THE RACE IS ON CORPORATE FINANCIAL LEADERSHIP

The turbulent economy continues to hit home for businesses and professionals in the Chicago area. But, as the local experts in financial recruiting and staffing, we can help you get ahead no matter which way the winds are blowing.

Our intimate understanding of the local job market, salary trends and business climate helps us connect great talent to great companies better than anyone else in Chicagoland. To find out more, visit us online or call your local office.

As the Thanksgiving and holiday season quickly approaches, I wanted to take a moment to personally express my gratitude and publicly acknowledge the volunteer leaders who generously contribute their time and expertise to the Illinois CPA Society

From our Board of Directors to our Chapter Presidents & Committee/Task Force Chairs, the ICPAS leadership is a diverse and impressive group of CPAs.

Thanks for all that you do to strengthen both the CPA profession and the Illinois CPA Society

I C P A S O F F I C E R S

Chair

James P Jones, CPA

Edward Don & Company

Vice Chair

William P Graf, CPA

Deloitte & Touche LLP

Secretary

Edward J Hannon, CPA, JD Freeborn & Peters LLP

Treasurer

Daniel F Rahill, CPA, JD

KPMG LLP

Immediate Past Chair

Accounting Principles

Jeffery P Watson Blackman Kallick LLP

Scott G Lehman* Crowe Horwath LLP

Audit & Assurance Services

James J Gerace BDO USA , LLP

Elizabeth J Sloan

Grant Thornton LLP

Employee Benefit Plans

Janice Forgue McGladrey LLP

Ethics

George Heyman

Retired - Oakton Community College

Gary E Kemnitz* Mueller & Co LLP

Financial & Treasury Management

Daniel F Rahill

KPMG LLP

Government Executive

Irwin A Lyons Miller Cooper & Company Ltd

Governmental Report Review

Gregory A Dunham

Wipfli

Illinois CPAs for Political Action

Lawrence A Wojcik

DLA Piper US LLP

Nominating

Robert E. Cameron

Cameron, Smith & Company PC

Not-for-Profit Organizations

Kimberley A Waite

Frost Ruttenberg & Rothblatt PC

Peer Review Report Acceptance

Gregory J. Pierce

Pierce Riesbeck & Associates

Catherine L. Allen*

Guthoff Mehall Allen & Company PC

Regulation & Legislation

Sheldon P Holzman

Retired - Baker Tilly Virchow Krause LLP

Tax Advisory Group

Joseph F Bigane III

Wolf & Company LLP

Taxation Business

Andrea K Urban Optiver US LLC

Taxation Estate, Gift & Trust

Michael A Deering

Mowery & Schoenfeld LLC

Taxation Executive

Mary Lou Pier

Pier & Associates

Greg Ciokajlo*

Ciokajlo, Hein & Associates Inc

Taxation Flow-Through Entities

Jeff Rozovics

Rozovics & Wojcicki

Taxation Individual

David V Kalet

BP Products North America

Taxation International

Thomas B Murtagh

Wolf & Company

Taxation Practice & Procedures

Norris C Harstad

Benchmark Aspen & Associates Ltd

Taxation State & Local

Bradley H Greenberg

Silver Lerner Schwartz & Fertel, CPAs

Women s Executive

Wendy A Kelly

Corbett, Duncan & Hubly PC

TASK FORCE CHAIRS

AICPA/ICPAS Collaboration

Charles F G Kuyk, III

Crowe Horwath LLP

Committee, Structure & Volunteerism

Mary Ann Webb

Sulaski & Webb, CPAs

CPA Exam Award Program

Mark P Joyce

AmeriQuest Transportation Services

Diversity Initiatives

Scott D Steffens

Grant Thornton LLP

Industry & Business Advisory

Edward H Stassen

Lifetime Acheivment Award

Robert E Cameron Cameron, Smith & Company PC

Outstanding Educator Award

Kenton J Klaus

Deloitte & Touch LLP

Outstanding Leadership in Advancing Diversity Award

Kristen N Jolaoso

The Corvus Group Inc

Women s Initiatives

Paula A Galbraith

Hubbard Galbraith

Young Leaders Advisory

Jared J Bourgeois

FTI Consulting Inc

Young Professionals Group

Sobia Farid

Deloitte & Touche LLP

Mark W Wolfgram

Grant Thornton LLP

MEMBER FORUM GROUP

Agribusiness

Jason S Bartell

Bartell & Barickman

Futures, Securities & Derivatives

Todd Briggs McGladrey LLP

Investment Advisory Services/PFP

Kevin Costello

Kevin W Costello, CPA

Not-For-Profit

Susan R Jones

Miller Cooper & Company Ltd

Taxation NW Suburban

Samuel Pass

Samuel Pass, CPA

CHAPTER PRESIDENTS

Central

Linda M Martin

Clifton Gunderson LLP

Chicago Metro

Sherman C Wright

Accurate Real Estate Assistance

Chicago South

Frank J McCauley

Retired

Fox River Trail

Marianne Phelan

Fox Valley

Larry E Navoy

Larry Navoy, CPA

North Shore

Burton W Goode

Burton W Goode, CPA

Northern Gerri Downing Siepert & Co LLP

O'Hare

Barbara M Monasky

Western

John T. Kustes

American Bank & Trust Company

CONFERENCE TASK FORCE CHAIRS

Accounting & Auditing (Chicago/Springfield)

Matthew G Mitzen

Blackman Kallick LLP

Advanced Topics in Flow-Through Taxation (Chicago/Peoria)

Jeffrey A Rozovics Rozovics & Wojcicki

Business Valuation

James S Kerwin

Kerwin Appraisal Associates Ltd

Construction

Catrina M Payne Miller Cooper & Company Ltd

Employee Benefits (Spring)

Nicholas Cheronis Verisight Group

Employee Benefits (Winter)

Kathleen A Musial BIK & Co LLP

Estate & Gift Tax

Eunice K Sullivan S & P Tax Solutions Ltd

Financial Forensic

Michael D Pakter Gould & Pakter Associates LLC

Financial Institutions

Brady J Nitchman

Plante & Moran PLLC

Fraud J Bradley Sargent Sargent Consulting Group, LLC

Government (Chicago/Springfield)

Linda S Abernethy McGladrey LLP

John L Eyth

Zumbahlen Eyth Surratt Foote & Flynn Ltd

Healthcare Compliance & Fraud

Howard L Stone

Stone, McGuire & Siegel

IRS Practice & Procedures

Harriet Jacobs Jacobs Tax & Consulting

IRS/Tax Practitioner Symposium

Harvey Coustan

Harvey Coustan LLC

Midwest Financial Reporting Symposium

David L Landsittel

David L Landsittel, CPA

Not for Profit - Chicago

Arthur Gunn

Arthur S Gunn, Ltd

Not for Profit - Springfield

Charlotte A Montgomery Illinois State Museum Society

Not for Profit Complex and Emerging Accounting & A-133 Issues

Howard I Blumstein

BDO USA LLP

State & Local Tax

David A Hughes Horwood, Marcus & Berk Chartered Tax

Michael N Radencich Trimarco, Radencich, Schwartz & Mrazek, LLC

Taxation on Real Estate

Douglas Hart Retired, DAD Associates LLC

Robert E Cameron, CPA

Cameron, Smith & Company, PC

I C P A S B O A R D O F D I R E C TO R S

Linda S Abernethy, CPA McGladrey LLP

Rose G Doherty CPA

Legacy Professionals LLP

John A Hepp, PhD, CPA

Grant Thornton LLP

Margaret M Hunn, CPA, CFE, CFF, CITP

Rozovics & Wojcicki

Geralyn R Hurd, CPA Crowe Horwath LLP

Paul V Inserra, CPA

McClure, Inserra & Co , Chtd

Leif J Jensen, CPA

Leif Jensen & Associates Ltd

Kathleen M Kedrowski, CPA

Retired, Navigant Consulting

Michael J Maffei, CPA

GATX Corporation

Marcus D Odom, PhD, CPA (inactive) SouthernIllinois University

Floyd D. Perkins, CPA

Ungaretti & Harris

J Bradley Sargent, CPA/CFF, CFE, CFS, Cr.FA

Sargent Consulting Group LLC

Marcus F Schultz, CPA

Dugan & Lopatka CPAs PC

Thomas L Zeller, PhD, CPA Loyola University Chicago

I N S I G H T M A G A Z I N E

Publisher/ICPAS President & CEO Elaine Weiss

Editor-in-Chief/

Publications Director

Judy Giannetto

Creative Services Director

Gene Levitan

Creative Services Manager

Rosa Garcia

Publications Specialist

Derrick Lilly

National Sales & Advertising

Natalie Matter DeSoto

YGS Group, 3650 West Market

York, PA 17404

P: 800 501 9571 x127 F:

717 825 2171

E: natalie desoto@theygsgroup com

Circulation/Member Services Director

Carl Siska

Editorial Offices

550 W Jackson Blvd , Suite 900 Chicago, IL 60661

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 24,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year,

means without the written consent of INSIGHT Permission requests may be sent to: Publications Specialist, at the address above

changes to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

The

throughout

client’s employee lifecycle including time and labor management, expense tracking, employee online self-service, COBRA administration, and applicant management.

