MCI (P) 002/07/2016 ISSN 2010-4227 SPECIAL FEATURE ON VIENNA AIRPORT ETIHAD SHOWS OFF ITS REPERTOIRE C-SUITE INTERVIEW WITH GEODIS

Dear reader,

Air cargo’s hot streak may be showing signs of cooling down, according to the latest data, but this issue has no shortage of interviews with some of the top airlines, airports and players in the air cargo supply chain.

First off we showcase the company profile of Singapore-based MRO services provider ST Engineering who is in a growth track not only in its home region but also in the United States. Find out what the company is doing by flipping to page 22.

In the C-Suite interview, Onno Boots regional president and CEO for Asia Pacific at Geodis, outlines the company’s strategy in the region as it looks to capitalize on the investments it has made in the last few years. Go to page 24 to find out more.

For this issue, we also take a virtual trip to Austria to find out the cargo prospects for Vienna Airport as it tries to establish a reliable air hub in the middle of Europe. Don’t miss out on what the airport is working on by turning to page 28.

Of course this issue won’t be complete without the latest roundup of news from our beloved ground handlers, freight forwarders and logistics specialists. There’s also the cover story with Etihad to make things interesting. Dig in and remember to pass it along for your peers to enjoy.

Let me also take this opportunity to thank everyone who attended the awards on 28 October and from the team at Payload Asia, it was certainly one for the books! Congratulations to all the winners and watch out for the special awards issue coming in December.

EDITORIAL/PUBLISHER Keen Whye Lee Publisher publisher@harvest-info.com Giullian Navarra PLA Editor editor-pla@harvest-info.com OPERATIONS Mari Vergara Head of Operations manager-ph@harvest-info.com MARKETING Lali Singson Marketing Manager mktg@harvest-info.com SALES Simon Lee Hong Kong, Europe and Middle East sales@harvest-info.com Chua Chew Huat Asia Pacific sales-sg@harvest-info.com Matt Weidner North America mtw@weidcom.com TECHNICAL SUPPORT Michael Magsalin tech@harvest-info.com Harvest Information Pte. Ltd. 150 Orchard Road, #07-05 Orchard Plaza Singapore 169206 150 Orchard Road, #07-05 Orchard Plaza, Singapore 169206

NOTE 1 www.payloadasia.com | OCTOBER - NOVEMBER 2022

Giullian Navarra Chief Editor

EDITOR’S

Singapore commits to green jet fuel with ICAO agreement

An interview with GEODIS Asia Pacific’s Onno Boots

Vienna Airport’s potential in the heart of Europe is growth with reliability

Cathay Pacific hopes SAF purchase sends ‘right signal’

Etihad to offer more belly space to China from October

Mammoth reveals launch partner for 777-300ERMF

Vietnam’s IPPG halts cargo airline plans

Peli BioThermal opens new station near Narita airport

Lödige Industries to modernize JFK’s cargo facility

Worldwide Flight Services wins contracts with ANA and Nouvelair

Mediterranean Shipping Company sets eyes on air cargo service

AirAsia to grow Teleport’s fleet with three Airbus converted freighters

UPS redefines package delivery with premier service in Singapore

China’s JD Airlines secures air carrier certificate

Singapore commits to green jet fuel with ICAO agreement

Asia’s handlers suit up for lithium battery shipments

Etihad pulls out all stops to become the air cargo partner of choice

GEODIS Asia Pacific’s Onno Boots on air freight, investments and customers

Vienna Airport’s potential in the heart of Europe is growth with reliability

ST Engineering gives rundown of its next go-to market outside Singapore

2 OCTOBER - NOVEMBER 2022 | www.payloadasia.com

04 21 24 26 07 18 20 19 05 10 14 15 16 06 12 13 11 CONTENT PAGE 26 NEWS MARKET REPORT COMPANY PROFILE COVER STORY C-SUITE SPECIAL FEATURE

FEATURE

SPECIAL

24 18

MARKET REPORT

C-SUITE

by GENERATION

Emirates tops up order for widebody freighter

Emirates now has 200 wide-body aircraft on its Boeing order book

after the airline announced a firm interest to add five new Boeing 777-

200LR freighters to its fleet, worth over US$1.7 billion at list prices, with delivery slated between 2024 and 2025.

The new order follows the US$1 billion investment the airline made during last year’s Dubai Airshow, which included two new 777Fs that have already joined the airline’s allBoeing fleet this year. The carrier also plans to convert 10 Boeing 777-300ERs into cargo aircraft with conversions scheduled to start next year.

Cathay Pacific hopes SAF purchase sends ‘right signal’

Emirates was the launch customer for the Boeing 777 freighter and it currently operates 11 of the aircraft type in its fleet. The carrier also offers bellyhold cargo capacity on its widebody 777 and A380 passenger aircraft. initiative by oneworld alliance, of which Cathay Pacific is a founding member.

Cathay Pacific has signed an offtake agreement with Aemetis for the supply of 38 million gallons of blended sustainable aviation fuel, with delivery scheduled to start in the next 3 years. Airline chief

Augustus Tang said the company hopes it sends the right signal to the SAF industry to encourage the muchneeded investment and scaling up of its supply chain. The agreement is part of the joint procurement

Korean Air to start new Budapest route in October

Korean Air is set to fly its inaugural passenger flight to Budapest in Hungary on 3 October using its Boeing 787-900. The service will fly once a week on Mondays from Seoul Incheon

Under the agreement, Aemetis will start delivering the supply in 2025 from San Francisco International Airport and continue for the next seven years. The blended SAF to be supplied under this agreement is 40 percent SAF and 60 percent Jet A-1 fuel, which will be produced at a plant currently under development in Riverbank, California. The facility will use waste wood to produce cellulosic hydrogen, and combine it with wastes and non-edible sustainable oils, which will then be converted into SAF using hydroelectricity.

to Budapest with a return flight the next day.

The airline said the move follows the launch of cargo services to Budapest in February 2020 as it plans to bolster the competitiveness of its European network, especially in the eastern region. Korean Air will increase the number of flights to Budapest to two (every Monday and Saturday) starting 31 October, adding a Saturday schedule from October 29.

4 OCTOBER - NOVEMBER 2022 | www.payloadasia.com NEWS - CARRIERS

Saudia Cargo renews partnership with Unilode

Saudia Cargo has renewed its full-service ULD management partnership with Unilode Aviation Solutions for a further 5 years or until 2028. Ross Marino, chief executive at Unilode, said the renewed agreement is based on a ‘more dynamic’ price modeling that enables Saudia to only pay for the ULDs that it uses whilst ensuring availability throughout their network.

The Middle Eastern carrier, with a fleet of 90 passenger and cargo wide-body aircraft flying to 87

destinations, awarded the supply and management of its 21,000-strong container and pallet fleet to Unilode back in 2017.

Over the past five years, Unilode has transitioned the carrier to new, 20-kilo lighter solid door containers.

IAG Cargo restarts Heathrow-Tokyo service in November

IAG Cargo, the cargo division of International Airlines Group, has restarted its direct service between London Heathrow and Tokyo Haneda airport with daily flights starting 13 November. The new service will utilize the belly hold capacity of British Airways Boeing 787-8 and 787-9 wide body aircraft.

IAG said the restarted service will support the flow of pharmaceuticals, as well as shipments like electronics

and automotive parts and other Japanese dried foods. Throughout the duration of the pandemic, IAG Cargo maintained its customer

The new agreement will also see the replacement of standard AKE containers with lightweight units from Unilode’s ULD pool. Unilode said it will also provide strategic buffer stock to Saudia Cargo during the Hajj, the annual Islamic pilgrimage to Mecca.

offering on this popular trade route via its cargo-only services and worked with interline partners to transport cargo between the regions. The company said it will continue to expand its capacity in South Asia with 16 destinations in Asia Pacific, India and Middle East from 13 November.

Etihad to offer more belly space to China from October

Etihad Cargo will introduce an additional 30 tonnes of belly capacity via two weekly direct passenger flights to Guangzhou using a Boeing 777 starting 10 October. In July, the carrier announced the introduction of direct passenger flights to Beijing, bringing the total number of direct passenger and freighter flights to China to 15. The airline also operates six Boeing 777-200 freighter flights for Shanghai and five dedicated

freighter services for Hong Kong per week.

With the introduction of services to Guangzhou by October, Etihad Cargo will offer 1,520 tonnes of total cargo capacity into and out of China per week. The carrier transports a wide range of products from China to the UAE, Europe and the US, with electronics being the most widely transported product. Earlier

this year, it launched a dedicated Mandarin version of its website and booking portal, making the booking process easier for customers located in China.

