Ifyou'rethinkingaboutbuyingahome,chancesareyou’vegotmortgagerates onyourmind.You’veheardtheyimpacthowmuchyoucanaffordinyour monthlymortgagepayment,andyouwanttomakesureyou’refactoringthat inasyouplanyourmove.But,itcanfeelabitoverwhelmingtokeeptrackofit all.Here'swhatyouneedtoknow.

Rateshavebeenvolatile–thatmeansthey’rebouncingaroundabit.And,youmaybe wondering,why?Theansweriscomplicatedbecauseratesareaffectedbysomanyfactors.

Thingslikewhat’shappeninginthebroadereconomyandthejobmarket,thecurrentinflation rate,decisionsmadebytheFederalReserve,geopoliticaluncertainty,andmorehaveanimpact. Lately,allofthosefactorshavecomeintoplay,andit’scausedthevolatilitywe’veseen.

AsOdetaKushi,DeputyChiefEconomistatFirstAmerican,explains:

“Ongoinginflationdeceleration,aslowingeconomyandevengeopoliticaluncertaintycan contributetolowermortgagerates.Ontheotherhand,datathatsignalsupsideriskto inflationmayresultinhigherrates.”

Whileyoucoulddrilldownintoeachofthosethingstoreallyunderstandhowtheyimpactrates, thatwouldbealotofwork.Insteadofspendingyourtimeonthat,leanonthepros.

Theycoachpeoplethroughmarketconditionsallthetime.They’llfocusongivingyouaquick summaryofanybroadertrendsupordown,whatexpertssaylaysahead,andhowallofthat impactsyou.Takethischartasanexample.

Itgivesyouanideaofhowmortgageratesimpactyourmonthlypaymentwhenyoubuyahome. Imaginebeingabletomakeapaymentbetween$2,500and$2,600workforyourbudget (principalandinterestonly).Thegreenpartinthechartshowspaymentsinthatrangeorlower basedonvaryingmortgagerates(seechartbelow):

MonthlyMortgagePayment(PrincipalandInterest)

$440,000$420,000$400,000$380,000$360,000

$2,709$2,586$2,463$2,340$2,217

$2,638$2,518$2,398$2,278$2,158

Principalandinterestpaymentsroundedtothenearestdollar.TotalMonthlypaymentmayvarybasedonloanspecificationssuchas propertytaxes,insurance,HOAdues,andotherfees.Interestratesusedhereareformarketingpurposesonly.Consultyourlicensed MortgageAdvisorforcurrentrates.

Asyoucansee,evenasmallshiftinratescanimpacttheloanamountyoucanaffordifyouwant tostayinthattargetbudget.It’stoolsandvisualslikethesethattakeeverythingthat’shappening andshowwhatitactuallymeansforyou.Andonlyaprohastheknowledgeandexpertise neededtoguideyouthroughthem.

Youdon’tneedtobeanexpertonrealestateormortgagerates,youjustneedtohave someonebyyoursidewhois.Let’sconnecttotalkaboutyourhousinggoals.

Ifyou’reinafinancialpositiontodosoand readytostayputforatleastafewyears, buyingahouseistotallyworthit.You’llgain stability,buildequityandretainasenseof ownershipandcontrol,ratherthanbeingat thewhimofalandlord.

-Bankrate

Areyouwonderingifitmakessensetobuyahomerightnow?While today’smortgageratesmightseemabitintimidating,herearetworeasons whyitstillmaybeagoodtimetobecomeahomeowner.

