending on what prescription comes out of the current negotiations and what mandate will be given to ESMA – and at this stage it is not clear – it could be that EU firms – buy-side and sell-side – have less access than non-EU firms to that global liquidity pool, which would negatively affect them competitively but also affect the way they can manage their risks.”

Clearing houses can calculate and call margin on a client’s net rather than gross position so it is normally cheaper for firms to put all their correlated products under one roof, in this case SwapClear.

Forcing firms to take their Euro

DANIEL MAGUIRE, LSE GROUP Spring 2023 20 www.globalinvestorgroup.com CUSTODY DERIVATIVES

Maguire: “I think it’s reasonable to say that there isn’t a desire to ‘cut-off’ EU firms from the supply of services from UK CCPs but there is still a desire from the EU to have more capability closer to home.”

swaps out of SwapClear and clear them in Europe could make these products relatively more expensive, thereby putting those companies at a disadvantage.

Maguire said: “It is clear from all the EU based firms that we talk to –whether dealers, pension funds or client clearers – that they want unfettered access to UK CCPs without any kind of limitation. Depending on where the prescription comes out on quantitative or qualitative, that will determine how good or bad this is for EU firms and the nature of financial stability risks in the EU.”

Maguire said LCH’s primary goal is to be able to continue to offer EU-based firms unfettered access to its services, adding: “We are regulated by the Bank of England and ESMA directly, as well as the Commodity Futures Trading Commission (CFTC) and several other supervisors, and we operate a central bank account with the European Central Bank for all our Euros and are directly subject to EU Law (EU EMIR). We are confident that these elements will allow us to continue supporting our customers.”

And the debate about Euro swaps clearing has not affected the demand for SwapClear, Maguire said.

“We continue to see our volumes grow across Euro and other currencies as well. EU firms tend to clear as much in Euro as in other currencies. We’ve seen no discernible change in customer behaviour, and 2022 was a record year in terms of volumes and growth. A lot of people have taken great heart from EMIR 3 and that they will continue to have access to us.”

Repo Clearing

While LCH and Eurex Clearing respectfully disagree over the future of Euro clearing, Europe’s two largest clearing firms are also contesting an emerging market: repo.

Easy to overlook in the low interest rate environment that has characterised recent decades, the repo market is currently booming as firms increasingly

use these instruments to alleviate their short-term funding problems.

Maguire said: “Our repo business is growing at pace. LCH Ltd provides a gilt clearing business and LCH SA a Eurozone government bonds clearing service. Prior to 2018, we had some Eurozone debt in LCH Ltd also – this was inefficient for customers. Following consultation with them, we agreed to migrate and consolidate our Eurozone debt offering in one clearing house, LCH SA – this was driven by market participants seeking greater balance sheet netting and funding efficiency.”

LCH RepoClear, based in the clearing house’s French division, processed €288 trillion (£257tn) of Euro debt and UK gilts last year, up more than a fifth (21%) on 2021 which was also a record year at €238tn, the firm said in February.

Maguire said: “In repo clearing, the efficiencies and associated savings are in balance sheet netting, so you trade bilaterally but give up to the clearing house so that your net settlement against the clearing house is a small percentage of the gross nominal. The shift from LCH Ltd to LCH SA of Eurozone debt happened in 2018 and then the volumes started to grow. The more netting you can get, the more you can trade, so it is a more efficient model.

“We have seen the increased attractiveness of Eurozone debt relative to others from a collateralisation point of view, so we have taken an active role in “internationalising” the service to build an international fraternity of Australian, Canadian Japanese, Hong Kong and Swiss banks.”

Maguire said there are three key drivers in the repo market: “Firstly, government debt issuance will continue at higher rates of interest than we have seen over the past number of years. Secondly, banks’ balance sheets continue to be constrained so anything that can help alleviate that is only a good thing. And, thirdly, buy-side and sell-side need more reliable access to funding and liquidity, and clearing is certainly helpful in this regard.”

