34 Recession & the Entrepreneurial Spirit

B y K r i st i n e B l en k h o r n Ro d r i g u ez

38 Make the Case for Green

B y Sh er yl N a n c e N a sh

Sell the sustainable concept to the powers that be

42 Tax Software Primer

B y D a n i el D er n

CPAs have choices probably more than they thought they had

s

16 Social Media Blog Star

B y C h r i st i n e B o c k el m a n

The internet offers infinite space in which to carve out a piece of blogger stardom

20 Talent Your Next Tax Pro

B y C l a r e Fi t zg er a l d Cultivate a new crew of talented young professionals

24 Education Ph D s Wanted

B y D er r i c k Li l l y

Higher education is searching for ways to remedy the accountancy Ph D shortage

28 Reporting Lease Law Lessons

B y Gl en n E Ri c h a r d s, C PA , a n d Kevi n V Wyd r a , C PA How will new lease accounting rules affect your business?

32 Corporate What Should You Ask Your CIO?

B y Met a L . Levi n

CIOs have a wish list, of sorts 10 questions they want their CFOs to ask them

4

6

A message from the Illinois CPA Society ’ s President & CEO

News bytes,

10

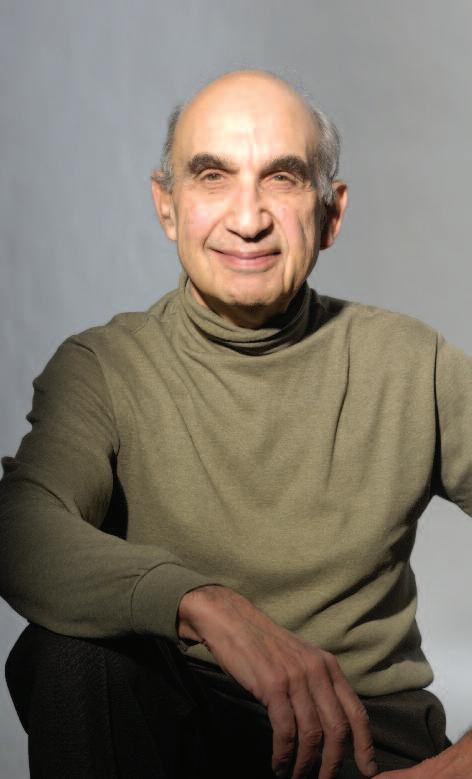

B y H a r vey C o u st a n , C PA

A look back on 12 years of tax regulation and 12 years of shared thoughts and views as INSIGHT’s tax columnist

12

B y Brad Sargent, CPA/CFF, CFE, CFS, Cr.FA , FABFA

Ebenezer Scrooge stingy tyrant or misunderstood realist?

14

B y Ma r k J Gi l b er t , C PA /PF S Are

Publisher/ICPAS President & CEO Elaine Weiss

Editor-in-Chief/Director of Publications Judy Giannetto

Creative Services Director Gene Levitan

Creative Services Manager Rosa Garcia

Publications Specialist Derrick Lilly

National Sales & Advertising Angie VanGorder

YGS Group, 3650 West Market Street, York, PA 17404

P: 800 501 9571 x176 F: 717 825 2171

E: angie vangorder@theygsgroup com

Circulation/Member Services Director Ron Jankowski

Editorial Offices: 550 W Jackson Blvd , Suite 900 Chicago, IL 60661

I C P A S O F F I C E R S

Chairperson, Sara J Mikuta, CPA Leaders Bank

Vice Chairperson, Robert E Cameron, CPA Cameron, Smith & Company PC

Secretary, Daniel F Rahill, CPA, JD KPMG LLP

Treasurer, James P Jones, CPA

Edward Don & Company

Immediate Past Chairperson, Lee A. Gould, CPA/ABV, JD, CFE, CFF Gould & Pakter Associates LLC

I C PA S B O A R D O F D I R E C T O R S

Brent A Baccus, CPA, Washington Pittman & McKeever

William P Graf, CPA, Deloitte & Touche LLP

Edward J. Hannon, CPA, JD, Freeborn & Peters LLP

John A Hepp, CPA, Ph D, Grant Thornton LLP

Cara C Hoffman, CPA, Blackman Kallick LLP

Geralyn R Hurd, CPA, Crowe Horwath LLP

Leif J Jensen, CPA, Leif Jensen & Associates Ltd

Elizabeth A Murphy, PhD, CPA, DePaul University

Annette M O’Connor, CPA, RR Donnelley & Sons Company

Michael J Pierce, CPA, RSM McGladrey Inc

J Bradley Sargent, CPA, Sargent Consulting Group LLC

Edward H Stassen, CPA, Recycled Paper Greetings Inc

Reva B. Steinberg, CPA, BDO Seidman LLP

In yet another year in which our lives and our livelihoods have been strained by the unpredictable economy, it‘s heartening each time the media confirms what we already know that accounting and auditing are great careers which continue to provide greater opportunities The Bureau of Labor Statistics predicts that the field will gain the most positions in the workforce by 2018

And such positive news couldn’t happen to a better group of professionals I am always struck by the intelligence, innovation and can-do spirit of our members. In September, more than 900 members volunteered for our first CPA Day of Service Our Young Professionals Group raised nearly $3,000 for the Endowment Fund, and more than 35 conferences held yearly wouldn’t be possible without members who serve on our taskforces, providing their expertise so we can offer the most upto-date information on relevant issues What we accomplish as a Society is the result of the dedication and commitment of our members

One of our most outstanding members in this category is long-time member Harvey Coustan, whose final tax column appears in this edition of INSIGHT We’ve been honored to have his insightful tax articles gracing the pages of our magazine for more than a decade The wealth of tax knowledge he shares was gleaned from an illustrious career

This former Ernst & Young partner is a past member of the ICPAS Board of Directors, the AICPA Board of Directors, the Internal Revenue’s Service Commissioner ’s Advisory Group, and the AICPA (governing) Council What’s more, Harvey has been distinguished with an Arthur J Dixon Memorial award, the accounting profession’s highest award for tax service, the ICPAS’ 2001 Lifetime Achievement Award, and designation as a DePaul University Ledger & Quill Lifetime Associate Currently, Harvey consults with the National Tax Office and Great Lakes Economic Unit at RSM McGLadrey on technical, procedural and organizational matters. Although he’s going to be moving on from his writing role for INSIGHT, we’re fortunate to have Harvey as a member and friend of the Society

Time and space keep us from recognizing everyone who contributes to the vitality of this Society Please know that we are grateful to all of you who actively participate in our efforts

The daily news always seems to focus on the negative Focus on the positives You’re a part of an organization filled with great people doing good things and in a great profession poised to grow in the years ahead

Our sincere thanks to all of you and best wishes for the New Year.

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 23,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race,religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility

Champaign-Urbana

November 3, 2010 | C37135

11:30AM - Networking and Lunch

12:00PM - 1:00PM - Program and Q&A

I Hotel and Conference Center 1900 South First Street, Champaign, IL

Springfield

November 4, 2010 | C37136

8:00AM - Networking and Breakfast

8:30AM - 9:30AM - Program and Q&A

President Abraham Lincoln Hotel

New Technology

Recent Legislative and Regulatory Updates

This a great opportunity to get out of the office and look at the big picture --- all while enjoying a free meal, networking with colleagues and earning 1 hour of CPE!

701 E. Adams Street, Springfield, IL

Glenview

January 19, 2011 | C37176

8:00AM - Networking and Breakfast

8:30AM - 9:30AM - Program and Q&A

Wyndham Glenview Suites

1400 N. Milwaukee Avenue, Glenview, IL

Oak Brook

January 24, 2011 | C37177

8:00AM - Networking and Breakfast

8:30AM - 9:30AM - Program and Q&A

The Hyatt Lodge at McDonald’s Campus 2815 Jorie Boulevard, Oak Brook, IL

Chicago

January 31, 2011 | C37178

Register today and bring a young professional colleague with you!

FOR ALL PROGRAMS: CPE: 1 Credit Hour Cost: Free

8:00AM - Networking and Breakfast

8:30AM - 9:30AM - Program and Q&A

The Crowne Plaza Chicago Metro 733 West Madison, Chicago, IL

We asked ICPAS members to recommend A-list reading for their fellow finance pros Here are their top picks

The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron, by Bethany McLean and Peter Elkind [Portfolio Trade, 2004, recommended by Mary Delaney Ceretto, CPA, Legacy Professionals LLP]

On the Brink: Inside the Race to Stop the Collapse of the Global Financial System, by Henry M Paulson, Jr [Business Plus, 2010; recommended by Jeffrey T McReynolds, CFO, The Strive Group].

