Task Forces/Working Groups/Steering Committees (TF/WG/SCs) 2022/2023

Thanksto the support from our Member Companies, we continued to receive numerous nominations this year. After thorough consideration by respective Chairmen, all TF/WG/SCs are duly formed for 2022/2023 and you may refer to our website for the latest list of Members. We thank you all for your community spirit and readiness to devote your time and expertise to support our work (Circular Ref: Mv050/22).

Green Insurance Road Map of the Consultancy Study

With the appointment of the professional consultant KPMG, we are on full steam to prepare an industry charter, a reporting framework for our market and a model for the aggregation of climate-related data / cross-industry climate risk collaboration. At the meeting held last week, we agreed on the road map and the milestones for the three initiatives. Members will be suitably engaged when we conduct industry consultations and focus group meetings.

HKICPA and ISSB Consultations

The Task Force would prepare an industry submission to The Hong Kong Institute of Certified Public Accountants (HKICPA) and International Sustainability Standards Board (ISSB) respectively in response to the consultations of ISSB’s proposed sustainability disclosures standards and relevant industry-based disclosure requirements. In this connection, on 1 June 2022, KPMG was invited to deliver a briefing on the said subject to enhance members’ understanding and help them furnishing relevant comments to the HKFI. Moreover, a meeting was held with the HKICPA representatives on 16 June 2022 to highlight areas of concern from members towards the proposals.

Repositories on Training, Internship and Data Sources

Withan aim to advance the Green and Sustainable finance (GSF) development in Hong Kong, the Green and Sustainable Finance Cross-Agency Steering Group (CASG) launched different spectrums of GSF repositories, including training information, internship opportunities and data source. For further details, please visit this LinkedIn post. Members will be welcomed to offer internship placements. Please contact us via committee@hkfi.org.hk should you be interested in joining the programme.

Meeting with Legal Aid

Atthe Legislative Council (LegCo)’s Joint Subcommittee on Issues Relating to Insurance Coverage for Transport Sector, we made a raft of recommendations to improve the eco-system relating to taxi operations. The Legal Aid Department (LAD) was one of the stakeholders we have been working with to achieve such goal.

At the steer of the joint Subcommittee Chair the Hon Frankie Yick and LegCo members the Hon KP Chan, the Hon PL Chan and the Hon Michael Lee, HKFI's core group met the Director of Legal Aid Mr Chris Chong and his senior team on 9 June 2022. In addition to having a candid exchange of views on the current situation, we also explored feasible options to improve the current system and beefed up our ongoing communication channels between LAD and HKFI. As a first step to enhance our collaboration, a focus group workshop will be conducted in Q3 to facilitate mutual understanding on our respective roles and practices.

Issue No.301 Jun 2022

Latest Developments of Protection-linked Products

(PLP)

Inadvocating a transparent regulatory framework, the HKFI formulated an industry position and submitted a proposed benchmark on platform fee and surrender change for PLP to the Securities and Futures Commission (SFC) in June 2022. The proposed benchmark would support the viability of PLP to serve the insuring public, and thus revitalising the Class C market. On another front, the HKFI also consolidated members’ comments and responded to an industry consultation of the Hong Kong Monetary Authority (HKMA), regarding a proposed guidance on distribution of PLP via the bank channels.

Elite Talent Development Programme (ETDP)

Thesecond cohort of ETDP launched on 22 June 2022. 21 mentees from 16 Member Companies were selected to be paired up with 10 veteran mentors. We are exceedingly pleased to see these young executives with diverse background and expertise came together and aspired to broaden their horizons through learning from the forerunners. A sincere vote of thanks to the mentors for devoting their time and efforts in grooming the next generation of insurance professionals. The launching event also celebrated the successful completion of the inaugural ETDP. Mentees from the first cohort received certificates of completion from HKFI Chairman Ms Winnie Wong.

HKFI InsurTech e-Seminar: Implication and Opportunities for Insurance Industry from the Rise of NFTs and Metaverse

NFTs

and Metaverse are more than buzzwords. To enable our Members better understand these two novel subjects, we have conducted the above e-Seminar on 28 June 2022. Dr Duncan Wong of CryptoBLK and Mr Andy Ann of New Digital Noise shared insights on the new wave and supplemented with use cases on NFT and Metaverse, which are now ubiquitous, and the arising opportunities and challenges to the industry. Positive feedbacks were received from the audience.

