also in this issue... Offbeat Team Building 5 Companies That May Live Forever Make Millennial Clients Happy 3 Ethical Dilemmas & How to Face Them Volunteer Circuit Stardom Financial Wellness Payoffs THE NEXT CFO? WILL YOU BE Exploring the issues that shape today’s business world g icpas.org/insight.htm FALL2014 THE MAGAZINE OF THE

© 2014 Robert Half International Inc. An Equal Opportunity Employer M/F/D/V. 0914-9015 My payroll clerk is sick –1.800.803.8367 roberthalf.com roberthalf.com/salarycenter.

SAVE BIG MONEY with Alliant’s low auto rates NEW as low as 1.99 APR1 % USED as low as 2.24 APR1 % Your ILCPA membership provides access to some great benefits including great rates on savings and loans for cars, homes, education and more from Alliant Credit Union. APPLY TODAY... • Visit www.alliantcreditunion.org • Call 800-328-1935 (1) APR=Annual Percentage Rate. Alliant rates as of 10/01/2014. Loan approval, APR and downpayment required and other terms and conditions based on LTV (Loan to Value), payment method, creditworthiness, collateral (including age of vehicle), and the term of the loan. Advertised rates include automatic payment option. Rates are 0.4% higher without automatic payment option. Refinancing of loans from other lenders is available. Member is responsible for any fees associated with transferring of title. Rates are 1% higher for refinancing an existing Alliant loan. Financing available in all 50 states. All loans are subject to approval. Rates, terms and conditions are subject to change. You must be 18 or older to apply. We may not extend credit to you if you do not meet Alliant criteria. Allowable terms vary by loan amount. You must be or become a member of Alliant to apply. Applicant must meet eligibility requirements for Alliant membership. ©2014 Alliant Credit Union. All Rights Reserved. SEG826-R09/14

i n d e x 38 5 Companies with Staying Power These heavy hitters are no flash in the pan Companies with staying power have more than just serendipity to thank for their long-term success. 42 What Would You Do If... Three tough ethical dilemmas and how to do the right thing 18 Generations Got Millennial Clients? Here are eight ways to keep them, and keep adding them 22 Team Building 3 Offbeat Ways to Bond a Team Check your insecurities at the door and get ready for the weirder side of team building 26 Wellness Fit Wallet, Fit Mind Is financial fitness the missing piece of the corporate wellness puzzle? 28 Volunteering The Helper ’s Helper Four key steps will take your volunteer efforts from so - so to super successful 30 Legalities Tied & Bound A recent case brings the legality of restrictive employment covenants into question 4 Today’s CPA So Much to Do From Champaign to Peoria and Rockford to Moline, members talk to me about complexity. By ICPAS President & CEO Todd Shapiro 6 Seen Heard Sound bytes, sound advice and practical business tips 10 Forensics Insider The Voice Within Ignore it when you ’ re talking forensics and ethics, and you’ll suffer the consequences. By Brad Sargent, CPA/CFF, CFE , CFS, Cr FA, FABFA 12 Tax Decoded The Battle Over Taxes Sourcing and transaction locations are a few of the factors making taxes tough By Keith Staats, JD 14 PFP Advisor A Guide to Perfect Conduct New standards guide the practices of CPA financial planners well into the future By Mark J Gilbert, CPA/PFS 16 Capitol Report Goodbye Summer Hello General Election, legislative wins and regulation changes. By ICPAS VP of Government Relations Marty Green, Esq 48 Hype It 3 Tips for Flawless Public Speaking Sarah Herrmann’s must-read-must-know news for young accounting pros the regulars

topics lead stories 2 INSIGHT icpas org/insight htm F A L L 2 0 1 4 | w w w . i c p a s . o r g / i n s i g h t . h t m on the cover

