Render

THE RITZ-CARLTON BACARA, SANTA BARBARA

THE RITZ-CARLTON BACARA, SANTA BARBARA

Join us at The Ritz-Carlton Bacara in beautiful Santa Barbara from October 22 through October 25 for an unforgettable California coastal experience. Visit NARA’s convention website for meeting information and secure online registration. New and creative sponsorship opportunities are still available, and our acclaimed Tabletop Reception & Exhibit offers an unrivaled opportunity to reach the industry’s top decision-makers. Make plans now.

Data-driven decisions ensure lower costs and better results.

Haarslev Connect is the ideal software tool for drilling down to the information you need to identify issues, inconsistencies, and potential problems in your rendering operations – so you can make better management decisions about how to deal with them.

Haarslev Connect does the data aggregation grunt work for you, so you can concentrate your time, efforts, and energy on the all-important decisions, priorities, and directions. FROM

Kemin is assurance for renderers. We offer industry-leading solutions and specialized expertise in food safety and oxidation control for the stabilization of protein, fats and oils, and raw materials. Assuring freshness throughout the rendering process and to delivery — Kemin is with you every step of the way.

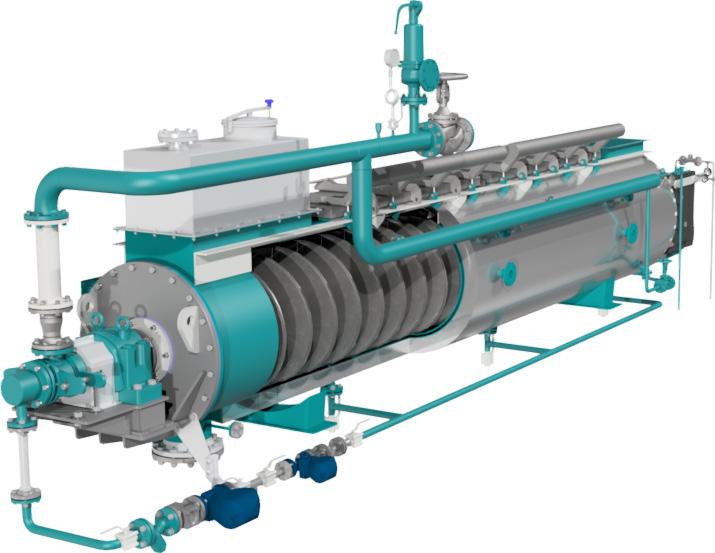

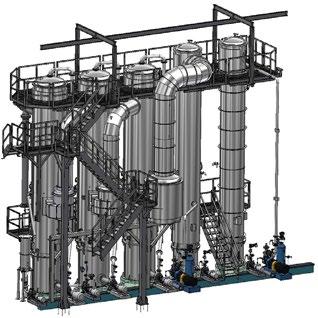

FISH COOKER AND WASTE HEAT EVAPORATOR

With Oestergaard’s Fish Cooker and Waste Heat Evaporator in your processing line, you can ensure low temperature and short processing time. Put that together with our Scandinavian knowhow and you can fulfill any quality requirements you have.

• Allows for both cooking and sterilization of fish to eliminate bacteria

• Gentle preparation of raw material for pressing

• Minimum or no preliminary processing of raw material required

• High quality of final meal

• Energy-efficient and reliable

Declining prices, narrowing margins and other macroeconomic shifts challenge aquaculture markets even as demand for seafood grows. Here are the trends renderers selling beneficial feedstuffs to the sector need to watch.

Meet some of the people who make up the fascinating and diverse community of the rendering industry.

Associate Editor Ron Kotrba

Magazine Production Raised Brow Productions

Phone: (888) 927-3634 editors@rendermagazine.com www.rendermagazine.com

Contact the North American Renderers Association 500 Montgomery St., Ste. 310, Alexandria, VA 22314 (703) 683-0155 Fax (571) 970-2279 info@nara.org • www.nara.org

Render (ISSN 0090-8932) is published bimonthly under the auspices of the North American Renderers Association by Clear Point Communications as a public service to the North American and global rendering industry. It is intended to provide a vehicle for the exchange of ideas and information pertaining to the rendering and associated industries. Render is distributed free of charge to qualified individuals upon written request. Publisher reserves the right to determine qualification. Periodical postage paid for at Benbrook, TX, and additional mailing offices.

© 2024 All rights reserved. Printed in USA

POSTMASTER: Send address changes to Render, 1305 Blanco Ct., Benbrook, TX 76126

Our family just celebrated the college graduation of our oldest daughter, Josie, from Texas A&M University. Being on campus, especially when it’s your alma mater, has always been a moving time for me — all those bright, shiny faces ready to soak up knowledge and find their place in the sun.

Graduation was especially poignant to me this year as our daughter walked among the 12,500 spring graduates from A&M, and I’d like to share some excerpts from an especially inspirational message from her ceremony. It’s the kind of pep talk we all need to hear from time to time, no matter how old we are or where we find ourselves in our careers.

The speaker was Gen. Mark Welsh, president of Texas A&M University, former dean of the Bush School of Government and Public Service at A&M and a retired U.S. Air Force four-star general.

“Before we turn over the world to you to fix all the things we just didn’t get done, I’d like to ask you for four pretty simple favors,” Welsh said. “First, make a commitment to yourself that no matter what path you choose for your life, that you’ll run it all full speed. Don’t cheat yourself, don’t hold back. Don’t wait for something good to happen, just go for it. Life is a phenomenal thing, and yours is right out in front of you. Go get it!

“Secondly, I’d ask despite all the chaos that swirls around in our world today, you live a respected and respectful life. You owe that to yourself and everybody else in your world,” he added. “Third, make your family, community and profession better because you are in it. Finally, never forget you are a Texas Aggie and what an honor it is to say that. We love you and we are all proud of you, but tomorrow your adventure begins. Go make yourself proud!”

For the last three years, I have learned it’s also an honor to be part of this vibrant rendering industry that has the power to change the world with its contributions to the sustainability of our planet in so many different applications. Even as the world around us changes rapidly — by the way, there were

three A&M graduates commissioning into the U.S. Space Force — people in the rendering industry can certainly lean into that bit about making your community and profession better because they are in it.

Check out our new highlight, Faces of Rendering, on page 22 to see some folks who are very proud of what they do in this business. R

Sharla Ishmael Editor/Publisher By advertising in Render!

By advertising in Render!

Render is the only print publication to serve the international rendering industry. If your company is selling products or services targeting this market, you need to get in front of our readers.

Venturing into climate-smart agriculture (CSA) policy, the U.S. Department of the Treasury and the Internal Revenue Service have released guidance outlining the steps necessary to qualify fuel for the sustainable aviation fuel (SAF) credit. The credit was passed as part of the Inflation Reduction Act in August 2022 and can be claimed for sustainable jet fuel sold into commerce in 2023 and 2024. Interestingly, the guidance was posted 21 months after the law was signed and applies to a tax credit that is only valid until the end of this year. See the Biofuels Bulletin column on page 26 for the technical details outlined to qualify for the SAF credit.

Render readers won’t be surprised that, like most new regulations, the Treasury guidance raised more concerns than it satisfied. For their part, CSA farmers must provide an attestation covering nearly 10 different requirements and keep records certifying 30 different conditions have been met for no-till cover crops and enhanced efficiency nitrogen use. While assurances have been made that a potential IRS audit trail will not enter the farm gate, biofuel producers will shoulder new reporting and recordkeeping requirements as well.

To qualify for the credit, and the corresponding IRS safe harbor, SAF fuel producers must employ third-party verifiers to certify compliance with recordkeeping and registration requirements. Those third-party certifiers must be certified as California Air Resources Board Low Carbon Fuel Standard verifiers pursuant to California regulation.

The Treasury guidance also sets the stage and underscores the urgency of getting right the next round of biofuel tax incentives known as 45Z. All biodiesel tax incentives moving forward will fall under the 45Z clean fuel production tax credits good for tax years 2025 through 2027 as also legislated in the IRA. The base amount of the clean fuel production credit is 20 cents per gallon for nonaviation fuels, which can increase to $1 per gallon if the fuel is produced in a facility that meets IRA apprenticeship, prevailing wage requirements and achieves an emission reduction factor. Achievement of that emission reduction factor will be determined by the forthcoming 45Z guidance, which biofuel advocates say cannot include the same climate-smart practices set forth by the SAF requirements.

In the end, very little SAF fuel is expected to qualify for the two-year credit expiring at year’s end. As one leading agronomist remarked, the number of farmers who can meet these SAF fuel requirements today could fit on a school bus. Perversely, these requirements can and likely will be met by Brazilian sugarcane ethanol, meaning the windfall of U.S. tax incentives will land squarely for the benefit of Brazilian — not American — producers.

This fact wasn’t lost on biofuel champion Sen. Joni Ernst, R-Iowa, who said, “This decision will ultimately hinder America’s ability to compete in this new alternative fuel market

and force our country to be more reliant on foreign feedstocks for expanded biofuel production.”

Leaders of the House and Senate agriculture committees have taken steps toward reauthorizing a new Farm Bill 20 months past the original expiration date. All Farm Bill programs are now operating under a 12-month extension signed into law following the Sept. 30, 2023, expiration of the 2018 Farm Bill.

