advertisement removed for legal reasons

advertisement removed for legal reasons

A WORLD OF OIL-INFUSED BEAUTY

A WORLD OF OIL-INFUSED BEAUTY

If there is a theme to virtually every conversation in travel retail this year it’s about how good business is. Even Asian companies — which still have a way to go to hit 2019 numbers, given the closures and lockdowns that extended into this year — are seeing skyrocketing sales, with a very attractive 2024 on the horizon.

The traveling shopper is back. But brands and retailers alike are seeing that the 2023 travel retail shopper is not the same as the 2019 shopper. Today’s consumer is younger, more environmentally conscious, more fashion-oriented and, after a few years of living the majority of life online, more expecting of a strong digital environment. Travel retail consumers are savvier and more discerning than ever, and both retailers and brands need a comprehensive omnichannel approach to capture them.

In the Middle East, ARI’s Rob Marriott says, “[The region] moves at a tremendous pace, and we need to move with it, in order to accommodate the constantly changing passenger profile.” ARI does this through a constantly evolving digital approach and a new brand identity that’s all about joy.

For Jordanian Duty Free, investing in digital means not only enables the retailer to reach customers beyond physical store locations, but also create a seamless omni-channel shopping journey. Iraq Duty Free is focusing its efforts on upgrades and expansion, expecting that this will double company revenue. As Skytrax once again announced Hamad International as the “World’s Best Airport Shopping,” we would expect much of Qatar Duty Free, and indeed it’s challenging to keep up with all the new openings and unique offerings by the retailer.

With China’s border open, DFA’s Macau store gets busier by the day, with Hong Kong, Taiwan and Japan picking up as source markets. Heinemann’s US subsidiary is truly coming into its own, with the cruise channel becoming increasingly important for the retailer.

Meanwhile, Lotte is wooing Gen Z with a plethora of approaches that go far beyond a digital offer. The Korea-based retailer uses star power to drive the younger generation — who purchase 70% of the world’s luxury items — to visit the store, with top K-pop concerts, as one example. The retailer launched two new apps this year, and also publishes its own digital magazine.

As our industry has been chomping at the bit for China’s international travelers to return, India quietly took over as having the highest population in the world, one with increasing capability of spending, and one that’s currently building the biggest airport in Asia; it will also be the region’s newest hub.

Brands and distributors such as Essence are bringing new items into its expanded travel retail territory again, focused on items that appeal to the youngest adult generation and the one that will be in the driver’s seat for some time.

With all the activity and positive news from these and other companies in travel this year’s TFWA World Exhibition in Cannes promises to be one of the most successful and spectacular ever. We at Global Travel Retail Magazine look forward to seeing you there.

Kindest regards,

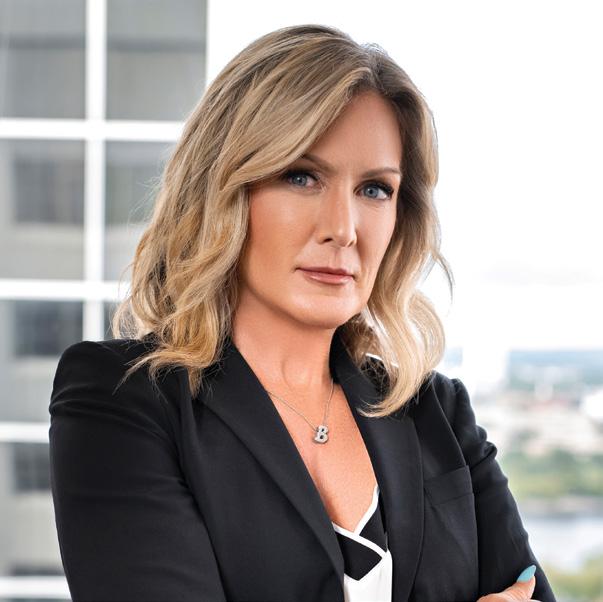

HIBAH NOOR Editor-in-Chief

Global Travel Retail Magazine (ISSN 0962-0699) is published seven times a year by Paramount Publishing Company Inc. The views expressed in this magazine do not necessarily reflect the views and opinions of the publisher or the editor. October 2023, Vol 35. No. 6. Printed in Canada. All rights reserved. Nothing may be reprinted in whole or in part without written permission from the publisher. Paramount Publishing Company Inc.

GLOBAL TRAVEL RETAIL MAGAZINE Tel: 1 905 821 3344 www.gtrmag.com

PUBLISHER Aijaz Khan aijaz@globalmarketingcom.ca

EDITORIAL DEPARTMENT EDITOR-IN-CHIEF Hibah Noor hibah@gtrmag.com

DEPUTY EDITOR Laura Shirk laura@gtrmag.com

SENIOR WRITER Alison Farrington alison@gtrmag.com

SENIOR EDITOR Wendy Morley wendy@gtrmag.com

SENIOR EDITOR Mary Jane Pittilla maryjanepittilla@hotmail.com

ART DIRECTOR Jessica Hearn jessica@globalmarketingcom.ca

CIRCULATION & SUBSCRIPTION MANAGER accounts@globalmarketingcom.ca

Since its inception in 1983, Dubai Duty Free has become one of the world’s top travel retailers; Executive Vice Chairman & CEO Colm McLoughlin tells Global Travel Retail Magazine how the company is celebrating its 40th anniversary

Dufry’s “Destination 2027” strategy and combined business with Autogrill demonstrates a new era of retail and F&B convenience; plus, the team on consumer monitoring and optimizing retail space

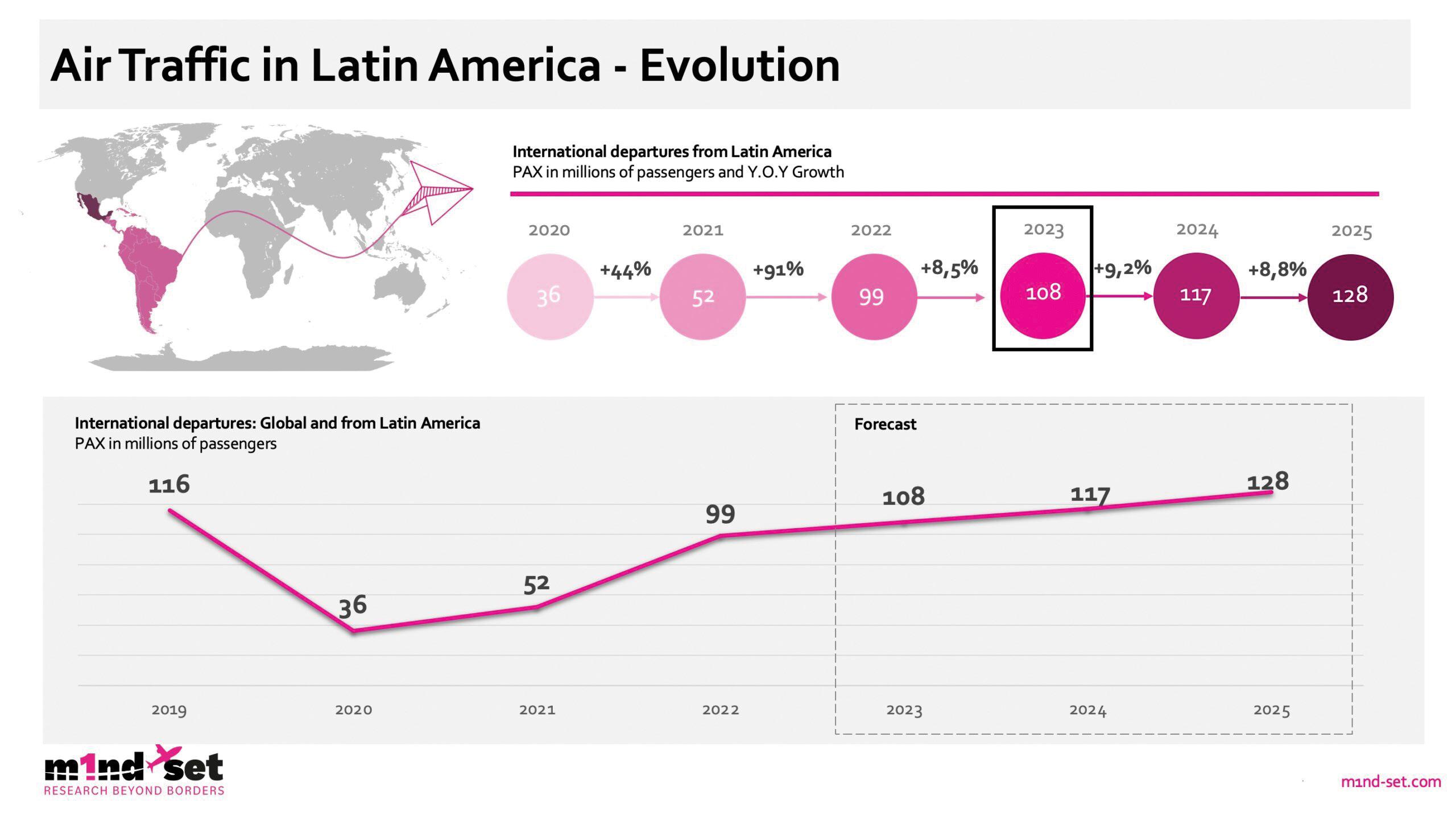

Drawing on research from ForwardKeys, ASUTIL, m1nd-set and other sources, Global Travel Retail Magazine reports on the state of international travel and the duty free channel in Latin America

With the rise in conversational AI, Global Travel Retail Magazine provides industry tech updates and a detailed look at the e-commerce relationship and the future of personalization

Together with Hamad International Airport, Qatar Duty Free has seen success since opening in 2014; Senior Vice President Thabet Musleh ensures this is the case by staying ahead of current trends and offering unique experiences

By understanding its strengths and forging strategic partnerships, The Shilla Duty Free is working to reach – and surpass – its sales and expansion plans

Since opening a location in Macau, Duty Free Americas’ CEO Jerome Falic has figured out the formula for success and is ready to branch out in an unexpected direction

The cruise channel has become increasingly important to Gebr. Heinemann’s business; the company’s Cruise Business Managing Director Kerstin Schepers discusses Royal Caribbean awarding Heinemann the retailer partnership for the biggest cruise vessel in the world

38 Blazing trails

From creating new business models and F&B concepts to achieving its ambitious CSR goals, Lagardère Travel Retail is focused on identifying local brands and delivering a sense of place

44 Bringing joy

ARI Middle East’s CEO Rob Marriot talks to Global Travel Retail Magazine about the company’s bespoke approach to a dynamic region and its new brand campaign “Joy On Your Way”

50 Second act

Upgrading its departure and arrivals stores in Babylon TB at Baghdad Airport and expecting a two-fold increase in sales, Iraq Duty Free switches gears to create a more diverse selection

52 Inspired expansion

Jordanian Duty Free Shops has secured a new 10-year agreement that underscores its strategic importance within Jordan’s travel retail landscape and allows it to further invest in both digital and brick-andmortar channels

58 Winning over Gen Z

Always innovative, Lotte Duty Free has taken omnichannel to a whole new level in its multi-tentacled digital and IRL approach to attracting and inspiring loyalty from a whole new generation

64 Reaching the summit

With the world’s largest population, an exploding middle class and travel expected to increase in the hundreds of millions of PAX in coming years, India is ripe with opportunity

