•

•

•

•

•

•

•

•

•

•

Big I State & National Technology Resources

Harnessing the Power of Your Agency’s Data

AI Predictions

Executive Committee

Chairman of the Board - Allyson Padilla allyson@blanksinsurance.com

President - Patrick Taphorn, CIC, CSRM ptaphorn@unland.com

President-Elect - Thomas Evans, Jr. tom.evans@assuredpartners.com

Vice President - Chris Leming cleming@troxellins.com

Secretary/Treasurer - Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

IIABA National Director - George Daly george.daly@thehortongroup.com

Mohammed Ali - mali@aliminsurance.com

Charles Hruska, IV - chas@hruskains.com

David Jenk, Esq. - djenk@nwibrokers.com

Rebecca Kohn - rkohn@worthyinsurance.com

Lindsey Polzin - lpolzin@presidiogrp.com

Ray Roentz - ray.roentz@hwcrins.com

Noele Tatlock - ntatlock@unland.com

Luis Tayahua - lt@goldenowlinsurance.com

Sharon Waldvogel - sharon@infinitybrokersinc.com

Andrea Wallace - andrea@aadins.com

Amiri Curry - acurry@assuranceagency.com

Kevin Lesch - klesch09@gmail.com

Jeff McMillan - jeff@mcmillanins.com

James Sager - james@sagerins.com

Luke Sandrock, CIC - lsandrock@2cornerstone.com

Budget & Finance | Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

Education | Lisa Lukens salibainsurance@gmail.com

Farm Agents Council | Steve Foster s.foster@ciagonline.com

Government Relations | Dustin Peterson dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC ngunn@envisionins.com

Technology | Brian Ogden brian@ogdeninsurance.com

Young Agents | Cody Imming cody@imminginsurance.com

Follow us on socials.

Member Support

Director of Information and Technology

Director of Education and Agency Resources

Accounting & Admin Services

Director of Human Resources, Board Admin

Sr. Vice President/Chief Financial Officer

Chief Executive

Director

Director

Office

Rebecca Buchanan (217) 321-3010 - rbuchanan@ilbigi.org

Shannon Churchill (217) 321-3004 - schurchill@ilbigi.org

Brett Gerger, CIC (217) 321-3006 - bgerger@ilbigi.org

Tami Hubbell, CIC (217) 321-3016 - thubbell@ilbigi.org

Jennifer Jacobs, SHRM-CP (217) 321-3013 - jjacobs@ilbigi.org

Mark Kuchar (217) 321-3015 - mkuchar@ilbigi.org

Phil Lackman, IOM (217) 321-3005 - plackman@ilbigi.org

Lori Mahorney, CISR Elite (217) 415-7550 - lmahorney@ilbigi.org

Evan Manning (217) 321-3002 - emanning@ilbigi.org

Kristi Osmond, CISR Elite (217) 321-3007 - kosmond@ilbigi.org

Rachel Romines (217) 321-3024 - rromines@ilbigi.org

Tom Ross, CRIS, CPIA (217) 321-3003 - tross@ilbigi.org

Carol Wilson, CPIA (217) 321-3011 - cwilson@ilbigi.org

Tech Talk with Brett. If I am giving a tech talk, something has gone significantly wrong. You had to be curious about what technology had to do with wildfires. This issue has enough information regarding technology, so I’ll leave that all to the “experts!”

Let’s talk about coverages around the country and how we can see them as a cautionary tale. There are enough indicators around the country as to what could possibly happen in our midwestern markets. We just have to pay attention to our surroundings.

For example, we only need to look at our coastal states to see how insurers react to heavy wind, hail, and flood losses. Coastal states have those hurricane things that arise every summer and fall and produce large-scale losses. How are insurers insuring structures in those areas? Many will not insure for wind and hail, or they require increased building standards along with actual cash value or schedules for roof coverage along with an increased wind hail deductible. Additionally, flood coverage, while available, is extremely prohibitively expensive. So most do not purchase flood due to cost. Helene and Milton produced an extreme amount of flooding last year which did not have insurance coverage. If you were one of those property owners, you needed to pray for the storm to blow your roof off to get some coverage (not funny but true).

So, how does this translate to Illinois? Well, in 2023, we took over the number one spot for tornadoes. Why are we always number one in the wrong things? So, what changes to property insurance did we see? How many of you saw new wind/hail deductibles anywhere from 1-2% of schedule “A”? How many saw your roof go to ACV or a declining schedule if your roof was a certain age? No more hail dances for that new insurance roof.

If losses keep going this way, what could we look forward to in the near future? Require stronger building standards so that when you build or rebuild, you must meet the more stringent building standards? Maybe. Less regional carrier coverage in high-loss areas? Could be a possibility. Many companies went to moratoriums in previous years, but we are now seeing them come out of those moratoriums with stricter underwriting guidelines as well as current carriers requiring much more rehabilitation to prevent cancellation. For example, they give your client 60 days to replace their roof, or they will be cancelled.

Now let us look at the California wildfires. I know what you are saying, Brett, we do not have wildfires. My response is that we do not have rate regulation either and that is where this cautionary tale lies. Illinois is a file-and-use state for insurance policies with copious competition keeping premiums at an appropriate level as the market dictates the cost through competition. Companies must charge the lowest premium they can to obtain market share. (It is the free market.) It works quite well. For example, Illinois is the 5th largest market in auto insurance but 25th in cost of auto insurance. There is no better example of the free market.

California must approve insurer rates for homes, and many times, they tell the insurers that they must charge less. This puts companies in a pickle, so to speak, as they must charge a rate that is not actuarially sound for the risk they are going to insure. Additionally, the California Department

of Insurance can dictate non-renewal and cancellation provisions. What does this do to companies? Well, they are forced to make up the premium in other states where they provide insurance, which could make them less competitive when free market forces are in play. It also makes it nearly impossible for a regional company to compete as a historical loss like we are seeing in L.A. could bankrupt them. Additionally, California has stated that they cannot non-renew or cancel these policies for the next year. So, what happened? One of the biggest companies for home insurance pulled out of the California market. Why, you ask? I can only speculate that it is because they do not want to insure California homes on the backs of consumers that they write in other states and they do not want to be on the hook for their share of the California FAIR Plan coverages.

