You’reprobablywonderingwhatthelatesthousingmarketnewsmeansforyour homebuyingplansthisfall.Herearethethreetopthingstoremember.

Housinginventoryismeasuredbythenumberofavailablehomesonthemarket.It’s alsomeasuredbymonths’supply,meaningthenumberofmonthsitwouldtaketosell allthoseavailablehomesbasedoncurrentdemand.Inabalancedmarket,there’s usuallyaboutasix-monthsupply–buttoday,weonlyhaveabouthalfofthat.With inventorythatlow,buyercompetitionisup,andthatmeansmanyhomesoftenreceive multipleoffers.Workingwithaprofessionalcanhelpyoubemorecompetitiveinthis kindofmarket.

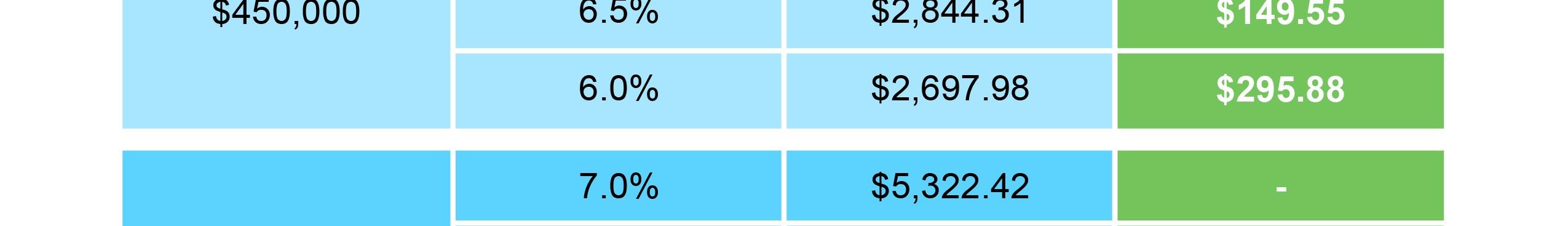

Mortgageratesmorethandoubledinthe2022calendaryear.That’sneverhappened before,andtherapidrisecausedsomebuyerstodelaytheirplans.Butsincelast October,rateshavesettledabitinroughlythe6%to7%range.

It'stimetounderstandratesaround6%or7%arethenewnormal.Therateswe experiencedafewyearsago,like3%,arenowathingofthepast.

Ifyou’rekeepingupwiththenews,youmightbeuncertainaboutwhat’shappening withhomepricesandworriedifthingswillgetworse.Wellknowthis,theworsthome pricedeclinesarebehindusandpricesareappreciatingnationally.

Butit'simportanttoknowpricesdifferdependingonwhereyoulive.Overall,low inventoryandrelativelystrongbuyerdemandaregoingtokeepupwardpressureon prices.DougDuncan,SVPandChiefEconomistatFannieMae,saysthisabouthome pricesrightnow:

“...housingpricescontinuetoshowstrongergrowththanwhatwas previouslyexpected...Housing’sperformanceisatestimonytothestrength ofdemographic-relateddemand...”

So,withpricesgoingupagain,ifyoufindahomethatsuitsyourneeds,it’sprobably notthebestideatowait.

Let’sconnectsoyouhaveanexperttohelpwithallyourquestionsaboutthehousing market.We’llgooveryourgoalsandwhat’shappeninginourarea,givingyouthe knowledgetomakeastrongandconfidentdecision.

Ifyou’rethinkingaboutshoppingfora homethisfall,giveyourselfplentyoftime tofindaproperty,andthenbringyour A-gametothenegotiatingtable.

-NerdWallet

Ifyou’rethinkingofbuyingahome,chancesareyou’repayingattentionto homepricesandmortgagerates.Herearethetoptwoquestionsyouneedtoask yourself–andwhatthedatasays–asyoumakeyourdecision.

OnereliableplaceyoucanturntoforthatinformationistheHomePriceExpectationSurveyfrom Pulsenomics–asurveyofanationalpanelofoveronehundredeconomists,realestateexperts, andinvestmentandmarketstrategists.

Accordingtothelatestrelease,theexpertssurveyedareprojectingbetween2.17%and4.18% appreciationeveryyearforthenextfiveyears(seethegraphbelow).Theworstpricedeclines arealreadybehindus,andpricesareappreciatingagain.

Thegreeninthegraphbelowshowspricesareexpectedtokeepappreciatingthisyearand beyond.

