Are We Still World leAderS?

Where does the USA stand on the global stage?

E x p l o r i n g t h e i s s u e s t h a t s h a p e t o d a y ’ s f i n a n c i a l w o r l d g i c p a s . o r g / i n s i g h t . h t m F A L L 2 0 1 3

alliant financial benefits is a winning combination An enhanced benefits solution that is good for your company and good for your employees. Good for Your Employees Give your employees a benefit that provides daily value—with better than bank rates, modern banking technologies and nationwide access. Good for Your Company Gain an edge in attracting and retaining top talent, increase employees’ productivity and reduce stress—while controlling costs. It’s easy to get started: alliantfinancialbenefits.com or call 800-328-1935 ext. 2067 ©2013 Alliant Credit Union. All rights reserved. SEG756-R09/13 good for your employees good for your company

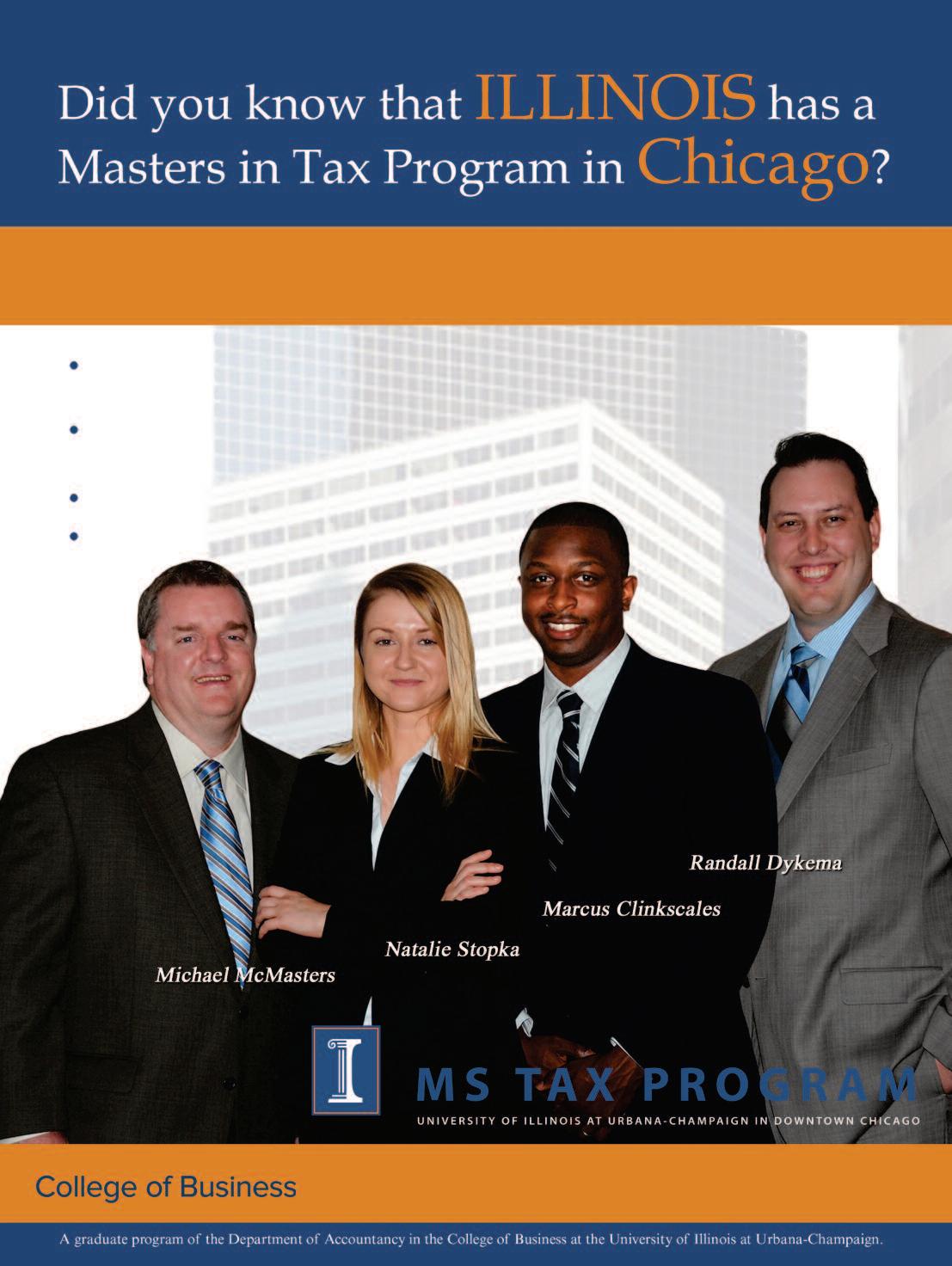

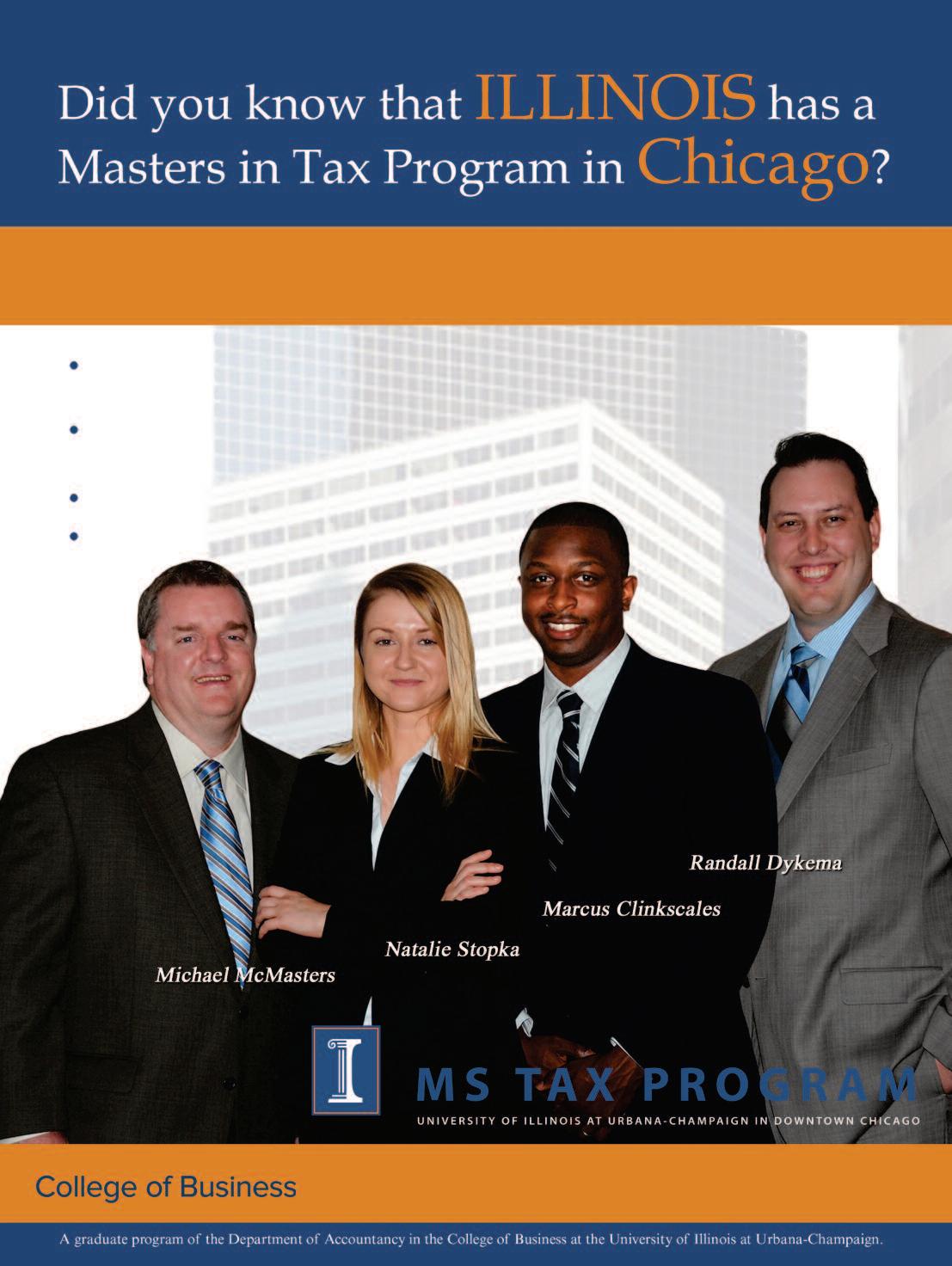

34 Is the USA Still a World Leader?

Our competitive position in the global economy continues to be debated But the national conversation is now being led by some very high-profile thinkers, which is usually how progress begins in a democracy The question is, can America take its place at the head of the global marketplace?

Same-Sex Marriage & Tax

With DOMA struck down, lots of questions are being asked about how tax equality for LGBT couples will

In these competitive times, no accounting firm can survive without a turbo - charged A-game. Here are five ways to boost your firm’s power

Top

How can public accounting firms keep their women professionals for the long haul?

Boost your professional development plans with these three approaches

The old way of saving for retirement just won’t hack it for Generation X

Office Space Hoteling Checks In

Want to save a ton of money while gaining employee flexibility? “Hoteling” could be the answer

Today’s CPA People Are Number One

Insights from ICPAS President & CEO Todd Shapiro

In this issue: Education is the key to making the most of your most valuable asset your people

tips.