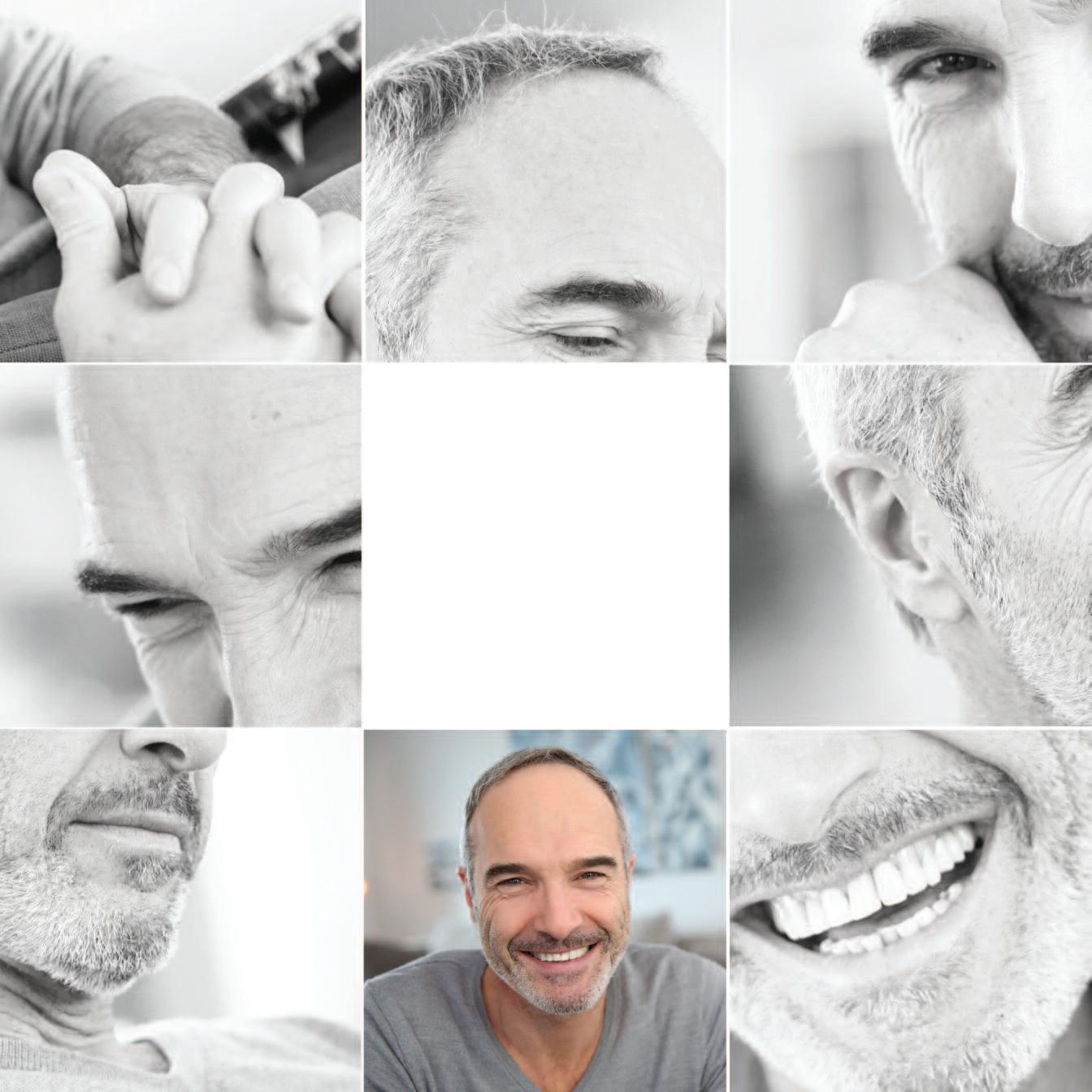

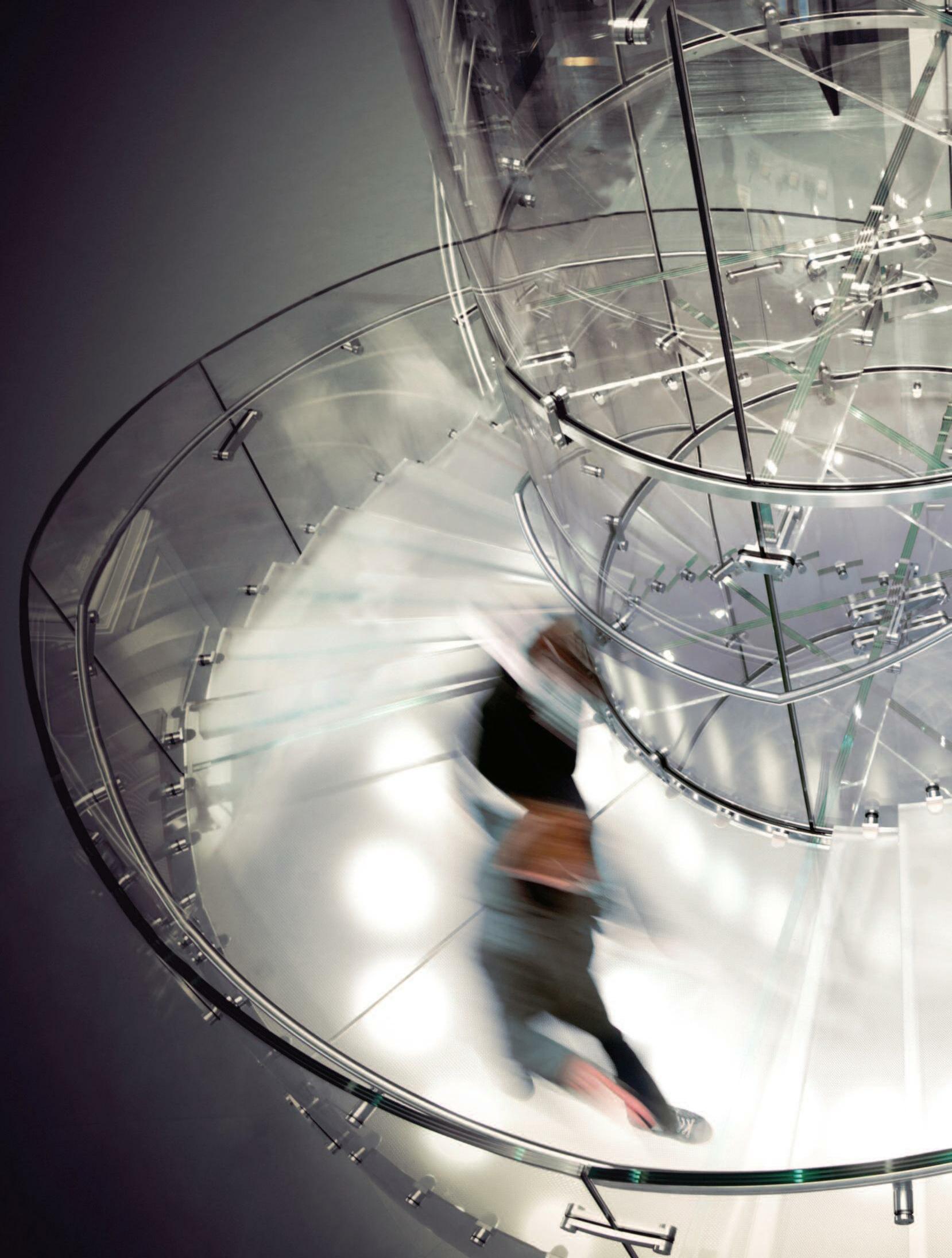

’ s a tough climb to the top So how do you get from the rank and file to the corner office? Start with these three must-haves. 34 @IllinoisCPA #INSIGHTmag

hot

You in the C-Suite It

INSIGHT MAGAZINE

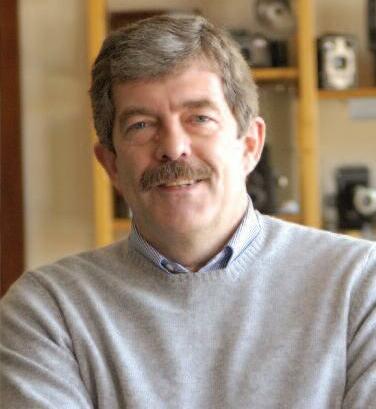

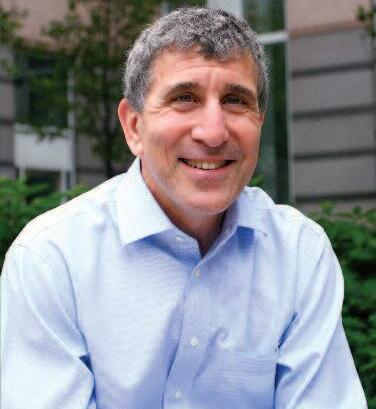

Publisher/President & CEO Todd Shapiro

Editor-in-Chief Judy Giannetto

Art & Layout Design Judy Giannetto

Production Design Rosa Garcia

Assistant Editor Derrick Lilly

Photography Jay Rubinic, Derrick Lilly, Thinkstock

National Sales & Advertising Natalie DeSoto

YGS Group, 3650 West Market Street, York, PA 17404

P: 800 501 9571 x127 F: 717 825 2171

E: natalie desoto@theygsgroup com

Circulation Carl Siska

Editorial Offices: 550 W Jackson Boulevard, Suite 900, Chicago, IL 60661

ICPAS OFFICERS

Chairperson, Daniel F Rahill, CPA, JD, LL M FGMK, LLC

Vice Chairperson, Edward J Hannon, CPA, JD Quarles & Brady LLP

Secretary, Scott D Steffens, CPA Grant Thornton LLP

Treasurer, Mary Lou Pier, CPA Pier & Associates, Ltd

Immediate Past Chairperson, William P Graf, CPA Deloitte & Touche LLP

ICPAS BOARD OF DIRECTORS

Linda S Abernethy, CPA, McGladrey LLP

Jared J Bourgeois, CPA, Mesirow Financial Consulting, LLC

Rosaria Cammarata, CPA, CME Group, Inc

Rose G Doherty, CPA, Legacy Professionals LLP

Eileen M Felson, CPA, CFF, PricewaterhouseCoopers LLP

Gary S Hart, CPA, MBA, Gary Hart & Associates, Ltd

Lisa A Hartkopf, CPA, Ernst & Young

Margaret M Hunn, CPA, CFE, CFF, CITP, Rozovics Group, P C

David V Kalet, CPA, MBA, BP Products North America, Inc

Thomas B Murtagh, CPA, JD, Wolf & Company LLP

Marcus D Odom, PhD, CFE, CPA (inactive), Southern Illinois University

Floyd D Perkins, CPA, Ungaretti & Harris

Kelly Richmond Pope, Ph D , CPA, DePaul University

Mark F Schultz, CPA, Dugan & Lopatka CPAs, P C

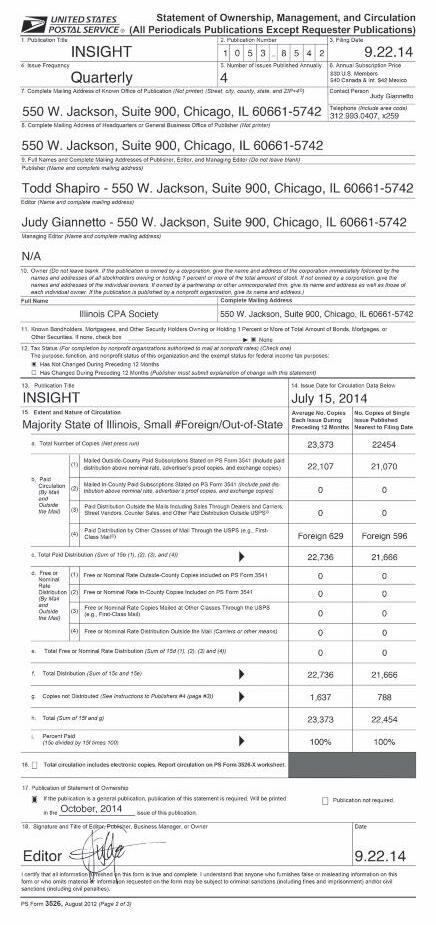

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 24,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result

icpas org/insight htm | FALL 2014 3

four

year, in Spring,

© 2014 No part of the contents may be reproduced by any means without the written consent of INSIGHT Permission requests may be sent to: Publications Specialist, at the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Sign up today! Visit www.icpas.org or call 800.993.0407, option 4. VALUE For only $199 you get 40 hours of onDemand education at less than $5 per credit hour. Earn those valuable CPE credits you need before the 2015 reporting year ends. Premier onDemand education from the organization you know and trust. TIMELY QUALITY

One low, flat rate of only $199 for ICPAS members. ($249 for non-members)

40 hours of onDemand education to take anytime and anywhere.

Special offer good through September 30, 2015.

Over 100 interactive courses in our OnDemand catalog.

of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published

times a

Summer, Fall, Winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA , 312 993 0407 or 800 993 0407, fax: 312 993 7713 Copyright

•

•

•

•

{Follow Todd on Twitter @Todd ICPAS}

{Watch Todd’s CEO Video Series on YouTube}

So Much to Do

From Champaign to Peoria and Rockford to Moline, members talk to me about complexity. For many, it’s the #1 issue they face today.

CLIENTS AND COMPANIES ARE ASKING CPAS TO DO MORE AND MORE NOT ONLY PUTTING IN MORE HOURS, BUT ALSO

This isn't a new trend; for years we've been saying that CPAs are trusted business advisors The change is that the demand to be a strategic business partner is greater than ever and the issues grow more complicated by the day

And so, in this ever-changing, increasingly complex world, what skills and competencies do you need to fulfill this role? In my opinion, it takes a set of very specific attributes, including:

n Strategic and critical thinking

n High-level communication skills

n Being attuned to broad business issues

n Staying technologically up-to-date

n Leadership ability

n A commitment to lifelong learning

Strategic and critical thinking skills in particular are vital. We have more data at our fingertips than ever before and our companies and clients expect us to turn that data into knowle d g e t h a t c a n b e u s e d a s a c o m p e t i t i v e a d v a n t a g e a n d a means to move a business forwards

Mastering the data is only part of the equation, however Successful CPAs will grasp a project, factor in external circums t a n c e s a n d a n t i c i p a t e o u t c o m e s . G u i d i n g c l i e n t s a n d c u stomers from point A to point B is no longer good enough We now need to lead them from point A all the way to point Z.

The way we communicate information and communicate with each other is changing fundamentally, too. The volume of data available has put a premium on being able to present content succinctly and quickly identify its impact on a business Added to that, technology has revolutionized the way b u s i n e s s e s i n t e r a c t w i t h c u s t o m e r s , s t a f f s a n d e a c h o t h e r, thanks in large part to social media

The business world has become not only more complex, but also more interconnected. PESTER is the acronym used to describe the Political, Economic, Social, Technological, Environmental and Regulatory factors at play today. Most if not all

opportunities need to look at the facets of PESTER to ensure success For example, businesses are expected to have a favorable social impact, be environmentally friendly, have a positive economic result and meet regulatory guidelines CPAs attuned to broad business issues will be looked to and valued for their input

A l l t h e s e c o m p e t e n c i e s r e q u i r e u s t o b e t e c h n o l o g i c a l l y adept Yes, technology is impossible to keep up with but critical in moving forward At the Society’s Midwest Accounting and Finance Showcase this year we showed a video that discussed “the Internet of things” the future of data, information and connections over the Internet. Well, that future is now. If we are to thrive as trusted business advisors, we'll need to continually adapt to technology. There is no alternative. Furthermore, it’s common for many organizations to have up to four generations in the workplace at the same time. With that comes differing motivation, expectations, styles of learning and work methods Effective and adaptable leadership is critical in developing a collaborative team

Lastly, lifelong learning has been a pillar of the CPA profession for a very long time. We need to move back towards competency rather than just earning CPE, however And that means changing the nature of continuing education to adapt to an individual's specific learning needs and career path The future is now you will learn what you need to know, when you need to know it and how you want to learn it

Yes, the future is bright for CPAs fulfilling the role of trusted business advisor, yet it will be more challenging than ever to maintain the skills, knowledge and competencies necessary to be the strategic business partner clients and the marketplace are calling for Visit www icpas org to learn how ICPAS can help with the

4 INSIGHT icpas org/insight htm

s s u e o f c o m p l e x i t y t h r o u g h i t s f o u r f u n d a m e n t a l p i l l a r s : Education, Advocacy, Connections and Information

i

I N S I G H T S & S O C I E T Y N E W S F R O M I C PA S P R E S I D E N T & C E O TO D D S H A P I R O today ’sCPA

GIVING MORE STRATEGIC BUSINESS ADVICE.