As your client grows, a competitive benefits package is essential to attracting and retaining necessary talent. Paychex offers integrated solutions for retirement plans and pre-tax benefits that work in concert with payroll.

Paychex can provide help with federal/ state applications and new hire forms. Other than payroll, services include consultations on business and health insurance, workers’ compensation, employee handbooks and more.

80% Percent of organizations that acknowledge their internal audit function has room for improvement. Ernst & Young

Key findings of the 2012 Accounting MOVE Project Executive Report show that the “best” firms commonly offer programs designed to retain and advance women to middle -management and partnership, blend community service with professional development, increase productivity and customer retention through flexible work options, and increasingly improve communication about successful women ' s initiative programs internally and externally

The American Society of Women Accountants [aswa org] and the American Woman’s Society of Certified Public Accountants [awscpa org] recently named Chicago’s Baker Tilly as one of the 2012 “Best Public Accounting Firms for Women,” saying, “Baker Tilly got more than it bargained for in several local mergers and was smart enough to keep thriving women ' s initiatives intact and growing Fifty-five percent of all managers are women, providing more and more young associates with examples of diverse career paths at the firm ”

Because there are no public reporting requirements for private companies, information on the current state of this crucial segment representing more than half of GDP and more than 65 percent of new job creation has been largely unavailable In response, Sageworks has developed the Private Company Indicator, which provides data on US privately held company profit and sales trends by aggregating approximately 1,000 financial statements per day in a cooperative data model Each metric’s monthly data point represents the trailing 3-month average for all privately held companies Visit sageworksinc com/private-company-indicator aspx for more

The Accounting Practice Exchange has launched a new website designed to make it easier and cheaper to buy and sell an accounting or tax practice Through the Exchange, sellers can connect with potential buyers at a national level without employing a third party, while buyers can easily search for the latest opportunities in the marketplace Advertising rates on the Exchange start from as little as $99 versus the standard 15-percent brokerage fee

Visit accountingpracticeexchange com for more

The Shoeboxed app processes receipts, expenses and documents using high-accuracy scanning techniques, human data verification and the latest encryption to ensure data security Ultimately, a user ’ s account will house secure digital contact lists, organized receipt and expense documents, and IRS -accepted receipt images that allow users to create expense reports, maximize tax returns and manage all contacts from one location Visit www shoeboxed com to take a tour, get the app and learn about premium options.

$9.9 billion

Audit and non-audit fees paid by large public U.S. companies to their independent auditors in 2011 (the second highest annual total ever)

Studies like The 2012 Millennial Impact Report [themillennialimpact com] reveal that Millennials are socially and environmentally conscious, and therefore ideal candidates for employee volunteer programs

How should businesses engage them? VolunteerMatch’s

Volunteering Is CSR blog offers these three tips:

1 Offer professional development opportunities: Instead of focusing purely on the social importance of a cause, emphasize the professional benefits as well.

2 Prove your impact: Provide tangible evidence of the impact of your efforts, including videos and stats

3 Communicate clearly: Describe volunteers’ precise responsibilities, outline your company ’ s positive impact and keep communications concise

Only 27 5 percent of bankers believe their local economy will improve over the next six months, says Grant Thornton LLP’s annual Bank Executive Survey The survey results reflect a stunning drop from the 44 percent of bankers who predicted improvements in 2011 What’s more, the number of bankers expecting their local economies to worsen rose from 6 percent in 2011 to 13 percent in 2012 The bearishness doesn’t stop there Only 13 percent of bankers now expect the nation’s economic outlook to improve, and 20 percent actually expect it to worsen Grant Thornton leaders attribute bankers’ attitudes to slow/stagnant global economic recovery, underwhelming job growth, high unemployment figures, and the increasing number and complexity of regulations In fact, regulatory compliance was cited as an ongoing issue by 94 percent of respondents, followed by margin pressures due to low interest rates (88 percent) and weak loan demand (67 percent) Overall, bankers are expecting an evermore challenging economy ahead For full survey results visit www.GrantThornton.com/banksurvey.

The winter 2011 edition of INSIGHT Magazine, the magazine’s first ever Practice Management Special Issue, has been awarded the 2012 APEX Award for Publication Excellence in the category of Print Magazines & Journals The annual APEX Awards for Publication Excellence are sponsored by Communications Concepts, Inc. to give national recognition to publishers, editors, writers and designers who create print, web, electronic and social media communications across all industries and sectors For a complete list of INSIGHT awards visit the About INSIGHT section at www.icpas.org/insight.htm.

YOU don’t want to just be an employee — You dream of working with an innovative team of colleagues who support YOU. Who inspire YOU.

YOU want to work in an environment that shapes YOUR career — and YOUR life. YOU want a competitive compensation package that includes incentives that recognize the value YOU provide.

YOU want flexibility — from how YOU schedule YOUR time, to the direction YOU grow YOUR career.

Grow. Thrive. Lead YOUR life at FGMK.

Candidates with 3-10 years in audit and/or tax public accounting experience, send your resume to Lee Singer, CPA, Managing Member at Lsinger@fgmk.net.

We’re all familiar with the deals to be had on Groupon, right? Well, in recent years, a number of companies that offer discount or “deal-of-the-day” vouchers have emerged, and with them various questions about state and local sales taxes

In a typical deal-of-the-day transaction, a r e t a i l e r c o n t r a c t s w i t h a d e a l - o f - t h e - d a y company, agreeing to provide its product or service whether limited or unlimited in n u m b e r a t a d i s c o u n t T h e d e a l - o f - t h ed a y c o m p a n y s o l i c i t s c u s t o m e r s t o p u rchase the voucher, entitling that customer to the agreed upon discount The vouchers usually are generated electronically, with the proceeds divided between the retailer and the deal-of-the-day company.

Keith is a senior manager of Grant Thornton’s State & Local Tax practice, based in Chicago Previously, he held the position of general counsel of the Illinois Department of Revenue, where he developed tax policy, evaluated and reviewed tax-related legislation, and oversaw tax-related litigation.

* keith staats@us gt com

F r o m a s a l e s t a x p e r s p e c t i v e , t h e f i r s t q u e s t i o n i s , “ I s t h e d e a l - o f - t h e - d a y f o r a tangible product or service subject to a particular state’s sales tax?” In transactions that involve the sale of both a tangible item and a n o n - t a x a b l e n o n - t a n g i b l e s e r v i c e , t h e next obvious question is, “How should the payment be allocated between taxable and non-taxable components?”

It seems that the states generally agree that the deal-of-the-day company’s initial sale of the voucher is not subject to sales t a x . H o w e v e r, t h e s t a t e s a r e n ’ t i n a g r e ement when it comes to the amount of tax due when vouchers are redeemed

In a transaction exclusively involving a sale of tangible personal property or a taxa ble s e rv ic e , de pe nding on the s ta te , the sales tax base could be (1) the amount the c u s t o m e r p a i d f o r t h e v o u c h e r, ( 2 ) t h e a m o u n t t h e r e t a i l e r r e c e i v e d f r o m t h e “deal-of-the-day” company, (3) the regular sales price of the product the customer has purchased, or (4) the amount the retailer received from the customer

The Illinois Department of Revenue issued advice on the sales tax treatment of these types of transactions at its annual meeting with tax practitioners earlier this year Taking the example of a customer who purchases a $25 deal-of-the-day voucher for

$50 worth of food at a local restaurant, we’ll get a better idea of the process for determining sales tax.

Illinois takes the position that in a deal-ofthe-day type transaction involving the redemption of a voucher for a discounted purchase, the amount subject to tax depends on whether the retailer knows the amount the customer paid for the voucher For example, if the retailer knows that a customer paid $25 for a voucher entitling them to $50 worth of food, then the tax base is $25 If, however, the retailer doesn’t know that $25 was paid, then they’re subject to a tax base of $50 What’s more, any receipts paid by the customer for additional food over the $50 amount increases the tax base For instance, $60 of food represents an additional $10 making the tax base $35 or $60, depending on whether the retailer is aware of the amount paid for the voucher.

