“Take risks and keep asking for opportunities.”

“Dream big. Deliver small.”

“Don’t be shy.”

“Seek out exciting, new opportunities and welcome any challenges ahead with open arms.”

“Take risks and keep asking for opportunities.”

“Dream big. Deliver small.”

“Don’t be shy.”

“Seek out exciting, new opportunities and welcome any challenges ahead with open arms.”

“You’ll do great things, but it is not going to come without hard work and grit.”

“Harness your authentic self and creativity.”

“Stay focused and don’t let distractions steer you away from your personal goals.”

“Do things before you feel ready.”

“Never say no to an opportunity.”

“Our habits determine who we become and what we achieve.”

“Don’t focus solely on

“Treat selfdoubt as a challenge.”

“Results don’t happen overnight.”

“Take a deep breath, be intentional and trust the process.”

material possessions and financial success. True wealth lies in the quality of our relationships.”

“Let feedback be constructive — not personal.”

MANAGING EDITOR JAMES KLEIMANN

EDITOR ANGELICA LEICHT

SENIOR MORTGAGE REPORTER BILL CONROY

REAL ESTATE & TITLE REPORTER BROOKLEE HAN

MORTGAGE REPORTER FLÁVIA FURLAN NUNES REPORTER CONNIE KIM

LEAD ANALYST LOGAN MOHTASHAMI

PRESIDENT MIKE SIMONSEN

REALTRENDS

VICE PRESIDENT OF REAL ESTATE MARK ADAMS TECHNICAL DIRECTOR KEERI TRAMM RESEARCH AND RANKINGS COORDINATOR ALICIA WYNTERSEND

REVERSE MORTGAGE DAILY EDITOR CHRIS CLOW

EDITOR-IN-CHIEF SARAH WHEELER

CORPORATE

CEO CLAYTON COLLINS

COO DIEGO SANCHEZ

VICE PRESIDENT OF FINANCE ANDREW KEY

DIRECTOR OF PEOPLE AND CULTURE AMY BEARD

VICE PRESIDENT OF GROWTH CAREN KARRIS

GRAPHIC DESIGNER BRANDON JOHNSON

VICE PRESIDENT OF PRODUCT HOLDEN PAGE

PRODUCT MANAGER OF MEDIA BO FRIZE

AD OPS COORDINATOR ELIZABETH LEDOUX

DIRECTOR OF HW+ & EVENTS BRENA NATH

SENIOR WEBINAR & EVENTS MANAGER ALLISON LAFORGIA

MARKETING PROGRAM MANAGER LESLEY COLLINS

MEMBERSHIP COORDINATOR SARAHI DE LA CUESTA

PEOPLE OPERATIONS MANAGER JAMIE BRIDGES

AD OPERATIONS MANAGER MATTHEW STAFFORD

MEMBERSHIP DEVELOPMENT SPECIALIST CAROLINE ABAD

EMAIL MARKETING SPECIALIST ALI MORRISSEY

GROWTH COORDINATOR SYDNEY SMITH

EVENT AND PROGRAM SPECIALIST MAKENNA CLAY

BUSINESS ANALYST WHITNI ROWE

EXECUTIVE ASSISTANT KRISTIN GROOME

SVP SALES AND OPERATIONS JENNIFER WATSON LAWS

VP STRATEGIC SALES CHRISTI HUMPHRIES

DIRECTOR OF STRATEGIC SALES PETER GRATT

WESTERN CASS HECKEL

CENTRAL & NORTHEAST SAMANTHA STEIN

DIRECTOR OF REVENUE OPERATIONS ADINA RITTER

STRATEGIC ACCOUNT MANAGER BRIA SOYELE

SALES MARKETING MANAGER TOD MOHNEY

CONTENT SOLUTIONS

SENIOR DIRECTOR OF DATA AND CONTENT TRACEY VELT CONTENT EDITOR JESSICA DAVIS

MAGAZINE EDITOR AUDREY LEE

MULTIMEDIA PROJECT MANAGER DALTON JOHNSON

JUNIOR DIGITAL PRODUCER ELISSA BRANCH CONTENT SOLUTIONS COORDINATOR EUNICE GARCIA

HOW TO REACH US LETTERS TO THE EDITOR EDITOR@HOUSINGWIRE.COM TIPS AND STORIES EDITORIAL@HOUSINGWIRE.COM

CURRENT MEMBERSHIP / SUBSCRIPTION HWPLUSMEMBER@HOUSINGWIRE.COM

NEW MEMBERSHIP / SUBSCRIPTION HOUSINGWIRE.COM/MEMBERSHIP

MARKETING & ADVERTISING JLAWS@HOUSINGWIRE.COM OR (469) 870-4572

ADVERTISING CLIENT SUCCESS CLIENTSUCCESS@HOUSINGWIRE.COM

TO QUOTE BON JOVI, “Whoa, we’re halfway there!” The last six months in the housing market were tough. 2023 has been a year that started off with some renewed optimism thanks to an uptick in housing activity but quickly took a turn as events, like the collapse of Silicon Valley Bank, threw a wrench into a lot of forecasts for the year. Over the next 6 months, the housing market winners will be the people who are forging opportunities despite what’s happening. For many in this industry, that’s going back to their roots, building relationships and working twice as hard for less.

But, much like two other lines from Bon Jovi’s hit song, “We’ve gotta hold on, ready or not,” so “Take my hand, we’ll make it, I swear.” Now is the time to lean in on those connections you’ve been making in housing, whether for advice, to sell or buy or even to partner.

It’s the context of this very challenging year that make the professionals we honor in the 2023 Housing Finance Leaders and Rising Stars even more impressive. These industry leaders are fidning a way through for themselves, for consumers and for their companies — that’s why we look to them as sources, and feature them in podcasts and events. Over the years, these award winners always make one thing clear: the key to success is the people you surround yourself with. Read more about these honorees beginning on pages 22 and 32.

Brena Nath Director, HW+ & Events @BrenaNath

The information contained within should not be construed as a recommendation for any course of action regarding legal, financial or accounting matters. All written materials are disseminated with the understanding that the publisher is not engaged in rendering legal advice or other professional services. HW Media does not guarantee the accuracy of information provided, and is not liable for any damages, losses or other detriment that may result from the use of these materials.

© 2023 by HW Media, LLC • All rights reserved

ServiceLink congratulates Melinda Maloney on being named a 2023 HousingWire Rising Star!

Melinda Maloney’s deep understanding of the mortgage tech landscape, marketing smarts and empathetic leadership style make her one of the industry’s rising stars to watch. Thank you, Melinda, for all that you do to move the industry forward! ServiceLink congratulates you on this well-deserved honor.

Learn more at svclnk.com

Melinda Maloney, Director, Business Line and Field Marketing

Melinda Maloney, Director, Business Line and Field Marketing

June

How have agent comissions changed in recent years? And what’s to come?

LERETA is giving property tax grants to deserving veterans.

Internet sensation Matt Lionetti has five tips to boost your online presence.

The 70s might seem far, far away, but the state of hosuing was similar to today.

Thanks for joining the HW+ community at the May 2023 Demo Day.

The HW Finance Leaders award honors the 30 most influential leaders in housing finance. From chief financial officers to company founders, these financial professionals are balancing the housing equation.

80 HW Rising Star honorees from mortgage and real estate share the best advice they’ve ever received, their habits for success and the advice they’d give their

Ashley Blackmore, Helena de

Reynolds and

share their thoughts on real estate trends in the industry. Get their insider knoweldge on the most pressing housing question, “How’s the market?”

A Call for Community Capital 20

Romi Mahajan

HousingWire Daily examines the most compelling mortgage, real estate, and fintech articles reported across HW Media

listen wherever you get your podcasts

with Sarah Wheeler

Plano, Texas-based Finance of America Companies (FOA) appointed Graham Fleming as CEO. Fleming has been serving as interim CEO following the 2022 retirement of predecessor Patti Cook. He has 25 years of experience in the mortgage industry, which includes prior leadership positions at Icon Residential Lenders and Finance America, a company that is unrelated to FOA.

United Wholesale Mortgage (UWM) appointed Andrew Hubacker to the position of chief financial officer. Originally joining the company in 2020 as its chief accounting officer, Hubacker has been serving as interim chief financial officer. Hubacker began his tenure at UWM preparing the company for a merger that would lead to its addition to the New York Stock Exchange.

