this issue

the economic stimulus really save us?

cultures could cost you the deal

for disaster, come rain or shine.

mobile technology menace

crunch

cuts

C

suite

as an IFRS guru

as finances flounder

The Magazine of the Illinois C PA Society www.icpas.org / insight.htm | May/June 2009 jobS top in a tough market

In

Can

Crossed

Prepare

Beware the

The credit

boosts careers Don’t get scissor happy with cost

Hire Gen X women into the

-

Watch out! Love could cost you Position yourself

IPOs plunge

Tax developments make for fast talk Hunting for tuition money? Find it here

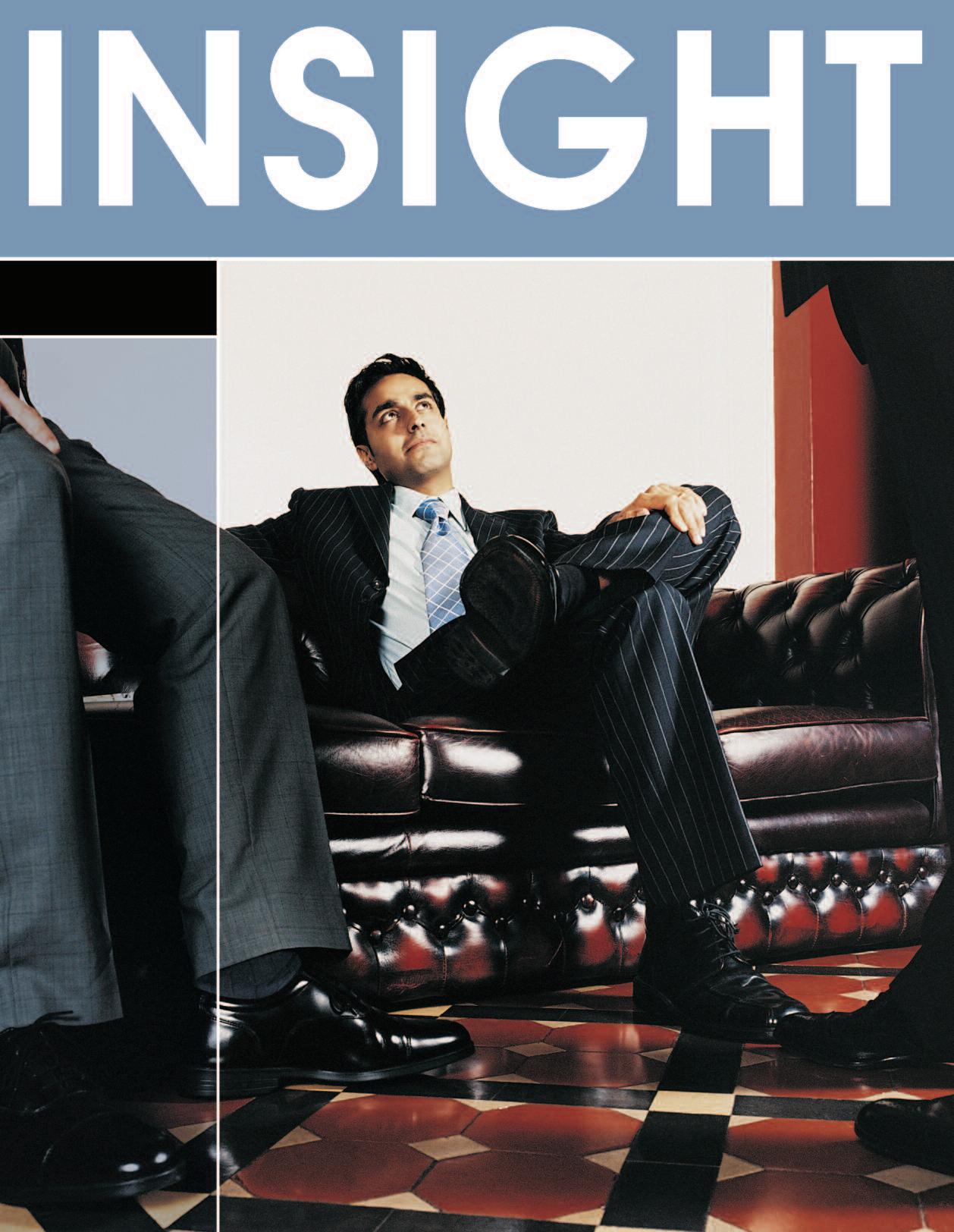

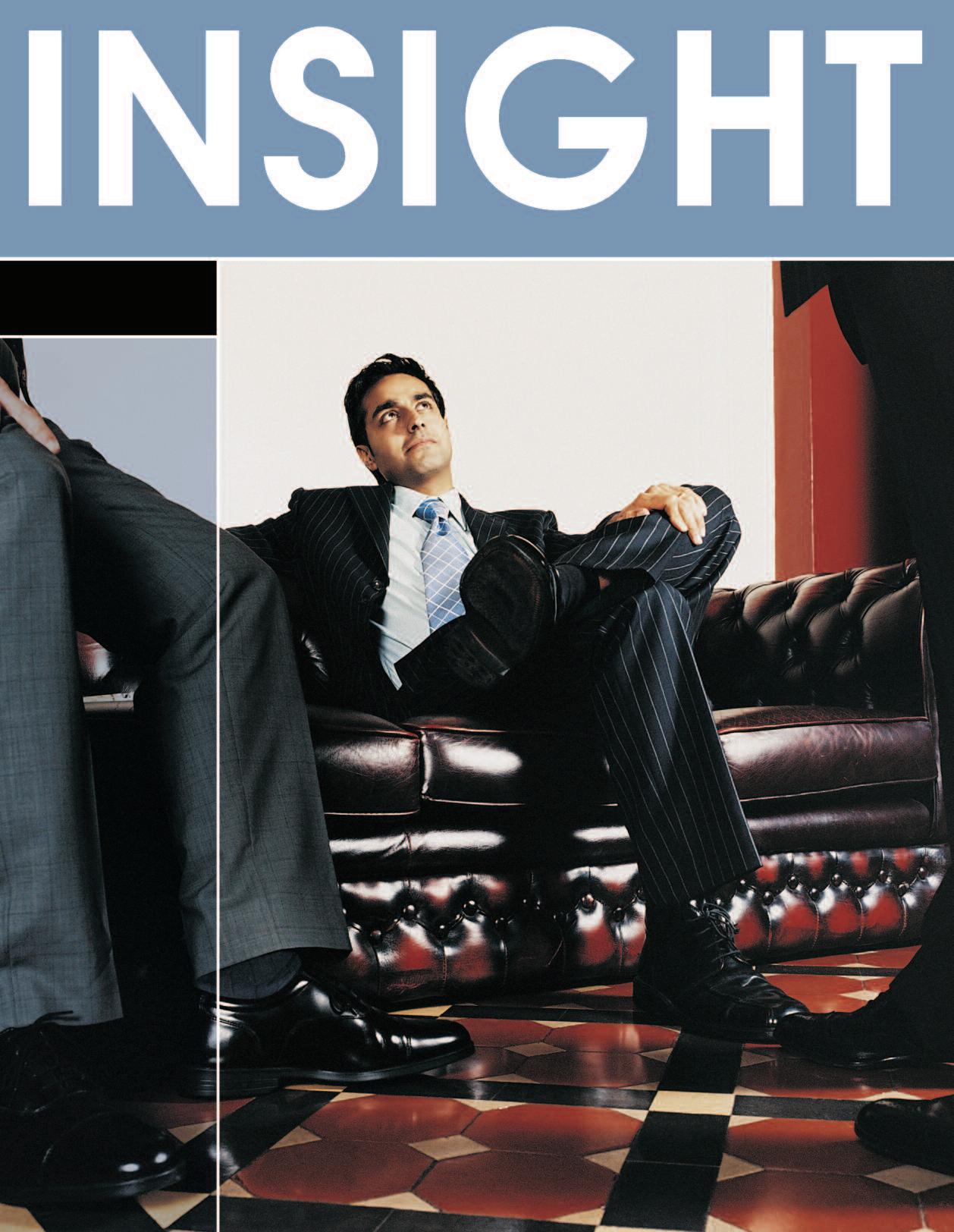

30 Where are the Top Jobs?

B y D er r i c k Li l l y

The job market may be stuck in a rut, but top finance spots can still be won

34 Crossed Cultures

B y Ju d y Gi a n n et t o

Did you give your Russian colleagues the thumbs up after that impressive presentation? Yeah, well, you might as well have told them to “%@$#-$@#!”

38 A Guide for Rough Weather

B y C a r o l yn Ta n g

Climate changes are bringing on a tidal wave of natural disasters, with a huge social and economic impact

42 Are We Saved?

B y K r i st i n e B l en k h o r n Ro d r i g u ez

What used to be a hopeful question now sounds naive in the face of an economic stimulus that has yet to take off

8 Career Crisis? What Crisis?

B y Sel en a C h a vi s

Ironically enough, the current credit crunch could mean an upswing in your career options

10 Economy Cutting Room

B y C h r i st i n e B o c k el m a n

Cut costs in a bad economy but don’t go overboard with the shears.

12

Diversity X Factor

B y Ren ee B ec k m a n , C PA

Now more than ever, Gen X women are a valuable commodity in the executive suite

14

IFRS IFRS Guru

B y Sel en a C h a vi s

Position yourself as an expert in all things IFRS

18 Strategy Public Exposure

B y Sh er yl N a n c e - N a sh

Is it worth taking your business public when the economy ’ s down?

22 Technology On the Move

T h er esa C a sey

WiFi is everywhere; mobile technologies are it But are you putting yourself at risk by using them?

