Brangus JOURNAL

Hear from our IBBA International Committee Liaison, Macee Prause, on the Australian Brangus breeders who recently had several opportunities for learning and networking during their visit to the United States.

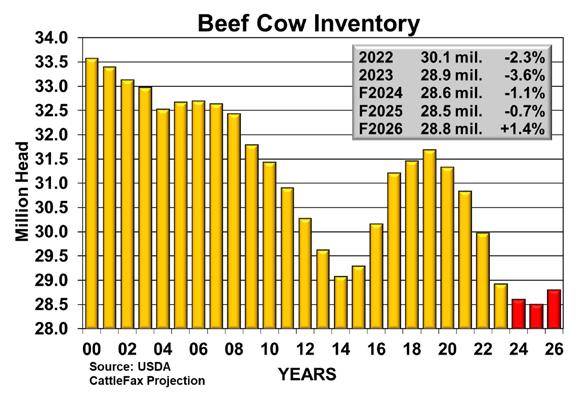

Cyclically tighter cattle numbers translated into the highest cattle prices in 2022 in years, this and much more can be found in CattleFax's 2023 Industry Outlook. Read on to see what could be coming in the year ahead.

Have you ever thought about the impact exporting United States bovine genetics has on breeders in other countries? Cattle breeders from across the globe seek U.S. genetics due to the traits found in the United States.

Featured on pages 52-56 are the results for the 2023 Western National Brangus point show at Cattlemen's Congress in Oklahoma.

In 2011 I was faced with the biggest decision of my life. Michelle and I were raising two kids, both working in town and running a commercial cow-calf operation that was transitioning into a registered Brangus herd. I was getting pulled in multiple different directions. If I wasn’t at work at the fire department or working on the ranch, I was running up and down the road teaching classes for the college, the hospital, or the fire department. The only people I was not making time for lived in the same house I did. Something had to change. The choice was super easy for me. I chose to come home and make a living on the farm.

The choice I made was not as easy for others. My friends all over the fire department couldn’t believe that I was retiring early and walking away from a promising future and from my other family. Any of you that have ever been in public service understand what I mean when I talk about my other family. I was involved and took a big role in multiple projects and committees that my coworkers didn’t want me to walk away from as well. My response to all of them was the same. If I did my job, I made sure that everything I knew was passed on and that I had put the next man up in the position to succeed.

When I was blessed with the honor of being President of the International Brangus Breeders Association last March, I embraced it with the same passion and drive that I did with my career in the fire service. My personal life was in a much different position than it was when my children were little. My family embraced the responsibility that I was given and told me to give it my all. I had only one agenda and that was to finish everything that we had started. Brangus had multiple projects that had been started and I felt that before we could move forward into anything else, we needed to finish everything we had open.

As we wrap up this last year, I hope you all feel that I did my job. We closed out project after project. We didn’t do this because I did something special. We did it because I

realized a long time ago that I didn’t have to be the smartest guy in the room. All I had to do, if I was the leader, was to put the people that were way smarter than I was in the positions that they had a passion for and to give them free rein to accomplish the goals that the organization had laid out.

We made money this year. That hasn’t happened in a long time for various reasons that had little to do with the leadership of the organization. We also grew. We knew going into 2022 that one of the largest 2 breeders was going to significantly reduce their registered herd. We faced the largest drought that we had seen nationwide since 2011. We budgeted a 2,000-hd reduction in THR headcount because of these factors, but only lost 250-hd of regular THR. We made it back and then some with THR on ET calves and calves of first calf heifers. That means we grew in spite of it all in 2022. That means the things we are doing to grow the breed are working. I’m very proud of the team that accomplished this. I have enjoyed the honor of being the 58th President of The International Brangus Breeders Association. In my lifetime there have only been two people serving more than one term as President. I will not be the third. This is an honor that so few will ever have the opportunity to have. If I have done my job then there are countless qualified individuals that deserve this honor and I would never stand in the way. I have offered the board of directors my willingness to serve as Treasurer of this great organization for the remainder of my term on the board of directors if they see fit. I gladly pass the honor to serve as President of this great organization to the next person. That being said, as I finalize my time in this job, I would be remiss if I didn’t pass down to the next generation the wisdom that has been given to me. As many of you know, I love to write and I will deeply miss the opportunity to speak to you all with the written word. In my last Journal entry, the following are my thoughts:

Please send men and women to lead this organization that love it and have the courage to speak their convictions. If you are worried that someone might not buy

your cow or bull if you stand up for what is right, please stay home. This organization needs multiple different people from multiple different backgrounds and perspectives to serve on committees to give us the broad picture we need to move forward. The board of directors needs to have diverse backgrounds as well but the majority of the people on the board need to feel the decisions they make. The majority of the board needs to be the guys signing the front of the check, not the back. We currently have an appropriate level of this diversity. It needs to stay that way.

If you call your board member to complain about a decision they made, good for you. If you do it regularly, maybe you should consider serving as well.

The purpose of a breed registry is to maintain and preserve the herd book and to empower members to provide high quality bulls from said registry to commercial cattlemen. Everything else that we do is just for our own benefit.

If you want to pass your ranch down to your children, make sure when they come to work the ranch that you show them how to pay the bills every month. Let them see it constantly so they won’t chase dreams that have no viability. My parents did this for me and I’ll do it for my kids if they return home. The people making the most money in the cattle business are the ones selling products and services to the people that own the ranches. Read that last line again.

I don’t know what a donor heifer is and I really don’t want to know. If I met one, I’d ask her to show me evidence. Don’t flush an unproven cow unless you can afford to cull all of the calves. I know I sound old fashioned but I’ve hung lots of ET calves upside down.

If a cow or bull rolls a hoof, it has no business in the

breeding herd. Send it to the train station.

A.I. every cow you possibly can with proven bulls. If you wouldn’t proudly put a bull on your commercial cows, it needs to be a steer.

You have three cuts of heifers at your ranch. The first cut are your replacements. The second cut should have their papers removed and sold as really nice commercial breeding heifers. The third cut should go to the feedlot. Every ranch will have a different percent that fall in each cut. If you need to sell some registered heifers to make the deal work, take them out of the first cut. Don’t sell other breeders registered heifers that don’t deserve to be registered.

EPDs are expected progeny differences not exact progeny differences. We have to evaluate cattle based on phenotype, performance and genotype or we will get left behind.

Brangus is not a lobbying organization. Find a lobbying organization whose sole purpose is to protect the rancher, and only the rancher. In Matthew 6:24, Jesus said, “No man can serve two masters: for either he will hate the one, and love the other, or else he will hold to the one, and despise the other. You cannot serve God and money.” There are many different issues that we can stand beside other providers in the beef supply chain. There are a few that we can’t. Don’t waste your time in an organization that doesn’t put you first. I’ll stick with the United States Cattlemen’s Association.

One event that always draws a big crowd at the annual NCBA convention is the Cattle Fax Outlook session. The session in New Orleans this year was no exception. The room was packed and everybody was taking notes or using their cell phones to take pictures of graphs and charts -- lots of charts and graphs. I am probably biased because I once worked in the same building with Cattle Fax and I know these guys personally, but I think they are the premier cattle market intelligence service in the industry. Cattle Fax is member-owned, governed by cattle producers. Membership is a good investment if you want to keep a keen eye on the market and seek a deeper understanding of the factors driving prices.

The session covered everything from the long-term weather forecast to diesel prices, interest rates and projected feeder calf prices. When I told Dr. Randy Schmidt that the Cattle Fax session would be 2 ½ hours long, he said “that’s a lot of facts.” Indeed, it was – and he sat through the whole session.

Through a special deal that IBBA has with Cattle Fax throughout the year, we are able to reprint the Outlook Session handout in this month’s Journal. I encourage you to read and re-read it. For the balance of this article, I am going to climb back on my soapbox and talk about the very last chart in the Cattle Fax Outlook reprint. It deals with beef quality.