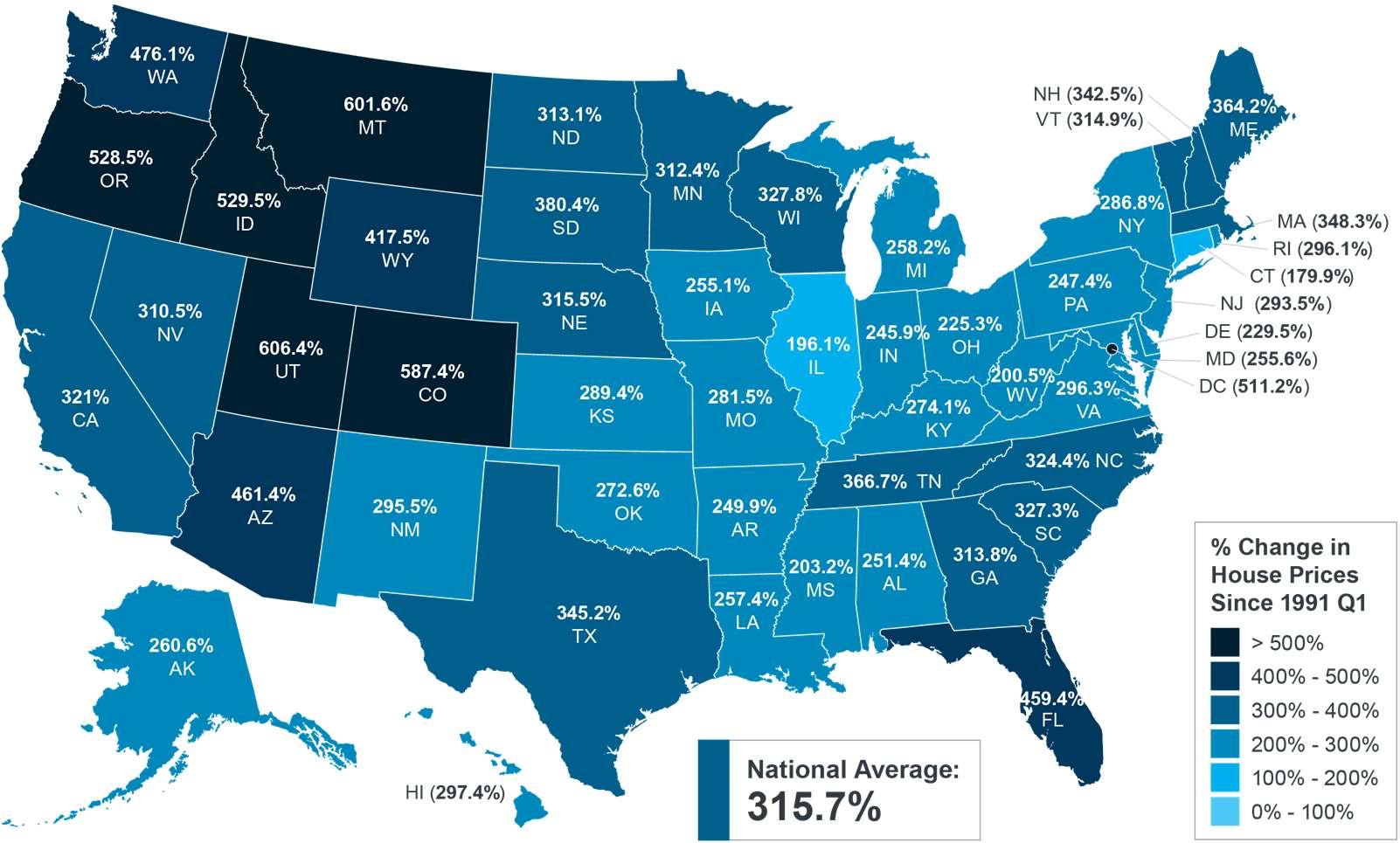

There’sbeensomeconfusionoverthepastyearorsoaboutwhichwayhomepricesareheaded. Makenomistake,nationallythey’restillgoingup.Infact,overthelong-term,homepricesalmost alwaysgoup(seegraphbelow):

PriceAppreciationovertheLast60Years AverageSalesPriceofHousesSoldintheUnitedStates

Basedonthechart,youcanseetheoveralltrendinhomepriceshasclimbedsteadilyforthe past60years.Therewasanexceptionduringthe2008housingcrashwhenpricesdidn'tfollow thenormalpattern,butgenerally,homevalueskeeprising.

Thisisabigreasonwhybuyingahomecanbebetterthanrenting.Aspricesgoupandyou paydownyourmortgage,youbuildequity.Overtime,thisgrowingequitycanreallyincrease yournetworth.

Here’sanotherreasonyoumaywanttothinkaboutbuyingahomeinsteadofrenting–rentjust keepsgoingupovertheyears.Sure,itmightbecheapertorentrightnowinsomeareas,but everytimeyourenewyourleaseorsignanewone,you’relikelytofeelthesqueezeofyourrent gettinghigher.AccordingtodatafromiPropertyManagement,renthasbeengoinguppretty consistentlyforthelast60years,too(seegraphbelow):

IncreaseinRentsovertheLast60Years MedianMonthlyRentintheUnitedStates(1960–2023)

Sohowdoyouescapethecycleofrisingrents?Buyingahomewithafixed-ratemortgagehelps youstabilizeyourhousingcostsandsaygoodbyetothoseannoyingrentincreases.Thatkindof stabilityisabigdeal.

