Advertising with the Illinois CPA Society provides you with opportunities to gain maximum exposure to decision-making CPAs and business leaders.

INSIGHT Magazine Facts

• 90% reader satisfaction rate

“recommend of readers would ater

• 84% of readers would “recommend articles that appear in INSIGHT to peers & colleagues.”

INSIGH

• 83% agree that INSIGHT contains “important information that I can apply to my professional life.”

important

• Multi-award-winning content and design.

br mor advertis Nat

advertis

esign.

ard-winning de w ng make. Add even ference he dif

Call Natalie TODAY and see the difference advertising with INSIGHT can make. Add even more brand impact by including digital to your advertising plans!

Multi-a • 8184

ing rand impact by includi ing m th talie

Natalie DeSoto 717.580.8184

d 717 580

natalie. 717.580 ww ICPAS org/insight h desoto@theygsgroup. .8184 htm

.com

natalie.desoto@theygsgroup.com

Visit www.ICPAS.org/insight.htm for more information!

Visit ww

1 APR=Annual Percentage Rate. Subject to approval. Rates, terms and conditions vary based on creditworthiness and qualifications and are subject to change. Refer to the Visa credit card disclosure at www.alliantcreditunion.org for details. Introductory rate and incentive offers, including bonus points, are not available to those members who in the previous six months have had (i) an open Alliant Visa credit card account, or (ii) an outstanding balance on a closed Alliant Visa account. We may not extend credit to you if you do not meet Alliant criteria. The cash advance fee is 2% of the amount of the advance, but not less than $10. We will begin charging interest on cash advances on the transaction date. The foreign transaction fee is 1% of each transactionwhere the merchant country differs from the country of the card issuer. The minimum payment required is 3% of your balance or $25, whichever is greater, plus the amount of any prior minimum payments that you have not made. 2 Balance transfers must be transferred from any financial institution other than Alliant Credit Union. Balance transfers and cash advances may not be used to pay any Alliant accounts. Amounts transferred are subject to your available credit limit. We are not required to honor a balance transfer request that will cause you to exceed your available credit limit. We will not be responsible for late payment or non-payment to other card issuers. We are not responsible for fees that may be charged for cash advances performed at other financial institutions and ATM owners. It may take up to three weeks to set up the new Visa account and/or to post the balance transfer transaction. You should continue to make all required payments until you confirm that the balance transfer was made. We will not close your other accounts even if you transfer the entire balance.

If you wish to close another account, you should contact the issuer directly. 3 Visa’s Zero Liability policy covers U.S.-issued cards only and does not apply to ATM transactions, PIN transactions not processed by Visa or certain commercial card transactions. Cardholder must notify issuer promptly of any unauthorized use. For more information, visit http://usa.visa.com/personal/security/visa_security_program/zero_ liability.html. 4 Cash Back option is

Every day CPAs face rapid change, whether it’s across the regulatory landscape or within the diverse populace they serve and work with. Which is why it's critical for CPAs to keep their eyes cast firmly to the future

As far as cautionary tales go, the last 150 years have offered up a boatload From barefaced ego -tripping to muddleheaded inertia, companies that ride high on the wave of fame and fortune crash pretty hard now and then

You Know Making connections, and making them matter

Companies are going all out to keep their Gen X and Y workers happy

What’s all the hoopla about? Virtual currency, that’s what. 26

If any of these describe you, then start bulking up your core leadership strengths pronto

EB -5 offers an unexpected source of financing for U S businesses Here’s how

Then maybe you shouldn’t say anything at all at least if what you ’ re saying is defamatory

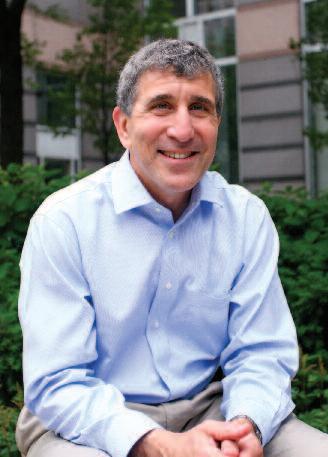

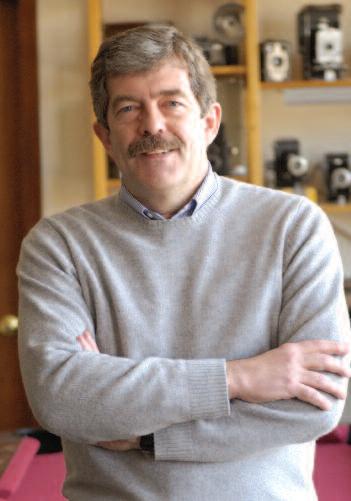

4 Meet the Chair Daniel F.

Dan is partner-in- charge, Tax Services for Bannockburn-based FGMK , LLC, Chicago’s 9th largest accounting firm He holds a JD and LL M (Taxation) from DePaul Law School, and a BBA (Accounting) from the University of Notre Dame In addition to his service with the Illinois CPA Society, Dan is a member of the AICPA, the American Bar Association, the Chicago Bar Association, the Economic Club of Chicago (where he serves on the Membership Committee), and the Executives Club of Chicago He also serves on the Advisory Boards of the University of Notre Dame Department of Accountancy and the University of Illinois MST Program

JD, LL.M.

JD, LL.M.

THIS

coming from the Illinois CPA Society's incoming board chair, but I wasn’t always in tune with the Society's benefits and initiatives Like many young people starting their careers, I joined a public accounting firm where a Society membership was “just something you do ” I accepted it blindly and never thought much about it Then, several years later, I was told quite frankly by my managing partner that I needed to get involved in this great organization and its committees if I wanted to emerge as a leader From entry-level auditor to partner-in-charge, I am where I am today thanks to that senior partner’s advice. In like form, now it’s my turn to encourage you to take advantage of all the Society offers

You get out what you put in If you’re content with only attending an annual conference, that’s fine But if you’re someone who wants more out of life, and wants more relationships, challenges, opportunities and knowledge, the Society offers you that You’ll get a lot more bang for your buck by joining a committee, networking group or task force, participating in the CPA Day of Service and other charitable and advocacy efforts, and attending events like the Young Professional Leadership Conference and the Midwest Accounting & Finance Showcase

Getting involved is a matter of personal choice, but there’s more at stake than the brand of the Society; it’s about building the brand of the CPA it’s about building the brand of you.

In helping you build your brand, we’re adapting ours The Society’s top priority is to become a premier provider of education and training. We know the days of being able to toss a master tax guide in your briefcase and answer all sorts of questions are long gone That’s why we’re developing new live and web-based education and training that’s topical, relevant, convenient and selectable by you The 100 live courses, 40 conferences and 120 online onDemand programs we currently offer are just the beginning The future of learning is online and just-in-time, and I’m very excited to be a part of building this future for our members

We face fast-paced change in a profession tasked with serving increasingly diverse clients, customers, colleagues and professionals across every industry We are CPAs That’s a powerful thought and a powerful feeling As a partner-in-charge, I always remind my staff members that they’re surrounded by the best and brightest; they’re dealing with people who will challenge them intellectually, and who will challenge them to work harder, persevere and to inspire every generation that follows.

I hope to spend the next year inspiring all of you to live up to all the CPA designation represents, and to help in advancing the Society’s strategic initiatives We are the fifth largest state CPA society, and we’re a premier society in many areas, from education and information to advocacy and networking That’s something to be proud of and something worth being a part of.

I look forward to talking with you

Publisher/President & CEO Todd Shapiro

Editor-in-Chief Judy Giannetto

Art Design Judy Giannetto

Production Design Rosa Garcia

Assistant Editor Derrick Lilly

Photography Jay Rubinic, Derrick Lilly, Thinkstock

National Sales & Advertising Natalie DeSoto

YGS Group, 3650 West Market Street, York, PA 17404

P: 800 501 9571 x127 F: 717 825 2171

E: natalie desoto@theygsgroup com

Circulation Carl Siska

Editorial Offices: 550 W Jackson Boulevard, Suite 900,Chicago, IL 60661

Chairperson, Daniel F Rahill, CPA, JD, LL M FGMK, LLC

Vice Chairperson, Edward J Hannon, CPA, JD Freeborn & Peters LLP

Secretary, Scott D Steffens, CPA Grant Thornton LLP

Treasurer, Mary Lou Pier, CPA Pier & Associates, Ltd

Immediate Past Chairperson, William P Graf, CPA Deloitte & Touche LLP

Linda S Abernethy, CPA, McGladrey LLP

Jared J Bourgeois, CPA, Mesirow Financial Consulting, LLC

Rosaria Cammarata, CPA, CME Group, Inc

Rose G Doherty, CPA, Legacy Professionals LLP

Eileen M Felson, CPA, PricewaterhouseCoopers LLP

Gary S Hart, CPA, Gary Hart & Associates, Ltd

Lisa A Hartkopf, CPA, Ernst & Young

Margaret M Hunn, CPA, CFE, CFF, CITP, Rozovics Group, P C

David V. Kalet, CPA, MBA, BP Products North America, Inc

Thomas B Murtagh, CPA, Wolf & Company LLP

Marcus D Odom, PhD, CFE, CPA (inactive), Southern Illinois University

Floyd D. Perkins, CPA, Ungaretti & Harris

Kelly Richmond Pope, Ph D , CPA, DePaul University

Mark F Schultz, CPA, Dugan & Lopatka CPAs, P C

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 24,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year, in Spring, Summer, Fall, Winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA , 312 993 0407 or 800 993 0407, fax: 312 993 7713 Copyright © 2014 No part of the contents may be reproduced by any means without the written consent of INSIGHT Permission requests may be sent to: Publications Specialist, at the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

Your Illinois CPA Society membership provides you with convenient and customized education, timely and relevant information, tireless advocacy, and countless opportunities to make powerful professional connections.