The U.S. House of Representatives Committee on Agriculture completed its markup of the Farm, Food and National Security Act of 2024 and passed the bill May 24. At press time, it was uncertain if the bill would be brought to the House floor for a vote due to a number of factors. On the Senate side, in early May, Rep. Debbie Stabenow, D-Michigan, chair of the Senate Committee on Agriculture, Nutrition and Forestry, released what she called a “serious proposal” of some 90 pages of summary points, without legislative text or budget scoring from the Congressional Budget Office.

The competing Farm Bill proposals take decidedly different approaches toward commodity price support, crop insurance, conservation spending and the Supplemental Nutrition Assistance Program, previously known as food stamps. The differences seem irreconcilable at this point given the costs of new spending in each

bill, the fractured nature of Congress and a presidential race on the horizon.

For the rendering industry, the House version includes key industry policy wins, including a substantial increase in the Market Access Program and Foreign Market Development Programs, as well as a directive to the U.S. Department of Agriculture to include rendering in the Draft National Strategy for Reducing Food Loss and Waste and Recycling Organics.

The MAP and FMD boosts are especially critical given the declining real dollar value of the programs since they were last increased 22 years ago. Combined with inflation and mandatory budget cuts known as sequestration, the real value of these export promotion programs has fallen by over 40%. Meanwhile, U.S. food and agriculture exports are now poised to run a trade deficit for the third consecutive year in the absence of any new trade agreements. Couple that with the growth of export promotion spending by governments overseas and the end result is a heavy one-two punch to U.S. exports.

Significant increases in the international trade of used cooking oil (UCO), particularly from major Asian exporting countries like China, have caught the attention of policymakers at the International Trade Commission, the U.S. Environmental Protection Agency and, most recently, the CARB as part of the LCFS implementation.

The U.S. has witnessed a remarkable rise in UCO imports, tripling in 2023 compared to previous years and surging even further during the first quarter this year. At the same time, soy oil utilized as feedstock for biodiesel is falling fast. According to Bloomberg , soy oil accounted for 32% of those feedstocks in January, down from 44% a year earlier and a record low. Notably, over 50% of the UCO imported into the U.S. in 2023 came from China, raising concerns about potential fraud or mislabeling at a time when anti-China trade policy has a bipartisan grip on Capitol Hill and looms large over the coming presidential election.

The anti-China trade war — viewed as cooling earlier in the year — is heating up again the closer the U.S. election gets as evidenced by fresh tariffs President Joe Biden announced in May targeting electric vehicle imports and their components. Immediate changes to other policies are unclear.

Both ITC and EPA have acknowledged the surge. Discussions within various interest groups, including the National Oilseed Processors Association, Clean Fuels Alliance America and

the Renewable Fuels Association are ongoing. In California, where the LCFS is seen as a magnet for such imports, CARB staff at an April LCFS workshop outlined potential policy changes aimed at cracking down on UCO imports.

Referring to LCFS changes as “guardrails,” CARB staff is proposing to remove palm-derived fuels from eligibility for credit generation and a prohibition on any feedstocks proven to come from crops or forestry harvested after 2008. R

With Camlin Fine Sciences you have options. You’ll get the shelf life performance you need with our NaSure® and Xtendra® antioxidant solutions, a custom application system and backed by our comprehensive customer application testing.

Email: info.us@camlinfs.com | TOLL: 1-844-808-2063

Declining prices, narrowing margins and other macroeconomic shifts challenge aquaculture markets even as demand for seafood grows. Here are the trends renderers selling beneficial feedstuffs to the sector need to watch.

By Walter Lanza, ScoularThe aquaculture market’s dynamic landscape continues to evolve globally. This industry is pivotal in meeting the growing demand for seafood through the cultivation of aquatic organisms and illustrates broader trends in the animal proteins sector. Aquaculture’s reliance on animal byproducts — poultry meal, meat and bone meal, and feather meal — underscores its integral role and interconnectedness with renderers around the world.

Despite robust demand, the aquaculture market faces mounting pressures, such as declining prices and narrowing margins, driven by macroeconomic shifts that put pressure on credit availability and producers’ balance sheets. To navigate these challenges, it is crucial to delve into key trends within the aquaculture market and analyze demand dynamics across major aquaculture-consuming nations.

By dissecting these trends and examining the major players in aquaculture demand, stakeholders can gain valuable insights to piece together the puzzle and anticipate trends in demand and pricing within the broader animal protein sector.

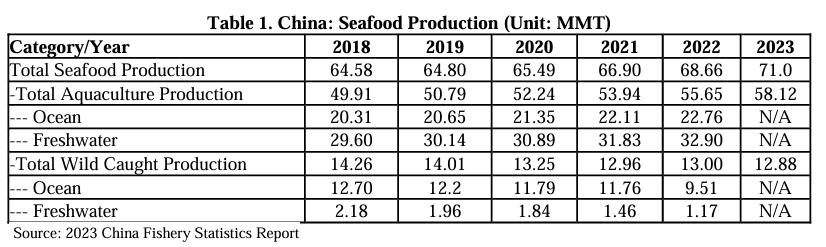

China’s aquaculture sector continued to thrive in 2023, solidifying the country as the world’s leading seafood producer. Consider this data from 2023:

• Seafood production increased 3.5% since last year, reaching an estimated 71 million metric tons (mmt), as shown in Table 1. Wild-caught production remained stagnant at 12.9 mmt.

Aquamarkets Continued from page 8

increasingly popular — especially among urban consumers. Looking ahead at China’s aquaculture sector, continued growth is projected, supported by consumer demand for high-quality seafood and government initiatives to expand production capacity. Despite challenges in the global market, such as shifting trade dynamics and regulatory changes, China’s aquaculture industry remains resilient, driven by innovation and adaptation to changing consumer preferences.

The Indonesian aquaculture market, vital to the nation’s economy, has achieved significant milestones and navigated key policies in 2023, setting the stage for anticipated developments in 2024. With a robust production output, Indonesia solidified its position as the world’s second-largest fish producer, exporting over 1.2 mmt of fishery products valued at $5.63 billion.

• Ca8ish: Produc<on experienced notable growth, driven by domes<c consump<on.

• Aquaculture rose by 4.4% to 58.1 mmt during this same time, which propelled the increases in seafood production.

• Seafood imports also surged, reaching 4.6 mmt, driven by increased demand for various products including fresh and frozen fish, crustaceans and mollusks.

• Crustacean: Shrimp produc<on, par<cularly Penaeus vannamei (whiteleg shrimp), con<nued to increase as some industry associa<ons in China work with local governments to promote crayfish in the domes<c market. They carry out chef compe<<ons, tas<ng events and other promo<ons to boost consumer demand and interest

• While there were lower exports of many U.S. commodities to China, U.S. seafood exports saw a modest increase of 2.9% in volume.

Furthermore, seafood processing advancements and the rise of e-commerce have driven consump<on. Processed seafood produc<on was up slightly with a focus on value-added products to cater to changing consumer preferences. The growth of e-commerce plaaorms has made seafood products more accessible, with fresh and frozen op<ons becoming increasingly popular especially among urban consumers.

Under the guidance of the Ministry of Marine Affairs and Fisheries, Indonesia unveiled a strategic blueprint for fostering sustainable growth and development in the fishing industry. This blueprint encompasses five policies, ranging from coastal area supervision to the expansion of marine protected areas, signaling the government’s commitment to nurturing a blue economy.

As Indonesia sets its sights on 2024, ambitious targets have been established to increase fisheries investment by 15%, building upon the previous year’s achievements. To meet both domestic and export demands, the ministry has identified five key commodities for increased production: shrimp, seaweed, crab, lobster and salted tilapia.

Looking ahead at China’s aquaculture sector, con<nued growth is projected, supported by consumer demand for high-quality seafood and government ini<a<ves to expand produc<on capacity Despite challenges in the global market, such as shiGing trade dynamics and regulatory changes, China’s aquaculture industry remains resilient, driven by innova<on and adapta<on to changing consumer preferences.

• China’s aquaculture production growth was particularly significant, reflecting ongoing efforts to expand production efficiency and meet evolving consumer demands. This growth was supported by the recovery of aquaculture water areas, intensified production efficiency and increasing demand for prepared seafood products. Despite challenges in the wild-caught seafood sector, including declining resources and stricter regulations, China’s aquaculture industry remains robust.

The dominant position of fish in aquaculture production persisted.

• Carp species: Led the freshwater segment.

• Tilapia: Maintained its status as the top marine product.

Shrimp, the crown jewel of Indonesia’s aquaculture sector, commands the highest value among commodities and stands as the nation’s top fisheries export. With a focus on three shrimp varieties, including the predominant Vannamei shrimp, Indonesia’s production soared in 2023, reaching 1.48 mmt.

Amid these successes, however, challenges loom — notably the volatility of the global shrimp market and intensifying competition from rival producers. To bolster competitiveness, Indonesia is exploring value-added and cooked shrimp products to carve a niche in premium market segments.

The Indonesian aquaculture market, vital to the na<on’s economy, has achieved significant milestones and navigated key policies in 2023, secng the stage for an<cipated developments in 2024. With a robust produc<on output, Indonesia solidified its posi <on as the world’s second-largest fish producer, expor<ng over 1.2 mmt of fishery products valued at $5.63 billion.

• Catfish: Production experienced notable growth, driven by domestic consumption.

Under the guidance of the Ministry of Marine Affairs and Fisheries, Indonesia unveiled a strategic blueprint for fostering sustainable growth and development in the fishing industry. This blueprint encompasses five policies, ranging from coastal area supervision to the expansion of marine protected areas, signaling the government ’s commitment to nurturing a blue economy.

