BY SUSAN SHULTZ

ravel, especially as we age, can sometimes seem to be more hurdles than happiness. Trying to coordinate an unknown area, figure out the perfect restaurants, the right lodging and more can be a challenge.

Then you try to add different age groups, like a full family from age 80 to 8, or maybe grandparents and grandchildren, and it presents more obstacles. How can you vet

activities that everyone will enjoy? How will you navigate an area that you don’t know that well? Where will you eat?

One travel company, uniquely operating as a nonprofit, has those questions answered for you, and more Boston-based Road Scholar has been the leader in educational travel for adults since 1975. >>

>> One sample trip for grandchildren and grandparents includes “Swiss Icons: Heidi, William Tell & Chocolate with Your Grandchild.”

The itinerary includes exploring the stories of Switzerland including Heidi, and William Tell, a folk hero representing the struggle for freedom (and the namesake of a famed overture)

“On this Swiss adventure, these stories come to life for you and your grandchild. Delight in activities like horse carriage rides and cogwheel train rides that give you a new perspective on the Swiss countryside, complete with a traditional Swiss barbecue on the slopes of Mt Rigi,” reads the trip description.

Another perfect destination for grandparents and grandchildren is to taste how Swiss chocolate is made Travelers will board a train Lindt Chocolate Factory and enjoy an expert-led exploration of the factory, and then learn to make their own chocolate

At Road Scholar, outside of flights to the destination, one price includes all of the trip’s itinerary, lodging, expert lectures, most meals and more This trip costs approximately $5,000 per adult and approximately $4,000 per child

Road Scholar offers a specific page just for these types of trips at www.roadscholar.org/ browse-collections/grandparent and also a separate collection for trips designed for several generations of family

Road Scholar offers thousands of learning adventures, serving 80-100,000 participants annually It is aimed for the traveler over 50, and caters travel plans to one’s taste, interests, physical ability, and more Trips can range from a virtual lecture to a local day trip, to a three-month European cruise.

These programs combine travel and education to provide experiential learning opportunities featuring an extraordinary range of topics, formats and locations, in nearly every state in the U.S., nearly 100 countries and aboard ships on rivers and oceans worldwide.

How Road Scholar was Born

1970s

In the early1970’s,two friends, MartyKnowlton and David Bianco,both at the University ofNew Hampshire at the time were discussing Knowlton’s recent backpacking trip through Europe.As they discussed,theywondered why there weren’t more educational travel opportunities for adults,especiallythose in retirement.

1975

The organization was initiallycalled Elderhostel,a play on theyouth hostel term,and was founded in 1975

The grandparent/family programs are chosen to be educational and fun. The programs must provide engaging and informative activities that both children and grandparents will enjoy.

Travelers input their ages, their age groups, the type of trip they are interested in, and more, and results are provided.

In addition to grandparent and grandchildren adventures, nearly any kind of travel dynamic is offered. Travelers can go with large family groups, micro groups, go as an individual paired with other solo travelers, or even have an educational itinerary planned around traveling alone.

1980

By1980 gaining momentum primarily through word-ofmouth,more than 20,000 adults had experienced a learning adventure with us in all 50 states and most ofCanada.

Road Scholar’s mission as a not-for-profit organization is to “inspire adults to learn, discover and travel.” Similar to all not-for profit colleges and universities, the Road Scholar team asks for support for its mission from those who believe in it. Donations go towards funding & more:

■ Administrative costs

■ Create a breadth of programs and itineraries to appeal to all audiences

■ The hiring of the most qualified experts around the world

■ More than $100,000 in scholarships, especially for those who might be single or widowed and lack the financial resources for these experiences

■ Caregiver grants for those who devote their lives to caring for a loved one can recharge on a learning adventure

To learn more, start exploring your own

or to donate,visit www.roadscholar.org n

2010

By2010 more than 4 million adults had taken Elderhostel programs,and the organization rebranded with a new name: Road Scholar

BY SUSAN SHULTZ

While each month has a variety of themes, some are more significant than others. The themes that remind us to focus on particular areas of our health are even more critical as we age. For example, those over the age of 65 can be more at risk for heart disease or a heart attack.

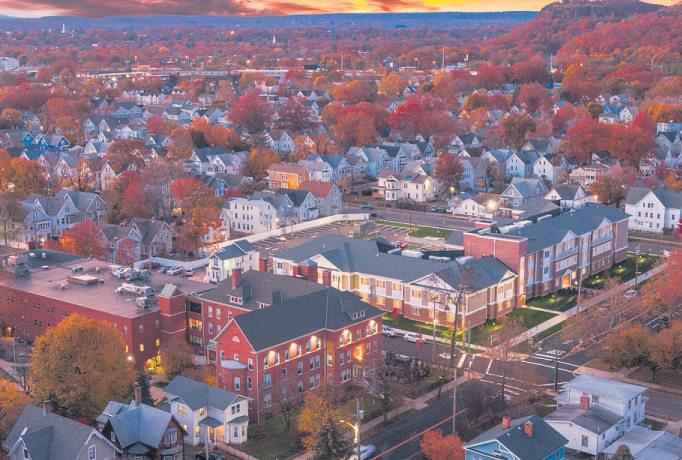

Mary Wade’s FullContinuum ofSeniorLivingCareoffers thelargest selectionoflivingoptions on one5.5-acre campus.Located in Historic Fair Haven, our non-profit communityallowsseniors to choose between 19 different care plans based onindividualneeds.Thisembraces abetter qualityoflife, more social time, andindependence, all without stressofthe future.