Yourhousingpaymentsarelikeaninvestment,andyou'vegotadecisiontomake.Doyou wanttoinvestinyourselforkeeppayingyourlandlord?

Whenyouownyourhome,you'reinvestinginyourownfuture.Andevenwhenrentingischeaper, thatmoneyyoupayeverymonthisgoneforgood.AsDr.JessicaLautz,DeputyChiefEconomist andVPofResearchattheNationalAssociationofRealtors(NAR),states:

“Ifahomebuyerisfinanciallystable,abletomanagemonthlymortgagecostsandcan handletheassociatedhouseholdmaintenanceexpenses,thenitmakessensetopurchase ahome.”

Whenitcomesdowntoit,buyingahomeoffersmorebenefitsthanrenting,evenwhen mortgageratesarehigh.Ifyouwanttoavoidincreasingrentsandtakeadvantageof long-termhomepriceappreciation,let’sconnecttogooveryouroptions.

Equityisthecurrentvalueofyourhome minuswhatyoustilloweonyourloan. Itgoesupwhen:

•Youpaydownyourloan

•Homepricesappreciate Here’salookathowjustthehomepriceappreciationpiececanincreaseyourwealthovertime.

-LawrenceYun,ChiefEconomist,NAR

Oneofthebiggesthurdlesbuyershavefacedoverthepastfewyearshasbeena lackofhomesavailableforsale.Butthat’sstartingtochange.

ThegraphbelowusesdatafromRealtor.comtoshowtherearemorehomesonthemarket in2024thantherehavebeeninanyofthepastseveralyears(2021-2023):

NumberofHomesforSale

Since2017,AprilofEachYear

So,isfindingahomeeasier?Theanswerisyes,andno.Ontheonehand,inventoryisup overthepastfewyears.Thatmeansyou’lllikelyhavemoreoptionstochoosefromasyousearch foryournexthome.

But,atthesametime,thegraphabovealsoshowstherearestillsignificantlyfewerhomesfor salethanthere’dusuallybeinamorenormal,pre-pandemicmarket.Andthatdeficitisn’tgoingto bereversedovernight.

Tohelpyouexplorethegrowinglistofchoicesyouhavenow,let’sconnect.Thatway youhaveaprowhocanreallyhelpyouunderstandtheinventorysituationwhere youwanttobuy.We’llgooversomehandytipsthathavehelpedotherbuyersinour areadealwithongoinglowhousingsupply.

Ifyou’relookingtobuyahome,youneedtogetpre-approvedtohelpfigureout yournumbersandshowsellersyou’reserious.Let’sbreakdownwhatitisand whyit’simportantifyou’relookingtobuyahomethisyear.

FreddieMacexplainsitlikethis:

“Apre-approvalisanindication fromyourlenderthattheyare willingtolendyouacertainamount ofmoneytobuyyourfuturehome..

..Keepinmindthattheloanamount inthepre-approvalletteristhe lender’smaximumoffer.Ultimately, youshouldonlyborrowanamount youarecomfortablerepaying.”

Now,thatlastpieceisespeciallyimportant withthecurrentaffordabilitychallenges.

Gettingagoodideaofwhatyoucanborrow helpsyoureallywrapyourheadaroundthe financialsideofthings.Itdoesn’tmeanyou shouldborrowthefullamount.Itjusttells youwhatyoucanborrow.

Aspartofthehomebuyingprocess, alenderlooksatyourfinancesto determinewhatthey’rewillingto loanyou.AccordingtoInvestopedia, thisincludesthingslikeyourW-2,tax returns,creditscore,bankstatements, andmore.Fromthere,they’llgiveyou apre-approvallettertohelpyouknow howmuchmoneyyoucanborrow.

Thissetsyouuptomakeaninformed decisionaboutyournumbers.Thatway you’reabletotailoryourhomesearch towhatyou’recomfortablewithbudgetwiseandcanactfastwhenyoufinda homeyoulove.

Ifyouwanttobuyahome,there’sanotherreasonyou’regoingtowanttobesure you’reworkingwithatrustedlendertomakethisapriority.

Whilemorehomesarebeinglistedforsale,theoverallnumberofavailablehomesis stillbelowthenorm.Thatmeanstherearen’tenoughhomesforsaleforeveryonewho wantstobuyone.Theimbalanceofmoredemandthansupplycreatesabitofatug-ofwarforyou.

Becauseofthis,you’lllikelyfindyouhavetoputupwithcompetitionfromotherbuyers. Butpre-approvalcanhelpwiththattoo.

