You’ll have access to tools, information and resources created by practitioners for practitioners.

And you’ll be part of the profession’s premier tax organization – 25,000 tax practitioners with whom you can network and exchange best practices.

Tax Section Benefits include:

• Tax practice support – 600+ pages of checklists, letters and practice guides (a $135 value!)

• The Tax Adviser – the top magazine for tax-planning tips and techniques (regular price $85 – you pay just $30!)

• Bi-weekly E-Alerts – updates on tax-law developments and practice trends

• Exclusive discounts – including 40% off RIA desktop tax references and more!

• Advocacy – representation in Washington for CPA tax practitioners

ISO Certified

Join the AICPA’s Tax Section!

Prepared!

Tax season will soon be upon us Are e a ? ready? adydy? youreaeadyy? you y r Apply online at aicpa.org/TAX Email at Taxinfo@aicpa.org Call us at 800.513.3037 We look forward to welcoming you to the AICPA Tax Section! Join today! AICPA Tax Section membership costs just $145 2 3 3 43 2 6 or $175 with The Tax Adviser

Are You Recession Proof?

These are troubled times Can you defend your business, career and investment from the econom ic downturn?

38 The Business of Farming

Illinois farmers face a landscape that ’ s changing literally and figuratively

42 Bankrupt America

Over the course of two weeks, the financial industry watched helplessly as Merrill Lynch and Lehman Brothers collapsed

46

The Public Road

What does the Sarbanes - Oxley Act mean to today ’ s nonprofits?

10

Image Math Geek or Business

Guru?

The days of number- crunching in dimly lit backrooms are over; the green eyeshades are off!

14

World Economy Global Giants

No longer an arena only for small players, emerging markets are being redefined in a big way

16

Workplace Speak No Evil

You may not intend it to be harassment, but it ’ s the impact, not the intent, that matters

18

Investing 2009: A Space Odyssey

Pull your space boots on and grab your helmet You may be next in line for destination space

22

Financial Planning Family Redefined

Estate planning for the non-nuclear 21st century family

24

Technology

New Age PM

It ’ s the dawning of a new era for performance measurement technology

28 Career Take the Stand

Want to be an expert witness? Prepare to feel the pressure

30

Succession Family Reins

In succession planning, keeping it all in the family isn’t as easy as it sounds

32

Tax Into The Fire

Things keep heating up for tax preparers, which means penalties may be harder to avoid

4

34 cover story

index features colu m n s regulars November/December 2008 Vo l 5 8 N o 4 www icpas org / insight htm

First Word

Seen + Heard

Classifieds

6

50

400,000smallbusinessestrustADP.

Toanemployee,it’smorethanjustapaycheck.It’satickettoaricherlife. That’swhyADPisthepreferredpayrollproviderforsomanysmallbusinesses— andtheaccountantswhoservethem.Whenitcomestomanagingpayroll,ADP offersaccountantsmorechoices.Andmorewaystosucceed.Wanttoprovide morevalueandmoreenhancedservicestoyourclients?Youcanstarttoday. accountant.adp.com1-866-4ASKADP

ChrisVitrano MarketingDirector ec-connection Milwaukee,Wisconsin

ChrisVitrano MarketingDirector ec-connection Milwaukee,Wisconsin

©2008ADP,Inc.TheADPLogoisaregisteredtrademarkofADP,Inc.

Most of us have a tendency to label things issues, people and events as if doing so simplifies life’s complexities and allows us to file them away in some orderly fashion and move on

So as much as we might want to wrap 2008 in a neat little box, label it and start fresh in 2009, finding a common label for the past year isn’t easy Was it a great year, a good one, or one we’d rather forget? Thinking about the past 12 months, did it meet our expectations or set us back a bit?

Much of what we’ve been talking about this year will probably still be on our agenda for 2009 and even beyond it International Financial Reporting Standards will undoubtedly change the business landscape and culture of the profession The shift to these standards is already taking place, and there will be widespread repercussions from the boardroom to the classroom Other matters we’re dealing with rapidly changing technology, creating a diverse workplace culture that works across generations, getting our offices more green and ourselves more environmentally conscious won’t be “wrapped up” in the foreseeable future They continue to need our time and attention

There are also, however, many reasons to feel a sense of accomplishment We can be proud of the work done by the Society’s Young Professionals Group with small businesses in Louisiana still suffering from the repercussions of Hurricane Katrina, as well as everyone who supported or trained them for this mission We can be proud of the Society members who quickly responded to a call for assistance from the IRS to staff Illinois FEMA disaster centers We can be proud of the more than 130 members who participated in the Center for Economic Progress’s Tax Counseling Project, which provides free federal and state tax return preparation to low-income families throughout the state

There shouldn’t be any frustration if the old year doesn’t have a clear ending and the new one a totally fresh start Seeing our careers, businesses and profession as an energized never-ending challenge that can’t be restrained by a calendar is a good way to start 2009

Good health and prosperity to you in the New Year

ICPAS President & CEO

I C P A S O F F I C E R

S

Chairperson, Sheldon P Holzman, CPA Virchow Krause & Company LLP

Senior Vice Chairperson, Lee A Gould, CPA Gould & Pakter Associates LLC

Vice Chairperson, James P Jones, CPA Edward Don & Company

Vice Chairperson, Michael J Pierce, CPA RSM McGladrey Inc

Vice Chairperson, Ray Whittington, CPA College of Commerce Depaul University

Secretary, Charles F G Kuyk III, CPA Crowe Horwath and Company LLP

Treasurer, Sara J Mikuta, CPA The Leaders Bank

Immediate Past Chairperson, Debra R Hopkins, CPA Northern Illinois University CPA Review

I C P A S B O A R D O F D I R E C T O R S

Brent A Baccus, CPA,Washington Pittman & McKeever

Therese M Bobek, CPA PricewaterhouseCoopers LLP

Robert E Cameron, CPA Cameron Smith & Company PC

William J. Cernugel, CPA Alberto-Culver Company (Retired)

Anthony Fuller Grant Thornton LLP

William P Graf, CPA Deloitte & Touche LLP

Cara C. Hoffman, Blackman Kallick LLP

Charlotte A Montgomery, Illinois State Museum

Gerald A Olsen, Illinois Wesleyan University

Annette M O’Connor, CPA RR Donnelley Logistics

Mary Lou Pier, CPA Pier & Associates Ltd

Marian Powers, PhD Northwestern University

Daniel F Rahill, KPMG LLP

Lawrence H Shanker, Shanker Valleau Accountants, Inc

4 INSIGHT www icpas org/insight htm F I R S T W O R D

Publisher

Elaine Weiss

Editor-in-Chief

Publications Director

Judy Giannetto

Creative Director

Gene Levitan

Design Manager

Rosa Garcia

Assistant Editor

Derrick Lilly

National Sales & Advertising

Janis L Mason

medrepcons@ aol com

Offi ce: 773- 325- 1804 Cel l : 312- 560- 3881

Advertising Sales Associate

Tito Apatira

apati rat@ i cpas org

Circulation

Jim Jarocki

j arocki j @ i cpas org

Editorial Office 550 W Jackson, Suite 900, Chicago, IL 60661

Advertising Sales Office 3711 N. Ravenswood Ave., Suite 146, Chicago, IL 60613

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some

23,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published bimonthly except monthly in July and August by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA, 312-993-0393 or 800993-0393, fax 312-993-0307 Subscription price for nonmembers: $30 U S , $40 Canada and International addresses, $42 Mexico Copyright © 2008 No

upcoming events

November 10, 2008 - Chicago, Illinois

TECHNICAL WORKSHOP SERIES

FASB Review for Industry

Richard Gesseck, CPA - Partner, UHY LLP

November 20, 2008 - Chicago, Illinois

Developing and Executing Strategies for Growth and Profitability: The Return Driven StrategyTM

Mark L. Frigo, PhD, CPA, CMA - Director, The Center for Strategy, Execution and Valuation, Kellstadt Graduate School of Business, DePaul University

November 21, 2008 - Chicago, Illinois

Leadership: Becoming an Impact Player

Dennis L. Faurote, CPA - President, The Faurote Group and Adjunct Professor, Kelley School of Business, Indiana University

December 12, 2008 - Chicago, Illinois

Assessing the Ethical Dimensions of Strategy and Execution

Mark L. Frigo, PhD, CPA, CMA - Director, The Center for Strategy, Execution and Valuation, Kellstadt Graduate School of Business, DePaul University

December 18, 2008 - Chicago, Illinois

TECHNICAL WORKSHOP SERIES

Shaping Up Your Accounting Function: Trimming the Fat and Going Lean

John Cox, JD - President & CEO, The Rome Group

March 17, 2009 - Rosemont, Illinois

CONTROLLERS CONFERENCE: The Changing World of Corporate Finance. Are Your Ready?

