www.globalbankingandfinance.com Issue 51 Austria’s Kathrein Privatbank: CHOM CAPITAL: Integrating Sustainability Into Every Stage of the Investment Process Continuing to Apply the Personal Approach in its 99th Year

Chairman and CEO

Varun Sash

Editor Wanda Rich email: wrich@gbafmag.com

Head of Distribution & Production

Robert Mathew

Project Managers

Megan Sash, Amanda Walker

Video Production and Journalist

Phil Fothergill

Graphic Designer

Jessica Weisman-Pitts

Client & Accounts Manager

Chanel Roberts

Business Consultants

Rick Saikia, Monika Umakanth, Stefy Abraham,

Business Analysts

Samuel Joseph, Dave D’Costa

Advertising Phone: +44 (0) 208 144 3511 marketing@gbafmag.com

GBAF Publications, LTD

Alpha House

100 Borough High Street London, SE1 1LB

United Kingdom

Global Banking & Finance Review is the trading name of GBAF Publications

LTD

Company Registration Number: 7403411

VAT Number: GB 112 5966 21 ISSN 2396-717X.

The information contained in this publication has been obtained from sources the publishers believe to be correct. The publisher wishes to stress that the information contained herein may be subject to varying international, federal, state and/or local laws or regulations.

The purchaser or reader of this publication assumes all responsibility for the use of these materials and information. However, the publisher assumes no responsibility for errors, omissions, or contrary interpretations of the subject matter contained herein no legal liability can be accepted for any errors. No part of this publication may be reproduced without the prior consent of the publisher

editor FROM THE

Dear Readers’

Founded by Carl Kathrein in 1924, Kathrein Privatbank is one of the leading private banks in Austria, offering customised investment advice, asset management, financing and consulting to families, entrepreneurs and foundations. Since joining Kathrein Privatbank as CEO in May 2019, Wilhelm, together with his team, has been responsible for the successful implementation of its ambitious growth strategy. When we spoke, he filled me in on how Kathrein Privatbank is prepared to help clients navigate the most difficult challenges being faced in the current financial climate. (Page 24)