So,whydoesthismattertoyou?Itmeansyourhomewilllikelygrowinvalueandyoushould gainhomeequityintheyearsahead,butonlyifyoubuynow.Ifyouwait,basedonthese forecasts,thehomewillonlycostyoumorelateron.

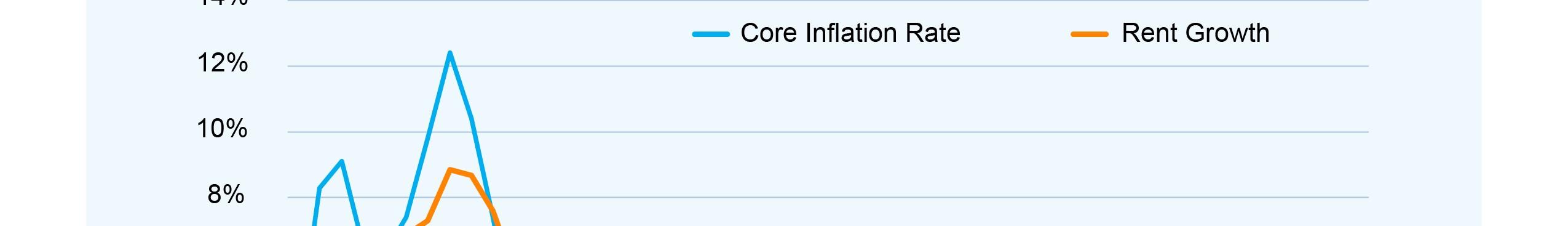

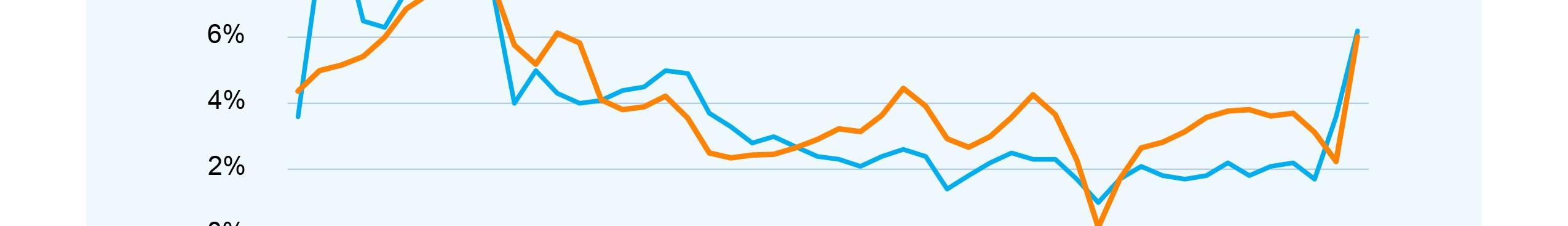

Weknowbasedonthelatestreportsthatinflationhasmoderatedfromitspeak.Thisisan encouragingsignforthemarketandformortgagerates.Here’swhy.

Wheninflationcools,mortgageratesgenerallyfallinresponse.Thismaybewhysomeexperts aresayingmortgagerateswillpullbackslightlyoverthenextfewquarters.

Butnoteventheexpertscansaywithabsolutecertaintywheremortgagerateswillbenextyear, orevennextmonth.That’sbecausetherearesomanyfactorsthatcanimpactwhathappens. So,togiveyoualensintothevariouspossibleoutcomes,here’swhatyoushouldconsider:

•Ifyoubuynowandmortgageratesdon’tchange:Youmadeagoodmovesince homepricesareprojectedtogrowwithtime,soatleastyoubeatrisingprices.

•Ifyoubuynowandmortgageratesfall(asprojected):Youprobablystillmadea gooddecisionbecauseyougotthehousebeforehomepricesappreciatedmore.And youcanalwaysrefinanceyourhomelaterifratesarelower.

•Ifyoubuynowandmortgageratesrise:Youmadeagreatdecisionbecauseyou boughtbeforeboththepriceofthehome,andthemortgageratewentup.

Ifyouwanttobuyahome,it'sessentialtostayinformedonhomepricesand mortgagerates.Expertscanprovidehelpfulprojectionstoguideyou.Let'sconnectso youhaveanexpertopiniononourlocalmarket.

-GregMcBride,ChiefFinancialAnalyst,Bankrate

Beforedecidingifyou’regoingtobuyahomerightnow,thinkaboutthe advantagesitcanbringyouinthelongrun.

