MAY 2020

INSIGHT The

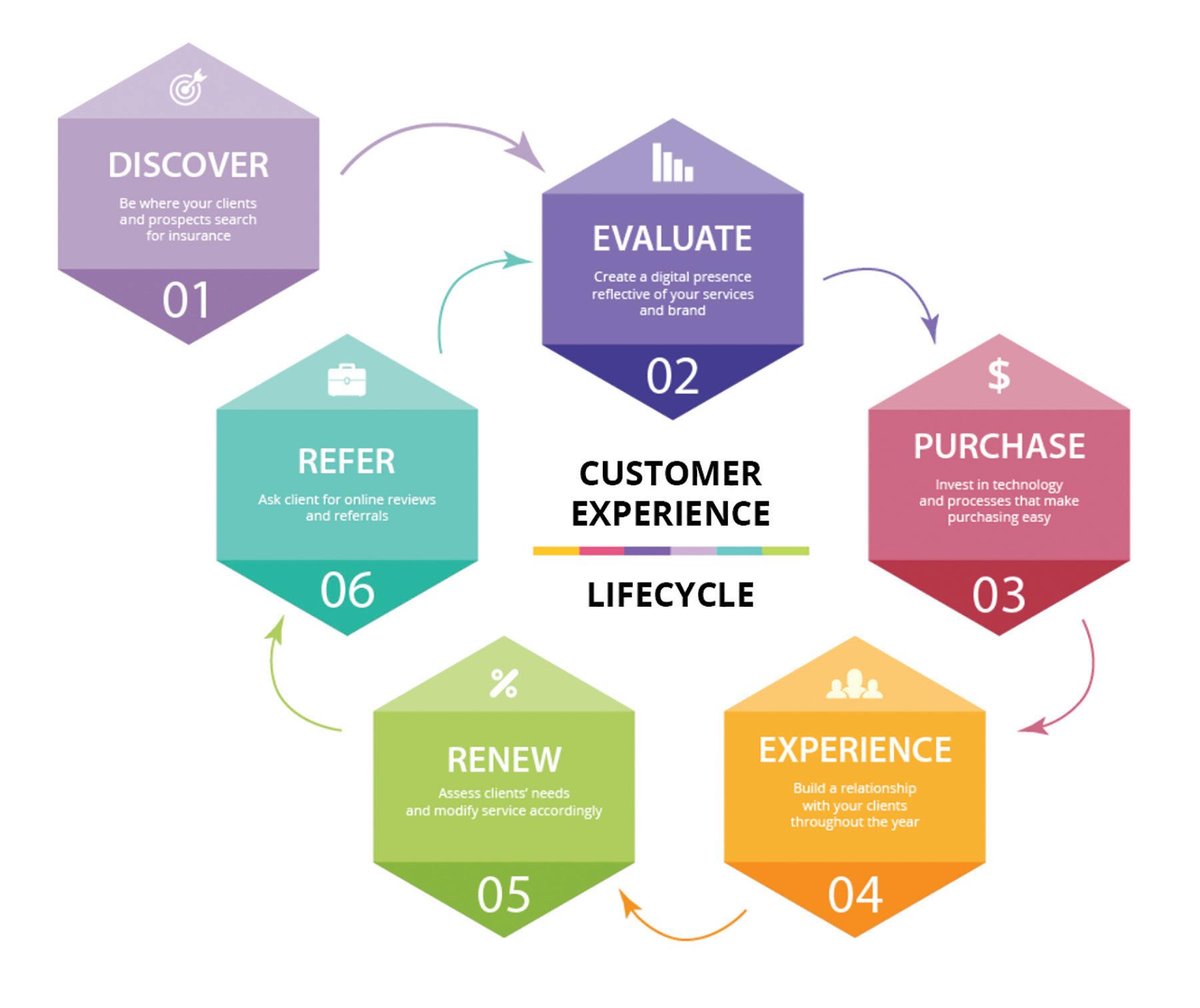

CUSTOMER EXPERIENCE Lifecycle Cultivate the Customer Experience Your Clients Want

WE BELIEVE THAT ORGANIZATIONS THRIVE WHEN THEY HAVE

HAPPY, HEALTHY, PRODUCTIVE EMPLOYEES That’s why we developed In-Sight 360 to manage all health, injury and absence events with one team focused on positive outcomes.

THIS CHANGES EVERYTHING.

LEARN MORE: 888-377-5845 • IPMG.COM/IN-SIGHT

Editor & Graphic Design - Rachel Romines

|

Advertising - Tami Hubbell

CONTENTS

May 2020

11

14

20

24

11 13 14

The Only Message Customers Want From You By John Graham

Simple Steps to Take to Prepare Yourself, Your Staff and Your Customers By Utica National

Changes in the Customer Experience: Two Different Agencies, Two Different Experiences, One Goal By Bill Durkin and Allyson Padilla

18 20 24 27 29

Hands-Off, But Yet Hands-On By Ron Berg

Cultivate the Customer Experience Your Clients Want By Agents Council For Technology (ACT)

What Businesses and Salespeople Should Do in the Current Environment By John Chapin

Is Your Website Doing More Harm Than Good? By SwissRe Corporate Solutions

Is the Coronavirus Causing a Change in Your Clients’ Exposures? By Curtis Pearsall

In This Issue

7 9 17 The Independent Insurance Agents of Illinois (IIA of IL) has been providing members with a sustainable competitive advantage since 1899.

Trusted Choice Government

e-Insight

30 31 32 34

Associate News IIA of IL News Board of Directors Profiles Classifieds

info@iiaofil.org | www.iiaofil.org | (800) 628-6436 or (217) 793-6660 | Fax: (217) 793-6744

2009 • 2010 • 2011 • 2012 • 2013 2014 • 2015 • 2016 • 2017 • 2019

Insight is the official publication of the Independent Insurance Agents of Illinois (IIA of IL). The magazine is published monthly for the members of the IIA of IL, with the office located at 4360 Wabash Avenue, Springfield, Illinois 62711-7009; Consumer Website: www.ChooseIndependent.com. The IIA of IL welcomes letters discussing concerns of the insurance industry, articles, editorials, other matters of interest to the membership. The editor reserves the right to edit and select submissions for publication. Address submissions for review to Rachel Romines at rromines@iiaofil.org. For advertising information, contact Tami Hubbell at thubbell@iiaofil.org.

ADVERTISERS

Board of Directors Executive Committee

Chairman of the Board | Patrick Muldowney (312) 595-7192 | patrick.muldowney@alliant.com

12

AMERISAFE

President | Bill Wirth (618) 939-6368 | billw@wirthagency.com

36

APPLIED UNDERWRITERS

President-Elect | George Daly (708) 845-3311 | george.daly@thehortongroup.com

16

BERKSHIRE HATHAWAY GUARD INS. GROUP

26

CIRCLES CONCIERGE SERVICE

8

EMC INSURANCE COMPANIES

Vice President | Jay Peterson, AFIS, LUTCF (217) 935-6605 | jay@peterson.insurance Secretary/Treasurer | Bennie Jones (312) 960-6206 | bjones@rmsoa.com IIABA National Director Gregory A. Sandrock, CIC, AFIS (815) 438-3923 | gregsandrock@2cornerstone.com

Regional Directors Region 1 | Lisa Lukens (618) 942-2556 | salibainsurance@gmail.com Region 2 | Joseph Heneghan (618) 639-2244 | joe.heneghan@hwcrins.com Region 3 | Christopher Leming (217) 321-3185 | cleming@troxellins.com Region 4 | Bart Hartauer, CIC (815) 223-1795 | hartauer@hartauer.com

28 5 16 2

EPAYPOLICY GRINNELL MUTUAL REINSURANCE COMPANY IMT INSURANCE INSURANCE PROGRAM MANAGERS GROUP

23

JM WILSON

35

SECURA

6 10

TRUSTED CHOICE WEST BEND MUTUAL INSURANCE CO.