CHEF PREPARED FOOD *ARTS& CULTURE* INDEPENDENCE ACTIVITIES *FULLCONTINUUM OF CARE *SOCIALIZATION

GeriatricPanelDiscussionon SeniorLivingReadiness

Date:Thursday,March6,2025

Time:4:00PM-6:00PM

Location:138ClintonAvenue,NewHaven,CT

138 Clinton Avenue |New Haven, CT06513 |chathamplace.org

According to the National Institute on Aging (NIA) age impacts the functionality of the heart in several ways:

■ Your heart can’t beat as fast during physical activity

■ Heart disease can be caused by a buildup of fatty deposits in the arteries

■ A stiffness or hardening of the arteries called arteriosclerosis, can lead to high blood pressure

■ Age can also cause arrhythmia, or an irregular heartbeat

dening of art ed erioscler can to blood pr e can cause arrh heartbea

The NIA reports several signs that mean you should check in with your physician, including pain or numbness in the shoulders, arms, or back; shortness of breath; chest pain; lightheaded-ness; dizziness; confusion and nausea >>

>> Seniors should aim for two and a half hours of moderate exercise per week, according to the Mayo Clinic. To achieve and contribute to the above you should get regular exercise If you have medical issues, talk to your doctor before beginning an exercise regimen The Surgeon General suggests two and half hours of brisk physical activity, like walking or bicycling if healthy enough.

SENIORS WHO EXERCISE DAILY ALSO HAVE AN INCREASED LIFE SPAN AND IMPROVED MENTAL HEALTH, STUDIES HAVE SHOWN.

The Center for Disease Control suggests lifestyle and behavioral changes can lessen your risk of heart disease.

Eating Healthy

Eating foods that are high in fiber and low in saturated fats and cholesterol can help keep your heart healthy. The CDC suggests eating many fresh fruits and vegetables and trying to avoid processed foods. The CDC also recommends avoiding excessive salt and sugar

Keep a Healthy Weight

Along with eating healthy, the CDC recommends keeping a healthy weight Those who are overweight or obese put more strain on their heart and blood vessels.

Minimize Unhealthy Habits

The CDC recommends minimizing alcohol use and urges all not to smoke. Smoking greatly increases your risk of heart disease.

Take Control of Your Health

The CDC suggests keeping on top of whatever long-term illnesses you may have, including high blood pressure, diabetes, and more. This is critical to keeping your heart healthy.

The Mayo Clinic suggests seniors use what they have in the home to incorporate a regular routine during shorter days of winter. Some Ideas Include:

■ Use cans of soup or water bottles as hand weights.

■ Go from a sitting to a standing position out of a dining room chair two to three times in a row instead of just once.

■ Walk up and down a hallway or large open space.

■ Go up and down your stairs multiple times.

■ Turn up the music and dance in your kitchen.

■ Join or watch an online or video exercise class.

■ Consider going outdoors for a brisk walk. Make sure to wear appropriate footwear and don’t risk walking on ice or going out in inclement weather

The CDC recognizes February as American Heart Month and has an education page on its website. This page is filled with heart facts and shareable social media posts to educate yourself and/or your loved ones. There are also printable guides to manage and log your blood pressure. Visit www.cdc.gov/heart-disease for more information. n Statements made are not meant to offer medical advice nor diagnose any condition.

whichiswhy at ourcommunity,lifeisfilled with compassionatecare, extensiveprogramming,chef-prepared meals, andassociatesthatmakeour residentsfeelathome. Schedule avisit todaytostart building lastingconnections now.

WBY SUSAN SHULTZ

e’ve all seen the movies where valuables are kept in a safe deposit box in the bowels of a bank or other financial institution. It could be new identification documentation for a spy, or family heirlooms—or even in the case of Harry Potter’s wizarding world, spells and magic money to finance future family legacies.

WHERE CAN YOU FIND ONE?

A safe deposit box is a physical, locked box in a bank, credit union or financial institution.

WHAT'S STORED IN THEM?

The best use for these boxes is for important documents that don’t need to be accessed regularly such as birth or marriage certificates, vehicle titles, home deeds and other important legal papers or stock certificates. You can also store important jewelry or coin collections or other heirlooms, but they should be insured on your homeowners’ policy. Items kept in safe deposit boxes are not insured by the financial institution. Anything deemed dangerous, such as firearms, is usually prohibited.

