Human Capital Management

Q1 2024 Report

Q1 2024 HCM Summary & Outlook

M&A Trends & Outlook:

In the first quarter of 2024, the Human Capital Management industry witnessed strengthening levels of M&A activity, representing the third most active quarter over the past 5 years. There were a total of 106 acquisitions, a 14% increase from the 93 deals in the fourth quarter of 2023. The talent management sector had the highest levels of M&A activity, as strategics in the learning and leadership development verticals ramped up their inorganic growth strategies Strategics view M&A as a key component of growth and PE players have record levels of dry powder to deploy Our outlook remains optimistic that activity will continue at these levels throughout 2024 as companies will continue to attract interest from buyers, despite geopolitical turbulence and recession fears.

VC Trends & Outlook:

The number of venture capital deals increased slightly from the first quarter of 2023 while the amount of funding decreased significantly. Investors are exercising caution as strong headwinds, including inflationary concerns and high interest rates, have decreased early-stage pre-money valuations, which have dropped significantly from the unprecedented 2021 highs (Page 12) The non-cyclical Core HR sector has remained active and accounted for 58% of all VC dollars raised this quarter, consistent with the sector focus on mission-critical functions There are some promising signs of healthy VC activity as for the first time since Q 4 2022, there were two newly minted unicorns: payroll provider DailyPay and workforce management platform Deputy (Page 13).

TALENT MANAGEMENT

M&A was highly selective in Q1. Large consolidators remain on the hunt for true competitive advantages – differentiated services, predictable revenue streams, or entry / expansion into high-margin / highperforming end markets – and PE firms are opportunistically considering platform investments. Additionally, PE-backed companies continue to drive add-on activity in Executive Search.

Staffing:

• PE firm MidOcean Partners acquired The Re-Sourcing Group, a leading provider of strategic staffing, consulting, and direct hire solutions, from McNally Capital

• INSPYR Solutions, a portfolio company of A&M Capital Partners, acquired Advantis Global, a leader in highly-specialized technology consultants and solutions

Executive Search:

• ZRG, a portfolio company of RFE, has continued to consolidate: Ignata Finance (backed by Hamilton Bradshaw), a UK-based executive search and finance recruitment business, and Wiser Partners, a Cincinnati-based marketing and sales firm

In the Core HR sector, M&A activity was driven by acquisitions of payroll and compensation & benefits companies. Automated payroll providers are increasing pay access and filing data transparency. Benefits providers are personalizing packages to retain employees in different life stages.

Payroll:

• The payroll business unit of Alight (NYS: ALIT) was acquired by H.I.G. Capital for $1.2B, and will partner with Alight to continue its services

• HiBob, a benefits provider and HRIS, acquired UK-based automated payroll platform Pento to add to their “all-in-one” service offering Compensation & Benefits:

• Alliant Insurance Services expanded their employee benefits capabilities by acquiring consulting firm Aldrich Benefits and the employee benefits division of PBC Insurance

• Employee benefits platform Vivup was acquired by Great Hill Partners to scale their go-to-market capabilities. The funds were used to merge with Perkbox, a global benefits and rewards platform

With 30 deals, the talent management sector had the highest M&A activity of the HCM sectors tracked, a 30% increase from Q1 2023 transaction levels. The learning and leadership development sectors accounted for over 50% of the acquisitions within talent management, as companies track and improve their continuous up- and re-skilling.

Learning:

• Employee learning provider Eloomi was acquired by Dayforce (NYS: DAY) to extend their enterprise people development capabilities

• Workplace LMS Learning Pool acquired Onscreen, a digital walkthrough platform, to train their clients on software applications

Leadership Development:

• Executive coaching agency Rovertson Lowstuter was acquired by total revenue performance consultancy Center for Sales Strategy to help clients increase productivity and find talent synergies

• True Capital Partners and LLR Partners acquired True Advance, a provider of leadership assessments and performance enhancement

• Create Impact Ventures acquired The Pipeline, a women’s leadership development, assessment, and coaching platform

TALENT ACQUISITION

The talent acquisition sector had the lowest public company performance of the HCM sectors tracked (Page 2), reflecting a higher exposure to the labor market cycle. M&A activity included notable deals in the background screening and RPO industries, driven by demand for reliable and cost-effective screening and recruiting solutions.

Pre-Employment Screening:

• Two of the largest players join as First Advantage (NAS:FA) will acquire Sterling (NAS: STER) for $2.2B to invest in AI automation. In Q1, Sterling acquired First Hospital Labs and Vault Workforce

• HireRight (NYSE: HRT) announced that they will be acquired by General Atlantic and Stone Point Capital at a $1.7B valuation Recruitment Processing Outsourcing:

• Student learning platform Podium Education acquired engineering and IT recruiting service Untapped to close the college-to-career gap

• Aya Healthcare acquired healthcare RPO managed service provider ID Medical to expand services into the UK-based NHS

HCM Q1 2024 REPORT 1 4% QOQ 103 VC DEALS 57% QOQ $0.9B VC ACTIVITY

CORE HR

STAFFING

106 M&A DEALS 2% QOQ

Q1 2024 compared to Q1 2023

HCM Public Markets

Comparative Multiples

YoY Median Revenue Multiples

TTM Median EBITDA Multiples

3/31/2023 3/31/2024

Source: PitchBook, Data as of March 2024

Driven by 45%+ decreases in EBITDA

3/31/2023 3/31/2024

Driven by a 38% decrease in EBITDA from Seek, the largest Talent Acquisition company

Sub-Sector Ecosystem

Driven by 25%+ increases in EV from two >$220B companies: Oracle and SAP

One-Year Historical Index Performance

The S&P 500 outperformed all four HCM indexes during this period. The Core HR index emerged as the topperforming HCM index, with 6 of the 18 stocks increasing their enterprise value by >45% (AOF, BBSI, SAP, SGE, TNET). The Talent Acquisition index performed poorly, with 4 of the 9 stocks decreasing over 25% (NWO, FVRR, ZIP, DHX)

