In This Issue 2010: A new breed of Board Director The private life of IFRS adoption Mortgage fraud lessons learned Unclaimed property puts cash in the hand Say ‘yes’ to SaaS Boost your emotional IQ Feather your recession-hit nest NOL carryback explained Exploring the issues that shape today ’ s financial world icpas org / insight htm | February/March 2010 THE MAGAZINE OF THE all tied up by Taxes? Corporate

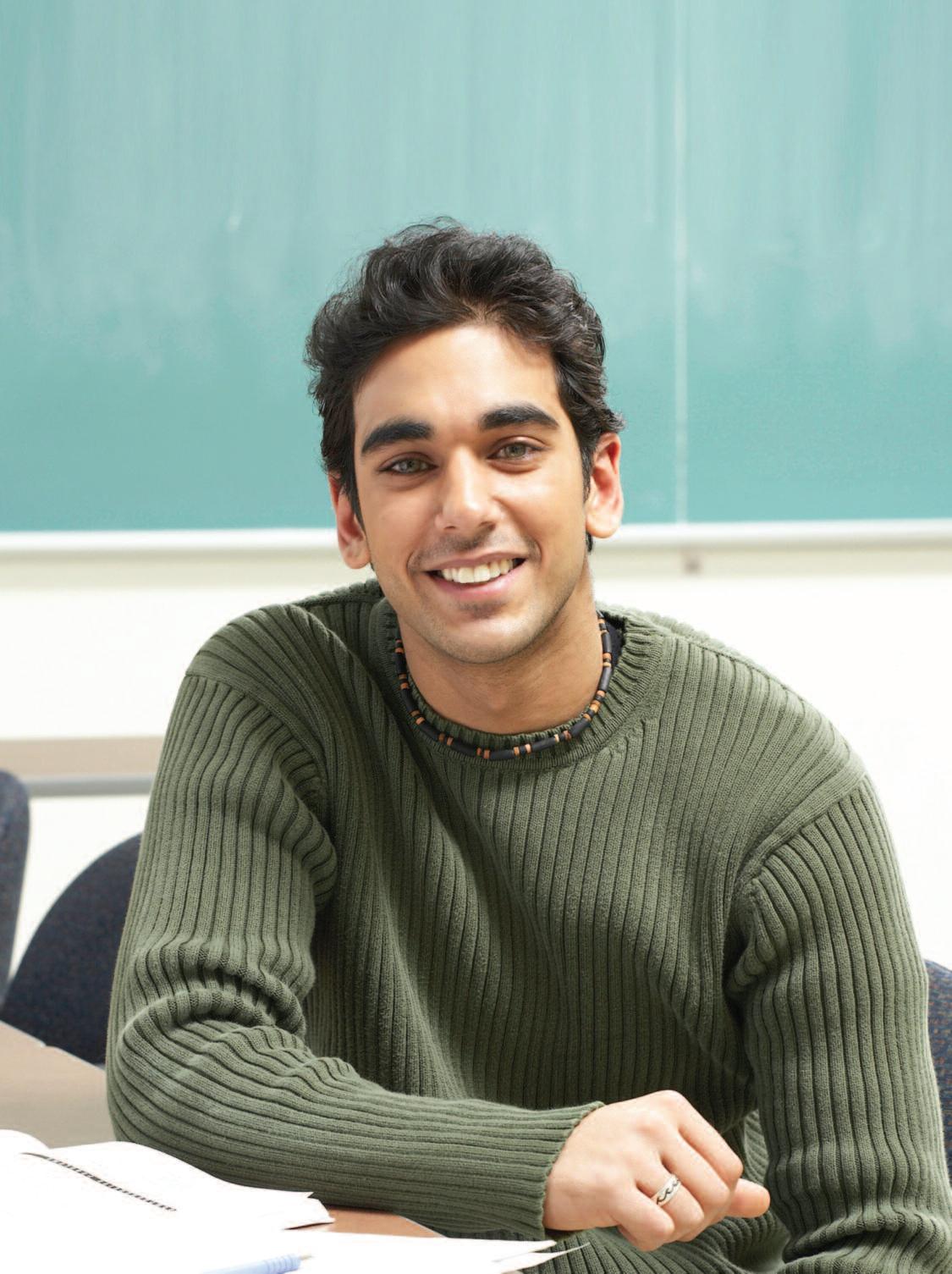

Give back to the profession that’s been good to you Your support means a great deal to me and will help me achieve my goal of becoming a CPA. THE CPA ENDOWMENT FUND OF ILLINOIS Provides Scholarships for Accounting Students | Funds Career Awareness Programs Promotes Diversity in the Profession | Develops New Leaders The CPA Endowment Fund of Illinois, working in cooperation with the Illinois CPA Society, raises philanthropic support to fund programs that nurture and sustain the CPA profession. Paving the Way for Tomorrow’s CPAs For more information or to make a tax-deductible gift: Julie Lenner, Director of Development, 312.993.0407, ext. 290 or go to www.icpas.org.

colu

26 All Tied Up

B y C a r o l yn Ta n g Are taxes handicapping corporate America?

30 The Director ’s Cut

B y K r i st i n e B l en k h o r n Ro d r i g u ez

Boards of directors traditionally take a more active role in a company ’ s story in turbulent economic times. Now is no exception.

34 This Way Please

B y N a d i r a M Sa a fi r, C PA a n d B a r r y Ja y E p st ei n , Ph D /C PA Private companies point the way to IFRS adoption

10 Fraud House of Cards

B y Sel en a C h a vi s

Mortgage fraud wreaked havoc on US real estate markets Lesson learned

12 Technology Are You Being Served?

B y D a n i el D er n

More and more small businesses are learning what SaaS can do for their mobility, productivity, IT security and budgets

16 Property Free Money

B y G Sa m u el Sc h a u n a m a n II, JD a n d C h r i st o p h er S Jen sen , C PA Unclaimed property laws put cash in the right hands

20 Investing Emotional Rescue

B y Si d n ey A B l u m , Kevi n Pa u l sen a n d Mi c h a el T h o m p so n How do emotions influence the investing public?

22 Retirement Empty Nest

B y Ma r k J Gi l b er t , C PA /PF S

Has retirement funding lost its feathers?

24 Tax Carried Away

B y H a r vey C o u st a n , C PA

A 2009 act expands and raises questions about the ability to carry back net operating losses

4 First Word

A message from the Illinois CPA Society ’ s President & CEO

5 Board Nominations

Nominations for the Illinois CPA Society ’ s Board of Directors & Officers

News bytes, sound advice and practical business tips 38

A shout out for the efforts and expertise of Illinois CPA Society members

index

Vo l 5 9 N o 5 features

FEBRUARY/MARCH 2010

m n s

regulars

6 Seen + Heard

Advertiser

Time

Classifieds 38

Index 40

+ Talent

eINSIGHT at icpas org / insight htm

Visit

Garelli

Wong and Jackson Wabash are Chicagoland’s experts in financial recruiting and staffing. Our team unites employers with the right accounting and finance talent for direct hire, temporary and consulting assignments. We look and listen beyond the job description to combine the right skills with the desired experience.

learn more about our dedication to finding the right fit, visit us on the web or call your local office. Great Clients Great Candidates Great Fit Chicago Schaumburg Oakbrook Terrace 312.583.9264 847.397.9700 630.792.1660 WWW.GARELLIWONG.COM WWW.JACKSONWABASH.COM

To

FIRST WORD

Publisher/ICPAS President & CEO Elaine Weiss, JD

Editor-in-Chief/Director of Publications Judy Giannetto

Creative Services Director Gene Levitan

Creative Services Manager Rosa Garcia

Publications Specialist Derrick Lilly

National Sales & Advertising

Angie VanGorder

The YGS Group

3650 West Market Street

York, PA 17404

Phone: 800 501 9571, ext 176

Fax: 717 825 2171

angie vangorder@theygsgroup com

Circulation/Member Services Director Ron Jankowski

Editorial Office

550 W Jackson Blvd , Suite 900 Chicago, IL 60661

Chairperson, Lee A Gould, CPA/ABV, JD, CFE, CFF Gould & Pakter Associates LLC

Vice Chairperson, Sara J Mikuta, CPA

The Leaders Bank

Secretary, Charles F G Kuyk III, CPA Crowe Horwath and Company LLP

Treasurer, Robert E Cameron, CPA Cameron Smith & Company PC

Immediate Past Chairperson, Sheldon P. Holzman, CPA, CFE, CFF

Baker Tilly Virchow Krause LLP

I C P A S B O A R D O F D I R E C TO R S

Brent A Baccus, CPA, Washington Pittman & McKeever

Therese M Bobek, CPA, PricewaterhouseCoopers LLP

William P Graf, CPA, Deloitte & Touche LLP

Reva B Steinberg, CPA, BDO

Cara C Hoffman, CPA, Blackman Kallick LLP

James P Jones, CPA, Edward Don & Company

Charlotte A Montgomery, CPA, Illinois State Museum

Elizabeth A Murphy, PhD, DePaul University

Annette M O’Connor, CPA, RR Donnelley & Sons Company

Michael J Pierce, CPA, RSM McGladrey Inc

Marian Powers, PhD, Northwestern University

Daniel F Rahill, CPA, KPMG LLP

Lawrence H Shanker, CPA, Shanker Valleau Accountants Inc

Edward H Stassen, CPA, Recycled Paper Greetings Inc

Everyday, someone’s reporting on our economic outlook Any good news is qualified w i t h w o r d s l i k e “ h o w e v e r ” a n d “ b u t ” b ec a u s e , t r u t h f u l l y, n o o n e c a n p r e d i c t t h e f u t u r e . We c a n , h o w e v e r, u s e w h a t w e ’ v e learned from the past to guide it

For more than a year now CPAs, like everyone else, have been challenged by the realities of a new financial landscape We’ve shared our experiences at Town Hall Forums and, fortunately, discovered the ability to adapt both professionally and personally. Smaller firms have found strength in flexibility Large firms have reevaluated their strategies or expanded into new and growing areas like forensics, healthcare and sustainability And everyone has a new appreciation for the old idea of networking to stay connected, better informed and alert to new opportunities.