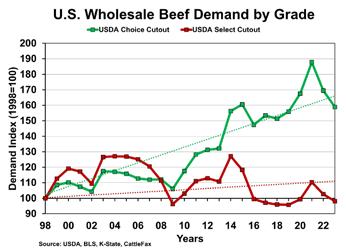

In a nutshell, the demand index for Select grade beef is the same as it was in 1998 while the demand index for Choice

beef has climbed 60%. Demand is not a simple metric. It factors in supply and price dynamics over time. Economists like to torture the concept with lots of math, but I know good demand when I see it. When you can sell more of something for a higher price, you have good demand. If you add 25 bulls to your bull sale every year, and the average price continues to increase – congratulations, you have growing demand (probably because of quality). That is exactly what has happened with Choice-or-better beef. We continue to produce more and more of it and the price continues to move higher. Compare this to Select grade beef. The industry is producing less and less of it, and the price – relative to Choice – keeps falling.

I am no expert on retail beef marketing, but I am a shopper and I can observe what’s right in front of me. Once a retail grocer upgrades to Choice beef, they aggressively promote it in their marketing campaigns. At that point, they are committed. They’re not going to switch back to Select beef just because it’s cheaper. I’m old enough to remember when WalMart went “all Choice”. It was a big deal. All the chatter in the industry focused on whether WalMart would squeeze the supply of Choice beef and drive the price higher. I don’t see that as a problem. Do you?

What does this mean for Brangus? It means a lot. With Brangus, we can produce Choice or better beef while running cows that are productive in harsh environments, and “harsh” environments in the U.S. comprise half the country and more

than half of the cowherd. Moreover, there is absolutely ZERO evidence that selection for marbling has a negative effect on any trait related to maternal productivity or growth efficiency.

I remember vividly when selection for marbling was gaining steam in the Angus world. Breeders who didn’t have it (and not all Angus do) were quick to theorize that high marbling cattle had all kinds of other problems – rail-gutted, hard-doing, bad-footed, etc. I’ve heard it all, and it was all nonsense. I’ve challenged people to show me the data that high marbling cattle have any of these so-called problems and I’ve never seen it. I have seen plenty of data showing that you can increase marbling and not suffer any detrimental effects on any other traits.

Marbling has moderate to moderate-plus heritability which means if you select for it, you’ll get it. Plenty of Brangus breeders routinely ultrasound their yearling bulls and heifers. As a result, the IBBA database continues to become richer in value. Less than one year ago, based on extensive deliberations by the Breed Improvement Committee, we re-grouped ET calves into yearling contemporary groups. This single move dramatically increased the value of thousands of ultrasound records which previously were attached to animals in single-head contemporary groups and, therefore, of limited value in genetic evaluation. Now, we have actual marbling and other carcass data from the Brangus Value Project which will complement the ultrasound data and provide further confidence that when you select for more marbling, you’ll get it.

Please don’t come away from this soapbox epistle thinking that I am advocating for single trait selection –with full emphasis on marbling. That is absolutely not the case. I loathe singletrait selection. It is always a mistake. Profitable cattle are multi-dimensional – without exception. With our powerful and growing database, topped off with nearly 50,000 genomically-enhanced animal records, it is more feasible than

ever to find genetics that cover all the bases including the critical trait of marbling.

Marbling is invisible. It is a “downstream” trait that doesn’t affect economics until a carcass is hanging in a packing plant, but the demand data for Choice vs. Select grade beef is so overwhelming that it cannot be ignored. It seems obvious that any breed hoping to still be relevant in 10 years must contribute to the uptrend in beef quality. Brangus is doing just that, and we have the data to prove it. This puts Brangus in the driver’s seat as the Breed of Choice to Produce Choice Beef in Harsh Environments. Maybe that should be our slogan. GO BRANGUS.

Australian Brangus breeders recently had several opportunities for learning and networking -- from the Cattle Industry Convention and NCBA Tradeshow as well as from visiting Tuna Rosa Ranch and Grahman Land & Cattle. How did these experiences stack up to expectations? What were the differences seen between the U.S. systems versus Australia’s practices? But most of all, how do we grow these initial meetings into productive relationships?

Beef Australia’s mission is to promote and advance a sustainable Australian beef community. With this commitment in mind, Beef Australia developed International Study Tours to send groups of Aussies to different regions of the globe, including: Southeast U.S., France, South America, and South Africa. These tours offer experience attending international cattle conferences, exploring farms and ranches, meeting with international leaders, networking amongst fellow cattle raisers, and advancing their careers.

The Southeast U.S., particularly Louisiana and Texas, was chosen to host a group of 25 Australian guests leading up

to and following the Cattle Industry Convention & NCBA Tradeshow. IBBA participates each year at NCBA and was more than happy to welcome our friends from “down under” to the convention. Everyone was able to enjoy great food and conversations while ‘Getting Jazzed’ at CattleCon23. It was fascinating to learn the depth of knowledge our fellow breeders had on UltraBlacks and UltraReds. In Australia, UB1s and UR1s are very well known and becoming a popular trend. Our guests also had a sophisticated knowledge of cattle and genetics along with best management practices. The outreach to Beef Australia offered a touring opportunity to fellow Brangus breeder, Jimmy Elliott, of Tuna Rosa Ranch in Gonzales, TX. Elliott is an active member on the IBBA’s International Committee and has previously hosted international guests from a variety of countries. “They were a very highly educated mix of Australian producers, from small to large relative to their [Australian] operations,” Elliott said. “They were a very inquisitive group with a high level of knowledge of genetics and their importance.”

The Australian guests were intrigued by the beef cattle they viewed on their tours as well as the infrastructure at the U.S. facilities. The group expressed amazement at the quality and quantity of pens, chutes, and other cattle handling features with which ranches and feedyards were equipped. Not only did they note the differences in facilities, but also the differences in scale and the ratio to labor. Our Australian guests had operations that ranged from 200 cows to 40,000 cows across 3 million acres! Seeing some operations such as Tuna Rosa Ranch with three full-time employees brought

awe due to the number of head are managed with only three people. It was also discussed at the feedyard how 15,00030,000 head were fed twice a day by only three drivers. While touring Graham Land & Cattle, electronic identification (EID) became a big topic of interest. Compared to the U.S., Australia hosts the National Livestock Identification System (NLIS) database. This is a mandatory reporting system in Australia to ensure traceability, which is necessary due to the isolation the island has from other regions of the world. There are many benefits for cattle producers to improve herd productivity and profitability by recording the individual performance of all animals. NLIS puts all aspects of the industry on the same platform to make the best management decisions

and allows one to know everything about an animal from birth to the rail with just an EID. This also allows Australia to compete in the European Union where an assurance program for lifetime management practices is required.

Beef Australia and the IBBA International Committee welcome you to join in the festivities in Rockhampton (Australia), May 5-11, 2024. This is a unique Beef meet in which the entire beef industry from Australia attends to showcase their genetics as well as host guests from around the world. Hotels fill up months in advance, so do not delay if you are interested! Feel free to contact Macee Prause at mprause@gobrangus.com for any questions related to this trip or international connections. Cheers!

I am frequently asked about certain EPDs that some breeds publish but we don’t. Why do some breeds publish EPDs for docility, foot angle and heel depth –for instance -- but we don’t?

We can compute an EPD for any trait that has these three components: 1) It is heritable; 2) It is measurable, and; 3) There is variation in the expression of the trait. The obvious fourth criterion is that we have data.

I have had numerous discussions with breeders about developing EPDs for traits such as docility or temperament. People often wonder how it is possible to create an EPD when the method of measurement is subjective. Stated differently, if the measurement is in the “eye of the beholder”, how is it possible to develop a reliable EPD?

Docility is a good example, so we’ll focus on that trait. Several different “scorecards” have been developed to score the behavior of animals when they are confined. When cattle are processed through a chute, for instance, they display variable behaviors. Some are very nervous and easily excitable. They usually hit the headcatch at a faster pace and they exit the chute at a faster pace. While in the chute, they fight and squirm against the pressure. Even though any type of score in this case will be “in the eye of the beholder”, it is very feasible to develop a scorecard, collect the data, and eventually convert it to an EPD.