Maguire is convinced that, based on these three themes, the fundamentals for the repo market are strong but he is fully aware this is a competitive market. As well as Eurex Clearing, CME offers repo clearing through its Chicago-based CCP, leveraging the US exchange’s fixed income trading platform BrokerTec.

Maguire continued: “We’ve started with dealer-to-dealer, and have expanded that, and we now have a sponsored clearing model where we are bringing in the buy-side. Additionally, in LCH SA we will soon integrate our

DANIEL MAGUIRE, LSE GROUP Spring 2023 21 www.globalinvestorgroup.com DERIVATIVES

+20% 2021 2022 921 1091 Revenue (Billions)

Chart Two. Repo and Cash Bond Clearing Performance 2022 Source:

LCH SA Annual Report 2022

Our repo business is growing at pace. LCH Ltd provides a gilt clearing business and LCH SA a Eurozone government bonds clearing service

GC (General Collateral) repo service with the much bigger classic repo service.”

A lot of RepoClear’s recent growth has been in the dealer-to-dealer space, signing up new dealers from around the world, said Maguire, before adding: “But I think the next generation of growth will come from the other half of that market, so the dealer-to-client business where people come through a sponsored model, as well as by combining the two repo services into one which will bring even greater efficiency for customers.

“With the environment we are in now, it’s becoming more compelling to access guaranteed funding and liquidity. For example, pension funds in Europe will need access to cash to pay variation margin on cleared swaps as the clearing exemption for EU pension funds expires in June 2023. We’ve got tools to help people do that so it’s about bringing the SwapClear and RepoClear solutions together to help people fix some of those challenges.”

Maguire concluded: “RepoClear has been around for a while – it was launched in 1998! – but it’s experiencing a second coming in some ways as funding and liquidity are becoming more important, in addition to the tremendous netting benefits generated from clearing.”

Credit Clearing

Another space where LCH is doing well is credit derivatives and specifically credit default swaps. Here, LCH has for more than a decade competed with Intercontinental Exchange’s ICE Clear Credit, which has historically had the larger CDS clearing book.

CDSClear, also based in Paris, has continued to roll out new services, extending its coverage of the credit derivatives universe, most recently by launching credit index options clearing in late March.

Another factor in CDSClear’s recent growth has been ICE’s June 2022 announcement that it would stop clearing CDS in London in March 2023

and transfer that business to Chicago.

Maguire said: “Five years ago, CDSClear, which is part of LCH SA, had around 5% of the Euro CDS index market and we are over 50% now. That has been hard-earned – building up product, building up liquidity and building up a deep partnership with customers. The fact that we have been investing for a while now and building and improving the service, product and risk management, has meant that people have a real alternative to the incumbent clearing house and that has been positive for us.”

CDSClear has positioned itself perfectly to pick up the business coming out of ICE Clear Credit’s London business and is looking to harness further that momentum to expand in Asia and even the US.

Maguire said: “The growth of CDSClear is a great story and has meant LCH SA has followed a similar path to LCH Ltd and SwapClear in the internationalisation of the services and its users. We started to clear US index families a few years back as well as Asian ex-Japan and Australian indices and Sovereign single names last year.

“LCH SA is also regulated by the CFTC and the Securities and Exchange Commission (SEC) due to it holding licences to clear CDS indices and single names for US firms. Our goal is to be the premier global CDS offering and cover all major products and we will keep investing and expanding. We really wanted to make sure we consolidate in Europe in the first instance, and we are feeling pretty positive about that, which is giving us the confidence to go beyond Europe in the future.”

Maguire concluded: “This story also shows that it is possible to move liquidity from one clearing house to another if there is broad market support from all global participants and if there is a compelling economic rationale.”

Foreign Exchange

Alongside swaps, repos and credit, LCH’s other significant derivatives clearing market is foreign exchange. Launched in 2012, ForexClear has also benefitted from regulatory change in the over-the-counter derivatives market.

