NOVEMBER

Bahrain DF’s strategic hosting p.6 Spend-per-head success for DDF p.10 Dag Rasmussen on progressive growth p.14 Morocco moving toward recovery, says IDFS p.18

NOVEMBER

Bahrain DF’s strategic hosting p.6 Spend-per-head success for DDF p.10 Dag Rasmussen on progressive growth p.14 Morocco moving toward recovery, says IDFS p.18

Still riding the high from TFWA WE Cannes, we are happy to be seeing every one again in the Kingdom of Bahrain for the MEADFA Conference. It is an excellent way to reconnect and move the industry forward before we all take our much-anticipated end-of-year holiday.

Bahrain Duty Free is a first-time host of the MEADFA Conference. Bassam Al Wardi, CEO, Bahrain DF, tells Global Travel Retail Magazine the responsibility helps solidify the retailer as an innovative trailblazer in duty free experiences. Plus, with its recent relocation to the new terminal at Bahrain International Airport, Al Wardi says Bahrain DF is ready to share its successes with the entire industry as the return to travel takes off.

“Bahrain has an impressive new airport with state-of-the-art duty free shops. It deserves to be celebrated and highlighted to the rest of the industry,” agrees Sherif Tou lan, President of the Middle East & Africa Duty Free Association (MEADFA).

Toulan reiterates that “recovery is already here,” highlighting ACI’s strong figures for African and Middle East passengers.

"Featuring prominent industry leaders, we are happy to be bringing the MEADFA event to Bahrain and look forward to the thought-provoking debates and discussions that will take place during the conference, covering a wider regional array with an emphasis on Africa," he says.

Erik Juul-Mortensen, TFWA President, calls the Kingdom of Bahrain “an important air hub in the Gulf region,” and describes it as the perfect location to connect industry colleagues from the region with those of other international markets and vice versa.

Global Travel Retail Magazine is a proud media partner for the event, covering all news coming out of the two-day conference. We’re excited to say that all conversations in the lead up to this event indicate expecations for recovery in the Middle East and Africa markets in the months and years ahead.

We believe that much of this recovery is driven by the GTR industry making moves in this region, from new listings, partnerships, store openings and sustainability strate gies, to addressing supply chain challenges and merging the physical and virtual world to reinvigorate the shopping experience and rebuild tourism.

We feel the optimism and momentum driving the industry and we are so grateful to be part of the journey. It’s been another good year – and 2023 will be even better.

NOVEMBER 2022 · VOL 34 · NO 7

Global Travel Retail Magazine (ISSN 0962-0699) is published seven times a year by Paramount Publishing Ltd. It is distributed digitally worldwide, with printed issues in April, May, June, July, Septem ber, October and November.The views expressed in this magazine do not necessarily reflect the views and opinions of the publisher or the editor. November 2022, Vol 34. No. 7. Printed in Canada. All rights reserved. Nothing may be reprinted in whole or in part without written permission from the publisher. Paramount Publishing Ltd.

GLOBAL TRAVEL RETAIL MAGAZINE

Tel: 1 905 821 3344 www.gtrmag.com

PUBLISHER Aijaz Khan aijaz@globalmarketingcom.ca

EDITOR-IN-CHIEF Hibah Noor hibah@gtrmag.com

MANAGING EDITOR Jane Hobson jane@gtrmag.com

DEPUTY EDITOR Laura Shirk laura@gtrmag.com

SENIOR WRITER Rebecca Byrne rebeccabyrne10@yahoo.com.sg

SENIOR EDITOR Mary Jane Pittilla maryjanepittilla@hotmail.com

ART DIRECTOR Jessica Hearn jessica@globalmarketingcom.ca

CIRCULATION & SUBSCRIPTION MANAGER accounts@globalmarketingcom.ca

Kindest Regards,

HIBAH NOOR Editor-in-Chief hibah@dutyfreemagazine.ca

6

More than a place to shop

With a thriving new terminal store and hosting the MEADFA Conference for the first time, Bahrain Duty Free dis cusses its successes of 2021 and the promising end to 2022

10 Spend-Per-Head Surge

Soaring sales for Dubai Duty Free Perfumes, liquor, gold, cigarettes, tobacco and electronics remain the top five categories as Dubai Duty Free sees improved sales from travelers from the Middle East, Americas and Indian subcontinent

14

Footprint on point

Dag Rasmussen at Lagardère Travel Retail provides an update on the re tailer’s progressive growth, expansion in the Middle East and PEPS program

18

Making

International Duty Free Shops reports passenger traffic in Morocco has increased by 108% (vs. 2021) and its presence at Casablanca Airport has been key

24

Heads to Bahrain

Strong Middle East

MEADFA President Sherif Toulan tells Global Travel Retail Magazine about what to expect at the MEADFA Conference, plus what is ahead for the Middle East & Africa Duty Free Association

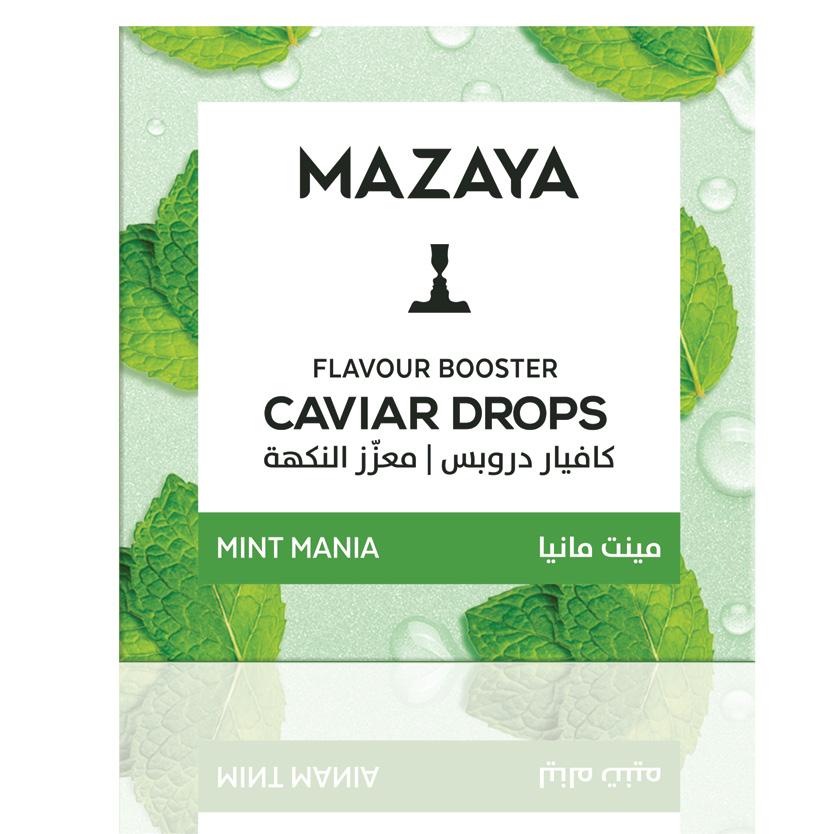

28 Mazaya Better Together

Core connection

Mazaya introduces its new brand identity, stemming from its original DNA of connecting people and sharing special moments

With a thriving new terminal store and hosting the MEADFA Conference for the first time, Bahrain Duty Free discusses its successes of 2021 and the promising end to 2022

by JANE HOBSON

by JANE HOBSON

Bahrain Duty Free plays a prominent role as a global travel retailer and first-time host of the MEADFA Conference. One year after relocating to the new terminal at Bahrain International Airport, Bassam Al Wardi, CEO of Bahrain Duty Free, speaks to Global Travel Retail Magazine about its successful expansion and opportunities to come.

Brand new to Bahrain

Among all discussions happening in the duty free and travel retail industry, two topics stand out for Al Wardi in lead up to the MEADFA Conference: the use of technology to enhance the customer experience, and driving recovery in the postpandemic world.

Bahrain Duty Free is the official host of the November 27 to 29 event managed by the Tax Free World Association (TFWA). This year marks the first time the MEADFA Conference will be hosted in the Kingdom of Bahrain.

“At Bahrain Duty Free, we consider ourselves as pioneers in the industry, especially within the MENA region. Partnering with MEAFDA and TFWA is a great opportunity for us to be involved in the discussions and debates that are most important to global travel retail right now,” Al Wardi tells Global Travel Retail Magazine.

Al Wardi says the partnership helps solidify Bahrain Duty Free as an “innovative trailblazer” in duty free experiences and gives it the opportunity to showcase its world-class offering to the wider industry. It also brings chances to build on existing and foster new relationships with suppliers and partners who continue to play a vital role in its business.