Source: Refinitiv

Excludes companies not traded prior to 4/1/2023

HCM Q1 2024 REPORT

Indices based on equal-weighted prices

0.4x 2.3x 1.9x 7.1x 0.4x 2.2x 2.2x 6.4x 0.0x 5.0x 10.0x Staffing Talent Acquisition Talent Management Core HR

6.4x 9.8x 14.9x 18.8x 9.5x 13.3x 14.2x 20.2x 0.0x 15.0x 30.0x Staffing Talent Acquisition Talent Management Core HR

2

-37% +1% +27% +18% -11% Talent Acquisition Talent Management Staffing Core HR 50 60 70 80 90 100 110 120 130 S&P 500 Core HR Staffing Talent Acquisition Talent Management

from Manpower Group and Robert Half International

HCM Public Trading Statistics

HCM Q1 2024 REPORT Company Name Enterprise Value ($B) TTM Revenue ($B) TTM EBITDA ($B) Revenue Multiple EBITDA Multiple Adecco Group – ADEN 10.1 25.9 0.9 0.4x 11.3x AMN Healthcare Services – AMN 3.7 3.8 0.5 1.0x 7.4x ASGN – ASGN 5.8 4.5 0.5 1.3x 12.5x BG Staffing – BGSF 0.2 0.3 0.0 0.6x n/m Cross Country Healthcare – CCRN 0.6 2.0 0.1 0.3x 4.9x GEE Group – JOB 0.0 0.1 0.0 0.2x 8.0x Heidrick & Struggles – HSII 0.3 1.0 0.1 0.3x 3.1x HireQuest – HQI 0.2 0.0 0.0 5.1x 16.6x Hudson Global – HQI 0.0 0.2 0.0 0.2x 7.8x Kelly Services – KELYA 0.8 4.8 0.1 0.2x 11.3x Kforce – KFRC 1.4 1.5 0.1 0.9x 15.9x Korn Ferry – KFY 3.2 2.8 0.3 1.2x 10.7x Manpower Group – MAN 4.5 18.9 0.3 0.2x 13.3x Mastech Digital – MHH 0.1 0.2 0.0 0.4x n/m Staffing 360 Solutions – STAF 0.0 0.3 0.0 0.1x n/m Randstad – RAND 10.4 27.5 1.2 0.4x 8.4x RCM Technologies – RCMT 0.2 0.3 0.0 0.7x 7.9x Resources Connection – RGP 0.4 0.7 0.0 0.5x 7.8x Robert Half International – RHI 7.9 6.4 0.6 1.2x 12.0x TrueBlue – TBI 0.4 1.9 0.0 0.2x n/m Median: 0.4x 9.5x Company Name Enterprise Value ($B) TTM Revenue ($B) TTM EBITDA ($B) Revenue Multiple EBITDA Multiple 2U – TWOU 1.0 0.9 -0.1 1.0x n/m BTS Group – BTS B 0.6 0.2 0.0 2.2x 15.1x Coursera – COUR 1.5 0.6 -0.1 2.3x n/m Docebo – DCBO 1.4 0.2 0.0 7.8x n/m Franklin Covey – FC 0.5 0.3 0.0 1.8x 14.2x Healthstream – HSTM 0.8 0.3 0.1 2.7x 12.7x Instructure – INST 3.3 0.5 0.1 6.2x 22.4x Learning Technologies Group – LTG 1.0 0.7 0.1 1.4x 8.4x Udemy – UDMY 1.3 0.7 -0.1 1.7x n/m Median: 2.2x 14.2x Company Name Enterprise Value ($B) TTM Revenue ($B) TTM EBITDA ($B) Revenue Multiple EBITDA Multiple DHI – DHX 0.2 0.2 0.0 1.1x 6.9x First Advantage – FA 2.7 0.8 0.2 3.5x 13.7x Fiverr – FVRR 0.9 0.4 0.0 2.4x n/m New Work – NOW 0.4 0.3 0.1 1.1x 3.5x Seek – SEK 6.7 0.8 0.2 8.4x 29.8x Sterling Talent Solutions – STER 1.9 0.7 0.1 2.7x 17.5x HireRight – HRT 1.6 0.7 0.1 2.2x 11.4x Upwork – UPWK 1.5 0.7 0.1 2.2x 24.4x ZipRecruiter – ZIP 1.2 0.6 0.1 1.8x 12.8x Median: 2.2x 13.3x CORE HR Company Name Enterprise Value ($B) TTM Revenue ($B) TTM EBITDA ($B) Revenue Multiple EBITDA Multiple ADP – ADP 104.3 18.6 5.3 5.6x 19.6x Alight Solutions – ALIT 8.2 3.4 0.2 2.4x 44.1x Atoss Software – AOF 2.3 0.2 0.1 14.2x 36.8x Asure Software – ASUR 0.2 0.1 0.0 1.5x 11.3x Barrett Business Services – BBSI 0.7 1.1 0.1 0.7x 9.2x Ceridian – DAY 11.0 1.5 0.3 7.2x 41.5x Dayforce – DAY 11.0 1.5 0.3 7.2x 41.5x Edenred – EDEN 14.3 2.5 0.9 5.7x 15.5x Insperity – NSP 3.8 43.1 0.3 0.1x 14.6x Oracle – ORCL 423.9 52.5 20.3 8.1x 20.8x Paychex – PAYX 43.7 5.0 2.3 8.7x 19.1x Paycom Software – PAYC 11.3 1.7 0.6 6.7x 19.2x Paycor HCM – PYCR 3.4 0.6 0.1 6.1x n/m Paylocity – PCTY 9.4 1.3 0.3 7.3x 31.4x SAP – SAP 224.6 33.8 7.6 6.7x 29.5x The Sage Group – SGE 16.7 2.7 0.5 6.2x 32.3x Trinet Group – TNET 7.5 4.9 0.6 1.5x 13.6x Workday – WDAY 67.5 7.3 0.5 9.3x n/m Median: 6.4x 20.2x TALENT MANAGEMENT TALENT ACQUISITION STAFFING n/m: multiples less than 0x or greater than 50x Source: PitchBook 3

