Exploring the issues that shape today’s business world.

What YPs Want From Your Firm

Is Starting a CAS Practice Right for You?

The Importance of Investing in Your Staff

What Makes a Modern Accountant?

Fostering a Change-Ready Finance Team

And More!

Fall 2022

26 Financially Speaking Liquid Alternatives: Is Now the Right Time to Invest?

By Mark J. Gilbert, CPA/PFS, MBA

28 Evolving Accountant

The 5 W’s of a Successful New-Hire Orientation By Andrea Wright, CPA

30 Practice Perspectives

3 Phases of Business Development for Long-Term Success By Art Kuesel

32 Corporate Insider

How to Foster a Change-Ready Finance Team By Shifra Kolsky, CPA

34 Tax Decoded Decoding Illinois’ Major

By Keith Staats, JD

36

By Elizabeth Pittelkow Kittner, CPA, CGMA, CITP, DTM

www.icpas.org/insight | Fall 2022 1 Fall 2022 www.icpas.org/insight WHAT YOUNG PROFESSIONALS WANT FROM YOUR FIRM IS STARTING A CAS PRACTICE RIGHT FOR YOU? ESG: A ROADMAP TO VALUE CREATION spotlights 3 Today’s CPA Diversity in Accounting? Still a Long Way to Go By Todd Shapiro 4 Capitol Report The Mobile CPA: Navigating Remote Work, Principal Place of Business By Marty Green, Esq. 38 Gen Next The Value of Unapologetic Authenticity By Sergio Rodriguez, CPA 40 IN Play Brian E. Daniell, CPA, talks personal connections and endless “carrots” in his local, downstate community. By Amy Sanchez trends 6 Corporate Strategy & Finance 3 Steps for Being a Modern Accountant and Controller

8 Leadership & People Management Why Investing in Your Staff Is More Important Than Ever By Del Wright insights 22 Leadership Matters ‘Enterprise Thinking’ Is Key to Your Next Promotion By Jon Lokhorst, CPA, PCC 24 Director’s Cut The Swing to Corporations Expressing Social Stances By Kristie

Paskvan, CPA, MBA

By Michael Shultz

P.

Sales Tax Exemptions

Ethics Engaged The Ethics of Pricing

14 18 10

ILLINOIS CPA SOCIETY

550 W. Jackson Boulevard, Suite 900, Chicago, IL 60661 www.icpas.org

Publisher/President & CEO

Todd Shapiro Editor Derrick Lilly

Assistant Editor

Amy Sanchez

Creative Director

Gene Levitan

Copy Editors

Mari Watts | Jennifer Schultz, CPA

Photography Derrick Lilly | iStock

Circulation

John McQuillan

ICPAS OFFICERS

Chairperson

Mary K. Fuller, CPA | Citrin Cooperman

Vice Chairperson

Jonathan W. Hauser, CPA | KPMG LLP

Secretary

Deborah K. Rood, CPA, MST | CNA Insurance

Treasurer

Mark W. Wolfgram, CPA, MST | Bel Brands USA Inc.

Immediate Past Chairperson

Thomas B. Murtagh, CPA, JD | FORVIS LLP

ICPAS BOARD OF DIRECTORS

John C. Bird, CPA | RSM US LLP

Brian J. Blaha, CPA | Wipfli LLP

Jennifer L. Cavanaugh, CPA | Grant Thornton LLP

Brian E. Daniell, CPA | West & Company LLC

Pedro A. Diaz De Leon, CPA, CFE | Accume Partners

Kimi L. Ellen, CPA | Benford Brown & Associates LLC

Jennifer L. Goettler, CPA, CFE | Sikich LLP

Monica N. Harrison, CPA | Built In

Scott E. Hurwitz, CPA | Deloitte LLP (Retired)

Joshua D. Lance, CPA, CGMA | Lance CPA Group

Enrique Lopez, CPA | Lopez & Company CPAs Ltd.

Stella Marie Santos, CPA | Adelfia LLC

Richard C. Tarapchak, CPA | Verano Holdings

BACK ISSUES + REPRINTS

Back issues may be available. Articles may be reproduced with permission. Please send requests to lillyd@icpas.org.

ADVERTISING

Want to reach 22,600+ accounting and finance professionals? Advertising in Insight and with the Illinois CPA Society gives you access to Illinois’ largest financial community. Contact Mike Walker at mike@rwwcompany.com.

Insight is the magazine of the Illinois CPA Society. Statements or articles of opinion appearing in Insight are not necessarily the views of the Illinois CPA Society. The materials and information contained within Insight are offered as information only and not as practice, financial, accounting, legal or other professional advice. Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication. It is Insight’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin. The Illinois CPA Society reserves the right to reject paid advertising that does not meet Insight’s qualifications or that may detract from its professional and ethical standards. The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within Insight, and makes no representation or warranties about the products or services they may provide or their accuracy or claims. The Illinois CPA Society does not guarantee delivery dates for Insight. The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering Insight. Insight (ISSN1053-8542) is published four times a year, in spring, summer, fall, and winter, by the Illinois CPA Society, 550 W. Jackson, Suite 900, Chicago, IL 60661, USA, 312.993.0407. Copyright © 2022. No part of the contents may be reproduced by any means without the written consent of Insight. Send requests to the address above. Periodicals postage paid at Chicago, IL and at additional mailing offices. POSTMASTER: Send address changes to: Insight, Illinois CPA Society, 550 W. Jackson, Suite 900, Chicago, IL 60661, USA.

Diversity in Accounting? Still a Long Way to Go

recently watched a documentary on General Colin Powell that was recorded in 2006 by The HistoryMakers, a nonprofit research and educational institution committed to preserving the stories of Black individuals who’ve made significant contributions to society. What struck me was Powell’s view on the world—for every problem, there’s an opportunity.

I share the late Powell’s perspective when looking at racial and ethnic diversity within the accounting pipeline and the CPA profession. Without question, we’ve made progress. The AICPA’s “2021 Trends Report” notes that there’s been a small but steady increase in new accounting degree completions by Hispanic students (from 10% of total degrees completed in 2014 to 13% in 2020). That said, there’s been little to no increase among other racial and ethnic minorities.

To stay on the “progress made” side of the ledger, there’s been a steady increase in the hiring of Asian/Pacific Islander and Hispanic accounting graduates. In 2020, 16% of new bachelor’s and master’s of accounting graduates hired into the accounting/finance functions of U.S. CPA firms were Asian/Pacific Islander versus 13% in 2007. More notably, Hispanic accounting graduates accounted for 11% of hiring in 2020 versus just 4% in 2007. Yet, the percentage of new accounting graduates hired that were Black has remained relatively unchanged, stuck in the 4%-5% range.