What is the FAIR Plan? It is a market of last resort for property insurance. For example, Illinois represents 1-5% of the home market. Every home writer in Illinois takes on the percentage of their market share when the losses come due in the FAIR Plan. As we all know, insurers do not like paying claims, but they especially do not like paying claims for which they did not collect a premium. California’s conundrum is that their FAIR Plan in the wildfire areas is over 20% uptake. The preliminary estimates had the California FAIR Plan losses at over six billion dollars, which if you were a company with 28% market share, you now have 28% of six billion. It’s no wonder why that large company pulled out of the home insurance market in California. This is why we as an Association have fought rate regulation through the years to preserve our open competitive market in which appropriate pricing exists, and our FAIR Plan uptake is a minimal part of our market.

Do not blame the company. Rate regulation and failure to mitigate played their part and should have prepared for these losses properly. It is devastating for all the families involved with everything they are losing, let alone the loss of life. Keep in mind that when devastation like this occurs, the blame game runs rampant, and everyone is looking for someone or some entity to hold responsibility. During these times, it does no good to throw blame around but instead to try to mitigate the effects of disasters before they happen. Once they occur, it is too late. In Illinois, we should stay away from rate regulation and make sure our insureds are doing their part with higher deductibles and building their houses with increased standards to mitigate company exposure and losses.

As always, this is just Brett’s 2 Sense and I hope it was helpful. You can contact me through my CONNECT and if it is urgent, do not hesitate to reach me through CONNECT. I may be pushing you to CONNECT. If you need any clarification or have any suggestions for future articles please email me at bgerger@ilbigi.org.

Big I Illinois Technology Committee

The committee, made up of Big I Illinois member agents, is working on some big initiatives this year, but we can’t do it without the help of members. If you have a passion for creating efficiencies for your agency and would be willing to spend an hour a month virtually discussing ways to use technology to help agencies, please email me about joining the committee. A few of our goals for 2025 include:

Big I Illinois is committed to keeping independent insurance agencies including technology. You need to run a business, manage employees, sand and your books out of the red. You don’t have time to keep even want to. That is where your state and national associations technology can help your agency stay relevant.

By Shannon Churchill

1. Phishing Simulation Program – We know phishing is one of the easiest ways for a “bad actor” to access your system. We are concerned that some agencies may not have the resources they need to keep their agency safe. We have created a resource to help train you and your staff. See more details below.

2. Artificial Intelligence – It’s time to embrace it! The Technology Committee is here to support you by providing valuable resources, including policies to implement in your agency, website protection language, and insights into how other agencies are leveraging AI. We’re on this journey together, so let’s explore how AI can empower you and your team.

3. Cyber – The committee is working on various resources to help agencies become better protected when it comes to cyber, and knowledgeable in educating your clients about cyber risks. Is your agency prepared in case of a cyber breach? Do you have cyber insurance for your agency? The Big I Illinois team can assist you in not only making sure your agency is properly covered, but we also have a policy you can sell to your clients. Find out more at https://tinyurl. com/Big-I-Cyber

4. InsurTech Companies in Illinois – We are committed to creating connections between our members and the InsurTech companies that could benefit independent agencies. Learn more about our new partnership with 101 Weston Labs on the next page.

One of the Big I Illinois Technology Committee’s 2024 goals was to create a variety of technology-focused resources for our members. These resources are available in the Big I Illinois Solution Center and cover topics such as tech articles, Artificial Intelligence (AI) tools and kits, data security, cybersecurity, disaster planning, accessibility, and more. This collection is continually growing and evolving, so we encourage you to check back often! Go to ilbigi.org/resources/solution-center/ technology for details.

5. In-Person Networking events with a Tech Focus – The committee is working with other committees in the Big I structure to offer several events this year that will either fully or partially have a technology focus. These events include the Sales & Leadership Conference (AprilPeoria), Technology Conference (June-Oak Brook), Metro-East/Southern IL Roundtables (TBD), and CONVO (October-Peoria). Watch the Big I Illinois website & future publications for more details.

6. Answering Questions from Members – The Technology Committee is committed to answering questions or brainstorming ideas with you and technology for your agency. We want to hear from you about your challenges, or ideas.

Reach out to the Committee through CONNECT or the website. We’re here to support you - don’t hesitate to let us help!

Shannon Churchill is the Director of Information & Technology for Big I Illinois. She can be reached at schurchill@ilbigi.org.

Want more info on anything your’re reading here? Interested in joining the Big I Illinois Technology Committee?

Big I Illinois has partnered with RLS Consulting to create a phishing simulation and email training program. This initiative is designed to improve awareness and understanding of phishing email campaigns, helping member agencies enhance their security. As part of the program, staff will receive monthly interactive emails to safely test their phishing awareness and provide valuable education on recognizing and avoiding phishing emails. If your agency doesn’t have a phishing program in place, I highly recommend establishing one. Ours is costeffective and a great place to start. If you already have a phishing program, this would be a good supplement to safely test if your current training is working. More details on the importance of protecting against phishing emails can be found in this issue. To learn more about why you need this program and purchase, visit ilbigi.org/phishing.

agencies informed on everything impacting our industry, employees, sell to clients and keep your head out of the keep up with the technology trends, or maybe you don’t associations come in. We are here to help you think about how

Have you CONNECTed on CONNECT, the member agents-only community where you can ask questions from peers and Big I staff? Technology is one of the items often discussed, from brainstorming with AI to website builders to a variety of other efficiency questions. You can also hear from leaders about legislative issues and their impact on our industry, resources from Trusted Choice, and many sources of information on the Hard Market.

Big I Illinois has joined the Collective of 101 Weston Labs, an InsurTech accelerator focused on innovations for independent insurance agents. The Collective is a group supporting forward-thinking entrepreneurs in their effort to build scalable InsurTech startups.

The program has 14 companies between its original 2023 alumni and its current 2024 participants, all providing innovative solutions in the industry. View the current list of participants at www.101westonlabs.com/our-companies. The accelerator is on a “rolling” admissions model and is now accepting applications for 2025 participants. Since Big I Illinois is a member of the Collective, our members have access to these companies. If you are interested in beta testing or finding out more, reach out to Shannon Churchill on the Big I Illinois team at schurchill@ilbigi.org. View the full press release at ilbigi.org.