GET THE PICTURE WHOLE

Introducing

Checkpoint Catalyst

TM

The fastest and most efficient way to research even the most complicated tax issues.

Checkpoint CatalystTM provides the clarity, color and context you need to quickly see the whole picture. It connects the dots between federal, state and U.S. international tax implications with multiple expert perspectives and embedded tools and diagrams, so you can take action with confidence and ensure you don’t miss a thing.

Jumpstart your research process with Checkpoint Catalyst.

Get results more easily, more rapidly and more accurately than with any other resource.

CheckpointCatalyst.com

© 2014 Thomson Reuters/Tax & Accounting. Checkpoint Catalyst is a trademark of Thomson Reuters and its affiliated companies. All Rights Reserved.

SEEN HEARD

68%

Millennials who expect their standard of living before retirement to be bet ter than that of their parents. (wells fargo)

TRENDWATCH Leadership Pipelines in Focus

In a recent global Right Management survey of 2,200 senior HR leaders, 46% said leadership development is their top priority, but a mere 13% said they have confidence in the strength of their leadership pipelines to fill critical openings

Specifically among U S participants, 48% reported that we’ll see increased spending on talent management initiatives aimed at developing leaders and building stronger talent pipelines HR leaders in China/Hong Kong (88%), India (77%), Brazil (75%) and the United Kingdom (45%) also plan to invest heavily in such programs

Perceived talent shortages, naturally, are driving these investments Right Management ’ s May 2014 Talent Shortage Survey found that 36% of employers globally are experiencing difficulty filling open positions due to a lack of available talent with the right skills for key positions

Current Issues:

Tech is Top of Mind

PricewaterhouseCoopers (PwC) usually gets a bunch of different responses when it asks business leaders about their primary focus areas, but this year was different U S CEOs are lasering in on technology, with 86% citing technological advances as the global trend that will most transform their businesses. Even those CEOs who ranked other megatrends (like urbanization and demographic shifts) as more transformative agreed that disruptive technologies would be a powerful change agent over the next five years

The top 10 techs global IT and business leaders are investing in for growth include:

(1) Business analytics 44%

(2) Socially enabled business processes 41%

(3) Mobile customer engagement 39%

(4) Cybersecurity 39%

(5) OnDemand biz & tech services 25%

(6) Sensors 20%

(7) Robotics 15%

(8) Battery & power technologies 15%

(9) 3D printing 11%

(10) Wearable computing 6%

Fast Track to Biz Success

Developing a successful business is hard work But maintaining success may be the hardest job of all Chief Executive offers these four tips for sustaining your business’ growth momentum

(1) Have a Clear Value Proposition

Make your value proposition concise and consistent, and make sure it differentiates you from the competition

(2) Evolve, Expand or Disrupt

Quickly respond to changes in customer needs, shifts in your industry, and new opportunities as they arise

(3) Grade Your Talent

Top performers need to know you have a growth plan for them

(4) Measure Ever ything

Capture feedback and data from all key audiences, including staff and customers

6 INSIGHT icpas org/insight htm

N E W S B Y T E S , S O U N D A D V I C E A N D P R A C T I C A L B U S I N E S S T I P S

CHICAGOLAND’S EXPERTS IN FINANCIAL RECRUITING AND STAFFING At Accounting Principals and Parker + Lynch, we use our intimate understanding of the local job market, salary trends and business climate to connect great talent to great companies across the Chicagoland area every day. To learn how we put the right accounting and finance talent in the right positions, contact us today. accountingprincipals.com parkerlynch.com Chicago 312.583.9264 | Deerfield 847.607.0550 | Oakbrook Terrace 630.792.1660 | Schaumburg 847.397.9700

FORMERLY JACKSON WABASH

FORMERLY GARELLI WONG

HOT TOPIC

Social Responsibility For All

Most business leaders think that only big corporations need to worry about social responsibility, but that ’ s a too common misconception, says The Vianova Group The consulting firm stresses that social responsibility is no longer optional for small- and medium- sized enterprises Here are three reasons why:

Employees want it : Real commitments to social and environmental responsibility help to engage and energize employees, which then helps to build a sense of community and teamwork in the organization

Customers expect it : A recent study shows that more than 90 percent of consumers are more likely to trust and be loyal to socially responsible businesses than they are to companies that aren’t

It saves money: Implementing environmental measures to reduce energy and water usage are proven to add to the bottom line

How To: Detect & Deter Fraud

Fraud is everyone ’ s responsibility financial executives, boards of directors, auditors and employees, among others At least that ’ s what public accounting and consulting firm Crowe Horwath LLP says, pointing out that while complacency is one of the biggest invitations to fraud, professional skepticism could be the biggest solution Crowe’s white paper, Skepticism: A primary weapon in the fight against fraud, suggests these five fraud-fighting strategies:

(1) Be the independent reviewer: Continuously challenge your beliefs and risk assessments.

(2) Resist complacency: Question whether you ’ re placing undue weight on prior risk assessments or discounting evidence inconsistent with your expectations

(3) Be aware of pressure: Pay particular attention to pressure to truncate risk assessment procedures or make unwarranted assumptions to beat time constraints and deadlines.

(4) Understand the evidence: Identify and assess audit risks from multiple perspectives, using multiple sources of evidence

(5) Question evidence reliability: Know that internal documents may be less reliable than external ones

U.S. CEOs who say they’re “pret ty sure” their companies’ revenues will grow this year. (PwC)

Are Bad Manners Stunting Your Career Growth?

It’s lonely at the top for a reason, says a recent A ccountemps survey Eighty-five percent of survey respondents said being courteous to coworkers positively impacts a person's career prospects, but 70% also said that people become less courteous as they climb the corporate ladder That’s not to say that bad manners exist only in the executive office, however A ccording to the survey, leading pet peeves include using a speakerphone or talking loudly on the phone (36%), loitering or talking around a colleague's desk (23%), eating foods that have strong odors (15%), keeping a messy or cluttered workspace (14%) and leaving the phone ringer on loud (8%)

8 INSIGHT icpas org/insight htm SEEN HEARD

89%

1,154 Illinois CPAs who took part in 2014’s CPA Day of Service, originally launched by the Illinois CPA Society in 2010.

forensics insider

The Voice Within

Ignore

c o u r s e o f m y c a r e e r i s t h a t forensic accountants have an innate ability to process large amounts of data and make instant analyses of very complicated data sets. We also seem to have instincts that protect us from harm and guide us when we encounter conflicting information let’s call this “the voice within,” which most people simply choose to ignore

When I offer this up to accounting students, however, I’m often met with some skepticism Then I ask them this: “A close and trusted friend approaches you with an investment opportunity. They tell you that you can expect returns in excess of 20 percent and that you can invest as much as you want. Do you make this investment?”

“Of course not!” they answer They can tell this is a trick question from a mile away When I tell them that 100 percent of them will do this, they scoff in disbelief

Ever hear of Bernie Madoff? Some of the most successful and sophisticated investors on the planet gave millions to Uncle Bernie. The question is, what is it that would compel someone to completely ignore their voice within and barge ahead?

Sociologists, psychologists and criminologists have studied the causes and effects of fraud for decades and they differ in their assessments, but the bottom line is, “we all want ” We all want more money and possessions, job security and acceptance to the point that we’ll disregard our own welfare. If we’re embroiled in litigation, we may seek vindication, retribution or justice, and the desire for justice may outweigh the rational ability to analyze a situation objectively from all perspectives and consider possible outcomes

Gerald L Pauling, II, Esq is a partner with the law firm of Seyfarth Shaw in Chicago His practice focuses on employment litigation and labor and employee relations, and he also provides advice, training and counseling to clients regarding employment policies and practices and diversity issues. Paul-

ing’s clients have included some of the largest organizations in the world, and he’s seen firsthand what happens when they ignore the voice within.

“Instinct, and 20-plus years of experience practicing law, no longer allows me to view any case, situation or fact pattern as a ‘slam dunk ’ A layup maybe; but true slam dunks are quite f e w a n d f a r b e t w e e n , ” P a u l i n g e x p l a i n s “ C l i e n t s a n d t h e i r c o u n s e l n e e d t o l i s t e n t o t h e i n n e r v o i c e t h a t o u g h t t o b e telling them there are two sides to every story, at least two counterpoints to every argument, and unknown facts that may later come to light Clients and lawyers put themselves at risk when they ignore the voice that begs them to think critically, even pessimistically, about their case and all of the possible outcomes This ignorance can lead to results that are unfavorable to the client and unexpected by the client. None of my clients like surprises ”

I’ll offer you a simple piece of advice: If you have any hesitation about a situation, then hesitate There’s a reason you’re feeling what you feel Stop and listen to your voice within Ask yourself why you’re so committed to moving forward when red flags are waving right at you The sad truth often lies in the wants. If we want something badly enough, we’ll ignore all the warning signs, good counsel and inner voices to get it

I’ll share this cautionary tale from my own past. I was at a new firm and my colleagues asked me to interview a candid a t e f o r a s t a f f p o s i t i o n , w h o I k n e w t h e y q u i t e f a v o r e d I wasn’t so impressed, but wanting to fit in and be accepted I agreed to the hire Within 30 days it was evident that something was seriously wrong. Further scrutiny revealed that this person had falsified the majority of their resume A fraudster victimized me, all because I wanted to be accepted by others me, the new head of the forensic practice It was a lesson that I learned the hard way

10 INSIGHT icpas org/insight htm W h a t I ’ v e d i s c o v e r e d o v e r t h e

it when you’re talking forensics and ethics, and you’ll suffer the consequences.