Ifyouaskcurrenthomeowners,you’dprobablyhaveahardtimefindingsomeonewhoregrets theirdecisiontobuyahome.That’sbecausehomevaluesgrowwithtime.Here’salookathow homepriceappreciationcanreallyaddupovertheyears.

HomePriceGrowthoverTime

ThemapbelowusesdatafromtheFederalHousingFinanceAgency(FHFA)toshowhomeprice gainsoverthelastfiveyears.Themapisbrokenoutregionallytoconveylargermarkettrends.

PercentChangeinHomePrices

Source:FHFA

Youcanseehomepricesgrewonaveragebyabout57%nationwideinafive-yearperiod. Differentregionsvary,butoverall,homepricesgainedsolidgroundinashorttime.

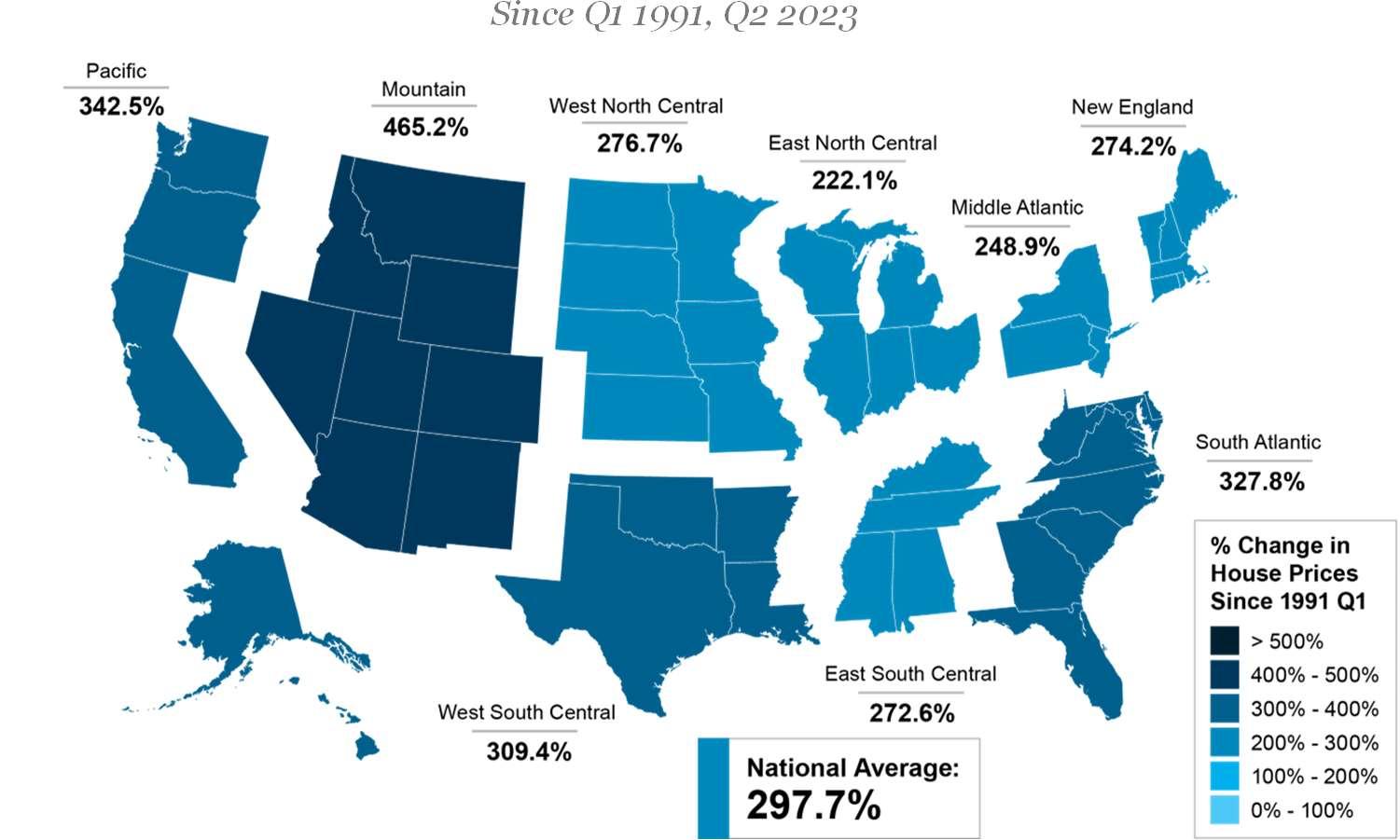

Andifyouexpandthattimeframeevenmore,thebenefitofhomeownershipandthedrastic gainshomeownersmadeovertheyearsbecomeevenclearer(seemapbelow):

SinceQ11991,Q22023 Source:FHFA

Thesecondmapshows,nationwide,homepricesappreciatedbyanaverageofover297% overaroughly30-yearspan.

