advertisement removed for legal reasons

advertisement removed for legal reasons

advertisement removed for legal reasons

advertisement removed for legal reasons

As we enter the second half of 2024, the spirits and tobacco industries continue to demonstrate remarkable resilience and adaptability in the face of global challenges. With shifting consumer preferences to regulatory pressures and sustainability concerns, companies are innovating at an unprecedented pace to stay ahead of the curve.

Major players like ARI and Changi Airport Group are leveraging digital tools and omnichannel strategies to enhance customer engagement and streamline operations. The integration of innovative concepts like robotic bartenders at Lotte Duty Free stores showcase how technology is reshaping the travel retail experience.

The popularity of local spirits is surging, particularly in emerging markets. Companies like Delhi Duty Free, Kreol Group and Ospree Duty Free are capitalizing on the country's growing appreciation for premium and craft spirits, while Indian brands are gaining international acclaim alongside global players, reflecting a broader global movement toward authenticity and heritage in spirits consumption.

Meanwhile, the rise of Generation Z as a key consumer demographic is driving significant changes. We explore how this cohort's preference for quality, authenticity and sustainability is reshaping product offerings and marketing strategies. Global Drinks Ltd and Rémy Cointreau are responding with premium, eco-friendly products and engaging digital experiences that resonate with these values.

In the tobacco category, we're seeing a pronounced shift toward Reduced Risk Products (RRPs) and sustainability initiatives. JT Group's collaboration with Altria to expand in the heated tobacco segment and KTI's solar park initiative demonstrate the industry's commitment to reducing its environmental footprint.

Oettinger Davidoff AG's consumer-centric innovations include travel-friendly products like pre-cut cigars and short puritos, while the company’s comprehensive ESG roadmap shows how it addresses current concerns while maintaining its commitment to quality.

As these industries navigate complex regulatory environments and changing consumer preferences, the importance of travel retail as a showcase for innovation becomes ever more apparent. From Changi Airport's World of Wines & Spirits (WOWS) event to exclusive product launches in duty free shops, the travel retail channel continues to be a vital platform for brands to connect with global consumers.

We hope you enjoy this issue, with its comprehensive look at how industry leaders are rising to these challenges, setting new benchmarks for quality, sustainability and consumer engagement in an ever-evolving global marketplace.

Kindest regards,

WENDY MORLEY Senior Editor wendy@gtrmag.com

Global Travel Retail Magazine (ISSN 0962-0699) is published seven times a year by Paramount Publishing Company Inc. The views expressed in this magazine do not necessarily reflect the views and opinions of the publisher or the editor. July 2024, Vol 36. No. 5. Printed in Canada. All rights reserved. Nothing may be reprinted in whole or in part without written permission from the publisher. Paramount Publishing Company Inc.

GLOBAL TRAVEL RETAIL MAGAZINE Tel: 1 905 821 3344 www.gtrmag.com

PUBLISHER Aijaz Khan aijaz@globalmarketingcom.ca

EDITORIAL DEPARTMENT

EDITOR-IN-CHIEF Hibah Noor hibah@gtrmag.com

DEPUTY EDITOR Laura Shirk laura@gtrmag.com

SENIOR EDITOR Wendy Morley wendy@gtrmag.com

SENIOR WRITER Alison Farrington alison@gtrmag.com

ART DIRECTOR Jessica Hearn jessica@globalmarketingcom.ca

CIRCULATION & SUBSCRIPTION MANAGER accounts@globalmarketingcom.ca

advertisement removed for legal reasons

8

India is becoming a pivotal market for premium spirits, reflected in the increased demand for high-end and luxury spirits among travelers. In this report, we discuss spirits trends with some of the major decisionmakers in the country

Driven by evolving consumer preferences and innovative retailer strategies, the spirits market is experiencing dynamic shifts in travel retail. Here, key leaders share insights on how the industry is working to capture the discerning spirits buyer

20

Since the reopening of the Babylon Terminal Departure Duty Free store at Baghdad Airport, Iraq Duty Free has welcomed a sharp increase in both liquor and tobacco sales

Featuring brand, retailer and cruise line feedback from players in the channel, this report discusses drink development, activation and consumer behaviors in line with the spirits category

24 Japanese craftsmanship

House of Suntory has reached a milestone with the introduction of its Yamazaki and Hakushu Kogei Collection; Bowmore’s single malt whiskies range to experience big change in H2

26 Generation zeitgeist

As Generation Z matures into key consumers within the travel retail spirits market, the cohort’s distinct preferences are shaping industry standards. With a clear emphasis on sustainability, authenticity and quality, this demographic is pushing all stakeholders to incorporate more responsible and engaging practices

36 Origin story

As its fourth country of origin, Penfolds discusses its relationship with China, as well as its position on digital integration, creative collaboration and experience-driven retail

40 Fine wines, full glasses

Based on industry experts and travel retail insights, Global Travel Retail Magazine reports on category trends, the return of rosé and the next generation of wine lovers

42 The future unfurls

With an eye set firmly on innovation, sustainability and consumercentricity, JT Group is reshaping the tobacco category and showcasing a profound pivot in industry priorities

44 Luxurious innovations

As Oettinger Davidoff AG leverages its expertise to push the boundaries of cigar innovation, the company's dedication to sustainability and consumer-centric strategies ensures its continued leadership in the luxury cigar market

46 Igniting innovation

BAT is lighting up the tobacco category in travel retail with reduced-risk products, cutting-edge technology and a commitment to sustainability

48 ANDS’ alternative nicotine one-stop offer

Arnaud Piorkowski, ANDS Managing Director – MEA & Global Travel Retail, considers the company’s focus on innovation, as well as its ability to cater to changing consumer needs and its long-term goals in the channel

50 Gaining ground

With a focus on innovation and sustainability, the independent tobacco producer KT International is expanding its presence in airport duty free shops

52 Key growth factors

What will influence spirit sales growth in the near future? Global Travel Retail Magazine talks with leading industry executives