Region 5 | Nick Gunn, CIC (309) 691-1300 | nickgunn@nixonagency.com Region 6 | Thomas Evans, Jr. (779) 220-6564 | tevans@crumhalsted.com Region 7 | Neidra Crosby, CPIA, CISR (708) 597-8731 | ncrosby@insxchg.com Region 8 | Andrew Allan (773) 891-8000 | aallan@lakeviewins.com Region 9 | Ed Boltz, JD (630) 443-7300 | eboltz@crumhalsted.com Region 10 | Christopher Bassler, CLCS (847) 480-0800 | cbassler@basslerins.com At-Large Director | William Durkin (312) 629-0725 | durkinb@danielandhenry.com At-Large Director | Michael-Charles Hilson (708) 333-3378 | mhilson@gbgins.com At-Large Director | Ryan Hite (309) 688-7316 | ryan.hite@eaglerockins.com At-Large Director | Patrick Taphorn, CIC, CSRM (309) 347-2177 | ptaphorn@unland.com

Committee Chairs Budget & Finance | Bennie Jones (312) 960-6200 | bjones@rmsoa.com Education | Teresa Fleming, CIC, CISR (815) 849-5219 | tess@leffelmanassoc.com Farm Agents Council | Randy Jacobs (309) 365-3231 | rjacobs@mtco.com Government Relations | Kevin Lesch (630) 830-3232 | klesch@arachasgroup.com IIAPAC | Dustin Peterson (217) 935-6605 | dustin@peterson.insurance

IIA of Illinois Staff Director of Information and Technology Shannon Churchill - (217) 321-3004 - schurchill@iiaofil.org

Director of Government Relations Evan Manning - (217) 321-3002 - emanning@iiaofil.org

Director of Education and Agency Resources Brett Gerger - (217) 321-3006 - bgerger@iiaofil.org

Office Administrator Kristi Osmond - (217) 321-3007 - kosmond@iiaofil.org

Accounting & Admin Services Tami Hubbell - (217) 321-3016 - thubbell@iiaofil.org

Director of Communications Rachel Romines - (217) 321-3024 - rromines@iiaofil.org

Director of Human Resources, Board Admin Jennifer Jacobs - (217) 321-3013 - jjacobs@iiaofil.org

Director of Membership Services Tom Ross, CRIS, CPIA - (217) 321-3003 - tross@iiaofil.org

Sr. Vice President/Chief Financial Officer Mark Kuchar - (217) 321-3015 - mkuchar@iiaofil.org

Products & Services Administrator Janet White, CISR - (217) 321-3010 - jwhite.indep12@insuremail.net

Chief Executive Officer Phil Lackman - (217) 321-3005 - plackman@iiaofil.org

Director of Prof. Liability & Ins. Products Carol Wilson, CPIA - (217) 321-3011 - cwilson.indep12@insuremail.net

Central/Southern Marketing Representative Lori Mahorney - (217) 415-7550 - lmahorney@iiaofil.org

Planning & Coordination | Cindy K. Jackman, CIC, CISR (800) 878-9891 x8745 | cjackman@arlingtonroe.com Young Agents | Allyson Padilla (618) 393-2195 | allyson@blanksinsurance.com

Find us on Social Media

TRUST US TO BE THERE WHEN YOUR CUSTOMERS NEED US We offer multiple lines of coverage, dedicated underwriters, and unmatched claims service. Add in 110 years of building trusted relationships and you can rest assured that we’ll be there with the coverages you need to protect every customer’s tomorrow. Trust in Tomorrow.® Contact us today.

AUTO | HOME | FARM | BUSINESS

grinnellmutual.com “Trust in Tomorrow.” and “Grinnell Mutual” are registered trademarks of Grinnell Mutual Reinsurance Company. © Grinnell Mutual Reinsurance Company, 2020.

AS AN INDEPENDENT AGENT YOU ARE A TRUSTED MEMBER OF YOUR COMMUNITY. Trusted Choice® will provide the tools, training and marketing materials for your agency to excel.

We do the work, so you can focus more on your clients. Go to trustedchoice.com/agents to access content today!

Looking for content?

Trusted ChoiceÂŽ has ready to use agent materials. The Content-to-Share section on the Trusted Choice Agent Resource Website offers graphics, video and articles on a variety of insurance topics, specialty products and more. Search by topic or type of content.

Trusted Choice does the work so you can focus more on your clients. Visit cobrand.iiaba.net/content-to-share to start using content today!

NEW: Coronavirus Resource Page for Clients As many of your clients look for answers to support their businesses in this difficult time, Trusted ChoiceŽ and the Big “I" created a landing page that contains resources you can share with them directly. Easy to navigate and featuring articles written in plain English geared toward any small business, this page can be linked directly from any individual independent agency's homepage. The page includes HR resources, CARES Act and FFCRA resources, FAQs for businesses, and planning, preparation and marketing resources. The page will continue to be updated with pertinent information. Visit independentagent.com/stronger-together to start sharing today!

Be more than an insurance agent.

Be the hero your clients can count on. Our agent partnerships are powerful. By developing tailored insurance products and high-level customer experiences, we give our agents the ability to deliver the protection their clients deserve. And, with every EMC policy, agents can help clients fight off costly risks, report claims in a flash and get them safely back on their feet. It’s this combination of innovation and service that makes an EMC agent a real hero.

www.emcins.com ŠCopyright Employers Mutual Casualty Company 2020. All rights reserved.

government | INSIGHT

PAC Donations: Investing in Your Future

By Evan Manning

These are truly trying times for all. Now more than ever before policyholders are relying on you, the insurance professional, to navigate these unchartered waters. Many clients are relying on you to understand and review their policies as well as deciphering state and national issues. You are their most trusted advisor. During this time, when clients need you the most, can you imagine not being considered an “essential employee”? Are you fielding questions about state and federal action? Did you know that you have state and federal information and resources tailored to the insurance industry and how it potentially affects you and/or your policyholders? The IIA of IL and our national association, the Big “I”, are working tirelessly for you and your policyholders. Collectively, the IIA of IL and Big “I” have been providing the most up-to-date and relevant information and resources regarding COVID-19 and how it affects the insurance industry. These resources are available to IIA of IL members on our respective websites at iiaofil.org and iiaba.net. I want to take the time to share with you some highlights of our collective efforts. At the state level, the IIA of IL lobbied the Governor and the Department of Insurance to include insurance agencies and employees as “essential services”. Recently, the Illinois Worker’s Compensation Commission (IWCC) extended their authority by issuing an emergency ruling that provided first responders, front-line workers, and all essential business employees who contracted the COVID-19 virus are “rebuttably presumed” to have contracted the virus from their employment. The IIA of IL stepped up to assist in litigation fees for the Illinois Manufacturers’ Association (IMA) and the Illinois Retail Merchants Association (IRMA) in their suit against the IWCC. To be clear, the suit is centered on the IWCC’s rulemaking authority, not the intent of the rule, to expand the existing law without being approved by the General Assembly and signed into law by the Governor. In response to the IWCC ruling, the IIA of IL lobbied the Director of the Illinois Department of Insurance to make a request to the National Council on Compensation Insurance (NCCI) to issue a rule that any workers’ compensation claim stemming from the COVID-19 virus will not negatively impact an employer’s experience mod. The NCCI responded to this request and the Department of Insurance has indicated their intention to adopt the ruling. IIA of IL has been interviewed by local media outlets to educate the public on insurance issues including business interruption coverage. We also participated and facilitated in a Facebook Live Event with the Chairmen of the Illinois House and Senate Insurance Committees. On the national level, our government affairs team at the Big “I” have worked closely with Congress on the CARES ACT, Paycheck Protection Program (PPP), and the COVID-19 Business and Community Continuity and Recovery Fund. Honestly, I can’t even begin to list all of their accomplishments. The information, resources, and webinars on all of the national issues is second to none and is available to all members of the IIA of IL. I could not be prouder of all of the work and effort our team at the IIA may 2020

of IL and our national association is doing to disseminate information to us so that we can get it out to legislators, our clients, communities, and our employees. However, we are now facing one of the biggest threats the insurance industry has ever encountered. Legislators in Washington D.C. and Illinois are considering legislation to provide retroactive business interruption insurance coverage to businesses and forcing carriers to pay claims for something that was never priced and for which a premium was never collected. According to industry estimates, a haphazard response such as this would cost between $255-$431 billion in claims per month. Essentially our industry would become insolvent in three months, and our nation’s small businesses would be left without a critical form of protection. Two bills have been introduced in the U.S. House of Representatives to do exactly this. While there has not yet been legislation introduced in Illinois, we strongly believe it will be introduced as soon as the General Assembly reconvenes. As a leader of the insurance industry in Illinois, you know first-hand the importance government and political action plays in the insurance system. Through the Independent Insurance Agents Political Action Committee (IIAPAC), our state-based political action committee, and InsurPAC, our national political action committee, you have the opportunity to play a significant role in the process as we face issues such as retroactive business interruption coverage being considered both on the state and national level. By contributing to IIAPAC and InsurPAC you allow your government relations leaders to be a player in public policymaking around this issue and many more. IIAPAC and InsurPAC funds are utilized to facilitate and establish a close relationship with legislators on both sides of the aisle. We use these funds to support campaigns, fundraisers and events for key legislators that impact your business. If you have already contributed to the IIAPAC and InsurPAC this year, I want to extend my sincerest gratitude and appreciation for your contribution. However, we are in need of more support from every agent and every agency. No contribution is too small, but if you have the means please consider donations of $250, $500, or $1,000 and more to each of our PACs. We are your employees, invest in your workforce! Not only am I challenging you to invest in us, but I want to challenge you to spread the word of our association. If you know an agency that isn’t a member, please reach out and share the value we bring to your agency. You may not be able to see every legislative or regulatory victory, but I guarantee you that without our combined efforts Illinois and the country would be a much worse place for agents, brokers and our company partners. Please consider investing in us. An investment in us will yield the greatest ROI you could imagine. To make a contribution to the IIAPAC please visit our website at iiaofil.org and to make a donation to InsurPAC please visit iiaba.net. Evan Manning is the Director of Government Relations for the IIA of IL and can be reached at emanning@iiaofil.org. insight