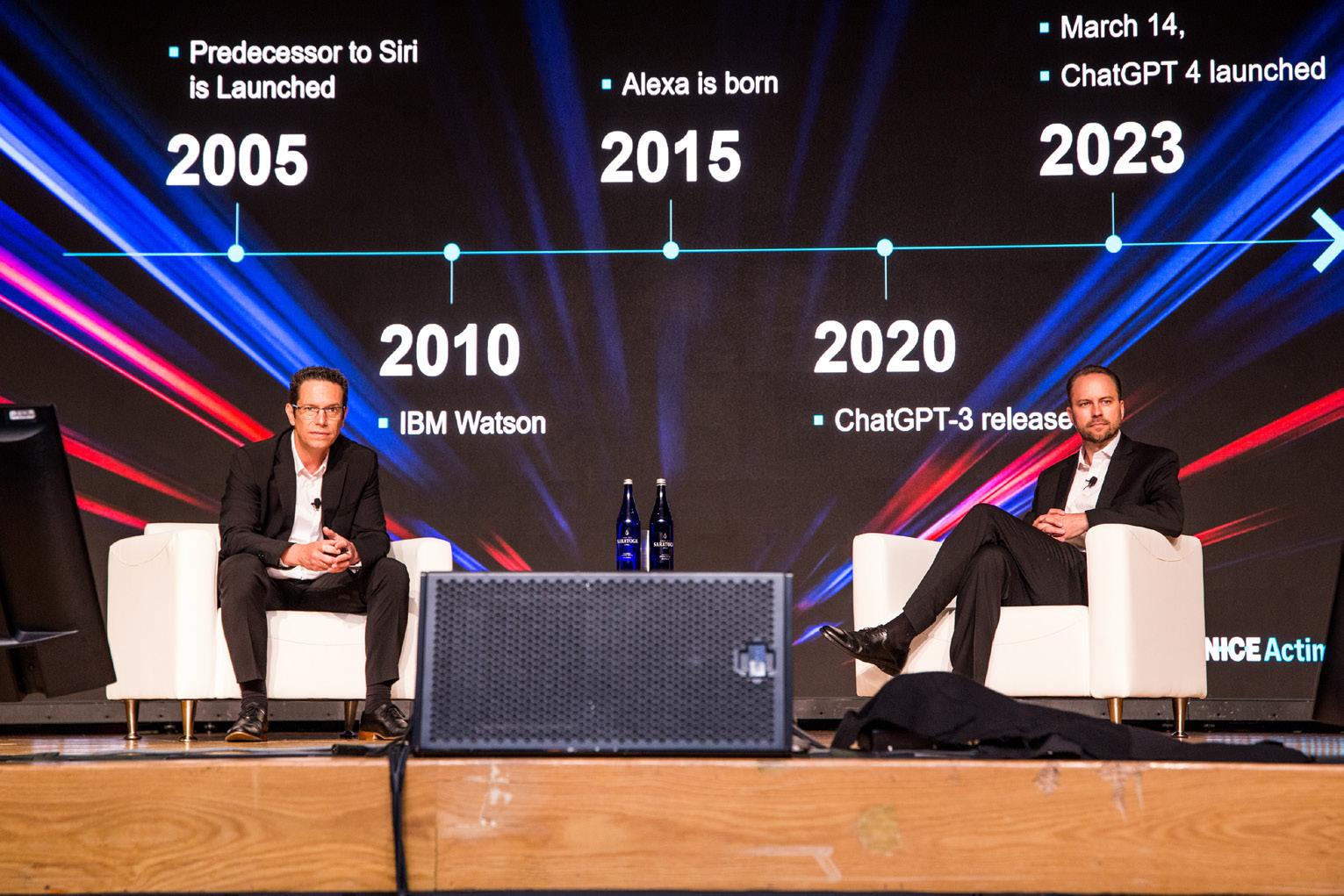

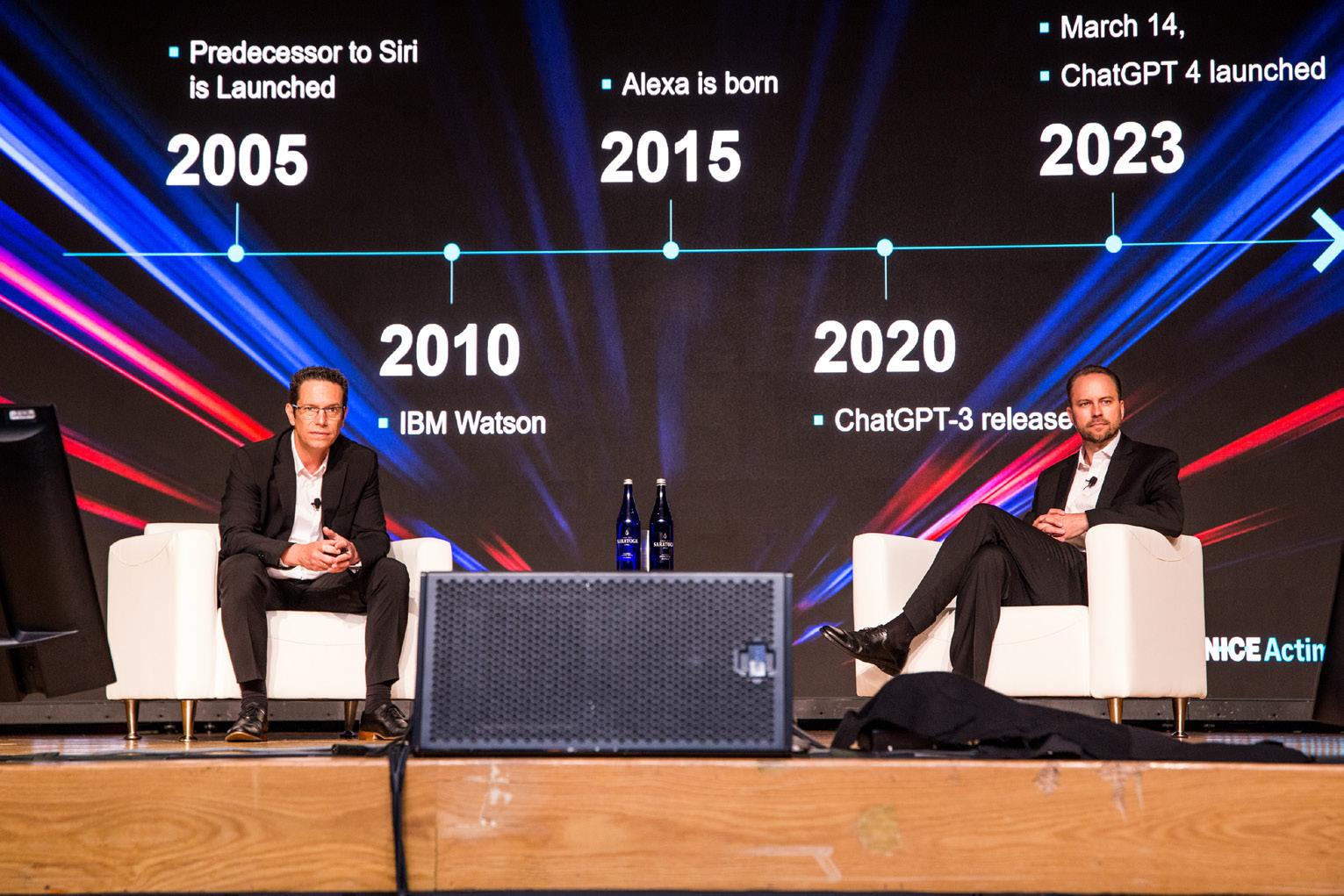

NICE Actimize recently held its annual financial services industry technology conference, ENGAGE 2023, with more than 500 participants and 200 financial institutions attending the New York event. Generative AI was a key trend addressed throughout the conference, including a keynote forum that uncovered the “Risk and Rewards of Generative AI," led by the company’s Global Head of Product, Chad Hetherington, and Global Head of Engineering, Yossi Levin. The technology executives saw positive growth for Generative AI innovations with a wide range of use cases under development that could increase productivity throughout bank operational function. Read their full discussion on page 22.

CHOM CAPITAL GmbH is an owner- operated asset management boutique with a proven track record across European equities. It is comprised of a team of highly qualified specialists who are committed to “delivering entrepreneurial success and serving the best interests of our investors,” as well as to its core values of transparency, responsibility and sustainability. I spoke to Christoph Benner, who in addition to being a founder also fulfils the roles of CEO and Portfolio Manager, and Benedikt Kirsch, Portfolio Manager and Head of ESG, who joined the team in 2018. We discussed the value proposition offered to investors by CHOM CAPITAL, the competitive advantages that arise from its ESG approach, and the ‘SUSTAINAMENTALS’ that drive its performance. (Page 16)

We strive to capture the breaking news about the world's economy, financial events, and banking game changers from prominent leaders in the industry and public viewpoints with an intention to serve a holistic outlook. We have gone that extra mile to ensure we give you the best from the world of finance.

Send me your thoughts on how I can continue to improve and what you’d like to see in the future.

Enjoy!

Wanda Rich Editor

Issue 51 | 05 EDITORS LETTER

Stay caught up on the latest news and trends taking place by signing up for our free email newsletter, reading us online at http://www.globalbankingandfinance.com/ and download our App for the latest digital magazine for free on Google Play and the Apple App Store

®

I am pleased to present Issue 51 of Global Banking & Finance Review. For those of you that are reading us for the first time, welcome.

14

BANKING Open Finance is changing the way we bank

28

BUSINESS

Businesses must empower their staff to plan for their financial future: here’s how Chieu Cao, CEO, Mintago

44

How financial services firms can prepare for the impending FCA Consumer Duty

Dr Robert Schumacher, Managing Partner, Bold Insight

46

Is your business ready for the new family-friendly employment laws?

Adrian Lewis, Director, Activ People HR

48

The essential guidelines for succeeding in times of crisis

32

INVESTING Turnaround time: private equity could be crucial to sub-Saharan Africa’s economic resurgence

By Bryan Turner, Partner, Spear Capital

06 | Issue 51 CONTENTS 20

14

Rajesh Saxena, CEO, iGCB, Intellect Design Arena

Brian Klingbeil, CSO, Ensono 48

10

The Impact Of Payment Partnerships for business growth in the E-Commerce Landscape

Anjulie Patel, VP of Partnerships, Nucleus365

E-wallets: The payment upgrade for marketplaces

Guido Kuhring, Head of Sales for Central and Northern Europe, Mangopay

12

TECHNOLOGY

Conversational AI can be transformational for customer service in the insurance industry

Sanjeev Kumar, VP EMEA, Boost.ai

Navigating the software testing market in the post-pandemic era

Suhail Ansari, Chief Technology Officer, Tricentis

Financial services companies seek to unlock efficiencies of cybersecurity automation

Leon Ward, Vice President of Product Management, ThreatQuotient

Read it on page 22

Risks and Rewards of Generative

AI: Productivity to Accelerate

Chad Hetherington, Global Head of Product, NICE Actimize Yossi Levin, Global Head of Engineering, NICE Actimize

Issue 51 | 07 CONTENTS

FINANCE

OpenText

can become a more powerful force for charitable giving

and

18 38 42

Friend, not foe: turning data to your advantage in financial services.By By Monica Hovsepian, Global Industry Strategist,

How wealth management firms

Joe Fisher, President

CEO, Ren

20 34

Austria’s

Continuing to Apply the Personal Approach in its 99th Year

Read it on page 24

CHOM CAPITAL:

Read it on page 16

Benedikt Kirsch, Portfolio Manager and Head of ESG, CHOM CAPITAL

Christoph Benner, Founder, CEO, and Portfolio Manager, CHOM CAPITAL

08 | Issue 51 CONTENTS

Wilhelm Celeda, CEO, Kathrein Privatbank

Integrating Sustainability Into Every Stage of the Investment Process

Kathrein Privatbank:

Banking Automation: Still So Much Potential Left

In an increasingly saturated banking and financial sector, particularly with intense competition from FinTech and other virtual banking solutions, it has become imperative for financial institutions (FIs) to continually evolve and provide exceptional customer experience. FIs today are also under significant pressure to optimize costs and boost productivity in a context which includes a scarcity of skilled resources, the need to keep increasing efficiency in processes, and a sharp rise in workforce costs. In order to combat these challenges, we are seeing a new age of automation and a heightened adoption of technology across the board.

As FIs are re-imagining branch networks and self-service experiences and developing new digital journeys, which are integrated into a person’s daily life, the banking experience is undergoing a significant period of evolution. Choice, convenience and meeting customers where they are, have been the driving forces behind a complete remapping of services. As part of this transformation, the roles of both branches and self-service channels are shifting.

FIs are continuing to optimize the size of their branch network, ensuring that each branch is profitable and a place where employees can focus on building customer relationships and delivering value-added activities. As physical presence through branches reduces, ATMs are increasingly operating as strategic customer touchpoints, essentially plugging any service gaps across the FI’s value chain.

Giving more to consumers, more efficiently

With ATMs acting as the branch, FIs are discovering untapped opportunities to deliver a more compelling experience and a broader range of services through the self-service channel, while better controlling operating costs, transactions costs and generating additional revenue.

For example, the development and enrichment of technologies such as artificial intelligence (AI) and machine learning is creating an exciting mix of new possibilities. Implementing

them across the ATM network helps optimize device performance and maximize cash availability, ensuring ATMs are in service and customers enjoy a positive experience for each and every visit.

Technical data can be collected and processed by AI to automatically diagnose failures and provide insights on how they can be fixed, which truly enables incidents to be dealt with earlier and resolved faster. In some instances, potential outages can even be predicted and pre-empted through targeted service actions. AI can also recognize cash withdrawal and deposit patterns, trends and seasonality to produce reliable usage forecasts and optimize cash planning so there is always the right amount of cash at the right time at an ATM – streamlining the process for the FI and ensuring continuous availability for the consumer.

There is still a lot of potential to unlock from the self-service channel, and technology is playing a critical role in the drive to operate more efficiently and streamline costs. With the right strategy in place, the ATM network can truly enable FIs to strengthen the relationship with customers and increase the profitability of the physical retail network, which remains a key differentiator to outperform neo banks and other nontraditional banking players.

Joe Myers | Executive Vice President Global Banking, Diebold Nixdorf

The Impact Of Payment Partnerships for business growth in the E-Commerce Landscape

Managing fast and secure financial flows has always relied on successful partnerships designed to create mutually beneficial outcomes. Recent findings from PWC reveal that 86% of surveyed professionals in the payments sector agree that traditional payments providers will collaborate with fintechs and technology providers as a primary of innovation. Collaboration is a well-established practice across the financial sector, be it banking, payments or e-commerce, with the benefits reaching far beyond the ability to deliver cross-border solutions.