Expert tax updates from Keith Staats,

The inside scoop from forensic accounting specialist Brad Sargent, CPA/CFF, CFE , CFS, Cr FA, FABFA In this issue: The real scoop on financial fraud in higher education

Personal financial planning tips from Mark J Gilbert, CPA/PFS In this issue: TDFs have exploded in popularity as a key investment choice But are they

Must-read-must-know news for young accounting pros

index FALL 2013 | www.icpas.org/insight.htm

38

42

actually work

5 Ways to Power Your Practice

18

Technology Financial App-titude

22 Diversity The Female Factor

mobile apps for corporate finance pros

24

Education Your Route to the Top

26 Retirement The Gen X Plan

30

4

Seen Heard

6

Sound bytes, sound advice and practical business

10 Tax Decoded Pushing the Envelope

JD In this issue: Across the nation, states are seeking revenue through aggressive sales and

tax nexus laws. 12 Capitol Report Guns, Marijuana & Accounting

round ups by ICPAS VP of Government

In this issue: New legislation promises to impact your people, your practice

14 Forensics Insider Schooled in Fraud

use

Legislative

Relations Marty Green, Esq

and society at large

16 PFP Advisor Target Date

the

48 Hype.It

worthy of all

press?

columns departments features 2 INSIGHT icpas org/insight htm

INSIGHT MAGAZINE

Publisher/President & CEO Todd Shapiro

Editor-in-Chief Judy Giannetto

Art Design Judy Giannetto & Rosa Garcia

Production Design Rosa Garcia

Assistant Editor Derrick Lilly

National Sales & Advertising Natalie DeSoto YGS Group, 3650 West Market Street, York, PA 17404

P: 800 501 9571 x127 F: 717 825 2171

E: natalie desoto@theygsgroup com

Circulation Carl Siska

Editorial Offices: 550 W Jackson Boulevard, Suite 900,Chicago, IL 60661

ICPAS OFFICERS

Chairperson, William P. Graf, CPA Deloitte & Touche LLP

Vice Chairperson, Daniel F Rahill, CPA, JD FGMK, LLC

Secretary, Edward J Hannon, CPA, JD Freeborn & Peters LLP

Treasurer, Mary Lou Pier Pier & Associates, Ltd

Immediate Past Chairperson, James P Jones, CPA Edward Don & Company

ICPAS BOARD OF DIRECTORS

Linda S Abernethy, CPA, McGladrey LLP

Rosaria Cammarata, CPA, CME Group Inc

Rose G Doherty, CPA, Legacy Professionals LLP

Gary S Hart, CPA , Gary Hart & Associates Ltd

Margaret M Hunn, CPA, CFE, CFF, CITP, Rozovics Group PC

Paul V Inserra, CPA, McClure, Inserra & Co , Chtd

David V Kalet, CPA, MBA, BP Products North America

Michael J Maffei, CPA, GATX Corporation

Marcus D Odom, PhD, CFE, CPA (inactive), Southern Illinois University

Floyd D Perkins, CPA, Ungaretti & Harris

J. Bradley Sargent, CPA/CFF, CFE, CFS, Cr.FA, Sargent Consulting Group LLC

Mark F Schultz, CPA, Dugan & Lopatka CPAs PC

Scott D Steffens, CPA, Grant Thornton LLP

Thomas L Zeller, PhD, CPA, Loyola University Chicago

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 24,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year, in Spring, Summer, Fall, Winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA , 312 993 0407 or 800 993 0407, fax: 312 993 7713 Copyright © 2013 No part of the contents may be reproduced by any means without the written consent of INSIGHT Permission requests may be sent to: Publications Specialist, at the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

Congratulations to the Award Recipients

The Illinois CPA Society’s Women’s Executive Committee and the American Institute of CPAs Women’s Initiatives Executive Committee are pleased to honor these women who have made significant contributions to the accounting profession, their organizations, and to the development of women as leaders.

These deserving women will be presented with their awards at the Illinois CPA Society “Women’s Leadership Breakfast” on Friday, November 15, 2013 at the Standard Club in Chicago.

The mission of the Women's Executive Committee is to enhance the recruitment, volunteerism, retention and leadership of women CPAs in the Illinois CPA Society and the profession through various programs and networking events. This program is one in an ongoing series designed to help women CPAs learn more about important professional issues, expand business networks and foster career advancement.

To register, please call 800.993.0407 and refer to Event Code C41260 or visit www.icpas.org.

Dawn Eber, CPA Managing Director, PricewaterhouseCoopers LLP

Experienced Leader

Charlotte Montgomery, CPA Director of Resource Allocation, Illinois State Museum

Experienced Leader

Melissa Bennis, CPA Principal, Davis & Hosfield Consulting LLC

Emerging Leader

Meredith Vogel, CPA Audit Managing Director, Grant Thornton LLP

Emerging Leader

icpas org/insight htm | FALL 2013 3

Fall is a great time to think about education. Millions of kids are heading back to school and my wife, a teacher, once again will be leaving the house early Education is something very personal to me; it’s always been a big part of my life Not only is my wife a teacher, but my mother also was in education I’ve served as a school board member of a high school district for 16 years, and my father and brother have also served on school boards

I know that education is significant to you too, whether it’s because your kids are going back to school, or because you need to get training or credits under your belt, or because you’re committed to developing the skills of your staffs I don’t think anyone can deny that it’s vital to invest not only in yourself, but in your people as well I for one am a very

strong believer that people are an organ i z a t i o n ’ s m o s t v a l u a b l e a s s e t . O u r staff members are the most visible and impactful part of any firm or company, and it’s critical that they are fully prepared to give the kinds of service, insight and knowledge that clients and colleagues expect.

H o w e v e r, e d u c a t i o n i s n ’ t t h e s a m e animal it was even just a decade ago It used to be pretty simple: You’d sign up, show up, listen and learn

Te c h n o l o g y h a s c h a n g e d a l l t h a t , offering a dizzying range of options to learn, 24/7 Not only that, but the very m e a n i n g o f e d u c a t i o n h a s c h a n g e d Today, education means ongoing learni n g a n d d e v e l o p m e n t , n o t j u s t 1 2 0 hours of CPE every three years

The Illinois CPA Society is a progress i v e o rg a n i z a t i o n , w h i c h m e a n s t h a t adding new ways to deliver education to you to keep pace with this ever-more complex world has been a top priority In fact, we’re so serious about education that we developed a mission for our education business: “To be a preeminent provider of learning and development to accounting and finance professionals ”

Yo u , a s t o d a y ’ s c u t t i n g - e d g e C PA , h a v e t o k n o w m o r e t h a n e v e r b e f o r e ; t h i n g s a r e c o m i n g a t y o u s o f a s t , a n d y o u a r e h a v i n g t o k e e p p a c e w i t h changes in regulation, technology, areas of specialization and more

A n d s o , w h i l e w e w i l l c o n t i n u e t o offer all the live education you expect f r o m u s , i n t h e c o m i n g m o n t h s w e ’ l l expand our content in the areas of both core and soft skills. We’ll also dramati-

cally increase our onDemand library to o v e r 1 5 0 p r o g r a m s b y t h e e n d o f t a x season onDemand programs are sure t o p l a y a n i m p o r t a n t p a r t i n f u t u r e learning, giving you the ability to learn w h a t y o u n e e d t o k n o w, w h e n y o u n e e d t o k n o w i t n o t w h e n s o m e o n e else tells you to learn it.

Watch our onDemand library grow over the upcoming months Beginning this year, members have access to a free quarterly webcast or onDemand program If you missed the summer onDemand program discussing the Illinois business climate, then I encourage you to take it at any time; it’s available to you as a member, free of charge.

To g e t a n e v e n c l e a r e r p i c t u r e o f where we’re headed on the education front, I also encourage you to check out knowledgehub [www icpas org/knowledgehub htm], our state-of-the-art training and development solution. Knowledgehub was developed specifically for a c c o u n t i n g a n d f i n a n c e p r o f e s s i o n a l s and provides you with a flexible online tool to proactively manage the development of you and your staff.

As a last note, I want to thank you all f o r y o u r w a r m r e c e p t i o n , k i n d w o r d s a n d s u g g e s t i o n s f o r t h e f u t u r e . Yo u r thoughts and feedback help us meet our mission of “Enhancing the Value of the CPA Profession.” It’s a mission we all take very seriously here at the Society

We have a full season of conferences and courses in the upcoming months, and I plan to attend as many as possible I hope to see you there connecting is what it’s all about.

4 INSIGHT icpas org/insight htm TODAY’S CPA

P e o p l e A r e N u m b e r O n e

Todd Shapiro, ICPAS President & CEO

I f y o u a s k m e , e d u c a t i o n i s t h e k e y t o m a k i n g t h e m o s t o f y o u r m o s t v a l u a b l e a s s e t y o u r s t a f f

“onDemand programs are sure to play an important part in future learning, giving you the ability to learn what you need to know, when you need to know it.”

24/7 Access

Choose from a full catalog of 1-2 hour online courses that allow you to learn on your schedule.

Engaging Content

Participate in a learning experience unlike any other – complete with video lectures and interactive quizzes and final exams.

Incredible Value

Here is the best part – the PRICE!

1-hour courses are $25 members/$45 non-members 2-hour courses are $50 members/$90 non-members.

