E x p l o r i n g t h e i s s u e s t h a t s h a p e t o d a y ’ s f i n a n c i a l w o r l d g i c p a s o r g / i n s i g h t h t m S U M M E R 2 0 1 3 THE MAGAZINE OF THE Don’t miss the Midwest Finance & Accounting Showcase, August 27-28! See the insert inside. Meet new ICPAS President and CEO Todd Shapiro, p. 8 FRAUD T he Centur y’s Top 10 Of fender s...So Far! corporate P l u s , Playing fair with Ponzi scheme investors Protecting against occupational fraud Targeting suspect offshore accounts

Your complete Robert Half will help you find the optimal balance of temporary, project consulting and full-time financial resources to maximize productivity and profitability within your organization. As the world’s leader in specialized financial consulting and staffing services for more than 60 years, only Robert Half offers you this complete solution. Accountemps, Robert Half Finance & Accounting and Robert Half Management Resources are the leaders in specialized financial and accounting staffing for temporary, full-time and project placement, respectively. Chicago • Oakbrook Terrace • Hoffman Estates • Northbrook Rosemont • Gurnee • Naperville • Tinley Park TEMPORARY / PROJECT / FULL - TIME 1.800.803.8367 accountemps.com 1.800.474.4253 roberthalf.com 1.888.400.7474 roberthalfmr.com © 2011 Robert Half. An Equal Opportunity Employer. 0806-0005

SAVE BIG MONEY with Alliant’s low auto rates NEW as low as Alliant rates are up to 66% lower than Illinois bank rates!2 1.49 APR1 % USED as low as 1.74 APR1 % For a purchase or refinance, apply for an Alliant auto loan today... • Visit www.alliantcreditunion.org/ilcpa • Call 800-328-1935, press 5, then 2 for loans 1. APR=Annual Percentage Rate. Alliant new and used vehicle rates as of 06/03/2013. Loan approval, APR and downpayment required based on payment method, creditworthiness, collateral and ability to repay. Rates include automatic payment option. Rates are 0.4% higher without automatic payment. Rates, terms and conditions are subject to change. Add 1% for over 72 month term. For pre-existing Alliant vehicle loans, members will have 1% APR added to their qualifying rate for refinancing. Refinancing loans from other lenders is available. Please ask an Alliant loan consultant for details. Payment Example: Financing for a loan period of 72 months and an APR of 1.49% APR (new) your monthly payment would be $14.53 per $1,000 borrowed. Financing for a loan period of 72 months and an APR of 1.74% (used) the monthly payment would be $14.64 per $1,000 borrowed. 2. Comparison of Alliant’s new auto loan rate as low as 1.49% APR and used auto loan rate as low as 1.74% APR as of 06/03/2013 vs. Illinois bank average 72 month new auto loan rate of 4.48% APR and 60 month used auto loan rate of 4.63% APR as of 06/03/2013. Illinois bank average rates are sourced from National Association of Federal Credit Unions in cooperation with Datatrac Corp. as of 06/03/2013. You must be or become a member of Alliant Credit Union to apply. Applicant must meet eligibility requirements for Alliant membership. ©2013 Alliant Credit Union. All Rights Reserved. SEG723-R07/13

34 The 21st Century’s Top 10 Frauds

These individuals perfected the art of “ now you see it, now you don’t ” We detail lessons learned the hard way 38

Illinois’ Big Four

Almost since inception, Illinois’ economy has relied on a foundation of manufacturing, construction, finance and agriculture Each was hard hit by the recession, and while the state might not be growing at the same rate as the majority of the nation, it is showing encouraging signs of improvement all the same

42 Are You Fit to Lead?

Whether you ’ re already kicking back in the corner office, holding tightly to the rung below it, or just a few short steps into what promises to be an enduro race up the leadership ladder, that’s a question you need to constantly challenge yourself with if you want to be a good no, scratch that, a great leader Complacency in today’s dynamic business world just isn’t an option; in fact, it’s one of the biggest mistakes you could make

M&A What’s Your Firm Worth?

Digging down to the real value of your CPA practice takes a big, healthy dose of reality

Drafting a social media policy is your greatest line of defense against bad press

With Baby Boomers hanging on to their executive posts and Millennials rising up to grab the brass ring, where does

game?

Pulled

Can

index SUMMER 2013 | www.icpas.org/insight.htm

18

22 Social Media Policy to the Rescue

26 Leadership

X?

What’s to Become of Gen

Gen X fit in the leadership

28 Fraud Ponzi Payback

assets

the nick of time?

30 Workforce All About Millennials Three ways to make Gen Y the focus of your culture makeover 32 Security The Threat Within

in

That may not be such a good thing

you really

4 Seen Heard Sound bytes, sound advice and practical business tips 8 A Conversation With Todd Shapiro, new ICPAS President and CEO 10 Tax Decoded Sellers Beware! A quirk in the Whistleblowers Act could throw Internet sellers for a loop 12 Capitol Report Illinois Triumphs The new 98th General Assembly passes a slew of ICPAS legislation 14 Forensics Insider Fraud on the Fly Travel to exotic locations might be just the clue you ’ re after in the hunt for telltale offshore accounts. 16 PFP Advisor The Planner’s Guide to Planning Gain a competitive edge with these industry-leading practice management solutions. 48 Hype.It Must-read-must-know news for young accounting pros columns departments features 2 INSIGHT icpas org/insight htm

trust anyone with your company secrets?

INSIGHT MAGAZINE

Publisher/President & CEO Todd Shapiro

Editor-in-Chief Judy Giannetto

Art Design Judy Giannetto & Rosa Garcia

Production Design Gene Levitan & Rosa Garcia

Assistant Editor Derrick Lilly

National Sales & Advertising Natalie DeSoto

YGS Group, 3650 West Market Street, York, PA 17404

P: 800 501 9571 x127 F: 717 825 2171

E: natalie desoto@theygsgroup com

Circulation Carl Siska

Editorial Offices: 550 W Jackson Boulevard, Suite 900,Chicago, IL 60661

ICPAS OFFICERS

Chairperson, William P. Graf, CPA Deloitte & Touche LLP

Vice Chairperson, Daniel F Rahill, CPA, JD FGMK, LLC

Secretary, Edward J Hannon, CPA, JD Freeborn & Peters LLP

Treasurer, Mary Lou Pier Pier & Associates, Ltd

Immediate Past Chairperson, James P Jones, CPA Edward Don & Company

ICPAS BOARD OF DIRECTORS

Linda S Abernethy, CPA, McGladrey LLP

Rosaria Cammarata, CPA, CME Group Inc

Rose G Doherty, CPA, Legacy Professionals LLP

Gary S Hart, CPA , Gary Hart & Associates Ltd

Margaret M Hunn, CPA, CFE, CFF, CITP, Rozovics Group PC

Paul V Inserra, CPA, McClure, Inserra & Co , Chtd

David V Kalet, CPA, MBA, BP Products North America

Michael J Maffei, CPA, GATX Corporation

Marcus D Odom, PhD, CFE, CPA (inactive), Southern Illinois University

Floyd D Perkins, CPA, Ungaretti & Harris

J. Bradley Sargent, CPA/CFF, CFE, CFS, Cr.FA, Sargent Consulting Group LLC

Mark F Schultz, CPA, Dugan & Lopatka CPAs PC

Scott D Steffens, CPA, Grant Thornton LLP

Thomas L Zeller, PhD, CPA, Loyola University Chicago

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 24,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all

•New!

•$85

•24/7

•New!

warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year, in Spring, Summer, Fall, Winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA , 312 993 0407 or 800 993 0407, fax: 312 993 7713 Subscription rates for non-members: $20 US, $28 Canada, $30 Mexico and $40 for international addresses Copyright © 2013 No part of the contents may be reproduced by any means without the written consent of INSIGHT Permission requests may be sent to: Publications Specialist, at the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA ICPAS

FREE quarterly CPE onDemand events ($100 value)

membership provides… •New!

8-hour courses now only $229

discount on all full day courses and conferences

CPE onDemand for only $25 per credit hour

ICPAS KnowledgehubTM – your training and development solution

connections to colleagues and business opportunities

INSIGHT magazine and Practice Advantage and inside finance epubs To renew visit www.icpas.org

Please contact Member Services at 800.993.0407, option 4. icpas org/insight htm | SUMMER 2013 3

•Invaluable

•

Questions:

SEEN HEARD

53%

percent of C-level executives who believe reputation increases sales/revenue intake.