24

Wealth Love & Money

B y Ja n et H a n ey

Protecting your client ’ s assets before they tie the knot goes beyond traditional prenups

26 Tax Talking Points

B y H a r vey C o u st a n , C PA

The end of tax season doesn’t mean the end of tax talk Here, three developments you should know about

48 Students Find Money Now

B y D er r i c k Li l l y

Higher education costs are a drag, but finding financial aid doesn’t have to be

4

index May/June 2009 Vo l 5 8 N o 7

icpas org / insight htm cover story features colu m n s regulars

www

First Word

Seen+Heard

Classifieds

6

46

I C P A S O F F I C E R S

Chairperson, Sheldon P Holzman, CPA Virchow Krause & Company LLP

Senior Vice Chairperson, Lee A Gould, CPA Gould & Pakter Associates LLC

Vice Chairperson, James P Jones, CPA Edward Don & Company

Vice Chairperson, Michael J Pierce, CPA RSM McGladrey Inc

Vice Chairperson, Ray Whittington, CPA College of Commerce Depaul University

Secretary, Charles F G Kuyk III, CPA Crowe Horwath and Company LLP

Treasurer, Sara J Mikuta, CPA The Leaders Bank

Immediate Past Chairperson, Debra R Hopkins, CPA Northern Illinois University CPA Review

I

Brent A. Baccus, CPA Washington Pittman & McKeever

Therese M. Bobek, CPA PricewaterhouseCoopers LLP

Robert E. Cameron, CPA Cameron Smith & Company PC

William J Cernugel, CPA Alberto-Culver Company (Retired)

Anthony Fuller Grant Thornton LLP

William P Graf, CPA Deloitte & Touche LLP

Cara C Hoffman, CPA Blackman Kallick LLP

Charlotte A Montgomery, CPA Illinois State Museum

Gerald A Olsen, CPA Illinois Wesleyan University

Annette M O’Connor, CPA RR Donnelley & Sons Company

Mary Lou Pier, CPA Pier & Associates Ltd

Marian Powers, PhD Northwestern University

Daniel F Rahill, CPA KPMG LLP

Lawrence H Shanker, CPA Shanker Valleau Accountants Inc

Th e r e a r e m a n y w a y s t o d e s c r i b e t h e s e times. Historic. Life changing. Uncertain. S c a r y B u t w o r d s w e ’ r e p u t t i n g i n t o p l a y h e r e a t t h e S o c i e t y p r o a c t i v e , r e s p o n s i v e a n d motivated just might help counter the daily dose o f u n e a s i n e s s w e g e t f r o m t h e m e d i a , o u r w o r kplaces and even our friends and family

The Society is striving to be as proactive as possible, reaching out to members through email mess a g e s a n d m a i l i n g s , a n d a t m e m b e r t o w n h a l l forums, to find out what you need. We’ve heard that you want to sharpen your skills and find ways to boost your career, and that you want us to keep c o s t s d o w n , p a r t i c u l a r l y w h e n t r y i n g t o g e t C P E credits in a reporting year

A n d w e ’ v e a l r e a d y t a k e n s t e p s t o r e s p o n d t o y o u r c o m m e n t s . E a r l i e r t h i s y e a r m e m b e r s received a special $25 gift certificate for a CPE program Society members continue to receive $70 off full-day conferences and classes, as well as discounts on publications, office products and insurance through our Member Buying Advantage Program At the Midwest Accounting & Finance Showcase on August 25 and 26, you’ll be able to get 17 hours of CPE credit for just $270 You can also stay closer to home and take advantage of local educational opportunities, including expanded downstate CPE offerings, to save money on gas and travel

Free or low-cost monthly career events on topics such as using social media in your job search and free career coach advice are now available through our Career Center, which already includes job listings, free resume posting and search firm directories. If you find yourself unemployed, call us to find out how you can maintain your membership and all of its benefits, including the Career Center, at a time when you need them most

Underlying these efforts is the wonderful sense of motivation you have to help each other through the growing number of members who volunteer for the Military Service Tax Preparation Project and others whose donations make scholarships possible and to help the profession by talking to the media or the community. In doing so, you carry out our mission of enhancing the value of the CPA profession

For the Society to continue to work effectively for you and with you, communication is key. Write, call or email Help us find the best ways to help you Together we can put meaningful actions behind the words that define our times

ICPAS President &

CEO

C P A S B O A R D O F D I R E C T O R S

4 INSIGHT www icpas org/insight htm F I R S T W O R D

Publisher

ICPAS President & CEO

Elaine Weiss

Editor-in-Chief

Publications Director

Judy Giannetto

Creative Services Director

Gene Levitan

Creative Services Manager

Rosa Garcia

Publications Specialist

Derrick Lilly

National Sales & Advertising

Derrick Lilly 312 993 0407 ex t 227

l i l l yd@ i cpas org

Information Systems Manager

Jim Jarocki

j arocki j @ i cpas org

Editorial Office

550 W Jackson Blvd , Suite 900, Chicago, IL 60661

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 23,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race,religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published bimonthly except monthly in July and August by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA , 312-993-0393 or 800-993-0393, fax 312-993-0307 Subscription price for non-members: $30 U S , $40 Canada and International addresses, $42 Mexico Copyright © 2008 No part of the contents may be reproduced by any means without the written consent of INSIGHT Permission requests may be sent to: Editorial Director, at the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, I l l i n o i s C PA S o c i e t y, 550 W Jackson, Suite 900, Chicago, IL 60661, U S A

31(-$11 +3 2(.7 '(" &. -2$0- 2(.- + 113$1 7 '(" &. .0$-1(" "".3-2(-& +% 7 7 '(" &. 6 2(.- .$ + 12 2$ 7 '(" &. 31(-$11 6 7 /0(-&%($+# 12 2$ (%2 6 7 '(" &. ,/+.7$$ $-$%(21 7 '(" &. .0/.0 2$ 6 7 .1$,.-2 -#(4(#3 + 6 +% 7 3+7 '(" &. 3#(2 //$ +1 +% 7 3+7 '(" &. 2$1 -# +." 2(.-1 0$ 13!)$"2 2. "' -&$ ++ ".-%$0$-"$1 .%%$0 0$#(2 "'$"* .30 5$!1(2$ %.0 (-%. .- -# .2'$0 1/$"( +27 "0$#(21 2009 is a CPE Reporting Year

120 hours of CPE* by September 30, 2009. *Must include 4 hours of Ethics CPE www icpas org / insight htm May/June 2009 5 I N S I G H T A W A R D S 2008 Apex Award, Magazine & Journal Writing 2007 Magnum Opus Award, Best All-around Association Publication 2006 Apex Award, Magazines & Journals 2006 Apex Award, Magazine & Journal Writing 2004 Apex Award, Magazines & Journals 2004 Apex Award, Magazine & Journal Writing 2002 Apex Award, Magazine & Journal Writing 2002 Chicago Women in Publishing Excellence Award, Writing/Editing 2001 Apex Award, Feature Writing 2001 Apex Award, Best Redesigns 2000 Apex Award, Magazine & Journal Writing 2000 Apex Award, Best Rewrites

Licensed CPAs need

SEEN H E A R D

$2.3

tril lion

Assets managed by hedge funds worldwide.

Source: Cayman Islands Monetary Authority, www cimoney com ky

How ’ s Your Morale?

As recession doldrums continue to weigh on employee morale, companies are taking action to dissipate the storm clouds In a recent Accountemps survey, 68 percent of the CFOs interviewed said they are implementing strategies to buoy the mood of their teams Thirty-seven percent cited increased and improved communication as the most common method Financial rewards, professional development opportunities and team-building activities are also popular options, each being cited by 18 percent of respondents.

percent, in fact, said their firms aren’t doing anything to improve morale

Is Your Firm Built for Success?

A preliminary report from an ongoing Bay Street Group LLC and Capstone Marketing survey reveals seven factors that lead CPA firms to success in the marketplace:

1 Clear company goals and managerial leadership

2 Enhancement or adoption of technology

3 Consistent staff training and development opportunities

4 Enactment of precise marketing and business development plans

5 A positive workplace environment

6 Strong client relationships

7 Team strategy accountability, collaboration and execution

To participate in this survey, visit cpatrendlines com/seven-keys-research

Data Analysis Just Got Easier

To simplify and improve the quality of data analysis work, CaseWare IDEA Inc and Audimation Services Inc have made enhancements to their new release of IDEA Version Eight This data analysis tool now includes a Project Overview, which provides a graphical representation of the entire audit or investigation process By recording all performed actions, auditors and accountants can independently share and review workflows The new release also features a Visual Script that allows users to build their own analysis and monitoring scripts without any programming Added features include the ability to create custom “@Functions,” which can be easily shared with others, faster drag-and- drop document import and extraction, calendar pop -ups and data- sorting abilities

Audimation Services is hosting training groups and walkthroughs of IDEA Version Eight For a schedule of User Groups, visit www audimation com/idea user groups cfm For a complete list of the new features, visit www audimation com

$170,000

Estimated average total compensation for a first-year investment banking associate hired in 2009

Source: www careers-in-finance com

Unlucky Seven

2008’s worst performing retail industries include:

1 Automobile Dealers: -11 77%

2 Furniture Stores: -6 36%

3 Home Furnishings Stores: -5 93%

4 Other Motor Vehicle Dealers: -5 08%

5 Building Material / Supplies Dealers: -4 97%

6 Clothing Stores: -3 19%

7 Automotive Parts, Accessories, Tires: -0 42%

Source: Sageworks, Inc

6 INSIGHT www icpas org/insight htm

N E W S B Y T E S , S O U N D A D V I C E A N D P R A C T I C A L B U S I N E S S T I P S

H o w e v e r, n o t a l l e m p l o y e r s h a v e j u m p e d o n t h e m o r a l e - b o o s t i n g b a n d w a g o n 2 6