BRAD SARGENT, CPA/CFF, CFE , CFS, CR.FA, FABFA, THE SARGENT CONSULTING GROUP

BEING

BACK ON COLLEGE CAMPUSES AROUND THE GREAT STATE OF ILLINOIS AND SPEAKING WITH ACCOUNTING STUDENTS HAS ME WONDERING EXACTLY WHAT IT MEANS TO “THINK LIKE A FORENSIC ACCOUNTANT.”

We can all look back on lessons from our lives and find paths taken that led to bad outcomes. Hindsight is 20-20, and it’s easy to think about the would haves, could haves and should haves

My sincere hope is to focus on a proact i v e r e s p o n s e w h e n I r e c e i v e c o n f l i c t i n g data I’ve tried to build in some stopgap measures in my professional and personal life; I have a spouse and close friends who I trust intrinsically to tell me their honest o p i n i o n s , a n d I h a v e s e r v i c e p r o v i d e r s (accountants and attorneys, for example) whom I pay to provide counsel

However, when I want something and I know that my trusted advisors will likely a d d v o l u m e t o t h e v o i c e w i t h i n , I o f t e n choose not to share the full details or to exclude them completely before committing to action Irrational? Absolutely, but it’s also very, very human How often have you offered advice and counsel to clients o r c o l l e a g u e s a n d w a t c h e d t h e m c o mpletely ignore you and forge ahead?

Daniel H. Minkus, Esq. is a member in Clark Hill's Birmingham, Mich law office, where he practices in the Corporate Practice Group and concentrates in the areas of business and real estate He has significant experience advising and assisting clients w i t h o n g o i n g b u s i n e s s n e e d s , i n c l u d i n g issues often faced when entering into or t e r m i n a t i n g r e l a t i o n s h i p s w i t h t h i r d p a rties. He offers this perspective:

“Many businesspeople have very good instincts, especially about their industry, and these instincts are worth heeding. When something doesn’t look right, it usually isn’t Ignoring the concern in favor of proceeding with haste rarely ends up saving time in the long run An ounce of prevention is truly worth a pound of cure, and listening to one’s instincts often provides that preventative measure or at least a more critical look at an open issue or challenge I have seen buyers of businesses get so caught up in the momentum of the acquisition that they ignore their usual good instincts and critical analysis in favor of getting the deal done. Often this results in costly expenditures after the deal closes expenditures that could have and should have been at the expense of the seller. Not only can failing to listen to your instincts result in added costs, it can also lead to added time and effort to address issues that could have been addressed early in the process ”

If I can push you in a positive direction just once, the next time you’re faced with one of these situations, you’ll choose a new course and listen to your voice within.

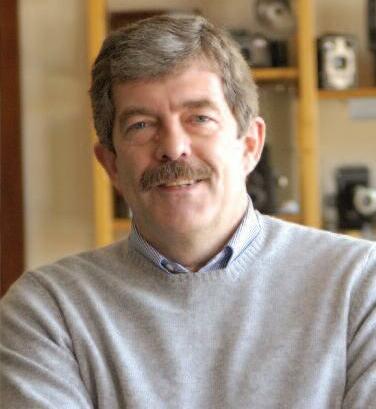

About Brad Sargent

Brad is the managing member of The Sargent Consulting Group, LLC, which specializes in forensic accounting and financial investigations. He is a frequent lecturer and chair emeritus of the American Board of Forensic Accounting, and serves on the American Bar Association, Section of Litigation, Expert Witness Committee and Criminal Justice Section, White Collar Crime Committee He is a member of the Association of Certified Fraud Ex-

aminers, the Association of Certified Fraud Specialists and the Association of Insolvency and Restructuring Advisors A member of the Illinois CPA Society since 2002, Brad has served on the Committee Structure & Volunteerism Task Force, the Fraud Conference Task Force (which he chaired from 2009-2010 and 2012-2013) and the Strategic Planning Committee (which he chaired from 20112013) Share questions and comments with Brad at bsargent@scgforensics.com.

icpas org/insight htm | FALL 2014 11

tax decoded

The Battle Over Taxes

Sourcing and transaction locations are a few of the factors making taxes tough.

Because tax increases are politically unpopular especially with an election approaching tax base “modifications” are the go-to for change, and corporate income taxes are always an attractive candidate

Before going any further, I’ll give you a few corporate income tax basics I’ll warn you, it’s a complicated topic

Illinois’ income tax is a typical state income tax imposed on the net income of corporations It begins with federal taxable income that is subject to a series of statutory additions and subtractions

Many corporations are located and operate in more than one state Income from ordinary business activities, commonly known as “business income,” is divided among the states in which the corporation is taxable. Certain income earned outside of ordinary business activities, “nonbusiness income,” is generally allocated to the state in which the corporation’s commercial enterprise is based

Unfortunately, states don’t use uniform formulas for apportioning a multistate corporation’s business income Illinois, for example, compares a corporation’s sales in Illinois to its sales everywhere, while other states may compare the corporation’s property, payroll and sales in the state to its property, payroll and sales elsewhere. These differences cause imbalances in taxable income across states, and create state-specific advantages and disadvantages.

Here’s an example: By comparing sales and ignoring property and payroll, Illinois provides an advantage to Illinois-based companies Essentially, out-of-state corporations pay higher taxes to Illinois than they would under a formula that takes property and payroll into account From a political standpoint, it’s always easier to tax out-of-state companies

Adding complexity is the fact that income from different sources carry different division rules Income from real property (land) is generally sourced to the location of that property. For example, a corporation with rental income from a building in Illinois will source that income to Illinois. On the other hand, income from the sale of tangible personal property will be sourced to Illinois only if the property is shipped to a purchaser in Illinois While this seems simple enough, I should tell you that there’s a page full of regulations discussing the basics of when a purchaser in Illinois is considered to be the recipient of shipped tangible personal property Sourcing of sales gets even more complicated when dealing with intangible items Patents, copyrights, trademarks and the like have their own special sourcing law, as do receipts from t h e s a l e o f t e l e c o m m u n i c a t i o n s s e r v i c e s a n d b r o a d c a s t i n g services, etc. Additional rules apply to the sourcing of other more general types of services These services are sourced to Illinois if they are received in Illinois commonly referred to as “market-based sourcing ” Defining “received” is a complicated matter so complicated, in fact, that the Illinois Department of Revenue has yet to adopt regulations to implement the legislative changes that occurred in 2008 Proposed draft r e g u l a t i o n s w e r e c o n t r o v e r s i a l a n d r e c e i v e d a s i g n i f i c a n t amount of criticism As a result, the Department never went forward with them.

In addition to determining how to divide income between states, state laws have to decide how to tax income generated by a group of related companies Some states, like Illinois, group together related corporations for purposes of filing and reporting income, while other states treat each legal entity separately

12 INSIGHT icpas org/insight htm

KEITH STAATS, JD, GRANT THORNTON STATE AND LOCAL TAX (SALT) PRACTICE

ILLINOIS SAW NO MAJOR TAX CHANGES COME OUT OF ITS SPRING LEGISLATIVE SESSION, BUT THE SAME ISN’T TRUE FOR EVERYONE STATES ACROSS THE NATION ARE ONLY MARGINALLY GROWING THEIR REVENUE BASES, AND IN MANY INSTANCES EFFORTS TO COVER EXPENSES ARE FALLING SHORT, FORCING THEM TO LOOK FOR ADDITIONAL REVENUE STREAMS.

Certain related groups of “taxpayers/persons” are defined as “unitary business groups” under Illinois law

By treating corporations that are members of the same unitary group as a single taxpayer and requiring combined filing, Illinois reduces the opportunity for taxpayers to decrease their Illinois taxes through various corporate structures.

With that as background, I’ll turn to some significant state corporate income tax legislation enacted last spring

New York has enacted extensive sourcing guidelines for many different types of transactions, like market-based sourcing for sales other than those of tangible personal property. Receipts from services will be s o u rc e d b a s e d o n a c u s t o m e r l o c a t i o n h i e r a rc h y, specifically starting with where the customer receives the benefit of the transaction And mandatory unitary combined reporting has been enacted, replacing the current combined reporting standards, including the substantial intercorporate transactions requirement.

Rhode Island, too, has big changes coming in the year ahead. The state will now require corporations that are part of a unitary business to file a combined return Rhode Island also enacted a single-sales-factor a p p o r t i o n m e n t i n t h e p l a c e o f t h e c u r r e n t e q u a l l y weighted three-factor formula Market-based sourcing was adopted and the state’s corporate income tax rate was reduced.