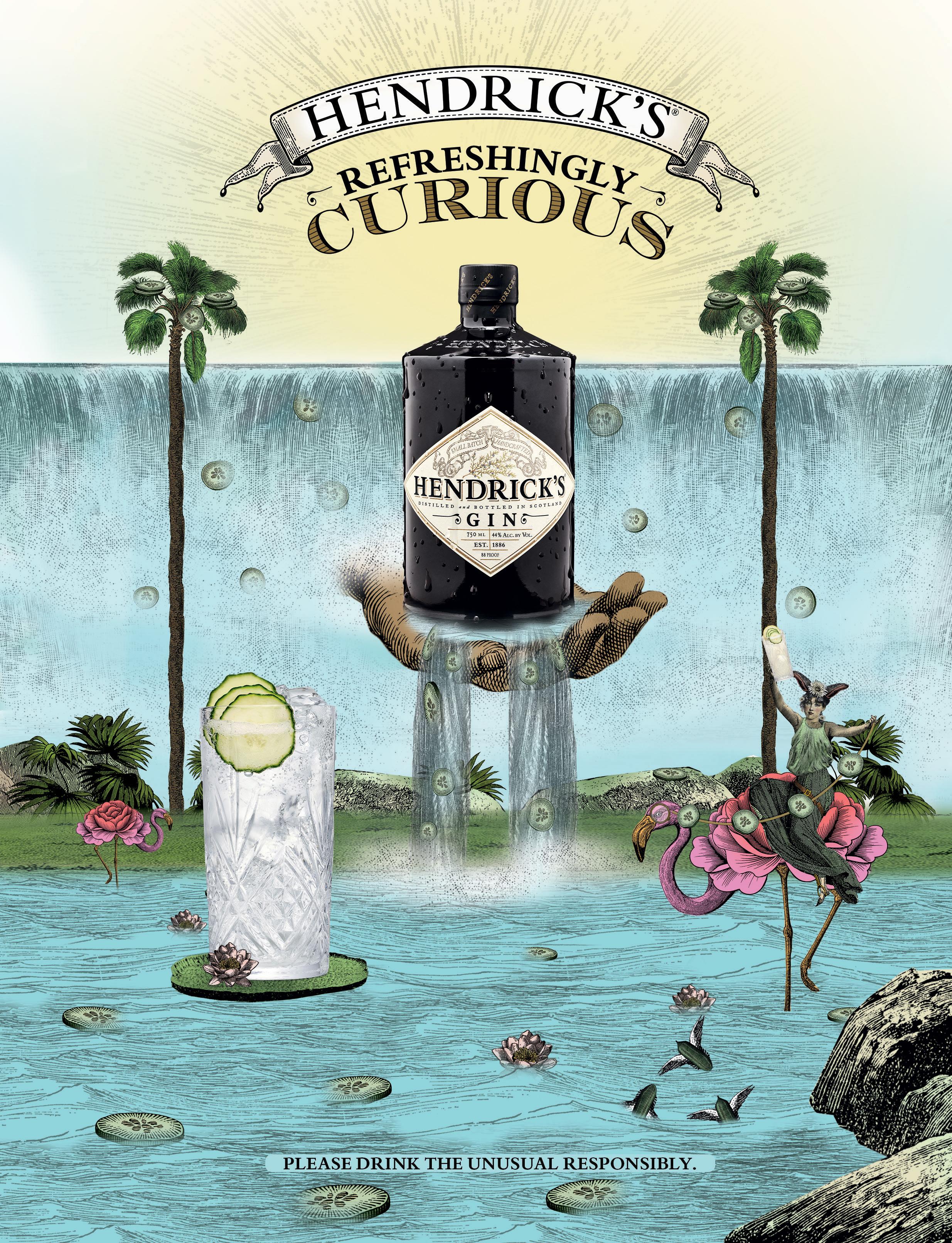

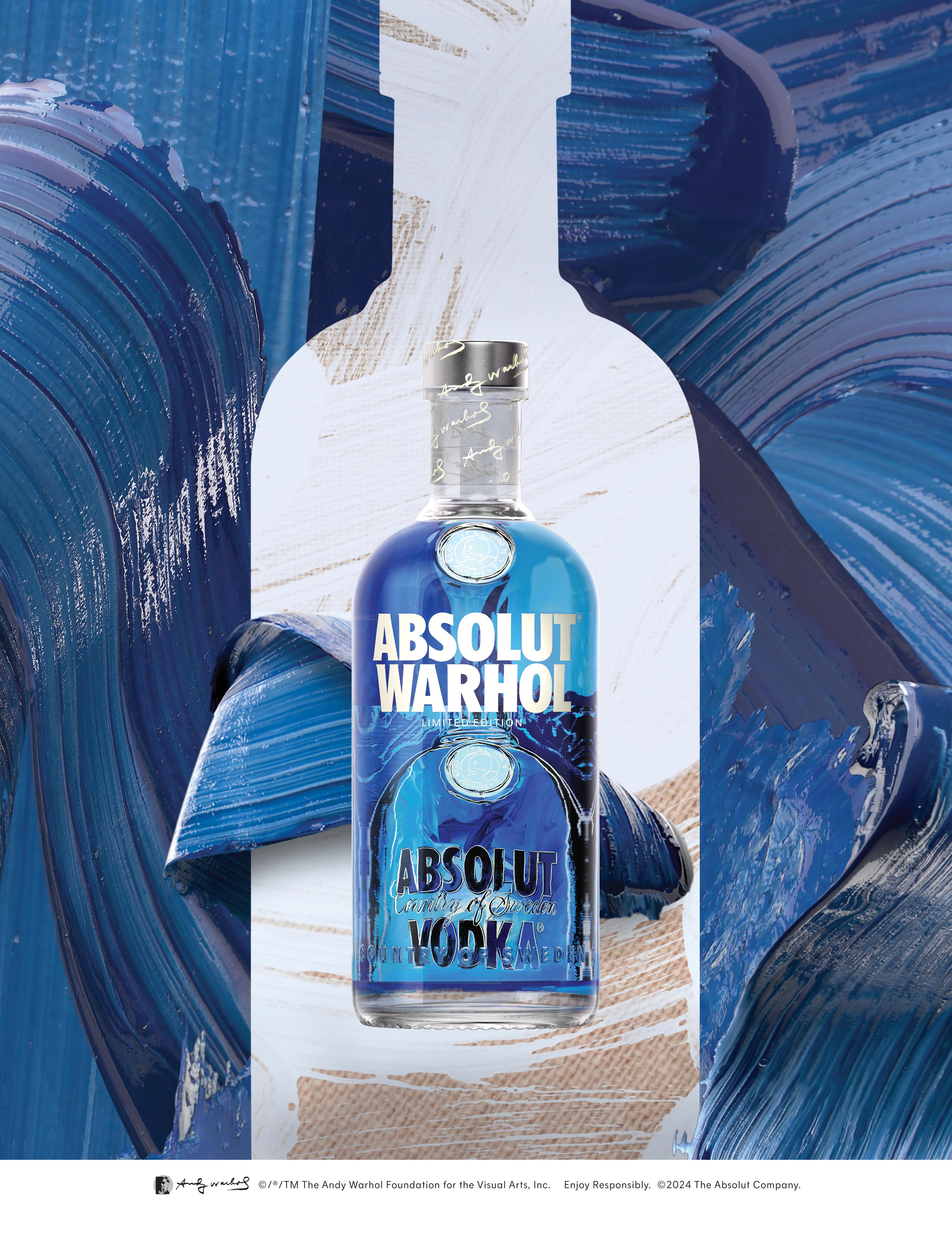

56 Travelers embrace art

Absolut Vodka's limited-edition Warhol Bottle will debut exclusively in the travel retail industry, launching first at Amsterdam Airport

58 Path to discovery

An update on William Grant & Sons’ presence in the channel; Managing Director – Global Travel Retail Rufus Parkinson discusses launches, strategies and activations across its portfolio

59 Jägermeister’s global reach

Experiencing success on a global scale, Mast-Jägermeister eyes India as a key growth market and finds a fit in the tequila category

60 Innovation and differentiation

Proximo Spirits is on a mission to source unique cask finishes and innovative production processes across its portfolio, honoring tradition and adding value along the way

62 Gin up your life

Crafter’s Gin has released a trio of miniature sensory sprays to introduce customers to the aromas of its botanical range; plus, the brand looks to the Americas as its next step in expansion

India is becoming a pivotal market for premium spirits, reflected in the increased demand for high-end and luxury spirits among travelers. In this report, we discuss spirits trends with some of the major decision-makers in the country

by WENDY MORLEY

India is becoming an increasingly important market in global travel retail for all categories, and spirits is no exception. The country’s burgeoning economy and a growing middle class are creating a surge in international travel along with a taste for premium brands – both trends to the benefit of travel retail. Evolving consumer preferences are driving significant growth and innovation, making it a focal point for industry stakeholders worldwide.

In general, Indian travel retail spirits trends are in line with those in other parts of the world, with one of the most prominent being the shift towards premiumization. Consumers in India are increasingly driven by a desire for exclusive experiences. This trend is expected to continue, with an emphasis on personalized customer experiences and exclusive product offerings.

“We are observing a strong shift towards premiumization, where consumers are increasingly opting for high-end, luxury spirits,” says Ashish Chopra, CEO Delhi Duty Free. “This trend is coupled with a growing interest in unique, limited-edition releases. We anticipate that this will continue in the coming year, with an emphasis on personalized customer experiences and exclusive product offerings.”

The broader growing consumer preference for authenticity and artisanal quality, along with a clear direction toward wellness and environmental impact, is also evident in Indian trends. “We’re seeing a growing interest in craft spirits and locally produced beverages,” says Lal Arakulath, CEO Kreol Group. “Consumers are also becoming more health-conscious, leading to a rise in demand for low-alcohol and nonalcoholic spirits. In the coming year, we

expect sustainability to be a key trend, with consumers preferring brands that prioritize eco-friendly practices.”

After years of inching its way up, tequila is finally seeing a growth explosion. “We observed significant growth in the sales of tequila, single malts and premium Scotch,” says Avishek Das, CEO Ospree Duty Free. “Tequila has seen a surge in popularity, driven by an appreciation for high-quality variants. Single malts continue to grow, with more interest in unique, limited-edition releases. Premium Scotch remains a staple, with consumers increasingly seeking aged and rare expressions.”

The Indian market has shown a remarkable shift towards premiumization, with

advertisement removed for legal reasons

a clear move toward high-quality, luxury spirits. Promotions and experiential activations are crucial partners in this trend, effectively highlighting the unique qualities and added value of premium products.

According to Chopra, younger consumers are leading this trend, showing a strong preference for innovative and premium offerings. He also sees a “notable” rise in the number of modern female travelers who are increasingly experimental and open to trying premium products. “Yes, Indians have enthusiastically embraced the trend of premiumization, reflecting a shift towards higher quality and luxury in their purchases,” he states.

Arakulath says the trend of premiumization is evident across various age groups and genders, with younger customers being drawn to innovative and trendy premium products, while older consumers often stick to established brands and personal favorites. “Indian consumers are willing to pay more for premium and super-premium spirits. Promotions play a crucial role in driving sales, especially during festive seasons,” he says. “Indians have certainly embraced the trend of premiumization, reflecting a growing preference for highquality, exclusive products.”

Indian spirits on the rise

The sales of Indian spirits are on the rise, driven by both knowledgeable locals and foreign travelers seeking unique souvenirs. This trend reflects a growing appreciation for the quality and heritage of Indian brands and the desire to take home a piece of India’s rich spirit culture.

“Local customers are increasingly appreciating the quality and heritage of Indian brands, while foreign travelers enjoy taking home a piece of India’s rich spirit culture,” says Chopra. “This dual appeal has contributed to the overall growth in sales.”

He adds that duty free is thriving in India, with a wide selection of high-

quality Indian spirits available. “This offers a unique opportunity for both local and international customers to explore and enjoy premium Indian brands, further enhancing the appeal of shopping at Delhi Duty Free,” Chopra says.

Arakulath says Kreol Group has observed robust sales of Indian spirits, attributed to strong domestic demand. “We expect this trend to continue, driven by the growing class of people willing to spend on premium Indian spirits.”

Das notes a significant and consistent rise in Indian spirits sales, highlighting a surge in interest in domestically produced beverages. This trend is fueled by a heightened sense of national pride and the increasing recognition of Indian whiskeys on both domestic and international stages. “Indian whiskeys have gained prominence both domestically and internationally, with brands like Indri, Rampur, Amrut, and Paul John receiving acclaim for their quality and craftsmanship,” Das says.