With digital commerce projected to reach a total transaction value of US$6.03tn in 2023, the rise and continued growth of digital e-commerce, which 89% of payments industry experts believe will persist, has led to an increased focus on payment partnerships.

While the payments sector possesses expert knowledge of payment-making processes and partnerships, merchants often lack awareness of the nuances in partnership types and the benefits of forming them. This lack of understanding can impede business growth, market competitiveness, and limit opportunities for higher profits and reduced risk.

What Is A Payment Partnership?

A payment partnership occurs when two or more businesses utilise each other’s infrastructures for mutual benefit. Typically, one business provides the technological

components to facilitate secure domestic or cross-border payments, while the other offers one or more sales channels and customer bases.

Partnerships depend on various factors such as sector, demographic, products, and market size of the partnering businesses. They can also be flexible or fixed-term, dependent on sales and payment success figures. Partnerships can encompass a business’s entire operation or focus on specific aspects, such as customer bases in a particular region or payment processing technology designed for a specific customer base or payment method.

The Benefits Of Payments Partnerships

The first benefit of partnerships is increased reach and exposure, leveraging partner networks to tap into new customer bases. By doing so, businesses can explore untapped markets and tailor their product and service offerings to newly-gained demographics, positioning themselves for faster growth opportunities.

It’s important to understand that partnerships are not limited to domestic or established markets. They can be just as, if not more, effective in markets primed for growth. Let’s take the UAE as an example, the region ranked as the fastest-growing e-commerce market in the world in 2022 and has a projected value of $17.2billion by 2027. At Nucleus365, we have seen an increase in merchant exploration

into rising markets, utilising our service to create effective partnerships and secure financial flows in regions such the UAE –namely Dubai, alongside the likes of Hong Kong and Europe.

Accessing new yet established markets also provides valuable market data, performance history, and experience to inform business decisions. Partnerships enable businesses to enter the market more swiftly by leveraging established supply chains and relationships of their partners, eliminating the need to start from scratch.

Payment partnerships actively work to reduce risk, which is one of their key advantages. The insights and customer bases previously unobtainable through partnerships allow businesses to make informed decisions without the trial and error processes that often come with increased risk. Moreover, accessing new markets diversifies sales, mitigating the negative impact of diminishing returns and a market downturn in a specific region, should it occur. By partnering, businesses can share the financial burden of payment investments and no longer rely solely on their own business performance, thus increasing operational resilience.

Businesses often underestimate the benefits of partnerships in encouraging information-sharing between companies. The most successful partnerships go beyond market growth, new customer bases, and risk reduction.

10 | Issue 51 FINANCE

Anjulie Patel VP of Partnerships Nucleus365

By treating partnerships as collaborative learning experiences, businesses can quickly gain insights that would have otherwise been unavailable. In doing so, businesses can generate new ideas, streamline operations for efficiency, and position themselves for more strategic growth trajectories.

Payment Partnerships In The Future

The benefits of payment partnerships are numerous, positioning businesses for increased growth and resilience. However, like the management of money in any instance, partnerships require thorough due diligence. Relying on an experienced and trusted intermediary can mitigate both short and long term risks and ensure mutually beneficial outcomes for both businesses. In the fast moving e-commerce landscape, the speed of setting up partnerships must be considered and choosing the right provider can accelerate this collaboration.

Partnerships will become increasingly common as the e-commerce sector continues to expand into emerging markets with more payment-making flexibility. The rise of technological infrastructures in developing markets will encourage the formation of new partnerships to access these regions safely. Ultimately, consumers will benefit from the increased robustness of global merchants, who can offer products and services to demographics at an accelerated pace, all while ensuring safe and secure payment facilitation.

Issue 51 | 11 FINANCE

Conversational AI can be transformational for customer service in the insurance industry

Conversational AI can be transformational for customer service in the insurance industryAs industries of all shapes and sizes look to AI, we examine what role can it play in insurance

Artificial Intelligence (AI) is on track to change the face of industries worldwide, and insurance is no different. The pandemic may have kick-started the digitisation of operations, but recent developments in AI have made it clear that adopting a digital-first customer service strategy is a matter of when not if. In these times of financial uncertainty, businesses need to source solutions that achieve immediate customer service improvements whilst also positioning them for long-term growth.

Conversational AI (CAI) is one such solution. CAI can improve customer service by increasing efficiency without sacrificing a personalised approach. For insurance specifically, AI can accelerate the claims cycle and automate customer interactions whilst freeing up human agents to focus on more valuable tasks.

Accelerating claims cycles

Claims are the bread and butter of any insurance broker but are amongst the most time-consuming responsibilities too. Many customers view the claims process as laborious and unwieldy, but CAI can change that. Modern CAI-

powered virtual agents can be easily integrated into existing systems to improve resolution speed through enhanced selfservice. Customers don’t want to be put on hold just to update their claims or personal information, and by using conversational AI, they won’t have to be.

It is with the most mundane tasks that AI can have the most significant impact, as these are often the most administratively heavy and timeintensive for human agents to deal with. CAI frees up the human agents to work on more high-touch tasks and can seamlessly hand over a customer for these enquiries. CAI’s integration with legacy platforms ensures that all customer information is accurately maintained across the organisation, addressing data silos that add unnecessary complexity to the claims process. Furthermore, the 24/7 availability of a virtual agent spreads the workload and gives customers access to critical services around the clock.

CAI also reduces the risk of errors and subsequent claims delays, identifying issues with customer policies or claims and providing personalised advice on resolving them – thus reducing the time between claim and payout and improving customer satisfaction.

Better customer service, happier employees

CAI can use natural language processing (NLP) to automatically interpret customer service requests from either chat or voice channels to handle policy questions and claims enquiries. The CAI can then analyse this data to create more accurate and more personalised responses –the more it fulfils its role, the better at that role it becomes.

But virtual agents don’t have to be customer-facing only. For example, internal chatbots can act as ergonomic interfaces for employees to find relevant information and useful resources during employee onboarding. In this way, CAI can alleviate pressure on workers by automating simple tasks and becoming a trusted virtual colleague.

12 | Issue 51 TECHNOLOGY

Sanjeev Kumar VP EMEA Boost.ai

The benefits of automation go beyond enabling accuracy, efficiency, and reducing workloads within customer service centres. CAI can expand employees’ horizons and offer opportunities to train and improve the programmes internally. Virtual agents require oversight and monitoring to perform their roles correctly. Customer service staff know the customers better than anyone and are vital in optimising that digital-first experience. Getting implementation right

Insurers must choose the right CAI solution for their specific needs and adopt CAI as part of a broader AI strategy. There is understandable scepticism amongst insurers about what role AI can play in an industry renowned for its complexity and regulatory minefields. However, with enough self-knowledge of the business, AI can navigate these complexities with ease.

Incorporating conversational AI as a frontline response to customer service extends the service capabilities of an institution and lays the groundwork for continued expansion. Typically, the assumption is that virtual agents are in some way reducing the need for human employees; however, the most effective use of conversational AI is one that strikes a balance between the two.

The future is bright

As the technology underpinning CAI evolves, insurers can provide a more personalised customer experience. Additionally, with the integration of nascent Generative AI models, these technologies will become even better at understanding user intent and pre-empting responses, leading to faster and more accurate answers.

Moreover, the longer that a conversational AI solution spends embedded in a business, the more it learns from the data, so insurers can use the gathered customer data to gain a deeper insight into customer behaviours and preferences, enabling them to better tailor policies for individual customers.

As AI continues to develop, it will become an increasingly integral part of the insurance industry, both internally and externally. Furthermore, new use cases and applications will appear with each technological advancement. Insurers cannot afford to sit on their hands with AI; the alternative is a lower customer service quality and customer base erosion.

Issue 51 | 13 TECHNOLOGY

Open Finance is changing the way we bank

Open Finance is changing the way we bankBanks are increasingly looking to add and scale services to meet the changing needs of their customers. Rajesh Saxena, CEO at iGCB, Intellect Design Arena, explores how banking on the cloud can help.

Real-time digital services have rapidly embedded themselves as an expectation in nearly every aspect of day-to-day life. This is especially the case with respect to banking, where evolving demands have initiated the birth of challenger (i.e. specialist digital) banks and third-party fintechs, which are providing innovative solutions and gaining market share from any incumbent players.