The tools we’ve gained such as a better sense of what’s of value, flexibility and creativity, and forethought before taking action –should make us better prepared to take on both old and new issues in the months ahead IFRS may be back on track, financial reform legislation is on the horizon, tax changes like the First-time Home Buyers Tax Credit continue, and, locally, there’s voluntary disclosure of peer review results, as well as Illinois’ transition to one-tier licensing

Although taped over the summer, the people I interviewed in this year ’s Street Sense video (posted on icpas org), reveal the sheer variety of opinions on our economic conditions Is the worst over or still ahead? The bottom line, as I’ve already said, is that no one really knows where we’re headed.

Nevertheless, drawing on our skills, know-how and experience, and sharing what we’ve learned with our clients and peers, all go a long way towards getting us where we need to be.

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 23,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race,religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published six times a year, in February/March, May/June, July, August, September/October, November/December, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA , 312 993 0393 or 800 993 0393, fax: 312 993 0307 Subscription rates for non-members: $30 US, $40 Canada and international addresses, $42 Mexico Copyright © 2010 No part of the contents may be reproduced by any means without the written consent of INSIGHT Permission requests may be sent to: Publications Specialist, at the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

El ai ne W ei ss, JD

I

C P A S O F F I C E R S

A M E S S A G E F R O M T H E I L L I N O I S C PA S O C I E T Y ’ S P R E S I D E N T & C E O 4 INSIGHT icpas org/insight htm

BOARDNOMINATIONS

Charles F. G. Kuyk lll

Secretary, Board of Directors

Illinois CPA Society

550 W Jackson Blvd , Suite 900 Chicago, IL 60661

Dear Mr Kuyk:

December 3, 2009

As provided in Article V of the Illinois CPA Society's Bylaws, the Nominating Committee hereby presents its unanimous nominations for Officers, Directors and Affiliate/Public Members We are also indicating our nominee for AICPA Council State Society Representative

OFFICERS

(To hold office for one year April 1, 2010 - March 31, 2011)

Chairperson Sara J Mikuta

Vice Chairperson Robert E Cameron

Secretary Daniel F Rahill

Treasurer James P Jones

CONTINUING DIRECTORS

To succeed Lee A Gould

To succeed Sara J Mikuta

To succeed Charles F G Kuyk lll

To succeed Robert E Cameron

(To hold office for new one-year term April 1, 2010 - March 31, 2011)

Brent A Baccus, Cara C Hoffman

(To hold office for second year of a two-year term June 1, 2009 - March 31, 2011)

William P Graf, Annette M O’Connor

(To hold office second year of a three year term June 1, 2009 - March 31, 2012)

Elizabeth A Murphy, Michael J Pierce, Edward H Stassen, Reva Steinberg

NEW DIRECTORS

(To hold office for three years April 1, 2010 - March 31, 2013)

Edward J. Hannon, John A. Hepp, Geralyn R. Hurd, Leif L Jensen, J Bradley Sargent

Lee A Gould, Chairperson, becomes a Director for one year beginning April 1, 2010 to March 31, 2011, in accordance with Section 4 2 of Article IV of the Bylaws.

In accordance with Section 4.2 of Article IV of the Bylaws, an affiliate member or a representative of the public may be elected as a director.

PROFESSIONAL AFFILIATE DIRECTORS

(To hold office for one-year term April 1, 2010 - March 31, 2011)

None at this time

AICPA COUNCIL State Society Representative

(To serve for one year October 2011 – October 2012

Sara J Mikuta

RETIRING DIRECTORS

Theresa M. Bobek, Sheldon P Holzman, Charlie F G

Kuyk lll, Charlotte A Montgomery, Marian Powers, Lawrence H Shanker

All of the aforementioned nominees have consented to serve if elected

The Nominating Committee has ascertained that all nominees to be elected are qualified in accordance with the provisions of Section 4 4 of Article IV of the Bylaws, and information on nominees for the membership as required by Section 5 3 of Article V thereof, is set forth following this report (available at icpas org)

SUBMITTED BY THE NOMINATING COMMITTEE:

Daniel P Broadhurst

Debra Hopkins

Lester H McKeever Jr ,

Kimberly R Rice

Michelle M Scheffki

Joyce M Simon

Sheldon P Holzman, Chairman

Lee A. Gould, ex-officio

N O M I N AT I O N S F O R T H E I L L I N O I S C PA S O C I E T Y ’ S B O A R D O F D I R E C T O R S & O F F I C E R S

SEEN H E A R D

Finance Salary Predictions

The 2010 Salary Guides from Robert Half International [rhi com] project that businesses seeking financial professionals will offer starting salaries that reflect an average increase of 0 5 percent

Positions with the best salary increase prospects include:

n Tax Accountant: Those with one to three years of experience at large companies (more than $250 million in sales) can expect an average national starting salary of $46,500 to $61,500

n Compliance Director: Needed for compliance with SEC mandates and new regulations, and to prepare for IFRS transition, this position can expect starting salaries at a small company (up to $25 million in sales) in the range of $83,750 to $108,500.

n Credit Manager/Supervisor: Credit and collections specialists who can evaluate credit risk, manage delinquent payments and help to improve cash flow can demand base compensation between $42,500 and $57,500 in small companies

n Senior Financial Analyst: A senior financial analyst at a midsize company ($25 million to $250 million in sales) is expected to earn a starting salary of $57,750 to $74,000

Five Tech Don’ts

According to CPATrendlines com, if you ’ re only worried about your computer and network security then you ’ re still not seeing the big IT picture Here are five of the top technology areas not to be overlooked:

1.Wireless Network Connection Security: Use protection like Wired Equivalent Privacy (WEP), Wi-Fi Protected Access (WPA), WPA2, or a Virtual Private Network (VPN) When you ’ re not using your wireless connection turn it off

2 Social Media Tools: For CPAs, Facebook, Twitter and LinkedIn are too important to ignore Firms need to establish policies and integrate the use of social media into everyday work practices

3.Instant Messaging Applications: AOL, Microsoft, Google and Yahoo provide popular IM applications that can be used as effective and expedient means of internal communications

4. Mobile Phones: Many fail to embrace devices like BlackBerrys, iPhones or Smartphones What ’ s more, mobile phones are sometimes irresponsibly used to store confidential information such as client data, Social Security numbers and passwords

5 Security for Portable Media: When it comes to USB drives, SD cards and laptops, every accounting office should supply encrypted and authenticated devices

61 percen t

Per c en tage o f C F O s w h o bel i ev e c o m pan i es w i l l n o t invest in IFRS conversion readiness activities without a clear date for IFRS adoption Source: Deloitte

Get Your Firm on the Map

Google Maps Optimization (GMO) is a valuable tool for businesses looking for ways to attract new clients through the web at low or no cost

Because it attracts local consumers, GMO is a powerful compliment to other search engine optimization strategies. And unlike sponsored search engine links, listing your firm or business on Google Maps is free

In addition to increasing visibility, GMO increases your general search ranking and the overall credibility of your business

To register with Google Maps, visit Google’s Local Business Center at google com/local/add

Source: Theprogressiveaccountant com

N E W S B Y T E S , S O U N D A D V I C E A N D P R A C T I C A L B U S I N E S S T I P S

6 INSIGHT icpas org/insight htm

ARE YOU FINANCIALLY PREPARED FOR “what if”? THIS PLAN, SPECIFICALLY FOR ICPAS MEMBERS, OFFERS: A variety of options to meet your financial planning needs. Affordable group rates that remain constant for a full 10 years. Coverage ranging from $50,000 to $250,000. Spousal/domestic partner coverage also available. Member support from dedicated customer service professionals. Simplified-solutions and hassle-free enrollment. of your employment situation. Group 10-year Level Term Life Insurance sponsored by the Illinois CPA Society can help protect you and your loved ones. IT’S TIME TO REEVALUATE YOUR LIFE INSURANCE NEEDS IF . . . You’ve recently changed firms, left a firm or experienced other major life changes. Your employer offers inadequate life insurance. Your financial situation has recently changed. Your spouse or domestic partner needs coverage. SECURE YOUR FINANCIAL FUTURE AND HELP PROTECT THE ONES YOU LOVE WITH THE ICPAS GROUP 1O -YEAR LEVEL TERM LIFE INSURANCE PROGRAM. For more information, call 1-800-842-ICPA (4272) or visit www.personal-plans.com/icpas Underwritten by Hartford Life and Accident Insurance Company, Simsbury, CT 06089 AGT-1014 All benefits are subject to the terms and conditions of the pollicy. Policies underwritten by Hartford Life and Accident Company detail exclusions, limitations, reduction of benefits and terms under which the policies may be continued in force or discontinued. CA Ins. Lic. #0633005 AR Ins. Lic. #245544 d/b/a in CA Seabury & Smith Insurance Program Management 48863, 45925 ©Seabury & Smith Inc. 2010 SPECIFICALL fordableAf overageC emberM Y TEALUA ALUATEREEV REEVALUA t a firm or ’ve lef You fers our of Y ourY implified-solutionsS ourY Company pollicy , , Simsbury .