Thisnationwideaveragetellsyouthetypicalhomeownerwhoboughtahouse30yearsagosaw theirhomealmosttripleinvalueoverthattime.That’sakeyfactorinwhysomanyhomeowners whoboughttheirhomesyearsagoarestillhappywiththeirdecision.

Andwhileyoumayhaveheardtalkinlate2022thathomepriceswouldcrash,itdidn’thappen. Eventhoughhomepriceshavemoderatedfromtherecordpeakwesawduringthe‘unicorn’ years,pricesarealreadyreboundingtoday.Thatmeansyourhomeshouldgrowinvalueoverthe nextyear.

Beforeyoumakeupyourmindaboutwhethertobuyahomethisfallornot, remembertheincrediblelong-termbenefitsofhomeownership.Ifyou’rereadytostart theconversation,let’sconnecttoday.

...homeownershipisacatalystforbuildingwealth forpeoplefromallwalksoflife.Amonthly mortgagepaymentisoftenconsideredaforced savingsaccountthathelpshomeownersbuildanet worthabout40timeshigherthanthatofarenter.

-LawrenceYun,ChiefEconomist,NationalAssociationofRealtors

Whenyouwanttobuyahome,oneofthefirstthingsyouneedtodoisgetpreapproved.Butwhyisthisstepsoimportant?Tofindout,let'sunderstandwhat pre-approvalisandhowithelpsyou.

Experianexplainsitlikethis:

“Amortgagepreapprovalisa documentfromalenderindicatingyou areconditionallyapprovedfora mortgageloan—uptoaspecific amount—tobuyahouse.Itusually specifiesthetypeofloanyouqualify forandtheinterestratethelender wouldchargeyouuponcompletionofa fullmortgageapplication.”

Basically,pre-approvalgivesyou criticalinformationaboutthe homebuyingprocessthat’llhelpyou understandhowmuchyoumaybeable toborrowsoyouhaveastrongergrasp ofyouroptions.

Aspartofthepre-approvalprocess, alenderlooksatyourfinancesto decidewhatthey’dbewillingtoloan you.Fromthere,yourlenderwillgive youapre-approvallettertohelpyou understandhowmuchmoneyyoucan borrow.

Thatcanmakeiteasierwhenyouset outtosearchforhomesbecauseyou’ll knowyouroverallnumbers.Andwith highermortgageratesimpacting affordabilityformanybuyerstoday,a solidunderstandingofyournumbersis evenmoreimportant.

Pre-approvalcanhelpasellerfeelmore confidentinyourofferbecauseitshows you’reseriousaboutbuyingtheirhouse. And,withsellersseeingaslightincrease inthenumberofoffers,makingastrong offerwhenyoufindtheperfecthouse iskey.

ArecentarticlefromCNBCsays:

“

Apre-approvallettershowsthat youcansecureamortgage.This alonegivesyouanadvantageover potentialbuyerswithoutpreapproval,especiallyincompetitive marketswhererealestateagents andsellerscanaffordtobepicky aboutwithwhom theywork.”

Gettingpre-approvedisabigdeal whenyouwanttobuyahome.It helpsyoufigureouthowmuch moneyyoucanborrow,anditalso showssellersyou'reseriousabout buyingtheirhouse.

Today’smarketisstillcompetitiveinmanyareasbecausethesupplyofhomes forsaleisstilllow.Ifyou'rebuyingahomethisfall,herearesometipstomake agoodoffer.

Relyonanagentwhocansupportyourgoalsandhelpyouunderstandwhat’s happeningintoday’shousingmarket.Agentsareexpertsinthelocalmarketandonthe nationaltrendstoo.They’llusebothofthoseareasofexpertisetomakesureyouhave alltheinformationyouneedtomovewithconfidence.

Plus,theyknowwhat’sworkedforotherbuyersinyourareaandwhatsellersmaybe lookingforinanoffer.Itmayseemsimple,butcateringtowhatasellerneedscanhelp yourofferstandout.AsanarticlefromForbessays:

"Gettingtoknowalocalrealtorwhereyou’rehopingtobuycanalsopotentially giveyouacrucialedgeinatighthousingmarket.“

Havingaclearbudgetinmindisespeciallyimportantrightnowgivencurrent affordabilitychallenges.Thebestwaytogetaclearpictureofwhatyoucanborrowisto workwithalendersoyoucangetpre-approvedforahomeloan.