Big I Illinois members have access to Big I National resources including, Agents Council for Technology (ACT). ACT is currently going through a strategic structure update and is creating foundational pillars to move forward in supporting independent agents in technology. The pillars include data, connectivity, AI, and people/culture. ACT has published two letters to the industry in regard to their pillars. ACT is currently seeking volunteers to support their industry workgroups on these pillars. To determine if participating in the workgroups is right for you, check out their participation guide at independentagent. com/ACT, which outlines the expectations and responsibilities involved. As these groups begin to work more on the four pillars of ACT, there are still lots of great resources available now, including the Agency Cyber Guide, Customer Experience Lifecycle, and Disaster Planning Guide. ACT also hosts various technology-related webinars throughout the year, free to Big I Illinois members. Watch the e-Weekly newsletter for upcoming dates.

Not technically a “technology resource,” but still an incredible resource for your agency is the Big I Illinois partnership with IA Valuations. IA Valuations will help your agency dive into numbers unbiasedly and work with you to develop strategies to help you meet your agency’s goals. Everyone thinks of an agency valuation when they are getting ready for a change in ownership, however, they are more than that.

Visit ilbigi.org/valuations to find out how IA Valuations can help you meet your goals and help your agency become more profitable. You’ll also find quarterly webinars hosted by the IA Valuations teams that are no cost.

Big I Illinois members receive access to Catalyit, a resource developed in collaboration with Big I Illinois states. Catalyit, with free basic access for members, provides tools to help you assess your current tech stack and identify resources available in several guides, reviews, and more. They also offer a variety of webinars. Check out all your free basic access includes. Find out more at catalyit.com/ilbigi.

The Big I Illinois Technology Committee wants to hear from you on EVERYTHING related to technology. Use the form at ilbigi.org/resources/technologyresources to submit.

Join us for a free roundtable discussion on Tuesday, March 18 where we’ll chat about AI. Register at ilbigi.org/events.

By Ryan Smith

If I wanted to hack your business, I’d start with phishing your employees. The odds would be in my favor because it is one of the easiest and most effective ways to attack someone. And I only need to be right once – while your users can’t afford a single mistake.

I don’t plan to attack you, and I hope you never fall victim to an attack. So, in that spirit, let’s help you level up your defenses in this short series and teach you what you didn’t know you needed to know about phishing emails and similar types of cyber-attacks that are designed to trick your users.

Chances are you’re already familiar with the term “phishing” and have probably seen plenty of training on email red flags, to “think before you click”, and understand the risk opening random files on suspicious emails.

We won’t get deeply technical, but across these three articles, we will dive deep into why it’s still a major concern today, how phishing attacks work, and how to protect yourself.

Despite how aware people are of this type of attack, it’s still a large problem – and one that is a growing concern especially with the advancements of Large Language Models (LLMs) and Artificial Intelligence (AI).

If you’re worried about attacks like ransomware, business email compromises, or data breaches, it’s important to know that many attacks may start with something as simple as a phishing email.

Email security tools can help but a lot of your ability to protect your business from phishing attacks depends on the user recognizing an email (or other interaction) as suspicious in the first place.

Let’s take a fresh look at what this is and what it means for your business.

Don’t Take the Bait

Social Engineering is a deceptive tactic used by threat actors to trick a victim into things like sharing sensitive information, capturing login credentials, and opening a malicious link or file. All of this is usually done by impersonating another person or another trusted resource. At times, it may even come directly from someone else you trust that has suffered a compromise of their own.

Phishing is a specific type of Social Engineering attack that leverages email and is most common, but the same tactics can be used over SMS texts (“smishing”), phone calls (“vishing”), QR codes (“quishing”), instant messaging services, and social media.

It can become a real problem because:

• Businesses need to allow outside communications. We can’t fully cut ourselves off from the rest of the world if we want the ability to communicate with clients, partners, and others.

• AI is making it harder for users to identify Social Engineering attacks. These great new tools can give threat actors ways to write more compelling messages with greater efficiency.

• Social Engineering and phishing are often the initial attack vector. When these attacks are successful, they can lead to data breaches, ransomware or other compromises (including Business Email Compromises).

• Business Email Compromises (BECs) can be particularly troublesome. If your email were to become compromised (perhaps because of a phishing attack), it could be used to launch additional phishing attacks in your name to people that trust you and harm your reputation. (A lot more can happen during a BEC, but we’ll have to dig into that in a future article!)

• Attackers go after the weakest links in our environment: our people! They play on human emotions, confusion, urgency, and other distractions that may cause even the most diligent of your staff to act irregularly.

• Users may not realize they have interacted with a phishing email or social engineering attack. The threat actor wants to stay hidden, so they do their best to try to trick the user, hoping they never realize what happened and that it goes un-reported.

• Training can only go so far. Training goes out the window if the user never realized the email they were working with was suspicious in the first place – it’s easier said than done!

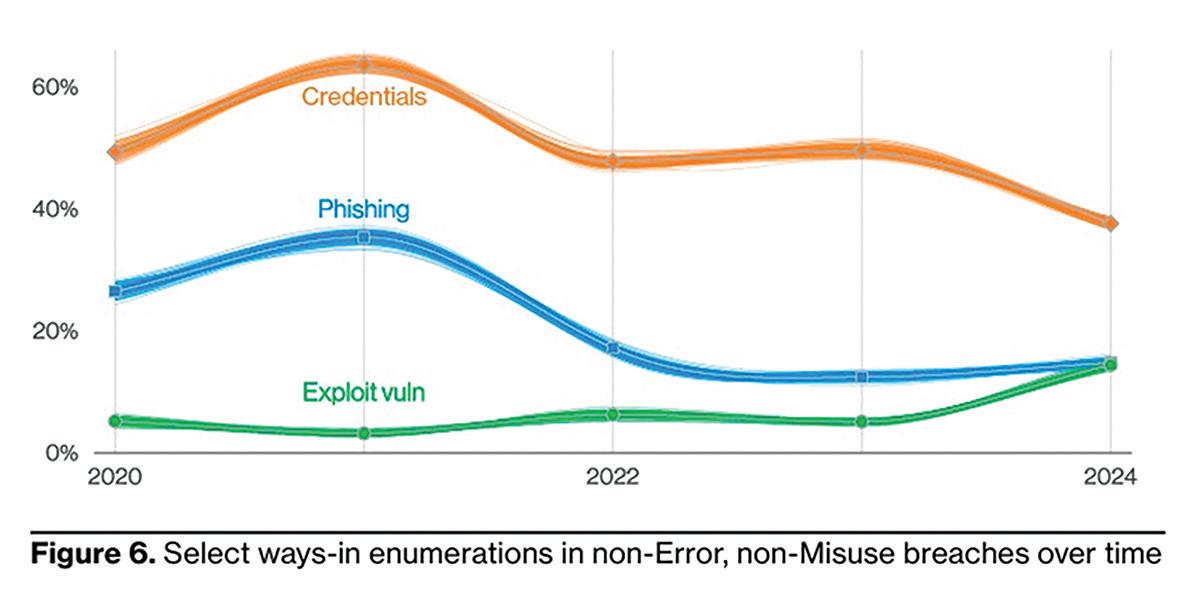

Phishing remains one of the top 3 initial attack vectors according to Verizon’s 2024 Data Breach Investigations Report:

Source: Verizon 2024 DBIR

Phishing is second to “Credentials”, which can end up in the hands of threat actors and the dark web from phishing attacks as well as other data breaches, using the same password repeatedly, connecting to unsafe networks, malware, looking at the password list under your keyboard, the list goes on…

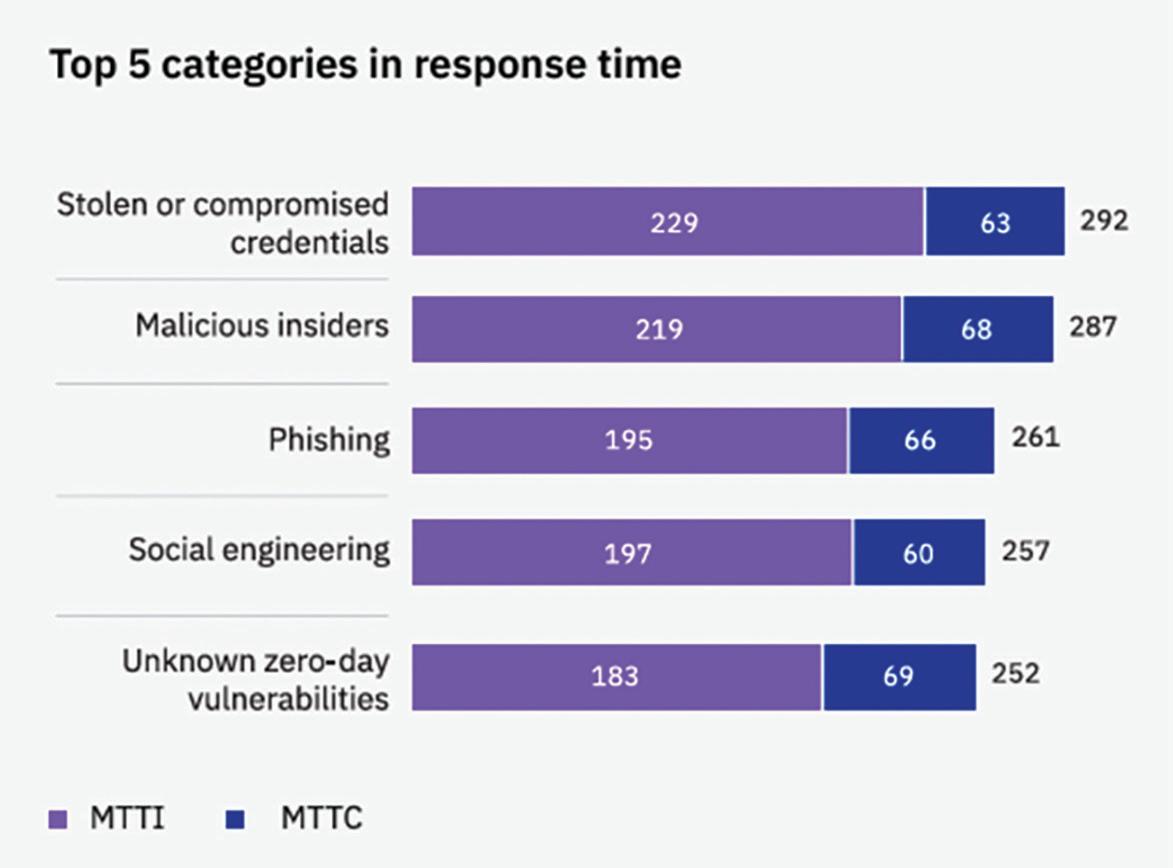

When attackers are successful with phishing, social engineering, and stolen credentials, they tend to stay hidden longer. Take a look at this information from the 2024 IBM Cost of a Data Breach Report:

It shows the Mean Time to Identify (MTTI) and Mean Time to Contain (MTTC ) data breaches based on the initial attack vector. Keep in mind here that Phishing could still be involved with attacks that used Stolen or Compromised Credentials, Social Engineering, and Business Email Compromises.

For the businesses IBM spoke to in their report, the average Phishing attack took 195 days to detect and another 66 to contain.

It’s worth noting that there are of course outliers here, sometimes you may find out right away if you’ve suffered an attack. However, many threat actors want to try to go undetected to maximize their attack once they get into an environment.

Follow along in the next two issues of Insight as we talk more about how these attacks play out and how to defend your

Big I Illinois has partnered with RLS Consulting to help protect your agency against email phishing scams.

Don’t get “Reeled” in by phishing scams. With a set it & forget approach, you can test your staff and prepare your agency against the bad actors. Learn in real-time through simulated phishing emails how to spot them and train your staff so they are on their guard.

This program works in conjunction with other phishing email training programs you may use. Or if you don’t have one this is a great place to start. Train your employees, test their knowledge and the end result will keep your employees, your agency and your clients safer.

By Justin Aebischer

As an independent insurance agent, you’re well aware of the current market challenges. You’re also well aware that success lies in balancing growth, profitability, and client satisfaction. But how do you help plan for this balance? You have some of answers already, but it lies in raw data that needs to harnessed and turned into insight-providing reports. Knowing this data is essential, and tracking it with specific Key Performance Indicators (KPIs) can provide a better path for your future success.

These KPIs not only measure performance but also provide valuable insights to help streamline operations, improve profitability, and ensure long-term sustainability. However, challenges like disparate data sources, disconnected carrier reporting systems, and lack of uniformity in metrics can make KPI tracking a difficult task. This is why focusing on the right metrics – and implementing tools to track them efficiently –can be a game-changer for independent agencies.