9

27 Years and Counting Unlike many other carriers, West Bend believes in the value of long-term relationships. That’s why many of our personal lines underwriters, like Kim, have worked with their agents for so long. Her agents know her well and depend on her to work with them to write the best business. And that makes the relationships that much stronger.

The

ONLY Message

Customers Want From You By John Graham

Messages That Miss the Mark

It only took the pandemic a couple of weeks to turn it all upside down - including marketing and sales. And along with it has come an endless tsunami of email messages flooding consumer email mailboxes. It was war with 50% to 80% off sales, “Lowest prices ever,” “Free shipping–Free returns,” “Final Markdown,” “Sale ends in 4 hours and 17 minutes,” and BOGO offers. Emails to customers from well-meaning businesses streaming to smartphones and computer desktops. It seems like a domino effect. One company starts it, and everyone else follows - with their version of the same message. Most open with a comment on the COVID-19 scourge and then quickly offer assurance that “We are here for you.” Words that companies would like to think customers want to hear. Then, in a nanosecond, attitudes changed. Customers rejected the century-long proposition that the near-sacred role of marketing and sales was getting customers to buy more stuff and doing anything and everything to get the job done. And driving it all was the arrogant (and mistaken) belief that, no matter how you dress it up, customers exist for only one reason: what they can do for us. And it worked - then it didn’t. How has the marketing and sales world changed? Some companies are listening. They get it: It’s no longer about what customers can do for us by buying our stuff. Now, it’s all about what we can do for them. Arrogance is out; candor is in. Opinion is out; facts matter. Lying is out; empathy is in. Telling customers what they want to hear so they will take the bait is out; understanding and transparency are in. Being conned and ignored are out, truth matters and play it straight are in. Sending customers BS-filled messages isn’t just unacceptable and stupid, it’s far more than that - it’s a missed opportunity. As demanding as it is to craft meaningful messages in troubling times, customers respond to those that make a difference in their lives.

What Customers Want to Hear

What customers are looking for is understanding and help. Not the run around, not endless delays, not a pat on the head, calling another number, not incomplete information, not being dropped like a hot potato the moment the order is placed. may 2020

Isolated, alone, stressed, and frightened by an unseen enemy, they look for those who are prepared to come to their aid, who are on their side. It’s also a message that better be clear, compelling, and positive, if we want their attention and their business. The good news is that the growing cadre of companies that get it is growing. But it may take sales reports dripping with gloom to spur the creative juices flowing in many more businesses. Nevertheless, it’s happening and that’s good news. Here’s a sampling of companies that are looking inward to find ways to help customers cope with a relentless enemy that would harm their health and safety. Anton’s Cleaners, New England’s largest dry-cleaning company, took the what-can-we-do-to-help question seriously and came up with an on-target message for the COVID-19 crisis: We care about your health. Sterilization is a standard part of our cleaning process No coupons, no discounts, no “Offer expires in 2 days.” Just a simple, direct, and factual message, that answers the question why someone should take their clothes to Anton’s: Anton’s sterilizes your clothes. The message neither knocks competitors, nor is it price driven. It highlights an existing benefit. It’s a guess that few Anton’s customer knew their clothes were being sterilized and all of a sudden, it’s a huge deal. Even so, there’s another side to the story. Supermarkets everywhere jumped in with early morning hours for the most vulnerable coronavirus age group, those age 60 and older. Some didn’t stop there. They limited the number of customers in a store the same time, provided wipes, and installed see-through barriers at check-out. Come to think of it, “Early Senior Hours” may deserve becoming permanent at least a day or two a week. Seniors tend to rise early and seem to like a slower pace when shopping, which might also please those who are in more of a hurry later in the day.

continued... insight

11

What’s it Take to Get Your Message Right?

Now, here’s the point. Why does it take something like a whack on the head with a two-by-four to come up with worthwhile idea like early morning hours for seniors? We talk “customer commitment” to death, without having a clue as to what it means. Happily, a growing number of businesses are now getting it and are coming up with helping innovative ideas that benefit customers. Here’s a snapshot of a few that are doing it right: • Cox Communications has increased internet download speeds from 30 MPS to 50 MPS to help improve productivity for at home workers. • Insurance Carriers are offering refunds and assistance to their clients. • Best Buy offers contactless curbside service for purchases and returns. • Constant Contact has a free Website Builder Business Plus plan to help small businesses get an ecommerce site up and running. • The Institute of WorkComp Professionals is offering its members a free five-part webinar series on prospecting and LinkedIn positioning. • Meero offers free large-file transfers to help remote workers, according to Forbes. • Planet Fitness offers free online home workouts.

Sure, the cynics may scoff. Sure, these companies want more business. But, so what? Yet, these, along with others, are digging deep to find new and innovative ways to be of help to their customers at a painfully difficult time. All we need now is more like them and we’ll come through this energized and on our feet. John Graham of GrahamComm is a marketing and sales strategy consultant and business writer. He is the creator of “Magnet Marketing,” and publishes a free monthly eBulletin, “No Nonsense Marketing & Sales Ideas.” Contact him at jgraham@grahamcomm.com or johnrgraham.com.

POLICYHOLDER RETENTION RATE

OVER

90%

*

When you only do one thing, you better do it well and workers’ comp is all we’ve ever done for over 30 years.

amerisafe.com - 800.897.9719

*Policyholder retention rate based on voluntary business that we elected for renewal quote: 93.6% in 2018. © 2020 AMERISAFE, Inc. AMERISAFE is a registered trademark of AMERISAFE, Inc. SAFE ABOVE ALL and the AMERISAFE LOGO are trademarks of AMERISAFE, Inc. All rights reserved.

12

insight

may 2020

Simple Steps to Take to Prepare Yourself, Your Staff and Your Customers By Utica National In the wake of the COVID-19 pandemic and its effects on the United States, it is important to be prepared to respond appropriately to questions and requests from your customers. Insurance agencies are not only faced with preparing for the effects of the pandemic on their business routines, but also with the ongoing business cycle of incoming clients, renewals and claims management for clients who have experienced losses. From an agency errors and omission prospective, here are some simple steps to take to prepare yourself, your staff and your customers for the challenges that lie ahead. Prepare for backup call service or update voicemail with contact information for claims reporting. - You should NOT just close your operation - If you are forced to (illness, isolation, quarantine, etc.) you must, at a minimum, alert your current clients and carriers. Update all client-facing portals, i.e., voicemail, email, website, Facebook, LinkedIn, etc., with your business’s plans and provide contact information for servicing of accounts. Communicate with your clients and carriers. - While several states are requiring the workforce to stay at home, excluding essential services, it is important to keep your clients informed of the status of your business operations, and the contacts for new business, renewals and claim submissions. To date, ever state with stay-athome orders considers insurance to be essential. - Likewise, if you will be unavailable, or your contact numbers have changed, alert the carriers that you work with and your state association, in the event they need to contact you. Make sure antivirus and firewalls are updated frequently. - While working remotely, there is even greater risk of cyber exposers: ensure that your computer system’s security software is up to date. - use a Virtual Private Network (“VPN”), where available.