The sales tax treatment of deal-of-the-day v o u c h e r s i s a n e v o l v i n g a r e a , a n d s t a t e s tend to be inconsistent in how sales tax is a p p l i e d W h a t ’ s m o r e , f o r t h e m o s t p a r t , state policies have been announced in policy bulletins rather than incorporated into r e g u l a t i o n s , r a i s i n g q u e s t i o n s o v e r h o w binding the pronouncements truly are

Adding to the challenge is the fact that policies are subject to change. For instance, Massachusetts originally treated the deal-ofthe-day discount like a gift certificate, which meant that the tax base for a $25 voucher worth $50 would be $50 (the value of the voucher), and tax would be due when the voucher was redeemed Recently, however, Massachusetts modified this treatment, entitling the retail customer to a reduction in the sales price at the time of the sale, with the taxable amount being based on the discounted price ($25 versus $50)

Needless to say, participants in these programs should carefully evaluate the requirements of the jurisdictions in which they conduct business and periodically review state pronouncements to ensure that state policies haven’t been modified

If you’re like me and became a parent for the first time before the onset of the new millennium, you must have noted the What to Expect books phenomenon with some bemusement I begrudgingly acknowledged their popularity once I started seeing them in friends’ homes on coffee tables, in kitchens and even in bathrooms Ultimate confirmation of the books’ mainstream acceptance came early in 2012 with the release of the major motion picture What to Expect When You’re Expecting

normal operations The long-term ramifications of fraud can be drastic since it can and often does have a material impact on an organization’s ability to continue as a going concern The legal and accounting expertise required is very different than what’s called for by day-to-day legal and accounting functions This means identifying the right experts and getting them on board quickly

Brad is the managing member of The Sargent Consulting Group, LLC, which specializes in forensic accounting and financial investigation He is a frequent lecturer and chair emeritus of the American Board of Forensic Accounting A member of the Illinois CPA Society since 2002, Brad also serves on the Society’s Board of Directors

I often wonder why such guidance doesn’t exist for those involved in a fraud for the f i r s t t i m e W h a t c a n s t a k e h o l d e r s e x p e c t when news of a breach breaks? What are the proper steps to take? Who should be i n v o l v e d ? H o w l o n g w i l l i t t a k e ? H o w much is it going to cost? What’s the most likely outcome?

These are questions that virtually every one of my clients has asked. To the best of my knowledge no such guide exists. And y e t , f r a u d d o e s h a p p e n , a n d v e r y f e w clients and advisors expect it when it does.

We l l , g u e s s w h a t , i t c o u l d h a p p e n t o you And how you react will make a huge difference to the eventual outcome

The initial news that something is wrong i s o v e r w h e l m i n g i n s o m e c a s e s P e o p l e tend to react with their hearts and not their heads This is, after all, an issue of broken trust Not overreacting and staying calm in the initial hours and days after a breach is discovered pays off in the long run Taking c o n t r o l a n d “ c i rc l i n g t h e w a g o n s ” i s t h e best first step Limit information to a needto-know basis until the nature and scope of t h e b r e a c h i s k n o w n O t h e r w i s e , a w e l lintentioned accountant or employee could inadvertently ruin an investigation by alerting a co-conspirator to the discovery

Once information is effectively contained, identifying the right experts to involve is critical. Understand and accept that the organization will need to go far outside the box of

Start by contacting legal counsel Far too often, entities and their accountants make the choice to conduct their own investigation, destroying evidence, alerting co-conspirators and sabotaging the process along t h e w a y. T h e a t t o r n e y ’ s p r i m a r y j o b i s t o protect the organization not the individuals, and to ensure that any investigation is conducted properly. What’s more, an attorney can identify other areas of expertise required to resolve the problem.

Allan T. Slagel, Esq., co-chair of Shefsky & Froelich’s Litigation Practice Group, has successfully represented clients in a variety of commercial disputes, ranging from breachof-contract actions to multistate class-action securities and derivatives litigation He has also worked extensively to defend and prosecute employment-related claims He states that, “Clients need to be provided with a clear understanding of the risks to their entity and themselves when dealing with claims asserting financial wrongdoing The failure to give due consideration to the consequences of such claims can have long-term serious ramifications ”

Once again, step one always should be “contact your legal counsel ”

The next seemingly obvious step, if not taken, can cause the situation to implode trust your legal counsel

If you’re a CPA serving clients, encourage them to listen to their attorneys and follow their directions. I have personally worked with clients who went off script and wrecked weeks of their attorneys’ and forensic accountants’ work. Allow your attorneys to lead

the investigative team As mentioned, these experts are unique in their skills and don’t come to the table free CPAs who are used to performing an audit and generating a tax return for client fees of $10,000 may have trouble comprehending a forensic investigation that costs $50,000

Keep in mind that the client’s future may h i n g e o n t h e r e s u l t s o f t h e i n v e s t i g a t i o n Don’t be afraid to ask any and all questions, a n d , a s a f i d u c i a r y, m a k e s u r e y o u a s s i s t y o u r c l i e n t i n i d e n t i f y i n g a n y i n s u r a n c e c o v e r a g e ( s u c h a s D i r e c t o r a n d O f f i c e r, Errors and Omissions, etc ) that may pay for the cost of an investigation and prosecution (or defense)

Allow the team to finish its work and provide complete and full data When approached or interviewed, always tell the unvarnished truth Key facts that are kept from the investigative team may be unearthed later on and cause severe damage The worst-case scenario is that withholding or destroying evidence may rise to the level of a criminal offense

If evidence of wrongdoing surfaces, be prepared to fully prosecute the matter Consider the tone at the top letting key em-

ployees off easy when they’ve committed ethical violations sends a disastrous message throughout the organization

Last but certainly not least, be prepared to litigate Entities have many compelling reasons to keep their dirty laundry out of the public eye and therefore seek to resolve t h e s e t y p e s o f m a t t e r s q u i e t l y H o w e v e r, some cases do require a court’s decision for a reasonable outcome The courtroom is an intimidating arena, but it’s also where having the right attorneys and experts in place from the beginning pays dividends

If your matter goes to court, be ready for any outcome Your vision of an open–ands h u t c a s e m a y n o t a l i g n w i t h t h e j u r i s t s ’ final determination As any attorney will tell you, going to trial is always a proverbial roll of the dice

If only the market recognized that business owners, managers and fiduciaries could benefit enormously from a manual on what to expect when the unexpected happens It’s invariably an unnerving process that could be mitigated with better guidance

The solution is clear: Keep an eye out for my future book, What to Expect When You Didn’t Expect It!

Personal financial planning as an executive perk is still around; it just looks a bit different

By Mark J Gilbert, CPA/PFS

Executive perks have gotten a bad rap over the last several years, starting in 20002 0 0 2 w h e n e x e c u t i v e s a t f i r m s s u c h a s Enron, Worldcom and others made headlines for their bad management The 2008 f i n a n c i a l c r i s i s a n d g l o b a l r e c e s s i o n a l s o l e f t i n v e s t o r s d e m a n d i n g f e w e r e x c l u s i v e benefits for company executives

principal in the financial planning f i r m o f Re a s o n Fi n a n c i a l A d v i s o r s , Inc , Mark’s 25-plus years of finance a n d a c c o u n t i n g e x p e r i e n c e i n c l u d e s

1 3 yea r s in p er s ona l f ina ncia l p la nning An ICPAS member since 1982,

M a r k c u r r e n t l y s e r v e s i n t h e I A / P F P

M e m b e r Fo r u m G r o u p a n d o n t h e

Structure & Volunteerism Committee

* mgilbert@reasonfinancial.com

H o w e v e r, t h e d e a t h o f p e r k s h a s b e e n g r e a t l y e x a g g e r a t e d T h e y ’ r e s t i l l a r o u n d , albeit in a more subdued way Thanks to regulations like Sarbanes-Oxley and DoddFrank, these executive programs are under a brighter spotlight and are more transparent Consequently, while some companies have chosen to scale back their perks, others continue to provide them as a means to remain competitive in the marketplace