Prepare for a Comeback

According to a recent survey by Ajilon Finance Solutions [ajilon com], companies could do more to ready themselves for the economic recovery Here are tips to help finance professionals prepare for a brighter future

n Focus on Talent Management: As workloads begin to increase, it ’ s critical to ensure your firm has highquality employees ready to take those workloads on. Think about adding temporary workers to balance peak workflows and ensure your existing staff doesn’t feel overwhelmed or burnt out Recognize star performers and openly acknowledge their contributions

n Improve Information Flow: Look into Enterprise Resource Planning systems that bridge communication gaps. Ensure information is passed on quickly and accurately to support key decisions

n Take a Transformational Approach: Focus on strategic and structural improvements that create a more scalable and sustainable cost infrastructure

n Consider Partnering for New Solutions: Partnering with a company in a complimentary industry can help to spread out risk and costs, and can help you gain access to new markets.

iPhone Travel Tips

Planning an overseas business trip or vacation? Don’t come home to a sky-high iPhone bill AT&T offers these tips:

n Turn Data Roaming “Off ”

n Use WiFi instead of 3G/GPRS/EDGE; it ’ s available in most hotels, restaurants and airports

n Turn “Fetch New Data” off so you can control the flow of data to your phone

n Reset your “Data Usage Tracker ” to zero, so you can track exactly what you use

n Consider purchasing a monthly international data plan, which will significantly reduce your data usage fees while overseas Once you ’ re back on home soil you can cancel the plan if necessary.

1 out of 7

Number of midcap companies that pose a potential credit risk to their suppliers

Source: CFO Financial Benchmarks

Job Dissatisfaction on the Rise

Adecco Group North America's [adeccousa com] latest A merican Workplace Insights Survey indicates that 75 percent of workers are looking for another job in today's tightening labor market. According to the survey, companies seeking to retain their employees need to start addressing three key areas of dissatisfaction: compensation, career growth and retention efforts Specifically, the survey revealed that 66 percent of American workers are not satisfied with their compensation; 76 percent are not satisfied with future career growth opportunities at their company; and 78 percent are not satisfied with their company ' s overall retention efforts

What ’ s more, 48 percent of workers are dissatisfied with the relationship they have with their bosses, and 77 percent disprove of the strategy and vision of the company and its leadership

If you sense employee dissatisfaction within your ranks, these tips may help to boost loyalty and morale:

n Make Retention Efforts Visible: Staff won't feel valued if your efforts to retain them aren't apparent Retention efforts begin with mutual dialogue and trust building In other words, engage your employees fully

n Reward Employees and State Your Reasons: If increasing compensation isn’t possible, reward employees through an awards program or team contest Improving morale by recognizing good work can help to ease compensation complaints

n Communicate Growth Paths for Employees: Managers need to map out a growth plan for employees and communicate it to their teams in order to build confidence

S E E N + H E A R D 8 INSIGHT icpas org/insight htm

Alliant Advantage! • 24/7 toll-free personal service and automated access • Online banking with Bill Pay and eStatements • Access to more than 80,000 surcharge-free ATMs5 • Great rates on savings, Certificates, IRAs, HSAs and more • Low rate mortgage, home equity, vehicle, boat and RV loans • Free checking that pays a high rate ©2009 Alliant Credit Union. All Rights Reserved. 1 Datatrac Great Rate Awards certify that the rate offered by a financial institution’s product has consistently outperformed the market average of all institutions monitored by Datatrac during an annual or quarterly period. For more information, please visit www.greatrateaward.com. Datatrac is America’s largest interest rate database with retail deposit and/or lending rates for over 90,000 financial institution locations. Datatrac has been conducting unbiased competitive research in the banking industry for over 20 years. For more information, please visit www.datatrac.net. 2 The January 2010 Savings and IRA dividend, declared 12/03/2009, provides a Dividend Rate of 1.982% –Compounded Annual Percentage Yield of 2.00% APY. Dividends are paid on the last day of the month to accountholders who have maintained an average daily balance of $100 or more. Savings dividend is subject to change monthly. APY = Annual Percentage Yield. 3 Source: Average bank rate provided by National Association of Federal Credit Unions in cooperation with Datatrac Corp. as of 01/01/2010. 4 Savings based on Alliant’s 2.00% APY January 2010 Dividend vs. Illinois average bank savings rate of .24% APY as of 01/01/2010. 5 Alliant charges a nominal fee after eight transactions have been performed in a month at non-Alliant ATMs, including CO-OP Network, Credit Union 24 CU Here, Bank of the West, Allpoint and Alliance One ATMs. Not every Allpoint ATM is surcharge-free. Please see our online ATM Locator at www.alliantcreditunion.org for a list of ATMs that accept deposits or are surcharge-free. Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government National Credit Union Administration, a U.S. Government Agency SEG323-R01209 As an Illinois CPA Society member, you’re eligible for… Better than bank rates on savings and loans Great rates and easy access! ALLIANT REGULAR SAVINGS…MUCH BETTER THAN BANK RATES! ILLINOIS AVERAGE BANK SAVINGS 2.00 % APY2 2.00 % APY2 .24 % APY3 .24 % APY3 Sign up today for the Alliant Advantage at www.alliantcreditunion.org/ilcpa 8x earn over more on your savings with Alliant4 Datatrac certifies that Alliant’s savings account consistently outperformed the Illinois and U.S. financial market institution average for the 12-month period 4/01/2008 to 3/31/2009.1

The

House of Cards

L e ss o n l e a r n e d

By Selena Chavis

A$43 million community bank hires a mortgage loan officer to generate business for a new loan program, intended to benefit individuals with poor or no credit histories Over time, the loan officer provides credit to individuals who are using false or stolen Social Security numbers. The loan officer also accepts and generates false or questionable documents to support the loans, including false rental and utility payment histories The bank is alerted to the problem only when another institution, which is purchasing some of these loans, conducts due diligence and discovers the falsified information The result? The bank has to repurchase these loans with expectations of further exposure.

In another case, a small community bank discovers inflated appraisals on residential properties when the borrowers default on their debt. Later it determines that one of the borrowers owned the appraisal firm preparing the documents The borrowers worked in collusion with bank loan officers to finance the properties at inflated values The combined fraudulent appraised value totaled approximately $2 million After the defaults, these properties were reappraised at less than one-third of their original value

These are only two of the many examples of mortgage fraud the Federal Deposit Insurance Corporation (FDIC) cites The epidemic racked up national losses to the tune of more than $1 billion at its height in 2005

“There has been a lot of mortgage fraud in recent years that has caused significant losses to many banks,” says Charles Kuyk, a CPA and Certified Fraud Examiner with Crowe Horwath’s Financial Advisory Services. “Going forward, banks need to be aware of the typical mortgage fraud schemes and institute internal controls to prevent and detect these frauds ”

Extending well beyond mortgage fraud, the credit market collapse, which was driven

Top Scams & Schemes

Source: 2008 Financial Crimes Enforcement Network (FinCEN) report, Mortgage Loan Fraud - An Update of Trends Based Upon an Analysis of Suspicious Activity Reports [FinCEN gov]

by the real estate crisis, has severely impacted many financial institutions, says Kuyk, including Citibank, UBS and Bank of America, which together racked up well over $100 billion in losses

A n d w i t h t h e i n c r e a s e d a w a r e n e s s a n d exposure created by these losses, the numb e r o f s u s p i c i o u s a c t i v i t y r e p o r t s ( S A R s ) filed with the Financial Crimes Enforcement Network (FinCEN) has risen steadily, climbing from less than 4 percent in 2004 to 9 percent in 2008 and 2009

P u t t i n g m o r t g a g e f r a u d i n i t s h i s t o r i c a l perspective, mortgage and real estate executive Curt Novy explains that the mortgage industry evolved dramatically after the turn of the century New loan options and practices intended to make home buying easier simply got out of hand; abuses with subprime loans and property investment practices resulted

“That’s what led to this massive investment in real estate. It was very easy money,” he states. “The lending just got too liberal. People started getting into trouble, and then the whole economic cycle kicks in. It’s had devastating effects.”

F i n C E N d e f i n e s m o r t g a g e f r a u d a s a “material misrepresentation or omission of i n f o r m a t i o n w i t h t h e i n t e n t t o d e c e i v e o r

10 INSIGHT icpas org/insight htm F R A U D

M o r t g a g e f ra u d w re a ke d h avo c o n US re a l e s t a t e m a r ke t s

Misrep income/assets/debts 43% Forged/fraudulent document 28% Occupancy fraud 14% Appraisal fraud 13% ID fraud 10% Straw buyers 6% ID theft 3% Flipping 3%

mislead a lender into extending credit that likely would not be offered if the true facts were known ” Michael Pakter, a Certified F

Gould and Pakter Associates, explains that in its most basic form mortgage fraud comes down to “someone making a false statement in the application process.

