International climate finance and carbon markets –opportunities and challenges

40th Annual Monetary & Trade Conference -

The Economics of Climate Change

Philadelphia, November 15, 2022

Klaus Oppermann, Senior Economist, The World Bank koppermann@worldbank.org

World Bank, https://openknowledge.worldbank.org/bitstream/handle/10986/33917/149752.pdf?sequence=2&isAllowed=y

Brown vs Green Economy - stylized

Non-climate externalities

Transition costs

Capex Opex

Climate externality Capex Opex Brown economy Green economy

Eight Sets of Climate Levers for Transformative Action

1. Project-Based Financing

Finance or project support to enable climate investments e.g. wind plant, climate resilient roads

5. Trade Policy

2. Financial Sector Reform

3. Fiscal Policy

4. Sector Priorities

6. Innovation and Tech Transfer

Development of new, more effective and cheaper green technologies e.g. demonstration plants, R&O, SME support, early/discounted financing

7. Carbon Markets

System to define and trade mitigation outcomes for cost efficient mitigation e.g. emission trading systems, baseline and crediting mechanisms

8. Climate Intelligence and Data

Knowing and planning tools to support policy and investment decisions e.g. 2050 low carbon resilience trajectories, NDC implementation plans

Financial sector regulations that catalyze green investment e.g. regulations for green bonds, climate risks in portfolio assessments

Setting taxes and adjusting spending priorities to support climate action e.g. green taxes, improved subsidy targeting, green procurement

Regulatory standards or information provision policies e.g. energy efficiency standards, building codes

Trade policies to encourage exchange of LCCR products e.g. carbon border tax adjustment, trade liberalization for LCCR products

Green financial sector reform – example: differentiation in capital requirement

https://openknowledge.worldbank.org/bitstream/handle/10986/38028/IDU0881e4d02027f504e120898502121116e2eb7.pdf?sequence=1&isAllowed=y

