Summer 2023 www.globalinvestorgroup.com

CUSTODY

Securities finance

Roundtable considers ESG challenges in stock lending and borrowing

DERIVATIVES

Cboe weighs opportunities in short-dated options

Summer 2023 www.globalinvestorgroup.com

CUSTODY

Securities finance

Roundtable considers ESG challenges in stock lending and borrowing

DERIVATIVES

Cboe weighs opportunities in short-dated options

SUB-CUSTODY GUIDE TRACKS DEVELOPMENTS IN KEY INTERNATIONAL MARKETS reflects on a turbulent year in rates and equities

Caterina Caramaschi was in good spirits when we sat down in July - her first year in charge of ICE’s interest rates and equities markets has presented some “laugh or cry” moments.

The timing of her promotion was impeccable. She took over the rates book (adding to the equities she was already running) on October 3 last year, exactly ten days after Liz Truss’s disastrous mini-budget sent the UK economy into a tailspin, forcing the Bank of England to intervene.

Now, markets (and their operators such as ICE) like volatility but as any trader worth his or her scars will tell you: “There is volatility and there is VOLATILITY”. And UK rates in October was definitely the latter.

Caramaschi’s recollection of that time makes interesting reading (page 10). To paraphrase, Caramaschi and her team went back to basics – they reinforced their measures to support liquidity, they engaged with clients and, when they said “be patient”, Caramaschi and her team rode out the storm.

Looking at the SONIA trading volumes around that time, this basically took three months. September’s monthly volumes were the highest in a single month last year but SONIA trading activity collapsed in October and November, so much so that December’s SONIA total was less than half that in September.

The New Year, however, brought renewed demand for SONIA futures, and volumes bounced back in January, hit a 12 month high in February and broke in March this year 10 million lots in a month for the first time. More recently, April, May and June volumes are all strong, up at least a quarter on the respective months last year.

It is fair to assume that Caramaschi’s second year in charge of ICE’s interest rates and equities arms will not be as fraught as her first but one challenge is already clear.

Deutsche Boerse’s Eurex announced

in June a plan to relaunch in the fourth quarter its Euribor contract backed by a new partnership programme aimed at short-term interest rate futures, an extension of an existing scheme for Eurodenominated interest rate swaps.

The German exchange, which said on June 7 that BNP Paribas, Deutsche Bank, Goldman Sachs, J.P. Morgan and LBBW have already pledged to support the effort, wants to take from London-based ICE Futures Europe some of its vast Euribor book of business, moving that liquidity back in to Europe under the control of European authorities.

The move by Deutsche Boerse is commercially-driven, of course, but it is backed by the will of the European authorities who have made no secret in the past two years of their disquiet with the fact that some Eurodenominated products are largely traded in London and therefore outside of the European Union postBrexit.

The truth is that the nature of the listed derivatives industry makes it inherently conservative. The cost savings from portfolio margining between correlated products in one clearing house and the implicit cost of trading in a market that is still building liquidity combine to make it tough for markets trying to take trading from an incumbent.

Eurex then has its work cut out but the German market is a big and credible supplier while its efforts to take market share in Euro-denominated interest rates swaps tell us that Eurex is in it for the long-haul. Caramaschi and her team will certainly not underestimate this challenge.

Also in this issue, special thanks to the participants in the latest ESG roundtable and congratulations to the winners in the annual sub-custody survey.

Luke Jeffs, Managing Editor, Global Investor GroupEDITORIAL

Managing editor

Luke Jeffs

Tel: +44 (0) 20 7779 8728

luke.jeffs@globalinvestorgroup.com

Derivatives editor

Radi Khasawneh

Tel: +44 (0) 20 7779 7210 radi.khasawneh@delinian.com

Securities Finance Reporter

Sophia Thomson

Tel: +44 20 7779 8586 sophia.thomson@delinian.com

Special projects manager

Anshula Kumar

Tel: +44 (0) 20 7779 7927 anshula.kumar@delinian.com

Design and production

Antony Parselle aparselledesign@me.com

BUSINESS DEVELOPMENT

Business development executive

Jamie McKay

Tel: +44 (0) 207 779 8248 jamie.mckay@globalinvestorgroup.com

Sales manager Federico Mancini federico.mancini@delinian.com

Chief Executive Officer Andrew Pinder

Chairman Henry Elkington

© Delinian Limited London 2023

SUBSCRIPTIONS

UK hotline (UK/ROW)

Tel: +44 (0)20 7779 8999 hotline@globalinvestorgroup.com

RENEWALS

Tel: +44 (0)20 7779 8938 renewals@globalinvestorgroup.com

CUSTOMER SERVICES

Tel: +44 (0)20 7779 8610 customerservices@globalinvestorgroup.com

GLOBAL INVESTOR

8 Bouverie Street, London, EC4Y 8AX, UK globalinvestorgroup.com

Next publication

Autumn 2023

Global Investor (USPS No 001-182) is a full service business website and e-news facility with supplementary printed magazines, published by Delinian Limited.

ISSN 0951-3604

6 Trading Places: GPFA taps ADIA’s Amy Borgquist; Clearstream Banking names Eckermann as chief executive; Brokertec hires

Sara Carter as head of repo; LME announces Warren as chair

8 Highlights from GlobalInvestorGroup.com: Bank of England warns about hedge fund concentration; Nasdaq shelves crypto custody plan; HSBC executes first Dubai securities lending trade; CFTC sets sights on carbon markets

COVER STORY:

10 Caterina Caramaschi has had a year to remember as Intercontinental Exchange’s global head of interest rates and equities with the UK mini-budget and equities markets under pressure

16 LSE Group’s 2021 acquisition of Refinitiv has made the British exchange a market-leader in the global foreign exchange market and the LSE is looking to capitalise on this position

20 Cboe Global Markets has developed many key products in the options space and is using this experience to design new short-dated tradeable instruments

23 US prime broker Clear Street has applied to the National Futures Association to launch a futures commission merchant that will initially support futures in the US and Europe

24 Crude oil index firms Platts and Argus changed in May the make-up of the Brent barrel and this has affected how firms are trading the European crude benchmark

26 Eurex plans to relaunch in the fourth quarter of this year its Euribor contract backed by a revenue share programme which could also drive demand for the exchange’s €STR future

27 Global Investor’s 2023 ESG Roundtable discussed how the securities finance market is responding to the increasing demand for sustainable practices in line with environmental, social and governance principles 40

48 Societe Generale Securities Services considers how network managers are having to change the way they do business in light of new ESG challenges

51 Global Investor Sub-Custody Survey: The 2023 survey tracks the performance of leading providers in some of the world’s most dynamic markets

73 Technology firms have been keen in recent months to discuss the challenges posed to their clients by the US transition to next-day, T+1 settlement, slated for May 2024

77 Lyons O’Keeffe, ESG director at IQ-EQ, argues that a focus on data will help firms step up to the challenges of offering effective ESG products

GPFA appoints ADIA’s Borgquist as international head

The Global Peer Financing Association has appointed Abu Dhabi Investment Authority’s Amy Borgquist (Armour) as the new securities finance trade body’s head of international outside North America.

In her new role, Borgquist is working closely with the Global Peer Financing Association (GPFA) board of directors to ensure GPFA activities are well coordinated globally to best serve the interests of the beneficial owner members of the association.

Based in the UAE, Borgquist is well placed to connect GPFA members across Europe, the Middle East & Africa (EMEA), and Asia Pacific (APAC), the trade body said in a statement.

Finbourne hires Ryan from BNP to run product marketing and solutions

Finbourne Technology, backed by Fidelity Investments and LSE Group, appointed in July Neil Ryan, formerly of BNP Paribas Securities Services, as the fintech’s new head of Product Marketing and Solution.

Prior to his new role, Ryan was the global head of Investment Analytics &

Data Services at BNP Paribas Securities Services. Before that, he had senior data & analytics roles at Citi and Ernst & Young.