5 www.payloadasia.com | OCTOBER - NOVEMBER 2022 NEWS - CARRIERS

Challenge Airlines secures license to operate in Malta

The long wait is over for Challenge Airlines MT as the cargo carrier received its air operator certificate (AOC) on 2 November. With two B767300ERs offering a payload of 60 tonnes each, Challenge Airlines MT said it will use its pool of 10 pilots to operate specific routes from the its Liège air hub (LGG) in Belgium.

The airline expects to transport

Asia Cargo Network Singapore expands in to the Middle East

Air charter specialist Asia Cargo Network is looking to expand its operations into the Middle East and nearby markets as it partnered

with Bahrain-based operator MENA Aerospace. Under the agreement, ACN plans to base six of its cargo planes to operate in Bahrain and the

perishables and pharma with sea-air connections in the short term with plans to include high-yield long-haul shipments for e-commerce and other specialist services for horses and automotives in the long term. Similar to its two other counterparts in Israel and Belgium, Challenge Airlines MT will operate regular services between LGG, Tel Aviv (TLV), Sharjah (SHJ), New York (JFK), and Mumbai (BOM).

GCC, which consists of Oman, Qatar, Bahrain, UAE, Kuwait, and Saudi Arabia.

ACN will invest capital, asset deployment, management services and expertise and hold a 49 percent stake in MENA subsidiary MAE Aircraft Management WLL. The company said the deployment shall be over the next 18 months with the first of six aircraft to include a B737800F and B767-300F due to arrive within the next two months.

Operations will be under the MENA Cargo brand, the freight cargo subsidiary of MAE. The company was established in 2020 and was awarded an air operator’s certificate (AOC) by Bahrain’s Civil Aviation Affairs (CAA) department in 2021. Operations will be managed by ACN moving forward as it holds an AOC in Bahrain.

Mammoth reveals launch partner for 777-300ERMF

Lithuania-headquartered AviaAM Leasing last week signed a conversion agreement for six 777-300ERMF converted freighters with Mammoth Freighters and is set to become the

launch customer of the programme, a press release announced.

The first 777-300ER of this order will undergo the conversion process in early 2023 at Aspire MRO’s facility at Alliance Airport in Fort Worth, Texas. Upon redelivery, the aircraft will be able to carry 99.79 tonnes of cargo on transatlantic routes and is expected to serve EU-US or China-EU trunk routes.

Including this order, Mammoth now has firm orders for twenty-nine 777 freighter conversions for multiple customers, and another twelve 777 freighter conversions in advanced stages of commitment, a total of 41 aircraft in its order book.

6 OCTOBER - NOVEMBER 2022 | www.payloadasia.com NEWS - LEASING & CHARTERING

Vietnam’s IPPG halts cargo airline plans

Vietnam retailer IMEX Pan Pacific Group has given up on plans to launch what could have been the country’s first cargo airline, citing concerns on softening demand and an uncertain economic outlook. The company’s shareholders made the decision on 26 October to ask the government to end the process of licensing its application to launch.

Jonathan Hanh Nguyen, chairman of IPPG, told local news that air cargo demand would decline given the current global turmoil, noting how

air freight fares have dropped to affordable levels for both foreign direct investors and other firms engaging in international trade.

The company in June announced a planned launch for September and had already completed the

procedures to lease four B737-800 converted freighters, along with orders for another 10 B777s worth US$3.5 billion. Nguyen in a statement added that IPPG would resume its plan at an appropriate moment when the global market recovers and stabilizes.

BBN Cargo Airlines plans to launch Jakarta unit this year

Aviation holding company BBN Cargo Airlines plans to establish a new airline based in Indonesia’s Jakarta Soekarno-Hatta International Airport as it looks to capitalise on growth in the region. The newly established cargo airline BBN Airlines Indonesia has set up its operations on 31 August 31 and is

in the process of getting the airline business license.

BBN Cargo Airlines, which operates Iceland-based cargo airline Bluebird Nordic, said the license should be ready this year, as it hopes to gain an aircraft operator certificate (AOC) in the second quarter of 2023.

MNG Airlines has received its second A330P2F converted freighter as the Istanbul-based carrier looks to expand its services and flight network amidst rising air cargo demand.

The aircraft, an A330-300P2F converted by Elbe Flugzeugwerke GmbH (with registration TC-MCN), is ready to take on the skies once again with commercial operations slated to start in mid-September. In November last year, MNG received its first A330300P2F with registration TC-MCM, which is being deployed in the airline’s China-Türkiye and Europe network.

MNG Airlines, which operates with a fleet of six A300-600s and three

A330s, said it was the first Turkish company to invest in the acquisition and conversion of the A330 aircraft into freighters in December of 2020. With a current fleet of nine widebody aircraft, it plans to add two more A330-300P2Fs beyond 2024.

7 www.payloadasia.com | OCTOBER - NOVEMBER 2022

MNG Airlines welcomes second A330P2F from EFW

NEWS - LEASING & CHARTERING

LOOK AHEAD WITH NEW GENERATION FREIGHTER

A350F.

Offering unrivalled operational efficiency, the Airbus A350F is based on the most modern platform ever developed. And with the latest technology to reduce fuel burn and CO2 emissions by up to 40%, it’s helping to keep the world a beautiful place.

airbus.com

New airport pact aims to boost GBA aviation

A new memorandum of understanding was officiated that aims to develop the aviation industry in the Greater Bay Area by leveraging the strengths of Hong Kong and Zhuhai airports and the bridge connecting the two cities and Macao (or the HZMB).

Under the MoU’s framework, the key collaboration projects include the launch of passenger link services, development of international cargo business, establishment of a high-

Samsung joins consortium to build US$11b Sangley project in the PH

Plans to ease the congestion in Manila’s main international airport could see a more positive direction as the SPIA Development Consortium was officially awarded the US$11billion Sangley Point International

Airport (SPIA) project in Cavite on September 14.

Led by Cavitex Holdings and the Yuchengco Group of Companies, the consortium will see foreign support

end aviation industrial park in Zhuhai, and active discussion on equity injection into Zhuhai Airport.

Talking about the modern industrial park to be developed in Zhuhai, HKIA said the two sides will collaborate on establishing a centre for aircraft maintenance, retrofit and configuration; a centre for aircraft parts and accessories production and distribution; a centre for aircraft engineering training and professional research; and other projects.

from Samsung C&T Corporation, the construction arm of the Samsung Group and builder of the Burj Khalifa in Dubai, Petronas Twin Towers in Kuala Lumpur and the Terminal 1 of Incheon International Airport. Other members of the consortium include MacroAsia Corp., Munich Airport International GmbH, and Ove Arup & Partners Hongkong Ltd.

Sangley Point International Airport is envisioned as a two-runway airport with a capacity for 80 million passengers per annum, expandable to four runways to handle up to 130 million passengers per annum. The project includes the construction of a 4-kilometer connector road, with provisions for rail connectivity, as well as fully integrated logistics and aviation support facilities.

Peli BioThermal

opens new station near

Narita airport

Peli BioThermal marked the official opening of a new service center in Japan with a grand opening event held on September 7. The new facility, which is the latest location to be added to the company’s growing network in Asia, is situated near Tokyo’s international Narita Airport.

It will also serve as an additional network station for the company’s

Crēdo™ on Demand rental program, which offers a flexible rental option for temperature-controlled pallet shippers. Peli BioThermal Asia said its products will be shipped on airlines operating in the region, including ANA and the JAL Group, which has the most comprehensive handling network in Japan, operating at numerous airports.

Located within Tokyo, Peli BioThermal’s latest facility is in proximity to Narita Airport and well positioned to support Japan’s biotech and healthcare sectors, including the likes of Takeda, Pfizer, GlaxoSmithKline, Novartis and Eisai.

10 OCTOBER - NOVEMBER 2022 | www.payloadasia.com NEWS - AIRPORTS

Cargo First streamlines handling operations at Bournemouth Airport

Cargo First, Bournemouth Airport’s dedicated cargo handling service, has strengthened its operation by bringing its customs bonded warehouse facilities in house, as the air hub aims to provide a faster alternative to the congested London airport system for freight customers.

Citing e-commerce growth as a catalyst, Bob Matharoo, head of cargo development at Cargo First, said the company is fine-tuning its system to

make the cargo ownership chain as short and responsive as it can be, with no third parties. The company spent 18 months benchmarking freight deliveries via Bournemouth to London warehouses and found it could cut the delivery time by half compared with using a London hub airport.

Cargo First and Bournemouth Airport are part of the UK’s privately-owned Regional and City Airports (RCA)

group, which also owns Coventry Airport, Exeter Airport and Norwich Airport. RCA also operates the XLR Executive Jet Centre FBO facilities at Birmingham, Bournemouth, Exeter and Liverpool airports.