Looking ahead, he expects sales of Indian spirits to continue increasing, driven by several factors. The global trend towards authenticity and heritage in spirits consumption benefits Indian spirits, which often have rich histories and traditional production

For Ospree Duty Free, while white spirits are growing especially with younger consumers brown spirits continue to be more popular in India, with single malts like Glenmorangie on the rise, with promotions such as this one are key

methods. Indian distillers continue to innovate and experiment with new flavors and styles, attracting a broader audience both domestically and internationally.

“Overall, the future looks promising for Indian spirits, and we expect to see continued growth in sales as they gain recognition and appreciation on the global stage,” Das says.

To effectively penetrate and capture the Indian market, spirits brands must prioritize understanding the diverse consumer preferences and regional nuances, according to Chopra. The Indian market’s complexity requires a tailored approach, and brands must seek strategic promotions and partnerships. “Investing in customer behavior studies and continuously adapting strategies to meet local tastes and preferences is crucial. Additionally, focusing on premiumization and offering superior promotions will help brands capture and retain a loyal customer base,” Chopra states.

Similarly, Arakulath highlights the need for brands to comprehend both varied customer preferences and the regulatory environment. “Brands looking to enter or capture more of the Indian market need to understand the diverse consumer preferences. They should also be aware of the regulatory

Held at Ospree Duty Free, the Ardberg launch event featured a captivating and unforgettable mix of

entertainment

environment and consider partnering with local distributors for better market penetration,” says Arakulath.

Prioritizing the diverse regulatory landscape and understanding regional preferences also top the list for Das, when discussing how brands can break into the market. “Effective promotions and strategic partnerships with travel retail stores like us can significantly enhance their market penetration and customer reach,” he adds.

With the growth of aviation in India, the distinction between how Indian and foreign travelers shop at duty free stores is becoming increasingly subtle. Both groups now fall into the broader category of world travelers, influenced by global trends and preferences.

“While there are some differences in preferences, such as foreigners still favoring white spirits over brown and India being predominantly whiskydriven, we are also seeing global trends influencing Indian customers. There is a notable migration towards premium gins, tequilas, and other spirits,” Chopra says. “Our aim is to cater to the evolving tastes of all travelers by offering a mix of globally recognized premium brands and exceptional value options, ensuring a satisfying shopping experience for everyone.”

The travel retail and duty free channel in India presents a unique opportunity for spirits brands who want to reach a global audience. With the recovery of travel post-pandemic, there is an anticipated surge in demand within this channel. This resurgence is coupled with a trend towards exclusive travel retail offerings, adding an element of exclusivity that attracts consumers, according to Arakulath. “Speaking specifically about Indian craft spirits, they offer a unique alternative to international spirits and are certainly worth exploring for those interested in expanding their palate. Often incorporating local ingredients and traditional distillation methods, their flavors reflect India’s rich cultural heritage,” he says.

Das emphasizes the growing demand for unique and exclusive products in the travel retail channel. “India’s travel retail and duty free channel is evolving rapidly. Travelers are increasingly seeking unique and exclusive products, and we’re committed to meeting this demand by offering a diverse range of high-quality spirits,” he says. “Our focus on personalized experiences, exclusive partnerships and innovative digital engagement ensures that Ospree Duty Free remains at the forefront of this exciting market.”

Das is excited about recent events such as the Ardbeg launch. Held at Ospree Duty Free, this launch event featured a captivating mix of fun activities and entertainment, creating an unforgettable experience for the retailer’s guests. Attendees enjoyed interactive games and live performances, all designed to celebrate the unique character of Ardbeg. “It was a fantastic opportunity to engage with our customers and showcase the exceptional quality of Ardbeg spirits in a vibrant and festive atmosphere,” Das reports.

The spirits market in global travel retail is witnessing dynamic shifts driven by evolving consumer preferences and innovative retailer strategies. Here, industry leaders share insights on the most significant trends and the strategies being employed to capture the discerning spirits buyer

by WENDY MORLEY

The global travel retail industry is navigating an era marked by significant technological advancements and evolving consumer preferences. As the market continues to rebound, often surpassing 2019 traffic, retailers are leveraging innovative strategies to enhance customer engagement and streamline operations. The integration of AI and digital tools has become a cornerstone, offering personalized travel

experiences and facilitating seamless shopping. This trend is particularly evident with AI-driven recommendations for dining, accommodations and activities, which are gaining popularity among travelers globally.

Sustainability has emerged as a critical driver, influencing both product offerings and consumer behavior. The industry is witnessing a shift towards eco-friendly practices, with companies focusing on reducing packaging waste and utilizing recyclable materials. The emphasis on sustainability is also reflected in the growing premiumization of product categories, where value over volume is becoming a dominant theme. High-end offerings, such as prestige spirits and premium wines, are experiencing robust growth as consumers are willing to invest more in quality and sustainable products.

High-value purchases and cross-category buying are pivotal to the travel

retail spirits market, and spirits have a significant impact on the overall shopping basket due to their high price points and premium nature. Paul Hunnisett, ARI Global Head of Buying for Liquor, Tobacco, Confectionery, and Souvenirs, emphasizes this dual benefit: “Spirits as a category have a significant impact on the overall shopping basket in travel retail. Spirits often have a high price point; therefore, shoppers who purchase spirits often contribute to higher overall basket spend as they are drawn to premium and exclusive products,” he says, adding: “These consumers tend to cross-category purchase as well; their propensity to explore and indulge in niche or exclusive spirits can often lead to additional purchases from complementary categories such as gourmet foods, chocolates, or even non-food categories such as beauty or accessories.”

Gwyn Sin, Vice President of Airside Concessions at Changi Airport Group, addresses the significance of premium spirits in contributing to overall sales

In

growth, stating: “The demand for premium and super-premium spirits will continue to grow as consumers increasingly value high-quality exclusive products.” At Changi Airport, a concerted effort to provide an extraordinary shopping and tasting experience sets it apart as a premier destination for discerning spirits buyers and travelers.

White spirits are growing in popularity. Hunnisett observes increased interest in these spirits: “We are seeing growth in tequila and rum, albeit from a smaller base,” he says. “This is driven by the popularity of white-spirit cocktails alongside an increasing consumer interest in premium and diverse spirit offerings.” The increasing demand for these spirits is indicative of a broader shift towards diverse and premium spirit offerings in the travel retail market, particularly in the context of innovative cocktail culture.

Travel retail exclusives, always popular, are becoming increasingly so. Sin says, “We also anticipate a rise in the popularity of travel retail exclusives offering unique items not available in

domestic markets.” This demand for exclusive products reflects a broader market trend where exclusivity and uniqueness are highly valued. Changi Airport Group, in collaboration with Lotte Duty Free and leading brands, has been proactive in offering such travel retail exclusives, enhancing the overall shopping experience for travelers.

Retailers are leveraging the trend toward exclusivity to differentiate themselves and capture the spirits buyer’s attention. Hunnisett says, “Our strategy on Irish whiskey has seen us develop new opportunities with our ongoing range of world exclusives such as the

recently released Redbreast Cuatro Barriles Edition.” By focusing on world exclusives and niche categories, ARI creates a unique and much-desired offering in the spirits category that sets the retailer apart. This strategy is complemented by tailored and bespoke offerings in various locations, ensuring that the product mix resonates well with local and international consumers alike.

Capturing the spirits buyer

Hunnisett emphasizes the importance of understanding and anticipating consumer needs: “At ARI we work closely with our global insights team to ensure

that we are anticipating consumer needs and demands, so that we are always striving to exceed them.” This approach enables the retailer to create a product mix that resonates with the diverse preferences of its customers.

Digital engagement and omnichannel strategies play a crucial role in enhancing the shopping experience and attracting spirits buyers. Sin notes the significance of digital tools in meeting modern travelers’ expectations: “At Changi Airport digital tools such as mobile apps and online pre-order services and our e-commerce platform iShopChangi make it easy and convenient for customers to purchase items.” These tools provide a seamless and personalized shopping experience, allowing customers to browse and buy products effortlessly. Innovative concepts like Changi’s robotic bartender and the interactive wine sommelier further enhance digital engagement, making the

shopping journey both engaging and informative.

Creating unique customer experiences is essential in attracting and retaining spirits buyers. Hunnisett highlights ARI’s efforts in this regard: “Keeping abreast of the latest consumer demands and working closely with our suppliers to create theatre instore and unique experiences for our customers.”

This strategy involves developing new opportunities with world exclusives and creating an engaging retail environment that captivates customers.

Sin points to Changi Airport’s immersive shopping experiences as a key strategy: “Throughout the year we also partner with brands to roll out Changi 1st pop-ups for various categories including spirits, which give customers the opportunity to be among the first to purchase limited-edition products.” These activations offer visitors an immersive travel journey with

interactive games, tailored product recommendations by brand ambassadors, and personalized gifting options, enhancing the overall shopping experience and driving spirits sales.

Tailored regional strategies are vital for addressing the distinct preferences of consumers in different markets, says Hunnisett. He emphasizes the importance of customizing approaches based on regional nuances: “Trends differ significantly between regions and we work closely with our local suppliers and with our teams in each location to ensure that we offer the best mix for that region.” For example, in Ireland, ARI focuses heavily on Irish whiskey exclusives, appealing to both local consumers and international travelers seeking unique, high-quality products. This strategy leverages Ireland’s rich whiskey heritage and ensures that the sales and

marketing activities are aligned with consumer preferences.