• Crustacean: E-commerce growth has boosted domestic seafood consumption in China, particularly fresh and frozen shrimp. The demand for crayfish has also increased as industry associations and local governments have promoted it through various events, further boosting consumer interest.

Behind Indonesia’s aquaculture prowess lie its aquafeed producers. A diverse array of fish feeds, comprising both imported and locally produced brands, underscores the industry’s vibrancy and resilience. Yet, as Indonesia marches forward, it confronts logistical hurdles — particularly in remote shrimp farming areas. While remote aquaculture practices enhance shrimp survival rates, transportation challenges pose operational constraints, necessitating innovative solutions to optimize supply chains and preserve product quality.

As Indonesia sets its sights on 2024, ambi<ous targets have been established to increase fisheries investment by 15%, building upon the previous year ’s achievements. To meet both domes<c and export demands, the ministry has iden<fied five key commodi<es for increased produc<on: shrimp, seaweed, crab, lobster and salted <lapia.

Furthermore, seafood processing advancements and the rise of e-commerce have driven consumption. Processed seafood production was up slightly with a focus on value-added products to cater to changing consumer preferences. The growth of e-commerce platforms has made seafood products more accessible, with fresh and frozen options becoming

The Vietnam aquafeed market is experiencing steady growth. With an estimated size of $2.38 billion in 2023, the aquafeed market is projected to reach $2.94 billion by 2028, marking a compound annual growth rate of 4.3% during the forecast period led by whiteleg shrimp, as shown in Figure 2.

Vietnam’s aquafeed market is fueled by its robust aquaculture sector, positioning the country as the fourth-largest

producer of seafood globally after China, Indonesia and India. Key factors driving demand include changing consumer dietary habits, increased seafood consumption and rising incomes. Shrimp, tuna, pangasius and marine fish are among Vietnam’s most popular seafood exports.

Government initiatives aimed at increasing the production of certified sustainable seafood, such as the plan to boost shrimp exports to $10 billion by 2025, drive the need for aquafeed in Vietnam. Also, there is a shift in focus toward whiteleg shrimp production due to its faster growth rate and lower production costs compared to black tiger shrimp. This transition is supported by farmers’ preference for manufactured compound aquafeeds over supplemental feeds like trash fish and small shrimp.

The EU-Vietnam free trade agreement has opened more opportunities for Vietnamese seafood exports, particularly tuna, with exports to the EU seeing significant growth. Export-oriented cultivation is expected to drive further market expansion and lead to increased investment in higher-quality feed.

Vietnamese farmers are increasingly adopting intensive models of whiteleg shrimp farming, resulting in higher stocking densities and a growing demand for whiteleg shrimp feed. This trend is evident in Vietnam’s central aquaculture production region, the Mekong Delta, where many farmers are transitioning from giant tiger prawn to whiteleg shrimp culture.

From a demand perspective, Vietnam presents notable challenges because of increasingly intricate legislation and stricter import regulations. Importers find themselves under significant pressure from governmental authorities, navigating smaller credit lines from financial institutions following a corruption scandal that unfolded in late 2023.

Overall, Vietnam’s aquafeed market is poised for continued growth, driven by increasing demand for aquaculture products and shifting preferences towards high-yield shrimp species.

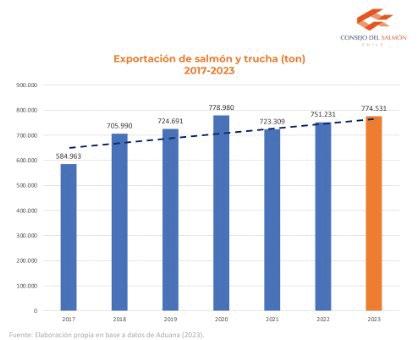

The Chilean salmon industry is a powerhouse in global aquaculture. It boasts a diverse range of salmon varieties including Coho, Atlantic and rainbow trout. With an annual output of around 1 mmt of finished product, Chile holds a significant position in the global salmon market, second only to Norway in production volume. Salmon and trout together represent the country’s most important nonmining export, comprising 16.2% of total nonmining exports.

While the industry has seen modest growth over the past five years with exported tons increasing at an average rate of just 2% annually, product formats and species preferences have shifted. In 2023, Atlantic and Coho salmon shipments increased slightly, with Coho salmon showing promising growth at 5.6% annually. Notably, fresh salmon exports have risen compared to frozen formats, indicating evolving consumer preferences and market adaptability. The industry, however, is not without its challenges. Projections for 2024 suggest a 10% decrease in production compared to the previous year, attributed to regulatory changes and natural phenomena such as algae blooms. Despite this setback, the Chilean salmon industry remains resilient and vital for the nation’s economy, providing significant employment opportunities.

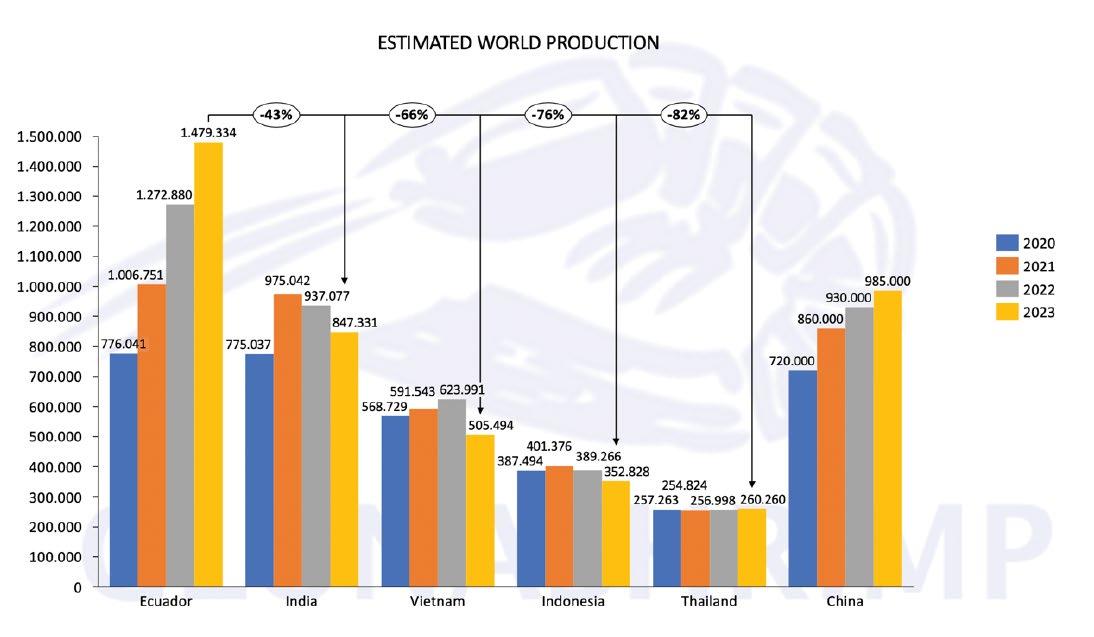

Over the past decade, Ecuador’s shrimp production has experienced consistent double-digit annual growth, with figures steadily climbing from 2013 to 2023. However, this trend created a global supply surplus and price decline. In 2024, for the first time in a decade, Ecuador’s shrimp production is showing signs of contraction, with a notable 10% decrease reported in both production and exports by the end of February.

Aquamarkets Continued from page 11

The plummeting prices challenge shrimp farmers. Many struggle to turn a profit or cover expenses. To mitigate losses, producers reduce stock densities and refrain from restocking problematic ponds or areas that typically yield subpar harvests.

Projections suggest that Ecuador’s shrimp exports will continue to decline through early this year, with estimates indicating a further 10% to 13% decrease compared to previous periods. But there is optimism that supply and demand dynamics may realign late this year to potentially stabilize shrimp prices at more favorable levels. The reduced demand impacts feed producers in Ecuador with an anticipated decrease of 10% to 15% in demand for aquafeed. This decline is expected to intensify competition among feed manufacturers.

Over the past five years, Mexico has witnessed steady yearon-year growth in shrimp production because of advancements in productive processes, the adoption of new technologies and enhancements in feed processing. Shrimp production is concentrated along its coastal states, particularly those bordering the Pacific Ocean. The lion’s share of production — over 80% — is concentrated in two states: Sinaloa, which contributes 45%; and Sonora, the second-largest producer with 38% of the national output.

Shrimp season typically spans from March/April to October/ November, although consumption remains consistent throughout the year in Mexican cuisine. Approximately 80% of shrimp production is derived from aquaculture, with the remaining 20% captured in open waters along the Pacific Coast. Shrimp feed production is integral to ensuring consistent production levels, with feed output experiencing consistent year-on-year growth over the past five years.

Despite the overall positive trend, Mexico’s shrimp industry has encountered challenges in recent years largely influenced by the international landscape. Volatility in prices, particularly evident in the past two seasons, along with surpluses in countries like Ecuador, have impacted the competitiveness of Mexican shrimp in international markets such as the U.S., Europe and Asia. However, Mexico has maintained an upward trajectory in production, reaching 243,400 metric tons in 2023, making it the second-largest producer in the Americas and the seventh globally.

Looking ahead, 2024 expectations are optimistic with anticipated growth of at least 2% in both capture and aquaculture compared to 2023 figures. This projection underscores the resilience of Mexico’s shrimp industry and its ability to adapt to evolving market conditions while continuing to contribute significantly to the global shrimp supply.

