0 Past Performance Is Not Necessarily Indicative Of Future Results. McVEAN Trading & Investments, LLC

Drury

McVean Trading and Investments, LLC JULY 12, 2023

OUR KEY LEAD INDICATOR IS PROFITS Michael

Chief Economist

• NO US RECESSION IN NEXT FOUR QUARTERS – REST OF WORLD AT RISK

• US INFLATION FALLS TO UNDER 3% BEFORE THE END OF THE YEAR -- ROW HMMM…

• BUT, THE FED REMAINS VIGILANT - WITH NO EASE BEFORE MID-2024

KEY TAKEAWAYS

1 Past Performance Is Not Necessarily Indicative Of Future Results.

Past Performance Is Not Necessarily Indicative Of Future Results.

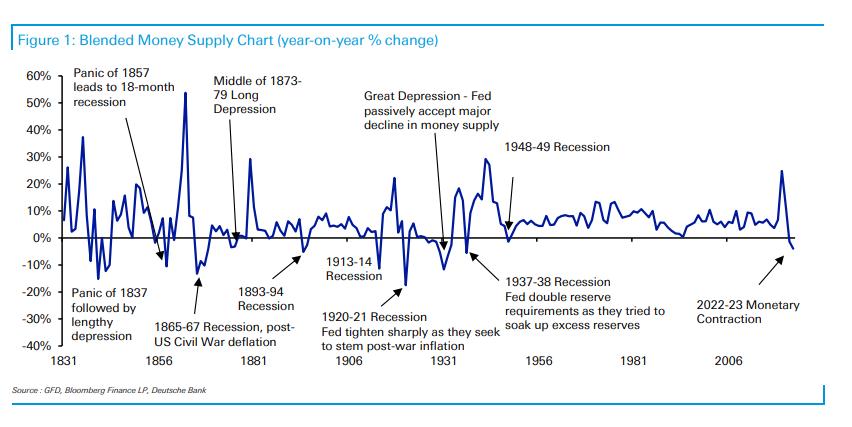

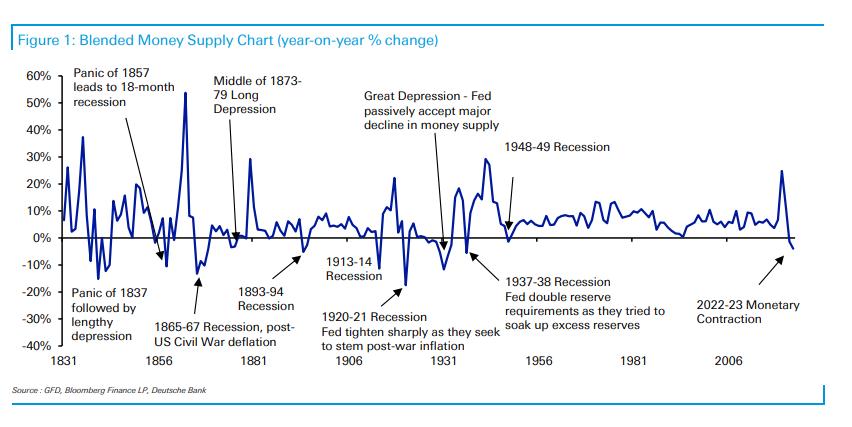

MONEY CONTRACTING AFTER BOOM –

2

1921, 1937, 1948?

OUR KEY LEAD INDICATOR IS PROFITS

CORPORATE AND NONCORPORATE MARGINS

CORP GDP - CORP. INDIRECT TAXES, DEPR., COMP, INTEREST AND TRANSFERS/ CORP GDP

GDP - TAXES, DEPR, COMP, TRANSFERS AND INTEREST - CORP PROFITS/ (GDP- CORP GDP)

SOURCE: BEA

Past Performance Is Not Necessarily Indicative Of Future Results.

3

13.0% 17.0% 21.0% 25.0% 29.0% 7.0% 11.0% 15.0% 19.0% 23.0% Jun-60 Jun-65 Jun-70 Jun-75 Jun-80 Jun-85 Jun-90 Jun-95 Jun-00 Jun-05 Jun-10 Jun-15 Jun-20

X

COMPENSATION THROUGHOUT THE RECOVERY

Past Performance Is Not Necessarily Indicative Of Future Results.

SOURCE: BLS

NOMINAL GDP HAS EXCEEDED

4

-10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% Mar-00 Mar-02 Mar-04 Mar-06 Mar-08 Mar-10 Mar-12 Mar-14 Mar-16 Mar-18 Mar-20 Mar-22

CURRENT QTR %CH FROM YEAR AGO QTR GDP COMPENSATION

GDP GROWTH VS COMPENSATION GROWTH

PRICES RISING FASTER THAN UNIT LABOR COSTS

UNIT LABOR COSTS NONFARM BUSINESS DEFLATOR SOURCE:BLS

Past Performance Is Not Necessarily Indicative Of Future Results.