SATS set to become world’s largest handler with Worldwide Flight Services merger

A week after news broke about a potential acquisition that would see a combination of the world’s top ground handlers, Singapore-based SATS Ltd has announced a proposal to acquire Paris-based air cargo handler Worldwide Flight Services at an enterprise value of US$2.1 billion.

SATS will acquire WFS from an affiliate of Cerberus Capital Management (Cerberus) and pay about US$1.2 billion in cash. The deal will be financed with a US$1.2 billion equity fund raising, with the balance coming from internal cash resources, SATS said. The acquisition is expected to close in March 2023. Temasek Holdings, which owns

about a 39.7 percent stake in SATS, has agreed to vote in favour of the acquisition.

Paris-based WFS operates in five of the top 10 cargo airports in North America and EMEA, including Los Angeles, Chicago, Miami, Frankfurt

and Paris. Its annual sales stood at €1.3 billion. Cerberus bought the French firm from Platinum Equity in 2018 for about €1.2 billion. SATS, on the other hand, is present in four of the top 10 cargo airports in Asia, including Hong Kong, Taipei, Singapore and Beijing.

Lödige Industries to modernize JFK’s cargo facility

Lödige Industries has been selected by on-airport developer Aeroterm to install a state-of-the-art automated cargo system at New York JFK’s future 350,000-sqft cargo facility, which will be exclusively used by Worldwide Flight Services.

Lödige’s system will feature two elevating transfer vehicles with a ULD storage rack for 218 ULD positions and three-level ULD racks to ensure high storage density in

WFS’s new terminal and free up space for other handling activities. The equipment also includes three truck docks, a castor deck area and 14 elevating workstations.

The new cargo facility, scheduled for completion in early 2024, will include greater ramp capacity to handle three of today’s large freighters (Group VI aircraft) simultaneously. It will also have more than 50 dock doors for the efficient transfer

and tracking of goods through the facility. It is expected to handle an annual throughput of approximately 350,000 tonnes.

11 www.payloadasia.com | OCTOBER - NOVEMBER 2022 NEWS - CARGO HANDLING

Worldwide Flight Services wins contracts with ANA and Nouvelair

ANA has signed a three-year agreement with WFS to provide offline cargo reception points at 11 regional airports, with road feeder services carrying cargo from the UK regions. Regional airports include Aberdeen, Belfast, Birmingham, Bristol, Cardiff, East Midlands, Edinburgh, Glasgow, London Gatwick, Manchester, and Newcastle.

WFS operates over 600 trucking services a week for airline and freight forwarding customers in the UK, transporting over 50,000,000 kilos annually via connections to 18 UK airports. ANA will continue to work with its existing cargo handler at London Heathrow.

At London Gatwick, Nouvelair has chosen WFS as the cargo handling partner for its weekly passenger flights to Tunis. The airline, which operates three Airbus A320s to the UK, said it will cut down its weekly flights for the winter season with plans to expand at regional airports in 2023.

Cathay Pacific unit opens purpose-built facility for pharma in Hong Kong

Cathay Pacific Services Ltd (CPSL) earlier this month opened its newest pharma facility at its cargo terminal in Hong Kong airport, the largest dedicated hub amongst Hong Kong’s cargo terminal operators. The dedicated pharma handling centre has a fully temperaturecontrolled area of over 1,250 square

metres, equipped with the latest technologies and described as the ‘largest’ dedicated facility for pharma amongst other Hong Kong-based air cargo terminals.

CPSL said the new facility is capable of processing 235,000 tonnes of pharmaceuticals per year, which is

double the capacity of the existing cold storage area and capacity. The company describes it as the ‘largest dedicated pharma handling centre of any Hong Kong-based air cargo terminal.’ To ensure prompt acceptance, storage and delivery, the pharma hub is directly connected to the container handling system and was built following the IATA CEIV Pharma standards.

CPSL said the new facility is one part of the company’s total cold chain solution. The cargo terminal operator also has a 1,250-sqm multitemperature-zone cold room, a perishable-handling centre, thermal dollies for airside transfers and a mobile container solution that allows optimal freshness for temperaturesensitive goods.

Cathay Pacific Cargo Terminal provides a full span of air cargo services for airlines operating at Hong Kong International Airport and is capable of handling an annual throughput of 2.7 million tonnes.

12 OCTOBER - NOVEMBER 2022 | www.payloadasia.com NEWS - CARGO HANDLING

Worldwide Flight Services has closed 3-year contracts with All Nippon Airways (ANA) and Tunisian airline

Nouvelair, a newcomer in the cargo business, as the airlines look to expand in the United Kingdom.

Mediterranean Shipping Company sets eyes on air cargo service

Mediterranean Shipping Company or MSC is making its first step into the air cargo market amidst customer demand with a dedicated solution that is expected to complement its container shipping services.

The new solution will be available from early 2023, following the delivery of the first of four Boeing 777-200F aircraft that will be branded with the shipping line’s own

livery. MSC has appointed Jannie Davel, formerly of Delta Cargo, Emirates SkyCargo and DHL, to build the future air cargo team.

Atlas Air, a subsidiary of Atlas Air Worldwide Holdings, will operate the aircraft under a long-term ACMI lease agreement (aircraft, crew, maintenance and insurance). Atlas earlier in January announced the order of the four aircraft, with delivery scheduled in Q4 of this year.

GEODIS widens footprint in southern Spain

GEODIS’ freight forwarding division has established a new service hub in the southern region of Spain, with a new office in Seville commencing business on 1 October. The company now offers both maritime and air transport solutions in the Andalusia and Extremadura parts of Spain along with additional value-added services, including a control tower for complete oversight, purchase

order and vendor management and emission reporting.

With well-established operations in other major Spanish cities including Barcelona, Bilbao, Madrid and Valencia, the Group’s freight forwarding services have been available to the country’s importers and exporters for over 20 years.

The GEODIS team in Seville joins the 350 employees in Spain and over 44,000 global staff across the group’s network spanning nearly 170 countries. The forwarder said it is enhancing the visibility of cargo status through its web-based platform IRIS.

Italy’s new flag carrier ITA Airways offers capacity on cargo.one

A year after officially starting its operations, Italian flag carrier ITA Airways has partnered with cargo. one to market its cargo capacity as part of the airline’ customer-centric and digital strategy.

Starting in Autumn, freight forwarders can gain quick digital access to ITA Airways Cargo’s capacity on cargo.one. The move comes as the Italian carrier is fasttracking its booking through digital sales channels like cargo.one. With a few clicks, forwarder users can view ITA Airways Cargo’s capacity on routes and rates in real time and instantly book and receive confirmation.

Moritz Claussen, founder and Co-CEO of cargo.one, mentioned the airline is savvy to pursue a digital strategy with customer centricity at its core. The airline, with its hub in Rome Fiumicino Airport (FCO), provides

cargo and mail transportation services using the bellies of its passenger aircraft, complemented by its own road feeder services. It celebrated its first year of operations on 15 October and plans to have 74 aircraft in its fleet by the end of this year. The airline aspires to become the greenest fleet in Europe within the next 4 years.

13 www.payloadasia.com | OCTOBER - NOVEMBER 2022 NEWS - FREIGHT FORWARDERS

CargoAi offers Neste’s green jet fuel to drive takeup of SAF

Freight forwarders of all sizes can now play a more significant role in reducing cargo-related carbon emissions with a new tie-up between CargoAi and Neste. Starting November, CargoAi offers the option to purchase Neste MY Sustainable Aviation Fuel when booking cargo transport. This can be done either after a booking is confirmed or when the cargo is being tracked.

AirAsia to grow Teleport’s fleet with three Airbus converted freighters

Teleport, the logistics venture of Capital A (formerly AirAsia Group Berhad), plans to expand its cargo fleet with the addition of three Airbus A321 converted freighters

or A321F. The three narrowbody freighters, which will be leased from BBAM, will be delivered in stages beginning in the first quarter of 2023.

During the booking or tracking phase, freight forwarders on cargoAi will be prompted with the CO2 emissions data calculated based on IATA standards. The digital cargo booking platform allows the option to purchase SAF in smaller quantities. Neste ensures specific SAF volumes purchased are delivered and used by partner aircraft operators.

Teleport said each A321F, capable of carrying up to 27 tonnes of cargo per flight, will be positioned across key markets like Malaysia, Thailand, Philippines and Indonesia. The digital forwarder noted that this payload capacity is ideal considering the surge in market demand for air cargo to fulfill both small-scale items of ecommerce and bigger scale volumetric cargo.

