ROBERT ZANGRILLO

ART BASEL MIAMI SPECIAL

ART BASEL MIAMI SPECIAL

on a Mission to Leverage AI to Evolve Humanity

ART BASEL MIAMI SPECIAL

ART BASEL MIAMI SPECIAL

on a Mission to Leverage AI to Evolve Humanity

Membership in Jet Club provides guaranteed availability, guaranteed hourly rates, and guaranteed access to our versatile fleet of 90+ Light, Midsize, and SuperMidsize aircraft.

Fractional provides a unique ownership experience with access to the new CJ3+ fleet, bonus hours on the entire flyExclusive fleet, and no monthly management fees.

Offering on-demand flights and servicing a myriad of specialized trip needs, flyExclusive accommodates clients with flexible, worldclass charter services.

Naked Diablo Tequila is a premium Tequila Brand in the exploding global Tequila market. We separate ourselves from all the other Tequila’s in the market with the word “Naked” on our label which encompasses the purest tequila: no added sugar, all natural ingredients, natural volcanic water and 100% Blue Webber Agave sustainably sourced both from the lowlands and highlands of Jalisco and then 2 times distilled at one of the finest distilleries in the Tequila Region.

We then created 8 incredible expressions and flavors based on the purity quality standards we’ve set as Naked Diablo’s Blanco, Reposado, Anejo, Extra Anejo, Vanilla, Cinnamon, Coffee, and Blanco 55% Extra Strength.

The Naked Diablo team spent 5 long years to get this right and to deliver a World Class Premium Tequila price affordably that delivers a quality line-up you would think you would have to pay more for. We assembled a team of visionaries, craftsmen and designers from around the globe, working towards one goal - to create the worlds most authentic tequilas.

Naked Diablo is currently in our initial launch phases in the States of California, Colorado, Georgia, Florida and Tennessee. In the next 6 weeks we will be opening Louisiana, Texas, Massachusetts, Rhode Island and the rest of New England and January 2023 will be our official launch in all these markets.

Today, Naked Diablo is available at Reserve Bar, an on-line retailer in 22 States at www.reservebar.com To find out more about our Premium Tequila’s please contact us at info@nakeddiablo.com

NANCY ZECKENDORF

A Small Town Girl With Big City Dreams

10 Eagle’s View Contrarian Macro Fund, Ltd.Wins HFM US Performance Award Plus Macro Thoughts…

By Neal Berger 14 BRIDGE A Web 3 Platform Empowering Consumers to Mint and Sell Their Own Data on the Blockchain

ByDavis Oliver 18

ROBERT ZANGRILLO

Tech & Real Estate Investor on a Mission to Leverage AI to Evolve Humanity

By

By

Hillary Latos

How lowering your U.S. Tax liability may help Maximize Your Social Impact

ByMike Packman

ByHillary Latos 28 PHILIP EVERGOOD An Overlooked American Painter

By Michael Klein 34

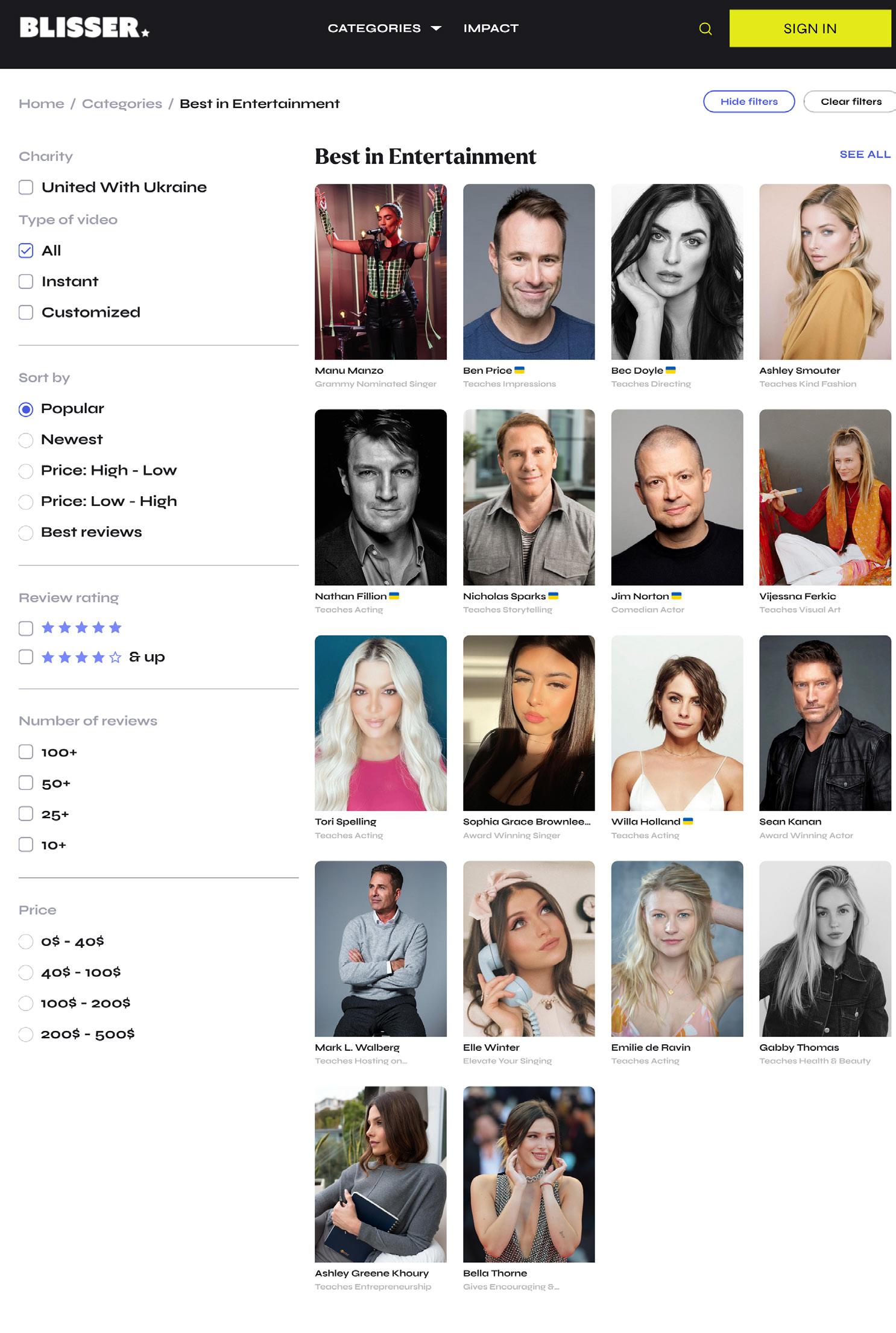

Life With Art in the Digital Age NFT Artist Erin McGean’s Outlook on NFTs, the Metaverse and their Place in the Artworld By Mosaka Williamson 40 BLISSER

A Revolutionary Social Media Platform Connecting Celebrities with their Fans i n a Meaningful Way

By Adora Trostle

By Hillary Latos

1640 Society’s Exclusive Southampton Pre and Post Oceanfront Dinners

By Hillary Latos

Impact Wealth x 1640 Society Host A summer Luxury Escape in the Hamptons at Libbie Mugrabi’s Estate

By Hillary Latos

This holiday season we are excited to return to Art Basel Miami which was the inspiration for our Art Theme this issue. We featured the visionary tech and real estate investor Robert Zangrillo who is equally as passionate about collecting NFT art and his philanthropic endeavors as he is about developing advanced AI that will change the trajectory of humanity.

Another visionary we featured this month is Greg Pelleteri who is disrupting the data driven business model to give the earning power back to the consumer. A serial entrepreneur in the fintech world, Greg’s latest company is Bridge which uses the Web3 blockchain authentication platform for consumers to mint an individual NFT with their own data to sell to data collection brokers and tap into a $500 billion market.

This December the art world will descend upon the sunny shores of Miami for a whirlwind of fairs, soirees and hobnobbing as billions of dollars’ worth of assets will trade hands and record setting prices will set precedence for rare works. We spoke to art historian and curator Michael Klein, who curated Microsoft’s first art collection, to discover an overlooked American artist who was a social and cultural observer of life in the 1950s whose depictions closely resonate with what is going on today. As the art world has evolved into the digital space we also spoke to up-and-coming NFT artist Erin McGean who explains why NFTs have become a viable alternative asset investment and why they are here to stay.

We also featured Gallery Red founder Drew Aaron and his supermodel wife Hana Soukupova who have the midas touch when it comes to investing and collecting in blue chip and emerging artists. Drew tells us about his art investment strategy, which artists he sees as the next big thing, and why they traded the fast paced cosmopolitan life in NYC for the bucolic and relaxed pace of sunny Mallorca.

With a bevy of holiday soirees around the corner, fashion icon Grace Coddington served as our inspiration and muse. Our creative director Fredo Montes recreated Coddington’s iconic style with her flaming red hair and bold unapologetically glamorous looks.

