High turnover is an issue the accounting profession can’t afford to overlook.

For a profession that revolves around numbers, one number that doesn’t seem to get enough attention is the turnover rate. Turnover in the accounting profession has been a challenge for many years (and arguably decades), and the costs are mounting at a time when they can’t really be afforded.

Not only does high turnover in the profession make it difficult to retain talent, it also makes it hard to attract and hire new talent. When it comes to recruiting fresh faces to carry the profession forward, those who see the high turnover in the profession are becoming increasingly reluctant to join workplaces that see so many people depart. In turn, our research on the matter found that turnover negatively impacts the employees left behind. Compounding the challenges, workplace morale can also drop, and trust in leadership may be questioned, when large numbers of employees depart.

Our recently released Insight Special Feature, “Righting Retention,” focused on, you guessed it, righting retention. In our research, the leading reasons employees cited for voluntarily leaving their employers shouldn’t surprise anyone. Salaries, burnout, and lack of work-life balance, just to name a few, were major drivers of the profession’s human capital-related issues. While those issues have historically been seen as “public accounting” challenges, that’s no longer the case.

Every segment of the profession is, or soon will be, impacted by retention challenges. Collectively, I think we need to become more attuned to the needs of our people. I believe we should focus on our underlying organizational cultures and truly consider how all the issues identified in “Righting Retention” may be driving our talent to pursue other opportunities, both in and out of the profession.

Resolving the profession’s turnover troubles is going to take meaningful and purposeful stewarding of our human capital

resources in a manner that’s responsive to employees’ needs and those of our individual organizations. Here are a few actions I think leaders can take to start addressing their retention issues now:

1. Hire the right people and manage their expectations.

2. Stay current with compensation and benefits.

3. Communicate early and often.

4. Articulate career pathways for every role.

5. Ensure that your workplace policies are flexible and responsive.

As we look to the future, we must be ready to discuss our culture gaps and how we can implement concrete, actionable solutions to address them. People join this profession with hopes of being supported throughout their careers. Creating the conditions for talent to develop their professional skills and contribute to organizational success, now and in the future, will undoubtedly increase connectedness and help us retain our best and brightest over the long term.

I encourage you to always listen to your people and genuinely consider their perspectives. They know what they need more than anyone else. Be honest and responsive. Be transparent and approachable. Foster the right strategy, stewardship model, and culture. Do this and you’ll demonstrate that you value your people and their contributions.

With this kind of foundation in place, I’m confident we can address the profession’s turnover issues and become more prepared for the future. In the end, we can’t afford not to do all we can to position the profession as one worth joining and staying in.

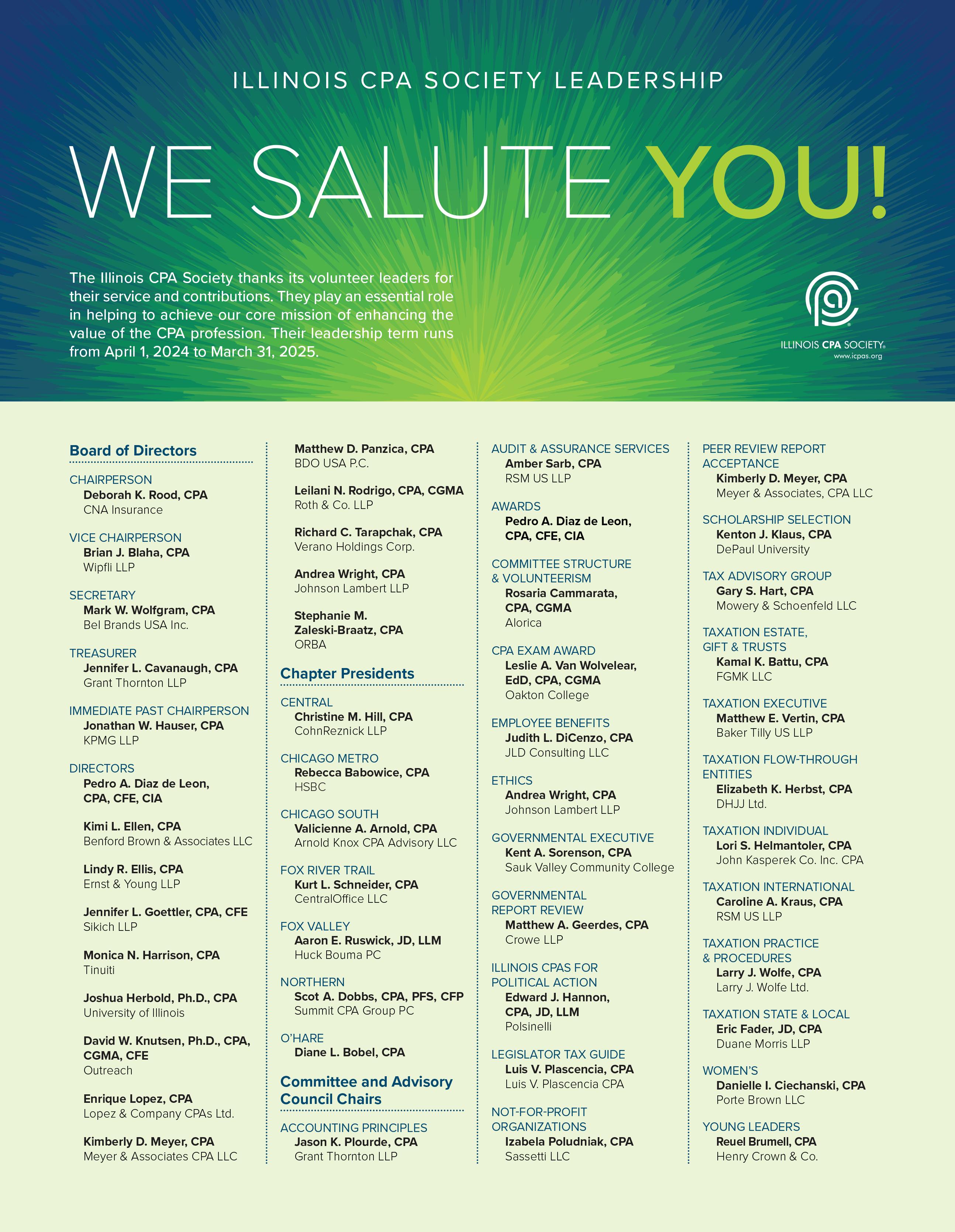

Monica N. Harrison, CPA | Tinuiti

Joshua Herbold, Ph.D., CPA | University of Illinois

David W. Knutsen, Ph.D., CPA, CGMA, CFE | Outreach

Enrique Lopez, CPA | Lopez & Company CPAs Ltd.

Kimberly D. Meyer, CPA | Meyer & Associates CPA LLC

Matthew D. Panzica, CPA | BDO USA P.C.

Leilani N. Rodrigo, CPA, CGMA | Roth & Co. LLP

Richard C. Tarapchak, CPA | Verano Holdings Corp.

Andrea Wright, CPA | Johnson Lambert LLP

Stephanie M. Zaleski-Braatz, CPA | ORBA

The CPA credential is a ticket to wherever you want your career to take you. So, where will you go?

In hindsight, I think I was destined to be a certified public accountant (CPA). My dad was an accountant and owned a small practice. My first job—at 8 years old and for the lofty sum of $5 per month—was sorting checks to help the bookkeepers balance client bank accounts. My dad continued to employ me through my teenage years, but I graduated from check sorting to data input for compilations and tax preparation. Thankfully, my pay increased as well. While I appreciated the work, I didn’t anticipate following in my father’s footsteps—until I took a bookkeeping class in high school and realized I found it easy while others really struggled. So, I headed off to Northern Illinois University to earn my accounting degree.

If you noticed, I said my dad was an accountant, not a CPA. After being in business for several years, one of his client’s bankers told him that they’d be unable to continue accepting his compiled financial statements unless he obtained his CPA. So, despite being a busy professional with a young family at home, he took a CPA exam review class at night, studied on the weekend, and was able to pass the exam successfully. Seeing the emphasis placed on the CPA credential, and the possible consequences of not having it, I prioritized earning my CPA upon graduation.

