In 2023 we made foundational investments at Hawaiian Airlines as we welcomed nearly 11 million guests who chose our award-winning brand of Hawaiian hospitality for their travel to, from, and within the islands.

Our teams undertook projects to improve the guest experience and make us more resilient, from adopting a new passenger service system to launching a dedicated freighter operation for Amazon and entering into an agreement to combine with Alaska Airlines. We also laid the groundwork to begin rolling out free high-speed Starlink WI-FI and inaugurate service with our Boeing 787-9s, both of which were done in early 2024.

As we strive to ensure a prosperous future for the company, we are equally proud of our work on environmental, social, and governance (ESG) initiatives, which are critical to our long-term success. We are pleased to share our progress in this year’s Corporate Kuleana Report.

Last year we published our roadmap to achieve net zero greenhouse gas (GHG) emissions by 2050 and committed to interim targets. We also conducted an in-depth Scope 3 GHG inventory to build on our climate-related reporting and inform our efforts to decarbonize our supply chain.

Replacing petroleum-based jet fuel with sustainable aviation fuel (SAF) remains the most promising way to help us reach our goal, and we plan to source SAF for 10 percent of our fuel needs by 2030. Toward that end we have contracted to purchase 50 million gallons of SAF over a period of five years from biofuel company Gevo, Inc., with deliveries to our gateway cities in California expected to start in 2029. In Hawai‘i, we are studying the commercial viability of SAF production with Par Hawaii, the state’s largest provider of energy products. We also became an investor in the United Airlines Ventures Sustainable Flight Fund to support early-stage SAF companies, and continue to partner with fuel producers, nonprofits, other airlines, as well as states and the federal government, to accelerate SAF production and distribution at commercially viable prices.

Our ongoing fleet modernization will allow us to further reduce our emissions intensity, and this past April we were excited to fly our first Boeing 787-9 service between Honolulu and San Francisco. We look forward to benefiting from the 787’s industry-leading fuel efficiency as we grow our flagship fleet to 12 aircraft by 2027.

To prepare for the 787-9s, we explored ways to enhance our onboard service while reducing waste – in line with our goal to phase out single-use plastics from our cabins by 2029 and source more local products. As part of that effort, in October we unveiled new, more sustainable in-flight amenities and soft goods in partnership with Hawai’i lifestyle brand Noho Home.

We were thrilled to welcome 953 new teammates to our ‘ohana (family) – reporting a year-end workforce of 7,362 people. More than 80% of our employees identify as racially or ethnically diverse, and our dedication to diversity, inclusion, and belonging continues to be an important driver of our recruiting and retention strategy, and integral to our brand.

To position our teams and business for growth, we increased our educational partnerships and school-to-career outreach. From hiring graduates of our innovative collaboration with the Honolulu Community College’s Aeronautics Maintenance Technology program, to having 150 employee volunteers representing us within our Career Ambassadors program, we are creating opportunities for students in the communities we serve. We are grateful to be recognized by the Hawai’i educational and career-development nonprofit ClimbHI as its 2023 Outstanding Business award winner for our community outreach.

Running a safe operation and ensuring a safe environment for our employees and guests is our priority and core to our values of Malama (care) and Po‘okela (excellence).

Our Board of Directors, along with our senior leadership, remain deeply engaged in assessing ESG risks and opportunities. For the third year, our Corporate Kuleana Report includes reporting aligned with the Task Force on Climate-Related Disclosures (TCFD), in addition to the Sustainability Accounting Standards Board (SASB) metrics we have provided since 2020.

As Hawai‘i’s hometown carrier, we have a deep connection to our islands, and we are committed to taking care of our people, our guests, and the communities we serve.

Last August, we were faced with an unimaginable crisis when wildfires fueled by tropical storm-force winds and arid conditions tragically devastated the town of Lahaina on Maui. Our teams sprang into action and conducted one of the largest civilian airlifts in Hawai‘i’s history, evacuating some 17,000 displaced visitors and residents in the first three days, while transporting in first responders and critical cargo.

While we were grateful that our nearly 500 Maui-based teammates were safe, many suffered unfathomable losses. And despite facing personal hardship, hundreds of them reported to work – in some cases on their scheduled days off – to help take care of our guests and keep our scaledup operation going.

I was moved by the initiative of our teams who quickly organized a company food drive and engaged our loyalty members to raise millions of HawaiianMiles to support the Lahaina community. Today – and for as long as necessary – our people and operations continue to assist organizations in Lahaina. We are encouraging our guests to travel to Maui to enjoy its beauty and culture, and to support residents and small businesses. To amplify our message, we produced a series of videos featuring some of our Maui-based employees highlighting ways that visitors can have a great experience on Maui while positively affecting the community.

In December, we announced our decision to join forces with Alaska Airlines, a combination that we believe will offer greater benefits to our guests, communities, employees, and shareholders. Our highly complementary networks will offer travelers in Hawai‘i and abroad access to more destinations with the same exceptional, guest-focused experience both airlines are known for. Together, we will compete more effectively within the domestic industry, and augment our ability to invest more in sustainability, environmental stewardship, our people, and community. More information about the combination can be found here, including information about future commitments to sustainability and community. With respect to ESG matters in particular, both airlines share a strong commitment and track record. We are excited about the positive impact that we can have by bringing together our respective strengths and expertise with the resources of the combined company.

I am immensely proud of our achievements in the past year, and the dedication of our employees to make us a better airline. Their aloha for one another, our guests, and the communities we serve, inspires me each day, and it is what will build our continued success in the years ahead.

Mahalo,

Peter Ingram, President and CEO

Peter Ingram, President and CEO

Now in our 95th year of continuous service, we are Hawai‘i’s biggest and longest-serving airline. We pioneered commercial air service in Hawai‘i in 1929, and today offer approximately 150 daily flights within the Hawaiian Islands, and nonstop flights between Hawai‘i and 15 U.S. gateway cities – more than any other airline – as well as service connecting Honolulu and American Samoa, Australia, Cook Islands, Japan, New Zealand, South Korea and Tahiti.

As Hawai‘i’s hometown carrier, we connect people with aloha and encourage our guests to Travel Pono (Responsibly) and experience the islands in a positive way. We are also committed to running a safe and reliable operation. We led all U.S. carriers in on-time performance for 18 consecutive years (2004-2021) as reported by the U.S. Department of Transportation.

In addition to introducing millions of travelers each year to our beautiful islands and providing dependable transportation for our kamaaina (residents), our cargo operation – the largest of any passenger airline serving Hawai‘i – enables businesses large and small to transport goods to, from and within Hawai‘i with speed and efficiency.

We continue to play an outsized role supporting the economy of our home state. Based on an economic impact study conducted last year, we stimulated $10.2 billion in economic activity in Hawai‘i and generated more than $600 million in Hawai‘i state tax revenue in 2022.

Hawaiian Airlines, Inc. is a subsidiary of Hawaiian Holdings, Inc. (NASDAQ: HA).

Additional information is available at HawaiianAirlines.com.

EMPLOYEES

Seoul / Incheon

Sapporo / Chitose SOUTH

Tokyo / Narita

Tokyo / Haneda

Honolulu - Salt Lake City

Lihue - Sacramento

Kona - Sacramento

Starting May 2024

Our 2024 Corporate Kuleana report offers a comprehensive overview of our environmental, social, and governance (ESG) initiatives, primarily focusing on activities between January 1 and December 31, 2023. Any mention of “we,” “us,” or “ours” or “the company” pertains to Hawaiian Airlines. We are committed to advancing our ESG objectives, hence, this report also covers progress made on various short-, medium-, and long-term strategies and initiatives through April of 2024. Upholding transparency and structured reporting, we adhere to the standards of the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD).

Our report focuses on our airline operations, which constitute our core business. Consistent with the Greenhouse Gas Protocol (GHG), this report includes GHG emissions from business activity under our control.

Our top environmental priority is achieving net-zero carbon emissions by 2050. In March 2023, we released our decarbonization roadmap and interim climate targets. Our current plan includes a 2035 target for jet fuel emissions intensity, along with other goals relating to the success of our emissions reduction efforts. We believe our emissions intensity target is in line with our peers, while acknowledging that our roadmap and targets may need to be updated and could require more aggressive emissions reductions to align with evolving scientific consensus.

These targets also support our existing pledge to cap emissions from international flights in accordance with the International Civil Aviation Organization’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

As we work to meet our ambitious targets, we are modernizing our fleet and investing in Sustainable Aviation Fuel (SAF), exploring SAF production in Hawai‘i, and advocating for state and federal policies and incentives that are essential to reduce costs and scale up the production of SAF. We also remain focused on reducing our emissions through various operational initiatives, and we are supporting research of new aircraft technologies.