68 Strength in numbers

Since the beginning of his first term as MEADFA President, Sherif Toulan has prioritized increasing the association’s effectiveness through relationship building

70 Ready for change

As the industry gears up for this year’s TFWA World Exhibition & Conference, which has been billed as “back to normal,” Global Travel Retail Magazine catches up with TFWA President Erik Juul-Mortensen on the latest changes at the association

74 The road ahead

Following the reopening of the border, FDFA continues to present a united front working toward the future; the association will hold its first convention in four years at the end of November in Toronto, Canada

82 Travel, tourism and multi-destination trips

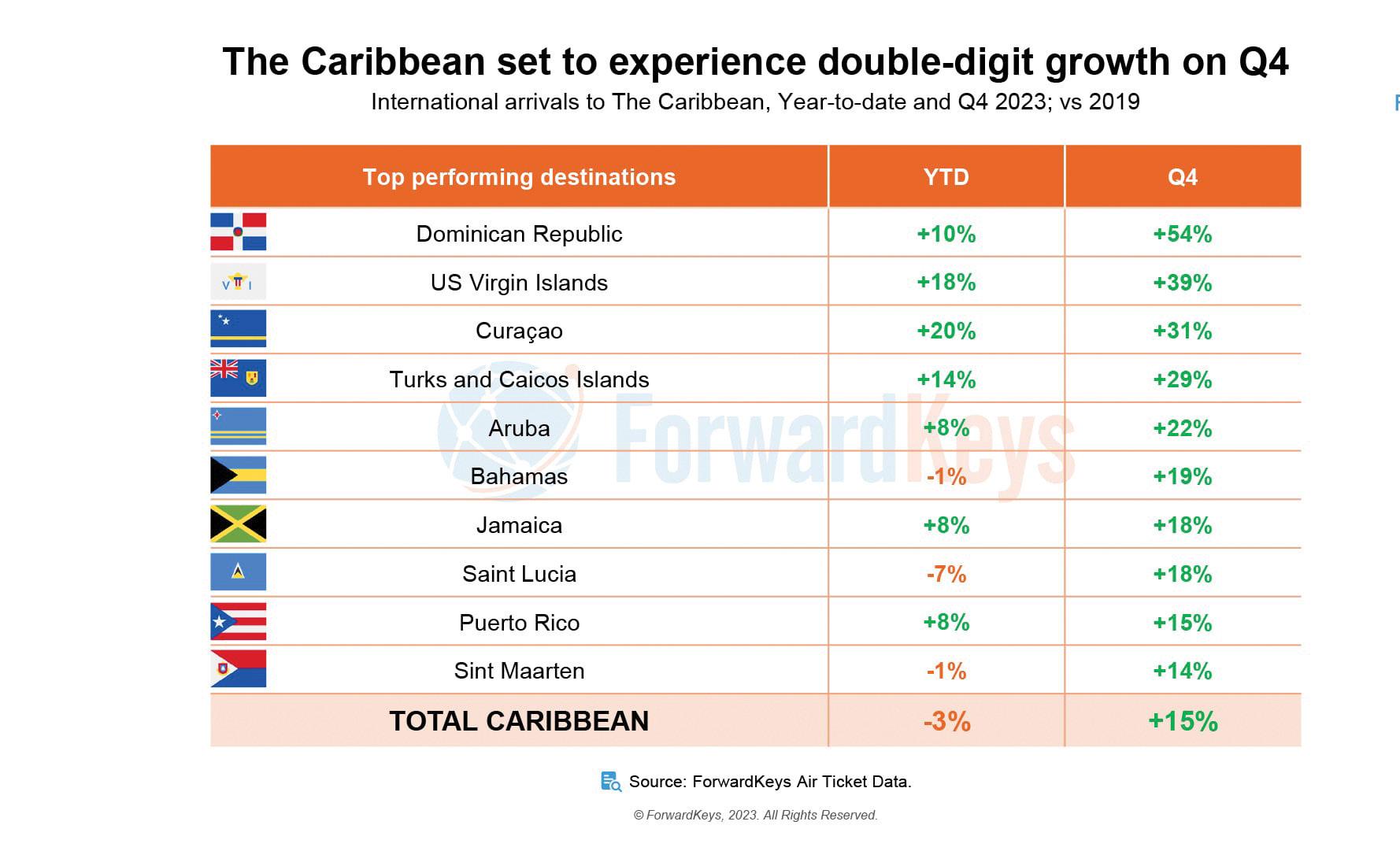

Covering air connectivity, current trends and a recent appointment, Global Travel Retail Magazine hears from ForwardKeys and the Caribbean Tourism Organization for an update on the region; plus, a case study of the Dominican Republic

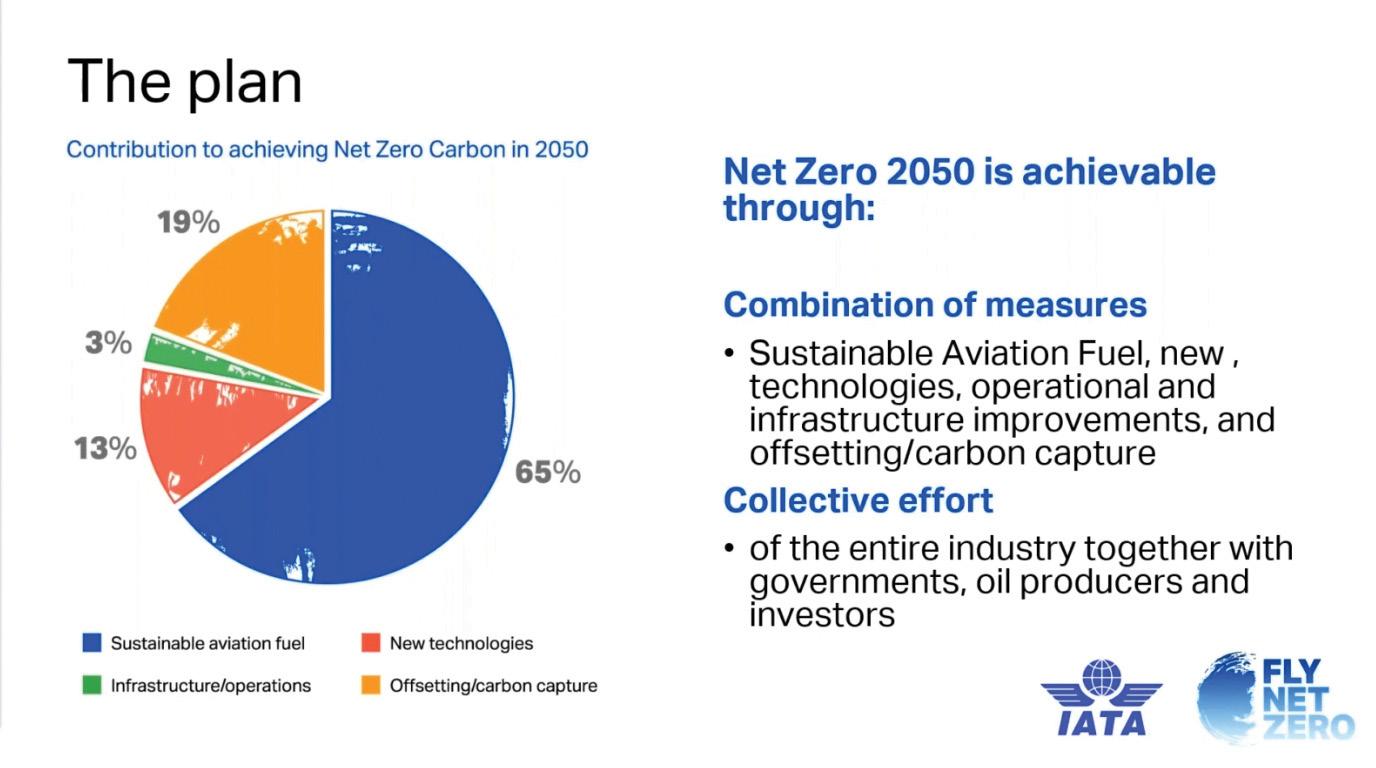

86 Net zero action plan

With input from IATA and research by Bain & Company, Global Travel Retail Magazine looks at what it will take to turn “Net Zero by 2025” into a reality and the possibility of falling short

90 Fully charged and ready to go

Global Travel Retail Director Gary Leong speaks with Global Travel Retail Magazine about FOREO entering the skincare category, its new Supercharged range and the integration of health and beauty in the digital age

92 Gaining momentum

Following its debut at TFWA Singapore in May, Essence Corp is prioritizing ways of working in Asia; and as Bath & Body Works’ travel retail distributor, it is also supporting the brand’s rapid growth and new point of sale formats

94 Upping the ante

Major beauty groups are investing in premium skincare lines –especially in Asia – as consumers search for more personalized product recommendations

97 Aggressive expansion

Blue Chip Group continues to broaden its offering and territory, with expansion into new regions a priority at TFWA Cannes; Japanese beauty brand HACCI is now available on Starboard Cruises’ Blue Dream Star

DURABLE WEIGHTLESS LIPCOLOR HYPER MATTE PIGM ENTS. UP TO 12H WEAR* REFILLABLE

explore all the shades of you

98 A vision of beauty

With back-to-back launches coming up in 2024, Moroccanoil brings attention to its diverse portfolio and strength as a lifestyle beauty brand

100 Ajmal’s return to form

For Dubai-based Abdulla Ajmal, CEO at Ajmal Perfumes, post-pandemic recovery is leading to global growth for the prestige fragrance house

102 Eastern ascendancy

With growth outpacing category averages in all regions, L’Oréal Managing Director Travel Retail Asia Pacific Tao Zhang is taking steps to ensure its eminence continues to grow at a dominating clip in Asia Pacific

104 Sweet smell of success

With company sales that almost doubled from 2020 to 2022, Inter Parfums Inc.’s strong portfolio and keen marketing strategies have placed the fragrance distributor on an upward trajectory; the company accumulated over $US1 billion in net sales last year

106 A blockbuster year

According to Tairo Co-Founder Robert Bassan, a pair of brand launches earlier this year solidify its position as a critical player in the thriving Caribbean and Mexico markets; the company is ready for a stellar 2024

108 Shining bright

Retailers and jewelry brands are investing in travel-specific research and development, concepts and floor space, adding fresh energy to the global travel retail marketplace

112 Tailor-made

As Founder & CEO of the luxury designer brand, Robert Tateossian’s name will forever be associated with jewelry that is unique, luxurious and perfectly suited for the travel retail channel; Tateossian is present in over 70 markets around the world

114 Category News

Q&A

116 New appointment, strong outlook

In this Q&A, new Duty Free Dynamics Martin Mairal discusses the importance of brand adaptability in the channel and how the travel retail distributor adds value to its portfolio