Two different people standing side-by-side at the same chute while cattle are being worked may score cattle differently using the very same scorecard and scoring the very same cattle. That alone will not compromise the data. Using a standard 1-9 scorecard, with 9 being

wild-and-crazy and 1 being old-dog- docile, I may score most cattle using a range from 4-8 and you may score the same cattle using a range of 2-6. This does not mean that one of us is right and the other is wrong. As long as we each score the most excitable cattle higher and the more docile cattle lower, both of us could turn in viable data to feed into a genetic evaluation and subsequent computation of an EPD for docility.

Given identical genetics, managed under two different environments/managements, one group may be calm and quiet and the other group flighty and rank – same genetics. It depends on how they’re handled and is significantly influenced by the quality and design of working facilities. But again, even within the calm ones, there will be some that are more excitable than others, and among the wild ones some will be less excitable. There will be variation and the variation is what matters. Assuming the trait is heritable – and it is – certain sire lines or families would prove out to be calmer (or less calm) than other families or sire lines across a variety of environments. This forms the basis of an EPD for docility.

To repeat a point made earlier, developing EPDs for such traits as docility requires commitment from a good number of members to collect and submit good data. Over a relatively short period of time, a reliable EPD could be developed. In the meantime, good breeders will continue to cull cattle with nasty disposition and will tend to favor those with calmer attitudes with or without an EPD for the trait. Having an EPD simply provides one more tool and many would use the tool to avoid the wild ones in the first place.

February 2023

Cyclically tighter cattle numbers translated into the highest cattle prices in 2022 in years. As reduced cattle numbers and beef production continue to unfold, prices and profitability will again favor cattle producers in 2023.

The cattle industry is entering 2023 with the smallest cattle supply since 2015 as drought caused the industry to dig deeper into the supply of feeder cattle and calves. Now the reality of reduced supply of cattle and beef will continue to push prices higher for all classes of cattle. Economic uncertainty remains high and recessionary challenges will be front and center. However, the quality, consistency and safety of U.S. beef will buffer demand headwinds and that, along with some cost relief, will help keep domestic and global consumers active.

While the exact path to drought relief is unknown, improvements are also expected to translate to moderating feed costs, especially into the second half of 2023. Combined with increased cattle prices, cattle producers, especially the cow-calf operator, will continue to see an improvement to margins for the next several years. This much-needed improvement to profitability at the cow-calf level will be vital to ensuring the long-term health of the cattle and beef industry.

The latest forecast for La Niña has only a 14 percent probability of existence this spring and down further by the summer, which means a pattern change comes our way this year. But what will take La Niña’s place? A neutral phase, which means neither La Niña nor El Niño controls the pattern.

That neutral phase may last a several months before giving El Niño a chance to grow this summer and into the fall. How long this process takes is yet to be seen, but it will likely be drawn out, perhaps longer than the current forecast accounts for.

Why is this important? The Pacific Ocean from South America toward Southeast Asia will fluctuate between colder and warmer than normal waters. This impacts how storms develop over this region, changing the global weather pattern. When cooler than average, the ocean is in La Niña, which promotes drought in North America. If that ocean is warm, called El Niño, it promotes storminess for much of the U.S.

Putting this latest La Niña episode in the rearview mirror suggests improving drought conditions, more favorable growing seasons, and healthier soils. Note: I’m not trying to imply that doing away with La Niña fixes everything. Considering an El Niño pattern can cause drought across the northern states, there is no win-win for everyone in any weather pattern.

How might the second half of the year look in terms of precipitation? Here is a comparison between those two most likely patterns (either Neutral or El Niño) for the summer and the fall. As of this briefing, probabilities for an El Niño pattern next fall appear slightly ahead of those odds for a neutral pattern. Sponsored

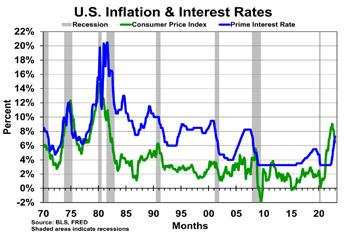

• Inflation reached a 40-year high in 2022 but ended the year with six straight months of slowing rates with December coming in at 6.5 percent CPI growth.

• To combat inflation, the U.S. Federal Reserve raised interest rates 7 times through 2022 and has indicated plans for further rate increases until inflation falls. Interest rates were cut at the start of the pandemic, beginning 2022 at zero and finishing the year at 4.25 to 4.5 percent.

• U.S. unemployment rates finished 2022 relatively low at about 3.7 percent. Increased interest rates and a slowing U.S. economy has 2023 unemployment projected to be higher.

• Though the Fed hopes to accomplish a “soft landing” and avoid recession, the U.S. economy is expected to slow in 2023 with most economists calling for a mild recession in the second half of the year.

• Average crude oil prices in 2022 were 39 percent higher than 2021, though prices weakened to end the year. Average prices in 2023 are forecast to be about steady, but wide ranges and volatility are expected.

• The Russia–Ukraine war has strengthened energy export demand, creating a historically tight supply for oil and natural gas reserves in the U.S. as demand has outpaced production.

• Global petroleum production will see limited growth in 2023 while global usage is expected to be above pre-pandemic levels, creating an overall tighter supply deeper into the year.

• China’s economic growth and consumption will be a large factor for petroleum consumption and demand through the year. Reopening will need to be monitored after lockdown policies have repressed demand since the start of the pandemic.

• WTI crude oil is expected to average $96/barrel with a forecasted range between $74 and $120/barrel in the next year.

• The USDA Annual Crop Production report estimated 2022 corn planted acres at 88.6 million acres with 89.4 percent of acres harvested. Corn yield down about 2 percent at 173.3 bushels per acre, placing production 9 percent lower at 13.7 billion bushels.

• Exports are expected to decline in 2023 with a tight domestic supply and increased competition from other countries, including Brazil, who is expected to double exports due to massive corn production.

• Current corn stocks-to-use just under 9 percent will continue to support the market above $6.00/bu. and provide resistance near $7.50/bu. into the summer with a yearly average price of $6.50/bu. expected.

• Expected growth in acres and improved yield should allow stocks-to-use to recover in the new crop year. Stocks to use have the potential to be above 11 percent. This increased supply would imply a lower price range of $5.25 to $6.50 throughout the second half of 2023, though disruptions in production are still a large risk.

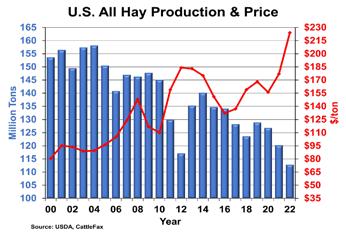

• National Dec. 1 on-farm hay stocks were down 9 percent from year-ago at 71.9 million tons. 2022 was the smallest U.S. production since 1959.

• All-hay prices averaged near $216/ton in 2022, and 2023 average prices should be steady to higher in the first half of the year with continued drought in key grazing areas.

• Improvements in pasture conditions as early as this spring should help stabilize and soften hay prices throughout 2023.

• U.S. cattle inventories have already fallen 1.5 million head from cycle highs. The 2023 beef cow herd is expected to be down about another million head to near 29.2 million.

• Drought affected nearly half of the beef cow herd over the last year, exacerbating the liquidation in 2022. Drought improvement and higher cattle prices should drastically slow beef cow culling through 2023.

• Cow and bull slaughter is forecast to be 6.9 million, which is down about 700,000 head.

• Feeder cattle and calf supplies outside of feedyards will be 400,000 to 450,000 head smaller than 2022 at 25.1 million head.

• After being full for most of the past 3 years, cattle on feed inventories are expected to begin 2023 300,000 to 400,000 head below year-ago, at 14.3 million head, and remain smaller.

• Commercial fed slaughter in 2023 is forecast to decline by 750,000 to 800,000 to 25.6 million head.