Center for Corporate Financial Leadership’s Executive Education Certificate Program

Separate yourself from the pack. Complete the five core classes and three electives to receive your certificate. For more information, visit www.CCFLinfo.org

= Core Class = Elective Class c e

be

the address above Periodicals postage paid at Chicago,

and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, I l l i n o i s C PA S o c i e t y, 550 W Jackson, Suite 900, Chicago, IL 60661, U S A

Center for Corporate Financial Leadership is a service of the Illinois

Society

part of the contents may be reproduced by any means without the written consent of INSIGHT Permission requests may

sent to: Editorial Director, at

IL

The

CPA

WWW.CCFLINFO.ORG e e c making your life easier www icpas org / insight htm NOVEMBER/DECEMBER 2008 5

SEEN H E A R D

6Tips for Client Wealth

It ’ s a volatile market, which makes keeping clients’ investments on an even keel evermore challenging These tips, though, will keep you and your clients sailing smoothly

1.Don’t panic: Give your clients the objectivity to focus on longterm goals, not short-term crises

2.Rebalance portfolios: During economic downturns, it ’ s not unusual to see portfolios thrown off balance Review asset allocations and redistribute funds where necessary

3.Emphasize diversity: A mixed portfolio of bonds, cash and stocks provides added protection in volatile markets

4.Look for income: Consider dividend-paying stocks, focusing on sound companies that pay consistent dividends and have a strong history of increasing payouts.

5.Stick to the plan: Establish a monthly contribution schedule to the client ’ s brokerage or retirement account in order to build longterm wealth and reduce exposure to market swings

6.Watch taxes: Assess the tax implications of your clients’ shortterm and foreign holdings If feasible, liquidate losing positions to offset year-end capital gains taxes

$613 bil lion

Total debts listed by Lehman Brothers on their chapter 11 bankruptcy filing

New Creditrak R&D Tax Credit Software

CrediTrak is a new web -based research and development tax credit software that provides companies and CPA firms with a simplified and faster way to calculate tax credits and process documentation Its primary benefit is a real-time expense tracking feature that allows CPA firms to gather the support documentation for R&D credit claims necessary to withstand the toughest IRS inspection

CrediTrak pricing is determined by the number of employees, company locations and entities involved in the calculation, and the chosen level of software and services used In general, an R&D study using CrediTrak will range from $750 for a Silver-level study to less than $10,000 for a full- service Platinum-level study involving RCG’s tax and accounting professionals

What ’ s more, CrediTrak ’ s R&D Credit Estimator Module allows CPAs to input basic wage and gross receipt information to determine the estimated R&D credits of a particular client, and to analyze their cost to perform an R&D study

Visit www.creditrak.com for more information.

6 INSIGHT www icpas org/insight htm

N E W S B Y T E S , S O U N D A D V I C E A N D P R A C T I C A L B U S I N E S S T I P S

www icpas org / insight htm NOVEMBER/DECEMBER 2008 7

Uncle Sam’s Home Loan

when filing their tax returns this year and next.

The credit applies to primary home purchases in the United States made after April 8, 2008 and before July 1, 2009 The fully refundable credit reduces the taxpayer ’s tax bill or increases his or her refund, dollar for dollar, meaning that the credit will be paid out to eligible taxpayers even if they owe no tax or the credit is more than the tax that they owe The credit is 10 percent of the purchase price of the home, with a maximum available credit of $7,500 for either a single taxpayer or a married couple filing jointly

The credit operates like an interest-free loan, and must be repaid o v e r a 1 5 - y e a r p e r i o d . F o r e x a m p l e , a n e l i g i b l e t a x p a y e r w h o bought a home after April 8, 2008, and claims the maximum available credit of $7,500 on their 2008 federal income tax return, must b e g i n r e p a y i n g t h e c r e d i t b y i n c l u d i n g o n e - f i f t e e n t h o f t h i s amount, or $500, as an additional tax on their 2010 return They must then continue the repayment on each return until the amount is fully repaid. The full credit is available to taxpayers with a modified adjusted gross income under $150,000 for married couples and $75,000 for single filers

Eligible taxpayers will claim the credit on new IRS Form 5405 This f o r m , a l o n g w i t h f u r t h e r i n s t r u c t i o n s o n c l a i m i n g t h e f i r s t - t i m e homebuyer credit, will be included in 2008 tax forms and instruct i o n s I n f o r m a t i o n a l s o w i l l b e a v a i l a b l e o n t h e I R S w e b s i t e [www.irs.gov].

CPA’s & Financial Professionals:

If you care about your clients, please continue. Learn to reach out and teach your clients howtogrowandimprovetheir businesses. Learn how to add a valuable newserviceofferingthatcreatesalucrative new profit center for your practice.

Cycle of Success Institute is a comprehensive one year training class that is, for the fist time, being licensed to just 30 select Illinois CPA firms. Help your clients by teaching them how to find and solve costly problems, improve operations and implement improvements that impact growth, productivity and profit margins.

To attendan upcominglunch andlearnorientation, contact:

John Mautner, President and Founder CycleofSuccessInstitute(312)371-7929 orjmautner @ cycleofsuccess.net.

$1-1.5 tril lion

Estimated cost of the US government ’ s efforts to rescue failing financial institutions and the mortgage market

You on YouTube

If you ’ re looking for an inexpensive way to add video to your website complete with analytics on who’s viewing YouTube has an enticing offer: They ’ll do it for free.

In an effort to become the default web video platform, YouTube has rolled out a series of free tools that essentially enables any business to edit, post and analyze viewership of a video at absolutely no cost.

It ’ s an offer worthy of serious consideration, given that over 12 billion online videos were viewed in May 2008 alone, with Google, owner of YouTube, trafficking 34.8 percent of that number, according to web research firm Comscore

E qu al l y pers u as i v e i s t he f ac t t h at by 2 0 1 1 , ebus i ne s s m ar k eti n g researcher, eMarketer, estimates that 61 2 percent of the US population will be watching videos online

A number of financial and accounting firms are already using web video to reach out to web viewers KPMG has its own YouTube channel featuring a variety of promotional, recruitment and testimonial videos, and Ernst & Young, which is also using recruitment and promotional commercials, has expanded its offering with a speech CEO Jim Turley gave at USC Leventhal School of Accounting.

Whether you ’ re putting a face on your firm or touting your company to potential new recruits, the cost of admission to YouTube zero dollars is tough to ignore.

Visit www youtube com for more information

Office Tech Etiquette

New and exciting gadgets are making their way into suit pockets and corporate offices, thanks in part to the wave of Generation Y e m p l o y e e s s t e p p i n g i n t o t h e w o r k p l a c e . A s d e v i c e s l i k e s m a r tphones, iPods and iPhones make their presence known, make sure you have a handle on these etiquette dos and donts

1. Is that English? When it comes to emailing and texting, text-messaging shorthand such as C U L8R (see you later) is best left to social rather than business communications

2. It’s a way of life. Although devices like the BlackBerry and iPhone have been integrated into offices around the world, their expansive capabilities can often be distracting. Internet surfing, texting, gaming and emailing, although tempting, should be used with discretion in the workplace

3. Noises off! For the courtesy of others, devices should be turned off or silenced during meetings and presentations Also, though study results are conflicting, many employees say that listening to music helps them focus The permitted use of personal radios, iPods, or similar devices may be determined by company policy, but as a common courtesy, watch the noise level

8 INSIGHT www icpas org/insight htm

Cycle-of-Success Institute 150N. Michigan Ave. 28th floor Chicago, IL60601

F i r s t - t i m e h o m e b u y e r s c a n t a k e a d v a n t a g e o f a n e w t a x c r e d i t i n c l u d e d i n t h e H o u s i n g a n d E c o n o m i c R e c o v e r y A c t o f 2 0 0 8

YOU BECOME A PRIME TARGET?

CPAs su er increased risk in turbulent economic times such as these. Clients whose personal or business nances have faltered may try to claim that it’s your fault. CAMICO risk management services help CPAs clearly document the advice given to their clients and avoid situations such as risky engagements and collection problems.

This is how CAMICO can help you minimize claims, unpaid fees and damage to your reputation. And if a claim should occur, you’re protected with our professional liability insurance and risk management program – the only program developed by CPAs for CPAs.

With CAMICO, you are primed for success.

1235 Radio Road, Redwood City, CA 94065 Phone: 800.652.1772 E-mail: inquiry@camico.com www.camico.com FREE REPORT: Get your copy of the CAMICO report “8 High-Risk Clients CPAs Should Avoid” plus “10 Tips to Manage Your Risk.” E-mail riskadvisors@camico.com or call 1.800.652.1772. HAVE

CAMICO professional liability insurance is endorsed by state CPA societies/associations in Arizona, California, Colorado, Indiana, Kentucky, Mississippi, Missouri, Nevada, New Jersey, New York, South Carolina, Tennessee, Utah, Virginia and Washington

Math Geek or Business Guru?

The days of number-crunching in dimly lit backrooms are over; the green eyeshades are off!