In response – and as the market becomes increasingly saturated – traditional banks are fighting back with flexible products and ecosystems based on “front to back” digital infrastructure (i.e. starting with the customer interface). And while this is helping them maintain a competitive edge, fresh challenges are emerging. These include the need for greater security (due to a spike in cybercrime and data breaches), as well as compliance procedures able to keep pace with the burgeoning number of instant-banking offerings. This is making data a key priority for banks, with both internal and external data being leveraged to improve the product offering and overall customer experience.

Open Finance led banking on cloud

So how can banks successfully navigate this rapidly changing environment to come out on top? Perhaps the answer lies with open finance powered banking, which complements a more flexible, incremental, software development style.

Historically, innovation in banking technology has been dominated by the larger clearing (or “high street”) banks, primarily due to the substantial investment required. The emergence of Open finance powered banking on cloud, however, has democratised banking by enabling banks of all sizes to leverage marketplace players, microservices and APIs to deliver unique products and services. This shift that’s brought significant advantages, including:

1. Speeding up launch: By offering a pre-integrated ecosystem, banks can expedite the launch of new offerings to the market. Banks can leverage and integrate with Fintechs to offer core banking products like Deposits through Aggregators or partner with another bank to offer products outside their core strength. Marketplace players into KYC, payments, CRM, document management etc can speed up overall product launch as well.

2. Reduced cost of acquisition: Banks can enable customers to open an account from the comfort of their homes through partner digital channels. The entire onboarding process can

be digitized, with the majority of the data being fetched through APIs through national registries. AI models can further perform credit checks by analysing various structured and unstructured data points.

3. Curated credit propositions: By partnering with credit players, banks can launch unique credit solutions like BNPL, Microcredits etc. Modern credit platforms are composable and come with prebuilt business components which further reduce the time to go to market.

4. Offering scalability: Cloud native platforms provide elasticity, allowing banks to easily scale-up (or scale-down) their resources as needed. For example, banks can quickly add or remove services to match the changing client demands. This flexibility ensures that banks only pay for the resources they use, which – in turn – optimises cost-efficiency.

5. Flexible payment options: Today technology players see banks as long term success partners and hence offer ‘Pay-as-you-grow’ based on factors like transaction features, users and features

Putting Open Finance platforms to work

Of course, turning this clearly advantageous theory into practice is where the dilemmas lie: onboarding is rarely a pain-free process. Yet take the example of onboarding an SME for financing. The process would

14 | Issue 51 BANKING

traditionally involve a representative of the SME physically visiting a branch and submitting up to 20 documents, typically including a certificate of incorporation, tax statements, proof of address, and more. Forwarded to the back office and credit department, they undergo evaluation using a limited number of algorithms. Ultimately, a credit decision would be made based on the customer and the required facility: a process usually taking at least 10 days.

With open finance enabled banking, however, the bank can provide the SME with a user-friendly, branded, microsite (or mobile app) that – by inputting basic information such as phone number or tax ID – can initiate self-onboarding that takes a few minutes. And, by eliminating the SME’s burden of organising and submitting physical documents, the process reduces the administrative burden on the client.

And onboarding is just one example of how open finance enabled banking platforms significantly improve the services banks can offer clients. For example, iGCB’s cloud-based core banking platform – just launched in the UK and Europe – helps banks offer services beyond their core

strengths. These can include: leveraging and integrating with fintechs to offer deposits through aggregators; providing “application to sanction” within minutes; and offering unique credit experiences such as buy now pay later (BNPL).

The future is Open Finance enabled platforms

Certainly – thanks to underlying customer demand – the innovation drive in financial services is not easing up. And as banks look to meet the needs of this changing landscape, cloud-banking technology is poised to become the new standard. This is something we should celebrate: it provides a real opportunity for a level playing field for all types of banks –from the largest “high street” names to the smaller tier-three outfits. They all have the opportunity to launch products quickly and at scale – leveraging a preintegrated partner ecosystem with in-built design and deliver contextual experiences for customers.

Issue 51 | 15 BANKING

Rajesh Saxena CEO iGCB, Intellect Design Arena

CHOM CAPITAL GmbH is an owneroperated asset management boutique with a proven track record across European equities. It is comprised of a team of highly qualified specialists who are committed to “delivering entrepreneurial success and serving the best interests of our investors,” as well as to its core values of transparency, responsibility and sustainability.

The name CHOM CAPITAL comes from the first names of its founding members (CHristoph Benner, Oliver Schnatz and Martina Neske). All three founders have been working together successfully in the capital market business for more than 30 years and have personal stakes in the company and the funds issued.

Wanda Rich, editor of Global Banking & Finance Review, spoke to Christoph Benner, who in addition to being a founder also fulfils the roles of CEO and Portfolio Manager, and Benedikt Kirsch, Portfolio Manager and Head of ESG, who joined the team in 2018. They discussed the value propositon offered to investors by CHOM CAPITAL, the competitive advantages that arise from its ESG approach, and the ‘SUSTAINAMENTALS’ that drive its performance.

CHOM CAPITAL:

Integrating Sustainability Into Every Stage of the Investment Process

“As a sustainability fund, we invest with a long-term focus in what we call ‘hidden sustainability champions’ across the European universe,” Christoph Benner said. “Unhampered by rigid corporate guidelines or index affiliation, our success is based on deep fundAMENTAL and SUSTAINability analysis (we refer to this symbiosis as SUSTAINAMENTALS®). In the latter, we see a key value-adding factor and thus have holistically integrated sustainability into all stages of our investment process.”

Christoph revealed that CHOM CAPITAL believes sustainable investing to be the future, and its value proposition centres around this idea. “We offer investors the opportunity to invest in companies that are aligned with their values, while also achieving strong returns,” he said. “Our funds address investors who, like us, are driven by an entrepreneurial mindset, share our enthusiasm for European equity markets, and value a balanced and responsible approach to capital market risk and natural resource management. It is our firm belief that our sustainable investment approach will help our portfolio companies to increase their value and reduce risks in the long run.”

He added that high levels of transparency and communication are also valued at CHOM CAPITAL, allowing investors to stay informed about their investments and the decision-making process. “Our close ties and regular meetings with the upper management of our invested companies enable us to make informed decisions and thus serve our clients in the best possible way.”

Christoph went on to explain that the firm’s investment strategy is active and based on fundamental and sustainable stock picking, meaning that the portfolio companies are selected irrespective of their country, sector or index affiliation. “Our fund products are characterised by a long-term investment horizon and a tightly focused portfolio of investments consisting of 30 to 40 holdings,” he said. “Ideas for the selection of companies are sourced through approximately 600 management meetings each year with company directors, as well as from industry studies, desktop research and various other publications. Through the analysis of the business model, trends and drivers, Porter’s five forces, regulatory value creation and risk, supply chain and product lifecycle, our team seeks out fundamental and sustainable long-term value drivers. Ideally, a strong investment offers the following characteristics: long-term resilience, steady and significant growth, supported by investments that can be financed, with a solid balance sheet, in a

16 | Issue 51 INTERVIEW

market-leading position, positioned in future topics at an attractive valuation, and executed by top management while being mostly undiscovered by the markets.”

At the core of CHOM CAPITAL’s operations is environmental, social and corporate governance (ESG), and Benedikt Kirsch stressed that they view sustainable investing as not only the right thing to do, but also as an opportunity for investors to gain a competitive advantage. “We are strongly convinced that ESG factors increasingly become material out of a fundamental analysis point of view. If one considers a schematic income statement, ESG considerations play a material role from top to bottom –sales potentials, higher willingness to pay, sales risks from policies such as the German supply chain law on the revenue level, to cost advantages and higher valuations at the bottom line. Hence, firms need to be analysed from a holistic point of view.”

Recent macroeconomic and geopolitical events would seem to support this view, considering the carbon emissions and energy mix of a company have become essential factors in assessing investment opportunities. “Water consumption and waste management are further areas that we analyse – all

Christoph Benner Founder, CEO, and Portfolio Manager CHOM CAPITAL

of these will become ever more relevant in the coming years. To put it in a nutshell, by incorporating ESG analysis into our investment process, we are able to identify companies that are not only aligned with our values, but also have the potential to outperform over the long term.”