District of Columbia budgetary legislation enacts a single-sales-factor apportionment, effective for tax years beginning after December 31, 2014 Legislation also has detailed both sourcing rules on the sale of services and market-based sourcing for the sale of items other than tangible personal property

All in all, corporate income tax is a complex topic, and a source of constant tension between states that wish to maximize collections, while limiting the tax b u r d e n o n i n - s t a t e c o r p o r a t i o n s A t t h e s a m e t i m e , c o r p o r a t i o n s a r e c o n s t a n t l y t r y i n g t o m i n i m i z e t h e a m o u n t o f i n c o m e s u b j e c t t o s t a t e t a x T h e r e a r e bright and creative people on both sides, and the battle never stops

About Keith Staats

Keith is a director in Grant Thornton’s State and Local Tax (SALT) Practice in Chicago, and has been involved in tax planning, consulting and dispute resolution in all areas of state and local tax He has served as General Counsel of the Illinois Department of Revenue (IDOR), was involved in the development of Illinois tax policy, reviewed and evaluated all tax-related legislation proposed by the Illinois General Assembly, contributed to the drafting of all tax legislation proposed by the Governor, and was a member of the IDOR Informal Conference Board He has represented taxpayers before both the Informal Conference Board and the Board of Appeals Keith is a professional affiliate member of the Illinois CPA Society, and is a member of the American Bar Association, the Illinois State Bar Association, the Chicago Bar Association and the Board of Directors of the Civic Federation of Chicago Got questions or feedback for Keith? Reach him at keith staats@us gt com

Spend the morning networking with your peers and participating in a panel discussion featuring the 2014 Women to Watch Award winners:

EXPERIENCED LEADER

Angela H. Hickey

Executive Director, Levenfeld Pearlstein, LLC

EXPERIENCED LEADER

Kristie P. Paskvan

CFO, Mesirow Financial and President, Retirement Plan Advisory, Mesirow Financial Investment Management

EMERGING LEADER

Annie Kolman

Senior Manager, Ernst & Young, LLP

These three exceptional women will share their strategies for finding work/life balance, managing multiple generations in the office, and supporting the advancement of women in the accounting profession. Have your questions ready!

Date: Thursday, November 13, 2014

Time: 7:30AM -10:00AM

Place: The Standard Club

320 S. Plymouth Court, 5th Floor Ballroom Chicago, Illinois

CPE: 1 Credit Hour

FOS: 1 Personal Development

Code: C41807

Cost: $39 Per Person

TO REGISTER: Call 800.993.0407 or visit www.icpas.org/women.htm.

The Illinois CPA Society’s Women’s Executive Committee and the AICPA’s Women’s Initiatives Executive Committee together recognize and celebrate women who have made notable contributions to the accounting profession, their organizations, and the development of women as leaders.

icpas org/insight htm | FALL 2014 13

MARK J GILBERT, CPA/PFS, REASON FINANCIAL ADVISORS, INC

A Guide to Perfect Conduct

New standards guide the practices of CPA financial planners well into the future.

THANKS TO RECENTLY ISSUED AICPA GUIDANCE, CPA FINANCIAL PLANNERS ADVISING INDIVIDUALS, FAMILIES AND BUSINESS OWNERS IN THE AREAS OF ESTATE, RETIREMENT, INVESTMENTS AND INSURANCE NOW HAVE A ROADMAP TO GUIDE THEM IN PROVIDING THEIR PERSONAL FINANCIAL PLANNING (PFP) SERVICES COMPETENTLY AND CONFIDENTLY

The AICPA’s Statement on Standards in Personal Financial Planning (PFP) Services No. 1 (the Statement) became effective on July 1, 2014 While binding to AICPA members who practice or may otherwise be viewed by the public as personal financial planners, the Statement’s reach is broader given the fact that CPAs are regulated by their state boards of accountancy

According to AICPA research, most state boards include PFP in their definition of accountancy activities, and therefore have jurisdiction over CPAs practicing in this area. That said, it’s likely that state boards will look to the Statement as authoritative in this practice area regardless of specific or blanket adop-

The objectives of the Statement are clear cut: To provide members with authoritative guidance in the practice of PFP a n d e s t a b l i s h e n f o rc e a b l e s t a n d a r d s t h a t a s s i s t m e m b e r s i n f u l f i l l i n g t h e i r p r o f e s s i o n a l r e s p o n s i b i l i t i e s . T h e S t a t e m e n t supersedes the de facto standard that is the AICPA’s Statement on Responsibilities in Personal Financial Planning Practice (SOR) SOR largely consists of best practices gathered over some 30 years of observing PFP activities performed by CPAs And with the growing demand for PFP services, there was a clear need to formalize CPAs’ responsibilities and ensure consistent delivery of services across the profession.

tion of other AICPA standards In Illinois, for example, nonAICPA member firms and sole practitioners are already required to follow AICPA professional standards in areas such as audit, accounting and peer review, so it’s reasonable to expect the same for those providing PFP services

But really, all CPAs who provide PFP services should understand and follow the Statement since its foundation is rooted in the AICPA’s Code of Professional Conduct, which the state boards of accountancy have based their own codes of professional conduct on

Through the Statement, the AICPA has defined how to deliver PFP services with integrity, professionalism, objectivity, competency and consistency It defines the nature of PFP services, as well as delineating when the Statement’s provisions are to be followed It describes a CPA personal financial planner ’s general professional responsibilities and stresses the importance of maintaining objectivity in PFP engagements. It addresses member responsibilities in the areas of ethics, knowledge of PFP, conflicts of interest and compensation disclosure. And, finally, it provides guidance for, and examples of, topics such as plan-

pfp advisor

14 INSIGHT icpas org/insight htm

“ While the Statement sounds like it should only matter to CPAs practicing in financial planning, the truth is it benefits all CPAs in terms of outlining values and conduct in CPA-client relationships. Essentially, this is the AICPA’s first authoritative pronouncement on how members should be delivering PFP services.”

ning the PFP engagement, obtaining and analyzing information, developing and communicating recommendations, PFP implementation engagements, PFP monitoring and updating engagements, and working with and using advice provided by other service providers

The Statement doesn’t set out to turn all CPA financial planners into clones, however It purposely remains mum on specific methodologies used, recognizing that individual planners have their own unique style when it comes to interacting with clients, preparing work product, delivering observations and recommendations to clients, and documenting their findings.

While the Statement sounds like it should o n l y m a t t e r t o C PA s p r a c t i c i n g f i n a n c i a l planning, the truth is it benefits all CPAs in t e r m s o f o u t l i n i n g v a l u e s a n d c o n d u c t i n CPA-client relationships.

Essentially, this is the AICPA’s first authoritative pronouncement on how members should be delivering PFP services to clients No other PFP self-regulatory organization’s standards presently carry the weight of state law behind them as this Statement is expected to do. It provides authoritative guidance built on the cornerstone of the CPA profession the public interest and aligns with the AICPA Code of Professional Conduct, which upholds the highest levels of integrity, professionalism, objectivity and competence

A s p e c i a l t h a n k yo u t o A n d r e a M i l l a r a n d Sarah Bradley of the AICPA Personal Financ i a l P l a n n i n g D iv i s i o n f o r t h e i r t e ch n i c a l assistance in preparing this column

For more on the AICPA’s Statement on Standards in Personal Financial Planning Services, visit www aicpa org/pfp/standards

A bout Mar k J. Gilber t

Mark is a principal in the financial planning and investment management firm of Reason Financial Advisors, Inc , with offices in Northbrook and Naperville, Ill He has been a CPA and member of the Illinois CPA Society since 1982, and was awarded the AICPA’s PFS designation in personal financial planning in 1999 He currently serves on the ICPAS Finance & Treasury Management Committee and the Committee Structure & Volunteerism Task Force. Mark is frequently called upon as a media contact, and has appeared on WBBM (Channel 2), WLS (Channel 7), WGN (Channel 9) and WDCB (90 9 FM), speaking on financial planning topics He has also been quoted nationally in notable titles such as the Chicago Tribune, Wall Street Journal, Money and US News Reach Mark at mgilbert@reasonfinancial com

icpas org/insight htm | FALL 2014 15

Creep y Regulator Lands Shif cape ting wit ct nn ou as er conve al ca i e a as s, su i nal ssi o CEO t sid Pr A I of ir h , ahil an n co iona prof ful power ea ety’s c S the with sation m t ing sh trends the as ll n tive s per fresh a r a , irecto Board PAS th ity. mu r y an shi r . zri h s row t o ’s da o i S d To ram prog all includ t breakfa r t li om our dit : C Bre and Networking - 8:00AM Code | 2015 15, y Januar Ter Te Oakbrook s: F : t Q&A and Program - 9:30AM - 8:30AM | akfast 41827C41 : race Con and atreTheat Lane y ur Dr Suites, Glenview Wyndham Bre and Networking - 8:00AM Code | 2015 , 21 y Januar Glenview Code | 2015 22, y Januar Chicago O Lane, y ur Dr 100 r, Center, ference Glenview, , Ave Av Milwaukee N 1400 Program - 9:30AM - 8:30AM | akfast 41825C41 : 41826C41 : IL Terrace, Te akbrook IL Q&A and IL o, Q&A and m Chicago Plaza Crowne The Bre and Networking - 8:00AM v or 800.993.0407 call h town a for register To Chicag Madison, West 733 Metro, Progra - 9:30AM - 8:30AM | akfast www.icpas.org. isit area, your in all

capitol report

Goodbye Summer

Locally there are important decisions to be made All our statewide officers, members of the Illinois House and one-third of members of the Illinois Senate are up for election, and ballots will include referendum questions to amend the Illinois Constitution, as well as several advisory questions put forward by the General Assembly

Nationally, the mid-term elections serve as a bellwether for the 2016 Presidential Elections, and commentators are already predicting that Republicans will maintain control of the House of Representatives and may even take control of the Senate

While I won’t comment on who I think you should vote for, I will say that the CPA profession has had some very good wins with the Illinois General Assembly this year

F o r s t a r t e r s , t h e G o v e r n o r s i g n e d H o u s e B i l l 4 7 0 7 , t h e Accounting Act Trailer Bill, into law This legislation benefits the CPA profession by authorizing the Illinois Department of F i n a n c i a l a n d P r o f e s s i o n a l R e g u l a t i o n t o i s s u e p r o v i s i o n a l l i c e n s e s t o n e w l y r e l o c a t e d C PA s w h o p o s s e s s l i c e n s e s i n good standing in substantially equivalent states, and who have applied for an Illinois CPA license. The provisional license allows applicants to use the CPA title and to perform accountancy activities while their Illinois application is pending

ICPAS also worked with Senators Michael Connelly (R-21, Naperville) and John Mulroe (D-10, Chicago) in establishing clear legislative intent for House Bill 5503, which provides new transparency audit requirements for county and municipal governments And ICPAS supported the passage of House Bill 3405 sponsored by Senator Daniel Biss (D-9, Evanston), w h i c h a m e n d s t h e I l l i n o i s C o n s u m e r F r a u d a n d D e c e p t i v e

t t

a k e p a t e n t t r o l l i n g a n u n l a w f u l p r a c t i c e .