That’llhelpyoubemorefinanciallyconfidentbecauseyou’llhaveabetterunderstanding ofyournumbers,anditshowssellersyou’reserioustoo.Andthatcangiveyoua competitiveedgeifyoudogetintoamultipleofferscenario.

It’sonlynaturaltowantthebestdealyoucangetonahome.However,submittingan offerthat’stoolowdoeshavesomerisks.Youdon’twanttomakeanofferthatwillbe tossedoutassoonasit’sreceivedjusttoseeifitsticks.AsRealtor.comexplains:

“...anofferpricethat’ssignificantlylowerthanthelistingprice,isoftenrejected bysellerswhofeelinsulted...ifasellerisoffendedbyabuyerorisn’ttaking thebuyerseriously,there’snotmuchyou,ortherealestateagent,cando.”

Theexpertiseyouragentbringstothispartoftheprocesswillhelpyoustay competitiveandfindapricethat’sfairtoyouandtheseller.

Overthepastfewyears,somebuyersskippedhomeinspectionsordidn’taskfor concessionsfromthesellerinordertosubmitthewinningbidonahome.Anarticle fromBankrateexplainsthisisn’thappeningasoftentodayandthat’sgoodnews:

“It’sinthebuyer’sbestinteresttohaveahomeinspected...Inspectionsalert youtoexistingorpotentialproblemswiththehome,givingyounotjustanearly headsupbutalsoausefulnegotiatingtactic.”

Fortunately,today’smarketisdifferent,andyoumayhavemorenegotiatingpowerthan before.Whenputtingtogetheranoffer,yourtrustedrealestateadvisorwillhelpyou thinkthroughwhatleverstopullandwhichonesyoumaynotwanttocompromiseon.

Whenyoubuyahomethisfall,let’sconnectsoyouhaveanexpertonyoursidewho canhelpyoumakeyourbestoffer.

Arealestateexpertknowsalotaboutwhat'sgoingonwithhomeprices,the numberofhousesavailable,andwhattheexpertspredict.Theyusethis knowledgetohelpyouwhenyou'rebuyingahome.

WhyYouWantToLeanonaTrustedProfessional

JayThompson,RealEstateIndustryConsultant,explains:

“Housingmarketheadlinesareeverywhere.Manyarequitesensational,ending withexclamationpointsorpredictingimpendingdoomfortheindustry.Clickbait, thesensationalizingofheadlinesandcontent,hasbeenanissuesincethe dawnoftheinternet,andhousingnewsisnotimmunetoit.”

Unfortunately,wheninformationinthemediaisn’tclear,itcangeneratealotoffearand uncertaintyinthemarket.AsJasonLewris,Co-FounderandChiefDataOfficerat Parcl,says:

“Intheabsenceoftrustworthy,up-to-dateinformation,realestatedecisionsare increasinglybeingdrivenbyfear,uncertainty,anddoubt.”

Butitdoesn’thavetobethatway.Buying ahomeisabigdecision,anditshouldbe oneyoufeelconfidentmaking.Youcan leanonanexperttohelpyouseparate factfromfictionandgettheanswers youneed.

Therightagentcanhelpyou understandwhat’shappeningatthe nationalandlocallevels.

Plus,theycandebunktheheadlines usingdatayoucantrust.Expertshaveindepthknowledgeoftheindustryandcan providecontext,soyouknowhowcurrent trendscomparetothenormalebbsand flowsintheindustry,historicaldata,and more.

Then,inordertoensureyouunderstand everythingcompletely,anagentcan informyouwhetheryourlocalareais followingthenationaltrend,orifthey’re noticingsomethingdistinctinyourmarket. Together,youcanuseallthatinformation tomakethebestpossibledecision.

Afterall,makingamoveisapotentially life-changingmilestone.Itshouldbe somethingyoufeelreadyforandexcited about.Andthat’swhereatrustedguide comesin.

Ifyouwanttogetthebestadvice andstayupdatedonwhat's happeninginthehousingmarket, let'sconnect.

“Abuyer’sagentwillhaveyourbackin negotiationsandcanhelpyoumakean appropriatelycompetitiveofferonahome.

-Bankrate