Staff should ensure compliance with carriers’ binding moratoriums in effect and communicate this to clients requesting changes in coverage. - Several states have already issued notices regarding cancellation of policies and renewals. Make sure that you check with the State Department of Insurance where your clients have effective policies. Have down-time procedures in place that are communicated with your staff. - In the event remote workers are unable to access the servers where your agency management system is located, have a process to manually document client requests for policy changes, renewals, cancellations, etc. Print a list of all policyholders, policy numbers, and important policy information and store it in a safe location, should you have issues connecting to the internet. - The internet is seeing record amounts of traffic as many companies across the U.S. are transitioning to remote work. Should there be an issue connecting to the internet, or a specific server, you will want to have a paper backup of client information. Print a list of all carrier claims information, including numbers to call and report claims, paper claims reporting forms, etc. - As indicated above, should there be an issue with connection to the relevant server it will be helpful to have a paper printout. Prepare for staffing needs post-event to handle your clients’ claims-management needs. - There will likely be an influx of claims related to the COVID-19 pandemic. Are you properly staffed to efficiently relay those claims to the appropriate carriers? This information was provided by Utica National, an AIS E&O carrier.

Mobile devices and communications containing Personally Identifiable Information (“PII”) need to be encrypted. - If you are working from a laptop computer or other mobile device, such as an iPad or tablet computer, you should have the information on these device encrypted with strong encryption software. - Any communication containing PII should always be encrypted to prevent release of sensitive information.

may 2020

insight

13

Changes in the Customer Experience During COV

Two Different Agencies - Two Differen ONE GOAL: GREAT CUSTOMER SERV

Big City Agency Impact of COVID-19 By Bill Durkin The Daniel and Henry Agency is located in downtown Chicago. At press time, Cook County has 27,616 positive COVID-19 cases and 1,220 deaths. In Chicago alone, we’ve seen 16,112 positive cases and 678 deaths. We are a hot spot. And it’s not looking at changing anytime soon. In the first week of March, prior to the Illinois executive orders shutting schools and issuing shelter in place, Daniel and Henry Agency management formed a COVID-19 task force It was designed to prepare for internal and external changes and the needs of our clients and staff. Many people spent several hours in identifying realistic problems in advance and having solutions ready to go. Proactiveness versus reactiveness. With the diversity of our workforce client base, we needed be as mindful as possible to provide both reasonable and realistic solutions. We have approximately 190 employees between our Chicago, Gape Girardeau, MO and home office in St. Louis. Our home office in St. Louis attracts a very large number of employees that live in Illinois. We also have quite a number of employees with children in K-12 schools. Governor Pritzker announced that beginning March 17, all public and private K-12 schools were to be closed in the entire state. The shelter in place for Illinois began on March 21. While Illinois Covid cases were rising in March, the State of Missouri had not seen much activity yet. With the children of employees learning from home and/ or spouses working from home as well, we thought that with everything changing so dramatically and quickly, we needed to be sure that there’s no shortage of laptops or desktops for our staff in case of shortages at home for equipment. We purchased a good number of laptops to make available as, or if, needed by producers or staff. We already had a large number of employees who would work remotely. However, with the increase of remote users comes the issue of needing more Citrix Licenses, and increasing server capacity to provide as best possible experience for our remote workers. The first week of increase in remote working brought a sluggish experience in some areas. But, once we amped things up with the servers and licenses, the feedback was that the experience was a lot better in the second week. At no time, however, did our customers feel a servicing slowdown and we can truly thank our professional, dedicated hard working employees for making things as seamless as possible. Our IT department was incredible in working with our employees on unforeseen issues of working remotely. Our in-house loss control department also did a fantastic job 14

insight

of working with employees on doing their best to have an ergonomically positive workspace at home. Since we are considered an essential industry, we were still allowed by the Executive Order to travel to and from work as needed. While we did not expect or require employees to be in the office (exception being mailroom staff), we provided the Illinois residents with signed statements from our management to keep with them in the very unlikely event they would be stopped by police or other authorities for disobeying the shelter in place order. In our Chicago office, our building management asked for a listing of key staff to allow access to the office. This was easy in that we identify every employee as important or essential and, if anybody wanted to come into the office to work, we allowed that. We have great management teams in each department of our organization and the work from home strategy went smoothly with our use of clear communication and maximizing the usage of our existing technology. Our IT department has been heavily involved in new or refresher webinars for employees on usage of certain technology or programs. The traditional ways of keeping in touch with clients like email, phone calls and texting have remained unchanged. While we were already using WebEx & Zoom, this has increased substantially for both internal agency meetings, and with our clients, prospects or carrier and vendor partners. Other ways also include LinkedIn, Vimeo and, depending on the circumstance, Slack. There are countless apps and social media platforms to communicate with, however, what works for one client, prospect, employee or carrier partner may not be liked or used by other parties. Therefore, with that, we remain flexible with open minds to make things as easy and comfortable as possible for our client. We adapt to our client needs and do not expect them to adapt to our comfort level or needs. Our agency has many great minds, as does our industry, and we will adapt with new ideas and innovation. The Daniel and Henry Agency is fully prepared to adapt and change to survive and become bigger, better, and more efficient to serve the needs of our clients while keeping mindful of the needs of our greatest asset- our employees. We have been in business since 1921 - just a few years after the devastating 1918 Spanish Flu worldwide outbreak. We have remained independent, have survived for all these years, and are unwaveringly committed to adapt to meet the new needs of our customers and how business will be transacted. Bill Durkin is a broker, serves on the Executive Committee and is on the three-member operations team at the Daniel and Henry Agency in Chicago. Bill also serves on the IIA of IL Board of Directors as an At-Large Director. He can be reached at DurkinB@danielandhenry.com. may 2020

OVID-19

ent Experiences RVICE Small Town Agency Impact of COVID-19 By Allyson Padilla Blank’s Insurance Agency is located in Olney, Illinois, which is a small town of just over 9,000 people in Southeastern Illinois’ Richland County. As of this publication, there have been only three positive cases of COVID-19 in our county. Jasper County, just north of Richland, has 41 confirmed positive cases and Crawford County, to the northeast, has 10 confirmed positives. All other surrounding counties have two or less. The positive cases are low in our area, considering the number of cases statewide, but the impacts to our way of life are no different. In a small town where it seems everyone knows everyone else this way of life, is a big change. After all, our agency motto is “The Name You Know, The People You Trust.” At our agency we pride ourselves on the direct and prompt service we are able to provide to our customers. We are used to seeing our clients and having a visible appearance in the community. Our agency office, normally full of 10 staff members, is now closed to customers. Most of the staff is working remotely now a large portion of the time. The agency voicemail has been setup to include alternate numbers so staff can be reached at any time. The change to working off-site has come with its own tribulations. Because we are in a rural area some staff has had trouble with accessing the internet from their homes in order to log in. Also, several of the staff members have children at home due to the school and daycare closures. We’re juggling claims calls, fraction lessons, insurance renewals and toddler boredom all at the same time! We do have staff coming in and out, some choosing to work from their desks at times and others coming in to pick up what they may need for the day/week. When someone is in the office, phones are answered and customers can come by to conduct business in person if they are unable to do so electronically. We continue to service our clients, just like always, but in a different way. We reached out to our commercial lines customers that may have been impacted by closures to ask how we can be of service to them during this difficult time. The staff is now emailing proposals to clients and holding renewal reviews and new business appointments all by phone. This is something that is not totally new to us, it is 2020, but not always our preferred method, especially if we have the opportunity to meet face to face.

may 2020

The agency also updated our website and social media accounts to reflect changes in contact information, as well as listing company information for claims. We are attempting to provide updated information from our companies as we receive it to keep our clients in the know the best that we can. When we think about the impact of COVID-19 on our agency, it may not be huge to some. And in the big picture, we hope it’s not. But when you are running an agency in a small town, where visibility is the norm, it’s a big change to our staff and our clients and community. We know we will come out of this strong, learning new and improved ways to communicate. We are working to assist our customers, and do so in whatever manner the new normal requires of us. Allyson Padilla is an agent for Blank’s Insurance Agency in Olney, IL and also serves on the IIA of IL Board of Directors as the Young Agents Committee Chair. She can be reached at allyson@blanksinsurance.com.

insight

15

AmGUARD • EastGUARD • NorGUARD • WestGUARD

Multiple Products.

One Source.

Commercial and Personal Insurance from the name you trust. We’re backed by the financial strength of the Berkshire Hathaway Group and A+ rated by AM Best. See what our competitive pricing and easy submission process can do for you.