Rule of 40 Analysis

The Rule of 40 is a financial ratio that assesses a company's performance by adding its revenue growth rate to its EBITDA margin The rule states that a company's combined growth rate and EBITDA margin should be 40% or higher. Notably, the Rule of 40 is not necessarily correlated with a stock’s performance, and several HCM companies that have had a combined revenue growth and EBITDA margin below 40 have experienced year-over-year enterprise value growth For example, TriNet Group and BBSI have grown their YoY Enterprise Value by ~50% while having a Rule of 40 metric of <15%.

TTM EBITDA Margin

YOY Revenue Growth % - Rule of 40 Baseline

Rule of 40 & Revenue Multiples Comparison

TTM March 2023

HCM Q1 2024 REPORT

4 Source: PitchBook, March 2022 – March 2023 TALENT MANAGEMENT 12 20 27 5 1 3 16 21 -2 27 16 0 21 15 12 -14 -19 -14 39% 37% 27% 26% 16% 16% 2% 2% -15%

TALENT ACQUISITION 0 -7 11 -6 1 -6 -11 7 -29 31 28 9 26 16 15 19 -3 14 31% 22% 20% 20% 17% 9% 9% 4% -14% 37 22 23 29 4 9 21 21 24 8 9 19 8 17 9 1 1 8 39 37 35 23 45 39 17 17 13 29 23 9 19 6 5 11 7 1 75% 59% 58% 52% 49% 48% 39% 39% 38% 36% 31% 28% 27% 23% 14% 12% 9% 8% CORE HR

-

-

Revenue Multiple 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 16.0x -20% -10% 0% 10% 20% 30% 40% 50% 60% 70% 80% Core HR Talent Acquisition Talent Management Rule of 40 (Revenue Growth + EBITDA Margin)

Count by Sector

HCM Q1 2024 REPORT 40 31 47 27 31 9 27 31 36 23 23 32 35 40 32 36 34 20 37 27 29 4 9 11 10 12 13 11 10 7 10 15 22 24 20 25 20 33 23 15 35 28 8 9 7 11 17 9 11 14 17 19 12 32 20 17 22 17 13 20 14 6 19 2 2 3 6 9 5 3 5 6 13 29 32 25 22 29 24 23 22 11 25 30 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2019 2020 2021 2022 2023 2024 Staffing Core HR Talent Acquisition Talent Management Deal