Upon the delivery of the three narrowbody freighters, Teleport will grow its dedicated cargo fleet to four freighters in total, in addition to over 200 AirAsia passenger aircraft with space on the belly. The lone freighter in its current cargo fleet, a 737-800F operated by K-Mile Asia, is parked, as of writing.

Scan Global Logistics opens second office in the Emirates

In early September. Scan Global Logistics opened a new office at the Abu Dhabi Airport Freezone, its second office in the United Arab Emirates. Situated close to the Khalifa seaport and Etihad Cargo’s

hub at Abu Dhabi airport, the new office is equipped with a dual license of a freezone and a mainland company for offshore and onshore requirements. Scan Global said the new office will be operational 24/7

and will offer round-the-clock service for shipments requiring urgent handling like aid and relief, as well as pharma.

23-year-veteran Leslie Farnworth, general manager for Abu Dhabi, said the forwarder will be able to provide customers with faster inspections and efficient solutions in no time with having customs close by.

Farnworth added that the company will also work closely with its sister office to offer land transportation to neighbouring countries in the region. Scan Global also offers solutions to help decarbonize their customers’ supply chains, including the option to use sustainable aviation fuel. The new office in Abu Dhabi comes after the opening of the company in Dubai seven months prior.

14 OCTOBER - NOVEMBER 2022 | www.payloadasia.com NEWS - FREIGHT FORWARDERS

UPS redefines package delivery with premier service in Singapore

UPS Healthcare in October launched its latest premium product in Singapore. The highly specialised UPS Premier service combines a new level of tracking, prioritisation and recovery for patient-critical, time- and temperature-sensitive shipments.

“Of three levels of UPS Premier available globally, UPS Premier Gold has now launched and is available in Singapore. The service offers

acceleration and first-in first-off package prioritisation, with realtime monitoring through a stateof-the-art proprietary mesh sensor built into package labels. This allows visibility of the package down to even 1 metre within the UPS network.”

Other benefits of UPS Premier include expedited package recovery processes and same day redelivery, temperature-controlled shipping environments, and 24/7 support by

live agents to ensure medications and healthcare packages remain compliant.

CEVA deploys electric vehicles for Decathlon in Thailand

CEVA Logistics is connecting sports enthusiasts in Thailand with Decathlon products thanks to an expanded fleet of electric vehicles. The fleet of three electric vans and two electric straight trucks are estimated to reduce the company’s carbon emissions by more than 100,000 kilograms each year.

The two started working together in 2021 under a deal that covered nationwide ground distribution for the retailer’s six stores at the time. The ground fleet at the outset in 2021 was composed of one electric van and three conventional diesel trucks. Two additional electric vans

are currently expected to be added to the fleet in 2023, along with two more of the six-wheel EVO G9 electric straight trucks, which are 32 feet long and have a gross vehicle weight of 33,000 pounds.

The new fleet is expected to

operate 5,500 trips per year totaling approximately 900,000 miles, including the pick-up of products from local suppliers, delivery to the Decathlon distribution center in Samutprakarn and moving merchandise into the nationwide retail network.

DB Schenker turns to robots for automated Prague facility

DB Schenker is set to open a new automated fulfillment warehouse in the Prague region next year. Along with retail operations, the new 55,000-sqm distribution center will manage B2C e-commerce activities, including an extensive valueadded services area addressing the demand for personalized products requested by consumers.

The fulfilment center, which will be located near Prague Airport and a major highway that runs to Germany, is scheduled to start operating in the summer of 2023 to

serve Central and Eastern Europe.

The new distribution center will feature a highly scalable, modular G-T-P (goods-to-person) system combined with an extensive conveyor system and a highperformance cross-belt sorter provided by partner Körber. The facility will also feature one of the largest deployments of autonomous mobile robots in Eastern Europe. Körber’s software solution will control more than 100 AMRs that will be part of the highly automated logistics ecosystem.

15 www.payloadasia.com | OCTOBER - NOVEMBER 2022 NEWS - LOGISTICS

DHL Express opens West Hanoi Service Center

DHL Express inaugurated its West Hanoi Service Center in Vietnam and received the TAPA FSR Class ‘A’ certification for the new facility in October. The companyinvested

around €2 million for the 2,600-sqm facility, which is almost three times the size of its previous site. The new service center is equipped with an array of technologies to minimize carbon emissions and maximize operational efficiencies, including ‘green’ air-conditioning systems utilizing variable refrigerant volume technology, helicopter fans and electric vehicles.

The West Hanoi Service Center is the 100th facility in the Asia Pacific region (excluding China) to achieve TAPA “A” certification by the Transported Asset Protection Association. The certification reflects the highest level of security standards and denotes a facility as one that offers “elevated security protection”.

The TAPA certification is an internationally recognized industry standard that is given to companies that meet the requirements for secure warehousing or in-transit storage of high value goods across the global supply chain. The TAPA certification is only awarded upon rigorous audit processes.

Atlas Air flies Hong Kong-Bogotá service

Cainiao Network is extending its partnership with Atlas Air with the launch of a new air freight route connecting Hong Kong to Bogotá, Colombia, using the latter’s 7478F plane. The freighter will depart Hong Kong International Airport and transit in Miami International Airport (MIA), with final destination at El Dorado International Airport (BOG) in Bogotá, Colombia.

Cainiao said the air freight route will be further optimized and upgraded to include transit in São Paulo, Brazil, flying a Hong Kong–Miami–

China’s JD Airlines secures air carrier certificate

Jiangsu Jingdong Cargo Airlines or JD Airlines, an affiliate of JD Logistics, received the air carrier certificate from the Civil Aviation Administration of China (CAAC) on August 31. The carrier will have its principal base

for Cainiao

São Paulo–Bogotá route which will shorten flight duration to only 37 hours.

Atlas Air started operating three weekly charter flights for Cainiao to link Hong Kong with Brazil and Chile in October 2020. In November 2021, Cainiao expanded this partnership to include daily charter flights between China and Santiago, Chile. And, in February, it welcomed a new Boeing 747-8F under a long-term agreement to increase capacity on routes from China to Brazil and Chile.

at Nantong Xingdong International Airport as it plans to develop its domestic network in China around the key cities of Nantong, Beijing, Shenzhen and Wuxi.

The airline said it will extend its reach to Chengdu and Chongqing and will gradually cover major cities in Southeast Asia, Japan and Korea and later in Europe, Middle East and North America by the end of 2025.

JD Airlines plans to open up its capacity to the market with a single trip able to transport as much as 23 tonnes. The carrier is looking to cater to highvalue goods, high-end manufacturing, medical, and fresh produce.

16 OCTOBER - NOVEMBER 2022 | www.payloadasia.com NEWS - EXPRESS

Singapore commits to green jet fuel with ICAO agreement

Singapore and the International Civil Aviation Organization (ICAO) have signed an agreement for Singapore to provide and receive assistance, capacity-building, and training (ACT) on Sustainable Aviation Fuel (SAF) under the ACT-SAF programme.

Under the programme, Singapore will provide experts and resources to share expertise and experience, tackling areas such as setting up an International Advisory Panel (IAP) to engage industry and canvas ideas, developing a Sustainable Air Hub Blueprint to provide a national roadmap, adopting an ecosystem approach and catalyzing

public-private collaboration to drive implementation.

The ACT-SAF programme is one of ICAO’s key initiatives in working towards achieving this goal. The capacity-building programme supports States on the development and deployment of SAF, fosters partnerships and cooperation as well as provides a knowledge sharing platform for SAF initiatives across countries and the world.

Singapore has embarked on a 1-year pilot to use blended SAF at Changi Airport and will have the world’s largest SAF plant when it

is completed next year, a useful reference for other States planning to develop and deploy SAF.

The Civil Aviation Authority of Singapore said the city-state will receive support in other areas of interest, including in policy and regulation, industry development and technology which will help in the development and deployment of SAF in Singapore. The city-state is the fourth signatory of the ICAO ACT-SAF agreement after Brazil, the European Commission, and Spain.

Mr Han Kok Juan, Director-General of CAAS said, “The ICAO longterm aspirational goal is a historic agreement to undertake highly ambitious climate action. Singapore signing onto the ACT-SAF programme is a statement of our commitment to this global goal and to do our part to contribute to this global effort. This multilateral collaboration complements what we are already doing at the national level through initiatives like developing the Sustainable Air Hub Blueprint and bilaterally with countries like New Zealand, United Kingdom and United States. They are mutually reinforcing and add momentum to the overall decarbonisation effort.”