7 Management Mistakes to Avoid

Managing employees is never easy, and a challenging economy makes it even harder Here are seven of the most common mistakes and the best ways to avoid them

1 T h i n k i n g y o u r s t a f f c a n ’ t h a n d l e t h e t r u t h Talk openly about the effects of the downturn on your firm, and collaborate on techniques to turn things around

2 B l a m i n g t h o s e a t t h e t o p If you ’ re a middle manager who has to deliver bad news, don’t tell employees that you would have done things differently Instead, explain the reasons behind the news, including how your firm will persevere

3 F e e l i n g p e o p l e a r e l u c k y j u s t t o h a v e a j o b Give your employees the attention they deserve, especially the top performers; not only are their contributions critical now, but they are also attractive targets for competitors

4 N o t a s k i n g f o r e m p l o y e e s ’ h e l p i n e x p a n d i n g c l i e n t r e l a t i o n s h i p s Ask your staff to think about initiatives to help to achieve business goals without sacrificing productivity When appropriate, involve your team in efforts to generate new business

5 M a k i n g w o r k “ m i s s i o n i m p o s s i b l e ” If one person is doing the work of two or more, identify which projects are mission-critical Put the other tasks on hold, delegate remaining tasks or bring in temporary professionals to avoid overwhelming your staff

6 . S h i f t i n g t h e f o c u s f r o m t h e f r o n t l i n e s . Client service matters even more when times are tough Employees that come across as indifferent or inexperienced could lose you both prospective and existing customers

7 W a i t i n g t o t r y n e w t h i n g s If you have a promising new service offering or client niche you want to pursue, don’t wait to act Well- calculated risks can separate you from competitors and possibly carve out an additional revenue stream

Source: Robert Half International, abstract from “The 30 Most Common Mistakes Managers Make in an Uncertain Economy ”

Boomers Boosting Social Networks

If you think that it ’ s the 20- and 30-somethings that are blogging, Twittering and Facebooking their way across the World Wide Web, then think again According to the latest Consumer Electronics Usage Survey from Accenture, Baby Boomers “ are the fastest growing users of social networking sites and are also increasingly reading blogs ” Surprisingly enough, Generation Y’s interest in these social networking tools has, in fact, plateaued Visit www micropersuasion com/2009/03/social-networking-demographics html for more

Twitterverse Codes of Conduct

While Twitter is still emerging as a communication outlet for individuals and businesses alike, users already are establishing some form of Twitter etiquette Here are five tips to guide you

1 D o n ' t s p a m : If you ’ re constantly sending out tweets that say things like: "I've just put up a new blog post Check it out" or "Sign up for my RSS feed," then you ’ re a culprit of spamming As a marketing method, you'd probably be better off flying paper airplanes out of your office window

2 F o l l o w s t y l e r u l e s : Twitter isn't text messaging, which means words should be words and not abbreviations

3 G i v e c r e d i t f o r r e t w e e t s : When one person spots a good tweet, he or she can pass it along, and soon it will spread across the Twitterverse But always give credit to the source

4 S t i c k t o 1 4 0 c h a r a c t e r s : This number is the max that can fit through SMS systems

Don’t separate your thoughts into three or four tweets keep them succinct

5 F o l l o w p e o p l e w h o f o l l o w y o u : Follow thousands of people and reading tweets will become a full-time job. Follow only close friends, and you’ll defeat the object of this communications tool

Source: Twitter Power: How to Dominate Your Market One Tweet at a Time, ” by Joel Comm, with Ken Burge

The Illinois CPA Society has made it easier than ever to identify the up and comers in the accounting profession. Just visit the Illinois CPA Society’s Career Center and search student resumes to fill your next internship.

All across the state, Illinois CPA Society student members have uploaded their resumes for you to view online. These students represent the future of the profession and your guidance as a seasoned member of the profession can put them on the right track. These students are available for summer, fall or spring internships.

Search by various criteria, including:

Geographic Location

Timeframe

Paid or College

Credit Internships

The best and brightest interns are at your fingertips.

click on

Center.

Visit www.icpas.org and

the Career

www icpas org / insight htm MAY/JUNE 2009 7

Crisis? What Crisis?

By Selena Chavis

As banks continue to tighten their belts and businesses try to protect their interests going forward, many finance industry experts believe that a specialization in credit risk and areas aligned with the credit industry will place finance pros in the land of opportunity

“Credit is emerging as a significant part of every company’s accounting function,” says Mike Cwiok, managing director of the Financial Risk Management group for KPMG in Chicago. “We’ve been continuing to enlist more people with credit experience to assist our audit teams in this environment of heightened credit exposures I think it’s a really hot area right now ”

In the present economic downturn, companies are focusing on the changes needed to effectively evaluate loss reserves. “We’ve been operating in such a strong economy for so long that many accountants have never had to analyze loss reserves in an environment filled with this level of uncertainty,” Cwiok explains, pointing out that market-savvy companies will be looking for a broader, more holistic approach to credit risk management “Companies will be looking for resources and tools to assist them in evaluating how market conditions impact value as investments are marked to market Today, the analysis may require going beyond traditional sources such as Bloomberg or looking up prices in the W al l Street Journal . ”

The demand won’t rest with public firms, Cwiok adds. He expects the need for this type of specialization to filter over to large and small enterprises alike He notes that even those

industries considered the last to be impacted by economic turmoil such as utilities are facing uncertainties with reserving for losses.

“When people can’t pay their bills, utili t y c o m p a n i e s h a v e t o s e t a s i d e r e s e r v e s T h e y n e e d m e t h o d o l o g i e s f o r w h a t t h o s e reserves should be,” he says. “The manufacturing companies that offer terms of 60 t o 9 0 d a y s a r e a l s o f i n d i n g t h e m s e l v e s e x p o s e d b e c a u s e p a y m e n t s a r e b e i n g delayed or not paid at all ”

And since much of the credit industry revolves around accounting principles, professionals in the field who have experience with credit risk will be in high demand in the coming years, says Tim Moritz, partner with Illinois-based McGladrey and Pullen

“CPAs understand financial statements,” he says. “The accounting profession provides a good stepping stone to careers in such areas as credit risk and credit analysis

“Accounting professionals have the skill s e t s t o m a k e s o u n d d e t e r m i n a t i o n s a b o u t the feasibility of borrowing,” Moritz adds, “a role that is certain to become a high-prof i l e a g e n d a w i t h i n t h e b a n k i n g i n d u s t r y going forward I think credit analysts will have added importance even when things are cruising along better in the economy. I t h i n k t h e r e w i l l b e i n c r e a s e d m o n i t o r i n g even in good times as opposed to what was done previously ”

Since history tends to repeat itself, Moritz also points out that past financial crises and economic downturns on the national level have often meant a move towards increased government regulation

“ T h e f i n a n c i a l a c c o u n t i n g p r o f e s s i o n a l h a s g o o d s k i l l s t h a t c a n h e l p f r o m t h a t s t a n d p o i n t , ” h e s a y s , r e f e r e n c i n g t h e d e m a n d c r e a t e d f o r p u b l i c a c c o u n t i n g f i r m s f o l l o w i n g S a r b a n e s - O x l e y i n 2 0 0 2 “When there’s more regulation, it typically m e a n s m o r e w o r k f o r a c c o u n t i n g f i r m s because we’re called in to assist. There will

8 INSIGHT www icpas org/insight htm C A R E E R

I ro n i c a l l y e n o u g h , t h e c u rre n t c re d i t c r u n c h co u l d m e a n a n u p s w i n g i n yo u r c a re e r o p t i o n s

be some good opportunities that will come out of economic cycles.”

Financial transactions and investments will require more scrutiny going forward And while current investment strategies have slowed to nearly a standstill, the expectation is that larger banks and investor groups eventually will look at the economy’s problem areas as opportunities

“Part of that decision-making process is due diligence. CPAs and financial professionals have a nice, well-rounded business knowledge for this area,” says Moritz “Businesses will seek out that expertise to ensure investments are sound especially since many investments have proven to rest on shaky ground due to mortgage industry mishaps ”

Other specialties likely to emerge from the credit crisis are pricing and treasury management, says Cwiok. “The price is reflecting the margin you want to get as well as the risk,” he explains, adding that effectively assessing risk as a component of the cost in relation to the cost of goods and services will be critical to companies that need to succeed in an uncertain economy “That piece from a risk management and accounting perspective is very valuable,” he says

“The current elevation of credit risk management complements an ongoing trend emphasizing the larger objective of better enterprise-wide risk management strategies,” says Marv Gordon, a CPA with Illinois-based Frost, Ruttenberg and Rothblatt P C , and a professor at Illinois universities, including Loyola University, Chicago

“At Loyola, I’m teaching a course that focuses on the role of the internal auditor The company’s internal auditor will become a line of defense going forward,” he explains. “If there are problems, they should be able to find those before external auditors do That’s one profession I would recommend to those who are not interested in public accounting ”

To s p e c i a l i z e i n c r e d i t r i s k m a n a g e m e n t , C w i o k s a y s t h a t a c c o u n t i n g p r o f e s s i o n a l s need to spend time in the field, with a focus o n c r e d i t A l o n g s i d e h a n d s - o n e x p e r i e n c e , M o r i t z i s a “ b i g b e l i e v e r t h a t a p u b l i c accounting start is a good one,” due in large part to the variety of industries and roles an accounting professional experiences “ T h e t i m e y o u s p e n d t h e r e t r a n s l a t e s s o well to various job opportunities,” he says “The experience could form a path to credit analyst or CFO There’s a lot of diversity to what you do ”

keep your career on track [in today’s job market] Career Center A benefit of your Illinois CPA Society Membership Search Job Listings | Post Your Resume Locate Search Firms | Explore Career Resources Find a Career Coach* Check out the Career Center today at www.icpas.org *fee-based service www icpas org / insight htm MAY/JUNE 2009 9

Cutting Room

Cut costs in a bad economy but don’t go overboard with the shears

By Christine Bockelman

By Christine Bockelman

Wi t h t h e U n i t e d S t a t e s s t r u g g l i n g through a recession, scaling back has become somewhat de ri geur

“ S o m e t i m e s , i t t a k e s a g o o d r e c e s s i o n t o kick us in the head,” says Jay Forte, CPA, a speaker, employee performance consultant and author of Fi re Up Y our Empl oyees and Smoke Y our Competi ti on “It’s a reason to examine almost everything ”

W h i l e d u m p i n g f a n c y t r a v e l a n d c l i e n t dinners is a bit of a no-brainer, there’s a right way and a wrong way to cut costs, especially when you put people and places into the equation

People Power

When the economy heads south, the kneej e r k r e a c t i o n i s t o s t a r t c u t t i n g t h e h e a dcount. Layoffs are sticky situations though. W h o d o y o u l e t g o ? T h e m o s t e x p e n s i v e staffers? The ones who have been there the least amount of time?