We are excited to close the books on 2022 and look forward to ushering in 2023 with hope and optimism.

Hillary Latos Editor in Chiefhillary@impactwealthmagazine.com

Creating Wealth. Creating Impact. WINTER 2023 ISSUE

Hillary Latos EDITOR IN CHIEF Candice Beaumont MANAGING EDITOR Emil Pavlov ART DIRECTORFredo Montes FASHION DIRECTOR

Christopher Micaud, Udo Spreitzenbarth CONTRIBUTING PHOTOGRAPHERS

Amy Louise Bailey, Neal Berger, Yvonne Beri, Hollie McKay, Davis Oliver, Samantha Silveira, Caroline Singer, Adora Trostle, Mosaka Williamson, Michael Klein, Jason Ma CONTRIBUTING WRITERS

Angela Gorman, Adam Weiss PUBLISHERS

Martin Weiss ASSOCIATE PUBLISHER

Colin Thompson DIRECTOR OF SPONSORSHIP

DIRECTOR OF ADVERTISING

Impact Wealth Media LLC 222 Broadway, 18th Floor, New York, NY 212 542 3146

www.impactwealth.org info@impactwealth.org

Impact Wealth Magazine is published quarterly. Copyright 2022 by Impact Wealth Media. All rights reserved. Reproduction of any material from this issue is expressly forbidden without permission of the publisher. Unsolicited manuscripts and photographs are welcome on an exclusive basis, but Impact Wealth Magazine cannot be responsible for unsolicited materials submitted. Printed in the U.S.A.

Eagle’s View Contrarian Macro Fund, Ltd. earlier this past week won the HFM US Performance award for Newcomer Macro Fund of the year. I have taken the liberty of sharing some of my macro thoughts both with respect to fundamental drivers as well as market mechanics and our trading approach. The purpose of which is to provide insight into how I view markets and the inputs that inform our trading decisions on both a shorter-term and longer-term basis.

First, we must acknowledge that the activity of Friday, Oct. 21st was very unusual and unexpected. This is precisely the kind of thing that I need to look out for when keeping an open mind on the overall direction of trading on an intermediate or longer-term basis. The market will not bottom when I or anyone else expects. It will bottom at an unexpected time with unexpected and repeatedly unusual price action. When investors have asked how I trade, I’ve often said, “I read price action”. This is precisely what I mean when I’ve stated, “I read

price action”. I am continuously on guard and taking note of repeated and persistent price action that deviates from expectations. Friday was a data point but, only one data point.

In addition, I must also be aware that the S&P 500 is trading higher than where we were trading briefly on June 16/17 (the date of the very first 75 bps rate hike) despite Fed Funds being 150 bps higher (3.00% to 3.25% today versus June 16 1.50% to 1.75%) and US 10-year note yields being 90 bps higher today versus June 16 at 4.20% versus 3.30%. I must be aware of all of this in the back of my mind.

In the context of above, I must keep the one day’s price action and the other factors in perspective. While remaining aware of them, I must remain resolute (until proven otherwise with repeated unexpected price action), that the overall trend in all asset prices is lower. For now, I must look at Friday as an anomaly and remain steadfast that all the security prices that benefitted from the

ocean of liquidity injected into the system remain in a strong and rapid downtrend as this phenomenon of liquidity infusion reverses course. However, I am not blind. I must have a mix of resolute confidence in my overall thesis both fundamental and technical, combined with a healthy respect for market price action and a lack of ego to act when necessary. Currently, the best bet is the downtrend remains firmly intact. So, what did we learn on Friday, Oct. 21? I recap as follows:

The Fed told us very clearly that they are going to raise Fed Funds by 75 bps in early Nov. and 50 bps in Dec. This will take Fed Funds to 4.25% to 4.50% by year-end. This was always my expectation and is very consistent with prior Fed commentary. They told us this as we enter the blackout period prior to the Nov. 1 FOMC meeting so that there are no surprises in the market. They telegraphed this through Friday’s Fed speakers as well as the Wall Street Journal article. So, barring something shocking in markets, we now know where we’ll be for the balance of the year..

The Fed told us that in 2023 and beyond, they feel future rate hikes will likely be in 50 bps or even 25 bps increments. They feel they’ve now moved sufficiently quickly off 0% to their expected year-end rate of 4.25%-4.50%. Unusually high 75 bp rate hikes are no longer needed after Nov. 1 is the present thinking. They’ve indicated that future rate hikes needn’t be as desperately large in magnitude and, can be more measured. They will continue to monitor economic data and the impact of their bold moves during 2022 upon inflationary pressures and react as necessary.

They’ve indicated that they are keenly aware that the global financial system is at risk of breaking. There has been increasing chatter about the Fed not ceasing rate hikes until “something breaks”. We see stress in bond markets in the UK, the soaring US dollar, the reduced liquidity in the US treasury market and the conundrum faced by the BOJ. The Fed is at the point whereby they want to take down the temperature. Whether or not they can do that, remains to be seen and will largely hinge upon the path of inflationary pressures.

The BOJ intervened for a 2nd time in the past month to sell USD and buy Yen. The Yen is in a downward spiral. The first intervention did nothing to stem the decline of the Yen and historically, market-based interventions that are in contrast with fiscal and monetary policy will not work and will only serve to temporarily slow the pace of Yen declines in the short-term.

It is instructive and interesting to note that US bonds did not rally all that much or as sharply as stocks on Friday despite a stepping down of interest rate increases seemingly being the catalyst for the market moves. The likely cause of this is that the BOJ sold US treasuries to fund their intervention in the FX market. There is also market fear that further selling of US treasuries will occur on continued dollar sales associated with currency intervention.

The BOJ has a problem because global interest rates are rising while the BOJ stubbornly pursues an ultra-loose monetary policy and artificially maintains the 10year JGB rate at 0.25% or below. The BOJ now owns more than 50% of all JGBs outstanding and owns an astonishing 87% of all newly issued 10-year JGBs in its quest to maintain the 0.25% cap on 10-year JGBs.

These artificially low rates allow for a very lucrative Yen carry trade whereby investors borrow Yen at low interest rates, sell Yen and buy USD (or other currencies where yields are higher) to invest at higher interest rates thereby capturing this increasingly large spread and causing the Yen to spiral downward.

Astonishingly, the BOJ maintains the bank overnight rate at -0.10% along with the yield curve control of 0.25% 10-year JGBs despite rising global interest rates, a 3% inflation

rate and a Yen that is in a downward spiral. As the Yen continues to weaken, inflationary pressures in Japan continue to build and particularly on imported essentials such as food and energy. Producer prices in Japan are increasing rapidly growing at a 9.7% YoY pace as of Sept., 2022. The next BOJ meeting at the end of October will be an important one.

Japan is very reluctant to raise interest rates as a rate increase would make it much more difficult for Japan to service its own enormous debt which in 2021 stood at 260% of annual economic output.

The BOJ is in a conundrum, and we may be gearing up for a Bank of England type “Soros moment” in either the Yen and/or Japanese interest rates. The problem is that the BOJ is a much stronger and well capitalized central bank versus the Bank of England when Soros famously “broke the Bank of England” by betting against the Pound.

We are in the “money making business” and not in the “being right” business. We have to make money and manage risk. The above makes for nice dinner and social club conversation but, we need to be in the trenches managing our positions actively and decisively through market gyrations that can be painful and/or full of opportunity even if short-term.

Friday’s price action was unexpected, and it was surprising. The market was “supposed” to go down on Friday. The fundamental news and catalyst for the move on Friday was nothing overly new or earthshattering. Possibly the markets got a bit over enthusiastic about the pace of rate hikes in the context of stubborn inflationary pressures and an economy that seems strong enough to absorb further rate hikes.

Every worthy speculator from ultra-short term, short-term, medium, and longer-term is short bonds and stocks. The slightest tipping of the scales such as the WSJ article on Friday morning has the potential to trigger a run for the hills and a self-reinforcing shortcovering rally. My current working thesis is this is what we saw on Friday. Nothing more than a market that is very short getting surprised and offside spiraling into a full-blown bout of short covering into the weekend. Countertrend rallies can be vicious during downtrends, so we need to be aware of this and watch out for something more persistent. There is no evidence of that yet.

Friday, we saw a key reversal in bond yields, we had a sharp flattening of the yield curve, and, we had a big reversal in the S&P. The speculators in the market are very short bonds, betting heavily on yield curve steepening, and very short stocks. We must acknowledge this and monitor this

on a short-term basis and manage our risk in this context. Each of these speculative postures is most likely the “correct” way to position however, we need to continue to look out for persistent, repeated unexpected market moves such as Friday’s action.

Over the near-term, in the context of our broader thesis, the clear downtrend of markets, if we don’t take advantage of market rallies to add and/or remain short, when should we do so? We remain true to our mandate and thesis and will continue to do so in the context of our risk management protocols and a keen eye on the bigger picture

We believe the markets will continue to head South and our multi-Manager Funds continue to produce strong non-correlated results during the period. Naturally, our macro contrarian hedge fund would be a direct beneficiary of declining markets.