By Bridget McCrea

It may well have taken decades, but the n o w a rc h a i c i m a g e o f t h e m e e k a c co u n t a n t s i t t i n g a t h i s s o l i t a r y d e s k h a s given way to today’s dynamic globetrotting financial pro, steering multi-million dollar businesses to success, policing the ranks for m i s c r ea n ts a n d f ra u ds t er s , an d ta k i ng t he p o d i u m t o s o o t h t h e f e a r s o f a s k e p t i c a l investing nation. This truly is the dawning

o f a n e w e r a f o r f i n a n c e and accounting professionals, not only at home, but around the world.

I t ’s b e e n a l o n g r o a d from math geek to business guru The advent of regulations like those contained in the Sarbanes-Oxley Act have sped things along by s h o w c a s i n g f i n a n c e a n d accounting pros as guiding lights for public firms that h a v e t o f o l l o w t h e r u l e s more closely than ever

“ T h e p u b l i c p e rc e p t i o n o f t h e a c c o u n t i n g p r o f e ss i o n h a s c h a n g e d q u i t e a bit over the last few years,” says Denny Reigle, director of academic and career development for the American Institute of Certified Public Accountants, or AICPA. “For example, where individuals working in this field were once called ‘accountants,’ they are now known as experts who are working in professional services firms

“ D r i v i n g t h a t c h a n g e , ” h e s a y s , “ i s t h e f a c t t h a t s u c h f i r m s n o w o f f e r a b r o a d e r r a n g e o f s e r v i c e t h e k i n d s o f s e r v i c e s t h a t g o b e y o n d t a x e - p r e p a r ation and auditing ”

A partner at Arthur Andersen in Chicago for 24 years before coming on board with the AICPA, Reigle is glad to see CPAs shed the image of the green eyeshade-wearing purveyor of debits and credits That image “wasn’t accurate to begin with , ” he says Even before the rest of the world realized t h e p r o f e s s i o n ’s e x p a n d i n g r o l e , m a n y accountants were already going far beyond j u s t r e v i e w i n g f i n a n c i a l o p e r a t i o n s a n d preparing financial statements.

“Even historically, accountants have been c o n d u c t i n g c a r e f u l a u d i t s a n d r e v i e w i n g prepared financial statements that the capital markets, in turn, use for any number of r e a s o n s , i n c l u d i n g i n v e s t m e n t p u r p o s e s , ” s a y s R e i g l e A n d w h e t h e r t h e c o m p a n i e s that hired them knew it or not, CPAs also have focused on internal controls and how a c c o u n t i n g w a s h a n d l e d i n a p a r t i c u l a r organization a concept that’s since morphed into “risk assessment.”

“CPAs have always analyzed which systems are at risk, which could break down a n d w h a t t y p e o f i n f o r m a t i o n w a s b e i n g fed into financial statements to ensure that i t w a s p r o p e r l y p r o c e s s e d a n d c l e a r e d , ” Reigle explains.

That role has expanded over the last decade or so, positioning the CPA as a “go to” person not only when problems come up, but also when firms are planning to grow and expand. A c a s e i n p o i n t : T h e r e w e r e three practice groups when Reigle started at Arthur Andersen: audit, tax and administrat i v e s e r v i c e s B y t h e t i m e h e r e t i r e d , t h a t number had grown to 46.

“In many cases, the expansion of services came because clients were looking to their audit firm as a one-stop shop for a growing n u m b e r o f f i n a n c i a l s e r v i c e o p t i o n s . T h e accounting firms then answered the call,” he explains

10 INSIGHT www icpas org/insight htm I M A G E

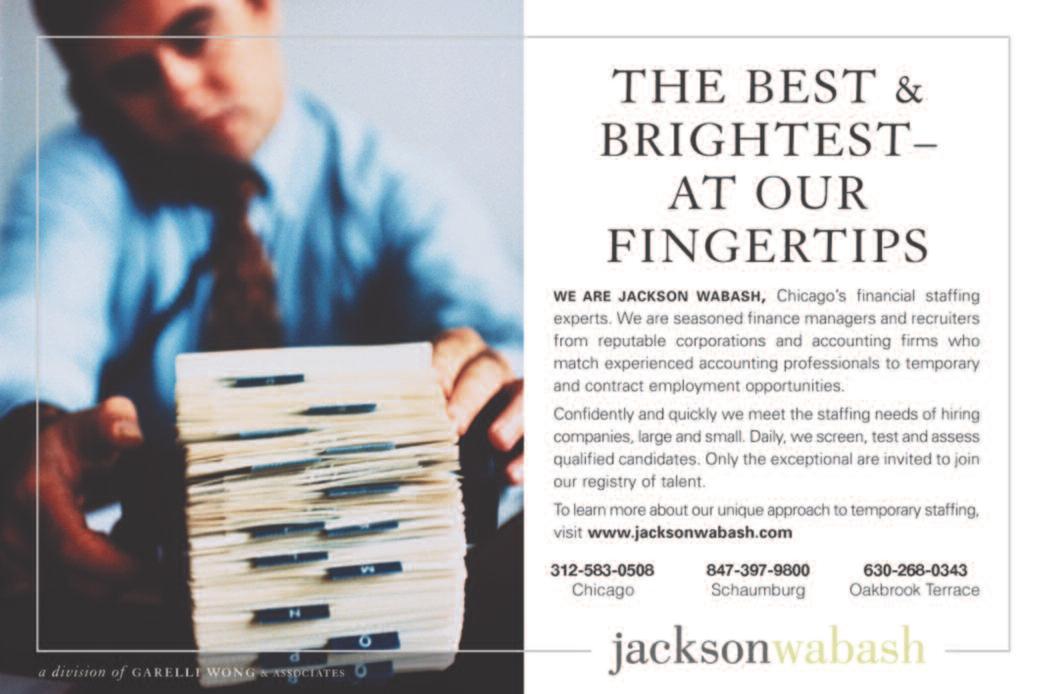

The Illinois CPA Society has made it easier than ever to identify the up and comers in the accounting profession. Just visit the Illinois CPA Society’s Career Center and search student resumes to fill your next internship.

All across the state, Illinois CPA Society student members have uploaded their resumes for you to view online. These students represent the future of the profession and your guidance as a seasoned member of the profession can put them on the right track. These students are available for summer, fall or spring internships.

You can search by various criteria, including:

Geographic Location

Timeframe

Paid or College

Credit Internships

Visit

www icpas org / insight htm NOVEMBER/DECEMBER 2008 11

The best and the brightest interns are at your fingertips.

and click on the Career Center.

www.icpas.org

While increased regulation has undeniably elevated the accountant’s role in corporate America, it has also brought attention to the negative side of the profession, where auditors “cook the books” to help their clients succeed Such strategies led to a very public backfire in the early 2000s, with big names like Enron and WorldCom at its center.

“It was a shock effect,” says Jeffrey Thomson, president and CEO of the Institute of Management Accountants (IMA) “We saw a very public display of accounting fraud and lack of ethics that wasn’t necessarily perpetrated by the accountants, but in some cases at the middle ranks it was clear that the management and financial accountants didn’t do as much as they could to stop fraud.”

The Arthur Andersen scandal followed shortly afterwards, bringing down a well-regarded institution thanks to a few “very highly visible acts of fraud,” says Thomson. “The management and financial accountant’s image took a shot to the head due to this scandal ”

Since then, says Thomson, regulations like Sarbanes-Oxley have helped to recover and restore credibility for accountants across the board “The bar has been raised significantly,” he explains, “and the profession as a whole now has to do an even better job of supporting CEOs, CFOs, shareholders and members ”

Interestingly enough, bad press is still press The cases of fraud and scandal splashed across the front pages of the nation’s newspapers had a dual effect: Raising public scrutiny of corporate finan-

cial practices, and increasing the appeal of the profession among future generations It’s not that fraud was attractive, but more that the idea of playing a key role in changing a tarnished image was sexy particularly to a generation for whom making a difference is as important as professional prestige

The passage of Sarbanes-Oxley in 2002 only highlighted this role. “ I t

H u m a n C a p i t a l P a r t n e r S a n d i G u y “ P e o p l e a r e s a y i n g , ‘ Wo w, accountants are really involved with these big clients,’” she says.

“Young professionals find it cool, and it’s attracting them to the industry It’s especially useful on college campuses, where a lot of students look at forensic accounting and, in a day and age of CSI and similar television shows, are very intrigued and attracted by it,” says Guy. “While it has been unfortunate for the firms and the organizations impacted, it’s given our industry some exposure and made them say, ‘Wow, accountants do far more than just accounting ’”

Sarbanes-Oxley also brought the auditor ’s primary responsibilities to light: To protect the public’s interest by auditing and opining on management financial statements, says Chuck Landes, vice president of professional standards and services for the AICPA.

“Too often during the 1990s, we saw auditors thinking that their allegiance was to management,” he explains “When SarbanesOxley was instituted, it forced the profession to again focus on the fact that our ultimate client is the public user of the financial statement, not the company management.”

Thomson says the bar will continue to be “raised significantly,” as the profession grows in a positive direction He points to the latest numbers from the Bureau of Labor Statistics (BLS) as proof of that expansion “The BLS says that growth for the accounting profession is higher than any other industry sector through 2016, which means there will be continued demand for accountants of different flavors, including internal auditors, exterior auditors, management accountants and fraud examiners ”

As companies of all sizes continue to struggle under the weight of Sarbanes-Oxley compliance, Thomson sees the role of the accountant becoming even more vital to overall business success.