Mortgage and real estate services provider Mr. Cooper hired Carlos Pelayo to serve as the new chief legal officer in charge of corporate governance functions as it seeks to grow its servicing volume. Previously serving as a legal advisor to companies including Bank of America, Barclays and Lehman Brothers, Pelayo most recently served as managing director and legal executive at Merrill Lynch Wealth Management.

Finance of America Companies (FOA) appointed Kristen Sieffert to serve as its new president. Previously the president of FOA’s reverse mortgage division Finance of America Reverse (FAR), Sieffert helped facilitate the acquisition of leading reverse mortgage industry lender American Advisors Group (AAG). She became the president of FAR’s predecessor, Urban Financial, in 2015 — and oversaw its rebranding efforts into FAR later that year.

Fairway Independent Mortgage Corporation appointed Tane Cabe as president of the reverse mortgage lending division as part of an overhaul of the department. Cabe, who was originally hired by Fairway to expand its reverse mortgage for purchase business in 2022, will lead the division under its new, more decentralized structure. The division revamp includes new hires in education, technology, sales support and more.

Government-sponsored enterprise Freddie Mac appointed Sonu Mittal as its new senior vice president and head of its single-family acquisition division. Mittal will focus on seller engagement, products, credit and affordable missions goals while also monitoring the technology that facilitates those goals. Mittal previously worked at McLean where he held several leadership roles including as president of its home mortgage division.

KCD PR hired Chris Cline to serve as its new director of media relations. Cline previously served as the director of communications for the state of Missouri and Veteran United Home Loans. He brings a deep experience of media relations both in the mortgage and finance spaces to his new role at KCD PR. Cline will usher in a new phase at KCD PR, focused on Blockchain and technology-based financial services.

Date: June 18 - 21

Cost to attend: $2,350

Presented by: RealTrends

This conference is the must-attend event of 2023 for real estate presidents, senior leaders and broker-owners. Attendees can catch an all-star lineup of CEOs and top real estate leaders on stage like Gary Keller, Nick Bailey, Denee Evans and Katie Johnson. There are sessions on M&A, brokerage success, technology, data and more. New to Gathering of Eagles this year are the “CEO Playbook” sessions. These rapid-fire, 15-minute sessions give attendees an inside look into the success stories behind today’s most powerful real estate leaders. Gathering of Eagles also includes several networking opportunities like the Charity Golf Tournament, wine tasting and welcome receptions.

Date: June 5 - 8

Cost to attend: Non Member $1,199 | Member $799

Presented by: MISMO

Learn the latest in mortgage industry standards while networking with colleagues from across the country at the MISMO Spring Summit. This year’s summit offers several informational sessions including a "tech sprint" presented by FHFA, GSE and housing agency updates and sessions on mortgage servicing. Attendees who are new to MISMO will have the opportunity to be paired with an industry veteran who can mentor and guide them throughout the conference. Plus, all attendees can join in on the MISMO Bootcamp to learn about MISMO’s operations, standards and vision for the future. Hear thought leadership on digital innovation, security standards and operating in a tough market from today’s industry leaders. After sessions are over each day, attendees will have the chance to connect with one another during evening receptions.

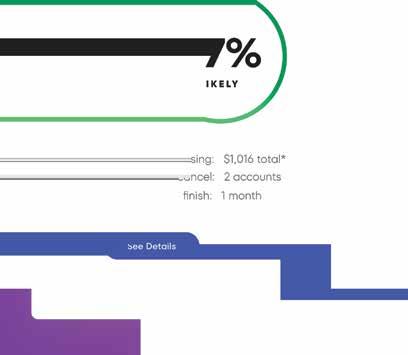

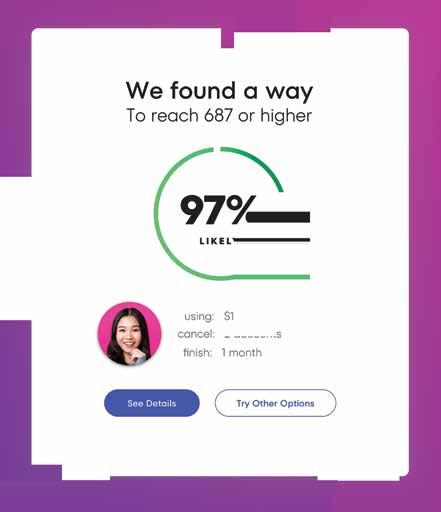

This episode’s guest is a mortgage industry veteran and entrepreneur who might be familiar to many of you: Dave Savage, chief innovation officer at TrustEngine and co-founder of Mortgage Coach.

Clayton and Dave's conversation hopes to bring a fresh, new angle to Dave's usual expertise. They talk about current market dynamics, how some new loan officers don't get it — and how the seasoned ones forgot it.

They also go into dissecting the modern sales process and building trust in the type of information that LOs should be sharing at different points in the origination process.

Clayton Collins: I see originators taking completely different approaches to educating their sphere of influence on what's happening. Are there any best practices or even worst practices that make you cringe and wish you could coach? Some of these originators are the first point of homeownership education that their audience members are getting. So, it seems like a fairly important thing to do, right?

Dave Savage: The worst practices are not having a playbook that you're using to deliver a consistent experience. And, unfortunately, I do think the majority of originators don't have a playbook. This is the first inning of the spring home-buying season — and it's a nine-inning game. It is a game when it comes to the purchase business. We're in the first inning where 70% of all mortgages will be done in the U.S. Literally every spring home buying season has very different nuances.

The only thing that's for sure is that January, February and March end at the same time. So bring home a playbook.

Scan the code to listen

"Setting aside the competitive spirit we all have and collaborating as leaders is the true value of these gatherings. It's also a time to recharge and focus on leadership principles."

- Ashley Bowers, president of HomeSmart International

“Dave Savage of Mortgage Coach on what new LOs just don't get.”

Peter Bowman is a trailblazer in the real estate tech industry. As the CEO and co-founder of Flueid, Bowman is passionate about bringing title data to the start of every workflow. Because of his experience in a wide variety of leadership positions, he was able to realize that title data is the cornerstone for every real estate transaction. Bowman, alongside his leadership team at Flueid, is responsible for driving the adoption of data and technology within the real estate category and creating the title decision-making category in the early 2000s.

Below, Bowman answers five questions that give an inside look at his life.

1. Besides my job and family, my greatest passion is...finding ways to serve people through different means.

2. My signature phrase...always ask "why?"

3. My favorite thing to do with my employees is...create lasting and impactful memories that remind the Flueid team that we get to work together — we don’t have to work together.

4. I can’t live without...the sun! Besides the scientific truth behind this, I try to catch the sunset as often as I can for a mental reset.

5. Biggest business success this year...transforming Flueid from a one-product start-up to a multiproduct company and raising Series B funds in a challenging market.

cristal@montecito-estate.com

999 Romero Canyon Road, Montecito, CA 93108

$20 million

5 bedrooms, 6.5 bathrooms

Cristal Clarke has been a full-time real estate agent for more than 35 years, specializing in Montecito, Santa Barbara, Hope Ranch and the surrounding California communities.

According to Clarke, the top requirement for any agent — whether they’re new to the industry or a seasoned pro — is to know their market and provide personalized service for their clients.

“Many people like to differentiate the ‘luxury market’ as opposed to the market at large,” she said. “My response to that is that the purchase of a home will, in all reality, be the most expensive purchase a person or persons may make. So to that buyer, it will be viewed as a ‘luxury’ no matter the price point, and you should treat the client accordingly.”

This 2.4-acre property is an exceptional remodel with breathtaking ocean views from almost every room. The Montecito estate showcases the finest design elements and materials, with designer touches including solid oak details and Calacatta marble. Its state-of-the-art technology features include a Lutron system, smart home functionality and top-of-the-line security elements. And the infinity edge pool offers views of the Channel Islands, Stearns Wharf and coastal sunsets.

The Romero Canyon property has been promoted via a social media campaign — including an Instagram reel with more than 25,000 views — as well as an email campaign to top luxury agents worldwide and ads in a variety of local magazines.