Benedikt also spoke about the CHOM CAPITAL PURE Sustainability – Small Cap Europe UI investment concept, which focuses on listed European small caps. He revealed that this asset class offers an attractive riskreturn profile over the longer term and has historically been able to deliver superior returns. “Oddly enough, analysts and investors tend to devote far less attention to small caps than to big corporations,” he said. “It is this very ‘neglected firm effect’ that opens up attractive investment opportunities for fundamentally driven investors. Moreover, this neglected effect also applies to the sustainability side, with ESG rating agencies systematically neglecting or underrating this market segment. However, it is exactly this segment where one finds the technologies and products necessary for the transformation of our economies and societies to reach our overarching climate and sustainable development goals.”

Clearly there are value potentials, as this systematic neglect results in attractive valuations for many of these ‘hidden sustainability champions’ he discussed. “The CHOM PURE concept offers institutional investors unique access to this difficult-to-access and challenging segment. And the segment is strongly growing – outpacing the overall economic growth by several percentage points over the next decade.”

Christoph concluded by outlining what’s next for CHOM CAPITAL. “We have a great, experienced team that implements an investment process with a proven track record, with deep analysis and great passion,” he said. “The topic of sustainability and positive impact are essential elements. We do not want to – and do not have to – reinvent ourselves, but simply continue on our path consistently. For us, actions always speak louder than words. For example, we donate 10% of our turnover in the CHOM CAPITAL PURE Sustainability – Small Caps Europe UI. Accordingly, we are happy about growing together with our clients while growing our direct impact with various great and sustainable projects that we support.”

Issue 51 | 17 INTERVIEW

Benedikt Kirsch Portfolio Manager and Head of ESG CHOM CAPITAL

E-wallets: The payment upgrade for marketplaces

The range of payment methods offered is one of the most important decisions online retailers and marketplaces must consider when designing the checkout process. If a customers preferred payment method isn’t offered, or if a payment process is too cumbersome or seems unsafe, customers can abandon their shopping carts and leave websites in doubt.

E-wallets are a great way for marketplaces to optimise the payment process for both merchants and buyers. Guido Kuhring, Head of Sales Central and Northern Europe at Mangopay, discusses what this looks like in practice.

What are e-wallets and how do they work?

E-wallets are electronic wallets that allow users to send and receive digital payments. This is possible thanks to a corresponding software application that stores digital currencies and payment information, allowing authorised users to access them.

E-wallets can be used for online purchases on e-commerce websites as well as marketplaces, or for payments on mobile devices. A customer’s own e-wallet can be topped up via bank transfers, credit cards or other digital payment methods. For example, if a customer wants to pay with an e-wallet on a marketplace, they select this payment method and confirm the amount to be paid. The transaction is then processed via their e-wallet and the money is transferred securely and quickly to the marketplace seller’s e-wallet.

Why are e-wallets valuable?

E-wallets are a fast and convenient payment method for all marketplace players. Customers can store their payment details in their e-wallet and access them instantly to make payments as and when needed. This speeds up the payment process, making it more convenient and can help customers shop more frequently on a marketplace. In addition, this supports marketplaces to strengthen customer loyalty as well as their revenues; by easily implementing loyalty programs, promotional offers, and discounts with e-wallets.

Another significant advantage of e-wallets is security. By storing their money digitally, users do not have to re-enter their bank or credit card information for each purchase. After all, this carries a certain risk as the data can be stolen or misused. E-wallets offer an additional layer of security, as customers only store their sensitive data once.

Users can top up their digital wallets with various payment methods, such as credit cards, bank transfers or other digital payment methods. This allows them to select their preferred payment method and use the money in the e-wallet quickly and easily for multiple transactions within a single platform. Simply put, e-wallets offer users both simplicity and flexibility.

In addition to the buying side, e-wallets are also an important factor for the selling side of marketplaces. Depending on the needs and business model of the marketplace, e-wallets can store collected funds securely

and in compliance with regulatory requirements, for an extended or shortened period of time. This way, marketplace operators gain flexibility and technical control over payment processing and payouts without coming into contact with the funds themselves.

How do e-wallets benefit online marketplaces?

The range of payment methods offered is one of the most important decisions that online retailers and marketplaces must consider when designing the checkout process. Customers often abandon their shopping carts and leave the website if their preferred payment method is not offered or if the payment process is too confusing or even seems unsafe. E-wallets are a great way for marketplaces to streamline the payment process for both merchants and buyers.

When customers place an order on a marketplace, they typically need to enter their payment information and go through a predetermined payment process before they can complete their order. This process is time-consuming and cumbersome at worst, especially if customers need to re-enter their payment information each time. By integrating e-wallets, marketplaces can make their checkout process faster and more convenient. Customers can store their payment details in their e-wallet and easily access them as needed to complete orders with just a few clicks. Processing international payments in different currencies is also faster and less complicated.

18 | Issue 51 FINANCE

Ultimately, e-wallets bring simplicity, security, and flexibility to payment processes on marketplaces. They allow users to virtually manage their balance, check their account balance and make payments in a straightforward manner, while making it easier for sellers to manage their revenue and monitor their cash flow. The more flexible the e-wallet infrastructure used, the better it can adapt to the processes of the respective marketplace and ideally support workflows

Guido Kuhring Head of Sales for Central and Northern Europe Mangopay

Guido Kuhring Head of Sales for Central and Northern Europe Mangopay

Issue 51 | 19 FINANCE

Navigating the software testing market in the post-pandemic era

The impact of the COVID-19 pandemic has been felt across multiple industries, and the software testing market is no different. Increased adoption of workingfrom-home practices and a shift towards the cloud have placed the software testing market under immense pressure and heralded the increased adoption of AIbased automated software testing solutions to aid with remote IT maintenance and software applications.

Constrained resources were one of the most significant issues. Multiple employees, including DevOps, had no choice but to work from home without access to the same tools they would have had in the office. Moreover, with 11.6 million people furloughed in the UK, software companies had to adapt to the same levels of testing requirements, if not higher, with fewer DevOps available.

Working remotely has not always been the smoothest of rides either, with isolated DevOps team members unable to communicate as freely about quality concerns and processes in a timely manner. In addition, with the pressure mounting to release software quickly to allow customers to have a ‘mobilefirst’ experience and keep businesses operating, the quality of software releases was put on the back burner, prioritising the speed of releases instead.

Finally, organisations had to rethink their delivery mechanisms by shifting their applications to the cloud and low-code/no-code platforms to allow borderless and seamless collaborations. As customers demanded newer features or reported new bugs, software updates and maintenance became challenging even with automated tests. This accelerated the need for AI-based automated software testing solutions to aid remote IT maintenance and software application development – a process that has become permanent in the current way of working.

20 | Issue 51 TECHNOLOGY

Suhail Ansari Chief Technology Officer Tricentis

Adapting to the new way of testing

However, simply accelerating application development is not enough due to the impact on quality. Slowresponding software with bugs leads to customer frustration and impacts retention. Organisations need to focus on Quality Assurance (QA) and performance testing, and finally replace legacy testing tools that are holding them back. Testing should be effective, efficient, and integrated with development to enable faster time to market at high quality.

When implementing robust software testing processes, DevOps need to be able to answer three critical questions – what to test, does it work, and does it scale? By using an AI-powered approach for end-toend test automation, businesses can accelerate their testing by more than 10x, dramatically reduce business risks by 90%, and cut costs by 50%. Therefore, shifting from manual testing practices to a balanced, AI-powered quality assurance methodology is critical, with a few successful ingredients:

Self-service environments – setting up automated test environments with the help of software-defined Infrastructureas-Code (IaC) and elastically scaled cloud capacity can dramatically reduce cycle times and costs.

Service virtualisation (SV) – a virtual environment helps capture, configure and simulate systems, negating the need to access the actual dependent systems and, as a result, creating more consistent test results through modelling the future scenario data.

AI collaborators – Machine Learning and AI can visually detect and identify user interactions, creating desired application logic. Once teams identify what AI should be looking for, the cognitive engine enables automation to keep track of changes, provide instant feedback, and minimise maintenance of the automation.

Automated impact analysis –evaluating the impact of changes made allows organisations to prioritise their efforts based on value and risks. As a result, less relevant tests can be parked or left off the test run entirely, thus reducing the effort and cost of testing.

Risks of blind automation

Whilst automation of tests and deployments is beneficial for the software’s health, in some cases organizations may also need some manual User Acceptance Testing (UAT) and human verification. Automated testing should be continuous; however, it must be applied strategically without undermining business agility.