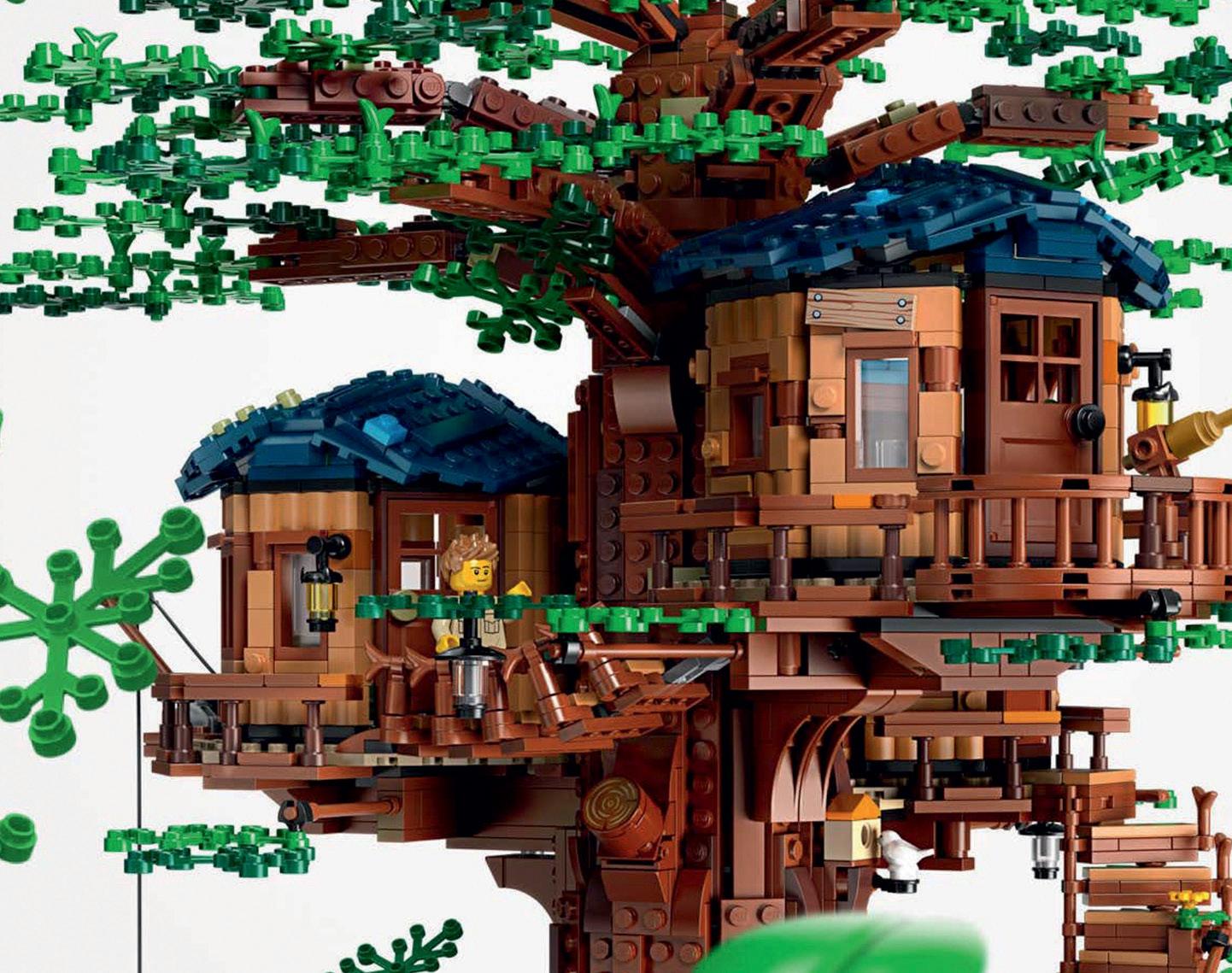

118 Passion point portfolio

With nine more airport openings scheduled this year, LEGO Travel Retail discusses sustainable growth and multi-generational appeal

120 Snacking done right

Known for its premium snacks, German confectionery brand Seeberger relies on snackification and its signature packaging to appeal to healthconscious consumers

122 Category News

SPIRITS & TOBACCO

126 New take on tradition

Taking a close look at the rise of new world whisky, Global Travel Retail Magazine tells the story behind a series of tastemakers in the growing segment and offers a glimpse at true innovation

128 Riding the wave

Servicing the cruise sector and exploring emerging categories in duty free, MONARQ continues to strengthen its brand portfolio and respond to key trends in the channel

130 Breaking barriers

Raffaele Berardi, Founder & CEO, Fraternity Spirits, showcases the company’s innovative new product that allows for the aging of a spirit without the time commitment

132 The heart of premiumization

Diageo Travel Retail on its “better, not more” approach to localized digital marketing and Heathrow Airport takeover

144 Independent but globally competitive

KT International COO Stuart Buchanan discusses the company’s expanded availability in major TR retailers and how its model of dealing directly with customers helps KTI deliver what consumers are looking for in travel retail

134 Drum roll for rum

After years spent trying to establish rum as a liquid with complex flavor, the category is ready for its moment in the channel; Global Travel Retail Magazine hears from multiple brand owners to learn more about the category’s momentum

138 Premium growth

Featuring input from Penfolds, Accolade Wines, González Byass and Bottega, this special report covers the deserved attention of wine in travel retail and trends such as premiumization, gifting and consumer interest

146 Category News

134

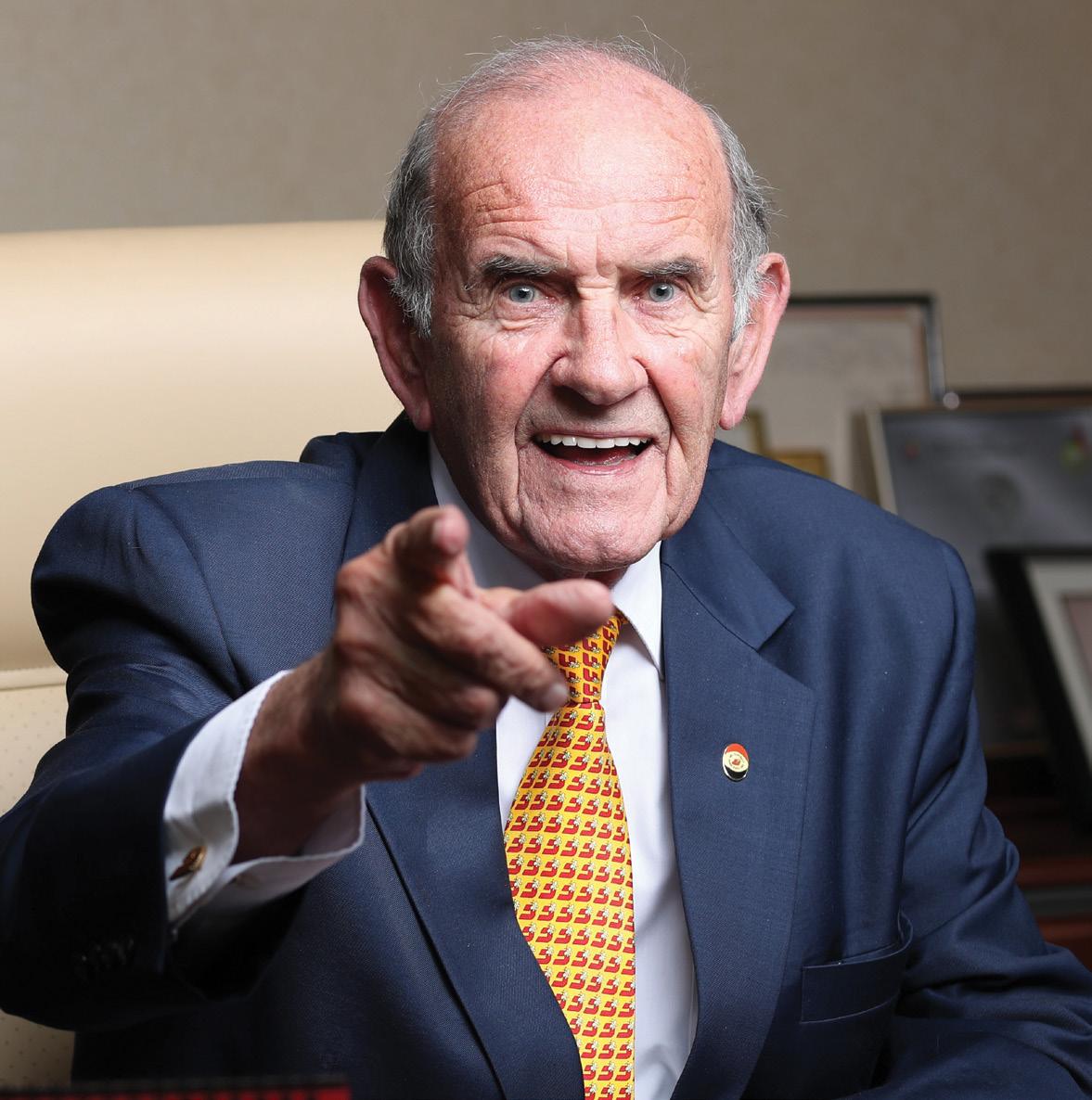

Since its inception in 1983, Dubai Duty Free established itself as one of the world’s most important travel retailers. Executive Vice Chairman and CEO Colm McLoughlin tells Global Travel Retail Magazine how the company is celebrating its milestone 40th anniversary

by HIBAH NOOR

by HIBAH NOOR

Dubai Duty Free will be celebrating its 40th anniversary this year, and with each passing year the retailer continues to grow. During the first seven months of 2023 compared to the same time period in 2022, Dubai Duty Free saw a 34% increase in sales, reaching US$1.23 billion.

As of writing, that figure had climbed to US$1.33 billion, which is 32.59% higher than the same period last year and 7.63% higher than pre-pandemic in 2019. Executive Vice Chairman and CEO Colm McLoughlin states that he is positive the retailer will meet its target of AED7.5 billion — over US$2 billion — by the end of the year.

The top five categories at Dubai Duty Free tend to be dissimilar to those in most travel retailers, especially with the inclusion

of gold, which is a big seller for the retailer. McLoughlin says the top five categories so far in 2023 are perfumes, liquor, gold, cigarettes & tobacco, and electronics. In numbers, perfumes sales reached US$219 million, representing a 26% increase. Sales of liquor were up by 20% at US$189 million, while gold sales increased by 30% over the same period last year, with sales amounting to US$129 million. Cigarettes & tobacco increased by 35% with sales totalling US$125 million, while electronics came in fifth place with sales of US$106 million, representing a 39% increase.

The Dubai Duty Free Millennium Millionaire draw, which began in 1999, continues to grow in popularity, as does the Finest Surprise promotion. “More and more participants are purchasing tickets both in store and online,” says McLoughlin. “One factor in its steady growth can be attributed to the trust and confidence of our customers in the promotions. This behavior reflects the significant progress in ticket sales, with an increase of 12% compared to the 2022 sales figure.”

Another reason for the continued growth of these contests is Dubai Duty Free’s use of digital marketing

tools, email campaigns in particular, says McLoughlin. “As one of the most strategic digital tools, Dubai Duty Free uses email communications with over 377,000 records in its database. The email campaigns greatly help to increase online sales, which represent 64% of overall Millennium Millionaire and Finest Surprise ticket sales. The average daily online sale is US$82,000.”

According to McLoughlin, email marketing boosts sales by 200% to 300%. “As an example, the email to promote Millennium Millionaire Series 426 in June this year drove over US$300,000 in sales in less than a day, which is triple compared to average daily sales on regular days,” he says.

In December of this year, Dubai Duty Free will celebrate 40 years in business, and it is not marking the landmark anniversary quietly. McLoughlin says, “Plans are in place to make our 40th anniversary a memorable occasion.”

The celebrations will feature a series of promotional activities involving customers, suppliers, and staff, as Dubai Duty Free’s way of saying “Thank you for helping us reach this milestone year.”