And while there is a substantial list of what to track, here are nine of the key KPIs every independent insurance agency needs to know and track to drive growth and improve operational efficiency.

Retention rate measures the percentage of clients who renew their policies with your agency.

Why It’s Important

Acquiring new customers can be five times more expensive than retaining existing ones. A strong retention rate for current market conditions indicates client satisfaction generated by effective customer service, strong relationships, and client trust.

How to Calculate It

Retention Rate = (Renewed Policies ÷ Total Policies Up for Renewal) × 100

If retention rates are lower than expected, it may be time to reevaluate customer engagement strategies or customer service quality.

The expense ratio is the percentage of premium revenue that goes toward covering your agency’s expenses, such as salaries, marketing, and overhead costs.

Why It’s Important

A high expense ratio can indicate inefficiencies in your operational structure, while a low ratio reflects smart budgeting and resource management.

How to Calculate It

Expense Ratio = (Total Agency Operating Expenses ÷ Written Premium) × 100

Reducing unnecessary expenses while maintaining the quality of service is key to improving this metric.

The loss ratio measures the relationship between claims paid out to policyholders and the premiums collected.

Why It’s Important

A high loss ratio may suggest poor underwriting practices or a need for better risk assessment strategies. Conversely, a low loss ratio could indicate efficient risk management.

How to Calculate It

Loss Ratio = (Claims Paid ÷ Premiums Earned) × 100

Keeping this metric balanced is essential for profitability.

Written premium refers to the total dollar value of all policies written (or sold) during a specific period.

Why It’s Important

This is a core indicator of the agency’s growth and market share. Written premium reflects sales effectiveness and overall business momentum.

How to Calculate It

Track written premium monthly, quarterly, and annually to spot trends and pinpoint which products or niches are performing well.

Policies in force represent the total number of active policies at a given point in time.

Why It’s Important

It provides a snapshot of your agency’s overall book of business. Changes in this metric are a leading indicator of future changes to financial results. This metric – when sourced from the carrier(s) – can be especially useful in projecting future agency financial results for carriers that include it as part of their profit share calculations.

How to Calculate It

Aggregate your PIF total directly from your carrier reports. Regularly monitor this number and compare it with historical data to spot fluctuations or growth opportunities.

6. Growth Rate

Growth rate measures how quickly your agency’s revenue is increasing over a specific period.

Why It’s Important

A healthy growth rate indicates strong sales performance and market expansion, while stagnation could signal inefficiencies or overlooked opportunities.

How to Calculate It

Growth Rate = [(Current Revenue - Previous Revenue) ÷ Previous Revenue] × 100

Identifying growth bottlenecks and trends is crucial for developing long-term strategies.

7. Quote-to-Bind Ratio

Quote-to-bind ratio tracks the percentage of quotes given that result in a bound policy.

Why It’s Important

This is an essential sales efficiency metric. A lower ratio may signal issues with pricing, quoting accuracy, or target audience misalignment.

How to Calculate It

Quote-to-Bind Ratio = (Total Bound Policies ÷ Total Quotes Issued) × 100

Improving this ratio may involve refining quoting procedures or tailoring offerings to better meet client needs.

EBITDA measures an agency’s profitability by focusing on earnings before deducting financial and operational costs.

Why It’s Important

This metric provides a clear picture of the agency’s financial health and operational efficiency, offering insights into profitability without being skewed by outside factors like taxes or interest payments.

How to Calculate It

EBITDA = Revenue - Expenses (excluding interest, tax, depreciation, and amortization)

High EBITDA indicates strong financial stability and competitive strength.

Sales velocity measures how quickly a lead moves through the sales funnel to become a paying client.

Why It’s Important

This KPI reveals the effectiveness of the agency’s sales process and helps indicate where potential bottlenecks lie. Faster sales velocity = happier customers and quicker revenue generation.

How to Calculate It

Sales Velocity = Total Revenue Generated ÷ Length of Sales Cycle

Track this to identify opportunities to speed up the sales cycle without compromising quality.

Independent insurance agencies face a unique set of challenges when it comes to KPI tracking. These include:

• Disconnected Sources of Data: Data from carriers, CRMs, and internal systems often remain siloed, making it difficult to generate comprehensive KPIs.

• Carrier product data may also be “locked”, especially on loss ratios. We’ve developed ways to source, bridge, and populate a “Data Lake” with this data from 110+ carriers.

• Uniformity of Data: Agencies must deal with varying formats and metrics across different systems, making apples-to-apples comparisons challenging.

• Consistent definitions of data are critical across the book of business, especially in cases like PIF. We can source agencies’ PIF directly from 110+ carriers, and additional KPI metrics can be generated using PIF such as average policy size. This can provide additional insights into key drivers of financial results over time.

• Streamlined Reporting: Many agencies lack an efficient reporting solution that can consolidate and visualize data in real-time.

• We combine Growth Rate, Loss Ratio and Total Written Premium and provide reporting to compare to Profit Share agreements and forecast contingency success.

• Reporting also helps you understand the behaviors which influence your results, such as a low Quote-to-Bind ratio (e.g., misaligned appetites, changes in UW practices, delays in processing, etc.).

Investing in centralized platforms or business intelligence tools can help overcome these barriers. Tools with robust integrations and data visualization capabilities can turn fragmented data into actionable insights.

For independent insurance agencies, tracking KPIs is not just about knowing where you stand - it’s about using that data to drive impactful decisions. With the right metrics at your fingertips, you can streamline operations, improve customer satisfaction, and unlock sustainable growth.

Need help optimizing your KPI tracking and reporting processes? Our team specializes in providing tailored data solutions that help independent agents like you plan more strategically for success. Go to agencykpi.com for details.

Justin Aebischer is the VP of Sales for AgencyKPI.

The Big I’s Agents Council for Technology (ACT) is increasingly aware that all technology decisions are much agencies, there are some very real things you can do to prepare for and navigate the journey of evaluating technology tech decisions. Keep focus on your people, processes & current technology throughout and you will be set

ü Update your business plan. Remain as true to your agency’s goals as possible.

ü Set your premium and/or revenue targets.

ü Plan for your employee count over the next 3-5 years.

ü Define your target business now and in 3-5 years.

ü Consider your number of agency locations now and in 3-5 years.

ü If you are a member of any networks or affiliations, discuss if they offer scaled pricing or other strategic benefits such as data/analytics and training.

ü Make a list of current tech and note its value to your organization.