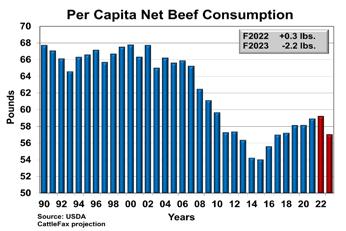

• With drought forced placement and culling, beef production was record large in 2022 at 28.3 billion pounds. Expect production to drop over the next several years – declining 4 to 5 percent in 2023 to 27.0 billion pounds.

• The decline in production in 2023 will lead to a 2.2-pound decline in net beef supply to 57 pounds per person.

• Beef prices have already moved into a higher trading range in the last few years. While prices should be supported above $7.00, additional increases will be limited as inflationary pressures restrict consumer spending.

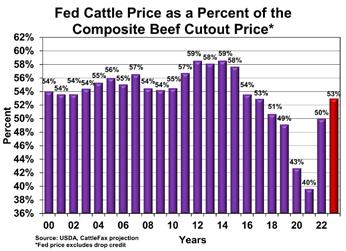

• Margin realignment will continue across the industry and pass the higher retail beef prices downstream to processors and cattle producers.

• Inflation, rising interest rates and general economic uncertainty will continue to impact consumer purchasing decisions as many look to limit spending.

• Despite these challenges, a tight labor market and low unemployment should remain supportive to consumer incomes and spending power in 2023.

• Wholesale demand will likely pullback in the coming year with such a tight supply, but the cutout should move higher to average $270/cwt compared to a $260 average in 2022.

• Premiums for higher quality beef were record large in 2022 and are expected to remain large in 2023 as consumers continue to show willingness to pay for Choice grade or better beef.

• Demand for proteins has continued to grow around the world and tighter global protein supplies should broadly support prices in 2023.

• After more than 20 percent of growth across the last 2 years, U.S. beef exports are expected to moderate, declining 3 percent in 2023 to 3.5 billion pounds.

• Japan and South Korea remain the top U.S. beef export destinations with stable exports in 2022. Meanwhile, Chinese demand has continued to grow with tonnage up about 20 percent last year, likely with continued room to grow.

• Pork exports declined by more than 10 percent in 2022 while imports were up by almost 15 percent as a smaller U.S. hog herd limited production. This year should see pork exports up 2 to 3 percent and imports stable.

• Expected growth in poultry production and continued global demand to support increased poultry exports in 2023, forecast to be 2 percent higher.

• All-Fresh Retail: $7.35/lb., up $0.04 - Though beef demand has softened as prices have not kept pace with inflation, consumers have shown willingness to continue to buy beef in a new and higher range. The 2023 USDA All-Fresh Retail Beef price is expected to range between $7.15 to $7.55/lb.

• Composite Cutout: $270/cwt, up $10 - Significantly tighter supply will support prices at and above 2022 levels, which averaged $260/cwt. Though demand will be softer the cutout should average about $10 higher and trade in a practical range of $260 to $300/cwt.

• Fed Steer: $158/cwt, up $14 - The fed cattle market averaged $144/cwt in 2022 with a general uptrend as cattle feeders regained leverage through the year. Tighter supply should continue to push 2023 prices generally higher while following in a seasonal pattern, trading in a range of $150 to $172/cwt.

• 800-lb. Steer: $200/cwt, up $29 - Stronger fed cattle values and smaller calf crops over the last four years should support feeder cattle prices at higher levels this year, after averaging $166 through 2022. Expect a 2023 U.S. average 800-pound steer to trade in a range from $180 to $215/cwt.

• 550-lb. Steer: $225/cwt, up $30 - A smaller calf supply supported prices in 2022 for a $195/cwt average. Aggressive, drought-force cowherd liquidation will further reduce future calf crops. U.S. average 550-pound steer values should increase $29/cwt. on average next year and range from $200 to $245.

• Utility Cows: $100/cwt, up $20 - Strong lean beef trimmings demand and a lower culling rate expected should support cow prices. After averaging $80/cwt in 2022, values should be $20 higher in 2023, with a range from $75 to $115.

• Bred Cows: $2,100/hd., up $300 - Herd contraction and calf values have pressured bred female values the past several years. The 2022 price was estimated at $1800/head and on average, values should improve in 2023 by about $300 – trading from $1,900 to $2,300 for load lots of quality, running-age cows.

• Demand for Quality – Though overall demand softened, consumers clearly have developed a stronger demand for high quality beef, as 2022 saw record premiums for Prime, Certified Angus Beef and other high end products. This is expected to continue, especially with a tightening supply.

• Trade – U.S. beef exports have trended higher the last few years but with tighter U.S. production are expected to decline in volume in 2023. Tighter global protein supplies should continue to support U.S. red meat and poultry values in 2023.

• Tighter supply – With drought forced placements and record large culling rates, 2022 finished with record beef production. The smaller cowherd and years of smaller calf crops means supply will tighten significantly in 2023 and beyond.

• Cattle Margins – Drought and a large fed supply has limited margin gains up to this point in all sectors, but improvements in the weather pattern and a tighter supply should distribute more money through all sectors of the cattle industry.

by

by

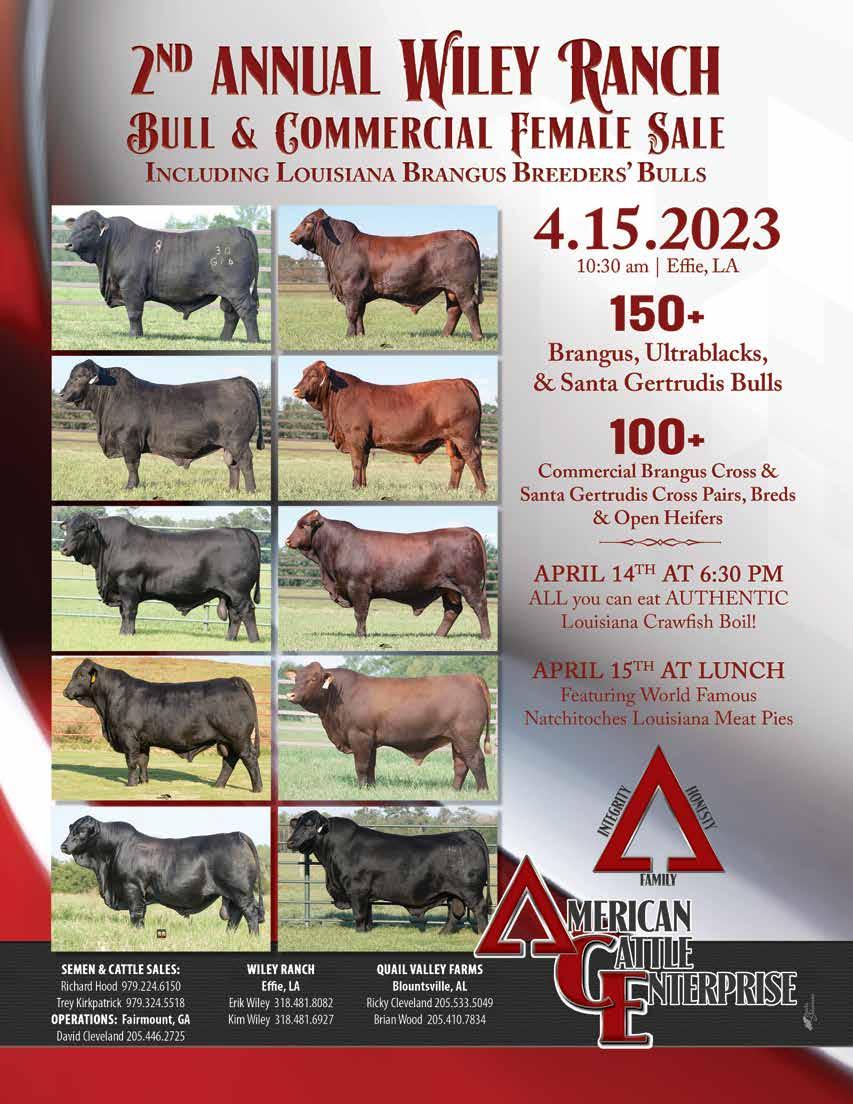

Hard to believe it is now March! Spring sale season will soon be upon us but life on the road is always busy. In the time since my last field update, I have visited with cattlemen from Louisiana to the rolling hills of northcentral Missouri, attended the largest cattle convention in the world, and helped put on a national Brangus show.