“Just as TFWA and MEADFA are committed to the exchange of identifying trends and building awareness for the global duty free and travel retail industry, we are equally dedicated to sharing with, and learning from, our peers in this fast-paced and exciting industry,” says Al Wardi.

to new terminal While hosting for the first time, Bahrain Duty Free is no stranger to welcoming travelers and providing unique hospitality experiences.

Last year, Bahrain Duty Free migrated its store to the new Departures terminal at Bahrain International Airport.

“We had the challenge – and opportunity – to build a best-inclass duty free experience. We needed to create an airport shop ping experience that was memorable and truly unique, and that is exactly what we have done at Bahrain Duty Free,” Al Wardi says. “We wanted to mirror and elevate the downtown shopping experience in our store.”

Bahrain Duty Free’s managing company Aer Rianta Interna tional helped execute the vision for the new terminal.

“Their experience and expertise within the industry is unmatched, and they’ve helped us to go through with brand propositions, as well as independent promotional campaigns that align with our voice,” says Al Wardi.

The retailer’s main strategy was to create a custom sense of place and a luxury mall-style relaxed atmosphere. The new store, at 4,700 square meters, is more sophisticated and integrated, with bespoke and boutique brands alongside luxury labels and some high-street offerings.

With annual capacity at 14 million passengers, Al Wardi says traditional and core category shops, such as cosmetics, fragrances, tobacco and liquor, are performing well in the new space. Specially curated areas for apparel, accessories, and elec tronics, including an Apple authorized reseller, plus other new brands in beauty, fashion and jewlery, are also performing well with travelers who want a detailed sense of place.

“It can be easy to get complacent in retail — but we are con stantly striving to improve our shops and spaces,” says Al Wardi.

The new store heavily focuses on niche fragrances, a key shop ping trend and gap identified by Bahrain Duty Free’s internal research team. Among the new products available at Bahrain

International Airport are Xerjoff Universe, family-owned Ital ian perfume house Terenzi, and precious extrait parfums from British brand Thameen. These join the existing names such as, Cartier, Chopard, Hugo Boss, Al Zain Jewelry, Michael Kors and Rolex.

“This effort to source and launch more niche brands is an example of how Bahrain Duty Free aims to keep its offerings fresh and unique,” Al Wardi explains.

Digital screens with bright dynamic visuals are placed throughout high-traffic areas in the airport to capture passen ger attention. For in-store communications, the screens can be configured into multiple shapes and sizes. QR codes enhance customer engagement by delivering relevant ads to passengers and alerting them to deals.

“By providing essential information on brands and offers, we help to streamline their shopping and improve communications. They have better opportunities to relax and spend more of their wait time at Bahrain Duty Free shops,” Al Wardi says.

In addition, the shop also has a cigar lounge where travelers can unwind, a VIP personal shopping lounge, and the traditional Souq Al Qaysariya designed like an Arabian marketplace that showcases products from local artists.

“The goal is to go beyond a place to shop. We endeavor to create a sense of place – from the layout of our shops to our highly personable customer service, to our unique product range and our use of technology to create seamless transactions for travelers. We have encapsulated the genuine warmth and essence of Bahraini culture in our store so that even if a traveler is only transiting through the airport, they will experience a true sense of Bahrain as we welcome guests with open arms and host them in the utmost comfort.”

Another unique offering from Bahrain Duty Free is its Shop & Collect and Click & Collect lockers at Bahrain International Airports Arrivals, which Al Wardi calls proof of the retailer’s “modern, inventive planning.”

Bahrain Duty Free is one of the first operators in the region to implement the service, and it has so far proven a “huge suc cess,” he says.

The lockers can be used for free, allowing passengers to shop and pay in Departures before they fly and collect on return from travel. It helps eliminate inconveniences of weight constraints and carrying around extra items. The service is available for all passengers arriving in Bahrain post-travel. When they get to the Arrivals hall, they collect the item from a dedicated locker using a unique pin that is sent via SMS.

“The ease and simplicity of using the lockers has made the service incredibly appealing,” Al Wardi says.

With the successes, there remain some challenges in recovery, Al Wardi warns, noting that supply chain constraints, lack of availability of certain materials and responding to evolving traveler needs will impact how fast and to what extent the market will recover.

He says Bahrain Duty Free’s commitment to offering excep tional value in both price and experience across all categories and accessibility to luxury items have been significant driving factors behind its post-pandemic success so far.

During the pandemic, the operator developed internal cloud systems, introduced digital payments and increased the frequency of its special offers and promotions to deliver a seam less and integrated duty free experience for its customers and service teams.

Al Wardi attributes the successes to the retailer’s internal work to align its goals for the future, as well as Bahrain being one of the busiest hubs in the region connecting North America and Europe to Asia. The rise in affordable air travel and access to vac cines and testing also play a role.

“We are incredibly proud of the whole team and all the departments that have made it possible for us to deliver such strong results as we emerge from a global pandemic. This is a tes tament to the return of air travel passengers and their enthusiasm for a quality duty free shopping experience,” he says.

Dubai Duty Free (DDF) recorded a 104% increase in sales for the first eight months of 2022, with turnover reach ing US$1.06 billion, placing the retailer well on track to reach its target of US$1.6 billion by year end.

In October, Ramesh Cidambi, COO of DDF, tells Global Travel Retail Magazine (GTRM) perfumes, liquor, gold, cigarettes, tobacco and electronics retained the top five category positions.

by JANE HOBSON

by JANE HOBSON

Perfumes showed an impressive 89% increase amounting to US$186 million, while liquor, which accounts for 16% of total

sales, reached US$168 million. Gold sales increased by 181% over the same period last year with sales amounting to US$106 million. Cigarettes and tobacco reached US$98 million and accounted for 9% of sales while electronics rose by 79% reaching sales of US$81 million.

Another notable increase was seen in the fashion category, which rose from US$41 to US$130 million. DDF credits the increase to recent openings of fashion brands including Louis Vuitton, Dior and Cartier. Along with Chanel and Gucci, they are now among the top five luxury brands at DDF.

Meanwhile, online sales reached US$29 million and accounted for 3% of total sales in the first eight months.

On the sales, Colm McLoughlin, Executive Vice Chairman & CEO, DDF, said, “We have had a fantastic year so far and I am pleased that we have recovered over 80% of our business from January to August, whereas the passenger recovery is about 67% of 2019 levels.”

Cidambi says recovery is balanced despite the Chinese travel ban and war in Ukraine.

The retailer has seen improved sales from the Middle East, Americas, and Indian subcontinent sectors, in addition to the strong UK and European markets. Earlier in the year, DDF said as some compensation for the lack of sales among Chinese and Russian consumers, other customers who are traveling are spending more. At one point, spend-per-head increased from US$32 to US$50, and is currently around US$47.

But, the continued imposition of the Chinese travel ban has meant the contribution of this important consumer group, which accounted for around 18% of DDF’s departures sales in 2019, continues to be 1% (1.02% from January to October 2022).

Russian customers, however, are still playing their part. The spend-per-head of those traveling is high, and the consumer group is at about 40% of what it was in 2019, Cidambi confirms.

Assessing the current state of the Middle Eastern duty free and travel retail market as the retailer heads into a busy sales period

for the last quarter and the FIFA World Cup, McLoughlin says this will boost traffic to Al Maktoum International Airport (DWC). He estimates the airport will handle an additional 30 return flights to Doha during the World Cup period.

DDF has recalled almost 2,000 laid off staff at DWC, with cur rent staffing levels getting closer to pre-COVID figures.

Meanwhile at Dubai International Airport (DXB), the retailer is continuing its ongoing retail developments, with particular focus on Concourse B.

“The renovations will make the Dubai Duty Free experience more attractive,” Cidambi says.

This includes refurbishments in the two liquor shops (East and West) and the electronics shop, plus the opening of the new fashion outlets, Dior, Cartier and Louis Vuitton, which has resulted in a big increase in the category.

“We have relooked at our brand/category allocation wherein various refurbishment projects have taken place to give our cus tomers a better exposure, particularly in Concourse D. We have also allocated promotional space to brands like Guerlain, Glen morangie, Givenchy and YSL to name a few,” McLoughlin says.

Departures sales in DWC and DXB, which account for 88% of total sales, show an 115% increase over the same period last year reaching US$927 million, while Terminal 2 Departures sales are up by 59%. Meanwhile sales across all Concourses have regis tered significant increases with overall sales in Concourse B up 35% over last year, mainly due to the luxury boutiques.

Dubai Duty Free will continue to look at its retail improve ments over the next 18 months including a full renovation of the liquor and tobacco offer in Concourse B.