PRODUCTS IN ILLINOIS: Businessowner’s Commercial Auto Commercial Umbrella Homeowners

Personal Umbrella Professional Liability Workers’ Comp

APPLY TO BE AN AGENT: WWW.GUARD.COM/APPLY/

WHAT THE HAIL JUST HAPPENED? NO WORRIES, CALL US. HOMEOWNERS INSURANCE THAT’S DESIGNED TO BE WORRY FREE A home is one of the most valuable assets. Whether it is a current homeowner, someone looking to own, or someone renting a home, financial protection is needed for the important things in life. A homeowners policy from IMT Insurance can help your policyholders Be Worry Free. Learn how you can represent IMT Insurance at imtins.com/contact.

AUTO | HOME | BUSINESS

e INSIGHT -

online journal at www.iiaofil.org/Resources/Insight

M AY 20 20

INSIGH T

T he

CUST EXPEROMER L i fe cy I E N C E cle Cultivat e the

Custom Your C er Experien lients c Want e

The Biggest MISTAKE Agents Make When Nurturing Prospects

By Alicja Grzadkowska, Insurance Business America In this month’s e-Insight. may 2020

insight

17

Hands-Off, But Yet Hands-On

By Ron Berg

Provide a GREAT CUSTOMER EXPERIENCE Using the RIGHT DIGITAL TOOLS 18

insight

may 2020

Regardless of circumstances, independent agents have the tools at their disposal to provide what customers need. They just need to look. The current state of affairs aside, this continues to be the best time to be an independent agent! Certainly, consumers and customers want ease of business, but they also want, and need, the hands-on guidance and knowledge that only an independent agent can provide. That’s where marrying the right digital tools with agency expertise can serve and delight customers.

But the tools you put in place are only half of the equation. You won’t be able to provide all the services your customers are looking for if your agency is not prepared for disasters or cyber intrusion. To this end we have a free, complete Agency Disaster Planning Guide, stepping you through all considerations needed for staff, office, remote location, technology, carrier partners and much more.

Do you know how well you’re doing in attaining this digital/service balance? Do you know where to start? This is where the Agents Council for Technology (ACT) comes in, offering a wide palette of free education and real tools to help agencies hit the mark. From insights on the Customer Experience, texting with customers, protecting against cyber threats, and disaster planning – all the resources you need are in ACT’s toolbox.

And now that having staff operate from many locations is a big part of any agency operation, we have a recentlyupdated Remote Work Best Practices guide to help understand all the facets of this new environment and set a solid plan in place for success.

From a customer experience (CX) perspective, our CX Journey website at www.independentagent.com/ ACTCX provides key insights on technology services your customers expect across their insurance lifecycle. SEO and website improvements? ACT’s got it. Chat, mobile apps, agency customer portals? It’s covered. Unsure of whether a mobile app will provide the value needed to customers? Check out our ‘CX Experience’ web page for insights on mobile account management and more. When was the last time you bought anything online without checking reviews on Amazon or Google? Your clients are no different. Your customers can help you build a wealth of website review and testimonials. Our CX website ‘Refer’ web page helps you understand and get started, and you’ll be surprised how easy it can be. Hint: You can even include videos without expensive equipment. And you can be confident that ACT doesn’t just list resources, we explain why they are important and the steps to take to utilize them well. We then extend the value working with our Big “I” national general counsel to offer tools to cover you from E&O. Tools like a downloadable agency-customer texting agreement (did you know the FCC requires this?), a cut-and-paste agency website Privacy Policy, and policy e-delivery consent (you know you’re emailing documents!). These are just a few examples of the vast collection of tools you will find on ACT’s website.

may 2020

Finally, having your business cyber-ready is not only good practice, but required by multiple laws. We have the Agency Cyber Guide, helping agents not only understand the constantly-escalating cyber trends and state/federal laws, but it includes ways to address each and every regulation. As with many ACT resources, this guide is being constantly updated. These are just a few of the resources there for the taking to elevate independent agents above the direct writers and those insuretechs competing in the IA space. Independent agents have the ability to control what they can control, and provide the “hands-on/hands-off” service balance today’s consumers are looking for. The following pages give more details on the Customer Experience Lifecycle. Ron Berg (ron.berg@iiaba.net) is executive director of the Agents Council for Technology (ACT). This article is adapted from ACT’s Customer Experience Journey website resource. View all of ACT’s customer experience resources at independentagent.com/ACTCX.

Consumers and customers want ease of business, but they also want, and need, the hands-on guidance and knowledge that only an independent agent can provide. That’s where marrying the right digital tools with agency expertise can serve and delight customers.

insight

19

Cultivate the Customer Exp What do customers want from their independent insurance agents? The Agents Council for Technology (ACT) has developed strategies to help you tap into technology, and motivate your team to provide the service today’s insurance consumers want. By creating a process with touchpoints throughout the insurance policy lifecycle, your team will build relationships and your clients will become champions for your agency and help you grow your business.

Community service affiliations, Trusted Choice logo and pledge, volunteer positions

Six Steps of the Customer Experience Lifecycle

Reviews: testimonials from current clients

To view additional details, resources, checklists and links on the following six steps, go to www.independentagent. com/ACTCX.

Discover

Be where your clients and prospects search for insurance. When considering an important purchase, where do consumers research? Online and possibly from a mobile device. That’s why it’s important for your agency to have a mobile-friendly website with lots of great content that emphasizes your experience in the marketplace. Add social media, a robust Trusted Choice profile, an understanding of SEO and your agency will make the right impression with the right customer.

How Do Consumers Find You? Four Steps to Create Awareness

1. Create a Robust, Mobile-Friendly Website Today’s consumer wants a website that’s mobile-friendly and easy to navigate. And in today’s 24-7 world, your website should make it easy for prospects to submit an inquiry. If a website does not provide the needed functionality from any device, 66% of viewers will not continue. Here are some resources to help your website make a great first impression. 2. Develop a Content Strategy Content is king, but it doesn’t have to be overwhelming. By creating a content strategy, including a blog, you’ll show new consumers your understanding of the marketplace and give policyholders a reason to come back to your website. Share the work with staff or look to resources like Trusted Choice for content to post. Here are some tips to help your website reflect your agency’s culture. “Who” is your agency? About Us: tell your agency’s story, agency locations and hours of operation Staff Listing: photos, direct email and phone numbers, areas of expertise (should a shopper be looking for a certain line of insurance) 20

insight

Keep the content coming... Content/Blog: Frequently Asked Questions, general insurance information, niche market highlights, staff contributed content, guest bloggers or authors, Trusted Choice can help

3. Improve Search Engine Optimization (SEO) Search Engine Optimization (or ‘SEO’), is the practice of increasing the quantity and quality of traffic to your website through organic search engine results. The goal is to Increase virtual foot-traffic to your website by prospects looking for local agents or specialization based on the line of business needs. Utilize keywords on your website, create local profiles and complete “Find an Agent” profiles with your carriers and Trusted Choice. Whenever possible use photos of agents and include specialization. 4. Build a Social Media Presence A business social presence is another open door to your agency and is a vital communication vehicle when disaster strikes. Determine what social media works for your agency and build a presence your clients want to follow. Consider Facebook, Twitter, LinkedIn, Instagram, YouTube, Snapchat, and Pinterest. Getting Started • Create a complete profile • Follow and engage your business clients and community leaders • Share new or relevant content from your website • Share posts of your staff and community engagements • Look to Trusted Choice for relevant and customizable content • Host a video series • Promote posts and advertise on social if affordable

Evaluate

Create a digital presence reflective of your services and brand. Once a consumer narrows their search how can you leverage your web content to make the decision-making process easy? Your website is your agency, and the same internal knowledge and expertise a client would get in the office should also be available online. Here are some strategies to help you build content clients want and help them choose your agency.

may 2020

perience Your Clients Want

By Agents Council for Technology (ACT)

Leverage Your Digital Presence Three Empowering Content Strategies

1. Demonstrate Your Expertise In the Discover phase, we learn content is king but doesn’t have to be overwhelming. The more information you have on your website, and the easier it is to find an agent, the better the customer experience. Blogs are an easy way to add content that’s easy to organize and easy to navigate. Tap into Trusted Choice, the Big I” Virtual University and your team for content. 2. Showcase Your Quality Make the most of memberships and online reviews. Solicit reviews on social media and collect testimonial stories from clients for your website. Be sure to monitor your social presence and respond swiftly to online inquiries. 3. Offer Comparative Rating Some consumers may want to compare rate and coverage options before making a purchase. RealTime rates on agency websites may provide enough preliminary rate information to reduce additional shopping on aggregator or carrier website.

Purchase

Invest in technology and processes that make purchasing easy. The consumer finds the right fit for their insurance needs and it’s your agency. Now, they need to be able to easily engage your staff. And, when it’s time to sign on the dotted line, many will look for a simple online application and want to complete the process via mobile-friendly e-signature and EFT payment.