Whether you work in public accounting, corporate finance, not-for-profit, consulting, government or education, the Society connects you with an extraordinary community of more than 23,000 accounting and finance professionals.

RENEW AT: www.icpas.org

QUESTIONS: Please contact Member Services at 800.993.0407, option 4.

If you look at great organizations throughout history, you’ll likely see a common theme: They all have a clear and consistent direction that guides their every action Well, the Society has taken a page out of the same book.

Last November the Society’s Board of Directors, senior staff and young professional leaders met with the goal of answering the question, “Based on what members are facing, is the Society’s current mission on track?”

Any conversation about the future needs to start with a frank discussion of upcoming changes and ongoing challenges, and ours was no different

Here's what we concluded:

n C PA s w i l l b e c h a l l e n g e d t o p r o v i d e a higher level of strategic business advice to clients and companies.

n While compliance work will continue t o b e i m p o r t a n t , c o n s u l t i n g w o r k w i l l provide the greatest growth opportunity

n Demand for specialization will increase

n Technology will remain a double-edged sword: Overwhelming to keep up with, b u t a b s o l u t e l y e s s e n t i a l i n m o v i n g u s forward

n Competition will be fierce, from CPAs and non-CPAs alike

n Successful organizations will embrace diversity thinking styles, ethnicity, age, national origins, and more

Our next question was, "How can the Illinois CPA Society help the CPA of today trans i t i o n t o t h e C PA o f t o m o r r o w ? " w h i c h went a long way in reaffirming our current mission of “Enhancing the value of the CPA profession ” (Incidentally, the "CPA of tomorrow" is the subject of our cover story, which was inspired by our November meeting )

As you know, our aim is to deliver relevant services and information through the four strategic pillars that I've been talking to you

about over the past year Education, Advocacy, Information and Connections

I n t h e y e a r a h e a d y o u ’ l l e x p e r i e n c e ICPAS as a premier provider of education and learning with enhanced OnDemand programming, access to the Knowledgeh u b L e a r n i n g M a n a g e m e n t S y s t e m , a n d i n - p e r s o n e v e n t s f e a t u r i n g t h e l a t e s t i n learning innovations all things you, our m e m b e r s , h a v e a s k e d f o r i n a n i n c r e a singly custom-fit world

You’ll also see the Society working to advance the professional interests of our members through legislative monitoring, regulatory intervention, CPA image initiatives, and attracting and engaging the next generation of professionals

Yo u ’ l l h a v e d i r e c t a c c e s s t o r e l e v a n t i n f o r m a t i o n t h r o u g h a n e w l y d e s i g n e d w e b s i t e , d i g i t a l a n d p r i n t p u b l i c a t i o n s , and our various highly anticipated events, i n c l u d i n g t h e u p c o m i n g Yo u n g P r o f e ss i o n a l L e a d e r s h i p C o n f e r e n c e ( w e h a v e details on page 48 and a feature inspired by our keynote, Jason Lauritsen, on page 34) and the annual Midwest Accounting & Finance Showcase in August.

And you’ll expand your opportunities to connect with other professionals, whether via LinkedIn, Twitter, Facebook, chapters, c o m m i t t e e s , e d u c a t i o n a l e v e n t s , p u b l i c service....and so many more venues.

"Enhancing the value of the CPA profession through education, advocacy, information, and connections " That simple but strong statement is our guidepost. It is the c l e a r a n d c o n s i s t e n t d i r e c t i o n t h a t w i l l guide our every action.

I’d love to hear your thoughts on how all of us members, leadership and staff can move the mission of our Society forward Send me an email or connect with me on Twitter anytime.

the year by which renewable technologies will account for 50% of new power generation capacity installed around the world Source: Bloomberg New Energy Finance

Here’s the good news from Jeffry Bartash of MarketWatch: The United States added more than 2 1 million jobs in 2013 for the third straight year

The bad news? We still need another 1 18 million to match our 2008 peak of 138.1 million.

Nevertheless, hiring highlights include:

n The finance industry gained 84,000 jobs

n Manufacturers hired nearly 80,000 workers

n The leisure and hospitality industry added almost 400,000 jobs

n Temporary administrative work was in demand, with approximately 247,000 positions filled

n Healthcare added at least 200,000 jobs

n The construction trades added 122,000 jobs

n 100,000 executives or managers were hired, and demand was high for architects, engineers and computer designers

n And the retail industry added the most workers in 14 years, nearing an all-time high

Venture Capitalists invested $29.4 billion (+7 percent) in 3,995 deals (+4 percent) in 2013, according to the MoneyTree Report by PricewaterhouseCoopers LLP and the National Venture Capital Association (NVCA) Investments in the software industry reached the highest level since 2000, accounting for 37 percent of all venture capital invested Internet- specific companies followed suit by capturing $7 1 billion in 2013, marking its highest level of investment since 2001.

The life sciences sector (biotechnology and medical devices combined) also saw strong money flows, accounting for 23 percent of all venture capital dollars invested in 2013 Biotechnology investments rose 8 percent to $4 5 billion across 470 deals, making it the second largest investment sector for the year; the medical device industry brought in $2 1 billion across 308 deals

Crowe Horwath LLP has a word of warning: According to its recent survey of 54 financial institutions, only one in five banks (20 percent) are ready to meet mandatory stress -testing requirements Banks with more than $10 billion in assets now have to submit stress test results or hypothetical analyses to federal regulators annually These stress tests measure how banks would perform under a variety of economic scenarios to determine whether they have sufficient capital to withstand issues, events and crises.

“A mediocre person tells. A good person explains. A superior person demonstrates. A great person inspires others to see for themselves ”

Harvey Mackay

62%

CEOs who expect to hire more people in 2014. Source: PricewaterhouseCoopers

The first year of a new client relationship is easy, says Stay or Stray Putting Some Numbers Behind Client Retention, a recent report by Toronto-based practice management software and data services company PriceMetrix The report quotes a retention rate of approximately 95 percent during this honeymoon phase But that number falls quickly in the two - to four-year period to just 74 percent Five factors are all important when strategizing for client retention during more trying years:

1. Client Size: Households with $100,000 in assets had a retention probability of 87 percent versus 94 percent for households with $500,000 in assets Managing many smaller clients actually led to lower retention rates

2 Fees: The optimal price range lies between 1 and 1 5 percent of revenue on assets

3 Account Types: Fee -based accounts (91 percent) edge out commission-based accounts (89 percent) only slightly in retention, but clients with both types of accounts under management are more likely to stay (95 percent)

4 Connections: Advisors who manage multiple accounts within a household are much more likely to maintain the relationship than if they manage only one (94 percent versus 85 percent)

5. Age: Older clients are far more likely to stay with their advisors. A 30-year- old client has a retention probability of 82 percent versus 87 percent for a 40-year- old client and 90 percent for a 50-year- old client

We all know that cloud computing can be a powerful tool, but have you figured out how it might benefit your organization, specifically? If not, you’d better Gartner predicts that cloud computing will grow by 41 3 percent through 2016, providing instant, secure access to hosted IT infrastructures from absolutely anywhere

According to a survey by Rackspace Hosting, the ability to cut costs is driving the move The survey of 1,300 businesses in the United States and United Kingdom reveals that 88 percent of respondents feel they have achieved cost savings, while 56 percent agree that cloud services have helped to boost profits What’s more, 60 percent say cloud computing has reduced the need for IT teams to maintain infrastructures, and 62 percent say they are reinvesting savings back into the business to increase headcount, boost wages and drive product innovation

3%

Average 2014 salary increase expected in the united states.