Finally, the Society was successful in playing defense on several measures to include employment non-compete legislation that would generally veer from industry practices.

Following the November election, the General Assembly w i l l r e t u r n t o S p r i n g f i e l d t o b e g i n a s i x - d a y Ve t o S e s s i o n Although the Governor has vetoed very few bills, the fate of t h e 2 0 11 Te m p o r a r y I n c o m e Ta x R a t e s s c h e d u l e d t o b e g i n sloping in January is a carryover from the Spring Session With t h e F Y 2 0 1 5 S t a t e O p e r a t i n g B u d g e t b e i n g b a s e d o n t h e assumption that these enhanced rates will continue, the General Assembly will either have to sustain the temporary rates or deal with a financial Armageddon and implement drastic budget cuts Let’s not forget that the Temporary Income Tax Rates originally passed during a lame duck session in 2011 with the support of many legislators who were leaving office Depending on the outcome of the gubernatorial election, it’s plausible that we’ll see this same play again Governor Quinn supports the continuation of the temporary tax rates, while his Republican opponent Bruce Rauner opposes the move In any case, November and December should be interesting as we monitor the General Assembly’s actions.

Elections aside, the Government Relations Office has been focusing on several issues on the regulatory horizon For example, the Illinois Department of Employment Security (IDES) implemented monthly employee wage reporting requirements in which we identified several material issues adversely affecting employers and firms Several payroll services firms helped us in flagging these issues, and we’ve shared them with the IDES director in the hopes of encouraging him to broadly exercise his waiver of penalty authority when there’s good reason.

16 INSIGHT icpas org/insight htm

P

a c t i

r

c e A c

o m

Hello General Election, legislative wins and regulation changes.

MARTY GREEN, ESQ , ICPAS GOVERNMENT RELATIONS OFFICE

WITH THE ILLINOIS STATE FAIR AND LABOR DAY SADLY BEHIND US, I THINK EVERYONE CAN AGREE THAT THIS SUMMER WENT BY WAY TOO FAST, ESPECIALLY WHEN YOU REALIZE THAT CAMPAIGN SEASON FOR THE UPCOMING NOVEMBER GENERAL ELECTION HAS KICKED INTO HIGH GEAR

{Follow us on Twitter @IllinoisCPA}

ICPAS also was named one of eight organizations that will serve on a new State Tax Preparer Commission created to study paid tax return preparer regulations The Commission’s charter specifies that a report will be made to the General Assembly by December 1, 2015, with recommendations for the appropriate scope of regulation for commercial tax return preparers, educational requirements and continuing education requirements. There are many moving parts to this issue, but we will actively work to educate members on IRS initiatives and preserve the CPA title

And finally, this summer marked the passing of former U.S. Senator Alan J Dixon, who served Illinois with great distinction as a member of the Illinois House and Senate and as the State Treasurer and Secretary of State. As an aide to former Governor Jim Edgar, I was fortunate to have met Senator Dixon in Illinois and Washington, D C He was always gracious and kind to whomever he met, and extremely humble both in and out of office. Senator Dixon served our state and nation well, and he will be missed I

n y o f y o u o v e r t h e s u m m e r months at Society chapter events and meetings, and I look forward to seeing you at the upcoming Town Hall Forums In the mean-

informed of what’s happening on the state and federal levels, and we’ve added a resources section for practitioners as well Check out all the information and resources at www.icpas.org.

About Mar ty Green

Marty is the Illinois CPA Society ’ s Vice President of Government Relations, working with the CEO and Board of Directors to oversee and implement the Society ’ s legislative and regulatory activities He also curates the Society ’ s monthly Capitol Dispatch, a digital digest of legislative news for Illinois CPAs Marty is a practicing lawyer, member of the Illinois Bar and a colonel in the National Guard He previously served as executive assistant attorney general for Illinois Attorneys General Lisa Madigan and Jim Ryan, and as director of the Governor ’ s Office of Citizens Assistance and assistant to the Governor for Public Affairs, both under Governor James Edgar. Marty holds a number of professional certifications and is admitted to practice before the state and federal courts He is the past president of the Western Illinois University Alumni Council and is an adjunct professor for the Department of Health Sciences Got questions or feedback for Marty? Reach him at greenm@icpas org

success possible

icpas org/insight htm | FALL 2014 17

a v e e n j o y e d v i s i t i n g w i t h m

t i m e , w e f r e q u e n t l y s h a r e i s s u e s o n o u r w e b s i t e t o k e e p y o u

h

a

CPA

Endowment Fund of Illinois make

“I am inspired by the pride CPAs have for the profession. Your support and recognition of others assures me that I chose the right career path.”

Kierra Smith - Scholarship Recipient

Make success possible. Donate today. www.icpas.org/annualfund.htm

Last year, the Fund awarded approximately $150,000 in support of tuition, textbooks, and the CPA exam to more than 100 of the most diverse and deserving accounting students across the state. This makes your profession’s charity unique among its peers.

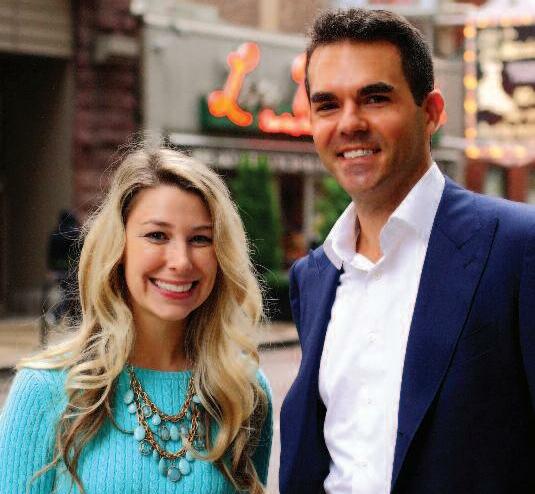

Got Millennial Clients?

Here are eight ways to keep them, and to keep adding them

By Derrick Lilly

Born between 1977 and 2000, there are more than 80-million Millennials in the United States, and they present a golden opportunity for your firm.

“Attracting the next generation of clients is so important, but most experienced CPAs and financial advisors are all too happy to go about providing their services in the same old way,” says Rita Keller, president and founder of management and consulting firm Keller Advisors LLC

For most, “the same old way” means prospecting for clients in their 40s, 50s and 60s, who have established businesses or collected wealth. But Pershing Advisor Solutions research suggests that this pool of prospects will grow only 1 percent over the next decade, meaning that engaging the next generation of clients is more important than ever

“Ask yourself what happens when the next generation takes over the family business or inherits wealth Will they choose to work with you?” asks Keller “To win tomorrow’s business, today’s CPAs and advisors need to position themselves to be relevant and tech savvy ”

Here’s how

1. Start Fresh

Discard every preconception you have about Millennials To win them, you need to understand them

“A lot of professionals have this misconception that all Millennials are know-it-alls, feel entitled, a n d w o r s e W h a t M i l l e n n i a l i n t h e i r r i g h t m i n d would want to go to a CPA or financial advisor who

t h i n k s l i k e t h a t ? ” a s k s 3 4 - y e a r- o l d E r i c R o b e rg e , CFP and founder of BeyondYourHammock.com, a financial planning website that helps young professionals achieve their lifestyle goals “Being able to t a l k t o M i l l e n n i a l s a s e q u a l s i s k e y G e t t i n g i n t o their world and understanding what drives them, what motivates them, and what they’re committed

t o i s a h u g e p a r t o f c o n n e c t i n g w i t h t h e m T h e y want advisors who are interested in growing with them The relationship has to be based on working together, not on age.”

2. Start Early

Wells Fargo’s 2014 Millennial Study found that 57 percent of Millennials “look primarily to family as a trusted source for information to help them make financial decisions ” Here’s an opportunity engage your clients’ children

“If you only focus on your contemporaries, you run the risk of being identified as ‘daddy’s CPA’,” s a y s K e n n e t h G u i d r y, C PA , p r e s i d e n t o f P a n n e l l Kerr Forster of Texas, P.C. “But by making a meaningful connection with your clients’ children, they w o n ’t f e e l t h e n e e d t o i m m e d i a t e l y r e p l a c e y o u when they inherit the family business or wealth ”

This doesn’t mean soliciting their business right off the bat Instead, ensure they know you and are c o m f o r t a b l e s p e a k i n g w i t h y o u ; i n v o l v e t h e m i n discussions about things that may affect them, and always offer them the opportunity to contact you.

3 Look Internally

Guidry also suggests that firms make the right internal moves to attract next-generation clients.

“You can do this by making sure that you’ve got people involved with your accounts that are part of the next generation,” he says “In our 145-person firm, about 60 percent of our people are under the age of 30 We strive to make sure our directors and m a t u r e p l a y e r s a r e i n v o l v i n g o u r y o u n g e r t e a m members as early as possible.”

“Young professionals can also focus on developing networks of peer business owners in their communities,” Keller adds

18 INSIGHT icpas org/insight htm

GENERATIONS

Program features include: • Coverage for a wide range of professional services • Up to $1,000,000 in financial protection • Full Prior Acts coverage available for qualifying firms • Extended Reporting Period (EPR) options • MyRiskAdvice™ — Interactive Risk Management helpline and website • Affordable, budget-friendly rates • Ability to purchase coverage online — pay by credit card 65095 (9/14) Copyright 2014 Mercer LLC. All rights reserved. AR Ins. Lic. #303439, CA Ins. Lic. #0G39709 In CA d/b/a Mercer Health & Benefits Insurance Services LLC ICPAS-SPONSORED: ACCOUNTANTS PROFESSIONAL LIABILITY INSURANCE FOR THE RISKS YOU FACE Net Ready to see how easy it can be to protect yourself and your firm? Get a quote today! Visit http://bit.ly/65095ICPAS or call 1-800-337-2621 for additional information.