18 OCTOBER - NOVEMBER 2022 | www.payloadasia.com

MARKET REPORT

Asia’s handlers suit up for lithium battery shipments

Asia’s cargo handlers are preparing themselves to ensure the safe transport of lithium-battery shipments with Singapore’s SATS Group and Hong Kong’s Hactl getting their certifications from the International Air Transport Association (IATA).

Named ‘Centre of Excellence for Independent Validators Lithium Batteries’ (CEIV Li-batt), the IATA certification programme establishes the air transport industrty’s baseline standards to improve competency and quality management in the handling and carriage of lithium batteries, alone or with finished products, along the supply chain.

Along with subsidiary Asia Airfreight Terminal in Hong Kong (AAT) and Indonesian joint venture PT Jasa Angkasa Semesta Tbk (PT JAS), SATS Ltd received its certificates during the 2022 World Cargo Symposium held in London. The Singaporebased airside services provider believes the certification, which will

remain in effect for two years, will set a new international benchmark for safe aviation travel and give added confidence in the handling of shipments labelled as dangerous goods. The ground handler has put in place a digital compliance solution to enable safer and automated dangerous goods verification checks

In Hong Kong, independent handler Hactl has been steadily tightening its procedures and improving resources for handling such traffic over recent years. It received its certification on 11 October. Being an IATA accredited training school since 2003, Hactl is authorised to train its own and thirdparty staff based on IATA’s Dangerous Goods Regulations (DGR) and Lithium Battery Shipping Regulations. Aside from lithium batteries, Hactl is also certified to handle pharma, perishables and live animals for air transport.

Hactl executive director and CFO, Amy Lam, commented: “Lithium batteries will become an increasing

element of air cargo traffic globally, so ensuring the correct procedures and training for handling them has never been more important.”

“CEIV Lithium Batteries represents a uniform and universally accepted standard. We are therefore proud to have achieved it, and to now hold all four CEIV accreditations,” Lam noted.

Handlers say there has been growing concern on rogue lithium battery shipments amid continued growth in eCommerce, which pose a safety risk to aircraft, passengers and crew. There is also the issue of risks arising from incorrect packaging and handling of battery shipments. Brendan Sullivan, IATA’s Global Head of Cargo, said, the plan is “to see a network of CEIV Li-batt trade lanes with participants certified at origin, destination and in transit points.”

Lithium batteries will become an increasing element of air cargo traffic globally, so ensuring the correct procedures and training for handling them has never been more important.

19 www.payloadasia.com | OCTOBER - NOVEMBER 2022

REPORT

MARKET

ST Engineering gives rundown of its next go-to market outside Singapore

In an interview, Jeffrey Lam, Commercial Aerospace President at ST Engineering, talks to Payload Asia about its biggest market outside Singapore and what the prospects are for the aerospace company amidst the current business environment.

Can you tell us about your US operations? What makes it a key market for ST Engineering?

ST Engineering’s operations span over 50 cities in 23 states in the US, providing innovative products and solutions to commercial and government customers across diverse market segments from aerospace, smart city to defense and public security. The US is the Group’s largest market outside Singapore.

ST Engineering’s aerospace operations in the US comprise three airframe MRO facilities in Florida, Texas and Alabama, an engine nacelle centre of excellence and an engine wash solutions provider. It is one of the largest airframe MRO solutions providers, if not the largest in the region, catering to a wide clientele including airlines, freight forwarders

and aircraft lessors.

Based on the press releases, it’s safe to say that ST Engineering is very active in introducing scholarship and training programmes in aerospace. How important are these programmes in ensuring that the next batch of engineers are well adept? Are there any skill gaps that need to be addressed?

Given the current mechanics shortage in the industry, scholarships and training programmes are important not only in attracting but also retaining talent by way of a rewarding career path. Working with airlines customers on some of these traineeship or onthe-job training programmes also help ensure that the trainees are exposed to the latest requirements and MRO work so that they pick up relevant skills that match market demands.

With very tight competition in the US market, do you see more demand for aircraft cargo conversions? What’s the outlook?

Amid global macroeconomic pressures, 2022 is still shaping up as

one of the air cargo industry’s strongest years with cargo revenues nearly double those before the pandemic according to IATA. Cargo volumes are projected to rise this year even as cargo yield moderates with the additional belly capacity from passenger aircraft returning to service. We hence remain positive on the demand outlook for freighter conversion.

Amongst your other products and services, which of them do you foresee will see increased demand based on the current macro environment?

With e-commerce here to stay, we foresee the growth of our freighter conversion business to continue strong in the near to mid-term before moderating to a steady state level. The other key business that we expect to pick up is MRO, which in the near term will be driven by flying activities recovering to the pre-pandemic levels. Over the longer term, as the global middle-class population expands, air travel demand is expected to also increase, leading to higher demand for MRO services.