“CEOs expect to achieve flawless transaction processing and a clean bill of health in terms of financial disclosures and internal controls,” Landes explains. “The question is, how can CPAs help those companies achieve those goals while also creating value?”

Looking at college campus recruits, Guy says the crop of new talent will continue to positively impact the profession’s image.

“They are definitely the future of the accounting profession, and they know that their jobs are less about counting inventory and handling debits and credits, and more about forensics, regulations and business strategy,” he explains “This trend will continue as

And as the green-eyeshade and bean-counter image fades farther from the public mind, expect the accountant’s role to be elevated even more

w o n d e r s f o r t h e i n d

’s d o n e

u s t r y, ” s a y s B D O S e i d m a n , L L P ’s

m o r e a n d m o r e s p e c i a l t i e s s u r f a c e w i t h i n t h e a c c o u n t i n g f i e l d , making it that much more exciting for younger people who are making career choices ”

12 INSIGHT www icpas org/insight htm

tools to help you find the job of your dreams. Featuring: Job Bank Resume Posting Service Salary Surveys Plus, access to a list of career coaches (fee-based service) to assist you in achieving your career goals. Check out the Career Center today at www.icpas.org. What do you want to be when you grow up? A benefit of your

Career Center

Illinois CPA Society membership.

“The public perception of the accounting profession has changed quite a bit over the last few years...where individuals working in this field were once called ‘accountants,’ they are now known as experts who are working in professional services firms.”

Email: http://tax.cchgroup.com/members/icpas (Enter

Phone: Wanda Brooks: 708.969.5355

Email: wbrooks@warehousedirect.com

Phone: 800.328.1935

Web: www.alliantcreditunion.org/ilcpa

800.422.4661,

Phone: 800.835.0894

Phone: 800.323.2106 (liability) or 800.842.ICPA (medical & life plans)

800.325.7000

www icpas org / insight htm NOVEMBER/DECEMBER 2008 13 Become a provider. For more information about becoming a Member Buying Advantage program provider of the Illinois CPA Society, please contact us at 800.993.0407, ext. 286. NEW! Publications

Offering more than 65,000 products at competitive prices. Office Products

30% member discount on tax and accounting books.

member discount code: Y6202)

Competitive loan rates and dividends as well as access to a diverse line of products and services. Credit Union

10% group discount rates and a no obligation quote. Find out how much you could save! Call for a free no-obligation quote. Use group #3408. Home/Auto Insurance

Complete administration of 125 Cafeteria Plan. 10% off of enrollment and administrative fees. Section 125 Cafeteria Plans Phone:

No annual fee and credit lines up to $10,000, plus low introduction APRs. Credit Card

Special group discounts on life, disability, major medical and liability plans. Various Insurance Plans Phone:

Discounts on products and services. UPS A benefit of your Illinois CPA Society membership... MemberBuying Advantage Program Save money on the products and services you use everyday. Contact a carefully selected Member Buying Advantage Program provider today and start saving.

Phone:

press 7

800.457.3714

Global Giants

By Christine Bockelman

Historically, “the emerging market has always been the smaller market,” says George T Haley, PhD, d i r e c t o r o f t h e C e n t e r f o r I n t e r n a t i o n a l Industry Competitiveness and professor of marketing and international business at the University of New Haven in Connecticut

Ho w e v er, C h in a , a mo n g o th e r n a tio n s , is changing all that

“ C h i n a ’s p o p u l a t i o n i s l a rg e r t h a n t h e p o p u l a t i o n o f t h e d e v e l o p e d w o r l d , ” s a y s Haley And for that reason, it’s become the case study for global competition

A huge population in China means that there’s a wealth of people ready to fill manu f a c t u r i n g j o b s H o w e v e r, “ T h e j o b s a n d m a n u f a c t u r i n g m o v i n g i n h a v e a t r e m e ndous effect on the growth of the emerging m a r k e t , ” H a l e y e x p l a i n s “ T h e r e a r e s o m a n y p e o p l e i n C h i n a t h a t i t ’s l i k e l y t o c a u s e s e v e r e e c o n o m i c p r o b l e m s i n t h e d e v e l o p e d e c o n o m i e s , b e c a u s e t h e r e a r e just so many jobs you can send overseas. It’s like trying to fill a black hole ”

For the first time, China has a burgeoning m i d d l e c l a s s , w h i c h h a s a d i s p o s a b l e i ncome it’s willing to spend The problem is, it’s not spending it on goods made by US companies. “China has a much higher perc e n t a g e o f i m p o r t s f r o m J a p a n t h a n f r o m the United States,” says Haley

If the world’s largest population happens t o b e w h e r e t h e b u l k o f m a n u f a c t u r i n g occurs, and if that population isn’t buying your goods, then you have to ship to markets that do buy them And that’s becoming i n c r e a s i n g l y e x p e n s i v e g i v e n r i s i n g o i l prices, among other factors.

More importantly, no matter the acclaim of Chinese markets, they’re still just emerging. Their transportation systems aren’t the same as those in more developed countries Rail transportation in the Western provinces is limited, so even if it’s cheaper to make something there, it’s probably going to cost

more to transport it. Without a doubt, shipping has become a huge problem for industrial manufacturing companies that went to China chasing the promise of lower wages.

“ Te x t i l e s c h a s e d t h e w a g e t o o , b u t t h a t i n d u s t r y i s d o i n g b e t t e r Yo u c a n d e n s epack textiles, though. You can’t dense-pack a whole lot of automotive engines. Those take up a lot of room,” explains Lou Longo, a p a r t n e r w i t h P l a n t e & M o r a n ’s G l o b a l Services. “For industrial manufacturing, it’s b e e n p r o v i n g a m i s t a k e t o g o a f t e r l o w wages,” he says

Chinese workers, among others, are making higher salaries, especially in markets where there’s been a lot of foreign company investment. Shanghai, for example, has been enjoying 8 4 percent wage inflation, according to human resources consulting firm Hewitt Associates.

“Companies have been trying to get cheap prices from China, and have been pouring investment into the country. Now they’re facing higher wages and very high transportation costs, which completely destroy the real economic rationale for investing in China,” Haley explains

Rising salaries in China isn’t the only factor cutting into US profit margins; the rising dollar is also taking a bite “The politics of m a i n t a i n i n g a h i g h - p r i c e d d o l l a r m a y b e good for investors, but it’s not good for manufacturers and their exports,” says Haley

Wall Street demands a high and often unrealistic return on investment, which limits how much companies can charge customers, and limits the markets they can enter

“From colonial times to the 1960s, the average return on investment of a major company was about 2 5 percent If you had a company bringing that in now, the whole board would be fired and the shares would be in the tank As time has gone by, Wall Street increasingly has insisted on higher returns You find yourself getting priced out

14 INSIGHT www icpas org/insight htm W O R L D E C O N O M Y

No longer an arena only for smal l players, emerging markets are being redefined in a big way.

of markets worldwide,” Haley comments “The economic policy has ceased to address the needs of US manufacturers, and addresses the needs of investment banks instead ”

What should companies do? For one thing, consider the actual cost of doing business

Take metal stampings, for example A large percentage of the cost of the product is the steel, not the labor or overhead Keeping production in the United States is going to be cheaper than shipping it offshore However, if the raw materials are a relatively minor portion of the cost and the product has more involved labor, there’s a case for exporting manufacturing

“When a manufacturer is looking at the cost comparison to an offshore entity, the larger the amount of value added to the product, the more likely the foreign competitor is going to have a price advantage,” Longo explains.

Companies should focus on keeping their most advanced production technology on home soil, where capital costs are lower. “Many companies are doing the exact opposite, and are putting it in a market with relatively low labor costs and high capital costs. It doesn’t make sense,” says Haley.

There are two other reasons investing in China and other overs e a s m a r k e t s i s t r o u b l i n g f o r m a n u f a c t u r e r s F i r s t , n o o n e r e a l l y knows the size of the Chinese economy In the communist era, p a r t y p e r s o n n e l p r o v i d e d n u m b e r s o n g r o w t h r a t e s O b v i o u s l y, there was no way of telling whether those were accurate, and the numbers kept growing Even with the iron curtain lifted, the Inter-

national Trade Commission is required by law to use figures prov

which limits their ability to get an accurate read

“When the Soviet Union collapsed, it became clear that even our o

explains “Military investments were a much larger proportion of their economy than the United States realized Estimates can be very, very off ”

Second, emerging markets don’t usually have the same intellectual property (IP) laws as the United States, meaning that just about any product or process you introduce is up for grabs In fact, it’s economically beneficial for an emerging market to steal IP.

It’s something General Motors (GM) learned the hard way. The company shared some of its most high-tech processes with Shanghai Automotive, which it had hired to produce GM cars. Shanghai Automotive then acquired the product design and production technology and capabilities of Rover. Now they’re using the technologies GM taught them to manufacture Rover products for their own profit. “It’s a continuing mistake,” says Haley.

