E x p l o r i n g t h e i s s u e s t h a t s h a p e t o d a y ’ s f i n a n c i a l w o r l d g i c p a s o r g / i n s i g h t h t m W I N T E R 2 0 1 2 THE MAGAZINE OF THE Read INSIGHT and earn up to 10 hours of CPE credit. Visit www.icpas.org for details. BE A WINNER generation blending n legacy building n green tech’s bottom line

Datatrac, America’s largest interest rate database,recently awarded Alliant Credit Union the Great Rate Award for our Platinum VISA credit card for the 12 month period ending December 31, 2011. This symbol of distinction certifies that in 2011 Alliant outperformed the national average credit card rates by 9.32%.

1 Cash Back option is provided as an account credit to your Platinum Rewards VISA credit card account. 2 Introductory rate as low as 0% APR is applicable to purchase balances and balance transfers in and during the first 12 billing cycles after your account is open. After the twelfth billing cycle, your rate will adjust to your standard variable rate, which may adjust quarterly based on the Prime Rate. The standard variable APR on purchases and balance transfers may increase or decrease quarterly. The rate will be determined by adding the highest U.S. Prime Rate published in The Wall Street Journal during the last business day of the previous calendar quarter plus a margin of 5.99% to 17.99% for Platinum or 7.99% to 19.99% for Platinum Rewards, and 14.99% to 19.99% on cash advances for Platinum and Platinum Rewards. The U.S. Prime Rate as of September 28, 2012, was 3.25%. Loan approval and standard variable APR are determined based on your ability to repay and creditworthiness. Refer to the Alliant VISA® Credit Card Agreement at www.alliantcreditunion.org/visa/ for details. APR = Annual Percentage Rate. Loan approval and Annual Percentage Rate (APR) based on creditworthiness and ability to repay. You must be or become a member of Alliant Credit Union to apply. Applicant must meet eligibility requirements for Alliant Credit Union membership. Visit www.alliantcreditunion.org for details. We may not extend credit to you if you do not meet Alliant criteria. 3 The Datatrac Great Rate Award certifies that the rate offered by Alliant Credit Union’s Platinum VISA credit card consistently outperformed the market of all institutions monitored by Datatrac for the 12-month period of January 1, 2011 – December 31, 2011. For more information, please visit www.greatrateaward.com. Illinois

members… Get

Alliant Platinum Rewards VISA®…

a

Back1 option ©2012 Alliant Credit Union. All Rights Reserved. SEG638-R12/12 It’s easy to apply2 • Online at www.alliantcreditunion.org/ilcpa • Call 800-328-1935 (24/7) You know how important managing your money is. Finding the right credit card is important, too. Get Alliant Credit Union’s Platinum Rewards VISA credit card and you’ll enjoy…

introductory rate as low as 0%

and balance

for 12 months2

annual fee

transfer

CPA Society

the

now with

Cash

•an

APR on purchases

transfers

•no

•no balance

fee •first-rate Alliant Rewards points program redeemable for Cash Back1, travel, brandname merchandise and more Great Rate Award3

index WINTER 2012 | www.icpas.org/insight.htm 34 Gen B: The Blended Generation Today’s accounting firms are mobilizing multi-generational workforces to boost productivity and meet client needs 38 Paperless Super Savings Bolster your firm’s bottom line by opting for cost- saving, productivity-boosting green technologies 42 Build a Business Legacy Creating a firm with staying power and an impactful brand is harder than it used to be. 18 Young Professionals Score With the Big Four Five ways to make yourself the Big Four’s next All- Star recruit 22 Liability Can You Keep a Secret? What privileges and protections apply to Illinois CPAs and their clients? 24 Auditing Audit Hike A multitude of factors have conspired to increase audit fee volatility 26 Career Top Jobs for CPAs The accounting field is bursting with opportunities Here’s where to look for them 30 M&A The Buy/Sell Guide 10 helpful steps for navigating accounting practice M&As 4 First Word 6 Seen & Heard 10 Tax Decoded Tribunal Power 2013 heralds a new way of doing things for anyone challenging IDOR audit findings 12 Capitol Report We Want You! The Military Tax Assistance Program celebrates a decade of serving those who serve our country 14 Forensics Insider Think Before You Give In Ronald Reagan’s famous words, “trust but verify” before giving charitably. 16 PFP Advisor PFP How To The ins and outs of adding personal financial planning to your practice 48 Hype.It Must-read-must-know news for young accounting pros columns departments cover stories 2 INSIGHT icpas org/insight htm

Whether

you are looking to elevate your business or take the next step up in your career, Jackson Wabash and Garelli Wong can help.

As Chicagoland’s experts in financial recruiting and staffing, we use our intimate understanding of the local job market, salary trends and business climate to connect great talent to great companies across the local area every day.

Chicago Schaumburg Oakbrook Terrace 312.583.9264 847.397.9700 630.792.1660 WWW.GARELLIWONG.COM WWW.JACKSONWABASH.COM

To learn more, visit us online or call your local office. Reach new heights in the Windy City.

FIRST WORD

A Resolution to Keep

The elections are behind us, the holidays are over and our New Year’s resolutions….well, let’s just say my treadmill soldiers on as a clothes rack, and my Swiss ball is as deflated as my hopes and dreams of getting in shape this year

B u t a s I s i t h e r e c o n t e m p l a t i n g t h e p a c k e t

M&Ms on my desk, I’m struck by a thought. Not all N

d particularly those that strive to make our careers more productive, rewarding and successful

2013 is poised to be a dynamic year, and CPAs are going to be busy. There’s never been a greater need from businesses and consumers for help with fiscal issues. Today’s economy has created even greater complexity in our jobs. As CPAs you need to understand these complexities and be able to make some semblance of order of them for your clients and companies Easier said than done, right?

In an era where every minute and every dollar counts, the Illinois CPA Society is providing you with efficient and flexible solutions to navigate our uncertain financial waters. One example is knowledgehub, our new web-based learning management system which puts content from multiple CPE providers in one easy-to-search place Designed for firms, companies and individuals alike, knowledgehub allows you to tailor development plans for your staff, and ensure they’re receiving training in the topics t h a t a r e m o s t c r i t i c a l t o y o u r o rg a n i z a t i o n A l s o , o u r n e w C P E o n D e m a n d [www.icpas.org/ondemand] provides you with 24/7 access to quality, affordable CPE. What’s more, we all know that learning isn’t delivered solely in traditional classroom and online settings. Thanks in part to the Society’s advocacy efforts, the Illinois Department of Financial and Professional Regulation has expanded what it recognizes as CPE credit Beginning in this reporting period, you are now able to earn credit for a wider range of education, as well as for activities you’re already doing, such as research and reading professional publications (you’ll find more information on page 6 of this issue).

The overarching goal is to keep you up-to-date and competitive and our resolution for the year is the same as it has always been: To advocate for and support the careers of each and every one of our members, whether in public practice, industry & business, government, education, not-for-profit or those only just graduating and starting a career in this wide, varied and rewarding profession of ours.

While my fitness plans may have fallen flat, the Society remains true to its resolution every single year.

Here’s to a successful 2013 for one and all

I N S I G H T M A G A Z I N E

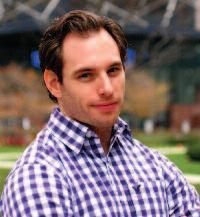

Publisher/ICPAS President & CEO Elaine Weiss

Editor-in-Chief/Director of Publications Judy Giannetto

Creative Services Director Gene Levitan

Creative Services Manager Rosa Garcia

Publications Specialist Derrick Lilly

National Sales & Advertising Natalie Matter DeSoto YGS Group, 3650 West Market Street, York, PA 17404