20 OCTOBER - NOVEMBER 2022 | www.payloadasia.com

COMPANY PROFILE

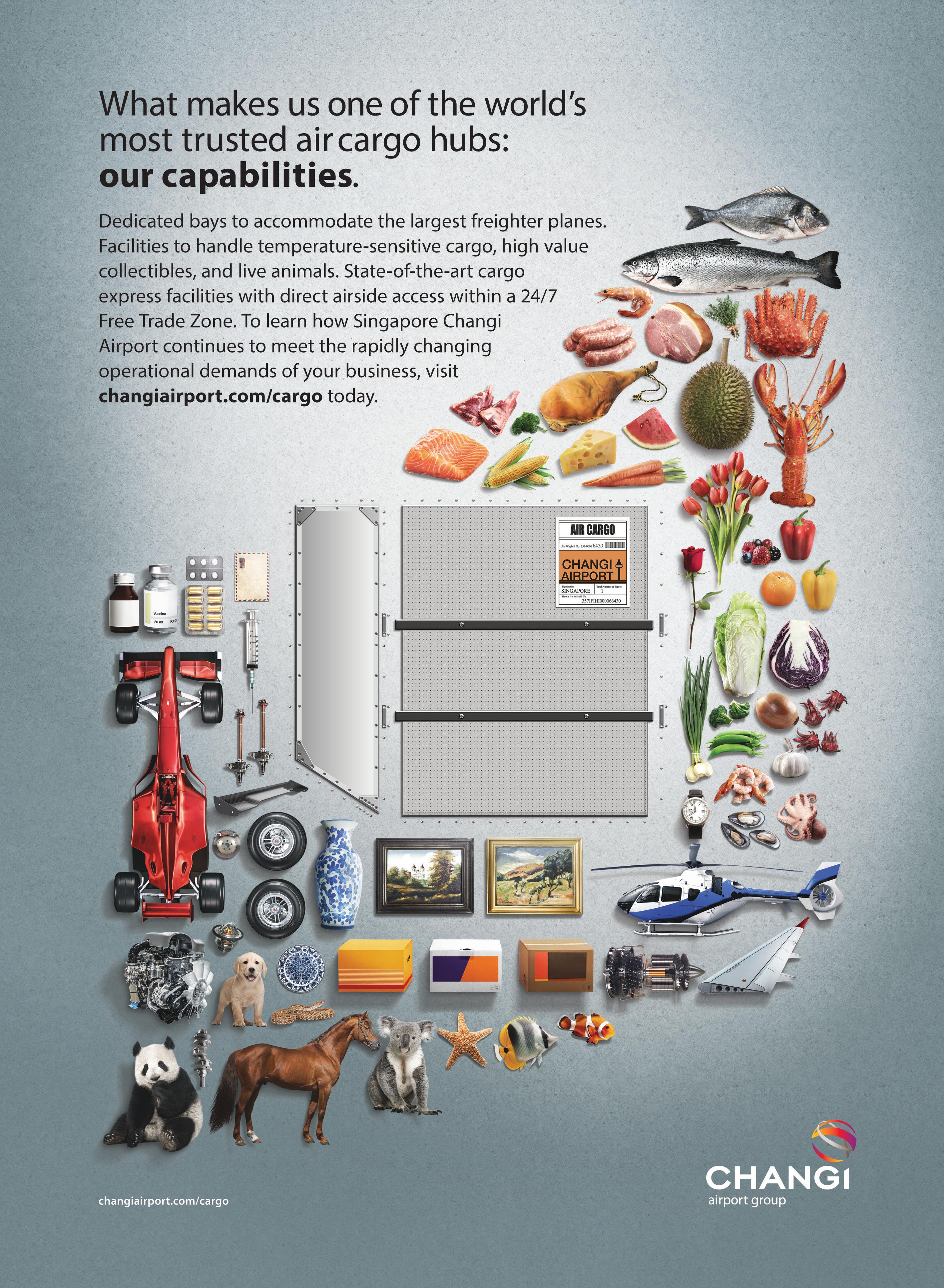

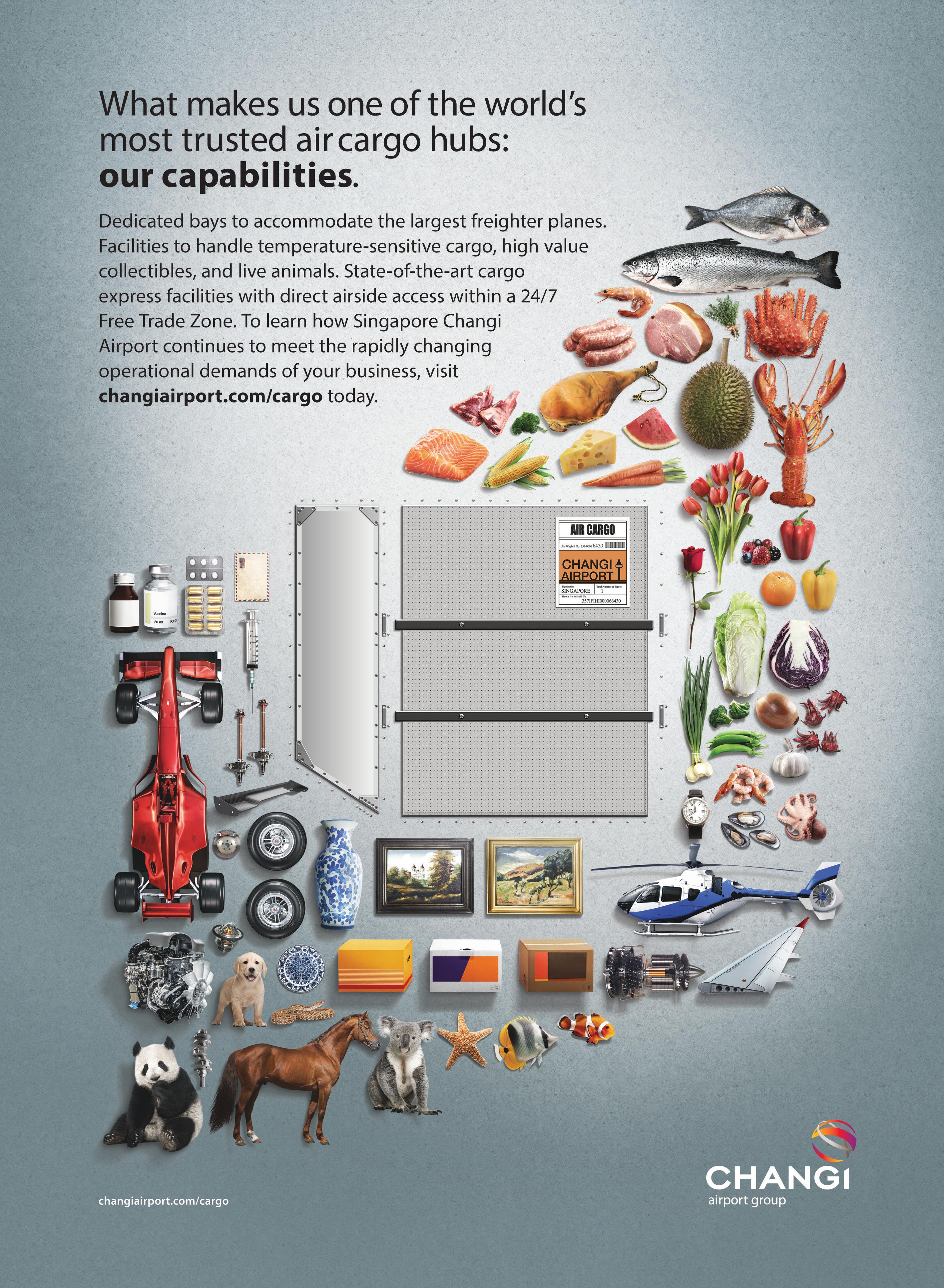

Etihad Cargo pulls out all stops to become the air freight partner of choice

Here’s an in-depth interview with Martin Drew, senior vice president global sales & cargo at Etihad Aviation Group, showing us the ins and outs of the company’s operations to give us a bird’s-eye view of what Abu Dhabi’s main carrier is doing to become the air cargo partner of choice.

Can you describe your fleet and how it meets your clients’ requirements? Are you seeing more demand for certain types of shipments?

Our current fleet comprises five Boeing 777 freighters, seven Boeing 777s, 40 Boeing 787s, 14 Airbus A320s and five Airbus A350s, with more 787s joining the fleet in 2022.

In terms of regions that show the most growth potential, Asia continues to be our largest market, accounting for 70 percent of our overall operations

To expand our freighter fleet and ensure we can continue to meet our customers’ capacity requirements, Etihad Airways has firmed up its order with Airbus for seven new-generation A350F.

The Airbus 350 freighters will upgrade Etihad’s freight capacity by deploying the most efficient cargo aircraft available in the market. With a 109-tonne payload capability, the aircraft features a large main deck cargo door, with its fuselage length and capacity optimised around the industry’s standard pallets and containers. Additional capacity through the complete conversion of Boeing 777s is another opportunity that Etihad Cargo will explore in partnership with Etihad Engineering.

In terms of demand for certain types of shipments, Etihad Cargo has witnessed growth across several of its premium products, which we have achieved through the introduction of new features and solutions, enabling Etihad Cargo to provide best-in-class services for the safe and

efficient transportation of cargo. For example, the performance of Etihad Cargo’s award-winning, CEIV Pharmacertified, dedicated pharmaceutical shipment solution, PharmaLife, increased by 46 percent in the first six months of 2022.

Etihad Cargo’s CEIV Live Animalscertified products dedicated to transporting live animals, LiveAnimals and SkyStables, have also witnessed year-on-year performance increases. We have achieved a 52 percent increase in the movement of live animals, and the performance of SkyStables increased by 137 percent compared to H1 2021. We continue to provide safe and secure transportation solutions for Etihad Cargo’s customers’ high-value cargo. Compared to H1 2021, revenue from FlyCulture, a tailored service for transporting valuable paintings, sculptures and musical instruments, increased by 128 percent.

You recently launched a new cargo service to Guangzhou. What are the new developments that are

21 COVER STORY www.payloadasia.com | OCTOBER - NOVEMBER 2022

having a positive impact on your operations on this route?

In terms of regions that show the most growth potential, Asia continues to be our largest market, accounting for 70 percent of our overall operations. China alone contributes over 20 percent of Etihad Cargo’s total operations, and adding 30 tonnes of capacity via direct flights to Guangzhou further demonstrates our commitment to China and the Asian market. With this latest addition to our network, Etihad has become the first international airline to operate long-haul passenger and cargo services to the top three Chinese gateways—Shanghai, Beijing and Guangzhou—since the start of the pandemic.

In addition to adding destinations and frequency to Etihad Cargo’s network across China, Etihad Cargo has launched new solutions and features to fully meet our customers’ needs in the region. In H1 2022, Etihad Cargo launched a Mandarin version of its website and booking portal, becoming the first Middle Eastern airline to launch a dedicated Mandarin website and cementing our strategic footprint in China. The Mandarin website and booking portal provide key features for our customers in China, including information about our products, station capabilities, feedback and claims. Since the launch of our new user-friendly platform, we have achieved an increase in usage and adoption. In H1 2022, 99.2 percent of all China’s bookings were made via the online portal, up from 94 percent at the end of 2021.

How has the pandemic changed the influence of cargo towards the airline’s overall direction in the near term and long haul?

The pandemic demonstrated the importance of cargo operations. With passenger flights grounded because of global travel restrictions, Etihad Cargo became the lifeline of the airline in addition to playing a major role in the UAE government aid programme as the national carrier. While Etihad remains predominantly a passenger airline, Etihad Cargo continues to have a prominent

position in the strategy and when making choices related to routes and aircraft deployed to destinations.

Based on your conversations with customers, what stands out as a key improvement when it comes to digitisation that they would like to see?

We continue to work closely with our customers to understand their requirements, and we have listened to what they want in terms of technology and digital solutions. Ultimately, our priority is to be the air cargo partner of choice, and we are achieving that by ensuring we are the easiest carrier to do business with.

Etihad Cargo committed to its digitalisation journey back in 2018, and we have invested in developing and launching features that have improved the customer experience. For example, we launched an enhanced booking portal to provide a quicker, easier and more intuitive process for our customers. Following the introduction of new updates to our online booking portal, including the enhanced look-to-book feature and

the addition of a dynamic newsfeed and personalized dashboards, the booking process is now more intuitive for our customers, resulting in higher quality booking data and a reduced need for booking modifications. As a result, usage of the online booking portal has surged, with 57 percent more bookings made via the portal.