The job market was tough when I graduated, so I took the job I was offered—a glamorous gig that involved reviewing small business insurance claims related to fires, hurricanes, and other disasters. Often, we’d tell a small business owner that their accident wasn’t as serious as they claimed and reduced, sometimes greatly, the amount of their insurance reimbursement. That wasn’t what I wanted to do. I wanted to help small businesses like my dad did. Therefore, I made the best of this first job and used it as a steppingstone to become what I wanted to be—a tax specialist.

A couple of steps later, I reached a destination where I stayed for almost 20 years, building a successful practice that specialized in state and local taxes along the way. After mentoring several individuals to carry on in my absence, I was ready for a new challenge, which led to my current position at CNA Insurance,

where I advise CPAs in public practice about the professional liability risks of providing services and how to mitigate them. Even though I’m no longer in public practice and don’t need an active CPA license to meet my job responsibilities, the “CPA” after my name still holds value. I consult with CPAs every day, and being a CPA with experience at firms of all sizes affords me credibility and provides a connection to those with whom I speak.

What also holds value is my involvement with the Illinois CPA Society (ICPAS). My journey with ICPAS began when, to borrow a phrase from our immediate past chairperson, Jonathan Hauser, CPA, I was “tapped on the shoulder” by a colleague and asked to accompany him to an ICPAS State and Local Tax Committee meeting. Twenty-five years later, I’ve served on numerous ICPAS committees and task forces, served the boards of directors for both ICPAS and the CPA Endowment Fund of Illinois, and received a few accolades along the way. I sought to become a board member to further my service to a profession that’s been so good to me and my family for so long.

Unfortunately, our profession, like many, is facing a talent crisis. The number of CPAs leaving the profession vastly outpaces the number entering it. Many students believe there’s little to no reason to obtain the CPA credential unless they’re planning to work in tax or audit. As most CPAs realize, there’s so much more you can do, places you can go, and value to unlock, when you’re a CPA. My goal as ICPAS’ chairperson this year is to demonstrate, through my career and others’, that so many more doors open—and open wider—when you have “CPA” after your name.

As a travel enthusiast, I like to think of the CPA credential as a ticket to wherever you want your career to take you. So, where will you go?

Martin Green, ESQ Senior Vice President and Legislative Counsel, Illinois CPA Society @GreenMarty

Martin Green, ESQ Senior Vice President and Legislative Counsel, Illinois CPA Society @GreenMarty

The 2024 CPA license renewal period is quickly approaching. Here are four steps CPAs should complete now to avoid potential delays.

It’s almost time—if you’re a certified public accountant (CPA), your CPA license will expire on Sept. 30, 2024. Many of you reading this column are “survivors” of the 2021 CPA license renewal process. It was, at the very least, a crisis that ran from July 2021 to December 2022. Since then, the Illinois CPA Society (ICPAS) has been working with Illinois Department of Financial and Professional Regulation (IDFPR) leaders and the Illinois General Assembly to avoid similar circumstances and confusion for the 2024 renewal year ahead.

As the saying goes, “Timing is everything.” In 2021, the CPA renewal process (along with other professions) was caught in a window of IT system failure. With ICPAS’ support, IDFPR and the General Assembly have since taken steps to address the failure by appropriating resources for the purchase of new licensing software. This will modernize the current outdated system.

As of this writing, I’m uncertain as to the impact the new system will have on individual CPA and CPA firm license renewals. We’ve all gone through IT conversions and know that even with the best laid plans, things don’t always go smoothly. However, there’s been marked improvement with the updated IDFPR website. It’s now easier to navigate and locate forms for many licensure processes. Another improvement made is to licensure processing—substantial backlogs in license application processing have been reduced. This is important since there are always licensure categories in the renewal phase, and backlogs cause inefficiencies and confusion.

Additionally, IDFPR has filled the accounting board liaison position, which is critical to the technical nature of the CPA profession. This will enable better interaction with the licensure processing unit, enforcement division, departmental counsel, agency leadership, stakeholder organizations (including ICPAS), and more importantly, licensees.

Fortunately, there’s also a new set of eyes at the IDFPR’s Division of Professional Regulation, with the appointment of Acting Director Camile Lindsay, who’s been responsive and engaging with ICPAS leadership. Notably, ICPAS has already begun communications with Lindsay and the IDFPR staff on the upcoming renewal period. Moving forward, we’ll be sending out sequenced and timely notifications on the process.

As you can see, these are all good things that’ll improve the CPA licensure renewal process this year. Importantly, CPAs are fortunate that renewals are completed online instead of being paper-based processes like many professions still are.

While there’s still plenty of runway for you to prepare for the 2024 license renewal period, we encourage you to take the following steps now to avoid potential delays:

1. Access Your IDFPR Account: Since it’s been more than three years since the last renewal, make sure your password still works to access your account. Once you’re logged in, make sure your information is correct.

2. Update Your Contact Information: CPA license renewals will be done online. Ensure that IDFPR has your correct and current email address, as renewal notices and instructions will be sent to the email in your records.

3. Check Your CPE Credits: Take time to anticipate the completion of your continuing professional education (CPE) requirements at the time you renew your license (remember, it’s 120 hours, including four in ethics and one in sexual harassment prevention training). Importantly, as part of your renewal, you’re attesting that you’ve completed this requirement. There are few, narrow exceptions to the CPE requirement, such as registered CPA status or medical and military waivers.

4. If Applicable, Complete the Peer Review Process: If you and/or your firm performed an audit, a peer review of historical financial statements or examinations of prospective financial statements during the preceding three-year period is required. Notably, this applies to both firms and sole practitioners’ individual licenses.

Typically, the renewal window opens 60 days before the expiration of licenses. Overall, I’m confident IDFPR will overcome many of the challenges encountered in 2021. As we enter another new phase into the license renewal process, I encourage you all to complete the above-mentioned preparatory steps now to avoid delays. Until then, we’ll continue to engage with IDFPR leadership and keep you informed.

With a plethora of new requirements coming into focus, sustainability reporting is quickly becoming a business imperative. Experts say now’s the time for organizations to act before it’s too late.

BY TERI SAYLOR

IN today’s world, business activities are scrutinized like never before, especially as it relates to environmental, social, and governance (ESG) practices. As such, corporate responsibility on sustainability reporting has come closer into focus, transforming from a point of concern to a business imperative.

Of course, aiding in this shift are the plethora of new requirements on the horizon. This year, sustainability reporting is expected to begin moving from voluntary to mandatory, with requirements dictating how companies measure and report their ESG metrics. For example, the United States Securities and Exchange Commission (SEC) finalized its climate-related disclosures rule in March 2024, and California has already enacted two statewide climate bills in 2023.

While mandatory requirements don’t impact all organizations, it pays for everyone to be prepared, even those that aren’t required to report, notes Elizabeth Sloan, CPA, a managing director in the ESG and sustainability services practice at Grant Thornton LLP in Chicago.

“Many entities are reporting ESG and sustainability information voluntarily to provide their stakeholders with a greater understanding of their values and how they operate,” Sloan says. “The voluntary reports are helping stakeholders understand what’s important beyond just the bottom line.”

The roots of sustainability reporting lie in corporate social responsibility (CSR), which has evolved into environmental concerns. Today, the marketplace is in its third wave.

“The first wave of CSR efforts focused on giving back to society and was manifested in donating to charities, sponsoring community

events, and supporting nonprofits,” says Anthony DeCandido, CPA, a partner and co-leader of the sustainability service solutions practice for RSM US LLP in New York City. “CSR reports from this era frequently resembled glossy brochures, showcasing the company’s philanthropic efforts rather than reflecting its operational impact on society and the environment.”

According to DeCandido, the second wave—marked by the transition from CSR to ESG reporting—saw the alignment of sustainability with corporate strategy, as organizations came to recognize that long-term success and risk management are linked to responsible environmental and social practices. But for some, the reporting may not have been applicable to their business.