P: 800 501 9571 x127 F: 717 825 2171

E: natalie desoto@theygsgroup com

Circulation/Member Services Director Carl Siska

Editorial Offices: 550 W Jackson Blvd , Suite 900 Chicago, IL 60661

I C P A S O F F I C E R S

Chairperson, James P Jones, CPA Edward Don & Company

Vice Chairperson, William P Graf, CPA Deloitte & Touche LLP

Secretary, Edward J. Hannon, CPA, JD Freeborn & Peters LLP

Treasurer, Daniel F Rahill, CPA, JD KPMG LLP

Immediate Past Chairperson, Robert E Cameron, CPA Cameron, Smith & Company, PC

I C P A S B O A R D O F D I R E C TO R S

Linda S Abernethy, CPA, McGladrey LLP

Rose G Doherty CPA, Legacy Professionals LLP

John A Hepp, PhD, CPA, Grant Thornton LLP

Margaret M Hunn, CPA, CFE, CFF, CITP, Rozovics & Wojcicki

Geralyn R Hurd, CPA, Crowe Horwath LLP

Paul V Inserra, CPA, McClure, Inserra & Co , Chtd

Leif J Jensen, CPA, Leif Jensen & Associates Ltd

Kathleen M. Kedrowski, CPA, Retired, Navigant Consulting

Michael J Maffei, CPA, GATX Corporation

Marcus D Odom, PhD, CPA (inactive), Southern Illinois University

Floyd D. Perkins, CPA, Ungaretti & Harris

J Bradley Sargent, CPA/CFF, CFE, CFS, Cr FA, Sargent Consulting Group LLC

Marcus F Schultz, CPA, Dugan & Lopatka CPAs PC

Thomas L Zeller, PhD, CPA, Loyola University Chicago

Suite 900, Chicago, IL 60661, USA, 312 993 0407 or 800 993 0407, fax:

of the contents may be reproduced by any means without the written consent of INSIGHT

CPA

requests may be sent to:

550 W Jackson, Suite 900, Chicago, IL 60661, USA

4 INSIGHT icpas org/insight htm

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 24,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year, in Spring, Summer, Fall, Winter, by the Illinois CPA Society, 550 W Jackson,

312

7713 Subscription

non-members: $20 US,

for international addresses

© 2012 No

Publications Specialist,

at Chicago, IL

additional mailing offices POSTMASTER: Send address

to:

I C PA S Pr e s i d e n t & C E O E l a i n e We i s s

993

rates for

$28 Canada, $30 Mexico and $40

Copyright

part

Permission

at the address above Periodicals postage paid

and at

changes

INSIGHT, Illinois

Society,

e w Ye

’ s

e s o l u t i o n s n e e d t o g o u n r e s o l

o f

a r

r

v e

SEEN HEARD

Average percent of total assets invested annually by private companies, versus only 4 percent for similar public firms Source: Sageworks Inc

Are Your Clients Following Your Directions?

The m a jor it y of p eop le who r eceiv e f ina ncia l a d v ice d on’t a ct on it , according to a survey commissioned by financial services firm TIAA- CREF Despite nearly 50 percent of respondents indicating that they’re worried about their financial futures, only 33 percent actually take action after being advised on what to do

Part of the reason could be that a constant supply of general information on how to reduce expenses, streamline budgets, save more and invest effectively for retirement is simply too overwhelming In fact, 74 percent of respondents said they’re not sure which sources of financial advice are reliable

TIAA- CREF analysis suggests that individuals provided with recommendations specifically tailored to their financial situations, objectives, risk tolerances and investment horizons are over 60 percent more likely to utilize the advice than people who receive generalized guidance

HOW TO :

10% Avoid Mistakes on the Job

In an Accountemps [accountemps com] survey, 28 percent of respondents said making a mistake is their biggest workplace fear With that in mind, Accountemps offers these four tips for dodging the bullet:

1 P l a n y o u r w e e k Prioritizing responsibilities and delegating when possible will increase efficiency and confidence

2 A s k f o r d i r e c t i o n If a new project is particularly challenging, share this with your manager so you can work together to overcome hurdles

3 Tr u s t i n a t r u s t e d a d v i s o r When preparing a critical project or communication, tap a mentor for advice or ask a confidante for feedback

4 L e n d a h a n d Volunteering to assist overburdened colleagues and being quick with praise for outstanding work fosters an environment where colleagues regularly help each other

S p e a k i n g o f m i s t a k e s Please note that the Fall 2012 Corporate Financial Leadership First Word column, A Time to Give Thanks, included a name misspelling Our apologies to Illinois CPA Society Diversity Initiatives Committee Chair, Scott D Steffens of Grant Thornton LLP for the error

Expanded CPE Recognition in Effect

Over the last year, the Illinois CPA Society has worked closely with the Illinois Department of Financial & Professional Regulations to broaden the scope of programs and activities that qualify for continued professional education (CPE) credit and meet the requirements for CPA licensure renewal As a result, you’ll be able to earn CPE for more of the job - specific activities you likely already perform, such as conducting research or consultation with outside experts, attending industry group conferences or webinars, and serving on one of ICPAS' technical committees You can even earn CPE credits for reading professional publications, like our own INSIGHT Magazine

Visit www.icpas.org/expandedCPE.htm for more information.

FEATURED APP: Outright

Forget full-blown accounting solutions and make quarter-end, year-end and sales tax events simple Outright [outright com] is a streamlined accounting solution for small-business owners that allows users to organize and track their income and expenses from their online accounts, with support for over 4,000 banks and credit cards, eBay, PayPal, Freshbooks, Harvest and Shoeboxed Users can even track cash sales and expenses by manually entering the data from paper receipts In a matter of seconds, Outright produces easy-to-read charts and graphs, and automatically categorizes transactions to IRS expectations, ensuring sales tax records are always current and accurate

Outright is a cloud-based solution that uses 256-bit SSL security to ensure data is always protected. Free Outright apps are available for Apple and Android mobile devices.

6 INSIGHT icpas org/insight htm

N E W S B Y T E S , S O U N D A D V I C E A N D P R A C T I C A L B U S I N E S S T I P S &

helping you run and grow your business

just-in-time information | relevant education professional connections

Executive Education

Strategic programs focused on real-world challenges

Workshops

Tactical programs providing practical knowledge

Signature Conferences

National speakers addressing current issues facing finance leaders

onDemand Education Programs on what you need to know, when you need to know it

knowledgehub

Innovative learning management system providing an easy to use, cost-effective way to manage your staff development

CCFL Finance Leaders Weekly

E-pub featuring the latest “must read” stories, videos and audio casts

Technical Resources

Information to help you keep pace with changing rules and regulations

Career Center

Job openings, resume posting, career coaches and development resources

www.CCFLinfo.org

Source: HP/Ponemon Institute

CFOs Wanted for Board Service

There’s an unprecedented demand for CFOs to serve on corporate boards thanks to increasing regulations, difficult economic conditions and the CFO’s broadening skill set, says Ernst & Young’s study, CFO and Beyond: The Possibilities and Pathways Outside Finance The report found that many CFOs are interested in roles that can improve their understanding of boardroom dynamics, generate cross-sector ideas and provide exposure to different corporate cultures In fact, most CFOs said that sitting on the other side of the table helps them fully understand how the boardroom works, and over half see it as an opportunity to learn lessons that have valuable applications in their core roles

Listen Up Emerging Partners

While emerging partners may feel that old leadership models need to be replaced pronto, Jim Boomer of Boomer Consulting Inc advises them to gain a deeper understanding of current partner culture For starters, realize that they have years of experience to tap into, and have paved the way for today’s partners to rise What’s more, they may find it hard to let go of what they’ve helped to build, and deserve respect for their views when new ideas are presented Understanding this will ultimately make for a far smoother partner transition

TRENDSPOTTER:

GREEN YOUR MEETINGS

Socially responsible businesses are increasingly in demand The Vianova Group [thevianovagroup.com] offers these tips for greening your meetings.

n

o n l i n e : Online discussion forums, chat functions, teleconferencing and webcasts all provide ways to connect while reducing carbon footprints and travel/meeting expenses

n

: If you must meet face-to-face, reduce travel time and distance by choosing a centrally located meeting place that’s convenient for all meeting attendees If spread far and wide, consider having only those “must-attend” individuals be present while others participate virtually

n

e s e n t a t i o n s : Project documents onto a screen so all meeting attendees can follow along without needing to print out paper copies All meeting materials can be stored in a central online location for viewing at any time

n R e c y c l e a t c l o s e : Collect and recycle paper, plastic cups, wrappers, trash bags, bottles and cans used in the meeting room Serving food from washable dishes instead of disposables is a smart choice as well

Why Your Staff Won’t Leave You

Whether or not the economy is turning around, keeping an eye on employee retention is always a priority According to the American Psychological Association’s [apa org] Workforce Retention Survey, 67 percent of working Americans stay with their current employers because their jobs fit well with other aspects of their lives A further 60 percent stay because of employee benefits; and 59 percent stay because of either the pay or their enjoyment of the work Despite consistently high unemployment numbers, only 39 percent of respondents said a lack of other job opportunities was a reason for staying with their current employer

8 INSIGHT icpas org/insight htm SEEN & HEARD

Average annualized costs of cybercrime incurred

US

$8.9 million

by

organizations.

M e e t

e t l o c a l l

M e

y

O p t f o r p r

Mobile App & Texting for easy account access (request a reimbursement!) (no additional cost) Online Enrollment & Account Management Increase plan participation and tax-savings with a more attractive FSA program in 2013! Mention this ad to receive 10% off your FlexSystem set-up fee! 1-800-422-4661 x8878 veronica.burger@tasconline.com www.tasconline.com

GROW. THRIVE.