On the day, a wide range of merchandise will be offered at a 25% discount; this promotion will continue for three days, from midnight on December 17 until midnight on December 20. McLoughlin states this is an annual celebratory event for passengers traveling through Dubai International and Al Maktoum International.

With the exception of gold, electronics and select fashion brands, this three-day 25% discount applies to all major categories, including the Dubai Duty Free Millennium Millionaire and Finest Surprise tickets. Shoppers do not have to visit the airport

to receive this discount, as it also applies to online shopping — using Dubai Duty Free's Click & Collect service and Dubai Duty Free's Home Delivery service — available to UAE residents.

Dubai Duty Free will run a special “Shop & Win” promotion, where customers who spend a minimum amount will have the opportunity to win gold with a 40th anniversary mark. “There will be 40 winners per week over four weeks,” says McLoughlin.

“We have worked closely with our suppliers to create a range of products and promotions that would link their brand exclusively with this milestone event,” he continues. “Currently we have over 25 products lined up from major categories such as liquor, perfumes and cosmetics, cigarettes and tobacco, gold, confectionery, and delicatessen.”

A special range of merchandise and corporate gifts will also mark the anniversary, and the Finest Surprise luxury car promotion will feature a special Bentley.

Leading up to the anniversary day, which is December 20, the company will offer a whirlwind of activities to whip up excitement. These include fun activations on social media, with CGI video content as one example. Dubai Duty Free will invite print and online coverage in various trade publications and key UAE media, and it will hold a black-tie gala.

The company commissioned a high-profile celebratory publication from The Moodie Davitt Report, with distribution to multiple audiences in print and online. This publication will showcase highlights of the Dubai Duty Free story so far and look ahead at what’s to come.

“We have also negotiated a series of anniversary day supplements with different trade publications and key UAE media

to coincide with the anniversary date. This includes a series of full-page and double-page ads booked in the leading trade press to appear in the Cannes issue,” says McLoughlin.

An Irish radio station, Clare FM, will create a podcast documentary capturing Dubai Duty Free’s history and four decades of retailing success, with the support of the retailer.

“On the anniversary day itself, December 20, Dubai Duty Free will ensure a party-like atmosphere throughout the retail operation, including a celebratory cake cutting, a Millennium Millionaire and Finest Surprise draw, and a staff surprise draw,” says McLoughlin.

Finally, as the anniversary draws to a close, Dubai Duty Free will host a “glittering” gala as a “thank-you” to those who have contributed to the company’s success. McLoughlin says: “It will be an evening of celebration with entertainment and fine dining that is sure to take you down memory lane.”

The term “industry veteran” doesn’t begin to cover Colm McLoughlin’s stellar career. With 54 years in duty free under his belt, he has been with Dubai Duty Free since its inception. “Forty years ago, in 1983, I never visualized for one second that I would be here 40 years later, and I feel very privileged to be so,” he says. “Although I never expected my tenure to be so long, I’ve been thrilled by the success. I feel very fortunate that I was given unbelievable trust to head up this organization and carry it through. And now, coming up to the 40th anniversary, I reflect very positively and honestly. I don’t regret one minute of my time here.”

McLoughlin does not want anyone to get the impression that he created this retail giant alone, however. “The growth and development of Dubai Duty Free are due to several factors, not least of which is the tremendous support I have receive from H.H. Sheikh Ahmed bin Saeed Al Maktoum, who is a superstar,” he says. “Also, I praise all our 5,200 staff, who were the best in the

industry, and lastly, I thank my wife Breeda and my family for their support down the years.”

He also attributes his success to his business values, represented by an adage learned from his father: “‘Keep your feet on the ground, act normal, treat people well, and you’ll be rewarded tenfold.’ And I think that is true. The right attitude will always carry you far in business,” he says.

After 54 years, has McLoughlin had enough? “As I usually tell people, I haven’t finished the job yet,” he says. “At 80 I still enjoy going to work and get huge satisfaction out of it. I have enjoyed very much what I have been doing, and I am enjoying very much the fact that Dubai Duty Free continues to grow. There are no strict rules about retiring. I talk to myself about it every year, and then I let it pass for another year.”

After 40 years of continuously growing success, McLoughlin says of the coming era: “I think the future is going to be terrific. Dubai Duty Free is a brand that continues to excel and grow, one of the most trusted and recognized in the UAE. Even after 40 years, we are constantly looking at our retail offer at Dubai International and Al Maktoum International airports, enhancing it, and pursuing innovation and sustainability. We always seek a more forward way of thinking and seek to improve our service to our customers.”

As the population of Dubai is forecast to reach five million, McLoughlin says his forecast for Dubai Duty Free 10 years from now would be annual sales of about US$3 billion with 7,000 to 8,000 staff members, and possibly another hotel. “We already own one hotel, and we already own a tennis stadium. We are currently looking at probably enlarging that and upgrading our tennis tournament. Within our tennis stadium, we have several restaurants, including The Irish Village. We have two outlets now in Dubai, we might have more!”

Together with Hamad International Airport, Qatar Duty Free has been a huge success story since opening in 2014. Senior Vice President Thabet Musleh ensures this is the case by staying ahead of trends and continuously offering unique experiences

by HIBAH NOOR

by HIBAH NOOR

Opened

2014, Qatar’s Hamad International Airport has soared in importance since its inception. The airport served 20.78 million PAX in the first half of 2023, which is on track to being the airport’s busiest year yet. Also in 2023, at the Skytrax World Airport Awards, Hamad International won the titles of “Best Airport in the Middle East” for the ninth time in a row, and, as a testament to Qatar Duty Free (QDF), “World’s Best Airport Shopping.”

For QDF Senior Vice President Thabet Musleh, this is only the beginning. “Our sole objective is to remain the best airport in the world and therefore offer unique experiences to our passengers,” he says.

Indeed, the operator has constant and consistent news about new openings and events — and often these are unique concepts unavailable elsewhere, such as the recently opened Louis Vuitton loungerestaurant concept.

“The Louis Vuitton Lounge is a tremendous success in a sense that it demonstrates how far QDF can raise the bar in offering exceptional experiences while partnering with extremely exigent and rigorous brands,” says Musleh. “All parties signed off on this project with the understanding that we are all committed to a long-term partnership. The feedback from our guests is the testimonial of this incredible success.”

Since that opening, QDF has had many more. For example, later this year

the operator has scheduled to open the world’s first Dior spa in an airport with the only Dior barbershop anywhere in the world — and only the fourth or fifth Dior spa in existence. QDF also recently opened a Dolce and Gabbana shop, and at writing a new CAPI store was soon to open. Musleh says two more major openings/events will be coming up before the end of the year — as yet unannounced — which will “elevate the passenger experience to new heights.”

“Being the best in the world does not happen when standing still,” he proclaims.

“We constantly bring new concepts on board, invite international and local brands to partner with us and feed from passenger trends and expectations to constantly innovate.”

Musleh says an important aspect of staying ahead is by continuously looking at trends, looking at what’s happening and delivering for QDF customers all the time. “We see that our customers are becoming more and more demanding of us, making sure they get these exclusives, and that is what we continue to work on,” he says, adding that it’s a testament to the great work the team at QDF does, that the brands trust the operator to be their launchpad any new trends that they have coming in travel retail. “But I think it’s also what we do as a company,” he says. “We’re continuing to monitor trends — what’s happening not just in travel retail but also downtown. That’s what we do.”

Next year will be an even bigger year for QDF, according to Musleh, who says we will see “loads of new openings” in 2024. As we were going to press, QDF was in the process of launching the deployment of Q2 2024 developments.

“That’s what QDF is about,” stated

Musleh on these openings earlier this year. “It’s about evolving the customer experience; it’s about looking at what customers want and delivering for them. It’s not about standing still. It’s about looking at our space, looking at our brands. It’s about looking at how we do business, and evolving it.”

No doubt, the success of QDF comes in part because the retailer and the airport operate together as a team as part of Qatar Airways Group. “The retail space is generally dictated and delivered through QDF,” says Musleh. “We run the commercial space as such.” This allows the retailer to constantly create, as the airport itself is also in the constant process of growing and redefining itself.

In January of this year, Hamad International started Phase B of its terminal expansion. This will add an extra 21 new gates, five in Central Concourse, eight in Concourse D and eight in Concourse E by Q4 2024 or Q1 2025.“This means our expansion will be bigger than most airports in the world. It doesn’t stop. If it stops it gets boring,” says Musleh.

Doha is predominantly a transit airport, with upward of 80% of passengers in

transit. This, of course, affects the retailer because of shopping times. But Musleh says of local travelers an ever-growing number are coming early, and additionally more people are now choosing Doha as a transit hub because they’ve got more things to do. “They know they will have a great experience and they’re able to relax and unwind before they get on to the next flight,” he says, adding: “What’s super interesting is we’re seeing fewer people spending time in the lounge. Look at what we’re offering. It’s the whole experience. It’s beauty, it’s liquor, it’s F&B. Instead of staying in the lounge, First and Business Class passengers are instead coming down and enjoying the experiences we have via Fendi Cafe, Ralph Cafe, Oreo Cafe, Harrod’s Tea Room, Armani Restaurant — you know we have everything for everyone. And we’re seeing more and more people enjoying these.”

Recently, Qatar Airways changed its rewards program from Qmiles to Avios, which Musleh says QDF fully supports. “We are constantly working with brands and partners to come up with unique opportunities for our Avios customers,” he says. “Any passengers can buy with Avios

and earn Avios in our stores and restaurants. Access to the Louis Vuitton lounge for Gold and Platinum Privilege Club members is one of the many exclusivities we offer Avios customers.”

TFWA WE in Cannes

Musleh confirms that, as industry events are extremely important to the retailer, QDF will again sponsor events at TFWA in Cannes this year. “We have been really consistent in our approach with the industry events and made sure we supported the industry as much as we possibly could, even in toughest of times,” says Musleh. “TFWA bears a particular significance for me and for QDF. Every year we sponsor the networking lounge and this year is no exception. As you know last year was unique and exceptional for QDF and we wanted to share our success with all our partners and industry colleagues, therefore we are also sponsoring the networking lounge at Frontier Awards,

as well as the BW Confidential party. Sponsoring networking events reflects our DNA; we are a central hub connecting passengers, brands and partners.”

While sustainability and CSR might be a current trend, it has been at the top of the agenda for Qatar Airways Group for some time, and as part of this group QDF is fully committed and engaged. “Sustainability is important, and we need to do more for the environment. For years we have placed a strong focus on supporting local communities, sourcing local products, as well as using recycled and recyclable items,” says Musleh. “Recently we removed 1.2 million single-use plastic bags from all our Day2Day stores and replaced them with cotton-based bags. As with everything QDF does, our first step’s always a big step. And this is a big change for customers now. So, we are testing the water, and if it’s successful it could be part

of a wider rollout. Also, every Day2Day store now has a water machine, so we're encouraging people to refill water rather than buy plastic bottles of water. Again, we’re constantly looking at what we do. We will continue deploying sustainable initiatives which we will share with you shortly.”

In speaking with Musleh, his energy is palpable. He has a clear vision as part of a team, and his days are spent relentlessly pursuing that vision — and that vision is to offer the very best experience to travelers passing through Doha. “I don’t aspire to be the biggest. There are a lot of airports out there that are much bigger than ours, and fair play to them, it’s great,” he says. “We will never be the biggest and that’s not our aspiration. My job is to make QDF the best. I want to be the best in travel retail, I want everybody to use QDF as a benchmark for being the best.”