Source: Reputation Institute

How To:

Be a G(rrr)eat Leader

Is your company surviving and thriving in these challenging times, or is it dangling by a thread? Are you a great leader? Do you have great leaders working for you? ManpowerGroup’s [manpower com] “Three Rs of a Great Leader” details exactly what you need to be:

1 Reliable People want leaders who they can trust and rely on for consistency Practice what you preach, update employees frequently and keep regular lines of communication open

2. Responsible. Take ownership and responsibility for your organization Embrace the leadership role; don’t break commitments, assign blame or make excuses when challenges arise

3 Resourceful Think outside the box Strong leaders must push for innovation and be driven to go beyond the status quo in all aspects of the job

FEATURED APP: Intuit GoPayment Card Reader

This app is a low-cost business solution that allows your customers to swipe and sign for your services on the go The app and credit card reader are free for up to 50 users; usage pricing plans range from $0 to $12 95 per month and 1 75 percent to 3 75 percent per swipe GoPayment is fully encrypted and secure, lets you view transaction histories, void charges, send and resend personalized receipts, account for location sales tax rates and, best of all, syncs with your QuickBooks accounts If you ’ re looking for a mobile credit card solution for your iPad, iPhone or Android device, this could be it Visit gopayment com for more information

THE TRUTH ABOUT... What CFOs Want from Accounting Recruits

A recent Accountemps [accountemps com] survey found that CFOs desire and value far more than traditional accounting and finance skills when it comes to evaluating finance department job candidates

In fact, 33 percent of CFOs said they value general business knowledge most, followed by information technology expertise (25 percent) Other leading skill sets most sought by CFOs evaluating potential accounting recruits include communication skills (14 percent), leadership abilities (13 percent) and customer service orientation (13 percent)

3 Social Media Musts

There’s no denying that each social media network has its own pros and cons when it comes to business use These three tips from Socialnomics net can save you from that “Why did I just post that?” moment:

1.Double-check before you send it. Even try reading your post out loud to see if it sounds right

2 Follow rules of etiquette LinkedIn is not the place for baby pictures save those for Facebook or Instagram Simply, think about what you want to share and who it’s appropriate for before posting.

3 S h a r e o n l y w o r t h y c o n t e n t Post content that’s new, exciting, important, funny or engaging If you wouldn’t want to look at it on someone ’ s page, you shouldn’t share it on yours

4 INSIGHT icpas org/insight htm

N E W S B Y T E S , S O U N D A D V I C E A N D P R A C T I C A L B U S I N E S S T I P S

Payroll is a huge business opportunity that’s right under your nose. Work less, worry less and profit more with RUN Powered by ADP® Payroll for Partners. With ADP’s easy-to-use online payroll solution, you can regain control of your time and rethink how payroll can help drive revenue and profitability. Our solution requires no upfront technology investment, and comes with simple pricing, dedicated service and marketing support. Count on our 60+ years of expertise as the payroll leader to help you benefit from less work, less worry and more profit. Learn more with the free strategy brief, “3 Easy Ways Payroll Can Help Grow Your Business.” Go to accountant.adp.com/opportunity ADP® and the ADP logo are registered trademarks of ADP, Inc. Copyright © 2013 ADP, Inc. HR. Payroll. Benefits.

75%

Percent of US workers who will work beyond retirement age by choice or necessity.

Source: Gallup

TRENDSPOTTER

CFO Confidence Makes a Comeback

It took a while, but CFOs are finally growing more confident in the U S economy, according to Grant Thornton LLP’s CFO Survey conducted earlier this year The survey findings revealed that 45 percent of respondents believe the economy will improve over the next six months, compared to only 31 percent last fall and 25 percent last summer What’s more, CFOs are predicting increased hiring; 40 percent said their company ’ s head count would increase, up 6 percent from fall 2012. These findings reinforce similar data found in the Grant Thornton International Business Report, which revealed that optimism in the performance of the nation’s economy among U S business leaders had risen from -4 percent in the fourth quarter of 2012 to 31 percent in the first quarter of 2013

Where are all the Women Leaders?

With women making up more than half of CPA firm employees, public accounting firms simply can’t grow without them So why is it that only 19 percent of CPA firm partners and principals are women? According to the 2013 Accounting MOVE Project results, it’s because defecting from the talent pipeline to pursue careers in industry or as firm owners still offers better chances of success than persevering in public accounting firms. To keep women moving upwards, the report says, firm leaders need to neutralize work/life conflicts, amplify the authority and efficacy of women role models, evolve firm culture to remove subtle barriers and communicate opportunities and career paths more consistently and clearly To learn more about the study visit www awscpa org/news moveproject2013 php

Employee Wallets Feel the Pinch

That 2-percent Social Security payroll tax hike has many working Americans pulling back on spending, according to a recent Accounting Principals [accountingprincipals com] survey In fact, the tax hike is draining about $130 from monthly take home pay, and as a result, 75 percent of survey takers said they had no choice but to cut back on spending

The survey also found that 28 percent of respondents had to prematurely pull money from their retirement accounts to pay for some of life’s challenges, such as unexpected home or car repairs, and unexpected healthcare bills

Correction: Please note the omitted attribution to Christina S Butcher, CPA, MST, manager at Kessler Orlean Silver & Company, P C in Deerfield, Ill , in the Spring 2013 issue article, The Obamacare Effect

Fact File: fraud

Numbers speak louder than words when it comes to the state of occupational fraud in the United States today, as these survey findings bear out (Turn to our cover story on page 36 for more on corporate fraud )

n When presented with a list of possibly questionable actions that may help the business survive, 47 percent of CFOs participating in Ernst & Young’s Growing Beyond: A Place For Integrity study felt one or more could be justified in an economic downturn

n In the ACFE 2012 Report to the Nation, survey participants estimated that the typical organization loses 5 percent of its revenues to fraud each year. Applied to the estimated 2011 Gross World Product, this figure translates to a potential projected global fraud loss of more than $3 5 trillion.

n According to the same ACFE survey, the median loss caused by occupational fraud cases was $140,000 More than one -fifth of these cases caused losses of at least $1 million The frauds reported to the National Association of Certified Fraud Examiners (NACFE) last an average of 18 months before being detected

n The survey further found that the industries most commonly victimized are the banking and financial services, government and public administration, and manufacturing sectors

6 INSIGHT icpas org/insight htm SEEN HEARD

Put a winning team behind you.

Nothing divides Chicagoans like our baseball loyalties. But at Jackson Wabash and Garelli Wong, we specialize in bringing Chicago together.

As Chicagoland’s experts in financial recruiting and staffing, we use our intimate understanding of the local job market, salary trends and business climate to connect great talent to great companies across the local area every day.

So no matter what side of the Crosstown rivalry you root for, we can help you win big in your business or your career. To learn more, visit us online or call your local office.

Chicago Schaumburg Oakbrook Terrace 312.583.9264 847.397.9700 630.792.1660 WWW.GARELLIWONG.COM WWW.JACKSONWABASH.COM

visit www

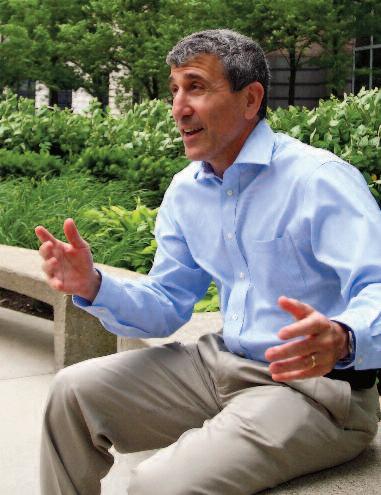

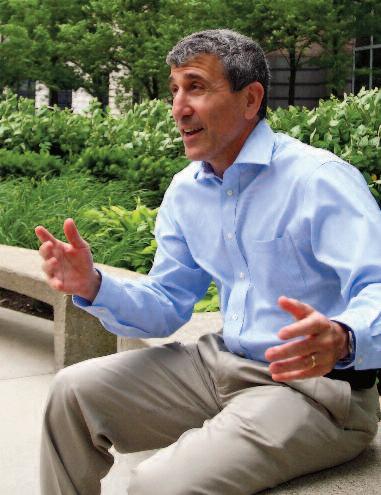

TODD SHAPIRO

By Judy Giannetto

By Judy Giannetto

A mini basketball hoop and a photo of an IndyCar. They’re the first things you see when you walk into Todd Shapiro’s office. And they’re the only things you need to see to understand the kind of dynamic, fast- charging leader the Society’s new president and CEO, and former CFO, promises to be Don’t see the connection? You will

Q.Tell us something about yourself we might not know a .I ’ m a n I n d y r a c e c a r d r i v e r O k , I ’ v e only done it once, but I loved it. I’m energized by intense activities that require my undivided attention. For example, when I g o b i k i n g , i t ’ s a t

Q.And how does that play into your leadership style?