Overall, rehiring and recruitment at DDF continues bringing its workforce to 4,506, which includes 94 new Emirati recruits.

“All in all, we are confident that we will reach our target at the end of December, which also marks our 39th anniversary," McLoughlin says.

Cidambi is a speaker at the upcoming MEADFA Confer ence, discussing the current and future state of the market in the Middle East and Africa.

With a long and rich history, Lagardère Travel Retail achieved an early international presence at the start of the 20th century. Originally rooted in press distribution and travel essentials, the company now considers the travel retail network as being made up of three businesses: duty free and fashion, food service and travel essentials.

During an interview with Global Travel Retail Magazine (GTRM), Dag Rasmussen, Chairman & CEO, Lagardère Travel Retail, tells the publication it is necessary to be present across all three businesses to establish a global vision of the traveler and its landlords. Over the past decade, Lagardère Travel Retail has ben efitted from organic and progressive growth and the successful integration of acquisitions made around the world. Rasmussen also attributes the retailer’s ongoing success to the “partnership mode” that it exhibits with its landlords and brands.

Lagardère Travel Retail doubled its sales in the first half of this year (vs. 2021). By the end of 2022, Lagardère Travel Retail will report close to 2019 figures, Rasmussen says. This momentum is driven by the company’s balanced portfolio and main domes tic markets across the United States, which have propelled its growth since March/April. He points out in terms of geographi cal coverage, when it comes to reporting, different markets and channels lead to a shift in dynamics. Air travel makes up 80% of the retailer’s business.

CEO,

CEO,

Earlier this year, Lagardère Travel Retail acquired HWH, a Dubai-based independent restaurateur. As part of LagardèreHWH Travel Retail, the retailer has incorporated HWH’s diverse portfolio of F&B operations including 13 existing restaurants at Dubai Airport. This move further strengthens Lagardère Travel Retail’s partnership with the airport and consolidates its food service footprint in the Middle East. Pre-acquisition, Lagardère Travel Retail already operated the Daily DXB at Dubai Airport T3, a bespoke concept that showcases Dubai’s history alongside street food.

“The Middle East is a great environment for travel. [Dubai Airport] is the largest international airport – and a major hub –and becoming the leader in food service there is fantastic. With so many different cultures and influences, the airport is open to testing and starting new concepts.

A core strategy, food is more or less 20% of our business today, and this is expected to grow,” comments Rasmussen.

Describing the food category as a dynamic market across retail, e-commerce and travel retail, he considers Lagardère-HWH Travel Retail to be at significantly less risk than downtown retail.

We are lucky to have the best consumers in the world come to our doorstep; our objective is to offer the best stores and the best staff – and provide digital support to both. Having to think about digital service, the in-store experience, brand selection and retail planning, [travel retail] is a great business to be in,” adds Rasmussen.

Demonstrating its commitment to the channel and its strategy to invest during the pandemic, Lagardère Travel Retail Pacific also merged with Australian travel retailer AWPL at the start of this year. Under the name Lagardère AWPL, the 50:50 joint venture “houses each company’s operations in Australia and New Zealand including duty free, food services, travel essentials and specialty,” reads a press release published by Lagardère Travel Retail.

Rasmussen reiterates to GTRM that by merging with its local competitor in the Pacific, Lagardère Travel Retail has streamlined its business model “to get the best of both worlds in the travel essentials and food market in the region.”

Lagardère Travel Retail has also recently entered new markets in South America and West Africa; continued to grow its part

nership with JD.com in China; and renewed its duty free contract with Paris Airports.

Looking to the future, when asked about Lagardère Travel Retail’s sustainability roadmap, Rasmussen refers to the retailer’s PEPS (Planet. Ethics. People. Social.) program. Made up of these “four dimensions,” the company’s CSR strategy is aligned to the global stakes the travel industry is facing. Supported by a global com munity of “local heroes” in countries across the globe, Lagardère Travel Retail’s PEPS governance encourages the exchange of practices, as well as training on how to better save energy and reduce consumption in-store. The retailer is working to reach carbon neutrality by the end of 2023.

“Direct emissions are a small part of it for us, it’s 5%,” Rasmus sen says. The other 95% is Scope 3 emissions (not produced by the company itself, indirect emissions from those it works with).

“It is about how we can work with our partners, with brands, with airports, to see how we can improve. [Sustainable develop ment] was at the top of our agenda during all of our conversa tions at [TFWA World Conference & Exhibition] in Cannes.

“We exchanged the brand road maps with our own road maps to see how these can interact because all of the work done by the brands are part of our efforts. In addition to leading and partici pating in conversation, Lagardère Travel Retail created the ‘We Care’ label which we will use to promote both environmentally friendly and local products. We’re taking a holistic approach to the issue,” he says.

Leading up to Global Travel Retail Magazine’s November issue, the team connected with Candice Medina-Tantoco, Director of Marketing at International Duty Free Shops (IDFS) to learn more about the ongoing recovery of travel and tourism in North Africa – more specifically, Morocco. As the pioneer of duty free shopping in the country, with more than three decades of experience, IDFS relies on the building – and maintaining – of customer loyalty to achieve continued growth. The region’s premier duty free retailer is present at 10 main air ports in Morocco.

Along with the easing of restrictions and reopening of borders, Medina-Tantoco says the implementation of various government programs has helped to boost recovery. As shared by Morocco World News at the end of August, the Moroccan government launched a new support program to aid 150 smalland medium-sized tourism businesses in Souss-Massa, Morocco. Looking to attract visitors to the region, the program will apply incentive schemes and provide funding, advice and technical expertise to both established companies and developing startups. The program is expected to produce more than 600 new job opportunities.

According to Medina-Tantoco, as of September, passenger traffic in Morocco increased by 108% (vs. 2021). However, com pared to 2019, traffic is still down 23%. Arriving and departing passengers from Europe remain the majority, with a third from France. Following Europe, most arriving and departing passen gers are from the Middle East and Africa, respectively.

Located in Nouaceur Province, Morocco, Casablanca Airport (CMN) registered three million passengers in 2020 – a signifi cant decrease compared to 2019 at 10+ million. But when asked how its presence at this key airport has benefited IDFS, MedinaTantoco says despite most air travel being cancelled through the pandemic, a few repatriation flights helped keep the retailer resilient.

“Our Casablanca shops contribute 41% to total passenger traffic at all Moroccan airports. In terms of sales turnover, Casa blanca contributes one third to IDFS’ global sales. Therefore, its presence at the airport is beneficial, as Casablanca is the number one sales contributor among all other airport shops.

“Currently, passenger traffic at Casablanca Airport is at more than 70% of the 2019 level. Month-on-month, traffic has gradu ally increased and we expect the number of travelers to increase closer to pre-pandemic levels soon – if this trend continues.

Other locations like [Fez-Saïss Airport, Agadir Al Massira Airport and Rabat-Salé Airport] are doing better on the road to recovery,” says Medina-Tantoco.

IDFS continues to report tobacco as its top-selling category, fol lowed by fragrances. When it comes to fine foods and confec tionery, IDFS has received requests to include healthier options with a focus on local products. Also, travel retail exclusives and special offers remain important for gifting purposes.

“Our foot traffic is constantly increasing and frequent travel ers are now visiting our shops. We are taking this time to person

ally engage with our consumers and provide exemplary service to those purchasing in-person. Our goal is to make the shopping experience memorable. However, on the other hand, IDFS is working to make its online channel stronger to best serve a par ticular market segment whose number is increasing,” she adds.

Communicating to visitors the better prices at IDFS versus shopping downtown or outside Morocco is at the center of IDFS’ marketing strategy. The retailer offers a range of special promo tions that allow customers to purchase in volume and save more – this particularly applies to items intended for gifting and/or self-gifting. IDFS highlights promotions that are exclusive to the channel via integrated marketing, discounts, bundles, gift with purchase and teaming up with external partners such as govern ment authorities and businesses within the hospitality industry.

Discussing plans, Medina-Tantoco lists several ideas IDFS has on the go: strengthening digital channels, introducing new brands, improving assortment to adapt to evolving passenger demands and highlighting its recent best-sellers.

Moving forward, with IDFS values in mind, the retailer aims to “start fresh,” including re-engaging its employees through upskilling and professional development. Medina-Tantoco says the company also wants to incorporate a more competi tive pricing approach to product exclusivity. She says the team will continue to work on providing customers with healthy and sustainable options via the launch of its e-commerce website “to cater to the new type of traveler.”

Aphrodite Duty Free is prepar ing for the opening of a slate of stores that will begin operating soon; one in Beirut port which is set to open soon, and its newest port in Tripoli, Lebanon is under renovation.

The retailer tells Global Travel Retail Magazine (GTRM) that despite the big

challenges, it believes in these strategic locations and promising future.