For U.S. renderers, this analysis highlights both promising prospects and some hurdles for feedstock producers. The global surge in aquaculture — propelled notably by nations like China, Indonesia and Vietnam — indicates a consistent demand for animal proteins such as poultry meal, feather meal and pork meat and bone meal. Nonetheless, renderers and traders face the intricate challenge of navigating fluctuating shrimp prices in Ecuador and worldwide, plus logistical complexities across various regions and with the ever-evolving regulatory frameworks in Vietnam.

Additionally, the backdrop of a macroeconomic slowdown in China adds further complexity to the market landscape. Adapting to these market dynamics and upholding a competitive edge through efficient logistics and quality will be crucial for ensuring enduring success in these important aquaculture markets. R

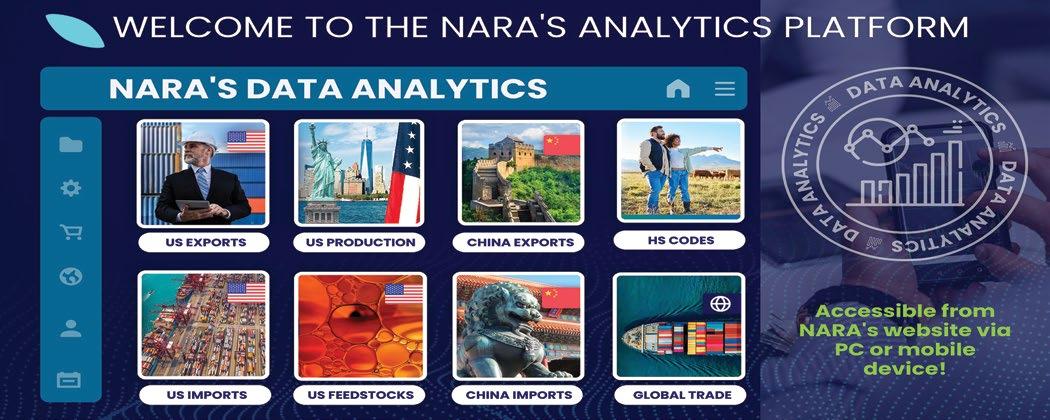

Renderers needing specific production, supply and demand statistics or export data for rendered and repurposed food and feed products now have access to a transformative tool at their fingertips via the North American Renderers Association member’s portal. NARA’s new Data Dashboard was introduced during the association’s spring meetings held April 30-May 2 in Vancouver, British Columbia, Canada.

The Data Dashboard gives renderers instant access to a treasure trove of data on the trade of rendered products, with historical comparisons and insightful graphics to interpret the numbers. It’s the first time all of this information has been aggregated — and automated — for easy, real-time access instead of waiting for the annual market report published by NARA in Render or calling on staff for updates.

“We were getting a lot of one-off requests from different members for data — particularly on exports but sometimes on production data — that our members use for presentations or internal meetings to look at things like the size of a market or who else is exporting to a particular country,” explained Dana Johnson Downing, NARA’s senior vice president of international programs. “Obviously, there are a lot of different factors that drive business decisions. For example, one of our members is looking to enter a new market and another member is trying to figure out whether or not their company is as competitive on price as in the past.

“Being able to see who else is exporting to the target market and what other products that country is importing helps these companies to make internal business decisions,” she added. “And so, when we were doing that on a one-by-one basis, it’s very labor intensive because we have so many different HS codes. An exporter might be shipping the same product, but it could go under four different HS codes.”

For reference, HS codes refer to the harmonized tariff schedule of the U.S., which sets out tariff rates and statistical categories for all merchandise based on the international harmonized system applied to most world trade.

“NARA will also use the data analytics as a decision-support tool to select markets and activities in which to conduct market development and trade capacity building projects. Working with AgriGlobal Market, we were able to build this dashboard with all of the data mapping behind the scenes, and it’s just magically happens,” Downing said. “The program vacuums up data from all the different sources we use, from government reports to trade partner data to customs reports and other databases — and it updates automatically as each data source refreshes in real-time.”

Felipe Hurtado of AgriGlobal Market was at the Vancouver meeting to provide one-on-one training sessions with interested NARA members to explain exactly what additional tools the program offers and how to use the platform. He will also make appointments with members who were not at the meeting but says the platform is designed to be intuitive and as user-friendly as possible.

“When we talk about these kinds of tools, there are two magical words — adaptable and scalable,” Hurtado explained. “It means that we can add as much data as possible, and that will not affect the results for the members. In other words, they won’t have to keep changing the information in an Excel spreadsheet as the information updates. When you have a system like this, a business intelligence system, we can update everything for them and send alerts to them. I mean, at the end of the day, it’s having information in real time. It’s just a matter of clicking in a couple of buttons and the entire system will change and get the information they’re looking for. That’s exactly what we’re trying to create, a very simple system that will show all the data that they want to get.”

The Data Dashboard is live on NARA’s website (nara.org), although some fine-tuning is expected. In fact, this is Phase 1 of the tool with plans to build new features into the program over time. One of the NARA members who got a first look at the Data Dashboard in Vancouver was Doyle Leefers with National Beef.

“It’s a fantastic opportunity for NARA members to utilize industry information — historicals and current volumes — to look at market trends that affect our daily business and future

potential, not only sales but also outlooks for production,” Leefers said. “There’s going to be some outliers, it’s not perfect yet, but it is a database that can be used today versus having to go back through old presentations to look for information, whether it’s from NARA or even USDA. The timeliness of the Data Dashboard is very beneficial. I’ve already thought about how I can use it with my internal business analysis to kind of crosscheck data and work out performance measures like market share.”

Kyle Canning of Scoular also liked what he saw in Vancouver. “I am thoroughly impressed by the new Data Dashboard featured on the NARA website,” he offered. “It offers a comprehensive and user-friendly platform, consolidating a wealth of information in one centralized location. The timely updates of import and export data on a monthly basis are particularly noteworthy and advantageous. Undoubtedly, this resource will serve as a valuable tool for industry professionals.”

For more information about the Data Dashboard, contact Downing at ddowning@nara.org.

The Fats and Protein Research Foundation meeting featured an interim report by Dr. David Ladner with Clemson University about his FPRFfunded research conducted with the help of three member organizations that have volunteered their facilities. Ladner is collecting data for a specific life-cycle analysis (LCA) project to identify methods for preventing waste of energy.

“A key objective is to create a tool for calculating detailed profiles of energy use at a rendering plant and perform life-cycle assessment or analysis of the operations with impacts assigned to specific unit processes,” Ladner explained. “And then to develop recommendations for energy saving measures. We’re using three case studies to develop and validate the tool. Initial data collected include energy bills, water bills, sewer bills, if there are any monthly treated wastewater discharge, permit records, etc.”

The FPRF board of directors approved funding for two projects studying the use of rendered materials — one to remove metals and another dealing with nuclear waste sequestration. The committee

also voted on the 2024 FPRF Innovation Award, which will go to Dr. Rhett Smith of Clemson University in recognition of his important work through the Animal CoProducts Research and Education Center. Smith will receive the award at the FPRF Innovation Conference in October, which occurs in conjunction with the NARA convention in California.

In the sustainability and environment committee, Dr. Charles Starkey, NARA’s vice president of scientific and regulatory affairs, discussed a request for proposals (RFP) recently announced for data collection on aerial emissions of volatile organic compounds (VOC) in the U.S. rendering industry.

“We’ve got a working group led by Barry Griffin that is looking at trying to get a true baseline of our current VOCs,” Starkey explained. “EPA is looking at some new guidelines later this year. One of the concerns is that they’re taking some testing from some brand-new facilities, which will have very low emission numbers, and will not be representative of all the facilities in the industry. So, we would like to get what we would consider a true baseline versus just emission data collected from a brand-new facility. We’re concerned about EPA getting ahead of it and using bad data.

“We want to use what we have on an

aggregate basis — not identifying specific plants or companies but providing an industry-based emissions factor used primarily for the purposes of air permitting emission modeling compliance and right to avoid stack testing,” he said. “The RFP is up on NARA’s website now.”

Paul Bredwell gave the committee an update on the status of effluent limitation guidelines (ELG) and the collaborative work industry organizations, including NARA, have funded to respond to the U.S. EPA’s proposals. ELGs are national wastewater discharge standards developed by EPA specific to certain industries. The ELGs for meat and poultry producers are currently under review by the agency.

EPA has put forth three different options for how to update these specific ELGs but, according to Bredwell, has shown a preference for the option that would put new phosphorus limits and revised nitrogen limits on large direct discharge facilities and new pretreatment standards on certain pollutants and conventional pollutants from indirect discharge facilities. Questions have arisen whether EPA has the authority to do that.

Members heard an outlook on the global fats and oils markets from Ryan Standard, FastMarkets, and reports from

Continued on page 16

Renderers were well represented by several companies at the 2024 Pet Food Alliance meeting in Kansas City, Missouri, held May 1-2 in conjunction with the Pet Food Forum. PFA brings together the pet food and rendering industries to find common ground and push progress forward. The technical program featured panels focused on foreign materials, education and industry updates. Working groups also broke into areas of interest for discussions as well.

Market Data Continued from page 15

NARA’s regional trade consultants the world over. Downing reported there has been very little trade disruption for rendered products due to the emergence of bovine influenza A in dairy cattle.

In the legislative action and biofuel committee, renderers got a report on the biofuel market from Mike Rath and

an overview of supply and demand from Kent Swisher, NARA president and CEO. Samantha Buchalter, vice president of the Russell Group, gave an overview from Washington, D.C., on progress toward a new Farm Bill and other legislative priorities for NARA. She encouraged all NARA members to attend the annual

Fly-In being held June 10-12 to meet with representatives in person and reinforce the importance of the rendering industry to their communities and voters.