Check it out today at www.icpas.org/ondemand.htm

SEEN HEARD

$5 million

The amount of investable assets to be amassed before Affluent investors feel they are truly wealthy Source: UBS

TOP 10 TIPS

SUCCESSFUL NETWORKING

Networking is tough For some it’s downright terrifying Unfortunately though, it’s an absolute business necessity And so, to help quell your fears, we bring you 10 tips for successful networking from professional resume writer Sandy Leary and Elephants at Work:

1 Start before you need it

2 Give more than you expect to receive

3 Be genuinely interested

4 Always follow up

5. Know people in different worlds.

6. Learn to listen.

7. Always say thanks.

8. Talk up your purpose more than yourself.

9. Join associations.

10. Leverage the networks of others.

Retirement Woes for Women

INSIGHT Magazine Wins Award (Again!)

INSIGHT Magazine was recently awarded a Communications Concepts 2013 Award of Excellence for Magazines & Journals for its fall 2012 Corporate Financial Leadership issue The 25th Annual APEX Awards for Publication Excellence is an annual competition where writers, editors, publications staff and business, nonprofit, agency and freelance communicators share their best work Visit www icpas org/insight htm for a list of all INSIGHT awards and accolades as well as to view the winning issue

A recent report by Aon Hewitt [aon com] shows that women ’ s savings and investing habits coupled with longer life expectancies mean they’re less likely than men to be able to meet their financial needs in retirement. Despite participating in employers’ defined contribution plans at the same rates as men, Aon Hewitt’s analysis of more than 140 defined contribution plans representing 3 5 million employees shows that women save an average of 6 9 percent of pay, compared to 7 6 percent for men, and that 31 percent contribute below the company match threshold, compared to just 25 percent for men As a result, women across all salary ranges have average plan balances ($59,300) significantly below that of their male counterparts ($100,000) According to Aon Hewitt, many women are woefully underprepared for retirement. Full- career contributing women should have 11 2 times their final pay to meet their retirement needs, but they’re on track to accumulate only 8 6 times final pay a shortfall of 2 6 times pay compared to 1 9 times pay for men

6 INSIGHT icpas org/insight htm

N E W S B Y T E S , S O U N D A D V I C E A N D P R A C T I C A L B U S I N E S S T I P S

“A good leader takes a little more than his share of the blame, a little less than his share of the credit.”

Ar nold H Glasgo w

TO BRING TOGETHER THE BEST FINANCE TALENT IN CHICAGO, WE’VE COMBINED THE BEST FINANCE STAFFING FIRMS IN THE COUNTRY. Jackson Wabash and Garelli Wong, Chicagoland’s experts in financial recruiting and staffing, are now part of Accounting Principals and Parker + Lynch. By combining our intimate local knowledge with unrivaled national resources, we can help you enhance your workforce or your career better than ever before. To learn more, visit us online or call your local office. accountingprincipals.com parkerlynch.com Chicago 312.583.9264 | Schaumburg 847.397.9700 | Oakbrook Terrace 630.792.1660 | Deerfield 847.607.0550

FORMERLY

JACKSON WABASHFORMERLY GARELLI WONG

44% number of working Americans who hire an accountant to perform tax preparation services

Source: Accounting Principals

Technology & Your Job Hunt

What do 300 job seekers and 100 hiring managers have in common? LinkedIn, smartphones and video interviews. These tech tools are becoming keys to job searching according to an annual survey by Right Management [right com] Ninety-four percent of job candidates reported LinkedIn was their top social media site for job hunting, while 66 percent of hiring managers chose it as their top social media site for sourcing candidates In addition to LinkedIn, job searchers and hiring managers are finding success on Google+, Facebook and even Twitter Possibly to some surprise, 74 percent of hiring managers and recruiters cited social media sites as their top method for sourcing candidates Video resumes are also gaining traction While only 18 percent of respondents have experienced a video interview, that’s double last year ’ s finding What’s more, 45 percent of recruiters are expecting video interviews to become more popular over the next few years

$649 billion

Total state & local taxes businesses paid in FY2012 a 3.9% increase over FY2011. Source: Ernst & Young

how to:

Use Instagram for Business

Instagram is a free app that allows you to take, edit and share photos and videos in unique and creative ways on your mobile devices It’s easy to use and integrates with other popular social media outlets like Facebook, Twitter, Foursquare, Tumblr and Flickr At first glance, it may not seem like a business tool, but look again; it’s actually an excellent marketing and branding supplement

Socialnomics net cleverly points out how businesses can use Instagram:

1 Get Behind the Scenes – Use photos and videos to show your audience a different side of your organization Whether it’s setting up an event, showing how a product is made, or just how your team interacts within the office walls, it’s fun to see the inner workings.

2. How -To Videos – Instagram’s video option is great for quick snapshots o f h o w t o m a k e o r d o s o m e t h i n g J u s t k e e p i t s i m

l ; remember it’s supposed to be a quick tutorial

3. Live Events – A product demo, keynote address, conference or any other live event is a perfect subject to document and share on Instagram, keeping your audience in the know and aware of all you ’ re doing

CPA Day of Service

On September 20, more than 1,000 Illinois CPAs came together as volunteers for ICPAS’ fourth annual CPA Day of Service They assisted over 100 organizations across Illinois, dog-walking for the Hinsdale Humane Society; preparing food packages at Feed My Starving Children in Schaumburg; assisting Habitat for Humanity; shopping for groceries and delivering food with St Damien Food Pantry, participating in the National Alliance for Mental Illness Run/Walk for the Mind race; providing office and tax assistance for the Little Giraffe Foundation in Mount Prospect, and so much more. To see how each o

www.icp a s .or g /CPA D a yof S er v ice. For information about next year ’ s CPA Day of Service, contact Rose Kelly, marketing & communications coordinator, at 312-993-0407 ext. 251 or kellyr@icpas org

8 INSIGHT icpas org/insight htm SEEN HEARD

A n o t h e r G r e a t Ye a r f o r

f t h e

e I l l i n o i s

s v o l u n t e e r e d t h e i r t i m e , v i s i t

s

C PA

e l p

p l e a n d h

f u

TRENDSPOTTER

P u s h i n g t h e E n v e l o p e

Across the nation, states are seeking revenue through aggressive sales and use tax nexus laws

By Keith Staats, JD

Familiar with this scenario? Your client sells items over the Internet. Your client also has a physical location in Illinois and fills customer orders with inventory from its Illinois warehouse or by direct shipment from manufacturers or wholesalers What’s more, your client pays commissions to other webbased companies for sales generated through links to your client’s website Naturally, your client charges Illinois sales tax on sales delivered to Illinois customers, but collects no taxes on sales to other states. Now, if it was 2007, they’d be handling their sales tax obligations properly. Alas, it’s 2013 and state sales and use tax laws have changed.

Keith is a senior manager of Grant Thornton’s State & Local Tax practice, based in Chicago Previously, he held the position of general counsel of the Illinois Department of Revenue, where he developed tax policy, evaluated and reviewed tax-related legislation, and oversaw tax-related litigation

* keith staats@us gt com

In fact, states across the nation are aggressively attempting to impose state sales and use taxes on Internet and mail order purchases Over the past year, state lawmakers have continued the trend of enacting legislation that pushes the envelope with respect to the limits on a state’s taxing authority, as outlined by the U.S. Supreme Court’s 1992 ruling in Quill Corp v North Dakota.

In Quill, the Court reaffirmed that a seller must have physical presence in a state in order for it to require the seller to collect that state’s sales taxes It also clarified that the physical presence requirement was grounded in the U S Constitution’s Commerce Clause, and that Congress has the authority to eliminate the physical presence requirement through federal legislation.

While Congress hasn’t passed legislation since the Quill decision, there have been a number of proposals to eliminate the physical presence requirement The latest, the Marketplace Fairness Act, passed the Senate on May 6, 2013 and will next be cons i d e r e d b y t h e H o u s e o f R e p r e s e n t a t i v e s where passage seems less certain

In the absence of federal legislation removing the physical presence requirement, the states have been aggressive in

determining what constitutes the requisite level of physical presence to trigger tax collection obligations Two recent manifestations are state laws involving “click-through” nexus and “affiliate” nexus

In taxing parlance, “nexus” is a connection with a state that is sufficient to authorize another state to assert its tax laws over a t a x p a y e r. I n t h e c a s e o f s a l e s a n d u s e taxes, Q u i l l requires physical presence to e s t a b l i s h n e x u s . I n t h e c a s e o f “ c l i c kthrough” nexus, 12 states assert that nexus applies if,

n An out-of state company has a link on the website of a company with a physical presence in State A (the “in-state” company)

n The out-of state company is not physically present in State A.

n T h e c o m p a n i e s m a y o r m a y n o t b e related.

n The in-state company receives a commission for sales resulting from clicks from its website to the out-of-state company’s website, and annual gross sales received by the out-of-state company from click-throughs are over a certain amount $10,000 in many instances

T h e s t a t e s c o n t e n d t h a t t h i s s c e n a r i o gives rise to sufficient nexus under the Quill p h y s i c a l p r e s e n c e s t a n d a r d . I n f a c t , i n a M a rc h 2 0 1 3 r e s p o n s e t o c h a l l e n g e s b y Overstock com and Amazon com, the New Yo r k C o u r t o f A p p e a l s h e l d t h a t t h e N e w York statute didn’t violate the U S Constitution on its face, and that it satisfied the Quill s u b s t a n t i a l n e x u s r e q u i r e m e n t s i n c e t h e out-of-state taxpayer established an in-state sales force through its click-through agreement. The Court explained that solicitation in a state that produces a significant amount o f r e v e n u e q u a l i f i e s a s m o r e t h a n t h e “ s l i g h t e s t p r e s e n c e ” f o r p u r p o s e s o f t h e physical presence requirement