While the media not surprisingly likes to focus on more glamorous perks like personal use of the corporate jet, a survey of recent S&P 500 company proxy statements published by the Ayco Compensation & Benefits Digest (June 15, 2012) indicates that financial planning is one of the most common perks offered In fact, 45 percent of firms provided both company aircraft personal use and financial counseling/tax preparation perks to their CEOs and certain

f a c t o r s : F i r s t , t h e n e e d t o b e c o m e m o r e competitive than (or remain as competitive as) a company’s peers from a compensation p e r s p e c t i v e ; s e c o n d , t h e n e e d t o r e d u c e e x e c u t i v e s ’ c o n c e r n s o v e r t h e i r p e r s o n a l financial situations so they can better focus on their employer firms; and third, the need to free up the time executives spend on personal matters in order to focus on running their businesses

Since Sarbanes-Oxley became law, public companies have had to disclose the types and amounts of executive perks for certain named executive officers Dodd-Frank introduced a requirement to provide nonbindi n g s h a r e h o l d e r v o t e s o n e x e c u t i v e c o mpensation and perks for public companies Both laws, as well as increasing public firm s h a r e h o l d e r a c t i v i s m , h a v e m a d e g r e a t e r scrutiny of the board and CEO or president a necessity

Some firms have responded by cutting perk programs back substantially over the last decade. Most have continued to run these programs in a tighter, more prudent way. Relatively fewer firms have opted for what I call an “egalitarian trend ” These firms take the position that corporate executives shouldn’t receive perks above and

named executive officers, followed by 37 percent that provided a car and 31 percent that provided an executive physical exam Encompassing anything from preparing a y

o ongoing financial advice and even investment portfolio management, financial planning perks owe their popularity to three key

beyond what middle managers and rankand-file employees receive, and have eliminated most or all of their programs. Others have attempted to increase the availability of at least some of the perks among a broader range of the corporate workforce And, in fact, a recent International Foundation of Employee Benefit Plans survey shows that

“In terms of total cost, these perks generally cost less than other, higher-profile perks, so they’re not likely to draw as much ire from shareholder activist groups. ”

70 percent of its member firms provide all or most of their employees with some form of financial education or financial planning

Financial planning perks are taxable as fringe b e n e f i t s , a n d t h e r e f o r e i n c l u d e d i n W- 2 i ncome, unless they specifically relate to advice provided on the employer’s qualified retirement plan, and such advice is available to all company employees.

As the call for transparency has increased, there’s been a decline in the practice of providing a tax reimbursement or tax gross-up to c o v e r t h e a m o u n t o f i n c r e m e n t a l i n c o m e taxes associated with the taxable perk The Ayco survey indicates that merely 5 percent of S&P 500 firms reported providing any sort of tax reimbursement

I expect that financial planning perks will continue to be offered to executives and certain other managers of large publicly traded firms In terms of total cost, these perks generally cost less than other, higher-profile perks, so they’re not likely to draw as much ire from shareholder activist groups Plus, a corporate board can more easily justify offering this type of benefit to its executives in light of the increasingly complex tax and financial environment.

F i n a l l y, a f i r m ’ s g o o d e x p e r i e n c e w i t h a financial planning perk results in an opportun i t y t o i m p r o v e f i n a n c i a l e d u c a t i o n a m o n g r a n k - a n d - f i l e w o r k e r s . I t ’ s c l e a r t h a t t h e s e workers are looking for help in this area from their employers, and I believe many employers are willing to provide it as long as their potential liability is limited.

T h e f u t u r e o f f i n a n c i a l p l a n n i n g p e r k s i s certainly less clear for privately held firms, but n o l e s s i m p o r t a n t I n t o u g h f i n a n c i a l t i m e s , s uc h dis c re tiona ry pe rk s a re a n e a s y ta rg e t Perhaps the best advice is to seriously consider providing a financial planning perk for members of the management team by engaging in the financial planning process yourself a n d d e v e l o p i n g a w e l l - p l a n n e d s u c c e s s i o n a nd owne rs hip tra ns ition pla n S uc h a pla n benefits the owner, the owner’s spouse and family, and the management team by letting everyone know how he or she plans to eventually transfer ownership It‘s far better to have a s u c c e s s i o n p l a n i n p l a c e t h a n t o h a v e t o deal with no plan at all when retirement or an unexpected event rolls around.

The Illinois CPA Society’s Women’s Executive Committee and the American Institute of CPAs Women’s Initiatives Executive Committee are pleased to honor these women who have made significant contributions to the accounting profession, their organizations, and to the development of women as leaders.

These deserving women will be presented with their awards at the Illinois CPA Society “Women’s Leadership Breakfast” on Friday, November 30, 2012 at the Standard Club in Chicago.

To register to attend this breakfast, please call the Illinois CPA Society at 800.993.0393 and refer to Event Code C41153 or visit www.icpas.org.

Confused about CPA licensure? These FAQs add up to perfect clarity

By Marty Green, EsqMarty is the ICPAS VP of Government Relations, and a practicing lawyer and member of the Illinois Bar He previously served as executive assistant attorney general for Illinois Attorneys General Lisa Madigan and Jim Ryan, and as director of the Governor’s Office of Citizens Assistance and assistant to the Governor for Public Affairs, both under Governor James Edgar

* greenm@icpas org @icpasgovt

CPA firm license renewals:

November 30, 2012.

Professional service corporation renewals:

January 1, 2013

We’ve talked to many of you over the last several months as we approached the application deadline for the Registered CPA title and the beginning of Licensed CPA renewals From many of your questions, it seems that there’s lingering uncertainty about the licensure and regulatory structure of CPAs in Illinois And so, I’m bringing you some useful FAQs to help you.

Q. Does Illinois have a Board of Accountancy that oversees CPA regulation?

A. No CPAs in Illinois are regulated by the Illinois Department of Financial and Professional Regulation (IDFPR). The IDFPR regulates 57 licensure acts, 60 professions and 229 types of licenses including the CPA Illinois also has the Illinois Board of Examiners (BOE), which is responsible for certifying candidates’ eligibility to take the CPA Exam, overseeing administration of the exam, and notifying candidates of CPA Exam scores The Illinois Public Accounting Act 225 ILCS 450/et seq is the statutory framework of CPA licensure and regulation in Illinois.

Q. I’m not a licensed or registered CPA but passed all portions of the CPA Exam May I post the CPA certificate in my office and specify on my resume that I passed the CPA Exam?

A. Yes The Certificate issued either by the University of Illinois or the BOE signifies that you passed all portions of the CPA Exam It is not a license to use the CPA title, however. By specifying that you passed the CPA Exam on your resume, you are not claiming to be a CPA or using the CPA title

Q. I have a CPA Certificate from the University of Illinois or the Board of Examiners Does it allow me to use the CPA title?

A. No The CPA Certificate represents the passage of all portions of the CPA Exam To use the CPA title on business cards, advertisements or letterhead you need to be a licensed or registered CPA through the IDFPR Since the deadline for applications ended on June 30, 2012, new registrations

are not being issued Those registered before June 30 are grandfathered for life subject to renewal every three years, and may continue using the designation All others need to apply for full licensure Using the CPA title without being a licensed or registered CPA may result in disciplinary action and a penalty not to exceed $5,000 per offense.

Q. Are my state licensure renewal and fees included in my ICPAS membership dues?

A. No The ICPAS is the professional organization for Illinois CPAs. The IDFPR is the state licensure and regulatory agency for CPAs Aside from your voluntary membership dues to the ICPAS, as a licensed or registered CPA, you are required by law to maintain your CPA license and renew your license or registration every three years.

Q. I’m not sure if I’m a licensed or registered CPA Is there a way to check?

A. Yes The IDFPR maintains a robust website at www.idfpr.com. Under “Agency Quick Links,” access “License Look Ups” and select either license or registered CPA

Q. Can I check whether my license or registration is in good standing?

A. Yes. Visit the same IDFPR Quick Links at www idfpr com

Q. I moved and haven’t received IDFPR licensure notices Does the ICPAS notify the IDFPR of change of addresses?

A. No. As a licensed or registered CPA, the Illinois Public Accounting Act requires you to notify the IDFPR of your current mailing address You can update your information at www.idfpr.com.

Q. I have repeatedly called the IDFPR with licensure questions and have gotten a continuous busy signal or was placed on hold for an indefinite length of time Is there any other way to get my questions answered?

A. Yes. Visit www.idfpr.com and send an email under the “Public Accounting” section The IDFPR also maintains offices in

Springfield at 320 West Washington Street and in Chicago at the James R Thompson Center IDFPR staff assists walk-ins at both locations. The ICPAS also has included FAQs under the “Licensure & Registration” Quick Links at www.icpas.org. What’s more, the ICPAS has expressed its concerns to the director of the Division of Professional Regulation about licensee customer service The IDFPR is currently automating the application process in order to issue computer-generated emails when applications for licensure or renewal are received, and as those applications go through subsequent stages

Q. I need to provide an out-of-state licensing agency with verification of my CPA Exam scores, which I took in Illinois Who should I contact?