Aftershock: Protect Yourself and Profit in the Next Global Financial Meltdown, by David Wiedemer, Robert Wiedemer and Cindy Spitzer, offering “alternative thought processes relying on the historic, cyclical ebbs and flows of our US economy versus taking an evolutionary view ” [Wiley, 2009; recommended by Noel T Hastalis, CPA, Partner, Construction/Real Estate Group, Baker Tilly Circhow Krause, LLP, and Paul Julien, VP Finance, Sweetener Supply Corp ]

88% Growth rate of social network users between the ages of 55 and 64 from April 2009 to May 2010

Source: Socialnomics net

GiftsOnTime com is a new online tool that allows accounting professionals to boost client retention efforts by scheduling personalized gifts for the entire year In essence, pros can show their goodwill by recognizing clients on their birthdays, anniversaries, and any other important occasion or date Furthermore, users can facilitate targeted “future gifting,” using an easyto-navigate data extraction tool that uploads contacts directly from several tax programs, Salesforce com or an Excel spreadsheet

Whether you ’ re in class, the office, or anywhere in between, the Dictionary of Accounting Terms app for BlackBerry users is just a tap away, ready to provide you with accurate and detailed accounting information The Dictionary is a complete reference tool ideal for all levels of user, from accounting students in need of a quick reference to a seasoned professional at a client meeting in need of a way to clarify a planning strategy The Dictionary contains more than 1,000 informative terms, covering every aspect of accounting, from basic to advanced What ’ s more, helpful charts, graphs, diagrams and examples underscore important concepts, providing detail that goes far beyond an ordinary dictionary The Dictionary is fully browseable, with a one -letter search feature that allows you to retrieve information in a single tap Once downloaded, no internet connection is required, so you can access this valuable tool whenever you need it.

The app is available from BlackBerry App World for $2 99 [appworld blackberry com]

37% manufacturing business leaders who plan to increase hiring by Feb 2011

Source: GrantThornton.com

Managers take note: staff may not think too highly of you In fact, says Right Management, according to their poll of 800 workers across North America, an alarming number of employees (33 percent) think their managers are either somewhat or completely incompetent. What ’ s more, a mere 17 percent are only marginally impressed with managerial competence, which could weigh heavily on employees’ commitment to the job On a happier note, despite growing scrutiny, 50 percent of all employees still believe their managers are either competent or very competent.

1. Pick a Secure Network. Many hotspots have no security settings, but if you have a choice, select one using some form of encryption You will need the password key for access, but some establishments provide guests with Wi-Fi passwords Look for networks secured with WPA2 encryption, then WPA, and lastly, WEP

2 Set Network Location to "Public " When connecting to a new network using Windows 7, the "Set Network Location" window pops-up automatically Be sure to set the location to "Public Network" when prompted if you ' re connecting to a public hotspot This option blocks file and printer sharing, which are common routes for data snoopers

3 Use a VPN A Virtual Private Network between your machine and your network is a virtual tunnel secured against anyone who may try to intercept your web session while connected to a public hotspot

4. Boost Your Defenses. E n c r y p t o r p a s s w o r d - p r o t e c t sensitive files and folders Consider encrypting your entire hard drive, in fact

5 Avoid Banking Transactions Don’t bill pay, access your bank account, or use your credit card

6 Don’t Save Passwords Websites and browsers are always asking if you want to save and store passwords, but you ' re probably better off saying “ no ”

7 Put Up Your Firewall You should have your Windows firewall or a third-party firewall enabled whether you are at home or on the road, but it's especially wise to turn it on when connecting to public hotspots.

8 Automatically Update Make sure your mobile devices are set to automatically update so you are always receiving the latest patches, security updates and other critical updates for your apps and operating systems

Source: PC Mag [PC Mag com ]

With the holiday season upon us, budgetary matters are understandably front of mind And if you ’ re looking for ways to increase your savings and take -home pay, these tips from Kiplinger’s Personal Finance [Kiplinger com] may be just what you ’ ve been waiting for They promise to help you find a few bucks in places you might have overlooked.

n Trim your grocery bill. Start tracking your purchases to get a handle on your spending habits Then ditch the gourmet grocers and shop at warehouse stores and don’t forget your coupons

n Cut your cell phone bill Scrutinize your bill to make sure you actually need all the minutes and features you ' re paying for every month A prepaid plan may be a better option

n Boost your deductibles An easy way to cut your auto and home insurance premiums is to raise your deductibles Combining policies from other insurers under one plan can achieve greater savings as well

n Switch your TV package. Competition among cable and satellite providers is running high Visit the websites of the companies that serve your area to compare plans

n Rein in your dining out budget. Try to limit your costly dining excursions Also, brew coffee at home and brown bag your lunch

n Get rid of your stuff All your unwanted furniture and belongings have to go Try selling them on Craigslist org or eBay com for some extra cash

n Refinance your mortgage With interest rates at their lowest levels in decades, it's a good time to refinance For the best deals, check with several lenders, including credit unions, local and community banks, and online mortgage brokers.

n Unload your second (or third) car. If you have an unused car sitting in your driveway, sell it Even if you don't get a lot of cash for it, you'll save money simply by eliminating the expenses associated with owning it

A look back on 12 years of tax regulation and 12 years of shared thoughts and views as INSIGHT’s tax columnist

Th i s c o l u m n w i l l b e m y l a s t I h a v e m i x e d feelings about bringing this chapter in my professional history to a close. I will miss the challenge of learning new rules and helping you to understand them I will miss the numerous conversations I have had with various readers who challenge my interpretations and my prognoses about substance and policy There is no better way to keep on top of changes to the tax rules I will not, h o w e v e r, m i s s t h e e d i t o r i a l d e a d l i n e s a n d m y concerns over writing about tax topics that might change before my column is even published!

Many changes in the rules have occurred since my first tax column in 1999. They include alterations to preparer penalty standards, required tax return disclosure of certain “reportable transactions,” additional due diligence requirements for “covered opinions,” financial statement accounti n g a n d d i s c l o s u r e c h a n

t i n g I n t e r p r e t a t i o n 4 8 t h a t b r e d a n I R S requirement for return disclosure of “uncertain tax return positions,” and mandatory registration for paid federal tax return preparers to name some of the more well-known

In 1999, the preparer ’s standard for signing and advising on nondisclosed federal income tax return positions was that the position needed to have a “realistic possibility of being sustained on its merits” the “realistic possibility of success” standard. This standard was defined by the IRS as a 1-in-3 chance of success The taxpayer ’s standard for avoiding a substantial understatement penalty was generally that a nondisclosed position needed “substantial authority.” Many practitioners estimated that standard as approximately a 40-percent chance of success

Fast forward to 2007, when the preparer ’s standard jumped to a more than 50-percent chance of success or “more likely than not.” Thus the preparer was put in the extremely uncomfortable position in certain situations of needing a taxpayer to make a disclosure on his or her tax return to avoid the preparer penalty, even though the taxpayer didn’t need such disclosure to avoid a penalty themselves Thankfully, the following year the preparer ’s standard was retroactively reduced to the same level as the taxpayer ’s standard or “substantial authority” therefore avoiding those ticklish situations with clients The IRS has been kind in its guidance and offers alternatives that enable preparers to avoid penalties in situations

H a r v e y C o u s t a n , C PA is an Ernst & Young retired partner who currently consults on substantive technical and professional standards issues An ICPAS member since 1986, he has also appeared as an expert witness on several cases

where taxpayers refuse to make disclosure, even though that disclosure is required to avoid taxpayer penalties.

E f f e c t i v e i n 2 0 0 0 , Tr e a s u r y r e g u l a t i o n s have required disclosure of certain transactions that the IRS feels need closer scrutiny. They are designated as “reportable transact i o n s ” a n d m u s t b e d i s c l o s e d o n a t a xpayer ’s return on Form 8886, as well as sepa r a t e l y t o t h e I R S O f f i c e o f Ta x S h e l t e r Analysis One set of reportable transactions is designated as “listed” transactions, and a r e t h o s e d e s i g n a t e d b y t h e I R S a s “ t a x avoidance transactions” (read “abusive”)

More recently, the category of “transactions of interest” has been added These are not yet deemed abusive but include transactions for which the IRS wants more information. Nondisclosure of a reportable transaction can result in significant penalties even where the transaction itself doesn’t result in an underpayment of taxes.