Three Cost-cutting Lessons

1 D o n ’ t b e c h e a p w i t h y o u r p e o p l e “Cutbacks can negatively affect employee morale,” says Forte “ You can let people have a longer lunch every once in awhile or be a little flexible about letting them leave earlier ”

2 D o n ’ t i n s u l a t e y o u r e m p l o y e e s “ You’re better off involving your people in your decision-making,” says Boswell “They can raise ideas you haven’t thought of or confirm ideas that you already considered They might surprise you with their creativity or their willingness to swallow tough medicine for the greater good ”

3 D o n ’ t g o l a y o f f c r a z y

“ Very often layoffs have unintended consequences, ” says Boswell “ You could end up cutting the things your customers value most. Or you could leave your best performers exposed to burn- out...Some of the companies that emerged from past recessions in a position to grow were the best at keeping layoffs to a minimum ”

“First and foremost, since your customers a r e u l t i m a t e l y f u n d i n g y o u r p a y r o l l , a s k yourself, ‘If my customers were making the decisions about what and who to cut, what decisions might they make?’” recommends E d B o s w e l l , C E O o f T h e F o r u m C o r p , a B o s t o n M a s s - b a s e d c o n s u l t i n g c o m p a n y “It might surprise you what you come up with from a customer ’s point of view ”

What about your superstars the people on your team who consistently perform the best and bring in the most business? Perhaps surprisingly to some, there are two schools of thought on how to handle your top performers during times of financial crisis

First, the cut ‘em argument: “I would start t h e c u t t i n g p r o c e s s w i t h t h e s t a r s , ” F o r t e s t a t e s “ T h e i d e a i s t h a t s t a r s k n o w t h e i r value, and that someone is willing to pay for them. I generally find that high performers...say, ‘Thanks for the paycheck, but I’ve found someone willing to give me more.’

10 INSIGHT www icpas org/insight htm E C O N O M Y

S o m e t i m e s t h e b e n e f i t y o u g e t f r o m a star doesn’t make sense. Should you keep a star if they’re hard to get along with, or if they don’t fit in long-term?”

S e c o n d , t h e k e e p ‘ e m a rg u m e n t : S t a r s often bring much too much to the table for a company to consider letting them go. Jim Muehlhausen, CPA, author of The 51 Fatal Busi ness Errors and How to Avoi d Them, suggests that companies approach staffing d e c i s i o n s m u c h a s p r o f e s s i o n a l s p o r t s leagues do; namely, introduce a salary cap. “Companies have x number of dollars for payroll, and need to figure out what perc e n t a g e o f t h e o v e r a l l p a y r o l l a s t a r i s worth,” he explains

The National Football League offers a few good examples Teams like the Indianapolis Colts could afford to hire or retain a lot more talent if they cut Peyton Manning and his reported $14 million a year contract from their payroll Manning, though, is a “superstar” who helped the team win a Super Bowl, says Muelhausen. Similarly, companies should identify who’s helping them meet their goals and then figure out how much of the salary cap they’re worth

Sure, the superstars are expensive, but they’re also hard to find Let yours go and your competitors, if they’re smart, will snap them up.

“A great salesperson is a great salespers o n , n o m a t t e r w h a t t h e e c o n o m y. L e t someone like that go and you’re only taking away a great revenue source for yourself,” says Muelhausen

Client Cutbacks

A s t e m p t i n g a s i t i s t o h o l d o n t o e v e r y client, it doesn’t always make sense to

“It’s important to keep the clients who a r e m o s t p r o f i t a b l e , ” B o s w e l l e x p l a i n s . “ T h a t m i g h t s o u n d l i k e a n o - b r a i n e r, b u t m a n y c o m p a n i e s t r e a t a l l c u s t o m e r s equally That’s a mistake ”

Hanging onto all your clients can be problematic, Muelhausen agrees, particularly if you’ve reduced your staff “Employee burnout becomes a risk,” he explains. “If your best people are working harder and getting paid the same amount, they’re not likely to stick around

“You have to do a customer-cost analysis,” he continues. “The mistake most people make is thinking that revenue drives expense....Some customers demand a lot more activity for the same amount of money If you’re a $100 client with a 70 percent margin and I’m a $100 client with a 10 percent margin, you’re a much better client ”

Space Savers

Now that you’ve streamlined your staff and clients, it may be a good idea to focus on your office space If you have fewer people, you probably need fewer desks, and even if you have the same number of people, you should ask yourself whether you can cut back on square footage

“ I t h i n k t h e r e c e s s i o n i s a n i m p o r t a n t opportunity for firms to really look at their real-estate portfolios, especially if they’re l e a s i n g , ” s a y s M i k e H i l l g a m e y e r, w h o overseas firm-wide operation services for Crowe Chizek

C u t t i n g s p a c e c a n b e a t o u g h c a l l , though, especially if the economy is predicted to gain momentum anytime soon “Business owners tend to say things like, ‘ I d o n ’t w a n t t o g e t r i d o f t h a t s p a c e , because things are going to pick up next year,’” says Muelhausen. “You need to be objective. If sales are down, and have been down, you don’t know for sure if they’re g o i n g t o p i c k u p i n s i x m o n t h s G o w i t h what you know to be true right now ”

During economic downturns landlords are likely to renegotiate the terms of a lease t o k e e p t h e i r b u i l d i n g s o c c u p i e d “ T h e r e are a lot of cards you can play right now You might be able to get a reduced rent per s q u a r e f o o t , a c e r t a i n t i m e p e r i o d w h e n you might not have to pay rent, or some tenant improvement dollars,” Hillgameyer suggests “Landlords also might allow you t o r e d u c e y o u r f o o t p r i n t i f y o u a g r e e t o extend the lease term ”

Be creative consider employee requests to work from home or telecommute What’s more, at Crowe Chizek, a few offices work with a system called “Space on Demand,” a revamp of the hoteling concept.

“It might be a desk, it might be a meeting room, it might be a project room,” Hillgameyer explains “When people do come i n t o t h e o f f i c e , w e o f f e r s e r v i c e s a n d amenities We’ll put pictures of their children or awards they’ve won at their desks, or give them a nice biscotti or cup of gourmet coffee ”

A l s o c o n s i d e r h o w a n d w h e n y o u u s e y o u r s p a c e . “ We h a v e o n e g r o u p t h a t works weekends during busy periods, and instead of giving them their own floor, we h a v e o n e g r o u p u s e a s p a c e M o n d a y t h r o u g h F r i d a y, a n d a n o t h e r u s e i t o n weekends,” says Hillgameyer

Simply think outside the box and you’ll find the savings you’ve been looking for

The Thirteenth Annual Multistate Tax Institute

highlights include:

A nationwide and regional perspective of the year’s most important state and local tax developments by the “best in the business.”

The state of critical multistate tax issues.

Expert insight into numerous money saving opportunities.

Cutting edge planning techniques being used in the nexus area. ✓ Department of Revenue roundtable on critical audit issues. June 18, 2009 Milwaukee, WI For program and registration information, call us at 414-229-3821 or email us at salt-conf@uwm.edu Deloitte Center for Multistate Taxation www icpas org / insight htm May/June 2009 11

Institute

✓

✓

✓

✓

X Factor

Now more than ever, Gen X women are a valuable commodity in the executive suite

By Renee Beckman, CPA

Sa n d w i c h e d b e t w e e n 8 0 m i l l i o n B a b y B o o m e r s a n d s o m e 7 8 m i llion Millennials is Generation X G e n X ( r o u g h l y a n y o n e b o r n b e t w e e n 1965 and 1976) accounts for about 46 mill i o n p e o p l e S o m e h a v e c a l l e d i t t h e l o s t g e n e r a t i o n , t h e u n d e r a p p r e c i a t e d g e n e r ation and even the overlooked generation. But one thing’s certain: Gen X amounts to n e a r l y h a l f t h e s i z e o f b o t h t h e B a b y B o o m e r s ( b o r n b e t w e e n 1 9 4 3 a n d 1 9 6 4 ) a n d t h e M i l l e n n i a l s ( b o r n b e t w e e n 1 9 7 7 and 1998).