Makes plans now to attend the NARA’s 91st Annual Convention Oct. 2226 in Santa Barbara, California. See nara. org for more information. R

Agriculture Secretary Tom Vilsack announced May 21 the U.S. Department of Agriculture is allocating $300 million to 66 U.S. organizations — including the North American Renderers Association — under the new Regional Agricultural Promotion Program to build demand for American food and farm exports in highpotential markets around the globe.

NARA was granted $3.3 million in RAPP funds in this first tranche of funding.

Vilsack set aside a total of $1.2 billion in Commodity Credit Corporation funding for the five-year RAPP program, launched in 2023, to help U.S. exporters expand their customer base beyond traditional and established markets. The regions in focus for RAPP funding currently include Africa, Latin America, the Caribbean, and South and Southeast Asia — where consumer demand and purchasing power are growing.

“NARA has been participating in USDA export promotion programs since the 1950s and has a long track record of increasing exports and market share of U.S. rendered and repurposed products overseas,” said Kent Swisher, NARA President and CEO. “I think the award of $3.3 million in RAPP funds to NARA shows that USDA has a lot of confidence in our approach to diversifying markets and boosting exports.”

NARA requested funding for activities in precommercial, early stage and strategic markets in the regions receiving special emphasis in the RAPP funding program requirements. Because RAPP excludes activities in China, Canada, the European Union and Mexico, NARA will reserve its Market Access Program and Foreign Market Development funds for

work in these more mature markets.

“Having a diverse mix of markets helps boost the value of our products and offers a hedge against potential market disruptions due to disease outbreaks or other trade irritants,” added Dana Johnson Downing, NARA senior vice president of international programs. “We will use RAPP funding to implement new strategies and innovative programs that we otherwise would not have been able to conduct under the traditional market development programs such as MAP and FMD programs.”

NARA will publish requests for proposals to begin implementing its RAPP activities as of June 1.

A bipartisan group of eight senators sent a letter May 8 to Michael Regan, administrator of the U.S. Environmental Protection Agency; Tom Vilsack, secretary of the U.S. Department of Agriculture; and Robert Califf, commissioner of the U.S. Food and Drug Administration, expressing concern that rendering was not included in the Draft National Strategy for Reducing Food Loss and Waste and Recycling Organics.

“For centuries, rendering has been at the forefront of a circular economy,” the senators wrote. “We urge EPA, USDA and FDA to ensure that rendering is included as part of our nation’s food loss and waste reduction strategy. In addition, we request that EPA update its Wasted Food Scale to reflect the importance of rendering

as a management strategy for wasted food. We are concerned that this draft strategy, with rendering omitted, will not accelerate progress towards the 2015 national goal to reduce food loss and waste by 50% by 2030. Instead, the strategy will only serve to incentivize other recycling technologies at the expense of the rendering industry.”

Swisher issued the following statement in response to the letter.

“NARA commends Sens. Roger Marshall, R-Kansas; Michael Bennet, D-Colorado; and Jerry Moran, R-Kansas; and this bipartisan group of senators for recognizing rendering’s longstanding role in reducing our overall food production footprint. The North American rendering industry has been upcycling otherwise lost and wasted food since the 1800s. We are the original recyclers and were a part of the circular economy even before the term was coined. We urge EPA and USDA to acknowledge rendering’s important role and how it can assist in reaching their reduction targets. We don’t see a path to meet the stated goal of reducing food loss and waste in the U.S. by 50% by 2030 without rendering, the largest food loss and waste recycler.”

The letter was also signed by Sens. Amy Klobuchar, D-Minnesota; John Boozman, R-Arkansas; Debbie Stabenow, D-Michigan; Alex Padilla, D-California; and Tina Smith, D-Minnesota.

Joining NARA in support of the letter was the American Feed Industry Association, American Farm Bureau Federation, Association of American Feed Control Officials, Clean Fuels Alliance America, Meat Institute, National Association of State Departments of Agriculture, National Cattlemen’s Beef Association, National Chicken Council, National Milk Producers Federation, National Turkey Federation, and U.S. Poultry & Egg Association. R

With the previously extended 2018 Farm Bill set to expire Sept. 30, legislators have been working on competing proposals for a new bill. As mentioned in Tyson Redpath’s View from Washington column on page 6, the House Committee on Agriculture passed its version of the bill out of committee May 24. Debbie Stabenow, D-Michigan, chair of the U.S. Senate Committee on Agriculture, Nutrition and Forestry, unveiled a Farm Bill proposal May 1 — the Rural Prosperity and Food Security Act. There are several provisions the North American Renderers Association promoted in the House bill.

NARA, as part of a larger coalition, helped to yield a major victory with the doubling of funding for the Market Access Program and Foreign Market Development Program, as outlined in Section 3201 of the House bill. This increase in funding will enhance NARA’s ability to promote U.S. agricultural products abroad.

A significant success for NARA relates to the inclusion of provisions concerning food waste management in Section 4307. This section mandate the U.S. Department of Agriculture food loss and waste liaison to submit an annual report to Congress detailing activities aimed at avoiding or managing market disruption and summarizing communication and coordination efforts with the U.S. Environmental Protection Agency. This initiative is aimed at adding transparency and accountability to efforts utilizing government funds to create competition for existing food loss and waste technologies — like rendering.

The new meat processing grant program established in Section 6305 now explicitly includes rendering activities — a direct result of NARA’s advocacy. Additionally, rendering is also specified in the Agriculture and Food Research Initiative workforce training program under Section 7053(D). These inclusions will provide essential support for rendering

operations and workforce development, ensuring the continued growth and modernization of the rendering industry. Rendering is mentioned nine times in the House bill.

Section 12004 of the House bill codifies USDA’ s authority to negotiate regionalization agreements, a critical component of the Securing America’s Food Economy Act. This provision will strengthen USDA’s capacity to manage animal health emergencies and trade disruptions, thereby protecting the stability and security of the food supply chain.

The Senate draft proposal contains more than 100 bipartisan bills. The Senate version does not increase MAP and FMD funding like the House version does; however, it does skillfully attempt to say that the recently established Regional Agricultural Promotion Program doubles the MAP and FMD funding. The RAPP program is a separate program and could go away in the future. It does not double the traditional MAP and FMD programs. Hence, work still needs to be done on the Senate side if the increase of MAP and FMD are to make it into the final Farm Bill.

Speaking of RAPP, Agriculture Secretary Tom Vilsack announced May 21, that USDA has allocated $300 million to 66 U.S. organizations to build demand for American food and farm exports in high-potential markets around the globe. NARA’s portion of this RAPP funding is $3.3 million with $1 million earmarked to be used for market development in Africa. This money will be put to effective use expanding export markets for rendered proteins. With the soy crush expansion in the U.S. weighing on protein markets, this funding will be imperative in continuing to move excess supply to markets deficient in feed proteins.

It is important for congressional representatives to hear from their constituents how these programs bring value back to their districts. A great opportunity to communicate that message is coming up during NARA’s Fly-In scheduled June 10-12. You can reserve rooms from NARA’s events page at nara.org/about-us/events/. We look forward to seeing you in Washington! R

As an essential link in the food chain, the rendering industry is conscious of its role in the prevention and control of bacteria and viruses, to provide safe feed ingredients for livestock, poultry, aquaculture and pets. Every effort is made to ensure that cooking destroys microbes and that recontamination does not occur after the rendering process.

Since 1985, the Animal Protein Producers Industry (APPI) has coordinated a program of education and laboratory testing for renderers to control potentially pathogenic bacteria. Now, APPI offers it's members training to comply with the Food Safety Modernization Act along with product testing to offer the most appropriate controls and practices to best assure safe products. Our advanced feed safety programs include strategies to control biological, chemical and physical hazards that can occur in animal production and processing systems. A concerted effort is made to foresee any hazard likely to occur and to build prevention of risk into manufacturing. Process controls in rendering verify that cooking temperatures control microbial and viral contamination. These programs also concentrate on recontamination prevention and biosecurity.

More than 95% of rendered products in the U.S. and Canada are produced under principles in the Rendering Code of Practice or equivalent programs. If you are a customer ask for these credentials and rest assured. If you are a renderer, make sure you take advantage of these excellent programs.

For information, contact Dara John at 660-277-3469 or djohn@nara.org or visit us on the web at https://nara.org/ biosecurity-and-appi/. APPI is a committee of the North American Renderers Association.

For information, contact Dara John at 660-277-3469 or djohn@nara.org or visit us on the web at https://nara.org/ biosecurity-and-appi/. APPI is a committee of the North American Renderers Association.

AB Foods LLC, Toppenish, WA

Agpack LLC, Sanford, NC

AB Foods LLC, Toppenish, WA

American Proteins, Inc.

Agpack LLC, Sanford, NC

The Animal Protein Producers Industry oversees biosecurity programs for the North American rendering industry. APPI programs feature ways to manage biological, chemical and physical hazards, and how to comply with changing feed regulations. APPI is a committee within the North American Renderers Association and membership is open to all renderers.

certification process includes independent third-party audits and aligns with the American Feed Industry Association Safe Feed/Safe Food Certification Program. Certifying with the latest version of the Rendering Code of Practice:

• Assures customers that a renderer is a verified safe supplier.

American Proteins, Inc.

American Proteins, Inc., Alma, GA

American Proteins, Inc., Cumming, GA

American Proteins, Inc., Alma, GA

American Proteins, Inc., Cuthbert, GA

• Ensures compliance with the Food Safety Modernization Act.