Aphrodite Duty Free was founded by Lebanese businessman Karl Raphael, an expert in the travel retail sector. Since then, the company has shown continu ous growth in creating dynamic retail environments. Aphrodite Duty Free has become one of the leading companies in its sector through the creation of new business co-operations and the use of the latest technologies, following the trends of the channel and responding to changing traveler needs and demands.

The operator has appointed Mariem Mersni, a veteran in the duty free indus try, to manage the travel retail department and development plans of the retailer.

“I am pleased to be part of the organiza tion and my goal is to help each customer enjoy the duty free experience and feel the added value by having the dedicated prod ucts at appropriate prices with the right

promotion plan,” she tells GTRM in October.

The goal of Aphrodite Duty Free is to inspire elegance, professionalism and modernity.

The yellow colors signify that the sun will always shine in the TR sector, a concept that was born after the pandemic when all industries were affected, the retailer explains.

“We will never give up, and we are confident about the future,” Raphael tells GTRM.

The large retail stores will highlight the world’s best-selling brands of cigarettes, cigars, liquors, wines, perfumes, cosmet ics, consumer electronics, high-end and collectible lighters, mobile phones, souve nirs and confectionery items.

They will also showcase up-andcoming brands, says Mersni, explaining

that Aphrodite is “creating a space for emerging talent.”

“This is to give a chance to new begin ners and young talents from different countries to develop and show their creations. They all need to have a starting point and we are happy to support them,” she says.

“I believe in the long-term relationship and the transparency with our partners and suppliers,” Raphael tells GTRM in conclusion. “Ware committed to treat each brand as it deserves in terms of pricing, display and visibility, offering to the client the right products, respond ing to their needs and mindset, putting staff in the best atmosphere and an ideal environment. Knowledge of our custom ers, trained staff and latest technologies are our strength.”

*Mariem Mersni can be contacted on mobile in Lebanon: +961 71 039 050; France: +337 87 75 40 58; or email: mariem@transaholding.com

MEADFA President Sherif Toulan tells Global Travel Retail Magazine about what to expect at the MEADFA Conference, plus what is ahead for the Middle East & Africa Duty Free Association

by MARY JANE PITTILLASherif Toulan, President of the Middle East & Africa Duty Free Association (MEADFA), is brimming with optimism about the upcoming MEADFA Conference and previewed the agenda and speakers at a press conference at TFWA WE in Cannes.

Taking place November 27 to 29 at the Art Hotel & Resort in the Kingdom of Bahrain, the three-day conference is managed by Tax Free World Association (TFWA) and hosted by Bahrain Duty Free. Global Travel Retail Magazine is a media partner.

"Featuring prominent industry leaders, we are happy to be bringing the MEADFA

event to Bahrain and look forward to the thought-provoking debates and discus sions that will take place during the con ference, covering a wider regional array with an emphasis on Africa," he says.

“Bahrain has an impressive new airport with state-of-the-art duty free shops. It deserves to be celebrated and highlighted to the rest of the industry,” Toulan adds.

At the press conference, Erik JuulMortensen, President, TFWA, said, "TFWA is delighted to continue our longterm partnership with MEADFA and we are glad to be supporting the MEADFA Conference once again. As an important air hub in the Gulf region, the Kingdom

of Bahrain is the perfect location for the event, connecting industry colleagues from the region with those from other international markets, and vice versa."

The conference will open with a welcome address from Toulan, then participants will hear from Bahrain’s leading industry experts; Gulf Air Acting CEO Waleed Abdulhameed Al Alawi and Bahrain Duty Free CEO & Board Director Bassam Al Wardi.

Prominent figures from the region’s duty free and travel retail industry will assess the current and future state of the market in the Middle East and Africa.

Speakers include Rob Marriott, CEO of Aer Rianta International - Middle East; Ramesh Cidambi, COO of Dubai Duty Free; and Isabel Zarza, COO North & Central Europe, Russia & Africa at Dufry Group.

Afternoon sessions will explore the potential of West Africa, innovation and insights into the regulations and chal lenges companies are facing.

Delegates will hear from Kojo Bentum Williams, Founder and Publisher of Voyag esAfriq Travel Media and Lead Communi cations at UNWTO Africa; Gordon Clark, Vice President Business Development at ForwardKeys; Keith Hunter, Chief Retail Officer at Urban-Air Port; Waleed Khalaf, CEO of Smart Way Consultancy; Rob Marriott, Chair of the MEADFA Advocacy Working Group; MEADFA Board Mem bers Roger Jackson and Mazen Kaddoura; and Sarah Branquinho, President of the Duty Free World Council.

Day two sessions preview

Day two will begin with discussion on how businesses are implementing sustain able practices, led by Munif Mohammed, Lagardère Travel Retail CEO Saudi Ara bia; Marcus Hudson, Mars Wrigley Global Sales Director; and Shivani Sathasivam, Bahraini sustainability champion and

Founder of New Normal Consultancy.

Attendees will then hear from Sharon Beecham, Senior Vice President Purchas ing, Dubai Duty Free, and Christian Mün stermann, General Manager Global Duty Free, Export and Travel Retail, Imperial Brands, on how global supply chains are transitioning.

Later in the day, market specialists Adrian Pittaway, Retail Director at MSC Cruises, and James Prescott, Managing Director at Harding Bros, discuss the growth of cruise lines in the region.

A session on rebuilding tourism in East Africa includes speakers Surafel Saketa, Country Manager at Ethiopian Airlines, and Baptiste Duguit, Vice President of Business Development at Lagardère Travel Retail.

Rounding off the event, Kevin Alder weireldt, Co-Founder of creative tech company Bureau Béatrice, examines meta-retail.

Alongside the conference, visitors benefit from a packed social program, which includes an opening cocktail on Sun day sponsored by Dufry, gala dinner on Monday sponsored by Bahrain Duty Free, and various coffee and networking opportunities, sponsored by Nestlé and Loacker (coffee breaks), Mazaya (net working lunch), and African + Eastern/ Gulf Beverages and Pernod Ricard Global Travel Retail (wines & spirits).

Diamond Sponsors include Dufry, Imperial Brands, Pointful, Mazaya and Swedish Match. Platinum Sponsors include Aphrodite Duty Free, Dubai Duty Free, African + Eastern/Gulf Beverages, JTI and Pernod Ricard Global Travel Retail. Gold Sponsors include ANDS, Mondelez and Oriental Group.

Strong industry recovery Post-COVID, the Middle East and Africa region is booming and Toulan is adamant that “recovery is already here.”

“If we consider Airports Council Inter national (ACI) annual traffic for 2021, we are impressed by African figures with 115 million passengers, up 49.4% from 2020. Middle East results are also good with 169 million passengers, an increase of 24.9% from 2020. Operations in Egypt, South Africa and Nigeria show a strong recovery,” he says.

“In the Middle East, especially in Dubai, from January to June the recovery has been 10 percentage points better than forecast. Dubai International Airport is back at 80 to 90% of pre-pandemic levels for footfall. Overall, summer 2022 is very good and in some countries our members are struggling with the surge of travelers,” Toulan explains.

He says the Middle East and Africa region have seen the fastest recovery compared to the rest of the regions.

Noting several key challenges that remain, he cautions, “This summer is the best season we have ever had since 2019 but it is harder to satisfy our con sumers’ surge in demand, especially due to the global logistics and supply chain disruption.”

MEADFA continues to work with public and government entities. It has renewed its relationship with the Federal Tax Authority in the UAE.

“We are very happy with this coopera tion,” he says.

The Association works with customs agencies and ministries of economy and finance in every country where there is a need.

MEADFA is a Business Council mem ber of COMESA (the Common Market for Eastern and Southern Africa). It also has a strong relationship with Airports Council International Africa and is a World Business Partner to ACI Africa.

Lastly, the Association initiated dia logue with the World Tourism Organiza tion during its webinar in June 2022.

Smoking shisha is enjoyed by many for its way of bringing people together and for Jorda nian shisha brand Mazaya, this concept remains at the core of its renewed brand identity.

“The new identity stems from Mazaya’s original DNA of connecting people and sharing special moments, in addition to keeping its promise of delivering an unmatchable shisha smoking experi ence by employing only the best-in-class ingredients,” says Rawan Elayyan, Global Travel Retail Manager at Mazaya. “It gives Mazaya an uplift as the brand has matured and established itself as a key player in the tobacco category.”

Represented by smiling faces and col orful fruits, the slogan “Better Together” highlights moments spent surrounded by family and friends when smoking Mazaya’s premium shisha products.