5 Deal

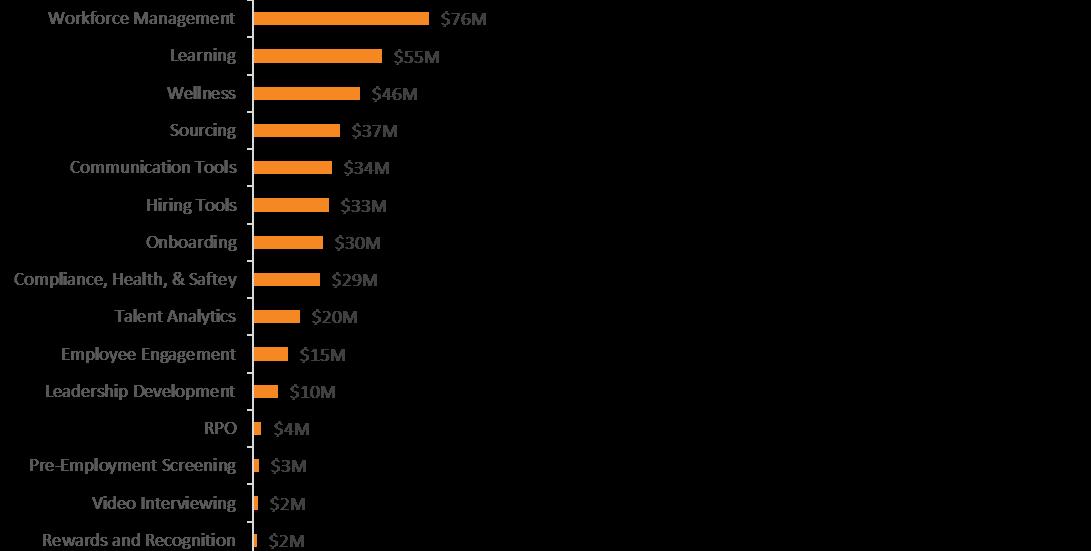

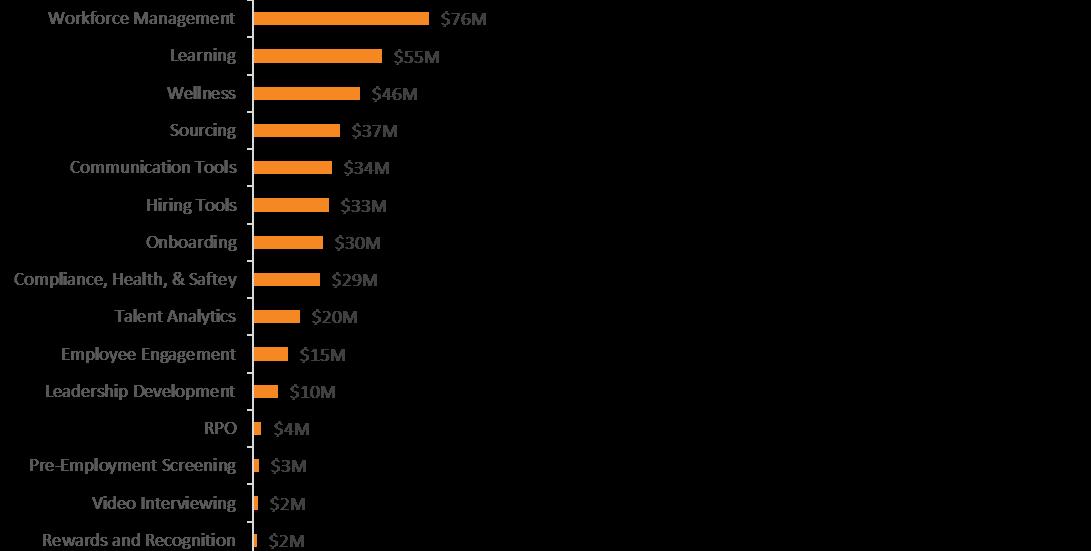

1 1 1 1 1 1 2 2 2 2 2 2 3 3 3 3 6 7 7 7 8 8 10 23 Applicant Tracking HRIS Recruitment Marketing Video Interviewing Hiring Tools Performance Management PEO Rewards and Recognition Assessments Sourcing Communication Tools Talent Analytics Wellness Employee Engagement Compliance, Health, & Saftey RPO Executive Search Payroll Workforce Management

Development Compensation and Benefits Pre-Employment Screening Learning Staffing

Count by Sub-Sector HCM M&A Summary

Leadership

Recent Notable Transactions

$2.2B FEB 2024

• Sterling Check Corp is a public provider of technology-enabled background screening, credential verification, and ongoing risk monitoring services.

• The transaction combines two of the largest pre-employment screening players, allows First Advantage to invest in AI-driven automation, and is expected to deliver $50M in synergies.

$413M FEB 2024

UNDISCLOSED MAR 2024

$165M MAR 2024

$1.2B MAR 2024

UNDISCLOSED JAN 2024

UNDISCLOSED FEB 2024

UNDISCLOSED MAR 2024

• HireRight is a global provider of background screening, verification, identification, monitoring, and drug and health screening services.

• General Atlantic and Stone Point Capital will acquire the remaining 25% of HireRight they do not already own at a total enterprise value of $1.65B.

• PaySpace offers cloud-based software with multi-country, multi-language human capital management and payroll solutions.

• Deel will become the first global payroll & Employer of Record (EOR) with its own full-stack payroll engine localized in 50 countries.

• Perkbox, a global benefits and reward platform and Vivup, a provider of health and wellbeing benefits will merge, following a majority investment from Great Hill Partners.

• The acquisition will help the newly integrated organization scale its go-to-market capabilities, innovate product offerings, and accelerate organic and inorganic growth.

• Alight (NYS: ALIT), a cloud-based human capital technology and services provider, announced that it will sell its Payroll & HCM Outsourcing business units.

• The transaction accelerates Alight’s evolution into a more simplified and focused employee wellbeing and benefits platform company.

• MidOcean Partners made a platform investment into The Re-Sourcing Group, which provides staffing with a focus personnel in legal, IT, finance / accounting, and HR and will look to grow the company organically, as well as through acquisitions.

• MidOcean is also invested in GHR Healthcare (healthcare staffing) and was previously invested in staffing firms System One and The Planet Group.

• A&M Capital Partners-backed INSPYR Solutions acquired Advantis Global in a transaction that merges two of the larger IT Staffing Firms (INSPYR is no. 30 and Advantis is no. 62 on SIA’s Largest IT Staffing Firms list).

• The combined company will have a significantly-expanded market reach and a broad range of enhanced technology and talent solutions for clients.

• RFE-backed ZRG, the seventh-largest executive search firm in the U.S., completed two strategic bolt-on acquisitions, continuing to add to its global capabilities and by-industry expertise.

• Since December 2021, ZRG has also acquired Seba International, The Registry, Helbling and Associates, Hub Recruiting, RoseRyan Inc., Terra Search Partners and Brimstone Consulting Group.

HCM Q1 2024 REPORT

HR TECH STRATEGIC

HR TECH FINANCIAL

HR TECH FINANCIAL

HR TECH STRATEGIC

STAFFING FINANCIAL

STAFFING STRATEGIC

STAFFING STRATEGIC

HR TECH FINANCIAL

6

Spotlight: SIA Conference

At this year’s SIA Executive Forum North America in Las Vegas, HVA met with a broad range of staffing and recruiting companies – and also attended the inaugural pop-up SIA Staffing Tech Summit. The content of the SIA Staffing Tech Summit was particularly noteworthy as many firms are actively wrestling with critical technology questions prompted by the age of digital transformation – what to adopt? how much to spend? what is the competition investing in? The Tech Summit keynote address broke down how technology is currently impacting strategy decisions made by staffing and recruiting firms, as well as the broader competitive landscape

Tech Summit Keynote Speech Highlights

Staffing firms with >$100M of revenue have automated ~64% of worker processes and just over 30% of client processes – these percentages distinctly decline when looking at smaller companies

Staffing firms are spending less on tech (hardware, software, services) than other types of companies – ~0.73% of revenue (or ~2.75% of gross margin) vs. a broader average of ~3-5% of revenue

AI, Big Data, and RPA investments are seeing the largest ROI (Sourcing Automation Tools, Analytics and Benchmarking, Recruitment Chatbots, etc.) – AI is most likely to disrupt Candidate Screening / Skills Assessments, Matching and Selection, and Redeployment in the near term

Staffing firms are facing increased competition from tech-savvy Hiring Platforms, Temporary Staffing Platforms, and Talent Platforms, many of which are recording 70%+ Gross Margins

SIA continues to offer extensive technology guidance for staffing and recruiting firms, from IT self-assessment frameworks to research and education on key topics, such as how to leverage an SPaaS solution. The messaging is clear: Digital transformation is not just about modernizing for efficiency and keeping important data safe – but also using technology for a competitive advantage in the marketplace.