Clarke said that in her local market, she’s seeing an overabundance of pent-up buyer demand with restricted inventory levels, which is supporting property values. Volume has been impacted, but mostly based on a lack of inventory rather than interest rate hikes, inflation or economic data.

New Jersey’s Bergen County gives homebuyers the best of both worlds. There are over 9,000 acres of parklands and easy access to New York City. “There are excellent schools and great transportation into Manhattan, but if you go a little bit north you can go hiking. It has a little bit of everything,” Max Stokes, a Bergen County-based Compass agent, said. Recently, Bergen County has been home to one of the hottest housing markets in the country. After hovering around $700,000 from late May until early December 2022, the 90-day average median list price of homes in Bergen County has been steadily on the rise, reaching a new peak of $859,000 in the week ending April 14, 2023, according to data from Altos Research. In addition, Altos reports that the 90-day average median days on the market has fallen back down to 56 days after reaching a high of 84 earlier this year. “A lack of inventory still exists in Bergen County,” Stokes said. “People aren’t moving because they are tied into low-interest rates, so they aren’t listing their home. For every seller I probably have 50 buyers.” But, homes are not receiving the same volume of offers that they used to. “At the peak, there was a lot more panic in the market. Every single house would get 20 to 30 offers, but most of them were not that strong,” he said. “Only the top five or six were really worth considering and now those top five or six offers are all you are seeing on properties.”

Named after County Road 30A, which spans roughly 20 miles along the Florida panhandle coastline, the 30A metro area encompasses Destin, Panama City, Santa Rosa and other towns in between. Known for its white sand beaches, coastal dune lakes and the vibrant blue waters of the Gulf of Mexico, the 30A region has become quite popular with vacation home and second home buyers. “The weather and the beach are unbeatable,” Ray Giacoletti, a local Corcoran Group agent, said. “It really is paradise here. The sun just makes you feel alive each and every day.” With 10 picturesque, beachfront towns in the area, Giacoletti says that depending on homebuyers’ budgets they are sure to find exactly what they are looking for. The median list price for homes in Walton County has been on the rise, increasing from a 90-day average median list price of $489,500 in April 2018 to $884,000 in April 2023, according to data from Altos Research. Although the market in Walton County cooled in the later part of 2022 and in the early months of 2023, things were back on the rise this spring. The share of active listings with price decreases fell to 32.67%, after hitting a five-year high of 44.59% in late November 2022.

Unlike many other markets across the country, Charleston’s housing market did not take off at the onset of the COVID-19 pandemic. In fact, the 90-day average median list price of a home in Charleston has yet to again reach the peak of $198,358 it hit in late May 2019. This spring, things were looking positive for a metro area whose median list price has spent the past five years hovering between $160,000 and $200,000, according to data from Altos Research. With inventory continuing to decline, hitting a 90-day average of 150 homes as of the week ending April 14, and the 90-day average median list price coming in at $193,147, it appears the record may be in reach. Sitting at the confluence of the Elk and Kanawha rivers, Charleston is the most populous city in West Virginia. With a variety of job opportunities and easy access to outdoor activities like hiking and whitewater rafting, Charleston offers residents big city amenities with small-town charms.

While most of the California housing market has been making headlines for declining home prices, there is still a strong seller’s market in Pasadena. It had an Altos Research Market Action Index score of 49, well above the 30-point reading that would indicate a balanced market. “The inventory remains low, which offsets the impact of higher interest rates and a diminished number of buyers,” Tracy Do, a local Coldwell Banker agent, said. “As a result of this, the last two listings we brought to the market in Pasadena received multiple offers from qualified buyers. Homes that are priced to meet the marketplace are doing well and selling within the first 14 days on the market.” Known for its annual Tournament of Roses, Pasadena has attracted newcomers and tourists alike since its founding in the 1880s. The area was originally home to the Hahamonga Tribe of Native Americans, before the establishment of the San Gabriel Mission in 1771 by Spaniards of the Franciscan order. Today, Pasadena is home to a wide variety of industries, as well as the California Institute of Technology.

An early stopping point for steamboats traveling down the Red River in the late 19th century, Fargo was originally known as Centralia. The city was eventually renamed to honor Northern Pacific Railway director, and Wells Fargo Express Company founder, William Fargo. Today the population of Fargo is roughly 128,600. It is the most populous city in North Dakota. In the past decade, the city has gained nearly 17,000 new residents, causing the demand for housing to rise. Despite the volatile mortgage rate environment, the median list price for homes in Fargo continued to rise this spring, reaching a new 90-day average median list price high of $373,357, according to Altos Research data. With only 170 active listings, the city’s still tight inventory has helped keep prices high this spring and contributed to the city’s Altos Market Action Index score of 40.

Social media is inseparable from doing business in the housing industry today. HousingWire has collected some of the most-liked, most informative and must-read posts on all your favorite platforms, below. Follow your colleagues across the industry, and keep up with HW Media on Facebook, Instagram, Twitter, TikTok and LinkedIn. Have a trending post you want us to feature? Reach out to us @HousingWire

Facebook: HousingWire

Instagram: @housingwire

LinkedIn: HousingWire

Twitter: @HousingWire

"The fed wanted sales to crash. Days on market to grow. Less bidding wars. Housing to go into a recession. They got all that. It was never about targeting home prices to crash at all, they even said homeowners balance sheets were fine." 3 12 10 by @LoganMohtashami

Liked by miabliss miabliss and others Edit this description with your own text. #instag m #template #vec r #set olsendrake

olsend rake Geneva, Swiss

starl

Liked by miabliss miabliss and others Edit this description with your own text. #instag m #template #vec r #set olsendrake

olsend rake Geneva, Swiss

starl

More single women than single men own homes, marking a major milestone in the progress of gender equality. It's hard to believe that when I was born, women couldn't get a mortgage without a male co-signer. This trend is just the beginning of what I believe will be a continued shift toward women's empowerment in the housing market.

Chris HellerAgents, it's crucial not to mistake emailing, texting or social media interactions for genuine conversations. Foster strong relationships with your clients and prospects by engaging in meaningful discussions regularly. Make it a habit and be consistent. There's no substitute for real world conversations.

The movement crew in southwest Florida showed up BIG TIME at the Best Buddies

@movementmtg

Friendship Walk

@realtordotcom

@uwmlending

When the broker community comes together, there's no stopping us. Thanks for investing in yourself to get better and for making our community stronger, too.

"Don't text me good morning, text me listings to look at while I'm bored."

Residential real estate is the single largest physical asset class. In the U.S. alone, the aggregate value of houses exceeds $45 trillion. As such, this sector attracts investors and entrepreneurs alike and spurs a huge ecosystem.

Yearly transactions are measured in the trillions, and with such staggering amounts at play, one is reminded of the apocryphal story of bank robber Willie Sutton. Upon being asked why he robbed banks, he said, “Because that’s where the money is.” The money is in real estate — for sure.

This statement is certainly a truism but it’s worth examining the matter with more nuance.

Questions worth posing include:

• Who is investing in real estate?

• What is the position of the ordinary family in this sector?

• Are houses affordable for most Americans?

• Who benefits the most from the rise in real estate prices?

The National Association of Realtors (NAR) predicts that approximately 4.8 million homes will be bought in 2023. Of that share, institutional investors are likely to purchase about 20%. This number is brought into bold relief when we consider that the U.S. is “short” circa 5 million housing units — both single and multi-family units.

standards.

like

Add this to another double-whammy, housing prices are near historic highs in the U.S. and mortgage interest rates have doubled over the last 18 months. This situation creates an impossible burden for tens of millions of American families.

When considering all of these facts, there are three straightforward conclusions to be drawn:

1. There are vested interests in creating the crisis of permanent renting. Today, 45 million American families rent their homes.

2. Capital talks. The “activation” capital that people need to become homeowners eludes tens of millions of American families while flush institutions can buy entire neighborhoods and convert them into rentals.

and

3. A large portion of these renters could become homeowners with just a little nudge. This is borne out by the fact that 45% of renters spend 30%+ of their gross household income on rent. With the right methodologies, that money could be spent on a mortgage.

What all of this comes down to is, you guessed it, capital.

The crisis is so deep that it affects even families that would be considered well-off by otherwise sensible standards. In some markets like San Francisco, San Jose, Seattle, Boston and New York, even families with incomes upward of $200,000 per year have a hard time achieving homeownership. Mind you, these lofty numbers apply to only 7% of all households.