10 INSIGHT icpas org/insight htm

TAX DECODED

In contrast, an Illinois Circuit Court ruled in May 2012 that Illinois’ click-through nexus statute failed the substantial nexus requirement The Illinois case is on appeal i n t h e a p p e l l a t e c o u r t , b u t t h e I l l i n o i s click-through nexus law currently remains in effect

A number of states also have amended their sales and use tax laws to enact what is commonly called “affiliate nexus” laws d e e m i n g t h a t a n o u t - o f - s t a t e s e l l e r w i l l have nexus with a state if it, n S e l l s t h e s a m e o r a s i m i l a r l i n e o f p r o d u c t s a s a n i n - s t a t e s e l l e r, w h i l e u s i n g a n i d e n t i c a l o r s i m i l a r n a m e , t r a d e n a m e o r t r a d e m a r k , o r m a i nt a i n s a n o f f i c e , d i s t r i b u t i o n f a c i l i t y, warehouse or storage place in-state to fa c ilita te the de liv e ry of prope rty or services sold by the out-of-state seller.

n D e l i v e r s , i n s t a l l s , a s s e m b l e s o r p e rf o r m s m a i n t e n a n c e s e r v i c e s f o r t h e seller’s customers in the state

n Facilitates the sellers’ delivery of property to customers in-state by allowi n g t h o s e c u s t o m e r s t o p i c k u p t h e property at a location maintained by the in-state seller.

n Conducts any activities in the state associated with the out-of-state seller’s ability to establish and maintain a market in-state

W h a t ’ s m o r e , s o m e s t a t e s h a v e d o l l a r t h r e s h o l d s s i m i l a r t o t h e c l i c k - t h r o u g h nexus thresholds

There are currently 14 states with affiliate nexus statutes, and one state, Pennsylvania, has taken on an affiliate nexus position through administrative pronouncement

Unless the federal Marketplace Fairness Act or a similar piece of legislation eliminating the Quill physical presence requirement passes Congress, or the Supreme Court rules against a state in a case involving click-through nexus or affiliate nexus, the states are likely to continue to push the envelope by enacting these types of statutes Kansas, Maine, Minnesota and Missouri have enacted new click-through nexus statutes, and Iowa, Kansas, Maine, Missouri and West Virginia have enacted new affiliate nexus laws in 2013 alone.

Check back with my future columns to see how all this plays out

Helping Tax Professionals Provide Independent Fee-based Financial Advice.

If you are considering adding financial services to your practice, or are looking to leverage your back office to spend more time serving clients, consider an affiliation with Forum. We are a team of highly credentialed professionals with experience helping accountants build profitable financial services businesses. Why build costly infrastructure? Leverage your business by outsourcing your non-client facing activities.

icpas org/insight htm | FALL 2013 11

Home Office: 1900 S. Highland Ave. | Suite 100 | Lombard, IL 60148 Phone: 630.873.8520 Web: www.forumfin.com Offices: Skokie, Illinois | Lake Forest, Illinois | Midlothian, Virginia For additional information, please contact Marcus K. Heinrich, CFP® at 630.873.8510 or mheinrich@forumfin.com

A SPECIAL THANK YOU... to the following advertiders who exhibited at this year’s Showcase.

Guns, Marijuana & Accounting

New legislation promises to impact your people, your practice and society at large

By Marty Green, Esq

Go v e r n o r Q u i n n s p e n t h i s s u m m e r months acting upon more than 400 pieces of legislation passed during the Spring Legislation Session Considering the volume of bills that dominated the Session, it’s no surprise that a number of the ones signed into law may directly impact you, your people, practice, workplace and community.

The following are some legislative highlights for your information and should not b e c o n s t r u e d a s p o s i t i o n s o f t h e I l l i n o i s CPA Society, specifically

Accounting Act Update

Marty is the ICPAS VP of Government Relations, a practicing lawyer and member of the Illinois Bar and a Lieutenant Colonel in the National Guard

He previously served as executive assistant attorney general for Illinois Attorneys General Lisa Madigan and Jim Ryan, and as director of the Governor’s Office of Citizens Assistance and assistant to the Governor for Public Affairs, both under Governor James Edgar

* greenm@icpas org @icpasgovt

Governor Quinn signed House Bill 2726 the top legislative priority of the Illinois CPA Society into law on August 9 The legislation updates the Illinois Public Accounting Act and extends the Regulatory Act sunset date to January 1, 2024

While its basis continues to be the need for licensure or registration to use the CPA title, significant changes have been made throughout the Act For starters, “Accountancy Activities,” which are services performed for a client or employer, replaces the practice of “Public Accounting ” The title “CPA (inactive)” also has been added to allow licensed or registered CPAs who don’t perform any accountancy activities to use the CPA title and be exempted from the 120-hour CPE requirement; that is, as long as “inactive” is placed adjacent to “CPA.”

With the bill signed, these changes are e f f e c t i v e i m m e d i a t e l y a s P u b l i c A c t 9 80254. Naturally, many questions are being r a i s e d b y o u r m e m b e r s , a n d s o w e h a v e posted FAQs on the Illinois CPA Society’s website [www icpas org]

Medical Cannabis Pilot Program

House Bill 1 creates a four-year pilot program allowing sick or dying patients to use up to 2.5 ounces of medical cannabis every t w o w e e k s , a f t e r r e c e i v i n g c e r t i f i c a t i o n

from an Illinois physician that confirms the patient suffers from a “debilitating medication condition ”

The legislation, effective January 1, 2014 as Public Act 98-0122, provides for 22 cannabis-growing operations and 60 licensed retail outlets across the state that will be regulated by the Illinois Department of Financial & Professional Regulation (IDFPR). Growers and dispensaries will pay a 7-percent privilege tax, which will be used for enforcement purposes, and patients will pay a 1-percent tax for purchases

The General Assembly did recognize and p r o v i d e d f o r e m p l o y e r s ’ d r u g - f r e e w o r kplace policies; Section 50 specifically states t h a t n o t h i n g i n t h e A c t p r e e m p t s a n e mployer’s drug-free workplace or drug testing policies.

CPAs should also recognize that, with the p a s s a g e a n d s i g n i n g o f H o u s e B i l l 1 i n t o s t a t e l a w, t h e r e i s a c o n f l i c t w i t h f e d e r a l law. Cannabis remains a schedule 1 drug a n d s u b j e c t t o f e d e r a l p r o s e c u t i o n , a n d CPAs should consult legal counsel if contemplating providing accountancy services to a dispensary or grower A f e d e r a l c o nv i c t i o n o f t h i s n a t u r e c o u l d r e s u l t i n l i c e ns u r e d i s c i p l i n e o r s u s p e n s i o n o r r e v o c at i o n b y t h e I D F P R o r o t h e r s t a t e l i c e n s u r e a u t h o r i t i e s M o r e o v e r, s u c h a c o n v i c t i o n a n d l i c e n s u r e s a n c t i o n c o u l d r e s u l t i n a d d i t i o n a l s a n c t i o n s b y t h e I l l i n o i s C PA S o c i e t y a n d t h e A I C PA

Firearm Concealed Carry

House Bill 183 allows residents and nonresidents who meet specified qualifications to apply for a license to carry a concealed firearm in Illinois. Illinois is the final state to enact concealed carry, and did so under a mandate from the Seventh Circuit Court of Appeals

Applicants must complete an application separate and apart from the Firearm Owner’s

12 INSIGHT icpas org/insight htm

CAPITOL REPORT

Identification Card (FOID), and must complete 16 hours of training. The Illinois State Police is in the process of completing regulatory guidelines for training providers, and will have concealed carry applications available on or around January 1, 2014

As an employer and business owner, you s h o u l d c o n s i d e r w h e t h e r y o u w a n t y o u r employees and customers to possess a concealed firearm in your place of business If you decide to regulate the carry of firearms in your place of business, employee policies and handbooks should be updated to reflect the prohibition and to ensure strict compliance with the law

Unfortunately, the General Assembly was not clear on prohibiting concealed carry in y o u r p l a c e o f b u s i n e s s i f y o u l e a s e o f f i c e s p a c e S e c t i o n ( a - 1 0 ) p r o v i d e s a c a t c h a l l provision that allows the owner of private real property to prohibit concealed firearms on the property under his or her control At this point, we really don’t know with cert a i n t y h o w t h e c o u r t s w i l l i n t e r p r e t t h e s e terms If you lease your office space, you may want to come to a contractual agreement with your landlord regarding who has the right to decide the policy on this issue.

If you also decide to prohibit concealed carry among customers in your office, you will be required to post signage of uniform d e s i g n a s e s t a b l i s h e d b y t h e I l l i n o i s S t a t e Police Even with this prohibition, the law d o e s p r o v i d e f o r a p a r k i n g l o t e x c e p t i o n w h e r e i n a f i r e a r m m a y b e p o s s e s s e d a n d the firearm or ammunition may be stored out of sight in a locked vehicle With the development of the application a n d v e t t i n g p r o c e s s t h a t e a c h a p p l i c a n t must undergo still pending, there’s plenty of t i m e t o d e v e l o p i n t e r n a l p o l i c i e s a n d t o h a v e d i s c u s s i o n s w i t h y o u r l a n d l o r d o r attorney if necessary

House Bill 183 is Public Act 98-0063 and is effective immediately

State Vendor Job Posting & Unemployment Insurance

House Bill 3125 requires individuals and entities with contracts other than certain construction contracts with state agencies under the executive branch and community colleges to post job vacancies on the Illinois Department of Employment Securities’ (IDES) IllinoisJobLink.com.