YOU don’t want to just be an employee — You dream of working with an innovative team of colleagues who support YOU. Who inspire YOU.

YOU want to work in an environment that shapes YOUR career — and YOUR life. YOU want a competitive compensation package that includes incentives that recognize the value YOU provide.

YOU want flexibility — from how YOU schedule YOUR time, to the direction YOU grow YOUR career.

Candidates

Lead YOUR life at FGMK.

Thrive. Lead YOUR life at FGMK.

Grow.

with 3-10 years in audit and/or tax public accounting experience, send your resume to Lee Singer, CPA, Managing Member at Lsinger@fgmk.net. 2801 Lakeside Drive • Bannockburn, IL 60015 • www.fgmk.net ©2012 FGMK, LLC

2013 heralds a new way of doing things for anyone challenging IDOR audit findings

By Keith Staats, JD

Re c e n t I l l i n o i s l e g i s l a t i o n h a s e s t a blished a new, independent Illinois Tax Tribunal that allows taxpayers to challenge Illinois Department of Revenue (IDOR) audit claim denials The Tribunal will begin operating on July 1, 2013, and will, with certain exceptions, replace the current administrative hearings function within the IDOR

or denials of licenses or certificates of registration, or any other collection of activities; any proceedings of the IDOR’s informal administrative appeals function; or any challenges to an administrative subpoena issued by the IDOR.

Keith is a senior manager of Grant Thornton’s State & Local Tax practice, based in Chicago Previously, he held the position of general counsel of the Illinois Department of Revenue, where he developed tax policy, evaluated and reviewed tax-related legislation, and oversaw tax-related litigation.

* keith staats@us gt com

Drilling down to the finer details, the Tax Tribunal will have jurisdiction over all IDOR sales and excise tax and income tax assessments, claim denials and notices of penalty liability. However, the Tax Tribunal legislation will not alter a taxpayer’s ability to utilize the State Officers and Employees Money Disposition Act (Protest Monies Act) as a method of challenging an assessment

T h e Tr i b u n a l ’ s j u r i s d i c t i o n w i l l b e l i mited to situations where the amount of tax a t i s s u e f o r t h e s a m e t a x y e a r o r a u d i t period exceeds $15,000, excluding penalt i e s a n d i n t e r e s t I n t h o s e i n s t a n c e s t h a t assert either an interest or penalty assessment or both, the Tribunal will have jurisdiction if the combined total of all penalt i e s o r i n t e r e s t e x c e e d s $ 1 5 , 0 0 0 C a s e s below the $15,000 threshold will continue t o b e h e a r d b y t h e I D O R a d m i n i s t r a t i v e hearings division

The Tribunal will not have jurisdiction to review any property tax assessment or any d e c i s i o n s r e l a t e d t o t h e I D O R ’ s i s s u e o r denial of a sales tax or property tax exemption ruling. And it will not have jurisdiction to review a notice of proposed tax liability, notice of proposed deficiency or any other notice of proposed assessment or intent to take action Proposed assessments, in fact, will continue to be eligible for review by IDOR’s Informal Conference Board

Furthermore, the Tribunal will not have jurisdiction to review any action or IDOR determination regarding tax liabilities finaliz e d by la w, inc luding but not limite d to liens, levies and revocations; suspensions

In general, with the exception of Protest Monies Act cases, a taxpayer cannot contest a matter within the Tax Tribunal’s jurisdiction in any other Illinois court If a taxp a y e r a t t e m p t s t o f i l e a c a s e i n a n o t h e r court, the action, suit or proceeding will be dismissed without prejudice

The Tribunal also will decide questions concerning the constitutionality of statutes and rules the IDOR has adopted, but will not have the power to declare a statute or rule unconstitutional or otherwise invalid on its face. However, a taxpayer challengi n g t h i s c o n s t i t u t i o n a l i t y c a n p r e s e n t t h e challenge to the tribunal to make a record f o r t h e I l l i n o i s A p p e l l a t e C o u r t ’ s r e v i e w Failure to raise a constitutional issue will n o t p r e c l u d e t h e t a x p a y e r o r t h e I D O R f r o m r a i s i n g t h e s e i s s u e s a t t h e a p p e l l a t e court level

What’s more, the Illinois Tax Tribunal Act includes detailed provisions concerning proceedings before the Tribunal. For instance, a taxpayer will be able to commence a proceeding by filing a petition protesting the IDOR’s determination, and the IDOR will be required to file its answer in the Tax Tribunal no later than 30 days after receiving notification of a petition being filed (A $500 filing fee will be imposed )

Taxpayers or attorneys representing the taxpayers can make appearances at Tribunal proceedings. Accountants and attorneys employed by accounting firms may not represent taxpayers before the Tribunal, howe v e r P r i o r t o a h e a r i n g , t h e p a r t i e s c a n choose to jointly petition the Tribunal for mediation in an attempt to settle any contested issues or the case in its entirety

10 INSIGHT icpas org/insight htm

TAX DECODED

Tr i b u n a l P o w e r

Tribunal hearings will be open to the public, but taxpayers can petition to close portions of t h e h e a r i n g f o r g o o d c a u s e A l l i n f o r m a t i o n received by the Tribunal as a result of a hearing o r i n v e s t i g a t i o n w i l l b e p u b l i c , e x c e p t f o r t a x returns and information received under seal or in relation to any mediation proceedings. Also, taxpayers may petition the Tribunal to require t h a t c e r t a i n p l e a d i n g s o r e v i d e n c e b e f i l e d o r a d m i t t e d u n d e r s e a l t o p r e v e n t e c o n o m i c o r other harm to the taxpayer

The Tribunal will be required to issue written decisions within 90 days of briefs being submitted or by the end of the hearing if no briefs are filed The Tribunal can extend the 90-day period f o r a n a d d i t i o n a l 3 0 d a y s , b u t t h e d e c i s i o n becomes final 35 days after the issuance of the notice of decision The tribunal is required to index and publish its decision in print or electronic form within 180 days

The taxpayer and the IDOR will be entitled to judicial review of a final decision in the Illinois Appellate Court This provision is different than the current administrative hearings system in two respects: First, under the current system, only taxpayers can seek an administrative hearings decision review; second, the first level of judicial review currently occurs in the circuit courts.

The legislation that established the tax tribunal also clarifies the IDOR’s settlement authority in informal proceedings. A new provision explains t h a t o f f e r s o f d i s p o s i t i o n o f a p r o p o s e d a u d i t adjustment may be proposed during the informal assessment review process. The Informal Conference Board should consider disposing of a matter if 1) it’s uncertain whether the proposed audit a d j u s t m e n t i s c o r r e c t a n d 2 ) i t ’ s n o t i n t h e IDOR’s best interest to issue an assessment or claim denial due to factors such as the potential hazards of litigation

D e s p i t e t h e f a c t t h a t a c c o u n t a n t s w o n ’ t b e able to represent taxpayers before the new tribunal, the tribunal has the potential to enhance the r o l e o f a c c o u n t a n t s i n p r o v i d i n g a s s i s t a n c e t o taxpayers under audit As I’ve noted, the legislat i o n e n h a n c e s a n d c l a r i f i e s t h e I D O R ’ s s e t t l em e n t a u t h o r i t y d u r i n g t h e i n f o r m a l r e v i e w process, and once a case is filed with the tribunal an independent body the IDOR arguably has less control over the matter than it does now.

This combination of factors may encourage resolution of audits at the audit level, including the Informal Conference Board process where accountants and accounting firms can, and do, provide valuable assistance to their clients

TAX UPDATES You Need Now

Be Prepared for the 2013 Tax Season

January 9 | Chicago St ate & Local Tax Conference

January 9 | Chicago

IRS Audit Practices and t he Viability of FLP Planning Workshop

January 9| Chicago, Joliet, Moline, Naperville, Springfield, Webinar

Small Business Entity Tax Forms Workshop

Januar y 10 | Chicago

Payroll Taxes, Benefits and 1099 Reporting: Ever yt hing You Need to Know

January 11 | Chicago

Tax Update for Pass-Through Entities: S Corporations, Partnerships and LLCs

January 16 | Webinar

Taxation for the 2 1st Centur y: Why Tax Reform is on t he Table and How to Help Your Clients Understand

January 17 | Chicago

Preparing Individual Tax Returns for New Staff and Para-Professionals

January 18 | Chicago

The Com plete Guide to Preparing Limited Liability Com pany, Partnership, and S Corporation Federal Income Tax Returns

January 28 | Chicago **NEW COURSE**

New Medicine: Key Issues CPAs Need to Know About t he Patient Protection and Af fordable Care Act

January 28 | Chicago **NEW COURSE**

Should Client Expenditures be Capit alized or Expensed? A Guide to t he New IRS Regulations

January 29 | Chicago **NEW COURSE**

Advanced Technical Tax Forms Training -- Form 1040 Issues

January 30 | Springfield

Preparing Individual Tax Returns for New Staff and Para-Professionals

January 31 | Chicago

Corporate Tax Update

January 31 | Springfield

The Com plete Guide to Preparing Limited Liability Com pany, Par tner ship, and S Corporation Federal Income Tax Returns

Register at www.icpas.org

icpas org/insight htm | WINTER 2012 11

We Wa n t Yo u !