Having over 25 years of experience globally in data strategy, product development, business intelligence, data governance and data architecture, Ryan brings an abundance of domain knowledge to Finbourne’s product team, the data management firm said.

Clearstream Banking names

Eckermann as CEO

Clearstream Banking appointed Stephanie Eckermann as the new chief executive officer, effective 1 July 2023.

As the new chief executive, Eckermann will lead the strategy of the bank, and will overlook the bank while remaining responsible for strategy, finance and compliance across all the entities within Clearstream.

Eckermann succeeds Berthold Kracke, who has stepped down from the role and left the executive board of Clearstream Banking. Kracke served as the chief executive of Clearstream banking for eight years.

Societe Generale reshuffles senior management

Societe Generale made in June three senior appointments across securities services, group inspection & audit, and global transaction & payment services divisions.

The Paris-based bank appointed Arnaud Jacquemin as head of Securities Services, Alexandre Maymat as head of Group Inspection & Audit, and David Abitbol as head of Global Transaction & Payment Services.

Maymat began his new role on July

1 2023, replacing Pascal Augé who has decided to leave the bank, Societe Generale said.

BrokerTec hires ex-Morgan

Stanley senior executive as global repo head

Fixed income platform BrokerTec hired in July Sara Carter as an executive director and global head of repo.

She was previously at Morgan Stanley for over 15 years, where she held senior positions across fixed income sales and trading. Most recently, Carter served as an executive director for nearly five years in client financing sales.

Carter said: “BrokerTec’s repo trading business has a great reputation in the market and I’m looking forward to engaging with clients and developing the business at this exciting time for fixed income.”

ISLA appoints Davidson to replace Jeffcoate as COO

International Securities Lending Association (ISLA) appointed Lee Davidson as chief operating officer (COO) effective June 1, replacing Jamila Jeffcoate.

Based in London, Davidson is responsible for ISLA’s operational activities and daily management of the trade body.

The industry continued to reshuffle the deck in the second quarter of 2023.LEE DAVIDSON NEIL RYAN

Davidson has spent almost two decades within financial services, predominantly on the sell-side, and joins ISLA from fintech firm ZFX where he was the head of global operations.

Previously, Davidson spent over five years at Australian banking firm ANZ as a director of strategic delivery and a senior finance business partner. He also worked at Deutsche Bank and ABN AMRO Bank.

Broadridge appoints Sleightholme as president of international arm

Global fintech Broadridge appointed in July Mike Sleightholme as president of Broadridge International.

Based in London, Sleightholme is responsible for delivering the fintech’s customer support along with its growing portfolio of technology and data solutions throughout the Europe, Middle East and Africa (EMEA) and Asia Pacific (APAC) regions.

Chris Perry, president of Broadridge, said: “At Broadridge, and throughout his career, Mike has an impressive track record of building high performing global teams to deliver business transformation and growth.”

Transcend hires Harris from EquiLend as product specialist

Transcend hired in June Emily Harris, formerly with Barclays and Credit Suisse, to help develop the collateral fintech’s products and expedite its growth in Europe and Asia.

Based in the United Kingdom, Harris is focused on leading Transcend’s securities finance product development efforts and expanding the firm’s global footprint, particularly in Europe and Asia Pacific, the New Jersey-based firm said.

The Global Legal Entity Identifier Foundation (GLEIF) appointed in July T. Dessa Glasser as its new chair,

replacing former chair Steven Joachim who had completed his three year term.

With three decades’ worth of experience in the industry, Glasser is a recognised veteran in financial markets, risk and data analytics, said Basel-based GLEIF.

Over her 35-year career, she had roles at the US Treasury, JP Morgan Chase, Credit Suisse and IBM Global Services, and currently serves as an independent board director at Oppenheimer Holdings.

The London Metal Exchange (LME) has appointed a former interim chief executive at London Stock Exchange Group (LSEG) to head the board of its clearing arm.

David Warren became chairman of the board at LME Clear on July 20. Warren has previously served as chief financial officer at both LSEG and Nasdaq. He took up the chief executive role at LSEG on an interim basis after Xavier Rolet stepped down in November 2017, relinquishing the post when Goldman Sachs’ David Schwimmer took up the post the following year. Warren left LSEG in 2020.

HKEX hires ex-Everbright chief Zhou to focus on Mainland China Hong Kong Exchanges and Clearing (HKEX) hired in July Zhou Jiannan as managing director and head of Mainland Development and a member of Management Committee. Zhou, a recognised veteran in financial markets, now leads HKEX’s engagement with key Mainland regulators, supporting the exchange’s goals to connect China to international markets.

Prior to his appointment, Zhou served as the chair of Jiahe Asset Management in Shanghai since 2021. Before that, he was chief executive at Everbright Securities, chief executive at Dacheng Asset Management and served in multiple roles at the China Securities Regulatory Commission (CSRC).

Hedge fund ‘concentration’ may amplify risk in rates markets – BoE

The concentration of interest rate derivative positions among a small number of hedge funds could pose a systemic risk in times of unexpected policy moves, research from the Bank of England has concluded.

In a staff working paper published in late July, analysts at the central bank found that 80% of sterling swaps, options and futures positions are held by the top five hedge funds – showing that the market is highly concentrated and comprises large speculative short duration positions.

“The degree of concentration in the interest rate derivatives markets could lead to greater risk of market disruptions,” the report said. “A small number of participants account for a large share of interest rate exposures, which could lead to dealer losses and infrastructure disruptions as they are hit with uninsurable idiosyncratic shocks.”

The amount of business being conducted on European primary markets fell to a five-year low in the second quarter of this year, according to a new report from TP ICAP’s trading platform Liquidnet.

Liquidnet published in July its latest Liquidity Landscape report that shows the normal seasonal slowdown in trading through April, May and June though volumes this year are lower than in the same period in 2022.

According to the report, the Average Daily Principal Traded on European venues in June was €48bn (£41.5bn), up slightly on the total in May but down from €55bn in June last year.

Lit primary markets (excluding auctions) accounted for 30% of European trading in April, May and June, which is their smallest market share in the last five years, according to the report.

Distributed ledger technology can play a crucial role in linking systems to promote the straight-through processing of trades, a new report from Banque de France has found.

Banque de France’s latest report, titled: “Wholesale central bank digital currency experiments with the Banque de France: New Insights and Key Takeaways,” highlights findings from its wholesale central bank digital currency (wCBDC) experiment using distributed ledger technologies (DLT). Banque de France made various recommendations in its paper including that DLT enhances the straightthrough processing of trade and posttrade activities; that interoperability should be prioritised to ensure seamless data and transaction exchange between DLT-based and conventional infrastructures; and continued experiments at domestic and international level are essential to advance analysis and efforts to develop an operational framework through a learning-bydoing approach.

The European Central Bank launched a public consultation on its guide to improve risk data aggregation and risk reporting.

Frankfurt-based European Central Bank (ECB) said the guide outlines prerequisites for effective risk data aggregation and risk reporting (RDARR) to assist institutions in strengthening their capabilities, building on good practices observed in the industry.

In the guide, ECB highlights the economic benefits of more accurate data, which includes advancements in digitalisation, improved risk management and more effective strategic planning, which can bring higher revenues and profitability to financial institutions.

Nasdaq shelves crypto custody plan to focus on $10.5bn Adenza merger

Nasdaq has scrapped plans for a crypto custody service as the US group looks to focus on integrating its technology services after its planned $10.5 billion (£8.2bn) acquisition of fintech Adenza.

Speaking as the firm presented second quarter results on July 19, Nasdaq’s chair and chief executive officer said it has decided to pause plans to launch the service after assessing regulatory shifts and the crypto market environment.

HSBC completes first securities lending trade in Dubai

HSBC has completed the first securities lending and borrowing (SLB) transaction on the Dubai Financial Market (DFM), marking a milestone for the Gulf market as it opens up to short selling.