• Offers a single audit for recognition by two well-known programs.

American Proteins, Inc., Cumming, GA

American Proteins, Inc., Cuthbert, GA

APPI’s mission is to assist member companies in manufacturing safe products. The Rendering Code of Practice corresponds very closely to biosecurity initiatives taking place throughout the entire food chain and furthers the concept of “safe feed — healthy livestock; safe food — healthy people.”

• Helps employees take pride in their work.

American Proteins, Inc., Plant B, Hanceville, AL

Ampro Products, Inc.

American Proteins, Inc., Plant B, Hanceville, AL

Ampro Products, Inc.

Ampro Products, Inc., Dawsonville, GA

Ampro Products, Inc., Pickensville, AL

Ampro Products, Inc., Dawsonville, GA

Baker Commodities, Inc.

With intense scrutiny on all feed ingredients, the development of the Rendering Code of Practice years ago by renderers demonstrates great foresight. Leaders in the rendering industry participate in this code of practice, with a list of participating companies available at nara.org/biosecurity-and-appi/. The

Ampro Products, Inc., Pickensville, AL

Baker Commodities, Inc.

Baker Commodities, Inc., North Billerica, MA

AB Foods LLC, Toppenish, WA

Baker Commodities, Inc., Phoenix, AZ

Agpack LLC, Sanford, NC

Baker Commodities, Inc., North Billerica, MA

American Proteins, Inc.

BHT Resources, Bessemer, AL

American Proteins, Inc., Alma, GA

Baker Commodities, Inc., Phoenix, AZ

American Proteins, Inc., Cumming, GA

Boyer Valley Co, Arion, IA

American Proteins, Inc., Cuthbert, GA

BHT Resources, Bessemer, AL

Cargill Meat Solutions

American Proteins, Inc., Plant B, Hanceville, AL

Ampro Products, Inc.

Boyer Valley Co, Arion, IA

Ampro Products, Inc., Dawsonville, GA

Cargill Meat Solutions

Cargill Meat Solutions, Dodge City, KS

Ampro Products, Inc., Pickensville, AL

Baker Commodities, Inc.

Cargill Meat Solutions, Friona, TX

Baker Commodities, Inc., North Billerica, MA

Cargill Meat Solutions, Dodge City, KS

Baker Commodities, Inc., Phoenix, AZ

Cargill Meat Solutions, Ft. Morgan, CO

• Identifies opportunities for continuous improvement. APPI will continue to develop innovative programs to promote the safety of animal proteins and feed fats through testing, continuing education and training, and collaborative research. When new regulations are issued APPI programs will be adjusted to keep participants up to date and in compliance.

Darling Ingredients, Inc., Dallas, TX

Rendering plants that have completed the required testing for the 2023 APPI TESTING PROGRAM

Darling Ingredients, Inc., Denver, CO

Darling Ingredients, Inc., Des Moines, IA

Darling Ingredients, Inc , East Earl, PA

Darling Ingredients, Inc., Ellenwood, GA

Darling Ingredients, Inc., East Dublin, GA

Darling Ingredients, Inc. Fayetteville, NC.

Darling Ingredients, Inc. Pet Food Div., Fayetteville, NC

Darling Ingredients, Inc., Fresno, CA

Darling Ingredients, Inc., Fremont, NE

Darling Ingredients, Inc., Grapeland, TX

Darling Ingredients, Inc., Hamilton, MI

Darling Ingredients, Inc., Houston, TX

Darling Ingredients, Inc., Jackson, MS

Darling Ingredients, Inc., Kansas City, KS (Blending)

Darling Ingredients, Inc., Kansas City, KS

Darling Ingredients, Inc., Kuna, ID

Darling Ingredients, Inc. Lewiston, NC

Cargill Meat Solutions, Friona, TX

BHT Resources, Bessemer, AL

Boyer Valley Co, Arion, IA

Darling Ingredients, Inc., Lexington, NE

Cargill Meat Solutions, Highriver, Alberta, Canada

Darling Ingredients, Inc. Linkwood, NC

Cargill Meat Solutions

Cargill Meat Solutions, Ft. Morgan, CO

Darling Ingredients, Inc. Linville, VA

Cargill Meat Solutions, Schuyler, NE

Cargill Meat Solutions, Dodge City, KS

Cargill Meat Solutions, Friona, TX

Cargill Meat Solutions, Highriver, Alberta, Canada

Darling Ingredients, Inc., Los Angeles, CA

Darling Ingredients, Inc., Lynn Center, IL

Cargill Meat Solutions, Ft. Morgan, CO

Cargill Meat Solutions, Wyalusing, PA

Cargill Meat Solutions, Schuyler, NE

Cargill Meat Solutions, Highriver, Alberta, Canada

Darling Ingredients, Inc., Mason City, IL

Darling Ingredients, Inc., Muscatine, IA

Cargill Meat Solutions, Schuyler, NE

Caviness Beef Packers, Hereford, TX

Cargill Meat Solutions, Wyalusing, PA

Cargill Meat Solutions, Wyalusing, PA

Darling Ingredients, Inc., National Stock Yards, IL

Darling Ingredients, Inc., Newark, NJ

Central Valley Meat Company, Hanford, CA ***

Caviness Beef Packers, Hereford, TX

Caviness Beef Packers, Hereford, TX

Central Valley Meat Company, Hanford, CA ***

Darling Ingredients, Inc., Newberry, IN

Darling Ingredients, Inc., Omaha, NE (blending 33rd Street))

Clemens Food Group

Clemens Food Group

Central Valley Meat Company, Hanford, CA ***

Darling Ingredients, Inc., Pocohontas, AR

Clemens Food Group, Coldwater, MI

Clemens Food Group, Coldwater, MI

Darling Ingredients, Inc., Ravenna, NE

Clemens Food Group

Clemens Food Group, Hatfield, PA

Coastal Protein, Godwin, NC

Clemens Food Group, Hatfield, PA

CS Beef Packer, Kuna, ID

Clemens Food Group, Coldwater, MI

DaPro, LLC, Huron, SD

Coastal Protein, Godwin, NC

Darling Ingredients, Inc.

Clemens Food Group, Hatfield, PA

CS Beef Packer, Kuna, ID

Darling Ingredients Canada, Dundas, Ontario, Canada

Coastal Protein, Godwin, NC

Darling Ingredients Canada, Hickson, Ontario, Canada

DaPro, LLC, Huron, SD

Darling Ingredients Canada, Moorefield, Ontario, Canada

CS Beef Packer, Kuna, ID

Darling Ingredients Canada, Winnipeg, Manitoba, Canada

Darling Ingredients, Inc.

Darling Ingredients, Inc., Amarillo, TX

DaPro, LLC, Huron, SD

Darling Ingredients, Inc., Bastrop, TX

Darling Ingredients, Inc., Bellevue, NE

Darling Ingredients, Inc.

Darling Ingredients, Inc. Rose Hill, NC

Darling Ingredients, Inc., Russellville, KY

Darling Ingredients, Inc. San Angelo, TX, Veribest Div.

Darling Ingredients, Inc., San Francisco, CA

Darling Ingredients, Inc., Sioux City, IA

Darling Ingredients, Inc., Starke, FL

Darling Ingredients, Inc. Strawberry Plains, TN

Darling Ingredients, Inc. Tama, IA

Darling Ingredients, Inc., Tampa, FL

Darling Ingredients, Inc., Union City, TN

Darling Ingredients, Inc. Wadesboro, NC

Darling Ingredients Canada, Dundas, Ontario, Canada

Darling Ingredients, Inc., Berlin, WI

Darling Ingredients, Inc., Butler, KY

Darling Ingredients, Inc., Wahoo, NE

Darling Ingredients, Inc., Wahoo, NE

Darling Ingredients Canada, Hickson, Ontario, Canada

Darling Ingredients, Inc., Watts, OK

Darling Ingredients Canada, Dundas, Ontario, Canada

Darling Ingredients, Inc., Clinton, IA

Darling Ingredients, Inc., Coldwater, MI

Darling Ingredients, Inc., Wichita, KS

Darling Ingredients Canada, Moorefield, Ontario, Canada

Darling Ingredients, Inc., Winchester, VA

Darling Ingredients Canada, Hickson, Ontario, Canada

Darling Ingredients, Inc., Collinsville, OK

Darling Ingredients, Inc., Winesburg, OH

Darling Ingredients Canada, Winnipeg, Manitoba, Canada

Darling Ingredients, Inc., Crows Landing, CA

Farmers Union Industries, LLC

Darling Ingredients Canada, Moorefield, Ontario, Canada

Darling Ingredients, Inc., Dallas, TX

Farmer Union Industries, LLC (Central-Bi-Products), Estherville, IA

Darling Ingredients, Inc., Denver, CO

Darling Ingredients, Inc., Amarillo, TX

Darling Ingredients Canada, Winnipeg, Manitoba, Canada

Darling Ingredients, Inc., Des Moines, IA

Farmer Union Industries, LLC (Central-Bi-Products), Long Prairie, MN

Farmer Union Industries, LLC (Central-Bi-Products), Redwood Falls, MN

Darling Ingredients, Inc., Bastrop, TX

Darling Ingredients, Inc , East Earl, PA

Darling Ingredients, Inc., Amarillo, TX

Darling Ingredients, Inc., Ellenwood, GA

Fieldale Farms Corp.