, I h a v e t o e n v i s i o n t h e route ahead and how I’ll get to the bottom I h a v e t o f o c u s o n t h a t w h i l e n o t l o s i n g track of my surroundings. I believe in the power of taking controlled risks

o n

a.My business philosophy is don’t wait for things to go bad before you make them better You have to stay ahead of the curve, which plays into the idea of controlled risk Always look for ways to improve I like environments that are constantly changing because it keeps you sharp It’s the same thing with skiing or biking The environment is always changing and you have to be constantly vigilant and make adjustments to compensate for those changes.

8 INSIGHT icpas org/insight htm

A C O N V E R S AT I O N W I T H T h e I l l i n o i s C PA S o c i e t y ’ s n e w P r e s i d e n t a n d C E O t a l k s a b o u t h o w t h i n g s a r o u n d h e r e a r e h e a d e d f o r c h a n g e t h e g o o d k i n d

y

e

t i o

o

e t o f o c

h e

I ’ m s k i i

g

2 0 m p h a t t h a t s p e e d

o u h a v e t o p a y a t t

n

n , y

u h a v

u s W

n

n

d o w n a d o u b l e b l a c k d i a m

d

To read more about Todd Shapiro,

icpas org/toddshapiro htm

Q.In terms of vision, what’s on your hotlist as the new CEO?

a.My vision is to advance the profession t h r o u g h w h a t I c a l l t h e t h r e e l e g s o f t h e stool Education, Advocacy and Information Connecting with members is key I’ll be out talking with, connecting with and engaging members, firms and companies

I have a strong outreach focus to find out how we can better serve members’ needs I want to talk with firms of all sizes, from sole practitioners up to the Big 4. We also want to engage our young professionals to a m u c h g r e a t e r d e g r e e , b u i l d i n g o n t h e hug e s uc c e s s of our Young Profe s s iona ls L e a d e r s h i p C o n f e r e n c e i n M a y A n d w e want to enhance our connection with and engage our corporate members as well

Another big emphasis is advocacy Our Government Relations Office in Springfield has two purposes: To promote the profession and to make sure things that are bad f o r t h e p r o f e s s i o n d o n ’ t g e t p a s s e d O u r staff monitors over 6,000 bills a year, and reviews proposed departmental administ r a t i v e r u l e s Wo r k i n g t o s t r e a m l i n e t h e renewal of firm licenses is a perfect example of the work our staff is doing We’re trying to make things better and easier to navigate for members by improving the licensing process Who’s looking out for the profession in Illinois? We are. No one else is doing that I mentioned it before, but I’ll s a y i t a g a i n , w e w a t c h m o r e t h a n 6 , 0 0 0 b i l l s a y e a r a n d r e v i e w p r o p o s e d r u l e s ; that’s huge!

Q Going back to education, what do you foresee the Society’s role being?

a.We ’ r e l o o k i n g a t C P E a s s o m e t h i n g more than a way to get your 120 hours of credit In talking with firms and companies of all sizes, I found that developing their people is a priority. They understand that it

will help their staffs do a better job, and it’s a great retention tool as they build the next generation of leaders

This is really the first time we’ve had a vision statement for education, and that vision statement is to be a preeminent provider of learning and education to accounting and finance professionals We want our members to think of us when they need the right content, on the right platform

We’ve developed a training solution, knowledgehub [www icpas org/knowledgehub/htm], that can really help firms and companies build the skills and competencies their staff needs to succeed. OnDemand learning will be a major part of our strategy going forward, although live will always be important OnDemand learning allows you to learn what you need to know when you need to know it I’ll give you an example I spoke to a member recently who was going in to perform a bank-related job He wanted a quick brush up, so he used our platform to find a one-hour class on credit He got the brush up he needed, just when he needed it.

Q.You were key in launching the Society’s Center for Corporate Financial Leadership (CCFL) back in 2000 How do you plan to make the Society evermore relevant to corporate members?

a CCFL continues to be the home for our industry and business members We have a very diverse membership We have almost the same number of corporate members as we do public accounting members, so it’s important that we’re seen as more than a society that focuses on public accounting.

It’s a tough nut to crack, but we’ve been successful with our initiatives so far, and we’re working to do even more Knowledgehub is a good example it was born out of talking with people in their businesses. While they don’t need CPE, they do

need and want to develop their staffs We also launched the Inside Finance eNewsletter, which has become our most successful ePublication to date, and we’re thinking of bringing back our networking breakfast series We have to find ways to get people to talk to and connect with one another

Q.Wha t ’ s t he m os t ins p ir ing exp er ience you ’ ve had as a leader?

a.I’ve always believed in the power of teamwork When I was coaching my daughter’s 8th grade soccer team, I saw a true synergistic team. They truly exceeded my expectations and their own expectations I can’t tell you exactly what made it work We weren’t a great team on the surface; we didn’t have the talent of other teams, or the experience, but we started winning games. If I had to guess, I’d say one of the keys was that I never yelled negative things at them I gave suggestions, and I tried to make it fun I remember calling out, “My mom runs faster than you do!” to one of the girls. It made them laugh. It has to be fun. Being motivational, giving strategic direction and putting people where they need to be that’s what’s key We ended up with a team of players who could virtually read each other’s minds; they were so in synch. It’s always been about teams for me.

Q .Yo u ’ v e m a d e i t t o t h e t o p . W h a t would you say to young professionals who want to do the same?

a.I’m a big sports analogy guy It was Wayne Gretzky who said, “You miss 100 percent of the shots you never take.” I absolutely believe that; you have no chance of success if you don’t take the shot My son is becoming a CPA because his father told him, “This profession will open doors to you.” He’s setting his sights high and isn’t afraid to take the shot.

E WITH BE 100% SURE WITH IDEA Ever left an audit wondering what you may have missed? IDEA® is a high-performance data analytics tool designed to increase the efficiency and effectiveness of every audit. • Import data from virtually any source • Analyze every transaction to search for fraud or errors • Share your results in a variety of formats Contact us for a live demonstration. 888.641.2800 • sales@audimation.com • audimation.com

TAX DECODED S e l l e r s B e w a r e !

A quirk in the Whistleblower Act could throw Internet sellers for a loop

By Keith Staats, JD

Your client is an Internet and mail order seller who files tax returns and pays sales t a x e s t o t h e I l l i n o i s D e p a r t m e n t o f R e venue The Department hasn’t ever audited y o u r c l i e n t , s o e v e r y t h i n g i s f i n e , r i g h t ? Maybe not.

One day, you get a panicked call from your client, explaining that he’s just been served with a lawsuit filed by a private law f i r m H e f r a n t i c a l l y e x p l a i n s t h a t i t h a s something to do with sales taxes But how can that be? Isn’t tax information confidential? Aren’t sales taxes administered by the Illinois Department of Revenue?

Keith is a senior manager of Grant Thornton’s State & Local Tax practice, based in Chicago Previously, he held the position of general counsel of the Illinois Department of Revenue, where he developed tax policy, evaluated and reviewed tax-related legislation, and oversaw tax-related litigation

* keith staats@us gt com

The answer is not so clear Thanks to a quirk in the Illinois False Claims Act (aka t h e “ W h i s t l e b l o w e r A c t ” ) , p r i v a t e p a r t i e s have the legal authority to file suit against a c o m p a n y, c h a l l e n g i n g h o w i t a c c o u n t s for sales taxes To put it simply, private part i e s c a n s u e a p e r s o n o r c o m p a n y f o r allegedly failing to collect and pay all sales and use taxes due on a transaction

T h e I l l i n o i s R e t a i l e r s ’ O c c u p a t i o n Ta x (commonly referred to as the “sales tax”) and the complementary Illinois Use Tax Act are imposed on the selling price of tangible

put

property As a rule, services aren’t subject to Illinois sales and use taxes if a customer b u y s a t a x a b l e i t e m o f t a n g i b l e p e r s o n a l p r o p e r t y, s e p a r a t e l y n e g o t i a t e s w i t h t h e seller for the shipment of that property, and the shipping charge is separately stated on the customer’s invoice, the shipping charge i s n o t s u b j e c t t o I l l i n o i s s a l e s t a x . T h a t s e e m s s i m p l e e n o u g h , b u t a s w i t h j u s t a b o u t e v e r y t h i n g a s s o c i a t e d w i t h I l l i n o i s sales taxes, it gets more complicated

Let’s examine an online sales transaction

A customer goes to a website to buy a new pair of running shoes. The customer finds the shoes she wants, adds them to her cart, a n d p r o c e e d s t o c h e c k o u t H o w e v e r, a t c h e c k o u t , s h e ’ s g i v e n d i f f e r e n t s h i p p i n g options ground, air, overnight, etc and, because the Internet seller doesn’t have a store in her area, or even if the company has a store but doesn’t give her the option to pick up her purchase, her only option is to a g re e to a s hipping me thod to fina liz e h e r p u rc h a s e I n t h i s c a s e , t h e I l l i n o i s Department of Revenue, as upheld by the Illinois Supreme Court, has ruled that the s h i p p i n g c h a rg e i s n o t s e p a r a t e l y n e g o t i -

c o m p a n y f o r a l l e g e d l y f a i l i n g t o c o l l e c t a n d p a y a l l

personal property at retail Exactly what is included in the selling price of an item subject to tax has been the topic of audits and l i t i g a t i o n s i n c e t h e R e t a i l e r s ’ O c c u p a t i o n Tax in the 1930s The taxation of shipping c h a rg e s a s s o c i a t e d w i t h a p u rc h a s e h a s b e e n a n e v e r- e n d i n g s o u rc e o f d i s p u t e between taxpayers and the Illinois Department of Revenue.