Circular 230 that body of regulations that governs practice before the IRS has been modified to require significant due diligence and mandatory disclosures for certain post-June 30, 2005 tax advisory opinions that fall into any of six “covered opinion” categories The most notable of these categories is the “reliance opinion” used to protect taxpayers from certain penalties Many practitioners use an authorized disclosure at the bottom of correspondence to avoid covered opinion status.

A l t h o u g h I h a v e n ’t s e e n a n y s a n c t i o n s imposed for failure to meet these requirements, a court in a recent case took shots at t h e o p i n i o n w r i t t e n b y o n e o f t h e m a j o r

accounting firms The Office of Professional Responsibility, charged with administering t h e r u l e s o f C i rc u l a r 2 3 0 , m a y s e e k t o impose some penalties in the future

Financial Accounting Standards Board

Interpretation No 48 (Fin 48) requires financial statement disclosure and quantification of uncertain tax positions. Although the IRS has indicated that it will continue its policy of restraint with respect to requesting accountants’ tax accrual workpapers, recently proposed regulations would require corporate tax return disclosure of uncertain tax positions The combination of FIN 48 and the mandatory tax return disclosure required by the proposals not only would give the IRS a roadmap to taxpayer return positions, but also could dampen candid conversations between taxpayers and return preparers

T h e p r o p o s e d r e g u l a t i o n s r e l a t i n g t o identification and registration of tax return preparers have caused considerable angst f o r a n u m b e r o f p r a c t i t i o n e r s O n e s e t o f regulations requires that all paid preparers, both signing and non-signing, obtain “prep a r e r t a x i d e n t i f i c a t i o n n u m b e r s ” ( P T I N ) , which must be included with each return prepared. Under another set of proposals (at this writing), those preparers who are not a l r e a d y s u b j e c t t o C i rc u l a r 2 3 0 C PA s , lawyers and enrolled agents (practitioners) w o u l d n e e d t o p a s s a n i n i t i a l t e s t a n d meet continuing education requirements in o r d e r t o b e “ r e g i s t e r e d t a x r e t u r n p r e p a re r s , ” a n e w c a t e g o r y o f p r a c t i t i o n e r t h a t would be subject to Circular 230

A l t h o u g h C PA s , l a w y e r s a n d e n r o l l e d a g e n t s w o u l d n ’t n e e d t o p a s s t h e t e s t o r obtain prescribed continuing education, all preparers would be required to pay fees In addition, by including non-signing prepare r s i n t h e n e w r e g u l a t e d c a t e g o r y, n o nCPAs employed by firms to assist in the tax return preparation process would have to become registered tax return preparers even in situations where they did not sign returns (if they’re deemed non-signing preparers) This not only would add mostly unnecessary requirements for these people, but also could significantly increase the cost of compliance for their firms Perhaps by the time you read this column final regulations that address this issue will be issued

Most of the changes I have described were at least, in part, responding to the proliferation of very aggressive transactions commonly referenced as tax shelters I have seen some very questionable transactions that were covered by opinions written by lawyers and CPAs To my knowledge, that situation has been substantially reduced, but its legacy can be found in the rather onerous changes I have just discussed

It has been fun to communicate with all of you in each edition of INSIGHT In this regard, I want to thank Judy Giannetto for h e r p a t i e n c e i n t h o s e s i t u a t i o n s w h e r e I m i s s e d a d e a d l i n e i n a n t i c i p a t i o n o f a c h a n g e S h e h a s b e e n a g r a c i o u s a n d t h o u g h t f u l e d i t o r M o s t o f a l l , t h a n k s t o you, the readers, for your loyalty and feedback throughout the last 12 years

Ebenezer Scrooge stingy tyrant or misunderstood realist?

Charles Dickens’ early childhood was scarred by the overtly hostile treatment the poor received in pre-Victorian London and his father ’s overspending (resulting in a stretch in debtor ’s prison) Many of his great works reflect these experiences, with his heroes typically rising above their circumstances.

One of Dickens’ best-known protagonists, Ebenezer Scrooge, Esq., had all the makings of a great forensic accountant. He was cunning, dispassionate, had a keen eye for detail, sharp business acumen, a suspicious mind and skepticism of others Think of all the recent f r a u d s t h a t c o u l d h a v e b e e n a v o i d e d h a d t h e r e been a touch more “bah, humbug!” from the auditors Scrooge’s “redemption” occurs when he is overcome with the Holiday Spirit; he opens his arms, home and wallet to his fellow man and, presumably, lives happily ever after

If this jaded forensic accountant (i e me) wrote the epilogue to A Chri stmas Carol , Scrooge would have been visited by kindly, seemingly respectable fraudsters incognito who would have talked him out of his fortune under the guise of building a home for underprivileged youth, while scheming cohorts ransack his china and silver

Most of us try our best to be a bit more patient, giving and positive as the holidays approach, and as we close one year and welcome another It’s at this time of year that attendance at houses of worship swells, charitable donations rise and fraudsters and thieves run amok. Statistics show that charity-based frauds are at their peak in November, December and January. But these aren’t the only nefarious activities witnessed around the holidays Theft of physical assets (primarily compute r s ) , f i n a n c i a l r e p o r t i n g i r r e g u l a r i t i e s a n d employee theft or abuse all occur more frequently when businesses and individuals are simply too filled with glad tidings to notice

is the managing member of The Sargent Consulting Group, LLC, which specializes in forensic accounting and financial investigations Brad is a frequent lecturer on forensics and fraud, and is chair emeritus of the American Board of Forensic Accounting He also serves on the Board of Directors of the Illinois CPA Society, and has been a member of the Society since 2002

Wi

offices are understaffed and thieves know it. Several years ago, I took a call from a client who requested that I travel out of town the next day. While the rest of my colleagues marched off to a great holiday party, I stayed behind in our Chicago Loop office to prepare for my trip While there, I was surprised t

“lost ” He was well-dressed and looked like he belonged in an office suite However, when I approached him, he disappeared quickly down the back stairwell

Building security later informed me that computer thieves are most active during the holidays, targeting businesses they believe to be near empty If a computer disappears from your organization, think of the ramifications What kind of sensitive client/company data is on the hard drive? How many IDs could be stolen? For any accountant in any role, this is a sobering thought. Envision The Grinch slinking through Whoville, stealing everything in sight, disguised as the very picture of respectability and benevolence Santa Claus

The holidays usher out the old year and usher in the New Year Year-end reporting witnesses exceptional “giving” first-hand: Customers, possibly overwhelmed with glee and good cheer, will often purchase inordinate amounts of slack inventory, miraculously boosting annual sales Oftentimes, these customers give without knowing (a truly altruistic act) because once the New Year comes and the holiday spirit wanes, sadly these sales are often reversed. But hey, the prior year finished strong! What’s more, shipping inventory to unsuspecting customers and booking the sale, aka channel stuffing, occurs more often at year-end than at any other time And vendors are also unwitting recipients of good cheer at year-end, usually in the form of payments dated prior to the period close, but mailed well into the New Year This cheerful scheme lowers liabilities without actually parting with the asset And then there’s “check kiting” and “lapping” which are also schemes that rely on timing differences, and can result in Peter sending holiday cheer to Paul.

In the current economy, “flat is the new growth,” and organizations have cut back on compensation in the form of wage freezes and zero bonuses However, creative employees find new ways to reward themselves in the form of padded expense accounts, conversion of company assets (supplies and inventory) for personal use, and mischaracterization of company funds usage These are the gifts that keep on giving unless the organization is vigilant

An account of fraud from a few years back comes to mind. A bookkeeper at a large construction company had bilked the business out of millions and gave her children life-size statues of Disney characters for the holidays These statues fit perfectly around the multimillion dollar mansion she lived in several states away Only after the fraud was uncovered did her colleagues come forward and state that they couldn’t figure out how she lived such an extravagant lifestyle on such a humble salary If someone is overtly over-generous and clearly giving beyond their means, it could be a red flag

The holidays and the year-end are times to reflect and reach out to our fellow man. But that doesn’t mean it’s time to abandon common sense Our heroic forensic accountant prototype, Ebenezer Scrooge, was last seen running through the snowy streets of London barefoot, wearing only his nightgown Money flying from his pockets, Scrooge buys the biggest and best goose in town to share with others. What Dickens fails to mention is that Scrooge left the front door to his townhome open and all of his belongings were promptly withdrawn by a roving gang of street urchins Not only that, but his trusty employee, Bob Cratchit, had been skimming receivables at Scrooge & Marley for years, and the entire business is now in default. Last, but certainly not least, Cratchit’s accomplice, “Tiny Tim” Leibowicz, a circus performer, was faking a leg injury and fraudulently drew workman’s compensation from Scrooge & Marley, exposing Scrooge to litigation from his insurance carrier.