Source: Buck Consultants

Nobody is saying that leaving one job for a better one isn’t a smart move, but you should know that doing it too often in too little time gives HR managers cause for concern In a recent Robert Half survey of more than 300 HR managers, participants were asked, "Over a 10-year span, how many job changes, in your opinion, would it take for a professional to be viewed as a job hopper?" The answer? Five job changes and you might be viewed as trouble

You probably already have life insurance. But do you have enough?

Over the years, your living expenses may have increased. Could your current life insurance benefits:

• Help your family maintain their lifestyle?

• Pay for your kids’ college education?

• Allow your spouse to retire comfortably?

It’s always a struggle to lose someone you love. But your family’s emotional struggles don’t need to be compounded by financial problems.

That’s why ICPAS the Group 10-Year Level Term Life Insurance Plan — exclusively for ICPAS members.* This valuable insurance program offers:

• Your choice of benefit amounts up to $250,000

• Rates that are locked in for 10 full years

• Benefit amounts remain steady for the 10-year coverage period. There are no age reductions.

* keith.staats@us.gt.com

Keith Staats is a director in Grant Thornton’s State and Local Tax (SALT) practice in Chicago, and has been involved in tax planning, consulting and dispute resolution in all areas of state and local tax. He has served as General Counsel of the Illinois Department of Revenue (IDOR), was involved in the development of Illinois tax policy, reviewed and evaluated all tax-related legislation proposed by the Illinois General Assembly, contributed to the drafting of all tax legislation proposed by the Governor and was a member of the IDOR Informal Conference Board He has represented taxpayers before both the Informal Conference Board and the Board of Appeals Keith is a professional affiliate member of the Illinois CPA Society, and is a member of the American Bar Association, the Illinois State Bar Association, the Chicago Bar Association and the Board of Directors of the Civic Federation of Chicago

To recap on Part 1 of my column in the Winter 2013/2014 issue, cloud computing refers to the remote access of computing applications, platforms and infrastructures from a central, third-party service provider, and includes Software as a Service (SaaS), Platform as a Service (PaaS), Infrastructure as a Service (IaaS), Business Process as a Service (BSaaS), Database as a Service (DaaS), Data Storage as a Service (STaaS), Security as a Service (SECaaS) and Application Programming Interfaces as a Service (APlaaS)

The first factor in determining whether there may be potential tax liability in relation to cloud computing in a particular state is to determine whether there is nexus; in other words, whether the provider has enough of a connection with a state to be subject to taxation Nexus can be established by the presence of employees or property, including leased property, within the state. For the purposes of this column, let’s assume the seller has nexus

The next step is to consider the characterization of the transaction what are you buying, tangible personal property, services or intangible property? Are you buying software versus data processing as part of an overall IT service? States that tax services view SaaS as a service Some states that don’t tax services may shoehorn SaaS as taxable prewritten software

Since a lot of purchases consist of a combination of software and cons

sider the impact of bundled charges

States tend to treat a bundled transaction containing both taxable and nont a x a b l e e l e m e n t s a s t a x a b l e i n t h e absence of evidence to the contrary. I t e m i z i n g t h e v a r i o u s e l e m e n t s o f a bundled transaction often can avoid taxes being overpaid.

A numbe r of s ta te s ha v e prov ide d guidance on SaaS and sales tax, mostly in the form of rulings and in some cases through litigation Here are just a few

I n d i a n a Web-based software accessed via the Internet constitutes taxable personal property and is taxable if prewritten. (See Revenue Ruling No. 2 0 09 - 03 , a n d L e t t e r o f F inding s No 09-0418 and No 09-0656 )

New York A license to use software accessed via the Internet results in a constructive transfer of possession, even when the software is never installed on a customer’s computer (See TSB-A09(15), S, April 15, 2009 )

Ohio Web-based software is taxed as an automatic data-processing servi c e . ( S e e O h i o R e v. C o d e A n n . S e c . 5739 01(B)(3)(e) )

Pennsylvania Canned software hosted on a server and accessed remotely is taxable if the user is located in Pennsylvania, but apportionment of in/out-of-state use is permitted. In the case of a Pennsylvania billing address, there’s a rebuttable presumption that users are located in the state. The software location is irrelevant and an explicit software license is not requir-

ed Access implies a license to use, control or exert power over the software, and applies to new and renewed contracts dated on or after May 31, 2012 (See Legal Letter Ruling No SUT 12-001 (May 31, 2012) )

Minnesota Charges for access are not subject to tax if the software is hosted on a s e r v i c e p r o v i d e r ’ s s e r v e r ; t h e c u s t o m e r only has remote access; the customer has use for processing only; and the customer has no title, possession or authority over the software Such access is considered to be more like an information service The application service provider owes sales or use tax on any hardware, canned software or other taxable inputs used to provide the nontaxable service, as long as the inputs are in Minnesota.

Tennessee Fees charged to access online software are not taxable where there is no transfer of title, possession or control of the software to the taxpayer, and where the server is located outside the state. (See Letter Ruling No 11-58 and Letter Ruling 11-21 )

New Jersey The Division of Taxation has issued technical guidance addressing the New Jersey sales and use tax treatment of cloud computing transactions, includ-

ing SaaS, PaaS and IaaS Receipts derived f

subject to New Jersey sales and use tax, since they aren’t seen as constituting the sale of tangible personal property and are not specifically enumerated services

Kansas When cloud computing is used to route electronic, voice, data, audio, video or any other information or signals, the charges to the customer are taxable as telecommunications or ancillary services

Michigan The Department of Treasury issued a Technical Advice Letter on SaaS taxability on September 7, 2012, in which it affirmed that the Department is evolving as the cloud computing market evolves Taxability “depends on the facts and circumstances of each transaction ”

If the transaction “involves a fee (license) for the use of prewritten software” or “is predominantly the lease/license of prewritten software,” it will be subject to Michigan sales/use tax, assuming that the transaction is sourced to Michigan Michigan currently takes the position that accessing software via the Internet constitutes the use of prewritten software and therefore is taxable

Michigan also has pending litigation, Thompson Reuters v Department of Treasury, Ct of Claims docket 11-91-MT, which questions whether a subscription-based database search tool requires a software license. Does access to vendor data via a vendor software tool have more of a service character than a SaaS transaction involving access to software and potential storage of customer data? The taxpayer has appealed to the Michigan Court of Appeals

Another case, Great Lakes Home Health Services, Inc v Department of Treasury, MTT Docket No. 410962 (August 30, 2012), is also on appeal to the Michigan Court of Appeals (COA No. 315835). The Tribunal has held that the taxpayer had a taxable use and purchased a license of software even though the software did not reside on the taxpayer’s computers or servers.

These cases demonstrate that there are more questions than answers when it comes to cloud computing and sales tax Making things even more complicated is the fact that the questions and answers vary from state to state

This will continue to be a rapidly evolving area as states develop more familiarity with the issues, and more business applications migrate to the cloud

FGMK specializes in serving privately and publicly held companies in a wide range of industries. We understand the challenges and opportunities of today’s constantly evolving business market and can offer you comprehensive tax, assurance and consulting expertise and responsive, proactive service.

ed one of the 10 lar Rank onsulting e e and c assuranc olving mark v tly e constan

essionals who activ prof . engagemen xibility e and fle servic ers clien GMK off , F Business

toda W ommend solutions ec ess r ely addr onsist of cr t teams c wledge talen xpert kno

Ranked one of the 10 largest accounting firms in Chicago by Crain’sChicago Business, FGMK offers clients expert knowledge and talent with close personal service and flexibility. Our engagement teams consist of creative, responsive professionals who actively address challenges and recommend solutions and strategies for improving our clients’ businesses and strengthening their bottom line.