“In the second wave, organizations realized the importance of ESG risk at an enterprise level, so many groups rushed to prepare reporting that may or may not have had a heavy level of relevance to their stakeholder group,” DeCandido says.

Today, as organizations navigate the third wave of reporting, the landscape is vastly different, focusing on how ESG reporting aligns with a broader societal shift toward sustainability and accountability.

“Many global businesses and businesses of certain profiles now need to do compliance reporting, and that’s a very different wave of reporting than we’ve seen in prior years,” DeCandido adds.

Today, four ESG and sustainability reporting regulations (currently in place or coming soon) have been deemed the most impactful. These include:

1. SEC Final Rule on Climate-Related Disclosures. The final rule, which impacts SEC registrants, was issued on March 6, 2024. Under the final rule, registrants are required to disclose the material impact of climate-related risks and the effects of severe weather events and other natural conditions within the footnotes of their financial statements. Additionally, certain registrants will need to disclose Scope 1 and/or Scope 2 greenhouse gas emissions, if material.

2. Corporate Sustainability Reporting Directive (CSRD). This new mandate was released on Jan. 5, 2023. It modernizes and strengthens the rules around the social and environmental information companies must report. The directive originated in Europe and impacts European entities, but also extends to organizations based in the U.S. and multinationals that do business in Europe. With the first CSRD reports due in 2025, companies whose fiscal year ends Dec. 31, 2024, should be prepared to provide accurate information from different parts of the organization to support the new assurance requirements. “CSRD metrics are broader, expanding past climate,” DeCandido says. “To me, they’re some of the more material metrics that companies are rushing to report on.”

These metrics include security and privacy; diversity, equity, and inclusion; governance and environmental waste; employee engagement; stakeholder engagement; and more.

Notably, both the SEC’s disclosure and CSRD rules impact wideranging companies that provide various general products.

3. Sustainable Finance Disclosure Regulation (SFDR). This regulation is based on a transparency framework. By setting out how financial market participants must disclose sustainability information, this regulation helps potential investors make informed choices about working with companies and projects that align and support their sustainability objectives.

“The SFDR is built around avoiding greenwashing and preventing companies from trying to promote that they have green and sustainable investment products when they’re not actually green or sustainable,” Sloan says.

4. Federal Acquisition Regulation Climate-Related Disclosure Rule. This rule would require some federal contractors to disclose their greenhouse gas emissions and climate-related financial risks and set science-based targets to reduce those emissions. “Not every organization would need to report on all these rules and regulations,” Sloan says. “However, even though the rules are all different, they do contain some overlaps, and there’s some interoperability between the requirements.”

Importantly, organizations should determine which of the above ESG and sustainability regulations apply to them now to protect themselves from any risks associated with inaction. These risks may include reputational damage (e.g., noncompliance may result in customers, investors, and other stakeholders viewing the organization as irresponsible). Additionally, organizations may risk experiencing lost business opportunities, decreased market share, and a decline in stock price.

In addition to global and federal ESG reporting activities, state legislatures are also weighing in. Some states are moving forward with requirements of their own, while others are pushing back.

California, for example, has two climate-related reporting rules in place, which require both in-state and out-of-state businesses doing business in the state to disclose their carbon emissions and climate-related financial risks. One is the Climate Corporate Data Accountability Act (Senate Bill 253), which requires large businesses operating in California to publicly report their greenhouse gas emissions. The other is the Climate-Related Financial Risk Act (Senate Bill 261), which mandates that companies disclose the threats they face because of climate change. Both bills were signed into law on Oct. 7, 2023.

Though still in its infancy, lawmakers in Illinois are also working on similar legislation.

Sheila Millar, a partner at Keller and Heckman LLP in Washington, D.C., leads the law firm’s consumer protection regulatory practices. She envisions a complicated landscape in the world of ESG reporting.

“The two California laws have gotten a lot of attention and are the subject of a legal challenge by the U.S. Chamber of Commerce,” Millar says. “While the SEC rule applies to publicly traded companies, California’s laws and their financial benchmarks aren’t limited to only publicly traded companies—they apply to private entities as well.”

Millar adds that the U.S. Chamber of Commerce and a variety of California business organizations have filed a lawsuit against the state over its new corporate climate disclosure laws, claiming the reporting requirements violate First Amendment rights by forcing businesses to engage in subjective speech.

Importantly, the U.S. Chamber’s challenge could potentially spawn further court challenges, legal questions around the scope of First Amendment rights, and obligations for communicating about ESG.

“I think the ongoing ESG and anti-ESG laws will continue to be a complicating factor,” Millar says. “I fully expect that we’re going to see more ESG laws in 2024 legislative sessions, as well as more anti-ESG measures coming through.”

Although regulations are still forming and working their way through the courts, Sloan stresses it’s crucial for organizations to get prepared now as it’ll take some time to gather the information needed to report in a timely manner: “We highly encourage entities to start looking at emerging rules and regulations at the state level to gain an understanding of what might impact them both directly and indirectly. Some of the reporting encourages entities to work with their entire supply chain, so it’ll be important for them to think through how they fit into that bigger picture.”

Sloan points to ESG and sustainability reporting as a multidisciplinary effort for organizational leaders to examine their business practices and determine what they want and need to report on and where to get that information: “You may seek information from your traditional finance function in the organization, but also your HR, tax, legal, and risk teams. You can also look to your customer sales, supply chain, and other groups you normally wouldn’t contact that can all fit into ESG and sustainability reporting.”

DeCandido acknowledges that climate reporting is relatively new, and some organizations struggle with either reskilling existing talent or identifying new talent in the marketplace that are equipped to handle ESG and sustainability requirements. To combat this, he suggests leaders offer learning opportunities and professional development for employees.

“That’s the human component,” he stresses. “It’s good for business and has all kinds of positive effects. When your people feel more engaged, they’re more likely to stay with you. And engaged employees are likely to result in better customer experiences, broader commerce activities, and more profits down the line.”

Of course, DeCandido admits that some of the technical requirements are difficult, and even the best and most sophisticated businesses don’t always have the in-house expertise to handle the reporting, particularly global companies tasked with aggregating data from varying locations and disparate systems.

Because rules are constantly changing, and others aren’t yet final, Millar cautions this can further complicate internal reporting.

“The first step to overcoming these challenges is to understand the business imperatives that come with ESG reporting,” Millar says. She advises organizations to put systems in place to report truthfully and with transparency to avoid overstating the good things they’re doing. Despite the challenges, DeCandido predicts a bright future for ESG and sustainability reporting and says it’ll become part of organizations’ strategic landscapes: “The future is a world where ESG is just another language business leaders speak.”

DeCandido also says the day is coming when business leaders will be talking about the usefulness of nonfinancial metrics just as much as financial metrics.

“There’s not a person out there who would say having more useful, relevant data isn’t helpful in leading a business,” he stresses. “If you can present some of the qualitative aspects of what you do so your stakeholders will be better informed, that’ll simply lead to better business decisions.”

Teri Saylor is a Raleigh, N.C.-based writer who covers a range of topics from business to lifestyles.

A new federal rule outlines a multifactor test for evaluating whether a worker should be classified as a 1099 independent contractor or W-2 employee.

BY LORI GOLDSTEIN, JD

DETERMINING whether a worker should be considered a 1099 independent contractor or W-2 employee can be tricky for businesses to navigate. Working remotely, part time, or with a flexible schedule, for example, doesn’t make one a contractor. Additionally, a tax practice and an accountant can’t simply “agree” to have a contractor relationship.

Further, complicated and conflicting worker status laws have led to audits, misclassification claims, class action lawsuits, and penalties, creating significant risks and costs for organizations to manage. The significant rise of gig workers since the pandemic, along with changing government agencies and federal administrations, have further contributed to the confusion surrounding worker classification.

In an effort to provide a resolution, the United States Department of Labor (DOL) released a final rule in March 2024 pertaining to worker status under the Fair Labor Standards Act. After a long and

interesting history, the new rule officially rescinds a 2021 independent contractor rule that favored businesses and outlines a seven-factor, employee-friendly “economic reality” test to help businesses determine an appropriate contractor status (the test differs under other statutes, including the Internal Revenue Code, Employee Retirement Income Security Act of 1974, and the National Labor Relations Act).