Also, I have been getting my feet wet visiting ranches and learning more about the unique challenges they face in a variety of environments. My first stop was the Louisiana Cattlemen’s Association Convention in Alexandria, LA. Wiley Ranch was generous enough to host a tour of their ranch in Effie, where Mr. Kim Wiley, Erik Wiley, Richard Hood, and myself all had the opportunity to speak about the benefits Brangus brings to the table, and IBBA initiatives such as the Brangus Value Project. The story I told of meeting the demand of high quality beef from cattle capable of thriving in harsh environments was echoed time and again by other speakers from CattleFax and prominent cattle marketers in the area. My next stop was right down the road from the house, The Branch Ranch. Manager Chris Koffskey was kind enough to

give me a tour of their North location in Mansfield and of their development center in Natchitoches. Afterwards, I prepared to make the trip to Milan, MO to meet with a potential Brangus Value Project cooperator. Along the way, I had the privilege of touring Schmidt Farms with Dr. Randy Schmidt and his manager Mr. Garrett Hinds, before moving north, stopping for the night in Joplin, MO, to narrowly miss a snowstorm. I spent the next day visiting with Cody Gariss at the GenePlus office in Lamar and continued pushing on to Kansas City just as the northern front of the earlier snowstorm was blowing in. Upon arriving in Milan, I had a fantastic visit with Jordan Deterding, manager for Adrian Farms, and his crew. They run a variety of different breeds of commercial cattle such as SimAngus, Gelbvieh, and Red Angus. While a sizable portion of northern Missouri is mostly flat, this area is “prime cow country” with rolling hills as far as the eye could see. Although there was about a foot and a half of snow on the ground at the time, Jordan spoke about the abundance of fescue that grows on much of their land, as well as how warm their summer season is with temperatures routinely reaching the mid-90’s. He is interested in what the Brangus Value Project had to offer and how Brangus-influenced calves would stack up to the composites he

is currently running. I have no doubt that introducing Brangus genetics will have a positive impact on their operation, and will help increase the overall presence of Brangus in that part of the world.

The next week, the IBBA crew travelled down to New Orleans for the annual NCBA Convention and Tradeshow. Due to the inclement weather in Texas attendance seemed to be slightly lower than expected, but the Brangus booth was busy to say the least! I had the opportunity to visit with many members who were able to make it, some familiar faces, others I met for the first time, and some attendees who knew nothing about the Brangus breed and the benefits we have to offer. At one point, I had to run back to my hotel room because I had given out all my business cards to people looking to find Brangus sales in their area. I always welcome the opportunity to

speak to producers from across the country to learn about their unique challenges and how Brangus could serve as a solution, and the NCBA Convention was a great place to do it.

My last stop for the month included assisting IBBA Show Director, Lori Edwards-Dunkerly, put on the Open Brangus Show at the Florida State Fair. This was my first show to attend with IBBA and was a wonderful experience getting to be a part of the behind-the-scenes work that goes on to make these shows run smoothly. The warm greetings I received from exhibitors and parents alike was a reminder of my own time in the showring and the profound impact it had on me growing up.

Next week, I will be making another trip out to Florida to visit the good folks at Fenco Farms and Phillips Ranch, working my way north to L.G. Herndon Jr. Farms, and ending the week at Hunt’s H+ Bull and Commercial Female Sale in Calhoun, GA. This will be my first round of producer visits in that neck of the woods, and I look forward to learning more about their respective operations and how I can help them in my capacity with IBBA.

Coming up, the Houston Livestock Show is quickly approaching, as well as the start of the spring sale season! I greatly look forward to seeing everyone during what will undoubtedly be a busy and successful spring. GO BRANGUS!

Have you ever thought about the impact exporting United States bovine genetics has on breeders in other countries? Cattle breeders from across the globe seek U.S. genetics due to the traits found in the United States.

Considering the country’s environmental impact, the adaptability of the breed plays a huge role in properly exporting the genetics. Exports improve the genetic diversity in other countries as well as provide the U.S. with additional avenues to market their animals.

Knowing what importers from other countries are looking for is important. Key factors may include milking ability, feet and leg structure for sound movement, reproduction advancements, and EPD numbers.

Macee Prause with the International Brangus Breeders Association said “All Brangus breeders who participate in the exportation of Brangus genetics are benefiting the growth of the market for Brangus, bringing awareness to the breed, and supporting our fellow Brangus breeders across the world through genetic improvement.”

Brangus breeders and Brangus commercial operators leading the industry have much to say regarding the exportation of U.S. genetics to other countries.

What are your thoughts on cattle breeders in the United States exporting bull semen & genetics to other countries? Please explain exporting U.S. genetics in your own words.

Allen Goode with Trio Cattle & Genetics says that the global beef industry is a highly integrated value chain that ends with a high-quality product that is desired by consumers of all countries.

“The U.S. has long been the leader in the development of beef genetics that can be produced for a wide range of production environments, yet all still resulting in the high quality that consumers want,” Goode said. “For this reason, American seedstock breeders have been, and must continue to strive to be, the source for cutting-edge genetics to the beef world.”

Joy Reznicek, who formerly owned Cow Creek Ranch and now operates Town Creek Farm, says she remembers 20 years ago when the ranch made an intentional decision to go after the export market.

“Our thought was that exporting genetics didn’t require us to buy more land or expand our cowherd. We could use our existing resources and genetic base and create an additional

revenue stream without increasing resources,” Reznicek explained. “While that decision seems very logical, our next step was to market our program and genetics.” Past exportation successes for Reznicek include embryo packages and semen sent to Australia and South America in addition to a live breeding bull to Thailand.

Buck Thomason with Indian Hills Ranch is adamant about raising his Brangus cattle in a stable and ever-growing environment. He believes exporting genetics provides an opportunity for your operation to be recognized and the opportunity to see your cattle in different environments. “Our exports have been both semen and embryos and this gives a really good look at our breeding program in other environments and under different management practices,” Thomason explained. “We know how our cattle will perform in our environment and under our management practices, but we can learn from seeing them in other areas of the world.”

How does exporting semen/genetics to other countries impact the Brangus breed itself?

Goode commented that you realize how similar the Brangus World is when one considers why Brangus were developed.

“The Brangus World consists of the tropical and temperate climates of the globe that need a breed that can adapt and produce a high-quality beef product. As Brangus breeders around the world work to improve their cattle and national herds, the sources for cutting-edge genetics are rather limited by national borders and regulations. However, U.S. breeders, by virtue of our national production protocols and systems, are a clear leader for the newest sires and donors,” Goode explained.

Additionally, he added that for U.S. Brangus breeders, the opportunity to share, provide, and export genetics is an opportunity to positively impact our breed’s position in the global beef industry. “For U.S. Brangus breeders who choose to participate in the global genetics trade, it is an added source of revenue for their operation and an opportunity to build their brand and has added proof of the merit of their genetics,” Goode said.

How has your operation grown economically (or possibly not grown) from exporting semen?

Goode stated that marketing and exporting semen and embryos to an international clientele is a business investment

that should be profitable. “For us, interest for our cattle began and has grown globally; it has become the primary economic driver of our operation,” Goode said.

Have you seen, firsthand, your genetics being used in other countries? If so, can you explain the genetic outcome?

“Cattle breeders all have inherent pride in their herds and brands. When another breeder expresses interest in your cattle,” Goode explained, “they buy from you, and then they have success; it provides tremendous personal satisfaction.” Imagine the immense feeling of taking your operation’s genetics to an international level and the satisfaction of seeing your own genetics on display in herds and in livestock exhibitions around the world. “In-person or in show reports and pictures, it has been gratifying to see the positive impact our genetics have had from South Africa to Australia, Mexico to Argentina, and all countries in between,” Goode reminisced.