Source: SIA, Gartner

HCM Q1 2024 REPORT

7

The Ever-Evolving

MOBILE APPS AND PORTALS MARCOMMS PLATFORMS FRONT OFFICE MIDDLE OFFICE BACK OFFICE SECURITY SERVICES INTEGRATION OFFICE AUTOMATION REPORTING Talent Mobile Apps and Portals Client Portals Recruiter Apps Payroll Financials Billing HR ATS CRM S&M ROA Onboarding Time & Attendance Compliance Rates Management Assignment and Contract Management Pay Rules Workforce Scheduling Messaging Word Processing Video Conferences Email Candidate Engagement Marketing Automation Job Boards Social Media Management Data Warehouses & Data Lakes Visualization & Reporting Tools Backup and Restore Email Security Web Scanning Intrusion Detection Native Integrations APIs Custom Integrations iPaaS = Past State

Staffing Firm Tech Stack

Automation

By Size

Staffing Firm Tech Spend

Anticipated Disruption

Competition from Platforms

HR M&A Transactions

CORE

TALENT MANAGEMENT

HCM Q1 2024 REPORT

HR

Source: PitchBook Deal Date Company Name Acquirer Deal Size ($M) Revenue ($M) EBITDA ($M) Revenue Multiple EBITDA Multiple Mar-24 Alight (Payroll Unit) HIG Capital $1,200 n/m $120 n/m 10.0x Mar-24 Creative Business Resources OneDigital n/m n/m n/m n/m n/m Mar-24 Smart Daily Management (EY) ServiceNow n/m n/m n/m n/m n/m Mar-24 Vivup Great Hill Partners n/m n/m n/m n/m n/m Mar-24 PaySpace Deel n/m $500 n/m n/m n/m Mar-24 G&A Outsourcing TPG n/m n/m n/m n/m n/m Feb-24 Zeit Volaris Group n/m n/m n/m n/m n/m Feb-24 The Capstone Group Businessolver n/m n/m n/m n/m n/m Feb-24 Creative Plan Designs Benefit Plans Admin Services n/m n/m n/m n/m n/m Feb-24 Pento Hibob $40 n/m n/m n/m n/m Feb-24 Tru HR Solutions OneDigital n/m n/m n/m n/m n/m Feb-24 Vimly Benefit Solutions Rubicon Technology Partners n/m n/m n/m n/m n/m Feb-24 Optessa Eyelit n/m n/m n/m n/m n/m Feb-24 Ralph C. Wilson Agency Risk Strategies Company n/m $9 n/m n/m n/m Feb-24 SourceOne Payroll Services IRIS Software Group n/m n/m n/m n/m n/m Jan-24 Easy Employer Valsoft Corporation n/m n/m n/m n/m n/m Jan-24 Punter Southall (Benefits) Foster Denovo n/m n/m n/m n/m n/m Jan-24 AHR Consultants Howden Schweiz n/m n/m n/m n/m n/m Jan-24 Payroll (TKS: 4489) TA Associates Management n/m $67 $20 n/m n/m Jan-24 Planbition Zvoove Group n/m n/m n/m n/m n/m Jan-24 Relogix HubStar n/m n/m n/m n/m n/m Jan-24 Aatrix Software Sovos Compliance n/m n/m n/m n/m n/m Jan-24 Mineral Mitratech n/m n/m n/m n/m n/m Jan-24 Syntrio Mitratech n/m n/m n/m n/m n/m Jan-24 Mployee Bullhorn n/m n/m n/m n/m n/m Jan-24 Aldrich Benefits Alliant Insurance Services n/m n/m n/m n/m n/m Jan-24 PBC Insurance (Benefits) Alliant Insurance Services n/m n/m n/m n/m n/m Jan-24 Solotes SoftOne Group n/m n/m n/m n/m n/m 8

Deal Date Company Name Acquirer Deal Size ($M) Revenue ($M) EBITDA ($M) Revenue Multiple EBITDA Multiple Mar-24 Orgnostic Culture Amp n/m n/m n/m n/m n/m Mar-24 Talespin Reality Labs Cornerstone OnDemand n/m n/m n/m n/m n/m Mar-24 Valuebeat LMS365 n/m n/m n/m n/m n/m Mar-24 4Industry ServiceNow n/m n/m n/m n/m n/m Mar-24 Perkbox Great Hill Partners $165 n/m n/m n/m n/m Mar-24 Employee Resilience Company Vivup n/m n/m n/m n/m n/m Mar-24 Courseplay CIEL Group n/m n/m n/m n/m n/m