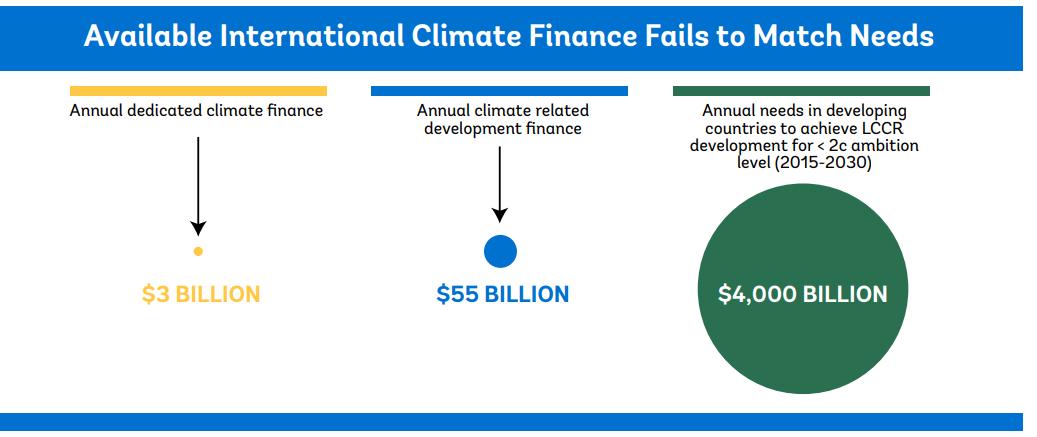

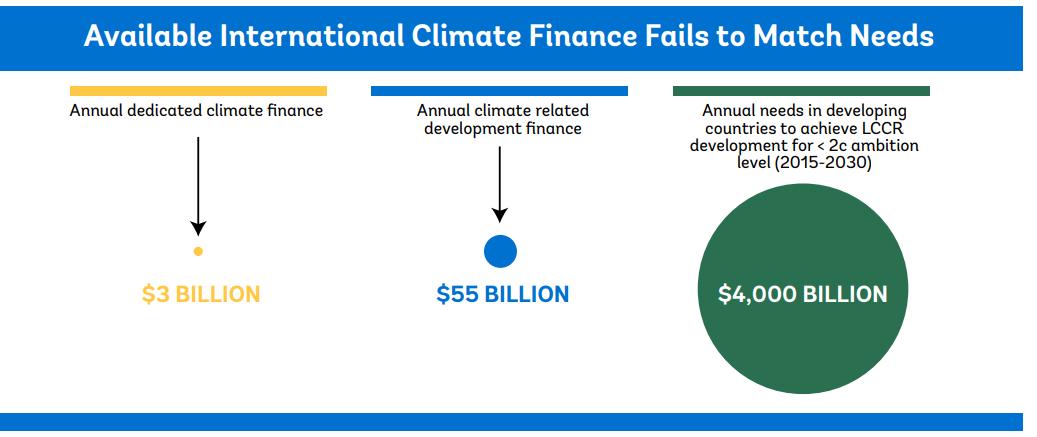

World Bank: https://openknowledge.worldbank.org/bitstream/handle/10986/25160/9781464810015.pdf?sequence=7&isAllowed=y Edmund, J. et all (2021): cost savings $300bn; flow volume $100bn, price $22/t.

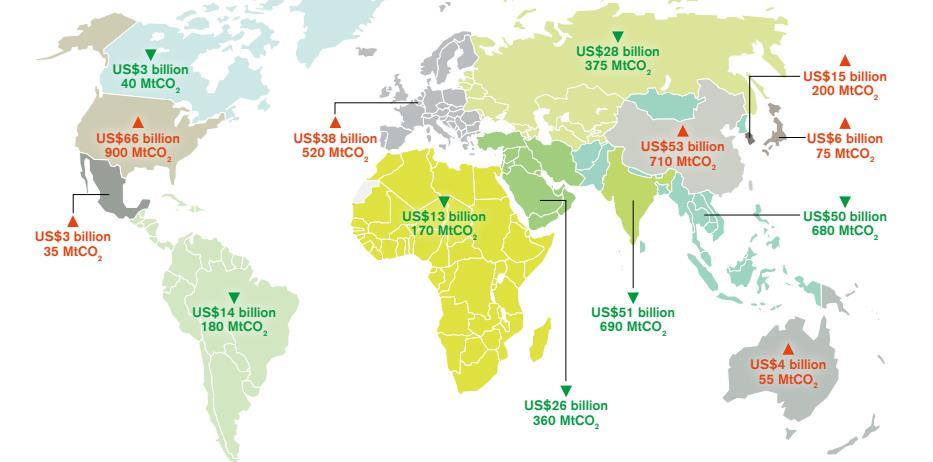

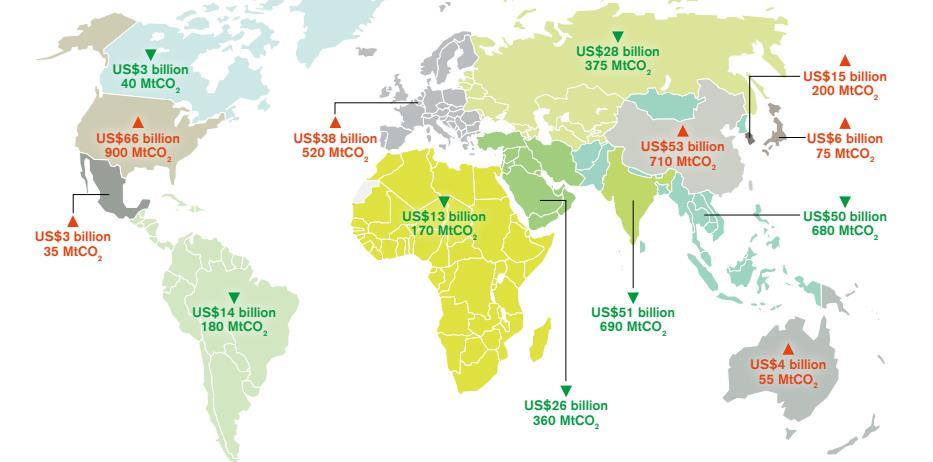

Modelling 2030 Carbon market flows

https://www.worldscientific.com/doi/10.1142/S201000782150007X

Example: Results-based climate finance to enable carbon markets Barriers to carbon markets under the Paris Agreement: • Environmental integrity and non-alignment risk; • Compliance risks under currently lacking intertemporal flexibility; • Pricing risks; • Insufficient domestic technical and administrative capacity. RBCF to: • Set environmental and Paris alignment standards; • Guarantee off-take at floor price; • Build and test required MRV and administrative procedures. https://www.worldbank.org/en/topic/climatechange/brief/scale-scaling-climateaction-by-lowering-emissions