From the desire of LVMH, World leader in luxury, to raise eyewear as an essential element of its Maison’s collections and a pristine expression of their creativity, Thélios was founded in 2017. Pioneering a new luxury experience in eyewear, Thélios masters each step of its value chain, from conception to distribution of luxury sunglasses and optical frames for LVMH Maisons. Through its state-of-the-art Manifattura, located in Longarone, Italy, Thélios stands for Alta Occhialeria: an advanced savoir-faire, combining outstanding creativity and manufacturing excellence. Thélios operates a highly selective distribution network with a direct commercial presence in all major markets.

by LAURA SHIRK

by LAURA SHIRK

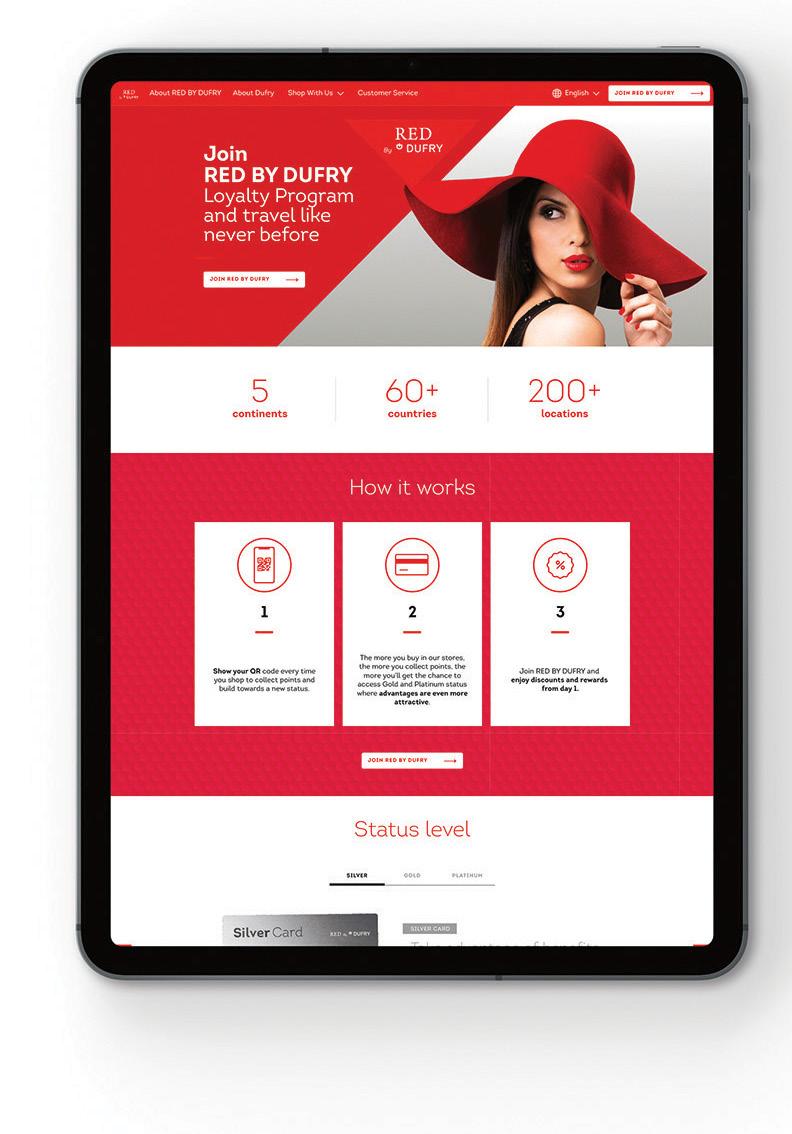

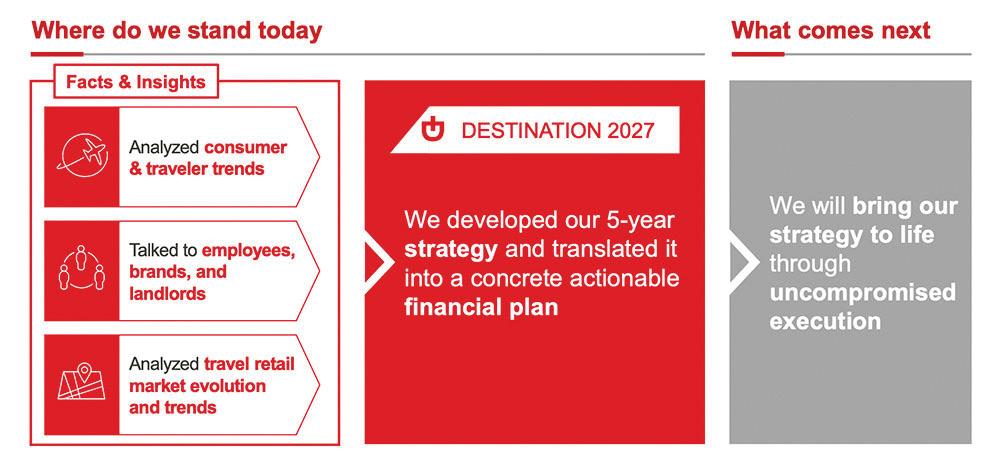

Following the unveiling of its new company strategy “Destination 2027” last year, Dufry Group (Dufry) has been on a mission to lead a travel experience revolution. With a focus on consumer and traveler insights and addressable market evolution, the purpose of this four-pillar strategy is a seemingly simple, but lofty one: to make travelers happier. Founded on environment, social and governance (ESG), geographical diversification and operational improvement culture, the retailer’s value proposition is set to advance in the next several years.

Described by Xavier Rossinyol, Chief Executive Officer at Dufry, as an inherent part of its vision to deliver a holistic travel experience, this direction is supported by the transformative business combination with Autogrill. According to the company, with this combination it is embarking on

a new era of retail and F&B convenience for travelers and well-positioned to maximize all of the opportunities provided as an integral part of its global growth strategy.

Dufry and Autogrill have joined forces to become a customer-centric, combined global travel experience player and be best placed to respond to the evolving consumer demands in both travel retail and travel food and beverage. Commercial space and product assortments will be adapted to travelers’ needs and digital engagement initiatives will further enhance the overall customer experience throughout the journey.

With the support of a consumerfocused approach and data insights, domestic and international traveler profiles across North America will be continuously monitored to identify new behaviors and requirements. According to the team at Dufry, this process of listening to customers, which is at the heart of “Destination 2027”, allows the company to fine tune its offering – not only matching, but exceeding the expectations of its customers and stakeholders.

Featuring new categories, exclusive products and hybrid shop concepts, the combined business will also deliver attrac-

Dufry’s “Destination 2027” strategy and combined business with Autogrill demonstrates a new era of retail and F&B convenience; plus, the team on consumer monitoring and optimizing retail space, passenger flow and revenue generationDufry’s Just Walk Out Hudson store at Dallas Love Field Airport Consumers can benefit from the convenience of online services such as Red by Dufry and Reserve & Collect

tive offers to concession partners in existing and new locations and enable airports to optimize retail space, passenger flow and ultimately, revenue generation.

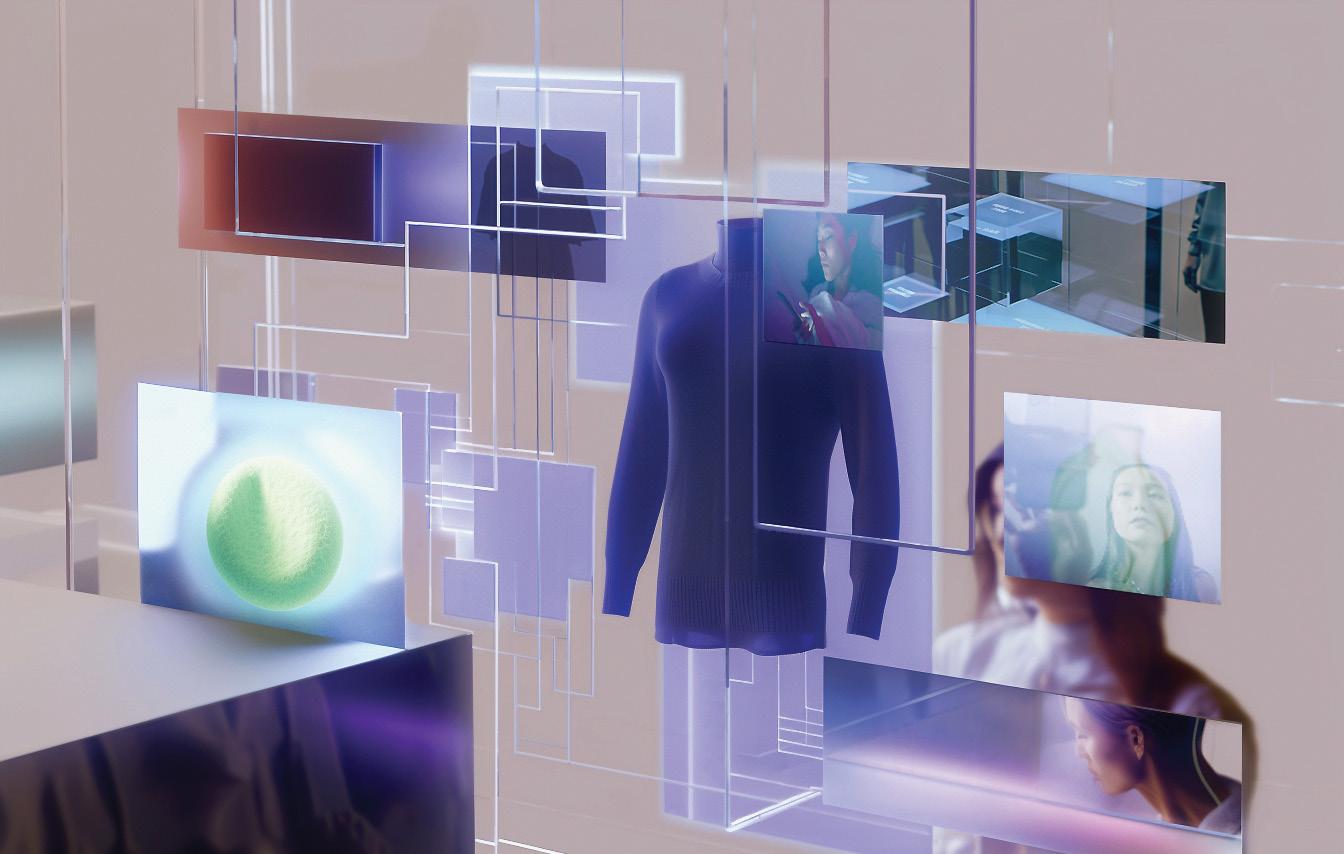

When it comes to consumer and traveler mix (2019 vs. 2025), Dufry reports an increase in Gen Y and Z of approximately 30% and a growth in sales directly influenced by online of approximately 20% (to over 30%). When asked how it is preparing to respond to the rise in discovery via Meta technologies and the desire for next-gen personalization, the company points out that Dufry is continually developing an omnichannel approach to boost consumer engagement via multiple touchpoints, as well as creating online and digital services. Along with interactive technologies available in-store, consumers can benefit from the convenience of online services such as RED by Dufry and Reserve & Collect.