“The importance of this is that Millennials are increasingly looki n g f o r a c c o u n t a n t s a n d a d v i s o r s w h o a r e c l o s e r t o t h e i r o w n ages,” says Roberge “They want somebody that they can trust will be around as long as they will ”

4. Partner Up

“Being proactive about building connections with young finance p r o f e s s i o n a l s i s a n o t h e r w a y t o g a i n M i l l e n n i a l c l i e n t s , ” s a y s Roberge. “If an older CPA or advisor reached out to me, I would definitely set up a meeting to hear what he or she had to say

“I probably spoke with 100 CPAs before finding a like-minded peer,” he continues “But now I have a go-to person that I trust to refer business to, meet clients through and bounce ideas off of This partnership is a huge plus for my clients, most of whom have never approached a CPA.”

5 Get Involved

“The whole concept of connecting with universities, serving on advisory boards and supporting startup incubators is an underappreciated opportunity for firms that have an appetite for attracting new business and young talent and clients alike,” says Guidry, whose firm supports many local business schools, entrepreneurial programs and startup incubators.

O f f e r i n g o n e e x a m p l e , G u i d r y ’s f i r m m e e t s a h o s t o f y o u n g entrepreneurs through its involvement with the world-renowned Rice Business Plan Competition

“As the accounting firm that tallies the scoring and results, our name and logo appears all over the place and we gain a lot of recognition amongst the contestants, judges, local business executives

and others,” he says. “Through interacting with them, we’re not only meeting the people forming new businesses, but we’re also meeting the investors in these ventures, so it’s really beneficial to us in meeting potential clients and interacting with referral sources ”

6. Get Online

Millennials are accustomed to accessing information and performing tasks on an anywhere, anytime basis. So naturally the best place to meet them is online.

“Millennials don’t always know what they need in an accountant or financial advisor, but when they want to learn, they hop online to read a blog or forum, listen to a podcast, or watch a YouTube video,” explains 29-year-old Joshua J Sheats, CFP, CLU, ChFC, CASL, CAP, RHU, REBC, and host of the daily Radical Personal Finance podcast.

“Besides having a great website, blog, podcasts or videos, social media can’t be overlooked,” says Roberge “I’d say that Facebook i s t h e m o s t e f f e c t i v e w a y t o r e a c h M i l l e n n i a l s , b u t L i n k e d I n , Google+ and Twitter can all be effective These sites let you showcase your expertise, educate viewers and drive traffic to your content. The point is that people want to see who you are before they talk to you.”

7 Ramp Up Tech

After wooing Millennials with your online presence, you’ll have to be able to service their needs online as well

“When young clients expect virtual office technology and older advisors and CPAs expect them to come in for face-to-face meetings for everything, that just doesn’t work,” says Roberge. “It’s too slow. Paperless offices, eSignature software, secure file sharing, video conferencing, cloud-based financial software, and virtual offices are becoming the things every professional needs ”

“Most Millennials don’t want to gather their documents, travel to an office, and sit down with you just to review and sign some forms,” adds Sheats. “Using online meeting services to share your desktop view with clients and mark it up online in real-time is much more effective than trying to do something in person anymore.”

8. Get the Price Right

While Wells Fargo points out that the percentage of Millennials using financial advisors has actually doubled since last year, to keep that trend going CPAs and financial advisors need to consider costs

According to the multinational banking and financial services company, the most common reason Millennials don’t use advisors is because they can’t afford them, which suggests there’s ample opportunity for financial services providers to win more Millennial clients with affordably priced advice

Launching fee-only virtual financial planning practices is how Roberge and Sheats are making these services more accessible to Millennials. “I didn’t want the overhead of a physical office space that I may not even use. I am location independent. Many of my clients I’ve only met through video conferences, so I can charge less for my services,” Roberge explains “I charge an engagement fee and a monthly retainer fee it’s like paying a gym membership or cell phone bill; it fits in their cash-flow cycle, it’s less of an impact on their savings, and they can engage me whenever and wherever they need to.”

“You have to match your service structure, your infrastructure and the economics of your firm to the opportunities that are out there,” Guidry adds And Millennials present a golden opportunity

20 INSIGHT icpas org/insight htm

We

Give us a call today so that we can start working to remove your selling headache

Selling Your Practice? Start selling right now. The Holmes Group Trent Holmes Toll Free: 800.397.0249 AccountingPracticeSales.com trent@accountingpracticesales.com

are different because we can produce the best results for YOU.

and to obtain the goal you desire.

CHICAGO | BLOOMFIELD HILLS | 866-717-1607 | www.cca-advisors.com If your clients require expert services, our Client Back Guarantee ensures our consultants are playing for your team. Gary Leeman, Walt McGrail, Harry Cendrowski, CPA/ABV CFF CGMA JD CPA CPA/ABV CGMA CFF CFE CVA CFD MAFF Working with consultants? Make sure your clients stay with Your Firm. Fraud Detection Risk Assessment Business Valuations Forensic Accounting Investigative Due Diligence Economic Damage Assessment Strategically consulting to build client relationships. Anniversary

3 Offbeat Ways to Bond a Team

Check your insecurities at the door and get ready for the weirder side of team building

By Judy Giannetto

By Judy Giannetto

Imagine sitting naked in a Turkish bath with your executive team Bonding experience or the stuff of nightmares?

“ I w o r k i n J a p a n , a n d m y w o r s t t e a m - b u i l d i n g exercise has been taking a bath with my boss and supervisors, although only of the same gender. It’s called ‘naked relationships’ and is thought to build trust,” explains one professional in an article posted on The Fast Track. “The idea is that when you are naked, everyone is equal and you will feel free to d i s c u s s t h i n g s a n d j o k e a b o u t t h i n g s t h a t y o u wouldn’t in the office setting ”

Well, the intention is good anyway

From Bug Eating Relay events at a team-building camp in South Africa to Human Table Football in the UK, creative and often bizarre team-building programs are cropping up all over the place And this side of the pond is no exception.

Here are three programs perfectly tailored for outside-the-box thinkers who are all about the team

You Rock!

Share the stage with former members of Guns N’ Roses, Marilyn Manson, Cream, KISS and other legends of rock, and boost the collaborative potential of your team while you're at it

T h a t ' s t h e c o n c e p t b e h i n d R o c k ‘ n ’ R o l l

F a n t a s y C a m p ( R R F C ) , w h i c h p u t s t e a m s center stage (literally) to build camaraderie, p r o d u c t i v i t y a n d c r e a t i v i t y A s a n a d d e d bonus you get to strut around like Mick Jagg e r f o r a c o u p l e o f d a y s w i t h o u t a n y b o d y judging you for it

T h i s i s h o w i t w o r k s : P a r t i c i p a n t s a r e divided into teams of 5 to 20 Each team is a s s i g n e d a s e r i e s o f t a s k s t h a t h a v e t o b e c o m p l e t e d w i t h i n 2 t o 3 h o u r s . A n o t a b l e Rock Counselor is assigned to each team to serve as a mentor Which means you might find yourselves jamming with former Guns N’ Roses drummer Steven Adler, YES frontman Jon Anderson, KISS founding member P e t e r C r i s s , o r f i v e - t i m e G r a m m y w i n n e r Wynonna Judd, to name a few.

Rock Counselors guide their groups through the process of assigning roles, establishing timeframes, deciding on an approach to the tasks at hand and collaborating to achieve the ultimate goal: Rewriting the lyrics of a famous song written or performed by the Rock Counselor in question (Sweet Boss o' Mine anyone? Welcome to the Junket perhaps?)

Finally, the group performs its rock masterpiece u p o n s t a g e w i t h a f u l l b a c k - u p b a n d , c h o r e ographed routine and costumes The best of the best win awards in a variety of categories, and the whole experience closes with an un-Rock ‘n’ Roll debrief.

In case you think this is all fluff and nonsense, know that RRFC's list of clients is an illustrious one, featuring the likes of Kia Motors America, Fortune Magazine, Olympus and GE

"We contracted Rock ‘n’ Roll Fantasy Camp to engage our 220 executives in a half-day corporate training Rock ‘n’ Roll camp," says Lorenzo Simonelli, president and CEO of GE Oil & Gas "While I was skeptical at first, the planning, execution and final product made me a firm believer in their process for

TEAM BUILDING

22 INSIGHT icpas org/insight htm SHARE a PIC or VIDEO! Show us your fav team-building exercise in action @IllinoisCPA #teamCPA

Cetera Financial Specialists LLC, Member FINRA/SIPC 200 N. Martingale Road, Schaumburg, IL 60173 © 2014 Cetera Financial Specialists LLC 08/14 Truth is... CPAs and tax professionals are our business. We can help you grow yours. Cetera Financial Specialists is a wealth management firm with a difference. We are the leading growth consultant for tax and accounting professionals and CPA firms that have successfully integrated wealth management into their practices. We know your business, and truly understand what it takes for an independent like you to thrive in today’s ultra-competitive marketplace. Learn how we can help you maximize your value as your clients’ financial quarterback at response.cetera.com/ourbusiness or call us at 888.410.9444

delivering a high-quality, interactive and exciting team-building program "

Even the New Jersey Society of CPAs has gotten in on the act, explaining that, "The R o c k ‘ n ’ R o l l e x p e r i e n c e w a s a b i t o f a stretch for our typically conservative group, b u t ( R R F C ) d e l i v e r e d a n e x p e r i e n c e t h e y will not forget We had over 120 leaders participate in the camps and I know they were amazed at what they accomplished "