Enhancing regional offerings involves curating products that resonate with local tastes and cultural preferences. Hunnisett notes the success of locally produced spirits and wines in Cyprus Duty Free: “In Cyprus Duty Free the business has had superb success with its range of ‘own-brand’ locally produced spirits and wines – which delivers a very strong sense of place for travelers and gives a taste of local to visitors to the region.” Similarly, in Portugal, premium port has seen a surge in popularity. By collaborating with premium Port Houses, ARI ensures that the Portugal Duty Free locations offer an extensive range that provides shoppers with an authentic taste of Portugal.

Changi Airport’s approach includes leveraging digital tools and omnichannel strategies to cater to the preferences of modern travelers. With the strong momentum of global traffic recovery, Sin says Changi expects an uptick in spirits sales, particularly from the Chinese market. “To bolster the awareness of our offer to our target markets, we work with brands to run marketing campaigns and promotions to spotlight exclusive and rare items, as well as highlight the unique qualities of various products,” she says. This approach ensures that Changi Airport can effec-

tively target its key markets and drive awareness of its unique offerings.

The future outlook for the spirits category in travel retail appears promising, driven by consumer demand for premium and exclusive products. Hunnisett sees a robust future for spirits sales, driven by innovation and consumer engagement.

Sin highlights the ongoing commitment to enhancing the shopping experience: “To grow Changi Airport’s reputation as a leader in the wines and spirits category we will be rolling out the

third edition of the prestigious World of Wines & Spirits (WOWS) in October this year.”

This event, organized in partnership with Lotte Duty Free, will showcase a curated selection of premium and rare fine wines and spirits, featuring exclusive tastings and masterclasses led by industry experts. Such events not only attract connoisseurs and collectors but also enhance the airport’s standing as a premier destination for spirits buyers.

“Attendees can expect exclusive tastings, masterclasses led by industry experts, and unique opportunities to purchase limited-edition releases,” says Sin.

EACH TERROIR’S RESPECTIVE TOBACCOS CREATE DIFFERENT SENSORIAL EXPERIENCES · DIFFERENT GROWING CONDITIONS BRING YOU DIFFERENT FLAVOUR PROFILES ·

Since the reopening of the Babylon Terminal Departure Duty Free store at Baghdad International Airport, Iraq Duty Free has welcomed a sharp increase in both liquor and tobacco sales

by HIBAH NOOR

Buoyed by the recent reopening of its Babylon Terminal Departure Duty Free store at Baghdad International Airport’s international departures terminal, Iraq Duty Free is enjoying a new era of growth.

At the same time, sales across major categories have increased with the travel retailer set to expand its downtown duty free business with a shop in Al-Karkh on the western side of Baghdad, its second off-airport location in the Iraq capital.

Ambitious expansion plans have the travel retailer set to open further downtown stores nationwide in coming years, while renovations to the Baghdad International Airport Samarra arrivals

duty free store are scheduled for later this year, along with its Basra International Airport operation.

According to a spokesperson for the travel retailer, Iraq Duty Free has witnessed a sharp increase in liquor sales since the reopening of the Babylon Terminal Departure Duty Free store. That increase is attributed to its featured products, and in particular to the retailer’s faster moving SKUs being showcased in a more premium way.

Iraq Duty Free has also noticed a change in buying habits, with an increased demand for higher end, more expensive single malt whiskies, as well as premium Scotch brands. The same can be said in the champagne and cognac categories, with purchases

increasing at a rate which the company has not seen in the past. Purchases of wine have also increased markedly, as Iraq Duty Free’s customers become more accustomed to wines of different quality and from different regions. “We are therefore moving our procurement towards these changes in buying habits,” the spokesperson adds.

Considering current trends in spirit sales and looking ahead to the near future, he notes, “Scotch whisky is still by far the number one selling type of spirit but the trend is now moving towards more premium brands and higher buying prices. We see our younger consumers now buying whiskies. Whisky is followed closely by vodka which is also very high in demand.”

Exclusive lines are not in Iraq Duty Free’s immediate plans as the company maintains a focus on ensuring it has the brands that match the demands and preferences of today’s traveling consumers.

Considering how the travel retailer is meeting consumers’ demands and tailoring its offer within the tobacco and tobacco products category, Iraq Duty Free says Marlboro remains the topselling brand, followed by Winston. “We have witnessed an increase in demand for cigars and will be introducing some very nice brands to cater to this demand very soon,” the spokesperson says.

“Cigarettes have and will always come as number one in demand followed by shisha tobacco, a category in which we have experienced a tremendous growth in sales. Heated tobacco products (HTPs) or heat-not-burn (HNB) products follow and then finally the vapes.”

Underlining the strength of the shisha category, Iraq Duty Free has listed shisha tobacco in its shops for the past three years, with sales increasing “tremendously on a yearly basis”. The travel retailer has opted to introduce a

second major brand and hookahs will be available in shops by the end of July. Iraq Duty Free has yet to decide on listing hookah accessories.

Leveraging trend towards highquality smoking experiences

According to the spokesperson, there is a noticeable trend in terms of higher

quality and more exclusive brands, “but this, of course, also applies to other categories”. Gifting plays a key role in Iraq Duty Free’s offer to match the needs of its Iraqi consumers who maintain strong gifting traditions, especially when traveling and bearing gifts on their return.

House of Suntory has reached a new milestone with the introduction of its Yamazaki and Hakushu Kogei Collection; Bowmore’s single malt whiskies range to experience big change in H2

by ALISON FARRINGTON

The House of Suntory, a founding house of Japanese whiskies, introduced its inaugural Yamazaki and Hakushu Kogei Collection at TFWA Asia Pacific in Singapore. According to Ashish Gandham, Managing Director – Global Travel Retail at Suntory Global Spirits, the introduction exemplified how this limited-edition is a new milestone for its whisky portfolio and a sign of the company’s legacy of craftsmanship. “No other market outside Japan has seen this kind of whisky innovation in travel

retail,” says Gandham.

The Kogei Collection explores the traditional crafts of Japan through artisan partnerships, in this case a collaboration with Chiso, Kyoto’s preeminent Kimono House and creators of the finest Japanese kimonos since 1555. The two collectible whiskies showcase a fusion of peated malt and Spanish oak and will be refreshed every two years with new packaging designs. “We know travelers have a sense of exploration in our channel; this launch is an indication of how House of Suntory brings value for

Bowmore will see a revamp in Q4 to focus on aged statements “to bring different facets of whisky to the channel”

money to travelers – a key tenet of what the house offers reflecting our endless quest for quality and creativity,” explains Gandham.

Featuring designs based on Chiso kimonos, the Yamazaki packaging incorporates intricate prints inspired by the serene Yamazaki Distillery, with the depiction of three merging rivers evoking a sense of calmness. The Hakushu packaging mirrors the Japanese Southern Alps that surround the Hakushu Distillery. This design features silver stamping, designed to call to mind forest clouds and delicate kimono threads.

“We were very clear we wanted to continue our leadership of Japanese spirits through innovation and craftsmanship,” Gandham tells Global Travel Retail Magazine. “The Kogei Collection is a priority for us; it is very special and only for our travel retail customers.”

Suntory Global Spirits recognizes the tenets of global travel retail and the sense of exploration travelers have when they shop in duty free. From a shopper perspective, the channel provides value for money and exclusivity. “I’m happy this space has been recognized by the company in a range of whiskies we hold most dear for what Suntory stands for,” he says.

Bowmore’s elevated offer

In the second half of this year, the Bowmore range of single malt Scotch whiskies will see change. Bowmore will have a big relaunch in Q4, explains Gandham. On top of the recent Bowmore Timeless Series launches – a 33-YO and 29-YO – which took place in May, respectively, in addition to the 31-YO that was released in 2021.

Bowmore will increasingly have an Asia steer in its brand positioning, according to Gandham. “For us, the

top 15 air hubs as travel retail locations for activity are absolutely key. We’ve expanded our portfolio in the last three years and we have a lot of headroom for growth.

The top 15 locations globally are where we need to show our best offer. They set the tone for us, in terms of what we want to achieve; we want to own the [single malt] category in terms of market share, we want to show our best leaders and show our quality products and innovation. These are the conduits of our strategy in global travel retail,” he says.

These 15 top locations are where Suntory Global Sprits will be focused on Bowmore and Japanese whisky. But outside these locations Bowmore will have an Asia steer for promotions, while Laphroaig will have more of a Europe steer, as we have already seen with the Laphroaig Elements series launch in late 2023 in the UK.

As Generation Z matures into key consumers within the travel retail spirits market, the cohort’s distinct preferences are shaping industry standards. With a clear emphasis on sustainability, authenticity and quality, this demographic is pushing all stakeholders to incorporate more responsible and engaging practices

by WENDY MORLEY

With its adult population now ranging from 18 to 28 years old, Generation Z represents today’s traveling zeitgeist. This cohort is reshaping the duty free spirits market with a distinct preference for quality over quantity, aligning with its broader values of authenticity, sustainability, and unique experiences.

Gen Z travelers are frequent and adventurous, typically taking an average of three leisure trips annually. They prioritize experiences that are off the beaten path and they are heavily influenced by social media. This demographic values ethical practices and environmental sustainability, often researching companies’ approaches to these issues before making purchasing decisions.