Hey, it could happen Happy Holidays!

Annuities are great products for retirement planners. While they’ve been around for a long time and continue to be primarily used as a source of retirement income, which was their original intent, they’ve also become investment accumulation vehicles thanks to amendment of the Internal Revenue Code over the years and sentiment in the financial m a r k e t s s h i f t i n g p e r i o d i c a l l y b e t w e e n t h e b u l l s and the bears.

Like any investment or insurance product, however, there are pros and cons you have to weigh

T h e a c c u m u l a t i o n p h a s e o f a n a n n u i t y i s t h e p e r i o d o f t i m e i n w h i c h t h e o w n e r m a k e s deposits This may be a single point in time, it may be a fixed number of occurrences (such as once a year for 10 years) or it may be as frequently as the owner wishes Earnings grow tax deferred under the annuity contract, making it particularly attract i v e t o s o m e p e r h a p s a n e x e c u t i v e w h o h a s maxed out of corporate savings plans or a selfemployed individual who wants to set aside more money than they can under an IRA

The distribution phase is the time period during which the owner takes money out of the annuity

T h e a n n u i t y h o l d e r m a y c h o o s e t o e i t h e r w i t hdraw funds or annuitize the payouts In the former case, the owner maintains control over the timing and amount of payouts and can withdraw earnings, principal or a combination of both In the latter case, the owner effectively relinquishes control of the assets to the insurance company and elects to receive a regular, recurring payment

is a principal in the financial advisory firm of Reason Financial Advisors, Inc

His 25+ years of finance and accounting experience includes 13 years in personal financial planning An ICPAS member since 1982, Mark currently serves in the Society ’ s IA/PFP Member Forum Group and on its Committee on Structure and Volunteerism

This annuitization feature distinguishes annuities from other products, since the insurer guarantees there’ll be sufficient funds to meet the owner ’s timeframe (often over his or her life, or the joint lives of the owner and spouse.) This is true even if the owner ’s account hasn’t grown enough to cover the required payouts. Also, in some annuities there’s a provision to distribute a minimum amount to heirs if the owner dies prematurely

A fixed annuity is one in which the issuer (the insurer) agrees to pay a fixed rate of interest on the invested dollars The insurer often guarantees that a minimum interest rate will be paid under the annuity contract Also, insurers often pay at higher interest rates in the first year or years of the annuity contract as an inducement to attract deposits

A fixed annuity therefore may be especially appropriate for an investor who is looking for a predictable earnings credit.

A variable annuity is one in which there is no promise made with respect to the earnings deposits will earn. Variable annuities feature subaccounts, which are similar to mutual

funds in that they’re pooled to invest in the equity, fixed income or cash markets. In fact, many mutual funds are available to investors as annuity subaccounts A variable annuity may be appropriate for an investor willing to take on more investment risk

Cost structure

T h e c o s t o f a n a n n u i t y c a n v a r y w i d e l y, a n d m a y i n c l u d e t h e underlying investment costs of the subaccounts (similar to mutual fund operating expenses) as well as the insurance costs (M&E) to provide guaranteed benefits Also, there may be additional costs t o p r o v i d e r i d e r s s u c h a s g u a r a n t e e d m i n i m u m l i f e t i m e i n c o m e b e n e f i t s , a n d m a n y a n n u i t i e s a r e s o l d s u b j e c t t o a n a n n u a l l y d e c l i n i n g s u r r e n d e r c h a rg e ( f o r c a n c e l i n g t h e a n n u i t y w i t h i n a period of 5 to 7 years or more.)

Client use

All things weighed, I think that annuities are best used as retirement distribution vehicles rather than for accumulation purposes For clients with relatively low asset levels and fairly high cash-flow needs that are not met by Social Security and a pension, a fixed annuity can provide peace of mind that some living expenses can be funded without having to otherwise deal with the volatility of the investment markets Fixed annuities also tend to carry lower costs than variable annuities

Using variable annuities for accumulation purposes works much l i k e a n o n - d e d u c t i b l e I R A , w i t h n o a n n u a l c o n t r i b u t i o n l i m i t s

Although current income tax deferral on earnings is an attractive feature, what’s not so attractive is the fact that future earnings withdrawals will be subject to ordinary income tax rates I feel that it’s better for a client to fund savings and investment accounts with the d e p o s i t s t h a t w o u l d o t h e r w i s e g o t o a v a r i a b l e a n n u i t y P r o p e r investment and tax management of these accounts can minimize or eliminate income taxes on current earnings, while protecting capital gains tax treatment on at least some of the future withdrawals Of course, no one knows what future income tax rates will look like, but traditionally, capital gains tax rates have been lower than ordinary income tax rates

The high cost structure of annuities also makes them less suitable as accumulation vehicles than ordinary savings and investment accounts In most situations, clients are better off funding their employer-sponsored retirement plans to their maximum limits before even considering the use of a fixed or variable annuity a s a n a c c u m u l a t i o n v e h i c l e R e t i r e m e n t p l a n c o n t r i b u t i o n s a r e generally tax-deductible and the plans usually feature lower costs than most annuities

Advisors can often rely on an insurer ’s promise to honor its financial commitment to an annuity holder. Nevertheless, you need to check out A M Best insurer ratings at the very least before making a recommendation What’s more, each state has a guaranty fund which steps in to make up payments in the event of insurer default, s u b j e c t t o l i m i t s M a k e s u r e y o u u n d e r s t a n d t h e s e l i m i t s i f y o u advise clients on annuities

From a features-and-costs viewpoint, today’s annuities are more attractive products than those offered a generation ago, and may make sense for some retirees and pre-retirees. Especially with volatile financial markets, the guarantees may provide annuity holders with reassurance that their assets will provide the needed cash flow At the same time, understand that guarantees come at a price.

The Illinois CPA Society is currently seeking nominations to honor the work of exceptional CPAs. The Outstanding Leadership in Advancing Diversity Award is designed to recognize individuals who have made a marked contribution to diversity within the accounting profession.

The Emerging Leader Award will recognize young professionals who possess the qualities of the Outstanding Leadership in Advancing Diversity Award but have 4+ years of full-time work experience.

Nominees can be employed in any area of accounting or finance; including public accounting, industry, not-for-profit, education, government or consulting.

Criteria considered for ideal candidates include:

A CPA credential, but do not need to be a current member of the Illinois CPA Society

Impactful efforts on the accounting profession

Unique and creative contributions to the profession in advancing diversity

Personal initiatives in advancing diversity outside of one’s day-to-day job functions

Activities to advance diversity within one’s day-to-day job functions

For more information or to nominate a candidate, please visit www.icpas.org.

Deadline for nominations is November 26, 2010.

The internet offers infinite space in which to carve out a piece of blogger stardom.

By Christine Bockelman

By Christine Bockelman

Before you start posting your musings online, there are legal issues you need to know about, says Michelle Golden Here’s a primer

1 Be original Don’t excerpt more than 20 percent of someone else’s content, and always credit the original author or organization, naming and linking to the source “With proper attribution and directing people to the original work, you ’ re helping the other person, which they ’ll appreciate,” she says

2.Tread carefully with images. “If you use pictures, be sure to honor licensing terms You can purchase photos or find free images on sites like flickr com, ” she suggests “Become familiar with ‘creative commons licensing’ [creativecommons.org] and always give the photographer appropriate credit for his or her work, or it ’ s stealing ”

3.Be tag savvy. Tagging the social media term for identifying individuals who appear in a photograph you post online without first obtaining the subject ’ s permission, is also a big no-no “It ’ s just not appropriate to use an image of someone publically, for business, unless they ’ ve said it ’ s ok,” she says

When CPA and financial fraud expert Tracy Coenen started her accounting blog The Fraud Fi l es [sequenceinc com/fraudfiles com] in November 2005, she intended it to be a way to market her name and experience Five years and hundreds of posts later, she’s getting 30,000 unique visitors a month. She also credits the blog with bringing in at least 30 percent of her firm’s annual revenue “And when I say 30 percent, I mean actual money in pocket,” says Coenen, owner of Sequence Inc , a forensic accounting and fraud firm with offices in Chicago and Milwaukee “Not bad for a little bean-counter, eh?”