In very general terms, shipping is a servi c e , a n d n o t a s a l e o f t a n g i b l e p e r s o n a l

ated, the shipping charge is part of the selli n g p r i c e o f t h e s h o e s , a n d t h e s h i p p i n g charge is subject to sales tax even though the customer’s invoice may list the shipping charge separately.

Many retailers get it wrong; they assume that shipping charges aren’t subject to tax b e c a u s e t h e y ’ r e s t a t e d o n a s e p a r a t e l i n e from the selling price But stating the charge separately isn’t enough the shipping has to be optional. If shipping is a required compo-

10 INSIGHT icpas org/insight htm

“To

it simply, private parties can sue a person or

sales and use taxes due on a transaction.”

n e n t o f t h e s a l e , i t ’ s n o t c o n t r a c t e d f o r s e p arately, and therefore is subject to tax.

So, back to the lawsuit. The whistleblower figured out that many retailers got it wrong and has filed hundreds of lawsuits knowing that they may be entitled to a portion of the proceeds recovered, along with expenses and attorneys’ fees. Section 3 of the Illinois Act provides that the defendant may be liable to the state for a civil penalty of not less than $5,500 and not more than $11,000, plus three times the amount of damages the state sustains (in the case of sales and use taxes, that would include the amount of the unpaid taxes) How’s that for an incentive?

Legislation was proposed during the spring s e s s i o n t h a t w o u l d m o d i f y t h e I l l i n o i s F a l s e Claims Act to limit the ability of private parties to file suits related to certain tax acts administered by the Illinois Department of Revenue As of this writing, though, the legislation has not moved forward

Wi t h n o t h i n g s t a n d i n g i n t h e w a y o f m o r e cases like this, practitioners with clients making I n t e r n e t s a l e s a n d t r a d i t i o n a l m a i l o r d e r a n d telephone sales need to review their current tax policies and ensure their accounting is correct Otherwise, you could be on the receiving end of the next unhappy, sued client call.

Day of Service

A Good Day for Doing Good

Be part of the Illinois CPA Society’s fourth annual CPA Day of Service. It’s as easy as 1-2-3: Choose a community organization or charity to help.

Register your volunteer activity plans at www.icpas.org/CPADayofService.htm.

Receive a free CPA Day of Service t-shirt (while supplies last, free to Illinois CPA Society members). Volunteer as an individual, or get a group together and volunteer as a team.

Questions? Please contact Taylor Banister at banistert@icpas.org or 800.993.0407, ext. 231.

Helping Tax Professionals Provide Independent Fee-based Financial Advice.

If you are considering adding financial services to your practice, or are looking to leverage your back office to spend more time serving clients, consider an affiliation with Forum. We are a team of highly credentialed professionals with experience helping accountants build profitable financial services businesses. Why build costly infrastructure? Leverage your business by outsourcing your non-client facing activities.

For additional information, please contact Marcus K. Heinrich, CFP® at 630.873.8510 or mheinrich@forumfin.com

Lake Forest, Illinois | Midlothian, Virginia

icpas org/insight htm | SUMMER 2013 11

Home Office: 1900 S. Highland Ave. | Suite 100 | Lombard, IL 60148 Phone: 630.873.8520 Web: www.forumfin.com Offices: Skokie, Illinois |

CPAs for the Public Interest (CPAsPI), the community service arm of the Illinois CPA Society, links the expertise of CPAs and finance professionals with Illinois not-for-profit organizations and community needs.

CAPITOL REPORT Illinois Triumphs

The new 98th General Assembly passes a slew of ICPAS legislation

By Marty Green, Esq

Despite several false starts during the Veto and Lame Duck Sessions, the new 98th General Assembly finally took on many of the significant issues confronting our state that the previous General Assemblies simply weren’t able to tackle Topics like concealed carry, fracking, gaming expansion, same-sex marriage and comprehensive public pension reform dominated the Spring Legislative Session agenda And, with over 6,000 bills introduced this spring, many other mainstream topics also garnered attention, like medical marijuana, school mandates, proposed tax credits, workers compensation reform and sealing criminal records for certain offenses.

of CPAs in Illinois. More information on the new Act can be found at www icpas org

The ICPAS also was successful in defeati n g a g e n c y r u l e s p r o p o s e d b y t h e I l l i n o i s Department of Revenue (IDOR) to include d e l i v e r y a n d t r a n s p o r t a t i o n c o s t s i n s a l e s tax We joined a coalition of other groups w o r k i n g i n o p p o s i t i o n b e f o r e t h e J o i n t C o m m i t t e e o n A d m i n i s t r a t i v e R u l e s T h e legislative panel ultimately opposed adopt i o n T h e I D O R w i t h d r e w t h e p r o p o s e d rules and agreed to work with stakeholders before proposing any new rules ones

Marty is the ICPAS VP of Government Relations, a practicing lawyer and member of the Illinois Bar and a Lieutenant Colonel in the National Guard

He previously served as executive assistant attorney general for Illinois Attorneys General Lisa Madigan and Jim Ryan, and as director of the Governor’s Office of Citizens Assistance and assistant to the Governor for Public Affairs, both under Governor James Edgar

* greenm@icpas org

@icpasgovt

Even with this packed legislative agenda, the Illinois CPA Society was successful in passing legislation to update the Illinois Public Accounting Act (HB 2726) with a new sunset date of January 1, 2024 A similar attempt was made during the last legislative session well in advance of the Act’s scheduled sunsetting date; however, our proposal, despite no opposition, was not considered before legislative adjournment

By design, professional acts such as the Public Accounting Act sunset every 10 years to force legislative reviews and updates The passage of HB 2726 was the result of a three-year effort by the ICPAS working closely with the Illinois Department of Financial and Professional Regulation in a three-phase process transitioning Illinois to a license-only state. This was our top legislative priority, and although uncontroversial, the ICPAS Government Relations staff used great care in tactically maneuvering the bill through the legislative process

The legislation now moves to the Governor for final action and we anticipate that it will be signed into law with an immediate effective date The Illinois Public Accounting Act dating back to 1904 serves as the centerpiece of the regulation and licensure

Similarly, we closely watched the reintroduction of the Corporate Tax Disclosure Act (HB 3627), which would have required p u b l i c l y t r a d e d c o r p o r a t i o n s t o d i s c l o s e confidential tax information This information would have been posted on a public website within three years A similar measure was introduced during the Lame Duck Session and passed out of the Senate with e x t r a o r d i n a r y p a r l i a m e n t a r y m a n e u v e r s B u t t h e H o u s e f a i l e d t o c a l l t h e m e a s u r e prior to adjournment sine die

Our advocacy efforts also extended to Capitol Hill this spring Working with the AICPA, the ICPAS reached out to members of the Illinois Congressional Delegation in support of Mobile Workforce State Income Tax Simplification Legislation (H R 1129) and the Tax Reform Due Date Simplification Act (H R 901 & S 420) During the Spring Council, Council members met with the staff of Congressman Aaron Shock, who serves on the House Ways and Means Committee, Congressman Bill Foster, who serves on the House Financial Service Committee, and Senator Richard Durbin, who is the Senate’s third-highest ranking majority member These “Hill visits” are an important opportunity to bring the profession’s credibility and expertise before members of Congress

It was a busy spring legislative session, and I’ll be sharing updates in Capitol Dispatch, at chapter legislative events and during Town Hall Forums

12 INSIGHT icpas org/insight htm

FORENSICS INSIDER

Travel to exotic locations might be just the clue you ’ re after in the hunt for telltale offshore accounts

By Brad Sargent, CPA/CFF, CFE , CFS, Cr FA , FABFA

As a frequent guest lecturer on campuses around Illinois and the Midwest, I am easily brought back to those halcyon days of attending classes and “discovering” accounting Something about the simple beauty of debits equaling credits, and assets equaling liabilities plus equity resonated within me, and I realized that I had found my academic and professional career niche When an early accounting professor recommended I contemplate a major in accounting because “you get this and most business students don’t,” the deal was sealed

leagues, employers and the general public to take note of red flags when they surface a n d t a k e a p p r o p r i a t e a c t i o n T h e r e a r e numerous areas of fraud that occur around accountants on a daily basis, but one in part i c u l a r h i t s m y r a d a r w i t h i n c r e a s i n g f r equency; the movement of assets offshore in anticipation of fraud or a judgment

Brad is the managing member of The Sargent Consulting Group, LLC, which specializes in forensic accounting and financial investigation He is a frequent lecturer and chair emeritus of the American Board of Forensic Accounting A member of the Illinois CPA Society since 2002, Brad also serves on the Society’s Board of Directors

* bsargent@scgforensics com

Today, when I speak to students about fraud and forensics, I feel the affinity of kindred spirits I feel the same affinity whenever I speak to professional groups. While I derive the greatest pleasure from pointing out landmines to my fellow accountants, I always tell both accounting students and seasoned accounting professionals the same thing: Without you, I’m out of work!