In travel retail, Gen Z shows a growing appetite for premium and authentic products. They are more likely to spend on high-quality, ethically produced spirits and seek out brands that tell compelling stories about their heritage and production processes. This is driving retailers and brands alike to adapt their strategies, ensuring their offerings meet the high standards of Gen Z consumers.

The trend of “drinking less but drinking better” among Gen Z is reshaping the duty free spirits market. Brands are adapting their strategies to cater to this generation’s preference for quality over quantity, ensuring that their product offerings meet the high standards of these discerning consumers.

Global Drinks Ltd (GDL) is addressing this trend through a strategic approach to product selection, brand partnerships and sales strategies. “GDL has carefully curated our own MISAKA whisky portfolio to include six super premium spirits that come with age statements and, importantly, a product story on our packaging that details why MISAKA whisky is a premium spirit that distinguishes itself from other whiskies,” says Marketing Director Harry Kartasis. “Whether it’s our fresh watersource stream that lies 250 meters under the MISAKA mountain range in Japan or the rare Mizunara casks we use to age five of our seven SKUs, we cater to Gen Z’s preference for quality over quantity.”

Rémy Cointreau GTR is also tapping into this trend by leveraging its extensive portfolio, rich heritage and

expertise. “We welcome the opportunity this development gives us to shine a spotlight on our premium offerings to travelers who are seeking out exceptional spirits across various product categories,” states Alice Hoffman, Worldwide GTR Marketing Director. Rémy Cointreau’s portfolio includes prestigious brands like Louis XIII and Rémy Martin Cognac, Bruichladdich Islay single malt whisky, Cointreau liqueur and The Botanist Islay Dry Gin, perfectly positioned to meet Gen Z’s demand for exceptional drinking experiences.

To address the trend of drinking less and the growing interest in mindful consumption, Rémy Cointreau is also showcasing the versatility of its spirits through low- and no-alcohol cocktail recipes. “These are often highlighted via our travel retail activations and our digital channels, educating consumers on how to savor the flavors of our brands while moderating their alcohol intake,” Hoffman states.

Emphasizing sustainability

Sustainability has become a significant consideration for all demographics, and none more so than Gen Z, who prioritize environmental and social responsibility in their purchasing decisions.

Spirits brands are increasingly focusing on sustainable practices.

Global Drinks Ltd represents brands like Stoli Group, Quintessential Brands, and Proximo Spirits, all of which have made sustainability an essential consideration. “Many of the brands we represent have implemented sustainability measures across their operations, from carbon-neutral production processes to eco-friendly packaging and responsible sourcing practices,” says Kartasis. “We closely collaborate with our brand partners to understand their specific sustainability goals and ensure that our distribution efforts align with and amplify their commitments.”

Additionally, GDL has launched its own sustainability initiative for MISAKA Whisky. “For every 1,000 bottles of MISAKA sold, we plant a Sakura tree in the MISAKA mountains, an initiative endorsed by the local government as an important part of their own sustainability goals,” Kartasis states.

While Rémy Cointreau GTR recognizes sustainability’s importance to Gen Z, this is a happy coincidence, as it is in strong alignment with its own company values. “We know that sustainability is an important purchase influencer for Gen Z, who care about the environment and social respon-

sibility, favoring brands with proven sustainable practices and ethical sourcing. In this respect we are very fortunate, as sustainability is absolutely a core aspect of our company’s mission too – as is DEI,” states Hoffman. “Fida Bou Chabke, Rémy Cointreau GTR CEO, also leads on our Diversity, Equity & Inclusion activities, in collaboration with the Committee that represents all our countries worldwide.”

Rémy Cointreau prioritizes efficient energy usage, the use of eco-friendly materials and lighting in addition to waste reduction and responsible resource management, to minimize environmental impact. “For us, sustainability is not just an idea, but a key guiding principle across all our activation spaces,” Hoffman adds.

Several key initiatives highlight Rémy Cointreau’s commitment to sustainability, as Hoffman further elaborates: “Champagne Telmont has partnered with glassmaker Verallia to create the lightest Champagne bottle in the world to date, reducing its weight to just 800g and eliminating gift boxes and other packaging, further reducing its carbon footprint by an impressive 8%,” Hoffman reports.

Additionally, the new LOUIS XIII Cognac coffret is crafted from 100%

advertisement removed for legal reasons

cellulosic materials, reducing CO2 emissions by 57% and facilitating more environmentally conscious shopping, shipping and transport practices.

“Within the whisky category, Bruichladdich’s new bottle for our signature Bruichladdich Classic Laddie contains an average of 60% recycled glass and is 32% lighter than its predecessor, significantly reducing our environmental impact,” she adds.

The Botanist Islay Dry Gin is also strongly committed to sustainability, aiming to reduce its impact in terms of energy, agriculture, biodiversity, packaging and waste. “As custodians of Islay, The Botanist is working tirelessly to reduce the impact of its operations and become more environmentally conscientious in its actions,” Hoffman emphasizes.

Cultural exchanges

Global travel and cultural exchanges have significantly shaped Gen Z’s preferences, leading to a more adventurous and discerning approach to beverage choices. This generation’s exposure to diverse cultures and flavors has been amplified by social media, where influencers and content creators share their

travel experiences, sparking curiosity about regional spirits and cocktails.

Hoffman acknowledges that Gen Z consumers typically have more adventurous palates, willing to experiment with new and unexpected flavors and moving beyond traditional spirit categories. “This openness stems from their exposure to global cultures and their desire for unique experiences,” she states. Gen Z values transparency and authenticity, seeking brands with compelling stories, traditional production methods and high-quality ingredients. While generally cost-conscious, they are also willing to spend more on spirits that align with their values.

To cater to these preferences, Rémy Cointreau GTR curates a travel retail assortment that reflects these values, showcasing heritage brands and distinct cultural origins along with company core principles, transparency, expertise, terroirs and sustainability. The assortment includes Rémy Martin, known for the heritage and tradition of Cognac making; Cointreau, essential for classic cocktails; Mount Gay, spotlighting the rich history of rum; and Metaxa, a Greek liqueur combining brandy, muscat wine, and Mediterranean botanicals.

Bruichladdich and The Botanist offer travelers a taste of exceptional craftsmanship from their Islay distillery.

“Importantly, we regularly innovate and update our heritage portfolio with limited-edition expressions and travel retail exclusives, tapping into Gen Z consumers’ desire for something that is rare and collectible,” says Hoffamn.

Kartasis notes that social media has played a crucial role in this shift.

“Influencers and content creators sharing their travel experiences have sparked curiosity about regional spirits and cocktails. This digital storytelling inspires Gen Z to seek out those flavors when traveling or through imported products back home,” he says.

The MISAKA brand, available only through global travel retail, leverages brand ambassadors to deliver its story, engaging with passengers at airports and border crossings. “Our brand story is delivered through people engagement by brand ambassadors who are highly skilled and educated to get our message across to passengers who are either departing or arriving through an airport or border crossing,” Kartasis adds.

by LAURA SHIRK

Cruise Lines International Association forecasts that global cruise capacity will grow at least 10% from 2024 to 2028. For a closer look at the multi-generational travel option that benefits from unparalleled dwell time, experience-driven retail and two forms of alcohol consumption: on board and duty free, Global Travel Retail Magazine turned to the experts. In this report, we hear from sector professionals about leading drink development and cocktail creation, the importance of a segmented approach, cruise activation and consumer behaviors.

Speaking about the cruise line’s approach to managing on-premise and off-premise consumption, Zachary Sulkes, Assistant Vice President of Beverage Operations at Carnival Cruise Line (Carnival), says on board its focus is on catering to the preferences of guests. “We recognize that when people visit one of our bars on board, they often

have specific tastes or favorites in mind, so our selection primarily includes brands that are consistently in demand,” he explains. At the same time, Carnival monitors emerging trends to match those seeking a different option during their cruise. It recently added a new Mezcal brand to its portfolio, reflecting the growing popularity of the spirit in the broader US market.

“We also recognize the importance of tailoring our offerings to enhance the guest experience, which allows us to introduce regional specialties and themed offerings. For example, on ships such as Carnival Firenze and Carnival Venezia, which embody the ‘Carnival Fun Italian Style’ experience, we feature a variety of Italian spirits and cocktails like Limoncello and Espresso Martinis, aligning with the thematic elements of each ship,” says Sulkes.

When it comes to drink innovation, mixologists curate a menu of cocktails that resonate with guests and reflect the

dynamic nature of Carnival’s dining and entertainment experiences. On evolving trends, the cruise line is also responding to those driven by sustainability practices and advancements in beverage technology. An example of this is its partnership with closed loop packaging leader ecoSPIRITS.

Tito’s Vodka says special tastings, gifts-withpurchase and price promotions, encourage travelers to engage with their favorite brands and learn about their versatility

Retail integration and dwell time

To integrate the core cruise experience into the duty free channel, it is essential that parties successfully work together to make the most of the retail environment on board. Sherrie Day, Global Head of Merchandising at Starboard Cruise Services (Starboard) notes, “We collaborate closely with our spirits brand partners to deliver a well-curated selection of products, maintain adequate stock levels and provide top-notch training for staff members, ultimately enhancing the overall shopping experience for cruise guests.”