However, we are also acutely aware that we cannot do this alone. Our targets are dependent on significant advancements in technology, supportive government policies, substantial capital investment, and cross-sector collaboration.

Achieve net-zero carbon emissions 2050 Published decarbonization roadmap and interim targets

Reduce life-cycle jet fuel emissions intensity per revenue ton mile (RTM) by 45% from 2019 levels

Replace 10% of conventional jet fuel with sustainable aviation fuel (SAF) 2030

5.8% higher than 2019

Contracted ~30% of goal1

Reduce electricity consumption per sq ft in core facilities by 20% from 2019 levels 2 2030

7% lower than 2019

Improve fuel efficiency per available seat mile (ASM) by 4% from 2019 levels

Conserve 3 million gallons of jet fuel through operational initiatives

1. While this volume is contracted, it is dependent on the facility getting financed and built.

2. Includes properties tracked through the U.S. DOE Better Buildings Challenge program. Legend: - Improvement, - Neutral, - Deterioration

0.9% less efficient than 2019

0.8 million gallons conserved

Our long-term decarbonization strategy focuses on five key areas:

Sustainable Aviation Fuel (SAF)

Fleet Modernization

Next-Generation Aircraft

Operational Efficiency

Air Traffic Control (ATC) Modernization

Our roadmap outlines how we currently anticipate these drivers will contribute to our decarbonization pathway. Achieving our targeted path to net-zero depends on significant advancements in technology over the next two decades as well as other factors outside of our control. Our near-term focus is on reducing emissions intensity through the use of more fuelefficient aircraft and operational efficiencies. As we progress toward 2050, our objective is to achieve reductions in absolute emissions as SAF becomes commercially viable at scale and other emerging technologies become available. While we will focus on in-sector measures, we expect that carbon offsets or removals may be required to bridge any gap.

▶ We remain engaged with the Sustainability Business Forum (SBF), a Hawai‘i business consortium that we helped found to drive private-sector action toward a sustainable future for Hawai‘i, and Hawai‘i Green Growth UN Local2030 Hub, a public-private partnership committed to advancing the United Nations Sustainable Development Goals and the state’s Aloha+ Challenge. The SBF continues to develop localized environmental, social, and governance metrics tracked publicly on the Aloha+ Dashboard. Additionally, SBF collaborates with public and private sector leaders on the role of data and ESG investing in the Pacific islands. Looking ahead, the SBF has committed to two priority areas and launched the Local Food and the Energy Efficiency Working Groups. We are actively engaged in both and serve as the co-chair of the Local Food Working Group.

▶ We are a member of the Climate Coalition, an initiative of the Hawai‘i Executive Collaborative, which includes dozens of local organizations committed to reducing emissions and working together to accelerate climate solutions. The Coalition provides a platform to drive systemic climate progress—particularly on advancing climate policy and building a shared understanding of effective decarbonization and resilience measures. The Coalition’s Climate Pledge, to which we are a signatory, can be found here

▶ We collaborate with the broader airline industry on environmental issues and policy advocacy as a member of Airlines for America (A4A) and the International Air Transport Association (IATA).

▶ In 2024, we joined the SAF Coalition, a nonpartisan nonprofit group advocating for SAF incentives and policies.

We recognize the pivotal role that transitioning to jet fuel derived from more sustainable sources can play in decarbonizing our operations. Our commitment is that by 2030, we aim to replace 10% of our jet fuel with Sustainable Aviation Fuel (SAF), and our roadmap has a substantial reliance on SAF to achieve our goals by 2035 and 2050.

However, we acknowledge that the production of SAF is still in its infancy, with limited volumes currently available and production costs ranging from 2 to 5 times that of conventional jet fuel. Scaling up SAF presents significant challenges, particularly in terms of access to financing for SAF production facilities and availability of predictable incentives. To address these hurdles, we are actively collaborating with industry partners, SAF producers, state authorities, and the federal government to expedite the production, availability, and distribution of SAF at economically viable prices.

We are currently focused on sourcing SAF in California, our largest market outside of Hawai‘i, where state policies strongly support SAF. In March 2023, we announced a commitment to procure 10 million gallons of SAF annually for five years from Gevo, a SAF producer planning to establish multiple facilities in the U.S. Midwest. If Gevo is successful in building its planned facilities, deliveries of SAF are expected to begin in 2029 at one of our gateway cities in California. While this represents significant progress, we continue to seek additional SAF supply to meet our needs.

We are also actively engaged in growing SAF supply within our home state of Hawai‘i through a partnership with Par Hawaii and Pono Pacific. While we expect that local production of SAF with local feedstock in Hawai‘i will not be sufficient to meet our full demand, our objective is to maximize local production to bolster our energy self-sufficiency and support Hawai‘i’s agricultural sector. This initiative aligns with our broader commitment to advance sustainability while enhancing the resilience of local communities.

1

Begin with sustainable feedstock

2

Convert to SAF

Up to

80% reduction in life-cycle emissions*

5 Fly aircraft with reduced life-cycle emissions

4

Deliver blended SAF to existing infrastructure at airport for storage and fueling**

3

Blend SAF up to 50/50 with conventional jet fuel

* Compared to conventional jet fuel.

** At this stage, the blended SAF is commingled with conventional jet fuel.

Sustainable Aviation Fuel (SAF) is jet fuel made from sustainable feedstock rather than petroleum. Some examples of sustainable feedstocks include plant and waste oils, crop sugars, municipal solid waste, and agricultural residues, among others. As a drop-in fuel, SAF can be used in the engines that power our existing aircraft, as well as airport and pipeline infrastructure, up to a blend of 50% with conventional jet fuel. The SAF blend limit is expected to increase substantially in coming years.

SAF is better for the environment because it has a lower life-cycle carbon intensity compared to petroleum fuel. A fuel’s ‘life cycle’ (see page 19) includes all of its associated GHG emissions, starting with sourcing feedstock, through refining, distribution and combustion. Although SAF and conventional jet fuel release the same GHG emissions in the combustion phase, carbon from petroleum jet fuel has been stored underground for millions of years, while carbon from SAF was recently absorbed from the atmosphere by feedstock through photosynthesis, meaning its intensity nets to zero during the combustion phase.

When all phases of the life cycle are included, SAF’s overall carbon intensity is approximately 50 to 80% lower than petroleum fuel, and it can be reduced even further if carbon capture and sequestration are used in the production process.

We believe SAF can only be successfully scaled with community engagement, innovation, access to financing and government support. We expect SAF will be cost competitive with conventional jet fuel at scale, but incentives are needed in the short term to drive production and adoption.

Acknowledging that current limitations in SAF production, distribution, volume, and cost challenge us to achieve our net zero commitment on time, this past year we doubled down on efforts to tap SAF’s potential through global and local partnerships, including:

We invested in the United Airlines Ventures’ (UAV) Sustainable Flight Fund in 2023. By becoming a limited partner in the fund, we join leaders in the exploration of cutting-edge technology and solutions to overcome some of SAF’s critical impediments, including limited feedstock and high production costs.

As mentioned, scaling SAF is essential to decarbonizing the aviation industry and many airlines, including Hawaiian, are working to accelerate production and distribution. The collective power and funding of the UAV Sustainable Flight Fund’s limited partners, which stands at over $200 million, position us to capitalize on new research, innovative processes, and advancements in SAF production technologies. Current UAV Sustainable Flight Fund Portfolio investments include start-ups such as Cemvita, which is developing an innovative technology for feedstock production, and Dimensional Energy, which is working on a technology to produce SAF from carbon dioxide emissions and renewable energy.

In 2023, with our partners Par Hawaii and Pono Pacific, we launched the Hawai‘i Renewable Fuels Coalition to collaborate on advocacy for renewable fuels policy at the state level. We gathered leaders from diverse sectors to share their perspectives on the benefits from and obstacles to renewable fuels in Hawai’i. The creation of the coalition recognizes that many sectors must play a role in Hawai‘i’s energy landscape and that we can do more to accelerate change in our state by working collaboratively with other stakeholders.

As a founding member of the coalition, we are encouraged by the cross-sector engagement of our membership and by the 2024 Hawai’i legislative session. The coalition’s proposed bill, SB2574, sought to create a regulatory framework to support what is currently a costly fuel production process through renewable fuel tax credits, while aligning with existing State of Hawai‘i decarbonization commitments. Given other important state budget priorities like Maui’s recovery, the bill was not passed this year. We look forward to continuing our advocacy for SAF production in Hawai‘i, which would support the decarbonization of aviation in Hawai‘i, establish a new green industry, and advance the state’s energy independence and economic development goals.