How Do You Make Purchasing Easy? Three Critical Technologies

1. Online Applications with Minimal Information Required from the Applicant Most consumers are used to completing a quick web form to order service and they will want the same from their independent agent. This can be further simplified when the agent and customer can work on the file simultaneously. Additionally, any information the agent can backfill from public assessors will streamline the process. Utilize as many online databases for supplanting information as possible. The application also needs to allow the customer to choose coverage and billing options.

2. E-Signature Consumers expect mobile-enabled e-signature for applications, coverage rejection and other forms. Common E-signature protocols must be accepted and implemented by all companies and agents and the time savings for agencies can be enormous. Big “I” members can save 20% on DocuSign! 3. Bonus Service Feature: Online Chat Assistance Chatbots and online chat are an easy way for consumers to get answers they need and to connect with your sales force. Coupled with an easy-to-find phone number, your team can help the client determine what coverage they may need and start the application process.

Experience

Build a relationship with your clients throughout the year. Let the relationship building continue as you become a trusted resource for valuable information and community support. To do this, it is important to create an experience based on your clients’ preferred communication outlets. By leveraging your agency management system, creating a communication strategy and being easily accessible when your client needs you most your clients will become champions of your agency. continued...

may 2020

insight

21

How Do You Build Better Experiences? Five Ways to Create Experiences

1. Mobile Account Management Clients will expect access to policy forms with 24/7 availability. In addition, payment features, ID cards, household inventory and claims reporting should be easy and mobile-friendly. Ensure your website is mobilefriendly and implement self-servicing features for clients. Consider text message alerts for important updates. 2. Communication Preferences Some clients may like text messages for non-policychange discussions and others may want email or phone call. Determine client communication preferences from the start of the relationship and leverage your agency management system to distribute content and alerts how your client wants it. 3. Robust Web Content Share insurance and risk management related tips with clients on your website and social media outlets. Target the content to the clients you want and utilize a mix of delivery methods including blogs and listicles, podcasts, video, web chats and more. It doesn’t have to be overwhelming and contributors can include staff, carriers and Trusted Choice has a wealth of customizable content. Once created, content can be sliced, diced and shared repeatedly when relevant. Craft an email newsletter and build a social media following to remind clients of the wealth resources available. 4. Be Proactive When Life Changes Implement a plan to nurture your client relationships. Recognize life changes including birthdays and anniversaries. Illustrate you understand your client’s needs by sending timely storm safety tips or a note when a teen becomes a licensed driver. Consistent touches throughout the year will solidify your relationship and open the door for inquiries when life changes are top-ofmind. 5. Value-Added, Community Building, Services In addition to building a robust website strategy, there are other ways to create value for your clients. Host shredding events, sponsor defensive driving course and highlight your community involvement online and in your agency. Advise customers of services available to them at no additional charge via agency newsletters, blog, website, social media, texting, etc. This is an excellent way to highlight agency advocacy and commitment in the community. Another great value for commercial lines customers is risk management and/or safety consulting. 6. Create a Positive Claims Experience During the claims process, clients will need clear process and after-hours options for reporting. Clients will want to be briefed on what to expect from the claim process and what they will need to submit. Follow-up with a phone call or email form on the agency’s claim status.

22

insight

If the problems occur, the agent acts on client’s behalf to resolve the issue. If the clients claim is denied, the agent will help the client understand why and identify next steps. Agencies should consider implementing a claims communication plan which might include a personal acknowledgment (by phone, email or note card) of each claim and after-claim service report cards to solicit feedback on the claims experience.

Renew

Assess Clients’ Needs and Modify Service Accordingly Be proactive and contact your client in advance of renewal armed with any new information you’ve collected during your touchpoints throughout the year. When you are proactive with content and information updates with your clients and involved in the community, your clients know you are there and will likely renew. Research shows that 90% of clients that have been touched three times in the policy period renew with that agency. 1. Be Proactive with Renewals Proactively reach out to the client prior to the renewal with a proposal inclusive of comparable quotes and rate increase explanations. With a management system in place, outreach can be automated. If rate changes are necessary, take care to clearly explain the renewal increase. Use this as an opportunity to update the profile you have on your customer in your agency management system. BEST PRACTICE: A key recommendation is to start the renewal process 90-120 days out from the actual renewal date. 2. Cementing Client Engagement An ongoing goal is to keep clients engaged with meaningful communication so the value you bring is top of mind, not price. This phase is a perfect opportunity to implement great client nurturing tools that allow agents to reach out and request Net Promoter Scores and testimonials in the months prior to renewal. This minimizes the friction at renewal if a client has previously provided a positive assessment of the agency. People who have scored the agency high are less likely to reconsider their opinion of the agency at renewal. And if a client does provide a negative score or review, there is time to address and correct the problematic issue prior to renewal.

Refer

Ask client for online reviews and referrals. A social media review or five-star business rating from a satisfied client can bring new business to your agency. Incorporate an ask for ratings or reviews in your outreach strategy after positive claims experiences, renewal, or after a community event. Monitor and respond to all reviews promptly and build your reputation as a trusted advisor.

may 2020

How Do You Create Agency Champions?

Three Ways Satisfied Clients Generate More Business 1. Reviews and Referrals Request satisfied clients post positive reviews on agency and social sites. Be sure to track and respond. Ask if you can use great social referrals for your website, marketing materials or newsletters. Some outlets may have an approval process in place before reviews go live. The more reviews your agency receives, and more consistent they are, the more effective. Make sure you thank your customers individually for writing a review this can be done via a phone call or mailing a brief thank-you note with a small gift.

This is a lot of information, but the ACT website makes it easy to understand and provides toolkits, links and resources to help you along the way. If you should have any questions regarding the Customer Experience Lifecycle, please reach out to Ron Berg, Executive Director of the Agents Council for Technology (ACT), at ron.berg@iiaba. net. Agents Council for Technology (ACT) includes the industry’s leading technology experts to provide blueprints on disaster planning, cybersecurity, customer experience, and other emerging trends to help your agency. View more information on ACT at www.independentagent.com/ACT.

2. Video Testimonials This can be the most effective type of review - providing it is natural and honest. The fastest-growing agencies use video on their website to marketing and educate - 52% of agencies who have more than 6% revenue growth on both personal and commercial lines rank videos as their most valuable tool. It doesn’t have to be expensive - Use simple video equipment, even a smartphone, to film testimonials in the client’s own words. If working with commercial lines clients, film the video at their place of business, in front of a sign or other marker to add value for the client. Post the video on your website and social media. Tag the client to reach their audience and it’s a win-win for both you and your client. Tip: If you are using a phone, make sure to flip it horizontally for optimal viewing. 3. Blog Posts and Written Testimonials Clients may welcome a mention or testimonial on your blog. Include background on the client, photos, and links to their website.

EVERY RISK IS AN OPPORTUNITY COMMERCIAL TRANSPORTATION | BROKERAGE | MARINE PROPERTY & CASUALTY | SURETY | PERSONAL LINES

(800) 666-5692 | JMWILSON.COM may 2020

JM Wilson 100th Insurance Insight.indd 2

12/5/19 10:44 AM insight 23

What BUSINESSES SALESPEOPLE Should Do in the CURRENT ENVIR After 54 years on the planet, and almost 33 in business, I know two things: one, this will be over at some point, and two, a few organizations will come out of this with a stronger, healthier business while the others come out of it anywhere from “okay” to “out-of-business.” If you want to be in the first category, here’s what to do. Note: The “stronger and healthier” mentioned above doesn’t refer to companies that will automatically grow from the current crisis.

How to Excel in the Current Environment Everything goes in cycles. The stock market, the economy, real estate… you name it. We are coming off of ten years of unprecedented growth. In the U.S., we have a disruption in the economy every seven to ten years. The past 19 years have given us 9/11, the 2008 recession, and now a virus. When the economy is strong, the stock market surging, and everything is coming up roses, the majority of companies and people act as if the good times will last forever. When things turn, most companies pull back, stop spending money, and hunker down and act as if it’s the end of the world. In war, retreating, or sitting and waiting, are sometimes viable optaions, they aren’t when it comes to business. In business it leads to stagnation and paralysis. At that point, your first indication that things are back to normal will be your competition whizzing past you while you sit still. The few companies that expand and grow in bad times act courageously. They take smart risks, they double their efforts versus cutting back, they continue to invest in their business and people, and they continue to push into the market place. The companies that take a big hit, or go out of business altogether, act fearfully. Fearful actions shrink businesses. For example, the average company during an economic disruption cuts sales and marketing activity and spending by 37%. The companies that grow do the opposite. The point? It’s okay to pause and get your bearings, just don’t get stuck in neutral or reverse. Don’t panic and act on emotion. You’ll lose market share. And it’s tough to get going again starting from a stand still. So, stop for a bit if you must, but once you get your footing, and go on offense.