Areas of Practice

2801 Lakeside Drive Bannockburn, Illinois 60015 847-374-0400

333 West Wacker Drive, 6th Floor Chicago, Illinois 60606 312-818-4300

fgmk.com

Audit, Risk and Compliance Tax Services Health Care Consulting

& Enterprise Risk Assessment Estate Planning Retirement and Planning Management Consulting Turnaround & Restructuring Real Estate & Construction Valuation & Litigation Support Mergers & Acquisitions Cost Segregation

Marty Green is the Illinois CPA Society’s Vice President of Government Relations, working with the CEO and Board of Directors to oversee and implement the Society’s legislative and regulatory activities He is also a practicing lawyer, member of the Illinois Bar and a Lieutenant Colonel in the National Guard Marty previously served as executive assistant attorney general for Illinois Attorneys General Lisa Madigan and Jim Ryan, and as director of the Governor’s Office of Citizens Assistance and assistant to the Governor for Public Affairs, both under Governor James Edgar He holds a number of professional certifications and is admitted to practice before the state and federal courts Marty is the past president of the Western Illinois University Alumni Council and is an adjunct professor for the Department of Health Sciences

Just as the Illinois General Assembly overcame one hurdle with the passage of comprehensive public pension reform legislation, it now has to deal with the sunset of the 2011 income tax increase when the rates slope from 5 to 3 75 percent for individual and from 9 5 to 7 75 percent for corporate These rate reductions are estimated to cost states $5 billion in tax revenues

Added to that, Speaker of the House Mike Madigan has introduced House Bill 4479, which would reduce the Illinois Corporate Income Tax Rate to 3.5 percent, costing Illinois an estimated additional $1 5 billion in revenue

A continued focus on the state’s tax code is central to the General Assembly’s Spring Legislative Session Legislators are forced to grapple with revenue losses and are focusing on just how effective business tax credits and incentives really are

The House Joint Committee on State

Ta x R e f o r m h a s b e e n l o o k i n g a t t h e state’s use of EDGE (Economic Development for a Growing Economy) Tax Credits, which have been highlighted by requests from Archer Daniels Midl a n d , Z u r i c h I n s u r a n c e a n d O f f i c e Depot, to name a few This focus on EDGE, along with Speaker Madigan’s corporate tax rate reduction proposal, m a y b e r e c o g n i t i o n o f I l l i n o i s ’ b u s iness climate or a possible screen to tee u p a C o n s t i t u t i o n a l A m e n d m e n t t o shift Illinois from a flat-rate income tax to a progressive tax rate state

Currently, there are Constitutional Joint Resolutions (HJRCA 33 & SJRCA 17, ilga gov) pending in the Illinois House and Senate that would amend the Revenue Article of the State Constitution (ILCON Art IX, Sec 3), essentially changing the current flat rate to a graduated rate The Senate version would keep the corporate tax rate flat, while the House version would impose a graduated rate on both individual and corporate. I predict that this Constitutional Resolution is being sought as the remedy to the state’s precarious financial situation

The Illinois income tax flat rate dates back to 1969 the infancy of state income taxes Delegates of the 1970 Constitutional Convention were given the opportunity to recommend a graduated income tax rate; however, they chose to maintain the status quo with a flat rate Political commentators surmised that the delegates understood the political reality that voters wouldn’t accept a proposed state Constitution with a graduated income tax rate at that time

Procedurally, Constitutional Amendment Resolutions require action by both chambers, with a vote of threefifths of the members elected to that chamber in order to appear on the General Election ballot A proposed amendment is approved and becomes part of the Constitution if it gets the favorable votes of either three-fifths of the persons who vote on that proposal at the election or a majority of all persons who vote in the election.

I n a d d i t i o n t o a g r e a t e r f o c u s o n t h e C o n s t i t u t i o n a l A m e n d m e n t R e s o l u t i o n s , there also will be an increase in voter educ a tion c a mpa ig ns a mong inte re s t g roups attempting to educate and persuade voters for the November ballot

It’s no secret that 2014 is also an election year, in which Illinois voters will be casting their ballot for our US senator, members of Congress, governor, constitutional officers, one-third of the Illinois Senate and all 118 members of the Illinois House. In this politi c a l y e a r, w e ’ l l a l s o s e e i n c u m b e n t s a n d c a n d i d a t e s o p i n e o n t h e c o n s t i t u t i o n a l question being presented to Illinois voters, a n d o n w h i c h o p t i o n i s i n t h e b e s t a n d long-term interest of Illinoisans.

The ICPAS Government Relations Office w i l l c o n t i n u e t o m o n i t o r t h e s e C o n s t i t ut i o n a l A m e n d m e n t R e s o l u t i o n s a n d w i l l k e e p y o u u p - t o - d a t e t h r o u g h t h e I C PA S me mbe rs -only C a p i t o l D i s p a t ch monthly e N e w s l e t t e r [ w w w. i c p a s . o rg / C a p i t o l D i sp a t c h . h t m ] a n d o u r L e g i s l a t i v e U p d a t e s emails We’re closely monitoring a number of bills impacting the CPA profession Keep the lines of communication open and as always please contact us if you have questions or if an issue catches your eye.

Providing timely, relevant updates from leading experts.

April 28 | Oakbrook Terrace

April 29 | Springfield Government

May 20 | Chicago

Estate & Gift Tax

May 22 | Chicago

Business Valuation Symposium

May 29 | Chicago

Employee Benefits

June 3 | Chicago

Not-for-Profit Advanced and Emerging Accounting and A-133 Issues

June 4 | Chicago Taxation on Real Estate

June 25 | Chicago

CCFL Going Global –

What You Need to Know to Ensure and Insure Your Success

July 17 | Des Plaines

July 24 | Springfield

Tax Practice & Procedures

August 27-28 | Rosemont Midwest Accounting & Finance Showcase

September 18 | Oakbrook Terrace Financial Institutions

September 23 | Rosemont Midwest Financial Reporting Symposium

Register at www.icpas.org/education.htm

CALL FOR NOMINATIONS

The Illinois CPA Society, together with the AICPA, is once again looking for outstanding women who have made significant contributions to the accounting profession, their organizations, and to the development of women as leaders. Awards will be given in the following two categories:

• mentoring other professionals

• community service

• major or unique contributions to the profession

• leadership in workplace improvements

• authorship of professional articles

• demonstration of leadership

• contributions to the profession

• creation and implementation of unique initiatives in the workplace

• community service

• involvement with her alma mater

Candidates must be members of the Illinois CPA Society (ICPAS) and the American Institute of Certified Public Accountants (AICPA). Not a member? Visit www.icpas.org and/or www.aicpa.org.

To nominate, visit www.icpas.org/womentowatch.htm. Questions? Please contact Gayle Floresca at 800.993.0407, x254 or florescag@icpas.org.

Deadline for submissions is 6.30.14

* bsargent@scgforensics.com

Brad Sargent is the managing member of The Sargent Consulting Group, LLC, which specializes in forensic accounting and financial investigation He is a frequent lecturer and chair emeritus of the American Board of Forensic Accounting, and serves on the American Bar Association, Section of Litigation, Expert Witness Committee and Criminal Justice Section, White Collar Crime Committee

He is a member of the Association of Certified Fraud Examiners, the Association of Certified Fraud Specialists and the Association of Insolvency and Restructuring Advisors A member of the Illinois CPA Society since 2002, Brad began his ICPAS Board service in 2010, and was a member of the Committee

Structure & Volunteerism Task Force, the Fraud Conference Task Force (which he chaired from 2009-2010 and 2012-2013) and the Strategic Planning Committee (which he chaired from 2011-2013)

One of my favorite phrases has to be “death by one thousand cuts.” To me, this means a major negative event that happens slowly, almost imperceptibly, over time.

I decided to look into the origins of t h i s p h r a s e a n d f o u n d t h a t i t c o m e s from the Chinese practice of executing p a r t i c u l a r l y h e i n o u s c r i m i n a l s , t y p ic a l l y i n a p u b l i c f o r u m f o r a d d e d drama, in a slow and painful fashion Gruesome stuff.

Applied to a situation where an accountant is aware of potentially unethical behavior but chooses to do nothing about it, we can see that an “ethical death” can indeed happen over time in small increments, so much so that the accountant doesn’t fully realize just how far he or she has gone

In recent months I’ve been hired to conduct several internal investigations

T h e s e a s s i g n m e n t s t y p i c a l l y i n v o l v e w o r k i n g f o r a n e n t i t y t o i n v e s t i g a t e activities from within the organization

E a c h t i m e , I ’ v e o b s e r v e d i n s t a n c e s where the accountants, many of them CPAs, sat quietly by and watched year a f t e r y e a r o f u n e t h i c a l b e h a v i o r O n numerous occasions, the accountants were involved in the unethical behavi o r a n d u n w i t t i n g l y f a c i l i t a t e d t h e f t , fraud and abuse.

Christina M Egan, Esq is a former deputy chief U S attorney and partner at McGuireWoods LLP. An experienced trial lawyer, she focuses her practice on representing companies and indiv idua ls with ma tte rs inv olv ing both

criminal and civil investigations by the g ov e rnme nt, a s we ll a s fe de ra l a nd state regulators She states that, “People don’t usually wake up one morning and say ‘I’m going to help commit a fraud today.’ Rather, it can start with the ra tiona liz a tion of a n a c tion tha t seems maybe not quite right but not blatantly unethical, and continues on that path until that person finds himself way over the line and may not even realize how he got there.”