Not bad at all.

There were more than 145 million blogs in existence in August 2010, according to BlogP u l s e c o m , w h i c h t r a c k s b l o g s t a t i s t i c s O f those, about 190 are written by practicing CPAs for their business development, says Michelle G o l d e n , w h o m a i n t a i n s a l i s t o f a c c o u n t i n g b l o g s a t G o l d e n P r a c t i c e s . c o m , a n d i s t h e author of the forthcoming book, Soci al Medi a Strategi es for Professi onal s and Thei r Fi rms. In other words, there’s a huge amount of opportunity for new accounting blogs

“Blogging, in my opinion, is the holy grail of marketing options for CPAs,” says Golden “In t h e b u s i n e s s o f s e l l i n g i n t e l l e c t u a l c a p i t a l , a CPA can demonstrate his or her unique knowledge and experience using blogs as a medium, a n d s i m u l t a n e o u s l y d e v e l o p c a r e e r- c h a n g i n g relationships with prospects, key trade people, m e d i a a n d o t h e r t h o u g h t l e a d e r s B l o g g i n g affords firms a level of visibility unimaginable just 10 or 15 years ago. And it’s free, or darn c l o s e t o i t . T h e k e y t o s u c c e s s i s p i c k i n g t h e right topics.”

A look at the accounting blogs on GoldenPractices com reveals CPA-authored blogs on topics such as farming, dentistry and women’s financial success, among other industries and niches

“The more specific a blog is with regards to its intended audience, the better,” says Golden “If you are thinking about starting a blog about tax, ask yourself, ‘Who will actually care to read

Writing style and tone, as well as length of post, are all important factors in a blog’s success Generally speaking, conversational, informal styles of writing are the most successful in drawing followers And it ’ s important to be “consistent with your tone, voice and subject matter,” says Bridget O’Malley, who blogs about campus recruiting for Protiviti “If you ’ re not consistent, things can get chaotic ”

It ’ s also important that your voice be imbued with authenticity “Be yourself,” says Golden “ You have an opportunity to create relationships through your writing Don’t secretly let others post on your behalf without disclosure, and be sure that each post reflects an author ’ s name, not just ‘admin,’” she warns “People can’t develop relationships with ‘admin.’”

What ’ s more, while a blog can boost your presence and recognition, it shouldn’t be overtly used for self-promotion That ’ s just a big turn off for blog readers

tax updates every few days?’ A client? Or perhaps just other CPAs?”

I f y o u ’ r e g o i n g t o p u t i n t h e e f f o r t t o write and update a blog bloggers recomm e n d a b o u t t h r e e p o s t s p e r w e e k , a n investment of a few hours, at least you want it to draw traffic and interest. A blog a b o u t b r o a d t a x i s s u e s i s n ’t p r o v i d i n g much value beyond what someone could get through a quick internet search, since most of that information could be found on accounting news sites

“ F o r b u s i n e s s d e v e l o p m e n t , y o u ’ r e much better off with a blog focused on an industry....If I’m a farmer, you can speak to f i n a n c i a l t o p i c s p l u s v i r t u a l l y a n y o t h e r issue, including floods, seed technology, or the newest bailers As long as it continu e s t o p e r t a i n t o m e , I ’ l l k e e p r e a d i n g , ” G o l d e n e x p l a i n s . “ R e a d e r s a r e q u i c k t o unsubscribe to content they don’t perceive a s r e l e v a n t I s t h e c h a i r m a n o f a f a m i l y business going to read tax updates every few days? Don’t lose them ”

If an industry focus seems too narrow for your practice, “Consider a market segment like family owned businesses or women business owners, or a demographic audie n c e s u c h a s a s p e c i f i c e t h n i c o r a g e g r o u p , ” G o l d e n a d v i s e s “ Yo u r c o n t e n t should stand apart; defining your desired readers enables you to deliver value and relevance,” she says, adding that, “When you effectively illustrate your distinctions, you’re also able to break free of competing on price Through good content marketing, you achieve multiple benefits ”

Coenen completely agrees. “My blog readers are not my clients, but they use the same search terms in search engines that my clients do,” she explains “I figured out

that my readers aren’t engaging me for consulting, but they’re enhancing my Google mojo enough that when a potential client is searching the internet for forensic accountants and fraud information, they get pulled to my site, which pops up first for many relevant search terms ”

Accounting blogs can be successful networking tools, too. Joel Ungar, CPA, CFE, founding principal of Silberstein Ungar, PLLC outside Detroit, has a blog called Ungar Cover on AccountingWEB, an online media company for accountants Ungar ’s blog focuses on topics related to the profession, and is primarily read by accountants Recent topics, which are often tongue-in-cheek (his particular differentiator) include, “Counting the Ways FASB Codification Has Improved My Life” and “10 Ways to Know You Were Born to Be an Accountant.” Some of Ungar ’s posts get about 200 hits within two or three days

“The blog is part of an overall effort to get myself known out there,” he explains “I’ve also met a lot of really interesting people, other accountants, and networked quite a bit. It’s helping to build some brand recognition for myself and my firm ”

No matter what your blogging intentions networking, attracting clients or exploring industry interests there’s plenty of room on the internet for your thoughts and expertise. You just have to be committed to the effort

“The reason I’ve been successful is I’ve kept up with it,” says Coenen “I’ve seen a lot of people start a blog, do 10 articles and never touch it again when it doesn’t generate a lot of traffic. You need to keep doing it to see the results ”

So start writing, CPAs

The Illinois CPA Society is seeking recommendations for the 2011 Lifetime Achievement Award, which is presented each year to an individual(s) who has provided distinguished service to the profession in Illinois and/or nationally.

Candidates are selected based on a lifetime of service to the profession. Factors to be considered include:

> Contribution to the profession

> Professional position attained

> Length of service

> Illinois professional involvement

Recent Award Honorees:

2010 Edilberto C. Ortiz

2009 Cameron T. Clark

Duane D. Suits

2008 Belverd E. Needles, Jr.

2007 Edwin Cohen

2006 Richard T. Sullivan

2005 Vincent E. Villinski

Richard E. Ziegler

2004 Lawrence M. Gill

Jerome A. Harris

Cheryl S. Wilson

Letters of recommendation with information supporting the individual’s qualifications (resume, biography, etc.) can be sent to:

Eileen Robbs, Lifetime Achievement Award, Illinois CPA Society, 550 W. Jackson Blvd., Suite 900, Chicago, IL 60661

Or by email to: robbse@icpas.org

Deadline for recommendations is December 15, 2010

Skilled tax professionals are a strong asset for accounting firms today, but they aren’t always easy to find or to keep That’s why many small and mid-sized firms are enhancing their training and development programs to help to retain their top talent and groom the next generation of tax professionals

“Despite the current state of the employment market, tax talent is still in high demand,” says Ryan Paquette, president of Schaumburg, Ill -based accounting and finance staffing firm Mark/Ryan Associates “Tax skills are still the hardest skill set to find and the hardest position to match and demand hasn’t wavered ”

Smaller firms in particular tend to be at a hiring disadvantage because talented tax professionals typically flow into large firms, says Ann Weatherhead, director of human resources at Frost, Ruttenberg & Rothblatt, P C (FRR) in Deerfield, Ill. That trend, however, may be changing Weatherhead says small and mid-sized firms have been able to take advantage of changes in the job market to hire talented tax hopefuls who may have been laid off from, or be disillusioned with, larger firms

Once snagged, smaller firms want to ensure their tax talent stays and form a l i z e d t r a i n i n g a n d m e n t o r i n g p r ograms can play a big role in guiding, molding and retaining this new crop of tax professionals.