24

insight

Remember why you’re in business and the people you’re trying to help, recommit to your mission. Things are different, you may be working from home, you may figuratively have one or both hands tied behind your back, but with today’s technology, you can still get out there and get to people. Your approach will most likely vary, but your overall objective will always remain the same: Act courageously, take massive action, and be visible and accessible in the marketplace. And ultimately deliver the benefits you promise clients and prospects. Here are the steps to do that. Step 1: Make clients your #1 priority. Reach out and let them know you’re there. Focus on showing empathy and let them know you care. First, find out how they and their family are doing then see if they have questions or need anything. They may not have time to talk right now, though most will, what’s important is for them to know that you care and you’re there should they need you. Also, when you do talk to clients, stay positive. You don’t have to be Pollyanna, but err on the side of being positive. You may have to let them vent a bit. One of your most important skills right now is to listen. Step 2: Reach out to current prospects. As with clients, lead with empathy and concern. Ask how they are doing, then get an indication as how they’d like to proceed. Step 3: Reach out to others you know you can help. If the current situation puts you in a unique position to help someone, contact them, but again, lead with empathy and concern. Address the trying times, then build rapport and ask questions and listen, versus launching into a sales pitch. Step 4: Reach out to past clients you’d like to get back. Your objective is to be a resource should they have any questions, not to sell something, at least not right now. Reestablish that connection and let them know you care.

may 2020

S and Do RONMENT Step 5: Look for future, or even current, opportunities. Companies in the food and beverage and medical industries are growing and seeing an increased demand for products. Other companies have problems they’ve never seen before. Who is a good prospect? All your communications should be about intent right now. Just as you should be doing at all times, do not focus on the money or the sales. Let clients and prospects know you’re thinking about them, you’re there for them, and you care. Be the certainty and courage they need right now. Step 6: Prepare. • Build your prospect list and do research on them now. • Create a vision and a plan for your business going forward. • Work on professional and personal development. Build your sales skills. Prepare for new objections and work on ones that have been tripping you up for years. Improve time management, organization, and mental toughness. Work on business and personal goals. Take some classes. • Work on your USP and overall messaging. Most companies have a weak answer for ‘why you?’ Also, where can you add more value to clients? • Improve your sales process. • Improve your Sales Playbook, Script Book and Concept Book. • Work on systems you have in place to make sure they are running as efficiently and effectively as possible. • Focus on your actions. What are you doing every day to grow the business? • Do things you haven’t had time for in the past, but do now.

By John Chapin Other ideas to keep in mind: • Get back to the basics: Hard work, activity, and perseverance are key character traits to embrace at this point. • Keep a good attitude in general. Watch what you consume mentally and physically because that will have the biggest impact on attitude. Practice healthy habits. Absorb positive, inspirational material, and surround yourself with positive people. • Don’t make assumptions. Don’t assume people don’t want to talk to you or don’t have time. • You can use Zoom and Skype, in addition to regular phone calls, but make sure it’s your client’s preference. Most executives prefer a phone call. • Your competition is facing the same problems you are. • Look for ways to help your community, friends, and family in any way you can. Use this time wisely. Make some changes, get educated, ramp up and get prepared. Be out there and visible. If you have solid goals, strong enough reasons why you need to achieve them, and show up every day and do what needs to be done, you’ll get to where you want to go, regardless of anything that gets thrown at you. Finally, I challenge you to come out of this better than you went in. In better health, with better relationships, and with a better business. Your attitude and actions are 100% under your control. John Chapin is a motivational sales speaker and trainer with over 26 years of sales experience. He is the author of the 2010 sales book of the year: Sales Encyclopedia. He can be reached at johnchapin@completeselling.com.

• Make any migrations, changes, upgrades, or conversions to computer systems, phone systems, CRMs, and the like. • Break some bad habits and create some new, good ones.

may 2020

insight

25

Taking care of everything from the ordinary to the extraordinary.

ASSIST. INFORM. SUPPORT. If your organization has been directly affected by the worldwide health threat, Circles Concierge can help alleviate some of the difficulties associated with this temporary situation by assisting with:

Information about COVID-19 in the United States Centers for Disease Control and Prevention www.cdc.gov/coronavirus/2019-ncov

Support Alternative Travel Arrangements

Employee

Sourcing office supplies & remote workspace needs

Solutions to extend company culture to a remote workforce

check-ins

Coronavirus advisory information World Health Organization www.who.int/emergencies Coronavirus Q&A World Health Organization www.who.int/news-room

CONTACT US TODAY www.iiaofil.org/circles

Shannon Churchill, IIA of IL schurchill@iiaofil.org | (217) 321-3004 26

insight

may 2020

Agency Risk Management Essentials:

Is your website doing more harm than good? Your agency’s website is your “business card” to the world. Well managed, it can be the cornerstone of your operational and marketing strategy. If not, it can and will be used to strengthen a claimant’s E&O case against you. The Swiss Re Corporate Solutions claims team has seen an increasingly emerging issue stemming from this evolving part of your business. Seemingly harmless content on your website, emphasizing competitive advantages or certain expertise, can very quickly and unintentionally increase the agency’s standard of care resulting in a higher duty than normally required. That can be detrimental to your defense in a claim situation. To help mitigate the risk of an increased standard of care, we consulted risk management professionals with expertise in this area. Their suggestions are shown below. We hope you find these useful in creating and reviewing your agency website’s content.

D D

Do clearly specify in which states the agency is licensed.

X

Don’t say the agency does things or provides services it does not do or provide.

Clearly state the lines of coverage the agency writes (or does not write). For example: not all P&C agencies handle benefits lines.

X

Don’t say that you can ensure that any claim will be fully covered.

D

Do clearly state that misstatements or omissions of relevant information by the client can lead to price variation or even declination or rescission of coverage.

X

Don’t use terms such as “expert”, “specialists”, “best price”, “most comprehensive”, “fully covered”, or “partner”.

D

Do clearly state that information requested to provide a quote or work on coverage will not be shared with carriers or with any other entity without the applicant’s permission.

X

Avoid terms promising absolutes such as “immediate response time”, “ALL lines of insurance”, “all risk”, “24/7”, “all carriers”, “addressing ALL of your coverage needs”, “constantly reviewing”.

D

Be clear: requesting coverage does not guarantee coverage can be provided. Coverage can begin only with specific statement by a licensed member of the agency staff.

X

Don’t include client testimonials that show the clients’ names and identifying information without being sure the testimonial is specific to their experience thus avoiding an increase in your standard of care. Be sure to have their express written permission, along with a procedure to remove their testimonial if they are no longer a customer.

D

Do clearly state by including a disclaimer that none of the information provided in the website is a guarantee that insurance will be provided or that the agency is obligated to procure insurance for the website visitor.

X

Don’t launch a website without carefully reviewing the language, with an E&O risk management eye. Template agency websites or advertising firms simply may not have E&O on their radar. Involve your legal counsel in reviewing the language.

D

Do obtain express written consent from your carrier(s) or any other entity(s) if you use their name or logo on your website.

X

Don’t have a quote mechanism (form-fill or Rater) and then fail to respond in a timely manner.

D

Do use a Privacy Statement on your website and be sure to encrypt any pages that collect Personal Identifying Information, such as an online quote form.

X

Don’t use open text boxes for customers to type messages to you unless adequately encrypted. You have no control over the information entered in the text box. If a breach occurs during transmission of that message, your agency may be held liable for the release of Personal Identifying Information.

REMEMBER: Risk Management starts before the sale

If you would like more information about websites and protecting your agency, as an IIABA member there are additional free member benefits available through the IIABA Virtual University and Agency Council for Technology. If you are also a Swiss Re Corporate Solutions/Westport Insurance Company policyholder, you have access to the premier risk management website, E&O Happens.

Go to rms.iiaba.net for details. may 2020

insight

27

IIA of IL members receive a FREE month!

Go to tinyurl.com/ePayPolicy to get started!