A. The BOE certifies applicants who have passed all portions of the CPA Exam when taken in Illinois Request for verification of exam scores should be made to the BOE at www illinois-cpa-exam com For applicants applying for an Illinois license through the IDFPR, the Department automatically verifies exam passage.

Q. As a member of the Illinois CPA Society and a licensed or registered CPA, am I required to follow an ethical code of conduct?

A. Yes ICPAS members are held to rules of professional ethics the Code of Professional Conduct of the AICPA (see www icpas org) Similarly, as a licensed or registered CPA, the Public Accounting Act requires you to follow the Public Accounting Rules of Professional Conduct outlined in the Illinois Administrative Code (visit the “Public Accounting” section at www idfpr com)

Admittedly, the licensure and regulatory process can be confusing Of course, ICPAS staff is always available to answer your questions and assist you with the process along the way

The support of ICPAS members like you makes a tremendous impact on the lives of hundreds of future CPAs every year. Help create more success stories for deserving accounting students across Illinois.

A SPECIAL THANK YOU... to the following advertisers who exhibited at this year’s Showcase.

“Without this scholarship, I wouldn’t be able to accomplish my goal of becoming a CPA.”

Amy Vrtis Scholarship Recipient, Lewis University

Amy is a 100% financially independent student who is currently working three jobs, is a collegiate athlete, and on the Dean’s list.

Where do savvy consumers go when they need to find an accountant? Do they (a). read your ad in Crain’s? (b) hunt for your postcard mailing? or (c). go to one of the many web-based rating sites to read surveys and reviews from people who have used your services?

If you answered (a) or (b) t h e n y o u m a y b e u n a w a r e t h a t i t ’ s 2 0 1 2 , a n d t h i n g s have changed.

This is the age of the digitally empowered consumer, and with so much information at their fingertips, a company’s carefully crafted marketing message may not have the same impact it did a decade ago. In fact, if information is readily available, consumers are more likely to do their own research and come to their own conclusions

Mana Ionescu, president of Lightspan Digital, a social media marketing company based in Chicago, explains that there’s never been so much information available to consumers as there is today An abundance of product research, buyer surveys and comparison shopping sites means that the public no longer has to rely on a company’s hype Instead, consumers are flocking to their iPhones, iPads and laptops to read reviews and criticisms whether constructive or otherwise

knowing more about certain products and their competitors than manufacturers do ”

Alton Adams, a principal at KPMG who also leads the organization’s Customer Strategy and Growth Practice, notes that a number of factors has created a new normal of consumer behavior, most notably a coupling of the recent recession and a more frugal and increasingly inform-ed buying public Quite simply, the balance of power has shifted

What this means to you is that you’re really no longer in control of your own messaging; the conversation is now in the hands of your c u r r e n t a n d p o t e n t i a l c l i e n t s a n d c u s t o m e r s . This new reality means that traditional forms of marketing and advertising won’t be as effective at enticing consumers to your door. And especially for the service industry, the concept of creating a personal brand through social media networking becomes evermore important.

“Without exception, service industry professionals always say that referrals are where they get the majority of their business,” says Sima Dahl, president of Parlay Communications, a C h i c a g o - b a s e d s o c i a l m e d i a c o n s u l t i n g a n d t r a i n i n g f i r m “ T h a t ’ s w h e r e t h e r e ’ s a h u g e o p p o r t u n i t y t o b u i l d a n d t h e n l e v e r a g e y o u r personal brand.”

For example, in the case of businesses with a handful of employees, Dahl suggests owners put their energies into sites such as LinkedIn and Facebook “I’m forever encouraging professionals to showcase their thought leadership and expertise. You’re only as well-known as what you’ve recently published, posted or shared,” she explains, adding that she’s received notable referrals through this kind of interaction on Facebook “The more my contacts know and like me, the more willing they are to refer me.”

t b e s t p r o d u c t , b e s t s e r v i c e a n d b e s t p r i c e , ” explains Ionescu “In fact, we see consumers

Part and parcel of the social media revolution is the fact that the concept of customer loyalty that existed a decade ago has pretty much fallen by the wayside Offering an example, Adams points out that switching cable or phone providers used to be a time-consuming burden many consumers would rather avoid In today’s technology-driven world, however, changing

plans or providers can be as easy as a click of a mouse. If one company offers essentially the same service or product as another, it typically comes down to price or relationship

“The loyalty equation has changed dramatically,” Adams asserts “Companies have to figure out how to create an environment that makes consumers want to do business with them They have to maximize the customer experience ”

Social media can actually make it easier to deliver a better, more fulfilling customer experience and improve relationships, Ionescu explains “What used to take a 10-minute phone call now can be a 10-second tweet It’s so much easier now to make a customer feel good about their recent visit with you With a simple tweet or Facebook shout out, you can make them feel special,” she says

With a social media presence comes the expectation of personalized attention. Lack of follow-through can deliver negative customer service scores. “There's no doubt that online consumers see social networks as customer-service channels,” Ionescu explains “I see so many business social media accounts that don't follow back their own customers That right there is a missed opportunity ”

Establishing a social media presence is only the first step, however How does a practice or company weed through the barrage of opportunities for exposure to find the best ways to be seen by customers?

According to Adams, the average consumer is hit with between 2,000 and 3,000 marketing messages a day, which makes an answer no easy task

“There’s an amazing amount of clutter,” he says “How do I reach consumers at the right time and right place to get their attention?”

According to Ionescu, the best way to be seen online is to be active online but in a thoughtful, strategic way. “My recommendation is to make a plan to leave footprints across the web, and make sure that those footprints all lead back to your website, your home base,” she says “The more tracks you leave, the more traffic you will get ” In other words, combine your Yelp presence, with y our Twitte r pre s e nc e , a nd y our L ink e dIn pre s e nc e , e tc . Upda te your sites daily. The time of day during which you post is important. For instance, best practices suggest that you tweet four times a day at regular intervals

The best strategic roadmap can’t be approached in a haphazard way, though, and there are no shortcuts It will take persistence to actively search for the right opportunities

“You can start by just answering questions on forums such as the Yahoo! Finance message boards or the Startup Nation forums. Another way to find opportunities to interact with people and get your name out there is by using the search tools every social network has,” Ionesco explains These search tools are available on both LinkedIn and Twitter as well as other key industry sites In particular, professionals should look for opportunities to answer questions that showcase their expertise to rise above the competition.

Companies that take the lead in becoming “the source” of information in their industry are approaching the empowered consumer in innovative ways, Adams notes Pointing to Progressive, he says the company has established a foothold in the insurance industry by becoming the place to go to compare rates and plans with other providers. “They made themselves a destination site for consumers to do their shopping,” he says.

With the rise of mobile devices and social media, Adams believes that, “Most companies and consumers are still evolving and learning how to use the technology and information available to them ”

Lifetime Achievement Award

Presented each year to an individual(s) who has provided distinguished service to the profession in Illinois and/or nationally.

Outstanding Educator Award

Presented each year to an educator(s) at a community college, college or university who has made continuous and outstanding contributions to the education of accounting students.

Outstanding Leadership in Advancing Diversity Award

Presented each year to individuals who are exceptional leaders committed to increasing diversity in the accounting profession.

For specific award criteria and nominating instructions, visit www.icpas.org/awards.htm

For this reason, KPMG recently partnered with Georgetown University’s McDonough School of Business to create the Georgetown Institute for Consumer Research Its focus is developing ground-breaking consumer research to highlight the challenges and opportunities that accompany technologically empowered consumers.

“While trying to help our customers understand the future of customer acquisition, marketing and retention, what we found was lacking was detailed, quantitative research,” Adams explains “We felt there was an opportunity for us to marry the commercial challenges and come up with a robust insightful look at the future of consumer trends and customer loyalty.”

The institute also will serve as a forum for global business executives and leading academicians to share perspectives on constantly changing consumer habits, and to help consumers make better buying decisions

“The objective,” says Adams, “is to bring a level of quantitative and proactive thought leadership” that hasn’t existed before.

For more information contact your local ADP Representative or call 312-935-7292. Visit accountant.adp.com today!

