The views expressed in this presentation are very definitely, unequivocally, and without a doubt my own. They do not necessarily represent the views of the Federal Reserve Bank of Atlanta, the Federal Reserve System, or anyone else for that matter.

The views expressed in this presentation are very definitely, unequivocally, and without a doubt my own. They do not necessarily represent the views of the Federal Reserve Bank of Atlanta, the Federal Reserve System, or anyone else for that matter.

The Federal Reserve supports the efforts of [central banks] to identify key issues and potential solutions for the climate-related challenges most relevant to central banks and supervisory authorities.

While the primary responsibility for addressing climate change itself rests with elected officials, the Federal Reserve is committed to working within our existing mandates and authorities to address the implications of climate change, particularly the regulation and supervision of financial institutions and the stability of the broader financial system. (emphasis added)

Something completely different from the ECB.

…we are turning our commitment to fighting climate change into real action”, says ECB President Christine Lagarde. “Within our mandate, we are taking further concrete steps to incorporate climate change into our monetary policy operations…

To that end, the Eurosystem will tilt [corporate bond] holdings towards issuers with better climate performance through the reinvestment of the sizeable redemptions expected over the coming years….

The Eurosystem will limit the share of assets issued by entities with a high carbon footprint that can be pledged as collateral by individual counterparties when borrowing from the Eurosystem.

Source: European Central Bank – “ECB takes further steps to incorporate climate change into its monetary policy operations,” press release, July 4, 2022.

The Federal Reserve Board on Thursday announced that six of the nation's largest banks will participate in a pilot climate scenario analysis exercise designed to enhance the ability of supervisors and firms to measure and manage climate-related financial risks….

The pilot exercise will be launched in early 2023 and is expected to conclude around the end of the year.

Source: Board of Governors of the Federal Reserve System – Press release, September 29, 2022, https://www.federalreserve.gov/newsevents/pressreleases/other20220929a.htm

Over the course of the pilot, participating firms will analyze the impact of the scenarios on specific portfolios and business strategies. The Board will then review firm analysis and engage with those firms to build capacity to manage climate-related financial risks.

there will be no capital or supervisory implications from the pilot.

firm-specific information will be

release,

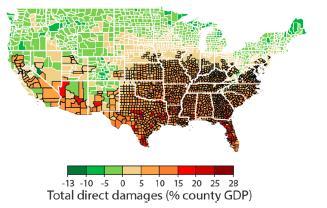

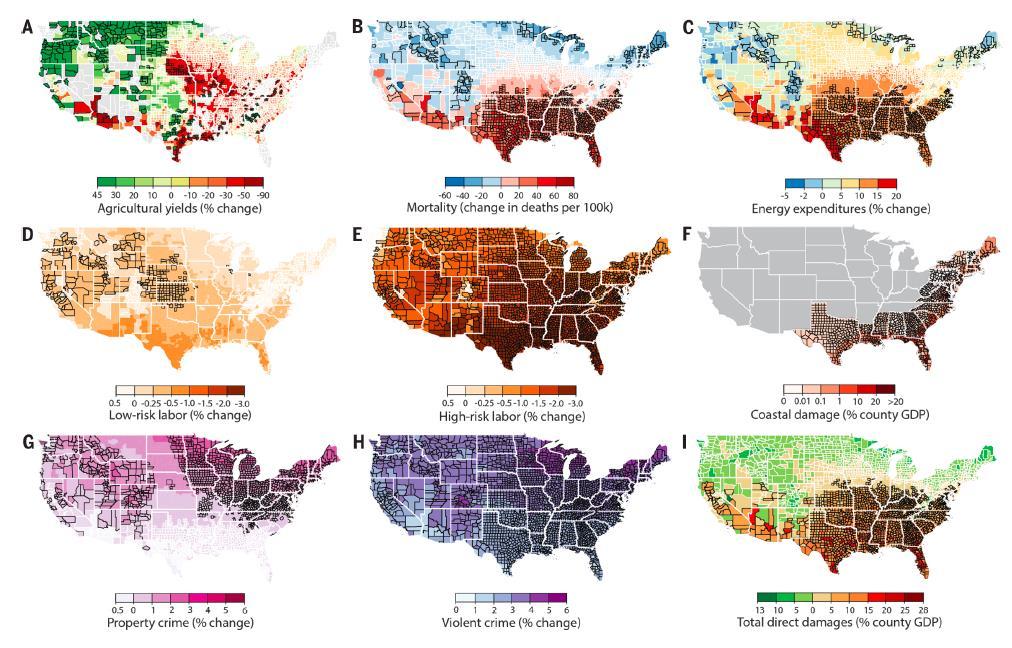

In some counties, median losses exceed 20% of gross county product (GCP), while median gains sometimes exceed 10% of GCP.

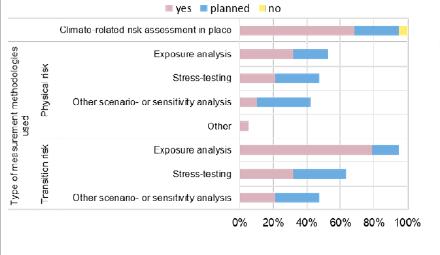

“… a specific subset of scenario analysis, typically used to evaluate a financial institution’s near-term resiliency to economic shocks, often through a capital adequacy target.”

“… a specific subset of scenario analysis that is used to evaluate the effect of a specific variable [e.g. policy changes] on economic outcomes”

“

“Climate Change and Financial Policy: A Literature Survey,” Benjamin N. Dennis, Federal Reserve Board of Governors, July 2022.

Climate Change and Adaptation in Global Supply-Chain Networks,” Nora M.C. Pankratzand Christoph M. Schiller, Federal Reserve Board of Governors, August 2022.

“How Communities on the Front Lines of Climate Change Are Mobilizing,” Belicia Rodriguez and Javier Silva, Federal Reserve Bank of New York, April 2021.

“Climate Change and Consumer Finance: A Very Brief Literature Review,” Jose Canals-Cerda and Raluca A. Roman, Federal Reserve Bank of Philadelphia, October 2021.

”Effects of Wildfire Destruction on Migration, Consumer Credit, and Financial Distress,” Kathryn McConnell et al, Federal Reserve Bank of Cleveland, December 2021.

”

Homeowners Insurance and Climate Change,” Shanthi Ramnath and Will Jeziorski, Federal Reserve Bank of Chicago, September 2021.

”Drought Risk to the Agriculture Sector,” David Rodziewicz and Jacob Dice, Federal Reserve Bank of Kansas City, December 2020.

”Long-Term Macroeconomic Effects of Climate Change: A Cross-Country Analysis,” Matthew E. Kahn et al, Federal Reserve Bank of Dallas, July 2019.

”Climate Change Is a Source of Financial Risk,” Glenn D. Rudebusch, Federal Reserve Bank of San Francisco, February 2021.