I know what you’re thinking: “I would never do that!” So how does an ordinarily ethical person reach the point of no return? It comes down to the “Fraud Triangle,” a well-known concept first introduced by criminologist Donald R Cressey, who stated that three factors had to be present for an ordinary person to commit fraud: Pressure, opportunity and rationalization

A s a c c o u n t a n t s , w e f a c e p r e s s u r e from clients and colleagues on a daily basis Consider, for instance, the business owner who takes “draws” out of the business and directs you to run it a s a n e x p e n s e W h o h a s n ’ t e n c o u ntered this itty-bitty ethical slip? What about the VP of sales who books an order just a few weeks early so that it counts toward a specific performance criteria and results in a higher bonus? T h e s e e v e n t s h a p p e n e v e r y d a y a n d have become virtually run of the mill

The accountant who has access to accounting records (Cressey’s second factor, opportunity) and is pressured by the client or a supervisor to make

bogus entries, tells him or herself that this happens all the time and that it’s no big deal Which brings us to Cressey’s third factor, rationalization The accountant lives with his or her unethical act by rationalizing that everyone does it Could this be someone you know and/or someone with whom you work?

As a society, we’ve developed a culture of rationalization For example, I attended an insurance fraud program years ago and left utterly depressed. The morning session focused on all areas of insurance, but I particularly recall an adjuster who detailed his career in automotive claims The overwhelming evidence he presented of claim fraud in cases involving car damage was stunning Schemes that ranged from kickbacks at body shops to luxury items added to the contents of stolen cars were simply rationalized away

I left that program empathizing with insurers, knowing they’re perceived as nameless, faceless, massive organizations that won’t be damaged by just a little extra on the claim.

Accountants often seek reassurance and guidance from one another Conferences and chapter meetings are great venues in which to network and get support I’ve attended many of these events and have often heard one CPA detail to another how

they faced some “aggressive” accounting issues and weren’t sure how to handle them More than once, the other CPA, being a true beacon of virtue, not only assured the troubled accountant that what they were contemplating was in the client’s best interests, but also suggested a few tips on how to further bury the transaction details We, the ones who claim that we would never get involved in unethical behavior, gather together and share best practices!

Are you a person who would add a $1,500 laptop to the contents of your stolen car (and the $2,000 set of golf clubs in the trunk, of course)? Would you consider having a nurse prescribe for you if you knew that person wasn’t legally authorized to do so? Would you ever cheat on the CPA Exam? Would you steal money or other assets from your employer or client? The answer to all these questions, I trust, is a resounding “No!”

Internal investigations create some tense moments for me because confronting people with facts and using terms like “fraud,” “steal” and “theft” is a tough job Almost all accountants have the same reaction: Poor at first, but then reluctant acceptance that one simple transaction compounded over time may lead to 20 years of activity that adds up to millions of dollars Death by one thousand cuts is gruesome, indeed

We are pleased to announce the publication of . . .

by Robert F. Reilly and Robert P. Schweihs

by Robert F. Reilly and Robert P. Schweihs

This 700-page book, published in 2013 by the American Institute explores the disciplines of intangible asset analysis, economic damages, and transfer price analysis. Guide to Intangible Asset Valuation examines the economic attributes and the economic and transfer the value of intangible assets and intellectual property. Illustrative examples are provided throughout the book, and detailed examples are presented for each generally accepted intangible asset valuation approach and method.

Available for purchase for $122.50 plus shipping from www.willamette.com/ books_intangibles.html.

Robert Reilly and Bob Schweihs are managing directors of Willamette Management Associates, an intangible asset and intellectual property analysis, business valuation, forensic analysis, and financial opinion firm.

Questions? Please contact Caitlin Kepple at kepplec@icpas.org or 800.993.0407, ext. 250.

Willamette Management Associates www.willamette.com

* mgilbert@reasonfinancial com

Mark J Gilbert is a principal in the financial planning and investment management firm of Reason Financial Advisors, Inc , with offices in Northbrook and Naperville, Ill He has been a CPA and member of the Illinois CPA Society since 1982, and was awarded the AICPA’s PFS designation in personal financial planning in 1999. He currently serves on the ICPAS Finance & Treasury Management Committee and the Committee Structure & Volunteerism Task Force Mark is frequently called upon as a media contact, and has appeared on WBBM (Channel 2), WLS (Channel 7), WGN (Channel 9) and WDCB (90 9 FM), speaking on financial planning topics He also has been quoted nationally in notable publications such as the Chicago Tribune, Wall Street Journal, Money and US News

I’d like to think there aren’t very many financial topics with which I’m not at least somewhat familiar So imagine my surprise when one of my clients told me he was selling highly appreciated lowbasis stock in his privately held employer’s firm, and that because of Code Section 1042 he could avoid paying taxes on the profits

He asked me if he should do it And thus began my journey into the obscure, arcane and procedure-laden world of Section 1042 exchanges. I’m hoping my column means you don’t have half as challenging a time as I did

First off, understand that the applicability of 1042 provisions is limited. This code section relates to the sale of corp o r a t e s t o c k t o a n e x i s t i n g o r n e w l y f o r m e d E m p l o y e e S t o c k O w n e r s h i p Plan (ESOP), and represents one way f o r a s h a r e h o l d e r i n a p r i v a t e l y h e l d firm to monetize his ownership interest.

O f c o u r s e , w h e n s t o c k i s p r i v a t e l y held, the market is much more limited and much less liquid than when stock is listed and traded on an exchange or o v e r- t h e - c o u n t e r. S o t h e s h a r e h o l d e r frequently has few alternatives for turning stock investment into cash except to sell according to the terms of a shareholder agreement or as corporate management dictates.

There are many reasons why corporate management or a controlling shareholder might want to establish an ESOP, and they’re far too numerous for me to cover here For our purposes, we’ll take

it that the ESOP will purchase some or all of the corporation’s shares presently held by shareholders

The capital gains from this type of sale will be subject to as much as 25percent tax (U S and Illinois) However, according to Section 1042, the tax liability can be deferred if:

n Sale proceeds are reinvested in the securities of other corporations (i e as replacement securities).

n The shareholder held the stock for at least 3 years

n The stock was originally acquired in a manner other than through a qualified retirement plan, a qualified or nonqualified stock option, or through an employee stock purchase program

n Purchase of the replacement securities occurs no earlier than 3 months and no later than 12 months after the sale of the stock to the ESOP

n A f t e r t h e s a l e t o t h e E S O P, t h e ESOP must own at least 30 percent of the common stock of the company that sponsors the ESOP.

R e p l a c e m e n t s e c u r i t i e s m u s t c o nsist of the securities of U S operating companies whose passive investment i n c o m e r e p r e s e n t s l e s s t h a n 2 5 p e rcent of gross receipts These securities m a y c o m p r i s e c o m m o n s t o c k , p r eferred stock, bonds, notes, convertible bonds and floating rate notes

However, replacement securities do not include U S government or municipal securities, mutual fund shares, ETFs, master limited partnership interests, foreign stocks and bonds, REITS,

or the securities of the corporation or its affiliates for which the ESOP transaction occurs It’s possible to set up a brokerage account in which the selling shareholder essentially borrows against the value of replacement securities, and may invest sales proceeds in an alternative way

Finally, there are three documents that the selling shareholder must file as part of his or her federal income tax returns:

1. A l e t t e r p r e p a r e d b y t h e c o m p a n y signifying its agreement with the selling shareholder’s decision to defer capital gain recognition under 1042.

2 A Statement of Election filed in the year of sale, summarizing the taxpayer’s intent to defer current capital gains taxation

3. A S t a t e m e n t ( s ) o f P u rc h a s e , w h i c h identifies the qualified replacement securities.

When all these conditions are met, the selling shareholder may defer taxable capital gains and therefore tax payment This deferral will remain in place for as long as the replacement securities are held. If the replacement securities are sold, then the taxpayer must recognize a pro-rata share of the taxes

The tax deferral benefit of using a Section 1042 is undoubtedly attractive. But like so

many other financial decisions, taxes are only part of the story

For example, replacement securities exclude diversified investment vehicles like mutual funds and ETFs, so a selling shareholder has to ensure that the sale proceeds are large enough to build a diversified portfolio of U S stocks and corporate bonds, or at least to add to an existing well-diversified portfolio U S government and foreign corporate securities don’t qualify as replacement securities either, so a taxpayer may decide to allocate funds to these investment asset classes elsewhere in the portfolio.