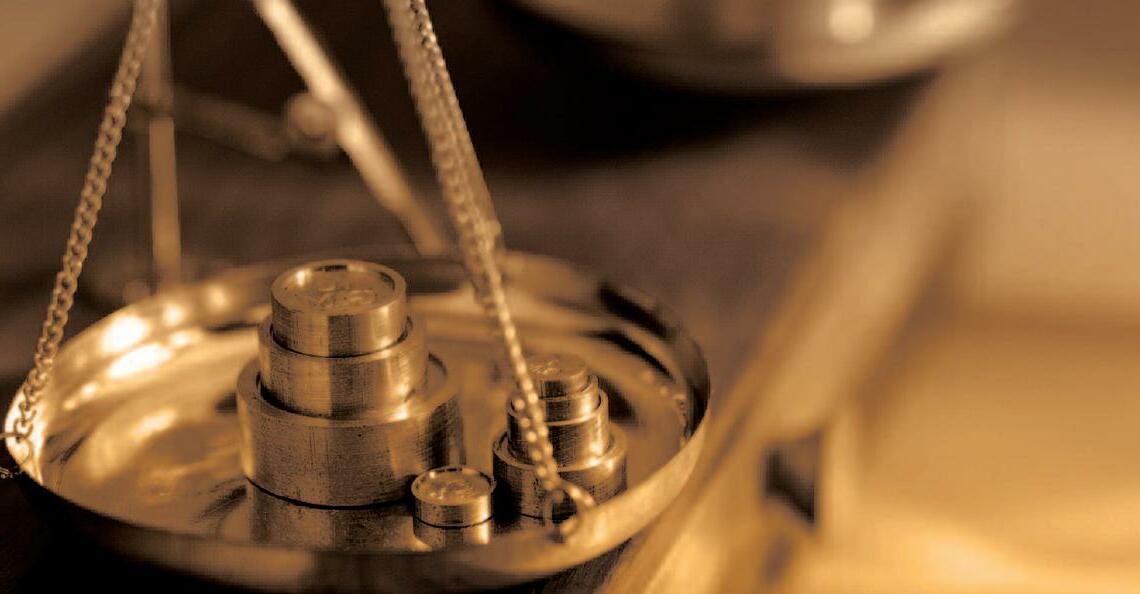

You prepare a tax return for a client. It results in severe penalties and interest charges...

You fail to file an amendment to a client’s tax return that would have enabled him to receive a $100,000 tax refund...

Every time a client faces financial harm, you could find yourself in court. The costs to defend yourself could cost more than the lawsuit itself.

If someone in your firm makes an error, do you have the right coverage?

Since you can’t predict which way the scales of justice will tip, your best protection is the ICPAS-endorsed Professional Liability Insurance Plan.

By Brian J Hunt, CPA/JD

By Brian J Hunt, CPA/JD

I n t h e c a s e o f Z a h l v. K r u p a , K r u p a b e g a n working as a salesman with Jones & Brown in 1973, rising to the position of vice president of sales, board member and, ultimately, president in 2003 By 2000 he had met Zahl, whom he h a d d a t e d a n d w i t h w h o m h e m a i n t a i n e d a friendship He represented to Zahl that, in addit i o n t o s t e e l m a n u f a c t u r i n g , J o n e s & B r o w n “made investments.” In 2000, Krupa informed Zahl that Jones & Brown had created an investment fund to raise money for business expans i o n a n d t h a t f r i e n d s c o u l d i n v e s t u n d e r t h e director’s name

Krupa advised that Jones & Brown “guaranteed” the investment (which would be “short term”) at a rate of more than 11 percent, and asked for the funds in cash. Krupa handwrote the terms of the agreement on Jones & Brown letterhead. Zahl didn’t ask for any additional documentation

Krupa returned the first investment of $10,500 with interest, as well as a second investment of $66,000 Then, in late 2002, Krupa advised that the fund was open again “probably for the last time,” and Zahl invested a further $160,000 Zahl testified that all of the investment offers, as well as the receipts and repayments, were made at Krupa’s Jones & Brown office

When a company director commits fraud, how extensive is the trickle down effect? It’s a question that has kept more than one director up at night A 2010 decision, Zahl v Krupa, sheds some light on the issue

As a general rule, corporate directors aren’t personally liable for the acts of other officers or directors merely because of their status as directors However, in certain circumstances, Illinois law does impose liability For instance, a director might be personally liable for the acts of subordinates if he/she fails to exercise ordinary care, and is personally liable for the acts of co-equals (namely, co-directors) only if he/she participates actively or passively in the acts (whether by knowing or reckless action or omission)

Creighton had been a board member at Jones & Brown since the 1960s, and became chairm a n a n d C E O i n 1 9 9 9 K r u p a r e p o r t e d t o Creighton, and Creighton in turn allowed Krupa a g r e a t d e a l o f a u t h o r i t y a n d d i s c r e t i o n I n 2 0 0 3 , C r e i g h t o n a p p r o v e d a J o n e s & B r o w n loan of $135,000 to Krupa based on Krupa’s plea that his daughter had been involved in a “very serious” car accident for which he had no medical insurance As a result, he claimed, he was facing sizable legal and medical bills that might drive him into bankruptcy.

Creighton didn’t specifically advise other directors of the loan, although some of them later became aware of it. Jones & Brown had made loans to high-level employees in the past Creighton later testified that the loan to Krupa had been a mistake and acknowledged that, in

hindsight, his supervision of Krupa had been negligent Creighton also testified that Jones & Brown had unwritten policies forbidding personal use of company time and property, but acknowledged that those policies were unenforced because of the trust and confidence he had placed in Krupa

At that point, no one at Jones & Brown was aware of Krupa’s gambling problem

In 2004, after Krupa had failed to return the third investment, Zahl visited Jones & Brown’s offices to see Creighton, explaining the terms that Krupa had represented Creighton then met with Krupa who, after a n i n i t i a l d e n i a l , a d m i t t e d t h a t h e h a d spent both Zahl‘s investment money and the Jones & Brown loan on gambling

Za hl file d s uit a g a ins t Jone s & Brown, C r e i g h t o n a n d o t h e r d i r e c t o r s , a l l e g i n g breach of contract, fraud and negligence w i t h r e s p e c t t o K r u p a ’ s h i r i n g , r e t e n t i o n and supervision Jones & Brown was later dropped from the lawsuit

The trial court granted summary judgment in favor of the directors, which the Appellate Court affirmed As for the breach of contract claim, the court noted the gene r a l r u l e t h a t c o r p o r a t e o f f i c e r s a r e n o t l i a b l e f o r c o r p o r a t e o b l i g a t i o n s . I t t h e n analyzed and synthesized two competing l i n e s o f I l l i n o i s d e c i s i o n s , o n e o f w h i c h holds directors liable for active participat i o n ( o r w i l l f u l i n a c t i o n ) w i t h r e s p e c t t o wrongdoing, and another which imposes liability for mere negligence.

As for the active participation claim, the c o u r t c o n c l u d e d t h a t Z a h l p r e s e n t e d n o evidence that the directors knowingly or recklessly participated, whether actively or passively, in Krupa’s misconduct

Referring to the more difficult inquiry of whether the defendants were negligent at all, the court similarly concluded that there was no triable issue of fact that the defendants were indeed negligent with respect to Krupa. Noting that Zahl presented no evidence that Krupa had a gambling habit or tendency to deceive when Jones & Brown hired him, the court also concluded that there was no question of negligent hiring.

As for Zahl’s argument that the directors turned a blind eye to Krupa’s “excessive and unusual” borrowing, the court rejected the argument out-of-hand, noting Jones & Brown’s custom of making loans to emp l o y e e s a n d t h e a p p a r e n t l e g i t i m a c y o f

K r u p a ’ s l o a n r e q u e s t . Wi t h r e g a r d s t o Creighton’s admissions of negligent supervision, the court noted that Creighton hims e l f w a s a p p l y i n g a h i n d s i g h t s t a n d a r d .

A n d a s f o r t h e p l a i n t i f f ’ s a s s e r t i o n t h a t

K r u p a h a d b e e n g i v e n t o o m u c h a u t o no m y, t h e c o u r t n o t e d t h a t d i r e c t o r s “ o f necessity” assign the immediate management of a particular business to subordinate officers, and found it unlikely that the m o s t i n t r u s i v e o f m e a s u r e s c o u l d h a v e thwarted Krupa’s machinations.

Rejecting Zahl’s efforts to argue backward from consequences, the court affirme d t h e l e g a l l y r e c o g n i z e d s t a n d a r d o f a s s e s s i n g w h a t w a s k n o w n a n d f o r e s e ea b l e t o t h e d i r e c t o r s a t t h e t i m e o f t h e i r conduct, and concluded that their conduct w a s r e a s o n a b l e a s a m a t t e r o f l a w T h e court concluded by noting that Illinois law w i l l “ t r e a t d i r e c t o r s w i t h m o r e l e n i e n c y w i t h r e s p e c t t o a s i n g l e i s o l a t e d a c t o f fraud on the part of a subordinate officer or agent, than when the practice appears to have been so habitually and openly comm i t t e d a s t o h a v e b e e n e a s i l y d e t e c t e d upon proper supervision.”