With the flood of retiring Baby Boomers, G e n X w i l l b e r e s p o n s i b l e f o r f i l l i n g k e y c o r p o r a t e l e a d e r s h i p g a p s , b u t w i t h o n l y h a l f t h e m a n p o w e r t o d o s o . G i v e n t h a t , understanding the needs of Gen X women, a n d w h a t w i l l k e e p t h e m i n y o u r r a n k s , becomes evermore vital

Why focus on Gen X women, specifically? Because, according to the Small Business

Administration, 1-in-15 Gen X women are leaving corporations to find new employment opportunities or to pursue their own entrepreneurial endeavors.

Charlotte Shelton and Laura Shelton, authors of The NeX t Revol uti on: W hat Gen X W omen W ant at W ork and How Thei r Boomer Bosses Can Hel p Them Get It, write, “This looming crisis constitutes more than a mere labor shortage; it’s a loss of the female perspective in leadership roles ”

According to the authors, a 2004 Catalyst research study revealed higher profitability among companies that hired a greater number of women for senior management roles “In fact,” they explain, “the companies with the most women on their senior management teams outperformed the businesses with the least women by at least 34 percent ”

What Makes Them Tick?

Gen X women saw their parents face economic downturns and limited job opportunities Not surprisingly, they mistrust institutions and give little loyalty to their companies. That’s not to say they have no loya l t y w h a t s o e v e r R a t h e r, i t i s r e s e r v e d f o r their peers, bosses and work

The aggressive nature of corporate consolidations has added to their mistrust by stunting career growth for those standing at the threshold of senior management Now, the corporate ladder is viewed more as a lattice, where movement up, down or out is a situational option.

Since Gen X women are the first to face widespread divorce and single parenthood, its populace tends to be fiercely self-reliant and individualistic. This group has become known for working smarter not harder by learning on the fly and maneuvering fluidly between teams Because of corporate America’s heavy focus on cost-cutting and downsizing over the last 20 years, there’s been very little on-the-job mentoring or long-term training for Gen X As a result, members of this generation of employees have been forced to become efficient self-managers.

12 INSIGHT www icpas org/insight htm D I V E R S I T Y

Keys to Retention

What, then, can corporate America do to retain this crucial group of professional women, who make up approximately 46 percent of today’s workforce?

Mike Shove, CEO of Computer Sciences Corporation-Australia and ceoforum.com, explains that, “Gen X-ers are no less willing than Boomers to do as the company directs, but they do expect something in return As managers, they hold you more accountable in keeping your promises to look after them you also have to take more time to explain things to get their commitment and be more open and transparent in your management style.”

For these women, each project is viewed as a learning experience and a way to acquire marketable skills However, they tend n o t t o c o m m i t t o t h i n g s w h e n t h e y d o n ’t h a v e a n i n t e l l e c t u a l u n d e r s t a n d i n g o f t h e o b j e c t i v e In fact, research conducted by Charlotte and Laura Shelton found that 77 percent of Gen X women would quit in a minute if offered “increased intellectual stimulation” at a different company.

Encouraging creativity and initiative-taking are key motivators for this demographic Keeping them informed and stimulated by establishing clear performance expectations and measures witho u t m i c r o m a n a g i n g c r e a t e s a n e n v i r o n m e n t i n w h i c h t h e s e women will thrive.

Charlotte and Laura Shelton also found that Gen X women are intent on managing their own time: 51 percent would exit their current position for the chance to telecommute, and 61 percent would leave their current jobs if offered more flexible hours elsew h e r e R e c o g n i t i o n s c o r e d v e r y l o w a n d p o w e r a n d p r e s t i g e ranked last.

Time management is indeed a significant factor among Gen X women, who tend to have different priorities than their Boomer bosses This generation grew up valuing time spent with family and the flexibility to take part in personally enriching activities Offering flex-time and telecommuting can significantly increase retention efforts. And, in fact, higher pay often will be conceded in exchange for the opportunity for greater work-life balance.

Gen X ’s openness to wage and salary discussions often leads to quick realizations of discrepancies in pay equity Even though federal laws protect women against discrimination, a pay gap exists Census statistics released on Women's Equality Day August 26, 2008 revealed that the gap between men's and women's earnings changed by less than one percent from 2006 to 2007; women earned 77 8 percent of men's wages in 2007 Clearly communicating to all staff that women receive the same pay as men for the same work is a vital retention tool

Career opportunities or the lack thereof has been a tiring point o f c o n t e n t i o n f o r m a n y G e n X w o m e n . I t i s i m p e r a t i v e t h a t employers understand that workers are more willing to stay in jobs that offer the opportunity for skills development and professional growth If not given this opportunity, then Gen X women will quickly opt for an organization that is willing to invest in their development, or will set up an entrepreneurial venture on their own. The result for employers is diminishing retention numbers and increasing business competition in the marketplace.

ICPAS member Renee Beckman, CPA, i s a pri nci pal at Pareto, I n c , a f i n a n c e , a c c o u n ti n g a n d I T pe r m a n e n t a n d te m po r a r y s ta f f i n g f i r m S h e c a n be r e a c h e d a t

o r r be c kman@ paretoi nc com

upcoming events

www.CCFLinfo.org

May 11, 2009 - Chicago, Illinois

Astute Cash Flow Management: Improving Company Value

Marian Powers, PhD - Adjunct Associate Professor, Kellogg School of Management, Northwestern University

May 12, 2009 - Chicago, Illinois

International Issues Conference

May 19, 2009 - Chicago, Illinois

Executive Roundtable Series: Obama’s Economic Policies - Good or Bad for Business?

Robert Kallen - Visiting Professor of Economics, DePaul University and Adjunct Professor, Lake Forest Graduate School of Management

June 3, 2009 - Chicago, Illinois

How to Measure Financial Success: The Which, When, Why and How of Strategic Financial Measurements

Thomas L. Zeller, PhD, MBA, CPA - Professor of Accountancy and University Scholar, School of Business Administration, Loyola University Chicago

June 30, 2009 - Schaumburg, Illinois

Executive Roundtable Series: The Lesser of Evils –Making Tough Decisions

Richard Burger - Executive Vice President, Chief Financial Officer, Secretary and Treasurer, Coleman Cable, Inc. and Faculty Member, Lake Forest Graduate School of Management

July 21, 2009 - Chicago, Illinois

Internal Controls in Today’s Business Environment

Debra R. Hopkins, CPA, CIA - Director of CPA Review, Northern Illinois University

September 25, 2009 - Chicago, Illinois

Midwest Financial Reporting Symposium

Center for Corporate Financial Leadership’s Executive Education Certificate Program

Separate yourself from the pack. Complete the five core classes and three electives to receive your certificate. For more information, visit www.CCFLinfo.org

= Core Class = Elective Class c e

The Center for Corporate Financial Leadership is a service of the Illinois CPA Society

www icpas org / insight htm May/June 2009 13

e c e

3 1 2 2 1 4 6 1 4 4

IFRS Guru

Position yourself as an expert in all things IFRS

By Selena Chavis

By Selena Chavis

It c o m e s d o w n t o b a s i c e c o n o m i c s . When the demand is high and the supp l y i s l o w, t h e c o m m o d i t y b e c o m e s much more valuable In this case, that commodity is International Financial Reporting Standards (IFRS) knowledge.

As the accounting industry readies itself for the adoption of IFRS, many companies are scrambling to find talent capable of getting them up to speed That demand for tale n t i s o n l y e x p e c t e d t o i n c r e a s e o v e r t h e next decade

“It’s no longer a question of whether we a r e g o i n g t o c o n v e r t t o I F R S , i t ’s w h e n , ” says Mike Shapow, regional vice president of Robert Half International (RHI) “This is the cutting edge of accounting ”

I n A u g u s t 2 0 0 8 , t h e U S S e c u r i t i e s a n d Exchange Commission (SEC) unanimously v o t e d t o i s s u e a p r o p o s e d r o a d m a p a n d rules changes for US public company adop-

Find Tomorrow’s Talent Today

Industry professionals agree that companies need to approach the search for IFRS talent as a strategic recruiting effort “For companies, it ’ s important that they identify someone in their firm as a champion,” says Resch, noting that clients are a l r e a d y a s k i n g a b o u t t h e a v a i l a b i l i t y o f IFRS talent up front Hopkins, agrees, adding that, “Companies should be looking for a sound technical person with a willingness to embrace global issues ”

And it ’ s not just a competency for public accounting, says Resch “Most of the air t i m e h a s b e e n g i v e n t o p u b l i c c o m p anies, but business globalization will drive I F R S n e e d s a c r o s s b o t h p u b l i c a n d p r ivate sectors ”

What ’ s more, “In five years, if a particular university isn’t teaching IFRS fundamentals, we ’ re not likely to recruit from that school,” says Grant Thornton’s Cavanaugh “In 10 years, US GAAP isn’t going to be talked about anymore, ” she stresses “ You’ve got to get on the wagon If you don’t start understanding what ’ s going on, you ’ re going to get left behind ”

t i o n o f I F R S b y 2 0 1 4 . T h e p r o p o s a l w i l l make 110 of the United State’s largest publicly held companies eligible to begin using IFRS at the end of 2009 in connection with their 2010 filings

“ T h o s e t w o p i e c e s t h e r o a d m a p a n d the rules changes firmly placed IFRS on the table,” says Ben Resch, IFRS technical leader for the Midwest region at Deloitte “If 2008 was the year of IFRS awareness, then 2009 will be the year of IFRS assessment for many companies ”

Don’t let your guard down, says Debra Hopkins, CPA/CIA, director of CPA Review at Northern Illinois University “Accounting professionals absolutely must be trained for IFRS,” she states “IFRS would be a cost-cutting measure across the world, which is what companies are looking for today ”8

14 INSIGHT www icpas org/insight htm I F R S

financial

staffing.

unites

accounting

finance

for

hire, temporary

consulting

description

Garelli Wong and Jackson Wabash are Chicagoland’s experts in

recruiting and

Our team

employers with the right

and

talent

direct

and

assignments. We look and listen beyond the job

to combine the right skills with the desired experience.

office. Great Clients Great Candidates Great Fit Chicago Schaumburg Oakbrook Terrace 312.583.9264 847.397.9700 630.792.1660 WWW.GARELLIWONG.COM WWW.JACKSONWABASH.COM

To learn more about our dedication to finding the right fit, visit us on the web or call your local

C u r r e n t l y, n e a r l y 1 0 0 c o u n t r i e s r e q u i r e o r a l l o w t h e u s e o f IFRS for the preparation of financial statements by publicly held companies. This growing acceptance puts increasing pressure on t h e U n i t e d S t a t e s t o c o n v e rg e i n t e r n a t i o n a l s t a n d a r d s w i t h i t s o w n . E s t i m a t e s s u g g e s t t h a t m o r e t h a n 1 2 , 0 0 0 c o m p a n i e s a r e currently reporting under IFRS, including listed companies in the European Union.