Since 2022 we have been in partnership with Par Hawaii, the largest refinery in the state, to explore SAF production. We are focused on three areas: (1) conducting an engineering study, completed in 2023, to evaluate the feasibility of converting a portion of Par’s facilities to produce SAF, (2) exploring the potential to grow oil-yielding crops in Hawai‘i as well as import sustainable feedstock, and (3) policy advocacy, including an evaluation of the best policy mechanisms to advance SAF in Hawai‘i.

Following the engineering study, in early 2023 Par Hawaii committed to invest $90 million to convert a portion of its facility to produce renewable fuels, including SAF. Over the past year, Par Hawaii has made progress on the state’s largest liquid renewable fuels manufacturing plant at its Kapolei refinery. They broke ground on the project, and production is planned to begin in 2025.

To address sustainable raw materials, Par Hawaii tapped Hawai’i land management expert Pono Pacific to lead a feedstock crop trial for biofuel production. With more than 20 years of conservation, agriculture, and renewable energy experience, Pono Pacific is conducting field trials of Camelina (pictured above) at four sites, including Kuilima Farm on Oahu’s North Shore, and with partner farmers Mahi Pono on Maui, Meadow Gold Dairies Hawai’i on Hawai’i Island, and Aloun Farms on Kauai. These trials will help determine the viability of growing Camelina as a source of locally-produced renewable fuel, including SAF. Camelina was selected for the crop trial due to its high oil content, low water requirement per growth cycle, and because it is a rotational cover crop that can be used to enhance soil health during otherwise fallow periods and does not compete with local food production. If the field trials are successful, locally grown feedstocks could provide Hawai‘i farmers a viable economic commodity to supply refineries like Par Hawaii, provide much needed local animal feed, and make use of idle agricultural lands.

We took delivery in the first quarter of 2024 of our first of 12 Boeing 787-9s on order, and began operating it in the second quarter of 2024. We received our second 787-9 in the second quarter of 2024 and expect to have a third aircraft delivered by the end of 2024, with remaining deliveries through 2027. The Boeing 787-9 features innovative aerodynamics, modern engines and a composite airframe contributing to up to 20% fuel-efficiency improvement over prior-generation, similarly sized aircraft.

Our long-haul fleet of Airbus A330s and A321neos is one of the most fuel efficient and youngest in the U.S. industry at an average age of 8.2 years1. We continue to use Airbus A330-200 aircraft –which are about 5% more fuel efficient than the Boeing 767-300, our previous widebody fleet type – on our transpacific long-haul, U.S. east coast, and busiest western U.S. routes, and the A321neo –the most fuel efficient and quietest aircraft of its type – to serve our mid-sized transpacific markets.

By 2028, we are targeting a 4% improvement in fuel efficiency per available seat mile (ASM) compared to 2019 as a result of the operation of our fleet of 787-9s and other fuel efficiency initiatives. In 2023, however, we registered a 3% deterioration in fuel efficiency per ASM compared to 2022, and a 1% decrease in fuel efficiency per ASM compared to our 2019 baseline, due to several external factors. Starting in the third quarter of 2023 through April 2024, we had to ground several of our A321neos for Pratt & Whitney to perform accelerated and time-consuming off-wing inspections of its engines. We expect to have our entire A321neo fleet available by the end of the second quarter of 2024. Additionally, from October 2022 through May 2023, we experienced unnecessary fuel burn and reduced performance due to airport runway repairs in our main hub in Honolulu, which required modifications to landing approaches and runway holding patterns. Our operations, punctuality, and fuel efficiency improved significantly once the runway reopened.

1 Note: Data reflects an immaterial administrative correction from our most recent Form 10-K.

We are actively exploring new low-carbon technologies with airframe and aircraft engine manufacturers.

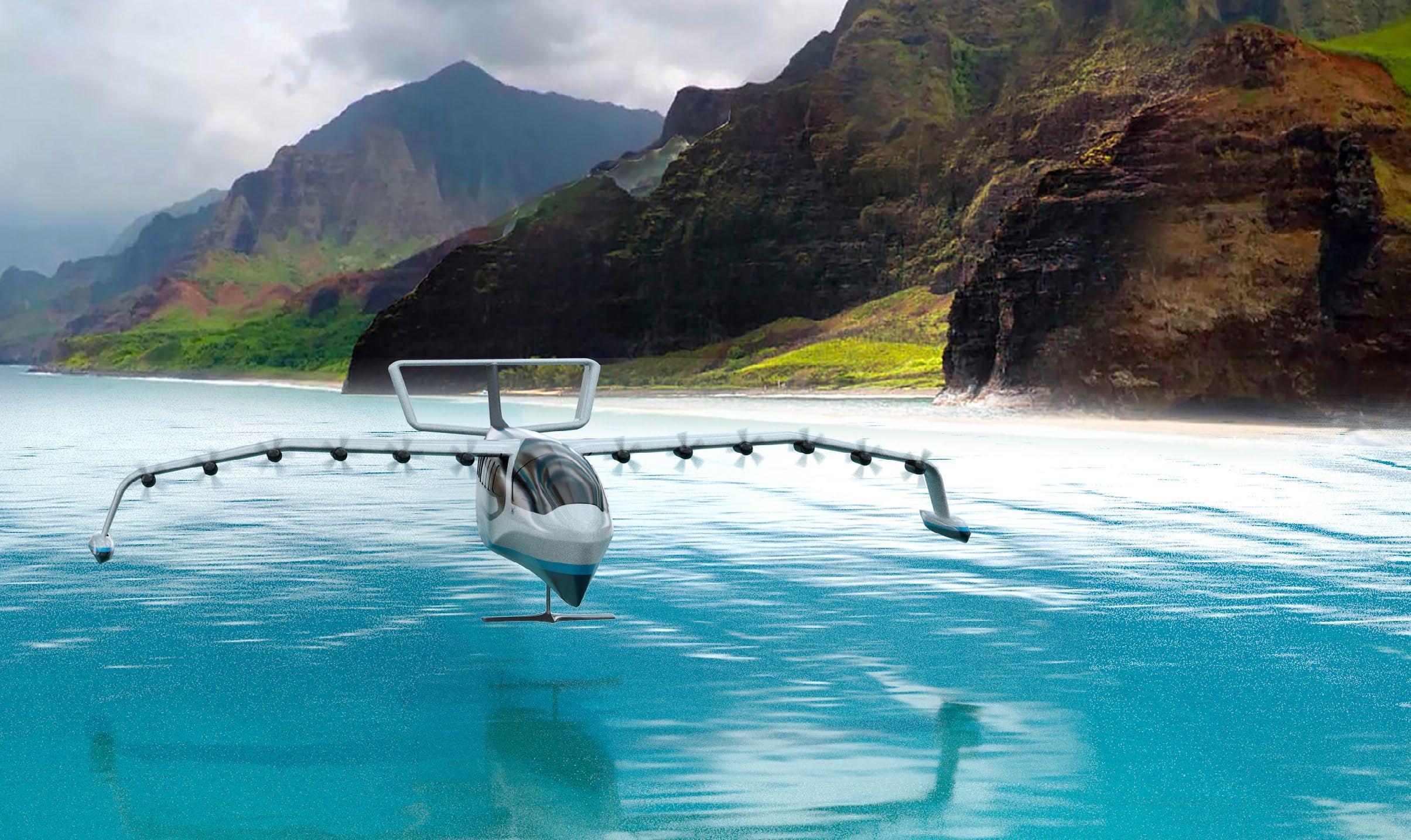

We recognize the potential of emerging alternative propulsion technologies like battery-electric and hydrogen systems for decarbonization of short-haul travel. Initial advancements in these technologies are expected in small aircraft for short-haul flights later this decade. While our interisland routes may be suitable for such technologies, the high traffic volumes require larger aircraft. Industry forecasts suggest it may take 10 to 15-plus years before these technologies can power aircraft that accommodate over 100 passengers on interisland routes. Although there are no near-term sustainable propulsion alternatives that could replace our current interisland fleet, we are exploring a transition to battery-electric or hydrogen-powered aircraft as technology evolves. We invested in REGENT, a company developing battery-electric seagliders, and we are collaborating with them on their larger vehicle concept. Alternative propulsion technologies hold promise for reducing our carbon footprint on interisland routes but are not expected to be viable for our North America and international routes within the timeframe of our 2050 roadmap. However, as part of our decarbonization roadmap, we have incorporated the impact of a next-generation aircraft with advanced jet engine technology for transpacific routes in the late 2040s.