Seasoned Fintech CEO Greg Pelleteri is the creative visionary behind Bridge. Leveraging his experience as a retail banker, Greg has gone on to launch several successful start-ups, most recently Bundlefi. One day while walking through Manhattan a green light went off in Greg’s mind which fueled his passion for helping to “level the playing field” for consumers on the blockchain platform. This was the foundation at Bridge to create a disruptive business model which allows consumers to mint NFTs of their own data on the Web3 platform and get a piece of the highly lucrative data market which has been in existence for nearly two decades. Here we speak to Greg about how Bridge works, the enormous market potential, implications for a global consumer base, and the buzz behind this exciting launch in March 2023.

By Hillary LatosHow did the concept for Bridge evolve to what it is today?

We have always been interested in crypto, NFT, and blockchain technology as early adopters. In the collectible art market NFTs prove authenticity. When I was walking one day, and I started thinking about NFT's and how they can reference a person. I know everyone's data has value and tried to figure out how to get that data referenced by an NFT and how can we get consumers compensated directly for it. This is where Bridge came into play, and we started to build the platform. Data is a $500 billion a year market and we're able to get consumers a little piece of that for their data.

We use the Web3 blockchain that utilizes crypto and NFT. If a consumer comes to

us and signs up for their NFT on Bridge with the cash application, they can input basic information about themselves, and we can mint an NFT for them. There's a huge amount of security protocols that have been put in place as the consumers go through the journey, and they then have an NFT that will reference their data.

What the consumer sees is super easy but on the back end it’s very complicated. We would go to consumers and inform them that we have a data buyer that is a broker, looking to buy data for a specific industry for a specific product on behalf of someone else. We investigate our database of NFT wallets and identify a group of 10,000 people fit into that demographic. We then send that

information over to the data broker who has a key to open it, and they're able to market to that consumer for say 30, 60 or 90 days depending on how the contract is written. This wasn't possible in the Web2 world, so we needed the evolution of Web3 to really make this possible because it lets us put additional security in place. And the smart contract makes the makes the whole system work.

What is most important to the consumer is their compensation. Every consumer has a value to the market that they're consuming. If someone wants your email address, your phone number, or home address to contact you to sell you something, there's a value to that already which is already getting paid. The data industry has been in existence for almost 20 years, the difference is that we're creating is a place for the consumer to get in

the middle of that transaction. We don't know anybody's data, all I know is wallet addresses, and I'll never know their data, nor do we even want access to it. For us to access the date, we need three different executives in the company to access it through keys, if we needed to for a legal reason. The only people that see the data is the consumer and the person they sell their data to and a monetary transaction is made between the buyer of the data and the owner. From a consumer standpoint, it’s very simple. We pay the consumer in crypto, and they'll have a choice on how they want to do that. The important part of using the crypto is that it lets us do this anywhere on the planet and we don't have to worry about fiat currencies. Once consumers get the crypto into their account, they can transfer it to another wallet or send it to their bank account. whatever they'd like.

We can’t go back and take away data that already exists, the only think I can do is to put a cork in the data flow as tight as possible for data going forward. But the buyers of data want the freshest data that’s available on each individual customer.

The scope of this product is enormous, and the global impact is huge. There's zero cost to the consumer. And everything we built is 100% consumer centric and we're getting as much money as we possibly can for them and have their best interest at heart The more people that use it, the more robust the ecosystem becomes.

There's also a significant environmental impact by blockchain technologies as the computing power uses a lot of power. To offset that, we're going to plant trees for these NFT's that will give us somewhat of a carbon offset and give back a little bit to the environment.

What kind of proprietary IP does Bridge have in place?

We have IP protection in place that uses Web3 and blockchain protocols, and we'll probably have additional patents filed as time goes on. The way we do this is proprietary, using

again, web three and blockchain protocols. The NFT is just a reference point for the data within the wallet so lets the computers know where to look for the data. The crypto becomes involved for compensation.

When you set up a cash NFT on our platform it’s super verified, unlike a social media platform like Facebook which is easy to set up fake profiles. We know who these people are, and it’s not only the freshest data possible but we can assure the data buyers that these are the actual people in order to mitigate some of the pitfalls that current social media has regarding data

integrity. We have ways to verify the person and make sure it's the right person.

Do you think some people would create different profiles in the metaverse so they can collect additional revenue?

There's two ways that we mitigate this situation. First the verification process, if they just throw their information into any data bar, the value of their data will become deflationary. We get feedback from data buyers, and we have an algorithm to determine who has the higher value and who has the lower value. We could in real time to monitor what wallets are doing something that looks nefarious or underhanded. There's always that 1% chance someone slips by the process but we have a very specific security protocol process for signing up for your first NFT. You can also add data to your profile to increase your data value. Also, a higher end product with a longer lifetime value for the company would pay a higher premium for your information, such as a bank looking for the consumer to open a new account.

The scope of this product is enormous, and the global impact is huge. There's zero cost to the consumer. And everything we built is 100% consumer centric and we're getting as much money as we possibly can for them and have their best interest at heart. The more people that use it, the more robust the ecosystem becomes. The consumer gets the lion's share, we get a piece of it, and then another piece will go back to the blockchain itself. Theoretically, just creating your NFT and never selling your data, you can make money from it. Over time, if you're just a member on the blockchain, money will just be added to your account as more and more people use it. We want to build a community around this. The social media platforms and data aggregators have their own community, and no one has a consumer side community which is what we're creating. This is happening already all I'm trying to do is get them a little piece of it.

We're looking at early March to have a full product launch that's out of beta which will be our alpha version and available in Apple Store and Google Play Store.

Robert “Bob” Zangrillo, Founder, Chairman and CEO of Dragon Global, a private investment firm focused on venture capital in tech and real estate investments. Zangrillo has managed investments exceeding $1 billion in companies that now have over $500 billion of market value and focuses on “developing Live, Work, Play and Learn communities focused on innovation, art, technology, experience, health and wellness and sustainability.” One of his missions is to evolve humanity and the world by leveraging artificial intelligence and he also looks at companies that specialize in clean technology, cybersecurity, data, ecommerce, the metaverse, mobility, and social networking sectors, amongst others. He has been an early investor in over fifteen high profile companies including DiDi, Digital Turbine, Twitter, Uber Technologies, Zynga and Facebook/Meta. We had a chance to sit down with the businessman to learn more about his philanthropic endeavors, what he attributes his success to, and his selection process for spotting potential unicorn investment opportunities.

By Hillary Latos Photographer: Richard GuatyIW: Tell us more about Dragon Global.

RZ: My firm Dragon Global is on a mission to leverage artificial intelligence and the Dragon community to evolve humanity and the world. We leverage artificial intelligence across all our investments. We are a co-GP and direct technology investor in innovative early-stage and late-stage tech funds and companies. Our goal is to identify the next trillion-dollar companies. When we look at early-stage investments, we are typically focused on companies we believe can become $10 billion enterprises. My background has been in the capacity of chairman, Chief Executive Officer, board member or advisor to over 15 Unicorn investments including an early stage investor in companies such as Facebook/Meta,

Twitter and other tech companies that have achieved market caps in excess of $40 billion and a trillion dollars. I have been doing this by making targeted investments and coinvesting with the best investors in the world by focusing on companies led by superhumans.

IW: What are some of your biggest success stories?

RZ: I would say the biggest success stories are on the technology side. From the mid-90s through 2000, I was founder, chairman and CEO of a company called InterWorld that built a high-end eCommerce application software that we licensed on a global basis to the some of the largest e commerce players in the world. Our customers were large retailers

such as Nike, Warner Co, Guess, Marks and Spencer. We also provided the eCommerce software for FedEx or NTT in Japan to host their own eCommerce solutions for their clients. I founded that company with two other friends and within five years this was a $3 billion publicly traded company that was Web 1.0. The second biggest success story was in 2008 when I invested in Facebook when they only had $180 million of revenue, and I became one of the larger early investors before the late-stage venture guys got involved. This year Facebook’s market cap is $290 billion and at one point was over a trillion.

In 2012, I could see Miami becoming a global technology city and a leader in innovation. I assembled land in the most

strategic areas of the city and teamed with local partners to entitle and we are developing over 10 million square feet of mixed-use properties in Wynwood, Little Haiti’s Magic City Innovation District.

IW: What are your thoughts on investing in cryptocurrencies or NFTs?

RZ: I am not a big crypto investor, but I am a big collector of NFTs. The reason why I'm not a big crypto investor yet is because I'm concerned about regulatory issues that can affect these companies and it is unchartered waters with future headwinds. But I am passionate and very knowledgeable about it, and I am very familiar with Etherium and Bitcoin, and web 3.0 companies and platforms. It will be a huge opportunity that is similar to Microsoft with the Windows platform and Google with their Android system, to really control the desktops and the platforms for other people to build technology. I feel much safer in cloud computing with Amazon and Microsoft, than I do in crypto.