5

• SOU -5.0% -2.5% 0.0% 2.5% 5.0% 7.5% 10.0% Mar-00 Mar-04 Mar-08 Mar-12 Mar-16 Mar-20 UNIT LABOR COSTS VS INFLATION YEAR / YEAR CHANGE

CORPORATE SAVINGS STILL ELEVATED SUPPORTED BY CONSUMER

SECTOR BALANCES

AS A PERCENT OF GROSS DOMESTIC PRODUCT

SOURCE: BEA

FOREIGN BALANCE HOUSEHOLD BALANCE GOVERNMENT BALANCE CORPORATE BALANCE

Past Performance Is Not Necessarily Indicative Of Future Results.

6

-24.0% -18.0% -12.0% -6.0% 0.0% 6.0% 12.0% 18.0% 24.0% Mar-19 Mar-20 Mar-21 Mar-22 Mar-23

A PAUSE NOW, NOT RECESSION LATER

Past Performance Is Not Necessarily Indicative Of Future Results.

7

0.380 0.420 0.460 0.500 0.540 0.580 0.620 0.660 0.700 Jan-98 Jan-00 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10 Jan-12 Jan-14 Jan-16 Jan-18 Jan-20 Jan-22

NON-MANUFACTURING

MONTH AVERAGE MANUFACTURING ISM NON-MANUFACTURING ISM

MANUFACTURING &

ISM NEW ORDERS INDEX THREE

Past Performance Is Not Necessarily Indicative Of Future Results.