The Military Tax Assistance Program celebrates a decade of serving those who serve our country

By Marty Green, Esq

In a letter to Illinois CPA Society President and CEO Elaine Weiss, Thomas R Lamont, assistant secretary of the Army, wrote:

“On behalf of the men and women of the United States Army and our sister services, I would like to thank the Illinois CPA Society for sponsoring the Military Tax Assistance Program for deployed military members and their families Military deployments take a tremendous toll on our military members and their loved ones The program relieves the anxiety of tax preparation for those deployed and their families Most importantly, it helps to relieve the burden of separation I know that our military members who have benefitted from this program are greatly appreciative of your efforts….[P]lease extend the Department of the Army’s appreciation to your member volunteers who give of their time to assist military members and their families ”

Marty is the ICPAS VP of Government Relations, a practicing lawyer and member of the Illinois Bar and a Lieutenant Colonel in the National Guard He previously served as executive assistant attorney general for Illinois Attorneys General Lisa Madigan and Jim Ryan, and as director of the Governor’s Office of Citizens Assistance and assistant to the Governor for Public Affairs, both under Governor James Edgar

*

greenm@icpas org @icpasgovt

Volunteer Now

To volunteer for the Military Tax Assistance Program, contact Jill Loeser of the ICPAS Government Relations Office, 217 789 7914 or loeserj@icpas org

Over the past decade, more than 300 military members have been served through the Military Tax Assistance Program, which began with Operation Enduring Freedom in Afghanistan and Operation Iraqi Freedom.

P a r t n e r i n g w i t h t h e I R S , C PA s p r o v i d e military tax assistance to members of the Armed Forces (both those on active duty and reserves) who have served in a combat zone or in a contingency operation during the tax year Qualifying military members are matched with volunteers in their community or regional location The volunteer initially meets with the military member or family member for basic information and t h e n s c h e d u l e s a f o l l o w - u p m e e t i n g t o r e v i e w, c o m p l e t e a n d e x e c u t e t h e t a x return. This also can be done remotely via email, phone and fax

As a Lieutenant Colonel in the National G u a r d , I c a n v o u c h f o r t h e f a c t t h a t t h i s program has a huge impact on the lives of military personnel and their families.

You don’t have to take my word for it As Military Tax Assistance recipient LTC Clay Kuetemeyer of the Illinois National Guard explains, “I first heard about the program during a briefing on post-mobilization bene

assistance. Not only did he do a thorough, professional job of reviewing and preparing our returns, but he took the time to get to know us and understand our situation ”

Hensley owns his own practice in Springfield, Ill , specializing in tax, accounting and consulting services He has been a Military Tax Assistance volunteer for more than five years When you visit Hensley’s office, you’ll see a folded American flag that flew over a US base in Afghanistan prominently displayed on his wall. The flag was given to him by a Marine Corps officer he assisted.

When asked why he volunteers for this program, Hensley explains that, “I have family members in the military and I realize that they don’t get some of the benefits of the private sector Military members deserve all the benefits they can get ”

With tax season fast upon us, we’re actively searching for volunteers who can help with this important project. Volunteering is very easy. You can devote as much or as little time as your schedule allows. You don’t have to be a tax specialist, per se; the ICPAS and the IRS provide training materials and resources to help you with the process Ultimately, the ICPAS Government Relations Office works with volunteers to match them with soldiers and airmen who qualify for assistance Even if you only have time to

12 INSIGHT icpas org/insight htm

CAPITOL REPORT

f i t s a f t e r r e t u r n i n g f r o m A f g h a n i s t a n D a v i d H e n s l e y w a s o u r I C PA S v o l u n t e e r t a x p r e p a r e r H e w a s e n t h u s i a s t i c a n d r e s p o n s i v e w h e n w e c o n t a c t e d h i m f o r

P h o t o : C o u r t e s y o f h e U S A r F o r c e

complete the training and assist one service member, you’ll make a huge difference

“I make it as easy as possible for [military personnel] to complete their taxes,” says Hensley “I typically email them before our meeting introducing myself and sending them some paperwork to complete before they come to the office If they call with questions, my staff has instructions to put them through to me directly. I treat them special ”

I recently spoke with another Military Tax Assistance volunteer who told me the story of a couple who both were in the military and had small children back at home Due to continued, multiple deployments for both, they were behind in several years of income tax filings This was a source of constant worry for them Our Military Tax Assistance Program volunteer went above and beyond to prepare their tax forms and explain their unique circumstances to the IRS, which waived all penalties and interest accrued.

Even though our nation recognizes the beginning of the end of 10 years in Afghanistan and our withdrawal from Iraq, military members and their families still need our help Our friends and neighbors who belong to the Guard and Reserves, as well as service members from Scott Air Force Base in Belleville, Ill and Great Lakes Naval Base in Northeastern Illinois, are still performing hazardous duty in dangerous places

We recognize that your time is valuable By being a Military Tax A s s i s t a n c e v o l u n t e e r y o u ’ l l m e e t s o m e o f t h e f i n e s t m e n a n d women who serve our country I guarantee that it will be both a p e r s o n a l l y a n d p r o f e s s i o n a l l y r e w a r d i n g e x p e r i e n c e o n e y o u won’t soon forget

Please note: The views expressed are not the views or opinions of the Departments of the Air Force or Defense

ONLINE CPA REVIEW

Work For You.

are st , your que met

Go with the biggest in the industry. Our biggest concern is you. Our broker’s wealth of experience culminates to make sure your comfort level is met, your questions are answered and everything is being done to sell your firm.

Give us a call today so that we may go to work for you and produce the results you desire.

Our online program uses focused preparation from expert professors, the resources of a top-ranked university, and the faculty behind the best-selling review manual to help you pass the CPA exam.

• Comprehensive in-depth coverage of all exam topics

• Full sets of practice questions and simulations

• Flexible scheduling with sections offered all year

• Credit option—earn up to eight semester hours

Learn more and register at go.depaul.edu/cpareview

icpas org/insight htm | WINTER 2012 13

The Holmes Group 1-800-397-0249 www.AccountingPracticeSales.com trent@accountingpracticesales.com

ll t

answe ions

o make s t culminate rn we conce

estgbig Go hing is veryt d and e re l is leve comfort h of alt s de result the we may hat oday t us a call t Give o se ent@accountingpracticesales.com .AccountingPracticeSales.com tr www sire u r yo rk fo wo to go

done

stbigge

FORENSICS INSIDER T h i n k B e f o r e Yo u G i v e

In Ronald Reagan’s famous words, “trust but verify” before giving charitably

By Brad Sargent, CPA/CFF, CFE , CFS, Cr FA , FABFA

The holiday season may have been and gone, and with it the “for-profit” world’s bid for our disposable income, but the desire to give to nonprofits and charities lingers far beyond the festivities for many of us At all times of year, and especially during the winter, churches, homeless shelters, local food pantries, animal welfare organizations, children’s charities, veterans’ groups, community outreach groups, and more, actively seek donations of food, clothes, money and time to help those less fortunate survive

s o l i c i t i n g m a y n o t b e d e l i v e r i n g t o t h e cause Check them out before giving ”

Another caveat: Even the most legitimate charitable organizations may not always exercise an appropriate level of internal due diligence. Many individuals join charitable organizations (accepting lower compensation in the process) for the reward of doing something for a cause in which they believe.