There are a few things organisations need to keep in mind when applying test automation:

• Testing goals that align with enduser goals such as functionality and security, avoiding the tickbox exercising approach.

• Creating flexible test strategies that allow for frictionless testing of new updates and contributions. Assets that are not responsive to tests can

produce 60% to 80% of false positives and negatives which forces DevOps to give up on repairing existing tests and opt for building new ones, increasing implementation times.

• Avoiding test bloat and burn out as a result of recreating tests rather than tracking the failures back to their source. Not only does it result in higher system costs and cloud OpEx, it also dramatically burns through labour and budgets, especially if integration partners are involved.

With the pandemic slowly becoming a distant memory for many, the effects of the seismic shift it created in how organisations work and operate are still very pertinent. According to Gartner, almost two-thirds of application software spending will be on cloud technologies by 2025, and those who do not adapt risk being left behind in the low-growth market.

As organisations continue shifting to the cloud and accelerating their digital transformation strategies, they must maintain focus on improving their software performance. Continuous and strategic automation that uses intelligence to address critical challenges can help free up DevOps’ time and allow them to change their focus to creative solutions and critical thinking, opening up channels for real innovation.

AI adoption might still be raising multiple questions, however, harnessing the full power of the available AI and ML tools will empower teams within the enterprise and further connect developers and testers. This will result in more efficient projects contributing directly to the business value and enhancing efficiency and speed of product launches

Issue 51 | 21 TECHNOLOGY

Risks and Rewards of Generative AI: Productivity to Accelerate

NICE Actimize recently held its annual financial services industry technology conference, ENGAGE 2023, with more than 500 participants and 200 financial institutions attending the New York event. Generative AI was a key trend addressed throughout the conference, including a keynote forum that uncovered the “Risk and Rewards of Generative AI," led by the company’s Global Head of Product, Chad Hetherington, and Global Head of Engineering, Yossi Levin. The technology executives saw positive growth for Generative AI innovations with a wide range of use cases under development that could increase productivity throughout bank operational functions.

How do you see the immediate impact of Generative AI playing out at financial institutions – what are the rewards?

Hetherington – Generative AI will generate a massive impact, particularly in accelerating productivity. Much like what we saw with the personal computer revolution, the real leap forward is squarely focused on efficiency. But the human touch will still be critical in its implementation. Whether it aligns with onboarding functions or with investigation teams, the core operations areas will experience a very material impact. According to Goldman Sachs, over the next ten years we will see a 7 percent increase in global GDP which translates to about 7 trillion dollars,

while lifting overall productivity by 1.5 percent. We advise our financial institutions to have the proper controls around Generative AI to ensure the right business outcomes. Many people define it as an advanced search engine, but it clearly delivers much more than that.

What are FIs saying are the most critical gains where generative AI is applied?

Levin – We have observed that Engineering and Data Science teams have been very quick to adopt the new technology in order to increase velocity to bring innovation to market faster. But when it comes to applying the technology to solving business problems, we should think about multiple horizons of execution and results. Low hanging fruit should be picked quickly – those quick projects that get fast results. But the bigger projects that can profoundly impact the business also need to start now. Big longterm bets can drive results that are meaningful to the overall operation.

What use cases are emerging that integrate Generative AI at financial services institutions?

Levin – We are seeing a focus around text-driven use cases. The “co-pilot” use case are taking shape of decision recommendation or decision support. This addresses the need to reduce labor cost while keeping the human in the middle to validate AI recommendations. But it

does not stop there. Text generation use cases are next. Things that are hard or lengthy to do and easy to review are also in flight. These use cases should be carefully released and teams should be trained on the various risks so they do not take AI recommendations blindly. During these processes, we should be careful not to de-humanize customer care. At first, AI may not be great at handling a client who was scammed out of his or her life savings. Moreover, while dealing with money laundering prevention, AI mistakes can have serious implications so initial efforts should be measured carefully. At this point, the man in the middle is relevant. I do think as humans take more of a reviewers’ role than doers role, we need to make UI and UX fit the new role.

What advice would you give financial institutions as they look to adopt Generative AI throughout their operations?

Hetherington – With good training data, there are use cases where Gen AI can accurately suggest what we should do in a given scenario. And we are seeing the tech evolve and tackle its weaknesses quite quickly. Examples include how to action an alert or fix a bug in software. The most advanced use cases are fully autonomous, where the machine drives decisions, and we oversee them. Imagine working your pre-investigated alerts over your morning coffee.

22 | Issue 51 TECHNOLOGY

How will Generative AI impact the job market?

Levin – The Challenger Report, which reports on the jobs market here in the US, added a new job cut code related to AI. In May, it was estimated that 3900 jobs were cut because of AI. But AI is not creative nor strategic. It is still necessary for humans to drive this innovation. Some roles will be handed over to AI for sure. The expertise in these roles will still be needed, so it is not role elimination we are looking at but instead some reduction as well as the emergence of entirely new fields. Therefore, technologists should make themselves savvy very fast to stay relevant.

Since the technology is relevant for multiple fields, I believe that in the coming years more roles will be created than roles eliminated.

Where do you see vendors bringing innovation to Generative AI? What is in the works at NICE?

Hetherington – NICE Actimize has a number of initiatives in place that we are investing in, and we are committed to bringing Generative AI in a responsible way to protect our financial institution customers’ interests as well as the interests of their customers. Many of our meetings at ENGAGE revolved around moving into Generative AI in meaningful ways which could accelerate performance across the institution. We are focused on use cases where financial services firms have painful business problems and we have data and domain expertise that others do not.

Our parent company, NICE, has also made significant inroads in Generative AI and has recently announced a series of breakthroughs

utilizing this advanced technology. NICE this week was the first to introduce an enterprise-grade AI for the CX business, based on domainspecific business cases, with humanized conversations with the highest level of security guardrails while ensuring responses are aligned with brand needs and goals.

As an industry, we have yet to understand the full potential of generative AI, but we have seen that this is a transformative leap forward. It provides reasoning capabilities that are much more "human-like." Today, we have a massive ecosystem and industry that includes almost 30M developers worldwide. This provides a substantial accelerating force for this technology. What is hard to imagine is that this technology has the potential to empower all 8B people on this planet to become developers. Never have we had a force multiplier as we do with Generative AI.

Issue 51 | 23

Yossi Levin Global Head of Engineering NICE Actimize

TECHNOLOGY

Chad Hetherington Global Head of Product NICE Actimize

Wilhelm Celeda has been CEO of Kathrein Privatbank since 2019. Considered a proven financial expert, he has been active in the capital market for more than 30 years, making him one of Austria’s most accomplished experts in the field. He spent almost 25 years of his professional career at Raiffeisen Centrobank, heading the securities division for many years before moving to the Executive Board in 2013 and serving as CEO from 2015 until his departure in 2019. In addition, from 2014 to 2021 he was a member of the supervisory board of the Vienna Stock Exchange.

24 | Issue 51 INTERVIEW

Founded by Carl Kathrein in 1924, Kathrein Privatbank is one of the leading private banks in Austria, offering customised investment advice, asset management, financing and consulting to families, entrepreneurs and foundations.

Wilhelm Celeda CEO Kathrein Privatbank

Austria’s Kathrein Privatbank: Continuing to Apply the Personal Approach in its 99th Year

Since joining Kathrein Privatbank as CEO in May 2019, Wilhelm, together with his team, has been responsible for the successful implementation of its ambitious growth strategy. When he spoke with Wanda Rich, editor of Global Banking & Finance Review, he filled her in on how Kathrein Privatbank is prepared to help clients navigate the most difficult challenges being faced in the current financial climate.

“Staggering inflation, a looming recession and the war in Ukraine are the significant factors shaping our economic environment,” he reported. “Investors have been confronted with the rare scenario of high economic uncertainty and political turbulence. For our relationship managers, times are intense. We are available for our clients nearly 24/7, which is particularly important in difficult times. But that is the added value of a private bank – trust that builds on the close relationship with our customers.”

Wilhelm revealed that while the environment for investors has been challenging, the bank has been continuously adapting investment strategies through its active asset management. “Even in this environment, we were able to

outperform the market with our portfolio,” he said. “In the equity sector, the focus is on defensive stocks – that is, companies whose business models are stable even in turbulent times. In the bond segment, for example, Kathrein invests in localcurrency bonds of emerging markets to generate higher returns, but only in issuers with excellent credit ratings, such as development banks.”