ü Determine appropriate budget allocated for your AMS/ tech.

ü Document expenses that could be eliminated with the right AMS partner.

ü Contact prospective partners and share your goals.

ü Ask how they can support goals and long-term plans.

ü Ask if they can articulate how they may not be able to help and who they may not be able to serve.

ü Understand their sales/RFP process before you dive in.

ü Schedule a no-commitment demo to get details about what data, dashboards, and reporting tools are available.

ü Consider executing an NDA.

ü Review their contracts for critical items like exit terms, notice timing, fees, data extraction when leaving etc.

ü Underwrite them as a business - time in business, financial health, testimonials, number of successful and unsuccessful implementations.

ü Get clarity on up/down time and service/support levels.

ü Require details about their post-implementation training.

ü Inquire about a user group and getting involved.

ü Require a list of current functional integrations - IVANS, a CRM, your raters, etc.

ü Make certain they support ACORD standards.

ü Understand all costs, what is included vs additional.

ü Understand their implementation timeline.

ü Ask your team what is working well.

ü Understand their pain points.

ü Determine if they fully utilize your current tools and technology? Why or why not?

ü Use the data to validate KPI’s such as hit ratios, NPS, New Leads, hold times, x-sell ratios.

ü Share your plans and efforts to consider a new AMS/ technology and why employee engagement is critical.

ü Offer to give key employees a seat at the table during all stages of your assessment.

ü Consider involving your legal resources in contract review - does it reflect all you negotiated and what you believe you are buying.

ü Be clear of your rights & financial implications.

ü Address terminating current relationships if impacted by your change.

ü Align timing with terminated relationships to maintain business continuity.

ü Make certain you understand any obligations set for you in the contract and discuss with your team –address if these are problematic.

ü Notify your staff of your plans - at many points along the way.

ü Layout plans specific to this implementation:

- Data clean up.

- Possible agency service interruptions and customer communications.

- Clear responsibilities of your team members.

- When key vendor activities will occur - onsite or remote.

ü Establish employees involved in the process.

ü Establish clear understanding of how training and support for your agency works – with your vendor and with your team.

ü Detail all impacted processes, those that can be eliminated, net new needs, and any training.

ü Consider roles and job description changes – people and process are just as critical for success as any technology.

ü Recognize your employee’s efforts and success.

By ACT

much more specific to an individual agency’s goals and needs than ever before. Despite the differences among technology solutions for your agency. ACT has developed seven steps to help your agency achieve great for success.

ü Determine if you are using their most current version and most aligned pricing tier.

ü Ask your team if they are trained and updated on all current capabilities.

ü Document your learnings and ask your team how they leverage what they learned.

ü Implement any quick wins you and your team identified.

ü Be objective about opportunities to terminate or unsubscribe from a product.

ü Identify features you were unaware of and can add with little/no expense.

ü Identify features that compete or contradict other tech you are using.

ü Clarify if they offer more seamless integration with a different provider, but you are using a similar product that does not integrate well.

ü Test, learn, and evolve.

ü Be willing to change and try new things - nothing works perfectly the first time.

ü Get regular feedback from your team – and act upon it.

ü Stay in contact with your new partner, share feedback, ask questions.

ü Be transparent with all new processes, expectations, and results.

ü Consider process & data audits, offer feedback and coaching. Be willing to make changes.

ü Keep iterating, learning, and changing..

ü Crush it!

ü Layout a plan aligned to your strategic goals –intentionality will help product vetting and decisionmaking.

ü Be clear about which specific part(s) of the plan you are going to focus.

ü Document which internal processes are impacted, need to be built, eliminated, or altered.

ü Have a change management plan – employee engagement is critical to the success of any change in an organization.

ü Consider other resources for insight – be willing to ask for referrals.

- Your State Big I and their strategic partners.

- Agents Council for Technology (ACT) and any of their supporting partners.

- Other agencies with experience on this specific tool or change.

ü Understand your budgetary situation … as well as the opportunity cost of investing in new and enhanced capabilities.

ü Spend time calculating and understanding ROI.

ü Remember: Less Can Be More.

Remain comparably focused on your people, processes, and your technology. It takes all three for any effective transformation.

Find out more about ACT at independentagent.com/act

AI has been incredible for our agency by helping us solve practical challenges and work more efficiently. One of the most used cases is using AI to generate call summaries and analyze a caller’s “sentiment” in real-time. If a call comes across with a negative sentiment, we’re notified and can review the recording immediately. This allows us to address potential issues quickly and gives us insight into where we can provide additional training for our team. It’s about using technology to respond, not just react. For us, AI isn’t taking the personal touch out of what we do. It’s allowing us to deliver a more modern experience without compromising on personal connection.

- Patrick McBride, Big I Illinois Member Agent, Owner of The McBride Agency

By Michael Combs

2025 will be a pivotal year for the risk management industry, as GenAI continues to drive innovation and reshape how organizations approach risk, efficiency, and ROI.

2024 was a year of steady growth for the risk management profession, largely attributed to the implementation of generative AI (GenAI). This technology, amongst others, continues to progress through the innovation cycle as demand increases and organizations look for ways to cut costs and improve overall operational efficiency. With the success that GenAI has brought to workers’ compensation, the C-suite is focusing on the technology’s return on investment (ROI).

I expect the buzz and conversations around GenAI will grow in 2025; the following encapsulates a few predictions about its impact on the risk management industry in the coming year.

Earlier this year, the risk management industry’s view on generative AI was somewhat skeptical. It took until the end of 2024 to witness a change in attitudes and opinions on GenAI despite the technology being in the market for the past two years. Now, many who once doubted the technology have shifted their view to cautious optimism. This change in direction has been critical for the industry, as it will foster growth in the adoption and implementation of advanced technologies and solutions in the coming year.

Our industry is ripe for continued digital transformation, and in 2025, GenAI and other advanced technologies will be further leveraged to drive increased innovation. C-suite leaders and executives are calling for solutions that manage risk and administer claims more effectively and efficiently, and GenAI is answering that call.

Defining and assessing the value of investments in emerging and advanced technologies is one of the biggest challenges facing executives today. We are witnessing a market saturated with vendors who offer solutions that promise to help reduce risk, improve operational efficiency, and cut costs.

But how can leaders be sure of these promises? As technology advances, the ability to demonstrate a measurable impact on the organization’s bottom line will separate the winners from the others.