Thomason has seen his genetics in several countries, including Columbia, Mexico, Argentina, Paraguay, Brazil, and Australia.

“We have seen how our genetics have been able to benefit other herds in all these countries,” Thomason said. "The pride of seeing your own genetics in other countries is not only a reflection on one’s operation but also, on the breed itself. "

Do you have to have a certification to export genetics to other countries? If so, what is it called & how do you obtain it?

Thomason said there are steps that must be taken to export semen and embryos. “The bull must be collected in a USDAapproved facility and must have a test run by an approved vet,” Thomason explained. “They must be isolated depending upon the criteria for each country.”

Goode mentioned how there is no certification at the ranch level allowing exportation to other countries. Overall, it takes many parties to qualify an animal and its genetics for export. “A breeder needs to associate themselves with semen and embryo collection facilities that properly collect and prepare the genetic product,” Goode said. “It is also vital to have good relationships with export agents who can assist you in navigating the export protocols and logistics.” The business of exporting can be rewarding and profitable, however, it requires focus and dedication.

What is the process of exporting genetics? Any safety protocols, or isolation once exported to the other country?

Depending on the other country’s criteria for importing foreign genetics from the U.S., other tests might be required. Due to some historical reasons, biosecurity, and safety concerns, it can be very specific. The country that the genetics are being exported to might require specific credentials, certificates, and other documentation. “If it is embryo transfers, the donor might have to be tested a certain number of days before getting flushed,” Goode stated. “They might have to be quarantined as well.”

The primary steps needed for the exportation of embryos that are taken chute side include tedious disinfection of the chute 10-15 minutes prior to each IVF procedure for EACH individual animal, blood samples for each animal for lab testing, and an anal swab to identify potential hazards that may be associated with the importation of embryos.

When exporting semen, some countries like Australia and Argentina require what is known as residency status. Bulls

are to be housed for 90 days, other countries require a CSS (Certified Semen Services).

Dr. Darrell Wilkes, Executive Vice President of the International Brangus Breeders Association, discussed the intent behind the Global Brangus Genetic Evaluation and the impact it would bring to exportation.

“IBBA is attempting to develop a Global Genetic Evaluation. The evaluation would incorporate the data on registered Brangus cattle from other participating countries, resulting in an apples-to-apples comparison of Brangus cattle across borders and oceans. This would allow a breeder in South Africa, for example, or South Carolina, to search the population for animals that best meet their breeding objectives irrespective of where in the world the animals are located. It would have the effect of dramatically increasing international trade in semen, embryos and potentially live animals. We believe that Brangus breeders in North America would enjoy enhanced demand for their genetics because of the decades of data collection and the significant investment that IBBA members have made in genomic testing.”

We are investing in your next calf crop by investing in

Everyone knows the value of a Brangus cow. The Brangus Value Project tests the value of Brangus steers.

Ninety research steers sired by five widely-used Brangus and Ultrablack sires were fed and harvested in southwest Kansas in the winter/spring of 2022.

Performance was compared against a southwest KS benchmark of same-weight steers placed on feed at the same time.

The steers were sold on a carcass merit grid.

The results didn’t surprise us because we look at Brangus data every day. But, some people may not realize what modern Brangus and Ultrablack cattle can do beyond the ranch gate.

There’s No Payday Without Payweight!

Steers finished at 1449lbs and yielded well to produce average carcass weight of 936lbs.

When sold on a carcass merit grid, they netted $64/head premium over the prevailing live price.

On 700lbs of feedlot gain, they gained 3.94lbs/day compared to southwest KS benchmark steers at 3.16. They converted feed 1/2lb per pound of gain better than the benchmark, netting $52/head in feed savings.

On 700lbs of feedlot gain, they gained 3.94lbs/day compared to southwest KS benchmark steers at 3.16. They converted feed 1/2lb per pound of gain better than the benchmark, netting $52/head in feed savings.

The Brangus Value Project is on-going and we will continue to invest in it.

Round 1

The Brangus Value Project is on-going and we will continue to invest in it.

Tested 5 sires. Data is on the books.

91% graded Choice or Prime, with over 50% grading Premium Choice or better. When tested for tenderness at a university lab, 95% tested Very Tender or Tender, with the vast majority Very Tender.

Round 1

Tested 5 sires. Data is on the books.

Round 2 7 sires represented. Steers are on feed. R

Round 2 7 sires represented. Steers are on feed.

The Brangus Value Project is a highly structured birth-to-beef progeny test managed by IBBA and funded by breeders like us who invest through the International Brangus Breeders Foundation.

The Brangus Value Project is a highly structured birth-to-beef progeny test managed by IBBA and funded by breeders like us who invest through the International Brangus Breeders Foundation.

91% graded Choice or Prime, with over 50% tested for tenderness at a university lab, 95% tested Very Tender or Tender, with the vast l

Randomizied mating of commercial cows and whole-life structured contemporary grouping results in very high quality data that flows into the genetic evaluation of Brangus.

Randomizied mating of commercial cows and whole-life structured contemporary grouping results in very high quality data that flows into the genetic evaluation of Brangus.

Round 3 6 sires represented. Calves on the ground.

RRound 3 6 sires represented. Calves on the ground.

PRound 4

Round 4

Selecting Sires, About to AI 800-1000 cows.

Selecting Sires, About to AI 800-1000 cows.

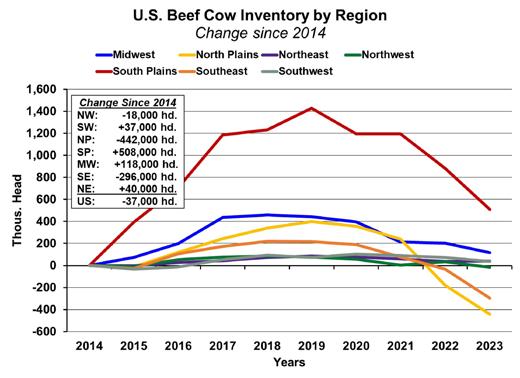

After the recent Cattle Inventory Report, it remains evident that the U.S. beef cowherd remains in liquidation and will continue to do so for at least the next couple of years. The January 2023 beef cow inventory of 28.9 million head, is the smallest since 1962. The beef replacement heifer inventory at 5.16 million head is the smallest since 2011 and has seen two consecutive years of reductions of over 300,000 head in 2022 and 2023. The beef replacement heifers expected to calve data only goes back to 2001 but is the second smallest number in the series to 2011 by only 4,700 head, totaling 3.17 million. This data continues to suggest the producing cowherd is expected to remain modest for the next couple of years, with zero data indicating expansion is even close to beginning.

The inevitable conversations about drought and when it will end lead to the next conversation of when and where will the cowherd expand? Expansion will occur when conditions allow, and producers see profit potential. The accompanying chart illustrates where the largest liquidation has occurred since the cycle peak in cow numbers

in 2019. It is measuring back to 2014 when the last herd expansion began. The South Plains cow numbers remain above where they were in 2014 but are nearly 900,000 head below the peak. The North Plains and Southeast numbers are well below 2014 levels. These three regions are where the most expansion is available to occur, as the other regions have tended to be flatter regarding inventory fluctuations. Still, the U.S. beef cow inventory is 37,000 head below the last cycle low.

After the modest herd reduction in 2020 it was setting up to be a better and more profitable year for cow-calf producers, with the potential for returns over cash costs likely exceeding $125/head. Certainly not a number that was going to set many up for retirement, but a more positive number nonetheless that would have provided about as good of a return over expenses since 2015. However, not only did the pandemic hit and set things back but so did drought. This was when herd liquidation started in mass and has continued until today. 2021 and 2022 saw increasing costs of production, inflation, higher interest rates, higher feed costs and a calf market that didn’t keep pace. Cow-calf producers have been in a very tight return over expenses environment since 2015.