“Shisha is a social activity that involves a lot of human interaction and brings people together which is a message Mazaya always conveys,” says Elayyan.

The uplifted identity has been imple mented in domestic markets and is in the process of rolling out in the travel retail channel. Mazaya previewed some visual elements at the BANG! yacht at TFWA WE Cannes in October.

So far domestically, the packaging has stayed the same and the change has been

in Mazaya’s communication strategy. The brand produced marketing collateral and successfully executed launch activations.

Elayyan says Mazaya did not rely on the TR channel to raise awareness for the strategic objectives of the new identity. Instead, it will use the channel to strengthen, develop and complement the brand identity plan.

Elayyan says the work done by Mazaya through the pandemic to Q3 2022 resulted in “remarkable market growth.” This year was a huge success for the brand across different channels and it has exceeded its 2019 full year performance.

“For the travel retail channel, Mazaya has successfully surpassed 2019 figures

Mazaya introduces its new brand identity, stemming from its original DNA of connecting people and sharing special momentsMazaya previewed visual elements of its new brand identity, such as smiling faces and colorful fruit, at the BANG! yacht at TFWA WE Cannes in October Rawan Elayyan, Global Travel Retail Manager at Mazaya

with a high two-digit growth percent age, especially with the upward estimated performance in Q4,” she confirms.

“Such performance, coupled with the roll-out of the new brand identity, gives Mazaya a great boost as [it] reaffirms its position as a key player in the tobacco category through driving recovery and securing additional revenue streams for operators.”

Contributing to this success is Mazaya’s listings with Lagardère Saudi Arabia, Dufry Morocco and Dufry Egypt (Cairo), Iraq Duty Free and Heinemann Egypt in Sharm el Sheikh. With Lagardère, Mazaya

partnered with the operator to have a proper shop introduc tion with two promotional areas: one high-profile promo tion and one small-profile promotion at Riyadh, Jeddah and Dammam.

At Dufry Morocco and Egypt and Iraq Duty Free, Mazaya expanded its portfo lio throughout 2022 and has planned activations for next year, including a memorable glass shisha GWP for travel ers passing through Heineman Sharm el Sheikh shops.

In 2023, the TR focus will be on its Caviar Drops, a flavor booster made of concentrated flavor essence and shaped like caviar. Caviar Drops are available in Fruity Fusion, Icy Frost, Luscious Lemon, Mint Mania, Rich Licorice and Sleek Vanilla flavors. The Drops can be added to Mazaya shisha tobacco for intensify ing the flavor or mixing flavors together. They offer a customized optimal smoking experience to suit and serve each taste and preference.

When asked about flavor preferences, Elayyan says the brand has two types of consumers. The first being those loyal to their preferred flavors, smoking the classic shisha flavors that have been on the mar ket for a long time, such as best-selling

Two Apples and Lemon Mint, as well as Grape, Grape Mint, Mint and Gum.

The second segment is the experimen tal segment who are “always keen and excited” for new flavors and mixes.

“We cater for both segments with our multiple variants of exciting flavors such as Two Apples Masri which has been developed to grow our consumer base by capturing various taste palates. [We also produce] flavors and mixes for the second segment, such as Candy Drops and most recently Love, which have both already been listed in many duty free shops.”

Expecting increased performance in Q4 and further growth in 2023, Elayyan says Mazaya is in the process of expand ing its fleet of brand ambassadors across key locations.

Brand ambassadors are the “eyes and ears on the shopfloor,” she explains, posi tioned to represent Mazaya’s core values, educate consumers on the brand and create a bond between Mazaya and the consumer. They also play an important role in planogramming and replenish ment, helping to ensure easy on-shelf navigation for shoppers and speeding up decision making.

Mazaya is a Diamond Sponsor for lunch at the MEADFA Conference 2022 hosted in the Kingdom of Bahrain. The company will operate its shisha service during the lunch break.

Iraq Duty Free completes phase five of its expansion plan with the Downtown Duty Free Shop in Baghdad and discusses plans to open more in major Iraq cities

by JANE HOBSONThis spring Iraq Duty Free (IDF) opened its first-ever Downtown Duty Free Shop in the center of Baghdad. In an interview with Global Travel Retail Magazine, IDF says the opening marks the completion of phase five of the retailer’s major expansion plans.

His Excellency the Minister of Trade Dr. Alaa Al Jubouri and other officials attended the opening of the Downtown Duty Free Shop on May 17. The store is attached to the Central Markets Shopping Mall, which is a standalone building part of the Ministry of Trade.

The purpose of the downtown store is to offer the same authentic products across all categories that travelers love and trust at IDF airport boutiques. At Bagh dad International Airport, Basra Interna tional Airport and Sulaymaniyah Inter national Airport, the retailer is known for

its wide range of luxury brands, including Armani, Lancôme, YSL, Dior, Cartier, Bvlgari, Burberry, Gucci, Hermès and others, available in both Departures and Arrivals. The Downtown Duty Free Shop will also mimic promotions and activities that take place at the airport stores.

Plus, IDF adds, it granted suppliers a larger space for their brands at the Down

town Duty Free Shop since the store is bigger, bringing more variety to shoppers. Rather than being restricted to the air port, the downtown shop gives all travel ers coming or returning to Iraq, including foreign nationals and the diplomatic core, the opportunity to make purchases within 30 days of their arrival. To shop at the space, local nationals must show a copy of their passport entry stamp and foreigners must present their passport.

In 2022, IDF aimed for 10% higher rev enue than 2019. In an October interview

with GTRM, the retailer predicted it will close out the year at 11% to 12% higher than 2019. Much of this success can be attributed to the opening and promotion of the new location which has performed above and beyond expectations, the retailer says.

Leaflet advertisements are distributed to all Arrivals passengers at Baghdad Airport, and to Departures passengers at Basra and Sulaymaniyah. Across all three airports, banners are on display at Arriv als and Departures shops, encouraging travelers to visit the downtown location.

In Iraq, travelers can be split 80/20: 20% of travelers to Baghdad are expatri ates traveling for business or visiting fam ily, while 80% are native Iraqis, of which 60% travel for pleasure and 40% travel for business, IDF explains, adding that culturally, Iraqis love to travel and spend money on gifts for themselves, family members, friends and colleagues.

But, a recent study conducted by IDF reveals travelers often felt too rushed to shop. Wanting to return home right away, they make only a quick stop at duty free before leaving the airport, purchasing maybe one or two items.

The Baghdad store offers the advantage of going back within a month’s time in a relaxed environment to purchase liquor, tobacco and perfumes, lessening the burden of feeling rushed and not picking up a gift.

While IDF is focused on the future, the retailer also looks back at history to highlight the significance of the Baghdad store.

Nineteen years ago, an off-airport duty free shop existed in Baghdad under a different retailer, but without much atten tion, it shuttered and never reopened.

The expansion of IDF with its Down town Duty Free Shop speaks to the state of recovery and economic growth in the region and globally, IDF says.

With phase five complete, the retailer has already moved on to phase six of its expansion plan. IDF is renovating its store at the international airline’s terminal at

Baghdad International Airport, known as Babel. The update should be complete by the second quarter of 2023.

Having postponed the renovation until 2021 to prioritize sales, IDF is now benefitting from the return of travel and an increase in business. Airlines are add ing routes to Baghdad, which brings more travelers.

Referring to IDF’s expansion beyond the airport, the retailer reveals that the plan is to open a second downtown loca tion on the eastern side of Baghdad. Once the retailer finalizes the deal with the Minister of Trade, the location will be dis closed. The goal is to expand stores into all major cities and eventually throughout the country.

Our brands are loved through out the world. With our unique portfolio of premium brands including Absolut Vodka, Jameson Irish whiskey, Chivas Scotch whisky, Martell cognac, Beefeater gin and Mumm and Perrier-Jouët cham pagnes to name a few, we have a wonder ful opportunity to engage with consumers globally and embark them on our sustain ability journey to drive positive change in the industry.

What is unique about the travel retail setting is that shoppers are quite literally a captive audience. Between customs and boarding, they have the time and space to explore new products and experiences — known as the ‘golden hour.’ This presents

us with a fantastic opportunity to engage with them in a way that is not possible in other retail locations.

Sustainability is now at the forefront of our shoppers’ minds when traveling. Following the pan demic, we have seen increasingly high expectations for brands in travel retail to be sustainable and responsible. Research from m1nd-set released in January 2022 shows that almost nine in 10 shop pers believe that sustainable values are important for a brand’s image, and eight in 10 consider sustainability when buying alcohol in duty free. Shoppers want to see brands that have a strong purpose and be confident that they are making sustainable

choices. Sustainability is no longer a “nice to have,” it’s become an absolute necessity for most shoppers in duty free.