For NFTs, I collect Teamlab out of Tokyo, and Refik Anadole, which I think are the two of the premier NFT artists in the world. I like being involved with some of the most creative minds on the planet and I have a lot of friends that are big art collectors, I collect what I think is the best and I'm constantly searching that out.

IW: Tell us about some of the philanthropic projects you're involved with

RZ: Through the Zangrillo Family Foundation, one project we donated $100,000 to went towards building a tech lab in the Church of Notre Dame in Little Haiti. We partnered with Microsoft to enable all the teenagers in Miami regardless of race or religion to have free access to technology, coding and literacy classes, along with mentorship programs outside of the lab. The second project is our Global Empowerment backpacks which includes books that all the successful entrepreneurs have used to build their companies as well as art supplies for those wishing to pursue creative fields and we also have a mentorship program. These kids would not only get the books and knowledge from reading, or art supplies but are also taught about sustainability. They can log on to a mentorship program and connect with

entrepreneurs, food experts that also discuss mental health and overall health and wellness.

IW: What do you see as the most interesting sectors to invest in?

RZ: We love real estate in Miami. This is going to continue for the next 10-15 years and will be a core part of our strategy. We also took one of our portfolio companies public, Selina which has 160 hotels in 25 different countries focused on the digital nomad or the remote worker. We see a trend where the new millennials will focus more on experience than they do on materialistic items. They get more pleasure out of going surfing while they're working remotely than they do out of buying a particular brand of clothes. Our core real estate is in Miami, and we are investing in best of breed technology managers or venture capital firms. We are also building out Dragon.

ai, a unique, innovative artificial intelligence company to enhance investor returns, empower our portfolio companies, provide our co-investment partners with valuable insights, and provide strategic advice to our strategic LPs, identify the next Amazon or Apple and we will invest in the growth capital stage or large investments in the public space.

In real estate we have a half million square foot project on the Miami River, which would be a combination of luxury apartments and office space with dock space and restaurants on the Miami River. I’m also working with Related on a big project in Wynwood, which is almost complete. The Magic City innovation district is zoned for eight 25 story, residential apartment buildings and six 20 story office buildings. It will have an entire 1000-foot promenade with interactive lighting on four and a half acres of public

space and over a half a million square feet of retail. So those are my big projects.

IW: Tell us about your art collection, how do you select which artists to collect?

RZ: I really look for things that I like and feel a connection to, and I look at things that would look great in my home. Unlike a lot of art collectors, I don't do it for the money, I do it for the passion. I don't buy pieces just to make money, I buy pieces to put my home. I spent three times what somebody normally would on my home and the construction and design, is in fact art itself. Highlighting the walls, the koi ponds or the experience inside the house is a reflection of the individual who owns the house.

IW: Do you have any other alternative investments that you're passionate about?

RZ: In my innovation category, I like climate and some of the energy technologies such hydrogen power and clean technology. There are also some areas where our mission is to leverage artificial intelligence in our community to evolve humanity and the world. If we don't save our planet, it's not going to matter. My girlfriend, Daniela Armijos is from Ecuador. She is very passionate about saving the indigenous people in the Amazon. We traveled to the Amazon to live with the Siekopi tribe. It is important to protect the Amazon, not only because it's the lungs of the planet, but there are enormous benefits from the plant species that we get out of the Amazon.

One of my real passions is in bioscience and biohacking, such as life extension longevity, achieving the longevity escape velocity, which basically to halt biological aging, and epigenetic reprogramming, which is the reversal of aging, and the ability to go backwards in age. Whether it’s using a NovoThor bed for infrared light, cold plunging, or using a PMF technology, there's a whole host of things I do to either halt or reverse aging.

I don’t invest in this area currently, but I will back other entrepreneurs or venture capitalists that invest in those areas because I do believe in the economic benefit of extending the productivity of humans.

Those of us that pay personal and/or business tax in the United States know how far-reaching Uncle Sam can be. As a result, I have always been interested in different sections of the tax code that may offer some potential relief.

By Mike Packman Founder & CEO | Keystone National Properties | knpre.com

This can be especially beneficial if you own a home on a large parcel of land. You can retain your normal rights on the portion of land that your house sits on, while donating the easement on the adjoining parcel. This would allow for you and your family to enjoy certain activities such as hiking, riding horses and enjoying the natural beauty of the land, while potentially making significant tax savings. This is often beneficial in estate planning, as it may help you pass on your land to the next generation at a substantially reduced valuation. (IRS Section 170H)

The IRS offers deferral of capital gains taxes when the proceeds from the sale of an investment property is “exchanged” for a like kind property of equal or lesser value within specific time limits. Commonly referred to as a 1031 exchange, this strategy can be used to defer capital gains tax until a later date in the future, and there is no limit to the number of exchanges an individual can complete. (IRS Section 1031)

Another investment strategy to consider when seeking to offset capital gains taxes are Opportunity Zones. When the U.S. Congress passed the Tax Cuts and Jobs Act in December of 2017, a new section of the Tax Code was created which resulted in the creation of Opportunity Zones across the United States.

Understanding the sections that allow

tax breaks

doing good in the world is especially intriguing to us as it is aligned with our core philosophy of Doing Well by Doing Good.

There are multiple ways to donate land and receive tax benefits. One way is when a landowner makes a complete donation of land to a qualified organization. That donation may be claimed as a charitable income tax deduction based on the property’s fair market value for up to 30% of the taxpayer’s adjusted gross income (AGI). AGI includes all types of income, from earned to passive to capital gains. Another program that also helps the environment, is a lesser-known strategy for creating conservation easements. A conservation easement is a voluntary, legal agreement that permanently limits uses of land to safeguard its conservation values and protect the land for future generations. All conservation easements must provide public benefits, such as water quality, farm and ranch land preservation, scenic views, wildlife habitat, outdoor recreation, education, and/or historic preservation. A conservation easement donation can result in significant tax benefits if it meets the requirements of federal law. There are three main advantages of conservation easements.

1. May qualify to deduct up to 50% of your adjusted gross income.

2. Can carry it forward for up to 15 years, as opposed to 5 years with a simple land donation; and

3. Still owns the land and can enjoy it in its natural state for as long as they own it.

An Opportunity Zone is a community that has been designated by the state and certified by the IRS to stimulate economic activity in certain selected areas across the country. Roughly 8,700 areas in all 50 states have been designated. Opportunity Zone investments allow investors to defer capital gains taxes until 2026. After that date, their tax liability on the original capital gains event will be due, however, if the investment in the fund was made prior to December 31, 2021, the amount is reduced by 10 percent. The biggest advantage is that if the investment is held in an Opportunity Zone Fund for 10 years or more, there is the potential to not owe federal taxes on profits earned in the Fund.

If you dig deep enough, the U.S. tax code does offer opportunities to reduce both income and capital gains taxes. It is important to consult your accountant and other advisors to fully understand the impact to your unique situation and determine if any of these sections of the tax code may be beneficial to you. Understanding how to offset some of your tax liability can potentially provide you with additional funds to deploy to further your business and philanthropic goals – a winning combination.

Keystone National Properties is a real estate and private equity firm specializing in the sponsorship of tax-advantaged and impact investment opportunities for accredited investors and Family Offices. Keystone National Properties (including its subsidiaries and affiliates) does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Hailing from a small town in Pennsylvania, Nancy Zeckendorf’s sheer will, and determination led her to NYC where she became one of the principal dancers of the Metropolitan Opera. From there she met and married the love of her life, William Zeckendorf, one of New York’s most prominent real estate families. Her latest memoir, “Small Town, Big Dreams” reads like a classic Audrey Hepburn biopic fairytale that inspires and captivates the reader. She details her fascinating career as a dancer along with the legends she has met along the way and provides an intimate look at her life after dance as a wife, philanthropist, real estate developer and fund raiser. Here Nancy imparts the valuable life lessons she’s learned, advice for a successful marriage, and how dance has imbued her life on and off the stage.

Tell us about your journey from a smalltown girl to the Metropolitan Opera Ballet?

NZ: I came from a very small town of 1,000 people, but I knew the minute I was born, I was going to get out of there. My mother brought me a little record player, and I fell in love with music, and started to dance. We spent our winters St. Petersburg, Florida, to get out of the cold of Pennsylvania where I started my dance lessons. Back in Pennsylvania the closest ballet school was in a nearby town and the mailman drove would drive me up there every Saturday morning and back at night for 25 cents for the round trip. I had to collect nightcrawlers to pay the fare. And that's how I got my first ballet lessons. From there I met some mentors who helped me get out of this small town in Pennsylvania to New York City, where I was given two weeks to prove to my parents, I could probably make it as a dancer.