The bank’s slogan, “Very personal,” is a reflection of what Wilhelm describes as the core of its business: listening to and understanding clients’ needs. “We are convinced that the personal relationship between our clients and their private bankers is the crucial success factor for private banking. Financial planning is one of our core capabilities. That is why we can provide a holistic approach and offer much more than just investment advice. Our services include support in succession questions, structuring wealth and assets, special loans and much more. That is what sets private banking apart from a retail bank – we don’t just take care of the money; we serve the clients.”

Issue 51 | 25 INTERVIEW

As the popularity of sustainable investing continues to rise, Wilhelm weighed in on where Kathrein stands in terms of ESG investment options and how its clients are responding. “Sustainability is more present than ever. At Kathrein, we are convinced that responsible business practices contribute to a better quality of life and future for generations to come,” he said. “That is why we started our first sustainable investments back in 2012. Today, we have already invested more than 50 percent of the total fund volume according to the sustainability approach. We see a growing interest from our clients in sustainable investments. Apart from last year, the MSCI World SRI has outperformed the MSCI World.

Thus, from an investor´s perspective, ESG investing bears fruit. Is it the right thing for everyone? That is for our clients to decide.

“As of last year, we can offer our clients 10 funds that are managed according to independently monitored ESG criteria. These funds encompass stocks and bonds. Moreover, we offer special funds for our institutional clients that often demand an even more rigid approach and specific exclusion criteria.”

Following almost a century of operation, Kathrein now manages several generations. Wilhelm explained how a deep understanding of a family's needs and goals, a long-term perspective and – crucially – the trust of its clients allow

the bank to navigate the challenges of multi-generational wealth management.

“As a private bank, our goal is to provide tailored solutions that meet the unique needs of each client and help them build and preserve their wealth for generations to come,” he explained. “We do so with our service Family Konsult, which consolidates the full spectrum of our expertise and services in the areas of succession, family and business assets, and foundations. These matters are all complex and frequently intertwined. That’s where our holistic consulting approach comes into play.

“We have identified, among others, three critical factors,” he continued. “First is succession planning – developing an

Information on past performance is not a reliable indicator for future results or returns.

26 | Issue 51 INTERVIEW

The purpose of this marketing information is to provide a general overview of current market data as well the market and investment strategy of Kathrein, and therefore it shall not be considered as a solicitation, recommendation or an offer for a certain investment strategy in the sense of a financial analysis. When investing in securities, price fluctuations due to market changes are possible at any time.

effective succession plan that ensures the smooth transfer of wealth from one generation to the next. This includes addressing issues related to taxes, estate planning, and governance. Then there is managing complexity. Multigenerational wealth management involves managing complex family dynamics, as well as financial and legal issues. It requires expertise in tax planning, estate planning, and financial planning to create effective strategies that meet the needs of each generation.

“The third is investment strategy. Creating an investment strategy that meets the long-term financial goals of multiple generations can be challenging. Investment decisions must balance the

needs of current and future generations while also considering their different goals and ambitions.”

At the core of Kathrein’s operations lies client relations, which contributes heavily to the level of trust it has earned among its clientele. The bank shows no sign of taking this trust for granted, and continues to take steps to consolidate these relationships. “We understand that the trust of our clients is our most important success factor,” Wilhelm acknowledged. “We aim to strengthen relations between clients and private bankers in various ways. We assign a dedicated relationship manager to each client, who acts as a single point of contact for all their banking needs.

If needed, we provide direct access to our Family Konsult team or our portfolio managers to address further topics. Thus, we provide our clients with personal access to a team of experienced professionals. Moreover, we have heavily invested in our digital capabilities. We are rolling out a portfolio analysis tool that offers comprehensive insights to our clients and allows for structuring of wealth and assets.

“Overall, our goal is to build long-lasting relationships with our clients based on trust, expertise, and personalised service. We believe that by listening to our clients, providing tailored solutions, and taking a proactive approach to client relations, we can continue to strengthen these relationships and help our clients achieve their financial goals.”

From an investor’s perspective, Wilhelm sees several opportunities for the year ahead. “One of the prominent issues highlighted by the multiple crises is the green energy transition. The decoupling of cheap Russian fossil fuels could be an accelerator for Europe´s economic development, although it will be painful in the near future. We spot opportunities to invest in clean energy, resource scarcity, and information technology.

“Inflation might be here for longer than anticipated. There is not one single asset to beat inflation; rather, we have taken a multi-pronged approach, dependent on the goals of our clients. A mix of bonds with actively managed duration and qualitative stocks could be promising for this year.”

The above mentioned sustainable funds are within Article 8 of Regulation (EU) No. 2019/2088. Social, ethical and environmental characteristics are promoted in the fund. Exclusion and quality criteria (negative and positive criteria) are considered in the selection process. However, no sustainable investments within the scope of the EU taxonomy are targeted or sustainable investment objectives are pursued.

Details on the carbon footprint, the ESG concept, the sustainability-related disclosures including the pre-contractual information on environmental and social characteristics as well as the fund's prospectus can be found at www.kathrein.at at "nachhaltigkeitsbezogene Offenlegungen".

Issue 51 | 27 INTERVIEW

Without a doubt, the challenging economic circumstances that we have witnessed in the last couple of years have severely impacted the financial stability of many employees in the UK, both in the immediate and distant future.

Growing inflation, eye-watering energy costs, and rising interest rates have all contributed to an enduring struggle for many Britons. In order to meet the basic cost-ofliving, some working people have had to live from one paycheque to another and focus on their short-term financial obligations. Unfortunately, this often damages employees’ aspirations for greater long-term financial security.

It is imperative, therefore, that employers, HR managers, and decision-makers within a business work to proactively facilitate and empower employees to continue to work towards their long-term financial goals – even in the face of short-term financial difficulties.

As such, employers must effectively enable their workforce to seize control of their financial wellbeing in the long run, and – especially during the cost-of-living crisis – it must be made a priority.

The importance of long-term planning

Across an employee’s life and career, it is inevitable that they will encounter significant financial goals that demand thoughtful and attentive planning.This can include homeownership, starting a family, building wealth, and ensuring a comfortable retirement. Many of these goals are difficult to fulfil, especially if employees are not given the tools needed to organise their finances beyond the day-to-day management of immediate financial obligations.

If we take the goal of a comfortable retirement as an example, employee pension schemes are a particularly important factor of an individual’s long-term financial wellbeing that are being overlooked in the current climate. Indeed, recent research

shows that a fifth of employees in the UK have stopped or reduced their pension contributions in the last year. Yet, to maximise the value of their pensions, employees need ample time for growth. As such, by reducing their pension contributions, employees could be missing out on the chance to boost their pension’s worth and secure future financial wellbeing.

Moreover, the ability to plan for the future becomes particularly crucial when unexpected

circumstances – like the cost-ofliving crisis – arise. Employers must ensure that their employees are able to tackle monetary emergencies without resorting to debt or facing other financial difficulties. Ultimately, this relies on their being in control of their future financial wellbeing. Businesses that are failing to foster a workplace that places value on a solid long-term financial strategy are putting their workforce’s entire future financial wellbeing at stake.

28 | Issue 51 BUSINESS

Businesses must empower their staff to plan for their financial future: here’s how

Unfortunately, such a lack of support is extremely prevalent amongst UK businesses, despite the media and public attention that the difficulties of the last year have attracted. Indeed, according to Mintago’s recent research, just 38% of workers have access to employer-provided support for managing their long-term finances.

The impact of failing to empower employees to manage their longterm finances

While some employers may perceive employee finances as being outside of their remit, it is crucial to acknowledge that this impact of a lack of long-term financial planning extends beyond the lives of individuals. Underestimating the ramifications for businesses would be a mistake, as the adverse effects of employees’ financial struggles can profoundly harm a business’ productivity levels and job satisfaction.

In a recent study conducted by Mintago, for example, half of the employees surveyed (49%)

reported that stress and anxiety stemming from financial worries had a detrimental impact on their overall job performance. The survey also revealed that the rising cost-of-living and money worries were the two leading causes of stress amongst employees. It is clear that businesses could see their team’s job performance falter if they do not step up and provide the right kind of support.

