2 minute read

2nd Year in a Row Standard Bank Categorised as Africa’s Most Valuable Banking Brand

Standard Bank which is also the umbrella for Stanbic Bank Botswana which is Africa’s largest bank by assets, has for the second year been ranked most valuable banking brand in South Africa and on the African continent this year 2023 in Brand Finance’s annual ranking of the world’s Top 500 Banking Brands. Standard Bank also increased its brand value by over 10% in the last year to reach over $1.74 billion US dollars.

Annually, Brand Finance tasks 5000 of the biggest brands to the test and publishes around 100 reports, ranking brands across different sectors and countries. The world’s top 500 most valuable and strongest banking brands are included in the annual Brand Finance Banking 500 ranking. Brand Finance is the world’s leading independent brand valuation consultancy and uses the royalty relief approach to quantify the financial value of a brand and this method estimates the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use. This value is a theoretical net economic benefit that the brand owner would achieve by licensing its brand in the open market.

Advertisement

Stanbic Bank Botswana being part of the Standard Bank Group provides the full spectrum of financial services, working to help make Batswana’s dreams a lasting reality in line with the Bank’s Purpose to fuel Botswana’s growth. Across their business and the breadth of services and solutions, with Stanbic Bank, IT CAN BE. It has direct, on-the-ground representation in 20 African countries and in 7 global financial centres. Standard Bank Group has more than 1 100 branches and 6 500 ATMs in Africa, making it one of the largest banking networks on the continent. It provides global connections backed by deep insights into the countries where it operates.

Standard Bank’s Group Chief Executive, Sim Tshabalala states that in the year 2019, Standard Bank began a journey that fundamentally redefined its business. The Group’s purpose of “Africa is our home, we drive her growth”, aiming to connect Africa to the world in pursuit of inclusive and sustainable growth for the continent.

“We’re delighted that we continue to lead as Africa’s most valuable brand. It’s the independently assessed indication that our business model – with its focus on providing consistently excellent service and complete banking, asset management and insurance solutions to our clients – is paying dividends,” said Standard Bank’s Group Chief Executive, Sim Tshabalala.

Stanbic Bank Botswana celebrates this achievement for the Group as a whole, committed to continuing to live the brand in Botswana and, crucially, to deliver shared value for and with Batswana. “This is an incredible victory for all in the Standard Bank family and we celebrate with our colleagues across the continent. The Stanbic Bank Botswana team continue to work tirelessly to ensure that we consistently deliver exceptional client experiences for all our customers here in Botswana and deliver on our brand promise ‘It Can be’,” said Stanbic Bank Botswana’s Chief Executive, Chose Modise.

Having operated in Botswana for over 30 years, Stanbic Bank Botswana continues to receive prestigious awards as testament to the helpful role we play in supporting Botswana’s economic activity in various sectors. The bank currently employs over 600 members of staff and has a national footprint comprising 13 branches. Six branches located within Gaborone, with representation in Francistown, Letlhakane (a digital branch), Maun, Mogoditshane, Palapye, Selebi Phikwe and Kazungula. The Bank also services customers through a network of 80 ATMs countrywide; and over 3 585 Point of Sale (POS) machines with 861 integrated with store tills in various retailers and outlets in a bid to offer greater convenience and onthe-go banking for its valued customers.

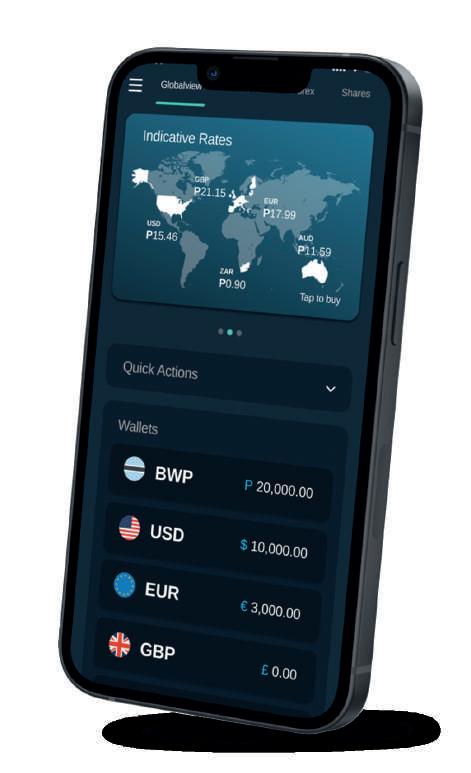

Stanbic Bank Botswana is committed towards attaining the Vision placed in order to create value for clients and the communities it serve by providing access to digital financial and related solutions that support sustainable growth. The Stanbic Letsema 2025 Strategy is a clear, actionable and measurable roadmap towards attaining this and achieving the growth and performance measures, both financial and Social, Economic and Environmental (“SEE”), for we believe Botswana is our home and we drive her growth.