The DFM said on July 20 HSBC executed the trade as a custodian lending on behalf of a large asset owner and borrowing on behalf of another client. The British bank also acted as lending agent and prime broker, borrowing Dubai-listed equities from the asset owner, DFM said.

Two thirds of firms increasing their repo trading activitiesreport

A majority of respondents to a new survey have said their clients are increasing their use of repo and want to execute more of their repo trades on electronic platforms in future.

The Fifth Sell Side Fixed Income Report produced by Acuiti in collaboration with fintech valantic found 10% of sell-side respondents said their clients are making “significantly more” use of the repo markets while another 57% said their clients are trading “slightly more” repo. Another 29% of the sell-side

respondents said their clients have not changed their position on repo while only 5% said their clients are trading less repo.

Wealth managers eye high margin services such as securities lending - Citi The increasing importance of retail investors to wealth managers could drive greater demand for securities lending services, a Citi report has concluded.

The US banking group published in July a report entitled “Disruption and Transformation in Wealth” that tracks sentiments among retail wealth experts, wealth managers and private bankers in Asia, Europe and North America.

The paper suggests that wealth managers are at “an inflection point”, faced by economic uncertainty, the increased cost of doing business and margin pressure.

in 2023 – EBA

The European Banking Authority (EBA) has said bank holdings of derivatives are set to increase further this year, extending last year’s trend as firms look to hedge their interest rate risk.

The Paris-based authority published in July its bank funding report, based on submissions from 159 regional banks. The survey found that firms intend to increase derivatives held on balance sheets by 11%, after a strong increase last year reflecting higher rates uncertainty.

“Holdings of derivatives strongly increased by 22% in 2022, reversing a decrease in 2021, whereas repurchase agreements broadly remained at the same level in 2022,” the funding report said. “Increased derivatives holdings may point to banks’ hedging strategies in a volatile market and interest rate environment in 2022.”

Regulators fine UBS £300m for historic Credit Suisse breaches US and UK regulators fined UBS $387 million (£302m) for breaches related to UBS-owned Credit Suisse’s “unsafe and unsound” risk management practices that caused losses when family office Archegos Capital Management collapsed in 2021.

The US Federal Reserve fined UBS Group $268.5 million while the UK Prudential Regulatory Authority has levied a fine of £87 million, the largest ever by the British regulator.

The fines have been imposed on UBS, which acquired Credit Suisse in March after a forced sale shepherded by regulators in the wake of a bank contagion crisis.

CFTC sets sights on ‘credibility crisis’ in carbon markets

The chair of the Commodity Futures Trading Commission (CFTC) has said the US derivatives regulator plans to goldplate standards in the voluntary carbon markets to tackle their “credibility crisis”.

Speaking at the CFTC’s second carbon markets open meeting in July, Rostin Behnam said the agency will look to support the development of high quality carbon credit markets in the near future.

Few have had a first year in a job like the year Caterina Caramaschi has had as Intercontinental Exchange’s head of interest rates and equities.

By Luke JeffsCaterina Caramaschi, who became the US group’s global head of equities in late 2020, was promoted in early October last year to run ICE’s rates book in addition to her duties in charge of equities.

The timing is significant because the UK economy was in early October still reeling from the Liz Truss mini-budget on September 23 which drove sterling to an all-time low against the dollar and caused a sell-off in gilts.

As the home of the UK interest rate derivatives market through its SONIA franchise, ICE (and therefore Caramaschi) found themselves in early October at the centre of fastmoving financial crisis.

She told Global Investor: “My expanded role into the rates business came at a very challenging time, we had not long finished the GBP Libor to SONIA transition and the rate cycle had begun after over a decade of very low rates.”

Caramaschi added: “At the time, both SONIA and Gilts were struggling because we had heightened global rates volatility and the mini budget which didn’t help SONIA liquidity.”

London-based ICE Futures Europe’s three month SONIA futures had a record month in September as firms sought to mitigate the effect of the mini-budget (see Chart One) but trading volumes collapsed after

that through October, November and December - the first three months of Caramaschi’s tenure in her new role. She said: “One of the first things the team and I did when I started was put in place measures to underpin liquidity in the SONIA future and we are now seeing future’s liquidity improve substantially as a result of those measures and some calm returning into the UK market following the appointment of a new chancellor and the unwinding of the mini budget.”

The longer end of the curve was also hurt by the mini-budget with open interest in the UK ten year interest rate future dropping to 350,000 lots in January.

Caramaschi said these were undoubtedly “tough times” but: “Client engagement was key during this time and all the feedback we got was important. Most said time is a great healer and we need confidence to come back to the UK markets before open interest will improve. This has been proved right as we are now back

Client engagement was key during this time and all the feedback we got was important

above 520,000 lots of open interest and growing. The ten year gilt futures market is definitely fixing itself with the help of our clients.”

Similarly, ICE SONIA trading volumes recovered in the early part of this year, as memories of the minibudget faded, and hit in March this year a monthly record for volumes, topping 10 million lots in a single month for the first time.

Caramaschi added: “What we see is in times of stress and, when capital becomes more expensive, is clients reallocating capital to the best opportunities. US rates and Euro rates are the largest, followed by sterling rates and, in 2022 and also early 2023, clients re-allocated their capital to trade euro rates, via our Euribor contracts and US rates, where they saw more opportunity to deploy their risk.”

While the UK rates book wobbled late last year, Caramaschi is right that

the ICE three month Euribor futures contract had a stand-out year in 2022, trading more than 20 million lots every month in the second half of the year (see Chart Two).

“Our Euribor futures and options had a strong 2022 with over 365 million lots traded, up 66% on 2021. 2023 is also proving to be another good year for our Euribor futures and options, especially in the futures where average daily volume (ADV) is up 10% year-to-date. We think Euribor is here to stay, and we want to continue to work with our clients to build liquidity.”

ICE’s strong Euribor franchise faces a challenge later this year when Deutsche Boerse’s Eurex relaunches its rival Euribor future backed by a revenue-sharing agreement aimed at investment banks, market-makers and other trading firms but Caramaschi declined to comment on this initiative.

She did, however, suggest there

has been a shift in emphasis in recent months as inflationary pressure has eased in Europe which bodes well for SONIA.

She said: “We are now potentially seeing the end to the US and Euro rates cycle. US markets are pricing in one more rate hike, in Europe another two, whereas in the UK markets were pricing another five rate hikes until recently, after the June inflation numbers that all changed and markets are pricing in another three, this could change again.

“Due to this uncertainty in UK rates, vs EU and US rates, we are seeing a lot more interest coming back into SONIA futures and options.”

SONIA futures and options broke their second record this year, after 1.37 million contracts were traded on May 24, ICE said.

Caramaschi continued: “This is the benefit of ICE as an exchange. ICE has positioned its rates business as a multi-

currency offering through Euribor, SARON, SOFR and SONIA, noting that the post zero interest rate policy years would likely see the return of monetary policy divergence.”

As well as SONIA and Euribor, ICE’s three month Swiss Average Rate Overnight (SARON) futures have done well this year, beating half a million lots traded in March and June (see Chart Three).

Caramaschi said: “SARON, which also went through a transition, is also doing very well with average daily volume up 123% year-to-date. We were the guinea pigs as the first exchange to go through a Libor transition with both SONIA and SARON. Credit goes to the rates team as it was a challenge which involved extensive client engagement, ensuring we have market-makers to build liquidity, support from back office and clearing, in addition to IT readiness.”

While Caramaschi is rightly

to this uncertainty in UK rates,

seeing a lot more interest coming back into SONIA futures and options.”

pleased with the progress of ICE’s SONIA, Euribor and SARON books, CME Group is currently winning the battle for the market of derivatives referencing the US Libor alternative,

the Secured Overnight Financing Rate (SOFR). CME launched its SOFR futures in May 2018, closely followed by ICE’s rival product in October that year.