8

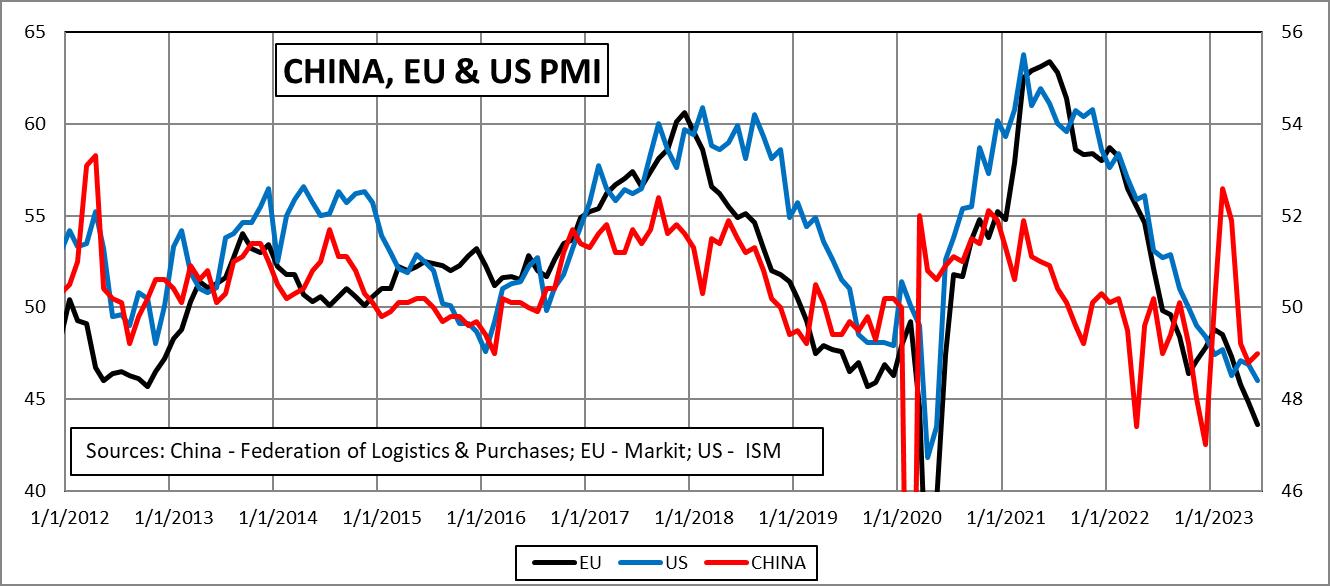

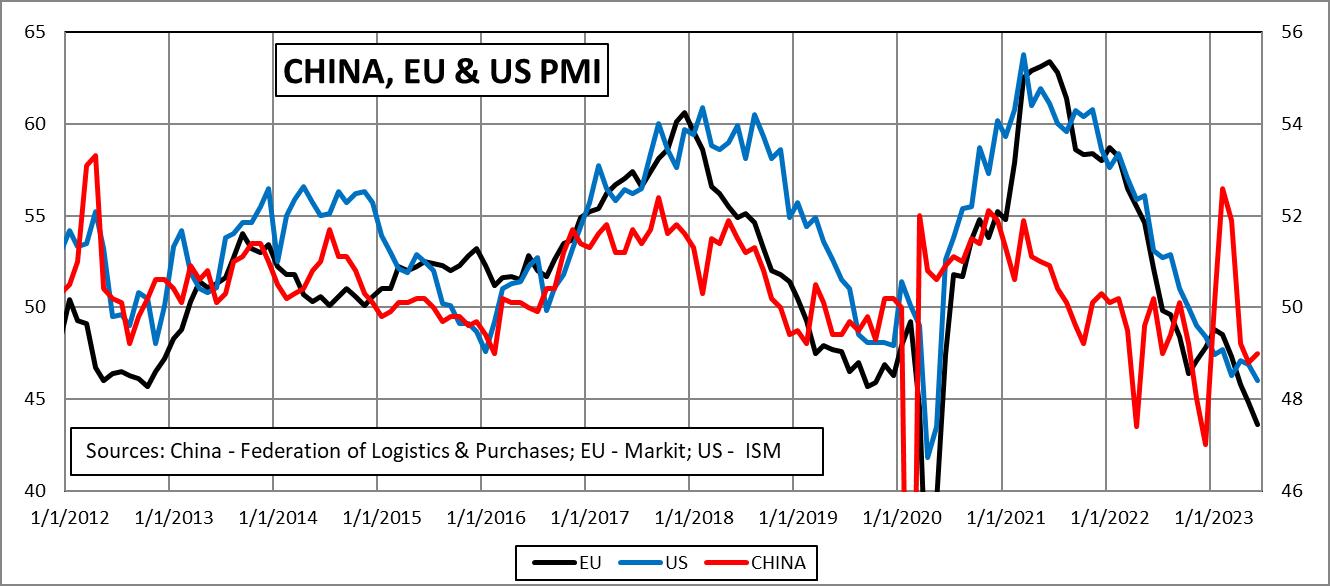

GLOBAL MANUFACTURING RECESSION

Past Performance Is Not Necessarily Indicative Of Future Results.