Today’s tax training and mentoring p r o g r a m s f o c u s o n t h e b a s i c s o f t a x r e t u r n p r e p a r a t i o n , b u t a l s o g o w e l l b e y o n d t h a t , e n c o m p a s s i n g d a y - t od a y t e c h n i c a l t r a i n i n g , r e s e a rc h , s o f t skills and overall career development

At FRR, entry-level professionals are matched with senior tax professionals who not only help them master the preparation of different types of tax return and develop more advanced technical skills, but also focus on the personal side of the job

“Those mentors become a technical resource and also a go-to person for any type of issue,” says Weatherhead. “They help new hires assimilate, feel included in the team and learn how to navigate organizational challenges ”

After about two years with FRR, the firm offers a career coaching program that helps tax professionals improve their interpersonal, supervisory and networking skills An outside consultant meets with the professional and a senior associate to discuss individual goals and areas of improvement.

“Tax professionals tend to be weaker on interpersonal and communications skills, and these programs can be very valuable in improving their comfort level in building relationships with clients and working with senior professionals on the accounting side or in other areas of the firm,” says Weatherhead

C h r i s t i n e To m a , h u m a n r e s o u rc e s d i r e c t o r a t C h i c a g o - b a s e d O s t r o w R e i s i n B e r k & A b r a m s , L t d ( O R B A ) , a g r e e s “ E v e r y o n e focuses on the technical side, but the softer skills are where everyone needs to improve,” she says

ORBA recently rolled out a new mentoring program that separates professionals by years of experience and sets expectations for each level. Professionals, who choose their mentors, identify training areas of focus such as work product review, delegating, mark e t i n g a n d p r e s e n t a t i o n s k i l l s , t i m e m a n a g e m e n t , p r i o r i t i z a t i o n and managing multiple projects.

Mueller and Co., LLP, an Elgin, Ill.-based financial management firm with an eight-person tax department, focuses mainly on traini n g c o u r s e s t h a t k e e p t a x p r o f e s s i o n a l s u p d a t e d o n t a x l a w c h a n g e s , b u t t h e f i r m a l s o o f f e r s s o f t s k i l l s t r a i n i n g , s a y s A n n

Behrens, tax partner She explains that the firm has held training courses on everything from cold calling and sales to working with different personality types, and is actively working to enhance its training initiatives

A t I t a s c a , I l l - b a s e d C o r b e t t , D u n c a n & H u b l y, P C ( C D H ) , research and general business skills are training program focus priorities, explains Dan Duncan, tax principal “Research skills can be particularly hard to cultivate,” he says, which is why tax professionals at his firm are given research responsibilities, such as

General business knowledge also is key “That’s often the weakest link,” says Duncan “People don’t always understand how a company works ”

It’s also important to incorporate opportunities for more interaction for tax professionals who may not be out meeting and interacting with clients as much as their accounting and auditing counterparts, says Duncan CDH holds marketing and soft skills training, and seeks out chances to send tax professionals to client meetings and events. “We’ll take tax individuals and get them working with a small company or place them on an internal committee anything to help to get them out of their cubes and interacting with other professionals at the client’s office or within our firm,” he says.

Overall career development also comprises a significant part of training and mentoring. CDH holds formal career development discussions and devises action plans to help tax professionals pursue their career goals. The firm offers team members direct interaction with CDH principals and exposure to a variety of client

o n investment is a steady value

“ W h a t t h e f i r m g e t s b a c k i s a m a z i n g , ” s a y s We a t h e r h e a d “When people know that the firm is investing in them, that they are important to the firm and have a future here, we see a higher level of commitment and a real increase in an individual’s efficiency and presence within the organization The payback is the strengthening of teamwork, client relationships and loyalty ”

Weatherhead admits that the accounting industry is notorious f o r s e e i n g t a l e n t e d p r o f e s s i o n a l s l e a v e a f i r m a f t e r f o u r o r f i v e years While that turnover trend has been tempered in the past two years as a result of the weak job market, she says successful training programs also can send a powerful message “When the economy turns around, we want people to know that even during tough times, we were still committed to developing our staff,” she says

Toma cites succession planning as another key benefit of training and mentoring “You have to foster an environment that allows for succession planning,” she explains. “It’s so important for firms to develop a pipeline of future leaders internally who have the right skill sets. It’s much harder to bring people in from the outside, and mentoring programs really help with that.

“Asking our professionals to be more focused on training and mentoring has been a big shift for us,” she continues, “but it’s been met with enthusiasm among our staff. We’re finding that people are very engaged. These aren’t billable hours but our staff knows it is still very important.”

Connecting with young professionals who are looking for more feedback and training than past generations might have done is another valuable payoff “It’s important to make sure your tax professionals are getting the right experience to make sure they’re progressing especially young professionals who are really looking to be mentored and continually challenged,” says Toma

“Continuous training and development is key,” adds Duncan “It’s so important to train, retrain and keep educating Young professionals are always looking for opportunities to learn and get valuable experience ”

MS ARE BASED IN PART LONGER YOU WAIT HIGHER YOUR PREMIUM RATE

YOU’VE WORKED HARD ALL YOUR LIFE to provide a good standard of living for you and your family and KEEP your current lifestyle in retirement. But long-term healthcare costs can get in the way. After age 65, Medicare can help you with healthcare costs.

YOU’VE WORKED HARD ALL YOUR LIFE to provide a good standard of living for you and your family and KEEP your current lifestyle in retirement. But long-term healthcare costs can get in the way. After age 65, Medicare can help you with healthcare costs.

MS

MS ARE BASED IN WAIT TE MA REMIUM

PART LONGER YOU WAIT HIGHER YOUR PREMIUM RATE MAY BE.

But if you develop a long-term health condition, you may need long-term health care.

But if you develop a long-term health condition, you may need long-term health care.

Medicare DOES NOT PAY full bene ts for extended care, assisted care facilities, custodial care, or nursing home facility expenses. If you need this type of care, you could face big expenses:

Medicare DOES NOT PAY full bene ts for extended care, assisted care facilities, custodial care, or nursing home facility expenses. If you need this type of care, you could face big expenses:

• The national average cost of a year in a nursing home is $79,935.1

• The national average cost of a year in a nursing home is $79,935.1

• The 2009 national average for an assisted-living, one-bedroom apartment with a private bath, or a private room with a private bath was $3,131 ($37,572 annually).2

• The 2009 national average for an assisted-living, one-bedroom apartment with a private bath, or a private room with a private bath was $3,131 ($37,572 annually).2

A lot of people think Medicare is going to cover long-term care expenses, but nd the coverage very limited. And a lot of people may go into their retirement not expecting to have to pay for these personal care services.

A lot of people think Medicare is going to cover long-term care expenses, but nd the coverage very limited. And a lot of people may go into their retirement not expecting to have to pay for these personal care services.

This is why millions of responsible Americans help protect their lifestyles with long-term care insurance. But nding the right protection isn’t easy. It’s tough to compare policies with di erent bene ts, features, limitations, costs, spouse coverage and more.

This is why millions of responsible Americans help protect their lifestyles with long-term care insurance. But nding the right protection isn’t easy. It’s tough to compare policies with di erent bene ts, features, limitations, costs, spouse coverage and more.

THAT’S WHY ICPAS HAS ARRANGED A SPECIAL BENEFIT FOR MEMBERS — the Long-Term Care Resources Network, a unique long-term care buying service. This bene t allows you to work with a long-term care insurance representative who will give you all the information about bene ts and rates of different, highly rated long-term care providers.

THAT’S WHY ICPAS HAS ARRANGED A SPECIAL BENEFIT FOR MEMBERS — the Long-Term Care Resources Network, a unique long-term care buying service. This bene t allows you to work with a long-term care insurance representative who will give you all the information about bene ts and rates of different, highly rated long-term care providers.

1 800.358.3795

CARE INSURANCE BY CALLING: 1.800.358.3795

1 800.358.3795

Yo u ’ v e h e a r d a b o u t h o w h a r d i t i s t o f i n d b r i g h t s h i n y n e w a c c o u n t i n g recruits, right? Fresh graduates and young professionals aren’t well-rounded enough; their soft skills are lacking; there just isn’t enough talent to go around But what happens when the talent shortage isn’t just affecting potential recruits? What happens when it affects higher educators the very people charged with teaching and molding the leaders of tomorrow?

Well, that’s exactly the situation we’re sparring with now. In fact, over the last decade, colleges and universities across the country have been struggling with the challenges presented by a shrinking population of academically qualified accounting faculty.