Dufry combines online services with complementary physical experiences in-store via hybrid and experiential store environments, innovative campaigns and a wide range of leading brands across all core categories. The retailer has the advantage of being able to work in close collaboration with its long-standing brand partners to introduce personalized product and service options – from bespoke engraving of products to personalized analysis to help customers discover the perfect product for themselves or gift for others.

As shared by the retailer, social media and AI-technology analysis by Dufry shows three “new personas” (Working Wanderers, Experience Seekers and Young Explorers). While discussing how the company adapts its business model to address these different groups of travelers, it is noted that alongside the characteristics of the personas, it is important to remember that a key factor is tracking the passenger profile and the demographics at

specific airport locations. Research shows consumers are seeking digital engagement, tailored experiences, sustainable products and wellness and local offerings; in addition to the appearance of new trends, Dufry expects these findings to further evolve.

Conducting business in an environmentally conscious manner is an essential component of “Destination 2027” and because of the special nature of the travel retail and F&B industry in which Dufry operates it works closely with third parties to reduce the environmental impact of its business.

Looking at key ESG initiatives that Dufry has executed in the first half of 2023, it is evident that the retailer is making strides across the developing sustainability movement. According to Dufry, in March, it received validation from the Science Basted Targets initiative for its greenhouse gas emissions reduction targets covering scopes 1, 2 and 3. As of June, as part of its commitment to fight climate change and an alternative to single-use bags, Dufry has teamed up with advocacy and ocean conservation group Oceana to offer reusable bags made of 100% recycled plastic bottles at select stores.

The phasing out of plastic packaging and waste management is also on Autogrill’s agenda. The company is taking the next step forward on the way to substituting single-use packaging items with non-plastic, recyclable and compostable materials. The goal is to reach 100% sustainable guest packaging by 2025.

The two are working on integrating the companies’ individual ESG strategies into a combined one moving forward. The basis for this is the development of a new joint Materiality Matrix, which is currently ongoing.

On applying Dufry’s zero-based budgeting approach to its 2023 budget, the company says leveraging this methodology ensures constant operational improvement. Dufry assesses every single activity – plus, how it contributes to the business and how it can be improved. At all levels of operation, Dufry teams are fully aligned in terms of managing costs, improving efficiency and focusing on what is necessary to run successfully.

Shilla Duty Free confirms that significant investments are on the horizon, adding that strategizing about these investments and product offerings will be at the forefront in coming months

The Shilla Duty Free is strengthening its position as a duty free operator both in its traditional region of East Asia and around the world. The tender to manage the large-scale Incheon T1 and T2 stores that was awarded to Shilla “signifies a remarkable milestone toward realizing our vision as a leading global top-tier operator,” says Younghoon Kim, Executive Vice President of Sales HQ, The Shilla Duty Free.

But expansion in Asia is only part of the retailer’s strategy. “Beyond the Asian region, we are exploring potential markets, including the Americas and Europe, as pivotal points for our international business expansion,” states Kim. “As part of this strategy, we invested in 3Sixty, with plans to steadily drive our business expansion in the American region, where mutual synergies can be harnessed.”

This expansion in other regions is not a new idea; as referenced above, in late 2019 Shilla acquired 44% of US-based 3Sixty Duty Free, a deal that closed in April 2020 just as the world was in the process of shutting down. With the world’s borders now fully open again, Shilla has the opportunity to continue what it started so long ago.

As international travel restrictions began to ease in the first half of 2022, Kim says Shilla observed a resurgence in travel demand, predominantly from local travelers. “At present, the domestic recovery stands at 85% of 2019 levels,” he says. “Concurrently, the influx of foreign visitors is swiftly rebounding. We anticipate the retail market demand fully recovering in the latter half of the year. Specifically, for China, we anticipate a rejuvenation in travel similar to pre-pandemic levels once various restrictions are fully lifted. In preparation, we are actively initiating strategies to capture this potential customer surge.”

Chinese and Japanese travelers were Shilla’s main customer base pre-2020. Kim says while these nationalities continue to comprise the majority of its customers, there is an upward trend in demand from Southeast Asia as well.

As of the first half of 2023, both Changi Airport and Hong Kong Airport are experiencing nearly triple the growth rate compared to that of 2022, and Kim says revenue and profits have surpassed Shilla’s targets at both airports.

“The early removal of travel restrictions in both countries led to a PAX recovery rate surpassing 50%,” he says. “Our proactive approach to business enhancement including augmenting inventory and staff and activating promotions, coupled with the solid partnerships with the airports cultivated throughout the COVID era, have been instrumental in our success. We are driving full throttle towards operational normalization, forecasting PAX to recover to 80-90% of pre-COVID levels by the close of 2023.”

He confirms that significant investments are on the horizon, adding that strategizing about these investments and product offerings will be at the forefront in coming months. Additionally, the company will focus on creating a solid strategy for online and offline marketing with the goal of delivering an enhanced experience to Shilla’s returning customers.

Understanding its considerable strengths and creating partnerships for strategic reinforcement is helping The Shilla Duty Free to reach and surpass its sales and expansion goals, with much more to comeYounghoon Kim, Executive Vice President of Sales HQ, The Shilla Duty Free

“Through these measures, we aspire to solidify our win-win partnership with the airports and broaden the synergy with the Korean duty free market,” he says.

Daigou – a double-edged sword Hotel Shilla’s Q2 report showed an interesting trend, with revenue down but profits up. This, according to Shilla, is because of an overall crackdown on the daigou business and the subsequent disappear-

ance of its commission payments.

During the pandemic, the majority of Shilla’s downtown duty free business came from daigou shopping. This brought necessary sales but a lessened profit margin. Although downtown sales have now dropped dramatically, airport sales have more than made up for it. Since airport sales do not have the daigou commissions attached, this has increased profitability.

“Throughout 2023, our primary focus

has been securing revenue from existing channels capable of generating sales while diligently striving to enhance our profit margin,” says Kim. “As travel demand reignites in the year's second half, we are optimistic about a further uplift in profitability.”

Cosmetics represent the highest sales ratio across Shilla’s domestic and international stores, with an incredible 80% of total sales as of June 2023. This is thanks to competitive pricing and the fact that it is a consumable item, which encourages frequent purchases, especially in comparison to luxury fashion, watches, or jewelry.

“Beauty products from globally renowned cosmetic companies such as SK-II, La Mer, Estée Lauder, and Lancôme consistently yield impressive sales performance. In luxury fashion, significant brands like Hermès, MCM, Chanel, and Saint Laurent continue to secure high sales numbers. Apart from appreciating the cost benefits associated with duty free shopping, our customers

also covet an assortment of experiential values, including introducing and trialing new products. We are unwavering in our commitment to cater to these desires,” says Kim.

Perfume and Cosmetics together have inspired a number of activations this year, including “Fly With Me,” a multi-brand fragrance discovery pop-up store featuring brands like Burberry, Chloé, Marc Jacobs and Miu Miu; and the “Kilian Bar” concept by luxury perfume brand Kilian Paris, which ran in early summer at Singapore Changi Airport, marking its first airport location worldwide — but most notably, Coty Inc recently struck a strategic digital partnership with Shilla to enhance their digital transformation as they innovate to meet travel retail consumers’ rapidly evolving needs.

This partnership aims to redefine the online and offline shopping experience by creating new ways of engaging with travelers, providing consumers with unique digital experiences such as its virtual class on the metaverse in beauty, which generated 3.5 times more engagement than the initial target and led to an 80% increase in the number of customer transactions compared to previous events. Many more metaverse workshops are in preparation.

While P&C remain core drivers, Kim notes that Shilla has seen “robust” growth in the fashion, alcohol and tobacco categories. “This growth trend aligns with the popularity of K-fashion across Asia and an increasing preference for diverse alcoholic beverages, such as whiskey, among millennials and Gen Z consumers,” he says.

Shilla Duty Free has consistently innovated within the e-commerce space. Kim says the company pioneered the creation of “Tipping,” which is the first socialbased review platform in the global dutyfree industry. It also created “ShillaTV,” the proprietary live commerce platform.

“This has allowed us to foster a dynamic dialogue with younger consumers,” he says. “We recently hosted a series of ‘Virtual Masterclasses’ using Zoom, delivering an immersive brand experience by integrating metaverse elements.

Participants of the Virtual Masterclass were offered limited-edition NFTs as mementos, in addition to special privileges at our airport outlets. This blending of youth-friendly content and digital technology has placed us at the forefront of a transformative shift within the duty free industry.”

Shilla is currently developing a new virtual studio-produced masterclass, which is on schedule to be completed in 2023. “This will feature cutting-edge AI and big data technologies, enabling us to understand customer contexts and create an integrated omnichannel experience where online and offline dimensions coalesce seamlessly,” says Kim “Moreover, building on our metaverse acumen, we aim to establish metaverse duty free shops in all three major Asian airports where The Shilla Duty Free operates, a strategy already demonstrating tangible success.”

While distribution and consumer habits changed around the world during the

pandemic, nowhere is this truer than in China. Kim says the most striking transformation for the Chinese consumer has been a pivot toward platform-centric consumer behavior. “This evolution has resonated within the Korean duty free market, prompting us to strategize on adaptive measures. In these rapidly fluctuating circumstances, we are committed to exploring innovative solutions to meet these challenges head-on,” he says, further explaining that the company is “comprehensively reassessing” its existing business structure and shifting towards a more digital-centric model.

“This entails providing actionable insights through a digital big-data platform and developing premium content to generate additional revenue,” he continues. “We are amplifying our virtual marketing programs by leveraging augmented reality (AR)/virtual reality (VR) technologies and fortifying our collaborations with brands via CRM integration. We are also enhancing our platform's core competencies by bolstering the functionalities of our commerce platform.”

The “enhancement of customer experience” has become Shilla’s primary focus. To achieve this objective, Kim states that the company is making “continuous efforts to identify and offer brands and products our customers seek, paired with Shilla's distinct high-quality spaces and distinguished services, creating a delightful experience for our customers.”

Shilla recognizes that revitalizing its overseas stores in Hong Kong and Singapore, which were impacted by the pandemic, is another crucial task to remain competitive. Kim says, “We plan to strengthen the competitiveness of our customer-focused strategy to improve the performance of our existing channels while preparing for the changing landscape and recovery of travel demand.”

Since making the decision to open a location in Macau just as business was expanding in the US, DFA’s Jerome Falic has figured out the formula for success at the location; the time since then has been spent expanding on it

by HIBAH NOOR

by HIBAH NOOR

After opening in Macau in 2007, it took some time for Duty Free Americas’ (DFA) Falic brothers to get the correct categories, but figure it out they did. When the store first opened, the product mix was typical of duty free stores, with spirits, tobacco, confectionery, accessories and electronics taking a lot of space. In short order they learned that there was only one magic category that would succeed at this location, and that was P&C — beauty and fragrance. All other categories have now been eliminated.

Throughout the 16 years since cutting the ribbon, the Falic brothers have continually shown their faith in the location by investing further, taking up space whenever it has become available. This was even the case when there was no end in sight for the pandemic lockdown; the company once again took on more space in 2022, believing that business would bounce back strongly once restrictions had lifted. Once again, its investments were wisely placed.