Is the Coronavirus causing a change in your clients’ exposures? by Curtis M. Pearsall, CPCU, AIAF, CPIA President – Pearsall Associates, Inc. and Consultant to the Utica National E&O Program

There is no doubt that the Novel Coronavirus (COVID-19) is causing major issues for businesses of all sizes, primarily a loss of revenue. However, there are some other potential issues that your clients may be dealing with that could have insurance ramifications that you should be aware of, which include:

•

Businesses being used for a purpose other than what they were designed for. Examples include schools being converted to day care centers, theatres and auditoriums used for storing supplies, college dorms and hotels becoming makeshift hospitals, etc.

•

Restaurants are much more active in the delivery of their products to make ends meet, as a significant part of the nation is engaged in Social Distancing or Shelter-In-Place, of varying degrees. Who is acting as the delivery service and do they have the proper insurance protection?

•

Manufacturers retooling their production lines to make much-needed medical and personal protective equipment. There is immunity, in certain circumstances, under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), but these exposures should be assessed to determine if the new risk is anticipated by the current policy or policies.

•

Some businesses have been forced to shut down, potentially resulting in a vacant building scenario.

These are all issues agents need to be sensitive to and encourage their clients to bring to their attention. Will the insurance carriers be willing to continue on the coverage when the exposure is different from what they were aware of? Will the policy, as written, respond to the current risk? It is best not to assume and to contact the carriers with new exposure information provided by your clients. It is advisable to reach out to each of your clients by letter/email or via your agency website, and request that they advise you if there has been any modification to their business operation that would change the risk associated with that coverage. It is important that you document all responses and any declinations to modified coverages that are proposed. While there are moratoriums in place in several states to prevent carriers from canceling policies, this does not guarantee that the loss will be covered. Having your clients alert you to any changes in their business operations is a proactive way to address the current crisis and will put accountability on your clients to advise you of their changing exposures. This information is provided solely as an insurance risk management tool. Utica Mutual Insurance Company and the other member insurance companies of the Utica National Insurance Group (“Utica National”) are not providing legal advice, or any other professional services. Utica National shall have no liability to any person or entity with respect to any loss or damages alleged to have been caused, directly or indirectly, by the use of the information provided. You are encouraged to consult an attorney or other professional for advice on these issues.

© 2020 Utica Mutual Insurance Company 5-R-1317 Ed. 4-20

may 2020

insight

29

INSIGHT | associate news Thank you to our Associate Members.

Diamond Level Members

Platinum Level

Progressive Surplus Line Association of Illinois

Gold Level AAA Insurance Arlington/Roe

Silver Level Grinnell Mutual Reinsurance Company Imperial PFS IMT Insurance

Nationwide West Bend Mutual Insurance Co.

Bronze Level A. J. Wayne & Associates AFCO Credit Corporation AMERISAFE AmWINS Brokerage of the Midwest, LLC Auto-Owners Insurance Co. Berkshire Hathaway Guard Insurance Companies Columbia Insurance Group Continental Western Group Donald Gaddis Company, Inc. Donegal Insurance Group Encompass Insurance Encova Insurance Erie Insurance Group Foremost Insurance Group Forreston Mutual Insurance Company Frankenmuth Insurance Grange Insurance Illinois Mine Subsidence Insurance Fund Illinois Public Risk Fund Indiana Farmers Insurance Insurance Program Managers Group J C Restoration J M Wilson Kemper Keystone Insurance Group, Inc. 30

insight

Liberty Mutual/Safeco Insurance Madison Mutual Insurance Company MarshBerry & Company Maximum Independent Brokerage, LLC Mercury Insurance Group MetLife Auto & Home Midwest Insurance Company miEdge PEOPLE Previsor Insurance ProAg Management Inc RT Specialty - Naperville Selective Insurance Company of America ServiceMaster DSI Society Insurance Specialty Risk of America Transcom General Agency Travelers UIG - The Agent Agency United Fire Group Universal Property & Casualty Utica National Insurance Group W. A. Schickedanz Agency, Inc./Interstate Risk Placement Western National Insurance Westfield may 2020

iia of il news | INSIGHT

Education Classes

Please Note: At press time, all May and June classroom education sessions are being held virtually. View the latest information on the IIA of IL website at www.iiaofil.org.

june

may

4 5 6 6 11 12 12 18 19 19 20 20 20 21 21 27 28

Pre-Licensing Course Property & Casualty Virtual Class CISR-Life and Health Essentials Virtual Class Pre-Licensing Course Life & Health Virtual Class CIC-Commercial Property Virtual Class E&O Roadmap to Personal Auto Webinar E&O Roadmap To HO Endorsements Webinar Ethics and E&O Webinar Pre-Licensing Course Property & Casualty Virtual Class CISR-Commercial Casualty 2 Virtual class Ethical Dilemmas Webinar CISR-Agency Operations Virtual Class E&O: Commercial Liability Coverage Gaps Webinar E&O: Roadmap to Homeowners Insurance Webinar Pre-Licensing Course Life & Health Virtual Class E&O Roadmap To Policy Anaylsis Webinar E&O Risk Management Webinar Agents E&O Webinar

8 9 10 10 16 16 17 17 17 18 18 22 23 23 24 24 25

Pre-Licensing Course Property & Casualty TBD E&O Roadmap To HO Endorsements Webinar Pre-Licensing Course Life & Health TBD CIC-Commericial Casualty Virtual Class CISR-Commercial Casualty 2 Virtual Class E&O: Roadmap to Pers. Auto & Umbrella Webinar Ethics and Agent Liability Webinar Culture, Ethics, and E&O Webinar E&O Roadmap To Policy Anaylsis Webinar Agents E&O Webinar CISR-Commercial Casualty 2 Virtual Class E&O Roadmap to Personal Auto & Umbrella Webinar Pre-Licensing Course Property & Casualty TBD E&O Risk Management Webinar E&O: Commercial Property Coverage Gaps Webinar Flood Insurance and the NFIP Webinar CISR-Personal Residential Virtual Class

New Members member agencies Campbell Insurance Group, LLC Marion, IL may 2020

insight

31

Board of Directors Pro

Thomas Evans, Jr. Region 6 Director

Crum-Halsted Agency, Inc., Crystal Lake, IL Sales Number of Years with Agency: 1 Year You Started in Insurance: 1996 Education: Brother Rice High school, Graduated Northern Illinois University with a BS Criminal Justice in 1996 Current or Past Civic, Political, or Community Service Activities: Former DuPage IIA President and board member. Also, served as IIA Region 9 Director for 6 years. Named 2014 IIA of IL Young Agent of the Year. What do you feel are major challenges facing our Association today? I believe the biggest challenge is the big Agencies/Equity houses buying up the Independent Agencies. What suggestions do you have to respond to these challenges? Promote.

What has been the most rewarding, for you personally, about your services on the board? The opportunity to work with the IIA board and IIA team. Phil, Rachel, Shannon, Tom and the rest of the IIA staff really go out of their way to work for the Agents.

What do you see at the greatest benefit to IIA of IL membership? The opportunity to work with your industry peers while working alongside the IIA staff to protect and grow the Independent insurance channel.

What advice do you have to share with someone considering a volunteer position with the IIA of IL? Do it. Not only is it a rewarding experience professionally, the friendships you make with your fellow agents and IIA staff alone is worth it. What prompted you to get involved with the Association? Tom Ross and Tom Walsh

Dustin Peterson

Government Relations Committee Vice-Chair and IIAPAC Chair Peterson Insurance Services, Inc., Clinton, IL Risk Manager Number of Years with Agency: 16 Year You Started in Insurance: 2003 Education: Northern Illinois University College of Business, graduated 2003 Licensed Realtor since 2004 Current or Past Civic, Political, or Community Service Activities: Just recently re-elected to my fourth term (2-year terms) as Chairman of the County Republican Organization. Have worked/volunteered on many past campaigns for various state and Federal Republican campaigns. Serve on the local YMCA board of directors. Past President Clinton Country Club. 32

insight

What do you feel are major challenges facing our Association today? A few challenges but some of the top ones I see is an aging Agency force of owners/producers. Another is utilizing/ engaging the value of technology in the independent agency platform, there is lots of room for agencies to move forward in this arena but can be daunting where to begin. What suggestions do you have to respond to these challenges? Continued focus and growth through the young agent channel selling the perks of a career in insurance with an emphasis on the advantages long term of being independent versus a captive agent. With technology connecting agency principals with their peers they know/ trust who have made some advancements on the tech front. Agents want to hear the real truth both positive and negative in making changes in their own agency.

may 2020

rofiles

Andrew Allan, CIC, AAI Region 8 Director