Pre-approvalshowssellersyoumeanbusinessbecauseyou’vealreadyundergonea creditandfinancialcheck.AsGregMcBride,ChiefFinancialAnalystatBankrate,says:

“Preapprovalcarriesmoreweightbecauseitmeanslendershaveactuallydone morethanacursoryreviewofyourcreditandyourfinances,buthaveinstead reviewedyourpaystubs,taxreturnsandbankstatements.Apreapproval meansyou’veclearedthehurdlesnecessarytobeapprovedforamortgage uptoacertaindollaramount.”

Sellerslovethisbecausethatmakesitmorelikelythesalewillmoveforwardwithout unexpecteddelaysorissues.Andifyoumaybecompetingwithanotherbuyertoland yourdreamhome,whywouldn’tyoudothistohelpstackthedeckinyourfavor?

Ifyou’relookingtobuyahomethisseason,knowthatgettingpre-approvedisgoingto beakeypieceofthepuzzle.Withmorebuyerscomingbacktothemarket,thiscanhelp youmakeastrongofferthatstandsoutfromthecrowd.

Don’tchangebankaccounts.

Don’tdepositcash intoyourbank accountsbefore speakingwithyour bankorlender.

Don’tmakeany largepurchases.

Consistencyisthenameofthegame afterapplyingforamortgage.Besureto discussanychangesinincome,assets, orcreditwithyourlender,soyoudon’t jeopardizeyourapplication.

Don’tapplyfornewcreditor closeanycreditaccounts.

Don’tco-signother loansforanyone.

Thebestplanistofullydiscloseanddiscussyourintentions withyourlenderbeforeyoudoanythingfinancialinnature.

It'simportanttoknowtoday’smarketiscompetitiveinmanyareasbecausethe numberofhomesforsaleisstilllow–andthat’sleadingtomultiple-offer scenarios.

Relyonarealestateagentwhocansupportyourgoals.AsPODSnotes:

“Makinganofferonahomewithoutanagentiscertainlypossible,buthavinga probyyoursidegivesyouamassiveadvantageinfiguringoutwhatto offeronahouse.“

Agentsarelocalmarketexperts.Theyknowwhat’sworkedforotherbuyersinyour areaandwhatsellersmaybelookingfor.Thatadvicecanbegamechangingwhen you’redecidingwhatoffertobringtothetable.

Knowingyournumbersisevenmoreimportantrightnow.Thebestwaytounderstand yourbudgetistoworkwithalendersoyoucangetpre-approvedforahomeloan. Doingsohelpsyoubemorefinanciallyconfidentandshowssellersyou’reserious.That givesyouacompetitiveedge.AsInvestopediasays:

“...sellershaveanadvantagebecauseofintensebuyerdemandandalimited numberofhomesforsale;theymaybelesslikelytoconsiderofferswithout pre-approvalletters.“

It’sonlynaturaltowantthebestdealyoucangetonahome,especiallywhen affordabilityistight.However,submittinganofferthat’stoolowdoeshavesomerisks. Youdon’twanttomakeanofferthat’llbetossedoutassoonasit’sreceivedjusttosee ifitsticks.AsRealtor.comexplains:

“...anofferpricethat’ssignificantlylowerthanthelistingprice,isoftenrejected bysellerswhofeelinsulted...ifasellerisoffendedbyabuyerorisn’ttaking thebuyerseriously,there’snotmuchyou,ortherealestateagent,cando.”

Theexpertiseyouragentbringstothispartoftheprocesswillhelpyoustay competitiveandfindapricethat’sfairtoyouandtheseller.

Afteryousubmityouroffer,thesellermaydecidetocounterit.Whennegotiating,it’s smarttounderstandwhatmatterstotheseller.Beingasflexibleasyoucanonthings likemovingdatescanmakeyouroffermoreattractive.

Yourrealestateagentisyourpartnerinnavigatingthesedetails.Trustthemtoleadyou throughnegotiationsandhelpyoufigureoutthebestplan.Asanarticlefromthe NationalAssociationofRealtors(NAR)explains:

“Therearemanyfactorsupfordiscussioninanyrealestatetransaction—from pricetorepairstopossessiondate.Arealestateprofessionalwho’s representingyouwilllookatthetransactionfromyourperspective,helping younegotiateapurchaseagreementthatmeetsyourneeds...”

Withinventorystilllowoverall,youwanttocomeinwithastrongoffer.Let'stalkso youcanhaveanexpertonyourteamtohelpyoubringyourbestoffertothetable.