While the test isn’t entirely new, and the rule’s impact may be limited, employers should evaluate and tighten up their worker classifications now to conform with the DOL’s final rule.

Most of the factors outlined in the final rule aren’t significantly new or controversial compared to the 2021 rule. For example, the 2021 rule focused on two core factors: the nature and degree of control over the work and the worker’s opportunity for profit or risk of loss. The rule identified three other less probative non-core factors, including the amount of skill required for the work, the degree of permanence of the working relationship, and whether the work is an integral part of the purported employer’s business.

Under the final rule, there are seven factors that should be tested in determining the “economic reality” of the parties’ relationship:

1. Opportunity for profit or loss depending on managerial skill (i.e., does the worker have the choice of using initiative or business judgment?).

2. Investments by the worker and potential employer (a worker investment that’s capital or entrepreneurial suggests 1099 status).

3. Degree of permanence of the work relationship (indefinite, continuous, or exclusive of work for others implies W-2 status).

4. Nature and degree of control over the performance and economics (e.g., the schedule, supervision, or decision on price for service).

5. The extent to which the work is an integral part of the potential employer’s business (work that’s critical, necessary, or central to the employer’s principal business infers employee status).

6. Skill and initiative of the worker (skills that are more specialized favors 1099 status).

7. Any factors that in some way indicate whether the worker is in business for themselves, as opposed to being economically dependent on the potential employer for work.

Unlike many regulations with strict rules, the final rule is an administrative interpretation based on DOL’s review of court decisions. Regulations aren’t laws and government agencies don’t have the final say on who qualifies as an independent contractor— courts do. While courts typically give deference to valid regulations, they’re not required to. Notably, based on the ongoing controversy, our political court system, and it being an election year, many probusiness courts will choose not to place weight on all these factors or follow DOL’s new test at all.

While not a legal defense, many employers unintentionally misclassify because they’re understandably confused by worker classification rules. Others, however, may be keenly aware that their contractors should be employees, but they’re avoiding the expense and responsibility for payroll taxes, deductions, and employee benefits. Of course, whether these errors are unintentional or not, misclassification claims and audits come at a significant cost, including liquidated damages, attorneys’ fees (both the employer’s and the claimant’s if they win), and negative publicity. Even winning costs time, inconvenience, and legal fees.

Additionally, employers that have both employees and contractors may see their employee base shift or increase under the new rule. This is because organizations that have been treating all their workers as contractors will become employers for the first time. Either way, it means new or additional costs and obligations, including expense reimbursement, overtime pay, mandated leaves, paid time off, retirement benefits, workers’ compensation, and other benefits.

Notably, employees generally have more legal rights than contractors. However, in Illinois, contractors are protected by state discrimination, harassment, and retaliation laws. Therefore, it’ll be important for companies to implement lawful background checks, employee handbooks, and sexual harassment training.

Worker statuses will also affect the use of non-compete agreements. Generally, a non-compete restriction isn’t valid for independent contractors since being exclusive negates the independent nature of the relationship. Also, a pending Federal Trade Commission rule, which I covered in the fall 2023 issue of Insight, would ban non-competes nationwide, covering both employees and contractors.

Meanwhile, attempting to impose and enforce a non-compete on an independent contractor could be used as evidence of misclassification of an employee. Besides the related claims and penalties, the non-compete agreement would probably be unenforceable for failure to meet employee non-compete rules. Employers must be careful, particularly in states like Illinois that have statutory requirements for employee post-employment noncompetes/solicits. (In Illinois, for example, these include minimum annual expected earnings, signing bonuses or other legal “consideration” [something of value], and a 14-day review period before signing.)

Public accounting firms in particular should stay current on the above requirements and implications, not only as employers themselves, but in advising their business clients. To avoid potential misclassification claims and penalties, consider these steps:

• Conduct an audit of the workers treated as contractors and determine how they fare based on the final rule. As part of this process, examine and update job descriptions and interview workers about their actual duties.

• Convert and reclassify workers as W-2 employees if it’s clear or probable that they don’t meet the test. Additionally, consult with an HR professional and obtain legal advice regarding conversion, costs, and related employer legal requirements.

• Prepare for audits and challenges by maximizing compliance with applicable independent contractor laws. Consider limitations to impose on the contractor relationship to fit the test.

• For independent contractor agreements, include a valid arbitration provision waiving class/collective action or upgrade existing arbitration agreements to comply with recent legal developments. Doing so can reduce the likelihood of misclassification class action litigation.

• Structure, document, and implement independent contractor relationships in a manner that conforms to applicable law. A company’s practices should be consistent with the language in its agreements.

As you can see, there are many nuances to wade through with DOL’s new final rule. Notably, states may have their own laws and tests for contractor status and may not use the DOL’s economic reality test. It’s probable that some business organizations may seek court relief to stop the rule through an injunction. Additionally, a new administration in 2025 could impact rulemaking. But we can’t predict or guarantee such actions, and they’ll take time. Therefore, employers and their strategic business advisors should take steps now to minimize any potential risks.

Lori Goldstein, JD, is the attorney and owner of the Law Office of Lori A. Goldstein LLC, in Northfield, Ill.

With much uncertainty surrounding the Corporate Transparency Act’s beneficial ownership reporting requirement, CPA firms must practice due diligence to protect themselves and their clients.

BY JEFF STIMPSON

WITH an eye to deter money laundering and gain transparency about who owns or controls an entity, the United States Treasury’s Financial Crimes Enforcement Network (FinCEN) now requires business entities, including public accounting firms and many of their small-business clients, to report beneficial ownership information (BOI) as part of the Corporate Transparency Act (CTA).

In 2024 alone, FinCEN estimates that the rule will impact some 32.6 million companies. Yet, despite the reach of the CTA’s new mandate, many companies aren’t prepared for or even aware that the requirement exists.

“For something that’s impacting so many people, it’s the most misunderstood law I’ve seen in years,” said Roger Harris, president and COO of Padgett Business Services, during the AICPA/CIMA Tax Section Odyssey podcast episode, “Traversing the Beneficial Ownership Information Reporting Requirements.” “Most small businesses think most laws exempt small businesses—whereas this one targets them.”

What’s more, the consequences for not reporting BOI can be severe, with fines from about $600 per day to even penalties involving imprisonment. Therefore, it would be wise for certified public accountants (CPAs) to educate themselves—and their clients—on the requirement and take the necessary steps to ensure compliance. Here are some key things to know.

Per the CTA, all domestic and foreign entities formed or registered to do business in the U.S. must file the BOI report unless they meet

conditions of exception. Twenty-three types of entities are exempt, mostly large companies and highly regulated businesses.

For companies that must report, the deadline to do so depends on when they were created. For example:

• Companies created before Jan. 1, 2024, have until Jan. 1, 2025, to report.

• Companies formed or registered during 2024 must report within 90 days of creation.

• Companies formed or registered on or after Jan. 1, 2025, must report within 30 days of creation.

Notably, the Illinois CPA Society joined the AICPA and many other accounting organizations in advocating for delayed implementation and reporting deadlines. To date, however, no movement on this goal has been met.

Additionally, on March 1, 2024, a federal district court for the Northern District of Alabama found the CTA to be unconstitutional. The court’s order puts the disposition of reporting requirements in flux pending a final appellate adjudication. According to a March 4 notice published on the FinCEN website, the agency is complying with the court’s order and won’t be initiating enforcement actions against the plaintiffs in the action. In the meantime, it’s recommended that CPAs and businesses required to report continue reporting pending final litigation on this issue.

The biggest wrinkle of liability for public accounting firms will likely involve the definition of a client’s “beneficial owner.” This means anyone in a client’s company who, directly or indirectly, has “substantial control” over a reporting company or owns or controls at least 25% of the “ownership interests” of the company.

Substantial control is when an individual:

• Is a senior officer.

• Has authority to appoint or remove certain officers or a majority of directors of the company.