But, for Caramaschi, her first year has been about one thing – securing ICE’s status as the British rates market while the future may see more innovation.

She said: “We are the home of the UK rates franchise, so the focus has been on SONIA in the months since my responsibilities expanded to our rates business. However, we want to expand our multi-currency offering. We still have more work to do to improve SONIA liquidity but we have come a long way. Euribor is doing well but there are opportunities to expand and improve our offering in Euro rates as well.”

One opportunity for ICE could be in Euro short-term rate (ESTR) futures but there are no immediate plans to promote that rate instead of Euribor so ICE is in no rush.

While the Truss mini-budget was the dominant event in UK rates, inflation has weighed heavily on equities

indices this year, restricting demand for hedging products like those offered by ICE.

Caramaschi said: “Equity Index Futures ADV in general are down by volumes across exchanges. Equity markets volatility has been coming off this year and we are close to pre-pandemic lows. It’s no surprise year-on-year ADVs comparisons are down as we are comparing a low volatility year with a high volatility environment last year.”

ICE Futures Europe has two equity index franchises: MSCI where it competes with Eurex and Hong Kong Exchanges and Clearing, and FTSE where ICE rivals Eurex again and, to a lesser extent, Singapore Exchange.

Caramaschi said: “If you’re looking at MSCI Futures open interest, there is a big pool of open interest in our market concentrated in MSCI Emerging Markets and MSCI EAFE (Europe, Australasia, and the Far East) Futures. If you look at traded volumes of global MSCI Futures, ICE has over

70% market share and that is because our MSCI Emerging Markets and MSCI EAFE Futures are established benchmark contracts which, based on notional open interest, are ranked in the top 10 index futures globally.”

A key theme in the equity derivatives market is offering environmental, social and governance (ESG) versions of the main blue-chip lists to allow institutional investors and pension funds to manage better their exposure to the underlying indices.

ICE, too, is working hard in this space. “When we made the decision to go into the ESG space, we decided not to go with “light touch” ESG but instead opt for the “greener indices”, so we started with the MSCI ESG Leaders Indices followed by the MSCI Climate Paris Aligned Indices. We are seeing good growth in our MSCI ESG and climate futures, volumes are up 24% year-to-date and notional open interest has exceeded $1.5billion (£1.2bn) up 51% year-on-year” said Caramaschi.

She continued: “ICE doesn’t just offer futures on ESG and climate indices, one of the many things ICE is proud about is we have been a global leader in environmental markets for nearly two decades. We offer the most liquid environmental markets, and our range of products are integral to valuing externalities and balancing the world’s finite carbon budget.”

Another important opportunity for equity index derivatives exchanges like ICE is offering products that are customiseable, enabling investors to take advantage of contracts that mirror more accurately their specific investments.

Caramaschi said: “We are also getting requests for more futures on customised ESG and Climate indices. We could have taken the stance that we are only going to list futures on one ESG variant and that is the only product clients can use but, at the moment, everyone has their own definition of ESG/climate, so we have to accommodate for this.

“So, if clients want a future on a bespoke index because it perfectly matches what they are benchmarked to, we are happy to list futures on it. A prime example is our recent launch of ICE MSCI Low Carbon Target Core Index futures, this was client led and we have already had trades in these contracts.”

There is a lot of talk about the prospects for ESG index derivatives but the truth is - trading of these products remains light compared with the parent contracts.

Caramaschi said it is “still early days” for ESG and climate fund futures but she is bullish: “Driving us is the demand that we are seeing from the Nordics and from North America, specifically Canada. There are asset managers who are mandated that if there is an ESG variant on an index, they must trade that so we want to ensure we can facilitate this business. At the end of the day, we are only here to provide risk management tools and, if there is client demand, we will deliver.”

ICE Futures Europe launched on June 26 futures on the FTSE 100 ESG Risk Adjusted Index and the FTSE All Share Risk Adjusted Index, new indices from FTSE Russell and the first ESG variants for the benchmark UK indices.

An interesting opportunity for ICE is its FTSE Total Return Future, the group’s first total return future launched in November last year, some 18 months after Eurex made available its own FTSE 100 TRF.

Caramaschi said: “It is more capital efficient to trade the FTSE TRF on our market because we have a huge pool of open interest in FTSE 100 futures and options which offers 90% offsets to the FTSE TRF positions. TRF are still a fairly new products so there’s an element of educating customers as to the benefits that they can get from trading on our market. We also have a fee holiday in our FTSE TRF that will last to the end of the year and we do not charge maintenance fees.”

Much has been made in the US

of the retail trading revolution that started in the COVID lockdowns and manifested into the meme stocks phenomenon, leading US exchanges such as CME to launch more smaller versions of their flagship contracts aimed at retail traders.

But Caramaschi is sceptical whether those types of products make as much sense in Europe. She said: “We had a mini-FTSE future many years ago which was largely targeted at retail and it didn’t really trade. We have to ask: “If we list a micro future on say the FTSE 100, are we going to get new business or are we fragmenting liquidity in an established product? The last thing we want is to fragment

liquidity?”.

She added: “There are some successful micro futures, mainly in the US, but most outside the US are currently just churning volumes with no meaningful open interest growth. Is this adding value to the market? We are watching the micro futures space closely but at the moment I don’t think there is real demand for a micro future on the FTSE 100 Index, however if this changes we are always willing to accommodate.”

Caramaschi’s second year in the role will surely be less fraught than her first but she will busy, managing the various challenges and opportunities faced by two of ICE’s core markets.

The FX market, a long-standing leader in terms of electronification, needs a technical overhaul and the LSE Group (LSEG) plans to put itself at the vanguard of that market structure change.

The firm created a behemoth after the British group sealed its $27 billion (£21bn) takeover of data and tech firm Refinitiv from Thomson Reuters in early 2021. The move launched LSEG into a position as the largest exchange by market share last year, with 18% of total exchange industry revenue, according to figures from consultancy Burton Taylor. Behind the headline noise around the landmark deal was an intriguing challenge for the firm – how to bring together disparate but market leading elements of its FX business into one compelling solution for clients.

With the acquisition, LSEG had two leading FX trade venues - FXall, a preeminent electronic aggregator, and Refinitiv Matching - designated by the Bank for International Settlements as one of only two “primary venues” running central limit order books for the FX market (the other being CME Group’s EBS). LSEG’s LCH, the clearing house bought in 2013, also

has a dedicated FX clearing division called ForexClear. Those elements can be brought together to reflect and drive changing execution trends in the market, according to Neill Penney, group head of FX at LSEG.

“Our vision is to have one FX platform that serves not just all current our venues but all types of execution paradigms in the FX market - from Central Limit Order Book (CLOB), to secondary Electronic Communication Networks (ECNs), to streaming liquidity and to Request For Quote (RFQ) protocol trading,” Penney told Global Investor. “We want to build that platform on a state-of-the-art technology stack, with a common set of services, including credit management, regulatory reporting and straightthrough-processing analytics. That’s the way our customers will get the best experience; they connect once into our full set of venues and everything is then available for them in a consistent way.”

The technical work alone has been quite an undertaking. After the acquisition, the firm announced plans to migrate FXall, the leading primary ECN for dealer-to-client activity, and FX Matching, its interdealer market, to the Millennium technology platform

LSEG uses for equity trading. The upgrade and revamp for Matching is expected to make the platform 10 times faster, according to LSEG chief executive David Schwimmer on an April earnings call.

“Coming into LSEG has been transformational for our FX business,” Penney said. “LSEG has extensive experience of running key market infrastructures on standardised technology. On the FX side, we’ve embarked on a multi-year project to move everything onto that single platform. This will enable us to create a unique and integrated offering in the FX space. We started the work shortly after the acquisition closed, and the first customer rollout will be the launch of our NDF matching platform in Singapore later this year.”