M

s l i d i n g d o w n t h e e t h i c a l c l i f f , i g n o r i n g obvious red flags, failing to follow up on critical questions, lacking the fortitude to confront a client or colleague and simply being incompetent at their job, there would be little to no need for forensic accounta n t s . I n a p a y - i t - f o r w a r d ( a n d t o n g u e - i ncheek) marketing strategy, I urge them all to go forth and be less than mediocre

Prior to the economic downturn, parties w e r e w i l l i n g t o l i t i g a t e ( o r t h r e a t e n l i t i g ation) on a wide variety of disputed matters. A s l o n g a s e a r n i n g s w e r e h i g h a n d c a s h flowed, court filings ran at all-time highs. To d a y ’ s e n v i r o n m e n t i s c o m p l e t e l y d i f f e rent Parties heavily weigh the odds of victory and also consider their ability to collect s h o u l d t h e y g e t a f a v o r a b l e j u d g m e n t Assets and income that appear on financial statements today can be quickly converted to offshore accounts and taken away from the purview of creditors Sadly, some outs t a n d i n g f o r e n s i c a c c o u n t i n g m i g h t w e l l identify wrong-doing and get a favorable litigation outcome, but it might fail to identify whether assets are collectable

S o , w h a t s h o u l d a n a c c o u n t a n t , i n a n y role, look for as a warning sign that assets are headed offshore? The first seems obvious in hindsight but is rarely noticed in foresight: The geographical movements of individuals with access to and control over the assets Travel outside the normal course of

“Ther e a r e num er ous a r ea s of f r a ud t ha t occur a r ound accountants on a daily basis, but one in

So, as much as I may strive to expand the population of potential fraudsters or fraud facilitators, I want to take advantage of this o p p o r t u n i t y t o h e l p y o u f o c u s o n l a n dm i n e s W h e t h e r a n a c c o u n t a n t i n p u b l i c p r a c t i c e , c o n s u l t i n g o r i n i n d u s t r y, y o u have a fiduciary duty to your clients, col-

business is a clear indicator. Do you review expense reports as a part of your job? Credit card statements contain all sorts of information indicating someone’s travel history Airfare purchases and point-of-purchase information provide direct links to an offshore route

14 INSIGHT icpas org/insight htm

F

o

r a u d

n t h e F l y

i c

l

w i t h o u t a c c o u n t a n t s

o r e s p e c i f

a

l y,

particular hits my radar with increasing frequency; the movement of assets offshore ”

However, fraudsters are rarely so obvious. A more subtle sign may be travel to a “jumping off point ” By this I mean a city with direct access to international destinations For example, consider a Midwestbased executive who starts traveling regularly to Miami for no obvious business purpose or personal reason Miami provides direct access by air and by sea to many Caribbean locations frequently used to stash assets offshore A minor purchase such as a cup of coffee from a location of note can be the clue that puts the forensic accountant hot on the trail of offshore assets Again, fraudsters try their best to cover their tracks and may not leave written clues behind. They will imbed a nefarious purpose in what appears, on the surface, to be a great vacation to the Caribbean or Central America Listening to a casual conversation about travel plans and trip details in the break room can lead to the money trail

E u g e n e B e c k e r i s p r i n c i p a l o f B e c k e r Law, a boutique special counsel law firm based in New York, concentrating on mult i j u r i s d i c t i o n a l a s s e t a n d f r a u d r e c o v e r y. B e c k e r s t a t e s t h a t , " d e a l i n g w i t h f o r e i g n m a t t e r s r e q u i r e s a l e a p f o r m a n y A m e r icans, including those who are used to traveling overseas Where a person who is in a position of trust demonstrates an interest i n f o r e i g n i n v e s t m e n t s a n d s h o w s a n extraordinary grasp of such, this fact while it is not reflective of wrongdoing is a factor t h a t b e a r s a t l e a s t c u r s o r y m o n i t o r i n g o f that person's work, his/her work habits and u t t e r a n c e s T h a t p e r s o n m a y h a v e m a d e the 'leap' and underpinning it may be nascent or advanced wrongdoing."

T h e a p p e a r a n c e o f n e w a s s e t s i n t h e form of bank or brokerage accounts is yet a n o t h e r f a i r l y o b v i o u s s i g n S a d l y, t r u e fraudsters are rarely so transparent However, you may review existing bank or brokerage statements that indicate transfers to previously unknown accounts These aren’t the only source of information regarding u n k n o w n a c c o u n t s ; s o u rc e d o c u m e n t s b e h i n d t h e s t a t e m e n t s c a n a l s o p r o v i d e c r i t i c a l i n f o r m a t i o n R e v i e w i n g e n d o r s ement stamps on the backs of checks is an e x c e l l e n t w a y t o i d e n t i f y e i t h e r o f f s h o r e accounts themselves, or accounts that lead to offshore accounts Forensic accountants d e v o t e h o u r s t o r e v i e w i n g r e c o r d s f r o m financial institutions Note that I’m not sug-

gesting you launch into full-fledged forensic accounting procedures; rather, I’m just reminding you to keep your eyes open and e a r s t o t h e g r o u n d f o r i n f o r m a t i o n t h a t doesn’t add up.

I’ve met with many remorseful fiduciari e s i n t h e c o u r s e o f i n v e s t i g a t i n g h i d d e n a s s e t s I n h i n d s i g h t , t h e y r e c o g n i z e d t h e

w a r n i n g s i g n s t h e y m i s s e d a n d t h e y s i nc e r e l y w i s h e d t h e y ’ d j u s t t a k e n n o t e o f them in real time If only it was that easy Hopefully, you’ll never be in that position. Just remember that “exotic” travel and new a c c o u n t s w i t h o u t a c o m p e l l i n g b u s i n e s s p u r p o s e j u s t m i g h t b e p a r t o f a c r i m i n a l scheme

icpas org/insight htm | SUMMER 2013 15 We don’t deliver dressed up wannabes. Our team delivers real Accounting, Finance and IT Superheros. Accounting & Finance Professional Search www.clearfocusfs.com 312.582.1700 Temporary Accounting & Finance Professionals www.brilliantfs.com 312.582.1800 Specialized Information Technology Professionals www.silverpointts.com 312.582.1910 Accounting & Finance Project Resources/Executives www.numeratepartners.com 312.582.1900 Four specialized companies with the goal of finding you the best talent. Let’s start a conversation today. — Jim Wong, CPA - Founder Are you in need of a real Superhero? e t d ’ on e d W We annabe p w d u resse r d ve live s l A ea s r re verelive m d ea r t Ou rch a Se sional s Profe e nc Fina & ounting c Ac on t a c r ta s s ’ ’s s Let n a p om d c izeliz a i ia c e p r s u Fo nd I e a inanc , F ccounting Pro e nc Fina c y A r mpora Te A - F P , C g n o m W i — J y. ay. od n t atio s r rs ve h u t o g y yo in nd f fi l o a o e g h h t it s w ie uperheros. T S . sionals s fe gountin c r e d n u o nt le a t t s e e b 0 312.582.170 o s.c f us foc r a e l c w w w 0 0 312.582.19 s er n t r a ep t a er m nu w w w cutive xe E / s e sourc Re ro e P nc ina g F ountin c Ac 312.582. a illi r w.b w w m 312.582. p r ve l i s w w w P chnology Te I d cialize Spe m o c s t c je 0 0 18 m co s f t n 1910 om c s t nt oi sionals s rofe mation nfor

Gain a competitive edge with these industry-leading practice management solutions

By Mark J Gilbert, CPA/PFS

There’s more to financial planning than the commercial side of things, providing clients with products and services CPA financial planners need to ensure they have the support services necessary for their own practice success Thankfully, a vast range of vendors is rapidly developing, and clear leaders are emerging among them

Whether you’ve been providing financial planning services for a quarter-century or a calendar quarter, the solutions I’ve highlighted here could be a great boost to your planning efforts.