“Companies need to know their borrowers,” he emphasizes “Fraud prevention happens at the point of source.”

The outcome of mortgage fraud isn’t always injury to another party, says Novy “Sometimes, when a person is investigated for an attempt to defraud, which is defined as causing injury or loss to a person by deceit, there may be no actual loss or injury to another person during the investigation. This is one of the hardest things for a person who is being investigated to comprehend It’s essential that people involved in any way in the real estate industry understand how the FBI investigates and classifies mortgage fraud, and what has and has not been deemed to be fraud ”

M o r t g a g e f r a u d f a l l s u n d e r t w o p r i m a r y c l a s s i f i c a t i o n s , s a y s Kuyk: Fraud for housing and fraud for profit

Perpetrated to obtain a house, fraud for housing tends to center on misrepresentations of employment, income, assets and debts

This type of fraud may involve forged or fraudulent documents, ID fraud and misrepresentations of the borrower ’s intent to occupy the property

M o t i v a t e d p u r e l y b y f i n a n c i a l g a i n , f r a u d f o r p r o f i t o f t e n involves a number of players, including straw buyers, mortgage brokers, real estate agents, appraisers and settlement agents, with t h e f o c u s b e i n g i n f l a t e d a p p r a i s a l s , a n u n d i s c l o s e d o r f a l s i f i e d owner or a falsified intent to occupy the property

While the vast majority of mortgage fraud involves misrepresentations of income, assets and debt during the application process, many other schemes have received their fair share of media attention. For one, there’s “flipping,” or the selling of a property at a low price, only to have it quickly improved (or simply dressed up) and put back on the market at an inflated price based on an inflated appraisal The property is then resold to a buyer who is unaware of the inflated price, and the income is pocketed The bank is ultimately left with a mortgage that is equal to more than the property’s fair market value

“Ba nk s we re n’t look ing a t this v e ry c lose ly,” Nov y a c k nowledges “It was all about making money and everyone winning ”

Another common scheme involves a straw buyer, where someone other than the real buyer provides a stronger credit profile and assists with getting a bigger loan The straw buyer receives a kickback, and the financial institution is left holding a high-risk mortgage.

“Equity skimming” is also a popular scheme, and involves an investor using a straw buyer, false income documents or a false credit report to obtain a loan in the straw buyer's name Subsequent to closing, the straw buyer signs the property over to the investor in a “quit claim deed,” which relinquishes all rights to the property and provides no guaranty of title The investor doesn’t make any mortgage payments and rents the property until foreclosure takes place several months later

“It’s easy to make a quick $200 or $300 by putting together a statement that a person is employed or involved in a particular activity,” Novy cautions “Finance professionals need to have full knowledge of their clients and their businesses. In terms of liability, there’s always that potential Investigations are looking at all parties involved.”

Information & Research Center An exclusive benefit of your Illinois CPA Society membership. Short on time… Short on staff… let us do the research for you. Wish you could spend more time actually serving your company’s or clients’ needs and less time researching them? Now you can. >Research by Professional Librarians >Lending Library and Online Catalog >Informal Consultation with Colleagues Contact Us Phone: 800.993.0407, ext. 226 Direct: 312.601.4613 Fax: 312.906.8045 Email: research@icpas.org Online: www.icpas.org icpas org / insight htm FEBRUARY/MARCH 2010 11

r a u d E x a m i n e r a n d m a n a g i n g m e m b e r w i t h C h i c a g o - b a s e d

Are You Being Served?

By Daniel Dern

For companies of all sizes, SaaS, or S o f t w a r e - a s - a - S e r v i c e , i s a r a p i d l y growing software alternative

"SaaS is a new generation of web-based business applications that can be acquired via the Internet on a subscription basis, and can be accessed by multiple users simultaneously, so they can more easily collaborate and coordinate their activities," says Jeffrey M Kaplan, managing director of THINKstrategies, Inc , a strategic consulting firm

In other words, the software is on the provider's servers, not on your desktop, notebook, or server computers and can even be accessed from a BlackBerry, iPhone or other mobile device. The data is stored with the SaaS vendor or their third-party data center. And you pay for using the service, much as you would for using a utility

"We use SaaS for CS Professional Suite f r o m T h o m s o n R e u t e r s , " e x p l a i n s J o d y L Padar CPA/MST at James J Matousek CPA, L t d I n M o u n t P r o s p e c t , I l l " We p a y a m o n t h l y f e e a n d h a v e a c c e s s t o a l l t h e i r u p d a t e d p r o g r a m s o n l i n e I l o g i n t o m y ' d e s k t o p i n t h e s k y ' a n d d o a l l m y w o r k . And they're storing all our data, including our email, and our Word and Excel documents. Now all I need is a browser and an Internet connection, and all our data and software is accessible "

SaaS Benefits

From a technology perspective, SaaS is part i c u l a r l y b e n e f i c i a l t o s m a l l e r c o m p a n i e s with limited onsite IT expertise, and those companies that want to minimize their IT s t a f f i n g a n d i n v e s t m e n t s . B y u s i n g S a a S , companies no longer have to worry about insta lling a nd a dministe ring softwa re a nd associated servers, or storing and maintaining data

"The anywhere, anytime access to data and the software is the main difference," states Heather Kirkby, product and market-

12 INSIGHT icpas org/insight htm T E C H N O LO G Y

M o re a n d m o re s m a l l b u s i n e ss e s a re l e a r n i n g w h a t S a a S c a n d o fo r t h e i r m o b i l i t y, p ro d u c t i v i t y, I T s e c u r i t y a n d b u d g e t s

Volunteer for an Illinois CPA Society Appointed Committee or Task Force

Use your skills, knowledge and leadership to help govern and guide the work of your Illinois CPA Society.

From developing new member services, to upholding quality assurance standards, to responding to technical issues, your service helps to enhance the value of the CPA profession.

Committee & Task Force service is open to all Illinois CPA Society regular and affiliate members. Positions are limited and all requests may not be able to be accommodated.

Visit www.icpas.org/GetInvolved.htm for full descriptions and to apply. Applications due March 15, 2010

Questions:

Please contact Kimberly Johnson at 800-993-0407, ext. 220

Committee & Task Force Opportunities:

Professional Practice

> Not-For-Profit Organizations

> Regulation & Legislation

> Taxation - Business

> Taxation - Estate, Gift & Trusts

> Taxation - Flow-Through Entities

> Taxation - Individual

> Taxation - Practice & Procedures

> Taxation - State & Local

Quality Assurance & Public Protection

> Accounting Principles *

> Audit & Assurance Services *

> Ethics*

> Governmental Accounting Executive*

> Governmental Report Review

> Peer Review Report Acceptance*

Programs/Special Issues

> CPA Exam Award Task Force

> Outstanding Educator Award Task Force

> Outstanding Leadership In Advancing Diversity Award Task Force

> Women’s Executive

> Women’s Initiatives Task Force

> Young Professionals Group

Education

> Conference Planning

Society Operations

> Committee Structure & Volunteerism Task Force

> Finance & Treasury Management

We need you at the table.

= Young professionals are encouraged to apply. * Indicates Senior Committee.

Advice for Newbies

Before you leap into SaaS and a specific vendor, here are some helpful hints

Understand the Selection Process "Write down your business requirements and priorities,” suggests Intacct's Druker “ To find the solution that best solves your business problem, you have to know what your business is Make an RFP (request for proposal), do a demo and a trial Look for happy clients and references, and find out about support Also check out the company ' s operational record as a cloud vendor " In other words, the company ’ s record as a vendor for cloud computing, or computing involving scalable and usually virtualized resources that are offered as a service over the web

Don’t Underestimate The Value of Credentials "Check to make sure the SaaS provider is properly certified," states THINKstrategies'

Kaplan There are two types of certification to look for, he adds: PCI DSS (Payment Card Industry Data Security Standard) and SAS70 (an auditing standard developed by the AICPA, “representing that a service organization has been through an in- depth audit of their control objectives and control activities,” according to sas70 com ) Note that these are security and process management standards, respectively, not SaaS - specific credentials

Put SaaS in Perspective. Don’t avoid Software as a Service simply because it's unfamiliar to you or seems like a radical departure from your previous methods "SaaS is mature and becoming mainstream," says Kaplan "And SaaS will become even more so, not just because it's becoming more advanced from a business model standpoint, but because the new generation workforce has been brought up on the web and is comfortable using web-based apps "

ing leader for QuickBooks Online. "You may be traveling, have multiple locations, but you can still work with your accountants With SaaS, an accountant no longer even needs to bring a laptop along, as long as they have access to an Internet-enabled computer.”

"Our research with the AICPA shows a 50-percent productivity i m p r o v e m e n t f o r a c c o u n t i n g f i r m s t h a t s w i t c h t o S a a S p l u s roughly a doubling in proactive consultation hours," says Daniel Druker, Senior VP at Intacct [intacct com] "And firms can serve around 10 percent more clients with the same staff, by reducing time for travel and error fixing "

SaaS also enhances collaborative capabilities, enabling CPAs and clients to exchange files and work on current data for business intelligence, reporting and other purposes.