Regardless of the US roadmap, many professionals agree that business globalization will continue to increase the demand for IFRS knowledge “I almost can’t come up with a client that isn’t challenged by globalization on some level Global accounting is an increasingly important cog in the wheel of how business is run today,” says Resch “Companies are trying to market to international investors they often need IFRS statements for that purpose ”

Large firms like Grant Thornton are already seeking IFRS talent and creating their own internal pool of experts to serve clients, s a y s J e n n i f e r C a v a n a u g h , p r o f e s s i o n a l s t a n d a r d s p a r t n e r i n t h e o rg a n i z a t i o n ’s C h i c a g o o f f i c e “ We a l r e a d y h a v e a n u m b e r o f clients on IFRS because they are subsidiaries of European companies,” she explains “As more and more companies demand that skill set, we’ll have more and more staff apportioned that way.”

It’s not just the big players though. In an unstable economy where smaller companies are being bought out by foreign players, Resch cautions that many are caught off guard by IFRS needs. “We’ve seen a number of smaller entities that are suddenly thrust into the realm of IFRS,” he explains. “They don’t have the time to plan.”

To get up to speed, Shapow sees larger firms forming IFRS teams from within “Last year, we had a large client that was way ahead

of the curve,” he recalls “They reached out to their Canadian subsidiary for talent Canada is three years ahead of the United States in adoption ”

Trends suggest that a number of companies, in fact, are starting with their overseas talent Grant Thornton, for example, is leveraging the knowledge of experienced staff in Europe to serve US clients and get others trained internally “I suspect that’s going to be expanded in the very near future,” says Cavanaugh, adding that the company has started an educational IFRS series for staff and clients as an introduction “Next we’ll move to the more nittygritty technical aspects of the standard.”

Deloitte kick-started its IFRS efforts by taking stock of partners and staff with experience working with overseas clients Next, it i

o u g h t n e e d e d t o have IFRS skills," Resch explains To help them develop the necessary skills, the company created a comprehensive course curriculum with an accreditation system and CPE credits “That is working well,” he says.

The firm also recently announced the availability of a complete IFRS academic curriculum through its IFRS University Consortium, offering lectures and transcripts from Deloitte subject matter leaders, actual case studies and case solutions, and other materials The course is available for free to all colleges and universities.

Hopkins acknowledges that the halls of learning are behind in their efforts to make IFRS curricula available to students “There’s a d e f i n i t e a

To learn more, contact: Katrina Street at 800.634.6780, option 4, or Mary Ellen Thomas at 800.993.0407, ext. 298

v a n t a

o r u n i v e r s i t i e s t h a t a r e g e a r i n g u p , b u t resources are tight,” she says “Small universities need help, but the big firms are reaching out.” Deloitte’s IFRS University Consortium, for example, numbers approximately 150 colleges and universities since its launch in spring 2008. KPMG, PricewaterhouseCoopers and Ernst and Young are also moving forward with strategic academic initiatives

H o p k i n s s u g g e s t s t h a t s m a l l e r f i r m s t h a t l a c k t h e n e c e s s a r y resources for training and education consider partnering with consortium groups that have an international sponsor and offer comprehensive education courses “There’s a cost involved, but there’s a g r e a t e r c o s t f o r n o t d o i n g i t , ” s h e s a y s “ Yo u w i l l b e c o m e a dinosaur fast if you don’t gear up Those firms that have done it already are pleased with the results ”

Resch suggests three strategies for accountants. First, “Seek out those in your organization who are knowledgeable about IFRS and let them know you are interested in learning more,” he says. Second, stay apprised of transitional plans and US roadmap status through industry newsfeeds and other resources And third, obtain specific skills in this area through seminars and online courses that c a n b e f o u n d o n w e b s i t e s d e d i c a t e d t o i n t e r n a t i o n a l f i n a n c i a l reporting topics (such as www.IASPlus.com).

I t ’s a s m a l l i n v e s t m e n t w i t h g r e a t r e t u r n s , s a y s R e s c h “ I believe that in the next 8 to 10 years, IFRS will be what we do for a living Even in the next 5 years I expect IFRS to develop as a core competency It’s the next platform that will generate leaders in the field.”

f i e d 3

0 0 p e o p l e i n t e r n a l l y “ w h o w e t h

d e n t i

, 0

d

g e f

You’ve come to us for years for high-quality education –now let us come to YOU! On-Site Learning allows your staff to receive customized training with their own colleagues without having to leave the office.

Illinois CPA

16 INSIGHT www icpas org/insight htm A new I n t e r n a t i o n a l F i n a n c i a l R e p o r t i n g S t a n d a r d s Ta s k F o r c e chaired

IFRS

IFRS

May,

AICPA

ICPAS Education

and a new International I s s u e s C o n f e r e n c e ; i n S e p t e m b e r, a n I F R S Fu l l - d a y S e s s i o n b y Debra Hopkins Visit ICPAS at www icpas org for information

Society’s

by Debra Hopkins will brainstorm

issues and provide

programming, including: In

an

two - day class held in the

Center

TheAlliantAdvantage!

TheaverageAlliantmemberearnsafinancialbenefitof $641peryear($1,218annuallyperaverage household) comparedtodoingbusinesswithabank,accordingtoanationaleconomicstudy.1

•Accesstomorethan80,000surcharge-freeATMs4

•24/7toll-freepersonalserviceandautomatedaccess

•OnlinebankingwithBillPayandeStatements

•Greatratesonsavings,Certificates,IRAs, HSAsandmore

•Lowratemortgage,homeequity,vehicle,boat andRVloans

•Freecheckingthatpaysahighrate

1CustomizedanalysisofestimatedmemberbenefitsforAlliantCreditUnionpreparedbyCreditUnionNationalAssociationEconomicsandStatisticsDepartment,December2008.Information containedinthisreportisasummaryofdatacomparingAlliant’sdividendrates,loanratesandfeestothoseofbankinginstitutionsinthestateofIllinoisobtainedwithpermissionfromCredit UnionNationalAssociation.2TheApril2009SavingsandIRAdividend,declared3/19/2009,providesaDividendRateof2.716%–CompoundedAnnualPercentageYieldof2.75%APY.Dividends arepaidonthelastdayofthemonthtoaccountholderswhohavemaintainedanaveragedailybalanceof$100ormore.Savingsdividendissubjecttochangemonthly.APY=Annual PercentageYield.3AveragebankratesprovidedbyDatatracasof4/02/09,basedonmorethan16,940institutions4Alliantchargesanominalfeeaftereighttransactionshavebeenperformedin amonthatnon-AlliantATMs,includingCO-OPNetwork,CreditUnion24CUHere,BankoftheWest,AllpointandAllianceOneATMs.NoteveryAllpointATMissurcharge-free.Pleaseseeouronline ATMLocatoratwww.alliantcreditunion.orgforalistofATMsthatacceptdepositsoraresurcharge-free.

©2009AlliantCreditUnion.AllRightsReserved.

Yoursavingsfederallyinsuredtoatleast$250,000 andbackedbythefullfaithandcreditofthe UnitedStatesGovernment NationalCreditUnionAdministration, aU.S.GovernmentAgency SEG296-R04/09 AsanIllinoisCPASocietyMember,you’reeligiblefor…

ItpaystobelongtoAlliantCreditUnion- $641 ayear!1 Greatratesand easyaccess! ALLIANT REGULARSAVINGS…MUCHBETTER THANBANKRATES! NATIONALAVERAGE BANK SAVINGS SignuptodayfortheAlliantAdvantage atwww.alliantcreditunion.org/ilcpa 7x earnover moreonyour savingswithAlliant

Public Exposure

Is it worth taking your business public when the economy is down?

By Sheryl Nance -Nash

No t s o l o n g a g o , c o m p a n i e s w e r e tripping over themselves to get to t h e h e a d o f t h e I P O l i n e T h e s e days, only the brave dare step up.

“ T h e I P O m a r k e t i s d e p l o r a b l e , e v e n non-existent. I’ve been in practice nearly 3 0 y e a r s a n d I ’ v e n e v e r s e e n a n y t h i n g remotely comparable,” says Thomas Murphy, partner-in-charge of the Chicago corporate practice at the law firm of McDermott Will & Emery.

The numbers aren’t pretty Globally, only six companies were able to raise more than $100 million in the fourth quarter of 2008, down 97 percent year-over-year, says Frederick Lipman, author of Internati onal and US IPO Pl anni ng: A Busi ness Strategy Gui de.