But when I got to New York City, and auditioned I was told that I was a pre beginner and needed three lessons a week with no point work. I was very lucky because I then got into Juilliard and had my picture on the cover of Colliers which proved to my parents more than anything else that I was probably going to make it. After Juilliard, I auditioned for a Broadway show, my first show and was made the understudy to the lead, though it was only around for three months. Following that, I got into the Metropolitan Opera Ballet Company, which was a divine place to be for nine years. And every year the entire

company went on tour across the country by train, with lots of wonderful parties, and entertainment. After the Metropolitan Opera I well, I also was in dancing in the Santa Fe Opera, where Igor Stravinsky was conducting his opera that we were in. I met my husband’s mother in Santa Fe where she was in the audience as her husband was a music critic. When I returned to New York, she introduced me to her son, Bill Zeckendorf.

That was the beginning of a new life. I stopped dancing because my husband said wanted me to be with him at night. I started raising money for the American Ballet Theatre before there were fundraisers. I was doing this just as a volunteer. I chaired 19 galas for them and raised money for them for 15 years. I seem to have a talent for seating the right people together as well.

NZ: I've been a fundraiser since I was a little girl, I brought home the most money from Girl Scout Cookie Drives, raised money

for the March of Dimes and had the most subscription sales from the high school. I guess it was in my blood. After I left the opera, we moved to Santa Fe where my husband was building a townhouse project. I was the project manager for about two years and came to love construction and architecture. I later joined the board of the Santa Fe Opera and became President of the opera and Chairman and launched a campaign to raise $21 million for our new opera house here.

My husband put together a deal to acquire a theater downtown, which he and I have turned into a Performing Arts Center, because there wasn’t one previously. I raised $9 million for the construction of the theater, which has become very successful and loved by the community.

What are some of the biggest life lessons you've learned along the way?

NZ: The fact that I was brought up Catholic in a conservative small town gave me a lot of determination and

ambition to succeed. Be the best. It's part of my personality, I'm an Aries.

One thing I learned about life is that having a really great marriage is when you stop expecting things from each other. Then you have a really good relationship, and I was married for 50 years to my husband before he died.

There was a very famous ballerina, Vera Zarina who was married to George Balanchine. She was in NYC when I was dancing in the opera and was my very best friend. Joan Fontaine was another friend that I met in New York. Being in the opera, we got to meet a lot of wonderful people. The founder of the Santa Fe Opera was John Crosby, and supposedly a very difficult person to work with. But I enjoyed my work with him more than anything else, I learned so much. I also have a lot of conductor and composer friends including Francesca Zambello, who was an

opera director who just left Glimmerglass, and of course all of my ballet teachers.

When you first met your husband, did you realize that he was the love of your life?

No. When I first met him, he thought I was like a nun, his mother told him to call me because they had tickets for the Bolshoi when they came to New York. She also didn't like some of his other girlfriends. It wasn't instant, but I really cared a lot about him, and I thought he needed me.

Doesn't every woman feel that about the man she married? It took him a while to decide, so I went on a vacation to let him think about it for a while. He came back, made up his mind, then we got married. And the rest is history.

Was it a natural progression to go into real estate and design?

NZ: This had something to do with living and working in the ballet Studios, which were very spacious. I really love architecture and I'm happier when I have plans in my hand. I.M. Pei, the iconic architect, was a great family friend and was a big influence on me too. Because we moved into an apartment that I.M. Pei

had created for Bill's father, and it was the first contemporary apartment that I had lived in which changed my life. When my husband bought the Delmonico Hotel, they were turning it into rental apartments in the 70s and I took all the furniture that was left over from the hotel, and I furnished 27 apartments with the leftover furniture and just bought new rugs. I like putting things together and making things work, but I'm not a designer. I love construction, it's all about line, design and space which is similar to dance.

When you look back at your life is there anything you would’ve done differently?

NZ: I have had a wonderful life with opportunities to do so many things and work with so many exciting people. Being in the Metropolitan Opera, the Santa Fe Opera, the American Ballet Theatre, with Baryshnikov and having great friends who were former ballerinas I had a very blessed life. The most important thing in my life was getting out of the small town I grew up in. I was lucky to do it because of these people who took me under their wing. He was a psychiatrist. She was an artist. They helped me have the courage to tell my family that I really had to do this and not go to college.

Luckily, Juilliard was offering a Bachelor of Science degree with a major in dance.

I'm just very fortunate that I got to do what I never thought or believed that I would ever get to do. When I was a little girl that somebody told me, I'm going to be in the Metropolitan Opera, with Risa Stevens, I'm listening to her recording on my little record player. I could never have believed that. That was a miracle. I also started dancing so late and the training was very mediocre. When I was in New York, I was 17 and was really a beginner. Now the dancers who are 17 are probably doing principal roles in a ballet company. Having started so late, I was really lucky that I got to do what I did.

How do you think ballet is different today than when you started?

NZ: In dance, the technique has gone beyond what anybody would have done 30 years ago and they couldn't touch what's going on today. I think in some ways athleticism has taken over in some respects. Now the emphasis is on contemporary dance, because a lot of the companies that do classical works think the public is more interested in seeing contemporary dance,

which doesn't make me thrilled. I still like classical ballet such as Swan Lake, Sleeping Beauty and Nutcracker, because that's what I grew up with. For a long time, we had a lot of wonderful Russian dancers here which we don't have any more. But everything changes, a lot of people who are directing operas today like to take a new look at it, set it in a different realm, and sometimes it's very successful and sometimes it is not.

Grand opera is supposed to be full of wonderful, exciting scenery and costumes.But I think a lot of contemporary directors prefer to do something that's a little less exuberant in its production. A lot of dance has been cut, which makes me sad. The thing that makes me really sad is we had 40 dancers when I was in the Metropolitan Opera for nine years and now they don't have any permanent

dancers, they just have an audition whenever something comes up. When we were there, they were doing grand Verdi operas with lots of big ballet scenes and we got to dance and perform a lot, which was terrific. It was incredible being onstage with Maria Callas. Being on the stage in the Metropolitan Opera doesn't matter whether you're doing a solo, or whether you're just standing in the back being a priestess or a prostitute. It is very meaningful and was special to have been in that company at that time.

Are there any principles that you've learned in ballet that you've applied to your life?

NZ: Discipline, discipline, discipline. I learned a very good lesson from somebody who was Martha Graham's early mentor. He was not

a dancer but a musician. He was teaching at Julliard and composed some scores for her. We became friends and he was a much older gentleman. One day he took me to dinner, and he told me the problem between Martha Graham and him, was that two toothbrushes can’t stay on the same counter. Don't push over. Don't make waves. My husband had been married before, but luckily; I didn't have to encroach upon his space. But it's more than just space, and this was a very interesting lesson to me.

When you take a ballet class everything else goes out of your mind. It's like doing yoga or meditating. You put your arm on the bar, the music starts, and you do what you have. It's automatic. It's very therapeutic. It’s the same thing when you go on stage, you can't think about anything else. It just becomes part of you. But you must learn in order for it to become automatic.

If there was anyone that could play you in a memoir of your life, who would it be?

NZ: A long time ago everybody thought I looked like Audrey Hepburn, and she studied dance. If we could go back in time, that would be my choice.

The most important thing in my life was getting out of the small town I grew up in. I was lucky to do it because of these people who took me under their wing. He was a psychiatrist. She was an artist. They helped me have the courage to tell my family that I really had to do this and not go to college.

Moments of discovery are so fascinating because you are suddenly caught up in something unexpected: over the course of a career here a few names and artists discovered beginning in the mid 70s till today. My art sleuthing has led me to such artists as Jackie Ferrara, Robert Longo, Cindy Sherman , Franz Erhard Walther, Ulay/ Marina Abramovic and Damien Hirst . Today recent discoveries and rediscoveries Include these five women to follow: Katherine Porter, Max Cole, Maureen Dougherty , Sally Davies and Tracey Snelling. Three were already found by me and collected for the Microsoft Art Collection that I curated in the early 2000s.