The non-deliverable forward (NDF) Matching venue in Singapore, the group’s first Asia hub, was first announced in May last year, and is set to launch in the middle of the fourth quarter of this year.

For Penney, a key differentiator is the relationship with the LSE clearing house. FXall already has a link with LCH’s ForexClear, which has carved out a niche with NDF clearing over the last decade. ForexClear’s most cleared currencies are all emerging market pairs, with an emphasis on Asia.

“We believe we already have the largest network of professional bank users in the FX market,” Penney said. “40% of those are based in Asia. That’s particularly relevant for our NDF platform with Asia being the main hub for NDF trading, and more generally for the future as FX markets expand Eastward.

What has been transformational for the FX businesses is coming into the LSEG which already runs key market infrastructures on one technical platform

Neill Penney, LSEG

“We’re launching a venue close to where our customers are, and building a capability that works well for both automated and manual trading. Support for manual trading is especially important; in this day and age, when somebody puts an order into a system manually, it’s an important order. It creates valuable order flow that in turn will attract more orders onto the venue.”

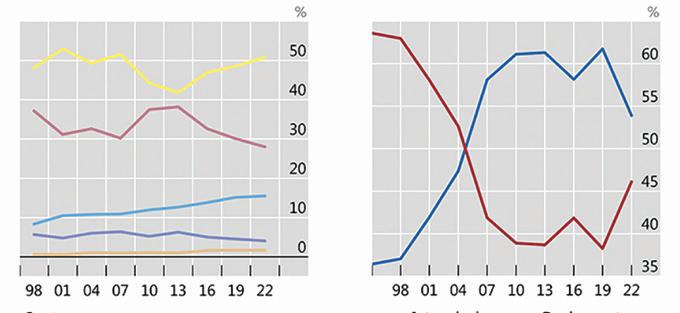

That shift is important as the nature of FX market behaviour has shifted. The latest BIS Triennial figures showed an increase in the share of FX trading using swaps versus a declining spot market, and a shift toward parity between interdealer and the traditionally larger dealer

to customer liquidity pools (see chart).

The figures reflected a highly volatile market environment last year, and the BIS also noted that more trading (relatively speaking) is taking place bilaterally.

LSEG can play a role in reversing that trend, and the NDF platform will be followed by the addition of spot and forward matching in the venue from the middle of next year. In that sense, the first launch will be a technical use case that allows customers to engage with the functionality.

“The second thing the launch of NDF Matching will do is showcase the increased ability we have to innovate as we migrate to newer technology,”

Penney said. “Building clearing deeply into the heart of the NDF matching engine is a true innovation, and we’ll be doing this on a platform where latency, capacity and performance is an order of magnitude better than anything we have now.

“The release will also act as a proving ground for users before we move the main Spot and Forward matching engines across to the new technology. Migrations are a lot of work for clients – and involve operational risk –therefore the opportunity to approach the migration of these key venues via the launch of a new venue provides an incremental route that has been welcomed by them.”

Ultimately our goal is to build that on one state-of-the-art platform, with a common set of all the things that sit around that functionality – including credit management, regulatory reporting and straight-through processing analytics

Neill Penney, LSEG

Instead of getting tied up in delivery dates, LSEG is looking to prepare the market for the additional functionality as it comes on board. That will also be informed by its deep experience in the space. For example, FXall will have another tilt at creating a secondary ECN within its platform.

“In setting the timeline for the Spot and Forwards Matching migration, our priority is to make sure the FX industry is ready for the move, rather than to hit a pre-set date,” Penney adds. “Beyond these initial phases, our next step is to leverage some of the agility we believe the new platform will provide. Initially, we’ll do that by launching a secondary ECN. It will provide customers with a valuable supplement to our Primary Market offering. It’s something

we’re excited to reintroduce as the technology in the old FXall Order Book is no longer able to keep up with market requirements. The final piece of this very ambitious initiative is to move the FXall RFQ engine, likely in 2025.”

The other advantage LSEG has is its terminal and desktop business, with functionality embedded within its Workspace offering creating a network and allowing more innovation.

That has come with opportunities to enhance the growing bilateral market identified by the BIS, with enriched functionality that taps into its existing trading functionality, such as its FX Trading desktop portal that allows messaging and matching. Those streams have recently been brought together in a service called Advanced Dealing.

“That human element – the need to support manual trading – is an equally important part of our strategy to supporting automated electronic trading,” he said. “Our Dealing network connects interbank traders in every FX dealing room in the world. As part of our FX investments, we’ve built a next generation version of Dealing, appropriately called Advanced Dealing. This is part of our new desktop offering, Workspace. The design goal of Advanced Dealing was to set it up for the next generation of users and banks, without losing what made it special in the first place – the capability for human traders to connect globally, and efficiently execute any type of FX trade, whatever the size or currency. This capability remains extremely valuable to the market, whatever the level of automation with more liquid trades.

“Emerging Markets are a good usecase, and in fact the first trade on the new system involved a counterparty in Nepal. But we also wanted to modernize. This means enabling API usage, so institutions can provide

Source: Burton Taylor estimates

LSEG leads the industry regarding market share, with ICE next.

Migrations typically are a lot of work for clients, so the ability to launch new venues with any specific onboarding requirements represents a much more convenient and less risky approach

automated support to augment the salesperson or trader. For example, by attaching a ‘bot’.”

Integrating and updating user workflows essentially means simplifying the user experience, and LSEG is in the process of allowing traders on LSE majority-owned fixed income venue Tradeweb to simply complete related FX trades in a window within the Tradeweb platform. The hedging solution, first announced in June last year, links emerging market bond trades to hedging needs in currency swap markets.

“If you’re an EMS provider whose core business is serving advanced execution needs for equity or fixed income traders, the cost of supporting FX execution as a secondary asset class is becoming increasingly unappealing as the complexity rises,” he added. “Part of our vision with our new FX venues is to enable them to become an alternative for EMS providers looking to provide FX offerings to their customers. Essentially, for these providers to see our FX venues as an attractive ‘manufacturing component’.

“We have been pleased by the level of interest across the industry to this approach and are excited by the partnership opportunities ahead. It’s an opportunity to provide customers with an improved FX execution experience and enable the EMS providers to devote more of their development budgets to their core equity or fixed income execution functionality.”

A similar effort is underway to link analytics functionality in TORA –the multi-asset class cloud analytics provider LSEG bought in February last year – to its FX liquidity directly through the network.

“The other way we think about

partnerships is to enable customers to combine our platform with specialist capabilities they have purchased from other vendors,” he said. “We want to simplify connectivity, such as messaging flows, and streamline the user interface experience. I see this as a growing focus for us in the future once our initial technology modernisation is complete.”

Going back to that huge change in the firm’s position in the overall exchange revenue landscape after the acquisition, Penney sees all of these initiatives combining to create a roadmap for where the company is looking to go.

“The evolution of the role of execution platforms within the overall market structure has been at the heart of our thinking,” he said. “What is exciting

for me is that at LSEG, we have such a wide range of ingredients available to respond to customer needs. Across the company, we have execution venues, clearing capabilities, STP networks, execution workflow tools, multi-asset EMS’s, a new desktop product, and of course extensive market data.

“It enables us to think about solutions that wouldn’t be possible without all those pieces. Our cleared NDF Matching venue is a good example of this – its new for the industry, and the seamless integration between execution and clearing enables us to deliver the maximum possible benefits to our customers. This approach is something I see being replicated in other product areas because it enables us to help move the industry beyond its current level of technological advancement.”

The evolution of the role of exchanges within the overall market structure has been key to our thinking, and what I think is very exciting for LSEG is we have venues, exchanges and market data as well as the post trade side of the business

macroeconomic events. The utility of these options has led to the explosive growth we’ve seen in volumes. That growth is not only coming from the short-dated or 0DTE options bucket, but across the SPX complex as a whole. Even on record days, we have not seen shifts in the volume ratios between 0DTE and the rest of the SPX flow. For example, on March 10 this year, we saw record volumes in SPX but 0DTE trading only accounted for 41% of all SPX volume that day.”