At Pernod Ricard, Sustainability & Responsibility is a key pillar of our Group

In this guest column, Vanessa Wright, Chief Sustainability Officer at Pernod Ricard, discusses opportunities to engage with travelers around sustainability in new waysVanessa Wright, Chief Sustainability Officer at Pernod Ricard The sustainable Jameson Whiskey exhibition stand at TFWA Cannes 2022 used recycled wood, flooring and signage, a reclaimed glass bar, moss walls and low-emission LED lighting

strategy, part of our company mission and driven through our ambitious 2030 roadmap ‘Good Times from a Good Place.’ We believe in being passionate hosts by promoting responsible drinking and creating a better way to live and work together, and respectful guests who care for the environment by partnering with local farmers and communities to benefit our planet and the people around us.

When it comes to travel retail, we have already eliminated all single-use plastic from our point of sales (POS) materials and our gifts with purchases (GWPs) and are leveraging new technologies to reduce the carbon footprint of our retail activa tions globally. Key to this transition is Life Cycle Analysis (LCA), which enables us to accurately assess the potential envi ronmental impact of our products and activations and determine whether we are meeting sustainability standards at all stages of our value chain, from manufac turing and packaging to transportation.

Our Global Travel Retail team received the inaugural ‘People & Planet’ award at the 2022 Frontier Awards at TFWA World Exhibition and Conference in Cannes last month for its two LCA tools specifi cally for travel retail, one focused on retail merchandising and one focused on gifts with purchases (GWPs). In just one year, we have completed close to 300 retail projects with our LCA tool for merchan dizing, reducing our carbon emissions from merchandising by 44%. Using our LCA tool for GWPs, we have developed new sustainable weekend bags and trol leys, achieving a 34% carbon reduction per unit.

This year, we also leveraged LCA to create our fully sustainable Jameson Whiskey exhibition stand at TFWA Cannes, using sustainable materials such as recycled wood, flooring and signage, a reclaimed glass bar, moss walls and lowemission LED lighting. Every component of the booth was modular and reusable

with zero waste. One hundred percent of the materials used were classified as ‘natu ral’ and 84% as ‘easily recyclable.’

In terms of blending the physical and digital, and engaging with our shoppers around sustainability in new ways, our new digital label is a breakthrough in how we communicate the origins and impact of our products. Launched this year as a European pilot and to be rolled out across our global brands by 2024, a QR code on the back of our bottles will direct consumers to a platform tailored to each of our products and the consumer’s loca tion with information on our ingredients, nutrition facts, responsible drinking and health, in the consumers’ own language.

With travel picking up and showing no sign of slowing down, travel retail really is the ideal testing ground for us to experiment, challenge how we do things and leverage the power of our brands to forge a new, more sustainable direction for this channel and across the wine and spirits industry.

TFWA WE BY THE NUMBERS:

Visitors: 5,983

Exhibitors: 387 (57 new)

Exhibition floor occupancy: 20,751 square meters

Representatives of DF operators and landlords: 2,095

TFWA Conference attendees: 1,179

On-site TFWA ONE2ONE meetings: 1,226

by LAURA SHIRKMore than a month later, the travel retail industry is making the most of the surge of energy that comes following the TFWA World Exhibition & Conference in Cannes. As reported by Tax Free World Association (TFWA), the event welcomed nearly 6,000 visitors, a figure that is up 77% from 2021.

“We’re very happy with the outcome here this week, in terms of exhibitors, square metres of stand space, delegates and buyers in attendance. A real mood of confidence has been confirmed by the conversations taking place around the event all week. We look forward to the future with confidence and by the time we are back here in Cannes next year I’m convinced we will be flying at full height once again,” said TFWA President Erik Juul-Mortensen at the post-show press conference.

“We closed our books today, and thanks to our prudence in the past, our finances are in a strong position. We are well placed to continue supporting the industry going forward to next year and beyond,” he added.

The 37th TFWA World Exhibition & Conference 2022 hosted 5,983 visitors up to midday on the final day of the event, up from 3,373 in 2021. This figure compares to 7,215 visitors at the same point in the 2019 event, which was a record attendance.

The 2022 total numbers included 2,095 representatives from duty free operators and landlords, more than double the 2021 total, and down by 12% compared to 2019.

TFWA says brands opted for larger stands, with the exhibition occupying a total of 20,751 meters-squared, up from 12,190 meters-squared in 2021. Three-hun dred-eighty-seven companies exhibited, 57 of which were new exhibitors. These first-time exhibitors came from eight sec tors and from as far afield as Ghana, Saudi Arabia and Republic of Korea.

And the TFWA ONE2ONE meeting service facilitated a total of 1,226 onsite meetings throughout the week, TFWA reports.

As shared by TFWA, 1,600 guests attended its opening “Get Together” event at Carlton Beach, and attendance at the

A snapshot of Tax Free World Association’s annual trade show event in October, which continues to foster a sense of community and resilience among the industryThe TFWA World Exhibition & Conference took place at the Palais des Festivals in Cannes from October 2 to 6 Economist, author and broadcaster David McWilliams spoke at the conference about confirmation bias within the workplace and beyond TFWA President Erik JuulMortensen at the TFWA closing press conference

TFWA Lounge night-time session peaked at 2,358 guests mid-week.

For those who missed the TFWA Confer ence on opening day, the Association welcomed a trio of top speakers to the stage: economist, author and broadcaster David McWilliams; Raymond Clooster man, Founder & CEO at Rituals Cosmet ics; and Swan Sit, Operating Partner at AF Ventures and leading voice on the social network Clubhouse.

Describing economics as accelerated evolution, McWilliams weaved together his area of expertise with work by Wil liam Yeats and James Joyce to bring to life topics such as non-linear thinking, groupthink and confirmation bias within the workplace and beyond. Cloosterman elaborated on wellness, sustainable luxury and the integration of new experiences and new categories. Lastly, Sit educated the audience on the metaverse, blockchain and the decentralization of data.

The conference is accessible via the Association’s online platform TFWA 365.

In addition to the TFWA Conference, delegates had the opportunity to attend a series of workshops and panel discussions throughout the week and take part in the TFWA i.lab online and on-site.

With almost 400 exhibitors at the trade show, players from across retail catego ries launched new products, displayed travel retail exclusives, offered samples, conducted demonstrations, highlighted sustainability commitments – via product

packaging, strategic partnerships, busi ness models, stand design – and more.

Here are some highlights from the TFWA Exhibition and events from Global Travel Retail Magazine reporters in attendance:

• International Beverages’ launches Caorunn Blood Orange gin, crafted at Balmenach Distillery in the Scottish Highlands and bottled at 41.8%

• Bitmore reveals carbon-neutral neck pillow range Snooza available in two models: one made from recycled memory foam and the other with recycled ABS beads

• Ritter Sport displays new travel retail exclusive range with redesigned hero products launching in 2023: Taste the World Tower and Mini Tower Colour ful Mix

• Mars Wrigley ITR’s outlines its moment-led strategy for growth in the channel

• The expansion of E. Gluck into wearable tech and its partnership with WITHit

• The celebration of Tito’s Vodka’s 25th anniversary

• Brown-Forman announces agreement to purchase the Diplomático Rum brand and related assets from Destill ers United Group S.L.

• Habanos wows dinner gala guests and introduces exclusive DF and TR exclu sive Quai D'Orsay Imperiales Travel Humidor, containing 20 Habanos

• Pernod Ricard GTR discusses sustain ability mission in 'Can duty free drive the ethical consumerism journey globally?' panel event

Brockmans Gin celebrated launch into GTR with Jean-Philippe Aucher in beach event at sunset

Brockmans Gin celebrated launch into GTR with Jean-Philippe Aucher in beach event at sunset

In other news, Women in Travel Retail (WiTR) raised more than €15,000 (US$14,958) in support of its nominated charity, Hope Foundation. Held by WiTR at the Palais des Festivals, more than 150 industry professionals gathered at the annual networking session. Outside of the event site, Molton Brown and Japanese luxury skincare brand Sensai invited delegates to Le Roof, Five Seas Hotel in Cannes, to learn more about their offerings and Kao Beauty Brands. Inviting delegates to wrap up their day at the beach, Diageo Global Travel hosted a series of panel discussions called “The Sunset Sessions.” Topics of conversation included positive drinking, sustainability and diversity in the workplace.

As confirmed by the Association, considering the attendance at social events throughout the week, in-person networking opportunities remain “a top priority for industry colleagues across all sectors.”