This measurable impact will become of utmost importance in 2025, meaning organizations will judge GenAI’s ability to deliver on financial promises while still driving continuous innovation. GenAI will need to enhance its capacities, and I believe that it will be an invaluable currency in today’s business landscape as employer-partner relationships deepen and vendors are viewed as extensions of an organization rather than just service providers.

Will Be Viewed and Used Similarly

The sheer volume of AI solutions available today is astounding but unsustainable. While companies of all sizes are putting time and money into developing native solutions, large companies are investing significantly in LLMs (large language models), refining them into versatile tools that can meet various needs.

As organizations continue to cut through the clutter in the coming year, expect a few prominent LLMs to surface. This shift will lead organizations to view AI and machine learning as essential utilities.

Like electricity, not every organization needs to build its own power plant, or in this case, an LLM, to operate efficiently and successfully. However, they need access to LLMs to fine-tune and consume. Under the utility model, success will depend on

on dozens of topics in an easy-to-navigate format.

We Make Understanding Insurance Tech Easy Many agencies struggle to understand, select, and implement their technology, leading to productivity bottlenecks that limit growth and profitability. Reaching your agency’s full potential requires using the right technology.

Many agencies struggle to understand, select, and implement their technology, leading to productivity bottlenecks that limit growth and profitability. Reaching your agency’s full potential requires using the right technology.

Catalyit can help with that.

Catalyit can help with that. Effective Tech Selection and Personalized Guidance Understand Your Technology

• Assess your current Tech Stack

• See what other agents are using • Browse solution provider profiles

Assess your Current Tech Stack See what other agents are using

TechTips weekly email

Starting at $17/mo.

Your Agency Management System (AMS) is the backbone of insurance agencies, streamlining operations and enhancing customer service. However, your agency may not utilize its AMS to its full potential, resulting in missed opportunities for increased efficiency and return on investment (ROI). Here’s a guide to help you maximize your AMS for peak performance and ROI.

Understand Your Technology Stack

• Assess Your Current Tools: Evaluate the technology currently in use within your agency. This includes everything from email to proposal tools.

• Team Involvement: Ensure everyone on your team, from producers to account managers, is on the same page regarding the technology used.

Leverage AI and Automation

• Identify Practical AI Uses: Use AI for repetitive tasks such as reconciling accounts, social media marketing, and policy checking.

• Automate Marketing: Push renewal information to marketing tools to automate communication with clients and prospects.

• Streamline Workflows: Integrate AI tools that work seamlessly with your AMS to reduce manual data entry and enhance productivity.

Data Cleanup and Management

• Clean Up Your Database: Regularly audit your AMS to ensure data accuracy. Remove inactive accounts and update contact information.

• Utilize Reporting Tools: Leverage your AMS’s reporting capabilities to generate insights into active accounts, policy statuses, and more.

Optimize Workflows and Procedures

• Review and Update Workflows: Continuously review your agency’s workflows to ensure they align with best practices and leverage the full capabilities of your AMS.

• Annual Reviews: Conduct annual reviews to assess the effectiveness of your workflows and identify areas for improvement.

By Angela Ford

• Ensure Seamless Integration: Choose tools that integrate well with your AMS to avoid data silos and redundancy.

• Compliance and Security: Maintain compliance with industry standards and ensure your data is secure. Evaluate the security measures of third-party tools before integrating.

• Evaluate Tools Based on Needs: Identify your agency’s specific needs before selecting new tools. Consider the makeup of your agency and the primary lines of business you handle.

• Test Before Committing: Utilize trial versions of tools to ensure they meet your agency’s requirements before making a long-term commitment.

• Continuous Improvement: Regularly evaluate the performance of your AMS and associated tools. Gather feedback from your team and make necessary adjustments.

• Training and Support: Invest in training for your team to ensure they are proficient in using the AMS and any integrated tools.

Embrace the Future of Technology

• Stay Updated: Keep up with the latest technological advancements and how they can be applied to your agency.

• Innovate and Adapt: Be open to adopting new technologies that can enhance your agency’s operations and provide a competitive edge.

By understanding your technology stack, leveraging AI and automation, maintaining clean data, optimizing workflows, ensuring seamless integration, and continuously evaluating and training, you can unlock the full potential of your AMS. This will streamline your operations and maximize your return on investment, ultimately driving your agency towards greater success.

Take the next step towards optimizing your agency’s performance and ROI with assistance from Catalyit. They make understanding insurance tech easy. Find out more at catalyit.com.

Angela Ford is Chief Strategy Officer for Catalyit.

Lots of companies make promises about how much your client can save if they switch their business insurance.

Well, here’s our promise – they can save everything.

Every memory. Every detail. Everything they’ve worked hard to build.

Protect what’s important for your client with a policy from an insurance company you can trust.

These companies have shown their dedication to the support independent insurance agents in Illinois.

Progressive Surplus Line Association of Illinois

Silver Level

Arlington/Roe Blue Cross/Blue Shield of IL Pekin Insurance

A. J. Wayne & Associates

AAA, The Auto Club Group

AMERISAFE

AmTrust Insurance

Amwins

Apollo Brokers dba Limit

Auto-Owners Insurance Co.

Berkley Aspire

Berkley Management Protection

Berkley Small Business Solutions

Bliss McKnight

BluSky Restoration Contractors, LLC

Boundless Rider

BriteCo Jewelry & Watch Insurance

Central Illinois Mutual Insurance Company

Chubb

Columbia Insurance Group

Cowbell Cyber

Donald Gaddis Company, Inc.

Donegal Insurance Group

EMC Insurance

Encova Insurance

Erie Insurance Group

Foremost Choice Property & Casualty

Forreston Mutual Insurance Company

Frankenmuth Insurance

Grinnell Mutual Reinsurance Company

IA Valuations

Illinois Mine Subsidence Ins Fund

Illinois Public Risk Fund

Keystone Insurance Group, Inc.

Berkshire Hathaway GUARD Insurance Companies

Bronze Level IMT Insurance

Imperial PFS

Independent Mutual Fire Insurance Company

Indiana Farmers Insurance

Insurance Program Managers Group (IPMG)

J M Wilson

Liberty Mutual/Safeco Insurance

Madison Mutual Insurance Company

Main Street America Insurance

Mercury Insurance Group

Method Workers Comp

Midwest Insurance Company

Nationwide

NHRMA Mutual Workers’ Compensation

Paychex HR and Payroll Solutions

Pinnacle Minds, Inc.