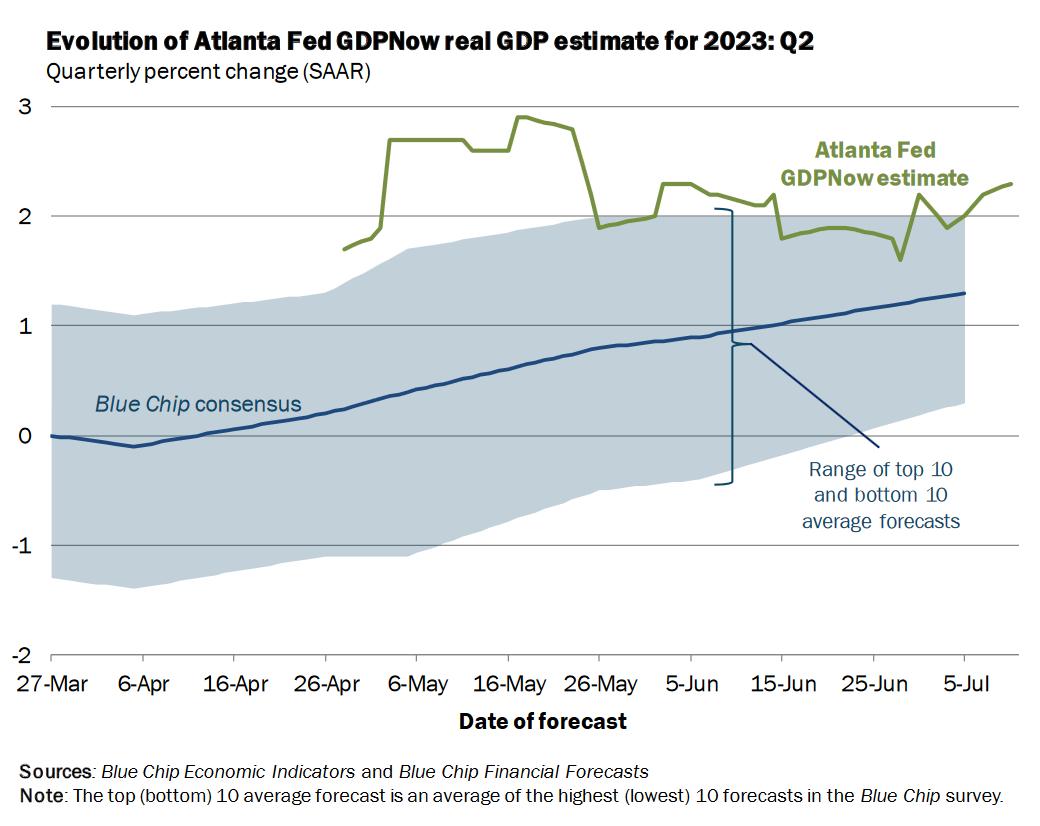

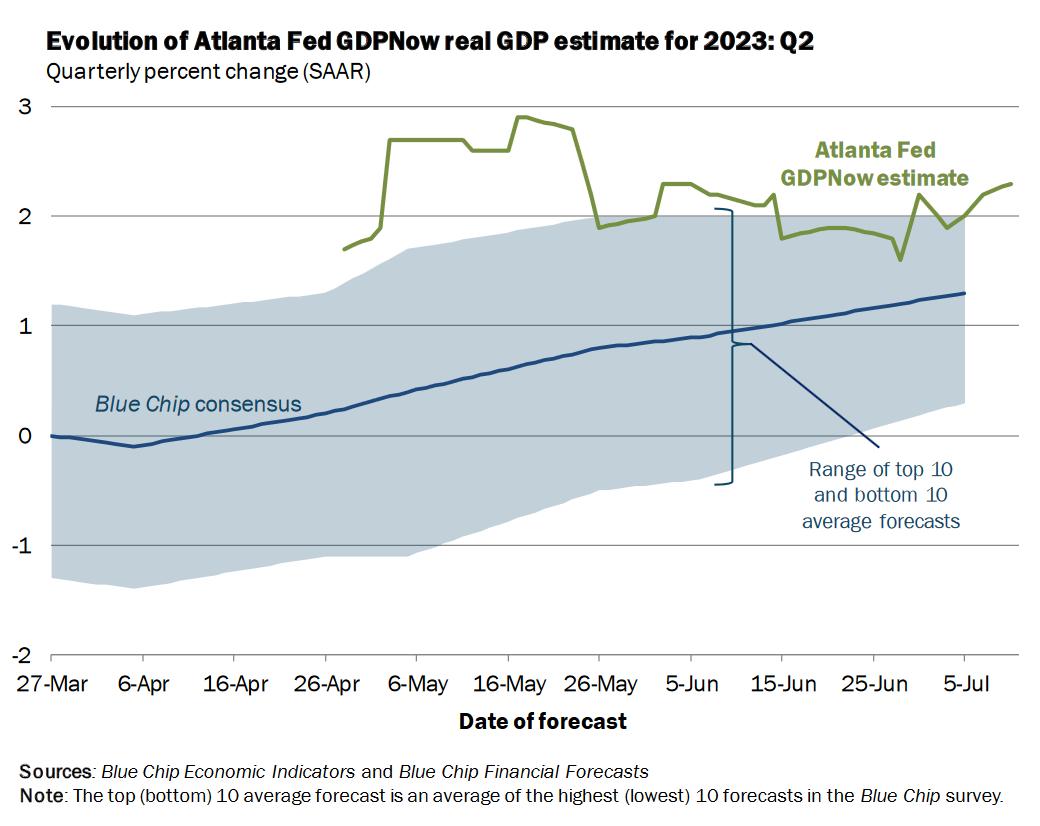

2% + QUARTER 9

ANOTHER

RIGHT ON SCHEDULE

REAL GDP VS TREND

Past Performance Is Not Necessarily Indicative Of Future Results.

SOURCE: BEA

10

15,000 16,000 17,000 18,000 19,000 20,000 21,000 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23

REAL GDP 1.66% TREND

BEST GUESS 1.4% PRODUCTIVITY

NONFARM BUSINESS PRODUCTIVITY GROWTH

SOURCE: BLS

Past Performance Is Not Necessarily Indicative Of Future Results.

11

-2.5% 0.0% 2.5% 5.0% 7.5% Mar-05 Mar-08 Mar-11 Mar-14 Mar-17 Mar-20 Mar-23

4 QTR CHANGE 3 YR AVG = 1.4% 2.8% 0.3% 0.9% 1.6% 1.4%

NO INFLATION – JUST SQUEEZING THE BALLOON

12

Performance Is Not Necessarily Indicative Of Future Results.

Past

-0.02 -0.01 0 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 -25.0% -17.5% -10.0% -2.5% 5.0% 12.5% 20.0% 27.5% 35.0% Mar-20 Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Jun-22 Sep-22 Dec-22 Mar-23 Jun-23

INFLATION CHANGE FROM SAME MONTH

AGO 60/40 RETURN

SOURCE: BLOOMBERG,BLS

BLOOMBERG 60/40 PORTFOLIO VS

ONE YEAR

PCE DEFLATOR

SOURCE: BLOOMBERG

Past Performance Is Not Necessarily Indicative Of Future Results.