According to Day, Starboard considers passenger demographics and preferences, seasonal and destinationcentric itineraries, brand-specific training programs and supply chain coordination when making decisions. In addition to tasting sessions and mixology classes, cross-brand activations such as “Watch and Scotch” events help to cross promote between on board consumption and duty free sales. On the digital front, it uses tools like mobile apps and interactive kiosks to provide convenient shopping options and tailored promotions.

Starboard leverages the extended time with travelers by organizing

frequent and diverse retail events including themed shopping nights, product demonstrations and exclusive samplings that connect with various age groups and interests and encourage multiple shopping visits. Day says the Spirited shop aboard the ship Celebrity Ascent attracts passengers by combining digital elements, personalized tastings and “unprecedented engagement” via its “What’s Your Whiskey” quiz-based interactive activation.

Day comments, “By integrating shopping seamlessly with the overall cruise experience and continuously engaging

passengers throughout their journey, Starboard enhances the appeal and accessibility of duty free shopping, driving higher conversion rates.”

A recognized name in the channel, Tito’s Handmade Vodka works with its cruise partners to ensure a seamless experience with the brand on board. Curran Zinn, Commercial Manager –Travel Retail at Tito’s Handmade Vodka, says since it’s likely that many cruise guests, especially in North America, have had their own experience with Tito’s Vodka already at home, its goal in the sector is to connect passengers with the brand in a unique and different way while they are on vacation. Special tastings, gifts-with-purchase and price promotions, encourage travelers to engage with their favorite brands and learn about their versatility.

“We appreciate that cruise lines seek to differentiate themselves from other lines, and so we’re very flexible in how we approach each cruise line. We create specific programs for each to meet their individual needs, whether that’s through bespoke cocktails or on board activations and promotions. Bar menus especially are a great way to customize our brand and engage with cruise guests in a memorable and meaningful way,” shares Zinn.

In a news update, Quintessential Brands has designed an on board, cross-category cruise pouring range to create a one-stop shop solution for operators. It has also released its full premium brand portfolio including BLOOM Gin and Feeney’s Irish Cream in partnership with Crystal Cruises. Oliver Storrie, Regional Director – Global Travel Retail at Quintessential Brands, explains the company aims to showcase its brands through the cocktail and premium menus on board. “We will then dovetail this with listings in the retail store on board, so passengers can try and buy,” he says.

Inspired by the hit Netflix series Emily in Paris, Quintessential Brands has also launched the premium Kir Royale ready-to-drink cocktail Chamère. The cocktail (10.5% ABV) is available in three formats: a 250-ml can and 20-cl and 75-cl bottles. According to Storrie, the company will be working with operators to bring the product to life in cruise via on board lifestyle events.

advertisement removed for legal reasons

As its fourth country of origin, Penfolds discusses its relationship with China, as well as its position on digital integration, creative collaboration and experience-driven retail

by LAURA SHIRK

Global Travel Retail Magazine recently sat down for an exclusive interview with team members at Penfolds, a division of Treasury Wine Estates. From contributing factors to Penfolds’ growth in Asia to key trends shaping the region’s wine market, the conversation covered the name’s long history with China, the launch of its first Chinasourced wine and plans for the future. Penfolds Managing Director Tom King and Michael Jackson, Global Director –Global Travel at Penfolds, spoke openly about its expansion in Asia, as well as its strategic planning.

Founded 180 years ago, the Australian wine producer first exported wines from South Australia to Shanghai, China, in 1893, forming connections in the trade and building a loyal consumer base. Penfolds launched its first Chinese wine two years ago, under the ONE by Penfolds label and in collaboration with

other winemakers. In 2023, the company released its first luxury wine made in China, Chinese Winemaking Trial 521, a unique blend of Cabernet from Yunnan and Marselan from Ningxia. King noted that there is sizeable opportunity long-term to create quality Penfolds wines from these two regions.

“Over the last few years, our business has changed and our portfolio has evolved from being an Australian wine business to now a brand that makes wines from the best winemaking regions around the globe,” shared King. These include California, Bordeaux and Champagne. “We’ve always had a desire to make wines in China, which is our fourth country of origin. During this time, we’ve accelerated this in terms of understanding the landscape, the different growing regions and sending our winemakers and viticulturalists to China.”

He continued, “We’re really excited about what we’ve been able to produce

in terms of the two non-negotiables for us: our quality and Penfolds house style. Our winemakers have been able to craft a wine that is not only in line with the Penfolds house style, but also representative of the great varieties of these regions [Yunnan and Ningxia].”

According to King, the response has been better than expected in regards to both the product and the welcoming received as a foreign company entering local businesses and communities. From the start, both parties wanted to partner, exchange ideas and learn more. Considering the trial is made up of limited quantities, he said it has been a challenge satisfying demand. “People have been impressed with the quality of the wine, as well as the way that we’re able to tell the story of how we make wine around the world – specifically, how we make wine in China in collaboration with local partners,” he commented.

Penfolds will be releasing a second vintage in August and hosting a reveal in Beijing, partly as a celebration of its core portfolio now being back in the China market post the lifting of tariffs.

“Wherever we make wine around the world, whether it’s in Australia, France or the US, we like to play a role in the industry that is more than just creating wines – in terms of being an active contributor,” King explained. “Clearly, at this point in time there is a desire within the Chinese government to build a domestic wine industry that rightly owns its place in the world. Penfolds wants to be part of that; not only on the production side in China, but also from a consumption perspective.”

As shared by Jackson, Penfolds is based on three pillars: portfolio, visibility and activation, and digital. Speaking about how its reputation for innovation is

exhibited in travel retail, he pointed out digital plays a key role in consumers’ desire to be part of the brand universe. The company has several digital initiatives on the go to drive engagement online and in-store – most notably, the Penfolds Digital Sommelier program. Launched 18 months ago, the program, which delivers an immersive user experience, helps travelers overcome one of the primary barriers of the wine industry: selection. It includes both limitededition and best-selling wines – plus, an educational component via a dedicated page. Users can check out a variety of insights including product information and tasting notes.

“Our 3D installation at Changi Airport also provides strong digital content for Penfolds. We’re working to become further integrated throughout the complete travel journey, which starts at home,” he said.

The Penfolds thematic “Venture Beyond” campaign also drives the growth of the brand globally via portfolio innovation and consumer experience. Supported by a personalized digital program and strong visual displays, the multi-sensory campaign boosts engagement and increases brand awareness. It is designed to integrate the company into the pre-trip and in-transit phases of the journey. “Venture Beyond”

has already highlighted space and underwater exploration, with the next theme to be announced.

When it comes to cultural-led partnerships and the blending of winemaking and luxury design, Penfolds has also teamed up with Human Made Creative Director Nigo on a second project, the Grange by NIGO collection. Described as a one-off series, this is the first-ever design takeover of Penfolds Grange. To also mark its 180th anniversary this year, Penfolds is releasing an expanded Champagne portfolio in collaboration with family-owned Champagne House Thiénot.

“Whenever we bring a brand to life, we provide consumers with an experience that is beyond just a product on the shelf. We think about how we can engage consumers in a different way, whether it’s digitally, or through packaging or activation,” said Jackson.

Returning to the lifting of tariffs on Australian wine in China, King explained, after the imposing of taxes in 2020, Penfolds made the decision to maintain a strong base in China and to continue to invest in the brand. Penfolds moved to a divisional model and now, with the country open for business, the brand is striving to fulfill global demand. This

means it has become more selective about product allocation.

“While it was more limited, we still offered a portfolio that enabled us to provide consumers with wines and experiences – and to keep the brand alive. It gave us the opportunity to think about our business in China long-term – and about what we wanted the brand to be. And now, we’re in a good position to rebuild our full portfolio. Having our full portfolio of wines available again [in China] is a big step forward.

“Our focus for the future is to continue building a portfolio from four different countries of origin. The opportunity to provide a consumer or wine collector with the experience of trying four different Penfolds wines from four different regions around the world is exciting. And we’re looking forward to bringing this experience into travel retail,” said King.

The two closed by discussing the impact of experience-driven retail in the channel and the fact that by creating experiences that drive emotional connection, Penfolds is able to further build demand. King added, “And, by investing in partnerships at the local level, we’re able to further build the availability of the brand. Finally, by leveraging what is now a broad portfolio, we can present the right wine for the right occasion.”

advertisement removed for legal reasons

As an Italian red aperitivo, Rirò offers consumers a slice of the Tuscan lifestyle and a new way of drinking wine

Based on industry experts and travel retail insights, Global Travel Retail Magazine reports on category trends, the return of rosé and the next generation of wine lovers by

LAURA SHIRK

“Elegant, fresh and intense,” Rosa dei Masi is described as Masi Agricola’s interpretation of the “Rosé Renaissance”

Driven by a focus on creating experiential retail environments that attract travelers seeking unique and premium items, Silvina Romani, Export Manager Global Travel Retail at VSPT Wine Group, notes that airports have transformed from transit hubs into shopping destinations. With an increasing appreciation for fine wines, travelers are willing to invest more on higher quality products and distinctive experiences. Also, given the airport setting and related circumstances, travelers are often in a mindset to indulge.

According to Romani, the Chilebased group offers a sensory wine experience, particularly via its travel retail exclusive 1865 Voyager Collection. The line consists of three wines: 20and 70-Year-Old Cabernet Sauvignons and a 40-Year-Old Red Blend. Romani explains the collection’s lifestyle is represented by discovery and a connection to exploration. “Our offerings cater to those seeking not only a wine, but an experience that aligns with their refined tastes and adventurous spirit,” she says.