Real estate has two mantras: “location, location, location” and “money, money, money.”

Capital, however, does not live in isolation from other factors. It’s a major disservice not to discuss other valences that have

“The crisis is so deep that it affects even families that would be considered well-off by otherwise sensible

In some markets

San Francisco, San Jose, Seattle, Boston

New York, even families with incomes upward of $200,000 per year have a hard time achieving homeownership.”

brought us to where we are today with regard to housing. The most decisive parameter is race, which cannot be seen as discrete from class. Rather, they are intertwined in powerful ways. In the U.S. today, approximately 65% of people live in houses they own. The Non-Hispanic, white homeownership rate is 73.3% while the rate for Black households is 42%. The average household income for the former group is $75,000 while for the latter it is $51,000.

Given the low rates of homeownership and income disparities coupled with the fact that home equity is the main source of generational wealth transfer for most families, historical trends weigh heavily on the present. This is not simply a product of individual bias. Redlining and “housing racism” has been enshrined in the law for the entire history of this country. Wealth disparities are hard enough to overcome, but disparity combined with an abetting ideology creates a boundary that appears to be insuperable.

To extend the NASA analogy, societies are known to make moon shots and are often taken, even kicking and screaming, into a new reality. That reality requires a new paradigm of capital.

Let’s call this new paradigm

“Community Capital” while the traditional/ incumbent I’ll label as “Wall Street Capital.” The latter category should be understood as a partnership between institutional money and government agencies. So what is the difference between the two? Community Capital can be seen as a form of altruism or as a form of long-term, sustainable business with positive externalities.

These externalities include both those realized at the personal or family level and also those realized on a societal level. Strong communities with economic and social “happiness” tend to be healthier, safer, more democratic and better at problemsolving. These factors benefit everyone, including those who ordinarily are on top of the hierarchy. In this way, housing inequality is like air pollution — it is toxic for everyone.

Community Capital can be the wave of the present and the harbinger of a positive future.

Housing is one sector that can benefit from this paradigm. No doubt, others can as well, like healthcare. This is a clarion call for a new paradigm whose time has come. Some companies have answered the call, but voices in the wilderness need amplification.

“Community Capital can be the wave of the present and the harbinger of a positive future. Housing is one sector that can benefit from this paradigm.”

24....Pavan Agarwal

Gil Arbitsman

25....Jim Balas

Kelly Brink

Vincent Ciardullo

Mike Clear

26....Bryan Dipo

David Eakes

Alejandro Franco

Marco Fregenal

27....Brenda Hedeen

David Hisey

Andrew Hubacker

Mark Kearns

28....Amber Kramer

Mike Leone

Carmine Napolitano

Stephen Nicolo

29....Sean O’Neil

Mary Rapoport

Michelle Ressler

Tom Rettinger

30....Sean Sievers

Vinay Singh

Kevin Thompson

Mike Wells

31....Don Wenner

Mike Witt

Eugene Wong

Chrissy Zotzmann Brown

If there’s one word that could be used to describe the role of an effective chief financial officer in 2023 it would be “stability.” Having the strength and ability to stand firm despite the waves of the housing market has proven to be vital for any finance exec in housing in the past 12 months. This year’s HW Finance Leaders have harnessed this strength, while exhibiting extraordinary leadership, innovation and financial acumen in driving their organizations’ success.

The 2023 HW Finance Leader Honorees exemplify the best of the finance executives who have carried their organizations through unstable times, riding the waves of the current market and ensuring that their organizations survive another day.

Mike Leone, for example, is the chief financial officer at Bright MLS. He provides expert financial guidance that positions Bright with the best financial opportunities while mitigating both financial and business risk. In 2022, Leone led and structured the successful execution of three joint ventures with California Regional Multiple Listing Service — an historic event as the two largest MLSs in the country set precedence with their strategic partnership.

Or Atlantic Bay Mortgage Group’s chief operations officer, Chrissy Zotzmann Brown, who is redefining the way Atlantic Bay looks at operations and loan processes in the mortgage industry. Her leadership and forward thinking guided the company to offer a full-stop digital mortgage experience for mortgage bankers and borrowers, and positioned the company as a leader in the e-Closing arena.

Another example of steady and experienced leadership can be found in The Real Brokerage’s chief financial officer, Michelle Ressler. She has led the organization through a massive hyper-growth stage, including an uplisting to the Toronto Stock Exchange and two acquisitions in 2022.

These leaders represent only a few of the 30 winners selected for this year’s class of HW Finance Leaders and are a testament to the importance of finance executives’ roles in the real estate and mortgage industries. Their contributions to the industry’s continued growth and success are innumerable. Congratulations to the outstanding 2023 honorees.

Pavan Agarwal currently serves as the president and CEO of Sun West Mortgage Company, Inc and Celligence, LLC. Agarwal leads Sun West Mortgage Company, a tech and financial firm focused on client satisfaction. Sun West is one of the largest privately owned mortgage lenders and servicers. The company uses innovative tech to provide customized loan programs. Agarwal’s vast experience and expertise make him a recognized Ginnie Mae HMBS (Reverse Mortgage) Issuer, Servicer and Master Servicer, with agency approvals from FHA, VA, USDA, Fannie Mae and Freddie Mac. Agarwal says navigating through the 2008 financial crisis was the proudest moment in his career. That time reflected his resilience and adaptability. Today, Agarwal is motivated by the thousands of people who depend on him to feed their families. In addition to his family life, Agarwal sees achievement in growing his team of 20 to a team of 2,000+ and serving hundreds of thousands of families all over the country.

Gil Arbitsman Chief Financial Officer UMortgage

Since joining UMortgage in June 2022, Gil Arbitsman’s expertise as chief financial officer has helped lead the company to a continued period of exponential growth. UMortgage outpaced its growth goals for the year thanks to Arbitsman’s financial structure, organizational restructuring and general tightening of the belt. Using his of experience in the finance sector — most recently as chief financial officer of American Financial Resources — Arbitsman helped materialize UMortgage’s growth, as it attracted more than 300 of the sharpest loan originators in the nation over the course of the year. Arbitsman utilized his executive-level experience to help facilitate a top-tobottom organizational restructure, which was a major catalyst in UMortgage’s continued scalability. Arbitsman led multiple capital raises that brought liquidity to UMortgage. This successful move allowed UMortgage to acquire some of the largest and most innovative brokerages in the nation. With these structures in place, UMortgage plans to continue its growth throughout 2023 and beyond.

Jim Balas is the chief financial officer at CoreLogic. Balas is responsible for overseeing the financial reporting, accounting, tax, treasury, capital allocation, risk management as well as the corporate finance functions including the company’s financial planning and analysis and business finance teams. Balas plays a key role in strategic initiatives including mergers and acquisitions and the company’s transformation and productivity programs. Balas oversees long-term tax planning, cost management policies, control and reporting operations. Balas joined CoreLogic as senior vice president, controller and principal accounting officer in March 2011. In 2012, his role expanded to include oversight of finance in addition to his other responsibilities. Prior to joining, CoreLogic Balas held a variety of senior finance leadership positions at several publicly traded companies after a successful 10year career at Ernst & Young and Capgemini.

Kelly Brink is the chief financial officer at Orchard. During her tenure, Brink has fostered relationships with multiple financial institutions, investors and external stakeholders to ensure that Orchard can continue to bring its customers the most stress-free, simple and fair way to buy and sell homes. Brink has been at the center of numerous strategic decisions including leading the 2022 acquisition of LoanMonkey — a move that enabled Orchard to rebrand their Home Loan Division as Orchard Mortgage and to become a lender. With 20 years of financial experience under her belt, she has worked with large financial institutions including JPMorgan and Bain Capital. This experience allows Brink to elevate Orchard’s financial performance and improve liquidity. She has been at the center of all Orchard capital infusions, including our $100 million Series D, which included funding from FirstMark, Revolution, First American, Juxtapose and a syndicate of new investors. Brink has achieved numerous accomplishments and benchmarks during her time at Orchard.