13

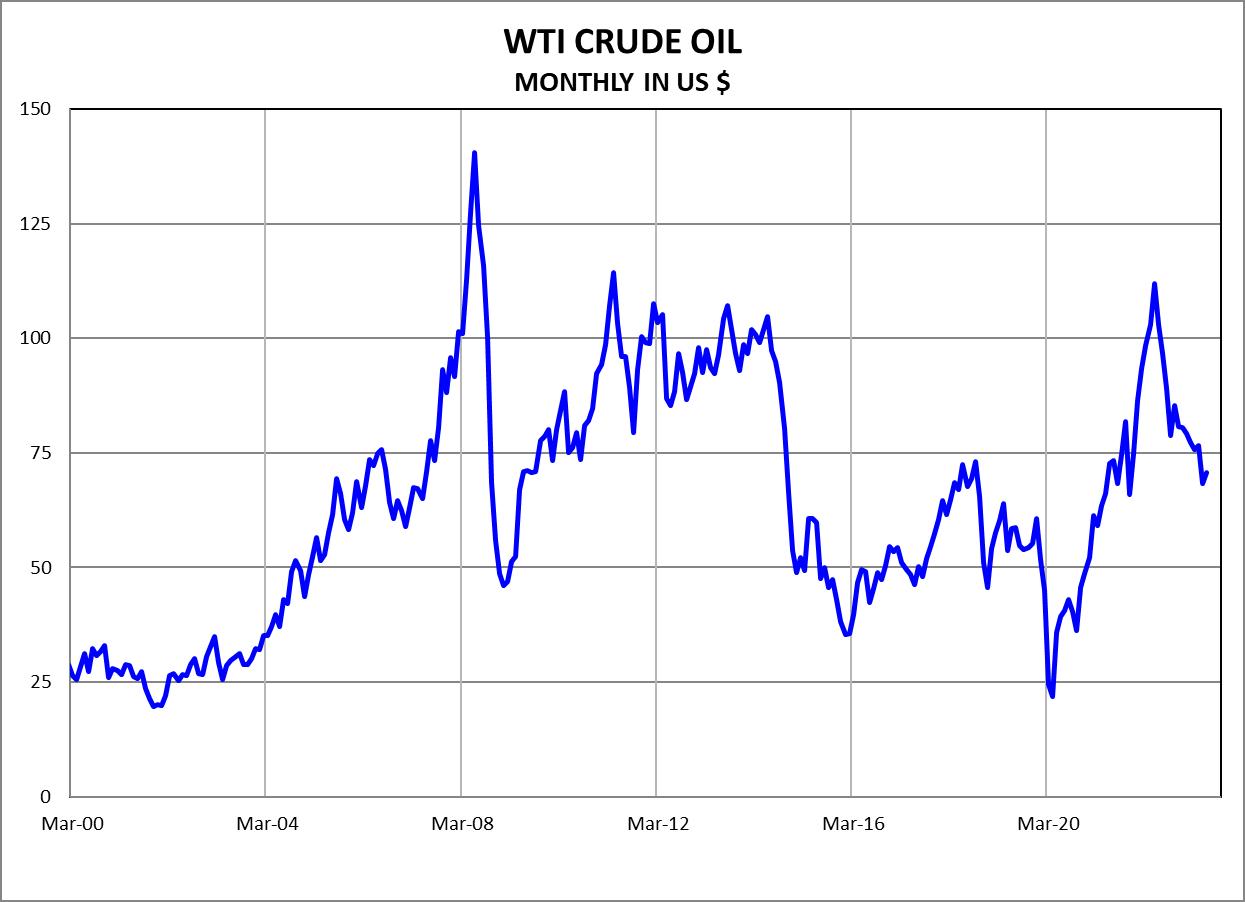

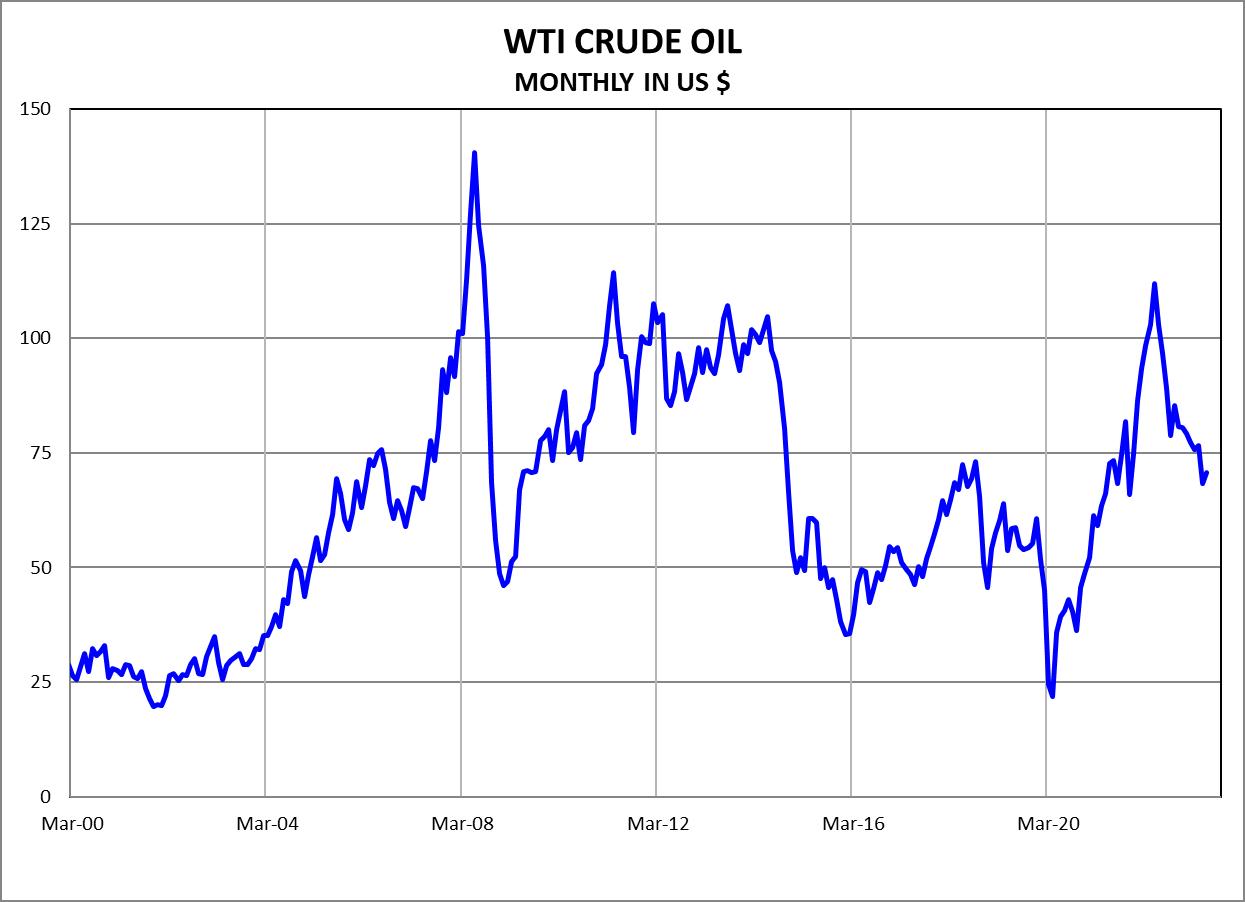

CRUDE IN LOW SEVENTIES

Past Performance Is Not Necessarily Indicative Of Future Results.