Etihad Cargo has also invested in AI solutions that will boost the capacity of flights. Additionally, we have continued to invest in and support efforts toward automated reporting and real-time information, forming and strengthening partnerships with several ‘smart’ industry initiatives, including One Record, Cargo iQ and the IATA e-AWB. In H1 2022, Etihad Cargo achieved 81 percent e-AWB adoption, benefiting our customers and accelerating our journey to paperless airline operations.

Utilizing technology to ensure the cargo Etihad Cargo transports is fully traceable and trackable has enabled us to simplify interactions with our customers and continue to provide them with a seamless end-to-end

22 OCTOBER - NOVEMBER 2022 | www.payloadasia.com

COVER STORY

Martin Drew, senior vice president global sales and cargo at Etihad Aviation Group

experience during all touchpoints throughout their cargo’s journey.

Where does the company stand on sustainability and inclusivity?

Etihad Cargo has built a culture that fully encompasses diversity and inclusivity. We ensure equality throughout the hiring process, and every team member has access to the same world-class learning, development and training opportunities to help them progress in their careers.

In terms of sustainability, Etihad Cargo has, in full alignment with Etihad Aviation Group’s sustainability plans, pledged to achieve net-zero carbon emissions by 2050. We recently became the first Middle Eastern carrier to join TIANA’s BlueSky sustainability verification programme. This demonstrates our ongoing and firm commitment to sustainability and willingness to invest in providing more sustainable solutions for our customers and the broader cargo sector. Becoming one of the first participants was a natural step in our aim to achieve net carbon emissions by 2050. The first phase assessment will enable Etihad Cargo to more effectively measure our performance and track our sustainability progress as we continue our sustainability journey. We hope to see other carriers join the programme in the coming months, so we can collectively start to make air cargo more sustainable.

Furthermore, we have partnered with IATA to trial a CO2 emissions calculation tool developed explicitly for cargo flights. This is another positive step in facilitating the use of real data to enable further improvement within the sector. Together, we will use the calculator to manage and report on sustainability progress to provide the entire value chain, including shippers, forwarders, investors and regulators, with reliable and trustworthy data. Over the three-month trial, Etihad Cargo will track flights and collect actual data on fuel burn, load factors and other key variables to develop an accurate calculator. This partnership demonstrates Etihad Cargo’s strong commitment to innovation, and we actively seek out and facilitate the

development, trials and launch of sustainable solutions for its customers and partners through the adoption of state-of-the-art technology and digital solutions.

These partnerships build on the sustainability progress we have already made, which has included replacing 3,000 containers from our original aluminum unit load device (ULD) fleet with a more environmentally friendly, lightweight version. The utilization of these lighter ULDs can provide a weight saving of over 200 kilograms on an average wide-bodied freighter flight, which has lowered fuel consumption and CO2 solutions.

Etihad Cargo has also entered into a memorandum of understanding (MOU) with B Medical Systems to develop and launch the world’s first airline-specific passive temperaturecontrolled container. The containers, which utilize passive cooling technology, retain temperatures from -80 to 25 degrees Celsius for up to five days without requiring an external power source and offer load capabilities ranging from two to 1,500 liters. These units will significantly reduce carbon emissions by reducing the power needed to maintain the temperature for temperaturesensitive pharmaceutical shipments. Trials of the sustainable container

units will commence shortly, and a commercial launch date will be announced following the successful completion of the trials.

Which issues do you foresee will bring headwinds for air cargo in the near term? How prepared is the airline when it comes to unforeseen challenges?

In the near term, the air cargo industry is facing a number of challenges, including high fuel prices and supply shortages. Although border restrictions are easing, a new wave of lockdowns and preventative measures being taken in China as part of the country’s zero-COVID policy will need to be monitored carefully.

At Etihad Cargo, we have worked together with stakeholders to manage the circumstances dynamically, focusing on providing capacity on key routes and expanding our network and operations. We have concentrated on reframing these challenges as opportunities to enhance and improve our products and services, utilizing a proactive and customer-centric approach to dynamically and agility manage these challenges. We have maintained very close relationships with our customers to ensure we can provide innovative solutions to their capacity challenges and can meet any unforeseen challenges in the future.

23 COVER STORY www.payloadasia.com | OCTOBER - NOVEMBER 2022

GEODIS Asia Pacific’s Onno Boots on air freight, investments and customers

Find out how French logistics and transport operator GEODIS is capitalizing on its strong air freight and logistics network as Onno Boots, regional president and CEO for Asia Pacific joins Payload Asia for this edition of our C-Suite interview.

Can you give us a brief background of the cargo network of GEODIS in Asia Pacific? Can you share with us the different infrastructure that GEODIS has invested in to achieve growth?

Pre-pandemic in late 2019, we invested into our very first own controlled air network, connecting Hong Kong to Mexico, serving our high-tech customers. It proved to be the game-changing service enhancement as the pandemic pushed countries into closing borders, and grounding of almost all available passenger flights. Within our own controlled network, we were initially aiming for the flexibility of solutions to our customers, allowing

them to trade off on time and cost. The AirDirect offerings on our own controlled network, namely AirFast, AirSave and AirFlex allows companies to pick and choose how fast they wish their cargo to be moved, balancing against the cost of freight, without sacrificing security and reliability. In the pandemic years, the reliability of our AirDirect services provided our customers with the assurance of service despite the challenging restrictions disrupting normal flow of cargo.

We made another large investment into our Intra-Asia Pacific air network infrastructure in late 2021. We positioned Malaysia as an air hub and invested 3-times-a-week flight operations using 330-300P2F aircrafts, connecting China, Hong Kong, Malaysia, India and Australia via key Southeast Asia cities as gateways. Our scheduled pick-up and delivery truck network connecting Southeast Asia from Singapore, Malaysia,

In the last 2 years we made large investments into data and integrated this data into our internal systems by partnering up with Seabury, WorldACD and TAC index.

Thailand and Vietnam enabled us to move the freight into different airports and gave our customers flexibility as we were able to offer all the features of our AirDirect network within the 3 service levels.

In mid-2022, we continued our investments by converting these charter operations to expanded nodes using multi-carrier Block Space Agreements in order to serve our clients on the same country connections with expanded reach. Our investments into Mexico from the North Asia and China region continues, we extended our current

24 OCTOBER - NOVEMBER 2022 | www.payloadasia.com

C-SUITE

scheduled charter operations to Mexico from Shanghai and Hong Kong.

In mid-2022, we increased the frequency of our own flight operations from CN to UK and NL Hubs from 2 times a week to 4 times a week. These consistent investments on our AirDirect network allow us to control the entire flight network and gives us great flexibility to manage our customers’ supply chain.

How is GEODIS navigating the uncertainties and staying resilient? Where does air cargo fit in the company’s overall strategy? We stay very close to our clients, airline partners and have regular forecast reviews to understand our clients demands and capacity changes in the market. In the last 2 years we made large investments into data and integrated this data into our internal systems by partnering up with Seabury, WorldACD and TAC index.

Our airfreight solutions are increasingly driven by the investments into our own controlled GEODIS Air Network. We have a controlled own flight network with our own A330-300 freighter. This allows us to manage the capacity based on the demand

and gives us options to use the freighters based on market and our customer needs.

Freight Forwarding plays a big role in our organization’s long-term strategy and our Global Air Network is one of the key enablers of our long-term vision.

What can you say about the recent move of major shipping lines into air cargo? Do you expect this trend to continue?

We acknowledge the market need for more fixed capacity services. That has been the reason driving our investments into our own GEODIS Air Network before the pandemic began. It would be interesting to see how the shipping lines will manage their new air cargo businesses as the cost drivers and the DNA of these two types of shipping services are very different.

What’s the best way to deliver goods right now? Is it by air, sea or multimodal? Do customers now have a better understanding on how much more they have to pay to avoid any shipment delay?

There is no best way to deliver one’s goods. There is only “voice of the customer” and meeting this demand. It is all dependent on the customers’

needs. GEODIS is well positioned to handle all requests regardless if it is Air, Sea, Road or multi-modal.

With air cargo demand slowing down, what’s the outlook for the last quarter with peak season on the horizon?

As the usual peak prior to the China Golden Week is not occurring this year, it has been reported that volumes have dropped year on year. It remains to be seen how the market will work out in the last quarter with the peak season on the horizon. With early planning and disciplined implementation, GEODIS is poised to handle any potential surge or increase during this peak season. We still see strong demand within Asia and stay focused to maintain our services within Intra-Asia.