How you’ll operate these efforts is the most fundamental decision you’ll have to make as a financial planner. To be more specific, will you be a registered investment advisor (RIA) or investment advisor representative, a registered representative of a brokerdealer, or both? (Hint: I discussed some of the pros and cons of each of these options in my summer 2012 INSIGHT column )

Here’s a quick overview

r v e s i n t h e I A / P F P

M e m b e r Fo r u m G r o u p a n d o n t h e Structure & Volunteerism Committee.

* mgilbert@reasonfinancial com

Custodians for RIAs

If you decide to be an RIA or investment advisor representative managing client asse ts , the n s e le c ting a c us todia n brok e ra g e firm to hold your clients’ assets is a business-critical decision

A s I nve s t m e n t N e w s r e p o r t e d b a c k i n July 2012, the custodians RIAs most rely on a r e S c h w a b A d v i s o r S e r v i c e s ( 7 , 0 0 0 R I A clients,) TD Ameritrade Institutional (4,500 c l i e n t s ) a n d F i d e l i t y I n s t i t u t i o n a l We a l t h Services (3,300 clients) Having provided custodial services to independent advisors f o r m o r e t h a n 2 0 y e a r s , S c h w a b ’ s c l e a r strength is its longevity Not only that, but it o f f e r s l a rg e a n d f l e x i b l e p l a t f o r m s f r o m which to do business

Partnering with any well-known brokerage firm, however, adds credibility to a small independent RIA’s profile especially when only just starting out. Be warned, though: The big-name recognition can be a double-

edged sword, since brokerages might solicit business without an advisor’s knowledge. Also, your clients may not understand that advertising, discounts and even branch office operations may apply to the brokerage’s retail customers (since they’re institutional customers of the brokerage firm) rather than to them I know, it gets confusing

Broker-Dealer Options

As a registered representative of a brokerd e a l e r, y o u m a y c h o o s e t o c h a rg e c l i e n t fees and commissions or both, and potentially offer a wider range of investment and insurance products (compared to an RIA or investment advisor representative)

According to Investment News, as of December 31, 2012, the largest broker-dealers as measured by number of registered representatives were LPL Financial LLC (13,336) and Lincoln Financial Network (8,263). Here, LPL Financial stands out by virtue of the fact that it stresses its high payouts on investment and insurance products placed with clients, and offers a low advisor-toemployee ratio that guarantees maximum access to support, cutting-edge software tools and packages, and a broad range of fee-based asset management programs not to mention that it’s also a top RIA custodian

Financial Planning Software

Good financial planning software is invaluable to planners and clients alike Being able to clearly and accurately illustrate a customized financial projection that helps clients understand whether their resources are sufficient to last throughout their lifetimes is key especially when trying to help clients plan for specific retirement ages What’s more, good financial planning software will allow planners to design investment asset allocation, insurance sufficiency, and estate and income tax

16 INSIGHT icpas org/insight htm

Fi n a n c i a l P l a n n i n g m a g a z i n e ’ s a n n u a l s u r v e y o f f i n a n c i a l a d v i s o r s a c r o s s t h e A principal in the financial planning f i r m o f Re a s o n Fi n a n c i a l A d v i s o r s , Inc , Mark’s 25-plus years of finance a n d a c c o u n t i n g e x p e r i e n c e i n c l u d e s 1 3 yea r s in p er s ona l f ina ncia l p la nning An ICPAS member since 1982, M a r k c u r r e n t l y s e

projections

PFP ADVISOR T h e P l a n n e r ’s G u i d e t o P l a n n i n g

United States found that the most widely used financial planning software is MoneyGuidePro (22 percent of respondents).

I n m y e x p e r i e n c e , M o n e y G u i d e P r o i s robust, fairly easy to use and features output that clients can easily understand On a side note, interestingly, 26 percent of the survey respondents said they don’t use any f i n a n c i a l p l a n n i n g s o f t w a r e t h e s i n g l e largest response in this survey

Portfolio Management Software

P o r t f o l i o r e p o r t i n g i s a n o t h e r i m p o r t a n t f u n c t i o n m a n y i n v e s t m e n t a d v i s o r s p r ov ide for the ir c lie nts . Ty pic a lly, portfolio reports show both periodic rates of return for client accounts and individual investment returns Returns, of course, help both advisors and clients assess whether they’re on track to achieve financial goals. Portfolio reporting also makes it much easier to a n a l y z e a n i n v e s t m e n t ’ s p e r f o r m a n c e t o d e t e r m i n e w h e t h e r i t s h o u l d s t a y i n a client’s portfolio

Additionally, when an advisor prepares a quarterly report using portfolio managem e n t s o f t w a r e , t h e c l i e n t c a n v e r i f y t h e advisor’s statement of assets by confirming a c c o u n t b a l a n c e s w i t h t h e c u s t o d i a n ’ s account statements.

In the Financial Planning survey, Morningstar Office was reported as the most widely used portfolio management software (19 percent of respondents) Morningstar has consistently updated features and enhanced functionality over the years The software also integrates with Morningstar’s well-regarded stock and mutual fund research and analysis capabilities to simplify the needs of most financial advisors. Again to my surprise, the single largest survey response regarding portfolio management software use was “None” (25 percent of respondents)

I continue to be amazed and impressed by the number and variety of services and products that have developed to support financial planners and the financial plann i n g i n d u s t r y a n d s o m e t i m e s b y h o w m a n y p l a n n e r s a r e n ’ t u s i n g t h e m N a t urally, as in most business-to-business environments, some providers have risen to the top If you too want to rise to the top, then my advice is to take a serious look at the firms a nd produc ts I’v e me ntione d he re They can give you an edge over your competition both now and into the future

ICPAS knowledgehubTM

A unique, cost-effective approach to the training and development of your team, featuring:

Cut through the clutter

• Multiple content providers in one easy to use platform

More than 1,500 educational offerings

• Search by topic, practice area or job function

Customizable development plans

• Monitor and guide the training of your staff

Comprehensive transcript of completed programs

• Taken both within and outside of knowledgehub

• Store certificates of attendance

Compliance tracking for:

• CPA licensing in all states

• Other credentials such as CMA, CIA, CFE, and CFP, as well as Yellow Book

icpas org/insight htm | SUMMER 2013 17

solution.

Discover a better training and development

All this for just a $25*access fee per person!

optional Compliance module can be added for $20 per person. Programs are purchased on an individual basis. Check us out at the 2013 Midwest Accounting & Finance Showcase August 27-28, 2013 | Rosemont, IL | Booth #1223 For more information: Call Jennifer Schultz, Vice President, Member Services and Professional Development at 312.601.4604. www.icpas.org/knowledgehub.htm

*The

What’s Your Firm Worth?

Digging down to the real value of your CPA practice takes a big, healthy dose of reality

By Sheryl Nance -Nash

There's no shortage of CPA firm M&As these days Whether it’s a matter of survival, offering new practice areas, gaining a foothold in new regions, adding talent, or any number of other factors, firms are pairing up at an impressive rate.

“CPA firm mergers and acquisitions are taking place at a frenetic p a c e , a t a l l s i z e r a n g e s , ” M a rc Rosenberg, CPA with The Rosenberg Associates, confirms “Each year the number of transactions seems to increase from the previo u s y e a r W h e n m a n a g i n g p a r tners talk to each other, it seems t h a t e v e r y f i r m i s t a l k i n g a b o u t mergers.”

Which means the question on e v e r y o n e ’ s l i p s i s , “ W h a t ’ s m y practice really worth?”

What Counts?

S t a n d a r d v a l u e r a n g e s f o r b u s inesses are somewhat segregated b y b u s i n e s s s i z e T h e s t a r t i n g p o i n t i s e a r n i n g s c a p i t a l i z a t i o n For example, if we say that companies with sales of $3-$10 million typically sell for 4-5 5 times r e v e n u e , w e a l s o k n o w t h a t s m a l l e r c o m p a n i e s w i l l h a v e a lower range, say 3-4 5 times revenue, and larger firms ($10-$25 m i l l i o n ) w i l l s e l l f o r a l a rg e r r a n g e , s a y 4 5 - 6 t i m e s r e v e n u e , e x p l a i n s J o h n M a r t i n k a o f M a rtinka Consulting

However, other factors determine where in the r a n g e o r o u t s i d e o f i t a s p e c i f i c c o m p a n y stands Nonfinancial factors such as customers, employees, vendors and competition are huge, says Martinka Two similar companies with the

same revenue may have a different value if one has three customers that account for 73 percent of sales and the other has 73 customers that account for 73 percent of sales Also, he says, supply and demand, terms and motivations play a big part in determining price.