Maintaining a longerrun focus, particularly for those with better than average cost considerations, cow-calf producers are the segment that stands to benefit the most over the next several years. When additional heifers are pulled out of the supply chain due to the ability to expand, that will only reinforce an already tight calf and feeder supply situation and add additional support to those markets.

So, when will it happen? It is not likely until 2026 to a large degree. Applying the math to the biological cycle indicates that if more replacement heifers are kept this fall and bred in 2024, they will calve in 2025 and will be counted as a cow in 2026. One additional reason it is likely that far out is because most cattlemen are conservative by nature and are particularly conservative coming out of a drought. Even if it does rain in 2023, a lot of them will want to see pastures and drinking water supplies recover before aggressively expanding. That doesn’t mean calf prices aren’t going to be significantly higher this year and in 2024, but price records will be broken when cowherd expansion begins.

Intensity of management will be important going forward, because among the many things the drought has done it has widened the gap between the most profitable and least profitable operations. Many industry research projects have shown that controlling cost is a bigger driver in profitability differences in the cow-calf industry than maximizing revenue. Both are obviously important, but you tend to have more control over costs. The present market signals are clear and increasingly insistent the herd needs to grow. How much will be driven by all the many variables in the marketplace regarding demand, exports, the economy, competing protein supplies, etc. But just as importantly as the expansion decisions, and to what degree to take advantage of higher market prices, is positioning your operation for the inevitable decline in prices after they peak.

It's important to remember just how quickly prices fell in two years from 2014 to 2016. 550-pound U.S. average steer prices in Q4 of 2014 averaged $280/cwt.

In Q4 of 2016 they averaged $137/cwt. A massive shift of $786/head, less than half their value just two years prior.

As in past cycles, there will be plenty of lower quality heifers kept back and bred as replacements. Maintain your focus on quality. Your replacements will likely be in your herd for the next 8-10 years. When numbers increase and prices are deteriorating buyers can afford to be more selective. You want cattle that will sell at the top end of the range, particularly in a declining market environment. As the saying goes “It takes just as much feed and expense to feed a bad one as it does a good one.”

The data is clear, the U.S. is producing the highest quality beef in history and consumers have responded with their pocketbook in terms of being willing to pay for a higher quality product. Remember, beef demand was cut in half from 1980 to the demand lows in 1998 due to an inferior product that consumers pushed back on. Presently, beef demand is the best it has been in 30 years. Consumers are willing to pay for Prime and upper 2/3 Choice product. Having a desirable and high-quality calf crop throughout this cycle will pay dividends for cow-calf producers. The next several years are going to be exciting and profitable for the cow-calf segment. But looking forward with a quality product focus will be important. Good cattle always sell well in comparison to the averages.

January 11, 2023 | Oklahoma City, Oklahoma| Judge: Jeff Bedwell | Photography: Next Level Images

aCC JUnGle CaT 674J12

Allen Cattle Company, Crockett, tx

ms BroKen a harloW 841h4

Lazy 3 Cattle, Tomball, tx Circle T, Central Point, la Lone Star Ranch, Okeechobee, fl

sJCC hennesseY 804h8 Roxton Stone, Stanton, tx

CAT 674J12, Allen Cattle Company, Crockett, TX

Reserve Senior Heifer Calf Champion: MP MS MIDNIGHT STAR 804J38, MP Brangus, Waco, TX

Summer Champion Heifer: PP MISS MI

AMOR 915J9, Pack Ponderosa, Boyd, TX

Reserve Summer Champion Heifer: TCR

BELINDA 302J8, Railee Steele, Gainesville, TX

Yearling Champion Heifer: MP MISS SWEET

HONEY 150J9, GKB Cattle, Desdemona, TX

Dayton, TX

Red Senior Heifer Calf Champion: 59/J DREAM TIME'S T-N-T, Matthew Shipp, Aubrey, TX

Red Reserve Senior Heifer Calf Champion: TAJO MS ADELLA 204J9, Tajo Ranch, Waller, TX, KO’s Cattle Service, Waxahachie, TX

Red Summer Champion Heifer: MS MBJ JOY 225J2, MBJ Ranch, Wharton, TX

Red Reserve Summer Champion Heifer: CX MS

KWm miss anGelina

Kayden Mascheck, Eagle Lake, tx

Junior Heifer Calf Champion: KK MISS STARSTRUCK 924K5, GKB Cattle, Desdemona, TX

Reserve Junior Heifer Calf Champion: MC

PHOENIX 468K, Mill Creek Land and Cattle, Puryear, TN

Senior Heifer Calf Champion: ACC JUNGLE

Reserve Yearling Champion Heifer: GKB MISS

TANK 88J2, GKB Cattle, Desdemona, TX

Champion Senior Heifer: ACC HELEN

674H10, Briana Hicks, Danbury, TX

Red Junior Heifer Calf Champion: SJCC

KRISTAAL 72K3, Jade Stone, Stanton, TX

Red Reserve Junior Heifer Calf Champion: HCC

TURBOS TRINITY 702K, Hanson Cattle Co.,

LEGENDS DREAMAKER 23J6, Audrey Acord, Madisonville, TX

Red Yearling Champion Heifer: GKB MISS VELVET 204J8, GKB Cattle, Desdemona, TX

Red Reserve Yearling Champion Heifer: M&M 844/J, Payge Dupre, Kathleen, FL

Red Senior Champion Heifer: MS BROKEN A HARLOW 841H4, Lazy 3 Cattle, Tomball, TX, Circle T, Central Point, LA, Lone Star Ranch, Okeechobee, FL

Grand Champion BUll

6B John BoY 804J10

Eris Basey, Florence, Texas

reserve Champion BUll

mC FUll ranGe 628J

Mill Creek Land & Cattle, Puryear, tn

Red Senior Bull Calf Champion: GCC JEFE

GRANDE 225J1, Greenwood Cattle Company, Plantersville, TX

Red Summer Champion Bull: VILLA'S

VALENTINO 59J14, Villa Ranch, Brookshire, TX

Red Reserve Summer Champion Bull: MR MBJ

JHONY CASH 428J3, MBJ Ranch, Wharton, TX

Red Senior Champion Bull: BROKEN A GKB

VALDEZ 841H, GKB Cattle, Desdemona, TX

Red Reserve Senior Champion Bull: DOS XX'S DYNAMITE'S HERCULES, Dos XX’s Cattle Company, Washington, TX

Champion Produce of Dam: DDD MISS JANA 150B22, Allen Cattle Company, Crockett, TX

Champion Junior Get of Sire: DDD TANK

468E, GKB Cattle, Desdemona, TX

Champion Senior Get of Sire: DDD TANK 468E, GKB Cattle, Desdemona, TX

Champion Breeders Herd: GKB Cattle, Desdemona, TX

Grand Champion red BUll

BroKen a GKB valdeZ 841h

GKB Cattle, Desdemona, Texas

BUll divisions

Junior Bull Calf Champion: GKB TANK 390K9, GKB Cattle, Desdemona, TX

Reserve Junior Bull Calf Champion: SANKEYS

TEJAS 392K1, Sankeys 6N Ranch, Council Grove, KS

Senior Bull Calf Champion: ACC HIGH FIVE 674J15, Allen Cattle Company, Crockett, TX

Reserve Senior Bull Calf Champion: TCR

RENEGADE 302J13, Triple Crown Ranch, Angleton, TX

Summer Champion Bull: 6B JOHN BOY 804J10, Eris Basey, Florence, TX

reserve Champion red BUll dos XX's dYnamiTe's herCUles

Dos XX’s Cattle Company, Washington, tx

Reserve Summer Champion Bull: VCC-MBJ LASER 12J, MBJ Ranch, Wharton, TX

Yearling Champion Bull: MC FULL RANGE 628J, Mill Creek Land & Cattle, Puryear, TN

Reserve Yearling Champion Bull: MP MR MAGNUM 804J65, MP Brangus, Waco, TX

red BUll divisions

Red Junior Bull Calf Champion: TAJO NIGHT CAP 307K2, Tajo Ranch, Waller TX, KO’s Cattle Service, Waxahachie, TX