Since China’s borders reopened completely earlier this year, Macau has seen increasing footfall, with each day at DFA getting busier. And, though Chinese mainlanders make up the vast majority of DFA customers in Macau — CEO Jerome Falic says that business is still more than 90% from mainland China — the crowds are much larger, and more and more visitors are expected throughout the year from Hong Kong, Taiwan, Japan and other markets.

The DFA store in Macau also sees traffic because of its location on the way to the casino. Similar to walkthrough stores in airports, regardless of how they’re dropped off, visitors to the casino see the DFA store on both their right and left as they walk through.

DFA’s continued investment in Macau has been both wise and profitable,

especially since Macau opened up before mainland China, offering travel options in the region.

Recent investments include the renovation and expansion of the DFA shop last December. “We introduced a number of new luxury brands such as Maison Francis Kurdjian, Aqua di Parma, Byredo, Diptyque, Maison Margiela and several others,” says Falic. “The demand for the niche fragrance category has increased quite a bit and is lifting the fragrance business up overall.” Some brands such as Maison Margiela are especially popular with a younger demographic, which is appealing in part because the spend is higher with this cohort.

DFA’s close relationship with L’Oréal Travel Retail, which helped to make a success of the store in early days, also helped to bring about the addition of SkinCeuticals. Other additions include Helena Rubinstein in early 2022, Gucci Beauty from Coty, and several others including L’Occitane, which was introduced this summer. “We are planning to introduce more brands over the next few months,” says Falic.

And now, DFA is branching out in an unexpected direction. The company

will soon open a standalone TWG Tea store next door to its Macau shop. The Singaporean luxury teahouse chain and artisanal tea brand will be located directly between DFA’s store and the US burger chain Five Guys.

Price consciousness

Falic says a new trend he’s seeing is that current consumers are far more price conscious than before. This is because China is such a huge market that has become highly accustomed to purchasing online, especially during the pandemic — and lockdowns and closed borders affect that country for far longer than others. “All of the brands are selling online in China at very big savings, which means consumers are checking prices before shopping, which was not the case in the past,” says Falic. “So, we need to be able to give the consumer a reason to shop in Macau. We have all of the brands they are looking for, but we have to be extremely competitive and therefore offer certain types of promotions to draw in the consumers and make sure they actually shop,” Falic concludes.

As the cruise channel grows, its segment within Gebr. Heinemann’s business has become increasingly important. GTR Magazine spoke with Kerstin Schepers, Managing Director of Gebr. Heinemann

Cruise Liner GmbH & Co. KG about the company’s growing focus on cruise retail and wholesale

by ALISON FARRINGTONIn its FY22 trading update in April of this year, Gebr. Heinemann cited the cruise and ferry channel as contributing 5% towards its overall US$4.1 billion group turnover. The company also noted that there would be a three-year consolidation for its US subsidiary, which will focus solely on the cruise retail and distribution business.

“After the pandemic the cruise industry experienced a very strong comeback,” says Kerstin Schepers, Managing Director of Gebr. Heinemann Cruise Liner GmbH & Co. KG. According to Schepers, the company is watching with interest the 62 ships coming into market by 2028. “The future of the cruise industry is looking very bright,” she adds.

Gebr. Heinemann currently runs retail operations on board 19 cruise ships including leading players such as Royal Caribbean, Hapag-Lloyd and TUI Cruises. In addition, it operates as a wholesaler, supplying over 240 cruise ships and ferries.

With both retail and wholesale operations in the cruise channel, Gebr.

Heinemann is experiencing strong growth in both areas, making this an extremely important pillar of its overall business. Renewed efforts in this channel are also in line with the overall strategy to diversify the business.

Regionally, Gebr. Heinemann has cruise operations in the US, Europe and the Middle East, but a core region is the Americas, which it operates from a subsidiary in Miami. “Our experienced colleagues in Florida focus mainly on the cruise business and work strongly together with the local industry partners,” says Schepers. “Europe is also of relevance with some key clients and for our wholesaling business. In addition, we see great potential in the Middle East and other emerging markets.”

The Heinemann Americas office is located in Miami, the most important hub of the cruise industry in the Caribbean, which is itself the busiest cruise region. For this subsidiary, a focus is building strong relationships with local partners,

including Royal Caribbean, with which Heinemann successfully operates several shops on board a number of cruise ships. “I am optimistic that Heinemann can extend this collaboration in the future,” she says.

This optimism looks well placed, as Royal Caribbean awarded Heinemann the retail partnership for Icon of the Seas, which will be the biggest cruise vessel in the world and the first one of its kind, a completely new ship class. Her maiden voyage will take place in January 2024.

In Europe, Heinemann operates the retail business on board Mein Schiff 1-6, operated by TUI Cruises, as well as five cruise ships operated by Hapag-Lloyd and four by Phoenix Reisen. Moving to the Middle East, the company’s latest partnership is with Cruise Saudi. “We are very happy for this relationship,” shares Schepers. “We will be the exclusive retail partner on board its first cruise line AROYA Cruises, which will be put to sea in 2024. This is a first step into a very promising market for us.”

Leveraging its Miami base as a regional hub for connections is important for Heinemann to grow its cruise business. “Miami is a hub for several key players in the cruise industry,” she says. “Therefore, it is a logical step that our Heinemann Americas team is focusing on our strong competences in retail and wholesaling services in the cruise sector. This also underlines the dedication of Gebr. Heinemann and Heinemann Americas to grow within this channel, in both retail and distribution.”

Strong collaboration with cruise partners is a critical strategy for Heinemann’s growth plans. “We always aim for strong outcomes for all partners involved, which then also fuels long-term partnerships,” says Schepers. “Our team in Miami plays an integral part in driving this development. Being one of only two regional headquarters for Gebr. Heinemann shows the strong support for the team. We all work closely together across regions and this collaboration is key as our global customers trust us and rely on our high quality of services across the world –for example when it comes to logistics.”

In March 2022, the Royal Caribbean cruise ship Wonder of the Seas set sail on

its maiden voyage with seven shops operated by Heinemann. These shops offer the core duty free categories including liquor, tobacco, confectionery, perfumes and cosmetics, complemented by a number of luxury goods such as fine watches and jewelry. After the ship’s first full Caribbean season after the pandemic, sales confirm that Heinemann is “on the right track,” with performance constantly improving, notes Schepers.

The operator’s next collaboration with the cruise line will be on Icon of the Seas. The categories offered on this new class of ship will match what Heinemann currently offers on board Wonder of the Seas, but Schepers says the brand line up and the retail execution will be tailored to the uniqueness of this vessel. “We will be operating 14 retail venues on board this ship; passengers will be offered a customized one-of-a-kind retail experience designed especially for Icon of the Seas. This way we will be able to contribute to the most iconic vacation experience offered on board.”

In its retail operations aboard Cruise Saudi’s AROYA Cruises, Heinemann aims to provide experiences and services specifically designed to embrace Arabian preferences. “As retailer on board this ship, we want to inspire travelers. To accomplish this, we will work directly

with the world’s best-known luxury brands and will offer a wide range of products which extends from perfume and cosmetics to confectionery, fashion, accessories, watches, and jewelry,” she explains.

In addition to operations on Icon of the Seas and with Cruise Saudi, Schepers says she is looking forward to further yet-to-be-announced developments coming in the next year, in Europe and Asia Pacific.

‘Turning travel time into valuable time” is a key element of the Gebr. Heinemann mission statement to travelers. Schepers points out that passengers spend far more time on board a cruise ship than they do at an airport, which means that the dwell time in shops is much higher. An additional difference with airport retail is that cruise ship shops compete with markets at the various ports along the journey. She adds that the guest structure varies depending on the ship’s itinerary.

“Assortment and pricing therefore have to be flexible to match the respective clients on board. This is a challenge we love to face, and we are always motivated to go the extra mile,” she says. “Personalization is a big part of that – we want to offer a spectacular assortment and provide unforgettable experiences. These two promises are especially key when it comes to retail on cruise ships, as it varies a great deal compared to the airport retail business.”

Heinemann accomplishes this with a variety of customer-centric actions to deliver on its promises, including personalized product offers, trunk shows and workshops. Digital elements and technology also play an increasing role in providing inspired personalized experiences to the guests on board. “We all agree that digitization will have a huge impact on our success in the future, and facilitating this is something we are working on closely with our partners, to provide even better shopping experiences to all guests,” Schepers concludes.

Lagardère Travel Retail has taken on a leadership role during this time of change, from creating new business models and F&B concepts to achieving its lofty CSR goals, and its empowered local teams are helping to deliver

In the years leading up to the COVID-19 outbreak, sustainability was becoming a serious topic of conversation throughout the world. However, during the pandemic this consciousness exploded, with sustainable practices becoming ever more important to consumers and the population at large. Lagardère Travel Retail made a huge

commitment to drive change, leading to its PEPS (Planet, Ethics, People and Social) roadmap.

“Lagardère Travel Retail has a strong and clear ambition: to play a leadership role in the transition to a more sustainable travel retail industry,” says Dag Rasmussen, Chairman & CEO of Lagardère Travel Retail. “CSR is a strategic priority, and we have built a solid roadmap, PEPS, to drive and monitor change. Limiting our environmental impact through a robust climate strategy across the entire value chain is our responsibility towards future generations.”

Rasmussen states awareness on the company’s part that it cannot act alone on this journey, highlighting the partnerships necessary for success. “We need all our stakeholders to join forces to make a

meaningful difference. Landlords, consumers and brands are essential partners to drive these positive changes. The products we sell account for more than 80% of our global carbon footprint. This is why collaborating with our brand partners is critical to achieving our carbon reduction objectives, through innovation, shared agendas, data sharing and a a testand-learn mindset. We see a lot of new solutions emerging in the market and we are very happy to be testing and promoting these in order to pioneer more sustainable practices.”

Lagardère Travel Retail had already been operating an extensive portfolio of F&B concepts at Dubai International, when it recently opened its first retail partnership

at the airport, Pangaia. One of the world's most innovative fashion brands, Pangaia harnesses science to create responsible clothing and accessories.

“Dubai Airport has been identified as a prime location for the store, as it is the world’s busiest international airport for the ninth year running, and is a trendsetter among global aviation hubs. It is the perfect setting for a new, edgy brand to break into travel retail and gain visibility amongst the world’s best consumers,” says Rasmussen. “This opening is a testament to Lagardère Travel Retail’s commitment to bring sustainable brands and a more responsible offering to consumers in airports and to pioneer more sustainable travel experiences and concepts. Both the range of products and the store design are serving this ambition.”

This is the first Pangaia store opened by Lagardère. Rasmussen states there are no current plans to open other Pangaia stores, but the operator will build on its strong partnership with the brand to explore new opportunities when relevant.

Hot on the heels of the Pangaia opening, Lagardère appointed Arnaud Rolland as VP CSR. Clearly, the company is putting its PEPS plan in action, and Rasmussen

affirms they are operating according to schedule.

“As planned, we are on track to achieve our contribution to global carbon neutrality by the end of 2023 thanks to the efforts already put in place everywhere in our network, a series of global energy reduction measures were implemented in all countries and operations, from stores to restaurants, offices and warehouses,” he says. “These include actions such as adapting the temperature, sharing IT best practices, using only coolers/fridges with doors, running extensive energy audits and adapting all store equipment in the most efficient way. We are making significant progress in reducing energy consumption in the countries where we operate. In 2022, we already achieved a reduction in energy consumption compared to the previous year.”

