State of the climate: six charts

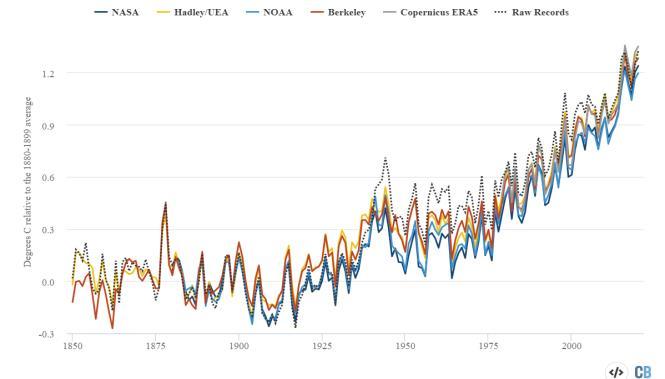

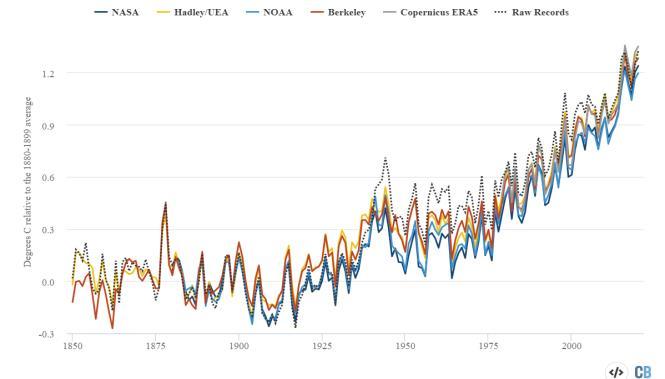

1850 – 2020

–

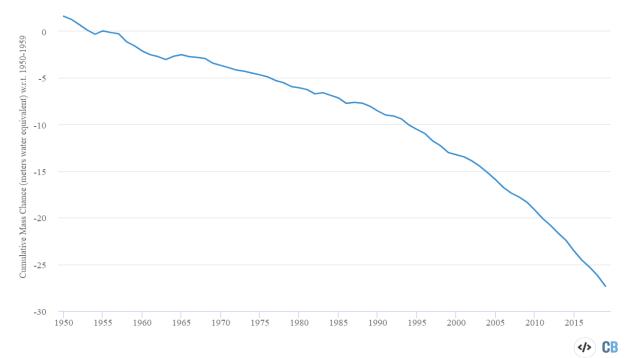

– 2020

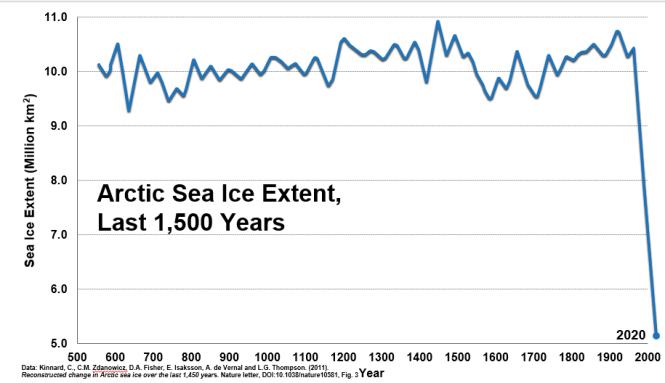

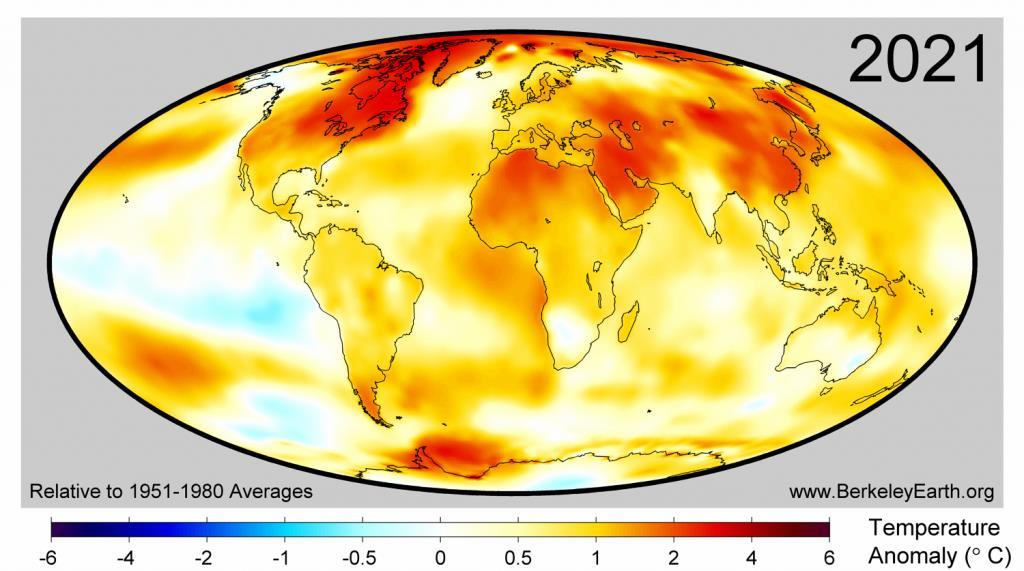