Vincent Ciardullo, senior vice president of capital markets at CIVIC, has played a pivotal role in CIVIC’s success with capital markets. From solidifying CIVIC’s position for a successful acquisition by Pacific Western Bank to assisting with the development of CIVIC’s Rental Loan product, Ciardullo has led the charge. Bringing that same determination and dependability to his relationships, with the CIVIC team and beyond, Ciardullo has become a truly inspirational leader that is leaving a lasting impact on the finance industry. With a decade of experience in the mortgage and finance industries behind him, Ciardullo guides CIVIC’s capital markets team with a balanced and dynamic approach that is optimized for success. Ciardullo puts communication, transparency and dependability at the center of all his relationships. Ciardullo has built a reputation of being an educator and a wealth of information, always willing to put his problem-solving skills to the test, intercept issues and assist wherever it’s needed.

Mike Clear currently serves as chief operations officer and chief financial officer at Realty ONE Group. Clear is a strategic adviser to business owners and real estate professionals contributing to think tanks with high-level executives around the country. Clear oversees human resources, marketing, accounting and finance, brokerage operations, technology and strategic partner programs. Despite a challenging market, Clear continues to guide the growth and international expansion of this popular lifestyle real estate brand while mentoring teams and individuals throughout its now global network. Under Clear’s leadership, Realty ONE Group grew its agent count to over 18,000, sold new franchises and opened new doors. Clear is called on to speak at industry events and appears frequently throughout Realty ONE Group’s ONE University coaching program to guide and train entrepreneurs to success. He is acutely focused on making an impact and strategically growing a healthy and profitable franchise organization while creating future leaders throughout the network.

Bryan Dipo is the senior vice president of secondary marketing at Academy Mortgage. His industry knowledge and standout personality have made him a key contributor and driver to the organization’s success since joining the company in September 2003. Dipo has allowed Academy Mortgage to be nimble at adapting to changing markets and position itself for continued success. He is a solution-driven leader, who has continually protected Academy by ensuring they have the correct coverage on all loans. Dipo’s teams continue to find success under his leadership. Dipo has been a driving force in making critical changes to how Academy sells loans and has helped to make pricing even more competitive with the recent introduction of the company’s new pricing model. He continues to build and maintain strong investor relations for the company, which has been instrumental in expanding Academy’s product offerings. The company brought on 112 new products in 2022 alone. His ability to affect change and execute plans and strategies has translated into great success for Academy.

David Eakes, chief financial officer at HomeLight, is responsible for all finance and administrative functions of the company. Eakes has over 25 years of experience in the finance, accounting and technology sectors, with leadership roles spanning public accounting, mergers and acquisitions and investor relations across companies like Deloitte, Sun Microsystems and Oracle. Eakes is proud to work for a real estate technology platform like HomeLight, reducing unnecessary complexity and empowering individuals to make one of the most important financial decisions in their life. In August of 2017, Eakes started at HomeLight as one of the first 50 employees and the company’s first full-time finance hire. He has assisted in the expansion of HomeLight as the company acquired three individual businesses, increased its headcount of employees, grew annual revenue and developed his own mighty team of finance leaders to support the company’s exponential growth. Most recently, Eakes led HomeLight through three equity financing rounds bringing the company to a valuation of $1.7 billion.

AlejandroAlejandro Franco is the controller and vice president of accounting and finance for JPAR Real Estate. Franco focuses on strategic accounting, financial management, forecasting and mergers and acquisitions. Since early 2022, Franco has been revitalizing the JPAR accounting department and financial reporting processes. He was instrumental in establishing stronger internal controls within the company. He also spearheaded improving the accounts receivable department. Within weeks, both the franchise and brokerage divisions increased cash flow by nearly 10%. He also developed a new program for the franchise division and increased the workflow in billing consumers. This led to increased efficiency by 97%. He introduced quick reporting on a weekly and monthly basis that was crucial in driving the business forward. He created a new forecasting methodology for the company as well. The forecasting method has been dynamic to the adjusting market, which allowed the company the ability to quickly react for potential M&A or joint venture opportunities.

Marco Fregenal has been Fathom Realty’s chief financial officer since 2012 and has served on its board since February 2019. Fregenal has also served as president since 2018. Earlier in his tenure with Fathom Realty, Fregenal was the chief operating officer and chief financial officer. Prior to joining the company, Fregenal was the chief operating officer and chief financial officer of EvoApp Inc., a provider of social media business intelligence. And he was the CEO and chief financial officer of Carpio Solutions, an information technology solutions company. Fregenal received a bachelor’s degree in economics from Rutgers University and a master’s degree in Econometrics and Operations Research from Monmouth University. His extensive financial experience, knowledge of the company’s operations and oversight of its business qualify him also to serve as one of Fathom Realty’s directors.

Brenda Hedeen is the chief financial officer at Open Mortgage, a multi-channel mortgage lender dedicated to empowering the dream of homeownership. She spearheads the firm’s finance and accounting operations. As a member of the chief executive team, Hedeen reports directly to Open Mortgage President Joe Stephenson and leverages her extensive background in analysis and fiscal planning to create a company wide infrastructure and implement comprehensive financial management standards. Staying up to date with industry trends and best practices, Hedeen leads her department to success by ensuring they have the resources and training needed to perform their duties. Prior to her role at Open Mortgage, Hedeen served as On Q Financial, Inc.’s chief financial officer and chief financial officer of Mann Mortgage. She has held roles in private and public accounting where her career growth was powered by a keen eye for optimization. Hedeen is a certified public accountant and earned her master’s in accounting from Stetson University.

United Wholesale Mortgage

Andrew Hubacker is United Wholesale Mortgage’s (UWM) chief accounting officer and interim principal financial officer. He brings nearly three decades of experience to the table and has been a key leader in developing UWM’s finance team capabilities as a public company. His impressive background, collaborative work style and teamfirst mindset have made him an invaluable asset to UWM. Hubacker and his team played a key role in leading UWM as the No. 1 overall lender in the nation. They assisted in various business initiatives to enhance the company’s liquidity position, through sales of mortgage servicing rights and establishing new secured and unsecured sources of financing. In addition, Hubacker oversees the financial compliance program at UWM, and he transitioned from a co-sourced model in 2021 — the first year as a public company — to a fully insourced model in 2022. He approaches everything he does with collaboration in mind and focuses on building strong working relationships with both team members and external vendors and partners.

David Hisey serves as chief financial officer, secretary and treasurer of Stewart Information Services Corporation. He leads Stewart’s financial organization and strategy, overseeing financial planning and analysis, accounting, treasury and audit functions, as well as investor relations and property management. As chief financial officer, Hisey partners with each area of the business to help them achieve their financial and commercial success. He focuses on top-line growth and bottom-line margin enhancement. Hisey brings to Stewart more than 30 years of financial leadership experience, most recently as senior adviser to the CEO and acting chief financial officer for Prospect Mortgage, LLC. Prior to this position, his roles included executive vice president and chief financial officer, as well as chief strategy and external affairs officer and chief of staff for Nationstar Mortgage Holdings, Inc.

PunchListUSA

Mark Kearns, chief financial officer of PunchListUSA, brings a proven track record of driving growth at companies of all lifecycle stages, both private and public. Since joining the company in April 2022, Kearns has led key initiatives and provided financial modeling and insights that have driven rapid growth. Kearns also led several process improvement initiatives in financial reporting, cash management, forecasting and transition to a new accounting system, among others. A veteran of the real estate tech industry, Kearns brings valuable insights to all business units to propel the company’s growth. In addition to being executive sponsor of initiatives streamlining financial systems and investor relations, he provides guidance on a wide range of interdepartmental initiatives including sales, marketing, vendor management, sales partnerships and product development to improve efficiency and position the company for both short-term and long-term growth. Kearns’ financial oversight and fiscal responsibility are critical during its high-growth stage.

Amber Kramer is the senior vice president and chief financial officer of Guild Mortgage Company. Kramer has held this position since August 2020 and is responsible for the accounting, finance, treasury, payroll and facilities functions within the organization. Prior to serving as Guild Mortgage’s chief financial officer, Kramer served in various finance positions at the organization, including as senior vice president of finance from 2015 to 2020 and vice president of finance from 2010 to 2015, a financial analyst from 2005 to 2007 and a staff accountant from 2004 to 2005.