• Is an important decision maker.

• Has any other form of substantial control over the company (a “catch-all” to ensure that innovative or flexible corporate restructures still report).

In addition, companies are required to identify all individuals who own or control at least 25% of the ownership interests of the company. Ownership interests may include equity; stock or voting rights;

a capital or profit interest; convertible instruments; options or other non-binding privileges to buy or sell any of the foregoing; and any instrument, contract, or other mechanism used to establish ownership.

Direct ways to exercise substantial control may include board representation, control of a majority of voting power, or voting rights or rights associated with financing or interest, among others. Indirect ways to exercise substantial control may include controlling one or more intermediary entities that have substantial control over a company, or through arrangements or financial or business relationships with other individuals or entities acting as nominees.

Notably, FinCEN says that every reporting company will be able to identify and report at least one beneficial owner. Small companies, for example, may have multiple beneficial owners. Each company must report the:

• Full legal name as well as any trade or DBA name.

• Current U.S. address of the principal place of business or the primary location in the U.S. where the company conducts business.

• State, tribal, or foreign jurisdiction of formation.

• IRS taxpayer identification number, including an employer identification number or a tax ID from a foreign jurisdiction and the name of the jurisdiction.

The information required for each beneficial owner and company applicant (i.e., whoever directly files or is primarily responsible for the filing of the document that creates or registers the company) includes:

• Full legal name, date of birth, and current residential street address.

• The unique identifying number from an issuing jurisdiction.

• An image from one of the following: a U.S. passport; state driver’s license; or ID issued by a state, local government, or tribe (if an individual has none of these, a foreign passport).

Bianca Lindau, a Boston-based associate for the law firm Caldwell, says companies should start gathering this information now: “They should consider adding to existing (or creating new) compliance policies to ensure that the information required is collected when an entity is created or as part of a checklist for sales or purchases of companies or ownership interests. Additionally, it’ll be important to include obligations to provide BOI in transaction documents, such as joint venture agreements and stock purchase agreements.”

Of course, entities will have to take account of all the various entities in their ownership structure and determine for each whether a BOI report must be filed or not. “For large organizations, this may be quite onerous and time-consuming,” Lindau warns.

According to experts, CPAs and other accounting professionals have two primary tasks if their business clients approach them for advice about BOI reporting: watch the scope of help and thoroughly document it.

During the AICPA/CIMA podcast, Larry Gray, owner of Alfermann Gray & Co LLC, a CPA firm in Rolla, Mo., said one of his biggest concerns with clients approaching his firm is the “off-the-cuff advice” that one of his staff members might give without thinking through the consequences.

While as of press time no state bar has made the determination of whether it’s an unauthorized practice of law for non-attorneys to be providing advice in response to BOI questions, many experts warn accounting firms against providing unresearched advice.

Other risks for firms providing BOI advice to consider include:

• Insurance issues if such advice should end up not being “professional services” by an accounting firm.

• Handling of personal client information that’s not routinely handled by an accounting firm.

• Bank underwriters asking CPAs to confirm clients’ CTA compliance.

When in doubt, Joshua D. Lowe, CPA, CFP, partner at West & Company LLC in Edwardsville, Ill., says it’s best for CPAs to advise their clients to seek legal guidance.

“Due to the legal nature of this new requirement, our firm’s stance is that we should raise awareness and advise our clients to seek counsel from their attorneys to ensure they’re able to maintain compliance with the CTA,” Lowe stresses. “The law firms in our market area are very aware of this new act, as it’s now become part of their initial required set-up process for new entities. Many times, however, accounting firms aren’t part of that initial legal formation process.”

According to CNA Insurance, an individual who willfully files a false or fraudulent BOI report on a company’s behalf (e.g., a CPA) may be subject to the same civil and criminal penalties as the reporting company.

Melanie Lauridsen, AICPA and CIMA’s vice president of tax policy and advocacy, has a few recommendations for preventing such penalties: Accounting firms should confer with their attorneys, insurance carriers, and even state regulators before accepting any BOI engagements, and they should create distinct and separate engagement letters for all BOI work.

She further cautions that if you’re not taking the engagement, make sure there’s specific language in all other engagement letters stating you’re not doing BOI work on that engagement.

“We have to be really clear what we’re going to do,” Harris adds. “We’re trying to find a way to help our clients but protect ourselves.”

Another tactic is to offer strictly administrative assistance with no advice or interpretation. “With most clients, it’s not practicing law to say, ‘Fill in your name, address, and your driver’s license number,’” Gray says. “It’s when you get to that section of ‘substantial control’ [that] we pull the attorney in.”

Harris believes that clients will fall into a couple of buckets: 1) a straightforward single-member corporation or LLC and no other owner, or 2) one where someone is working in the background who has substantial control, and the firm will have to determine how this person’s situation fits into the law. “That’s when we’re stretching over into whether it’s practicing law or giving advice that we’re not qualified to give,” Harris cautions.

Overall, the BOI requirement is uncharted waters for all parties involved. As such, Harris encourages CPAs to be diligent about getting their clients up to speed: “Everybody in our industry has to spend the next few months informing people about the law, including the seriousness of it and the penalties for failing to comply, and asking for their patience while we try to figure out how to administer something that—while well intended—doesn’t really fit well into anyone’s business model.”

Jeff Stimpson is a New York-based reporter and has covered tax for 20 years. His work has appeared in various business and general interest publications, including Accounting Today and Financial Advisor magazine.

Shock, dismay, and even panic are all natural reactions to being laid off. Here, experts share advice for how CPAs and other accounting and finance professionals can navigate these challenging career moments.

BY NATALIE ROONEYWhen Davonte Carson graduated from Ball State University in 2022 with his master’s in accountancy, he accepted a position with the Big Four firm where he interned. He worked full time doing SOX compliance and internal audit but could see there wasn’t a lot of new work coming his way.

Then, the layoffs began. In September 2023, Carson found himself on the receiving end of a difficult phone call. “They told me that due to market conditions, I was being let go,” he recalls. “I was in shock.”

Unfortunately, Carson’s story isn’t unique or uncommon as of late. According to Bloomberg, since February 2023, several Big Four firms have shed more than 9,000 jobs through multiple rounds of layoffs across the firms’ largest markets. Additionally, worker exits at the Big Four firms in the United States—both voluntary and not— are up 43% through October 2023 from the previous year, according to a review of online professional profiles by Revelio Labs, a provider of workplace data.

While aggressive layoffs are rare for the Big Four firms, which typically see employees leaving voluntarily at higher rates, some experts suggest this recent shift is due to the hiring frenzy that occurred in 2021 as clients sought help navigating the COVID-19 pandemic and Great Resignation.

Of course, no matter the reason, shock, dismay, and even panic are all natural reactions to a layoff—but certified public accountants (CPAs) and other accounting and finance professionals can rest assured that a layoff isn’t a career-ender. Here, recruiting experts share their advice for navigating these difficult career transitions.

Jerry Maginnis, CPA, accounting executive in residence at Rowan University and author of the book, “Advice for a Successful Career in the Accounting Profession: How to Make Your Assets Greatly Exceed Your Liabilities,” advises laid-off employees to first take a moment to catch their breath.

“Give yourself time to process,” Maginnis recommends. “Talk to loved ones and friends who will bolster your confidence and help you focus. Attitude is important. If you’re down on yourself, it can show when you interview and meet with people—stay positive and upbeat.”

Brian Esko, principal at LHH in Chicago, has witnessed people experience a spectrum of emotions after a layoff: “Some people panic, others dive into action.”

Carson admits that it took some time to find the motivation to get his resume together and begin applying for new positions. He leaned on family and friends for support and connected with others who had also been laid off by the firm. “Once I started to communicate with my peers, we motivated each other,” he says. “It’s important to have a community to push you to take the next steps.”

Before jumping into a job search, Krista Kapsa, CPA, senior director for Truity Partners, a search firm specializing in accounting and finance, recommends taking time to reflect on what’s most important for your next career move.