Fieldale Farms Corp., Cornelia, GA

Darling Ingredients, Inc., Bellevue, NE

Darling Ingredients, Inc., East Dublin, GA

Darling Ingredients, Inc., Bastrop, TX

Darling Ingredients, Inc. Fayetteville, NC.

Darling Ingredients, Inc., Berlin, WI

Darling Ingredients, Inc. Pet Food Div., Fayetteville, NC

Darling Ingredients, Inc., Bellevue, NE

Darling Ingredients, Inc., Fresno, CA

Darling Ingredients, Inc., Butler, KY

Darling Ingredients, Inc., Fremont, NE

Darling Ingredients, Inc., Berlin, WI

Darling Ingredients, Inc., Grapeland, TX

Fieldale Farms Corp., Eastanollee, GA

Foster Farms

Foster Farms, Farmerville, LA

Foster Farms, Livingston, CA

FPL Foods, LLC, Agusta, GA

G.A. Wintzer & Son Co., Wapakoneta, OH

Darling Ingredients, Inc., Clinton, IA

Darling Ingredients, Inc., Hamilton, MI

Darling Ingredients, Inc., Butler, KY

Darling Ingredients, Inc., Los Angeles, CA

Darling Ingredients, Inc., Lynn Center, IL

Darling Ingredients, Inc., Mason City, IL

Darling Ingredients, Inc., Muscatine, IA

Darling Ingredients, Inc., National Stock Yards, IL

Darling Ingredients, Inc., Newark, NJ

Darling Ingredients, Inc., Newberry, IN

Darling Ingredients, Inc., Omaha, NE (blending 33rd Street))

Darling Ingredients, Inc., Pocohontas, AR

Darling Ingredients, Inc., Ravenna, NE

Darling Ingredients, Inc. Rose Hill, NC

Darling Ingredients, Inc., Russellville, KY

Darling Ingredients, Inc. San Angelo, TX, Veribest Div.

Darling Ingredients, Inc., San Francisco, CA

Darling Ingredients, Inc., Sioux City, IA

Darling Ingredients, Inc., Starke, FL

Darling Ingredients, Inc. Strawberry Plains, TN

Darling Ingredients, Inc. Tama, IA

Darling Ingredients, Inc., Tampa, FL

Darling Ingredients, Inc., Union City, TN

Darling Ingredients, Inc. Wadesboro, NC

Darling Ingredients, Inc., Wahoo, NE

Darling Ingredients, Inc., Wahoo, NE

Darling Ingredients, Inc., Watts, OK

Darling Ingredients, Inc., Wichita, KS

Darling Ingredients, Inc., Winchester, VA

Darling Ingredients, Inc., Winesburg, OH

Farmers Union Industries, LLC

JBS Swift & Company, Marshalltown, IA

JBS Swift & Company, Omaha, NE

JBS Swift & Company, Tolleson, AZ

JBS Swift & Company, Worthington, MN

John Kuhni Sons, Inc., Levan, UT

Keystone Protein Co, Fredericksburg, PA

Maple Lodge Farms, Brampton, Ontario, Canada

Mason City By-Products, Mason City, IA

Mendota Agri Products, Mendota, IL

Mid-South Milling Co., Inc.

Mid South Milling, Ft. Smith, AR

Mid South Milling, Kansas City, KS

Mid South Milling, Memphis, TN

Mountaire Farms of Delaware, Inc., Millsboro, DE

National Beef Packing Co., LLC, Dodge City, KS

New Angus Beef dba Demkota, Aberdeen, SD ***

NF Protein LLC Sioux City, IA

Nutri Feeds, Inc., Hereford, TX

Nutrimax Inc., Laurinburg, NC

Pilgrim’s Pride Corp.

Pilgrim’s Pride Corp., Edinburg, VA (was Mountain View Rendering)

Pilgrim’s Pride Corp., Mt. Pleasant, TX

Pilgrim’s Pride Corp., Moorefield, WV

P.O. Box 132, 1143 C.R. 1123 Huntsville, MO 65259

Telephone: 660-277-3469 FAX: 660-277-3466 www.animalprotein.org

Farmer Union Industries, LLC (Central-Bi-Products), Estherville, IA

Farmer Union Industries, LLC (Central-Bi-Products), Long Prairie, MN

Farmer Union Industries, LLC (Central-Bi-Products), Redwood Falls, MN

Fieldale Farms Corp.

Pilgrim’s Pride Corp., Sumter, SC

Pilgrim’s Pride Corp., Timberville, VA

Protein Products, Sunflower, MS

Sacramento Rendering Co., Sacramento, CA

Sanimax

Sanimax, Charney, Quebec, Canada

Sanimax, Green Bay, WI

Fieldale Farms Corp., Cornelia, GA

Fieldale Farms Corp., Eastanollee, GA

Foster Farms

Foster Farms, Farmerville, LA

Foster Farms, Livingston, CA

FPL Foods, LLC, Agusta, GA

G.A. Wintzer & Son Co., Wapakoneta, OH

Sanimax, Hoschton, GA

Sanimax, Montreal, Quebec, Canada

Sanimax, So. St. Paul, MN

S.F. Rendering LTD, Centreville, N.S., Canada

Rendering plants that have completed the required testing for the 2023 APPI TESTING PROGRAM

Hahn & Phillips Grease, Marshall, MO

Harris Ranch Beef Co., Selma, CA

Simmons Feed Ingredients, Southwest City, MO

Smithfield Foods, Inc.

Smithfield, Clinton, NC

Smithfield, Crete, NE

Smithfield, Denison, IA

Smithfield, Kansas City Sausage Co., dba Pine Ridge Farms, Des Moines, IA

AB Foods LLC, Toppenish, WA

Hormel Food Corp., Austin, MN

Indiana Packers Corp., Delphi, IN

Smithfield, Milan, MO

Smithfield, Monmouth, IL

Integrated Proteins, Kansas City, KS

Agpack LLC, Sanford, NC

Smithfield, Sioux Falls, SD

American Proteins, Inc.

Island Commodities, Inc., Kapolei, HI

JBS

JBS Foods Canada, Brooks, AB, Canada

American Proteins, Inc., Alma, GA

Smithfield, Smithfield, VA

Smithfield, Tar Heel, NC

Smithfield, Vernon, CA

JBS Souderton, Inc., D/B/A MOPAC, Elroy, PA

American Proteins, Inc., Cumming, GA

JBS Souderton, Inc., D/B/A MOPAC, Elizabethville Blending, PA

JBS Swift & Company, Beardstown, IL

American Proteins, Inc., Cuthbert, GA

JBS Swift & Company, Cactus, TX

JBS Swift & Company, Grand Island, NE

Standard Fertilizer, Greenburg, IN

Tyson Foods

Tyson Foods - N. Alabama Blending Mill, Cullman, AL

American Proteins, Inc., Plant B, Hanceville, AL

Ampro Products, Inc.

JBS Swift & Company, Greeley, CO

JBS Swift & Company, Green Bay, WI

JBS Swift & Company, Hyrum, UT

Ampro Products, Inc., Dawsonville, GA

JBS Swift & Company, Marshalltown, IA

JBS Swift & Company, Omaha, NE

Ampro Products, Inc., Pickensville, AL

JBS Swift & Company, Tolleson, AZ

Baker Commodities, Inc.

JBS Swift & Company, Worthington, MN

John Kuhni Sons, Inc., Levan, UT

Baker Commodities, Inc., North Billerica, MA

Keystone Protein Co, Fredericksburg, PA

Baker Commodities, Inc., Phoenix, AZ

Maple Lodge Farms, Brampton, Ontario, Canada

Mason City By-Products, Mason City, IA

BHT Resources, Bessemer, AL

Mendota Agri Products, Mendota, IL

Boyer Valley Co, Arion, IA

Mid-South Milling Co., Inc.

Mid South Milling, Ft. Smith, AR

Cargill Meat Solutions

Mid South Milling, Kansas City, KS

Mid South Milling, Memphis, TN

Cargill Meat Solutions, Dodge City, KS

Mountaire Farms of Delaware, Inc., Millsboro, DE

Cargill Meat Solutions, Friona, TX

National Beef Packing Co., LLC, Dodge City, KS

New Angus Beef dba Demkota, Aberdeen, SD ***

Cargill Meat Solutions, Ft. Morgan, CO

NF Protein LLC Sioux City, IA

Nutri Feeds, Inc., Hereford, TX

Nutrimax Inc., Laurinburg, NC

Cargill Meat Solutions, Schuyler, NE

Pilgrim’s Pride Corp.