SaaS Leaders

Among the country’s leading SaaS accounting/business software p r o v i d e r s a r e C C H , F i n a n c i a l F o rc e , I n t a c c t , I n t u i t , N e t S u i t e , Peachtree and Thomson Reuters familiar names in the accounting technology world

A c c o u n t i n g a n d b u s i n e s s S a a S o f f e r i n g s f r o m C C H [ t a x c c hgroup.com], for example, include income tax, document management and other workflow tools, as well as information pertaining to tax and accounting workloads. Components of its ProSystem fx suite include Portal (for exchanging data with clients), Document (for document management), Workstream (workflow and notification) and Practice (time and billing, et cetera).

FinancialForce [FinancialForce com] provides "a unified multidimensional multiledger financial accounting system that users can split into ledgers based on what a business needs to do," explains Jeremy Roche, chairman and CEO "For example, an AP/AR ledger, or a ledger for people, projects sales, shipping, et cetera."

While FinancialForce applications provide broad accounting capabilities, they also link to other line-of-business applications so that data won’t need to be re-entered "FinancialForce applications

Intacct focuses on "the core accounting and financial applications," says Druker. And, indeed, the company’s client list speaks for itself: Intacct has been selected by the AICPA and its subsidiary CPA2Biz as "its preferred provider of financial applications "

"We have two products," Druker explains "Intacct Accountant Edition is for accounting firms, for working with their clients, providing the accounting application used simultaneously via the net both by you and your clients, so both of you can collaborate on the same financial data at the same time Intacct Accountant Edition is used by CPA firms to serve small-business clients with 5 to 100 employees. Here, the CPA firm is in control in terms of determining how the system works and who has access "

Intacct's second offering, simply called Intacct, is "for businesses that have outgrown QuickBooks or as a direct replacement for mid-market on-premises applications like those from Microsoft or Sage," says Druker "Intacct is typically used by companies with 25 to 1,000 employees Their accounting firms and auditors can just login as users Here, the business owns the system and controls who gets access."

Household name Intuit [intuit.com] offers many of its well-known accounting and business programs for installation or for access via the web In fact, the company's Connected Services represented 57 percent of its FY 2009 revenues Today, Intuit has a number of online services relevant to accounting, including QuickBooks Online, ProLine Tax Online, and Intuit Online Payroll for Accountants

Yet another well-known SaaS provider, NetSuite [netsuite com] offers SaaS-only software, and is, according to Craig Sullivan, VP of International Products, "A business management suite, encompassing all the functions you need to run your business, including

, marketing, lead generation, prospecting, etc), ERP (accounting, f i n a n c e , i n v e n t o r y a n d p r o d u c t i o n m a n a g e m e n t ) , a n d e C o m -

14 INSIGHT icpas org/insight htm T E C H N O LO G Y

a r e 1 0 0 p e rc e n t b u i l t o n t o p o f S a l e s F o rc e . c o m ' s p l a t f o r m , s o financial and business-critical information can be automatically available to finance and non-finance users alike," says Roche

C R M ( s a l e s f o rc e a u t o m a t i o n , c u s t o m e r s u p p o r t m a n a g e m e n t

m e rc e , w h i c h r e q u i r e s i n t e g r a t i o n i n t o t h e E R P a n d w h i c h w e have, right out of the box."

NetSuite provides targeted industry offerings for software, wholesale distribution/physical goods spaces and, recently, professional services and service management typically small and mid-market companies, with anywhere from 20 to 1,000 employees, and divisions of large enterprises.

Peachtree [Peachtree com] has a two-pronged SaaS approach: SaaS-based offerings that integrate with existing desktop products, and a standalone SaaS strategy, including invoicing/billing application BillingBoss, which "includes a click-on link to an online portal where a small business’ customers can pay them via credit card, PayPal, or other means," says Connie Certusi, general manager, Small Business Accounting Solutions, for Sage North America,

Also, says Certusi, "Our ePeachtree is available on the web It p r o v i d e s b a s i c a c c o u n t i n g , f i n a n c i a l m a n a g e m e n t a n d p a y r o l l functionality via an SaaS delivery model "

Last but not least, Thomson Reuters' SaaS for CS Professional Suite [cs thomsonreuters com/saascs], which we mentioned earlier, includes roughly a dozen applications, such as UltraTax CS, Accounting CS, Practice CS and FileCabinet CS.

"Our customers are public accountants and tax practitioners," explains Matt Jagst, product manager, Tax & Accounting. “One distinctive aspect,” he notes, “is the per-user role-based pricing ”

For a growing number of firms, Software as a Service is easing IT loads, and taking the often intimidating side of business technology out of top management’s day-to-day realm of responsibility

There are many ways to make a deal work and we have tried them all at one time or another. Our reservoir of experience will serve you well, whether you are an owner gettingwhat you deserve for your practice or a buyer seeking a new adventure. Accounting PracticeSales is always working for you. Call Trent Holmes today and let’s talk. 1.800.937.0249 trent@accountingpracticesales.com

adside Assistance s avai able anywhere n the U.S and Canada. W th the purchase of our optional Tow ng & Labor coverage, the cost of towing is covered, subject to policy im ts.

Coverage provided and underwritten by Liberty Mutua Insurance Company and ts affi iates, 175 Berkeley Street, Boston, MA. A consumer report from a consumer reporting agency and/or a motor vehicle report, on all dr vers listed on your pol cy, may be obtained where state laws and regu a ions allow. Please consult a Liberty Mutual specia ist

Help when you need it with 24/7 Enhanced Emergency Roadside Assistance** and 24-hour claims service A multi-policy discount on your home when you insure both your car and home through Group Savings Plus Get More. Save More. Find out just how much more today. • Call 1-800-835-0894 an d m ent i on client #3408 • Go to www.libertymutual.com/ilcpa • Or visit a Liberty Mutual office near you Th s organiza ion receives financia support for allow ng Liberty Mutual to offer this auto and home nsurance program.

Discounts and savings are avai able where state aws and regu at ons allow, and may vary by state. To the extent permitted by aw, applicants are ndividually underwritten; except n Massachusetts, not all appl cants may qual fy. **Emergency Ro

*

for speci ic details. ©2008 Liberty Mutua Insurance Company. All Rights Reserved AUTO HOME With Group Savings Plus®, Illinois CPA Society members can get more from their auto and home insurance. Extra savings on auto and home insurance with a special group discount* icpas org / insight htm FEBRUARY/MARCH 2010 15

Visit www.AccountingPracticeSales.com to view current listings NORTH AMERICA'S LEADER IN PRACTICE SALES We Can Make That Deal for You. Good News Good News

Free Money

U n c l a i m e

d p ro p e r t y l a w s p u t c a s h i n t h e r i g h t h a n d s

By G. Samuel Schaunaman II, JD and Christopher S. Jensen, CPA

According to The Wall Street Journal, Illinois collected approximately $226 million in unclaimed property in fiscal 2006, and held about $1.7 billion in unclaimed property as of June 2006 “The 50 states collectively held roughly $35 billion in unclaimed property as of June 2006,” the publication explained

The Illinois State Treasurer [treasurer il gov] defines unclaimed property as “money o r a s s e t s t h a t h a v e b e e n s e p a r a t e d f r o m their owner for at least 5 years ” Generally s p e a k i n g , u n c l a i m e d p r o p e r t y h a s f o u r characteristics:

1. It is intangible personal property, such as uncashed checks, outstanding customer credit balances and unclaimed stock certificates (Note, though, that many states claim a few limited types of tangible personal property, such as the contents of safe deposit boxes )

2. The whereabouts of the apparent owner is unknown

3. The property has remained unclaimed for a prescribed “dormancy” or “abandonment period.”

4 The holder owes a “fixed and certain obligation” to the owner

I f u n c l a i m e d p r o p e r t y i s i n d e e d b e i n g held, determine which jurisdiction is entitled to receive the funds Under the rules of j u r i s d i c t i o n ( w h i c h w e r e p r o m u l g a t e d b y the US Supreme Court in the seminal case Te x a s v N e w J e r s e y ) , t h e s t a t e o f t h e o w n e r ’s l a s t - k n o w n a d d r e s s h a s t h e f i r s t r i g h t t o c l a i m t h e p r o p e r t y I f t h e h o l d e r doesn’t have the last-known address, then t h e s t a t e o f t h e h o l d e r ’s “ d o m i c i l e ” c a n c l a i m t h e p r o p e r t y U n d e r t h e 1 9 9 5 U n iform Unclaimed Property Act, the holder ’s d o m i c i l e i s d e f i n e d a s “ t h e s t a t e o f t h e h o l d e r ’s i n c o r p o r a t i o n f o r c o r p o r a t i o n s , and principal place of business for holders other than corporations ” While seemingly s t r a i g h t f o r w a r d , d e f i n i t i o n s o f d o m i c i l e vary according to jurisdiction

Unclaimed property audits have increased significantly in recent years, due in part to low rates of compliance with the law, as well as state budget shortfalls Triggers for a u d i t s m a y i n c l u d e m e rg e r s a n d a c q u i s itions, increased publicity about a company, c o m p a n y s i z e , i n v o l v e m e n t i n a s p e c i f i c industry or possession of certain property t y p e s , f i l i n g r e p o r t s w i t h o u t t h e r e q u i s i t e i n d u s t r y p r o p e r t y t y p e s ( f o r e x a m p l e , o i l a n d g a s c o m p a n i e s f a i l i n g t o r e p o r t uncashed royalty payments), and even the filing of zero (or negative) reports.