Esko agrees: “Consider what you’ve really enjoyed from your prior roles and companies and make those characteristics a priority in your search. That’ll shape your strategy for finding your next role.”

Of course, starting with the basics can also move your job search forward purposefully. Many recruiting experts suggest:

• Updating your resume, highlighting your accomplishments. If you haven’t been updating your resume periodically, this can feel overwhelming. Online templates can help you get started. The goal isn’t to have the most glamorous resume, but rather to have one that tells the right story about your experience.

• Updating your LinkedIn profile. Use specific information and keywords. Turn on the “Open to Work” feature so recruiters receive notification. Use the “About Me” section to add important details about yourself and what you’re seeking. Additionally, ensure your resume and LinkedIn profiles are aligned and tailored to reflect what you want to do.

• Creating and saving job searches on LinkedIn and Google. By doing so, you’ll receive daily updates on new opportunities that match your search criteria.

• Reengaging personal and professional networks. Think outside the box and consider anyone you’ve ever worked with on internal and external projects: bankers, auditors, recruiters, benefit managers, attorneys, or software providers. Also, don’t forget about your university’s alumni network or your other professional affiliations.

Despite how you might feel, Kapsa says now isn’t a time to be embarrassed about a layoff. “There’s a lot of press around it now,” she assures. “So be ready to tell the world you’re looking for a new position. You never know what opportunity will come from where.”

Kapsa suggests casting a wide net as you start your search. “Identify a list of companies that interest you, follow them on LinkedIn, and reach out to those companies directly,” she says. “You might discover you’re already connected to the company through your own network.”

While mining through all the different job aggregator sites can be daunting, Esko says to think about the opportunities and companies you want to pursue rather than just applying randomly: “The first and best way to find a new role is through your direct network. It’s all about those personal connections.”

Maginnis suggests also looking in the newspapers—not necessarily in the job listings, but by discovering opportunities in the business news. “If there’s a story about a company that just raised $50 million in venture capital, there’s often a need to beef up accounting staff,” Maginnis says. “It’s a reason to reach out.”

Although personal referrals tend to yield the best results, Kapsa recommends collaborating with a reputable recruiter who can provide insight into the talent landscape. “Recruiters have contacts with local employers, so they know where turnover is happening, and they can help identify a good culture fit,” Kapsa says. “They know about opportunities that aren’t being advertised.”

Eventually, you’ll get asked for an interview with one of your prospects, so make sure you’re prepared to address the elephant in the room: your layoff.

Layoffs can happen for many reasons, and it’s generally not seen negatively, but it’s still necessary to assure the interviewer it’s not because of poor performance. “Maybe your company was bought out or reduced its workforce. Whatever it is, be honest about the situation,” Kapsa says. “Share the facts, speak positively about your former employer, and keep it as simple as possible. Practice explaining it in 30 seconds.”

Carson was transparent about his layoff: “People were very understanding. During interviews, I explained how I learned to accept and embrace the layoff and how the experience has pushed me to want more for my career now.”

Esko agrees with these approaches and offers some phrases that can be used to address different reasons for a layoff. Notably, performance-related layoffs can be more challenging to address. In these instances, you’ll want to be straightforward but not throw yourself under the bus:

• “I worked on interesting projects, picked up new skills, and learned from some really smart people. Unfortunately, I, along with many others, were caught up in several rounds of layoffs and my role was impacted.”

• “I’m looking to leverage my experience, and this role fits well with what I’d like to do.”

• “I’m excited to move forward. Here’s why I’m ready for this role specifically.”

“Address your layoff humbly and add a positive spin that shows you’re ready to move forward,” Esko stresses. “Discuss what you’ve learned and what you might do differently if you had another opportunity.”

If needing to address a performance-related layoff, Esko suggests using phrases like these:

• “I was in the wrong organization for a year. I learned a great deal, but there were certain pieces of the role that were really challenging.”

• “Given the constraints on the business, I didn’t have time to perform at the level they needed.”

• “At a larger organization with more structure, I’ll have more success.”

Just because you’ve experienced a layoff, experts say it doesn’t mean you’re on the back foot for future salary negotiations. Using sites like Glassdoor and other salary guides can help determine what your salary range should be. “Create a realistic range you’re comfortable with and isn’t out of whack for the market,” Esko recommends.

Experts advise when you receive an offer, consider the full package: retirement, time off, flexible work options, and professional development opportunities, and rank each in order of importance. “Companies vary in their benefits, especially for health care costs, which can add or subtract significantly to your take-home pay,” Kapsa points out. “Express your excitement at the opportunity and then ask for whatever it is that would make it the best offer for you.”

Kapsa also advises countering just once: “There’s often give and take from both sides, so it’s important to know what’s a must-have on your side. If you’re asking for more of two different things, know which one you’re comfortable letting go of.”

Growing and maintaining professional relationships takes time and dedication, but experts say it’s critical to future success. “Networking is something you need to be doing constantly so when you need help, you’ll have dozens of people to contact,” Maginnis says. “It can pay huge dividends every time you’re in a career transition.”

Above all, stay positive, Maginnis encourages: “A new job can present an opportunity to enhance your career. You may feel negative, concerned, and panicked, but this could be the best thing that’s ever happened to you. A dream job, more money, or a career path with long-term rewards could be just around the corner. This is a real opportunity to take your career to the next level.”

Despite some of the large layoffs happening at Big Four firms, Kapsa says the job market for accounting and finance in Chicago is still strong. “Don’t be embarrassed about being laid off. Reconnect to your network, have good follow up, and just get out there,” Kapsa urges.

For Carson, putting himself out there was tough, and he admittedly says contacting companies through LinkedIn didn’t generate the results he hoped for. Then, an Illinois CPA Society (ICPAS) networking event changed Carson’s entire job search trajectory. “That’s when I felt like the ball finally landed in my court,” he says. “At the networking event, I was able to connect in person and tell my story.”

The networking event generated phone calls, which led to interviews. As of mid-February 2024, Carson was considering two job offers, which he says are the direct result of his ICPAS network.

Natalie Rooney is a freelance writer based in Eagle, Colo. A former vice president of communications for the Ohio Society of CPAs, she has been writing for state CPA societies for more than 20 years.

1.

2.

Be clear and focused. “Don’t frantically pursue the same job at another company,” Esko cautions. “Pause and ask yourself if this is the right path.”

Make the job search your job. “Those who have good networks and use them well succeed, and those who treat the search like a job are the ones who tend to land the quickest,” Maginnis says.

3. Meet face-to-face. “In-person meetings can enhance someone’s commitment to help you, including possibly surfacing additional networking options,” Kapsa says.

4. Keep asking. Wrap up every networking session by asking: “Is there anyone else you think I should meet?” Maginnis says this approach turns a cold call into a warm intro, which can be very effective at opening doors.

5. Follow up. Keep the people you meet at networking events updated on your search progress.

6. Join professional organizations. Continue to grow your networks by joining relevant organizations. If you’re already a member of an organization, get engaged in its activities, attend events and meetings, and utilize the career resources it offers.

7. Upgrade your skills and certifications. These will boost your appeal. “You might even find yourself with more time to study for the CPA exam or another credential,” Kapsa suggests.

If You Build It, They Will Stay

Could your people be your firm’s greatest retention asset? Five experts share why putting people first is the key to building the firm of your dreams.

BY CAROLYN TANG KMETEmployee retention has been a bleak topic for some time in the accounting profession. Since 2019, the number of employed accountants in the United States has sharply fallen 17.3% (as of 2023), according to the U.S. Bureau of Labor Statistics. Notably, this decrease is a result of attrition at both ends of the profession: At entry, there are fewer college students choosing to enter the field, and simultaneously, many accountants are choosing to voluntarily exit the field.

Though, despite this long-term and devasting trend, there does appear to be some gleaming hope that certain strategies may be able to reverse this tide. According to Gallup’s State of the Global Workplace 2023 Report, 52% of voluntarily exiting employees say their manager or organization could’ve done something to prevent them from quitting.