As a second parallel step, Lagardère Travel Retail is also switching to green and renewable electricity wherever it is possible, he says. “Where we depend on indirect contracts, we are looking into Renewable Energy Certifications. With all our efforts and structural changes, we can significantly reduce our direct emissions, achieve our ambitious objectives and greatly contribute to the overall efforts of the industry.”

During the pandemic travel retail operators discussed at length creating contracts with more balanced risk between airport and retailer. Lagardère was the first operator to sign such a contract, an innovative long-term profit-sharing agreement with Lima Airport Partners (LAP), a business model where partners equally share risks and benefits.

“The profit-sharing model is more a partnership than just a contract, and it has opened up a significant revenue potential for both Lagardère Travel Retail and LAP, as well as greater investment opportunities – ultimately benefitting travelers and enhancing the airport experience,” says Rasmussen. “Building on this very successful experience, we are promoting similar partnerships when and where they prove to be the most adapted.”

While this agreement garnered a great deal of attention, recently Lagardère signed an agreement with AENA with even higher MAGs than before, so clearly the former business model is not dead.

“The crisis has helped the industry to open up to more innovative and balanced ways of collaboration. We are confident that this change is sustainable and that we can capitalize on our global coverage and strong relationships with partners

to replicate this model elsewhere. But this is a long-term process, and it will take some time before the industry adopts new models,” says Rasmussen. “The recent tender process launched by AENA demonstrated that MAGs are still firmly anchored in the industry’s culture, with which we can live and prosper. What is most important is to keep an open conversation with landlords, evaluate which model is most appropriate based on a set of different factors, and to know where to draw the line.”

Lagardère Travel Retail has recently been appointed by Time Out Market to support its expansion into travel locations. Rasmussen explains, “The bespoke travel hub model will feature key elements of Time Out Market, with its curation of the best of the city through a targeted selection of local chefs and restaurateurs, as well as bars. Everything will be appropriately scaled to the footfall and speed of a busy travel hub. In addition, travelers in transit will also be inspired by the Time Out Media brand, with screens displaying its inspirational content on the best things to do in cities around the world.

“With this partnership, Lagardère Travel Retail and Time Out Market are combining their expertise, footprints and foodie passion to offer travelers an unforgettable experience: ‘a true culinary journey within their trip.’”

Lagardère Travel Retail is also “progressing very well” in the integration of Marché international into its network, according to Rasmussen. “We are working

very effectively with Marché teams to further develop the globally recognized Marché concept,” he adds.

The Chinese traveler has been of the utmost importance globally, with the sale of luxury goods in particular. While travel, especially international travel, dropped drastically in 2020, it edged up in a slow climb until borders began reopening. Uncertainty remains regarding the return of Chinese travelers, however, and these individuals are very high spenders.

“We don’t have a crystal ball and cannot say when or if these passengers will come back to pre-crisis levels,” says Rasmussen. “As we navigate this uncertainty, the key success factor is to remain agile and to adapt our category strategy to a different PAX mix. Our teams are making the most of our customer data to constantly improve our offering and be relevant to the passengers visiting our stores. This has proved to be a very effective strategy and we are on track to deliver our best year ever.”

Overall, Rasmussen says, the Asia Pacific region is recovering slowly, and not in a uniform pace. “Singapore and the Pacific have been recovering since the second half of 2022 and North Asia only since the beginning of 2023, driven by robust domestic traffic. We believe that this region will see fast and strong sales improvement through accelerated recovery, further business development initiatives and a very innovative omnichannel sales strategy.”

More than ever, Asia Pacific travelers are expecting both an unrivalled in-store experience and the ability to make their purchases on different channels. “Our expertise of social media livestream sales and our sophisticated approach to customer engagement will help us make the most of these dynamics. Other trends that we have identified are the increase of luxury consumption and the increasing importance of downtown duty free in Hainan, both areas where Lagardère Travel Retail has a clear competitive advantage,” he explains.

While Rasmussen admits it may be some time before Asian travelers resume international travels to the previous degree, he says, “We have had to adapt to this, by shifting some elements in our offer, for example, by further developing the local authenticity many passengers are looking for. We are also seeing more young travelers, and want to develop an offer that specifically meets their expectations. We believe our ongoing focus on experiential and conscious retail experiences is a strong factor of success with this cohort.”

Speaking about how local authenticity is a leading revenue driver, he concludes, “We are well-positioned to deliver this through our locally empowered teams, who know the specifics of each local market and can identify the local brands that will deliver a sense of place. Finally, we are working hard to deliver more sustainable travel experiences, which is something all travelers – whatever their age or origin –are expecting.”

ARI Middle East’s Rob Marriott talks to GTR Magazine about the company’s bespoke approach to a dynamic region and its new brand identity campaign: Joy On Your Way

by ALISON FARRINGTON

by ALISON FARRINGTON

ARI Middle East (ARIME) has just celebrated its 30th anniversary and for ARIME’s Chief Executive Rob Marriott, that three decades have passed since its first location opened in Bahrain showcases just how much the company has grown in line with this fast-paced region.

After taking up the group role 18 months ago further to his role as CEO at Muscat Duty Free, Marriott says he has learned quickly that the Middle East is a very dynamic region. “It moves at tremendous pace, and we need to move with it, in order to accommodate the constantly changing passenger profile.”

ARIME has ventures in Bahrain, Cyprus, Lebanon, Oman, Qatar and Saudi Arabia. It’s an impressive regional stronghold and each location represents its own opportunities for growth and investment potential.

ARI Middle East’s Chief Executive Rob Marriott has seen a lot of growth in ARIME and the region itself in the past three decades

“Each location is different. It’s a bespoke ‘by business’ operation, and we need to make sure the offer is right in each one,” says Marriott. “ARIME operates a collaborative partnership model, and each of our stores and partnerships is tailor-made; one size certainly doesn’t fit all.”

In ARI’s most recent trading update for FY2022, the Middle East region delivered strong results following a solid overall performance for 2021. The Bahrain business traded ahead of forecast while the Riyadh T5 operation performed well, with the domestic terminal faring better than the international terminal during the pandemic, due to the international travel restrictions.

Marriott says he is cautiously optimistic about the end of year performance, “2022 was a good year to rebound and 2023 is shaping up to be double digits ahead. I would hope to be back to 100% of pre-pandemic sales for 2023, but we have some way to go.”

Bahrain focus

Bahrain Duty Free recently opened a new store location focused on the region’s best-selling travel retail brands and exclusives. “In July, we opened a new liquor & tobacco store, to make it easier for passengers going into the lounges not to miss the retail experience. It’s an amazing facility there and now the retail offer is more easily accessible,” he says.

“Retail space here is at a premium and it’s great to see that brands are investing in activations again,” says Marriott. We keep adapting and brands are showing more confidence; we are ensuring that there’s a return for them too. Yes, there have been challenges post-Covid, but brands are on the front foot again, they want to support their business in this region which is so dynamic.”

Marriott is excited about the opening of Abu Dhabi’s new terminal, and with good reason. The 742,000 square-meter Terminal A is expected to open in November of this year, enabling the airport to service 45 million PAX annually. This new terminal, which will feature an array of world-class amenities, will have 163 retail and F&B locations.

“The Middle East is always exciting; there’s lots coming to market,” Marriott says.

Sense of place has become increasingly important in the travel retail atmosphere, and ARIME has ensured passengers will notice it. “Passengers feel as if they’re in Abu Dhabi, from the sense of place, the beach, the ocean etc. It’s the newest, most luxury example of what we can do here. The space allows us to give a full offer across those categories – all the main brands want to be there. It’s a major opening and will be a world leader for its proposition.”

ARI recently launched its new brand identity campaign, which celebrates, expresses and attempts to elicit joy. “We’ve just rolled out our new ARI brand supported by an emotive expression of ‘Joy On Your Way,’” says Marriott. “Our new brand framework and strategy will deliver clarity, cohesion and consistency across the ARI estate. It marries our strategic ambitions, vision, mission and customer value proposition (CVP). ‘Joy’ is an uplifting message; it’s the glue that combines all the elements of our business under one framework.”

Marriott has found meaning in this brand message on a professional and personal level. “For me it’s the cultural piece that shows a global attention to detail. How do you make sure the passenger flying to the Indian sub-continent at 2am from Oman Airport has the best experience, compared to another passenger traveling at 10am when everyone is around? It’s a cultural approach to experience, delivered through joy.”

Marriot says ARIME is focused on making authentic and emotional connections to its customers through a bespoke approach, and not just a homogenous one. “To this end, in 2020 we constructed our new customer value proposition, which includes principles such as value, convenience, gifting solutions, brand range and, importantly, bespoke concepts and sense of place.”

With over 70 initiatives around the world, the company has worked hard to deliver over the last 18 months and the teams are now in the process of evolving ARI’s value proposition. “We identified areas where we can do more, do better, enhance our engagement across every touchpoint, from before people travel to online to in-store to point of payment and after-sales service too. It’s about engaging better or in new ways.”

New brands are coming to market and Marriott affirms the priority of taking the opportunity to showcase them as soon as possible. “We are very excited to be getting new beauty bands such as Charlotte Tilbury,” he says. “Anything that our customers want is what we aim to get for them. Some are very clear they want to come in for a special product or others want guidance. It’s about giving them an informed decision. This is where personalization techniques such as gifting, engraving stations or brand activations, such as Toblerone’s named sleeve,

allow us to give a bit of extra joy to their experience. Our mantra is giving something you can’t get elsewhere, delivering the wow factor, offering a personalized service. It all adds to the overall experience.”

Marriott adds that liquor remains an integral part of the business. “It’s very fast moving. We are sensitive to the trends of the region and that means working closely with our brand partners,” he says.

Personalization also means a digital approach that is constantly evolving in line with the passenger. “ARI has a very strong ecommerce offer focused on beauty, liquor, fashion and accessories – online shopping that adds value for the customer,” says Marriott. “The ‘Joy On Your Way’ theme is all about that personal and value approach.”

In keeping with the bespoke concept the company manifests, Marriott says the Middle East behaves differently to Europe and digital plays such an important part in capturing the regional culture.

ARIME is investing in more digital solutions from social media to new platforms. The company has recently set up a new digital centre of excellence in Ireland. “This is the base to understand what the full opportunity is for us across all our different locations at ARI,” explains Marriot. “We are also looking at our Shop and Collect, Shop and Go services, leading in what we offer for our passengers looking for that convenience. We know that arrivals is more successful than departures and it’s helping us to learn from these insights and plan for future locations. Also coming soon is Delivery to Seat — these processes are easier to navigate where we’ve got partnerships with airlines.”

As Abu Dhabi’s new terminal inches closer to opening, ARI has chosen a new GM to head a new joint venture between ARI Middle East (ARIME), and local partners, Travel Retail Sales and Services (TRSS).

Adrian Bradshaw, General Manager, TRSSAdrian Bradshaw has been announced as General Manager, TRSS, which will operate the perfume, cosmetics, jewelry and sunglasses categories at Terminal A. Bradshaw will assume his new role later this year.

Bradshaw comes to Abu Dhabi directly from his role as General Manager, Beirut Duty Free; before that position he held senior roles at ARI and elsewhere, including Alshaya Group, Marks & Spencer, and as Senior Vice President at Qatar Distribution Company.

In a recent release, Rob Marriott, CEO of ARIME, welcomed Bradshaw to the role, expressing delight in the appointment and confidence that he would continue to drive growth in this position as he has in Beirut.