The bill also authorizes IDES to mandate electronic payment of unemployment insurance taxes and to assess a penalty to payments made by check; eliminates the requirement that employers estimate monthly wages on new hire reports; clarifies that IDES may accept electronic mailing receipts as proof of service where service or certified mail is required; and provides that filing a fraudulent unemployment insurance return is classified as a Class 4 felony.

HB 3126 is Public A c t 98-107 a nd became effective on July 23, 2013

The legislation detailed here is only a sample of the bills that may have significance to you and your professional environment We’ll continue to keep you posted on items of interest through our monthly Capitol Dispatch e N e w s l e t t e r [ w w w. i c p a s . o r g / c a p i t o l d i s p a t c h h t m ] and through my Twitter account [@icpasgovt]

As always, I appreciate your feedback, insight and suggestions, so keep the lines of communication open and let me know if there’s a particular piece of legislation or regulation that you’re interested in

CPA Endowment Fund of Illinois

make success possible

I have always believed in myself, but it’s a great feeling to see that someone else does too.

Sharnay Bradford - McKendree College

Make success possible. Donate today. www.icpas.org/annualfund.htm icpas org/insight htm | FALL 2013 13

The Fund provided Sharnay with increased financial security, professional networking tools, and the opportunity to intern at one of the world’s largest accounting firms.Support from people like you changes the lives of hundreds of future CPAs every year.

c h o o l e d i n F r a u d

The real scoop on financial fraud in higher education

By Brad Sargent, CPA/CFF, CFE , CFS, Cr FA , FABFA

Brad is the managing member of The Sargent Consulting Group, LLC, which specializes in forensic accounting and financial investigation He is a frequent lecturer and chair emeritus of the American Board of Forensic Accounting A member of the Illinois CPA Society since 2002, Brad also serves on the Society’s Board of Directors

* bsargent@scgforensics

The thought of school, particularly at this time of year, conjures up many different images We all have our own unique experiences and memories from our school days Whatever your first association is, though, I bet it’s not “fraud ”

Unfortunately, frauds ranging from revenue recognition to credit card abuse run r a m p a n t a n d t h e y ’ r e r a r e l y r e p o r t e d i n the media Pause for a moment and cons i d e r t h e c o n t r o l e n v i r o n m e n t i n h i g h e r e d u c a t i o n ( i e h i g h s c h o o l , c o l l e g e a n d beyond) It’s the perfect scenario for frauds t e r s t o p l y t h e i r t r a d e : A g r e a t d e a l o f a u t h o r i t y a t t h e i n s t i t u t i o n a l l e a d e r s h i p l e v e l , l o w - c o m p e n s a t i o n p e r s o n n e l w i t h a u t o n o m y o v e r h i g h - d o l l a r c o n t r a c t s , boards with possibly little or no financial sophistication, and a dash of higher-cause altruism spread across the culture.

S i m p l y s t a t e d , s o m e o f t h e m o s t e g r egious and devious frauds I’ve investigated occurred in the higher education sector.

Like most other industries, higher educat i o n h a s b e e n i n c o s t - c o n t a i n m e n t m o d e s i n c e 2 0 0 7 . S t a f f h a s b e e n c u t i n e v e r y department, compliance and internal audit functions have been severely curtailed, and a d m i n i s t r a t o r s h a v e b e e n g i v e n c a r t e b l a n c h e t o i m p l e m e n t a w i d e v a r i e t y o f fraud schemes

While we examine a few scenarios, keep in mind that fraud always has an incentive attached to it

Most schools enjoy three primary sources o f r e v e n u e t u i t i o n , p r i v a t e f u n d - r a i s i n g (aka “advancement”) and public funding

Let’s start with the case of the admissions officer with a bonus incentive for increasing s t u d e n t h e a d c o u n t , t h e r e b y i n c r e a s i n g tuition revenues This creative admissions officer is incented to find new and inventive ways for more students to qualify for more

s c h o l a r s h i p s , w h i c h w i l l t r a n s l a t e i n t o a l a rg e r s t u d e n t b o d y, p o s i t i v e l y i m p a c t i n g institutional growth and miraculously more

r e m u n e r a t i o n f o r t h e a d m i s s i o n s o f f i c e r Win-win-win, right? That’s until the scholarships provided by the school equate to nothing more than a dramatic discount on the cost of tuition The revenue per student suddenly plunges, while the cost per student r e m a i n s s t a t i c O v e r t h e c o u r s e o f a f e w y e a r s , t h i s c a n h a v e a p o w e r f u l e f f e c t o n income statements.

Advancement, or fundraising, is an area r i f e w i t h p a r t i c u l a r l y p e c u l i a r p r a c t i c e s Representatives from the school are tasked with seeking out committed donations large and small from alumni and organizations Due to circumstances known and unknown, total actual funding never truly equates with total commitments, which results in a classic case of recognized revenue not equaling realized revenue

Advancement personnel often have incentives for reaching certain commitment thresholds; this is paying a bonus for recognized revenue, not realized revenue Talk about a recipe for disaster!

In one instance I encountered an advancement officer who calculated the net worth of an older, prominent donor/alumnus and r e c o g n i z e d 8 0 p e rc e n t o f t h i s f i g u r e a s a commitment to the school simply because t h e d o n o r d i d n ’ t g e t a l o n g w i t h h i s a d u l t children and was nearing death. The school officer was careful to instruct his colleagues not to mention this to the donor himself, as it would upset him and possibly jeopardize the “gift ” The advancement officer’s bonus was paid, and his fictitious fundraising campaign was trumpeted as a huge success.

Public funding for higher education, however, does come with strict guidelines and regulations, and schools must qualify for funds by adhering to clearly documented metrics Sadly, there still have been many highly publicized cases of school administrators “fudging the numbers” to keep the public dollars rolling in I once interviewed a school employee who completed compli-

14 INSIGHT icpas org/insight htm

S

FORENSICS INSIDER

com

ance documents with false data that resulted in hundreds of thousands of public dollars coming to a school district This is a typical case of a mid-level manager doing what he/she was instructed to do and suspending any notion of ethics under the perceived threat of losing their job

Individuals with control over revenues aren’t the only fraudsters in education. Individuals who have access to the cost side of the income statement may also engage in nefarious activities A senior e m p l o y e e w i t h o v e r s i g h t o f t h e g r o u n d s a n d m a i n t e n a n c e a t a large high school, college or university can control the vendor relationships and millions of dollars for all facets of building repair, construction, landscaping and furnishings. Consider the vice president of facilities who rented university dorm rooms to non-students and pocketed the proceeds. The same individual stocked th e i r pe r s o n a l r e s id e n c e w i th a ppl i a n c e s e a r m a rk e d f o r f a c ul t y housing. A careful review of the school-provided credit cards at this person’s disposal re-vealed years of unauthorized spending adding up to hundreds of thousands of dollars. The charges, which ranged from gasoline for personal vehicle use to buying a new truck, were all systematically approv-ed by finance department personnel who lacked the underlying knowledge to question any of these expenses Even the “exotic dance club” charges on the credit cards were approved as “meal and entertainment.”

The government, however, is getting more aggressive in investigating education fraud Preston Pugh is a former federal prosecutor, former head of compliance investigations at GE Healthcare a n d c u r r e n t p a r t n e r a t P u g h , J o n e s & J o h n s o n w i t h o f f i c e s i n Chicago and New York He handles many large-scale investigations and serves as a compliance monitor in Illinois and New York. He and his firm also advise many clients in higher education

Pugh states that, “With the increasing indicators of fraud that are arising in higher education, it’s important that colleges and universities improve their internal compliance monitoring systems and take the required steps to prevent small problems from becoming much, much larger In-house counsel in higher education can take l e s s o n s f r o m t h e i r p e e r s a t h o s p i t a l s a n d p h a r m a c e u t i c a l s w h o know all too well the prevalence and scale of government investigations in that sector Change happens quickly; 20 years ago the scrutiny in healthcare fraud and enforcement was certainly not what it is today ”

A s I ’ v e s a i d , t h e v a r i o u s s c h e m e s I ’ v e e n c o u n t e r e d o v e r t h e years in the education sector would make most felons blush After all, how do people get away with such unethical abuse in a culture e s t a b l i s h e d t o s e r v e a h i g h e r p u r p o s e ? F r a u d s t e r s i n a c a d e m i c institutions exploit this culture to their maximum advantage. One of the most unfortunate byproducts of education fraud is the fact that most schools are loathe to publicize the fact, fearing a major drop in donations Instead, the wrong-doers are often quietly sent packing and typically find gainful employment at another school.

Fraud in education is as systemic and pervasive as insurance fraud Sadly, most victims accept it as part of the process

I encourage everyone to do as my fav-orite bumper sticker says: “Think globally, act locally ” Don’t hesitate to ask questions about the leadership and finances of your local school districts, colleges or universities Often, a small bit of due diligence can save the school from bringing the proverbial fox into the henhouse.

icpas org/insight htm | FALL 2013 15

PFP ADVISOR Ta r g e t D a t e

TDFs have exploded in popularity as a key investment choice But are they worthy of all the press?

By Mark J Gilbert, CPA/PFS

v i s o r s ,

, Mark’s 25-plus years of finance

c c o u n t i n g e x p e r i e n c e i n c l u d e s

1 3 yea r s in p er s ona l f ina ncia l p la nning An ICPAS member since 1982, M a r k c u r r e n t l y s e r v e s i n t h e I A / P F P

M e m b e r Fo r u m G r o u p a n d o n t h e Structure & Volunteerism Committee.