Nestlé ITR gave an

At a press conference, Jose Luis Donagaray, Secretary General, ASUTIL, revealed the return of ASUTIL Conference to Argentina in 2023

Looking to learn more about the current state of the fashion, accessories, watches and jewelry (FAWJ) category, Global Travel Retail Magazine (GTRM) con nected with Jan Richter, Director of Purchasing, FAWJ at Gebr. Heinemann. He says the company’s FAWJ category is on track to close the year with a slight increase in turnover com pared to 2019.

Earlier this year, Gebr. Heinemann in a joint venture with ATÜ Duty Free, opened the biggest Cartier boutique in its port folio in Istanbul. Describing the Turkish hub as a strategic loca tion, Richter reports the boutique is outperforming the retailer’s forecasts across the business.

With Istanbul Airport being geographically located as a unique connection between Asia Pacific, Western Europe, Africa and the United States, it has an “ideal passenger structure,” Richter says. Chinese passengers currently make up only six percent of traffic, but he believes that they will be back in greater numbers in the second half of 2023. Seeing this opportunity, Gebr. Heinemann, Unifree Duty Free and ATÜ Duty Free established Luxury Hill in the opening year of 2019 as part of the airport’s overall retail concept. The design of the duty free area is set across nine zones with different thematic focuses. Gebr. Heinemann together with Unifree Duty Free, ATÜ Duty Free and its brand partners, has created a luxury marketplace with mono-brand boutiques and multi-brand concepts that bring the ambience of international department stores to the airport.

Now the Luxury Hill zone is home to a long list of monobrand stores, including Bvlgari, Gucci, Louis Vuitton and Prada, with several multi-brand marketplaces in the middle and F&B options.

The Cartier boutique is located in the heart of the luxury section. Described as shining like a piece of high jewelry, the 12-meter-high, 180-degree façade is designed with three-dimen sional illuminated elements for high visibility. The entrance features highlights of Cartier’s watch and jewelry collection, drawing shoppers into the Maison.

The location carries the full Cartier collections including jew elry, watches, sunglasses, small and large leather goods, writing instruments, perfume, cosmetics and travel accessories.

“The mono-brand Cartier boutique is a perfect addition to our range of exclusive brands in Istanbul. As part of our strategy for the FAWJ category, we are strengthening our collaboration with the world’s leading luxury brands. Cartier is part of the Richemont Group, one of our key strategic partners for this,” Richter commented at the time of the opening.

Richter says the combination of tier one luxury brands as monobrand boutiques and the marketplace-style of the multi-brand area brings a sense of satisfaction to the passenger experience.

“Travelers continue to treat themselves and the same pas senger tends to enjoy shopping in different fashion categories and brands. That’s why we create multi-brand areas and curated cross-category assortments,” he explains.

The layout of Luxury Hill attracts travel retail shoppers of all generations. Richter points out that there are increasing numbers of younger people shopping for FAWJ as well as lifestyle shoppers

who are searching for an entire look or for high-end accessories to upgrade their wardrobe.

The watches category is performing well in both the mono-brand boutiques and multi-brand space at Istanbul airport and remains a driver for Heinemann growth in general, up 11% compared to 2019, Richter reports.

ATÜ Duty Free operates Luxury Timepieces at Luxury Hill, a dedicated watches store within the marketplace. Watch sales here are outperforming global Heinemann figures. However, main taining stock continues to be a challenge for the retailer.

This section displays brands such as Breitling, Chopard, Frederique Constant, Hublot, IWC and Messika.

Looking ahead, Gebr. Heinemann will extend the luxury marketplace in Zone 5 of the airport in collaboration with ATÜ Duty Free. Taking place in Q1 2023, this move will introduce a dedicated sneakers and streetwear space, which Richter notes as a disruptive move in the multi-brand travel retail airport space.

He says sneakers purchases have been increasing in recent years as the pandemic normalized casual clothing in all settings.

“When it comes to combining brands and presenting prod ucts within a multi-brand marketplace in travel retail, we aim to set new standards,” he explains.

On a mission to become the most relevant brewer of beer, cider and other drinks categories, Niek Vonk, Manager Global Duty Free & Travel Retail Heineken explains the com pany’s strategy commitment to ferries, airlines and cruises.

“Global duty free is a unique and exciting channel for us to engage a huge range of consumers from across the globe with our brand portfolio and we are committed to developing our long-term partnerships,” he tells Global Travel Retail Magazine.

The strategy highlights portfolio innovations, sustainability initiatives and motivating customers as the crucial contexts that help ensure its customers maximize onboard commercial opportunities.

Despite challenges, such as the world wide supply-chain crisis, inflation and the war in Ukraine, Heineken reported global revenue of more than €16.4 billion (US$15.1 billion) in First Half 2022 – an increase of 37% versus the same period in 2021.

“Heineken rejects the one-range-suits-all strategy that used to prevail when supply

ing beers and ciders in duty free chan nels,” explains Vonk. “For instance, we know in different regions, consumers are often looking for no/low-alcohol beers, trusted local brands or more premium, craft options.”

Launching on European ferries and cruises, Heineken Silver is a lager brewed to 4% ABV, balanced with crisp flavor and subtle finish to offer a lighter drinking profile. It suits a range of drinking occa sions for the ferries and cruises market.

Other options, such as non-alcoholic choice Heineken 0.0, Italy-inspired Birra Moretti, Lagunitas IPA for fans of US craft beers, and local favourite Kalik from The Bahamas, ensure there are choices for every customer on every ship or flight.

“Above all, we aim to provide a bal anced range of draught beers and ciders underpinned by consumer insights to ensure ferries, airlines and cruises globally delight their passengers and maximize sales potential,” Vonk says.

As part of its ‘2030 Brew a Better World’ global sustainability and responsibility ambition, Heineken launched a new ini tiative with KLM committing that 100% of the Heineken and Heineken 0.0 beer

served onboard the Dutch flag carrier is brewed with 100% green energy.

It has also implemented sustainable points of sale (POS) in cruises. Merchan dising printed materials are replaced with digital formats where possible while assets made from sustainable and reused materials are prioritized. To reduce waste, Heineken plans to recover used PET kegs from cruise customers. The aim is to recycle them and bring them back into the market, Vonk explains.

Recognizing pandemic-hit cruiseline partners, Heineken gifted a 20-liter Heineken Brewlock Keg and a case of Heineken bottles to every bar onboard each ship operated by customers, as well as free samples of Heineken 0.0 for crew bars to generate staff motivation.

“In short, we are saying to our valued ferry and cruise customers, ‘The first round is on us,’” Vonk says.

To help drive onboard sales, such as at outdoor pool areas, Heineken installed mobile draught beer bars and detailed sampling plans for Heineken 0.0, including branded merchandising and staff t-shirts. Crew training options, including the Heineken Star Serve Pro gram, encourage staff to enhance learning and skills – with the possibility to win prizes if they hit sales targets. Other e-learnings include a focus on the com pany’s Enjoy Responsibility responsible consumption program.

Following its attendance at TFWA World Exhibition & Conference in October, Perfetti Van Melle (PVM) tells Global Travel Retail Magazine its category vision is to create consumer engagement opportunities across its portfolio with the support of its travel retail partners. The company also looks to “inject moments of color and fun” into the store environment with its dedicated product ranges.

The company launched its Chupa Chups activation concept at the annual event. Featuring a photo booth and production promotion area, the con cept encourages visitors to engage with and learn more about PVM’s key brand.

According to Femke van Veen, GTR Brand Manager at Perfetti Van Melle, visi tors can snap a photo as one of the Chupa Chups backpack animal family, take away a polaroid memento and can receive the photo digitally to share across social media platforms. Outside of PVM’s stand, its life-size mascot roamed the exhibition floor to promote the activation.

When asked how Pefetti Van Melle is working to unlock category growth and drive category awareness, van Veen says the company offers a house of brands that fits different travelers’ needs and aims to intensify its commitment to kids gifting innovation in 2023.

“We are here to make winning plans with our partners; this means having the right product portfolio, creating appeal ing and fun promotions and having best in-class visibility tools. We believe our range provides something for all types of confectionery buyers and it promotes

by LAURA SHIRKgreat awareness of the category due to the breadth of offer,” explains van Veen.

Discussing the company’s performance across the Middle East, van Veen says business has been steadily building in line with returning traveler numbers across the region. Earlier this year, PVM col laborated with Dubai Duty Free to launch a Mentos activation at Dubai Airport. The six-week long promotion featured four different Jumboroll sleeve designs and allowed guests to choose a personal ized message in combination with their favorite Mentos flavor. Thanks to the sup port of an on-site brand ambassador, the promotion led to doubled sales.

“We will continue to leverage our hero products with high visibility promo tions. We also want to create a sense of place with localized promotions and high impact in-store branding. For example,

our Chupa Chups’ mascot will continue on its airport world tour – from Riyadh to Cannes, Copenhagen and New Delhi,” she adds.