HR M&A Transactions

TALENT MANAGEMENT

TALENT ACQUISITION

HCM Q1 2024 REPORT

Deal Date Company Name Acquirer Deal Size ($M) Revenue ($M) EBITDA ($M) Revenue Multiple EBITDA Multiple Mar-24 Before You Apply Job Mobz n/m n/m n/m n/m n/m Mar-24 FWB Park Brown (Energy) Boyden n/m n/m n/m n/m n/m Mar-24 Wiser Partners ZRG n/m n/m n/m n/m n/m Mar-24 Johnson Downie Lippmann Jungers n/m n/m n/m n/m n/m Mar-24 Ignata Finance Group ZRG n/m n/m n/m n/m n/m Mar-24 CastleBranch (Screening Unit) DISA Global Solutions n/m n/m n/m n/m n/m Feb-24 Velents Core Vision Investments n/m n/m n/m n/m n/m Feb-24 HiredScore Workday n/m n/m n/m n/m n/m Feb-24 Untapped Podium Education n/m n/m n/m n/m n/m Feb-24 Profit4you TEP Capital n/m n/m n/m n/m n/m Feb-24 Kölner Institut Acture Group n/m n/m n/m n/m n/m Feb-24 Validata DISA Global Solutions n/m n/m n/m n/m n/m Deal Date Company Name Acquirer Deal Size ($M) Revenue ($M) EBITDA ($M) Revenue Multiple EBITDA Multiple Feb-24 Reliant Talent Management Arrowhead Consulting n/m n/m n/m n/m n/m Feb-24 Sales Concepts San Francisco Partners n/m n/m n/m n/m n/m Feb-24 SurveyConnect TimeForge n/m n/m n/m n/m n/m Feb-24 Bonrepublic HRworks n/m n/m n/m n/m n/m Feb-24 Robertson Lowstuter The Center n/m n/m $0 n/m n/m Feb-24 Coach & Result Complementair Group n/m n/m n/m n/m n/m Feb-24 True Advance LLR, True Capital Partners n/m n/m n/m n/m n/m Feb-24 Klaus Zendesk n/m n/m n/m n/m n/m Feb-24 Simply-Communicate Arthur J. Gallagher n/m n/m n/m n/m n/m Feb-24 Zavvy Deel $20 n/m n/m n/m n/m Feb-24 Fly Select HR n/m n/m n/m n/m n/m Feb-24 Eloomi Dayforce n/m n/m n/m n/m n/m Feb-24 FLOW LDN ROWBOTS n/m n/m n/m n/m n/m Jan-24 Tango Card Blackhawk Network Holdings n/m n/m n/m n/m n/m Jan-24 The Pipeline Create Impact Ventures n/m n/m n/m n/m n/m Jan-24 Trivie Quantum5 n/m $1 n/m n/m n/m Jan-24 AL MANQAB Tech Services Amantra Cleaning Services n/m n/m n/m n/m n/m Jan-24 Mobiess Bellrock Property Mgmt n/m n/m n/m n/m n/m Jan-24 teroGO Tero belgium n/m n/m n/m n/m n/m Jan-24 Bloomin Zest n/m n/m n/m n/m n/m Jan-24 Onscreen Learning Pool n/m n/m n/m n/m n/m Jan-24 Xyleme MadCap Software n/m n/m n/m n/m n/m Jan-24 Core Strengths Crucial Learning n/m n/m n/m n/m n/m 9

Source: PitchBook

HR and Staffing M&A Transactions

TALENT ACQUISITION

Larger

STAFFING

HCM Q1 2024 REPORT

Deal Date Company Name Acquirer Deal Size ($M) Revenue ($M) EBITDA ($M) Revenue Multiple EBITDA Multiple Mar-24 Reference Point Resources Connection n/m n/m n/m n/m n/m Mar-24 Staffing Engine LRS Healthcare n/m n/m n/m n/m n/m Mar-24 Headfirst and Impellam N/A (Merger) n/m n/m n/m n/m n/m Mar-24 Signature Hire Careers Launch n/m n/m n/m n/m n/m Mar-24 Berry Virtual Legal Soft n/m $4 n/m n/m n/m Mar-24 Executive Solutions Hudson RPO n/m n/m n/m n/m n/m Mar-24 Leap Consulting Newbury Partners n/m n/m n/m n/m n/m Mar-24 Martin Recruiting Co. Good Labor Jobs n/m n/m n/m n/m n/m Mar-24 InfoCorvus (Staffing Unit) Yasha Staffing n/m n/m n/m n/m n/m Mar-24 PeopleReady

Vertical Staffing Resources n/m n/m n/m n/m n/m Feb-24 OnStaff USA Active Staffing n/m n/m n/m n/m n/m Feb-24 HVN Solutions S.i. Systems n/m n/m n/m n/m n/m Feb-24 Zelo Digital Salt n/m n/m n/m n/m n/m Feb-24 Advantis Global Inspyr Solutions n/m n/m n/m n/m n/m Feb-24 Staffing 360 Solutions (UK) IPE Ventures n/m n/m n/m n/m n/m Feb-24 Kolter Solutions Tandym Group n/m n/m n/m n/m n/m Feb-24 Morson Group Onex Corp n/m n/m n/m n/m n/m Feb-24 Custodial Housekeeping Commercial Sanitation Mgmt n/m n/m n/m n/m n/m Jan-24 Job Exchange Associates Emerson Group n/m n/m n/m n/m n/m Jan-24 The Re-Sourcing Group MidOcean Partners n/m n/m n/m n/m n/m Jan-24 Belflex Staffing Network Elwood Staffing n/m n/m n/m n/m n/m Jan-24 Kelly Services (European) Gi Group Holdings n/m n/m n/m n/m n/m Jan-24 Power Funding Fourshore Partners n/m n/m n/m n/m n/m 10 Deal Date Company Name Acquirer Deal Size ($M) Revenue ($M) EBITDA ($M) Revenue Multiple EBITDA Multiple Feb-24 Sterling Check Corp First Advantage $2,200 $720 $111 3.1x 19.8x Feb-24 HireRight General Atlantic, Stone Point $663 $722 $140 0.9x 4.7x Jan-24 PSI Services Educational Testing Service n/m n/m n/m n/m n/m Jan-24 RMC Learning Solutions Peterson's n/m n/m n/m n/m n/m Jan-24 FlexJobs FlexJobs n/m n/m n/m n/m n/m Jan-24 Nexti Talent Nexti n/m n/m n/m n/m n/m Jan-24 ID Medical Aya Healthcare n/m n/m n/m n/m n/m Jan-24 Enspira HUDDL3 Group n/m n/m n/m n/m n/m Jan-24 Grace Blue Partnership Sinecure.ai $9 n/m n/m n/m n/m Jan-24 Employrite Veremark n/m n/m n/m n/m n/m Jan-24 Otta Welcome to the Jungle n/m n/m n/m n/m n/m Jan-24 First Hospital Laboratories Sterling Talent Solutions n/m n/m n/m n/m n/m