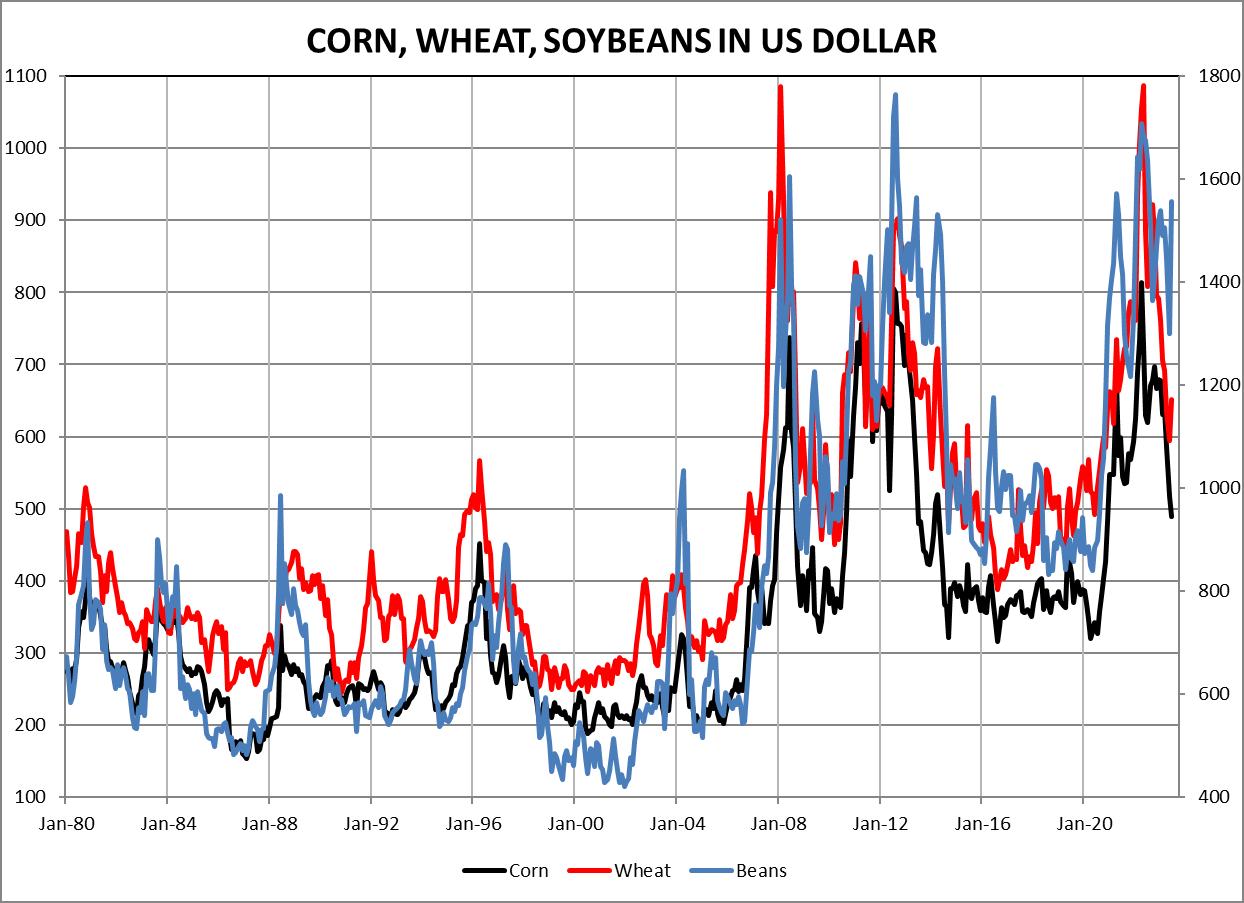

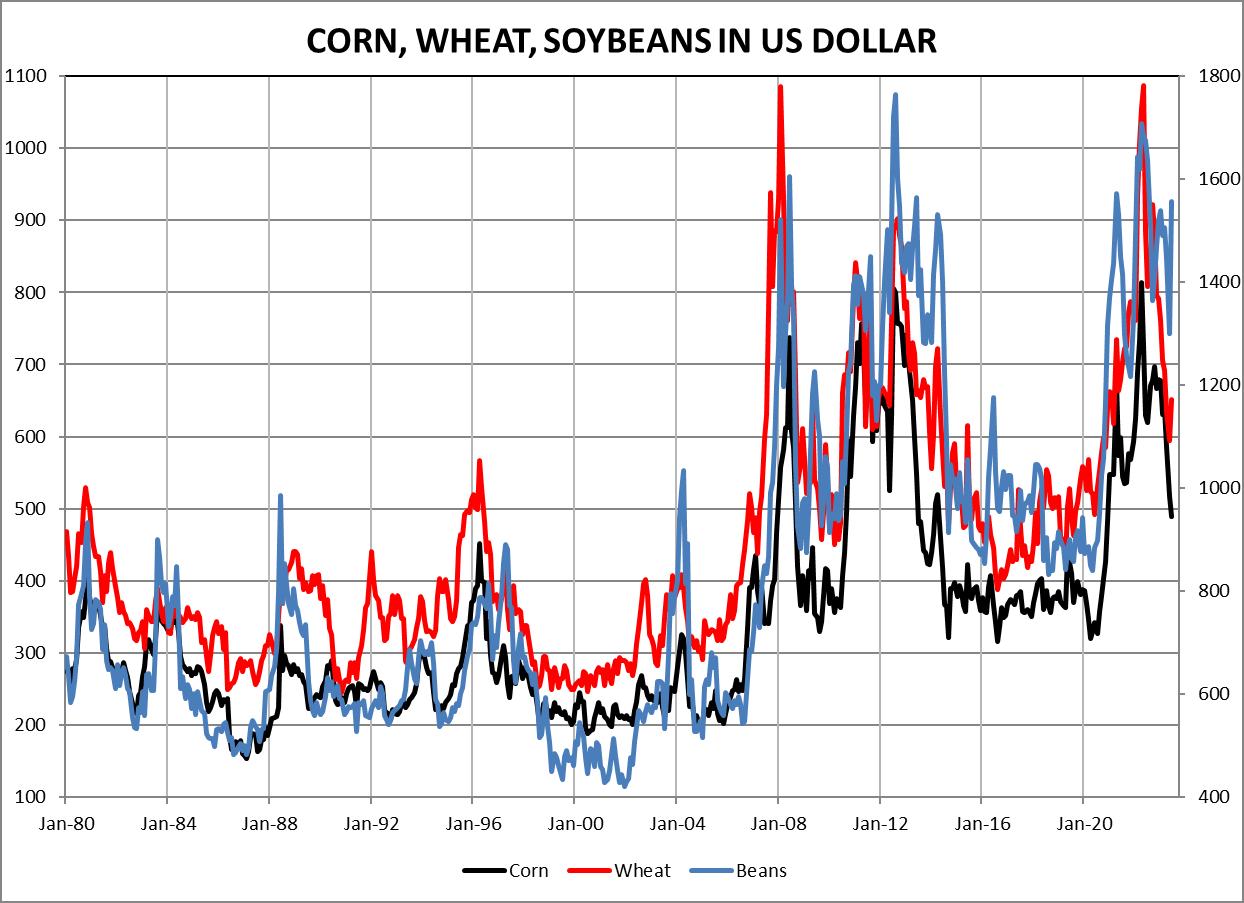

GRAINS WELL PAST PEAK 14

SOURCE: BLOOMBERG

GOODS PRICES HEADED UNDER ZERO

SOURCE: ISM, BLS

Past Performance Is Not Necessarily Indicative Of Future Results.

15

-6.0% -3.0% 0.0% 3.0% 6.0% 9.0% 12.0% 0.10 0.30 0.50 0.70 0.90 1.10 1.30 Jan-03 Jan-05 Jan-07 Jan-09 Jan-11 Jan-13 Jan-15 Jan-17 Jan-19 Jan-21 Jan-23

ISM MANUFACTURING INDEX VS INFLATION

PRICES PCE GOODS DEFLATOR

SUPERCORE COOLING TO UNDER 3%

SERVICES ISM PRICE INDEX VS SUPERCORE INFLATION

SERVICE ISM PRICES SUPERCORE INFLATION (BLS)

SOURCE: ISM, BLS

Past Performance Is Not Necessarily Indicative Of Future Results.

16

0.0% 1.5% 3.0% 4.5% 6.0% 7.5% 0.40 0.50 0.60 0.70 0.80 0.90 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23

AND RENTS WILL FOLLOW HOME PRICE

APPRECIATION VS RENT HIKES CURRENT

EXISTING HOME PRICE OWNERS EQUIVALENT RENT SOURCE: NAR, BLS

Past Performance Is Not Necessarily Indicative Of Future Results.

17

-1.00% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% -16% -12% -8% -4% 0% 4% 8% 12% 16% Jan03 Jan04 Jan05 Jan06 Jan07 Jan08 Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 Jan16 Jan17 Jan18 Jan19 Jan20 Jan21 Jan22 Jan23

MO % CH FROM YEAR

AGO

18 Past Performance Is Not Necessarily Indicative Of Future Results. 4.2 -1.7 + ? = -0.1% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 0.7% 0.8% 0.9% 1.0% Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 PCE INFLATION MEASURES ONE MONTH CHANGE PCE DEFLATOR PCE CORE Source: BEA EXP FROM CPI

3.4% HEADLINE PCE DEFLATOR IN AUGUST?