* mgilbert@reasonfinancial com

Target Date Fund (TDF) defined contribution plan assets totaled nearly $97 billion in September 30, 2012, and consulting firm

C a s e y Q u i r k & A s s o c i a t e s p r o j e c t s t h a t they’ll swell to $3 7 trillion by 2020 That’s approximately 48 percent of all plan assets

As a personal financial planner, I appreciate the investment concepts behind TDFs But I fear they’re not the pot of gold at the end of the (investment) rainbow that some plan sponsors and plan participants think they are.

Whether you’re a retirement plan sponsor fiduciary, you advise business owners on setting up and maintaining these types of plans, or you invest in them yourself, it’s important to be aware of TDF pros and cons.

But first, what exactly is a TDF? It’s a bala n c e d m u t u a l f u n d c o m p r i s e d o f s t o c k s , bonds, alternative investments and cash, or funds that invest in these vehicles, whereby the asset allocation changes over time. The t y p i c a l T D F i d e n t i f i e s a r e t i r e m e n t d a t e , with the asset allocation becoming decidedly more conservative as the target year draws near

The use of TDFs in retirement plans really took off in 2007 as a result of the 2006 Pension Protection Act, which identified them as retirement plan Qualified Default Investment Alternatives (QDIA) In other words, plan sponsors were absolved of a good deal o f f i d u c i a r y l i a b i l i t y w h e n u t i l i z i n g t h e s e funds as investment options.

B u t t h i s Q D I A s t a t u s m a y b e s e n d i n g investors the wrong signal A 2012 LIMRA Retirement Research survey of more than 3,500 consumers revealed that 10 percent believe TDFs include guaranteed returns, become risk-free at retirement, or require

income to be withdrawn during the target y e a r U n f o r t u n a t e l y, n o n e o f t h e s e p r o v isions are true. What’s more, a 2012 SEC survey indicated that only 64 percent of those s urv e y pa rtic ipa nts k ne w tha t TDF s don’t provide guaranteed income after retirement.

O b v i o u s l y, e m p l o y e r s n e e d t o p r o v i d e communication and education about TDFs r a t h e r t h a n s i m p l y r e l y i n g o n t h e i r Q D I A s t a t u s t o a v o i d p o t e n t i a l l e g a l p r o b l e m s down the road.

There are at least two fund management issues that plan sponsors need to consider when selecting from competing TDFs. First is the fund’s “glidepath” or change in asset a l l o c a t i o n o v e r t i m e . T h e g l i d e p a t h c a n v a r y s i g n i f i c a n t l y f r o m f u n d t o f u n d F o r example, earlier this year Morningstar reported that year 2055 TDFs had almost a 2 0 - p e rc e n t a g e p o i n t d i f f e r e n c e b e t w e e n their most conservative and least conservative asset allocations

The other issue is whether the fund changes its asset allocation in the years prior to the target date (after which it stops making changes) or through the target date until a later time Consequently, “to” funds gene r a l l y h a v e l o w e r e q u i t y w e i g h t i n g s t h a n “through” funds at the target date, which goes to show that TDFs aren’t interchangeable and instead need careful consideration

b e f o r e b e i n g a d d e d t o a r e t i r e m e n t p l a n investment menu.

Since TDFs invest largely in a combination of stocks and bonds, their investment returns generally reflect some sort of blende d a v e ra g e of dome s tic a nd inte rna tiona l stock and bond indexes, performing better than stock averages in falling stock markets b u t t r a i l i n g i n r i s i n g s t o c k m a r k e t s T h i s

16 INSIGHT icpas org/insight htm

A principal in the financial planning f i r m o f Re a s o n Fi n a n c i a l

A d

Inc

a n d a

“I appreciate the investment concepts behind TDFs. But I fear they’re not the pot of gold at the end of the (investment) rainbow that some plan sponsors and plan participants think they are ”

makes TDFs a good choice for plan participants who need to reduce stock investing risk, while willingly sacrificing the potential for otherwise higher returns But TDFs certainly carry some risk. In 2008, for exa m p l e , w h i l e T D F s s u f f e r e d s i g n i f i c a n t losses alongside the stock and bond markets, the average loss for a 2010 TDF was still 24 percent compared to 37 percent for t h e S & P 5 0 0 i n d e x . S i n c e t h e n , t h e S E C actively has worked to compel plan mana g e r s a n d i n v e s t o r s t o b e t t e r u n d e r s t a n d TDF risks

The most important aspect of fund performance and analysis, however, is identif y i n g w h i c h o n e s w i l l d e l i v e r s u f f i c i e n t returns to meet investors’ expected needs over the long term Morningstar concluded in one study that investors in any investment product providers’ TDFs have similar probabilities of having sufficient savings to last through age 85, but beyond that, TDFs w i t h l o w e r e q u i t y e x p o s u r e p r o v i d e a greater likelihood that assets will run out before age 95. As I sometimes find in worki n g w i t h i n d i v i d u a l s , t h i s o u t c o m e o f t e n means that investors need to invest more a g g r e s s i v e l y t h a n t h e y w o u l d o t h e r w i s e like to in order to reduce the risk of depleting their retirement assets

Furthermore, Morningstar’s survey results are only moderately encouraging given that the majority of investors sell their TDFs within three years of retiring from an employer. With that in mind, a TDF with a glidepath designed to preserve principal at age 65 or 70, rather than through life expectancy, is probably more suitable for the average investor who holds his or her TDF for only a short time

N e v e r t h e l e s s , i n t e r e s t i n T D F s a m o n g retirement plan participants is almost cert a i n l y g o i n g t o g r o w P a r t i c i p a n t s l i k e t h e s e f u n d s b e c a u s e t h e y ’ r e i n t u i t i v e l y a t t r a c t i v e a n d e a s y t o u s e . T h a t d o e s n ’ t mean, however, that investors should “set it and forget it.”

What’s more, plan managers should ignore the inherent simplicity of these funds and educate and communicate with participants about their risks Also, sponsors and advisors should understand the behavior of participants who typically invest in TDFs in order to offer investment choices that best support that behavior. In a c c o m p l i s h i n g that, plan sponsors will not only fulfill their r e g u l a t o r y d u t i e s , b u t a l s o d o t h e r i g h t thing for their employees

Join

Bill Graf, Chair of the ICPAS Board of Directors, along with Todd Shapiro, ICPAS President and CEO, look forward to talking with you to better understand your needs and challenges.

We’ll also touch base on a variety of subjects including:

This is a great opportunity to connect with YOUR Society… and each other. We hope you will join us!

or visit www.icpas.org

icpas org/insight htm | FALL 2013 17

us for a complimentary breakfast or lunch program.

November

Springfield

FOR ALL PROGRAMS:

CPE: 1 Credit

Professional Standards and Issues Regulatory Environment Business Climate

Champaign-Urbana

18, 2013

November 19, 2013 Oakbrook Terrace January 21, 2014 Glenview January 22, 2014 Chicago January 23, 2014 To REGISTER for a program in your area, call 800.993.0407

Hour Cost: Free

Financial App-titude

Top mobile apps for corporate finance pros

By Derrick Lilly

By Derrick Lilly

In today’s untethered business world, corporate finance gurus need to be smart-device-wielding, cloud-surfing pros. But, with each day bringing more business apps to market, it’s more confusing than ever to decide which ones will actually help or hinder your productivity And so, here we give you some simple, easy-to-use apps that will help to keep you on the business edge whether you’re in the confines of the office or roaming free with your mobile devices.

Passwords Protected

If you’re anything like ICPAS’ o w n a c c o u n t i n g a n d f i n a n c e m a n a g e r s , y o u h a v e a l o t o f w o r k t o g e t d o n e o n a d a i l y b a s i s , a n d a w h o l e m e s s o f usernames, passwords and authentication codes to remember to get to it.

If you’re having trouble keep i n g t a b s o n t h e s e d a s t a r d l y things (which you likely have to change frequently), writing them on yellow sticky notes or s a v i n g t h e m a s t e x t s i n y o u r s m a r t p h o n e i s n ’ t going to cut it (unless you’re trying to leak sensitive company information)

Instead, password management apps like Ascendo DataVault [ascendo-inc.com] and Keeper [keepersecurity com] will temper security concerns and memory lapses by storing and organizing all of your usernames, passwords, PIN numbers, credit card numbers, and any other sensitive information in one location, with only one password required to access them What’s best, both work across your mobile and desktop devices, so you can access information anytime, anywhere

Documents Everywhere

Speaking of important information, how often do you find yourself needing or wanting a copy of a document or receipt when you’re nowhere near a photocopier or scanner? Well, CamScanner [cam scanner net] has the solution for you: Turn your mobile device (which we know you’re never without) into a scanner Just snap a picture of your realworld document with your Android, iPhone or iPad camera, and CamScanner will convert it into an editable PDF that you can save to your device or in their “cloud” so all your mobile and desktop devices can access and share it

And how likely is it that some, if not many, of the business-critical documents and contracts coming your way each day need your signature? If you’re always on the move, getting those signed and sent may be a chore for you and your staff That’s where Adobe’s EchoSign [echosign.adobe.com] eSignature solution comes in EchoSign allows users to send, sign, track, manage and access documents across the web, including from their iPad, iPhone and iPod Touch devices. What’s really great is the fact that documents can be signed in person right on your touch-screen-enabled smartphone or tablet with your finger, plus it’s a secure signing process with key authentication, privacy and fraud protection What’s more, EchoSign seamlessly integrates with many leading business solutions from Citrix, Microsoft Dynamics CRM, NetSuite, Oracle, Salesforce, SAP and more to further streamline business processes.