W h a t s e t s u n c l a i m e d p r o p e r t y c o m p l iance apart is the fact that, generally, there i s n o s t a t u t e o f l i m i t a t i o n s f o r p o t e n t i a l l y reportable unclaimed property This means that, unlike a tax audit, unclaimed property audits in some states can reach back more than 20 years Amounts deemed immaterial i n a n y g i v e n y e a r t h e r e f o r e c a n b e c o m e material, given the cumulative effect of the unclaimed property audit liability (as well as penalty and interest assessments) over a 5-, 15-, or even 20-year period

In terms of the Illinois Uniform Disposition of Unclaimed Property Act, CPAs need to be familiar with three areas: Key provis i o n s , r e p o r t i n g a n d r e m i t t a n c e r e q u i r ements, and exempt property types

16 INSIGHT icpas org/insight htm P R O P E R T Y

keep your career on track

[in

today’s job market]

Key Provisions

The Illinois Uniform Disposition of Unclaimed Property Act is broad in scope, and several sections detail the types of property covered For example, the Act defines “reportable property” as “property, tangible or intangible, presumed abandoned under the Act that must be appropriately and timely reported to the Office of the State Treasurer under this Act ” [765 ILCS 1025/1, Sec 1(l) ]

The breadth of categories is expansive In fact, the Instructions for Filing the Annual Report and Annual Remittance Detail of Unclaimed Property (Reporting Instructions) on the Illinois State Treasurer website lists approximately 100 unclaimed property categories (“reportable abandoned property”), including “inactive savings and checking accounts, unpaid wages or commissions, stocks, bonds and mutual funds, money orders and bill overpayments, paidup life insurance policies, and safe deposit box contents ”

Reporting & Remittance

A l m o s t a l l h o l d e r t y p e s a r e c o v e r e d u n d e r t h e A c t ’s r e p o r t i n g r e q u i r e m e n t s . T h e A c t c o n t a i n s a b r o a d d e f i n i t i o n o f t h e t e r m “holder” as “any person in possession of property subject to this Act belonging to another, or who is trustee in case of a trust, or is indebted to another on an obligation subject to this Act.” [765 ILCS 1025/1, Sec.1(d).] “Person” is defined as “any individual, business association, financial organization, government or political subdivision or agency, public authority, estate, trust, or any other legal or commercial entity.”

The Reporting Instructions indicate that the annual report is due on May 1 for life insurance companies, business associations and utilities, and on November 1 for banking and financial organizations, insurance companies other than life insurance companies, and government entities.

In terms of the reporting process itself, the Act allows amounts due to owne rs tha t indiv idua lly a mount to le ss tha n $25 to be reported in the aggregate According to the Reporting Instructions, Illinois requires holders to file a negative or zero report, and, like most other states, requires missing owners to be notified before their property is reported to the State Treasurer

The Reporting Instructions also indicate that, “If the holder has not communicated with the owner at his last-known address at least 120 days before the deadline for filing the annual report, the holder shall mail, at least 60 days before that deadline, a letter by first-class mail to the owner at his last-known address if any address not shown to be inaccurate is known to the holder ” The instructions further state that, “No contact (is) required on accounts less than $10 ”

Exempt Property

There are, however, several property types that are exempt A “limited exemption,” for example, exists for certain gift certificates and gift cards According to the Illinois State Treasurer, “Gift certificates and gift cards are required to be turned over as unclaimed property if they have expiration dates or service fees If an expiration date is specified, the balance is presumed abandoned 5 years from the date of purchase If they are rechargeable, they are considered abandoned 5 years from the date of the last owner-initiated transaction ”

Furthermore, gift certificates or cards that were issued prior to “

f t h i s a m e n d a t o r y A c t o f t h e 9 3 r d G e n e r a l Assembly” generally will qualify for exemption if “it is the policy and practice of the issuer of the gift certificate or gift card to honor

the gift certificate or gift card after its expiration date” and “it is the policy and practice of the issuer of the gift certificate or gift card to eliminate all post-sale charges and fees, and the issuer posts written notice of the policy and practice at locations where the issuer sells gift certificates or gift cards ” [765 ILCS 1025/10 6; see also P.A. 93-945, Sec. 5, eff. Jan. 1, 2005.]

Illinois also has enacted a statutory business-to-business exemption effective March 23, 2000, whereby amounts held for missing business associations are exempt from being reported and remitted as unclaimed property Specifically, the provision states that, “any property due or owed by a business association to or for the benefit of another business association resulting from a transaction occurring in the normal and ordinary course of business shall be exempt from the provisions of the Act ” [765 ILCS 1025/2a(b) ] The term “business association” is defined as “any corporation, joint stock company, business trust, partnership, or any association, limited liability company, or other business entity consisting of one or more persons, whether for profit or not for profit.” [765 ILCS 1025/1(b).]

What’s more, a leading Illinois Federal court case, Commonwealth Edison Co v Vega, ruled that unclaimed amounts emanating from an ERISA-covered pension plan need not be turned over to the State Treasurer as unclaimed property, due to federal pension law (ERISA) preemption

So how can you minimize risk and ensure compliance with the law? The easy answer is to establish an unclaimed property program, the vital elements of which include:

n Identifying Unclaimed Property Exposure. Conducting a thorough review of a company’s books and records will help to identify and perform any required due diligence. If left unresolved, report any outstanding unclaimed property liability to the proper jurisdiction

n U n d e r s t a n d i n g S t a t e Vo l u n t a r y C o m p l i a n c e I n i t i a t i v e s Become familiar with state unclaimed property voluntary disclosure programs or amnesty initiatives

n Setting the Tone at the Top. Integrate unclaimed property policies into the corporate culture. The policy should be rolled out by an appropriate management representative and disseminated throughout the organization

n Developing and Implementing Detailed Procedures. Also retain records in accordance with state law provisions and educate staff in unclaimed property procedures.

n Conducting Regular Internal Audits. This will confirm that the policy and procedures are effective

n Forming an Unclaimed Property Committee. Creating this committee is integral to the success of any compliance initiative It should consist of various c-suite leaders and management executives.

Unclaimed property is a key revenue source for the states, and, u n d e r s t a n d a b l y, e n f o rc e m e n t e f f o r t s c o n t i n u e F o r C PA s t h i s means an opportunity to enhance a company’s compliance and e n s u r e t h e p r o p e r p r o c e d u r e s a r e i n p l a c e f o r i d e n t i f y i n g a n d r e p o r t i n g u n c l a i m e d p r o p e r t y I t a l s o m e a n s t h e o p p o r t u n i t y t o assess whether a company’s financial statements accurately reflect its potential unclaimed property exposure.

G Samuel Schaunaman II, JD [ sam schaunaman@thomsonreuters com]

i s a seni or manager of Uncl ai med Property at Thomson Reuters Chri stopher S Jensen, CPA [ chri stopher j ensen@thomsonreuters com]

i s a seni or consul tant of Uncl ai med Property at Thomson Reuters

18 INSIGHT icpas org/insight htm

e c t i v e

t h e e f f

d a t e o

P R O P E R T Y

member buying advantage program save mney

on the products and services you use every day.

NEW! Accept more payments, lower processing costs and build your business with a card processing program from Bank of America Merchant Services. Be sure to mention promo code ILCPA01. Phone: Mike Gallagher at 773.293.7259

Competitive loan rates and dividends, and access to a diverse line of products and services.

Phone: 800.328.1935 Web: www.alliantcreditunion.org/ilcpa

Earn points and get rewards you want, with a no annual fee Platinum Plus MasterCard.

Phone: 866.438.6262 Apply Online: www.bankofamerica.com/creditcards

$300 discount on one full four-part Becker CPA Review course. Phone: 800.868.3900 Web: www.becker.com.

30% member discount on tax and accounting books.

Email: http://tax.cchgroup.com/members/icpas (Enter member discount code: Y6202)

Complete administration of 125 Cafeteria Plan. 10% off of enrollment and administrative fees.

Phone: 800.422.4661, press 7

Provides effective and ethical solutions for collecting debts and improving cash flow.

Phone: 800.279.3511 Web: www.icmemberbenefits.com

30% discount (up to $420 in savings) on real-time, interactive Online Review Courses or Self-Study Online Review Courses. Discount applicable to multiple or single section purchases.

Phone: 800.CPA.2DAY (Use code: ICPASKAP)

Up to 15% off on auto insurance and 10% on home insurance. Call today for your no-obligation rate quote! Be sure to mention group #3408.

Phone: 800.835.0894

Special group discounts on life, disability, major medical and liability plans.

Phone: 800.323.2106 (liability) or 800.842.ICPA (medical & life plans)

Discounts on products and services. Phone: 800.325.7000

Offering more than 65,000 products at competitive prices.

Phone: Wanda Brooks at 708.969.5355 | Email: wbrooks@warehousedirect.com

A BENEFIT OF YOUR ILLINOIS CPA SOCIETY MEMBERSHIP

Emotional Rescue

H ow d o e m o t i o n s i n f l u e n c e t h e i n ve s t i n g p u b l i c ?

By Sidney A . Blum, Kevin Paulsen and Michael Thompson

Ask anyone about their financial goals, and you get a glimpse into not only the way they spend their money, but also something far more personal how they see themselves Financial planning is inextricably linked to emotion positive emotions when returns are high, negative emotions when returns are low.