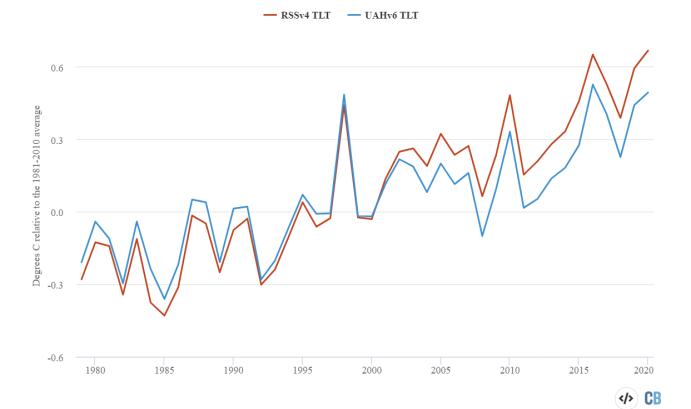

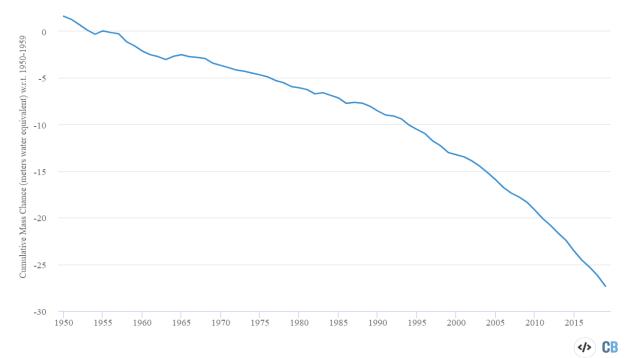

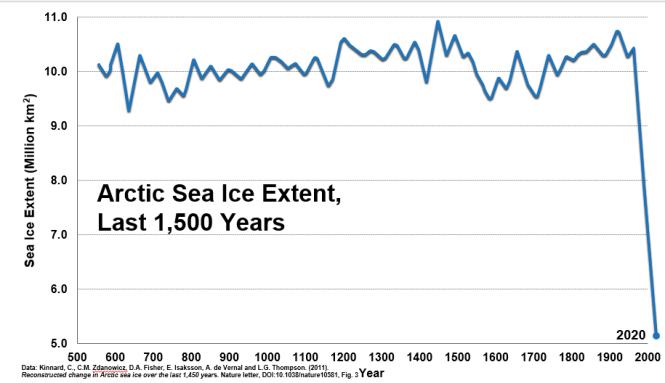

Arctic Sea Ice Extend, Last 1,500 Years Sea Level Rise 1900 – 2020 Glacier Ice, 1950 – 2020 Global Surface Temperatures,