HOW DOES IT WORK?

Safe deposit boxes linger on in a world where much of our life and assets seem to become more and more digital. And while some argue there’s a good case for using a safe deposit box, there are also some limitations on and shortcomings with using them. Here are some things to know about these timeworn treasure chests.

HOW BIG ARE THEY & HOW MUCH DO THEY COST?

According to U.S. News and World Report, they are usually about 2 inches by 5 inches or up to 10 inches by 15 inches. They average starting at about $25 annually

Generally both the financial institution and the owner keep a key. You can only access your safe deposit box during banking hours, which is why it is not suggested that emergency items be stored there. Items not recommended for a safe deposit box include passports, drivers’ licenses, social security cards, wills or living wills with end-of-life directives and especially cash. In addition, it is recommended that you share the information about the safe deposit box and its content with a trusted person in the case of an emergency or death.

WHY NOT CASH?

SAFE DEPOSIT BOX VS HOME SAFE

Once again, there are positives and negatives to both. The FDIC reports that while a home safe has a more convenient access point, it is also less secure than the locked box at the bank. Thieves can steal entire safes from private homes while the security at a large banking or financial institution is more impenetrable.

WHAT IF THE BANK FAILS?

If your bank recently fails the FDIC or the bank that assumed the failed bank’s business may have the account or safe deposit box contents, according to the FDIC. State law may also require unclaimed items to be relinquished after a certain amount of time.

Much like valuable items, cash in your safe deposit box isn’t protected by FDIC insurance if it is damaged or stolen. Cash left in a safe deposit box also will not earn interest and gain in value as it would in an interest-bearing account at the same institution.

Talk through your financial and valuable asset coverage with your local financial institution and homeowners’ insurance. In addition, always keep an accurate log as to what you have stored in your security deposit box in case of bank failure, theft or a natural disaster No matter where you invest or store your valuables, make sure you are covered for the unlikely loss, and also make sure you are getting the best return on your investments. For more information visit www.fdic.gov n

Try Meditation These days, you don’t have to be part of some club or group to try meditation. Thanks to the digital age, there are many apps on your phone or tablet that offer a variety of meditations or affirmations. This can be especially helpful just before bed and before leaving the house in the morning It clears your mind and helps you relax before whatever you are facing

Invest in the Best of Something Not all of us can afford the best car the best house or the best vacation. So when thinking about something on the smaller scale, invest in the best of something. Treat yourself Why settle for just cheese and crackers when you can get locally produced at Arethusa Farm, which has created some of the most popular cheeses in the world. Many of these varieties are available at local supermarkets. Like maple syrup? CT is dotted with specialty farms producing their own varieties Invest in a luxurious hand soap for some aromatherapy, or splurge for the high thread count sheets. These little wins can make a difference.

Keep a Notepad & Pen Nearby We constantly have thoughts about a recipe our moms used to make, a song we hear on the radio we forgot about, a friend we’ve been meaning to call, and more. Having a notepad and pen lets us jot these down and not put them off.

Take Care of Medical Appointments All of us regardless of age should have a primary doctor who hopefully reminds us when it’s time for a check-up But that’s not enough. Firstly, make your general annual physical appointment depending on your health needs. In addition, all of us over 50 should be arranging for a colonoscopy; women should be visiting their gynecologist and scheduling a mammogram. We should also have our eyes checked and make sure our prescription is up to date Make the appointments and keep the appointments.

Take it Easy on Yourself Look at your list of resolutions as a draft that will continue to be defined and refined throughout the year It’s great to add ones you know will be hard (an exercise regimen for some, quitting smoking for others) knowing it will be a challenge But also adding resolutions that are easy for you to do (buying paper towels at Costco to save money) can help you feel good about your accomplishments.

THE WORLD IS HARD ENOUGH ON US ALL. GIVE YOURSELF A BREAK.

Focus on a Health Regimen It doesn’t have to be the New York City Marathon, but walking outdoors keeps your heart pumping gives you fresh air and various statistics show that those everyday walks lead to longer healthier lives—especially over age 50

Treat Yourself You can’t take it with you. As your budget allows indulge in that food craving, check out or buy the book you’ve been wanting to read, schedule a massage or pedicure, or get that new golf club you’ve had your eye on. Treating ourselves means something different to everyone, but we should all be able to do it once in a while. n

NEW

BY SUSAN SHULTZ R

While New Year’s resolutions are famously made in good faith but often broken (see full gyms in January rapidly trickle back to regular attendance in February), sometimes making them alone can help In order to make resolutions, we tend to have to take stock of our current state of being and how we’d like to see it improve. That alone is a good mental health strategy Even better is to decide what we’d want our life to look like after these changes, and then establish life changes, or resolutions, to get ourselves there. These don’t have to be serious problems. It could be as easy as switching to decaf coffee before bed. But these changes, whether big or small, might make our lives a little easier, healthier, happier, and brighter What’s not to love?