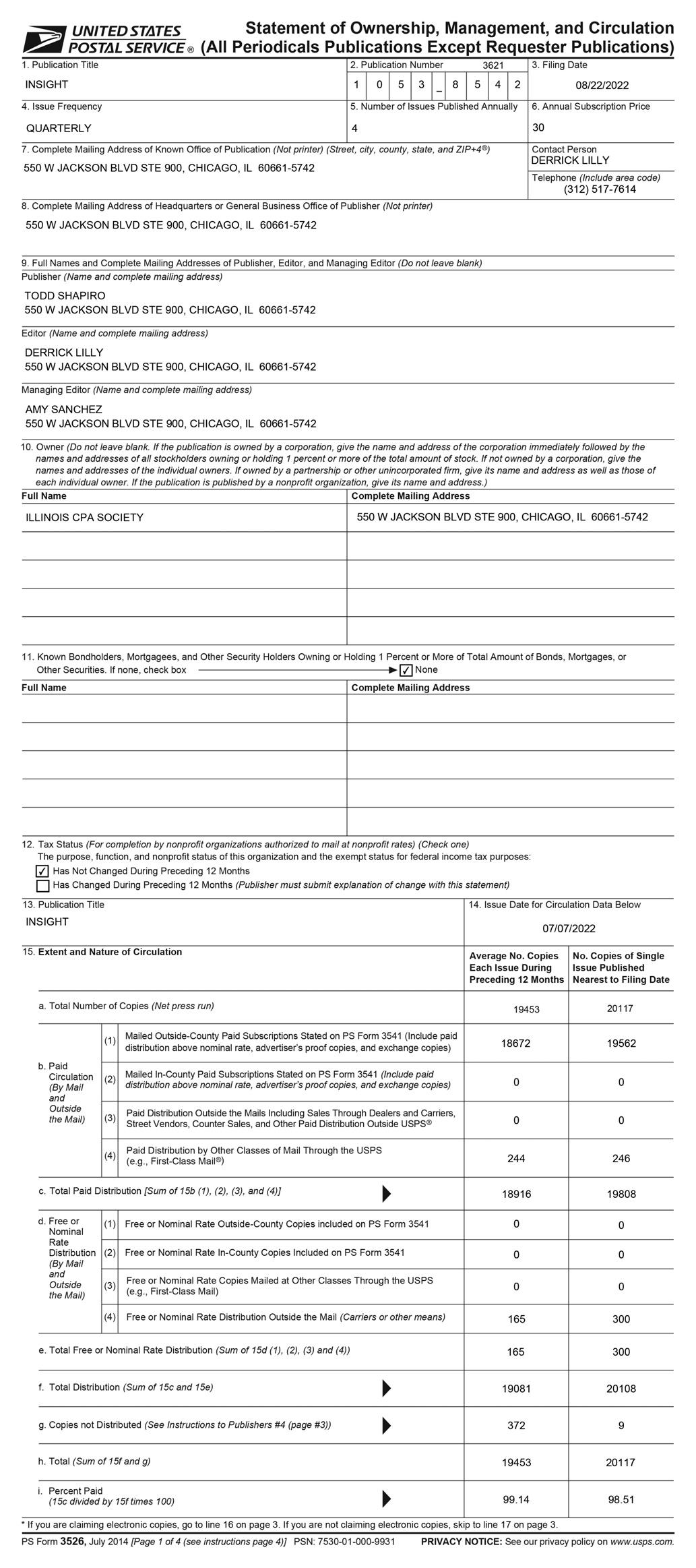

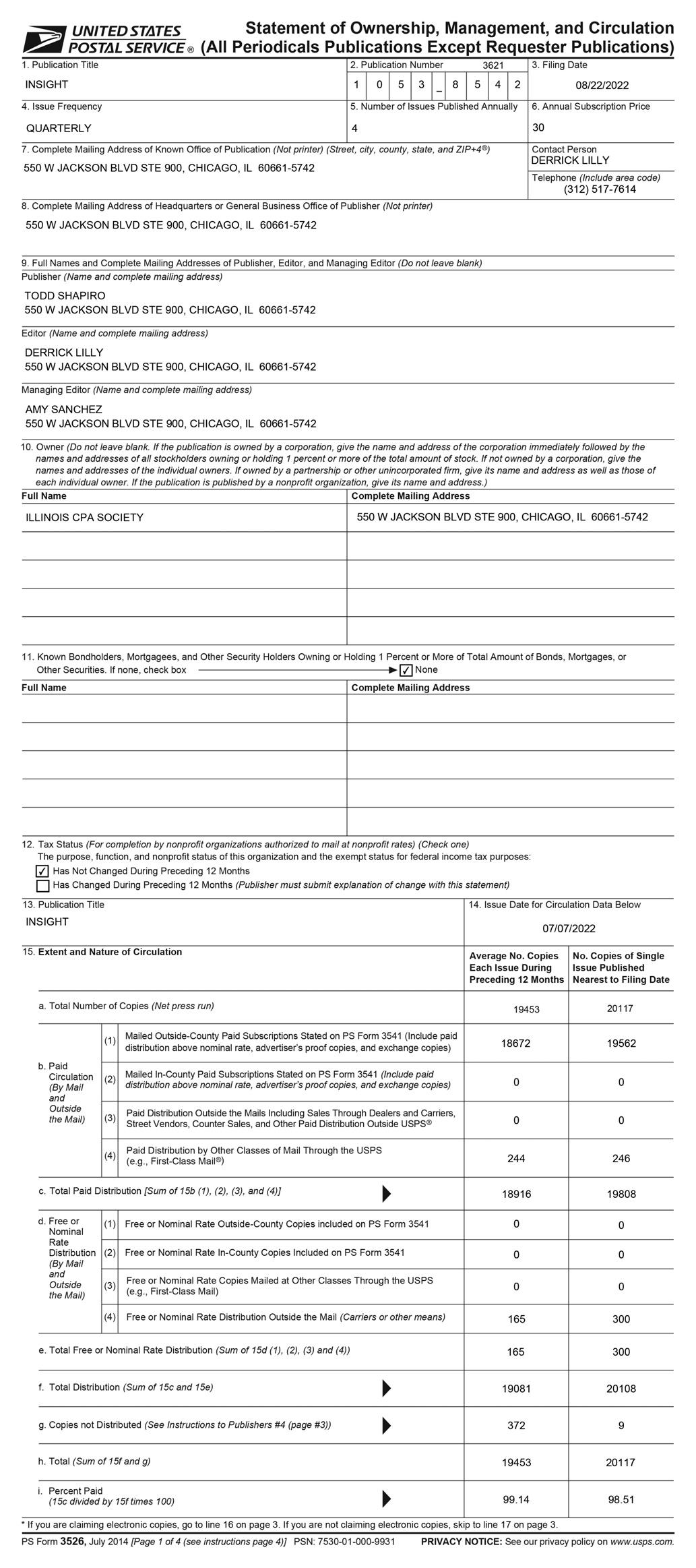

While we should celebrate that some progress has been made, we can’t ignore that the profession has a real challenge attracting and advancing individuals of color, especially in CPA and partner roles, as the AICPA’s chart of U.S. CPA firm demographics in 2020 illustrates:

Despite the progress in hiring more individuals of color, that progress all but goes away when we get into the CPA and partner ranks. This challenge is further borne out by participants in our Mary T. Washington Wylie Internship Preparation Program (MTWW IPP). The MTWW IPP recruits promising racial and ethnic minority accounting students to participate in an intensive three-day program that prepares them to enter the accounting profession. Content includes panels on what it’s like to work in accounting firms and corporate finance departments, resume development, CPA exam preparation, and more, and culminates in interviews with accounting firms and companies offering internship and career opportunities. On the positive side, most participants receive internships and/or job offers. On the downside, we’ve learned that a significant number of these individuals don’t advance in the profession and often leave it or are pushed out of it.

Between the AICPA’s documented trends on diversity in accounting degree programs and U.S. CPA firms, and the experiences of our MTWW IPP alumni, our attention has been piqued to the point that we needed to better understand why diverse individuals aren’t more widely succeeding in the accounting profession. We’ve conducted research with our MTWW IPP scholars to better understand the challenges and barriers they face, and will be issuing a new Insight Special Feature this fall to share what we’ve learned.

The goal of this year’s Insight Special Feature is to raise awareness and help identify challenges that there must certainly be solutions to that’ll further move the profession toward greater diversity across all levels. I’ll say this, the issues we’ve identified are deep, complex, and often disturbing. But we have an opportunity to make positive change. If we’re truly committed to creating a CPA profession that’s more diverse, this is a conversation we need to have. As always, I’ll welcome your feedback.

www.icpas.org/insight | Fall 2022 3

Minorities make up more accounting graduates and new hires than ever before, but more needs to be done to make the CPA profession truly diverse.

today

New Grad Hires Professional Staff CPAs Partners Asian/Pacific Islander 16% 24% 14% 10% Black 5% 5% 2% 2% Hispanic 11% 7% 5% 5% White 65% 62% 77% 82%

INSIGHTS FROM TODD SHAPIRO, ICPAS PRESIDENT & CEO @Todd_ICPAS

’sCPA

INSIGHTS FROM MARTY GREEN, ESQ., ICPAS VP OF GOVERNMENT RELATIONS @GreenMarty

The Mobile CPA: Navigating Remote Work, Principal Place of Business

nlike some other professionals, CPAs were well prepared to face the challenges of the worldwide pandemic—thanks to our mobility practice privilege and generally well-established routines of working remotely. Despite the perceived severity of the pandemic receding, remote work practices continue to be the norm for many firms and businesses, and state regulators across the country are taking notice and have begun discussing remote working and state licensure practice privileges.

With varying laws across all 54 U.S. states and jurisdictions, there are many legal nuances to consider when it comes to remote work, as well as a CPA’s designated principal place of business (PPB). To touch on these points, we must first understand and define PPB. From my standpoint, the bottom line on PPB is threefold:

1. Designation of your PPB requires you to have a CPA license in the state where the PPB is located.

2. A licensed CPA being substantially equivalent is the touchstone of mobility.

3. Mobility is the reciprocity recognition that allows a CPA to perform services in another state without having to obtain that state’s license unless it’s where their PPB is located.

The Illinois Public Accounting Act defines PPB as the office location designated by the licensee from which the person directs, controls, and coordinates their professional services. This designated PPB is central to obtaining an Illinois CPA license and for determining substantial equivalency and mobility practice privilege.

To help illustrate, consider this hypothetical:

An Illinois-licensed CPA’s designated PPB is Illinois. The CPA remotely performs work in North Carolina for their designated office in Illinois. While one may wonder if this Illinois CPA remotely working in North Carolina for clients serviced by the Illinois PPB would be required to obtain a North Carolina CPA license, the general answer is no. The Illinois Public Accounting Act is substantially equivalent for mobility purposes, and the Illinois CPA benefits from mobility reciprocity in North Carolina. While the CPA’s work is being done remotely in North Carolina, the designated PPB servicing clients is in Illinois.

Due diligence and mobility practice dictates that CPAs should be familiar with state laws where they’re performing services, establishing residency, and being employed. In Illinois, PPB is designated by the licensee as the office location from which the person directs, controls, and coordinates their professional services. Some states, like New Jersey, use residency as the PPB. While others, like Virginia, use the place of business or office location where the licensee is employed as the PPB.