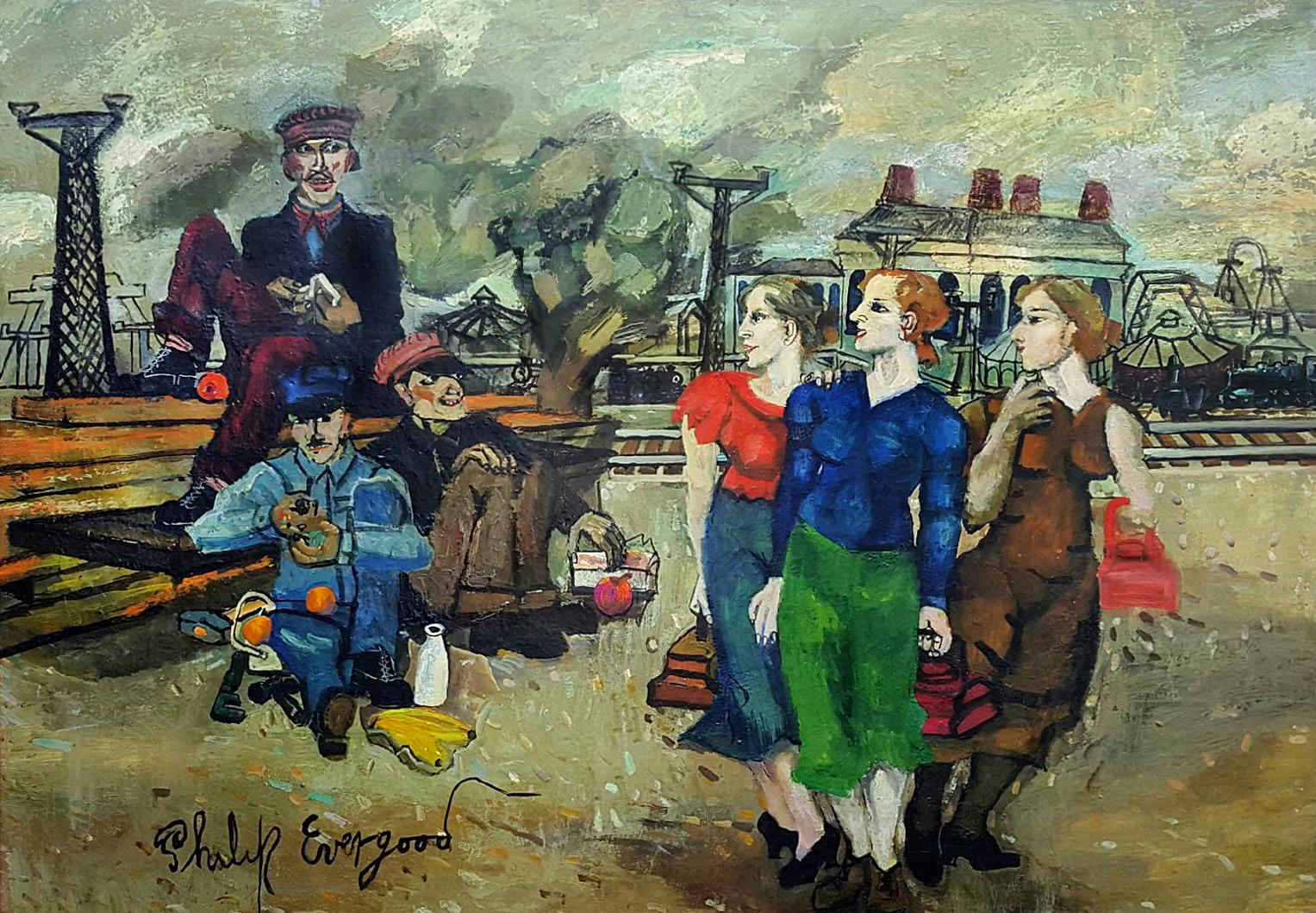

By Michael KleinWhile researching the history of the Terry Dintenfass Gallery for the exhibition, The Women Who Made Modern Art Modern, an exhibition I organized back in 2016, I was introduced to the work of the painter Philip Evergood. Perhaps re introduced to his work is a better way to explain this event, having been in the Whitney ISP program many years earlier I knew one of his classic paintings in the museum’s permanent collection, Lily and the Sparrows -1939, a work that always intrigued me because of its psychological intensity. This was painted in the fall of 1939 just as the war had erupted in Europe. She is a girl seemingly locked into her red brick world-a foretelling of the Anne Frank storywho watches as sparrows fly freely before her open window. Freedom is there just outside her window but now not reachable.

Likewise the painting, The Future Belongs to Them-1938/52, now in the collection of Terry’s son Andrew and his wife Ann, is quite remarkable in that it is a mature visual statement coming after the painter’s years studying abroad who is now building a life and career in New York. It is also one of Evergood’s largest canvases- a

masterpiece as both story and image. This is an honest and heartfelt representation of a woman holding onto a number of babies of different colors and races. She is the absolute representation of a tolerant world, a world in which all have opportunities to grow and thrive. She is mother and heroine both modest and proud. She is a beacon of hope in the world of 1938 — one year away from the outbreak of WW II and all that it destroyed. Evergood painted it in 1938 and then further embellished it in 1952 .

For many the question asked is simply, who is Philip Evergood? I had wanted to answer this in the form of an exhibition, and what follows instead is the beginning of an essay. And you ask why? He is a significant artist in the history of American art who has been sorely overlooked. His work connects to the political and social climate of today even though his works date back to the 30s- the years of the Great Depression. Yet we are now confronting some of the same issues as then: a political crisis in our government, the likes of which we have not seen before; economic imbalance, mass migrations caused by war, issues of race and inequality in our

society, and extreme weather events causing floods and droughts. By the time Evergood had finished his beautiful image, Mussolini had been in power since 1923, Hitler since 1933, and Franco of Spain the next year. War was to be everywhere which became a preoccupation of Evergood’s, exemplified by the intimate portrait of a badly wounded young boy who survived the siege of Stalingrad. The daily life of those on the battlefront and those surviving in cities across Europe are tied up in the portrait of a young Russian depicted in the 1943 painting, Boy from Stalingrad. Akin to Otto Dix’s portraits in graphic reality of wounded soldiers of WWI, Evergood presents to us not the heroes of battle but the victims of such violence. The battle for Stalingrad was a major event in Hitler’s plans to invade and conquer Russia. It ultimately failed but at the cost of thousands of lives.

Deep in the archives of WNYC radio, one will find a 1944 interview with the American artist Philip Evergood. ( Self Portrait in Straw Hat ) The interview is conducted by his long time friend and colleague, the painter Frank Kleinholz. Evergood was invited to

Waiting room, 1936

participate in a weekly radio program and was asked to define his philosophy when it came to painting. Evergood was quick to explain that he had just completed twelve images for the Russian War Relief Calendar, a calendar used to help raise funds for the victims of Russia’s battle against fascism. Evergood, very proud of his work and his contributions to the relief fund, was clear to explain that he saw himself in a long tradition of humanist painters, those artists who like Rembrandt or Brueghel represented aspects of the human condition. In fact six years earlier in 1938 he wrote that “great art lives because it has universal human appeal.”

For Evergood, the follies, foibles and actions of men and women were the focus of his life’s work. Contemporary life as represented in his paintings across some five decades was a statement about the values, concerns and actions of humanity. It was the story of people living in the 20th century.

And while other painters in this modern era as diverse as Philip Guston, Jacob Lawrence or Leon Golub have become recognized and championed for their social awareness, it is Evergood who represented these causes over the course of his life and in depth through paintings, works on paper and prints. ( Waiting Room,1936 ) And these causes,

whether it is freedom, liberty and equality that are, still today, of keen importance for our society. We witness the same struggles with the issues of social justice, economic equality and the security of our democratic system of government on the internet and in social media, and before the impact of technology was the impact of painting. 75 years ago in the war year of 1944 all three characteristics of a free and open society were under attack by the forces of fascist regimes as in many ways they are similarly under attack today in the form of racism, bigotry and economic disparity. I would argue that Evergood’s images from the past are extremely relevant today; though the painting

style we see is different, the images reflect today’s very complex and very conflicted social order. For example there is (Home, 1946 )

Lost amongst the many ongoing developments and overlapping movements of the post-war art generations, Evergood has been off the art world’s radar for many decades. With no heirs or foundation no one has been charged to keep his works in the public eye. In fact, his last solo show at the now closed Kennedy Galleries was in 1972. Yet this American born and English educated artist has much to tell us; to share with us and can stand as a model of social consciousness and an innovator in the visual arts.

His idiosyncratic if not peculiar style seems to be an amalgamation of an expressionist drive with some of the hard edge reality of Germanic painters like Dix and his contemporary Max Beckmann. Evergood’s figures are crude at times, beings twisted and bent by poverty, war and fate. He is a great chronicler of American society in the pre and post war eras; those living in the countryside ( The Lake ) or those living in the city.