Red Reserve Junior Bull Calf Champion: IC JIMBO 61K, Irons Creek Ranch, Pattison, TX

Red Champion Produce of Dam: RED VELVET 204D, GKB Cattle, Desdemona, TX

Red Champion Junior Get of Sire: CX HOME RUN 135/P, Tajo Ranch, Waller, TX, KO’s Cattle Service, Waxahachie, TX

Red Champion Senior Get of Sire: TRIO'S MLS

CORTEZ 175C6, GKB Cattle, Desdemona, TX

Red Champion Breeders Herd: Tajo Ranch, Waller, TX, KO’s Cattle Service, Waxahachie, TX

Ultra Champion Junior Get of Sire: WC

UB FORTRESS 322F, Wyman Creek Cattle Company, Summersville, MO

Ultra Champion Senior Get of Sire: WC

UB FORTRESS 322F, Wyman Creek Cattle Company, Summersville, MO

Ultra Champion Breeders Herd: Wyman Creek Cattle Company, Summersville, MO

January 11, 2023 | Oklahoma City, Oklahoma| Judge: Jeff Bedwell | Photography: Next Level Images

Mabank, TX

Ultra Reserve Summer Champion Heifer: GKB

SQ AVEN 302J, Madelyn Eskew, Tarzan, TX

Ultra Yearling Champion Heifer: OCR PARTY

LINE 487J, Allen Cattle Company, Crockett, TX

Ultra Reserve Yearling Champion Heifer: MCC

MISS DIXIE 17J, Hanson Cattle Company, Dayton, TX

UlTra BUll divisions:

Grand Champion UlTra Female

GKB miss Bella 118J

GKB Cattle, Desdemona, tx

reserve Champion UlTra Female CT ms FinleY 108J2

Carlee Taylor, Lakeland, fl

Ultra Junior Bull Calf Champion: CT MR FORBES 108K2, Carlee Taylor, Lakeland, FL

Ultra Reserve Junior Bull Calf Champion: GKB UNMATCHED 390K11, GKB Cattle, Desdemona, TX

Ultra Senior Bull Calf Champion: CHAMP MR LIMITLESS 150J7, Champions Valley Brangus, Schulenburg, TX

Ultra Reserve Senior Bull Calf Champion: CHAMP MR UNDENIABLE 150J4, Champions Valley Brangus, Schulenburg, TX

Grand Champion UlTra BUll

mC ranGer 924h9

GKB Cattle, Desdemona, tx

UlTra Female divisions:

Ultra Junior Heifer Calf Champion: MNR MS SHAKIRA 617K2, Madilyn Nichols, Kathleen, FL

Ultra Reserve Junior Heifer Calf Champion: WC

MISS KARISMA 022K, Wyman Creek Cattle Company, Summersville, MO

reserve Champion UlTra BUll CT mr ForBes 108K2

Carlee Taylor, Lakeland, fl

Ultra Senior Heifer Calf Champion: GKB MISS BELLA 118J, GKB Cattle, Desdemona, TX

Ultra Reserve Senior Heifer Calf Champion: CT MS FINLEY 108J2, Carlee Taylor, Lakeland, FL

Ultra Summer Champion Heifer: MGS TRIO'S JABELLA 700J, TRIO Cattle and Genetics,

Ultra Summer Champion Bull: DIAMOND JV JOKER 23J, Cheyene Durheim, Spring, TX

Ultra Senior Champion Bull: MC RANGER 924H9, GKB Cattle, Desdemona, TX

January 10, 2023 | Oklahoma City, Oklahoma| Judge: Terri Barber | Photography: Next Level Images

Heifer Calf Champion: JP BORN IN THE STORM 895K, Jadyn Young, Wetumka, OK

Reserve Heifer Calf Champion: ACC KELSEA B 649K3, Cleavie Allen, Crockett, TX

Junior Heifer Champion: TCR BELINDA

302J8, Railee Steele, Gainesville, FL

Reserve Junior Heifer Champion: ACC JUNGLE CAT 674J12, Katherine Allen, Crockett, TX

Grand

TCr Belinda 302J8

Railee Steele, Gainesville, Florida

reserve

GT ms TanK 804J4

Eris Basey, Florence, Texas

Senior Heifer Champion: GT MS TANK 804J4, Eris Basey, Florence, TX

Reserve Senior Heifer Champion: GKB MISS ONE SOURCE 38J, Monty Eskew, Tarzan, TX

Red Heifer Calf Champion: SJCC KRISTAAL 72K3, Jade Stone, Stanton, TX

Red Reserve Heifer Calf Champion: GKB MISS RED VELVET 204K4, Monty Eskew, Tarzan, TX

Red Junior Heifer Champion: VILLAS MS DAZE 23J11, April Villarreal, Brookshire, TX

Red Reserve Junior Heifer Champion: 59/J

ms daZe 23J11

April Villarreal, Brookshire, Texas

844/J

Payge Dupre, Kathleen, Florida

DREAM TIME'S T-N-T, Kenna Smith, Aubrey, TX

Red Senior Heifer Champion: M&M 844/J, Payge Dupre, Kathleen, FL

Red Reserve Senior Heifer Champion: KTS MS VALENTINE 135J1, Cheyene Durheim, Spring, TX

Ultra Heifer Calf Champion: TT MS PENNY 121K, Truman Taylor, Lakeland, FL

Ultra Reserve Heifer Calf Champion: WC MISS KATNISS 556K, Michael Pritchard, McLoud, OK

GKB sQ aven 302J

Madelyn Eskew, Tarzan, Texas

reserve

mCC miss diXie 17J

Payton Hanson, Dayton, Texas

Ultra Junior Heifer Champion: GKB SQ AVEN 302J, Madelyn Eskew, Tarzan, TX

Ultra Reserve Junior Heifer Champion: MGS TRIO'S JABELLA 700J, Corbyn Whittall, Mabank, TX

Ultra Senior Heifer Champion: MCC MISS DIXIE 17J, Payton Hanson, Dayton, TX

Ultra Reserve Senior Heifer Champion: AG MS WRANGLER, Wyatt Jackson, Gentry, AR

Champion Female Grand Champion red Female villas Champion Female reserve Champion red Female m&m Grand Champion UlTra Female

JOHN MILAM, OWNER Grady Green, Ranch Manager 870-314-3673 | grady@dragginmranch.com El Dorado, Arkansas www.dragginm.com 2020 IBBA Top ET Breeder

ABOUT THE BRANGUS JOURNAL The International Brangus Breeders Association (IBBA) is proud to offer its members and industry affiliates the opportunity to promote themselves through Brangus Publications, Inc.’s (BPI) print and digital mediums. IBBA’s printed publications are produced by BPI and are distributed to a mailing list, comprised of addresses in Australia, Colombia, Costa Rica, Mexico, Philippines, Thailand, and the United States; with a circulation of approximately 2,000.

The Brangus Journal (ISSN 0006-9132) is published by Brangus Publications, Inc. (BPI), 8870 US Highway 87 East, San Antonio, Texas 78263, monthly except February, June, July, and September. Periodicals postage paid at San Antonio, Texas and additional mailing offices. POSTMASTER: send address change to Brangus Publications Inc., P.O. Box 809, Adkins, Texas 78101.

The Brangus Journal is the official publication of the International Brangus® Breeders Association (IBBA). The Brangus Journal is published eight times annually. The purpose of the Brangus Journal is to serve the best interest of IBBA members by showcasing breeding programs, efforts, and achievements to other Brangus® seedstock producers. Lastly, the Brangus Journal serves as an outlet for the IBBA to provide updates by directly communicating with the membership. The claims made by advertisers in this publication are not verified by BPI or the IBBA.

For subscriptions, email info@gobrangus.com, or call 210.696.8231. Domestic periodicals (one year) $25; first class $55; foreign periodicals (one year) $25; air mail to Canada or Mexico $70; air mail to other countries $115.