Fraudsters are aware of this altruistic culture and seek to embed themselves within an entity, gain trust and steal at will

Brad is the managing member of The Sargent Consulting Group, LLC, which specializes in forensic accounting and financial investigation He is a frequent lecturer and chair emeritus of the American Board of Forensic Accounting A member of the Illinois CPA Society since 2002, Brad also serves on the Society’s Board of Directors

* bsargent@scgforensics

B u t a r e t h e y a l w a y s w o r t h y c a u s e s ? What if the charity you’re eyeing is, in fact, a scam? Take this scenario: A phone call f r o m s o m e o n e r e p r e s e n t i n g a c h a r i t a b l e organization, looking for donations of clothes and household items, will have a truck m a k i n g p i c k - u p s i n y o u r n e i g h b o r h o o d You’re not home during the day, so you tell t h e c a l l e r y o u ’ l l l e a v e t h e i t e m s o n y o u r f r o n t p o rc h W h o , e x a c t l y, h a v e y o u j u s t i n v i t e d t o y o u r e m p t y h o u s e ? Wi l l t h e n e i g h b o r s t h i n k t w i c e w h e n a b i g t r u c k starts loading your household items when some of them are already out on your front porch? Did you also mean to “donate” your cash, jewelry and electronics?

Floyd D Perkins, Esq , CPA, is a member of the Illinois CPA Society Board of Direct o r s a n d a p a r t n e r a t t h e l a w f i r m o f Ung a re tti & Ha rris , L L P He c onc e ntra te s his practice on counseling businesses and charities on financial and compliance matte rs , litig a ting bus ine s s a nd fina nc ia l disputes, and representing clients in contested p r o b a t e a n d c h a n c e r y m a t t e r s P r i o r t o

j o i n i n g U n g a r e t t i & H a r r i s , P e r k i n s w a s bureau chief of the Illinois Attorney Gene r a l ’ s C h a r i t a b l e Tr u s t s D i v i s i o n f o r 1 4 years, where he was responsible for many of the office’s complex financial and business litigation matters concentrating in the chancery and probate practice.

Perkins offers this simple advice: “Give but give wisely Know who you’re giving to; the cause may be great but the people

Sadly, the very attributes that make these l e g i t i m a t e o rg a n i z a t i o n s e f f e c t i v e i n t h e i r missions can lead to a failure to maintain proper internal controls. Many large-dollar frauds are committed in the charitable sector, but are almost never reported since nonprofits rely heavily on their positive public i m a g e I ’ v e i n v e s t i g a t e d m a j o r f r a u d s t h a t r o s e t o c r i m i n a l l e v e l s , y e t t h e r e s p e c t i v e boards chose to resolve the matters quietly. I urged them to set a more rigorous tone at the top and pursue all means to prosecute the fraudsters, and in return was given a pers o n a l t u t o r i a l o n t h e p r e c a r i o u s n a t u r e o f these entities and their public personas, and a primer on how discretion is essential for their continued existence.

Lisa M Noller, Esq , is a litigation partner w i t h F o l e y & L a r d n e r L L P, w h e r e s h e i s a member of the firm's Government Enforcement, Compliance & White Collar Defense, B u s i n e s s L i t i g a t i o n & D i s p u t e R e s o l u t i o n , a n d S e c u r i t i e s E n f o rc e m e n t & L i t i g a t i o n practices, as well as the Health Care, Medi c a l D e v i c e s , a n d L i f e S c i e n c e s I n d u s t r y teams. She is an experienced trial lawyer, having spent more than 15 years investigating and litigating complex criminal and civil cases Her practice focuses on responding t o g o v e r n m e n t i n v e s t i g a t i o n s , c o n d u c t i n g corporate internal investigations, and litigating a wide variety of civil and criminal matters in state and federal courts.

Noller states that, “The government doesn ’ t d i f f e r e n t i a t e f o r p u r p o s e s o f c h a rg i n g ,

14 INSIGHT icpas org/insight htm

com

p l e a n e g o t i a t i n g o r s e n t e n c i n g ; f r a u d i s f r a u d C h a r i t i e s a n d n o n p r o f i t s w o u l d d o w e l l t o f o l l o w t h e i r f o r- p r o f i t c o u n t e r p a r t s a n d i m p l e m e n t r i g o r o u s c o m p l i a n c e p r og r a m s a n d i n s t i t u t e i n t e r n a l c o n t r o l s t o detect and combat fraud Doing so doesn’t u n d e r m i n e t h e t r a d i t i o n a l c u l t u r e o f n o nprofits Rather, with strong policies and proc e d u r e s f o r i n t e r n a l a u d i t s , i n v e s t i g a t i o n s a n d r e m e d i a t i o n , n o n p r o f i t s a n d c h a r i t i e s can ‘trust but verify

’”

The “trust but verify” phrase is often attributed to Former President Ronald Reagan, when he addressed the former USSR and its leader, Mikhael Gorbachev Upon hearing Reagan’s proclamation, Gorbachev famously responded, “But you say that at all of our meetings!” In reality, Reagan quoted a Russian saying which he knew would be familiar to Gorbachev

Regardless of the source, these words ring true Arm yourself before you give; look into t h e o rg a n i z a t i o n o r i n d i v i d u a l c o n t a c t i n g you, validate that your assets will be allocated to a worthy cause, and conduct due d i l i g e n c e t o p r o v i d e a s s u r a n c e t h a t y o u r assets will be used wisely and in pursuit of the cause of your choice

make success possible

“An accounting degree would not be an option for me without this scholarship. Even with loans, grants and income from part-time jobs, I could not afford all of my college expenses without your support.”

Andrew Barnes - Scholarship Recipient, SIUE

Andrew Barnes - Scholarship Recipient, SIUE

Help pave the way for tomorrow’s CPAs.

The CPA Endowment Fund of Illinois makes an accounting education accessible and attainable to bright, promising college students who alone cannot keep up with the rising costs of the educational requirements necessary to become a CPA.

Funded solely by voluntary contributions, a variety of scholarship and outreach programs are helping students pursue a career in accounting with support for tuition, textbooks, the CPA Exam and more.

Make success possible. Donate today. www.icpas.org/annualfund.htm

icpas org/insight htm | WINTER 2012 15 For CPA career-climbers and the people who hire them Must-read news for today's busy corporate leaders Regulatory & legislative updates for Illinois CPAs Public practice news you can use Exploring the issues that shape today’s financial world Connect with us: To subscribe to these free Illinois CPA Society ePublications, visit www.icpas.org/publications.htm corporate government public business & finance career careerspace newsflash capitol dispatch practice advantage eINSIGHT

The ins and outs of adding personal financial planning to your practice

By Mark J Gilbert, CPA/PFS

Ithink you’d agree that the best CPAs don’t merely prepare a tax return or an accounting write-up, but rather help their clients make decisions for the future. That’s where personal financial planning (PFP) comes in

As a client’s trusted advisor, CPAs are a natural choice for personal financial planning services. After all, you understand your clients’ hopes and dreams for the future, as well as their finances

For those aspiring CPA personal financial planners out there, here’s a basic guide to adding these services to your practice

PFP Defined

e x a m F i n a l l y, e a c h d e s i g n a t i o n r e q u i r e s three years’ work experience in the field In practice, the CFP is the most common of the credentials The CPA/PFS traditionally emphasizes tax planning, while the ChFC emphasizes insurance planning

A principal in the financial planning

f i r m o f Re a s o n Fi n a n c i a l A d v i s o r s , Inc , Mark’s 25-plus years of finance

a n d a c c o u n t i n g e x p e r i e n c e i n c l u d e s

1 3 yea r s in p er s ona

Personal financial planning is a practice area in which advisors provide clients with direction in any or all of the following areas: cash flow, insurance and risk management, investments, taxes, retirement and employee benefits, and estate planning After thoroughly reviewing a client’s current situation, the advisor provides observations and recommendations for improvement Depending on the engagement, the advisor may implement insurance or investment products as part of the planning process

Designations & Memberships

The personal financial planning marketplace is increasingly demanding that advisors demonstrate their expertise through select professional credentials, particularly the Certified Financial Planner (CFP®), Chartered Financial Consultant (ChFC®) and Personal Financial Specialist (CPA/PFS), which is awarded only to CPAs who are members of the AICPA

Each requires completion of a rigorous

In addition, the CFP and CPA/PFS both require successful

We CPAs know the benefits of belonging to professional associations such as the ICPAS for training, education, problem-sharing and networking The largest financial planner organization is the Financial Planning Association (FPA), while the AICPA’s Personal Financial Planning (PFP) division supports CPA financial planners Financial planners who operate on a fee-only basis (and will not accept insurance and investment product commissions) may join the National Association of Personal Financial Advisors (NAPFA)

Registrations & Licenses

Generally, CPAs and others who advise on i n v e s t m e n t s a s p a r t o f t h e i r P F P s e r v i c e s h a v e t o r e g i s t e r w i t h e i t h e r t h e s t a t e i n w h i c h t h e y d o b u s i n e s s o r w i t h t h e S E C I n v e s t m e n t a d v i c e i n c l u d e s b o t h c l i e n t investment recommendations (non-discretionary management) and buying and selling investments on behalf of clients (discretionary management).