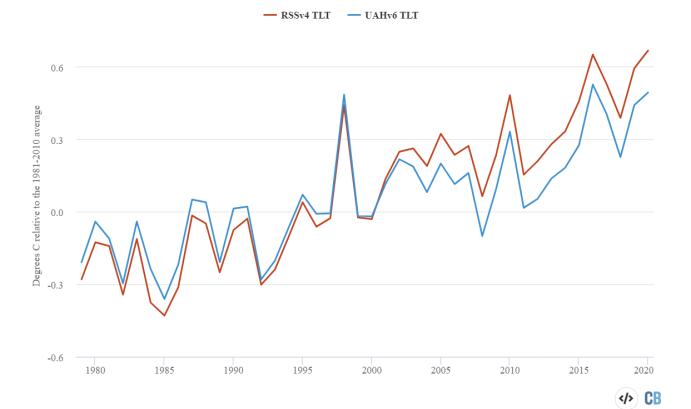

Satellite Temperature, 1980

2020 Ocean Heat Content 1960

State of the climate: how are we going to get there?

Today

OPPORTUNITIES

is happening Financial Impact Strategic Planning Risk Management Revenues Expenditures Capital& Financing Assets & Liabilities Balance Sheet Cash Flow Statement Income Statement RISKS Transition Policy and Legal ‒ Carbon pricing and reporting obligations Mandates on and regulation of existing products and services ‒ Exposure to litigation Technology ‒ Substitution of existing products and services with lower emissions options Unsuccessful investment in new technologies Market Changing customer behavior Uncertainty in market signals ‒ Increased cost of raw materials Reputation ‒ Shift in consumer preferences ‒ Increased stakeholder concern/negative feedback Stigmatization of sector Physical Acute: Extreme weather events ‒ Chronic: Changing weather patterns and rising mean temperature and sea levels

Transition

‒ Use of more efficient modes of transport and production and distribution processes Use of recycling ‒ Move to more efficient buildings ‒ Reduced water usage and consumption

Source ‒ Use of lower-emission sources of energy Use of supportive policy incentives Use of new technologies ‒ Participation in carbon market Products & Services ‒ Development and/or expansion of low emission goods and services Development

climate

and insurance risk solutions ‒ Development of new products or services through R&D and innovation

to new markets

public-sector incentives ‒ Access to new assets and locations needing insurance coverage

e ‒

in renewable energy programs and adoption of energyefficiency measures ‒ Resource substitutes/diversification

Resource Efficiency

Energy

of

adaptation

Markets Access

Use of

Resilienc

Participation

Risks are evident and opportunities exist

• Understanding climate risks does not require absolute certainty regarding attribution. Thus, the G20 Financial Stability Board launched the Taskforce on Climate-Related Financial Disclosures (TCFD) in 2015.

• Climate risks are defined as climate-related financial risks. Climate risk has two categories of risk – physical risk and transition risk. Physical risk are the physical effects from changing weather patterns that result from climate change.

• Physical risk results from hazards subdivided into acute risks and chronic risks. Acute risks include weather related or impacted events such as hurricanes. Chronic risks include gradual risks such as sea-level rise and increasing average temperatures.

• Transition risks arise from tighter government regulations, carbon taxes, technology changes, and investor / consumer behavior changes and preferences.

• Climate risks impact financial statements, drive asset and liability repricing, impact loan defaults, and supply chain revenue / cost of goods sold.

• Institutions face different hazards, exposures, and vulnerabilities.

Climate Risk Hazards / Drivers Exposure Vulnerability

Contact us to assess your

transition

Alpha gthoumi@responsiblealpha.com Strictly Confidential 8

Gabriel Thoumi, CFA, FRM, Certified Ecologist, CEO Responsible