By Radi KhasawnehCboe Global Markets has a long track record of firsts – from index options through volatility trading to listed crypto contracts. At the end of last year, the Chicago-based exchange group took a fresh approach by bringing together a dedicated team in a formal innovation hub.

Global Investor talked to Rob Hocking, global head of product innovation and the person in charge of shepherding development at Cboe Labs. Cboe is in its fiftieth year and Hocking has been a member and trading permit holder of Cboe options exchange for nearly twenty of them. Trading behaviour in the options market has changed significantly in that period, and that shift is only accelerating. The exchange’s flagship S&P 500 (SPX) index options product suite has gone from strength to strength and has ridden the wider wave of US equity index options growth, but it is the users and their needs that represent the most dramatic changes.

Back in May, Cboe chairman and chief

executive Ed Tilly opened his results call welcoming record performance, driven by a 28% growth in options revenue across its four venues. Nearly 43% of its first quarter SPX volume was made up of zero-day-to-expiry (0DTE) options or single day options, more than double where they were two years ago. The strength and persistence of that flow has caused a lot of debate in the market, but it’s clear from rival exchanges the trend has now accelerated across asset classes. People want to trade with more frequency and flexibility, and that makes sense to Hocking.

“Over the past two decades, there has been continued customer demand for the ability to trade with greater precision around market events,” Hocking said. “What we have seen is the culmination of that process with the growth of daily or 0DTE options, which have been available before, but wasn’t as robust of a product set as we have now.

“With daily-expiring options available today, it is possible for investors to accurately and more costeffectively reduce volatility around

In March 2020, amid the trading frenzy around the Covid pandemic, there was a boom in equity trading across platforms – driven by retail flow that came to be known as the “memestock” phenomenon. Commentators tended to lump that together with the increase in shorter dated activity in options, particularly in equity markets but Cboe believes the truth is more nuanced.

“An interesting point that bears that out is the very balanced mix of users we have, where customers make up approximately 41% of the volume, firms are 8% and market-makers or liquidity providers comprise the remaining 51%,” Hocking added. “If we focus on the customer capacity, as of July, about 75% of all SPX customer volume originated from retail broker platforms. If we only look at 0DTE, that number jumps to around 90%.

“It’s important to note that order flow is coming from what we’re calling retail broker platforms, which does not necessarily mean retail or an individual investor. As we can’t see where these orders originate, we can only make an educated guess around exactly how that

breaks down. What I can say is that the feedback has all been positive, and we continue to hear from a diverse group across institutions, systematic algo traders, registered investment advisors (RIAs), even larger retail investors that are engaging in different 0DTE strategies. It’s this broad and diverse user base that’s creating the robust and liquid market that we have today.”

That is only just beginning as the pool of players widens out and people begin to test the waters of what is possible in this new environment.

“Even large volatility players on the street, who have become active in these contracts, say the growth of 0DTE has led to one of the biggest shifts in how they’re managing risk, and changing the way they trade volatility,” Hocking added. “We’re really excited about the continued growth that we believe we will see. More and more industry participants are asking for our open/ close data source to back-test shortdated options trading strategies, and seeing how they can bring that liquidity pool into their existing execution playbook.

“Some firms are still in the early stages of figuring out how they can best use these tools today, and we see potential for continued growth and adoption over time.”

Where a systematic trader is using an overwriting strategy (selling protection where they see options are overpriced), the more exercise windows the trader can cycle through, the more opportunities they have to maximize the profitability of the strategy.

And even traditional indicators of a one-way market (such as the put-tocall ratio) point to a healthy ecosystem, counteracting the hyperbolic commentary that has sometimes attended the growth figures it has seen.

“So far, the vast majority of those strategies are defined risk trades, with what you might call limited downside,” Hocking said. “That would be the selling of spreads and buying of outright options across a wide range of strikes. What that does is limit

concentration risk. As of July, 41% of all SPX and 0DTE trades were spreads. The balance were single-leg option orders, with the vast majority originating as buy or long orders. So that is limited risk and defined outcome trades, and the best way we can show that is that the balance of put/call ratios is typically around one to one in 0DTE. This is really much, much lower than the historical 1.5 to one put/call ratio that we’ve seen in SPX. We also see momentum trades, or trades serving a particular purpose – whether that’s trying to capture premium or yield overlay position.”

All of that is important because it forms the genesis of a significant recent move shepherded by the product

innovation team at Cboe – the creation of the one-day VIX (VIX1D) index in April. Its original Volatility Index (VIX) launched in April 1993, providing a measure for 30-day implied volatilitybased S&P100 options prices (switching to SPX in 2003). The measure became widely used by the market and led to the launch of futures and then options on the VIX in 2004 and 2008.

On the index side, Cboe added threemonth, six-month and one forward implied numbers, and created a nineday VIX in 2018. One thing none of those capture sufficiently is short-dated options to reflect that new trading flow. The 30-day calculation methodology for example only takes into account options that expire in the 23 to 37 day range.

“The VIX1D was created to answer customer demand for a volatility measure that captures trading in short-term contracts.” Hocking added: “That to us was a natural next step and expansion of the VIX Index suite. The other indexes just weren’t designed to capture extremely short-term signals. So, the intention was to provide a tool that would help market participants make more informed decisions around positioning and timing of their trades given the evolution of the market.”

The new index saw some wild swings just after launch, demonstrating the difference with the other measures and prompting some to ask whether there would be derivatives launched.

“We have no immediate plans to make VIX1D tradeable – nor to launch a product directly on this index,” Hocking commented. “That said, our process for product innovation always begins with first understanding our customers’ needs. So, while there was a clear rationale for launching the VIX1D index, we continue to take the time to educate market participants and make sure everyone knows how it works. Let the marketplace digest it, model it, and really understand it so that in turn, they can provide the necessary feedback to guide us in delivering the right tradable product. We’re in that process right now.”

Even large volatility players on the street, who have become active in these contracts, say the growth of 0DTE has led to one of the biggest shifts in how they’re managing risk, and changing the way they trade volatility

Rob Hocking, Cboe

That collaborative approach is core to what Cboe is doing with its innovation hub. The history of such teams goes back to the fabled “skunk works” division at Lockheed Martin. There have been many research and development focussed divisions at investment banks and technology firms. Creating a space dedicated to innovation is nothing new, but what differentiates this latest iteration by Cboe is that it aims to give users a voice at the start of the design process.

“We have a rich history of innovation as an exchange, but what remains a challenge in the innovation process is knowing where to start,” Hocking said. “With the introduction of Cboe Labs, we have a dedicated team centred on the creation, development, and implementation of new ideas. It’s a touchpoint for the industry to come when firms are looking to create something new. We strive to take a customer-driven approach when looking at these new ideas. Nobody knows how to evolve a product, or the need for a product, better than those using them to manage risk. The differentiator for Cboe is that as the exchange platform, we’re uniquely positioned as a neutral partner. We

operate a global platform in 26 markets around the world and have industryleading expertise in developing and supporting tradable products.

“Many innovation hubs are also very internally focused, so you don’t get access to them as an outsider. That’s where we want to go 180 degrees in the opposite direction. We want to work with the market. We want to be the first call for everyone when they have ideas to improve that risk transfer process, that customer experience and we are fully committed to supporting our clients. In that sense, what we have created is a resource for the industry.”

First on the horizon are dispersion strategies, a version of volatility trading that involves taking a position on an index through the option, and taking a series of opposite direction on the components. For example, you could sell volatility on an index and use atthe money-straddles to buy volatility in the individual names. This makes for a cumbersome trading flow which in turn can create barriers to entry.