As for Zahl, we can easily see how she was duped, as well as what she might have done differently in order to protect herself f r o m t h e f r a u d W h i l e s h e w a s n a t u r a l l y hesitant (because of her relationship with Krupa) to ask for more formal documentat i o n , a s w e l l a s c o n f i r m a t i o n o f t h e a r rangement with other Jones & Brown representatives, that’s precisely what she ought to have done

The lesson is this: If the directors had been aware of their co-director’s gambling habit or his tendency to take investments, and had they known he was using any company property or company time to conduct any type of separate business, we can easily imagine a different analysis, if not an entirely different outcome The need for vigilance is all too clear As a corporate director, you will be known and potentially responsible for the company you keep ICPAS member Brian J. Hunt is the managing principal of The Hunt Law Group, LLC (THLG), where his practice focuses on business litigation and the representation of CPAs In 2012, THLG was selected as a “Go-To Litigation Firm for the Fortune 500 ” Email Brian at bhunt@hunt-lawgroup com

Elaine Weiss, ICPAS

Jim Jones,

Oak Brook |Janaury 22 |C19950

The DoubleTree Hotel 1909 Spring Road, Oak Brook, IL

Glenview |January 23 |C19951

8:00AM - Networking and Breakfast

8:30AM - 9:30AM - Program and Q&A

Wyndham Glenview Suites 1400 N. Milwaukee Ave., Glenview, IL

Chicago |January 28 |C19952

8:00AM - Networking and Breakfast

8:30AM - 9:30AM - Program and Q&A

The Crowne Plaza Chicago Metro 733 West Madison, Chicago, IL FOR

only a few years ago, most small businesses scoffed at the concept of “going green ” It was a drain on time and resources, and, most likely, just a fad

According to the Office Depot Small Business Index, today’s reality is quite different, with 61 percent of small businesses actively strategizing to go green, and 70 percent anticipating becoming more environmentally conscious over the next two years

“From a strategic perspective, it’s a competitive advantage, a market differentiator that needs to be integrated into business operations,” stresses Peter Locke, MBA, managing director and co-founder of TerraLocke Sustainability Consultants

“Consumers definitely want to do business with more environmentally friendly organizations Consumer demands change and businesses need to evolve with them.”

Despite the social benefits and oft-touted business rewards like lower operating expenses, a positive public image, and stronger recruiting and retention campaigns many small and midsized businesses are still reserved about making the leap into green initiatives

“ Bus ine s s le a de rs a re a fra id of ta k ing the ir eyes off the bottom line, particularly during a challenging economy,” says Zbig Skiba, presid e n t o f s u s t a i n a b i l i t y c o n s u l t i n g f i r m S k i b a C o n s u l t i n g , L t d “ M a n y s m a l l a n d m i d s i z e d businesses interested in environmentally sustainable practices feel that environmental sustainability is a concept only large corporations can afford, but any business can be environmentally conscious regardless of size, industry, or financial resources.”

You won’t maximize your sustainability efforts if they’re limited to a one-man show, however, so get your staff involved Simply announcing to employees that your organization would like to become more green will encourage engagement, invite new ideas, and allow a sustainability-minded, values-driven culture to grow That culture shift alone can work wonders for your employee recruitment and retention efforts.

“From a longer-term business perspective, it can be a differentiator New grads are definitely l o o k i n g t o h a v e m o r e t h a n j u s t a j o b , ” s a y s Locke. “They want to be part of an organization that contributes to society and doesn’t pillage the environment ”

What’s more, he adds, “The younger generations are already being introduced to sustainability concepts that they’ll transition right into the business world,” which will certainly come in handy when forming your “green team ”

What green team you ask? Our experts are adamant that such a team is a key component of successful sustainability efforts

“Starting to change behaviors and raise sustainability awareness can be as simple as putting ‘Please Turn Off’ signs on light switches and electronics,” says Peter Locke, MBA, co -founder and managing director of TerraLocke Sustainability Consultants “There are all sorts of easily implemented solutions out there ”

Need a jumpstart on the path to shrinking your carbon footprint? Double-sided printing, limiting HVAC system activity to business hours, recycling and making conscious efforts to reduce waste are all first-class no-cost options With the savings you realize, you can cycle funds back into your green initiatives, trading outdated equipment for energy-efficient models and recycled products as they come up for replacement “Many people think that going greener will cost more, but that’s not necessarily the case, ” says Yalmaz Siddiqui, chief green advocate at Office Depot “Customers can look at purchasing energy- efficient lights and computers, remanufactured printer cartridges and a wide range of greener supplies that cost less than less -green alternatives ”

“It’s absolutely best to have a volunteer or committee champion sustainability initiatives,” says Locke “Your green team can take an inventory and consolidate current initiatives, initiate discussions amongst departments to identify new cost-saving conservation opportunities, assign some criteria to prioritize them and, finally, act on them.”

Your chosen champion(s) can also initiate special projects in response to specific company needs. An example Skiba offers is an init i a t i v e t o d e c r e a s e e l e c t r i c i t y u s a g e “ T h e financial benefit is obvious,” he says. “Lower u s a g e o f e l e c t r i c i t y m e a n s l o w e r c o s t s a n d increased profits The environmental benefit includes a decreased effect on global warming, lower toxic releases and lower utilization of limited energy resources ”

S u s t a i n a b i l i t y i n i t i a t i v e s i n t h e b u s i n e s s world are rising to even greater heights, however, with two corporate strategies: Certified B Corporations and Beneficial Corporations.

Realizing the influence businesses have on s o c i e t y, t h e C e r t i f i e d B C o r p o r a t i o n w a s founded by the nonprofit organization B Lab [www bcorporation net] with the goal of carving out a niche for businesses that use their p o w e r t o s o l v e s o c i a l a n d e n v i r o n m e n t a l problems Certified B Corporations meet rigorous independent social and environmental p e r f o r m a n c e , a c c o u n t a b i l i t y, t r a n s p a r e n c y and legal standards that ensure they’re working to achieve a positive environmental footprint, create great places to work and build stronger communities

“Becoming a Certified B Corporation is a really great opportunity for all businesses It’s a process any business can go through, and it promotes to the public that you’re acting sustainably and trying to create change and publ i c b e n e f i t , ” e x p l a i n s L o c k e , w h o s e f i r m i s currently a Certified B Corporation, with the intention of pursuing legal incorporation as a Beneficial Corporation

Beneficial Corporations are like traditional corporations except they seek to achieve similar goals to B Lab’s Certified B Corporation declaration. Beneficial Corporations are legally required to have a corporate purpose to create a material positive impact on society and t h e e n v i r o n m e n t ; e x p a n d f i d u c i a r y d u t y t o require consideration of the interests of workers, the community and the environment; and publicly report on overall social and environmental performance against a comprehensive, credible, independent and transparent thirdparty standard

Governor Quinn has signed legislation allowing Illinois businesses to be incorporated as Beneficial Corporations effective January 1, 2013, and Locke sees this as an opportunity for businesses to further differentiate themselves from their competitors

“Now a consumer looking to do busin e s s w i t h a n o rg a n i z a t i o n t h a t t r e a t s i t s e m p l o y e e s w e l l , t r e a t s t h e e n v i r o n m e n t w e l l a n d i s e n g a g e d i n t h e c o m m u n i t y,

can simply search for Beneficial Corporations,” he says

As it turns out, business greening isn’t a fad, it’s the future. Businesses want it, consumers want it, and even politicians want it If you’re serious about the future of your business, you have to think and act sust a i n a b l y. “ L o n g t e r m , ” s a y s L o c k e , “ i t ’ s going to be critical for businesses to take action ”

By Derrick Lilly

By Derrick Lilly

d g e i n t o d a y ’ s c o n s t a n t l y e v o l v i n g a c c o u n t i n g a n d f i n a n c e profession is a feat Too bad time is short and dollars are tight

Not surprisingly, demand for fast, convenient and affordable CPE is at an all-time high And thankfully, many of today’s education and training providers are rising to the challenge, quickly establishing new ways to deliver learning in cutting-edge interactive digital formats

“ I t ’ s t h e e r a o f ‘ p e r s o n a l l e a r n i n g . ’ I t ’ s a l e a r n e r ’ s w o r l d n o w, ” s a y s D o u g H a r w a r d , CEO of Training Industry, Inc. in his article, Key Trends for 2012: Mid-Year Review “[T]hey personalize their learning experience by getting r e l e v a n t i n f o r m a t i o n w h e n , h o w a n d w h e r e they want it.”