The bottom line is that, “Companies need to be globally aware, not globally active,” says Longo “They don’t necessarily need to have manufacturing abroad, but they need to know who their direct competition is overseas, what their suppliers and customers are doing in foreign markets, and what everyone’s plans are for those markets Many manufacturers, in my view, are not very globally aware, and they need to be ”

www icpas org / insight htm NOVEMBER/DECEMBER 2008 15

i d e d b y e a c h c o u n t r y ’s g o v e r n m e n t t o d e t e r m i n e m a r k e t s i z e ,

w n e s t i m a t e s o f m a r k e t s i z e w e r e s e r i o u s l y o v e r r a t e d , ” H a l e y

Speak No Evil

You may not intend it to be harassment, but it’s the impact, not the intent, that matters.

By Evelyn Beck

Wh a t d o e s “ w o r k p l a c e h a r a s sment” really mean? Most people would answer something along the lines of, “unwanted sexual advances ” And true enough, the most publicized and sensationalized cases of harassment have been of the sexual variety

However, “This is not always the case, and is something that needs to be commu-

n i c a t e d t o e m p l o y e e s , ” e x p l a i n s G e r a l y n McClure Franklin, PhD, dean of the University of South Florida St Petersburg College of Business “Harassment is much broader in nature than just sexual harassment.”

By 2000, sexual harassment policies in o rg a n i z a t i o n s w e r e b e i n g p h a s e d o u t i n favor of more general harassment policies. To d a y, “ w o r k p l a c e h a r a s s m e n t ” r e f e r s t o t h e w i d e r a n g e o f u n w e l c o m e v e r b a l o r physical conduct that falls under Title VII of the Civil Rights Act of 1964

T h i s a c t c o v e r s h a r a s s m e n t t h a t c a n t a rg e t n o t o n l y s e x a n d g e n d e r, b u t a l s o r a c e , c o l o r, r e l i g i o n , n a t i o n a l o r i g i n , a g e a n d d i s a b i l i t y. ( W h e t h e r Ti t l e V I I o f t h e C i v i l R i g h t s A c t o f 1 9 6 4 a l s o a p p l i e s t o h a r a s sm e n t b a s e d o n s e x u a l o r i e n t a t i o n h a s n o t y e t b e e n a d d r e s s e d b y t h e U S S u p r e m e C o u r t a n d i s c u r r e n t l y a m a t t e r o f d e b a t e )

While easily blurred, the distinction between harassment and sexual harassment is an area of intense focus for the US Equal Employment Opportunity Commission, or EEOC Since fiscal year 1997, the EEOC has been charting harassment and sexual harassment charges separately, and has compiled guidelines to help to distinguish what falls under each offense heading

A c c o r d i n g t o t h e E E O C , i t r e c e i v e d 12,510 charges of sexual harassment in fisc a l y e a r 2 0 0 7 , w i t h 8 4 p e rc e n t o f t h o s e charges filed by women. During the same p e r i o d , t h e c o m m i s s i o n r e s o l v e d 11 , 5 9 2 sexual harassment charges, and recovered $ 4 9 9 m i l l i o n i n m o n e t a r y b e n e f i t s f o r plaintiffs and other aggrieved individuals However, since Title VII only applies to organizations with 15 or more employees,

these numbers don’t necessarily reflect all c h a rg e s . A n d a l t h o u g h v e r y s m a l l f i r m s h a v e b e e n s u e d u n d e r c o m m o n l a w o n r e l a t e d c h a rg e s , t h e r e a r e l i k e l y s o m e harassment victims who aren’t reaching out for help in the first place

Kim Rice, CPA, has spent the majority of her 18-year career working for large firms i n t h e p u b l i c a c c o u n t i n g f i e l d A l t h o u g h she left public accounting in 1999 and now heads her own consulting firm, she rememb e r s e x p e r i e n c i n g h a r a s s m e n t f r o m b o t h colleagues and clients

“Somebody would say or do something t h a t w o u l d m a k e m e u n c o m f o r t a b l e , o r m a k e i n a p p r o p r i a t e j o k e s , ” s h e e x p l a i n s , adding that, “Back then, there was a lack of sensitivity towards harassment Most of the time I and other women would keep quiet because we didn’t want to be considered difficult or be singled out as not being ‘one of the guys.’”

When the guilty party is a client rather than a co-worker or supervisor, things can feel even more desperate. However, “The same rules apply when working at a client site,” says Julie Pesce-Marcus, Grant Thornt o n ’s n a t i o n a l d i r e c t o r o f e m p l o y e e r e l at i o n s “ T h e f a c t t h a t t h i s b e h a v i o r c o m e s from a client adds a level of complexity in the employee’s mind, but that doesn’t mean he or she shouldn’t bring it forward People may think they can take it or just want to ignore it But if they’ve noticed it, they’ve b e e n a f f e c t e d I t ’s i m p o r t a n t t o s p e a k u p because they might not be the only person experiencing it ”

A 1999 article by Brian B Stanko and Mark Schneider, “Sexual Harassment in the Public Accounting Profession?” stated that, “Most women CPAs employed in the practice of public accounting believe that they and/or their female colleagues have been the victims of sexual harassment and genderbased discrimination in their workplaces.”

W h a t ’s m o r e , a s u r v e y o f 4 8 9 f e m a l e AICPA members identified sexually vulgar

16 INSIGHT www icpas org/insight htm

W O R K P L AC E

language, remarks about physical anatomy and derogatory gender comments as the most prevalent behaviors experienced

A profession that is primarily male dominated, like accounting, r e m a i n s p a r t i c u l a r l y s u s c e p t i b l e t o h a r a s s m e n t t o w a r d s w o m e n

Although that has changed over the last three years with the number of males who file claims increasing, current statistics show that sexual harassment towards women is still the most significant form of harassment faced in the workplace

H o w d o y o u k n o w w h e t h e r a b e h a v i o r i s d e f i n i t i v e l y h a r a s sment? Determinations are based on the “reasonable person” standard; in other words, the extent to which the average person would consider the behavior inappropriate.

What you may find surprising is that the “intent” of the behavior has no bearing on the harassment definition What matters is the “effect.” Even something as seemingly innocent as repeating a joke that refers disparagingly to a particular religion can be considered harassment if the behavior occurs more than once, and especially if the teller has been asked to stop and ignores the request. Repeate d l y s p e a k i n g o r a c t i n g i n a p p r o p r i a t e l y e v e n i f n o i l l w i l l i s meant can certainly fall under the heading of harassment

Industry leader Grant Thornton is committed to offering harassment training to its employees (According to the AICPA Work/Life and Women’s Initiatives Executive Committee, Grant Thornton is one of only 14 percent of accounting firms that offer such training.) A l l n e w h i r e s a r e i s s u e d t h e f i r m ’s h a r a s s m e n t p o l i c y a n d a r e required to attend workplace harassment workshops Some of the firm’s training uses polling technology to survey participants anonym o u s l y a b o u t h o w t h e y w o u l d r e a c t t o v a r i o u s s c e n a r i o s O n e question asks employees whether it is appropriate to repeat a joke

heard on the radio “People wonder if that might be appropriate since the joke was out in the public,” says Pesce-Marcus “We tell them that even though the joke was broadcast, when they bring it into the workplace, it may be inappropriate ”

Margaret Stockdale, director of the Applied Psychology Program at Southern Illinois University in Carbondale, shares Pesce-Marcus’s views “Harassment occurs in a climate,” she says “It’s likely t h a t i f o n e p e r s o n i s h a r a s s e d , t h e n o t h e r s a r e , a n d h a r a s s m e n t doesn’t just have consequences on the victim, but spreads out and affects others If my coworker is being harassed, I’m going to feel the effects, and it will affect my attitudes about the workplace I might consider quitting.”

Stockdale’s research indicates differences in perceptions about harassment based on age and race Young women, for example, who demographically are the group most likely to be the target of harassment, tend to treat it less seriously than older women Stockdale thinks this may be because they didn’t face the sexism that their mothers and grandmothers did. Regardless, the result is that “they may be putting up with stuff that’s harmful to them and to others ”

In the event of harassing behavior, make sure you have strong reporting procedures in place, such as anonymous hotlines and non-retaliation policies. “Harassment reporting is typically to the immediate supervisor, but this may be the person doing the harassing, so all organizations need dual-reporting mechanisms,” says Franklin “Alleged victims must feel that they will be free from retaliation but that an investigation will happen ”

Most importantly, though, educate your employees. Make sure they know when they’re crossing the line.

www icpas org / insight htm NOVEMBER/DECEMBER 2008 17

2009: A Space Odyssey

Pul

l your space boots on and grab your helmet You could be next in line for destination space

By Judy Giannetto

Space tourism a decade ago was more a glint in the eye of futurologists than a reality for middle-class America But a lot can change in 10 years

Pioneered by Russian space adventurers, w e c a n c r e d i t t h e R u s s i a n S p a c e A g e n c y with providing today’s only bona fide tourist space transport however elite its clientele The price for a flight brokered by Russia’s Space Adventures is now $20 million

I n s p i t e o f t h e a s t r o n o m i c a l p r i c e t a g , f l i g h t s a r e f u l l y b o o k e d u n t i l 2 0 0 9 T h e i r destination is the International Space Station (ISS), a low-orbit research facility constructed at an altitude of 217 miles above the Earth’s surface

T h e f i r s t f e e - p a y i n g s p a c e t o u r i s t o r

“ s p a c e f l i g h t p a r t i c i p a n t ” w a s A m e r i c a n businessman and former JPL scientist Dennis Tito, who traveled to the ISS in 2001.