“We hope that the new Cboe S&P 500 Dispersion Index – and subsequent futures that we plan to launch on it –will do the same thing for one-month implied dispersion as we’ve done with

the VIX Index and futures and options for trading volatility: take a very complex strategy and simplify it into an index that can be used as a benchmark, and then eventually tradeable as a simple contract,” he said. “It fits our playbook of innovating with the end goal of breaking down access barriers, and making complex strategies more accessible, efficient and easier to trade for all investors.”

In June, the Commodity Futures Trading Commission approved Cboe Clear Digital to offer margined crypto futures in a significant step for the firm. This capped the US exchange’s re-entry into the crypto market after forming Cboe Digital in May last year based on Cboe’s acquisition of US crypto market ErisX. That is one area where further collaborations could reap benefits for the firm.

“We are excited about some of the various initiatives that we’re working on at Cboe Labs. We hope to bring something to market in the not-toodistant future, hopefully before yearend. Again, that will very much be driven by customer feedback,” Hocking said. “We certainly have some ideas that we’re back testing – and going through all of the data collection around that.”

Clear Street has applied to the US futures regulator for approval to launch a futures clearing broker next year focused on the main US and then European markets, part of the ambitious US firm’s plan to develop a multi-asset prime broking service.

New York-based Clear Street has applied to the National Futures Association (NFA) for permission to launch a futures commission merchant (FCM) and start offering futures clearing services to trading firms.

The application has emerged ten days after Clear Street acquired React Consulting Services and detailed its plan to integrate React’s flagship platform BASIS into its own infrastructure and use that to offer futures clearing.

Andy Volz, the chief operating officer of Clear Street, told Global Investor: “To date, we’ve only been a US equity and option firm. That was until a month ago when we launched fixed income. So we have built the platform on US equities and options, we have made it scalable and flexible enough to handle new asset classes and we are now adding new asset classes with fixed income, futures and, after that, international.”

He continued: “We will work to transition the BASIS platform into Clear Street and our underlying systems so BASIS will be fully integrated as the futures clearing component of our FCM build which is also currently going through FCM approval with the NFA.”

Clear Street, which raised in April $435m (£331m) in a Series B funding round which values the company at $2bn, is a technology firm that has until now developed its own systems but the React deal was attractive

partly because it will reduce Clear Street’s time to market.

Volz said: “On the regulatory side, obviously we are at their discretion, but we would like to be transacting business by early next year, which is as much about the technology integration as the approval.”

The Clear Street COO added: “In terms of the markets we will offer, we are looking at all of the major US futures exchanges and a few in the UK and Europe. We hope the integration of the futures exchanges will begin early next year. Ultimately, we aim to be a broad-based FCM and hope to be able to move quickly in our addition of exchanges.”

Volz said the firm has identified what he calls “an underserved client base” which has emerged in recent years as some banks have quit prime broking.

He said: “In addition to the banks that have pulled out, there are others that have pulled back to service only

the top 100-200 hedge funds, leaving everything below that - from the startups to the $500m and $1bn dollar hedge funds - really underserved.”

Volz believes banks are struggling to make prime pay due to outdated technology and regulation that requires banks in particular to set aside capital against risky client assets sitting on their books.

He added: “A lot of the equity long/ short hedge funds were asking us for fixed income so we have delivered that and they were also asking us for futures. Hedge funds in London have also been asking us to move into that market because they have had a bigger drain on the number of providers than even the US has.”

Credit Suisse started to close down its prime broking arm in late 2021 citing losses from the Archegos default and Deutsche Bank completed in early 2022 the transfer of its prime finance division to BNP Paribas.

Volz said the integration of the React Consulting Services technology is the next key step before moving outside of its home market.

He said: “Once BASIS is integrated, we will have US equities and options, fixed income including corporates, convertibles, treasuries and futures, but we still want to expand globally so that will be our next push. We don’t do anything today outside the US. The plan is to expand to the UK and Europe first, then Asia, and other developed and emerging markets.”

The prospect of a new futures clearing broker is interesting because the number of US-registered FCMs has dropped significantly in recent years from over 190 firms before the 2008 financial crisis to just 59 in July 2023, according to data from trade body the FIA.

Brent has been the international crude oil benchmark for decades but a recent change to the make-up of the North Sea barrel will likely affect how firms trade and hedge the commodity.

Commodity index firms Platts and Argus added on May 2 West Texas Intermediate (WTI) Midland to the basket of crude oils used to calculate Brent for deliveries dated June 2023, the first time a US barrel has contributed to the European benchmark.

This decision is not particularly controversial, and came after two years’ of consultation by the index firms that involved the world’s top oil producers, users and traders.

The problem is the North Sea fields that were being used exclusively to calculate the price of Brent have been drying up for decades, raising questions about the long-term viability of Brent as the international standard.

The inclusion of WTI Midland, a seaborne light sweet crude similar to Brent, is a neat solution then, as US crude exports have increased over recent years and particularly in the past 18 months as Europe has cut its reliance on Russian energy.

Joel Hanley, global director of Crude & Fuel Oil Markets at S&P Global Commodity Insights, said: “The addition of WTI Midland, the first nonNorth-Sea oil into the Brent complex marks an important milestone in the

more than 35-year history of the Platts Dated Brent benchmark.

“Dated Brent has long been the marketplace’s chosen global yardstick against which other grades of oil are measured. Its continued evolution to reflect six crude grades shows its ability to adapt to changing market fundamentals and serve global markets well into the future.”

More controversial than the decision to change the make-up of Brent, however, is what it means for trading flows in the coming months and years.

Intercontinental Exchange’s ICE Futures Europe is home to the Brent crude oil futures contract which traded 19.6 million lots in April, according to that group. ICE Futures Europe, based in London, also has a smaller WTI market, including a physicallydelivered WTI Midland contract underpinned by 4 million barrels of supply capacity into two terminals.

Joel Hanley, S&P Global Commodity InsightsThe New York Mercantile Exchange, part of CME Group, is the main market for the WTI Cushing crude barrel, the US standard that traded over 15 million lots in April, according to the exchange.

The addition of WTI Midland, the first non-North-Sea oil into the Brent complex marks an important milestone in the more than 35-year history of the Platts Dated Brent benchmark

NYMEX also has a cash-settled WTI Midland contract, various Brent crude oil products and spreads between Brent, WTI Midland and other WTI products.

Interestingly, both firms have reported increased demand for their oil products in recent months.

Intercontinental Exchange said in late May open interest in its Brent crude oil futures and options is up 32% this year to over 5 million lots and average daily trading volume in the European crude benchmark is now 1.2 million contracts.

CME Group said at the same time open interest in its futures linked to the US WTI benchmark passed 500,000 contracts for the first time on Friday May 19.

The Chicago-based group also said open interest in its Argus contracts has increased almost 50% this year as the market has prepared for the inclusion of the WTI Midland barrel in the Dated Brent complex.

Jeff Barbuto, global head of oil markets at ICE, said the inclusion of WTI Midland in the Brent complex has given the North Sea standard a new lease of life: “We are bullish about this development which comes after several years of consultation by Platts and ICE to ensure that we understood correctly the market feedback. Now we are up and running, and Midland cargos are being delivered into dated Brent, Brent now has more than double the physical capacity underlying the derivatives contract based on an extra million or so extra barrels of WTI Midland, which is ultimately good for Brent.”

He added: “Brent has been evolving for decades and it is clear that Brent has retained its global benchmark status as a waterborne crude with ample supply and natural outlets to anywhere in the world.”

Peter Keavey, managing director, global head of energy and environmental products at CME Group, agrees the Brent change is timely: “When Brent had a reduced underlying physical capacity, something had to be

done to make Brent more robust but I would tend not to draw any major conclusions at this stage because most of what is happening is a validation of the pattern of the last few years.