This past year, Hawaiian joined its partner REGENT as one of the founding members of the Hawai‘i Seaglider Initiative (HSI) The HSI is a collaboration among private and public sector leaders and community stakeholders focused on understanding, educating, and evaluating the potential for seaglider transportation in Hawai‘i. We were pleased to support the funding of a critical feasibility study that kicked off in January 2024. Looking ahead, we eagerly anticipate the evolution of REGENT’s technology and look forward to evaluating the technological advancements, necessary infrastructure requirements, and environmental impact. Our support of REGENT underscores our dedication to innovation and sustainability within the aviation industry.

Our Fuel Efficiency Campaign encompasses a number of initiatives aimed at conserving fuel across our operations. These efforts include regular engine washes, single-engine taxi-in and -out procedures, utilizing cleaner electric power at gates instead of the aircraft’s APU (auxiliary power unit), and minimizing over-fueling to both reduce consumption and emissions.

We are actively exploring additional technologies, such as software tools, to continuously optimize our flight operations for enhanced efficiency.

In 2023, we made a commitment to conserve a minimum of 3 million gallons of jet fuel through our Fuel Efficiency Campaign between 2023 and 2028. We are pleased to report that we are steadily progressing toward this goal. As of December 2023, our operational initiatives have already resulted in savings of approximately 800,000 gallons of jet fuel.

Through our ongoing efforts and dedication to fuel conservation, we are not only reducing our environmental impact but also enhancing the sustainability of our operations for the benefit of our stakeholders and the communities we serve.

We strive to reduce our fuel burn and emissions at every phase of the flight. For example, where possible we take the following steps:

BEFORE EACH FLIGHT

On our transpacific flights, we utilize state-of-the-art flight planning systems to chart the quickest, most comfortable and fuel-efficient trajectory from take-off to landing.

Our pilots taxi between the runway and gates using one engine to reduce unnecessary fuel burn, whenever conditions allow.

DURING THE CLIMB

Take-off is the most energy-intensive portion of a flight, and our systems recommend optimum climb paths to reduce fuel use based on specific routes, aircraft, and weather conditions to limit emissions.

Throughout the flight, updated atmospheric data delivered to the flight deck help inform our pilots’ decisions to adjust routing, altitude and speed to conserve fuel.

We monitor airport weather conditions and communicate with Air Traffic Control to ensure our descent follows the best and most fuel-efficient approach.

AT THE GATE

During boarding and deplaning, we turn off our engines and APU (Auxiliary Power Unit) and use cleaner electrical power supplied by the airport to keep our avionics systems running and to air condition our aircraft.

Air Traffic Control (ATC) modernization (also called NextGen) is a Federal Aviation Administration (FAA) program to modernize our country’s ATC system, which would bring fuel savings to all airlines operating in U.S. airspace. While not a specific Hawaiian Airlines initiative, we have included an estimate for the potential impact of the NextGen program on our carbon footprint in our roadmap. While material, the potential is lower for us than some other U.S. carriers because we operate relatively fewer flights into congested airports where NextGen will have the most impact.

While we are focused on in-sector measures to achieve our decarbonization goals, we have also committed to offsetting our employee business travel as well as offering guests the option to offset emissions generated by their flights with us through our partnership with Conservation International. Our offset program for 2023 represents an estimated 3,780 acres of forest protected.

While emissions from flight operations account for the vast majority of our carbon footprint, we are also working to improve the emissions profile of other areas of our business.

As of December 2023, energy use per square foot in our facilities was 7% lower than our 2019 baseline and we remain on track to cut electricity use by 20% per square foot by 2030 – a goal that we committed to achieving as the first airline participating in the U.S. Department of Energy’s Better Buildings Challenge (BBC). Our energy efficiency initiatives include the use of motion sensors, LED lighting, and automatic heating, ventilation, and air conditioning (HVAC) controls.

We also work with building owners and airports that prioritize sustainability in their operations. In 2023, we realized $34,000 in energy cost savings and reduced CO2 emissions by 667,776 pounds thanks to the photovoltaic solar array at our corporate office.

3.3 million metric tons CO2e

The vast majority (~99%) of our Scope 1 carbon emissions result from jet fuel consumption on our flights.

Last year, we expanded our Scope 1 data to include estimated emissions from ground vehicle fuels, which represented less than 1% of our Scope 1 emissions. These emissions are not included in prior years’ Scope 1 inventory and would not materially change previous reporting. In 2023, our Scope 1 emissions represented 78% of our total GHG emissions footprint, or 2.58 million MTCO2e.

As we continued to restore operations in 2023, we increased Available Seat Miles (ASMs) by 8%, Revenue Passenger Miles (RPMs) by 13% and GHG emissions by 12%, compared to 2022.

However, our 2023 operations were still slightly below pre-pandemic levels, primarily driven by the slow return of demand for travel from Japan to Hawai‘i. In 2023, as compared to 2019, we had 2% lower ASMs, 5% lower RPMs and 1% lower GHG emissions.

Our GHG emissions intensity per ASM increased by 3% compared to last year (Table B) due to (1) the unexpected grounding of several of our fuel-efficient A321neos to enable Pratt & Whitney to perform accelerated and time-consuming engine inspections, (2) higher load factors across our network, (3) more long-haul flying, and (4) the impact of air traffic control (ATC) routing changes in our Honolulu hub due to runway construction. Our emissions intensity per ASM was about 1% higher than 2019.

In 2023, our emissions from ground vehicle fuels increased by 38% compared to 2022, but still remain less than 1% of our total Scope 1 footprint. Our ground vehicle fuel emissions are estimated based on spend data. The increase in spend year-over-year was primarily due to increased operations as well as the impact of some spend associated with consumption in prior years.

1. RTMs for 2019 through 2021 have been revised to use the 2022 average of 230 lbs per passenger, including bags, in order to present metric on a comparable basis. RTM figures for 2023 exclude Amazon.

2. Excludes jet fuel consumed on flights operated for Amazon.

1. Excludes emissions associated with jet fuel consumption on flights operated for Amazon. Our Amazon cargo-only flights are captured separately under Scope 3 emissions.

2. Jet fuel emissions calculated based on a factor of approximately 9.624 kg CO2e per gallon of jet fuel.

3. Ground vehicle fuel emissions were not measured in 2019-2021 but will be going forward.

4. We evaluate our emissions intensity trends against our 2019 base year as well as year-over-year due to the unprecedented impact of the COVID-19 pandemic on air travel.

In 2023, our scope 2 emissions made up less than 1% of our overall GHG emissions, or 6,600 MTCO2e.

Last year, we modified our Scope 2 methodology to include all properties, owned or leased, where we have operational control, including corporate and airport offices, and maintenance and cargo facilities. We measure and report our Scope 2 emissions in line with the GHG Protocol using the location-based method.

In 2023, our location-based Scope 2 emissions increased by 5% compared to 2022 (Table C). This increase was primarily due to the inclusion of several new facilities. However, our emissions intensity per square foot decreased by about 9%, primarily due to lower regional grid emissions factors.

SCOPE 2, LOCATION-BASED1:

BETTER BUILDINGS CHALLENGE (BBC) PROGRAM PERFORMANCE2:

Table C emissions calculated using GHG Protocol location-based method. CO2e stands for metric tons of CO2 equivalent.

1. From 2019 through 2021, we reported our Scope 2 emissions based on the primary consumption data available for eight properties tracked through the U.S. Department of Energy Better Buildings Challenge (BBC) program. For the 2022 reporting year, we refined our Scope 2 emissions to include all properties where we have operational control. This involved removing emissions associated with space within a property we previously owned but did not occupy, as well as adding estimated emissions associated with some additional spaces where we had operational control but did not have primary data.

2. In 2023, we removed a property that we no longer own from our BBC program portfolio; per BBC program rules, we also removed the property from our 2019 baseline and other prior years.

In 2023, we fully assessed our Scope 3 emissions using the GHG Protocol Corporate Value Chain Reporting Standard. Our 2023 Scope 3 made up 21%, or 705,244 MTCO2e, of our overall inventory. Our Scope 3 inventory consists of our purchased goods and services, capital goods, fuel and energy (including upstream production of jet fuel), waste in operations, business travel, employee commuting, and upstream leased assets. In the fourth quarter of 2023, we began our contracted freight operation for Amazon, which falls under Scope 3, category 8. Where possible we used primary data; however, for some categories we applied a hybrid or spend-based methodology to calculate our emissions.

▶ Fuel- and Energy-Related Activities constitute 76% of total Scope 3 missions, reflecting our operational reliance on jet fuel.

▶ Purchased Goods and Services are the second largest area of emissions, accounting for 18% of our Scope 3 footprint.