Comparing other state public accounting acts to this situation, let’s consider this hypothetical:

Due to COVID-19, a Virginia-licensed CPA relocates to their parent’s home in New Jersey where they work remotely for their Virginia firm and clients. The Virginia-licensed CPA doesn’t establish residency in New Jersey. Does the Virginia CPA need a New Jersey CPA license? No. The Virginia CPA works for a Virginia CPA firm

4 | www.icpas.org/insight

With remote work becoming the norm, and as more state agencies scrutinize its practice, CPAs must stay abreast on the latest laws, the nuances of working remotely, and their designated principal place of business.

capitolreport

LEGISLATIVE

providing services to their clients in Virginia. The New Jersey Public Accounting Act specifies individuals with an out-of-state PPB shall be presumed to be substantially equivalent and have all privileges of a licensed CPA in New Jersey.

Florida’s Public Accounting Act is even more straightforward. The Florida act states that an individual who doesn’t have an office in this state has the privileges of a Florida CPA and may provide public accounting services in this state without obtaining a license if they’ve obtained a license from a substantially equivalent state.

The CPA profession is fortunate to have well-established mobility practice privileges in place that allow a CPA a no notice, no escape authorization to provide CPA services in another state. However, the mobility practice privilege only extends so far; CPAs should be diligent on situs state licensure laws, particularly in instances where they’ll be remotely working for an extended period and considering

factors such as residency. This is even more relevant and important as remote work continues to proliferate and as state regulatory agencies are closely scrutinizing remote work practices.

CPAs working remotely should also be aware of their designated PPB. It’s important to note that various state laws use thresholds for PPB, such as where the CPA lives; where the CPA is employed; and where the CPA’s office is located from which they direct, control, and coordinate professional services. To help stay abreast of these laws, you can access the jurisdictional licensure requirements from the National Association of State Boards of Accountancy website at https://nasba.org/stateboards.

I believe the CPA profession will continue to be at the vanguard of mobility practice privileges and evolving licensure requirements, and our Government Relations team will continue to closely monitor both state and federal regulatory developments on this matter.

www.icpas.org/insight | Fall 2022 5

3 Steps for Being a Modern Accountant and Controller

Corporate finance professionals need a mindset change if they’re going to handle all their traditional tasks while meeting modern business demands.

BY MICHAEL SHULTZ

BY MICHAEL SHULTZ

raditional, manual, and Excel-based accounting processes aren’t sustainable in the current business environment. Already long gone are the days of putting on our green visors and completing journal entries, account reconciliation financial statements, and spending late nights with the audit team. While the work is still there, the ways we do it are rapidly changing, and so too are the demands of us corporate finance professionals. We’re now expected to be partners throughout our organizations, aligning with the CEO and CFO to support their needs, seeing through significant business transactions, having a hand in talent recruitment and retention, and so much more.

How do we manage all our traditional tasks plus these new demands? We could work more hours, but that’s not realistic or sustainable. We could hire more staff, but that’s not usually afforded to us. Or we could change when and how we work—this is what I call “modern accounting.”

Modern accounting is all about changing your mindset and not following the “same as last year” mentality. The good news is, while technology plays a key role in achieving this accounting nirvana, there are steps you can take now, even before the technology is in place, to start moving you in the right direction. While this may seem like a daunting task, it’s easier than you think.

As a recovering accountant with more than 20 years of experience in various accounting roles, I understand that change isn’t something we generally readily embrace. However, I think my view of what modern accounting and controllership is might excite you. Here are three steps to take now.

1. UNIFY

Do you have data coming at you from many different systems? Do you have processes that change based on who is completing a task? Do you have to hunt to get visibility into where the monthly

6 | www.icpas.org/insight

CORPORATE STRATEGY & FINANCE

close or annual audit is at? If you answered yes to at least one of these questions, then you likely need to unify.

With today’s new modern accounting technology solutions, you can integrate, or unify, all your data into one source, allowing you to link your data sources through various connectors, file transfer protocols, and application programming interfaces. More importantly, by applying a timing interval of your choice—hourly, daily, weekly, etc.—the data is brought into the technology solution for you, cutting out manual effort.

By unifying your data, you’ll also be able to vastly improve the templates for standardizing your accounting processes, such as account reconciliations and journal entries. Every time you look at a digital workpaper, it’ll look the same. No longer will you spend extra time looking at a spreadsheet to understand how it’s built. Instead, you can use that time to look strategically at the work in the workpaper.

What’s more, you’ll no longer have to call your team members, send emails, or wait for responses in a bid to get the data you need. In a few mouse clicks, you’ll be able to understand things like which reconciliations are done, what journal entries need to be completed, where your audit stands, who’s accountable for the data, and more.

In other words, unifying your data is a huge time saver, it standardizes your processes, and it affords you real-time, global visibility into the entirety of your finance function.

2. AUTOMATE

Automation is my personal favorite aspect of modern accounting and controllership. I, like many of you, didn’t spend time in university and studying for the CPA exam only to do busy, manual, mundane work. A significant portion of the manual tasks we complete in our finance departments can be automated. One simple example is the ticking and tying of bank data. Depending on the number of transactions, this can take a significant amount of time. What if you could get this done in seconds and only spend time on exceptions? I know of one company that automated a bank transaction set, going from reviewing 40 million transactions each month to analyzing only a few thousand exceptions—an amazing time savings. My point is that being a modern accountant and controller demands you to seek ways to automate the manual, mundane, and time-consuming tasks that take you away from being the strategic business advisor you need to be to meet the ever-growing demands placed on you. Or, maybe more importantly, you free up the time to be the accountant or controller you want to be—one that’s not bogged down by the minutiae.

3. CHANGE

When do you complete certain tasks during your monthly or yearend close? Whenever the checklist tells you to, right? Why? Because that’s when your predecessor did the work and that’s when their predecessor did the work. But is this the best way or time to work? No.

There are changes you can make today, even without the implementation of a modern accounting technology solution, that can help you become more efficient and invaluable to your organization. For example, one step might be as simple as moving certain tasks from the close period to earlier in the month. Consider this modification:

Your company issues 10-year debt. For the next 120 months, you journal the amortization of fees, accrual of interest, and more. You’re doing this during the close only because the checklist says to do it on day two. However, why not do it throughout the month? It’s the same journal set month after month. This frees up time during the critical close period to focus on other things, like being a partner to the other departments in your organization.

Of course, this is just one example. There are many tasks that fall on the finance function that can be moved around to create positive change. Combine simple changes with unified technologies and automation and there’s even more that you can do without the fear of errors or time constraints.

Ultimately, modern accounting and controllership is about modernizing your mindset and developing one that continually thinks about the future of the profession. Change is inevitable, and as corporate finance professionals we must embrace that change to stay relevant and be all we can be for our organizations. The costs of not changing may include longer close periods, riskier processes, lost time, shrinking profits, and a diminishing of our value and credibility. The “same as last year” approach must become a thing of the past. If you don’t embrace change now and start taking the steps to become a modern accountant or controller, you’ll be left behind.

Michael Shultz is BlackLine’s director of strategic accounting. He has more than 20 years of experience in auditing, consulting, and financial reporting management.

www.icpas.org/insight | Fall 2022 7

Why Investing in Your Staff Is More Important Than Ever

A comprehensive, professional development strategy might be the boost your firm or company needs to keep your CPAs and other professional staff from running out the door.

BY DEL WRIGHT

BY DEL WRIGHT

t’s impossible not to hear about it—Americans are leaving their jobs in droves. Millions of business professionals, including CPAs, are reevaluating their relationship to both their employer and, ultimately, their profession. In fact, between April 2021 and May 2022, an average of more than 4 million people resigned from their jobs each month, according to the U.S. Bureau of Labor Statistics.

The natural question, of course, is what can be done to stem the tide? How can employers retain talent when it seems like everyone has their eyes on the exit? A plethora of possible solutions have been proposed, ranging from the usual suspects (greater flexibility in scheduling, work-from-home options) to the downright luxurious (in-office massages and yoga classes).

However, there’s one investment that, while perhaps not as buzzworthy as lunchtime shiatzu, has proven to keep staff engaged and minimize turnover: ongoing professional development.