Maguire said: “If you look at the FX product set – NDFs (non-deliverable forwards) and FX options are subject to UMR – NDFs are seeing real growth in terms of dealer-to-dealer and dealerto-client activity, particularly in APAC and LatAm currencies and there we are seeing month-on-month growth, which is helping us pick up a lot of customers in the APAC region.”

The LCH chief said ForexClear cleared $2.2 trillion of NDF notional in March 2023 alone while the first quarter was 35% higher than the previous record quarter for client NDF volumes.

He continued: “In October this year, LSEG will launch the NDF matching platform in Singapore. The integration of clearing into the NDF matching platform means that customers can decide on a pre-trade basis to clear their NDFs. Margin savings and operational efficiencies will be key benefits of this service – we’re really looking forward to supporting customers as this market continues to grow and there is a lot of interest in this innovation.”

DANIEL MAGUIRE, LSE GROUP Spring 2023 22 www.globalinvestorgroup.com CUSTODY DERIVATIVES

Chart Three. CDSClear Performance 2022

+48% 2021 2022 1683.5 1141

Source: LCH SA Annual Report 2022

Notional Cleared (US$ Billion)

Maguire added: “The second thread is FX options (and associated hedges) where we are connected to CLS for physical settlement and there we are also seeing volumes and the number of participants growing month-on-month at a pretty high rate − this is driven by both margin and capital benefits.”

LCH reported in the first quarter of this year three successive record months for FX options and set on April 4 a daily volume record of €14.8bn.

“We have approximately doubled our volumes over the past year and expect to do so again in the next 12 months, with a number of major global banks activating in the next few months.”

In line with LCH’s strategy to offer more products and services in the less standardised, uncleared end of the derivatives market, the LSEG posttrade business is focusing on delivering capital efficiencies in FX forwards and FX swaps, drawing on the unique capabilities of its various businesses.

Maguire said: “FX forwards and swaps are really important because these products are subject to capital requirements under SA-CCR.”

LCH has developed something

it calls Smart Clearing, supporting customers’ capital optimisation needs by clearing selective portfolios of FX forwards, without increasing margin excessively.

“Essentially what we have done is, with their agreement, analysed various banks’ and buy-side firms’ FX forwards and swaps books, run an optimisation simulation through Quantile so we can take portfolios of relatively delta neutral FX forwards, and put them into ForexClear where we can net down the exposure and manage the initial margin within constraints.

“In addition, any residual uncleared risk can be swept into SwapAgent to further streamline the exposure and capital management process. So, this is supporting customers across the cleared and uncleared space and leveraging Quantile’s services across both.”

Foreign exchange is another market where Maguire sees the opportunity to offer services that straddle the cleared and uncleared divide, offering efficiencies across two correlated businesses that are currently managed separately.

He said: “FX has been and is a longterm play for us. We are seeing good growth in NDFs and options but now, with our capability for customers to be able to ‘toggle’ between cleared and uncleared dependent on their preferences and goals, we have the tools to make these currently uncleared products much more capital and margin efficient and, by extension, more operationally efficient too.”

LCH goes “crypto”

The point of a clearing house like LCH is to mitigate risks on behalf of clients and the industry at large; these are

highly risk-averse businesses by nature. So, it was somewhat surprising and at the same time entirely appropriate to learn that LCH is set to foray into the most volatile of all asset classescrypto-currencies.

LCH SA said on April 13 it had reached agreement (subject to regulatory approval) with crypto market GFO-X to start clearing bitcoin futures and options traded on GFO-X when it goes live, slated for the fourth quarter of this year.

GFO-X represents LCH’s first cryptocurrency client and the clearing house has set up to support GFO-X a new division called LCH DigitalAssetClear, which sits within its Paris-based clearing house LCH SA.

Maguire said: “We are also looking at how can we take the apparatus, regulatory approvals and technology we have to work with alternative trading venue partners to launch existing and new listed derivatives products and services.”

Maguire is quick to stress that LCH DigitalAssetClear is fully segregated from the other clearing services already in operation, so there is no chance of contagion between the crypto-currency pool and ForexClear’s or any of the other default funds.