What’s next for GEODIS APAC? Which current trade blocs and policies do you see will help logistics and transport in the region

We will continue to serve our clients by maintaining our fixed capacities, connecting Asia to Europe and Transpacific. Our focus within IntraAsia with our core carrier partners on block space agreement levels will continue. We continue to sharpen our capabilities to match our customers’ growth within the Asia Pacific region, and we foresee IntraAsia demand will further push ahead in 2023 given the changing locations for sourcing we have observed since the pandemic started.

Within Asia Pacific, countries where the fears of an incoming recession have been less pronounced, we fully anticipate to grow our business in India and Vietnam, particularly as companies seek to de-risk their supply chain with a China+1 strategy, for example in India where Apple is shifting its production to India, and in Vietnam, where it is expected that the country’s economy will grow much faster than historical trends and faster than China

We continue to invest in our contract logistics facilities in China, India and Singapore, to meet our customers’ needs in ensuring they are faster to market, as well as grow our pharma capabilities and offerings.

25 www.payloadasia.com | OCTOBER - NOVEMBER 2022

C-SUITE

Onno Boots, regional president and CEO for Asia Pacific

Vienna Airport’s potential in the heart of Europe is growth with reliability

Flughafen Wien AG knows certain investments need to be made in cargo and this time the airport operator is banking on Vienna Airport’s major potential as a central hub. Location-wise, the airport sits in the middle of Europe with around 20 countries reachable with a oneday drive. In this interview, Michael Zach, vice president for sales and finance, ground handling and cargo operations at Flughafen Wien AG, gives us a rundown of Vienna’s airport community, as it aims to take its fair share under the sun.

Can you give us a brief background of the cargo community at Vienna Airport?

Thanks to its spacious and modern infrastructure, Vienna Airport achieves reliable and fast cargo turnarounds and is well equipped for further growth. Our excellent cargo

infrastructure and well-trained staff is a huge advantage for the entire cargo community such as freight forwarders and airlines. Vienna Airport has established itself as the ideal cargo hub that connects Asia with Central and Eastern Europe. We provide a dense and reliable road feeder network with direct access to the European highway network and are ideally positioned in the heart of Europe, reaching 15-20 countries with a one-day drive.

With a dedicated cargo sector, AirportCity Vienna is the most attractive and best-known business location in Austria. Urban and modern facilities provide an attractive business environment for air cargo entrepreneurs regarding office and warehouse spaces, conferencing and event locations, numerous hotels, and gastronomy.

Vienna Airport has established itself as the ideal cargo hub that connects Asia with Central and Eastern Europe.

Who are the main operators that bring in cargo business to the airport?

Vienna Airport is the base for many global cargo airlines. Lufthansa Cargo with its partner Austrian, Korean Air, Asiana, Cargolux, Silk Way Airlines, Turkish Airlines, EVA Air, Emirates or Qatar are just a few of many airlines operating in Vienna. Also, many international freight forwarders like DHL, Cargopartner, DB Schenker, Kühne + Nagel, DSV, Expeditors, Bollore, C.H. Robinson and CEVA Logistics are represented at Vienna Airport.

26 OCTOBER - NOVEMBER 2022 | www.payloadasia.com SPECIAL FEATURE

Which international cargo routes does VIE connect to?

Regular freighter and widebody connections are offered to Seoul, Istanbul, Baku, Taipei, Bangkok, Shanghai, New York, Chicago, Los Angeles, Washington D.C., Toronto, Montreal, Doha, Dubai, Abu Dhabi, Addis Abeba, Milan, Madrid, Luxembourg, Oslo, Cologne and Leipzig.

What are the issues airports currently face on ground? How has the pandemic influenced the airport’s overall direction in the near term and long haul?

Vienna’s tonnage is characterized primarily by the following: Stability and potential. Thanks to generous investments in infrastructure and capacities, handling ran smoothly even during the corona crisis or holiday peaks in 2022. Strong investments in logistics infrastructure as well as intensive cross-qualification activities in our handling department ensures generous, fast, and congestion-free handling capacities. Customers can plan their growth with reliability.

With the Vienna Airport Pharma Handling Center, customers have access to a highly specialized facility to maintain temperature-sensitive cold chains seamlessly, quickly, and safely. Our Pharma Handling Center is GDP compliant and fully temperature controlled with a dedicated CRT and COL zone. It connects air- and landside directly and offers short apron distances to the aircraft. Exclusive truck docks (including ULD handling dock), dry ice and electricity charging services are available.

What are the airport’s plans in terms of sustainability?

With a consistent and comprehensive sustainability strategy, Vienna Airport will very soon be completely CO2-neutral. Austria’s largest photovoltaic plant with a capacity of 24 megawatts peak and an area of 24 hectares is operational from

Spring 2022. Further measures for reduction of CO2 like the current conversion of the airport vehicle fleet to electric drives or a CO2-free use of district heating are ongoing.

The consistent implementation of its sustainability strategy was one of the decisive factors for Vienna Airport’s recognition as “Best European Airport 2022” by the Airport Council International.

Which technologies or infrastructure are you looking at for future investment?

We have already invested heavily in our logistics infrastructure and are well prepared for further growth. The available handling capacity is

Strong investments in logistics infrastructure as well as intensive cross-qualification activities in our handling department ensures generous, fast, and congestion-free handling capacities.

meanwhile up to 350,000 tonnes per year, which created potential for further 90,000 annual tonnes in regard to the previous tonnage. Furthermore we are focussing on training and cross-qualification activities of our employees to be able to best cope with traffic peaks in the various departments.

27 www.payloadasia.com | OCTOBER - NOVEMBER 2022 SPECIAL FEATURE

Michael Zach, vice president for sales and finance, ground handling and cargo operations at Flughafen Wien AG

IATA draws attention to cargo’s top priorities at WCS in London

The International Air Transport Association (IATA) outlined four priorities to build resilience and strengthen air cargo’s postpandemic prospects. The priorities, outlined at the 15th World Cargo Symposium (WCS) held in London this year, included achieving netzero carbon emissions by 2050, continuing to modernize processes, finding better solutions to safely carry lithium batteries and making air cargo attractive to new talent. IATA also encouraged more cargo carriers to sign on to the industrywide 25by2025 initiative to promote gender diversity. “The need to create equal opportunities for the female half of the world’s population is highlighted by the situation today where the industry is struggling to attract sufficient talent. Achieving an equal gender balance must be core to any long-term talent strategy,” said Brendan Sullivan, IATA’s Global Head of Cargo.

Neutral Air Partner paints Bali red for another year of excellence

The 6th Annual General Meeting of Neutral Air Partner and OPENAP Asia returned to Asia in September, at the wonderful Ritz-Carlton in Bali, Indonesia—the island of the gods. Overall the event was stellar and first class in the making. More than 200 air cargo experts from around the world converged on the sandy beaches to exchange ideas, views, and solutions for the air cargo industry’s most pertinent issues. The 3-day event capped off with a cocktail party complete with live music and a sumptuous barbecue buffet in one of the best sunsets that the archipelago has to offer. The 7th OPENAP will move to Greece next year, scheduled for 21-25 May 2023 at the Costa Navarino in Messinia Peloponnese.

28 OCTOBER - NOVEMBER 2022 | www.payloadasia.com

EVENTS

IN THE NEXT ISSUE

9th

1-3 November 2023 Sands Expo and Convention Centre, Singapore Connecting the Transport and Logistics Experience Southeast Asia’s Most Influential Event for the Logistics, Mobility, IT and Supply Chain Industry transport logistic and air cargo Southeast Asia More than 100 exhibiting companies Exciting start-up pitching zone Extensive business matchmaking & networking opportunities More than 4000 trade visitors High-level summit with industry expertsharing Technical site visits & tours » Airlines, airports, supporting services » Charter brokers » Consulting, commercial insurance, related services » DP systems for logistics, transport, and airline management » Equipment for freight transport » Intralogistics, warehouse management systems, auto ID and packaging » IT, telematics, e-business, telecommunications » Organizations and trade associations » Services, freight transport, logistics ...and more! » Chemical » Consumer goods: clothing / textiles » Consumer goods: fast moving consumer goods » Consumer goods: food and beverage » Consumer goods: furnishing » Electrical products » Glass / Ceramics / Stone / Soil » Mechanical engineering » Metal » Oil refining » Pharmaceutical » Retail / eCommerce » Rubber / Plastic » Transport / Logistics » Vehicle manufacturing » Wood Who should exhibit with us: Meet decision makers from: What to Expect Scan here to book your space with us today! www.transportlogisticsea.com www.aircargosea.com JULIA KWAN, Group Project Director, MMI Asia Pte Ltd tlacSEA@mmiasia.com.sg | +65 6236 0988