What’s more, replacement securities are intended to be held for a very long time, because once the securities are sold or otherwise disposed of, the tax deferral attributed to those securities must be recognized and taxes paid So the common stocks and long-dated bonds of high-quality U.S. companies expected to continue to operate for many, many years typically are the investment of choice

In my client’s case, the sales proceeds received represented a relatively small portion of his overall investment portfolio, so broad diversification among investment asset classes wasn’t critical He was very comfortable with investing in individual corporate equity and fixed-income securi-

ties, and it wasn’t important to invest the sales proceeds in U S government, mutual fund and/or ETF securities We decided to plan for a 20-year time horizon and selected securities as if they would be the absolute last securities the client would ever liquidate, and would perhaps form part of his estate

O r d i n a r i l y, t h i s m i g h t m e a n u s i n g t h e common stocks of megacap U S companies. However, the reality is that even the best companies may go out of business or reorganize within a 20-year timeframe

Instead, we opted to use a portfolio of 1 8 - t o 2 2 - y e a r m a t u r i t y U S c o r p o r a t e bonds rated AAA and AA. Since the client likely wouldn’t need these assets to maintain his lifestyle, the risk of rising interest rates and lower prices on these holdings p r i o r t o m a t u r i t y w a s a c c e p t a b l e w h e n compared to the tax savings offered.

If the assets do in fact become part of his estate, his heirs will be able to either liquidate or hold the securities

Code Section 1042 exchange provisions offer the opportunity for meaningful tax deferral despite their complexity That said, they’re certainly not for everyone. Unless your client’s financial and investment situation is just right, a 1042 exchange is just another code section.

possibilities await those who practice in business valuation, forensic accounting, information management and technology assurance, and personal

By Christine Bockleman

By Christine Bockleman

Would you feel happier at work if you had access to free onsite laundry, cheap onsite childcare or unlimited vacation days? What about if you could bring your dog to work or take leisurely bike rides around the corporate campus?

A lot of companies, across a lot of industries, are banking on the idea that perks like these will n o t o n l y k e e p t h e i r e m p l o y e e s h a p p y, b u t a l s o convince them to stick around for the long haul.

“Companies are facing very big retention issues right now, especially with younger workers,” says Joyce Gioia, president and CEO of The Herman Group, strategic futurists who focus on the workforce and workplace issues

These younger workers namely Generation X a nd e s pe c ia lly Ge ne ra tion Y (a k a the M ille nnials) are known for their short attention spans for jobs Where it was common for Baby Boomers to stay at one company for an entire career, younger workers flit from company to company, resting in one spot for an average of only 3 to 5 years

“There are talent wars going on,” Gioia explains. “Moving forward, we are going to have increasing issues with recruiting because there are fewer and fewer good people in certain professions and employers will have to up the ante to attract them.”

Tech companies like Google have long subscribed to this more is more philosophy. The company makes just about every “Best Places to Work” list for offerings such as free on-campus haircuts and laundry services Employees also benefit from onsite gyms and medical services, free rental cars and massages, and lots and lots of free food (the company provides all employees with breakfast, lunch and dinner, prepared by a gourmet chef)

Google isn’t the only company offering great perks Have a long list of errands and not enough free time? At Racine, Wisconsin-based SC Johnson an onsite concierge will mail packages, send flowers and even stand in line for concert tickets The company also looks after former employees, who get lifetime use of the onsite fitness center

New moms love California biotech company Amgen, which makes it easier to return to work p o s t - c h i l d b i r t h w i t h o n s i t e L a m a z e a n d b r e a s tf e e d i n g c l a s s e s , a c c e s s t o l a c t a t i o n r o o m s a n d one-on-one nutritional counseling.

A nd a t S e a ttle -ba s e d pe t ins ura nc e c ompa ny Trupanion, more than 80 dogs and cats are in the office each day The company offers a free petwalking service, so pets can get all the exercise they need

Trust is key at movie delivery company Netflix, where no one keeps track of vacation or sick days There’s also no company dress code. CEO Reed Hastings told Bloomberg Business Week that the company has a “freedom and responsibility culture,” where the “focus is on what people get done not how many days they worked.”

While the types of perks these companies offer a r e p r e t t y v a r i e d , t h e r e ’ s o n e c o m m o n t h r e a d : T h e y ’ r e d o i n g w h a t e v e r i t t a k e s t o k e e p t h e i r employees happy.

“I think that if people generally enjoy going to w o r k , t h e y a r e g o i n g t o s a y a n d t h i n k p o s i t i v e t h i n g s a b o u t t h e c o m p a n y a n d a r e g o i n g t o b e l o y a l a n d s t r i v e t o d o t h e i r b e s t w o r k , ” s a y s N a t a s h a H u b b a r d , g e n e r a l m a n a g e r o f h u m a n

Whether it’s a dash or full measure you are seeking, our professionals bring the missing ingredient to your business. Every organization needs a little punch every now and then. You know, something different that brings new perspective to the project or helps round out a team. That something is Salo. Our exceptional resources talent step in to help your company achieve business outcomes.

resources at Xero, which specializes in online accounting software and has U S offices based in San Francisco

Xero places a heavy emphasis on its workplace culture, and has a slew of organized social activities for employees, ranging from monthly drinks outside of work to a coffee club that walks to different cafes around the city “A lot of really great ideas are formed when people can relax and talk,” says Hubbard.

A l o n g t h i s s a m e l i n e , t h

c o m p a n y ’ s o f f i c e s h a v e l o t s o f c o m f y couches, big kitchens that encourage lingering, a pool table and a large rooftop deck “Culture plays a big part in making somewhere a good place to work,” she explains

Even accounting and finance firms with a more traditional bent are thinking outside the box At Deloitte, for example, employees can take sabbaticals to explore interests beyond finance “We want our employees to always be growing and developing,” says Byron Spruell, vice chairman, Central Region managing principal and Chicago managing principal “If you need time off to do a world service project or travel abroad or just focus on yourself we will support you ”

D

B r e a k p r o g r a m , w h i c h encourages employees to participate in a weeklong service project with college students “We are very focused on making an impact on the c o m m u n i t y, a n d s o w e e n c o u r a g e o u r e m p l o y e e s t o d o t h e s a m e , ” Spruell explains.

In the past, the company has also run a popular online film festival, where about 2,000 of the firm’s U S employees made videos that were uploaded to YouTube and incorporated into the firm’s recruitment efforts

Some may ask, why not leave the war for perks to all those hip tech companies? Because, with a well-documented dearth of young talent coming through the ranks, accounting and finance firms need to lure future hires from not only other firms, but also other professions.

Ernst & Young LLP (EY) has a set retirement age for partners, so having a strong pipeline of professionals is especially important, explains Sandra Turner, director of EY Assist, the firm’s work-life and employee assistance program In fact, the firm estimates that by 2015 in the Americas, Generation Y will make up 68 percent of its workforce, with Generation X comprising 25 percent and Boomers only 7 percent

“Competitive compensation and flexibility compete as top priorities for our younger employees,” says Turner. Which means that in addition to the common work-from-home options, the firm also helps parents with childcare, offering 12 days of backup emergency care to every employee each year EY also allows its employees to take their children with them when they need to travel for client meetings Backup childcare is provided in the city where those meetings are taking place And for parents of adolescent children, a college coach is offered through Bright Horizons, while parents of high school juniors get help selecting schools, filling out applications and applying for financial aid.

Another benefit the firm offers is considerably less cheery. “Our bereavement benefit is significant,” says Turner “If an employee dies, his or her family is immediately given either $50,000 or four months salary, whichever is greater The money can be used for anything There are no strings attached ”

No matter the perks, all these organizations are thinking creatively to keep employees motivated and engaged. The goal of every one of these perks, whether a free latte or unlimited vacation days, is to let employees know they matter.

“Companies are trying to create an environment where everyone, including Gen X and Y, wants to come to work every day,” Gioia explains “You want your employees to be engaged, maybe have some fun and feel like the time they are spending doing work is valuable ”

money to Bitcoins on an online exchange Second, a user can exchange goods or services for Bitcoins Third, users can mine for Bitcoins by using computers to solve complex math problems The probability of discovering Bitcoins through this approach is proportional to the amount of computer processing power that can be applied

In January 2009, a computer programmer using the pseudonym Satoshi Nakamoto released an open-source digital currency that was intended to provide individuals with the means to financially transact without a third-party intermediary Dubbed “Bitcoin” or BTC, the system eliminated the middleman, namely traditional financial institutions such as banks, credit card companies and exchanges. What’s more, the system enabled pseudonymous transactions, since the identities of buyers and sellers are encrypted and no personal information is exchanged However, unlike an anonymous transaction, every exchange conducted via Bitcoin is recorded on a public ledger

N a k a m o t o ’ s o b j e c t i v e w a s t o m a k e e C o mm e rc e d e p e n d e n t o n f i a t d o l l a r s , o r c u r r e n c y that’s not backed by a commodity. Nakamoto outlined the Bitcoin system design in a paper published at Bitcoin org In it, he states that, “The root p r o b l e m w i t h c o n v e n t i o n a l c u r r e n c y i s a l l t h e trust that’s required to make it work The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

Nakamoto continues to outline how a currency could be decentralized by tying it to the principles of cryptography to validate transactions and govern the production of the currency itself.