LOW PAY WAGES STRONG, HIGH PAY WEAK

Past Performance Is Not Necessarily Indicative Of Future Results.

SOURCE: BLS

19

1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% Jan-08 Jan-10 Jan-12 Jan-14 Jan-16 Jan-18 Jan-20 Jan-22 AVERAGE HOURLY EARNINGS 3 MO AVG % CH FROM YEAR AGO 3 MO AVG PRIVATE SECTOR NONSUPERVISORY

MORE CHEAPER FOREIGN LABOR

TRADE DEFICIT / GDP

Past Performance Is Not Necessarily Indicative Of Future Results.

20

2.00% 2.50% 3.00% 3.50% 4.00% 4.50% Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23

SOURCE: BEA

SOURCE: BLOOMBERG

Past Performance Is Not Necessarily Indicative Of Future Results.

21

MADE EVEN CHEAPER BY STRONG DOLLAR

“RICHCESSION” LIKELY A PERSISTENT FACT

BLOOMBERG 60/40 PORTFOLIO / PCE DEFLATOR MONTHLY

Past Performance Is Not Necessarily Indicative Of Future Results.

22

50 100 150 200 250 300 1/31/2007 1/31/2009 1/31/2011 1/31/2013 1/31/2015 1/31/2017 1/31/2019 1/31/2021 1/31/2023

AVERAGE

SOURCE: BLOOMBERG, BLS

UNEMPLOYMENT RATE VS JOBS HARD TO GET CURRENT MONTH LEVEL

CONFERENCE BOARD'S JOBS HARD TO GET (SA) CIVILIAN UNEMPLOYMENT RATE (BLS)

Past Performance Is Not Necessarily Indicative Of Future Results.

TIGHT 23

LABOR MARKETS REMAIN

2.5% 4.5% 6.5% 8.5% 10.5% 12.5% 5 17 29 41 53 65 Jan-04 Jan-07 Jan-10 Jan-13 Jan-16 Jan-19 Jan-22

SOURCE: CONFERENCE BOARD, BLS

WORK WEEK BACK TO PRE-COVID NORM BUT DIFFERENT MIX

ALL WORKERS NONSUPERVISORY WORKERS

SOURCE: BLS

Past Performance Is Not Necessarily Indicative Of Future Results.

24

33.2 33.4 33.6 33.8 34.0 34.2 34.4 34.6 34.00 34.20 34.40 34.60 34.80 35.00 35.20 35.40 AVERAGE WORK WEEK MONTHLY

BANKS ARE ADAPTING MUCH FATTER MARGIN ON NEW MORTGAGES

0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 1/1/1976 1/1/1981 1/1/1986 1/1/1991 1/1/1996 1/1/2001 1/1/2006 1/1/2011 1/1/2016 1/1/2021

MORTGAGE RATES - US 10YR YIELDS

25 Past Performance Is Not Necessarily Indicative Of Future Results.

Bloomberg

Source:

BIG GUYS HAVE A DIFFERENT FINANCING COST THAN OTHERS

SOURCE: BLOOMBERG

26 Past Performance Is Not Necessarily Indicative Of Future Results. 500 1000 1500 2000 2500 3000 3500 4000 4500 5000 S&P 500

RUSSELL 2000

27 Past Performance Is Not Necessarily Indicative Of Future Results. 500 700 900 1100 1300 1500 1700 1900 2100 2300 2500 1/9/2009 1/9/2011 1/9/2013 1/9/2015 1/9/2017 1/9/2019 1/9/2021 1/9/2023

SMALLER GUYS SUFFER

SOURCE: BLOOMBERG

NFIB EARNINGS VS EXPECT ECONOMY UP POSITIVE RESPONSES MINUS NEGATIVE

EXPECT ECONOMY UP ACTUAL EARNINGS

Past Performance Is Not Necessarily Indicative Of Future Results.

OUTLOOK POOR, EARNINGS MEH 28

NFIB

-50 -40 -30 -20 -10 0 10 -70 -60 -50 -40 -30 -20 -10 0 10 20 30 40 50 60 Jan-86 Jan-91 Jan-96 Jan-01 Jan-06 Jan-11 Jan-16 Jan-21

SOURCE: NFIB

NEXT SHOCK OR POLICY ERROR? UP AS LIKELY AS DOWN

• NOT FISCAL UNTIL AFTER NEXT ELECTION

• FED ALMOST DONE – AND 50 BP IS NOTHING AFTER 500!

• STUDENT LOANS AND DEBT CEILING KICKED INTO 2024

• OUTSIDE US: CHINA SLUMP HURTS WORLD, BUT HELPS US

• EUROPE: RECESSION OR PEACE BREAKS OUT?

• ROW: OPEC BECOMES AN EFFECTIVE CARTEL?

• ASEAN & INDIA FLOURISH ON GLOBAL CAPITAL FLOWS

• AI? CLIMATE CHANGE? TAIWAN? FINANCIAL BLACK SWAN?

29 Past Performance Is Not Necessarily Indicative Of Future Results.