F i v e m o r e s p a c e f l i g h t p a r t i c i p a n t s h a v e s i n c e t a k e n a g i a n t s t e p f o r t o u r i s m . T h e l a t e s t , R i c h a r d G a r r i o t t , a v i d e o g a m e

developer and son of former NASA astronaut Owen Garriott, took his space trip in October 2008

While these early explorations have threatened to label space tourism as the playground of the rich and famous, a number of progressive entrepreneurs have been working hard to make space travel a reality for everyman. They’re still light years away from an affordable price tag, but they’re whittling it down as quickly as humanly possible.

At the forefront is Sir Richard Branson, mastermind behind the Virgin empire. Branson’s Virgin Galactic [www virgingalacticcom], the world’s first commercial spaceline, started selling tickets in mid-2005, and has already presold hundreds of seats for its suborbital space flights (Suborbital flights reach an altitude of approximately 60-100 miles, allowing passengers to experience three to six minutes of weightlessness.) Projected costs are expected to run about $200,000 per passenger

Since the venture is privately funded (by Branson and the Virgin Group), strict deadlines are not being published Instead, states Virgin, “We will launch as soon as possible, but only when we are happy with the results of the exhaustive test flight programme ”

O t h e r e n t r e p r e n e u r i a l v e n t u r e s i n c l u d e EADS Astrium, which announced its space tourism project in 2007; SpaceX, which has a l r e a d y c o n d u c t e d t e s t f l i g h t s ; C o n s t e l l ation Services International, which is working on a commercial circumlunar project; and Excalibur Almaz, which is concentrati n g o n o r b i t a l s p a c e f l i g h t s f o r t o u r i s t s Some companies, Excalibur Almaz included, are also looking into “space hotels” and satellite resorts.

NASA’s interest in space tourism as a means to further US solar system exploration is one factor spurring companies on Another is a growing list of lucrative awards, including the Ansari X, a $10 million prize awarded in 2004 for the first non-government organization to launch a reusable manned spacecraft into space twice within

18 INSIGHT www icpas org/insight htm

I m a g e c o u r t e s y o f V i r g i n G a l a c t i c L L C w w w v i r g i n g a l a c t i c c o m I N V E S T I N G

Ifyouhaveaninsuranceclaim, thelast thingyouwanttoworryaboutiswhetheror notyouhavethepropercoverage.

That’swhytheICPAS-sponsoredgroup insuranceprogramissoimportant.

Theseplansaredesignedspecificallyforyou. It’sworthaphonecalltoexplorethis importantmemberbenefit.

Wethinkyou’llfindtheICPAS-sponsored insuranceprogramsoarsabovethecompetition whenitcomestoprovidingyouandyour familywitheconomicalfinancialsecurity.

•ProfessionalLiabilityInsurance •LifeInsurance •DisabilityIncome •GroupDentalInsurance* •HealthInsuranceMart •GroupAccidentalDeathand DismembermentInsurance* •Long-TermCare •HospitalIncome •GroupCatastrophicMajorMedicalInsurance* •VeterinaryPetInsurance •10YLTLifeInsurance Formoreinformation*,contactMarshAffinityGroupServicesat: 1-800-842-ICPA(4272) www.personal-plans.com/icpas Takethefirststeps towardhelpingsecureyourfamily’sfuture withtheICPAS-sponsoredInsurancePlans CaliforniaLicense#0633005 AdministeredandbrokeredbyMarshAffinityGroupServices,aserviceof Seabury&Smith,Inc.,InsuranceProgramManagement *UnderwrittenbyTheUnitedStatesLifeInsuranceCompanyintheCityof NewYork,amembercompanyofAmericanInternationalGroup,Inc. AG-5677 34172 34172MarshAffinityGroupServices,aserviceofSeabury&Smith,Inc.2008 * Theplansaresubjecttotheterms,conditions,exclusions,andlimitationsofthe grouppolicy.Forcostsandcompletedetailsofcoverage,contacttheplan administrator.Coveragemayvaryandmaynotbeavailableinallstates.

two weeks. The Google Lunar X Prize, which was announced in 2007, now offers $20 million to the first team that successfully launches, lands and operates a rover on the lunar surface

Even with the help of NASA and cash-rich sponsors, these private commercial developers face major barriers For one, space travel’s elitism has always counted against it from an investment point of view, although, says Alex Howerton, head of business

Advisors, Inc., ”Just like cars, planes, computers and any other industry you can think of, the early adopters are mostly the wellheeled with disposable income But as the systems get develo ped, economies of scale increasingly come to play, and the technol-

take about 20 to 30 years for this to happen in the commercial space industry ”

And yet, investors are taking notice As Virgin Galactic explains, “Commercial manned space travel has been constrained historically due to a lack of funding, safety, and a reliance on antiquated government programs. However…the era of commercial space travel has finally begun ”

“We are just at the ramp-up phase of the sigmoid wave of commercial space applications; we are positioned just before the upturn of the ‘hockey stick,’” says Howerton “It may still be a little bit, but within 5 years, that take-off point will arrive Now is the time to research and get positioned.

“An adjunct to tourism in space is virtual tourism on Earth There are many simulation centers being planned in New Mexico, Florida, the United Arab Emirates and Singapore,” Howerton adds “Again,

Information & Research Center

an investor will have to be patient, and be prepared to wait 5 to 10 years for a beginning of a return on investment, but now (the next 2 to 3 years) is the time to get positioned for maximum returns ”

Perhaps quite fittingly, it’s mainly angel investors or “space angels” who have kept space tourism aloft so far

In June 2007, space tourism got a major boost when Boston Harbor Angels forged a deal with XCOR Aerospace, a commercial launch company the first time an angel investor group invested in this type of venture In October 2007, the Space Angels Network, LLC [www spaceangelsnetwork com] was launched in the United States and Canada This virtual network consists of accredited investors who focus on seed and early-stage investments for aerospace-related opportunities.

The Network’s creation is particularly significant since, while big name companies such as Virgin can rely on their own financial resources for R&D, smaller companies striving to introduce the next big innovation tend to lack the billionaire backing they need

As the Space Angels Network puts it, “There is a powerful economic engine that drives most giant leaps in human progress In the early stages of each era, a certain amount of ‘visionary capital’ is necessary to ‘prime the pump’ until a critical mass is attained and more mainstream mechanisms take hold As visionary entrepreneurs create new innovative technologies, mold exciting business models, and craft entirely novel industries, they need the support of business-savvy, returns-focused, and equally visionary investors ”

Visionary entrepreneurs and private investors, in fact, are making the industry flush with cash. According to a June 2008 Popul ar Mechani cs article, “Space tourism has attracted over $1.2 bill i o n i n i n v e s t m e n t , m o s t l y f r o m i n d i v i d u a l ‘ a n g e l i n v e s t o r s , ’ o f which only about 25 percent has been spent Revenues last year were $268 million, up from $175 million the year before ”

T h e n u m b e r s a r e i m p r e s s i v e g i v e n t h e f a c t t h a t c o m m e rc i a l space flights haven’t even left the ground yet, and the lure of more established and less risky investments in biotech, medical-device and software start-ups, to name a few, have a pretty firm grip on investor purse strings

S o , w h a t ’s f u e l i n g p r i v a t e i n v e s t o r i n t e r e s t ? S i m p l y t h i s : A s k t o d a y ’s J o h n D o e w h e t h e r h e w o u l d l i k e t o t a k e a v a c a t i o n i n s p a c e , a n d o d d s a r e h e ’ l l s a y, “ Ye s p l e a s e ! W h e n d o I l e a v e ? ”

According to a 2006 Futron space tourism marketing study, space tourists will reach nearly 14,000 by 2021. Top lures include the chance to view Earth from space, being a part of the rocket launch experience, and experiencing weightlessness

“Including the ground-based simulation experiences, the business model and margins (but probably not the total market volume) can be expected to mirror the cruise industry,” says Howerton.