▶ GHG emissions from capital goods, employee business travel, upstream shipping, waste, upstream leased assets and employee commuting account for the remaining 6% of our Scope 3 emissions.

MTCO2e stands for metric tons of CO2 equivalent.

1. Includes emissions from well-to-tank jet fuel, well-to-tank ground vehicle fuel, and grid transmission and distribution (T&D) losses.

2. Includes emissions from jet fuel consumption on flights operated for Amazon and estimated emissions from electricity used in facilities that we occupy but where we do not have operational control.

Well-to-wake jet fuel emissions intensity: metric tons of CO2e per thousand RTM/million ASM

TASK FORCE ON CLIMATE-RELATED FINANCIAL DISCLOSURES (TCFD)ALIGNED CLIMATE CHANGE QUALITATIVE RISK ASSESSMENT

In 2023, we refreshed our impact assessment of the TCFD-recommended climate change risk categories. We gathered input from our senior leaders and a cross-functional team from various departments including Accounting and Finance, Corporate Audit, Investor Relations, Law, Marketing, Operations, Safety, and Sustainability, as well as guidance from aviation industry experts. The output was a qualitative assessment of the top climate- related risks and opportunities for us over the short, medium and long term, as well as mitigation and adaptation actions we are taking. (See Top Identified Climate-Related Risks and Opportunities on the next page).

To arrive at the overall impact-rating of each climate-related risk and opportunity, we assessed the likelihood of an event occurring against the potential business impacts of such an event. We identified risks through industry analysis and discussion with our leadership team.

Risk impact time horizons were categorized as follows:

▶ SHORT-TERM: 0-4 YEARS

▶ MEDIUM-TERM: 5-10 YEARS

▶ LONG-TERM: 11-30 YEARS

The following tables summarize the top climate-related risks and opportunities, including the impact, time horizon, and risk management and opportunity realization strategy associated with each. The Risk Management and Opportunity Realization Strategy columns are keyed to the numbered legend on page 45.

POLICY AND LEGAL

Policy/ regulation related to carbon pricing

Carbon tax or carbon offsetting requirements have the potential to impact operating cost and/or affect demand through higher ticket prices. For example, the United States has voluntarily committed to participate in CORSIA, the International Civil Aviation Organization’s Carbon Offsetting and Reduction Scheme for International Aviation, for which we expect to incur compliance obligations for the period 2024-2035. We may also be subject to additional costs if different jurisdictions in which we operate create their own carbon pricing schemes.

Enhanced emissions reporting obligations

Mandates on, and regulation of, existing products & services

Regulators and lawmakers are placing increased emphasis on climate transparency and accountability. For example, California recently enacted legislation requiring GHG accounting and climate risk reporting and voluntary carbon market disclosures, and the U.S. Securities and Exchange Commission recently adopted new climate disclosure requirements.

The United States could require domestic emission reduction targets for airlines which could have the potential to limit our ability to grow. Over the long term, domestic policies could favor and/or incentivize smaller, electric aircraft, different forms of propulsion such as hydrogen power, and SAF mandates could increase our fuel costs. California recently proposed to obligate intrastate jet fuel in its Low Carbon Fuel Standard (LCFS) program, which, if it were to go into effect, could increase the cost of jet fuel for all operators serving California.

TECHNOLOGY

Substitution of existing products / services w/ low emissions options

Upgrading aircraft with revolutionary technologies (e.g., electric, hydrogen) may require large-scale changes to infrastructure and operations. For example, we are an investor in and design partner for REGENT Craft’s 100-seat seaglider that is in the early stages of development. If seaglider operations or electrification of some neighbor island flights would come to fruition in Hawai‘i, there would be significant infrastructure implications related to renewable energy generation, battery charging and storage, and potentially port modernization.

Unsuccessful investment in new technology

There is a possibility of unsuccessful investment in emerging aircraft and engine technologies, acceleration of SAF, and longterm partnerships, which could impact our ability to meet our sustainability goals and result in financial loss. For example, we have made investments in REGENT Craft and United Airlines Ventures Sustainable Flight Fund, each of which may fail to produce financial, environmental or business benefits.

The base case cost of abatement for SAF or direct air capture is high, and transitioning to these technologies may lead to an increase in our operating costs. In addition, our SAF offtake contracts may not ultimately lead to any SAF, as the volumes of SAF are dependent on the producer obtaining financing and constructing a facility to produce the SAF. The SAF industry may not scale sufficiently to meet industry demand and we may not achieve supply priority to meet our goals in a constrained marketplace.

Jet fuel may become more

as SAF may be difficult to obtain, particularly in our isolated geography.

Shifts in consumer preferences

REPUTATION

Increased stakeholder concern or negative stakeholder feedback

Larger airlines may have greater funds for sustainability and marketing efforts. There is a risk that consumers and businesses may opt to fly on an airline perceived as more sustainable to reduce their carbon footprint.

As all of our passenger flights touch Hawai‘i and nearly all are bringing visitors to Hawai‘i, impacts of climate change that affect Hawai‘i have the potential to make Hawai‘i less attractive to visitors and Hawaiian Airlines less attractive to shareholders.

OPPORTUNITY

RESOURCE EFFICIENCY

SOURCE

Use of more efficient modes of transportation

PRODUCTS AND SERVICES

Use of loweremission sources of energy

Opportunity to decrease operating costs with more fuel- efficient aircraft, such as our 12-aircraft order for Boeing 787-9s, which are significantly more fuel efficient than priorgeneration, similar-sized aircraft.

Use of SAF through our long-term offtake agreement for SAF supply in California that is expected to start in 2029 and will reduce carbon emissions and may enhance resiliency through diversification of energy sources. Potential local SAF production, through our partnership with Par Hawaii or other local producers, may reduce logistics costs and complexity.

Shift in consumer preferences

Opportunity to increase revenue by bettering our competitive position to reflect shifting consumer preferences toward sustainable services.

Increased severity of extreme weather may cause disruptions such as runway closures, airport closures, or the need to temporarily relocate aircraft or evacuate guests, impacting flight operations and increasing the potential for supply chain disruptions in Hawai‘i, resulting in decreased revenue and increased costs.

Climate change has the potential to have a major impact on our business as changes in long-term weather patterns result in sea level rise, more frequent and extreme weather, rising mean temperatures, and risk of wildfires.

Sea level rise may impact locations close to the shore, including airport runways in Hawai‘i as well as Los Angeles, New York and Osaka, Japan, among others, and visitor destinations such as Waikiki Beach, which could disrupt our flight operations, increase operating costs, affect demand, and lower our revenue. Managed retreat from coastal areas in response to sea-level rise may put pressure on housing stock and the visitor industry, leading to a reduction in Hawai‘i’s population and difficulty attracting and retaining employees.

Hurricanes, typhoons, and other extreme weather events are likely to become more frequent and intense and may impact our flight operations and the resiliency of our infrastructure.

Higher average temperatures, at airports in places such as Phoenix and Las Vegas, may result in payload restrictions, as well as increased fuel consumption and cooling costs, which could impact our revenue, flight operations and operating costs.

Extreme heat and weather may also be a health and safety risk to our employees who work outdoors with specific risk outcomes, ranging from loss of productivity, injury to employees, difficulty recruiting and retaining employees, and higher operating costs.

Aircraft engine performance also deteriorates in polluted air, which may result in increased maintenance operating cost over time.

Severe weather events in most cases drive the use of less efficient flight routing through the airspace for weather avoidance purposes and result in increased fuel burn requirements and delays that lead to higher operating costs.

1

We are proactively lobbying for incentives and tax credits to accelerate SAF uptake, and we continue to evaluate how offsets and other investments will factor into our emissions reduction strategy.

2 We have reported on SASB metrics since 2020, and we incorporated TCFD-aligned reporting in 2022.

3 We monitor regulatory developments, including those related to ESG, and integrate these into our processes and plans.

4

We are currently exploring SAF offtake agreements with providers in continental U.S. markets and working toward developing SAF supply in the Hawai‘i market. In 2022, we established a partnership with Par Hawaii to explore production of SAF in Hawai‘i, and in March 2023, we entered into an agreement with Gevo to purchase 10 million gallons of SAF annually over five years starting in 2029.

5 We are engaging with SAF producers and airframe and aircraft engine manufacturers to evaluate new low-carbon technologies. In 2022, we made a strategic investment in REGENT, a company that is developing a battery-electric powered seaglider. In 2023, we joined United Airlines Ventures Sustainable Flight Fund, an investment fund focused on investing in technologies to scale SAF.

6 We continue to enhance our Travel Pono program introduced in 2020 to encourage responsible tourism.

7 We are committed to reducing our carbon emissions in line with industry goals and continue to be transparent about our impact and progress. In 2023, we established interim targets to support our 2050 net zero carbon emissions goal.