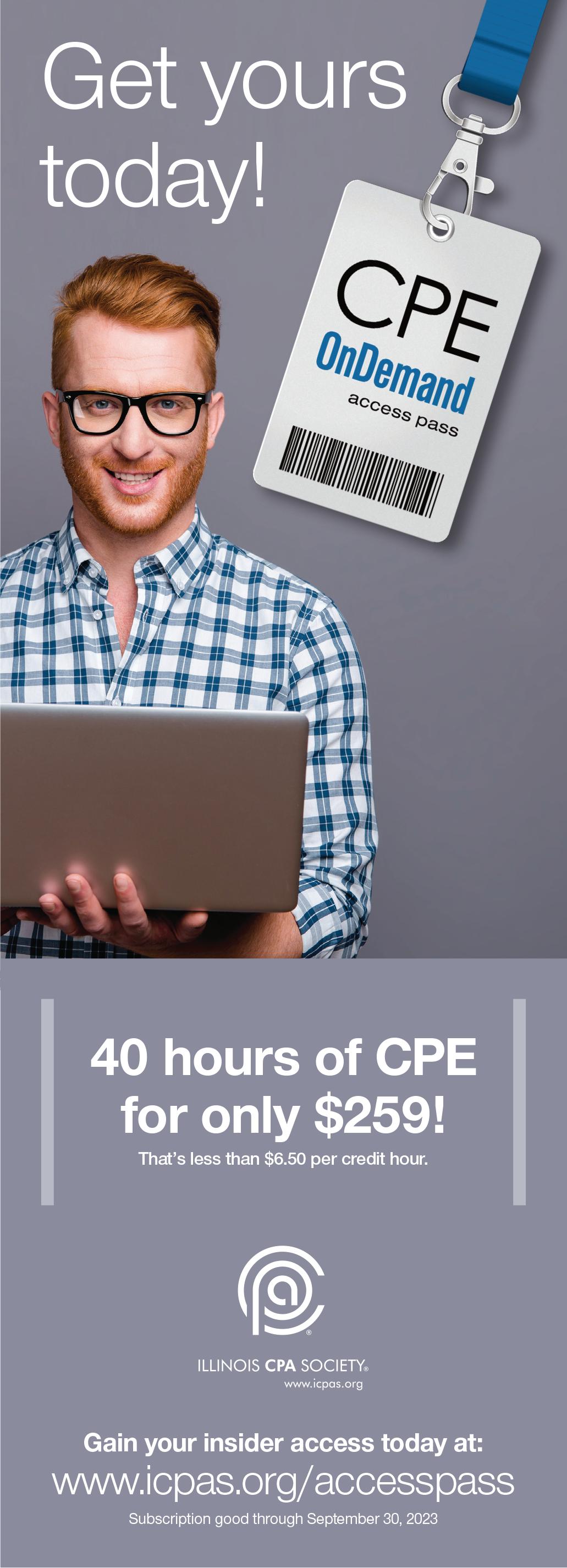

According to a 2019 Forbes article, most employees view employer-provided continuing professional education (CPE) favorably and see it as an investment in their careers and professional goals. The article notes that 86% of surveyed employees said they would leave their job for another that provided more professional development options. And, citing a 2018 LinkedIn workplace report, 94% of employees would stay longer with an employer that invested in their career.

SHOWCASING THE VALUE OF EDUCATION

While CPAs are required to complete 120 hours of CPE every three years as a condition of license renewal, CPE shouldn’t just stop with CPAs—there’s value in developing the skills of all your accounting and finance staff regardless of whether they’re working in public accounting, corporate finance, the nonprofit sector, or elsewhere. And, more importantly, skills development shouldn’t stop once a not-so-new hire has mastered the core competencies of their role.

Prado & Renteria, Illinois’ largest Hispanic, woman-owned CPA firm, takes a 360-degree approach to CPE, allowing staff to apply newly acquired knowledge in real time. As a CPE-sponsored licensee, the firm presents staff with engagement-specific training sessions prior to them beginning new engagements.

Hilda S. Renteria, CPA, co-founder and partner of Prado & Renteria, and a 30-plus-year Illinois CPA Society (ICPAS) member, notes that this approach has helped the firm defy the idea that CPE is separate from one’s immediate, day-to-day responsibilities. Instead, tailoring training sessions to the specific needs of upcoming projects ensures that their staff has the most up-to-date information needed to provide excellent service to their clients. “Our firm understands that in order to contribute to the growth of the communities the firm serves, the firm must invest in its team members’ growth,” Renteria says.

8 | www.icpas.org/insight LEADERSHIP & PEOPLE MANAGEMENT

This commitment to professional development is also shared by Miller Cooper & Co., the 10th largest accounting firm in Chicagoland, where staff are supported in charting unique personal career paths. “We understand that everyone has different professional goals, and we’re continually looking for new ways to help our employees realize them,” says ICPAS member Emerys Murray, the firm’s HR and finance assistant. “By doing so, not only are we demonstrating our commitment to them, we’re also building a strong and knowledgeable workforce that’s able to help our clients achieve their goals.”

While Miller Cooper places an emphasis on the technical skills necessary in the firm’s engagements, cultivating the so-called soft skills doesn’t go overlooked. “Areas like communication, leadership, and time management are necessary to keep people engaged and motivated,” Murray notes.

At the Oak Brook, Ill.-based accounting firm Selden Fox, mentorship plays a further role in developing—and retaining—staff. From green new hires to subject matter experts, the firm’s HR manager, Daniel J. Ridgway, works to facilitate employee development. He says this early focus on growing skill sets helps to ensure non-management staff are able to act as firm resources and leaders even within their current roles. Then, as they’re promoted and expand their reach and influence in the firm, they’re already prepared to pass on their expertise to those they’ll supervise and mentor. “As employees progress through their careers and discover their areas of interest and expertise, we invest in them becoming subject matter experts who can be counted on to address specific client needs as well as pass their knowledge down to future leaders of the firm,” Ridgway explains.

By all indications, knowledgeable and engaged employees stick around longer and drive better business results—even outside of the accounting and finance world. Consider these two examples:

1. CarMax: In response to the Great Recession of 2008, the auto dealer enhanced their employee training offerings, specifically to increase retention. Instead of cutting employee benefits, CarMax expanded its employee training and development programs and helped existing employees earn raises and promotions. As a result, CarMax’s sales went up 116% in eight years, as reported in 2020.

2. Hyatt: The prominent hotel chain has long been known for robust trainings—from the housekeeping staff to the C-suite. The brand’s commitment to ongoing professional development is borne out in its retention rates. As of 2020, at least 14,000 of the company’s 75,000 employees had been with Hyatt for more than a decade.

INVESTING IN ONGOING TRAINING

So, you know you need to invest in your staff. What now? First, if you’re training your CPAs and other professional staff, it’s recommended that any education vendor you partner with be licensed as a CPE provider with either the Illinois Department of Financial and Professional Regulation—or equivalent agency, if not in Illinois—or the National Association of State Boards of Accountancy. Second, it’s also recommended that the content you provide your staff be as closely aligned as possible with the scope of their current duties and roles.

ICPAS’ Corporate Access Program (CAP) covers these bases, offering a comprehensive CPE solution specifically targeted to corporations and non-profit organizations looking to provide their accounting and finance professionals with ongoing, customizable professional development. The program provides participating companies with team access to 40 hours of on-demand training

courses, complimentary admission to select ICPAS conferences and various networking events throughout the year, as well as inhouse soft skills training with a veteran leadership coach.

Several participating companies have found value in joining the CAP. Diversified CPC CFO Paul Caponigri, CPA, CGMA, MBA, a long-time ICPAS member, says that his finance team finds the program beneficial—even the non-CPAs who aren’t mandated to earn CPE.

Rhett Stenzel, controller for Rose Paving LLC, notes that he appreciates that the CAP offers material for “all staff at all levels.” His colleague, Samantha Spalding Davis, director of financial planning and analysis, feels that Rose Paving’s participation in the program “clearly demonstrates the company’s dedication to ongoing employee development.”

An ICPAS member for more than 20 years, Gayle Bobo, vice president of asset management and financial planning with the National Association of Realtors, stresses that the CAP has made it “seamless” for her team to register for relevant conferences and load up on on-demand content that suits each user’s needs.

When you consider that a recent Pew Research Center survey found that 33% of employees considered a lack of advancement opportunities as one of the major reasons they quit, it’s clear that organizations need to do more to make their talent feel valued. Access to relevant, timely CPE and ongoing professional development may be the missing pieces they’re looking for at your organization. And what do you have to lose? Allowing your staff to meaningfully engage in their development and investing in their advancement may just inspire them to invest in your organization’s growth.

Del Wright is an Insight contributor and development manager for the CPA Endowment Fund of Illinois.

www.icpas.org/insight | Fall 2022 9

BY ANNIE MUELLER

Like many industries, widespread effects of the pandemic, changes in business conditions, and new career alternatives are creating a major talent shortage within the accounting profession. Struggling to fill open positions and deal with increasingly competitive recruiting tactics, CPA firms of all sizes are exploring new strategies for attracting and retaining talent. But which strategies actually make a difference to the young professionals that you so desire and require to build a firm that lasts for generations to come?

It’s easy—too easy, really—to make decisions based on generational stereotypes. Sure, in some areas, generational differences are stark, but the pandemic has shifted employee expectations so drastically that even long-standing stereotypes feel outdated today. Putting in the legwork to understand exactly how the next generation of accountants think, and what they want from their employers, is key to building a sustainable talent pipeline for your firm.

UNDERSTANDING GENERATIONAL GAPS

By 2025, Gen Z will comprise about 30% of the global workforce. Before then, the youngest of the millennials are dipping their toes in the workplace waters, while older millennials are rising through the ranks. Making sense of what these modern generations of workers care about when making career decisions has been anything but easy for most, which has led to widespread misunderstandings about how to attract and retain younger talent as well as division and dissatisfaction in the workplace.

“One factor causing this generational divide is the notion that young generations are looking for sexy jobs,” says Will Baker, marketing and CPA experience director at Once Accounting. “What they’re influenced by is doing something of value.” In fact, according to the 2016 Monster Multi-Generational Survey, 74% of Gen Z workers and 70% of millennials “rank purpose ahead of a paycheck.”