In Illinois, state registration is required when client assets are less than $100 million Otherwise, planners must register with the SEC. Registration takes place at both the firm level (as an investment advisor) and at the individual level (as an investment advisor representative), except in certain solo practices. Also note that financial planners who intend to sell commissionable investment and/or insurance products have to be affiliated with a broker-dealer firm, and become a registered representative of that firm Investment advisor representatives and registered representatives must also success-

16 INSIGHT icpas org/insight htm

l f ina ncia l p la nning An ICPAS member since 1982, M a r k c u r r e n t l y s e r v e s i n t h e I A / P F P M e m b e r Fo r u m G r o u p a n d o n t h e Structure & Volunteerism Committee

mgilbert@reasonfinancial.com PFP ADVISOR P

*

F P H o w To

c o l l e g e - l e v e l p r o g r a m o f s t u d y, a l t h o u g h C PA s m a y c h a l l e n g e a n d w a i v e t h e C F P educational requirement.

c o m p l e t i o n o f a n a t i o n w i d e c e r t i f i c a t i o n

fully complete one or more securities license exams in order to do business These exams are administered by FINRA, the Financial Industry Regulatory Authority, which is also charged with supervising broker-dealer firms and registered representatives. Investment advisor representatives have to pass the Series 65 exam, while registered representatives have to pass the Series 6 exam to deal in mutual fund and other investment company products, or the Series 7 exam to also deal in corporate securities, municipal securities, options and direct participation programs

Business Models

At the onset of establishing a personal financial p l a n n i n g b u s i n e s s , C PA s h a v e t o d e c i d e whether they intend to collect commissions on the investment and insurance products they recommend, charge fees to clients for advice or services, or both. Those who collect commissions are able to sell insurance products, and often include lower net-worth clients as part of their target market

M o s t p l a n n e r s , h o w e v e r, c h o o s e t o e a r n compensation through both fees and commissions, thereby expanding their services to the widest market available. This type of dual registration means you’re subject to the compliance requirements of both FINRA and the state or SEC

In light of professional liability, CPA personal financial planners often operate their planning businesses out of a separate LLC or other entity

PFP Benefits

From a business perspective, adding personal f i n a n c i a l p l a n n i n g s e r v i c e s t o y o u r p r a c t i c e helps you to diversify your revenue stream It also smoothes the typically cyclical nature of cash flows during busy season and other tax-filing deadlines.

From a personal standpoint, practitioners can develop their practices any way they want to. If you want to target a niche market like corporate e x e c u t i v e s o r r e t i r e e s o r t e a c h e r s o r a t h l e t e s , you can do so If you want to offer limited services like hourly consultations, or more complete s e r v i c e s l i k e p r o j e c t - b a s e d e n g a g e m e n t s , o r comprehensive services such as ongoing portfol i o m a n a g e m e n t a n d p e r f o r m a n c e r e p o r t i n g , you can do that too

There are thousands of ways to offer some form of personal financial planning The challenge is getting up to speed on PFP practices a n d d e t e r m i n i n g w h a t ’ s t h e b e s t f i t f o r y o u r interests, experience and skill set

icpas org/insight htm | WINTER 2012 17 Discover bright new ideas for today’s complex business environment. March 19, 2013 Rosemont, Illinois | 8 CPE Credit Hours enterprise risk management financial reporting for privately held companies tax changes healthcare reform rolling forecasts cash flow maximization internal controls cloud computing To register or for more information, call 800.993.0393 or visit www.CCFLinfo.org.

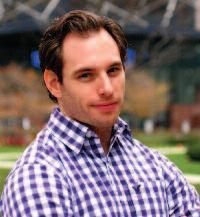

Score with the Big Four

Five ways to make yourself the Big Four’s next All- Star recruit

By Derrick Lilly

Whether you’re an accounting student or a young professional still getting your feet wet in the accounting and finance world, there’s likely one thing you’re pining for: Big Four experience

Having a Big Four name on your resume simply looks awesome The only problem is, most of your peers are chasing the very same dream

“The competition is fierce,” says Alyson Ryan, a former campus recruiter for KPMG and PwC, and director of Business Career Services at Loyola University in Chicago “It’s not unusual for recruiters to get 800 resumes during a single four-hour career fair ”

And don’t forget that every applicant is competing for a limited number of widely marketed positions, posted on campuses, at career fairs, on the firm’s website and on job boards across the web, among other places.

Here, then, are five ways to stand out from all that competition

1. Make the right moves

Your first steps: Check your ego at the door, take advantage of every opportunity to make contacts and don’t get discouraged along the way You can absolutely find a position with the Big Four, and it never hurts to ask for help.

“It’s hard to get in if you don’t go through the right channels or get referred by someone within a firm,” says Ryan. “Applicants can’t be shy about using their contacts for referrals If you’re still in college, take advantage of the incredible amount of access to recruiters that you’ll never have again. It’s critical to meet campus recruiters and career advisors, and then stay in contact with them ”

“The most important thing is to keep every line of communication open,” adds Warren Smith, Ernst & Young’s Midwest People Leader, especially for experienced hires. “We’re in a highly relationship-oriented business, and your ability to network and connect with people is

18 INSIGHT icpas org/insight htm YOUNG PROFESSIONALS

always important About half of our experienced hires are by way of employee referrals.”

Insider Tip: Don’t forget about your campus career center Both Ryan and Smith strongly encourage current students and alumni to turn to campus career centers for help in making connections, locating internships and career opportunities, fine-tuning resumes and honing interview skills

2. Make a good impression fast

“You don’t have a lot of time to make an impression on recruiters at most events, so you have to present yourself professionally, you need to be friendly and approachable, and you have to follow up,” says Ryan

But be forewarned; don’t get too friendly Chances are you’ll get to know some recruiters pretty well if you frequent career events, but you can’t consider them your friends or be too casual; after all, it’s a professional relationship Always keep in mind that recruiters and hiring managers are asking themselves, “Is this candidate someone we would feel comfortable putting in front of our clients?”

“Firms are looking for well-rounded recruits,” says Ryan. “There’s a misconception that being really book smart is all that matters to succeed in public accounting, but that’s absolutely not true. You have to be personable; you have to be someone who can bring in business as you progress in your career.”

“Working everyday hand-in-hand with clients in the professional services business creates a wide range of stressful and challenging situations,” adds Smith. “Being able to flex your style, and connect and engage with different people in different situations, is very important.”

3 Be socially conscious

While a good academic track record is important especially if you’re currently a student candidates also need to demonstrate attributes such as strong technical and soft skills, relevant work experience, the ability to manage commitments and a proven interest in volunteerism.

because clients and candidates are increasingly expecting solid evidence that firms are committed to the community and environment,” says Ryan “Firms expect their staffs to participate in volunteer initiatives, and are looking for candidates who are already active ”

That doesn’t mean you should list each and every club or volunteer initiative you’ve ever been involved in on your resume “It’s not just the fact that you’re involved or have volunteered; we’re looking at what you’ve done during that process,” Smith stresses

“You don’t want to only be able to say, ‘I’m a member and I go to the meetings,’” Ryan continues “You want to be able to say, ‘I was elected to this position, and these are my accomplishments ’”

4. Give a killer presentation

Of course, the best place to detail your accomplishments is on a carefully crafted resume, so get it critiqued by your contacts and career center staff

“It’s really important to have it in a layout that’s pleasing to the eye and free of unnecessary information,” says Ryan “Decisions on who to invite to personal interviews often have to be made very quickly, and I commonly see resumes that make it challenging to find the critical information recruiters look for ”

Including a clear objective statement unique to the opportunity you’re applying for is critical. “People who can clearly state their objectives and why they feel their experiences are valuable are the ones who really stand out,” says Smith “We expect applicants to have

icpas org/insight htm | WINTER 2012 19 Choose from a robust curriculum of 30+ webcast topics each month and 1000+ hours of self-study. Enjoy CPE savings for a full year! Get More For Your Money www.cpelink.com/value-pass or call 800-616-3822.

“ C o m m u n i t y s e r v i c e e x p e r i e n c e i s b e c o m i n g m o r e i m p o r t a n t

done their homework and to know the organization they’re applying to Hopefully that’s portrayed on their resume ”

Applicants also should pay particular attention to any application rules or requested details to ensure their resumes are accepted in the first place Meaning, if a firm posts 20 distinct jobs and says to apply for one, don’t apply for them all.