8 We perform preparedness sessions and planning exercises with operational leaders to mitigate the impacts of physical risks. Additionally, we can reposition our fleet to mitigate impacts of extreme weather and consider options for relocating or re-routing flights.

9 We coordinate closely with the State of Hawai‘i Department of Transportation on our respective sustainability initiatives to ensure a collaborative approach to addressing potential impacts of climate change on airport infrastructure and possible mitigation measures.

10 Ongoing fleet investment is a critical component of our carbon reduction goal, and in April 2024 we began operating the first aircraft of our fuel-efficient Boeing 787-9 fleet.

11 We pursue fuel efficiency initiatives through our fuel efficiency campaign.

12 We provide guests with the ability to offset their emissions when flying with us, and we continue to make our products more sustainable, including via our commitment to replace 50% of single-use plastics from in-flight service items with sustainable alternatives by 2025, and eliminate single-use plastics by 2029.

Since 2020, our Travel Pono initiative has been at the forefront of promoting sustainable and responsible tourism as Hawai‘i embarked on the path of recovery following stringent pandemicrelated quarantine measures. This program has been instrumental in providing millions of guests with essential information on how to experience Hawai‘i in a positive way.

Through various channels such as pre-trip emails, our website, Mana‘o blog, social media platforms, and on-board videos, we ensure that travelers are well-informed about sustainable practices and cultural sensitivities.

Moreover, in addition to our in-flight Travel Pono video, our guests benefit from a wealth of informative content produced by local partners, covering topics ranging from ocean safety to cultural education. This collaborative effort underscores our commitment to fostering meaningful connections with the community and policymakers in Hawai‘i.

In response to the West Maui wildfires in 2023, we introduced specialized Maui Travel Pono videos Hosted by Maui-based Hawaiian Airlines employees, these videos offer guidance on how visitors can contribute to Maui’s recovery while ensuring a fulfilling and positive experience.

TRAVEL PONO ON MAUI WITH A321NEO

CAPTAIN SHEILA

Follow Maui local and A321neo Captain Sheila as she talks with residents and business owners throughout the community about how you can support local and travel pono (travel responsibly) when visiting Maui. Hear how local businesses are also providing ways for people to help those affected by the Maui fires from afar.

Through initiatives like the Travel Pono program, we remain dedicated to cultivating a more sustainable and equitable tourism economy that not only enriches the lives of our people and preserves our natural resources but also enhances the quality of life for everyone.

We partner with the grassroots, local nonprofit Sustainable Coastlines Hawai‘i (SCH) to help inspire communities to care for our coastlines. We are proud to support SCH’s vision of a world of inspired people, clean beaches, and healthy coastlines. SCH also coordinates educational programs, team-building corporate cleanups, resource recovery services, public awareness campaigns, and helps others organize their own beach cleanups.

O‘ahu visitors have likely seen the Ala Wai Canal, one of the many picturesque backdrops of Waikīkī. People often run, walk their dogs or bike along its 3.5-mile promenade, and outrigger canoe paddlers often practice for races in its gentle waters. However, the landmark was recently named one of the most polluted waterways in the state. All of that is changing, thanks in part to the hard work and brain trust of the Genki Ala Wai Project and its volunteers. Since 2019, the Genki Ala Wai Project, a nonprofit group under the Hawai‘i Exemplary State Foundation, has gathered community partners – including Hawaiian Airlines – to accomplish one big goal: making the Ala Wai Canal safe for fishing and swimming by 2026.

CLICK HERE TO LEARN MORE

Our ongoing company-wide waste reduction efforts include recycling of cans, bottles and menus, upcycling of materials from our cabins, from seat covers to expired life vest, and initiatives to source compostable products for our in-flight service items, such as stir sticks and cutlery, as well as amenity kits featuring paper packaging.

Plastic pollution is a significant threat to our environment, especially marine life and its benefit to the health of the ecosystem of the Hawaiian Islands. In 2022, we committed to replacing 50% of single-use plastics from in-flight service items with sustainable alternatives by 2025 and eliminating single-use plastics by 2029.

▶ We are committed to achieving our goals and are working with our vendors to identify potential sustainable alternatives. When weighing our decision on which alternatives to plastic would be best, our team considers the operational and product cost, availability and scale, function, and lifecycle of the product – including the appropriate technology and infrastructure to break down and sustainably dispose of waste. As of December 2023, our streamlined service on transpacific flights carries approximately 24% less single-use plastic per flight, compared to our 2021 baseline. However, overall consumption of single-use plastic is higher than our 2021 baseline due to an increase in volume of flying. We continue to partner with Mananalu to phase out plastic water bottles from our cabins and replace them with recyclable aluminum bottlesand last year we diverted over 355,000 plastic bottles from our cabins. In 2023 we introduced a disposable salad dish and cutlery made from more sustainable products on our flights between Honolulu and both Sydney and Auckland.

▶ In 2023 we also launched a new line of in-flight soft goods and amenity kits with Hawai‘i lifestyle brand Noho Home by Janele Kanani Bell that we offer to our business class guests traveling on our long-haul international flights and first class guests traveling between Hawai‘i and New York, Boston and Austin. The amenity kits are made with responsibly sourced materials and guests are offered an assortment of amenities a la carte to minimize waste.

Food sustainability is a key priority for us, especially in our home state of Hawai‘i. We actively support local food production as part of our commitment to bolstering the economy and reducing GHG emissions associated with shipping. Our goal is to increase our spend on locally sourced inflight food and beverage products at our Hawai‘i hubs to 40% by 20251. To achieve this, we feature Hawai‘i-made products from popular local companies like Kona Chips, Honolulu Cookie Company, and LaTour Bakehouse in our in-flight offerings.

In collaboration with Mana Up, a local business accelerator, we empower emerging entrepreneurs statewide, ranging from chocolate makers to coffee growers and honey producers. In 2023, we introduced locally grown and distilled Kō Hana Mai Tai and Diamond Head strawberry soda, replacing non-local alternatives. Additionally, our resumption of service on more international routes enables us to offer a higher proportion of locally sourced items. As of December 2023, local food and beverage products comprised 32% of our catering spend for Hawai‘i departures.

1 Note: we had a change in our tracking methodology that changed our baseline as well as our 2022 performance. Baseline is now 26%, and December 2022 status stood at 29%.

Photo courtesy of Kō Hana Rum

Photo courtesy of Kō Hana Rum

In the summer of 2022, the Hawaiian Airlines Foundation awarded a $109,500 grant to Kāko‘o ‘Ōiwi (pictured above) to fund the construction of a wash and pack facility that is now being used to process crops grown in the Kaneohe region of O‘ahu such as kalo (taro), ‘ulu (breadfruit), ‘uala (sweet potato) and hō‘i‘o (warabi). The facility opened in 2023 on a 405-acre site leased by Kāko‘o ‘Ōiwi, within the He‘eia wetlands. The 4,000-square-foot station outfitted with washing tumblers and wash tubs allows area farmers to process their produce to the standard required for retail and wholesale distribution.

We have also committed to providing monthly volunteer service days at Kāko‘o ‘Ōiwi through our Team Kokua program.

OUR COMMITMENT TO ENVIRONMENTAL STEWARDSHIP IS OUTLINED IN OUR ENVIRONMENTAL POLICY STATEMENT.

In 2023, we grew our workforce to 7,362 people by welcoming 953 new teammates. We recruited for jobs across our organization with a focus on hiring pilots and mechanics to support new business such as our cargo flying for Amazon and to prepare us for growth associated with the deliveries of our Boeing 787-9 fleet. In March of 2023 we ratified a new four-year contract with our pilots, and as of May 2024 none of our union contracts are amendable.

We increased our educational partnerships and outreach, from early exposure to the world of aviation to scholarships and technical opportunity networks while also supporting our employees’ continuing education. We were honored to be recognized by the Hawai‘i nonprofit ClimbHI as the 2023 Outstanding Business award winner for our community outreach at college and high school campuses in Hawai‘i and the Continental U.S.

Our commitment to diversity, inclusion and belonging remains an important driver of our recruitment and retention strategy and success.

We continue to expand our recruitment for qualified veterans, women, and other historically underrepresented groups. In 2023, we were proud to lead major U.S. airlines once again in having the highest percentage of women pilots at more than 9.7%, well above the 4.9% 2022 U.S. average.