THE FLEXIBILITY FACTOR

However, purposeful work isn’t the only thing young professionals are looking for. As a result of the COVID-19 pandemic, workplace priorities have forever changed. Now more than ever, flexibility and work-life balance have risen to the top of many young professionals’ career wish lists.

“Young professionals know they can be productive while working on their own terms, and they expect the ability to do so,” says Kiara Schuh, CPA, risk and financial advisory senior consultant at Deloitte.

“We’re all adults who know our working styles and our capabilities. That’s just what makes a good professional.”

Of course, financial security—fair wages and good benefits—is important, too. However, it’s just another consideration, not the consideration, says Maria Tranchina, assurance associate at BDO USA LLP: “Paying the bills is important. But getting paid slightly more at a firm that doesn’t provide the flexibility you want isn’t, for most of us, a good trade.”

For that reason, putting the structures and tools in place to enable ongoing flexibility might deserve a higher priority than firms have historically given it. Firm leaders may want to consider these flexibility options:

• Let teams determine their own in-office schedules. “My team is very much on a ‘come as you wish’ basis for being in the office,” Schuh says. “Not every team is like that; some operate on a scheduled rotation.” The point is to allow teams to have the freedom to work in the ways that best meet their project’s—and people’s—needs.

• Keep mandatory in-person meetings to a minimum. We’ve all heard of Zoom fatigue, but in-person meetings can be just as fatiguing and disruptive, particularly for firms that have already adopted hybrid work environments. Consider requiring team members to only travel to the office for necessary meetings and engagements to prioritize their productivity and work-life balance.

• Measure productivity by results, not hours. Focus on your team getting the right things done rather than them putting in a certain amount of face time behind a desk.

• Don’t fall behind on technology. Baker advises delegating new tech implementations, which make greater productivity and flexibility possible, to younger staff to help build the skills they’re going to need in the future.

• Balance remote work with in-person socializing. Regular opportunities to socialize help build camaraderie that carries over to digital interactions. “In-person events, like happy hours, help facilitate that sense of community,” Schuh suggests.

CAN YOU OFFER CAREER CLARITY?

Overall, young professionals take their career development seriously and are seeking firms that offer opportunities for varied and new experiences, ongoing guidance, and clear pathways to growth.

10 | www.icpas.org/insight

Understanding the wants and needs of today’s young professionals is key to building a sustainable talent pipeline for your firm of tomorrow.

www.icpas.org/insight | Fall 2022 11

Young professionals don’t want to start slowly, says Stephanie Zaleski-Braatz, CPA, an audit manager at ORBA and chair of the Illinois CPA Society’s Young Leaders Advisory Council. “I see a lot of young professionals trying to step up to the plate earlier and get as much experience as they can in all aspects of their industry right off the bat,” she says.

Knowing that young professionals want to hit the ground running, Tranchina stresses that it would be very beneficial for firms to prioritize the continuing professional development of their new hires and focus on diversifying their experiences.

Having the ability and support to rotate through different specialties during their first few years with the firm appeals to new hires who haven’t fully determined their career direction. Schuh shares that “a huge factor” in her employment decision was the resources, training, and quality of experience she knew she would get.

Along with honing skills and gaining experience, young professionals want guidance and feedback. “Career path discussions are a huge help,” Zaleski-Braatz says. “It’s an opportunity for leaders to explain how we can help the firm grow and give examples of what other people at the firm have done to be successful.”

This guidance and feedback can range from formal, scheduled meetings to daily, ongoing interactions. “So often, it’s the power of simple conversations, sharing observations, and providing supportive feedback that matters,” says Nicole Szczepanek, CPA, a tax partner at Baker Tilly US LLP and a 2022 Women to Watch Award winner. “These daily interactions can make a difference in not only everyday experiences but in people’s career paths.”

“When young professionals jump ship, it’s often because they don’t know what their next step is,” Zaleski-Braatz cautions. “At some point, they’ll have moved through a variety of work and be ready to specialize in specific areas. The conversations about what their futures are at the firm can’t be overlooked.”

To better support a young professional’s career development, consider these ideas:

• Offer professional development opportunities. Over the past few years, young professionals have experienced major change and expect to go through more. They’re keen to add new skills, expand abilities, and be ready to adapt.

• Don’t squeeze support into a box. “As a leader, look for those everyday opportunities to support your team,” Szczepanek encourages. “It can come in different forms—review notes, a formal meeting, status updates, or going to lunch.”

• Support career milestones. From sitting for the CPA exam to gaining certifications, young professionals value practical help in reaching their career goals.

• Support personal milestones, too. The pandemic has reprioritized life outside of work. For Schuh, the ability to take a sabbatical and pursue a personal project is meaningful. “The firm is supporting me as a person, not just as a professional,” she says.

• Be supportive of the person. A revealing question to ask yourself: Can you support a young professional as a person and help them develop their career in the best way, even if that means they don’t stay with your firm?

REAL RELATIONSHIPS MATTER

Incorporating the kind of work-life flexibility expected by young professionals requires trust, on all sides. Additionally, providing genuine feedback and career support requires time and sincere

interest. In both areas, there can be no progress without sincere, ongoing human connection. This is especially true with young professionals who value building relationships with the people they work with. Schuh says that a big factor in her decision to stay with her employer was the opportunity to connect with people: “From the beginning, I have felt invested in and very valued, which makes me want to stay because I feel like I really have someone in my corner.”

“The role of mentoring and relationships has a huge impact in the attraction, development, and retention of talent,” Szczepanek stresses. “It takes effort. Relationships don’t happen from just sitting back. Firm leaders have to be actively engaged and set the tone for young professionals. It’s important to make sure they have the confidence to speak up, to ask for help, to reach out knowing that they also have a voice.”

On the other hand, Baker adds that being able to learn from someone is of great importance, whether you’re 25 or 55. “When older professionals exhibit a willingness to learn from younger staff, everyone benefits,” he says.

Indeed, continual back-and-forth communication, whether via digital platforms or in person, helps establish real relationships and loyalty. “From my first day, I had people messaging me and scheduling calls,” Tranchina says. “There was never a time when people weren’t effectively communicating and making me feel welcomed.”

There’s no single right way to build real relationships, but it’s made much easier by developing a welcoming firm culture and thoughtful systems that encourage interaction. To help young professionals build relationships at your firm, consider these tips:

• Encourage all types of mentoring. Both formal and informal mentorship helps young professionals learn through experience and meaningful discussion.

• Be deliberate about digital communication. Without daily, casual interactions of in-office work, you have to be more conscious about creating touchpoints through digital means.

• Mind your message. When communicating via digital platforms, body language is lost. Szczepanek advises that we all “think a little more specifically about what we say and how we say it.”

• Facilitate collaboration. Remote and hybrid work environments can hinder collaboration in a team, so it’s important to keep your teams talking. “Keep in mind that many young professionals that started during the pandemic didn’t get to work with people at the same level because of the circumstances,” Zaleski-Braatz says, stressing that it’s important to “find ways to work together more.”

• Listen to their ideas. The youngest members of your workforce have plenty to learn, and plenty to offer. “If an individual has a good idea, and they’re passionate about it, they should have the opportunity to lead it,” Szczepanek suggests.

Ultimately, firms can attract and retain the dedicated, loyal talent they’re looking for if they’re willing to listen to and understand each generation’s own unique needs. Today’s young professionals value the stability of the accounting profession, but they’re not eager to join firms that aren’t focused on the future. That means offering purposeful work, work-life flexibility, personalized career development, mutual respect, and genuine relationships.

Annie Mueller is an experienced financial writer and principal of Prolifica Co. She works with clients from individuals to large financial companies and is a frequent contributor to various financial and business publications.

12 | www.icpas.org/insight

When Opportunity Knocks: Is Starting a CAS Practice Right for You?

Expanding cloud-based technology, pandemic-fueled business needs, and evolving approaches to getting work done have accelerated the demand for outsourced accounting services, opening a door for robust CPA firm growth. Before walking through that door, three experts weigh in on what questions you should be asking when considering building a client accounting services practice.

BY CLARE FITZGERALD

14 | www.icpas.org/insight

www.icpas.org/insight | Fall 2022 15

Outsourcing is losing its stigma. The negative connotations associated with hiring out tasks are fading as the pace of life accelerates, work-life balance priorities shift, entrepreneurship expands, and business challenges grow increasingly complex.

Enter the boom of client accounting services (CAS). CAS has become a highly marketable and profitable practice area— especially for CPA firms with a growth mindset. In the same way homeowners might hire a lawn care service to free up a few weekend hours, business owners seeking more time to focus on their core competencies are increasingly turning to firms that can do everything from taking over back-office accounting work to providing CFO-level financial analysis and advice.

How firms package and brand their CAS practice area varies, but the most often used monikers, according to CPA.com, are client advisory services, client accounting services, outsourced accounting services, business process outsourcing, finance and accounting solutions, and managed accounting and advisory services.

And, according to CPA.com’s 2020 CAS Benchmark Survey, which gathers data from U.S. CPA firms to set CAS practice benchmarks and develop key performance indicators (KPIs) and best practices, the top five reported CAS offerings among respondents included financial statement preparation, CFO and controller advisory services, accounts payable, forecasting and budgeting, and 1099 creation and filing.