“Imports of WTI into Europe did not start this month, rather they have been ongoing for years. The Price Reporting Agencies (PRAs) will tell you that WTI sets the incremental price the majority of the time so this just validates what is already happening,” Keavey added.

CME said traders have reacted to the Brent change by trading more WTI products generally, so that is WTI Cushing, the US domestic barrel, and the WTI Midland.

Keavey said: “Average daily volume and open interest have grown both in the underlying WTI Cushing global benchmark but also in the Gulf Coast trade. We have two major financiallybased Argus Gulf Coast crude contracts - WTI Midland and WTI Houston. We launched those in 2018 when the pricing of US exports became much more important.”

He added: “They were stable for several years but they have grown significantly over the last six months to the extent that they have now passed 500,000 lots of open interest. That means the third largest crude oil trading market in the world today is the US Gulf Coast.”

Barbuto says ICE Brent has taken a small market share from WTI Cushing this year: “If we look at the market share statistics, Brent’s market share compared to WTI Cushing has increased from about 50% at the end of last year to 56% in May, reflecting the clear move away from WTI Cushing

towards Brent.”

ICE’s global head of oil markets is also keen to stress that it is WTI Midland not WTI Cushing that delivers into the Brent barrel. “When we talk about WTI, most people think of WTI Cushing which is a blend of domestic crude grades delivered into Cushing, Oklahoma. What is being delivered here is WTI Midland which is a very different, light sweet crude delivered directly from Midland, Texas in the Permian Basin to the USGC for either export or to domestic refineries.”

Barbuto said ICE is seeing more firms taking physical delivery through the ICE Midland WTI (HOU) contract as well as an increase in the use of Exchange for Physicals.

Keavey said the change to Brent solidifies the US’ status “not just as a major exporter but also as the freely traded marginal pricing barrel”. He added: “This is a developing market. This change is new but it has been talked about for a long time. The most obvious outcome is that it positions WTI as the price-setting physical and financial grade for crude.”

The CME Group global head of energy and environmental products concludes by suggesting the Brent change has attracted more attention because of global macro-economic factors. “There is an enormous amount of interest today because there are geopolitical concerns, in Europe for example, as well as economic concerns out of Asia so there has been an increase in macro-event management tools such as short-term options, which are our fastest growing product,” Keavey said.

Brent has been evolving for decades and it is clear that Brent has retained its global benchmark status as a waterborne crude with ample supply and natural outlets to anywhere in the world

Jeff Barbuto, ICE

Eurex’s short-term interest rate (STIR) derivatives push at the end of the year should help accelerate the European exchange’s recent momentum in the euro short term rate (€STR) futures market, the Deutsche Boerse-owned venue has said.

Speaking to Global Investor as the firm launched the new STIRs program, which opened for early registrations in June, the firm’s global head of fixed income and currencies product development said the initiative was a natural next step as Eurex sees momentum growing in the three-month €STR future launched by the Frankfurtbased exchange early this year. Volume data covering May show that there were 3,838 contracts traded in the month, compared to 192 lots in the month before.

“It made perfect sense for us to extend and expand the product base with the STIR partnership program,” Lee Bartholomew said in an interview. “The launch of €STR futures was a natural extension and the first step in getting to this point. €STR volumes in the last couple of sessions have been trending above a thousand contracts a day which is a real sign of positive momentum. We have a healthy number of liquidity providers, and we are grateful for their support.

“What we have done is create a framework where all the stakeholders can benefit from the development of this liquidity pool, and that is something that is always core to what we do when taking the decision to launch new markets. This announcement will help us accelerate that development as we go into the end of the year.”

A key part of the new partnership program will be the integration of its

STIR product suite – which includes listed Euribor contracts, with Eurex’s existing over-the-counter interest rate swap, repo and long-term interest rate complex (covering longer term government bonds).

The combined margin pool of fixed income instruments cleared by the German clearing house was €70 billion euros (£60bn) on June 1, according to Eurex estimates given in a presentation published on its website. The derivatives exchange expects to finalise details of the new program in the fourth quarter, when it will “relaunch” its Euribor STIR contracts with on screen liquidity and execution support for clients, it says.

“Extending that in a meaningful way to Euribor futures and options is also a key component, and it gives clients a very strong value proposition when they are looking at where to place their liquidity,” Bartholomew added.

“The STIR partnership program will be wrapped within the legal framework of the existing program, and we will finalise the details on the cornerstones of that offering with our key design partners as we go through the process.

“While we have existing listed Euribor contracts, at relaunch clients will have active lit markets with committed liquidity support. In combination with the €STR product suite, that will mean that we will then have the ability to then develop things like inter-product

spreads and TED spreads. That will only enhance the product offering that we have.”

Having opened the registration on Monday, Eurex has given stakeholders until the end of July to be in the “early registration” cohort, and the process will include feedback on possible changes to the contracts.

“As we are doing our assessment and working with the market, of course we will look at things like functionality within the existing markets, and if there are changes that we feel are required for the benefit of the broader market then we will have that flexibility to execute on that,” he said.

BNP Paribas, Deutsche Bank, Goldman Sachs, J.P. Morgan and LBBW are backing the move by Eurex into European STIRs, a market dominated by Intercontinental Exchange’s Londonbased venue.

Eurex Clearing said the banks are backing its plan to extend its partnership programme for interest rate swaps, which incentivises banks to clear their swaps with Eurex’s clearing house, to cover for the first time European shortterm interest rates.

Eurex Clearing plans to cross-margin the STIR derivatives against the longerdated European derivatives (where the German exchange is strong) and Eurex’s growing interest rates swaps (IRS) clearing book.

The launch of €STR futures was a natural extension and the first step in getting to this point. €STR volumes in the last couple of sessions have been trending above a thousand contracts a day which is a real sign of positive momentum

Global Investor held their inaugural ESG Roundtable in June. It was moderated by Roy Zimmerhansl who led an engaging discussion with the diverse panel on ESG integration in portfolios to regulation to practical implications and much more. Each section features the complete video along with a concise transcript for you to peruse.

Roy Zimmerhansl (RZ): Thanks everyone for participating in the 2023 ESG roundtable, which is hosted by Global Investor, so appreciate your time and contribution here. I thought it might be just useful for everyone to really start from their opening position. How do you view ESG generally, and how does it fit into securities finance? So I’m wondering, Jane, maybe we can start with you.

Jane Wadia (JW): Sure. I mean, I guess my perspective is that every player or actor within the financing value chain has a role to play. So everybody from the asset owners to the asset managers to securities finance. They can each contribute to this journey that we’re on to create a more sustainable economy.

Donia Rouigueb (DR): I fully agree with that. I think that we get a call for action today and securities finance is definitely one of the industries that has to answer that with concrete solutions for the final investors and this is a very, very important topic for everyone.

Harpreet Bains (HB): Securities lending is not a sustainable product in its own right, but it plays an important role in supporting the capital market ecosystem, which is key to the success of the broader sustainable agenda. However direct ESG objectives are an increasing feature of our

PARTICIPANTS:

clients’ strategies, and in order to maintain consistency and alignment across their investment activities and prevent an undermining of their overall ESG strategy, they are assessing for where aspects of the securities financing flow are crossing over with their ESG objectives. The journey doesn’t look the same across all lenders and also varies in terms of progress made so far. It really is an individual lens.

RZ: Maybe you can talk to us about sort of the considerations that go into constructing a portfolio and how you approach that.

JW: Sure, I mean, that multiple different ways that we incorporate ESG or sustainability in some portfolios that are managed, I think what has become relatively mainstream today, at least here in Europe, is where investment managers such as ourselves, are incorporating ESG information to help meet their investment decisions historically. We have looked at valuations and equities, and credit worthiness in bonds, and today, we’re adding more information about the E, S or G of a particular company to help us inform whether we want to hold or not a certain security increasingly however, what we’re seeing is the shift from that to now also looking