We embrace our work ‘ohana’s (family) diversity and interests by supporting the following employee resource groups (ERG): ASCEND (A Support Community for Employees Nurturing Diverse Abilities); Ha‘aheo (LGBTQA+); Network for Black Employees and Allies (NBEA); Sustainability; Hawaiian Airlines Veterans Employee Network (HAVEN); and Wāhine (Women) in Aviation. We have established and supported these resource groups – which have a combined membership of almost 600 employees – to foster community and to inform the development of our collective goals.

▶ October 2023 marked the 50th anniversary of the Rehabilitation Act of 1973. To support inclusivity, our ASCEND ERG encouraged employees to enable the live captioning feature in their Microsoft Teams meetings to be more inclusive of colleagues with a hearing impairment, learning disabilities, or non-native English speakers.

▶ For National Pride Month, Hawaiian’s Ha‘aheo team hosted a Lunch and Learn featuring the Hawai‘i Health & Harm Reduction Center, a nonprofit whose director of marketing and development, Andrew Ogata, emphasized the importance of the center’s work in fighting stigma and promoting wellness across the Hawaiian Islands and the Pacific.

▶ Our Network for Black Employees and Allies ERG led a company-wide celebration of Juneteenth by supporting black-owned businesses that visited our Corporate Headquarters and our Phoenix Technology Center. NBEA also hosted guest speaker Mark “Feijão” Milligan II (pictured below at his Honolulu studio) whose art brings to life the history of the African Diaspora.

“Our Juneteenth celebrations were a potent example of the impact that strong allyship has toward creating intentional progress and more inclusive workplaces,” said Michael Harvey, senior manager of information technology and president of the NBEA. “Our group started with a blank canvas, but we felt it was important first to take some time to figure out who we were and how we would amplify our mission of empowering our Black employees. I feel we’ve done a great job at painting a colorful identity for ourselves and serving as stewards of diversity and inclusion.”

▶ Our Sustainability ERG toured Par Hawaii to better understand our partnership with the state’s largest refinery to advance the local production of sustainable aviation fuel. The group also took part in the City and County of Honolulu’s Tour De Trash to learn about the lifecycle of Oahu’s waste products during visits to Hawaiian Earth Recycling, H-POWER and the Waimanalu Gulch Sanitary Landfill.

Our HAVEN members welcomed back 103-year-old Ike Schab, who returned to Honolulu for the 82nd commemoration of the attack on Pearl Harbor. He served aboard the USS Dobbin when the attack occurred on Dec. 7, 1941. “I’m glad to be with you all, that’s the best feeling I can express.”

▶ In August 2023, we hosted our first military open house at our Corporate Headquarters. Members of our Veterans ERG HAVEN shared their personal experiences on their transition from military to civilian careers with some 55 participants. This event included information sessions on career opportunities from industry experts and networking opportunities to connect with military personnel and professionals in the aviation field. Earlier this year, we hosted a virtual military open house with 70 attendees.

▶ In September 2023, our Wāhine in Aviation ERG and the Women in Aviation International Aloha Chapter hosted 38 girls ages 12 to 17 and provided a glimpse into careers at the company. Seventy employees from across our company volunteered at this event, where the group experienced our flight simulators, and learned about various roles in technical operations as well as emergency procedures.

>81% OF OUR ACTIVE WORKFORCE IDENTIFY AS RACIALLY OR ETHNICALLY DIVERSE

>47% IDENTIFY AS FEMALE

7% IDENTIFY AS VETERANS

DIRECTOR AND ABOVE

>55% OF OUR DIRECTOR-LEVEL AND ABOVE EMPLOYEES IDENTIFY AS RACIALLY OR ETHNICALLY DIVERSE

>32% IDENTIFY AS FEMALE

13% IDENTIFY AS VETERANS

In the fall of 2023, our operational teammates received a paid day of training to attend our Purpose and Values immersion. Over 4,400 teammates across work groups and geographies experienced engaging content and examples of what living our values looks like in various company roles and in our community.

We maintain our Human Rights Policy Statement to formalize our commitment to human rights and heighten awareness among our employees. Human trafficking remains a significant issue for our industry globally and we provide our guest-facing employees initial and recurrent training on awareness and response strategies.

With our Purpose and Values in mind, and to highlight our commitment to safety, security, and compliance, in 2023 we launched a Safety Kuleana training for leaders on our commitment to fairly addressing issues and sharing accountability when errors occur. In 2024, all of our employees will receive training on employee empowerment, just culture, and hazard and risk reporting.

Our employees are proud to share Hawaii’s culture with our guests and each other. We offer employee-led hula and ‘ōlelo Hawai‘i (Hawaiian language) classes, recognize those who speak the language and encourage them to use it with our guests and colleagues. During ‘Ōlelo Hawai‘i Month in February, we celebrate and help perpetuate the language through various company and community activities and events.

This year, we hosted a Hawaiian language roundtrip flight between Honolulu and Boston with ‘ōlelo Hawai‘i shared at the gate and through activities onboard, including language translation cards and ‘ōlelo coloring sheets to encourage passengers to participate in the fun. After arrival, crewmembers and fellow employees visited the Peabody Essex Museum to pay homage to Kū, a revered Native Hawaiian relic.

We also donated $12,240 to Hawai‘i nonprofit Awaiaulu to fund a donation of 272 copies of the book “Ke Kumu Aupuni: The Foundation of Hawaiian Nationhood” – an invaluable catalog of data about Hawai‘i, Hawaiians, and the nature of national and cultural identity in the Pacific – to 34 Hawaiian language immersion schools throughout Hawai‘i.

In February 2024, HA90 crewmembers joined their fellow Hawaiian Airlines employees on a special trip to Peabody Essex Museum during their layover.

Last year we continued to expand schoolto-career pipeline partnerships that are broadening opportunities for students to consider Hawaiian as an employer and increasing our access to talent, especially in Hawai‘i.

2023 was our first full year having 150 employee volunteers with our Career Ambassadors program represent Hawaiian Airlines by visiting over 95 classrooms, career academies, and high school and college career fairs. Our Career Ambassador program consists of volunteers who receive training to speak at schools and colleges to increase awareness of career pathways at our company and in our industry.

In 2023 we invested in the ongoing development and careers of our teammates by offering them access to undergraduate and graduate education classes at Hawai‘i Pacific University. We are subsidizing HPU’s tuition by up to 40% for all active employees and HPU is waiving the application fee.

In July 2023, we again partnered with the Organization of Black Aerospace Professionals (OBAP) to host middle-to-high-school students enrolled in the nonprofit’s annual Aerospace Center Education (ACE) Academy. Many employees and OBAP members volunteered to give students a tour of our operations, including our pilot and flight attendant training facilities.

For the 8th annual Girls in Aviation Day in September 2023, 70 of our employees from across the company volunteered to give a group of 40 future women leaders a glimpse into a career at Hawai‘i’s hometown carrier.

We had a successful 2023 internship program, consisting of two sessions from May to July, with 19 interns working across the organization, including in information technology, marketing, technical operations and supply chain management. We were pleased to extend full-time positions to several IT interns.

Hau‘oli Kalipi (second from left), Matthew Chimbos, managing director of information technology at Hawaiian Airlines (center right), and Preston Na‘alelalani Ponteras (right) pictured with ASU Mascot Sparky the Sun Devil at the 2023 ‘Ohana Day, sponsored by Hawaiian Airlines.

In August 2023 we established a $100,000 scholarship program at the University of Hawaii for students in the information technology, computer science and cybersecurity programs. In September we also awarded the first of eight grants from our $100,000 New Horizons Scholarship Fund to two native Hawaiian undergraduates enrolled in Arizona State University’s W. P. Carey School of Business’s Information Systems program (pictured above). Both students received $10,000 in tuition assistance to support their paths toward information technology careers. We also provided a $20,000 sponsorship of ASU’s annual ‘Ohana Day, a gathering of Hawai‘i students and their families.

In 2023 we hired six graduates of Honolulu Community College’s Aeronautics Maintenance Technology (AERO) program who first experienced our company as apprentices. Between 2022 and 2023, we helped triple student enrollment in the school’s AERO program by having our maintenance training instructors teach classes at the campus. In February 2024, we launched an Aircraft Maintenance Technician Opportunities Network for interested individuals to remain connected or kickstart their aviation career with us. We connect via newsletters and workshops, and provide members access to company resources.

Earlier this year we also partnered with Universal Technical Institute and the National Aviation Academy to guarantee a first-round job interview for graduates who have earned their FAA certifications. If hired, they are eligible for a sign-on bonus of up to $10,000 and a relocation budget of up to $12,000. We will also participate in UTI’s career fairs, classroom visits, and webinars.