There are three ways Bitcoins can be obtained First, a user can pay a fee to convert conventional

According to a report issued by the Congressional Research Service, in mid-November 2013 there were approximately 12 million Bitcoins in global circulation, up about 2 million from a year prior. “However, the total number of Bitcoins that can be generated is arbitrarily capped at 21 million coins, which is predicted to be reached in 2140. Also, because a Bitcoin is divisible to eight decimal places, the maximum amount of spendable units is more than 2 quadrillion (i e 2,000 trillion),” the report explains.

In early February 2014, a single Bitcoin was worth approximately $836 Then, on February 28, Japan-based Mt. Gox, the once dominant exchange for Bitcoin trading, filed for bankruptcy after more than $470 million worth of the virtual currency vanished. According to The Wall Street Journal, Mt. Gox lost almost 750,000 of its customers’ Bitcoins, as well as roughly 100,000 of its own Within a week of the news the value of a single Bitcoin dropped 23 percent to $640

This type of fluctuation isn’t unusual for Bitcoin investors. From October 2013 to January 2014, prices ranged from $134 to over $1,000 In July 2013, the exchange rate for Bitcoins was at $65, with a market capitalization below $800 million.

For users, Bitcoin’s benefits include lower transaction costs, increased privacy and long-term protection against the loss of purchasing power thanks to a mathematically capped supply Disadvantages include sizable price volatility, uncertain security from theft and fraud, and a deflationary bias due to the capped supply that could encourage hoarding There are also numerous legal and regulatory concerns, such as the system’s potential for money laundering, its treatment under federal securities l