Carmine “CJ” Napolitano leads financial strategy and operations at Side. He has more than 25 years of experience as a chief financial officer, chief operations officer, general manager and CEO. Napolitano has also completed over $1 billion in corporate financial transactions. Prior to joining Side, Napolitano served on industry-leading teams at Propel, Electric Cloud, Computer Access, LeCroy, Centric Software and Wavefront Technologies. These companies all pioneered new markets and in some cases were ahead of their time. Napolitano earned his MBA from New York University, and BS in mechanical engineering from the University of California, Santa Barbara.

Mike Leone is the chief financial officer for Bright MLS. Leone is responsible for overseeing the company’s financial functions including accounting, financial planning and analysis, financial investments, financial systems and controls, tax and audit. In addition, Leone leads contracts management and has led the customer support and policy operations in past years for Bright MLS. Leone is also the staff liaison for Bright’s Board of Directors’ Finance Committee. As a member of Bright’s executive leadership team, Leone consistently provides expert financial guidance that positions Bright with the best financial opportunities while mitigating both financial and business risk. He’s an advisor to the CEO, C-suites and the board. Under Leone’s leadership, Bright MLS has become one of the most financially secure MLSs in the country. Bright consistently receives the highest audit opinion, has a strong credit rating and excellent credit standing. Leone has successfully managed Bright’s multimillion-dollar Broker Rewards program, benefiting hundreds of participating broker subscribers.

Vice President of Financial Analysis SagentStephen Nicolo is the vice president of financial analysis at Sagent. Nicolo understands the future of mortgage servicing technology must be built on sound financial footing. He built an investment framework that allows Sagent to identify and pursue partnership opportunities that benefit the firm, its clients, and the mortgage ecosystem at large. Nicolo manages both incremental investment with existing stakeholders, including a leading private equity firm, and outside dealmaking with strategic partners and acquisition targets. Over the last 12 months, Nicolo solidified Sagent’s sound financial position through the development of detailed expense management processes while pursuing and modeling key M&A opportunities in the marketplace. Nicolo helps keep Sagent profitable at scale by holding the company to a diligent expense management framework, all while encouraging rapid innovation by providing internal teams with the resources they need to best serve clients and achieve wider business goals.

Chief Financial Officer and Chief Operating Officer Side

Stephen Nicolo

Chief Financial Officer and Chief Operating Officer Side

Stephen Nicolo

Sean O’Neil has served as executive vice president and chief financial officer at Ocwen since June 2022. Most recently, he served as chief financial officer for Bayview Asset Management, which he joined in 2015. At Bayview, O’Neil was responsible for finance and accounting, treasury and financing structures, liquidity, loan accounting, funding and collateral activities. Prior to joining Bayview, he was the group financial officer for Wells Fargo, Eastern Community Bank. Prior to this role, O’Neil was the chief financial officer for Wachovia’s Wealth Management Group. Before joining Wachovia, he was a senior manager at Boston Consulting Group, where he worked with financial services companies in Europe and North America.

O’Neil began his career as a nuclear submarine officer in the U.S. Navy, and he earned a Master of Business Administration degree from Harvard Business School and a Bachelor of Science degree in Mechanical Engineering from Pennsylvania State University.

Senior Vice President of Investor Relations and Capital Markets Freedom Mortgage Company

Senior Vice President of Investor Relations and Capital Markets Freedom Mortgage Company

Mary Rapoport is a senior vice president of capital markets at Freedom Mortgage Corporation. She has over 30 years of structured finance and capital markets experience. Rapoport has positioned the company to implement and execute its capital and liquidity initiatives, which have enabled Freedom Mortgage to grow its servicing and origination businesses. She is a key member of the senior management team and has contributed to the success of Freedom Mortgage’s finance initiatives under multiple economic and interest rate cycles. Rapoport’s contributions in 2022 supported the company’s primary mandate of fostering home ownership across the country. Rapoport is a member of a small team of executives focused on an initiative that involves interfacing with the FHFA and other market participants to develop a strategy to allow non-bank institutions, including Freedom Mortgage, to be eligible to access the FHLB system. Rapoport has promoted and developed alternative access to liquidity including during times of market distress for Freedom Mortgage and the non-bank mortgage sector.

Michelle Ressler has led The Real Brokerage through a massive growth stage. Under Ressler, Real saw year-over-year growth in all of its key measures — agent count grew by 126% to more than 6,700 agents, transactions increased by 197% to 11,233, revenue was up 188% to $112 million and gross profit grew 158% to $9 million. Ressler’s financial acumen has led to Real’s strong operating leverage and the company’s continued geographic expansion and product diversification. Real expanded into Alabama, Mississippi, Maine and New Mexico in the U.S., and British Columbia in Canada in 2022. The company also expanded into the title and mortgage businesses with the acquisitions of Expetitle — now Real Title — and Lemonbrew. With Ressler’s guidance, Real has successfully integrated two companies in a span of less than 12 months, giving the company entry into two new ancillary, revenue-generating services. As a leader, Ressler exhibits a hands-on and inspirational leadership style with the more than 35 employees she manages.

Tom Rettinger is the senior managing director and head of secondary marketing at Pennymac. Rettinger, a seasoned finance professional with over 35 years of experience, has a track record of effectively managing teams and is skilled in complex financial analysis, risk management, and automation and process improvement. His expertise in hedging, mortgage finance, asset valuation, trading and project management has made him a valuable asset to Pennymac since he joined in 2010. Known for his loyalty and dedication to the company, Rettinger consistently goes above and beyond in his role and responsibilities. Rettinger’s contributions to Pennymac are a reflection of the company’s status as a leading mortgage lender. He has been instrumental in developing the talent within his teams, fostering a culture of open communication and collaboration. In the past year, Rettinger has implemented a comprehensive framework for employee development. Through his efforts, Rettinger has not only added value to the individual employees, but also to the company as a whole.

Chief Financial Officer The Real Brokerage

Sean Sievers is the chief financial officer for Guaranteed Rate. He has spent over 25 years in executive financial leadership positions. This expansive tenure has earned Sievers pivotal roles across his career where he worked through some of the most challenging issues. Starting his career as a CPA for Grant Thornton, he later played a pivotal role in the early stages of Countrywide Financial, as the founding chief financial officer for CHL’s internet bank and as segment chief financial officer in retail originations. Sievers worked for Freddie Mac in investments and capital markets. He later served as the chief financial officer over SunTrust’s consumer banking division, including its massive mortgage company. Most recently Sievers helped restructure Citibank’s global mortgage operations. He also worked at Barclays Bank as the global chief financial officer over cards and payments. Before he began working with Guaranteed Rate, Sievers had the opportunity to work in the fintech space as the chief financial officer for fintech blockchain giant Figure Technologies.

Vinay Singh is the chief financial officer at the U.S. Department of Housing and Urban Development (HUD). Singh has been in numerous leadership roles in the private sector for over 25 years that span accounting, finance, technology and operations management spheres. His work in the private sector provided him an opportunity to learn and lead teams with closing the books; SEC reporting; IT and business auditing; business process design, budgets and reporting, governance, risk and compliance; technology implementations and organizational restructuring. The critical thread across roles is program, process and project management. During his time with the International Trade Administration as deputy assistant secretary, Singh learned how to balance priorities and execute complex tasks with multiple stakeholders inside the federal government. It was here where he worked on infrastructure and smart cities and learned that housing is the core pillar of not only economic growth but individual and community integration.

As the head of finance for PURE Property Management, Kevin Thompson has overseen the acquisition of 37 property management companies in just under one year. That ferocious pace equals three acquisitions per month, an unprecedented feat within the industry. Under Thompson’s financial leadership, PURE is operating profitably as it maintains its high-tech, high-growth and high-profit focus. Since its founding in October 2020, PURE has completed over 60 acquisitions representing more than 25,000 residential and 20,000 HOA properties. Thompson is the key driver of profitability for every local branch office and the company as a whole. As a result, PURE is operating profitably. A recognized Silicon Valley executive, Thompson brings more than 25 years of experience in M&A, raising private equity and venture capital, GAAP accounting and contracts and has a proven track record of driving growth and building high-performance finance teams.