When it comes to CPA firms/practices, three main factors help to determine value:

1. The market. What will the market pay for the firm based on the seller’s major attributes? Imagine the case of a 65 year-old sole practitioner with a $700,000 practice that is profitable, clean, has an attractive client base, good staff that will come along with the deal and a prime location in one of Chicago’s northern suburbs

“I'm an M&A consultant, I could sell this firm in a heartbeat to any of a dozen eager buyers for 1.3-1.5 times the firm's annual revenues because that’s what the market is currently paying for a d e s i r a b l e , p r o f i t a b l e p r a c t i c e o f t h i s s i z e , ” s a y s Rosenberg

2 Negotiating position Much depends on the negotiating ability of the seller and buyer and the urgency of each to complete the deal, says Rosenberg. For example, say a seller who establishes the desired terms refuses to budge from that position and is prepared to walk away from the deal without losing sleep Then the buyer is obviously in a much weaker negotiating position On the other hand, perhaps a buyer with a small firm exhibiting flat profits has the opportunity to buy a small, clean practice the type of practice that doesn’t come on the market very often Then the buyer is in a weaker negotiating position, and may have to pay a premium to beat out rivals

3 . S e l l e r a t t ra c t ive n e s s . S o m e q u a l i t i e s g a r n e r i m m e d i a t e b u y e r a t t e n t i o n . T h e s e i n c l u d e a weighting towards annuity-type clients, accounting and tax return engagements that repeat every year, fees and billing rates close to those of the buyer and a young partner group In fact, more and more of today’s firms seek to merge with or acquire smaller firms with vibrant young partners who are anything but retirement-minded.

18 INSIGHT icpas org/insight htm M&A

Continuing Professional Education: New Pricing to Meet Your Needs

We know how important it is to keep up with a constantly changing business world. That’s why Becker Professional Education provides you with the most current information on today’s critical and challenging business issues. With new pricing options, our Continuing Professional Education (CPE) courses are now more accessible than ever.

Get access to our entire catalog of 190+ OnDemand courses for only $325 per year. Purchase our high quality, interactive Becker CPE courses for only $79 each. Receive additional savings when purchasing multiple CPE courses.

Key topics include Taxation, U.S. GAAP, Audit, Ethics, Government, Fraud and much more.

Visit for more information on our special pricing options.

Becker is proud to sponsor a tax track (Small Business Tax Update) at the Midwest Accounting and Finance Showcase on August 28th.

®

O ers valid until December 31, 2013. *Not valid in all states. ©2013 DeVry/Becker Educational Development Corp. All rights reserved. AC:13-979:01:1M:5/13

Be up to date, up to speed. And, definitely, up to the challenge.

Other attractive qualities include skilled staff that will make the transition, engagements that are mostly business based rather than 1040-only clients, close cultural/personality fit, and seller specialty skills or expertise in an area of planned expansion Specialization is a particular plus. “Most firms pine for specialties because expertise i s e a s i e r t o m a r k e t a n d m o r e p r o f i t a b l e t h a n g e n e r a l i s t w o r k B u y e r s w i l l p a y a premium for specialties,” says Rosenberg

New Issues, Old Game

How the buy-sell landscape has changed remains a major focus of attention.

“ I t ’ s n o l o n g e r s i m p l y h o w m a n y c u stomers you acquire, but actually how many customers you effectively retain It’s also important to realize that the new social currency is relationship capital,” explains Bill Wa l s h , C E O o f P o w e r t r a i n , a b u s i n e s s coaching and venture capital firm.

There’s also less financing out there today, meaning value greatly depends on the buyer's purchasing ability “This may limit the marketability of larger practices,” explains Ken Sterner, a senior valuation consultant with Adams Capital

Then, too, there’s the question of how the business did during the recession “If it was affected in a negative way, you can be pretty sure it will go down again when the next recession hits,” says Martinka.

The recession put risk on the radar with a new intensity. “Partners want a higher rate of return now because of risk Discount rates are higher because of the uncertainty of future revenue projections Given the

competition in the profession, firms can't 100-percent realize their projections so there is 'performance risk,' so you use a higher discount rate to compensate for risks,” explains Robert Reilly, managing director of business valuation firm Willamette Management Associates

Client and employee retention is critical now. “People want a longer retention period; in many deals they want a minimum

o f o n e t o t h r e e y e a r s a f t e r t h e s e l l . F e w deals are done with no retention requirements,” says Joel Sinkin, president of Transition Advisors

Reality Check

Missteps in this process can be costly, so be realistic

“It's easy to believe your own press. You put your own projections together for management purposes so you want them to be aggressive The numbers are really aspirational you hope to get 10-12 percent growth, and if you get 8 percent it's good But when it comes to the valuation process, you have to evaluate the numbers more realistically,” says Reilly

Here are five tips to help to boost your firm/practice value and get a better grip on what it’s actually worth.

1. Get your house in order. One way for the seller to maximize value is to get things organized before courting buyers. “Sloppy practices include offices that look like a pigsty, client projects that are late, WIP and receivables that are way past due, an office lease that has many more years left on it and debt on the books,” says Rosenberg

2. Study up. It's important to have good market data to help you estimate your value Then the issue is knowing how to use the data

3 Dig deep “Understand where revenue is coming from. Is it recurring (e g from audit and tax clients) or non-recurring (e.g. from consulting work or a forensic investigation). Know who's in the practice, who's generating revenues, and whether they’ll stay on If you don't think they will, you may need to incent them to stay,” says Bernard Pump, partner and head of Deloitte's national gift estate and valuation practice in Chicago.

4. Sell yourself. “Put together a black book comprising partner bios, specialty areas, history of the firm, client testimonials, firm metrics,” says Robert Fligel, a CPA and founder of RF Resources. Hire a professional to put this together. “Accountants are better off doing accounting, not sales and marketing,” says Martinka

5 Shop the practice “Don't just go with one buyer. Create competition, get a bidding war going,” says Martinka.

Although predictions are that the merger market will continue at its current frenetic p a c e , “ M o s t o f t h e m o r e a t t r a c t i v e a n d a g g r e s s i v e b u y e r s a r e g e t t i n g p i c k i e r, ” Rosenberg explains.

“Because there are so many firms looki n g t o m e rg e u p , t h e b u y e r s a r e a b l e , t o some extent, to cherry-pick the best availa b l e f i r m s T h e i r s t a n d a r d s f o r w h o t h e y w i l l a c c e p t a s a m e rg e r c a n d i d a t e h a v e i n c r e a s e d i n r e c e n t y e a r s , a n d w i l l c o nt i n u e t o r i s e a s t h e u n i v e r s e o f s e l l e r s increases ”

20 INSIGHT icpas org/insight htm

Be a Better Trusted Business Advisor to Your Clients

Please join us as Paychex and CPA2Biz celebrate a decade of partnership success helping you enhance your value as a trusted business advisor to your clients with best-of-breed solutions, from payroll processing to retirement planning, to HR and beyond.

Paychex recognizes the critical role that accounting professionals play in consulting with business owners. Now, with the Paychex Partner Program from AICPA Trusted Business AdvisorSM Solutions, you can offer programs and services to your clients that solve their business problems, while enhancing your status as a trusted business advisor.

Regardless of your role in payroll, retirement planning and HR, we invite you to learn about outsourcing and the advantages of working with Paychex.

Over 35,000 AICPA members have already enrolled in the Paychex Partner Program. Learn why. Membership in the program is free and without obligation.

Call 1-877-264-2615 or, visit cpa.com/Paychex

Policy to the Rescue

Drafting a social media policy is your greatest line of defense against bad press

By Selena Chavis

In the age of social media, not all publicity is good publicity Consider the nightmare Applebee’s faced earlier this year when it fired a waitress for posting a customer’s critical receipt on R e d d i t T h e c o m p a n y ’ s F a c e b o o k p a g e w a s assaulted by angry comments from people who sympathized with the waitress even after the company posted its internal policy regarding social media activity.

S o c i a l m e d i a i s e n t r e n c h e d i n t o d a y ’ s c u lture , a nd c ompa nie s ha v e to be proa c tiv e in leveraging it as a tool, while protecting their brand and customers

“Whether you’re a product- or service-based company, consumers have high expectations of y o u r p r e s e n c e o n s o c i a l m e d i a , ” s a y s L i z B a r t e k , s e n i o r I n t e r n e t m a r k e t i n g c o n s u l t a n t , social media with Chicago-based Rise Interactive. “A company always needs to be aware of what’s being communicated by its brand.”

That’s a complicated task for most companies, and it requires a well thought-out social media

policy, as well as internal processes for responding to firestorms such as the one Applebee’s faced While the existence of a social media policy didn’t keep the Applebee’s waitress in question from making a decision that ultimately resulted in her firing, industry experts agree that having written guidelines and processes in place better equips a company to avert disaster and respond swiftly and appropriately when unwelcome publicity surfaces.