If your main objective is simply synching and sharing files of all types with multiple devices and u s e r s , D r o p b o x ’ s p e r s o n a l a n d b u s i n e s s c l o u d solutions have you covered You can say goodbye t o w o r r i e s a b o u t y o u r s e n s i t i v e e m a i l a t t a c hments, file-size limitations, cumbersome FTP serv e r s , a n d p e o p l e m o d i f y i n g d o c u m e n t s t h e y ’ r e not supposed to Dropbox gives you all the storage space and administrative controls you need t o s e a m l e s s l y s t o r e a n d s h a r e f i l e s f o r u s e a n d c o l l a b o r a t i o n w i t h y o u r t e a m , o r a n y o n e y o u

want for that matter Dropbox for Business [drop b o x . c o m / b u s i n e s s ] s p e c i f i c a l l y o f f e r s enhanced document management and tracking, and secu-

18 INSIGHT icpas org/insight htm TECHNOLOGY

r i t y a n d a c c e s s c o n t r o l s , s o n o m a t t e r where you and your staff are located, each u s e r c a n s e c u r e l y a c c e s s a n d w o r k w i t h t h e f i l e s a n d b a c k u p s s y n c h e d t o D r o pb o x ’ s c l o u d f r o m M a c s , P C s , m o b i l e phones and tablets.

HR Anywhere

So, you have your documents, they’re signed and shared securely, and your team is seamlessly collaborating on all their projects. But what about your HR needs?

SurePayroll and ADP might be able to help since both companies offer free apps t h a t e x t e n d t h e i r p r o d u c t c a p a b i l i t i e s t o their customers’ mobile devices.

With SurePayroll’s mobile app [surepayroll com], you can accurately run your company’s payroll anywhere, anytime from your Android or Apple device The app allows users to pay salaried, hourly, and 1099 employees; enter earnings, deductions, hours worked and benefits like accrued personal time; change check dates and direct deposits; pay and file payroll taxes; and much more Plus, their Mobile Paycheck for Employees app allows employees to view their paychecks on their mobile devices just as easily.

If running payroll from your mobile device isn’t quite as important, but empowering your employees with greater access to a host of information typically controlled by the HR department is, ADP Mobile Solutions offers businesses running ADP an excellent app specifically for Apple and Android devices Designed with the mobile workforce in mind, ADP Mobile [adp.com/mobilesolutions] allows users to securely review pay statements, earnings, deductions and deposits; punch in/out and submit timesheets; review retirement account balances, contributions, rates of return and loan balances; access detailed FSA account information; review company benefits plans and elections; receive company news updates; access a detailed employee directory to call, email or locate colleagues; and more It basically puts your HR department at your employees’ fingertips 24/7 without the hassle.

Work Wherever

Last but not least, a good remote desktop application always comes in handy After a l l , y o u r w o r k s t a t i o n i s u s u a l l y t h e m o s t powerful and efficient machine you have, so you shouldn’t have to be without it.

Splashtop [splashtop com] offers remote desktop apps for Android, Apple and Win-

dows smartphones and tablets, specifically g e a r e d t o w a r d s b u s i n e s s a n d e n t e r p r i s e users who need high-speed, high-quality, mobile access to all of their business-critical programs, applications, files and multimedia content Splashtop uses high-speed streaming optimized to be fast and respons iv e on 3G/4G a nd Wi-F i ne twork s , a nd uses 256-bit AES/SSL encryption to ensure

your remote connection is absolutely secure It even ensures that complex ERP and graphics-heavy programs will operate seamlessly. How’s that for a productivity booster?

Have a business app that you can’t live without? Let us know about it and we might just highlight it in an upcoming issue of INSIGHT; email me at lillyd@icpas org

We can help you before you reach your breaking point. We start a conversation and you will have help, guidance and resources at your fingertips. We become your trusted advisor.

Jim Wong, CEO & Founder

Clear

and Numerate Partners rebrand under one name — Brilliant. specialized recruiting, temporary staffing and management resources in accounting, finance and information technology 312 582 1800 www.brilliantfs.com

Focus Financial Search, Brilliant Financial Staffing, SilverPoint Technology Staffing,

—

d un rebran echnolo t T Te SilverPoin Financial Focus Clear rillia e B am e n n r o de e d Num n , a fing taf y S g Finan Brilliant Search, nt. tners ar e P at rat fing, Staf cial w w w 3 in and management and r specialized m o .c s f t n a i l l i r .b 0 180 12 formation accounting in resources staf temporary ecruiting, finance , fing icpas org/insight htm | FALL 2013 19

The Female Factor

How can public accounting firms keep their women professionals for the long haul?

By Selena Chavis

By Selena Chavis

High-Five Your Employees

It’s quick and easy for employers to put these best practices into place, and they go a long way in boosting employee morale, loyalty and longevity, and ultimately recruiting and retention efforts These practices appeal equally to men and women, and simply make great management sense.

1 Maintain an open- door policy

2 Promote from within

3 Offer fair compensation

4 Recognize outstanding work

5 Provide professional development opportunities

As a n i n d u s t r y h i s t o r i c a l l y d o m i n a t e d b y men, accounting is witnessing something of a gender shift The AICPA’s 2013 Trends in the Supply of Accounting Graduates and the Dem a n d f o r P u b l i c A c c o u n t i n g R e c r u i t s r e v e a l s that 48 percent of accounting graduates Bache l o r ’ s a n d M a s t e r ’ s c o m b i n e d a r e w o m e n , a n d t h e r e c e n t l y r e l e a s e d 2 0 1 3 A c c o u n t i n g MOVE Project Report found that 51 percent of accounting firm managers are women

U n f o r t u n a t e l y f o r m a n y, m o v e m e n t u p t h e firm ladder often stops there; in fact, only 19 percent of partners are women Subsequently, i t ’ s n o s u r p r i s e t h a t T h e M O V E P r o j e c t ’ s r esearch found that 44 percent of women most of them senior staff have been strongly tempted to leave at least once, and more than half of them are still considering defecting

Somewhere along the way, women exit the talent succession pipeline, says Louise Single, Ph.D., accounting department chair at St. Edwards University and a member of the AICPA Women’s Initiatives Executive Committee. “If firms want to have the best talent stick with them, they have to have women hang in there for the long term,” she says. “Public accounting firms stand to lose their ROI if they can’t leverage the skills of these professionals in the C-suite.”

Even more research points to a challenging retention environment ahead Nearly 75 percent of employees interviewed in a 2013 Accountemps survey noted that they would be comfortable seeking new employment before leaving their current firm, and 48 percent said they would likely conduct job searches while at work.

What’s a firm to do? A thorough assessment and refinement of retention strategies targeted to women sounds in line, but as Dow Scott, a prof e s s o r o f h u m a n r e s o u rc e s i n t h e G r a d u a t e S c h o o l o f B u s i n e s s a t L o y o l a U n i v e r s i t y i n Chicago, points out, “'Context’ is an important consideration when trying to identify retention

22 INSIGHT icpas org/insight htm DIVERSITY

s t r a t e g i e s t h a t w i l l a p p e a l t o m e n a n d women. It’s never a ‘one-size-fits-all’ situation Most people are complex ”

“ E m p l o y e e s e v a l u a t e t h e i r e m p l o y e r s and their positions based on a multitude of factors with varying degrees of importance to them,” explains Marilyn Bird, vice presi d e n t o f R o b e r t H a l f I n t e r n a t i o n a l i n Chicago “Compensation, benefits, flexibility, paid vacation and commute, along with professional development and career aspirations, are all factors that contribute to job s a t i s f a c t i o n . ” F o r e x a m p l e , a n e m p l o y e e m a y f o c u s o n c o m p e n s a t i o n d u r i n g o n e stage of life, and on work-life balance later

In addition, there are studies out there that point to different motivations depending on gender. For example, WorldatWork’s 2010 study, Beyond Compensation: How Employees Prioritize Total Rewards at Various Life Stages, reveals that men favor compensation most while women and parents of young children favor work-life balance

The 440 women surveyed as part of the most recent Accounting MOVE Project Report confirmed this assertion, while also providing deeper insight into other factors that contribute to successful retention strategies

For women managers, for example, the report found that the top four retention fact o r s i n c l u d e w o r k - l i f e b a l a n c e , r e l a t i o nship with co-workers, firm culture and a variety of career options Somewhat different from managers, the top four priorities f o r s e n i o r w o m e n s t a f f a r e f i r m c u l t u r e , relationships with co-workers, relationship with clients and technical challenge

Plante Moran is as ideal a role model as you can get when you’re talking about retaining women accountants The Accounting MOVE Project recently named the firm the “Best Public Accounting Firm for Women in 2013,” largely because of internal policies designed specifically to attract, retain and move women up the ranks

I n a d d i t i o n t o e s t a b l i s h i n g p r o g r a m s e n c o u r a g i n g f l e x i b l e w o r k a r r a n g e m e n t s a n d w o r k - l i f e b a l a n c e , i n 2 0 1 3 t h e f i r m l a u n c h e d a n e w Wo m e n i n L e a d e r s h i p (WIL) program intended to bridge the gap between men and women reaching the top ranks. Mentoring and advocacy are key, a f a c t t h a t i s p a r t i c u l a r l y s i g n i f i c a n t g i v e n that data from both the Accounting Move P r o j e c t a n d t h e A I C PA ’ s w h i t e p a p e r, Advocacy and Advancement: A Study by the Women’s Initiatives Committee of the AICPA, co-authored by Single, reveal that

female accounting professionals exposed to mentoring and advocacy reported the highest levels of advancement

At the same time, however, key findings of the Accounting MOVE Project indicate t h a t m a n y m i d - l e v e l w o m e n a r e q u i e t l y d i s c o n n e c t i n g f r o m t h e i r a m b i t i o n s t o o e a r l y, a n d a r e o f t e n

“Sometimes we assume that people know how ambitious we are and what our career aspirations are,” says Single, “It’s important for women in senior leadership roles to be more vocal about the benefits of climbing up the ranks Women who are in leadership roles sometimes don’t let the people coming up know how good they have it ”

ICPAS knowledgehub™ – your training and development solution

CPE onDemand – $25 per credit hour

Live Conferences, Courses and Webinars

Succession Planning and Buy/Sell/Merge

Marketing Resources Including a Toolkit for Communicating Your Value as a CPA

Technical Resources

Thomson Reuters Online Tax Library – only $60

CPE & Licensing Requirements

Practice Requirements

Peer Review FAQs

Ethics Inquiries and Case Studies

Staff Subject Matter Experts in licensing, CPE and More

ICPAS LinkedIn Group

ICPAS Committees, Chapters, & Member Forum Groups

THE NETWORK

www.icpas.org/public.htm

r e l y i n g p r i m a r i l y o n peer relationships for

career guidance

icpas org/insight htm | FALL 2013 23

Check it out today at...