Of course, many stakeholders, including the Illinois CPA Society (ICPAS), have gone to great lengths to know exactly what that “something” could be. In its 2023 Insight Special Feature, “Righting Retention,” ICPAS shared research findings to shed light on what’s driving the accounting profession’s perpetually higher-thanaverage turnover rates. In the report, the top three reasons cited for accounting and finance professionals voluntarily quitting their employers were salary, too many hours/burnout, and lack of worklife balance. Interestingly, workplace culture was cited as the fourth reason for employees exiting—and some experts believe this factor, specifically as it relates to valuing and prioritizing people, could be the key to building a firm where no one wants to leave.

Tammy Daugherty, M.Ed, is the owner of People Matter Consulting Ltd., a Cincinnati-based change management and leadership consulting firm. She emphasizes that accounting firms need to focus on prioritizing people over outcomes.

“In the accounting and finance field, numbers matter—they’re the first focus,” Daugherty observes.

She adds that numbers are what accountants naturally gravitate toward, noting that quantitative measures are more tangible than qualitative measures (i.e., revenue is easier to quantify than happiness). However, Daugherty stresses that a firm’s success is dependent on the well-being of its employees. In her experience, the firms that prioritize their people are the ones that see results.

“When leaders or managers put results first, their people suffer. You can see this by their results, turnover, and loss of traction when trying to implement changes to make their company better and stay competitive,” Daugherty says.

One characteristic deterring people from careers in accounting is the concept that it’s all about the hours and not about the people. “That’s how the profession has been thinking for so long, and it’s just not sustainable,” explains Randy Crabtree, CPA, co-founder of Tri-Merit Specialty Tax Professionals.

Crabtree wonders if maybe the challenge stems from the industry being so client-focused for so long, and that it forgot to focus on itself.

“As a profession, we don’t have enough people right now. We all have so much work and so many clients, and the personality of an accountant is to want to help everyone and find answers to all the problems,” Crabtree says. “So, we find solutions for our clients, but we forget that the people we work with also need care and support.”

Crabtree suggests that the accounting industry as a whole needs to shift its thinking away from counting hours to instead valuing employees. By doing so, Crabtree believes employees will want to put in those extra hours when needed. “There’s a difference between expecting employees to work on the weekends and creating an environment where employees want to work on the weekends,” he says. “Start by building a personal relationship and showing them that

they’re important rather than the work being most important. “When your employee comes into the office in the morning, instead of saying to them, ‘Hey, you know that project you were working on yesterday?

I need it today,’ say, ‘Hey, how was your evening?’”

Perhaps because of the emphasis on the quantitative aspects of accounting, accountants find themselves feeling more like cogs and less like people, suggests Loretta Kilday a Chicago-based attorney, who specializes in personal finance, debt, business collections, bankruptcy, and family law. She says this feeling is reinforced when accountants feel a lack of connection to firm objectives.

“Today’s employees are motivated by more than just salaries. They need to grow, learn, and make significant contributions to their organizations,” Kilday explains. “There’s often a lack of effective communication [among accounting and finance firms] that makes workers feel unappreciated or disconnected from the goals and accomplishments of the organization.”

Dennis Shirshikov, head of growth at Awning.com and a professor at the City University of New York, agrees that communication is key to keeping employees engaged with overall firm objectives.

“One common oversight is underestimating the value of transparent communication and feedback loops,” Shirshikov says. “In the labyrinthine structure of accounting and finance firms, it’s easy for employees to feel disconnected from the broader mission and undervalued in their daily contributions.”

The benefits of connecting employees to firm objectives go beyond retention strategies. Shirshikov says that authentically engaged employees exhibit higher productivity, lower turnover rates, and foster a sense of innovation.

“An engaged employee, feeling valued and understood, transforms from a mere cog in the machine to a pivotal force for growth and innovation,” Shirshikov emphasizes. “Engaged employees are the bedrock upon which firms can anticipate market shifts and adapt services to meet evolving client needs.”

The difference, Kilday observes, is that engaged employees don’t feel obligated to do their jobs, they feel ownership and pride in their work, and this translates into overall firm health.

“Truly engaged employees want to do more than just feel good about their jobs, they want to contribute to their companies’ success, which has measurable benefits, such as reduced staff turnover, increased productivity, better customer service and, ultimately, improved financial performance,” Kilday says. “Additionally, firms that have mastered employee engagement often see stronger client relationships and a more resilient brand.”

Susan Stutzel, CPA, is a sole practitioner who serves nonprofit clients. Per her own words, she lives, breathes, and loves the accounting profession—and has for more than 20 years. For the first time in her

experience, she says there are multiple generations in the workforce at the same time, and each generation has very different needs and expectations. Stutzel says one of the biggest challenges the accounting industry faces is shifting the perception that being a certified public accountant (CPA) is merely a job, not a career.

“We can no longer do things the way they’ve always been done,” Stutzel stresses. “This new generation, more than ever before, is asking for mentoring, technical training, professional skills development, and more. The firms that are listening and investing in their people are seeing lower attrition rates.”

Stutzel says that one of the motivational drivers specific to the CPA profession is mastery—the idea of getting better and better at something that matters: “If an employee feels like they’re caught in a hamster wheel doing the same thing over and over again, they’re not going to gain mastery.”

Notably, managers can play an important role in this process by guiding and mentoring younger CPAs. “If an employee has been auditing an inventory section for the last few engagements, a manager can step in and show how one might be different from the other—they can explain how it’s more complex with multiple locations, or how inventory is moving at year-end. This helps employees see how they’re gaining mastery, and therefore, are more motivated to do the work,” Stutzel explains.

Interestingly, in its 17-year history, Tri-Merit is a firm that’s only had about 10 people leave voluntarily. Crabtree attributes the firm’s strong retention rate to the firm’s strategy of investing in its people. He estimates that it costs the firm anywhere from one-half to two-times someone’s salary to replace them, so they intentionally invest that cost savings into their retention strategies, including mentoring, training, and team building. This people-focused mindset also extends beyond the firm’s walls. Tri-Merit offers free continuing professional education to support CPAs and partner firms, as they believe talented employees are more likely to stay with a firm where they’re given opportunities to develop, succeed, and grow professionally.

Daugherty agrees and says you’ll never regret investing in people. She stresses that supporting people so that they support the business is a mental shift that needs to happen.

“People can tell if you care about them or not,” Daugherty says. “To create life-long employees, business owners need to realize their responsibilities in helping fulfill employees’ visions and dreams and give them the tools and resources to allow them to grow.”

Stutzel believes that every individual has their own unique set of talents, passions, and skills, and firms that provide space for employees to showcase these and make significant contributions are the firms that are attracting and retaining talent. “As CPAs, we’re problem-solvers. We want to have an impact and make a difference. If I can find a firm that allows me to do that, I no longer have a job, I have a fulfilling career,” she stresses.

Stutzel also agrees that accountants can sometimes get a bad rap for being “more robotic than human,” but says the profession is actually

driven by a sense of purpose: “We want to know that the work we’re doing matters. Not just that we’re meeting budgets and getting high realization, but that we’re making a difference to our clients.”

Part of employee engagement is investing in culture and building social connection within a firm. Stutzel says it’s important to give all employees a sense of belonging, regardless of whether the firm’s workforce is in person, hybrid, or virtual: “Even those who would call themselves introverts need community—they need to know they belong.”

Shirshikov suggests that one way to create a sense of belonging and connection is to recognize and celebrate the individual contributions of employees: “Customized career development plans, opportunities for mentorship, and involving employees in decision-making processes can foster a deeper connection to the company’s mission and goals.”

Interestingly, based on ICPAS’ survey findings from “Righting Retention,” career advancement paths and opportunities, and mentors and mentorship programs, were cited as some of the top benefits most attractive to employees.

Shirshikov’s also says that facilitating cross-departmental collaborations can help employees understand the impact of their work across the organization, which in turn enhances their sense of purpose and connection.

By connecting with employees directly, firms can also get a better understanding of what truly motivates them. Beyond meeting with employees one-on-one, firms can also distribute surveys, host forums, or provide an anonymous feedback channel. Shirshikov also stresses that it goes beyond the mechanism of operationally asking for feedback. Firms have to truly listen and then act on what they learn.