Pier Giuseppe Torresani, Export & Travel Retail Sales Director at Masi

Agricola, says the unprecedented growth in demand for premium wines is partly because of the nature of the business. “While some consumers are looking for good price opportunities, others are seeking unique and exclusive products that are difficult to find in the domestic market,” he comments. “These are not necessarily different consumers; it can be the same person buying for different occasions.” Torresani adds, in this light it’s normal that there is increasing interest in premium wines, since they are linked to specific grapes, vineyards and producers and therefore scarce.

Speaking about Gen Z, Torresani says while wine has traditionally been consumed by a more mature population, he’s confident that “step by step” the next generation of consumers will enter the wine world. It is important for Masi Agricola to offer an assortment that covers the emerging needs of consumers of all ages, which is why the company has launched the organic wine range Fresco di Masi. Made up of one white and one red, the range is low in alcohol and a response to the growing demand for sustainable and light-bodied products among the younger consumer segment.

The Italian winemaker has also introduced Rosa dei Masi, which it describes as “elegant, fresh and intense” and its interpretation of the “Rosé Renaissance.” Torresani explains wine is about enjoying flavors and pairing with foods. “Each bottle represents a specific

culture, territory and people. Choosing a specific winery or wine is a way for a wine lover to express themselves and to share certain values with others. In that sense, wine has become a lifestyle choice,” he says.

Beyond the return of rosé in the category, the segment is seeing a shift from intense pink and fruity rosé wines to those that are “light salmon in color and more mineral on the palate.”

On the digital side, VSPT Wine Group leverages digital platforms and social media to create informative and interactive content. Romani notes that partnering with influencers allows the company to reach and resonate with a younger audience. Additionally, through sustainable initiatives like its International Wineries for Climate Action membership, VSPT Wine Group demonstrates its commitment to climate change and sustainable progress –shared values among Gen Z.

Chile-based VSPT Wine Group caters its offering to those seeking an experience that aligns with their refined tastes and adventurous spirit

To appeal to the next wave of consumers, Esteban Garcia, Duty Free & Travel Retail Manager at Italian Wine Brands explains the wine industry needs to adapt its strategies to align with the preferences and behaviors of the tech-savvy and socially conscious demographic. “We’re embracing such changes with our main brands including VOGA Italia, specifically it’s new offering Prosecco DOC Still,” remarks Vittoni. In addition to teaming up with social media personalities to increase awareness and engagement, Enoitalia relies on peer reviews and recommendations from trusted figures to influence purchasing decisions.

According to Vittoni, VOGA Italia Prosecco Still symbolizes modern Italian winemaking and provides a sensory experience that is both sophisticated and approachable. “With its stylish presentation, versatile appeal and commitment to quality and innovation, the wine attracts a new generation of wine lovers who appreciate the blend of tradition and contemporary flair,” she says.

Italian Wine Brands is also presenting a new way of drinking red wine with Rirò, the Italian red aperitivo. Crafted in Tuscany, Vittoni shares, the new generation of red wine respects tradition and captures the essence of a region deeply rooted in its heritage, while embracing innovation and change.

With an eye set firmly on innovation, sustainability and consumer-centricity, JT Group is reshaping tobacco and showcasing a profound pivot in industry priorities

by HIBAH NOOR

With increasingly stringent regulations and changing consumer trends, JT Group must be increasingly innovative and savvy to grow its business globally while adhering to both market demand

and applicable rules and regulations. Reduced Risk Products (RRPs) are proving an important focus that serves all these areas.

The company’s recent joint venture with Altria marks a significant step in the expansion of RRPs, particularly in the heated tobacco segment. This collaboration is set to bolster the company's strategic goals, enhancing its global presence and supporting sustainable growth for all stakeholders. In the context of the global market, this partnership provides JT Group with a competitive edge.

“The JT Group believes this newly formed partnership with Altria will support its strategic ambition to build a global presence in RRPs through a strong focus on HTS, driving sustainable growth for all stakeholders of the 4S model: our shareholders, consumers, employees and a broader society,” says Claudio Ferreira, General Manager, Global Travel Retail. The combined expertise of JT Group and Altria is expected to drive the growth of Ploom HTS in the US.

The introduction of Ploom Heated Tobacco Sticks (HTS) in major travel hubs will cater to the rising demand for next-generation products among international travelers. This aligns with JT Group's broader strategy to integrate

advanced product offerings in travel retail, ensuring that these offerings meet the diverse preferences of global consumers.

The collaboration leverages the scientific and regulatory strengths of both companies to navigate the stringent requirements of the US Food and Drug Administration (FDA). Together, JT Group and Altria are preparing to submit a Premarket Tobacco Product Application (PMTA) for the latest Ploom HTS products, targeting the first half of 2025 for submission. This joint effort is a testament to their joint commitment to innovation and regulatory compliance, aiming to set new standards in the tobacco industry.

No stranger to regulations, JT Group is in full support of regulations, a topic of great interest currently. “Proper and balanced regulation is very critical in international travel retail markets,” says Ferreira. “Some of the key regulatory challenges include the implementation of domestic regulations in the travel retail environment and the reduction of inbound duty free allowances. The company continues to advocate a balanced approach to regulation that incorporates input from all the parties involved in the travel retail ecosystem.”

JT Group is implementing new sustainability initiatives to address the increasing consumer demand for environmentally responsible products in the travel retail channel and in the retail world at large. “Our sustainability strategy is guided by our purpose and specifically defines how we actively strive for a better future focusing on our products, and wider society, including people and planet,” states Ferreira.

And, according to Ferreira, creating a better future begins with creating that better future for their consumers. “We focus our investment and innovation efforts on lowering the health risks associated with smoking by providing our consumers with a great choice of alternative products that are marketed responsibly. At the same time, we are improving circularity through new designs and materials, reducing waste, and supporting consumers in making more environmentally sustainable choices,” he says, adding that JT Group has committed to be Carbon Neutral for its own operations by 2030 and Net-Zero across its entire value chain by 2050.

With the rising trend of healthconscious consumers, JT Group is addressing the demand for reduced-risk and non-tobacco products by introducing innovative offerings. Ploom X, the company’s latest addition in the HTS segment, represents most its exciting and ambitious launch to date.

“As our consumers are looking for alternatives to combustible tobacco and are willing to try different reduced-risk products, the company is focusing its resources on the HTS segment, as the largest, fastest-growing, and hence most promising segment, to compete more successfully in this rapidly moving category,” explains Ferreira.

In travel retail, Ploom X is now available in Japan, Switzerland, Italy and Greece, with plans for further geographic expansion in the coming 12 months in a move aimed to cater to the growing demographic of healthconscious consumers seeking reducedrisk alternatives.

As JT Group continues to expand its presence in emerging markets, the

company is focusing on a couple of its most popular offerings, which combined serve to positively impact overall growth, especially in Asia Pacific.

“Growth opportunities will increasingly come from the Asia Pacific region, where travel retail continues to grow due to the rise of Indian travelers and the recovery of Chinese travelers,” says Khim Lim Chua, Regional Director Asia Travel Retail. “We have a very strong portfolio of leading brands in Asia Pacific, centered around Mevius, the leading tobacco brand in Japan. Our consumer-centric offerings include the launch of innovations such as Mevius Option Fizzy Dew, a new capsule proposition that was very well-received by our consumers in Asia.”

To enhance consumer engagement and experience in the heated tobacco category, JT Group has expanded and rolled out new activations in Japan travel retail, including a Ploom pop-up store in Narita International Airport and a Ploom lounge in Kansai International Airport. “The Ploom lounge offers a unique shopping experience for consumers to browse the range of Ploom products, view product demonstrations, and participate in tasting sessions,” Chua says. “Ploom X is growing fast in Japan travel retail, mirroring the excellent performance obtained so far in the Japanese domestic market.”

With the increasing consumer demand for unique and premium experiences in the travel retail market, JT Group is continuously introducing innovations in its product line to cater to the changing preferences of consumers in the duty free market, with Ploom X as a prime example, according to Ferreira. He says, “It combines authentic taste, refined HeatFlow technology and personalized style, all of which come together to deliver the ultimate heated tobacco pleasure.”

As Oettinger Davidoff AG leverages its expertise to push the boundaries of cigar innovation, the company's dedication to sustainability and consumer-centric strategies ensures its continued leadership in the luxury cigar market

by WENDY MORLEY

Oettinger Davidoff AG has a substantial presence in travel retail, which is a key area of its overall business strategy. Leveraging its extensive experience in the channel, Oettinger Davidoff continuously strives to innovate within the cigar category, particularly in terms of product presentation and customer engagement.

According to Jean-Christophe Hollay, Head — Partner Markets & Duty Free EMEA / Americas, the company’s merchandising model helps the company achieve superior sales in a luxury market. “Luxury poses unique

challenges to deliver the best possible shopper experience. Oettinger Davidoff has created a unique, fact-based merchandising model designed to achieve ease of navigation, enhancing shopper propensity to purchase.” This model includes innovations like the Zino Fresh Packs and Half Corona Pre-Cut in the Zino Nicaragua line, which Hollay says have been well-received by consumers and shoppers.