All You Need to Know about Insurance

Wepublished the All you need to know about insurance – medical insurance book in 2019 with an overwhelming response. To enrich the contents and keep it abreast with the latest development of the medical insurance market and the Voluntary Health Insurance Scheme, the working group set up under our industry think-tank Club 2028 has updated the book and the latest edition has just been released.

The book is now available in the Joint Publishing bookstores. Go and grab some copies before the stock runs out!

Hong Kong Insurance Awards 2022

TheHong Kong Insurance Awards 2022 is calling for applications!

Entry submission deadline is 29 July 2022. Submit your entries now to showcase your outstanding accomplishments and successful stories for the period between 1 July 2021 and 30 June 2022. For details, please visit our official website at https://www.hkfi.org.hk/hkia/ and contact us at 2565 2495 / 9700 4400 for any enquiries.

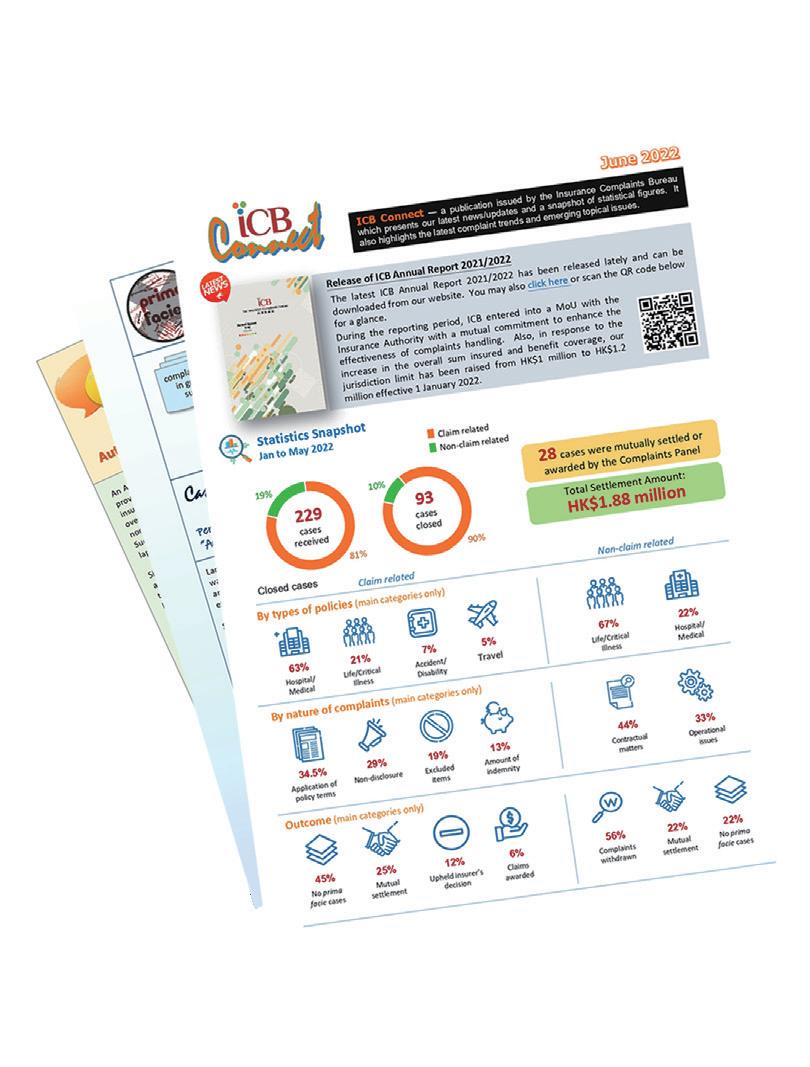

Thelatest ICB Annual Report 2021/2022 has been released and can be downloaded from the website of ICB. Members may scan the QR code or click here for a glance and learn more about the latest updates of ICB.