“The shortage is very, very severe,” stresses Steve Matzke, manager of the Accounting Doctoral Scholars (ADS) Program [adsphd org], which is administered by the American Institute of CPAs (AICPA) Foundation. “The most recent data from 2005 to 2008 shows the overall supply of new Ph D s will only meet 49 to 50 percent of the demand. It’s shocking, and this is only going to get worse.”

“The question now is, will the universities have sufficient numbers of appropriately trained professors to serve the people who come to the universities?” explains Ira Solomon, Ph.D., CPA, head of the Department of Accountancy at the University of Illinois at Urbana-Champaign

And in case you think this is simply a problem academic institutions and students will have to deal with, the truth is that you will feel the impact as well. “The university, and in particular the accounting professor, is a critical part of the supply chain of human capital to the profession,” explains Solomon “If the supply chain becomes insufficient in terms of the accounting professor, then it w i l l i m p o s e a c o n s t r a i n t o n t h e n u m b e r a n d q u a l i t y o f p e o p l e w h o a r e attempting to enter the accounting profession ”

“ We r e a l l y d o n ’t k n o w w h a t ’s g o i n g t o h a p p e n t o t h e p r o f e s s i o n . L a rg e g r o u p s o f i n d i v i d u a l s t h a t s t a r t o u t i n p u b l i c a c c o u n t i n g l e a v e a n d g o i n t o industry and government, so the supply of accounting professors and their students affects many aspects of the industry,” Matzke adds “If the Ph D shortage is not addressed there will be a shortage of professionals ”

W h a t ’s m o r e t r o u b l i n g i s t h e c o m p l e x i t y o f t h e s h o r t a g e i s s u e . P r o f e s s o r retirements and a shrinking number of professionals choosing careers in academia may be at the forefront of the problem, but countless other factors below the surface weigh on its severity.

To s t a r t , M a t z k e c a l l s t h e s h o r t a g e a “ s e l f - p e r p e t u a t i n g p r o b l e m ” A s h e explains, “One of the big issues is the capacity of universities to bring in new Ph D students With so many faculty members retiring there isn’t only a shortage of faculty to teach the courses, but there’s also a shortage of professors to chair dissertations ” On top of that, he points out that only 73 institutions in the United States grant accountancy Ph D s, which in itself limits the number of new professors in the pipeline “It’s like a perfect storm,” he says.

“If it were to turn out that things don’t change, there will come a point in time where we will have to turn students away,” warns Solomon. Diving deeper into the shortage, he says, “More specifically, the nature of this shortage doesn’t exist evenly across all sectors of accounting When we talk about the several different domains of accounting tax, audit, financial accounting, systems, managerial accounting, etc it turns out that the prime shortage areas are auditing and tax. If you think about the domain of public accounting, auditing and tax run right to the heart of that line of business ”

Illinois CPA Society | 2011

The Illinois CPA Society is currently seeking to recognize three outstanding educators. Two educator awards may be from 4-year schools--one from a school that offers a graduate accounting program and one from a school that does not. One educator award may be from a 2-year school.

Nominations are welcomed from any interested person (colleague, student, administrator, etc.). Nominees must be an Illinois educator at a community college, college, or university with a minimum of five years teaching experience.

Educators who are noted for their teaching abilities, but are now predominantly involved in administration or research are eligible for the award. Nominees do not need to hold a doctoral degree or be a member of the Illinois CPA Society, but must be a CPA.

The primary criteria to be considered in making the selection are the following factors:

Excellence in teaching

Student motivation and mentoring

Educational Innovation

Contributions to the academic community, and/or contributions to the accounting profession

For more information or to nominate a candidate, please visit www.icpas.org/students.htm.

The deadline for nominations is Friday, November 26, 2010.

A 2005 study by the American Accounti n g A s s o c i a t i o n a n d t h e A c c o u n t i n g P r ograms Leadership Group found that the supply of new Ph.D.s specializing in audit and tax would meet only 22 8 and 27 1 percent of demand in these disciplines, respectively.

The reality is, there’s no simple, or single, solution to the problem. “This is something that is going to have to be addressed by all aspects of the profession, not just the academic institutions, but public accounting firms, business, industry and government; this is going to be far-reaching,” says Matzke. “This issue is going to have to be tackled from many angles.”

In the short-term, universities and colleges are supplementing their professorial ranks with lecturers and adjunct faculty members, but Solomon warns that this approach has its limits “There are accreditation constraints as to how far one of these educators can go Further, while we can rely on these people to share their rich knowledge and experiences, they aren’t going to be conducting research or not nearly to the extent of a Ph D,” he says “Ultimately, research is what furthers the profession It really does offer new insights i n t o t h i n g s t h a t o t h e r w i s e m a y n o t b e explored,” Matzke explains

been working to bring the shortage in tax and audit Ph D s under control “The goal of the ADS Program is to incrementally increase the pool of Ph D s that aren’t currently in the pipeline,” says Matzke “Over a four-year period, we want to increase the current Ph D pool by 120 Ph D faculty members ”

To do this, the Program collaborates with academic institutions to boost their rosters of Ph D entrants “For example, on average Indiana University accepts two Ph D candidates per year,” says Matzke, “The ADS Program says, ‘Great, but we want you to take a third and we’ll fund it ’ There are a lot of people interested in getting a Ph.D., but the issue is that it is a financial hardship; this program addresses that.”

Leaders and sponsors from more than 70 of the largest accounting firms and over 47 s t a t e C PA s

number of very intelligent and highly exper i e n c e d p e o p l e e x p r e s s i n g a n i n t e r e s t i n accounting Ph D programs at any time during my 32 years as a faculty member,” says Solomon “It’s clearly having a big impact in terms of making people aware of the opportunities and the financial support the program provides; it’s making a Ph D feasible for people ”

To date, 54 ADS Program Scholars have been enrolled at participating universities The program is now in its third year, and while no Ph D graduates have been produced yet it takes a minimum of four to five years to earn a Ph D the supporting universities are continuing to take on prospective Ph.D.s across the country.

With the Program showing early signs of success, it looks to be just what the doctor ordered. And while the focus is on the publ i c a c c o u n t i n g s i d e o f t a x a n d a u d i t , w i t h any luck this Program is the beginning of a more all-encompassing solution.

“

a l c o m m u n i t y What I have seen consequently is the largest

“I think the successes the ADS Program i s s e e i n g a r e g o i n g t o g o a l o n g w a y towards future programs of a similar scope that address different aspects of the profession,” says Matzke

Illinois law requires that all CPAs who are not licensed but hold themselves out to the public in Illinois in any way as a CPA, must register with the Illinois Department of Financial and Professional Regulation. This would include anyone who uses the CPA designation on resumes, business cards or letterhead, or in any other manner.

The registration option has been extended to July 1, 2012. Special accommodations are in place for out-of-state CPAs meeting certain criteria.

Visit www.icpas.org for more information.

>$90 for initial registration and $90 every three years after that to renew your registration.

>Registration does not require CPE or experience.

>If you are not registered by the new July 1, 2012 deadline, you will have to be licensed in order to use the CPA designation, and will be subject to all license requirements, including CPE.

>If you don’t register now and continue to use the CPA designation, you could be fined up to $5,000.

Register Today.

To download the registration form, and for help in filling it out, visit www.icpas.org

Please share this with other CPAs in your firms and companies.

The Financial Accounting Standards Board (FASB), as part of a joint project with the International Accounting Standards Board, has proposed new accounting rules that, if adopted, will significantly change how companies and nonprofits treat their leases on financial statements. Under the current rules, proper treatment turns on whether a lease is classified as operating or capital. Operating leases aren’t recognized on a lessee’s balance sheet, and rent payments are treated as an expense Capital leases, on the other hand, relate to property acquisition and financing, and therefore produce an asset (i.e. the rights granted to the lessee) subject to depreciation and liability (the obligation to pay rent), which are both recognized on a lessee’s balance sheet Capital leases result in the recognition of both depreciation and interest expenses Under current rules, capital lease assets and liabilities are measured in terms of the present value of the minimum lease payments over the fixed term of the lease, without considering optional renewal periods

The proposed rules, however, make no distinction between operating and capital leases. They do require a lessee to recognize a right-of-use asset and a liability from the date the lease begins, much as the current rules do for capital leases. Rent payments are recorded as principal and interest payments on the lease obligation However, unlike the current rules, these new rules require a lessee to estimate the term of the lease based on the “longest possible term that is more likely than not to occur ” This concept is broadly structured so that a lessee considers factors such as the lessee’s contractual ability to extend the lease, the statutory and business consequences of terminating the lease (such as the existence of significant leasehold improvements or whether the leased asset is specialized or crucial to the lessee’s operations), and the lessee’s intentions and past practices. The lessee then would be required to reassess the value of the lease obligation over each period These changes could have far-reaching effects on a company’s financial statements

Companies with operating leases will see the most dramatic effects Take this example (see table), where Company A leases a manufacturing facility under a 10-year lease, and where the facility is used exclusively for manufacturing The lease calls for annual minimum rental payments of $1 million, and the present value of the obligation as of January 1 is $6.7 million.