Mike Wells Senior Vice President of Accounting and FinanceMike Wells is the senior vice president of accounting and finance at PrimeLending. For more than a decade, his expertise, guidance and ingenuity have helped PrimeLending strengthen its reputation as a premier mortgage lender with an impressive track record of profitability and growth. As a 20+ year industry veteran, Wells plays an integral role in the development of the company’s strategic plan. His knowledge and expertise have been instrumental in the development and implementation of financial and performance management applications, including playing a key role in the recent implementation of both the Oracle general ledger and Loan Vision subledger systems. From profit and loss reporting at the individual loan offer level to financial consolidation at the corporate level, Wells is proficient at measuring and maximizing financial performance. He developed a loan level and branch profit simulator to further exemplify his industry knowledge and equip leaders in making educated business decisions.

Don Wenner is the founder and chief executive officer of DLP Capital. Wenner has led DLP to 10 straight years on the Inc. 5000 list of fastest-growing private companies and a ranking as one of the top 15 real estate professionals in the country by the Wall Street Journal. In 2022 alone, DLP Capital acquired more than $990 million in multifamily and commercial properties, funded real estate loans totaling more than $850 million and increased DLP’s assets under management from $2.25+ billion to over $4 billion. Wenner founded DLP Capital with an audacious goal to provide housing to one million people and positively impact and transform 10 million lives. This led to a spot on the Forbes list of the top 100 private companies in America. And with DLP Capital’s year-over-year growth for the last 16 years, expanding into new markets — including Texas and Florida — DLP Capital is well on it’s way. In 2022, DLP added 350+ new investors with more than $450 million of new capital invested, allowing DLP to acquire over 5,590 units.

Mike Witt Chief Financial Officer Deephaven Mortgage

Mike Witt is the chief financial officer of Deephaven Mortgage, taking over the role in 2017. Prior to Deephaven, Witt held the same position at Boston National Title where he was instrumental in its growth from a regional provider into one of the nation’s largest, independent title services companies. Witt’s extensive mortgage leadership experience includes division CFO roles at HSBC and First Union, and senior finance or credit risk roles at HSBC, Bank of America, First Union and Nations Bank. He holds a B.S. in Commerce from the University of Virginia.

Hometap

Eugene Wong has quickly risen through the ranks to become a C-suite financial executive. Though he began his role as Hometap’s chief financial officer quite recently, his decade of experience in various areas of finance has already proven to be an invaluable asset to the company. Wong works closely and cross-functionally with the company’s capital and investor product teams to raise asset capital in order to grow home equity investment originations and support homeowners at an unpredictable and ever-changing time in both real estate and finance. Wong embodies Hometap’s values of being a good owner by executing with intention, rolling up his sleeves and creating solutions for the company. Wong’s deep experience in the banking and financial services industries, combined with his business acumen and his passion for mission-driven performance and results that make a tangible difference in the lives of others, have positioned him as a force to be reckoned with in the finance world.

Atlantic Bay Mortgage Group

Chrissy Zotzmann Brown is the chief operations officer at Atlantic Bay Mortgage Group. Zotzmann brings nearly 25 years of extensive mortgage operations and sales experience to her role at Atlantic Bay where she focuses on creating the smoothest cost-effective loan process in the business. Through her insight, she has advocated and assisted in the implementation of new technologies and automation/ bots that have continued to improve efficiencies. Her leadership has guided Atlantic Bay to offer a full-stop digital mortgage experience for mortgage bankers and borrowers and positioned the company as a leader in the e-Closing arena. Brown serves on many advocacy boards and volunteers her time as an instructor with the MBA’s School of Mortgage Banking. She is an active advocate to government agencies on behalf of the mortgage industry. Recently, she spoke with the White House on the effects of the PSPA amendments. Zotzmann is also an active member of the CMB Society, the Community Home Lenders Association and serves on the LendersOne Advisory Council.

What is the best piece of advice you have ever received?

What is one thing you would tell a younger version of yourself?

What one habit has helped you succeed?

34....Craig Austin

Chris Basinger

35.... Julia Bi

Ashley Blackmore

Beau Blankenship

Brannen Blazer

36....Alex Boand

Gareth Borcherds

Lauren Bowen

Lauren Brown

37.... Jesse Burrell

Shellie Burton

Brock Cassidy

Mike Chang

38....Lindsey Clark

Chad Crile

Helena de Forton

Devang Doshi

39....Brendan Fairbanks

Josiah Feuerbacher

Alison Flinn

Eric Forney

40.... Justin Foster

Kimber Fox

Nick Friedman

Alayna Gardner

41....Kerri Girouard

Rogelio Goertzen II

Nicole Goodman

Courtney Graham

42....Matt Harbus

Grace Harrison

Kelly Hebert

Jozef Hlavek

43....Christopher Hussain

Dalip Jaggi

Ryan Jancula

Andrew Jewett

44....Victoria Keichinger

Azar Kheraj

Morgan Klabenes

Renee Lawlor

45....Nate Levin

Peter Lillestolen

Lindsay Listanski

Kayla Lopez

46....Michael Lucarelli

Brandon Lwowski

Melinda Maloney

Reno Manuele

47....Greg Middleman

Jonathan Morales

Amanda Morrow

Andres Munar

48....Thu-Lynn Nguyen

Tony Nguyen

Jason Nicosia

Elizabeth Perez Barletta

49....Matt Pettit

Sunny Ramamurthy

Rahkiya Reid

Sarah Reynolds Oji

50....Nuria Rivera

Saurabh Shah

Shailendra Singh

Scott Slezak

51.... Jeff Smith

Brandi Snowden

Ori Tamuz

Brittany Tei

52....Brian Tolkin

Nate Trunfio

Dave Umphress

Karol Villavicencio

53.... Jennifer von Pohlmann

Mike Vough

Chris Wade

Lyra Waggoner

54....Xun Wang

Katherine Warren

HousingWire’s Rising Stars award program recognizes the up-and-coming leaders in housing who have made their mark on the industry all before the age of 40. These leaders bring fresh perspectives, new ideas and a willingness to take risks and embrace change in an effort to drive the industry forward.

One of the traditions of the HW Rising Stars submissions is to ask the nominees to provide their response to a question that touches on advice they have received throughout the course of their career or a habit that they swear by. Each year, the responses are fascinating and shed light into the drive and determination that helped lead them to the success they are experiencing in their careers today.

“I always pick up the phone,” said Lauren Brown, retail market manager at Sierra Pacific Mortgage. “Even if I send an email, I follow it up with a phone call. If it’s bad news or not-so-great news, I still pick up the phone. Too much is lost in a text or email.”

“[I] never stop asking questions,” noted Nicole Goodman, senior director of product marketing and strategy at First American Data and Analytics. “I want to understand things thoroughly enough that I feel comfortable talking about the subject and can successfully communicate with others about it. Curiosity really drives that. No question is stupid and keeping my curiosity alive is critically important in helping me deliver the best results that I can.”

Kelly Hebert, first vice president of sales operations and Marketing at LERETA, said, “I’m not afraid to start with only a germ of an idea. I can take a raw concept and turn it into something concrete with goals, project plans and deliverables. My colleagues trust me to be a sounding board for ideas, and I will challenge, push back, take notes and help to spin new ideas that can result in ground-up concept creation and execution.”

Want to hear more from this year’s winners? Flip through the next several pages to see what they had to say and learn more about their impressive accomplishments.

Congratulations to the 2023 class of HW Rising Stars!

Craig Austin Executive Vice President FirstCloseCraig Austin is the executive vice president of FirstClose, a fintech provider of digital HELOC solutions for banks, credit unions and lenders nationwide. Austin is responsible for leading new and existing client initiatives. In less than a year, Austin has closed several high-impact deals with large lenders and partners, resulting in both business and revenue momentum. Since joining the firm in August 2022, Austin has played a crucial role in FirstClose’s growth. He has led several initiatives that significantly streamlined the home equity lending process, including FirstClose’s partnership with Evolve Mortgage Services. The partnership enables lenders to approve HELOCs within seven minutes and eClose lines within seven days, significantly faster than the industry average. The collaboration combines FirstClose’s home equity application management system with Evolve’s SigniaDocument engine and its eSign and RON capabilities.

Know yourself. Know yourself very well. Be honest with what you’re good at and your strengths and limitations. We all have them.