Related to this, the implications of poor long-term financial wellbeing extend to staff retention, as a lack of support could be interpreted as a lack of concern for employee welfare. Alarmingly, less than a third (32%) of workers currently feel that their employer genuinely cares about their financial wellbeing, which is perhaps why 44% expressed their willingness to leave their current role in search of better employerprovided financial wellbeing support. Obviously, employees value employers who show willingness to help them reach their long-term financial goals.

Issue 51 | 29 BUSINESS

It is worth noting that The Society for Human Resource Management (SHRM) estimates that the cost of replacing an employee ranges from six to nine months of their salary. So, considering the average salary in the UK is around £30,000, the average staff turnover cost is estimated between £15,000 and £22,500 per employee, which could be incredibly detrimental to a business in the current climate. As such, there is not only a moral case for supporting employees, but also a business case for investing in financial wellbeing as a strategic approach to enhance staff satisfaction and retention.

How employers can better support their employees’ long-term financial planning

One of the most effective approaches to assist employees in planning for their financial future is by offering comprehensive financial education and training. Many employees lack the necessary financial literacy to make informed decisions regarding their finances, particularly when it comes to the complexities of long-term financial planning.

As such, even something as simple as providing access to educational resources can help employees acquire essential skills such as budgeting, saving, investing, retirement planning, and debt management. These resources enable employees to make better-informed monetary decisions, providing them with the support they need to effectively manage their longterm finances.

Additionally, facilitating access to independent financial advisors (IFAs) can be instrumental in helping employees develop a personalised strategy to grow their savings, despite the challenges posed by the current economic landscape. IFAs offer tailored, unbiased advice that aligns with employees’ specific long-term financial goals, whether they are saving for a property or want to ensure they have a dream retirement.

Moreover, the implementation of a comprehensive pension dashboard proves invaluable in enabling workers to effectively plan for their long-term retirement goals. Such platforms streamline and optimise pension management, while also providing the added benefit of helping employees trace any lost pension pots from previous employers. Indeed, this can deliver a healthy boost to an individual’s financial outlook.

30 | Issue 51 BUSINESS

Final thoughts

While the economic situation is beginning to look more positive, businesses cannot become complacent when it comes to supporting their employees. They must continue to ensure that they are providing the support that their staff need to navigate the rest of their financial lives with confidence. By taking some of the measures described above, employers will empower their workforce to take charge of their financial futures, fostering a more confident and financially secure workforce for years to come.

Chieu Cao is the founder and CEO of Mintago, an FCA-regulated company that provides its users with the UK’s most complete and inclusive financial wellbeing solution. By equipping its users with financial planning tools, over 1,000 pieces of educational material, access to financial advisers, a Money Helper AI and a dashboard that allows for full pension management, Mintago helps businesses support their staff during the cost-of-living crisis and supply them with everything they need to navigate their financial lives with confidence. Mintago can also assist businesses in saving thousands in NIC, as well as providing their staff with direct savings.

Issue 51 | 31 BUSINESS

Chieu Cao CEO Mintago

Turnaround time: private equity could be crucial to sub-Saharan Africa’s economic resurgence

Let’s not try and gloss over reality. The global economy has had a tough few years. A global pandemic was followed by supply chain disruptions (exacerbated by Russia’s war in Ukraine), which was then followed by rampant inflation, rises in energy costs, and increasingly high-interest rates that have suddenly made everyone’s debt a lot more expensive. Few regions, however, have felt the impact of those economic ructions to the degree that countries in subSaharan Africa have.

In fact, the pandemic drove reductions in gross domestic product (GDP) across the region as well as depressed formal and informal economic activity and increased unemployment and increases in extreme poverty. And in 2022, inflation for the region hit 14.47% , a rate it last came close to in 2001. Economic growth, meanwhile, fell to 3.6% in 2022 , down from 4.1% in 2021.

It’s a far cry from the heady days of The Economist’s iconic “Africa Rising” cover of December 2011. But it’s also true that governments and businesses across the region are looking beyond the current crisis and towards an eventual resurgence. As they do so, it’s vital that they consider the role private equity could play in that resurgence.

Helping companies survive, then thrive

With the current global economic crisis piling on top of domestic economic issues, many countries are seeing a growing number of businesses that are either in distress or on the verge of closure. Many others have already been forced to close. In South Africa, for example, company liquidations in December 2022 were up 30.3% year-on-year.

Those companies that were forced into liquidation weren’t necessarily bad companies either. Far from it. In all likelihood, they lacked a combination of capital and the expertise needed to get through a period of economic volatility. The same is true of companies on the verge of closure.

That’s where private equity firms come into play. The right private equity firm can help a promising company in even the most difficult of economies survive and then thrive. That’s not just something I believe either. It’s something we’ve managed to achieve a number of times with our own portfolio companies. There are also others out there that are committed to helping African companies reach their full potential.

As sub-Saharan Africa prepares for an economic resurgence, private equity firms could prove crucial in ensuring that businesses are in the best possible position to bounce back and even fuel further growth.

The right PE partners

The key, however, is to attract and find the right private equity firms. You don’t have to be an industry insider to know that some firms have a reputation for buying out a distressed company, stripping it of its assets, and selling them off for a tidy profit.

Those aren’t the kinds of private equity firms you want in the region right now (or ever, really). You want firms that see the potential in portfolio companies and take a ‘boots-on-the-ground’ approach to investing. More than that, you want firms that use African expertise to help their portfolio companies achieve their full potential.

That’s because it’s those firms that recognise that all the factors which made Africa so attractive in 2011 (a young, increasingly well-educated population, growing levels of connectivity, and rapid urbanisation) are still in place. Once the current global economic crisis reaches its endpoint, those factors will really come into play again.

It’s also worth noting that those kinds of private equity firms are also less likely to be spooked by rising interest rates and will continue investing in the region, regardless.

32 | Issue 51 INVESTING

Unity of purpose

But if private equity investors are to play that role to full effect, then players from across the economic value chain must come together and work with unity of purpose. In addition to the investors themselves, governments need to create conditions that incentivise the right kinds of investments and educate businesses on what types of investments are available. Regional business bodies, meanwhile, need to promote the businesses in their region to investors. And the businesses themselves need to be receptive to the suggestions of their investors.

I have no doubt that sub-Saharan Africa can, and will, experience an economic resurgence. But in order for that resurgence to be something that can be built on and that benefits people across the region, a lot of players are going to have to come together and work in the same direction. Private equity can’t create that resurgence on its own but it will be crucial to it.

Issue 51 | 33 INVESTING

Bryan Turner Partner Spear Capital

Financial services companies seek to unlock efficiencies of cybersecurity automation

As cyber threats intensify and the resources to deal with them remain limited, there is a growing need for automation in cybersecurity. The intelligent automation of key processes can significantly improve an organisation’s security posture while supporting under-pressure employees by reducing reliance on manual activities.

This is particularly relevant for financial services CISOs, who are under pressure to support digital transformation and mobile-first initiatives that are rapidly increasing the cyber attack surface, and who need to leverage all the efficiencies possible as they strive to defend the digital vault. However, automation is a relatively new approach in cybersecurity. Evidence suggests that many organisations are struggling to implement it effectively.

To understand more about the automation challenge, ThreatQuotient surveyed 750 cybersecurity professionals from organisations in the USA, UK, and Australia, with 150 respondents coming from the financial services industry. This was a follow-up to our 2021 UK survey, which revealed businesses had a lack of trust in outcomes from automation processes. Despite this, cybersecurity automation has gained traction over the intervening period, and this year’s results show that concerns have moved to more practical deployment issues such as integrating with existing technology and a lack of skills in the workforce.

These challenges were also evident when we asked respondents to rate the current maturity of their cybersecurity operations on a scale adapted from one originally developed by Accenture. We wanted to get a sense of how cybersecurity professionals view the sophistication of their set-up and how it contributes to the wider business.

Cybersecurity operations maturity scale:

LEVEL 1 We know we need to establish a cybersecurity operations capability, but we have no budget, personnel, or technology in place to build one.

LEVEL 2 We are using some intelligence feeds but do not have a SOC or SIEM in place and cannot link threats to our strategic position. We have limited resources to support our security operations practice.

LEVEL 3 We have an established cybersecurity operations practice with dedicated personnel, we curate our feeds and can relate threats to our organisational environment and events, but our approach is reactive and mean time to detection is longer than we would like.

LEVEL 4 We have an established cybersecurity operations practice that is tuned to recognise threats that are specific to our organisation and prioritises them accordingly. We integrate with the wider business.