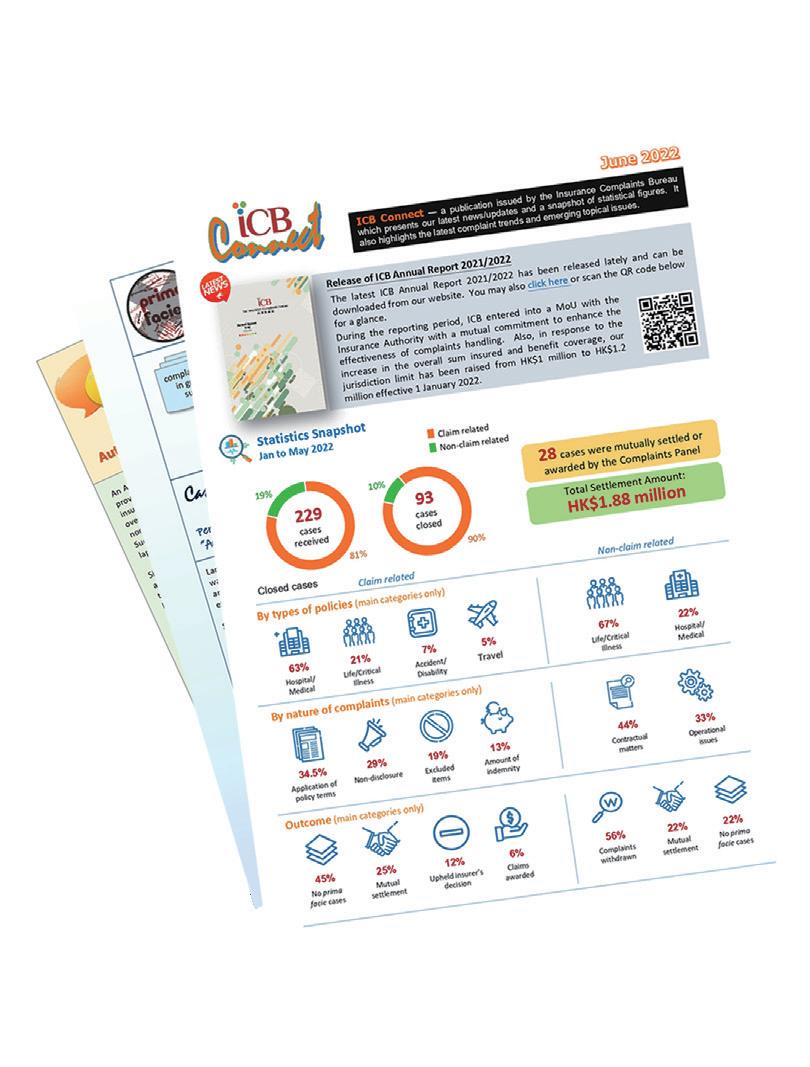

In addition, ICB also published the latest issue of ICB Connect (June 2022) which encompasses the latest news and statistical figures of ICB. There are also sections on case study and topical issue for sharing. Please scan the QR code or click here to view the content.

Release of the Insurance Complaints Bureau (ICB) Annual Report 2021/2022 & ICB Connect (June 2022)

Release of the Insurance Complaints Bureau (ICB) Annual Report 2021/2022 & ICB Connect (June 2022)

ICB Connect ICB Annual Report

Insurance Fraud Prevention Claims Database Executive Committee (Executive Committee)

Congratulations to the newly elected Executive Committee Chairman Mr P L Chan and the Members. The membership for the new term 2022/2023 is as below:

Mr P L Chan (Chairman) China Taiping Insurance (HK) Co., Ltd.

Ms Kelly Wong AIG Insurance Hong Kong Limited

Mr Elvis Fung AXA General Insurance Hong Kong Limited

Ms Carol Fung Blue Cross (Asia-Pacific) Insurance Limited

Mr Ted Wen BOC Group Insurance Co Ltd

Mr Yuman Chan BUPA (Asia) Limited

Mr Ronald Kwan California Insurance Co. Ltd.

Ms Linda Ng Dah Sing Insurance Company (1976) Limited

Ms Dorothy Sung Hong Leong Insurance (Asia) Ltd

Mr Vincent Lee HSBC Life (International) Limited

Mr Philip Kent MSIG Insurance (Hong Kong) Limited

Ms Susana Lee Prudential General Insurance Hong Kong Ltd. & Prudential Hong Kong Limited

Ms May Liu

QBE Hongkong & Shanghai Insurance Limited

Mr S K Li Sompo Insurance (Hong Kong) Co., Ltd.

Mr Hannes Bostam Zurich Insurance Company Ltd

Membership News

Change of Authorized Representative

Life Insurance Member: Chubb Life Insurance Company Ltd - Mr. Leong Kean Hah

HKFI Membership

As at 30 June 2022, the HKFI has 84 General Insurance Members and 54 Life Insurance Members.

Release of the Insurance Complaints Bureau (ICB) Annual Report 2021/2022 & ICB Connect (June 2022)

Release of the Insurance Complaints Bureau (ICB) Annual Report 2021/2022 & ICB Connect (June 2022)