Why travel to a live seminar, for example, when you can attend a live webinar from the comforts of your home or office at a fraction of the cost? Forget the commuting, the parking, the time away from work or family, and all of the other hassles that go along with attending a live

event Thanks to high-speed internet access and constantly advancing internet-ready devices, webinars are accessible to more participants than ever and demand keeps growing Google Trends, for example, reports that searches for “webinar” have steadily climbed since 2004. And accounting and finance professionals are jumping right on board

“Two conditions have become exacerbated in today’s work environment the demand on people’s time and the pace of change,” explains Rod Mebane, a partner with St. Charles Consulting Group, and a specialist in corporate learning strategy and executive leadership development “So there’s been a very strong trend within the accounting and finance professions towards utilizing more webcasts and webinars.”

“ M ov ing to the dig ita l world is the big g e s t trend we’re seeing in professional education,” stresses Curtis Marquardt Jr , online education m

stronger, the online learning experience is coming closer to what you would experience at a live event.”

Couple this with the explosion of available content and it’s no surprise that online education is bringing many professionals the instant gratification they’re feverishly looking for “People are going to make smarter choices now about how they learn new content,” says Mebane “Nowadays, it’s a whole lot easier for professionals to mix and match the most relevant courses for their work and development goals ”

For those professionals with unpredictable downtime, or those who often find their backs against the wall around CPE reporting time, ondemand courses are a godsend

“With on-demand courses, it’s all in your power to learn where you want and, more importantly, when you want, as they offer the convenience of learning online with recorded, interactive courses,” says Marquardt. “It’s an a la carte sort of world where professionals can pick a topic, sit down with their PCs or mobile devices at their convenience and learn.”

“It’s really helpful to walk through a structured course where the materials are nicely organized for you when you’re learning something new,” adds Mebane “The better designed on-demand platforms are packaged in a nice technology shell that walks you through the learning program while giving you the ability to pause, stop, or replay something, or search for key terms within a lesson to review again On-demand content goes beyond being just a training course; it’s a research tool for today’s digital learner ”

Hence the rise of the learning management system (LMS) Described by Marquardt as “online learning on steroids,” an LMS is a large-scale interactive online platform that enables users whether individuals or organizations to plan, track and manage the learning experience from start to finish It’s the ultimate tool for cutting through the cluttered online learning world.

“When a professional or employer looks for training today they’re going to find a dozen different providers with different courses and different prices; it’s a little bit overwhelming to make decisions,” says Mebane. “Conversely, an LMS allows you to organize content in a very useful and meaningful way ”

An LMS is for users who need to do more than just take a course here and there, granting users full control over the learning process with scalable capabilities to create custom curriculums for specific job functions, detail specific professional development goals, monitor training progress and results, track and manage education budgets and expenses, and ensure professional regulatory compliance

Cost effectiveness is another plus For $25 per person, for example, the Illinois CPA Society’s new knowledgehub initiative [www icpas org/ knowledgehub htm] allows users access to more than 1,500 educational offerings from four trusted CPE providers: the Illinois CPA Society, Becker Professional Education, SmartPros and Western CPE.

Many of these 24/7 programs are presented in HD video under one easily navigated website. What’s more, knowledgehub allows individuals and employers to search for programs by topic or job function, develop course plans tailored to specific job functions, and monitor and guide the development process while conveniently tracking CPE and licensing compliance for CPAs, CFEs, CIAs, CMAs, and much more

Given the restraints on time, dollars and accessibility accounting and finance professionals constantly face, along with the challenges o f t r

learning models

Moving up the organizational ladder comes with many perks more involvement with strategy, access to leaders and a larger paycheck, to name a few The shift to the other side of the desk, however, can be daunting for even the most technically competent CPA

While the accounting profession makes the transition from reviewee to reviewer more rapidly than most, professionals in industry and business get their feet wet within just a few years. Typically at this point, they’ve completed the CPA Exam and have been mentored under various managers Those with a public accounting background also may have the benefit of experience reviewing work, which g i v e s t h e m a c e r t a i n l e v e l o f c o m f o r t when it comes to giving feedback.

No matter your range of experience, however, once promoted to manager, employers are expecting their young professionals to be competent in all areas of management, from agenda-setting to consensus-building Getting up to speed quickly is vital.

In her book, Becoming a Manager: How New Managers Master the Challenges of Leadership, Linda A. Hill tracked 19 managers during their first year in the role, interviewing participants as well as supervisors and subordinates Surprisingly, she found that expectations among these groups were anything but aligned. While new managers viewed their role as one t h a t f o c u s e s o n s e t t i n g g o a l s a n d e x e c u t i n g workflow to achieve those goals, both subordinates and supervisors expected a greater emphasis on people management and network-building Specifically, supervisors expected new managers to achieve goals by orchestrating a diverse network of relationships

A great deal of management is art rather than s c i e n c e . N e w m a n a g e r s c a n k e e p t e c h n i c a l , strategic and interpersonal factors in balance by following these five tips:

1. Become a technical pro

If you know your stuff, then evaluating others’ work and providing meaningful feedback will be a breeze Amanda M Rzepka, CPA, CGMA, senior staff accountant at Jet Support Services, I n c i n C h i c a g o , r e c o m m e n d s t h a t n e w m a na g e r s , “ R e a d e v e r y t h i n g a t y o u r f i n g e r t i p s . While a news piece or a technical standard may not be immediately relevant, it’s something to r e m e m b e r, s o y o u c a n h e l p y o u r t e a m l a t e r Consider yourself the source of information for your organization, particularly if you are one of only a few CPAs on staff.”

2. Learn the art of delegation

Harvard Business Review’s “Manager’s Toolkit” warns, “If you try to do too much as a new mana g e r, y o u w i l l h u r t t h e t e a m ’ s p e r f o r m a n c e , damage your relationships with team members a n d r i s k b u r n o u t ” I t s u g g e s t s t h a t d e l e g a t i o n builds a team member’s sense of belonging, and recommends that new managers clearly articulate goals, break those goals down into meaningful tasks, shore up resources and put a plan into action. Results are important. If an initiative i s n ’ t l i v i n g u p t o i t s k e y m e a s u r e s , d o n ’ t b e afraid to redefine it and change direction.

New managers sometimes struggle with the concept of trust, since they’re making the trans i t i o n f r o m s o m e o n e w h o d o e s t h e w o r k t o someone who reviews the work. Rzepka reco m m e n d s t h a t y o u n g p r o f e s s i o n a l s k e e p t w o lines of communication open, so all team members can delegate to one another with a mutual end goal “If the staff understands the end goal, t h e y c a n b e t t e r s e e t h e i r c o n t r i b u t i o n t o t h a t goal,” she says

Follow up is key Determining the effectiveness of the work product will keep everyone on the right track

Often, expectations aren’t articulated and therefore aren’t aligned across the board Savvy managers know how to identify those misalignments and bring a group to consensus

At Apple, arguably the most high-tech company the world has ever seen, Steve Jobs led meetings face to face Take a lesson from Jobs and do the same Consensus is hard to build electronically

Rzepka stresses that open communication is vital She began meeting with her team on a weekly basis This wasn’t only a time for team delegation, but also proved to be the connection team members needed to feel comfortable asking questions and sharing their ideas

There are ways to read body language and evaluate others’ emotions Your emotional intelligence will clue you into how to manage information so your audience responds favorably, and will enable y o u t o b e t t e r u n d e r s t a n d n o n - v e r b a l s i g n a l s a n d t h e i r u n d e r l y i n g meaning Essentially, emotional intelligence allows you to build a stronger bond with your team, and can go a long way in aligning expectations and agendas

Your supervisor was a new manager once too He or she understands the challenges associated with the transition from one side of the desk to the other Ask him or her for constructive advice and first-hand examples After all, you were promoted because your supervisor saw leadership potential in you, and talent that could be nurtured to bring about even greater organizational success

Yo u r l e a r n i n g s h o u l d n ’ t s t o p t h e r e , h o w e v e r N e w m a n a g e r s should tap into everyone around them, forging cross-departmental bonds Build your internal network and you’ll have a means to find the answers you need in your first foray into management

“Ultimately,” says Rzepka, “the most successful people are those surrounded by a strong team ”