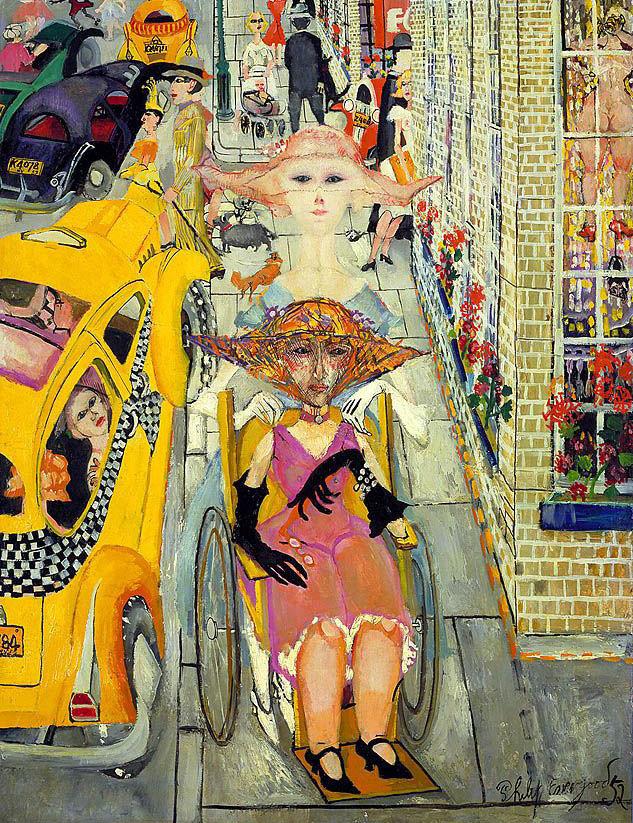

( Sunnyside of the Street ) A Corcoran Gallery of Art prize winner that was then purchased by the former museum in 1950. In Artnews, the reviewer noted ,” a lively street scene by Evergood which is one of the outstanding

paintings in the show.” The street is a meeting place for kids, black kids who play stick ball, hopscotch, the street is the playground for the neighborhood. But in this neighborhood too lives a blind man, a child in a wheelchair and in the distance an ambulance arrives for a patient. This was typical of Evergood to present us with all aspects of daily life.

Children are his heroes; they live in an idealized world not yet affected by conflict. Families are his barometer of a happy life and an equally happy future. In spite of the horror, terror and calamity of war and economic hardships of his middle years, Evergood largely remained an optimist.

He had a taste for romantic things, symbols and images of a world made up of fancy and fantasy as much as of the ordinary day to day, borrowing from literature and history to describe and represent the present. Though he never served an avant-garde such as the younger generation of painters developing around him, nonetheless he saw himself as a significant maker of images and pictures whose virtues were the constant examination of human interests, desires and tales. (Boy Eating Pear) ; and the Smithsonian’s (A Woman at the Piano).

am a social painter,” Evergood remarked in an article of the same title in the Magazine

“I

Realism means being concerned with this world, expressing emotions common to all mankind. Realism to the artist, is the expression and interpretation of his experience.

Philip EvergoodDowager in a Wheelchair, 1952

of Art in 1943. Like his uptown New York contemporary, Alice Neel, much of Evergood's social painting was born from his domestic situation. His dancer wife, Julie, was partner, model and muse. Though the couple had no children of their own, children remain important characters in his work, representing youth, hope, fraternity and the future of society as suggested by the title of that early painting The Future Belongs to Them 1938/52.

An exhibition of his work right now would bring some fifty years of this truly American painter and commentator back into the light of a 21st century discourse. From his pictures of crowds, women, and children we see a painter who recognizes the power in the people; in the portrayal of an innocence and the noble character of the modern woman. There are images of crowds who are the players in the world’s drama. From social realist to imaginary realist, the figure was key to Evergood’s paintings and his figures could be elegant and reserved or crude and suggestive. Both represent the extreme of humanity, the heroes and the victims of war, strife, or difficult economic times; those who survive and those who falter. Has anything about these protagonists changed since Evergood put brush to canvas and began to exhibit his works?

“Philip Evergood,” wrote Alfredo Valante curator for his 1969 solo exhibition at the Gallery of Modern Art in New York, “has remained a proponent of sympathetic analytical views of people and their problems, a visionary interested in their dreams, theirs hopes, their tragedies.”

Evergood’s life ended suddenly in 1973. He died in a small fire in his home in Southbury, Connecticut. Fate had extinguished a long career that had led to a retrospective at the Whitney Museum of American Art in 1960 at the age of 59 with the support of many of the important collectors of his day including Joseph Hirshhorn who collected some 68 paintings and works on paper over a 30 year period. Nevertheless, Evergood gets short shrift now. When included in the 1991 Museum of Modern Art’s Art of the Forties, he is published between the pages of Ben Shahn and Jacob Lawrence and he is represented by a single print, hardly fitting for a painter who decades before garnered significant attention and awards.

Evergood is never billed as a modernist and he is pigeonholed as a Social Realist which casts him in the light of being Socialist, Communist or subversive. One might argue that the mercurial nature of his works, his deeply romantic position and his political ideals as a painter puts him ahead as an early Modernist in the tradition of Van Gogh or Gauguin more than the tradition of Rothko or Newman. He is painter, a poet of the people depicting strife as well as pleasure. His paintings are intimate, easel size, distinct vignettes. Over time he was more and more on his own far afield from the trends of Abstraction

Expressionism, or Pop Art and Minimalism.

He is an exile at home followed by a small but loyal crowd led by Herman Baron, founder of the ACA Galleries and longtime friend, and John Baur, former Director of the Whitney Museum who followed up on his 1960 catalogue for the artist and wrote a lengthy monograph on Evergood published in 1975 two years after the artist’s death. Baur summed up Evergood’s sensibilities this way, “He had to weep or laugh in life with the same intensity that he wept or laughed on canvas. And he had to translate the emotions

of life into the very different languages of art with the utmost intensity of feeling.” In 1966, critic Lucy Lippard wrote at length for a monograph focused on Evergood’s array of drawings, studies and prints. For Evergood his painting or drawing style was subject to need, desire and ultimately to the end product of his search for meaning through the invention of highly imaginative pictorial narratives that drew from sources close at hand including friends, families and colleagues. “The work of Picasso and his outstanding contemporaries Braque, Rouault, Matisse Chagall has substance and meaning no matter how experimental it may be,” says Evergood. Similarly, Evergood saw himself free to experiment to create the paintings that worked best for him.

Painting was a form of storytelling. In an unpublished essay of the 50s. Evergood said “Realism means being concerned with this world, expressing emotions common

to all mankind. Realism to the artist, is the expression and interpretation of his experience.” It is an examination into the moral and ethical character of men and women, young or old, black or white, at work and at play, at peace and at war. His was an encyclopedic overview, an examination of the human condition not as a judge but simply as an observer. His observations could be close and detailed or far and fanciful as if in a dream. These extremes that are now accepted as concepts today were not so much in his heyday. Look at painters such as Squeak Carnwath and Charles Garabedian and even the late works of Grace Hartigan; or others like Malcom Morley and Jonathan Borofsky—figurative invention is their way to find meaning.

Over the years other writers, critics and artists have expressed their support too: Manny Farber, Fairfield Porter even Jack Tworkov, a leading member of the Abstract Expressionist

group, painters whose aesthetic was in direct opposition to Evergood’s humanist beliefs. As a painter in his own right, Porter’s profile in Artnews in January1952 he describes

Evergood’s techniques and materials in detail, focusing on the mechanics of getting the image on the canvas having studied the subject. The final painting,Girl and Sunflowers, is a classic Evergood which depicts a young girl surrounded by giant sunflowers making numerous charcoal drawings,. We see the creation of a romanticized landscape where youth is secured and surrounded by natural beauty.

In the hands of art historians, critics and curators who understand that the history of art is not a static history but a dynamic one which needs constant attention, the past is reexamined and its relevance to the present made clear. Evergood deserves a place at the top of the list.