In the United States, more than 100 companies withdrew or cancelled their plans to go public, adds Stephen Ferrara, a partner with BDO Seidman in Chicago Total US IPO proceeds were approximately $30 billion in 2008, a 50-percent drop from 2007 Much of that money included the $18 billion from Visa, which was the largest US IPO in history.

“If you exclude Visa, it was the worst IPO market since 1990,” says Ferrara

Many of those who ventured into IPO waters nearly drowned “The average return on IPOs in 2008 was negative 32 percent,” Ferrara adds

“Poor economies or strong economies are not the problem with markets uncertainty is. Stock analysts and investors love stability, not uncertainty,” says Mark Lundquist, cofounder of SellMyBusiness.com, an online resource for finding business, real estate and equipment for sale or lease

That uncertainty, plus the costs and complexities of Sarbanes-Oxley, have really hurt the public market, says Lundquist. Nobody expects a major turnaround any time soon

“Based on recent economic reports, we will be lucky if the economy picks up this year. Maybe the fourth quarter will bring an uptick in IPO activity But in reality, it may be 2010 before we see market conditions

m e r e a l i m p r o v e m e n t . B e c a u s e w e ’ r e i n u n p r e c e d e n t e d e c o n o m i c t i m e s , no one really knows what the future holds at this point,” says Ferrara

Companies that are in declining industries, including retail, financial services and real estate, likely aren’t good candidates for a n I P O i n t h e n e a r f u t u r e , h e a d d s W h o else should think twice? “Companies that need 5 years before reaching positive cash flows or any appreciable revenue, and possibly even energy-related products, unless t h e r e a r e s o m e h u g e g o v e r n m e n t i n c e ntives,” says Lundquist.

Rather than selling equity in the public markets, companies might look at alternative ways to raise capital For example, in late 2008, Chicago firm Entrex announced that it was institutionalizing an alternative n e w s e c u r i t y s t r u c t u r e k n o w n a s “ T I G Rc u b s ™ ” ( To p - l i n e I n c o m e G e n e r a t i o n Rights Certificates) for private and public c o m p a n i e s . T h i s s e c u r i t y s t r u c t u r e r e p r es e n t s a f i x e d o w n e r s h i p i n t e r e s t i n a n issuer ’s GAAP gross revenues, in consideration for a lump sum infusion of cash This i n t u r n p r o v i d e s i n v e s t o r s w i t h c u r r e n t income and avoids dependence on liquidi t y e v e n t s a s t h e s o l e s o u rc e o f i n v e s t o r r e t u r n s I t ‘ s i d e a l l y s u i t e d f o r c o m p a n i e s with annual revenues of between $5 million and $250 million.

“ T I G R c u b s ™ i s a n a l t e r n a t i v e s e c u r i t y t o e q u i t y a n d m e z z a n i n e f i n a n c i n g f o r c o m p a n i e s t o u s e , a n d i s a t t r a c t i v e t o i n v e s t o r s b e c a u s e o f i t s p r i c i n g a n d c u rrent income features” explains Entrex CEO Stephen Watkins.

Chief among the advantages for an issuer is the fact that there is no equity dilution, which means that ownership percentages are retained For investors, the advantage is that cash distributions are provided monthly and, unlike equity investments, returns a r e n o t d e p e n d e n t o n l i q u i d i t y e v e n t s o r market timing

“It’s a radical change that reverts back to t h e o r i g i n a l a n d f u n d a m e n t a l m e t h o d s o f

18 INSIGHT www icpas org/insight htm S T R AT E G Y

s h o w s o

t h e r e g i o n a l s e c u r i t y e x c h a n g e s t h a t w e r e s o s u c c e s s f u l w h e r e there was transparency,” says Watkins

Even with the risk, doom and gloom, going public still might be a savvy strategy for some. Two factors are making going public attractive now “First, the SEC changed its rules just before the holidays, making it easier to conduct an IPO The SEC recognizes that if banks and private lenders can’t provide the capital for companies to grow, it’s best to allow more companies to raise capital via shareholders,” says Lundquist.

“Second, hedge funds and some investment banks have decided to take matters into their own hands, away from Wall Street, and are now aggressively seeking appropriate companies to invest in Some investment banks that normally shied away from pre-review or early-stage companies now see that these opportunities may provide better returns than the Standard & Poor ’s,” he explains.

“It may be a good time, too, for companies with proven business models in mature industries that are generating significant cash and returns, that have a fast return on cash, but are looking to transition the business,” says Roger Hardy, CEO of Coastal Contacts, an online vision-care supplier based in Vancouver, Canada

If a company is already a household name, with great growth plans and a compelling reason for the money, then public may be an option, says Murphy Companies that haven’t been so adversely impacted by the recession, such as healthcare businesses, energy and defense, also may make good candidates

What’s more, some companies will stand to benefit from the economic stimulus package. For those fortunate businesses, the timing might be right for an IPO. There isn’t likely to be a crowd of companies hankering for the spotlight They’ll get their 15 minutes and hopefully more

So if the odds are in your favor, here’s what you need to consider

For starters, be clear about your objectives “CEOs have to look hard at the IPO journey. Besides the often underestimated cost and resource implications to reach and maintain public status, you have to consider what being on the open market offers you in t e r m s o f s u p p o r t f o r o n g o i n g s h a r e p r i c e Wi t h s t o c k p r i c e s s o depressed, it’s hard to say where a company might price or what it can sustain for shareholders beyond that If remaining as, or becoming, a public company doesn’t provide efficient access to

capital (at a reasonable cost), along with shareholder liquidity, then what’s the value of being public?” asks Watkins

“The IPO process in itself is not the end all and be all that it’s chalked up to be. An IPO is not a kind of accomplishment of stat u s , a s i t w a s o n c e t h o u g h t t o b e ; i t ’s a n a c t i v i t y t h a t t a k e s a tremendous amount of attention and resources, has its associated risks, and needs to be considered in relation to its benefits It’s an extraordinary commitment, actually, and if alternatives to raising capital at less cost are available then they should be seriously considered,” he explains.

Secondly, be willing to complete your transaction at a lower price Think conservatively, says Murphy

“Don’t rush Spend more time than usual planning and preparing for the offering Don’t hurry to market to meet a window Even i f a w i n d o w o p e n s i n t h i s m a r k e t , o v e r- p r e p a r e a n d o v e r- p l a n , because it will be hard to extrapolate from previous markets, since there’s no real comparison,” he explains

Slowing down will keep you grounded in those things that are important, such as researching the investment bank behind the IPO “Gain an understanding of the strengths and weaknesses of the partner they are working with, including the bank’s success rate in completing IPOs, the bank’s knowledge of your industry, its track record in getting the price promised to the target company and for supporting the company in markets post-IPO,” explains Ferrara

Most importantly, ask yourself, “Will the IPO help my company in the future when seeking financing, acquiring businesses and recruiting/retaining talent?” and “Are we ready for the microscope?”

You’ll be measured quarter to quarter, and senior management will be required to disclose personal compensation and benefit information There will be less flexibility in managing your business, since you’ll be required to report to an independent board And you’ll need to guarantee the appropriate internal corporate structure to support a public company’s reporting requirements.

If after a good, long look the answer is decidedly a go, know that success is possible in any market, even this one Says Ferrara, “The top performing IPOs in 2008 were all niche businesses that had a distinct market for their products They returned approximately 30 percent on average ”

Not so bad after all, perhaps.

20 INSIGHT www icpas org/insight htm

e believe your money should be b as successful as you u are. T hat is why we‘ve been helping clients manage e their wealth h for r over 160 years with our disciplined investment philosophy. We combine fundammental research with local portfolio management, guided by an appreciation of A .R.T. (After-tax s str t ategies, Risk contrrol and Time horizons). The result is a customized investment policy statement, a long t -term plan that helps you grow and preserve your wealth.

Now that we’re part of PNC, you can rely on our reputation as one of America’s best-performing large bank s. With an A rating from Standard and Poor’s* and over $110 billion in assets under management,** let our strength and stability be the basis for yours

Trus t is som et hing we ea rn. To experience the Private Cli ent Group in Chicago, call Michael F. Smith, Market Executive, at 312.214.2125.

WEALTH PLANNING | Investments | Private Banking | Trust & Estate Services NATIONALCITY COM /PRIVATECLIENTGROUP

Investment products are: *As of January 19, 2009. **As of December 31, 2008. ©2009 The PNC Financial Services Group, Inc. All rights reserved.

The PNC Financial Services Group, Inc. (“PNC”) provides investment and wealth management, fi duciary services, FDIC-insured banking products and services and lending and borrowing of funds through its subsidiaries, PNC Bank, National Association, PNC Bank, Delaware and National City Bank, which are Members FDIC . PNC does not provide legal, tax or accounting advice.

On the Move

WiFi is everywhere; mobile technologies are it But are you putting yourself at risk by using them?

By Theresa Carey

By Theresa Carey

Whether you’re on the road or just o u t t o d i n n e r, m o b i l e d e v i c e s used for everything from schedu l i n g m e e t i n g s t o p a y i n g b i l l s o n l i n e a r e part of our everyday lives. But are we risking identity theft, corporate data loss, or an empty bank account by using them?

Probably the biggest risk facing mobile device users is theft or loss Imagine forgett i n g y o u r l a p t o p a t t h e a i r p o r t , o r h a v i n g your iPhone pickpocketed Wave good-bye to email accounts, logins, photos, and more

Then there’s the WiFi peril Thieves use strategies such as packet sniffing, phishing, and pharming to steal login information.

Not familiar with these terms? Well, you should be.