Chris Basinger Vice President of Strategic Partnerships Earnnest

As Earnnest has grown into one of the real estate industry’s leading earnest money deposit and digital payments solutions, there are few folks who have played as big of a role as Chris Basinger. Basinger is the vice president of strategic partnerships at Earnnest. He was Earnnest’s first sales hire, and he is the longest-standing current employee that has had a hand in every one of Earnnest’s major partnerships. Basinger joined the Earnnest team in 2019. It was his first role in the real estate technology industry, but he built a successful track record of bringing transformative products to market. Today, Basinger continues to drive adoption of Earnnest’s award-winning digital payments platform with industry-leading brokerages, title companies, real estate attorneys, lenders and proptech companies across the country. Basinger has played an integral part in building the collaborative, customer-centric culture at Earnnest.

Treat self-doubt as a challenge. While you take the biggest risks and do the things that scare you most, embrace the human part of yourself that’s most authentic.

As Head of Product Strategy at Orchard, Julia Bi is tasked with creating the most delightful buying and selling experience for our customers at Orchard. Her perspective and leadership have been vital in the launch of new services at the company. Bi embodies all of Orchard’s values and makes sure to connect with her colleagues on a personal level. Bi is masterful at combining qualitative and quantitative feedback and translating these insights into actionable brainstorms. One of her strengths is building advocacy for new products and service improvements. When Equity Advance was set to launch, Bi secured buy-in from the Orchard team through both companywide and teamspecific presentations that explain the value to the customer and to the business. Bi employed a variety of techniques, including fun trivia questions over email, Q&A sessions and shared decks to bring agents, marketers and engineers up to speed. As a leader, Bi makes a massive impact on the business.

WHAT IS ONE THING YOU WOULD TELL A YOUNGER VERSION OF YOURSELF?

Your career path is your responsibility — don’t be afraid to advocate for yourself and take opportunities when they come.

Engel & Volkers 30A Beaches

Beau Blankenship is the license partner of Engel & Völkers 30A Beaches and is a private office adviser. At only 32 years old, Blankenship is the lead adviser for Blankenship Group. The group recently represented the highest sale in the Florida Panhandle at $24 million. Between 2021 and 2022, the Blankenship Group has sold over $1 billion in real estate, making them the top team in northwest Florida, and Blankenship the highest-grossing advisor within Engel & Völkers Americas. As a leader, Blankenship has a clear vision to assist real estate advisers within the brokerage to focus on their careers. He created a strong leadership team consisting of marketing and operations professionals, a non-compete managing broker and a brand ambassador. He provides the brokerage with various adviser enrichment courses regarding communication, investments, new construction and more. Always willing to share his knowledge through experience, Blankenship has carefully curated a culture of collaboration.

Ashley Blackmore CEO and Founder Blackmore Group

Ashley Blackmore CEO and Founder Blackmore Group

At just 30 years of age, Ashley Blackmore is an individual top producer and 1% in the world. In January of 2022, she started Blackmore Group with 12 agents and has grown the company to over $68 million in sales volume. She is creative and authentic, and she is always a positive light. Blackmore coaches her team to be their authentic selves and encourages them to dig deep into their creativity to create an authentic brand identity. On top of running the brokerage, Blackmore also works as an agent with her boots on the ground. She has sold $29 million in sales volume. Blackmore is passionate about her family, and she preaches balance for both a healthy lifestyle and good mental health for top-producing agents. At her previous brokerage, Blackmore was on the company’s Rethink council, where she traveled the country creating forward-moving creative ideas. Now, she harnesses that mentality and is growing organically within her own brokerage, changing the world of real estate and encouraging agents to be more forward-thinking.

WHAT IS ONE THING YOU WOULD TELL A YOUNGER VERSION OF YOURSELF?

Harness your authentic self and creativity. Don’t be afraid to show it. That energy will attract those who you align with to your business.

Brannen Blazer is the executive director of private equity at Amherst. He has distinguished himself as a leader within Amherst’s Private Equity team, spearheading capital raising, new venture formation, investment management and other strategic initiatives for the firm. Blazer oversees the entire investment life cycle of Amherst’s single-family rental (SFR) portfolio, working closely with institutional partners from purchase through to sale. Blazer works closely alongside Amherst’s leadership team to establish joint venture partnerships while also supporting the firm’s capital-raising efforts and investment management operations. As a part of these processes, Blazer leads the onboarding of each of these partners and their investments into Amherst’s ecosystem. Blazer remains hyper-focused on supporting the company’s mission to transform the way real estate is created, owned, financed and managed. He and his team work tirelessly to identify new solutions for a fragmented, slow-toevolve real estate ecosystem, leveraging Amherst’s proprietary data and analytics.

Creating my own listings, especially during periods of low volume.

Slow down and be patient with the process. Our generation is often in a rush to get where we want to be in life.

Alex Boand, managing director of correspondent group sales at Pennymac, is a results-driven finance executive who quickly rose through the ranks to become an executive leader at the age of 38. Boand leads a highly experienced team of regional sales managers, serving more than 800 clients and is directly responsible for correspondent service levels, revenue optimization, risk mitigation and client engagement. Boand is committed to nurturing and expanding the talent at Pennymac. He routinely conducts educational sessions for his sales and support groups, providing valuable insights on the market, Pennymac’s initiatives and overall strategy. Throughout his illustrious career, Boand has emerged as a respected leader in the correspondent channel. He earned the admiration of his peers, colleagues and clients. His outstanding performance is a testament to his upward trajectory within Pennymac’s leadership team, as evidenced by the support of other senior leaders.

WHAT IS THE BEST PIECE OF ADVICE YOU HAVE EVER RECEIVED?

Actions speak louder than words. What a person does should tell you everything you need to know.

After joining Sierra Pacific Mortgage (SPM) in 2018, Lauren Brown quickly made her mark as one of the top-producing loan originators in her region. She is a driven leader, dedicated to being the most educated professional in the mortgage industry. As a retail market manager, she is constantly pushing the boundaries of her comfort zone to create opportunities for improvement. Brown started in the mortgage business nearly 20 years ago. In 2022, the Wichita team funded over 630 closings resulting in $140 million worth of volume. Brown continually demonstrates her compassion, understanding and integrity as a leader who is always willing to go the extra mile on behalf of her customers and teammates. Brown leads by example and is in the trenches every day with her team, empowering them with the time and resources they need to accomplish their goals. Brown holds the team accountable to high standards of service on every loan file and is quick to offer her support. Her selfless nature to develop others both personally and professionally is an innate part of her character.

I always pick up the phone. Even if I send an email, I follow it up with a phone call. If it’s bad news or not-so-great news, I still pick up the phone.

Gareth Borcherds Managing Director Ascent Software Group

Gareth Borcherds has led Ascent Software Group as the managing director and founder, and he created the Jaro technology platform. The platform connects lenders with their vendors in an innovative, streamlined approach. Borcherds understands his customers’ pain points more than most, having previously run an appraisal management company. He used this knowledge to solve his customers’ biggest complaints about the lengthy and disorganized valuation process. Borcherds implemented a data intelligence feature called AssignIQ that measures the complexity of a potential appraisal assignment. AssignIQ gives users a score that estimates the difficulty of getting an appraisal done based on a variety of factors. His main goal is to share the products he and his team have built through demos and conferences to help as many individuals and companies in this industry as possible. He is passionate about the change they will bring to the mortgage industry in hopes of creating a more efficient and organized valuation process.

WHAT IS ONE THING YOU WOULD TELL A YOUNGER VERSION OF YOURSELF?

Results don’t happen overnight. There is no shortcut to putting in the time and effort to build something meaningful.

Lauren Bowen is the youngest and first female chief operating officer of Robert Slack. Bowen is a real estate broker in six states and sits on the board of directors for Robert Slack’s non-profit Slack Serves. For the past five years, Bowen has been a team leader to one of the most successful teams within the company. Two out of the past three years her team has succeeded in holding the trifecta of highest conversion, highest volume and highest transactions closed within the company. Bowen not only oversees 15 team leaders within the organization, she oversees all of the lead sources that supply the entire company’s leads. As Robert Slack is a leads-driven model, this entails managing numerous different sources. Bowen has been with Robert Slack since its inception, and she strives to keep and promote the family culture it started with. While they have grown from four agents to over 700, making sure everyone feels at home is something the company wants to prioritize across all teams.

Whatever you choose in life, choose to be the best and do it to the best of your ability.