Emotional intelligence is a learned skill, hinging on the concept of four basic emotions glad, sad, mad and scared that guide our actions and decisions These emotions determine just how risk averse a client will be

A s w e s a i d , p e o p l e r e a c t emotionally to market downturns. The first emotion to hit t h e m m a y b e f e a r ( s c a r e d ) , followed by anger (mad) and dejection (sad). When a pers o n i s e x p e r i e n c i n g t h e s e emotions, it’s all too easy to lose perspective, focusing too c l o s e l y o n s h o r t - t e r m s a l v e s that may have a negative impact in the long term

At the other end of the spectrum, when there’s a market upturn, optimism reigns so much so that investors may be lulled into the belief that things will always be this good They’re so caught up in their euphoria (glad) that they lose sight of their underlying strategy and goals, perhaps even buying shares that are, in fact, overpriced.

Furthermore, pulling out of the market to protect temporary downside losses in value means not participating in the upside, which eventually will come around From the major d o w n t u r n i n t h e s p r i n g o f 2009 to the fall of 2009, for

example, the market recovered better than 3 5 p e rc e n t T h o s e w h o p u l l e d o u t o f t h e market and stayed out missed out.

People also lose sight of the fact that fund investments are made in actual companies, some of which survive and some of which fail. There are no guarantees when it comes to return on investment That said, a certain amount of volatility is normal, and, in fact, it’s the price we pay for the opportunity to earn a higher return than “safe” investments would give us

And how safe are safe investments, anyw a y ? I f t h e y ’ r e e a r n i n g 1 p e r c e n t w h i l e i n f l a t i o n i s r u n n i n g a t 3 p e r c e n t , y o u ’ r e losing purchasing power A bucket with a slow leak will still end up empty.

H o w d o e s a n a d v i s o r h e l p t o k e e p i n v e s t o r s f o c u s e d o n t h e r i g h t s t r a t e g y, rather than reacting emotionally to market c o n d i t i o n s ? T h e a n s w e r i s t o g i v e t h e m perspective Markets tend to return to the n o r m , w h a t e v e r t h e c u r r e n t d o w n t u r n M a r k e t c o n d i t i o n s a r e f l u i d a n d a s s u c h s u b j e c t t o c h a n g e T h i s s e n s e o f n a t u r a l and cyclical ebb and flow brings with it a s e n s e o f e m o t i o n a l s t a b i l i t y t h a t a l l o w s investors to make studied rather than reactionary financial decisions After all, it’s far m o r e p r o d u c t i v e t o k e e p y o u r e y e s o n your goal, not on the dollar value of your portfolio In the end, your net worth is not the same as your self-worth

Sidney A. Blum, CFP®/ CPA / PFS / ChFC, a practicing CPA since 1975 and a member of the Illinois CPA Society, is the founder of GreatLight Fee Only Advisors, LLC (GLFOA) in Chicago Kevin Paulsen, CFP®/ RPA, a member of the GLFOA team, is an expert in executive deferred compensation and consults on life, disability and long-term care insurances Michael Thompson, Ph D , CEC/ CEIC holds a doctorate in Clinical Psychology and is a frequent lecturer and speaker on the topic of emotional intelligence

20 INSIGHT icpas org/insight htm I N V E S T I N G

For further information or to register, call 800.993.0393 or visit www.CCFLinfo.org. March 18, 2010 | Rosemont, IL March 19, 2010 | Carmel, IN $325 members / $395 non-members Receive 8 CPE Credit Hours Featuring Innovative Sessions on: > Economic Outlook for 2010 > Top New Technologies > Accounting Update for Corporate Finance Professionals > Emerging Trends for Retaining and Engaging Workforce Talent > Cost Control and Reduction Strategies > Effective Cash Management controllers conference

Empty Nest

H a s re t i re m e n t f u n d i n g l o s t i t s f e a t h e rs ?

By Mark J. Gilbert, CPA/PFS

Th e l a s t 1 8 m o n t h s h a v e l e f t t h e investing public scared, worried and angry Many more people now reco g n i z e t h e u n c e r t a i n t y o f t h e i r f i n a n c i a l f u t u r e s T h e i r n e s t e g g s a r e s m a l l e r a n d they’ve got far less job security than before the economic crisis hit The Great Recession has seen the highest unemployment rates in a generation, meaning that workers are contributing less to their 401(k)-type accounts

W h a t ’s m o r e , r e t i r e m e n t a c c o u n t s h a v e b e e n t a p p e d b y p r e - r e t i r e e s w h o ’ v e l o s t their jobs or are under-employed and have no other option

The downside of a smaller nest egg isn’t s i m p l y l e s s m o n e y a t r e t i r e m e n t M a n y investors now have a lower investment risk tolerance and a stronger desire to hold large amounts of low-yielding cash. These people may be investing too conservatively in order to accomplish their long-term goals.

E v e n w o r s e , t h e y m a y h a v e g i v e n u p o n investing in the markets altogether.

True enough, virtually every major investment asset class stocks, bonds, commodities, real estate is well under the highs of 2007 and earlier Only short-term treasuries

a n d c a s h e q u i v a l e n t s l i k e m o n e y m a r k e t f u n d s h a v e k e p t i n v e s t o r s f r o m l o s i n g money But strong global market returns in 2 0 0 9 h a v e r e c o v e r e d s o m e o f t h e e a r l i e r losses, which should convince most investors of a place for at least some equities in their portfolios

T h e b r i g h t e r s i d e o f s m a l l e r r e t i r e m e n t accounts here in the United States is that personal savings apparently are up Through August, in fact, 2009 monthly savings rates varied from 3 to 6 percent, compared to 1 t o 3 p e rc e n t b e t w e e n 2 0 0 5 a n d 2 0 0 8 . I t seems that the average consumer is making a c o n s c i o u s e f f o r t t o r e d u c e s p e n d i n g . I n addition, people seem to be pursuing more r e a l i s t i c r e t i r e m e n t g o a l s , e x p e c t t o r e t i r e later, spend less once retired, work part-time rather than retiring completely, or find supplemental work

F o r C PA s , w o r k i n g w i t h t h e s e c l i e n t s p o s e s o b v i o u s c h a l l e n g e s F o r o n e , i t ’s increasingly difficult to reconcile what an investor needs with what an investor is willing to do. In other words, clients will tend t o w a n t t o i n v e s t m o r e c o n s e r v a t i v e l y because of their concerns over stock market volatility, but may face low returns that don’t meet their financial goals Many will h a v e t o l e a v e t h e i r i n v e s t m e n t c o m f o r t zones and take on more risk.

Communication is absolutely key to the a d v i s o r- c l i e n t r e l a t i o n s h i p W h e n i n v e s tment returns are high, clients won’t feel as m u c h n e e d f o r t h e i r C PA a d v i s o r ’s f e e db a c k B u t w h e n r e t u r n s f a l l , c l i e n t s w i l l w a n t e x p e r t a d v i c e t o h e l p t h e m m a k e sense of the conflicting financial and economic reports they’re hearing, and to plot t h e r i g h t c o u r s e t o w a r d s t h e i r f i n a n c i a l goals On the other end of the spectrum, h o w e v e r, c l i e n t s ’ e f f o r t s t o s c a l e b a c k o n expenses may mean that they are, in fact, less engaged with their advisors

Either way, a growing number of clients will seek out investment products that carry some type of guaranteed return or income stream While insurance products that offer s e c u r i t y h a v e b e e n a r o u n d f o r y e a r s , mutual fund companies are now developing their own line of guaranteed products

H o w s h o u l d a C PA a d v i s o r h a n d l e t h e c h a l l e n g e s o f t h e s e r e c e s s i o n - h i t c l i e n t s ?

F i r s t , p r e p a r e t h e m f o r a m u c h d i f f e r e n t financial and economic environment than they’ve experienced in the past an environment that involves lower growth, higher income taxes, and possibly higher inflation

In my opinion, to enjoy both growth and lower portfolio volatility, US-based investors will need to diversify away from predominantly US-based stocks and towards foreign equities, foreign and US bonds, and commodities

Also encourage clients to set more realistic lifestyle and retirement goals, and dis-

22 INSIGHT icpas org/insight htm R E T I R E M E N T

’ s Note

Read the first in a series of new columns on the topic of retirement, authored by ICPAS member and personal financial planning expert Mark J Gilbert

Editor

c o u r a g e t h e m f r o m i n v e s t i n g t o o c o nservatively The fact is simply that they w i l l n e e d i n v e s t m e n t g r o w t h t o o v e rcome price inflation Most people will b e n e f i t f r o m i n v e s t i n g i n g r o w t h - a n dincome-oriented portfolios, or in portfolios balanced between equity and fixed income investments.