Notably, many accounting firms have long been providing those services without formally grouping them into a practice area or marketing them as such, but times are changing. For example, Porte Brown LLC, an Elk Grove, Ill.-based accounting firm, “started” its CAS practice in 2020 even though the offered services weren’t new. “We realized we were doing this already and could brand it and sell it separate from the accounting services we provide,” says Partner-in-Charge Michael M. Massaro, CPA, CGMA.

Regardless of the label, the goal with any CAS practice is to deliver strategic, high-value business insight that helps organizations grow. And, not surprisingly, the demand for that insight is strong. CAS practices participating in the biennial 2020 CAS Benchmark Survey reported a median growth rate of 20%—nearly twice the rate reported in 2018 and more than three times the 5.7% average growth rate reported by other accounting firm practice areas in 2020.

In addition to increased comfort with outsourcing, the expansion of cloud-based technology has also contributed to CAS practice growth, according to Amy Vetter, CPA, a Cincinnati-based trainer and speaker who offers courses for starting and scaling a CAS practice. “The development of CAS sped up when the tech industry started focusing on cloud-based accounting software,” she explains. “Being on the same system and sharing files remotely allowed clients and firms to see the same data in real time and have conversations about it.”

Massaro cites the COVID-19 pandemic as another accelerant in the CAS boom. “The pandemic really opened the floodgates. Everyone was gone from their offices, and we were already set up to handle this work remotely,” Massaro says, noting that his firm was already working in cloud-based systems.

While the market and opportunities are here, building a CAS practice requires rigorous planning. To determine if opening the door to the growth potential a CAS practice offers is right for your firm, here are six questions you need to weigh.

ONE Can We Secure Buy-In?

Be ready for skeptics because convincing partners that clients can and will pay for CAS can be a tough sell, Massaro says, who recommends getting partner buy-in as one of your first steps. He notes that it’s often the price tag and number of hours required to do the work that gives partners pause.

That said, Kalil Merhib, vice president of growth and professional services at CPA.com, says it’s important to ascertain if leadership will support investing in CAS: “CAS really requires immersion and understanding of the category at the partner level to secure the necessary resources.”

One way to gain leadership support is to encourage partners to look at their own clients with a critical eye for who could be a potential CAS client. “Get them to realize that a client could benefit from the services and be sold on them,” Massaro recommends, adding that firms can start small and look for low-hanging fruit that can be easily shifted to the CAS practice.

Also, if you’re the only one advocating for CAS, it makes sense to bring in reinforcements. “It can be a bear to be the champion on your own, and you need to have someone dedicated to the practice,” Massaro says.

Vetter agrees, stressing that firms often make the mistake of not identifying an owner of the category who can be involved, proactive, and talk about the practice in other department meetings. “Many firms know it’s an important service line but don’t have the right leader to own it,” she says.

TWO Are We Open to New Business Models?

Anyone considering building a CAS practice needs to understand that it’ll require a different operating model, Vetter says, as it doesn’t have the streamlined processes that tax and audit have, and firms won’t be able to run it the same way they run those practices. Pricing, for instance, is where your firm will need to be most open to different business models. “You need to price services based on value, not on hours, which can be a big shift for CPAs,” Massaro says.

Vetter adds that firms also need to be open to measuring success differently. “Evaluating how you’re working with clients is always a struggle, but success in CAS is much more dependent on client relationships,” she explains. “This practice is about helping clients make business decisions and meet their goals. You need to find ways to be as efficient as possible, so you’re spending less time behind the computer and more time with the client.”

THREE Do We Have, or Can We Develop, Industry Expertise?

Fulfilling the role as a trusted and strategic business advisor often depends on your depth of knowledge in the client’s industry, and providing industry-specific business insights is an important differentiator in CAS. Merhib stresses, “You need to be able to look at a dashboard of KPIs and understand how the data connects to provide insights. Bringing industry expertise really illuminates the data.”

Massaro adds that specialization and developing niches helped his practice narrow its focus: “Clients want to know that you’re an expert in their industry.”

16 | www.icpas.org/insight

“It’s simply harder to be one-size-fits-all with CAS,” Vetter adds. She suggests starting with industries that you’re already passionate about. “Build on your interest in the industry and gain an understanding of what keeps people in that industry up at night. Then focus on helping them solve those problems.”

With your specialties identified, Vetter says it’s then easier to be clear on your client profile and ensure that your messaging, marketing, and sales processes align with the specific industry you intend to serve.

FOUR Do We Have a Growth Mindset?

Firms that are operating successful CAS practices are providing highly valued strategic advice and positioning their firms for crossselling and long-term engagements, and with an entrepreneurial mindset, innumerable opportunities to provide ongoing support to clients can be found.

“When done properly, CAS architects value for the client and gives the firm a seat at the table for natural business conversations,” Merhib explains. “Businesses really value these services, because so many struggle with their financial hygiene and keeping their back offices clean. CAS establishes a solid foundation. Building a relationship at the data level also allows you to look at day-to-day business activities and become a trusted advisor for them to turn to as they mature.”

Vetter agrees that the strength of that advisory relationship is what separates CAS from other service offerings. In fact, Vetter uses the term “cherished advisor” to describe successful CAS providers. “They earn trust and become such a strategic part of the business that the owners can’t imagine not having their input and analysis. Opportunities then grow because you’re so deeply invested in your clients,” she says.

Taking advantage of those opportunities also requires communication among different practice areas within a firm. “Go to market thinking about the lifetime value of a client,” Merhib advises. “Successful CAS teams think about their client engagements in an ongoing way rather than as finite projects. As clients continue to improve and grow their businesses, you’re positioned to be right there with them.”

FIVE Are We Willing to Invest in Nontraditional Staff?

Staffing a CAS practice likely will require upskilling and adding new roles, so it’s important to consider whether your organization is willing to invest in hiring and training nontraditional staff. “As the complexity of the marketplace grows and technology becomes more sophisticated, firms will need many different experts, ranging from customer service to implementation,” Merhib says.

Vetter advises taking a strategic approach to assessing talent and roles: “It’s important to really determine what the jobs are that’ll be required. Don’t just think about hiring as filling seats, and don’t assume you have to look outside the firm. CAS often provides an opportunity for someone who was considering leaving your firm but might be interested in the new practice.”

Firm leaders should also consider adding people with operational backgrounds who know how to be proactive with financials. For analysis and business processing work, Vetter says auditors bring great background in looking at internal controls, and they might be pleasantly surprised that people on the CAS side want to hear their

suggestions. For controller services, Massaro suggests looking at your accountants with five to 10 years of experience who can dive into strategic discussions with clients.

From his experience, Massaro has found that some of the easier service areas, like bookkeeping and bill pay, can be the hardest areas for which to find talent. “You can’t hire a bunch of bookkeepers and have them sitting around when you don’t have a client project,” he says. To solve that problem, Porte Brown relies on strong internal administrative staff, many of whom were former bookkeepers, who can perform administrative tasks for the firm and jump in on CAS client projects.

Another group you can’t afford to have warming the bench are your CFO-level players. For high-level projects, Massaro suggests making contacts with outside consultants who can be ready to engage as contributors.

Additionally, firm leaders should look at people in IT and other technology roles who can be strong additions to the practice to help with systems implementation.

Merhib adds that you also need to build career paths for all roles. “When you’re recruiting people with business, industry, and technology backgrounds, you need to find a way to showcase how their career can progress,” Merhib says.

Lastly, don’t overlook what can be an even more critical indicator of success than experience—passion. “Always look at people who want to learn the CAS side and have an excitement for it,” Vetter says.

SIX Are We Committed to Learning?

Having a passion for and a curiosity about CAS is key, but understanding its value and possibilities—and getting a practice off the ground—requires research and training.

Massaro says he had an interest in CAS and studied the space long before his practice took off. “Because I was out there learning, I could see that CAS was going to grow and that we had to enter the fold or be left in the dust,” he recalls.

To build your knowledge, Massaro suggests attending virtual and in-person conferences and connecting with and listening to experts in the field.

Vetter further recommends working with coaches to help develop business plans.

Merhib suggests engaging with the marketplace and talking to other firms that have previously entered the space can be especially insightful. “There can be a lot of benefits to not being an early adopter,” he says. “You can learn a lot from others who’ve been successful.”

However you choose to build your CAS expertise, one of Vetter’s biggest tips is to get started now. She stresses, “You don’t want to keep waiting until next year.”

As we’ve already seen, the demand for CAS will continue to grow as business needs evolve and the category itself becomes more widely understood. “As with any change, things start slowly and then rapidly accelerate,” Merhib says. “We’re in a period of great acceleration now, and it’s exciting that the profession has this opportunity on its doorstep.”

www.icpas.org/insight | Fall 2022 17

Clare Fitzgerald is a Chicago-based freelance writer with experience working in CPA firms and covering trends in the industry.