Take these four steps to prepare for the proposed new rules

1 Perform pro forma calculations

The proposed transition rules provide a simplified retrospective application of the guidance This applies to the beginning of the first comparative period presented in the first financial statements in which the new guidance is applied However, companies should also consider recasting their other financial metrics (such as EBITDA) according to the proposed new rules, so that comparative information is readily available It ’ s common for lenders and owners to use EBITDA to estimate a company ’ s value and evaluate management ’ s performance Re -measuring these metrics will allow an apples -to -apples comparison going forward

2. Restructure existing debt covenants in loan agreements

Loan agreements typically include debt covenants based on metrics such as debt-to -total assets and cash- coverage ratios

Because the addition of lease -related assets and liabilities to the balance sheet could affect these metrics, companies should let their lenders know about the proposed rules and their implications for the company ’ s debt covenants If management is in the process of refinancing or renewing the company ’ s loan agreement, making the necessary changes and knowing debt ceilings sooner rather than later might be a good idea

Under the current rules, companies often treat their operating leases like any accounts payable expenditure, with management simply reviewing the check as payments are due The proposed new rules call for more record-keeping to separately track lease asset depreciation and amortization, and classification of lease liabilities They also require companies to develop policies for estimating the term of lease agreements

4 Understand the implications for acquisitions

EBITDA is widely used to gauge a target company ’ s operations To avoid misinterpreting the increased EBITDA as a fundamental improvement in a target company ’ s financial situation, companies considering an acquisition have to fully grasp the effects of the proposed new rules Acquiring companies also need to be aware of implications in order to effectively compare the acquisition’s results before and after the rules take effect

Although the underlying economics of lease agreements haven’t changed, companies with operating leases could experience a jump in their earnings before interest, income taxes, depreciation and amortization better known as EBITDA. Under the current rules, rent paid on an operating lease would be recognized as an expense and therefore would reduce a company’s EBITDA However, under the proposed rules, the present value of all lease payments would appear as an asset and a liability As rent is paid, the majority would be applied against the liability, with the remaining portion recognized as interest expense The asset would be depreciated

Over the course of the lease, total depreciation and interest expenses recognized will equal the total rent expense reported under current rules However, the proposed new r u l e s d o a c c e l e r a t e e x p e n s e r e c o g n i t i o n . This is because interest expense would be r e c o g n i z e d u s i n g t h e e f f e c t i v e i n t e r e s t method, versus a straight-line basis over the contractual term of the lease.

Presuming the proposed new FASB rules are a d o p t e d , n o t o n l y w i l l E B I T D A a n d n e t income be affected, but a number of financ i a l r a t i o s c o m m o n l y u s e d i n d e b t a g r e e -

ments will change as well Many companies also will see an increase in the current and n o n c u r r e n t l i a b i l i t i e s p r e s e n t e d o n t h e i r books, since they’ll be required to recognize t h e c u r r e n t a n d n o n c u r r e n t o b l i g a t i o n s i n h e r e n t i n l e a s e a g r e e m e n t s T h e c u r r e n t p o r t i o n o f l e a s e l i a b i l i t i e s w i l l a d v e r s e l y affect the working-capital ratio

What’s more, many companies have debt a g r e e m e n t s t h a t r e s t r i c t o r p r o h i b i t t h e amount of debt a company can assume (frequently referred to as “permitted indebtedness”) The added indebtedness caused by l e a s e s m i g h t a f f e c t f i x e d - c h a rg e c o v e r a g e ratios, since the lease payments would now be considered debt or obligation payments

The proposed rules could lead companies to perform a de facto consolidation of their related-party leases with variable interest entities (VIEs). Currently, a company wouldn’t record the lease on its financial statements unless it is a primary beneficiary of the VIE

The proposed new rules require all leases, including related-party leases, to appear on the balance sheet regardless of whether the lessee is a VIE primary beneficiary

A company’s statement of cash flows identifies three types of activity: operating, investing and financing The focus is usually on c a s h f l o w s f r o m o p e r a t i n g a c t i v i t i e s , a n d

c u r r e n t l y a r e n t p a y m e n t o n a n o p e r a t i n g lease represents an outflow from operating a c t i v i t i e s . U n d e r t h e p r o p o s e d n e w r u l e s , however, most of the rent payments (other t h a n t h e i n t e r e s t c o m p o n e n t ) w o u l d b e treated as a reduction in lease principal or an outflow from financing activities.

The FASB released an exposure draft of the new lease accounting rules, “Leases (Topic 840),” on Aug 17, 2010, and requested that comments be submitted by Dec. 15, 2010. The FASB expects to issue the final ASU in 2011. The complete exposure draft and future updates can be found at fasb org/home

If and when implemented, the rules could significantly impact a company’s EBITDA and balance sheet The quicker companies understand how these proposed rules will affect their business, the better equipped management will be to address related issues.

ICPAS member Gl enn Ri chards i s wi th Crowe Horwath L L P i n the Oak Brook, Il l i noi s offi ce He can be reached at 630.575.4323 or gl enn ri chards@ crowehorwath com ICPAS member Kevi n W ydra i s a partner wi th Crowe Horwath L L P i n the Oak Brook offi ce and serves on the ICPAS Audi t and Assurance Servi ces Commi ttee He can be emai l ed at kevi n wydra@ crowehorwath com, or you can cal l hi m at 630 586 5242

The Illinois CPA Society’s Women’s Executive Committee and the American Institute of CPAs Work/Life and Women’s Initiatives Executive Committee are pleased to honor these women who have made significant contributions to the accounting profession, their organizations, and to the development of women as leaders.

These deserving women will be presented with their awards at the Illinois CPA Society “Women’s Leadership Breakfast” on Thursday, November 18, 2010 at the Standard Club in Chicago.

The mission of the Women's Executive Committee is to enhance the recruitment, volunteerism, retention and leadership of women CPAs in the Illinois CPA Society and the profession through various programs and networking events. This program is one in an ongoing series designed to help women CPAs learn more about important professional issues, expand business networks and foster career advancement.

To register to attend this breakfast, please call the Illinois CPA Society at 800.993.0393 or visit www.icpas.org.

Lindy Antonelli, CPA President and Founder, AccessTek Experienced Leader

Wendy Hambleton, CPA Director, National SEC Department, BDO USA Experienced Leader

Jo Ellen Helmer, CPA Partner, Midwest Health Science Industry Leader, Ernst & Young LLP Experienced Leader

Heidi Verbiscer, CPA Senior Manager, Federal Tax Services, Crowe Horwath LLP Emerging Leader

Jennifer Oinounou, CPA Manager, Management & Distribution Services Group, Baker Tilly Emerging Leader

Lindy Antonelli, CPA President and Founder, AccessTek Experienced Leader

Wendy Hambleton, CPA Director, National SEC Department, BDO USA Experienced Leader

Jo Ellen Helmer, CPA Partner, Midwest Health Science Industry Leader, Ernst & Young LLP Experienced Leader

Heidi Verbiscer, CPA Senior Manager, Federal Tax Services, Crowe Horwath LLP Emerging Leader

Jennifer Oinounou, CPA Manager, Management & Distribution Services Group, Baker Tilly Emerging Leader

CIOs have a wish list, of sorts 10 questions they want their CFOs to ask them.

By Meta L LevinLaura Huska draws a picture to illustrate each element of the computer network at Chicago Botanic Garden in Glencoe, Ill Huska, director of information services, isn’t being condescending to her CFO She‘s just making sure that the person who not only controls the purse strings, but also is responsible for bringing her department’s issues and proposals to upper management, understands as much as possible about the IT function