Cargill Meat Solutions, Wyalusing, PA

Pilgrim’s Pride Corp., Edinburg, VA (was Mountain View Rendering)

Tyson Foods - Pine Bluff Blending, Pine Bluff, AR

Tyson Foods - River Valley Animal Foods, Forest, MS

Tyson Foods - River Valley Animal Foods, Harmony, NC

Tyson Foods - River Valley Animal Foods, Scranton, AR

Tyson Foods - River Valley Animal Foods, Sedalia, MO

Tyson Foods - River Valley Animal Foods, Texarkana, AR

Tyson Fresh Meats

Tyson Fresh Meats, Amarillo, TX

Tyson Fresh Meats, Columbus Junction, IA

Tyson Fresh Meats, Dakota City, NE

Tyson Fresh Meats, Hillsdale, IL

Tyson Fresh Meats, Holcomb, KS

Tyson Fresh Meats, Lexington, NE

Tyson Fresh Meats, Logansport, IN

Tyson Fresh Meats, Madison, NE

Tyson Fresh Meats, Perry, IA

Tyson Fresh Meats, Storm Lake, IA

Tyson Fresh Meats, Wallula, WA

Tyson Fresh Meats, Waterloo, IA

West Coast Reduction LTD

West Coast Reduction, Calgary, AB, Canada

West Coast Reduction, Edmonton, AB, Canada

Cargill Meat Solutions, Highriver, Alberta, Canada

West Coast Reduction, Vancouver, BC, Canada

Caviness Beef Packers, Hereford, TX

Pilgrim’s Pride Corp., Mt. Pleasant, TX

Pilgrim’s Pride Corp., Moorefield, WV

Central Valley Meat Company, Hanford, CA ***

Pilgrim’s Pride Corp., Sumter, SC

Clemens Food Group

Pilgrim’s Pride Corp., Timberville, VA

Protein Products, Sunflower, MS

Sacramento Rendering Co., Sacramento, CA

Clemens Food Group, Coldwater, MI

Sanimax

Clemens Food Group, Hatfield, PA

Sanimax, Charney, Quebec, Canada

*** denotes new plants 3

Coastal Protein, Godwin, NC

Sanimax, Green Bay, WI

Sanimax, Hoschton, GA

CS Beef Packer, Kuna, ID

Sanimax, Montreal, Quebec, Canada

Sanimax, So. St. Paul, MN

DaPro, LLC, Huron, SD

S.F. Rendering LTD, Centreville, N.S., Canada

Simmons Feed Ingredients, Southwest City, MO

Darling Ingredients, Inc.

Smithfield Foods, Inc.

Darling Ingredients Canada, Dundas, Ontario, Canada

Smithfield, Clinton, NC

Smithfield, Crete, NE

Darling Ingredients Canada, Hickson, Ontario, Canada

Smithfield, Denison, IA

Darling Ingredients Canada, Moorefield, Ontario, Canada

Welcome to Render magazine’s newest editorial highlight that aims to showcase the variety of career opportunities in the rendering industry.

In Faces of Rendering, each month we’ll be highlighting the various roles of North American Renderers Association member companies’ employees, what they do and what they like about their jobs in the rendering business. This first edition spotlights more people than the following months will because the kickoff attracted tremendous participation, which is greatly appreciated.

If you or a valued employee want to be in future issues of Faces of Rendering, send us the candidate’s information (name, age, title/role, company, location and a testimonial) as well as a high-resolution photo and look for it in upcoming issues of Render. Join us in telling more of rendering’s story as seen through the eyes of the people who do the work day in and day out — and love what they do!

Name: Doug Blackmon

Age: 49

Title/Role: Class A Driver

Company: BHT ReSources

Location: Loxley, Alabama

“I have been a mechanic, overthe-road truck driver, milkman, breadman and dump truck driver. But the rendering business is unique in the sense we render used cooking oil and meat scraps from grocery stores, and these items are used to help make animal feed and makeup. By doing this it helps keep some items out of landfills and repurposes them into something useful. BHT is a great company to work for and I have learned a lot. There’s still more to learn!”

Name: Andy Black

Age: 59

Title/Role: General Manager

Company: Reno Rendering Company

Location: Reno, Nevada

“As the GM, I manage all dayto-day operations of our business. I absolutely love everything about the rendering business. Recycling, sustainability and the essential nature of our business. What’s not to love!”

Name: Frank Fox

Age: 61

Title/Role: Complex Manager

Company: Tyson Foods

Location: Scranton, Arkansas

“I have worked for Tyson Foods going on 37 years in November. I worked for Simmons for two years prior to that. I am a complex manager over four rendering plants for Tyson Foods: RVI Sedalia, Missouri; RVI Scranton, Arkansas; RVI Texarkana, Arkansas; and RVI Clarksville Arkansas. I started at Scranton in 1987 working third shift as clean up. I worked there nine years before going to Clarksville as manager for 22 years and I’ve been in my current position for close to six years.

“I am a second-generation renderer — my dad worked at Simmons when I was a child and then I went to work for them. Rendering is in my blood. I love this industry!

Rendering brings a different challenge each and every day,

if not multiple times a day. It has been so rewarding knowing we are the top recycler there is. We take what is thought of as waste and make it into a usable, renewable finished product. The changes over the years have been dramatic, challenging and exciting. I believe we have exceeded expectations in protecting our environment and am excited to see what every day brings.”

Name: Jennifer Asbill

Age: 52

Title/Role: Senior Customer Service and Logistics Export Specialist, Ingredient Solutions Group

Company: Tyson Foods

Location: Springdale, Arkansas

“As a senior customer service and logistics export specialist at Tyson Foods Ingredient Solutions, my role involves facilitating the seamless movement of products across borders, ensuring compliance with international trade regulations and optimizing logistics. My responsibilities include strengthening relationships with external customers, managing export orders for international accounts, and ensuring compliance with regulations and product standards, optimizing supply chain efficiencies by identifying opportunities for cost-effective solutions and negotiating pricing for distressed products.

“I enjoy my role as an export specialist in ingredient solutions and the opportunity it provides to continuously learn and adapt in a rapidly evolving global marketplace. The environment keeps me engaged and motivated, allowing me to expand my skill set, broaden my knowledge base, and grow both personally and professionally — to not only drive business growth but also foster relationships with clients worldwide, enabling them to access top-quality ingredients for their products.”

Name: Jonathan Bryars

Age: 33

Title/Role: Grease Trap Driver

Company: BHT ReSources

Location: Loxley, Alabama

“My job consists of maintaining and cleaning out grease traps at restaurants. I pump them out and deposit the contents at the desired disposal sites. I love my job, not only because it’s an amazing company to work for, but we are family here.”

to keep our plant up and running. I enjoy working with my coworkers, helping our team members and dealing with customers on a day-to-day basis.”

Name: Mike Ankrom

Age: 65

Title/Role: Used Cooking Oil

Driver

Company: BHT ReSources

Location: Loxley, Alabama

“I am a used cooking oil recovery specialist. The division I work in has two of the best bosses I have ever had the pleasure of working for. I drive around all night picking up used cooking oil, and it is one of the easiest jobs I have ever had. It is easy work and the company, BHT, is a great place to work. I enjoy coming into work.”

Name: Geoffrey Shields

Age: 34

Title/Role: Regional Sales Manager

Company: Reno Rendering Company

Location: Reno, Nevada

“In my role, I get to wear many hats. I am in the field signing accounts for used cooking oil collection, grease trap services, dead stock pickup, and fat and bone pickup. Along with that, I do all account management within all divisions including collections, price increase, routing, equipment repairs and more. My favorite part of my job is getting out and helping our customers and getting to know them on a personal level — I love our customers! I also am a huge outdoor fan and an avid mountain biker with my kids. We love spending time in the mountains and lakes of northern Nevada and northern California. Rendering is recycling — anything I can do to help save the environment is a win for me, so being involved in the rendering/recycling world is a passion of mine!”

Name: Lakeasha Sharpe

Age: 44

Title/Role: Material Specialist

Manager

Company: RVI-Forest

Location: Forest, Mississippi

“As the material specialist, my responsibilities are ensuring that we have everything needed

Name: Dr. Macc Rigdon

Age: 34

Title/Role: Senior Manager of Research and Development

Company: Tyson Foods/River Valley Ingredients

Location: Springdale, Arkansas

“My role in the rendering industry is process improvement and innovation. Moving the industry forward is what motivates me to continue with recruitment, innovation and byproduct value up.”

Continued on page 24

Name: Kindall Shine

Age: 45

Title/Role: Used Cooking Oil

Driver

Company: BHT ReSources

Location: Montgomery, Alabama

“I love working for BHT because the company cares about employees and their wellbeing on and off the job. Also, this company makes the job as comfortable as possible to ensure a high level of performance by their drivers. Finally, the staff here is understanding and cooperative when it comes to staff-employee relationships.”

Name: Jorge Perez Cebreros

Age:

Title/Role: General Manager

Rendering

Company: Tyson Foods

Location: Holcomb, Kansas

“I started working in construction building swimming pools in Phoenix, Arizona. After moving to Guymon, Oklahoma, in 2014, I started working for

Seaboard Foods — a pork plant. As a mechanic in rendering, I learned how to weld, wire up motors and everything that has to do with mechanical and electrical equipment. Then I moved to harvest and became a maintenance supervisor. After learning the pork side, I wanted to learn the beef side, so in 2019 I joined Tyson Foods, starting as a maintenance supervisor in harvest in Joslin, Illinois. I decided to go back to rendering but wanted to learn the production side of it so I moved to Garden City, Kansas, to become a production supervisor in rendering. I promised my wife, Betty, that one day I would become a superintendent. From learning equipment to product specs and quality and speaking with vendors, contractors, corporate, sales, scheduling, ordering, chemicals, trucking, shipping, railroad and inventory, to name a few, I think I have learned a lot — more than I could have ever imagined.

“I believe if we don’t invest in our people, we are failing. If we invest in people, we gain but we have to invest the right way. If everyone knows what they are doing, I believe we run well and make better a product all the way around. We need to empower employees to be creative and take ownership of their jobs, coach and educate them as much as possible to deliver results. I’m proud of what I do and I will give 110% as long as I can. I’m a firm, good manager and my goal is to drive employees to success, teach, coach and hold them accountable when we need to. I want to be able to say one day you can take my job. I want to build a good team, where everyone wants to work, not because they have to work. One day, I want to work in harvest and learn the harvest production side, yields and everything…. After 10 years of working in a packing house, I would like to be a harvest superintendent one day.” R