Vault Workforce Screening Sterling Talent Solutions n/m n/m n/m n/m n/m

(out of TrueBlue)

Jan-24

higher revenue

Sources: PitchBook, SIA

deals often command

and EBITDA multiples

HCM Financing Summary

Notable Financings

Retracting Early-Stage Pre-Money Valuations

Early-stage pre-money valuations have stabilized below 2021 highs

$175M JAN 2024

RECEIVED INVESTMENT FROM Payroll

$95M JAN 2024

RECEIVED INVESTMENT FROM Performance Management

$50M MAR 2024

RECEIVED INVESTMENT FROM Payroll

$37M MAR 2024

RECEIVED INVESTMENT FROM Workforce Management

Annual Financing Activity

HCM Q1 2024 REPORT $0.8B $0.9B $1.3B $0.8B $0.8B $0.7B $0.9B $0.5B $2.2B $3.6B $6.0B $6.3B $4.7B $4.2B $1.7B $1.4B $2.2B $0.9B $1.2B $1.1B $0.9B 70 57 53 44 49 44 44 38 62 56 97 104 116 97 79 78 100 97 122 95 103 0 20 40 60 80 100 120 140 0 1000 2000 3000 4000 5000 6000 7000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2019 2020 2021 2022 2023 2024 Sum of Transaction Sizes Transaction Count

Source: PitchBook 11

HCM 2023 REPORT $49M $75M $81M $173M $98M $22M $22M 2018 2019 2020 2021 2022 2023 Q1 2024

HCM Q1 2024 REPORT HCM Financing Activity Sources: PitchBook, HRTECHFeed 12

VC Deals Over $100M 2 1 3 1 9 14 17 17 17 12 2 1 3 1 3 2 1 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2020 2021 2022 2023 2024

Q1 2024 Financing Activity by Sub-Sector

HR Tech Unicorn Tracker

Newly Minted Unicorns

HCM Q1 2024 REPORT

13 Talent Acquisition Talent Management Core HR 6 8 8 6 7 4 1 2 1 0 0 1 2 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 HRTech Unicorns Source: PitchBook

HCM Financing Activity

EARLY-STAGE VENTURE CAPITAL

Mar-24

Mar-24

Mar-24

Mar-24

Mar-24

Mar-24

Feb-24

Feb-24

Feb-24

Feb-24

Feb-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

HCM Q1 2024 REPORT

Sources: PitchBook, HRTECHFeed Deal Date Company Name Broad Category Deal Size ($M) Pre-Money Valuation ($M) Lead/Sole Investors

Buddywise Core HR $4 n/m Kvanted

Ventures & J12

Borderless AI Core HR $27 n/m

SIG & Aglaé Ventures

Ababa Talent Acquisition $4 n/m SMBC,

Oriental Land, & Iyogin

RecruitU Talent Acquisition $2 n/m Undisclosed

Aimiable Core HR $3 $12

Capital

Offlight Core HR n/m n/m

Angels

Welbee Talent Management $2 $3

Wrky Talent Management $3 n/m DataOp

L'Atout Core HR $2 n/m Karista

Mar-24

Bienville

Mar-24

Mashup

Mar-24

KCP, WCS & MNL Mar-24

Mar-24

Fijoya Core HR $8 n/m

Team8

Deep Care Talent Management n/m n/m Kreissparkasse,

Workflex Talent Acquisition n/m n/m Undisclosed

AutoGraph Core HR n/m n/m

Capital

Mão boa Talent Management n/m n/m Femmes

Angels

Trace Talent Management $2 n/m Undisclosed Feb-24 Clasp Core HR $2 n/m Base10 Partners

Yurtle Core HR $2 n/m Insurtech

Maze

Feb-24 The Bridge Talent Management $2 n/m

Tuned Core HR $7 n/m

Rivet Work Core HR $6 n/m

Volksbank Mar-24

Mar-24

8-Bit

Mar-24

Business

Mar-24

Feb-24

Gateway,

X

Undisclosed Feb-24

Distributed Ventures & Unum Feb-24

Red Cedar Ventures

Hatch Talent Acquisition $5

2045 Studio Talent Management n/m n/m

Atlas Talent Acquisition $3 n/m Hi Ventures

MeVitae Talent Acquisition $2 n/m Apex Black

SocialCrowd Talent Management $2 n/m

n/m Rampersand Feb-24

O'Shaughnessy, Tishman Speyer Feb-24

Feb-24

Feb-24

Bread & Butter Ventures

LogistiVIEW Talent Management n/m n/m

Undisclosed

Zylon Talent Management $3 n/m

Felicis

Core HR

HelloBonnie

n/m n/m Innovationsstarter

Remofirst Talent Acquisition $25 $75

Ventures

Ema Talent Management $25 n/m

Octopus

Feb-24

S32, Accel & Prosus

GAGE Talent Management n/m n/m

Eagle Venture Fund

Levit8 Talent Management n/m n/m

Antler

Future Brain Talent Management n/m n/m Undisclosed

Compa Core HR $10 n/m Storm Ventures

Cultivate Advisors Talent Management $2 n/m Undisclosed

Ansel Core HR $29 n/m

UpSmith Talent Management $5 n/m

Huler Talent Management $4 n/m

Midlands

Jan-24

Jan-24

Jan-24

Portage Jan-24

Hannah Grey Ventures Jan-24

Mercia Asset Mgmt &

Leadr Talent Management $10 n/m

Capital

Cubit

Ask-AI Talent Management $11 n/m Leaders Fund

Peerlogic Talent Management $6 $20

AZ-VC

ClearPoint Health Core HR n/m n/m

Point Capital

Stone

Anecdotes Core HR $25 n/m Glilot Capital Partners

Quan Talent Management $3 n/m

capital,

4impact

HearstLab

Craftt Core HR n/m n/m

Wavemaker Partners

Finwello Talent Management n/m n/m

Solidea Capital

Slice Core HR $7 n/m

14

TLV Partners

HCM Financing Activity

LATE-STAGE VENTURE CAPITAL

Feb-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

Jan-24

HCM Q1 2024 REPORT

Sources: PitchBook, HRTECHFeed Deal Date Company Name Broad Category Deal Size ($M) Pre-Money Valuation ($M) Lead/Sole Investors