“Sometimes applicants think that applying for every single position will increase their chances of getting an interview, but the opposite happens,” warns Ryan “There have been situations where recruiters simply say, ‘You can’t follow directions, I’m not interviewing you ’”

Insider Tip:

If you don’t have your CPA, include your eligibility date on your resume “Recruiters work backwards from that date to determine where you fit in the recruiting cycle,” says Ryan

5. Practice Your Interview

W h e n y o u ’ r e c a l l e d i n f o r a f a c e - t o - f a c e i n t e rview, be ready to shine. Preparation, performance a n d p u n c t u a t i o n a r e t h e “ t h r e e P s ” t h a t m a t t e r, says Smith

First, research the firm you’re interviewing with. You have to understand the organization, what it’s known for, what’s important to it, and what type of person it’s looking for You can learn most, if not all, of this from the firm’s website.

Next, “Be prepared to come in and tell your story,” says Smith “A lot of candidates look great on paper, but in person they’re less dynamic. Those that do well always have a very cohesive story about why they chose to do the things they’ve done, what they’ve learned as a byproduct of their experiences, and why they fit into the firm.”

Insider Tip:

Have a good question ready “One thing that always baffles me is when a candidate doesn’t have any questions for me, ” says Smith. “Surely, you can ask me something that will show me you ’ ve done your homework and are truly interested ”

Finally, it never hurts to show your appreciation “Call me old-fashioned, but I like a ‘Thank You’ note,” says Smith “It demonstrates your conscientiousness and appreciation, and when it’s not done it sticks out ”

“A well-written personalized note that shows a genuine interest in the position can help candidates stand out to recruiters or hiring managers who are still on the fence,” Ryan adds

Remember, though, that landing a Big Four job isn’t the be-all-end-all of your career “There are advantages to working for small and midsized firms, and there are advantages to working for the Big Four,” says Ryan. “You learn these advantages by meeting and interacting with people who work at these different firms; the Big Four isn’t for everyone and there’s nothing wrong with that ”

20 INSIGHT icpas org/insight htm Get the credits you need FAST! 24/7 Access Earn CPE from the convenience of your computer, anytime day or night. Incredible Value 1-hour courses are $25 members/$45 non-members 2-hour courses are $50 members/$90 non-members. Engaging Content Choose from a full catalog of high-quality HD video courses. Check it out today at www.icpas.org/ondemand.htm

You’d never give your clients the same solution. Neither would we. Call , Business Banking, at 3. Our Business Banking Specialists will create solutions that fit your business, helping you with cash flow, payments, and loans for future growth. And now you can get a U.S. Bank Business Quick Loan with rates as low as 2.99% APR,* for equipment, vehicles and more. *Applications subject to credit approval. The 2.99% rate applies to new or used vehicle & equipment loans up to 80% LTV and terms up to 36 months for credit qualified applicants. Disclosed rate reflects 0.25% discount based on automatic monthly payments from a U.S. Bank Business Checking account. Standard fees apply. Rates are subject to change. Some restrictions may apply. Deposit products offered by U.S. Bank National Association. Member FDIC. © 2012 U.S. Bank 2.99 % APR* QUICK LOAN branchusbank.com/smallbusiness RATES AS LOW AS i B O N never You’d Yo ill t li i S ki B we would either th clients your b fit t th ti l t . solution same e i l h i . ll allCal Ca O L K C I U Q 9 2.9 L S A S E T A R m Busi Bank S. U cash with you ness us ur at g, ng,ingkinnkiankBan ss essinessinusiBus , S N A O APR A W ore ra with Loan Quick ness loans and payments, pay flow, cre w s s a pec ng an 3 APR, 99% 2 as low as tes no And future for your a ons u so e a for * APR,* a get can you w ng p e ness, us Ba S U a from aymentspay ap credit to bjectsubj Rates Ra apply fees Standard account Business nk e & vehicle used or new to rate 99% 2 The proval usbank.com/s branch Dep apply may restrictions Some change to bjectsubj are mont 36 to up terms and LTV LT 80% to up loans quipment mallbusiness M Association As National Bank S U offered osit 0 reflects rate Disclosed applicants credit for hs Bank S U 2012 © FDIC ember automatic on based discount 25%

Can You Keep a Secret?

What privileges and protections apply to Illinois CPAs and their clients?

By Brian J Hunt, CPA/JD

By Brian J Hunt, CPA/JD

Not all information is intended for public d i s c l o s u r e , a n d t h e l a w r e c o g n i z e s t h i s f a c t .

The two most common legal protections are the attorney-client privilege and the work-product doctrine In Illinois, accountants also have their own privilege, known as the accountant-

client privilege

Of course, an assertion of protection is easy to make But, if contested, a court may rule that p r o t e c t i o n s s i m p l y d o n ’ t a p p l y S t o p k a v s American Family is a case in point.

The Stopkas had employed a builder for a single-family home project. The builder, in turn, hired various subcontractors, one of which caused a fire Subsequently, the subcontractor’s general liability carrier, American Family, was engaged to remediate the construction

Aside from their lawyers, the Stopkas also relied heavily on their CPA and financial advis o r, Wo l o w i c k i , w h o p r o v i d e d a d v i c e a n d

a c t e d a s t h e i r r e p r e s e n t a t i v e i n c o m m u n i c ations with American Family, various remediation subcontractors and their attorney.

When the relationship between the Stopkas and American Family broke down, the Stopkas filed suit against the liability carrier and, as is customary, American Family requested the form a l p r o d u c t i o n o f c e r t a i n d o c u m e n t s T h e Stopkas withheld 22 emails sent to and from Wo l o w i c k i a n d t h e i r a t t o r n e y, a s s e r t i n g t h a t t h e s e i t e m s w e r e p r o t e c t e d b y t h e a t t o r n e yclient privilege, the work-product doctrine and t h e a c c o u n t a n t - c l i e n t p r i v i l e g e T h e C o u r t therefore was forced to decide on the applicability of these protections

The attorney-client privilege is designed to encourage open discussion between attorneys a n d t h e i r c l i e n t s . To b e e n f o rc e d , t h e p a r t i e s have to establish that the communications 1). were made to any attorney acting in their legal capacity, 2) originated in the belief that they w o u l d n o t b e d i s c l o s e d , 3 ) i n v o l v e d l e g a l

22 INSIGHT icpas org/insight htm LIABILITY

a d v i c e , a n d 4 ) r e m a i n e d c o n f i d e n t i a l T h e p r i v i l e g e p r o t e c t s c o m m u n i c a t i o n s flowing from the client to the attorney and vice versa, but is to be construed within the narrowest limits possible.

By contrast, the work-product doctrine p r o t e c t s d o c u m e n t s t h a t a n a t t o r n e y o r party representative creates in anticipation of litigation. A lawsuit need not be underway, “provided the prospect of litigation is not remote ” The protection prevents the d i s c l o s u r e o f p r o t e c t e d d o c u m e n t s o r communications, but doesn’t protect the underlying facts from disclosure

T h e s t a t u t o r y a c c o u n t a n t - c l i e n t p r i v il e g e i n I l l i n o i s , l i k e t h e a t t o r n e y - c l i e n t p r i v i l e g e , p r o m o t e s o p e n a n d f o r t h r i g h t disclosures by individuals using accounting services. It has four requisite elements: 1) the communication must originate in t h e c o n f i d e n c e t h a t i t w i l l n o t b e d i sclosed, 2). the confidential element must be essential to maintaining the relation of the parties involved, 3) the relationship i t s e l f m u s t b e o n e t h a t p u b l i c o p i n i o n believes should be protected, and 4). disclosing the communication would injure the relationship between the parties more t h a n t h e u n d e r l y i n g l i t i g a t i o n w o u l d b e benefited by its disclosure

Furthermore, the accountant-client privilege doesn’t extend to communications disclosed to third parties, unless those parties have a common interest with the disclosing party

Once the Court compared these privileges, it turned to the question of application As for the work-product doctrine, the Court concluded that certain documents were protected insofar as they were created just before or soon after the action was filed. However, it concluded that the accountant-client privilege didn’t prevent disclosure, and further noted that the privilege only protects “accounting services involving opinions on financial statements,” and doesn’t extend to non-financial services

Although the Court acknowledged there were services that could be interpreted as giving rise to the accounting privilege, it concluded that the relevant issue wasn’t the general nature of Wolowicki’s work, but rather whether the specific documents named involved activities that were protected. Ultimately, the Court concluded that the Stopkas failed to carry the burden of proof

For purposes of the attorney-client privilege, the Court separated the remaining emails into two categories: Emails between Wolowicki and the Stopkas, and emails sent to or by one of the Stopkas’ attorneys to Wolowicki and/or the Stopkas.