C a m p s a r e h e l d e i t h e r a t R R F C h e a dquarters in Vegas, or at the location of your choice Visit rockcamp com to learn more

Zombie Houdinis Wanted

Fans of The Walking Dead and Z Nation will really appreciate this one

It all starts with a terrible, terrible accident World-renowned brain surgeon Dr Oxy was pricked by a needle when researching a cure for a virus mutation Knowing what’s to befall him, he locks himself in a room, hides the key and throws together a bunch of clues, riddles and “Minute-ToWin-It” challenges. Before waving goodbye to the last vestiges of his humanity, Dr Oxy chains himself to the wall

Enter your team. You and up to 11 teammates mysteriously find yourselves locked in this very same room A clock is counting down from 60. Every five minutes a buzzer sounds and Dr Oxy’s chain gets a foot longer By the end of the 60 minutes Dr Oxy will be able to reach the door and all of you The team has to work together to find all the hidden clues, solve the riddles, beat the challenges, find the key and escape before becoming dinner

On a practical level, Trapped In A Room With A Zombie “recreates the stress and communication challenges that exist in the workplace by giving an intense goal to a team that they must meet within a certain deadline,” says Bucket List Productions LLC founder and Room Escape Adventures script creator Marty Lee Parker. “Without leaders, followers, group communication, thinking outside the box, problem-solving as a unit, listening, admitting you’re wrong, working together and effectively communicating, the team will fail in its mission,” he explains

“Nationally only 30 percent of the teams who attempt to escape make it out,” says Parker However, “Those who do show an excellent display of an efficient unit that q

leadership and they will run out of time O n e o f t h e m o s t i m p o r t a n t a s p e c t s t h a t teams realize is that by listening to everyone in the room, regardless of their position in the company, they are able to successfully escape their predicament.”

The program has proved extremely popular, with 12 show locations in the United S t a t e s ( i n c l u d i n g C h i c a g o ) , e a c h r u n n i n g 10 to 20 shows a week Branches in Seattle, Houston, Cleveland, Denver, Miami, To r o n t o , M a d r i d , L o n d o n a n d To k y o a r e scheduled to open by the end of this year

Who is this activity best suited for? “Anyone that a zombie would eat,” says Parker L e a r n a l l a b o u t e s c a p i n g z o m b i e s a t roomescapeadventures com

Flash Mobbing in the USA

If you’ve been living under a rock the last few years, then flash mobs might be a foreign concept Wikipedia defines them as “ a l a rg e g r o u p o f p e o p l e , w h o a s s e m b l e s u d d e n l y i n a p u b l i c p l a c e , p e r f o r m a n unusual and pointless act for a brief time a n d t h e n q u i c k l y d i s p e r s e ” A n d n o t h i n g says “team” quite like it

“Just like in the workplace this program is designed to (get people to) work together to achieve a successful outcome. This is a twopart program where the team learns and rehearses the dance and the second part is where they take it to the streets and in a very short time have something that they are proud of,” explains David Goldstein, COO of California-based TeamBonding™

TeamBonding’s “Flash Teams” consist of a m i n i m u m o f 3 0 p e o p l e w h o c o m e t ogether to learn the moves to a Flash Inspir a t i o n s o n g a n y t h i n g f r o m K a t y P e r r y ’s Fireworks to Fat Boys’ Yo, Twist The team t h e n d e s c e n d s o n a d e s i g n a t e d p u b l i c space, cranks up the tunes and performs b e f o r e a c o n f o u n d e d p u b l i c T h e w h o l e event is captured digitally so the memory of your team’s collaboration lives on forever The whole program runs about 3 to 4 hours, depending on the size of the group.

gested yet need to have the right amount of leadership at certain times Too much leadership and they will run adrift; not enough

Fun? Most definitely An effective way to bond teams? Yes, says Goldstein, for the right group “This is designed for a group that is not looking for serious outcomes but to have fun as a team,” he explains. “This program really offers something for everyo n e a n d t h e f i n a l f l a s h m o b e n d s w i t h a celebration and memories that they bring back to the team to draw on in the future w h e n t h e y w o r k t o g e t h e r w i t h t h e o t h e r participants ”

L e a r n a b o u t F l a s h Te a m s a n d m o r e a t TeamBonding com

24 INSIGHT icpas org/insight htm

Wi l l y o u g e t o u t a l i v e ? P e r h a p s n o t .

u i c k l y s h a r e s i d e a s , t r i e s c o n c e p t s a n d , w h e n t h e y d o n ’t w o r k , m o v e s o n t o t h e n e x t i d e a . T h e y l i s t e n t o t h e i d e a s s u g -

© 2014 Salo connectors. and consulting super can evolve. be exacted, and business

can So that

e.

SaloLLC.com a alliance

And an

” “ O c

embraced, change

change can be

ways, within your cultur the right work, in the right of the right people, doing Let's connect the thoughts capital YOU.

with

.

apital a outcomes with Let's talk

Fit Wallet, Fit Mind

Is financial fitness the missing piece of the corporate wellness puzzle?

By Selena Chavis

There’s little question that employee health and the bottom line are irrevocably tied With healthcare costs soaring to unprecedented levels, corporate America is waking up to the need for wellness programs that promote healthier lifestyles for employees. It’s also waking up to the ROI that investing in these kinds of programs can realize

While wellness programs promoting better physical and mental health are becoming more the norm than the exception, the truth is, money is still being left on the table Why? Because there’s a major missing piece of the puzzle: Financial wellness

“Financial stress has a huge impact on an organization,” explains Liz Davidson, CEO of Financial Finesse, a provider of financial education programs to corporations, groups and municipalities. “There’s actually been a good deal of research done on this t

,

between financial worries and health issues.”

According to the company’s own research, 60 percent of illnesses are caused by financial stress And the American Psychological Association (APA) recognizes financial stress as the leading cause of unhealthy behaviors like smoking, weight gain and alcohol and drug abuse

“All of this has an immediate and direct impact on productivity, absenteeism, healthcare costs and even benefits utilization,” says Davidson “Healthcare costs tend to be higher for organizations that have a large number of financially stressed employees due to more doctor ’s visits and ongoing health issues ”

Offering the real-life case of a Fortune 500 company that has successfully instituted a financial wellness program, Davidson points out a 23 9-percent difference in healthcare costs between employees who participated in financial wellness education and those who didn’t over a seven-year period

So why are companies not rushing to address this issue head on? Marty Martin, Psy D , M P H a pioneering financial psychologist, internationally acclaimed speaker and associate professor in the Department of Management at DePaul University, Chicago, suggests there’s a disconnect between financial health and the people who tend to manage wellness programs, explaining that healthcare professionals and benefits and compensation managers often are unaware of the impact that poor financial health can have on employees

“Traditional workplace wellness initiatives are largely driven by people with backgrounds in exercise physiology, maybe a few psychologists or nutritionists, and primarily managed by benefits managers who really control the healthcare spend,” he explains. “Financial wellness is not on their radar because it simply wasn’t something they were educated or trained in ”

Martin hasn’t found a large cadre of advocates. “When we think of money, we may think of the acquisition and disposition of it, but not our relationship to it how money impacts our psychological and physical health,” he says

On the brighter side, the timing may be right for a greater focus on financial wellness initiatives “The

26 INSIGHT icpas org/insight htm WELLNESS

p

c

a n d a l l o f i t p o i n t s t o a d i r e c t c o r r e l a t i o n

o

i

world appears to be moving and even accelerating toward a culture of wellness physical, mental and financial,” says Davidson. “We’re seeing more employers tying their wellness programs together to offer sophisticated guidance in a variety of areas ”

Like any new concept, there are always pacesetters For Aetna, which operates a successful multi-year financial wellness program, at least 97 percent of employees consistently identify the program as an important part of their benefits package year after year, according to Senior Benefits Consultant Stacy Romano. “Since we began tracking our progress in 2011, we have seen a trend of employees who regularly participate in financial education as having higher 401k deferral rates, better debt management and lower absenteeism. We will continue to look at these trends as we expand our program in years to come,” she says

Aetna’s financial wellness program is a component of its Wellness Works strategy, which includes free, one-on-one personal consultations, as well as workshops and webcasts delivered by unbiased Certified Financial Planners a key differentiator of the program, according to Romano “In order to build and maintain credibility with our employees, we’ve been very careful to ensure that there is never a sales pitch or specific advice on securities,” she explains.

In addition to opportunities for live interactions, the program a l s o h o s t s s h o r t v i d e o s , c a l c u l a t o r s , a n d m a n y o t h e r t o o l s v i a A e t n a ’s e m p l o y e e i n t r a n e t . B y a g g r e g a t i n g a n s w e r s p r o v i d e d through an online Financial Wellness Assessment, employers can help their employees see how they fare against the national average, assess their most vulnerable areas and develop a step-by-step action plan for improving those areas. This kind of pre-assessment a l s o p r o v i d e s a n i n v a l u a b l e b i r d ’s - e y e v i e w o f t h e s t a t e o f a n employee’s financial health, enabling companies to better tailor their offerings to meet the specific needs of their staff.

“We see the feedback from employees over and over again,” says Romano “They can’t believe they waited to participate in the program. They tell their colleagues about it immediately, and many times they’ve already signed up for another event by the time they’ve completed the survey ”

One size does not fit all, however, and companies need to consider a variety of factors before determining the best approach “I think it’s important to note that financial wellness programs cover virtually every financial issue and topic from serious cash-flow and debt issues to advanced estate planning,” Davidson explains “Financial wellness is about helping employees with every aspect of their financial planning lives, tying their benefits into the big picture as well, since they have a major impact on an employee’s ability to achieve financial goals and are often misunderstood or poorly used ”

Companies that succeed with financial wellness have made it a core benefit and an integral part of their culture, Davidson notes “This helps to set the stage for the entire program, and even bigger than that, establishes an understanding among employees that they are ultimately responsible for their financial situations,” she says