18 | www.icpas.org/insight

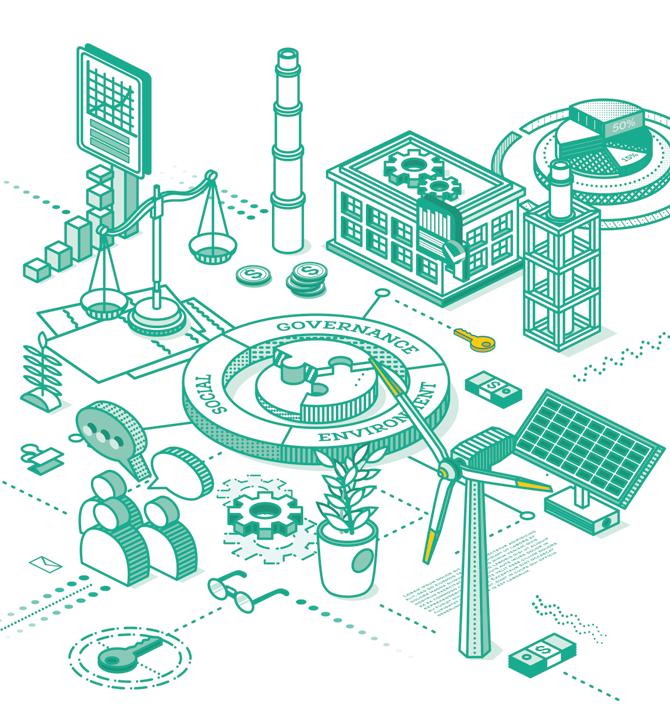

As investors, employees, customers, and other stakeholders turn their increasingly watchful eyes toward the ethics, sustainability, and global impact of the businesses they support, the acceleration of organizations prioritizing the integration of environmental, social, and governance (ESG) initiatives and reporting into their operations has gained momentum. Caught in the slipstream of that momentum is the imperative that these newfound ESG strategies be a value creator, fulfilling stakeholder concerns while also bettering the business by attracting talent, reducing costs, improving corporate image, and fostering innovation, just to name a few. But the road to implementing such an effective ESG strategy remains a foggy one. In turn, business leaders being challenged to adopt continually evolving ESG concepts and frameworks are increasingly turning to their accounting and finance teams to navigate this uncertain terrain. Charting a roadmap that offers a clear path to sustainability and success won’t come easy, but it’s an opportunity that offers CPAs a new frontier for which they can position themselves as strategic business advisors that drive long-term value creation.

Regulating a Roadmap

Socially conscious organizations have been behind much of the early ESG momentum, taking action to respond to society’s growing concerns about the global climate crisis and social issues plaguing our world, but this momentum is gaining further traction in the United States thanks to, unsurprisingly, rising regulations.

In March 2022, the U.S. Securities and Exchange Commission (SEC) proposed new regulations enhancing and standardizing public company climate-related disclosures in registration statements and periodic reports.

“The proposal is intended to address investors’ needs, help registrants disclose climate-related risks more efficiently and effectively, and strengthen existing disclosures, including the SEC’s 2010 climate-related interpretive guidance,” explains Elizabeth Sloan, CPA, Grant Thornton’s managing director of ESG and sustainability services.

In summarizing the SEC’s proposal, Sloan points out a number of new disclosures:

• Qualitative disclosures on climate-related risks, governance, and risk management, and impacts on a registrant’s strategy and business model.

• Identification of any board members or committees responsible for the oversight of climate-related risks, and the frequency by which they meet to discuss the risks.

• Whether and how climate-related targets or goals are set, and how progress is measured.

• Processes to identify, assess, and manage climate-related risks.

• Whether any climate-related risks are reasonably likely to have a material impact on a registrant’s business or consolidated financial statements that might occur in the short, medium, and long term.

• Greenhouse gas emissions for the most recent fiscal year and the historical periods included in the financial statements.

Given that the SEC received more than 15,000 responses during the proposal’s public comment period, it’s yet to be seen if any or all these disclosures will ultimately become part of a final regulation expected this year. However, as record-breaking temperatures sweep through the United States and across the globe, wreaking havoc on transportation, infrastructure, the agricultural industry, and overall economic productivity, the urgency over the SEC’s proposal has become immediately evident. Consider this: A 2021 study published in Nature Communications revealed the impact of historical heatwaves, finding that these climate crises lowered annual gross domestic product growth in Europe by as much as 0.5% over the past decade, and up to 1% in more vulnerable regions.

Investing in Transparency

Regardless of the SEC’s proposals and ultimate mandates, the call for increased corporate transparency is coming from multiple fronts. How organizations respond will be critical.

“In times of crisis, investors in particular will increasingly look at what steps a company is taking to minimize risks,” says Mark Stout, CEO of Apollo Energies Inc., a consulting firm that helps organizations become carbon-free and develop or improve their ESG reporting. Pointing to climate change, for example, Stout says it’s led to instances of “business disruptions, lost revenue, employee turnover, lost investments, and lost customers. Investors want to know how companies are mitigating the risk of losing revenue or slowing down operations.”

Beyond business risks, Stout believes it’s becoming increasingly important for organizations to demonstrate how they’re actively reducing their environmental impacts. “The extent to which a company manages their environmental footprint provides transparency into their actions and impacts the minds of stakeholders, regulators, and government agencies,” Stout says.

According to Chris Bolman, co-founder and CEO of Brightest, a software platform that provides individuals and organizations with an ESG and sustainability dashboard, 61% of institutional investors consider strong ESG performance an indicator of ethical corporate behavior and good management.

“Strong ESG performance is becoming intrinsic to your business model now and increasingly correlates with access to capital,” Bolman notes. “There are also many examples of companies

www.icpas.org/insight | Fall 2022 19

With continually evolving frameworks and numerous data points to navigate, the road to incorporating an effective ESG strategy into any business model is a foggy one. But a carefully charted roadmap can reveal a clear path to long-term value creation. Here’s what today’s accounting and finance professionals need to consider if they want to drive their organizations toward sustainability and success.

BY CAROLYN TANG KMET

generating millions in incremental revenue, or cutting millions in expenses, from thoughtful ESG implementation.”

“For example, acting wastefully regarding energy or other resources usually comes with a steep price tag for companies. The same goes for operating in an environmentally harmful way—taxes and other measures could substantially raise operating expenses,” explains Sarah-Marie Rust, founder and CEO of EVE, an intelligence and data analytics company that helps organizations electrify their transportation fleets and report their emissions.

Emphasizing that adopting a meaningful ESG reporting framework can help organizations uncover value creation opportunities, Rust says, “Companies are usually able to uncover wasteful activities that aren’t sustainable and are able to implement measures that reduce costs in the long run.”

A clear investment in ESG initiatives and reporting also signals to stakeholders that an organization is actively engaged in corporate responsibility, beyond the bottom line. “ESG reporting allows companies to take a stand on ethical and sustainability measures. It creates transparency, which builds valuable trust with customers, employees, and shareholders,” Rust suggests.

ESG initiatives also help build trust with employees—an important component in a competitive labor market where there’s increased scrutiny from potential employees. “Companies are noticing that attracting, hiring, and retaining talent is reliant upon an alignment of company values and documented actions,” Sloan says.

Keys to Your ESG Roadmap

When it comes to developing an ESG strategy, Luke Jacobs, cofounder and CEO of Encamp, an enterprise technology company for environmental compliance data management and reporting, says organizations need to start with empowering their employees to get involved—internally and externally. He suggests providing resources for employees to organize internal sustainability groups and providing paid time off for employees to volunteer at missiondriven organizations.

“Measuring these efforts and making them visible builds the momentum necessary for effective sustainability programs and evolves a company’s brand to genuinely reflect the desire to make an impact at an individual and at a corporate level,” Jacobs says. With a noticeable shift in consumer attitude toward corporate social responsibility, companies also need to consider how they build trust with customers.

“Sustainability and impact are now the core of a customer’s purchasing decision, and some even go as far as to not purchase products or services from companies that don’t align with their values. This is putting significant pressure on companies looking to retain and grow their customer base,” Rust observes.

One key to building trust with customers is to be transparent with your ESG initiatives and reporting. While some organizations may be hesitant to share their ESG metrics for broad consumption, which could expose operational weaknesses, Jacobs stresses that “remaining truthful to your organization’s mission and purpose is the best way to avoid backlash when sharing ESG metrics and providing the larger directional narrative about where the company is on its ESG journey.”

In fact, Rust argues that backlash isn’t always a bad thing—it could create a sense of urgency for organizations to improve their metrics and behaviors in order to be perceived in a more positive light: “Companies shouldn’t fear backlash when it comes to their ESG performance metrics but embrace it as a tool for becoming better.”

Ultimately, instilling an ESG mindset into your organization requires strong, clear leadership, and a commitment to investment and action. After all, it’s a cultural and operational shift. ESG needs to become part of your analytics practice, influence corporate goals, and be embedded in performance incentives.

When you further consider that ESG touches every department in your organization in some way, and impacts everything from board governance to sustainability, Stout advises that setting clear key performance indicators (KPIs) and goals are critical to getting buy-in, measuring success, and making meaningful change. Getting started doesn’t have to be a big ask, either. He suggests going after the lowhanging fruit first to start building internal frameworks for gathering data. “You have direct control over your energy use, and how your electricity is generated. So that can be your first destination to visit,” Stout says. “From there, you can visit your value chain.”