Your Route to the Top

Boost your professional development plans with these three approaches

By Derrick Lilly

By Derrick Lilly

Whether you’re just finding y o u r f o o t i n g i n y o u r r e s p e c t i v e profession, or you’re already trav e l i n g d ow n a c a r e e r p a t h t h a t demands a stronger skill set, taki n g o w n e r s h i p o f y o u r p r o f e ssional development is crucial to your journey’s success

Here are three routes to take along the way

1. Mentors Wanted

How do I get to where I need to go? What opportunities are there? What doors will open? How do I become a better manager?

If these kinds of questions keep you up at night, then you may be in need of a mentor Sometimes all you have to do is ask

“Everybody loves to give advice, and that’s a good way to open the door to forming a mentor/mentee relationship,” says Paula A. Galbraith, Esq., CPA. A leader of her own consultancy and legal practices, and chair of the Illinois CPA Society’s Women’s Initiatives Task Force, Galbraith openly admits that she would not have had the same opportunities to succeed without the guidance of strong mentors throughout her academic and professional careers. “A mentor is going to give you advice, support and encouragement; they are going to help you find opportunities and maybe even use their network to open up some doors for you,” she explains. What’s more, they’re going to expose you to new and different experiences

“What’s important is being able to gain different perspectives If we get locked into our own worlds we miss opportunities. I learned a lot about how to handle responsibilities and issues, communicate with clients, and provide

them with superior service thanks to mentors not only in my early career, but also during my mid-management years,” says Mark Stutman, c h i e f l e a r n i n g o f f i c e r a t G r a n t T h o r n t o n L L P. “We know that the vast majority of learning is experiential; mentors and coaches will without a doubt have a positive impact on your career and development ”

To n o s u r p r i s e , e m p l o y e r s i n c r e a s i n g l y a r e trying to capitalize on the benefits mentoring and coaching programs bring to their professional development plans Grant Thornton, for instance, is focused on providing greater experiential learning opportunities to its staff through f o r m a l d e v e l o p m e n t p l a n n i n g . “ We a c t u a l l y have a formal coaching program that assigns appropriate coaches to all of our people to help facilitate their growth and development through counseling, feedback, encouragement, direction and everything else that goes along with it,” Stutman explains “The benefits are a greater focus on our peoples’ abilities to grow, take on more responsibilities, advance roles and succeed through career continuance.”

Exposure to mentors and coaches shouldn’t b e l i m i t e d t o p r o f e s s i o n a l s a s s i g n e d t h r o u g h e m p l o y e r p r o g r a m s , h o w e v e r M a n y p r o f e ssional groups and associations are jumping into organizing mentoring circles because of their unique twis t the y g roup profe s s iona ls of a ll ages and skill levels into intimate “circles” and e n c o u r a g e o p e n d i s c u s s i o n s o n a l l k i n d s o f issues. Not only do junior members learn from the experienced, but mid- and senior-level professionals also gain insight into the minds of the younger generations These circles are proving to be invaluable, building lasting relationships and developing referral networks in a comfortable, unintimidating atmosphere

“The thought behind mentoring circles is that the relationships these professionals form with each other will continue for several years and provide guidance regardless of your experience level,” explains Kim Rice, CPA, MST, partner at R&M Consulting and chair of the Illinois CPA

24 INSIGHT icpas org/insight htm EDUCATION

Society’s Women’s Executive Committee mentoring program

The Illinois CPA Society has created its own Women’s Executive Committee Mentoring Circles, which benefit women of all ages and in all stages of professional development. Each Circle is comprised of 8 to 10 women of varying levels of experience from a wide range of practice areas and industries, and meets at least four times a year. The Circles are organized to encourage members to speak freely about the issues that working women struggle with on a daily basis, such as professional development, networking and work-life balance (For information contact Gayle Floresca, assistant director, Professional Standards and staff representative, Women's Executive Committee at florescag@icpas org or 312 993 0407 ext 220 )

2. Boardroom Calling

Although it’s not always first to mind, volunteering is actually a great way to expand your professional network and skill set Not only that, but it stands out to employers

“Volunteering often calls for organization, people, management and even persuasion and sales skills Between the peop l e y o u m e e t a n d t h e o p p o r t u n i t i e s y o u have, it’s a great testing ground,” says Galb r a i t h “ W h a t I w a n t a s a n e m p l o y e r i s somebody who’s going to take that extra step; I want to know they have initiative ”

Volunteerism is increasingly being ingrained in the cultures of today’s firms. It builds camaraderie, keeps people engaged, and supports their altruistic missions At Grant Thornton, for example, Stutman explains that their view as a firm is that the more they connect with the community, build relationships and contribute through their actions, the better off the firm and their people will be.

“It’s important for our people to understand that there is something greater than just doing accounting. We are in a people business,” Stutman stresses “The better we understand the world around us, the better we can relate to our clients. Our mission is to have our people make a difference ”

“It’s especially important for young professionals to understand the value of being involved instead of just going to work and going home,” Rice adds “Get involved with professional organizations and their respective committees or serve on a nonprofit’s board It gives you purpose, and it’s great for developing your professional skills You may be tasked with leading committees and meetings, organizing events, fundraising, and using your professional

expertise to guide these organizations in decision-making It’s also a great networking tool ”

3. Knowledge Search

“At the end of the day, you’re responsible for your career progression and getting to where you want to be Part of that comes from mentors and being involved with professional organizations and volunteering, and part is getting the education that you think you need to take your career to the next level,” says Rice.

Whether it’s a podcast, webinar, tutorial, or even an eBook, onDemand education has you covered with skills-building when you want it, where you want it And education providers are expanding their offeri n g s t o c o v e r m o r e t h a n j u s t t r a d i t i o n a l technical know-how and CPE needs

“True professional development is about deep learning and education,” says Ralph Gaillard, M Ed , ICPAS chief learning director. “Here at the Society we are diversifying and building programs that speak to multiple levels of competencies; we want to focus on the skills that people need to succeed throughout their careers ”

The Society’s learning management system, knowledgehub [www.icpas.org/knowledgehub htm], combines content from four d i f f e r e n t e d u c a t i o n p r o v i d e r s , c o v e r i n g technical and soft skills topics for a wide array of accounting and finance professiona l s , w h i l e t h e s e p a r a t e C P E O n D e m a n d [ w w w. i c p a s . o rg / o n d e m a n d . h t m ] s e r v i c e offers a growing selection of quick one-off webcasts and webinars.

“ O n D e m a n d c o u r s e s c o v e r a b r o a d range of topics and reside in different platforms and technologies, but more import a n t l y, g e t t i n g w h a t y o u n e e d w h e n y o u need it is extremely important to getting the job done,” says Stutman. “If you’re not always learning, if you’re not always growi n g , i f y o u ’ r e n o t a l w a y s g e t t i n g b e t t e r, you’re getting worse. You need to have the ‘and’ not the ‘or’ mentality This isn’t about d o i n g o n e t h i n g a n d n o t t h e o t h e r ; t h e b r o a d e r t h e e x p o s u r e y o u c a n g e t , t h e m o r e o w n e r s h i p y o u t a k e i n y o u r o w n d e v e l o p m e n t , t h e m o r e t h i n g s y o u g e t involved in that will grow you personally and professionally, the better off you will be,” he emphasizes, adding that, “To me it’s sort of like taking the formal training, t h e m e n t o r i n g a n d c o a c h i n g , t h e v o l u nteerism, the onDemand courses, webcasts, books, research, and all of the other things you do, and you put it all into a mixing bowl and hopefully what comes out is a better you ”

Recognize Your Peers!

Nominate a colleague for one of the Illinois CPA Society’s prestigious awards:

Lifetime Achievement Award

Presented each year to an individual who has provided distinguished service to the profession in Illinois and/or nationally.

Outstanding Educator Award

Presented each year to an educator(s) at a community college, college or university who has made continuous and outstanding contributions to the education of accounting students.

Outstanding Leadership in Advancing Diversity Award

Presented each year to an individual who is an exceptional leader committed to increasing diversity in the accounting profession.

Emerging Leader in Advancing Diversity Award

Presented each year to a young professional who possesses the qualities of the Outstanding Leadership in Advancing Diversity Award but typically has four plus years of full-time work experience.