A

Jehan Abbedelal

Mark John Abbott

Michelle Lee Abbs

Danielle N. Abendroth

Nina F. Abraham

Joshua E. Abrego

Jacalyn Kaye Ackerman

Mary Beth Adducci

Zayna Afifa

Haley Kristen Africano

Shilpa N. Aggarwal

Elizabeth Agnes

Leticia Aguilar

Andrew J. Ahern

Amir A. Ahmed

Siraj Ahmed

Jessica Marku Ahoni

Shruthi Ajjampur

Benjamin Sitze Akers

Nabil Alam

Jaime Alban

Zachary Albert

Becky Marie Albin

Jason Alice

John R. Allegretti

Kaitlin Allen

Joanne Almond

Lisa Marie Alter

Madeline I. Alviar

Synda S. Amoral

Daniel Ampon

Soo C. An

Jason Frederick Ananias

Jessica R. Andersen

Arden J. Anderson

Daniel K. Anderson

Jacob Lee Anderson

David Michael Anderson

Michelle Anderson

Samuel Anderson

Grant Anderson

Justin Mark Andrews

Vladimir Andreychuk

Raherivelo Andriamiharisoa

Christopher L. Andrus

Joshua Kory Anker

Mary Grace Tiburcio

Aquino

Joanna B. Arellano

Lauren Aristorenas

Rhonda D. Armstrong

Laura Armstrong

Christopher Arvanitis

Jason D. Askin

Elizabeth Atchison

Nicolas Richard Atkinson

Joshua Cartier Aubey

Erin A. Austin

Anna Avalos

Sergio Mauricio Avalos

Perez

B

Kevin Bernhard

Michael Berry

Robert O. Baban

Robin Baby

Kathryn Michelle Bacon

Leah Baer

Lin Bai

Joshua M. Bailey

Jake Bailey

Damandeep Bajwa

Andrew Baker

Timothy D. Balcerzak

David Bambuch

Stephanie Banach

Christopher Bandemier

Preeti Baniya

Maamonai Bareach

Devin Barnas

Elizabeth P. Barnett

Abigail Barra

Diane Barrett

Melissa E. Barringer

David M. Barson

Benet Bartell

Melanie Barthel

Ellen Elizabeth

Bartindale

Emily Ann Bartlett

Kara Christine Bartolone

Andrew Paul Bartolotta

Brett Barton

Adam M. Bassett

Donald Matthew Basta

Kamaljit Kaur Battu

Laura Bauch

Steven Bauer

Marguerite Beach

Meagan Bebchuk

Jenna Bechard

Bridget Marie Bechtel

Brian M. Beck

Harvey Becker

Lillian Beckerleg

Kymberly Catherine Beebe

Michael Beesley

Brian R. Begalke

Mark Charles Behncke

Michael A. Behnke

Brian Andrew Behnke

Bailey Behrens

Andrew Armstead

Beimford

William Beirne

Jennifer Azaria Bekker

Muhittin Bekler

John Thomas Bellaire

Kristen J. Bellendir

Dominick Bellino

Tatiana Belova

Efren Beltran

Alyssa Beltran

Matthew R. Benjamin

Alexandru Bercean

Ella Patricia Bergmann

Elizabeth Anne Bergstrom

Andrew Bernardi

Natalie J. Betscher

Colin Beveridge

Evgenia Beyrak

Rupan Kaur Bhandari

Anjali Bhatia

Bhavika Bhatt

Maciej Bien

Catherine Bigoness

Robert T. Birkett

Grace Emily Biss

Naomi Marie Bjerk

Joshua Louis Blaine

Hillary Fay Blake

William Blaszak

Patrick Christopher

Bleyer

Ryan R. Bloom

Derek Bloomquist

Joseph Blum

Amy Elizabeth Blume

Layne Bodily

Cody Boender

Sebastian Bohorquez

James A. Boles

Michael Bolzan

Antonino Bondi

Kristin P. Bonnett

Jeffrey John Bonoma

Emily Sue Bonvallet

Jacqueline

Boomershine

Henri T. Boone

Rita Bootsma

Amy K. Borbely

Erik Borg

Rebecca Borgeson

Malgorzata A. Borla

George Boumitri

Lucas Bowden

Anna Boyarko

William Boyd

Christina Boykin

Don Bradley

Megan Bradshaw

Erik Bramman

Kevin Brand

Sharon Brandys

Christopher Brannan

Teilla L. Bransford

Ian H. Braverman

Kyle Eric Brazeal

Courtney Brickner

Jonathan Britva

Jorden Joelle Brooks

Kathleen Greene

Brower

Rebecca Anne Brown

Daniel Cary Brown

Kevan D. Brown

Natalee H. Brown

Erin M. Brown

Michael Patrick Brown

Nathan Tyler Brown

David Browne

Daniel Bruins

Peter John Bryniarski

James Buehne

Bogdan P. Bujanowicz

Mehreen Bukhari

Brian Bukowski

Michael Bukowski

Mary Bull

Clifford Bumgarner

Kimberly Lynn

Buonadonna

Lauren Joanne Buoscio

Benjamin David Burge

Erin Elizabeth Burke

Luke Murphy Burket

Aaron Burnett

Alex S. Burt

Xavier Michael Burton

John Edward Bussa

John Christopher Butler

Catherine Ferrel Butts

Mae M. Bys

C

Michael Ryan Cailteux

Kristin Callero

Joseph Callero

Alyssa Calzaretta

Margaret Campbell

Katherine Canning

Ruizhe Cao

James Capel

Maria Daniela

Capotescu

Peter Joseph Cappetta

Seneiya Carew

Melissa Ann Carlson

Jack C. Carpenter

Jose Miguel Carrera

Rachel Cassara

Scott William Castell

Michael A. Castillo

Patrisha Castrataro

Elizabeth Ashley Catena

Blasko Cekorov

Daniel A. Cesario

Mrinal Chag

Eric Tristan Challenger

Maureen Elizabeth

Champa

Ta-Chih Chang

Alexander Peter Chapman

Janelle Chapman

Eric Chapman

Tianqi Chen

Si Chen

Yilin Chen

Jingxi Chen

Tingyi Chen

Xi Chen

Shu Chen

Chun Chen

Sijia Chen

Yu-Tung Chen

Can Chen

Ruoqi Chen

Xinyi Chen

Xin Chen

Yanmei Chen

Jinchun Chen

Christine M. Cheng

JuYun Cheng

Jacqueline Cherkas

Matthew Chiappetta

Emeka Chike-Obi

Samuel Chmell

Alice Cho

Keunyoung Cho

Samuel Choi

Jessica Lynn

Christensen

Daniel Christensen

Scott W. Christie

Kevin William Christman

Patrick Cieslinski

Brian Cihlar

Jonathan Ciminieri

Johnathan Clancy

Kathleen Erin Clapper

Benjamin Allen Clark

Michael O'Neil Claussen

Kristin J. Clay

Estienne Coetzee

Alexandra L. Cohen

Akelo Colbert

Natalie Cole

Ahdieh Khosh Coleman

Lindsay Mae Coleman

Lindsey M. Collins

Traci Collins

Shelby Colyer

Ross Conner

Matthew Christopher

Connor

Daniel Bruce Connors

Stacy Hronopoulos

Constan

Najiba Contractor

Julie Contreras

Heather Lynn Cook

Timothy Scott Copeland

Cameron Copple

Patrick Corcoran

Moira Corcoran

Adam Cornelius

Melissa Cortez

Troy A. Costlow

Nathaniel S. Cottrell

Ashley Council

Cory Scott Cowan

Zachary Cox

Ioan M. Cozuc

Cosmin Mihnea

Craciunescu

Kayla Crandall

Rhodora Rodrigo Credo

Brent Crews

Nancy Veronica Criollo

Zachary Crolius

Tracy Xue Jie Cron

Morgan Crosier

Elena Alexandra Crowe

GuanXiong Cui

Luke Culley

Eileen Cumming

Robert Curley

David Joseph Curosh

Kevin Curran

Bridget Curran

Nicholas Currier

Monika Cwikla

D

Victoria Elizabeth Dalton

Matthew Dalton

Shaunna Dangremond

Cody D. Daniels

Kimberly Dardi

Sarah R. Darnall

Seth Anthony Davis

Edward Davis

Christopher R. Day

Viviana De La Paz

Ervin E. DeCastro

Daniel Patrick Degnan

Mallory DeHaven

Anna Catherine

del Castillo

Jason dela Cruz

Timothy J. Delany

Erika DelBrocco

Megan DeMarco

Kathryn Eloise DeMeritt

Minyu Deng

Yichao Deng

Yue Deng

Urszula Depczyk

Sarah Derges

Vladimir Deronja

Michael DeRusso

Kush Desai

Darshan Desai

Kevin Dettloff

Joseph Deutsch

Maire Caitlin Devlin

Benjamin Karl DeVries

Peter DeVries

Marc DeWalt

Lynne DeYoung

Michael Joseph

DeZenzo

Peter Didier

Shelby S. Dietsch

Laura DiLuia

Robert Dion

Tiffany Dixon

Arsen Djatej

Sheila Doheny

Julie Ann Doherty

Jenna Michelle

Donahue

Yijie Dong

Douglas L. Donoghue

Mark Doroba

Evan Dosch

Dobrila Dosen

Kelly Driscoll

Fei Du Jing Du

Angelika Dubas-Zacher

Thomas Alexander

Duderstadt

Jeffrey Duncan

Matthew Dunn

Megan Dunne

Volha Dziadyk

James F. Dziubla E

David Earhart-Price

Sarah Earnhart

Benjamin Mark Eder

Keith Devon Edgerton

Michael Christian Eggert

Jeffrey James Eickhoff

Weiwei Eiden

Michael James Eifel

Isabel Elizalde

Antonio Tomas Elizondo

Essam A. Elshafie

Mark Embree

Derrick Emmendorfer

Brett Engdahl

Eric Anthony Erspamer

Deliana Andrea

Escobari

Cristina Escobedo

Daniel Ettleson

Michael Eulitz

Katelyn Evans

Suzanne Everett

Nicholas Patrick

Everson

F

Scott Michael Faherty

Samuel Failla

Meng Fan

Sadaf Fatani

Kristin Fedor

Lee Feinerer

Max Wisper Feldman

Sha Feng

Yanan Feng

Jing Feng

Lin Feng

Kyle Ferguson

Pei Yee Fermoyle

Joseph John Ferrari

Jason Field

Daniel Finkel

Klayton Michael Finley

Michael Fiorella

Kevin Fishbein

Marjorie Claire Fisher

Bryant Fitz

Tim Flanagan

Adam Fleishman

Kaitlin Fleming

Nicholas Flemming

Albert Flores

Stephanie Florey

Megan Celine Foley

Paul Foley

Matthew Foltz

Brian Forsberg

Jonathan Frantz

Daren Freebing

Kevin Ladell Freeman

Stacie Ann Freisleben

Mark Freking

Russ Friedewald

THE FOLLOWING INDIVIDUALS WHO EARNED THEIR CPA CERTIFICATE

Henrik Turk

Michael Tuttle

Michael Tverdek

Daniel Richard Twait

Brandon Twite

Jennifer Mallory Tyler

Plamena Tzoneva

U

Benjamin Ulman

Michael Upham

Matthieu Raymond

Urbain

V

Michelle VadeBoncouer

Allison Marie Vajda

Armon Vakili

Veronica M. Valdez

Roshmi Valiyapurayil

Jordan Tyler Valle

Thomas Van Derpluym

Lauren Alan Van Dyke

Andrew Vanausdoll

Joanna Agata

VanDerVant

Scott Vanderzee

Georgi Ivanov Vankov

Audrey VanSolkema

Benjamin Louis VanStraten

Arti Srivastava Varma

Lindsey A. Vaught

Smitha P. Vayalil

Eric Veale

Karina Vega

Boris Veksler

Rene Velazco

Catherine L. Venta

Elena G. Verizova

Manjary Verma

Carolyn Vermeulen

Michael Vian

Sameer Mukund

Vijayakar

Janelle Vik

Rogelio Alfredo Villageliu

Jimena A. Villamor

Norell Viray

Christina Marie

Visintainer

Joseph James Vlahovic

Susan Teresa

Vogler-Wesp

Jodi Lynn Vogt

Ninette Lewis Voiles

Kyle Vrabac

William Vydra

W

Kelly Waclawik

Diana Walker

Lloyd Walker

Austin Walker

Michael Wall

Lawrence Holden Wan

Jingjing Wan

Xi Wang

Zhao Wang

Mingyuan Wang

Xiyan Wang

Liwei Wang

Mo Wang

Anlin Wang

Long Wang

Ye Wang

Xiaowen Wang

Yimiao Wang

Zhe Wang

Christopher Ward

David A. Wargo

Nathaniel Warman

Chad W. Warner

Marek J. Warzecha

Brien Michael Wasserman

Emily Anne Watkins

Joseph Paul Wattenbarger

Miroslaw Wcislo

Jacob Wear

Stephanie R. Webb-Powell

Jeffrey Weberg

David Weidenaar

Philip Weil

Lucas Weiss

Joseph Welch

Amanda J. Wells

Andrew Joseph Welp

Joshua Welsh

Zhe Wen

Olga Wendling

John Wentz

Michael D. Wenz

Carissa Dawn Werlinger

Steven Werner

Nicholas Edward Westerhof

Jeremy Wetter

Anthony Whalen

Micah L. Wheat

Brian John Wheeling

Ryan Daniel Whetsel

Aaron Whetstone

Sarah Eileen Whisson

David J. P. White

David Matthew White

Steven Phillip White

Dennis Joseph Whitlow

Molly Katherine Whitmore

Brigid Eileen Wholey

Mark Wicherek

Laura Christine Wichmann

Neal Wicks

Ursula Widawska

Adam Widener

Christine M. Wiegel

Jennifer Wiercioch

Paulina Paula Wieslaw

Caroline Wild

Matthew Willems

Katherine Elizabeth Williams

Lauren Irene Williams

Jennifer Lori Williams

David Vincent Williams

Elisabeth Ashley Winbigler

Aaron Winer

Keevin Wise

Dagmara J. Wisnicki

Benjamin Isaac Wohlleber

Joanna Wojnar

Peter James Woldman

Jacqueline Wolff

Joseph Wondolowski

Pui Man Wong

Ching Annie Wong

Travis Charles Wood

Patrick Woulfe

Blake David Wroan

Yali Wu

Xian Wu

Ying Wu

Yinghui Wu

Yanli Wu

Jingxia Wu

Tzu-Ying Wu

Chaonan Wu

Wenjuan Wu

Mengyi Wu

Jingjie Wu

Kuan-Jou Wu

Yiwen Wut

X

Yu Xia

Lu Xu

Xiaohua Xu

Minyinjie Xue

Y

Trevor Michael Yamada

Qiwei Yan

Ruipeng Yan

Yuntong Yan

Yunya Yang

Huijuan Yang

Jeffrey Yeager

Yang Yi

Daniel Yin

Jiexi Ying

Jennifer Yong

Peter Yoon

Caleb T. Young

Kristy Young

Erin Young

Mabel Young

Michael Yovkovich

Nancy Yu

Dawei Yu

Yue Yu

Renfei Yuan

Quan Yuan

Lisha Yuan

Jun Yuan

Jena Kim Yuen

Z

Ramin Zacharia

Motasem Zaitouni

Daniel H. Zajac

Pawel S. Zajac

Adrian Zalewski

Peter McKeown Zarob

Brian Anthony Zasada

Laura A. Zautcke

Corey Thomas Zavilla

Martyna Zawilinska

Douglas Joseph Zbikowski

Christine Zeh

Brett Zehr

Karen Zelby

Stacey Elizabeth Zeller

Blake Zemaitis