Packet sniffing refers to software or hardware that logs data being transmitted over a d i g i t a l n e t w o r k T h e i n t e n t i s u s u a l l y

b e n i g n t o l o c a t e t r o u b l e s p o t s o r h i g hl i g h t a t t e m p t e d b r e a k - i n s e a r l y o n B u t packet sniffers also can be used to steal data such as passwords

Former FBI agent Geoff Bickers suggests u s i n g a s e c u r e Vi r t u a l P r i v a t e N e t w o r k (VPN) to tunnel your web traffic through an open access point and therefore avoid sniffing. You can install a VPN on your mobile devices for a monthly fee between $7.50 a n d $ 1 5 . ( Ta k e a l o o k a t H o t s p o t V P N [www hotspotvpn com] or Hotspot Shield [www hotspotshield com] ) Or you can use non-commercial open source VPN equivalents, but these require technical expertise to deploy Linux users, however, will have relatively few problems

An even better option, says Bickers, is to “Leave open WiFi for dead and join the rest of us on EVDO (Evolution Data Optimized, [ w w w. e v d o i n f o . c o m ] ) o r G P R S ( G e n e r a l P a c k e t R a d i o S e r v i c e ) . I t ' s f a s t e r, m o r e secure than WiFi, and not that much more expensive when you realize you won't be wasting time looking for a signal or worrying about what you can and can't do on it ” N e x t o n t h e l i s t o f t h r e a t s i s p h i s h i n g , which uses a seemingly legitimate email to d e c e i v e a r e c i p i e n t i n t o c o m m u n i c a t i n g confidential information For example, an email might claim to be from your bank, and sensitive financial information, like a Social Security or bank account number, is needed ASAP.

In pharming, the victim is lured into making transactions on a phony website that looks like the homepage of a bank or legitimate investment company These sites typically ask for a lot more log-in information, including Social Security number and credit card information, than a legitimate site would do in order to verify your identity.

One way to thwart these scammers is to use a digital security ID card, which is the size of a credit card with a small numerical display The number changes every minute

22 INSIGHT www icpas org/insight htm T E C H N O LO G Y

or so, in sync with the broker ’s system. A user logs in with his or her ID and password, and then types in the current number. Many banks and brokers make these “two-factor authentication” cards available to their customers upon request

S c o t t M c G r a t h , d i r e c t o r o f p r o d u c t m a n a g e m e n t f o r R a v e Mobile Safety, says that, ”Mobile security risks are much the same as those confronting web surfers. Watch out for phishing, and use caution and common sense when clicking links from emails, SMS messages and Twitter feeds If you want to get to the web, type in the web address rather than trusting a link, and use bookmarks in your browser Even at the cost of typing on a small or virtual keyboard, never reveal passwords ”

I f y o u ’ r e m a k i n g a n y f i n a n c i a l t r a n s a c t i o n s f r o m a m o b i l e device, make sure the firms you’re working with employ encryption for transmitted data, and that they’re monitoring transactions for unusual behavior Most banks and brokers are now on the lookout for activity that originates from geographical areas that they know are hotbeds of criminal activity, and have been successful at stopping the great majority of these intrusions

Another major line of defense is firewall software, which monitors your Internet connection and alerts you to intruder attacks. It’s also a good idea to disable file and printer sharing, especially on Windows-based laptops, when working in a public hotspot You should password-protect extremely sensitive files, and consider encrypting them as well

Jamie Rawson, a technical instructor at VM Ware, Inc., who t a u g h t s e c u r i t y a t S u n M i c r o s y s t e m s f o r o v e r a d e c a d e , s a y s , "Encrypt everything you send across wireless connections Once you send data over a medium that you do not control 100 percent, you risk it being intercepted by unauthorized folks Encryption is the best protection to reduce that exposure to acceptable levels "

Also password-protect your mobile devices, including your laptop. While this won’t stop a determined crook, it will slow down the amateurs. If your laptop carries confidential data, you should seriously consider some kind of biometric security, such as a fingerprint recognition device

Your laptop isn’t the only problem though The incredible popularity of Apple’s iPhone has made it a target, especially now that it’s possible to write third-party applications for the platform. In t h e “ S e t t i n g s ” m e n u , y o u c a n d e f i n e a 4 - d i g i t p a s s c o d e l o c k , which should be one of the first things you do when you buy your phone The passcode can be set so that all the data the iPhone h o l d s , i n c l u d i n g c o n t a c t s , t e x t m e s s a g e s , a n d e m a i l l o g i n , i s erased if someone enters the wrong code 10 times

P h o n e n u m b e r s p o o f i n g i s a n o t h e r t r i c k b e i n g p e r p e t r a t e d a g a i n s t o w n e r s o f v a r i o u s S m a r t p h o n e s w i t h b u i l t - i n w e b browsers Let’s say you’re searching for a copy shop or a restaurant while you’re traveling, and you want to call one that came up on your device’s web browser Some crooks are formatting the dial links so that you are charged for an expensive 900 number or overseas number You may need a defibrillator when you read your next mobile phone bill should that happen.

Mobile devices, whether phones or laptops, are indispensable to business today It’s not as though we can say, “These gadgets a r e r i s k y ; l e t ’s n o t u s e t h e m ” I t ’s s i m p l y a m a t t e r o f k n o w i n g w h a t t h e r i s k s a r e , a n d d o i n g w h a t e v e r n e c e s s a r y t o p r o t e c t against them

2009 | call for nominations

Women toWatch AWARDS

The Illinois CPA Society, together with the AICPA, is once again looking for outstanding women who have made significant contributions to the accounting profession, their organizations, and to the development of women as leaders.

Awards will be given in two categories:

experienced leaders

•mentoring other professionals

•public or community service

•major or unique contributions to the profession

•leadership in workplace improvements

•authorship of professional articles

emerging leaders

•demonstration of leadership

•contributions to the profession

•creation and implementation of unique initiatives in the workplace

•public or community service

•involvement with her alma mater

For more information or to nominate a deserving woman, visit www.icpas.org, or call 800.993.0407, ext. 220.

Deadline for submissions is June 20, 2008

www icpas org / insight htm MAY/JUNE 2009 23

Love & Money

Protecting your client’s assets before they tie the knot goes beyond traditional prenups

By Janet Haney

By Janet Haney

Romance isn’t all wine and roses

The nation’s divorce rate is proof of that In fact, marriage is just as much about protecting assets as it is about love these days

“You don’t know what the future will bring, so arm yourself with the best defense,” advises Mark Gilbert, CPA/PFS, of Reason Financial Advisors “Look at your future spouse as a future creditor down the road ” That might not seem the most romantic sentiment, but it is, perhaps, the most practical A r e c e n t U n i v e r s i t y o f P e n n s y l v a n i a Wharton School of Business study reveals that divorce rates in the United States fluct u a t e d e p e n d i n g o n a g e , e d u c a t i o n a n d length of marriage "The ubiquitous 50-percent divorce rate is unlikely to ever be true for those who married in the past few decades," says Betsey Stevenson, assistant professor of business and public policy at Wharton. "For many of these folks, their divorce rates so far have fallen substantially compared with previous generations "

So why worry? “My view is that it is less expensive if you have a premarital agreement that delineates what is marital property and what the rights are to maintenance,” says Barbara Grayson, partner at Mayer Brown LLP in Chicago. “Without a premarital agreement, there is room for more vigorous litigation Since a premarital agreement is negotiated when the future spouses are feeling more fondly about each other, they will be more generous,” she says “What clients are worried about is facing a long, drawn-out court battle.”

Commonly, spouses-to-be will establish either a revocable or an irrevocable trust to protect individual or business-related assets

The grantor of a revocable trust determines who will serve as the trustee and who the beneficiaries will be upon death The trust is considered part of the grantor ’s estate, and assets are therefore subject to individual taxation The trust can be changed or cancelled during the grantor ’s lifetime, and con-

tributions can be withdrawn while the grantor is still living

The grantor of an irrevocable trust, on the other hand, cannot take contributions out of t h e t r u s t , b u t c a n g i v e a w a y a s s e t s h e l d while he or she is still living (in cases of succession, for example) The downside is that the grantor effectively eliminates all of his or h e r r i g h t s o f a s s e t o w n e r s h i p O n t h e upside, he or she is relieved of tax implications on the income generated by the assets.

“The separation of assets is the most important thing. If you have assets keep them titled in your name,” says Kevin Metke, private client advisor in the tax practice at Deloitte & Touche in Chicago

This means keeping bank accounts and titles to homes and businesses independent. Each person also should be represented by his or her own attorney

Gloria Birnkrant, CPA, partner at NSBN L L P, s u g g e s t s t h a t b o t h p a r t i e s a t t a c h a s i g n e d b a l a n c e s h e e t t o t h e p r e n u p t i a l a g r e e m e n t , a c k n o w l e d g i n g w h i c h a s s e t s will remain separate. Non-marital property such as a house purchased before marriage, an investment portfolio or an inheritance generally goes back to the individual who holds the title

There are exceptions, however “How property is held can differ from state to state, and the rules covering property rights differ from state to state,” Birnkrant warns. If the assets increase in value during the marriage, or if a spouse buys additional property with income from the original assets, it might all be tagged as marital property upon divorce

“Meticulously maintain the separate property and the income from it so that the separate property doesn’t get comingled with the community property,” Birnkrant advises “This is the usual problem for couples and creates issues concerning which property is really separate and which property, by comingling, has become community. Keep detailed records of the source of the assets and the income from those assets ”

24 INSIGHT www icpas org/insight htm W E A LT H

Cash flow is more than just moving money. It’s the lifeblood of your business.

b a e o m t t no out,

n t o i o d e t op u h o t y ha n w ntio

e , w tantly mpor e i or . M uture e f h

o a u t o h y t i k w or l w e’l . W t t i u o