The successful launch of pre-cut cigars in the Zino Nicaragua line has paved the way for further innovations catering to modern, on-the-go lifestyles. “Zino Cigars continues to innovate with

products, providing flexibility for cigarillo fans and aficionados alike,” Hollay says. The upcoming launch of the Zino Nicaragua Short Puritos in 2024 exemplifies this trend, offering the perfect cigar for those with limited time.

Travel retail is an increasingly important channel for Oettinger Davidoff, with significant potential for expansion, and neither the importance of this channel for the company nor the insight it gleans on the channel’s behalf begin and end at its own doors. “We endeavor to share insights and ideas, encouraging industry stakeholders to embrace a new category vision,” says Hollay.

By optimizing opportunities in travel retail, Davidoff aims to implement solutions that release tremendous new category value. This approach, coupled with the company’s category management strategy, is enabling meaningful activities to meet the famously growing global demand for cigars, with luxury cigars sitting atop that growth.

When tailoring strategies to strengthen its presence in specific regions like the Middle East and the Americas, Oettinger Davidoff leverages extensive consumer research and a globally focused

consumer profiling strategy. “We are able to prioritize respective product attributes by region or market,” Hollay notes, adding: “We also endeavour to fully understand every step in the process to deliver both a purchase and a consumption occasion, adapted to local environment.” This approach ensures that every step in delivering both purchase and consumption experiences is enhances both relevance and customer satisfaction.

Corporate responsibility is another key focus for Davidoff. “Within our ESG Roadmap, we are tackling different initiatives that cover all these areas,” Hollay explains. Recent examples include the installation of a drip water system in the company’s Dominican Republic facilities, reducing water consumption by 82 percent, and the opening of a Learning Center, offering free extracurricular English courses for employees’ children. These initiatives highlight Davidoff’s commitment to environmental responsibility and social impact.

Looking to the future, Davidoff plans to continue its tradition of innovation and excitement within the cigar category. “Davidoff's brand history is rich in

exceptional cigar innovations and iconic achievements. Oettinger Davidoff AG will continue to innovate and excite the category. Davidoff will conclude its successful ‘Cigar History Re-Rolled’ series with a grande finale that will also go down in the history of the brand: The Grand Cru Diademas Finas Limited Edition Collection,” Hollay reveals. While he affirms that other launches are planned for 2024, for now details remain under wraps. This promises a steady stream of exciting developments for cigar enthusiasts.

Oettinger Davidoff is not just a leader in the cigar industry but a pioneer in innovating product presentation, customer engagement and sustainability. By leveraging extensive research, embracing unique regional characteristics and continuously introducing new products, Davidoff ensures its position at the forefront of the luxury cigar market. As Hollay succinctly puts it, “We are focused on offering appropriate solutions to shoppers, understanding their needs and concerns, and continually enhancing the shopping experience.”

British American Tobacco (BAT) is lighting up the tobacco category in travel retail with reduced-risk products, cutting-edge technology and a commitment to sustainability

by HIBAH NOOR

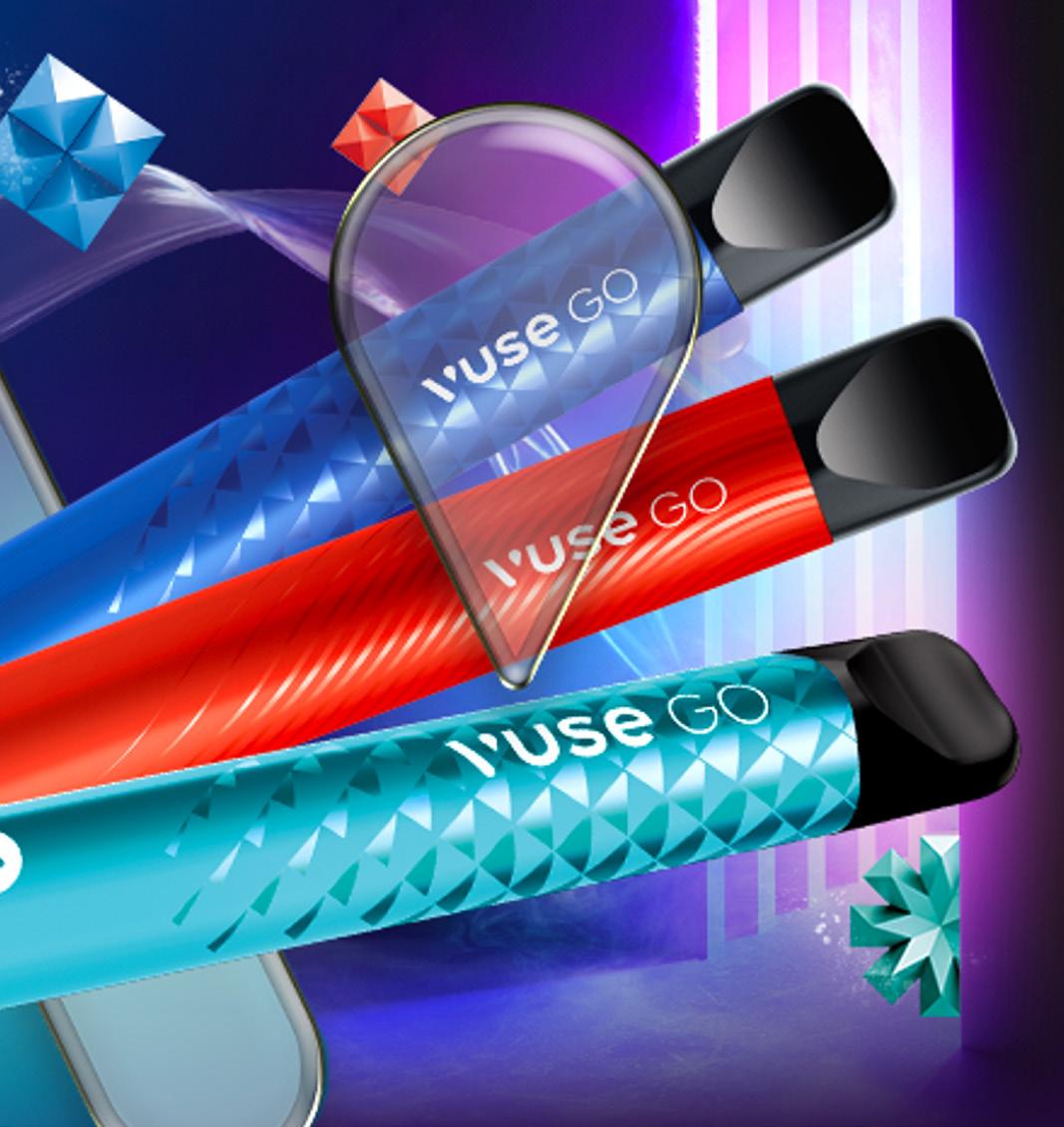

British American Tobacco's (BAT) progress in the first half of 2024 is marked by the rollout of innovative offerings like the Vuse Go 2.0, a single-use vapor product with enhanced taste, design and a removable battery. “We have made significant progress towards our ambition of creating A Better Tomorrow™ by building a smokeless world with our reduced-risk* products in the first half of the year,” says Andy Hrstic, BAT General Manager China and Global Travel Retail.

The glo™ brand, BAT’s flagship heated product, has also seen advancements with the introduction of glo hyper Pro and improved consumables.

Hrstic emphasizes BAT’s commitment to providing adult smokers with a wide range of satisfying alternatives: “At BAT, we are committed to building A Better Tomorrow by offering a greater choice of high-quality, enjoyable, and less-risky* products for adult smokers to switch to,” he says.

Catering to diverse preferences

BAT recognizes the diverse needs of today’s consumers and offers a variety of alternatives, each with a unique experience. The company places great importance on consumer education, ensuring that customers can make well-informed decisions when choosing their preferred products. Hrstic emphasizes the crucial

role of brand ambassadors in this process: “We ensure that our on-site brand ambassadors at the travel retail outlets educate our consumers about our products in thorough manners, so that each consumer can make an informed decision to switch to a product that best caters to their preferences,” he says. Strategic partnerships are another way BAT enhances the consumer experience and optimizes brand essence.

The VELO x McLaren Formula 1 Team Pop-Up Activation at Hamad Interna-

tional Airport in Doha exemplifies this approach, offering a unique on-the-go experience for consumers while introducing a limited-edition product for the Qatar Grand Prix last year. “In order to optimize the unique brand essence, we often invest in partnerships to enhance our consumer experience,” Hrstic says.

Sustainability is a core focus for BAT, with the company taking pride in its achievements. As of 2023, 94% of packaging for new category products is reusable, recyclable or compostable. Hrstic highlights the eco-friendly features of glo and VELO: “The packaging of our glo device comes without a power adapter. The device can be recharged with a USB-C port to reduce electronic waste. VELO modern oral nicotine pouches now come in recyclable cans,” he says. BAT also focuses on responsible disposal and recyclability of its products.

The Vuse Go 2.0, a single-use vapor product with enhanced taste, design, and a removable battery, exemplifies BAT's progress in offering innovative reduced-risk alternatives

“We continue to focus on the disposal and recyclability of Vuse products through innovative design and life-cycle schemes, including the introduction of ‘Drop the Pod’ and device takeback schemes for used vape products to reduce waste sent to landfill,” Hrstic explains.