RallyPoint Talent Acquisition $9 n/m Undisclosed Mar-24 Metaview Talent Acquisition $7 n/m Plural Platform Mar-24 Cloverleaf Core HR $7 $33 Advantage & Origin Ventures

ZayZoon Core HR $50 n/m Export Dev, Viola & Framework Mar-24 Confetti Core HR $16 n/m IN Venture and Entrée Capital Mar-24 LASSO Core HR $5 n/m Undisclosed Mar-24 Joinrs Talent Acquisition $2 n/m Innova Venture & Doorway Mar-24 Instaffo Talent Acquisition $11 n/m Crosslantic Capital Mar-24 Deputy Core HR $37 $1063 Express Services

Youverify Talent Acquisition $3 n/m Elm

SynergyXR Talent Management $2 n/m Kvanted Ventures Mar-24 Argyle Core HR $30 $165 Rockefeller Capital Management Mar-24 RemotePass Core HR $6 n/m 212 Mar-24 Better Place Core HR $4 $24 UTokyo Innovation Platform Mar-24 Healthee Core HR $32 $55 Group 11, Glilot, & Fin Capital

Teacher Booker Talent Acquisition n/m n/m The FSE Group Mar-24 Quizizz Talent Management $16 $332 SVQUAD

Zizzl Health Core HR $11 n/m Arthur Ventures

hellohive Talent Acquisition $3 $17 Tisch Family

PeopleForce Talent Acquisition $2 n/m Pracuj Ventures

Pivt Core HR n/m n/m Noemis Ventures

Mar-24

Mar-24

Mar-24

Mar-24

Mar-24

Feb-24

Feb-24

Feb-24

Feb-24

Scribe Talent Acquisition $25 $220 NY Life Ventures

Redpoint

Phenom Talent Acquisition n/m n/m Meyer Keith Ventures

&

Feb-24

Benepass Core HR $20 $69 Portage & Clocktower Tech

Upwards Core HR $21 $79 Alpha Edison

Jan-24

BeeDeez Talent Management $9 n/m

Arkéa, SWEN & Wille Finance

DailyPay Core HR $175 $1750 Carrick Capital Partners

Kashable Talent Management $26 n/m Moneta & Revolution Ventures

Jan-24

Oxford Medical Sim Talent Management $13 n/m

Capital

Frog

DriverReach Talent Acquisition $4 n/m

Fulcrum Equity Partners

LifeGuides Talent Management $17 n/m

Barma Talent Management n/m n/m Anyhow & Cand.selv

Undisclosed Jan-24

Savi Talent Management $12 n/m

Coast Ventures

Next

Ceresa Talent Management $9 n/m Undisclosed

PerformYard Talent Management $95 n/m

Partners

Jan-24

Updata

Advantage Club Talent Management n/m n/m

Partners

AFG

goHappy Labs Talent Management n/m n/m

10X Venture Partners

Smart Access Talent Management n/m n/m

Deal Date Company Name Broad Category Deal Size ($M) Pre-Money Valuation ($M) Lead/Sole Investors Feb-24 Sapience Analytics Talent Management n/m n/m Kayne Anderson Capital Advisors

Aspenwood Ventures

EXPANSION

PRIVATE EQUITY GROWTH /

15

HCM Q1 2024 REPORT HCM Expertise

an Investment from Acquired by Received an Investment from Acquired by Acquired by Acquired by Acquired by Received an Investment from Acquired by Acquired by (Non-Leader Assessment Division)

Acquired by Acquired by

Connect with Our HCM Team

by Acquired

Carolyn Mathis Partner cmathis@hvadvisors.com Nick Mignone Senior Associate nmignone@hvadvisors.com Margaret McCormick HCM Director mmccormick@hvadvisors.com Zuri Goodman Analyst zgoodman@hvadvisors.com 16

by Received an Investment from

Received

Acquired by

Acquired by

Acquired

by Acquired by

Acquired

About Harbor View Advisors

the

and

Industrials, and Consumer.

and

HCM Q1 2024 REPORT

specialize in

key

Technology

FinTech, Financial Services,

We specialize in the key industries of B2B Technology & Services, FinTech, Financial Services, Industrials, and Consumer. Call 904 285 4278 Email vision@hvadvisors.com Visit harborviewadvisors.com 17

Operating at

intersection of investment banking

consulting, we partner with inspiring companies and private equity firms to help them design and execute their strategies for growth or exit. With years of experience as investment bankers, management consultants,

operators, we help growing teams improve their opportunities for success. We provide Sell-side and Buy-side advisory to innovative companies and

five

industries: B2B

& Services,

The material in this report is for information purposes only and is not intended to be relied upon as financial, accounting, tax, legal or other professional advice. This report does not constitute and should not be construed as soliciting or offering any investment or other transaction, identifying securities for you to purchase or offer to purchase, or recommending the acquisition or disposition of any investment. Harbor View Advisors does not guarantee the accuracy or reliability of any data provided from third party resources. Although we endeavor to provide accurate information from third party sources, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.