“It’s important that companies have a policy because everyone needs to be on the same page,” says Genia Stevens, a social media trainer and marketing strategist. “There are a lot of companies that don’t establish a social media policy until after a disaster happens.”

Kris Cifolelli, director of employee relations with Plante Moran, says that embracing social media and proactively staying at the forefront of the movement has been a positive strategy for the firm “As social media was becoming all the rage, we sat down to consider what would be

22 INSIGHT icpas org/insight htm SOCIAL MEDIA

appropriate use,” she explains, pointing out that the firm’s policy continues to evolve with the social media movement “We meet on an annual basis to review and revise It’s a constant education process.”

One successful strategy has been for the firm to post positive or informational messages to a company-branded social media s i t e , a n d t h e n w a t c h a s e m p l o y e e s a n d c u s t o m e r s r e p o s t t h e m , c i rc u l a t i n g t h e material with little effort The danger, however, is not having the guidelines in place to educate employees on what should and shouldn’t be posted.

“We want to make sure that there aren’t 2,000 interpretations of an IRS regulation being posted by employees, for example,” e x p l a i n s J e f f A n t a y a , p a r t n e r a n d c h i e f m a r k e t i n g o f f i c e r w i t h P l a n t e M o r a n “Sometimes companies can get into problems by not being at the forefront of social media use in business. If employees start using social media first, that’s where you can run into problems ”

W h i l e e v e r y c o m p a n y ’ s s o c i a l m e d i a policy should reflect its unique needs and c u l t u r e , s o c i a l m e d i a a f i c i o n a d o s o f f e r these six basic elements with which to lay your policy groundwork.

1.Choose Your Gatekeepers

The first step is to name the key players involved in decision-making. Depending on the company, this could be a single social media manager who reports to owners or officers, or it could be a team For smaller firms in particular it’s a good idea to narrow the social media management team to a few key people “Specifically identify who is allowed to speak for the company on social media sites,” Stevens advises.

2. Set Clear Guidelines

To be in synch with company expectations, employees have to understand what constitutes appropriate use of social media. According to Cifolelli, Plante Moran’s policy includes an overall statement on the firm’s social media stance, as well as detailed descriptions of appropriate use, discouraged activity and specific activity that is off limits

“We applied the same rules about behavior in the office,” Cifolelli adds “It’s critical to distinguish between when employees are representing the firm and when they are not Social media really blurs the line between personal life and work life Things people wouldn’t have known before now bleed into the workplace ”

On a hiring note, the company discourages its managers from using social media as a means to research potential new hires “From an employment law perspective, I would not encourage it,” Cifolelli asserts “There is no way to know how much stuff on the Internet is true. We never want peop

affected our choice.”

3. Be Transparent

she explains, adding that being transparent doesn’t mean loss

control over confidential

icpas org/insight htm | SUMMER 2013 23

e t o l e a v e t h i n k i n g t h a t s o c i a l m e d i a

l

F i r s t a n d f o r e m o s t , s a y s B a r t e k , t r a n sparency should be a constant goal “Em-

and customers can become great b r a n d a d v o c a t e s a n d h e l p t o p u s h t h e c o m p a n y ’ s b e s t a s s e t s t h r o u g h a l l t h e available channels,”

of

Illinois

Wanda

wbrooks@warehousedirect.com Illinois CPA

Service Representative Stacy Goldman (708)

We are your Workplace Solutions! Order by 7:00 p.m. for Free Next-Day Delivery www.warehousedirect.com Call To Open An Illinois CPA Society Member Advantage Sale Society CPA Illinois Brooks Wanda wbrooks@warehouse Represent Service C CPA Illinois Manager s 969-5355 com direct ative ustomer our e y r e a W ww.www p. 7:00 Order Illin An pen o O T Call Goldman Stacy e S Workplac luti omedirect.cwarehous ext-Day e N re r F fo m. Member CPA ois 631-7135 ons Advantage

ployees

information

CPA Society Sales Manager

Brooks (708) 969-5355

Society Customer

631-7135

4. Educate Everyone Often

Education should be ongoing and at the forefront of company human resource activities

Tr a i n i n g s h o u l d b e g i n a t o r i e n t a t i o n a n d include regular refreshers.

“It’s not a good idea to create a social media policy and shoot it out by email,” says Stevens “At a minimum there should be a signed copy of the policy in every employee file ”

5. Prepare For Crisis

Whether a small mishap or full-blown public relations disaster, companies need to be prepared to respond when something goes wrong Bartek points to the recent Tesco social media blunder The first major retailer to be linked to the recent horsemeat scandal, the company tweeted, “It’s sleepy time, so we’re off to hit the hay! See you at 8 a.m. for more” on its Twitter page soon after the scandal broke. Perceived as a joke and widely criticized by the general public, the company later apologized, adding that the tweet had been scheduled before the company knew about the situation

“Clearly, there wasn’t a strong social media p o l i c y i n t h i s s i t u a t i o n , ” s a y s B a r t e k “ I t ’ s e s s e n t i a l t o h a v e c o n s t a n t c o m m u n i c a t i o n b e t w e e n c o m p a n i e s ’ s o c i a l m e d i a a n d P R t e a m s i n o r d e r t o p r e v e n t s o c i a l m e d i a s l i pups Having a well-coordinated social media action plan establishes consistency with internal communications ”

6 Maximize Opportunities

“Part of our brand is that we are ‘nice people,’” says Antaya. “Social media enforces this brand by allowing us to connect with people on an emotional level Being human is part of that brand ”

Following the merger of Blackman Kallick and Plante Moran, the newly formed company c r e a t e d a l o t o f e x c i t e m e n t i n t e r n a l l y a n d externally through its social media presence by launching the Chicago Community Champions contest online. Designed to showcase the company’s continued commitment to the local community, three rounds of voting were held for 91 nonprofit organizations

T h e w i n n e r G r e a t B o o k s F o u n d a t i o n received a $25,000 check The campaign produced more than 840,000 votes and plenty of exposure and goodwill for the new company

It’s a new day for communication both in t h e b u s i n e s s w o r l d a n d p e r s o n a l l y. “ S o c i a l media is just the next generation of communication tools,” says Cifolelli, adding that successful businesses have to stay on top of the e v o l u t i o n a n d b e r e a d y t o e m b r a c e c h a n g e After all, “Who knows what will come next ”

24 INSIGHT icpas org/insight htm

us for a complimentary breakfast or lunch program. Bill

talking with you to better understand your needs and challenges. We’ll also touch base on a variety of subjects including: This is a great opportunity to connect with YOUR Society… and each other. We hope you will join us! Peoria October 1, 2013 Bloomington-Normal October 2, 2013 Rockford October 7, 2013 Champaign-Urbana Novermber 18, 2013 Springfield November 19, 2013 To REGISTER for a program in your area, call 800.993.0393 FOR ALL PROGRAMS: or visit www.icpas.org CPE: 1 Credit Hour Cost: Free Professional Standards and Issues Regulatory Environment Business Climate

Join

Graf, Chair of the ICPAS Board of Directors, along with Todd Shapiro, ICPAS President and CEO, look forward to

800-404-7439 | | www.CPEasy.com/ICPA Everything You Expect From America’s Best Selling CPE Provider Stop wasting time and money with multiple CPE sources –your search for convenience and value is over. With hundreds of available credits and an unmatched selection of CPE courses in all formats for all states, CPEasy is the one-stop shop for all your needs. Formats include live, online, textbooks and DVD ©2013 Bisk Education, Inc. All rights reserved. SC: 195650zbt1 I MCID: 23588 All State Requirements. Unlimited CPE. One Stop. FOR ONLINE, GROUP STUDY & LIVE • 100% satisfaction guaranteed • Instant access, instant grading and instant certificates – with online format • Complete your live CPE credit requirement: with over 80 live credits per year in tax, accounting & auditing and more Try a FREE COURSE Online!

What’s to Become of Gen X?

With Baby Boomers hanging on to their executive posts and Millennials rising up to grab the brass ring, where does Gen X fit into the leadership game?

By Renee Beckman, CPA

By Renee Beckman, CPA

D“ecade of the Child” is a much-touted phrase when it comes to describing Millennials And, truthfully, I’ve found them to be both the most challenging and rewarding group of people to lead

But, if Millennials are our future, where do we Gen Xers fit in?

We were born somewhere between 1961 and 1981 and came of age in the 1970s and 1980s when growing up fast was the thing to do. After the publication of Douglas Coupland’s book, Generation X: Tales for an Accelerated Culture, the media picked up the term Generation X and introduced us as body-pierced, Starbucks-drinking, flannel-wearing, alienated, over-educated, underachieving slackers who didn’t want to work. We were the children of parents with the highest divorce rate in history, and well-versed in households with working moms. The media criticized us for failing to measure up to “adult” expectations, calling us a “nowhere generation.”