“As a company, we’re setting up milestones and KPIs that we want to achieve in order to be both more sustainable and inclusive, from the way we run our business to the way we hire new colleagues,” Rust shares as an example.

Point being, your milestones and KPIs must be informed by data, so it’s important that you understand where the data originates, where it lives, and how it’s collected, managed, and interpreted.

“Not knowing where your data is leads to inconsistent, inaccurate, and poor reporting. You can only improve your ESG roadmap and performance over time if you get command of your data,” Jacobs stresses.

“It’s important to not only set and track big milestones—for example, being carbon neutral by 2030—but to also focus on an engagement plan that allows you to follow through,” Rust says.

“While large, ambitious goals are typically the most publicized parts of an organization’s ESG strategy, don’t overlook small changes you can implement quickly that’ll have a lasting impact on your ESG performance.”

No matter the scope, ESG-related initiatives and reporting will remain challenging for all organizations to navigate as the regulatory and social landscapes develop, and accountability will be critical, Sloan says. She suggests assigning responsibility for ESG initiatives to someone with the support of management and the board to ensure greater acceptance and accountability for success.

As we’ve already seen, many organizations put their finance leaders in the driver’s seat, banking on them using their regulatory know-how and deep insight into financial health to guide the organization toward meaningful ESG initiatives and reporting metrics that bring added value to the organization and all its stakeholders.

Sloan says ESG initiatives are a terrific opportunity for accounting and finance professionals to provide strategic value and insight. A new or deeper emphasis on ESG practices in your organization is also a positive change for all employees, as it offers a new opportunity to upskill talent, helping them to fully understand the impact of ESG initiatives, and enabling them to incorporate ESG best practices into their everyday job functions.

While navigating the road to integrating ESG concepts into daily management and internal and external reporting may seem daunting, the benefits of doing so are worth the trip. Being a more socially conscious organization will not only benefit your bottom line, you’ll also better serve the environment and society as a whole.

20 | www.icpas.org/insight

Carolyn Tang Kmet is a senior lecturer in Loyola University Chicago’s Quinlan School of Business and a frequent Insight contributor.

Jon Lokhorst, CPA, PCC Executive Leadership Coach, Lokhorst Consulting jon@lokhorstconsulting.com

Jon Lokhorst, CPA, PCC Executive Leadership Coach, Lokhorst Consulting jon@lokhorstconsulting.com

‘Enterprise Thinking’ Is Key to Your Next Promotion

Prioritizing your organization’s success over your own is a necessary step for climbing up the leadership ladder.

Are you looking to move up in your organization? Perhaps you aspire to become your firm’s managing partner or your company’s next CFO?

While it’s natural to look out for your own best interests or those of your team—thinking this is how to get ahead—this narrow-minded view only leads to the destructive formation of silos, creating internal competition that divides an organization and prevents it from moving toward its vision and goals. A true leader knows better. If you really want to make your climb to the top of the leadership ladder, you’ll need to start thinking at an enterprise level— meaning, you see the big picture and what’s best for the entire organization.

Here are a few steps you can take to help develop your enterprise thinking skills and foster a collaborative environment that brings all parts of the business together.

1. LEARN FROM DYSFUNCTIONAL LEADERSHIP

It can be a great value to first learn from the destructive behavior of others. Consider this cautionary tale of one of America’s best-known retailers, whose competitive internal environment played a pivotal role in its downfall.

Founded in 1893, Sears, Roebuck & Co., or more commonly known as Sears, eventually became one of America’s top-selling retailers. For many decades, Sears held the top spot for retail sales until Kmart surpassed them in the 1980s. Sears then fell to third place in 1990 when Walmart took the lead in total sales. And, despite Kmart purchasing Sears in 2005, forming Sears Holdings, the famous retailer continued its steady decline. In 2018, on its 125th anniversary, Sears filed for bankruptcy and is now a mere fraction of its former self.

There will be endless case studies written about the demise of Sears. They’ll address failed acquisitions, subpar innovation, bad marketing, and other strategic errors. Still, most of these studies will miss the most significant root cause of all these factors: poor leadership.

As one example, I can point to former Sears CEO Edward Lampert, who created an ultracompetitive internal environment that destroyed any chance of collaboration within the company. Rather than inspiring Sears’ numerous brands and product lines to work together, Lampert instead directed these lines to compete against each other. For example, if a division wanted to utilize IT or HR services, they were required to contract with them, giving the division the option of contracting with entities outside of the company. The appliance division was required to pay royalties to the branding division when it sold the company’s

22 | www.icpas.org/insight

LEADERSHIP MATTERS ENHANCING YOUR ABILITY TO LEAD

popular Kenmore appliances. That led them to feature other brands more prominently because they were more profitable. One former executive told a Bloomberg investigative journalist that the situation at Sears had become “dysfunctional at the highest level.”

2. PRACTICE ENTERPRISE THINKING

Avoid the trap that Sears’ leaders fell into. Enterprise thinking requires you to prioritize the organization’s overall success over your own and act and make decisions accordingly. It also requires you to develop greater influence among your peers as you lead horizontally across the organization. In essence, enterprise thinking puts you in the organization’s shoes, thinking as if you were the business personified.

Enterprise thinking creates synergy, recognizing that the entire enterprise is more likely to succeed when its parts collaborate, share resources, and support one another. In turn, each part gains from that success through increased resources, opportunities, and recognition. If you develop a reputation for driving this cycle of success, you’ll position yourself to lead at higher levels within your organization.

3. TAKE A ‘FIRST TEAM’ APPROACH

To start building your enterprise thinking skills, Patrick Lencioni, leadership speaker and author of “The Advantage: Why Organizational Health Trumps Everything Else in Business,” recommends identifying your “first team.”

What’s your first team? Lencioni puts it this way: “The team you belong to must come ahead of the team you lead: this is putting team results (i.e., organizational needs) ahead of individual agendas (i.e., the team or division you lead).”

Leaders often overlook this principle and, like what occurred at Sears, place their top priority on the team they lead. That’s understandable. After all, your team’s performance directly reflects your leadership. It’s crucial to secure resources, build your staff, and achieve your team goals. However, when you prioritize the needs of your team over the needs of the organization, that’s when those pesky silos start forming.

Recognizing your first team will help you navigate the tensions inherent in thinking at an enterprise level. Chances are that your first team is led by your boss, and the majority of the team is made up of your peers. Here are a few ways to use the first-team approach to build your enterprise thinking skills:

1. Pay attention to what the leaders one level above you are focused on. Doing so will give you an understanding of the goals and priorities at higher levels within the organization.

2. Listen to the questions and issues the leaders at your level raise. This information will help you understand the challenges in other parts of the organization and provide opportunities for you and your team to help address those challenges.

3. Summarize your observations from these meetings and conversations for your team. This practice will enable your team to see the big picture and make it easier to enlist their help as you serve the greater organization. It’ll also give your team members a jump-start in developing their enterprise thinking skills.

View your work through the lens of the entire organization by looking at the big picture and watching for opportunities to benefit the greater good rather than just your team or functional area. By developing your enterprise thinking skills, you’ll be climbing into new levels of leadership in no time.

www.icpas.org/insight | Fall 2022 23

Kristie P. Paskvan, CPA, MBA Board Director, First Women’s Bank and SmithBucklin Leadership Fellow, National Association of Corporate Directors kppaskvan10@gmail.com

The Swing to Corporations Expressing Social Stances

When determining whether to address social and political matters, corporate boards and leaders must consider the needs of all stakeholders—and have a clear process in place—before taking a stand.

Today’s consumers consider more than price when shopping for a product or service, and job candidates consider more than pay when seeking employment. Consumers and workers have seemingly evolved toward supporting brands and working for organizations that align with their values and beliefs, exhibiting a new level of social awareness.

Some experts attribute this major cultural shift over time to cutthroat business leaders who put competition and profitability above all else. Recently, I’ve been reading David Gelles’ book, “The Man Who Broke Capitalism: How Jack Welch Gutted the Heartland and Crushed the Soul of Corporate America—and How to Undo His Legacy.” As you can guess from the title, Welch, the former chairman and CEO of General Electric, known simply as GE, took a controversial approach to business. During his tenure from 1981 to 2001, Welch changed the cultural corporate climate in America, shifting the focus from growing the middle class through worker benefits and retirement plans to short-term stock performance and shareholder value.

I remember talking to a GE business manager who worked during Welch’s leadership, and he recounted that the annual incentive goal was to make your budget by any means necessary. Generally, that took the form of layoffs, intercompany sales between divisions, contracted outsourcing, buybacks, and a performance review metric whereby every year the bottom-rated 10% of employees were fired. Welch’s strategy of maximizing profits over people and acquiring competitors became a roadmap for other companies at that time.

In a review of Gelles’ book, author Kurt Andersen writes, “Welch oversaw the acquisition, on average, of one $130 million company every week for 20 years and sold a business off every two weeks.” That’s a lot for a company to absorb and manage, as well as for a board of directors to oversee from a strategy, risk, operations, and succession perspective. During those 20 years, boards then rarely found themselves taking sides in political or social matters.