Finally, expand your professional netw o r k I n p a r t i c u l a r, g e t t o k n o w s o m e q u a l i f i e d p e r s o n a l C PA f i n a n c i a l a d v is o r s t o w h o m y o u c a n r e f e r c l i e n t s i f t h e y n e e d m o r e h a n d s - o n o r o n g o i n g attention than you’re willing to give

Mark J Gilbert, CPA/PFS is a principal in the financial advisory firm of Reason Financial Advisors, Inc His 25-plus years of finance and accounting experience includes 13 years in personal financial planning A member of the Illinois CPA Society since 1982, Mark currently serves in the Society’s IA/PFP Member Forum Group and on its Committee on Structure and Volunteerism He can be reached at mgilbert@reasonfinancial com

upcoming events

making your life easierwww.CCFLinfo.org The

Illinois CPA Society

February 5, 2010 - Chicago, IL

Strategic Risk Management: Aligning Strategy and Performance Measures with ERM

Mark Frigo, PhD, CPA, CMA Director, The Center for Strategy, Execution and Valuation, Kellstadt Graduate School of Business, DePaul University

February 16, 2010 - Chicago, IL

February 18, 2010 - Oak Brook, IL

February 23, 2010 - Northbrook, IL

Networking Breakfast: Influencing without Authority

Steve Garrett, CPA, MBA

Principal, Garrett Consulting, Chicago, IL

March 18, 2010 - Rosemont, IL Controllers Conference

icpas org / insight htm FEBRUARY/MARCH 2010 23

Center

a service

the

for Corporate Financial Leadership is

of

Be seen by the targeted market you’re looking for… without breaking the bank. 2010 Media Kit Visit online at www.icpas.org/MediaKit.htm > INSIGHT Magazine > eINSIGHT > CCFL NewsFlash > Practice Advantage > HYPE > Midwest Accounting & Finance Showcase > Marketing & Sponsorship

By Harvey Coustan, CPA

The Homeownership and Business

A s s i s t a n c e A c t o f 2 0 0 9 g r e a t l y expands the number of taxpayers eligible to increase the carryback years for a n e t o p e r a t i n g l o s s ( N O L ) E a r l i e r i n 2 0 0 9 , t h e A m e r i c a n R e c o v e r y a n d R e i nv e s t m e n t Ta x A c t ( A R R A ) l i b e r a l i z e d t h e c a r r y b a c k p e r i o d t o t h r e e , f o u r, o r f i v e y e a r s , b u t o n l y f o r e l i g i b l e s m a l l b u s in e s s e s ( E S B s ) ( t h o s e w i t h a n n u a l g r o s s r e c e i p t s o f $ 1 5 m i l l i o n o r l e s s ) T h e Homeownership and Business Assistance Act, on the other hand, extends this elect i v e b e y o n d E S B s , t o t a x p a y e r s w h o s e annual gross receipts exceed $15 million. The language of the Act, however, has left some unanswered questions Revenue Procedure 2009-52, issued in November 2009, has answered a number of them, including when and how to elect in three situations: Taxpayers that have not claimed a deduction for an applicable NOL, taxpayers that previously claimed a deduction for an applicable NOL, and taxpayers that previously filed an election to forgo the carryback period

Ta x p a y e r s g e n e r a l l y a r e allowed to carry back NOLs to each of the two years preceding the year in which the l o s s i s s u s t a i n e d ( t h e “ l o s s year”) Certain life insurance

c o m p a n i e s a r e a l l o w e d a three-year carryback period, a n d u n d e r t h e A c t t h e s e c o m p a n i e s a r e a l s o a l l o w e d a n e x t e n d e d c a r r y b a c k period for losses from operations

In addition, after applying the NOL in those two or three years, taxpayers other t h a n l i f e i n s u r a n c e c o m p a n i e s c a n c a r r y any excess NOL to each of the 20 years

f o l l o w i n g t h e l o s s y e a r. L i f e i n s u r a n c e

companies can carry the losses forward to each of the 15 years after the loss year.

Taxpayers (including life insurance comp a n i e s ) c a n o p t t o f o rg o t h e c a r r y b a c k period and carry NOLs forward only Those that elected to forgo a carryback period for a l o s s y e a r e n d i n g b e f o r e N o v e m b e r 6 , 2 0 0 9 c a n r e v o k e t h a t e l e c t i o n b e f o r e t h e due date (including extensions) for filing a return for the last taxable year beginning in 2009 An application for a tentative carryback (“quickie”) refund on Form 1139 for corporations and Form 1045 for other taxpayers is considered timely if filed before the due date.

U n d e r t h e e a r l i e r A R R A p r o v i s i o n , a n ESB can apply an NOL in either the fifth, fourth or third year that precedes the loss y e a r E l i g i b l e l o s s e s a r e t h o s e t h e E S B i n c u r r e d i n y e a r s b e g i n n i n g o r e n d i n g i n 2008 The Act extends this benefit for NOLs sustained in a taxable year ending after calendar year 2007, and beginning before calendar year 2010.

Both the ARRA election and the election u n d e r t h e A c t g e n e r a l l y c a n b e m a d e f o r o n l y o n e t a x a b l e y e a r H o w e v e r, a n E S B that has made or makes an ARRA election can also make an election for another year, as long as the NOL was sustained in a year that falls within the stated period. To carry an NOL to the fifth preceding year, the NOL applied to that year cannot exceed 50 percent of the taxable income in that year (calc u l a t e d b e f o r e t h e N O L i s a p p l i e d ) T h e excess NOL then can be carried to taxable y e a r s a f t e r t h e f i f t h p r e c e d i n g y e a r i n chronological order.

If the NOL is a minimum tax NOL, the 5 0 - p e rc e n t l i m i t a t i o n i s s e p a r a t e l y c a l c ul a t e d o n t h e A M T t a x a b l e i n c o m e i n t h e fifth preceding year An ESB’s ARRA election is not subject to a 50-percent taxable income limitation, and TARP recipients are n o t a l l o w e d t o e l e c t t h e p r o v i s i o n c o ntained in the Act.

24 INSIGHT icpas org/insight htm TA X

Away A 20 09 a c t ex p a n d s a n d ra i s e s q u e s t i o n s a b o u t t h e a b i l i t y t o c a rr y b a c k n

Carried

e t o p e ra t i n g l o ss e s

Under the Act, the election can be made on a statement attached to the taxpayer ’s federal income tax return for the loss year. If a return has already been filed, the statement can be attached to an amended return

To qualify, the election statement must confirm that the taxpayer is electing under Internal Revenue Code Section 172(b)(1)(H) or Section 810(b)(4) (life insurance companies) under Revenue Procedure 2009-52 Also, it must indicate that the taxpayer is not a TARP recipient or, in 2008 or 2009, an affiliate of a TARP recipient. And it must specify the length of the NOL carryback period elected (3, 4, or 5 years)

T h i s e l e c t i o n s t a t e m e n t m u s t b e f i l e d w i t h t h e o r i g i n a l o r amended return for the loss year on or before the due date (including extensions) For example, a taxpayer that has filed a return for loss year calendar 2008, but has not filed a claim for a refund, can file the election statement with an amended 2008 calendar year r e t u r n , a s l o n g a s i t i s f i l e d b e f o r e t h e 2 0 0 9 c a l e n d a r y e a r r e t u r n d u e d a t e ( i n c l u d i n g e x t e n s i o n s ) A c o p y o f t h e election statement must be filed with the claim for refund for the year to which the loss is applied The due date for filing a quickie refund claim is extended to the d u e d a t e ( i n c l u d i n g e x t e n s i o n s ) f o r t h e taxpayer ’s last taxable year beginning in 2 0 0 9 o r S e p t e m b e r 1 5 , 2 0 1 0 ( i f f u l l y extended) in the example

I n l i e u o f t h i s , R e v e n u e P r o c e d u r e 2009-52 permits the election to be made i n a c l a i m f o r r e f u n d o r q u i c k i e r e f u n d application If this is the case, the statement must include the same information as that used to make the election in the loss-year return Also, it must adhere to the same due dates

W h a t ’s m o r e , t a x p a y e r s c a n r e v o k e a prior claim for refund or application for a quickie refund, unless the claim or applic a t i o n w a s m a d e u n d e r t h e A R R P E S B program. The procedures are the same as those followed by taxpayers that have not claimed deductions for applicable NOLs, with the exception that the election statem e n t m u s t c o n f i r m t h a t t h e e l e c t i o n amends a previous refund claim or carryb a c k a p p l i c a t i o n D u e d a t e s a r e a p p a re n t l y a l s o t h e s a m e . A M T N O L r e f u n d c l a i m s a r e a l s o e l i g i b l e a n d , a g a i n , t h e same rules apply

If an election has been made to forgo a carryback for an applicable NOL with a taxable year ending before November 6, 2009, the election can be revoked, and a n e l e c t i o n f o r a n e x t e n d e d c a r r y b a c k

carryback waiver and electing to apply §172(b)(1)(H) or §810(b)(4) (life insurance companies) Once again, the statement must be filed before the due date (including extensions) for the taxpayer ’s last taxable year beginning in 2009.

The process for filing for an extended NOL carryback period is straightforward, since Revenue Procedure 2009-52 is more taxpayer friendly than the guidance published for ESB refund claims under ARRA: Revenue Procedures 2009-19 or 2009-26. And although the election itself is irrevocable, the due date for making the election allows plenty of time to make an informed decision.

Harvey Coustan is an Ernst & Young retired partner. He is presently c o n s u l t i n g o n s u b s t a n t i v e t e c h n i c a l a n d p r o f e s s i o n a l s t a n d a r d s issues and has been an expert witness in a number of cases.

icpas org / insight htm FEBRUARY/MARCH 2010 25

m a d e T h e s a m e p r o c e d u r e s a r e f o l l o w e d , a n d t h e e l e c t i o n s t a t e

s r e v o k i n g a

L

m e n t m u s t c o n f i r m t h a t t h e t a x p a y e r i

n N O

26 INSIGHT icpas org/insight htm

ALLTIEDUP