In 2023 we hired our first employees through our University of Hawai‘i Leap-Start Program and Embry Riddle Aeronautical University’s partnership. The Leap-Start Program is a workforce readiness program that provides part-time internships to recent or approaching University of Hawai‘i graduates in the high-demand fields of information technology and cybersecurity. The Aviation Maintenance Technology (AMT) SkillBridge program with Embry-Riddle Aeronautical University provides veterans and military spouses who have obtained their airframe and powerplant certification the opportunity to join our maintenance team.

Each year we support our island communities and cities across our network through our Team Kokua (Help) giving program and the volunteerism of our employees.

In 2023, our philanthropic activities once again benefited people across our network, with a total of 187.2 million HawaiianMiles donated to 246 organizations, including 35 million miles given to our longtime partner, the Polynesia Voyaging Society, to support its “Moananuiakea: A Voyage for the Earth.” In all, more than 1,500 employees volunteered 8,548 hours while we contributed $1.8 million in cash and in-kind donations in the areas of culture, education, environment, and health and human services.

In the summer of 2023, we were faced with one of the most urgent calls to action in our history following the wildfires in Lahaina, Maui. Displacing thousands of people along with the tragic loss of life, and burning more than 2,000 acres, the wildfires brought Maui’s travel, economy, and everyday activities to a grinding halt.

One of our early tasks was to ensure that our nearly 500 Maui-based colleagues were safe. Activating quickly, we also ramped up our operation to evacuate visitors and displaced residents, and transport first responders and essential supplies. As part of our comprehensive response, we:

▶ Operated a full schedule of flights in and out of Maui, with 18 additional flights in the first two days of the fires.

▶ Within the first 72 hours of the disaster, we carried more than17,000 residents and visitors on flights departing Maui.

▶ Made every main cabin seat from Kahului to Honolulu available at $19 through Aug. 14, so costs would not be an obstacle for people needing to leave the island.

Kōkua, Hawaiian’s employee volunteer group, packing donation boxes during a company-wide food drive supporting Maui.

▶ Deployed dozens of volunteers to assist travelers departing from Kahului and arriving in Honolulu.

▶ Set aside dedicated space on our aircraft to support essential cargo, and in the first week of our response, our interisland and transpacific flights to Maui brought in more than 54,000 pounds of goods ranging from food and water to life-saving blood and medical supplies to communications equipment and animal kennels.

▶ Donated and shipped soft goods and catering items, including 300 bottles of Mananalu water, 550 sandwiches, 3,000 snack items, 1,600 amenity kits, mattress pads, lounging pillows and other supplies, for evacuees arriving at Kahului Airport.

Hawaiian Airlines Cargo is proud to help transport essential medical supplies to Maui and support first responders in providing critical medical care to communities impacted by the wildfires.

Team

Team

▶ Deployed employee members of the Hawaiian Airlines Emergency Assistance Response Team (HEART) to work at the Honolulu Convention Center and other shelter facilities for visitors and displaced residents.

▶ Activated employee support resources for team members on Maui and elsewhere who were personally affected by the disaster.

▶ Waived cargo fees and limits of our employee shipping program, which facilitated the distribution of more than 17,000 pounds of supplies to Maui.

▶ More than 400 employees raised over $164,000 via our Wings of Hope nonprofit to support colleagues who suffered property loss or damage.

▶ Contributed $150,000 ($50,000 each to Hawai‘i Foodbank, Maui Food Bank and the Maui Strong Fund of the Hawai‘i Community Foundation) to further support the organizations’ wildfire relief work. We are grateful to our corporate partners who added $500,000 in donations to our partner charities.

▶ Organized a daylong company-wide food and supply drive through which employees collected over 10,000 pounds of goods that were donated to Hawai‘i Foodbank and Maui Food Bank for people displaced by the wildfires.

A Kona resident asked the Mālama Maui Desk for help flying to Kahului to volunteer with Nāpili Park’s Nāpili Noho, a community hub for impacted residents and those without internet access after the West Maui wildfires. Hawaiian Airlines granted him HawaiianMiles to join the community in building a school for displaced children.

▶ Partnered with Maui Ola: A benefit concert for Maui, a live concert and broadcast fundraiser at Honolulu’s Bernice Pauahi Bishop Museum, by flying in artists, event organizers and participants, and providing volunteers. The event raised over $1.3 million.

▶ Donated seats to first responders, including City and County of Honolulu firefighters to help Maui stations battle the wildfires.

▶ Provided nearly 140 million miles (equivalent to some 18,000 interisland flights) in joint donation with our HawaiianMiles members to the American Red Cross of Hawai‘i to facilitate travel for volunteers, support personnel and community members in need.

▶ Established the Malama Maui Desk, which assisted over 230 individuals and organizations with urgent, high-impact requests for support related to travel, baggage waivers, volunteers, sponsorships and more. Hawaiian Air Cargo shipped nearly 19,000 pounds of donations to Kahului, including meals, electronic devices, school supplies, first-aid and hygiene products, wheelchairs and walkers.

▶ Gifted $10,000 to the rebuilding of Punana Leo o Lahaina, a Hawaiian language immersion school in Lahaina whose facilities were destroyed by the wildfires.

We know that a full recovery will take time and is dependent on visitors returning to Maui in support of local businesses and communities who rely on tourism — the foundation of the island’s economy.

We remain committed to Maui’s long-term recovery and supporting sustainable tourism across our state.

We are proud to connect our nonprofit partners through financial, flight, cargo and volunteer support. Our longtime partner, the Polynesian Voyaging Society, approached us to support its 2023 “Moananuiākea: A Voyage for Earth,” which seeks to develop young leaders and engage communities around the world while sharing the vital importance of our oceans, nature, science and indigenous wisdom. We signed on as the official airline sponsor, donating 34 million air miles for crew travel and committing to transport cargo associated with the voyage around the Pacific. We were proud to be named the voyage’s Moa’e Kū sponsor – a reference to the predictable, steady, and reliable wind that navigators depend on.

For a fourth consecutive year, we encouraged 5,369 people worldwide to holoholo (go out) and prioritize their wellness during the annual Holoholo Challenge. The Hawai‘i inspired fitness challenge invited participants to track their progress with virtual routes around Kaua’i. Around $25,000 was raised for local nonprofit McBryde Garden, which is part of the National Tropical Botanical Garden and is home to the largest ex situ collection of native Hawaiian flora.

More than 89% of our employees are Hawai‘i-based, live in all of the state’s non-military zip codes and are a part of the fabric of the community. Our employees serve on school committees, neighborhood associations and nonprofit boards. Others volunteer at community and cultural events, coach youth sports and are active members of their faith-based communities.

We value the diverse perspectives of employees both inside and outside of our home state.

Company leaders regularly engage with stakeholders, community and business groups, and nonprofit organizations to share news about the airline and participate in discussions on important issues affecting the state.

Each year, our CEO and other senior executives participate in “Talk Story” events with chambers of commerce in Hawai‘i and on the U.S. mainland to share news about the airline and hear from stakeholders. This year, executives from both the company and Alaska Airlines were present at our Talk Story meetings to discuss our pending merger. Our leaders also serve as guest speakers at business and industry events and have joined panel discussions on regenerative tourism, market trends and sustainability.

Our Voice of the Customer program surveys every direct booking guest, receiving about 85,000 survey responses each year, and results are analyzed and shared weekly with operational leaders. Quarterly reviews are held with our CEO and senior leaders to review guest satisfaction and identify areas for improvement and investment. Our Consumer Affairs team corresponds with guests about issues after their travel, and regularly reports their feedback to our management team

We engage with our shareholders formally on a quarterly basis to provide business updates. We also proactively reach out to our investors through a variety of platforms including conferences, roadshows, news announcements and individual meetings.

Our Board is directly involved in evaluating strategies, programs, policies, and communications related to ESG. The Board consists of current and retired senior business leaders who have a wide range of knowledge and experience in governance matters, including those concerning climate and sustainability. Additionally, all Board members are typically present for each Board committee meeting, increasing Board awareness of climate and other ESG-related topics.

The Board holds regularly scheduled quarterly meetings. ESG and climate-related issues, such as key priorities, strategies, updates and other related matters, are discussed with the Board on a regular cadence. Additionally, the Board is kept apprised of material regulatory developments, including those related to ESG.

While the Board oversees ESG risks, strategy and performance, the Governance and Nominating Committee of the Board has responsibility for reviewing and reporting findings and recommendations to the Board regarding the company’s ESG strategy and for periodically reviewing our policies and public disclosures related to ESG, as stated in its charter. Our other Board Committees also regularly address ESG issues relevant to their respective oversight areas. For example, the Board Safety Committee has oversight of Safety Risk Management processes and governance, including short-term climate-related physical risks (e.g. extreme weather events).

DESIGNATED EXECUTIVES