Further stressing this point are ICPAS’ survey findings, which highlight that 28% of employers never ask their employees what benefits they value most.

“Implementing regular ‘temperature checks’ and creating an environment where feedback is encouraged and valued can unearth valuable insights into employee needs and desires,” Shirshikov says.

Daugherty emphasizes that simply soliciting feedback isn’t enough. “Make the investment on a consistent basis to get to know your people. Take notes about them and review reports or outcomes of town halls—but make sure you act on them. Otherwise, trust erodes and you lose the ground you may have gained,” Daugherty warns. Crabtree says that employee engagement and retention starts right at hiring. You have to hire the right people, build the right culture, and value each employee. In fact, whenever a new employee is onboarded, Crabtree schedules a one-on-one video conference with them just to chat.

“During these calls, we talk about anything but work to get to know each other. We talk about what we enjoy doing outside of work, our families, or anything they want to talk about—and I’ll share anything they want to know about me,” Crabtree relates. “These conversations set the atmosphere of the company.”

Crabtree admits that Tri-Merit’s corporate culture is one of its greatest assets. It’s why the firm has such low attrition, and why at a recent corporate gathering, the hired photographer couldn’t distinguish the firm’s partners from the staff.

As Crabtree simply puts it: “The most important asset you have is your people. If you don’t create a culture that’s going to attract and retain people, then you’re not going to have the firm of your dreams.”

Claire Burke, CPA CFO and Treasurer, Dearborn Group claire_burke@mydearborngroup.com

Claire Burke, CPA CFO and Treasurer, Dearborn Group claire_burke@mydearborngroup.com

If we want to create lasting value for our organizations, we’ll need to embrace new mindsets and models.

I was recently interviewing a candidate for a staff-level accounting position. During the interview, he mentioned his accounting career interest stemmed from enjoying the accounting courses he took in his MBA program. With that response, my mind quickly jumped ahead a few years and wondered: If I hired him, would he still be around? Would the accounting and finance field provide the career he was looking for? Would my organization be a place he would want to stay?

As these flooding questions suggest, finding ways to retain talent continues to be top of mind for most corporate finance leaders, including myself. We know what high employee turnover costs our bottom lines. Not to mention the fact that open positions place an extreme burden on existing staff and management as work gets temporarily shifted until the position is filled.

Ultimately, if we want to create lasting value for our organizations, and also help our bottom lines, a great place to start is by lowering our turnover rates. Fortunately, thanks to some leads from recent survey findings, there are a couple of areas where we can start now to make that happen—pay and flexibility.

Based on the Illinois CPA Society’s survey findings featured in the Insight Special Feature, “Righting Retention,” salaries are cited as the leading driver of accounting and finance professionals voluntarily leaving an employer. Pay is top of mind for almost everyone, and it’s no secret that accounting salaries remain lower than technology and financial analysttype positions—but why?

Thanks to technology advancements, our industry has changed considerably over the past 10 years, allowing accountants to gain a variety of new skill sets applicable to our datadriven world. For example, certain fundamental accounting and finance processes are being automated, with some tasks completely replaced by robotic process automation or artificial intelligence. Tasks that would’ve taken hours or days to complete, can now be accomplished in a fraction of the time. Fortunately, this has shifted the type of work many staff accountants perform to become more analytical and technological. So, why wouldn’t this translate to salaries that are commensurate with technology and other finance positions? It’s a shift we should all consider across the industry.

Of course, solid accounting knowledge is still a fundamental requirement, but being able to adapt with the changing landscape is also imperative. When I’m interviewing potential candidates, I now look for candidates that have technical skills (e.g., Power BI, building reports in Tableau, advanced Excel skills, etc.). I also look for candidates with analytical aptitude—I need more thinkers, people who can analyze and explain drivers of outcomes. One of the biggest values my team provides our organization is insight into key drivers of our financial results and opportunities to improve earnings.

Other leading causes of turnover cited in “Righting Retention” were too many hours/burnout and lack of work-life balance.

At times, accounting professionals are held hostage by cycles, whether monthly, quarterly, or annually. The traditional mindset is you either accept this seasonality of multiple busy seasons or consider pursuing another career—the mentality of “it is what it is.” But is there a better model?

While we can’t get away from the cyclical nature of our profession, we can find opportunities to make up for this by offering better worklife balance. The pandemic provided a great revelation: Employees can work remotely and still be productive. In my experience, I’ve found that employees aren’t only more productive when you allow them to do so, but happier. I also found that some employees became more innovative in finding ways to make their work easier to do remotely. With the advancements in technology that make a virtual office work well, why not find a balance between in-office and remote work that allows for better work-life balance for all?

For example, my organization has adopted a hybrid approach that promotes in-person collaboration by requiring employees to be in the office part of the week, while offering the flexibility to work from home the other days.

Simply put, if we want to create a better balance for employees choosing this profession, we’re going to have to change how we manage and how our teams work together.

There are tools available to make flexible work arrangements a success for everyone, while maintaining (even enhancing)

productivity, collaboration, teamwork, and engagement. Video, instant messaging, and virtual collaborative workspaces can promote a team environment and allow you to effectively manage when employees are remote. You can also schedule in-person team building activities periodically to make it more enjoyable to come into the office. These can be as simple as team meetings or team lunch days.

Of course, with flexible work arrangements, sufficient guardrails in the form of policies and procedures need to be clearly communicated—it shouldn’t be a free for all. For example, I require anyone working remotely to have an “online presence” during our core business hours, which means their online status needs to reflect where they’re at throughout that time. If they’re “away,” they need to include a message, such as, “At lunch until 1 p.m.” Clear communication is critical, so it feels no different than if everyone is in the office together.

While flexible work arrangements will never eliminate our crunch times, providing employees with the opportunity to complete their work when, where, and how is best for them can help offset the effects of long hours and offer a better work-life balance. We just need to be willing to change how we manage, change how our teams work together, and have effective policies and procedures in place.

If you’re currently operating under the traditional mindsets and models that have stereotyped the accounting profession for decades, I encourage you to pause and reconsider how a new way of thinking could work for you and your recruiting and retention efforts. By doing so, you might just find that you add some downstream value to your organization.

Brian J. Blaha, CPA Growth Partner, Wipfli LLP

Brian J. Blaha, CPA Growth Partner, Wipfli LLP

bblaha@wipfli.com

By focusing on these six leadership traits, you can create and support environments where employees are motivated to stay and work.

There’s been no shortage of focus on the growing problem of talent retention across our industry, with many stakeholders working to uncover the reasons for why accounting and finance professionals are leaving their employers at a higher-than-average clip. The Illinois CPA Society, for example, released its related survey findings in the Insight Special Feature, “Righting Retention,” citing several factors that are driving voluntary resignations. Among them are lack of advancement opportunities, defined career advancement paths, and mentors/mentorship programs, along with uninteresting or mundane work and wanting a job that has more social impact.

For employers, these factors can appear overwhelmingly large and impossible to solve. But I’ll contend that it’s leadership that carries the burden of creating an environment where employees are inspired and motivated to navigate these perceived barriers.

While there are various leadership models, most point to the ability of inspiring and motivating others as having the highest impact on employee engagement. When employees are engaged in their work and enthused to go the extra mile, they’re more successful at solving problems and achieving objectives, and therefore, retaining them almost becomes a moot point.

Sounds pretty easy, right? Create an organization of motivated employees led by inspiring leaders and the retention problem goes away. Of course, nothing is that easy, and all of us need to do our part in evolving our leadership skills.

At a recent internal continuing education class on the topic, Wipfli’s Chief Human Resources Officer Maureen Pistone offered this: “Having spent my entire career in HR, I’ve coached, trained, and learned along the way, and evolved my own management and leadership approaches over the past 30 years.”

The key takeaway here is “evolved.” Being an inspirational leader takes practice and reflection. You have to understand the big picture, read the room, and know your team. Honing your leadership skills and taking the time to get to know each employee will help foster inspiration as an outcome.