>Research Assistance by Professional Librarians

Growing public interest, however, is contingent on a number of factors, from ticket price to the level of fitness and extent of preflight training required of passengers Also, the industry will need to address public perceptions of space travel as highly specialized, p o t e

and beyond their means Even the European Space Agency (ESA) recommends “a position of cautious interest and informed support,“ citing “Exclusiveness of an activity aimed initially at a very small and wealthy minority” as a major stumbling block

Simply, the potential annual market for space tourism makes talk of investment a given but high risks and the need for millions and even billions in investment makes benefiting from the industry a precarious endeavor at least for now

20 INSIGHT www icpas org/insight htm

d e v e l o p m e n t a n d s t r a t e g i c m a r k e t i n g a t A m e r i c a n A e r o s p a c e

o g y b e c o m e s f i r s t ‘ d e m o c r a t i z e d , ’ t h e n ‘ c o m m o d i t i z e d ’ I t w i l l

n t i a l l y h a z a r d o u s t o t h e e n v i r o n m e n t , a t h r e a t t o p e r s o n a l

safety

your company’s or clients’ needs and less time researching

Wish you could spend more time actually serving

them? Now you can.

Phone:

Fax:

Online:

Have a research question? We can help.

>Lending Library and Online Catalog >Informal Consultation with Colleagues Contact Us

312.601.4613

312.906.8045 E-Mail: research@icpas.org

www.icpas.org

A benefit of your Illinois CPA Society membership.

Congratulations to the 2008 Women to Watch Award Recipients

The Illinois CPA Society’s Women’s Executive Committee and the American Institute of CPAs Work/Life and Women’s Initiatives Executive Committee are pleased to honor these women who have made significant contributions to the accounting profession, their organizations, and to the development of women as leaders.

These deserving women will be presented with their awards at the Illinois CPA Society “Women’s Leadership Breakfast” on November 20, 2008 at the Standard Club in Chicago. To register to attend this breakfast, please call the Society at 800-993-0393.

Ann Marie Goddard, CPA

Partner, KPMG LLP

Experienced Leader

Dot Proux, CPA

Partner, Ernst & Young LLP

Experienced Leader

Trudie Duan, CPA

Manager, Crowe Horwath LLP

Emerging Leader

SanDee Priser, CPA

Partner, Ernst & Young LLP

Emerging Leader

The mission of the Women's Executive Committee is to enhance the recruitment, volunteerism, retention and leadership of women CPAs in the Illinois CPA Society and the profession through various programs and networking events. This program is one in an ongoing series designed to help women CPAs learn more about important professional issues, expand business networks and foster career advancement.

Vanessa Salinas, CPA

Manager, PricewaterhouseCoopers LLP

Emerging Leader

Family Redefined

Estate planning for the “non-nuclear” 21st century family.

By Margaret Schroeder

Co n s i d e r a r r a n g i n g a n e s t a t e p l a n f o r t h i s c o u p l e : A t w i c e - m a r r i e d father of three expecting a fourth c h i l d w i t h h i s l i v e - i n g i r l f r i e n d , w h o h a s two children from a previous marriage

It’s not a rare request in the 21st century, where the definition of “family” has increasingly evolved and expanded

For “traditional” nuclear families, even if a will isn’t made, the laws governing who inherits what and when are pretty straightforward spouse, children, grandchildren, on down. But when it comes to nonnuclear families, a lack of estate planning can create problems

“Th e re sh oul d b e more e x pe rtise,” says Mark Gilbert, CPA/PFS, principal and financial planner at Reason Financial Advisors, Inc in N o r t h b r o o k , I l l “ N o n t r a d i t i o n a l f i n a n c i a l a n d e s t a t e p l a n n i n g i s likely to become more necessary as the number of nontraditional couples increases Certain state statutes p r o t e c t l e g a l l y m a r r i e d s p o u s e s when there is no written instruction from the deceased or disabled person; often these statutes do not protect the ‘significant other ’ in a nontraditional relationship ”

“A nontraditional family must understand how the laws (or lack thereof) impact them, and what they need to do to carry out their objectives,” says Barry Siegal, an attorney and CPA with Chicago-based Stahl Cowen Crowley Addis LLC

“ O n e b a s i c e x a m p l e i s t h a t u n l e s s a n i n d i v i d u a l h a s a w e l l thought-out estate plan, the intest a t e l a w s o f t h e s t a t e o f d o m i c i l e dictate who gets a person’s assets at death, and in almost every case

the recipient must be a relative Similarly, the estate and gift tax laws provide that transfers between spouses are free of estate and gift tax implications Finally, employee benefit plans, such as pension and profit-sharing plans, provide that without a properly executed beneficiary designation, benefits at the participant’s death are paid to certain designated persons in a certain order usually spouse, children, etc In most cases, domestic partners are not included ”

It’s not all bad news, however. There are certain advantages out there, if you know where to find them

For instance, the Grantor Retained Income Trust allows an individual to transfer property, but retain the income for a period of time, which essentially reduces the value for gift tax purposes "This technique was e l i m i n a t e d a n d r e p l a c e d w i t h a m o r e restricted technique for certain lineal relatives (parents, children, grandchildren, etc), but is still valid for non-related individuals," says Siegal

“As a planner, you have to be aware of solutions to be able to direct assets to surv i v o r s , ” s a y s M i c h a e l A r m o u r, C PA / C F P, managing member of consulting firm Bird Armour LLC. And, of course, it’s important to be up-to-date with any changes in the l a w “ A g o o d e x a m p l e a r e c h a n g e s t h a t have taken place over the past few years that allow for retirement plans to be rolled into inherited IRAs to eliminate some of the t a x h i t t h a t p r e v i o u s l y o c c u r r e d w h e n a non-spouse was named as a beneficiary,” says Armour

M o s t i m p o r t a n t l y, y o u h a v e t o h a v e a strong understanding of the basics “A great example is merely the titling of things like b a n k a c c o u n t s a n d i n v e s t m e n t a c c o u n t s (joint, pay on death, etc ),” says Armour “It n e v e r s u r p r i s e s m e w h e n a b a n k o r a n i n v e s t m e n t r e p r e s e n t a t i v e g i v e s o u t t h e

22 INSIGHT www icpas org/insight htm F I N A N C I A L P L A N N I N G

wrong information in this area; there seems to be a lot of wrong stuff out there ”

This is a burgeoning area of the law that requires more than a passing knowledge of tax laws. “The State of Illinois is considering legislation that will require estate planners to be certified, and this is a good example of why this is so necessary,” says Siegal

Consulting with other professionals is one way to gain the expertise necessary to put together nontraditional arrangements. In cases w h e r e t h e r e a r e m a n y c o n s i d e r a t i o n s o u t s i d e o f t h e t r a d i t i o n a l planning framework, Armour recommends a team effort, including a financial planner, accountant, attorney, insurance professional, etc. all working together, because some nontraditional situations may require specialized knowledge

“A great example is insurance,” says Armour, explaining that in order to buy life insurance, a person must have an “insurable interest” to prevent someone from just buying insurance on someone or something on the speculation that they will collect a benefit.

“In the case of unmarried partners,” he says, “it’s important that the professionals work together to make sure that policy ownership and beneficiary designations are such to obtain the desired results (i.e. the partner collects the benefit), and at the same time meet the standards set by the insurance company of an insurable interest The obvious solution is for each partner to own his/her own life insurance policy and name the other as beneficiary However, in higher net-worth individuals, owning your own life insurance can create additional estate tax considerations This is when you need the attorneys, CPAs, planners and insurance professionals working together to reach a solution ”

Pointing to contributing factors like the higher rates of divorce, couples living together without gettin g married, unwed couples having children together, and same-sex couples, Siegal says the need for such planning is absolutely growing

“ U n f o r t u n a t e l y, o u r s o c i e t y t y p i c a l l y t a k e s m a n y y e a r s , i f n o t generations, to keep up with the realities of these situations. As a r e s u l t , m a n y l a w s ( e s p e c i a l l y t a x l a w s ) d o n o t t a k e t h i s i n t o account,” he explains

“Furthermore, nontraditional couples have become more generally accepted in society and therefore estate planning for nontraditional couples is more generally accepted,” says Gilbert Certainly, the subject of same-sex marriage has been in the national spotlight enough to generate considerable talk about what happens under current law, and has likely caused many more people to consider the need to make a plan

The growing demand for nontraditional estate planning also may be a reflection of a general trend toward more planning across the b o a r d . “ T h e r e a r e a f e w r e a s o n s f o r t h i s : t h e a g i n g p o p u l a t i o n ; greater absolute levels of wealth generated during the 1980s and 1990s, especially as more people are aware of the need for estate planning; the aggressive marketing of ‘loving trusts’ and other living trusts that the legal community embarked upon about 20 years ago or so,” Gilbert explains.

B e c o m i n g k n o w l e d g e a b l e a b o u t t a x r a m i f i c a t i o n s a n d l e g a l considerations associated with financial and estate planning for t h e n o n - n u c l e a r 2 1 s t c e n t u r y f a m i l y i s a t o p p r i o r i t y f o r t h o s e financial advisors who have their fingers on the pulse of our everevolving culture

TheIllinoisCPASocietyisseekingnominationsforits prestigious2009PublicServiceAward,whichispresented eachyeartoaSocietymemberinrecognitionofhisorherlifetime ofpublicservicecontributionsandforpresentingapositiveimage ofCPAsandtheaccountingprofession.