Rhodian Group

Rockford Mutual Ins. Co.

SECURA Insurance

ServiceMaster DSI

Society Insurance

SPRISKA - Specialty Risk of America

Steadily

Summit Insurance

Travelers

UFG Insurance

Universal Property & Casualty

Utica National Insurance Group

W. A. Schickedanz Agency, Inc./Interstate Risk Placement

West Bend Insurance Company

Western National Insurance

Westfield

XPT Specialty

Bryce Carey, 72, of Elburn, Illinois, passed away suddenly at his winter home in Texas on December 16, 2024. Born on February 5, 1952, in DeKalb, Illinois, to Wheeler and Doris (Dannewitz) Carey, Bryce attended Hinckley-Big Rock High School, graduating in 1970, and later earned a degree in finance and business administration from Western Illinois University, followed by a Certified National Insurance Counselor designation. A dedicated independent insurance agent for over 45 years, Bryce owned BMC Insurance Inc. and served in numerous leadership roles, including president of the Independent Insurance Agents of Illinois (now Big I Illinois) and chair of the Junior Golf Classic for many years. He was also a committed member of the Hinckley Lions Club and the Hinckley Business Association.

Bryce’s passions included golf, Harley Davidson motorcycles, flying, and drag racing, as well as traveling to all 50 states, Canada, and Mexico. A kind and generous soul, Bryce will be deeply missed by his wife of 28 years, Melissa Sams-Carey; his children, Allison (Bryan) Pickert and Grant (Elisabeth) Carey; and three grandchildren.

The Big I Illinois staff and Board extend our sincerest condolences to Bryce’s family and friends.

The traditional coverage your customers need.

The customized options your customers desire

The affordable price your customers deserve

We’ve been successfully protecting small businesses since 1983.

n Envision’s proprietary system enables brokers to present unique benefit programs not available through any insurance company

n Envision’s professional, easy enrollment and customer service team delivers seamless processing for your customers.

n Envision’s innovative reporting capability is designed to enable management to make informed decisions concerning their employees’ healthcare costs

Shannon Churchill, in her role as Secretary/Treasurer of Illinois Society of Association Executives (ISAE), attended a professional development conference to learn about building desirable events for members as well as worked with other association professionals on strategic planning and focus groups.

January’s Women in Insurance Network Group meeting focused on the goals our members have set for the year ahead. Members shared a range of challenges, including delegating tasks effectively, finding time to train staff, prioritizing revenue-generating or high-value projects, maximizing the use of agency systems, and breaking down goals to decide where to focus first.

As an association, our goal is to provide a supportive space for women in the industry to connect, discuss challenges, and share ideas and solutions with one another.

Mark your calendar for the first Friday of every month and join us for our Women in Insurance networking calls!

Lori Mahorney and Rachel Romines recently attended the Big I Marketing Summit, joining fellow marketing professionals from other states under the Big I umbrella. The summit provided valuable insights into successful strategies being implemented in other states, as well as emerging trends such as the role of AI in associations. They also explored event marketing best practices, uncovering key do’s and don’ts, and actively contributed to a collaborative planning session.

Evan Manning, Brett Gerger, and Lori Mahorney joined members in Wheaton and Wheeling, IL for local legislative events. Held in conjunction with two of our locals, Big I DuPage and Big I Northeastern, and partner associations, attendees heard the latest updates from Springfield and got a sneak peak into the upcoming legislative session. Several legislators were in attendance.

Class 16 hours of IL CE

CE Available in other States, contact Big I Illinois for details

In the CIC Life and Health course, you will learn practical information related to Life and Annuity Policies, Business Life Concepts, Health Insurance, and Employee Benefits. What are the basic characteristics, provisions, and riders found in most life, health, and retirement contracts? Learn how to target these financial products to meet your client’s personal and business needs. Leave the class with information that you can put to use immediately. ilbigi.org/education

For information regarding Big I Illinois membership or company sponsorship, contact Lori Mahorney, Director of Membership Services, at (217) 321-3008, lmahorney@ilbigi.org.

28. Are you an agent who owns their book and would like to reduce your overhead cost? Are you currently with a large agency and want less office politics? We have office space available and all of the tools needed to move your book of business, along with the carrier relationships. Full agency management system, VoIP phones and client support staff. Located in the Springfield, IL area. All discussions will be held in strict confidence.

For more information, contact Tami Hubbell, Big I Illinois, at thubbell@ilbigi.org.

02. Forest Park/Oak Park agency for over 60 years, will meet your needs by providing space, markets, marketing & sales support, automation, merging with or purchasing your agency. Perpetuation/ Succession Plans, BuySell Agreements also available. We have experienced, educated and dedicated staff for you and your clients. Have access to our numerous companies, office services and many other resources. Please look closely at us- we are an agency you want to do business with! We’ve done it before, we know how- we make it easy! Visit our website at forestagency.com/agents.html, or call for a confidential discussion and a list of Agency benefits.

Dan Browne will provide an agency evaluation/appraisal at little cost to you. Please call:

Dan Browne or Cathy Hall Forest Insurance/Relation Insurance Services (708) 383-9000 www.forestinsured.com/mergers-acquisitions

23. Are you looking for an exit strategy while still continuing to produce for a few years or are you ready to sell now? Paczolt Insurance would like to talk with you! We are an independent agency dating back to the 1970s that is located in the western suburbs. Our focus is on mid-to-small commercial accounts and personal lines. Our companies include EMC, Badger Mutual, Safeco, Progressive, and Travelers. We have the flexibility and capital to get a deal done. Contact:

Susan Troppito Paczolt Insurance susan@piaigroup.com (708) 215-5202

25. Small Agency for sale, including AMS360 management system, website, six carriers, VOIP phone system including a complete crm for insurance agents from Bridge, an Orange Partner with Vertafore. Ideal for an insurance professional expecting a fast start to build with everything in place.

For more information, contact Tami Hubbell, Big I Illinois, at thubbell@ilbigi.org.

20. Since 2004, Central Illinois Agents Group LLC has been providing independent agents with a variety of markets with contingency opportunities. Agents have availability to several markets that they may not be able to sustain or maintain on their own. We have markets for personal, commercial, agricultural and crop insurance lines. Let us help you get to the next level.

Visit www.ciagonline.com for contact information.