Paper sticks are the future

Overseen by its Chief Sustainability Officer, Sustainability Steering Commit tee and Executive Committee, PVM has formed a sustainability governance model to support its commitment to eliminate plastic packaging wherever possible. The company has also established Group plas tic packaging goals, which it has trans lated into three areas: Reduce, Recycle and Recover.

Launched exclusively in GTR in June, PVM’s Chupa Chups Strawberry Love Pouch Bag consists of all new Chupa Chups made with paper lollipop sticks. Pefetti Van Melle reports that close to the brand’s full range has made the transition from plastic to paper.

PefettiVan Melle

aims to create consumer engagement opportunities across its portfolio with the support of its TR partnersA look at PVM’s Chupa Chups activation concept in action

Fraternity Spirits World (FSW), the Costa Rica-based drinks developer with a representative office in Mex ico, has extended its product portfolio of Mexican spirits.

The company is spearheading the worldwide rollout of a new Mexican whisky brand rollout called Ley Seca, and preorders are rolling in, according to CEO Raffaele Berardi. The spirit is made by Hacienda Corralejo, the Mexican familyowned maker of Corralejo tequila, which FSW has supplied to travel retailers for many years.

This Mexican 100% malt whisky is called Ley Seca (“dry law” in Spanish) because it references the 1919 Prohibition that banned the production of liquor in the U.S. and resulted in the smuggling of spirits across the Mexican-U.S. border. The whisky is distilled in a separate facility from the tequila factory and was launched globally in June 2022.

“Ley Seca whisky is an exciting product, and our balanced portfolio is an interesting angle for retailers,” Berardi tells Global Travel Retail Magazine. Berardi is a well-respected drinks indus

try figure who has supported the travel retail channel from the beginning. He established FSW in 1994.

The portfolio comprises Mexican mezcal, Mexican tequila, Mexican rum and now Mexican whisky, allowing FSW to create a specialist Mexican spirits sec tion inside liquor stores. Consumers can choose from a range of four distinctively packaged Mexican spirits brands at differ ent price points. As travel retailers battle to distinguish themselves from domestic outlets post-pandemic, this is an attractive retail proposition, Berardi says.

And the innovation continues. Three years ago, Fraternity Spirits World added another distinctive new brand to its portfolio: Nobushi Japanese whisky. After a pandemic pause that affected its rollout, Nobushi is performing well worldwide, as consumer enthusiasm for Japanese spirits gathers pace.

Nobushi is a craft spirit made by Kiyokawa Co Ltd., a blender and distiller based in the remote mountains of Nagano Prefecture, near Iiyama city. The distillery

Fraternity Spirits World offers “wonderful balance” in its drinks – and also in its product portfolio, as entrepreneur and CEO Raffaele Berardi tells Global Travel Retail MagazineLey Seca, the new Mexican whisky brand rolling out from Fraternity Spirits

is located in an area known for big atmo spheric pressure changes, resulting in a whisky that represents more of the barrel's wood flavors and natural color.

Importantly, Kiyokawa was the first to bring the art of distillation into the region, and was the first Japanese distill ery to develop and grow mountain barley on its own farms as the main ingredient for the production of Japanese single malt whisky.

Today, Nobushi Japanese blended whisky is distributed all over Europe, and thanks to FSW’s network, Nobushi is distributed globally in domestic markets across the U.S., Canada, Mexico, Central America, India and Dubai. The brand has just been launched at Delhi Duty Free. Nobushi also offers a single grain whisky and a pure malt expression under five years old. A new five-year-old pure malt will be launched at the end of this year.

“We’re very excited about the Nobushi brand, it’s been very success ful, and the category is well accepted,” enthuses Berardi.

Speaking to Global Travel Retail Magazine, Berardi said there was “a huge

opportunity” for Nobushi to capture a share of the sizeable travel retail whisky market. “We’re working with the only mountain-based distillery that produces its own malt in the mountains – no one has ever done that before. It’s a unique product.

Next year, FSW will be unveiling a new vodka and a gin, both from Japan, in a bid to expand its Japanese spirits portfolio. A canny strategy, as noted above.

Turning to the Mexican tequila brand Corralejo, a new high-end heritage line consists of 1810, 1821 and 1755 expressions. These ultra-premium tequilas are related to the history of Mexico and Hacienda Corralejo and have been launched only in the U.S. domestic market due to the limited supply.

Also new – and available in travel retail – is Tequila Corralejo Extra Anejo (40%abv), retailing at US$78, which was launched this year and is doing “extremely

well,” according to Berardi, particularly in the U.S., where the market for high-end tequila is booming post-pandemic. “This unique liquid and the bottle are very attractive to the consumer,” Berardi says.

Additionally, FSW has introduced to the U.S. market a Corralejo tequila product made with a higher agave sugar content, bottled at 40%abv. This smooth, sipping tequila has a sweeter taste and is available in Mexican travel retail.

As for Ron Prohibido, Berardi reports that the Mexican rum brand is perform ing very well in Europe, Canada, Mexico, Australia, Japan and Italy — and Spain in particular is a growing market, he points out.

Despite the uncertain geopolitical situation, Berardi passionately believes in the future of his growing product port folio with its distinctive point of view. After a long business trip to Japan to see Nobushi’s production in action, he says, “It’s an exciting moment.”

Quality Street’s move to recyclable paper wrappers has proved challenging because the material needs to be suitable for twist wrapping and cover nine different product shapes

by LAURA SHIRK

by LAURA SHIRK

Central to Nestlé International Travel Retail’s (NITR) ambition to build food into the most purchased category in travel retail is the VERSE model (Value, Engagement, Regeneration, Sense of Place and Execu tion). “Regeneration” is a critical element of the model and aims to protect, renew and restore the environment across Nestle's brand portfolio and company mission. It is a key driver in the company’s ambition to reach number one.

Commissioned by NITR, a study by m1nd-set reveals that 69% of consumers ranked food, chocolate and confectionery (grouped together) as the most appealing category to shop in global travel retail. With this in mind, NITR’s holistic approach to unlocking the potential of food via one “superfood” category relies on nurturing consumers’ trust in global brands and lever aging the popularity of local food to establish sense of place.

During a Q&A with Stewart Dryburgh, General Manager at NITR, Global Travel Retail Magazine asks how the company is communicating its model and about the next on its sustain ability journey.

Tuning & tapping in Having updated its media campaign to further communicate NITR’s VERSE proposition and create additional impact, the

Nestlé ITR on building food into the most purchased category in the channel and taking the next steps on its sustainability journeyStewart Dryburgh, General Manager, Nestlé International Travel Retail

company invites retailers and buyers to learn more via a video presentation by Dryburgh. The video features an explanation of Nestlé’s ambition – and its strategy to grow food beyond confectionery; this means tapping into subcategories coffee and wellbeing via VMHS (vitamins, minerals, herbals and supplements).

According to the research, 84% of global shoppers are 1.5 times more likely to buy coffee vs. confectionery and VMHS is rapidly growing in popularity. McKinsey Institute reports that the global wellness market is val ued at more than US$1.5 trillion. As a category leader, NITR is asking industry partners to join the movement and “grasp the scale of the wider food category’s untapped potential.”

When it comes to educating the consumer, Dryburgh says the team relies on marketing messages that are supported by clear packag ing labels and used across all of its markets. He cites the message displayed on Smarties sharing bags that reads: I’m Paper. Be Smart. Recycle Me.

One of Nestlé’s latest social media cam paigns “Generation Regeneration” emphasizes the environmental threats of climate change and the company’s plan “to support and accelerate the transition to a regenerative food system.” At the center of the campaign is the livelihood of farmers and the wellbeing of farming communities.

Place and Execution) supports its holistic approach to unlocking the potential of food in travel retail

Separately, Dryburgh says NITR connects with media partners to promote steps that specific brands take to accelerate their sustainability journey. This includes Smarties’ transition to plastic-free packaging and Quality Street’s current move to recyclable paper wrappers. A challenging one because the paper has to be suitable for twist wrapping and cover nine different sweet shapes.

“The new [Quality Street] packaging has been developed by teams at Nestlé’s Confectionery Research & Development Centre in York, UK, along with the Swiss-based Nestlé Institute of Pack aging Sciences.

“The transition to paper required extensive work and development in terms of engineering new materials, coating and printing techniques and the adaptation of existing equip ment to ensure that machinery could continue in full and con tinuous production.

“The decision followed a detailed lifecycle assessment which indicated that paper offered the lowest environmental impact for the rest of the Quality Street assortment,” explains Dryburgh.