Criteriatobeconsideredinclude:

>Impactonacommunity

>Uniqueefforts

>Leadershipandinitiative

>Highlevelofinvolvement

>Diversityofpublic servicework

>IllinoisCPASociety membership

2008

DanG.Loescher,CPA

CherylS.Wilson,CPA

2007

MichaelA.Cullen,CPA

2006

GregoryS.Dowell,CPA

2005

DavidA.Hirsch,CPA

2004

JohnF.May,CPA

2003

JeromeH.Lipman,CPA

2002

WalterF.Nolan,CPA

2001

HowardG.Kaplan,CPA

KennethR.Diel,CPA

2000

ErnestG.Potter,CPA

www icpas org / insight htm NOVEMBER/DECEMBER 2008 23

2009PUBLIC SERVICEAWARD NominationsNow BeingAccepted

Torequestanominationform,contact JudiKulmat800-993-0407ext.251or emailkulmj@icpas.org. Youalsomaygoonlinetowww.icpas.org. Deadline:January18,2009

RecentAwardHonorees:

New Age PM

It’s the dawning of a new era for performance measurement technology

By Selena Chavis

With the explosion of robust enterp r i s e r e s o u rc e p l a n n i n g ( E R P ) s y s t e m s o n t h e m a r k e t , b u s in e s s e s a r e i n c r e a s i n g l y a b l e t o m a n a g e , segment and use data in a meaningful way.

A c c e s s t o r e a l - t i m e d a t a h a s n e v e r b e e n e a s i e r, a n d c o m p a n i e s a r e e v o l v i n g t h e i r performance measurement (PM) approach as a result.

“There’s a greater awareness within CFO c i rc l e s o f h o w o p e r a t i o n a l p e r f o r m a n c e impacts financial results,” says Chris Denver, senior manager with SolomonEdwardsGroup LLC, Chicago. He explains that technology has been a driving force behind this evolution, allowing the field of statistics to enhance PM’s scope and management.

“The importance of technology in terms o f P M i s t h a t i t h a s r e a l l y e n a b l e d e v e n s m a l l c o m p a n i e s t o c o n d u c t r o b u s t a n d r e a l - t i m e t r a c k i n g C F O s h a v e a m u c h great er ability to get information in more timely and cost-effective ways,” he says

I n f a c t , a 2 0 0 8 s t u d y i s s u e d b y g l o b a l m a n a g e m e n t c o n s u l t i n g f i r m A c c e n t u r e found that top-performing organizations or “finance masters” were nearly twice as l i k e l y t o h a v e i m p l e m e n t e d a d v a n c e d enterprise performance management capab i l i t i e s , s u c h a s p r e d i c t i v e o r a d v a n c e d analytic tools or executive dashboards that help them monitor corporate performance against management metrics

The PM function has become much more than just the monthly process of financial reporting, where accountants analyze basic P & L m e a s u r e s , s a y s D e n v e r H e s u g g e s t s that the key to making the most of the data explosion is deciphering what data is truly relevant to the management team’s overall strategic objectives

He points to a retail client who was able to use PM data to determine why one store performed well, while another didn’t By peeling away irrelevant pieces of the data puzzle, the company was able to find a cor-

relation between success and staff tenure the longer the staff ’s tenure, the better the store’s performance. Strategic decisions were then made to transfer experienced staff to stores with low performance numbers to mentor new staff and improve outcomes

In an era where increasing global competition is a reality, the ability to leverage company data in creative ways will be a d i f f e r e n t i a t o r f o r m a n y b u s i n e s s e s , s a y s Dan Bulos, president of consulting group Symmetry Corporation

“ D u r i n g t h e b o o m y e a r s ( 1 9 9 0 s ) , w h o measu red an ything ? Sinc e the bu st (early 2000s), we’ve seen a lot more interest in measuring performance,” he notes, adding that some industries are only just dipping t h e i r t o e s i n t o P M w a t e r s “ P e o p l e a r e scrambling for what the right metrics are They aren’t always good, but you have to start somewhere,” he says

And new technology makes getting started easier than ever

According to Saeed Uddin, a consultant with Accenture’s Finance & Performance Management group, recent generations of PM technology allow for the automated integration of key data elements into delivery platforms that simplify the management of operational objectives. Tools and graphical presentations may include scorecarding, analytical insight into why a company is performing in a particular way, dashboard technology, near real-time performance monitoring, and other data offerings for improving strategic planning and budgeting

“A good PM system has strong linkages between shareholder goals and what’s happening on the front line,” he explains “It's about making profitable, value-added decisions at every level of the organization ”

The ability to capture, segment and communicate actionable data that aligns an organization’s goals will only get easier as technology continues to improve, he adds

24 INSIGHT www icpas org/insight htm T E C H N O LO G Y

ProfessionalLiabilityInsuranceFocusedon theNeedsoftheAccountingProfession.

ThePremierPlanfocusesonyourfirm’sprofessional liabilityinsuranceneeds—soyoucanfocusonyour business.That’swhythePremierPlanisendorsedand recommendedbytheAICPA.AndthePlanismonitoredby acommitteeofpracticingCPAs.

EverythingaboutthePremierPlan,fromourcompetitive ratesandouruniqueRiskManagementProgram,toour outstandingcustomerserviceandclaimsservice,hasbeen designedtoprovideCPAfirmslikeyourswithexceptional professionalliabilitycoverage.

Over25,000accountingfirmslikeyourshavemade theAICPAProgramthemostpreferredprofessional liabilityprogramforCPAsinAmerica.

FindouthowyourfirmcanbenefitfromthePremierPlan’s flexiblebenefitsandexceptionalservice.Youmayalsobenefit fromPremierPlan’spremiumcreditswhichincludeAICPA GovernmentalandEmployeeBenefitPlanAuditQuality Centersmembercredit.Withliabilitylimitsrangingfrom $100,000to$10million,thePlancanprovideyourfirmjust therightlevelofcoverage.Getafreepremiumestimatefor yourfirm.It’sfree,easy,andthere’snoobligation.

WiththePremierPlan,thedifferenceiseasytosee.GetaFREE,no-obligation premiumestimateforyourfirmtoday.Visitusonlineatwww.cpai.com/adpremier or callDanSkrydat1-800-537-4103or312-381-2760, andhewilltakeyourfirm’s informationrightoverthephone.

Endorsedby:

NationallyAdministeredby:

Underwrittenby:

AonInsuranceServicesisadivisionofAffinityInsuranceServices,Inc.;inCA,MN&OK,(CALicense#0795465)AonInsuranceServicesisadivisionofAISAffinityInsurance Agency,Inc.;andinNY,AISAffinityInsuranceAgency.

OneormoreoftheCNAcompaniesprovidetheproductsand/orservicesdescribed.Theinformationisintendedtopresentageneraloverviewforillustrativepurposesonly.Itisnot intendedtoconstituteabindingcontract.Pleaserememberthatonlytherelevantinsurancepolicycanprovidetheactualterms,coverages,amounts,conditionsandexclusionsforan insured.Allproductsandservicesmaynotbeavailableinallstatesandmaybesubjecttochangewithoutnotice.CNAisaservicemarkregisteredwiththeUnitedStatesPatentand TrademarkOffice.Copyright©2008CNA.Allrightsreserved.

E-1906-608IL

➔ ➔

THEAICPA-ENDORSEDPREMIERPLAN.GiveYourFirmtheQualityInsuranceitNeeds.

➔

AICPAAudit QualityCenter PremiumCredit

Dr Howard A Kanter, CPA/CITP, an associate professor in the School of Accountancy and Management Information Systems at DePaul University, Chicago, contends that making this link isn’t the only key; you also have to leverage real-time access to data Take, f o r e x a m p l e , Wa l - M a r t ’s r a p i d d e t e r m i n a t i o n t h a t a n e w l y d i scounted product wasn’t selling at the volume expected, because it was mispriced.

“In older systems, when a transaction occurred, it was keyed into the computer and processed into a report It could be two to six weeks from the time of the transaction, though,” Kanter explains, suggesting that the ability to monitor transactions or occurrences at the source makes the decision-making function very different. “The fact is that you can catch the transactions more quickly now, so you can do something about them Information provided too long after the transaction occurs makes it unusable ”

D a s h b o a r d t e c h n o l o g y o f f e r s u s e r s a g r a p h i c a l s n a p s h o t o f important goals and performance indicators by means of red and green lights, alerts, drill-downs, summaries, charts, graphs, and the like. The information is usually set in a portal-like environment that i s r o l e - d r i v e n a n d c u s t o m i z a b l e t o s p e c i f i c c o r p o r a t e f u n c t i o n s such as human resources, sales, operations, information technology and customer relationship management.

“On the face of it, dashboards can be a critical tool for management to use,” says Denver, explaining that the technology can provide a real-time snapshot of what an organization has agreed is important to monitor “That’s what an effective dashboard does,

and that’s the result of an organization doing its homework correctly,” he explains

As technology becomes more robust and performance metrics are pre-built into the system, making sure that the correct measures a

process and the success of the organization