Under the first category, the Court noted that just because an email doesn’t involve an attorney as a direct sender or recipient, it doesn’t necessarily mean that the attorney-client privilege won’t apply. However, the Court also noted that, irrespective of the sender or recipient, the attorney-client privilege extends only to communications that either seek or give legal advice Concluding that this category of documents didn’t reflect any intention of confidentiality, the Court determined that it wasn’t protected by the attorney-client privilege

Under the second category, the Court noted that the mere involvement of an attorney isn’t sufficient to establish the attorneyclient privilege. Rather, each document has to show all the hallmarks of the privilege. The Court also noted that a privilege can be waived by disclosure to third parties, but that analysis of the attorney-client privilege also has to consider whether the third party is a proper agent of the client

Ultimately, the Court concluded that disclosure of information to Wolowicki, who was a “central cog” in the Stopkas efforts to resolve this matter, didn’t constitute a waiver of the attorney-client privilege Accordingly, it found that, in those instances where the communication was to or from an attorney and originated in the belief of confidentiality regarding legal advice and remained confidential, the attorney-client privilege did apply

For accountants, attorneys and the people who rely on them, the Stopka decision is a useful example of how information should be generated and shared in order to protect it from disclosure, and how a court ultimately will apply those protections

Brian J Hunt is the founder and managing principal of The Hunt Law Group, LLC, which focuses on the counseling and representation of CPAs and other business professionals, and on the resolution of business disputes Brian was recently selected as a “2013 Illinois Super Lawyer in Business Litigation ” Reach him at 312 384 2301 or bhunt@hunt-lawgroup com

icpas org/insight htm | WINTER 2012 23 Job Listings | Resume Postings Career Coaches* | Career Resources Check it out today at www.icpas.org *fee-based service career center A benefit of your Illinois CPA Society membership.

Audit Hike

A multitude of factors have conspired to increase audit fee volatility

By Carolyn Kmet

By Carolyn Kmet

Ten years ago, SarbanesOxley (SOX) was signed into law. Largely considered to be the most significant piece of reform legislation since the Securities and Exchange Act of 1934, SOX set new and enhanced standards for public companies, and management and accounting firms. Since its enactment, financial transparency and compliance have become an absolute must, and auditors are now part of every company’s front-line force

So what has this meant to audit fees?

In 2004, accelerated filers became the first group required to comply with Section 404 of SOX. This section mandated that all publicly traded companies would need internal controls and procedures in place for financial reporting, and that management would take responsibility for these measures As such, Section 404 was expected to be the most expensive section of SOX to implement Audit as well as non-audit fee data disclosed by SEC accelerated filers in electronic filings was compiled into an Audit A n a l y t i c s r e p o r t , Au d i t Fe e s a n d N o n - Au d i t Fees: A Ten Year Trend. According to this report, the average amount of audit fees paid per $1 m i l l i o n o f r e v e n u e i n c r e a s e d f r o m $ 4 0 5 i n 2003 to $596 in 2004, a 47-percent jump

Since then, the report found that audit fees have trended downwards, and in 2011 they reached their lowest value since 2004 $466 of audit fees for every $1 million in revenue.

“I believe the downward trend was due to t h r e e c o n c u r r e n t f a c t o r s , ” e x p l a i n s D o n a l d Whalen, Audit Analytics’ director of research

“First is the fact that many of the initial costs

incurred to implement the requirements of SOX 404 were one-time costs For some companies it may have taken a couple of years to improve ICFRs (internal controls over financial reporting) to the point of effectiveness. But after the i m p r o v e m e n t i s a c h i e v e d , t h o s e p a r t i c u l a r costs cease.”

S e c o n d , s a y s W h a l e n , “ I m p r o v e d s o f t w a r e s y s t e m s a n d o t h e r p r o c e d u r e s e n a b l e d m o r e e f f i c i e n t a c c e s s t o i n f o r m a t i o n , r e d u c i n g t h e costs associated with independent audits. And lastly, audit firms have become more efficient a s t h e p r o c e s s o f i m p l e m e n t i n g S O X 4 0 4 requirements has become more routine ”

H o w e v e r, a c c o r d i n g t o a F i n a n c i a l E x e c utives Research Foundation survey released earlier this year, private companies reported a 7percent increase in external audit fees in 2011, while public ly he ld c ompa nie s re porte d a 5percent increase. The 2012 Audit Fee Survey summarized the responses of executives from 111 p u b l i c l y h e l d U S c o m p a n i e s , 1 3 8 p r ivately held U S companies, four foreign companies and 24 nonprofit organizations

Specifically, publicly held companies reported paying an average of $3 9 million in total audit fees for FY2011 The primary reason given for the increase was more work for internal audit staff and other finance staff. Private company respondents reported an average of $231,200 in total audit fees in 2011 They cited more work for internal audit staff as a primary reason for the increase, as well as inflation.

The 2011 numbers deviated slightly from the trend of recent years In 2008, 2009 and 2010, Audit Fee Survey respondents from both private and public companies reported that fees either increased less than 4 percent over the prior year, or decreased Even so, Andrew Schrage, coowner of Money Crashers, a personal finance blog, points out that the subtle rise over the past few years is nothing compared to the early 2000s.

“Audit fees rose by more than 100 percent from 2001 to 2004, right around the time of SOX and the collapse of Enron and Arthur Andersen,”

24 INSIGHT icpas org/insight htm AUDITING

Reshma Soni

Alan Sorba

Kent Sorenson

Alain Sothikhoun

Veronica Soto

Fernandez

Megan Sowash

Debora Spagnolo

Alexandra Spellman

Marcin Spik

Sharon Sritong

Ryan St. Joseph

Valerie Stables

Heather Stachnik

Jason Stanckiewitz

Kim Standen

Lauren Stanley

John Starr

Jackie Staudacher

Erica Stein

Stephanie Steinbach

Eli Steinberger

Jeanne Steines

Kendra Stephens

Emily Sterling

Ross Stern

Natalia Sterrett

W Brett Stetson

James Stevens

Tamara Stockinger

Megan Stockwell

Gregory Stoerger

Kristin Stojcevski

Julie Stoller

Ann Stone

James Stonehocker

Dominic Storto

Scott Stosek

Matthew Stosich

Erica Stout

Jason Stratton

Margaret Stremel

Adam Strode

Kevin Strutz

Dzmitry Stsihneyeu

Brendan Stuart

Joseph Stuckel

Ross Stuursma

Gayathri Subramanian

Racheal Sudkamp

Nilesh Sudrania

Bruce Sufranski

Daisuke Sugyo

Erin Sullivan

CERTIFICATE RECIPIENTS

Katie Sullivan

Maura Sullivan

Patrick Sullivan

Ming Sun

Ro Chia Sun

Zhu Sun

Sunith Suresh

Stella Suryanto

Douglas Sutherland

Michael Sutis

Robert Sutter

Elena Suvorova

Azumi Suzuki

Yasushi Suzuki

Corinne Swan

Matthew Sweeney

Samuel Swisher

Michael Szaflarski

Kinga Szendala

Suk Szeto

Suk Keung Szeto

T

Miki Takahashi

Midori Takenaga

Ryuichiro Taki

Arthur Tam

Joseph Tamburello

Wenwen Tan

Michi Tanaka

Neha Tandon

Kathryn Tandy

Allan Tang

Lin Tang

Van Tang

Jeffrey Taxe

Benjamin Taylor

Bryan Taylor

William Taylor

James Temple

Daniel Teper

Bradford Terry

Dhara Thakkar

Sunny Thakkar

Linda Theres-Jones

Christopher Thiersch

David Thompson

Kyle Thompson

Mark Thompson

Susan Thompson

Tara Thompson

Erin Thorson

YiShan Tian

Celine Tischler

Susanne Tisljar

Staysha Titus

Matthew Toczylowski

Denica Todorova

Alison Toman

Tara Tometich

Peter Tomkie

Daniel Toni

David Toni

Amanda Torello

Steven Trapp

Brent Travers

Daniel Trevino

Abhigna Trivedi

Clayton Trolard

Chi Tao Tsai

Samuel Tsamoulos

Andy Tse

Amanda Tucker

Tara Tunpicharti

Bryan Turner

Molly Twigg

Franceska Tylka

James Tyner

Sarah Tysk

U

Yasuyo Uchida

Timothy Ulaszek

Scott Ulbrich

Ana Ulla

Katri Ulmonen

Laura Unger

Jillian Urbelis

Veronica Uwumarogie

Rachel Uytenbogaart

V

Vinson Vadakara

Eugene Vakhovsky

Robert Valdes

Christopher Vallez