Ifyou’vedecidedyou’rereadytobuy,chancesareyou’retryingtofigureout whattodofirst.Itcanfeelabitoverwhelmingtoknowwheretostart,butthe goodnewsisyoudon’thavetonavigateallofthatalone.

Whenitcomestobuyingahome,expertadvicefromatrustedrealestateagentispriceless,now morethanever.Andhere’swhy.

Arealestateagentdoesalotmorethanyoumayrealize.

Youragentisthepersonwhowillguideyouthrougheverystepwhenbuyingahomeandlookout foryourbestinterestsalongtheway.Theysmoothoutacomplexprocessandtakeawaythe bulkofthestressofwhat’slikelyyourlargestpurchaseever.Andthat’sexactlywhatyouwant anddeserve.

ThisisatleastapartofthereasonwhyarecentsurveyfromBrightMLSfoundanoverwhelming majorityofpeopleagreeanagentisakeypartofthehomebuyingprocess(seevisualbelow):

Ofrespondentsagree "Itwouldbeverystressful tonavigatethehomebuyingprocess withoutarealestateagentorbroker.”

Ofrespondentsbelieve "Arealestateagentorbrokeris anessential,trustedadvisorfor ahomebuyer."

Source:BrightMLS

Togiveyouabetterideaofjustafewofthetopwaysagentsaddvalue,checkoutthislist.

1.DeliverIndustryExpertise:Therightagent–theprofessional–willcoachyou througheverythingfromstarttofinish.Withprofessionaltrainingandexpertise,agents knowtheinsandoutsofthebuyingprocess.Andintoday’scomplexmarket,theway realestatetransactionsareexecutedisconstantlychanging,sohavingthebest adviceonyoursideisessential.

2.ProvideExpertLocalKnowledge:Inaworldthat’spoweredbydata,agreatagent canclarifywhatitallmeans,separatefactfromfiction,andhelpyouunderstandhow currentmarkettrendsapplytoyouruniquesearch.Fromhowquicklyhomesareselling tothelatestlistingsyoudon’twanttomiss,theycanexplainwhat’shappeninginyour specificlocalmarketsoyoucanmakeaconfidentdecision.

3.ExplainPricingandMarketValue:Agentshelpyouunderstandthelatestpricing trendsinyourarea.What’sahomevaluedatinyourmarket?Whatshouldyouthink aboutwhenyou’remakinganoffer?Isthisahousethatmighthaveissuesyoucan’t seeonthesurface?Noonewantstooverpay,sohavinganexpertwhoreallygetstrue marketvalueforindividualneighborhoodsispriceless.Anofferthat’sbothfairand competitiveintoday’shousingmarketisessential,andalocalexpertknowshowto helpyouhitthemark.

4.ReviewContractsandFinePrint:Inafast-movingandheavilyregulatedprocess, agentshelpyoumakesenseofthenecessarydisclosuresanddocuments,soyou knowwhatyou’resigning.Havingaprofessionalthat’strainedtoexplainthedetails couldmakeorbreakyourtransaction,andiscertainlysomethingyoudon’twanttotry tofigureoutonyourown.

5.BringNegotiationExpertise:Fromoffertocounterofferandinspectiontoclosing, therearealotofstakeholdersinvolvedinarealestatetransaction.Havingsomeoneon yoursidewhoknowsyouandtheprocessmakesaworldofdifference.Anagentwill advocateforyouastheyworkwitheachparty.It’sabigdeal,andyouneedapartnerat everyturntolandthebestpossibleoutcome.

BottomLine

Realestateagentsarespecialists,educators,andnegotiators.Theyadjusttomarket changesandkeepyouinformed.Andkeepinmind,everytimeyoumakeabigdecision inyourlife,especiallyafinancialone,youneedanexpertonyourside. Expertadvicefromatrustedprofessionalispriceless.

Agoodbuyer'sagentcanactasaguideonyour homebuyingjourney.They'llshowyoupropertiesthat fityourcriteria,helpyoucraftacompetitiveoffer, negotiateonyourbehalfandgenerallyprovideyou withknowledgeandsupportthroughoutthe homebuyingprocess.

-NerdWallet

I’msureyouhavequestionsandthoughtsaboutthe realestateprocess. I’dlovetotalkwithyouaboutwhatyou’vereadhereandhelpyou onthepathtobuyingyournewhome.Mycontactinformationis below,andIlookforwardtoworkingwithyou.