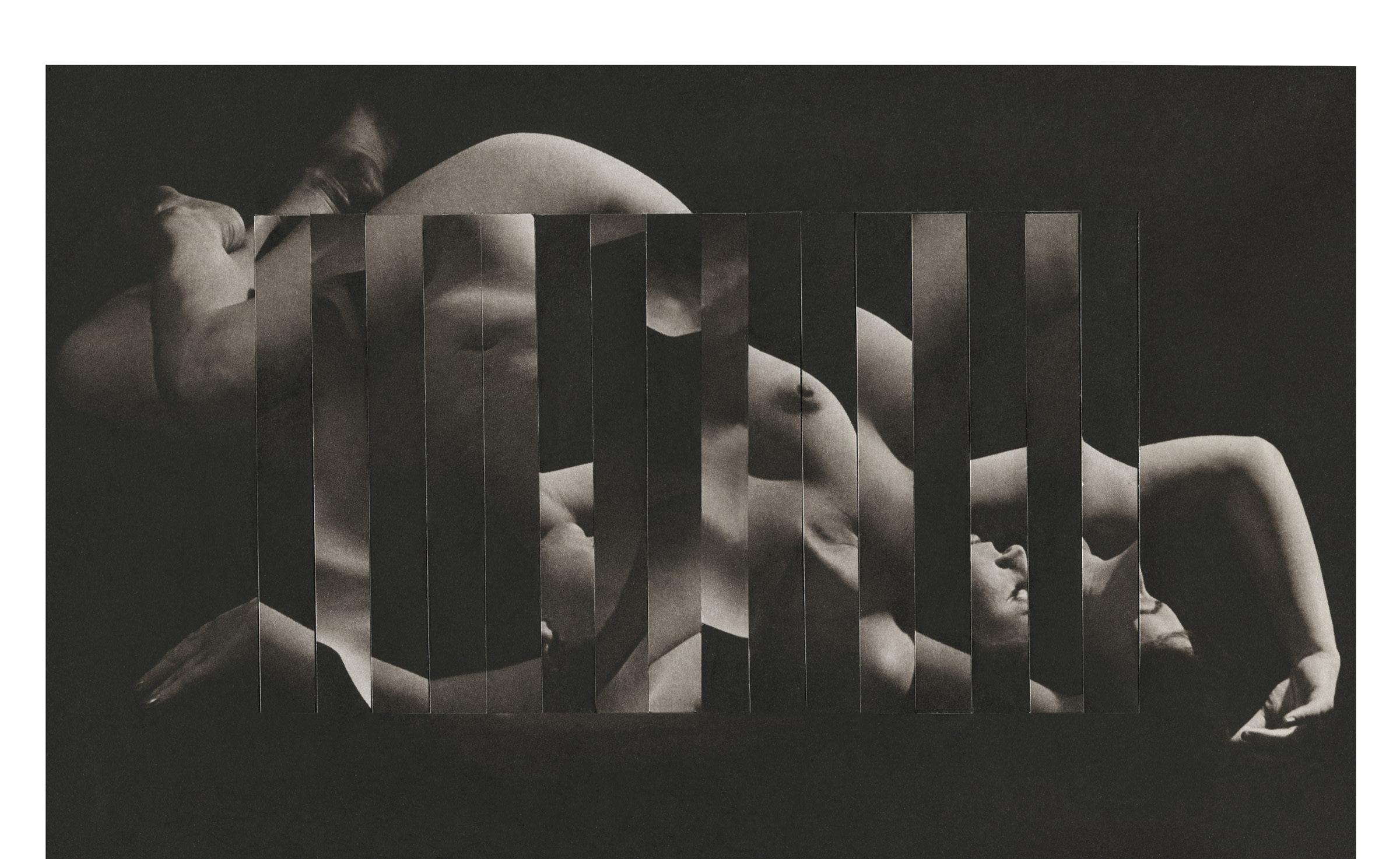

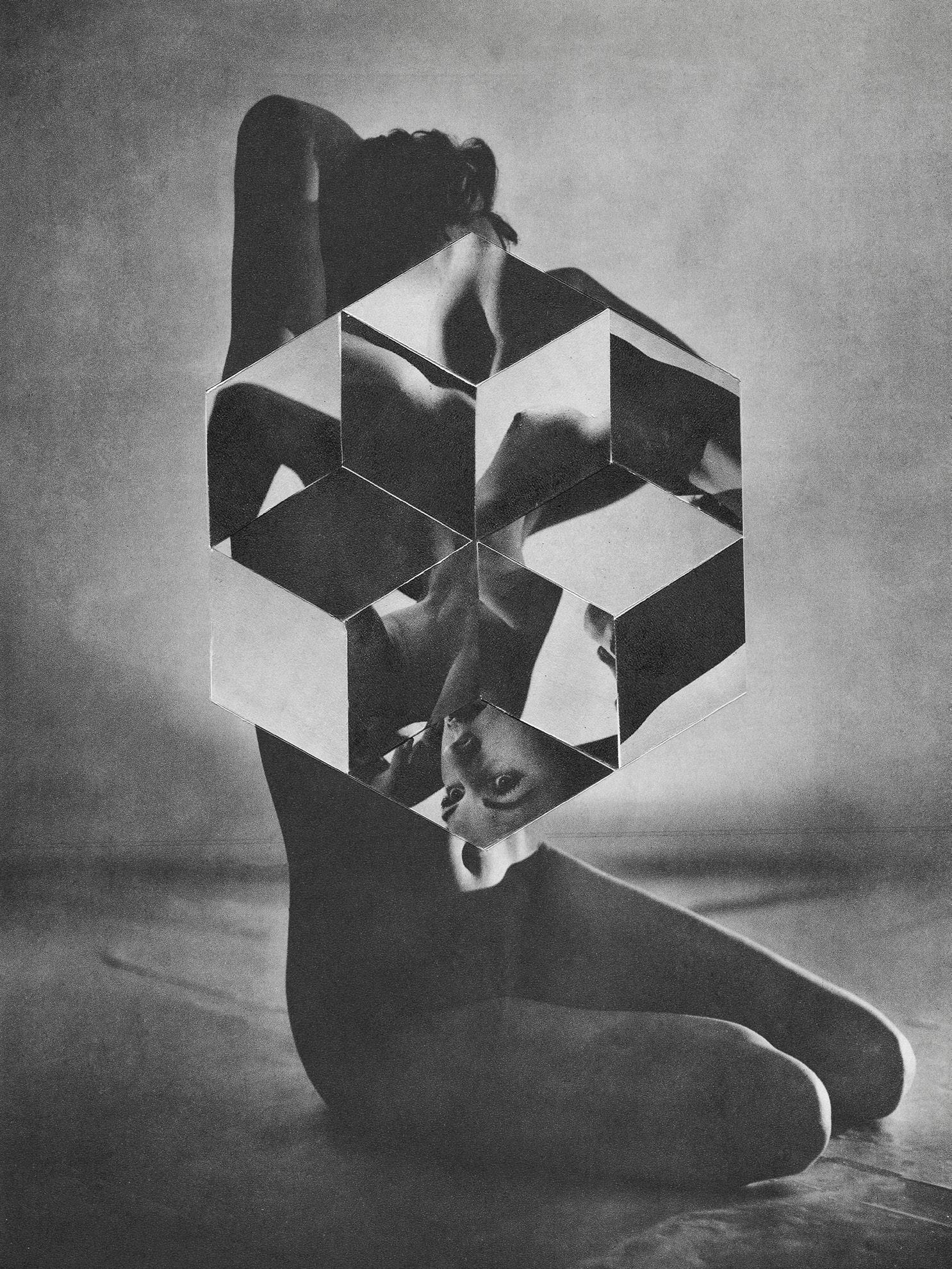

Canadian artist Erin McGean began her career as a trained illustrator and painter and has transformed her art form into creating analog and digital collages. Over the past several years she has exhibited her art at galleries, sold her artworks to private and corporate collectors, and has had work commissioned by magazines like Elle Canada to name a few.

By Mosaka WilliamsonMcGean has described her love of deconstructing images to create something entirely new as her “current ongoing visual obsession”. She studied painting, drawing, and art history at York University in Toronto earning an Honors B.F.A., followed by a B.Ed. from Brock University. She currently resides in Oakville, Ontario where she continues to hone her craft and use conventional collage techniques in combination with digital technology to repurpose found imagery. McGean’s work has evolved as she has evolved and her work can be described as avant-garde, experimental, and innovative, and was greatly impacted by Instagram and social media. Impact Wealth had a chance to sit down with her to learn more about her and her artistic vision.

Impact Wealth: Please tell us how you got started in collage work and about your inspiration.

Erin McGean: I've always been an artist, I studied painting and drawing as a student back in university. I painted for a long time, and I had some success as a painter, then I had children and I stopped doing art for several years. Then Instagram happened and I began to see all these people post photos, photos that they had put filters on, and something changed. The photos were a little bit altered and it inspired me to start doing that with pictures of my young children. I began experimenting with a lot of different apps, smartphones were relatively new at the time, and all of a sudden, I was introduced to this world of greater capabilities.

The art I saw on Instagram was inspiring me and it felt like an accessible way for me to create art because I didn't need to set up my studio and paint tools, it was a whole new process of creating things. The process of making something on your phone with photos that you have, or photos you can obtain, became an easy and accessible way for me to begin creating art again. I joined Instagram very early on; at that time it was a really small community. Instagram was an intimate and somewhat of an artist community. I was able to meet a lot of people both on the app and in real life, have fantastic experiences, and go to different types of events.

Eventually, I got bored with making art with my phone and sort of hit a wall. I realized I was missing the materials I had worked with all my professional life, however, being a painter is very tactile which is something I am not fond of. So, I started editing photos of my work into something that was more in the form of a collage, and this continued to evolve. You can see examples of this evolution on my Instagram stream, it's all there and visible from my 2011 posts up to today. I began by grabbing a few magazines I had around the house and that kicked everything off.

Now I am pretty obsessed with regular analog collage, cutting up old books and magazines and I am working towards developing digital collages. What I have discovered is that due to the popularity of the NFT (non-fungible token) space, traditional artists are digitizing their traditional art, so I started doing that. But for me, it wasn't enough to scan a still collage so my first NFTs included animated versions of my collages. I scan them and use different software and apps to add motion and sound. From my perspective, this is a bit more worthy of being in the NFT space. So that's kind of where I'm at now. I am selling still versions of my collages, and I am animating as well.

Impact Wealth: Where did you get your ideas for your juxtaposition? And how has it evolved?

Erin McGean: Since high school I have always used female figures in my art to symbolize myself, the figures often represent me and my feelings about the things in my life. When I look back at my paintings from high school there was always the presence of a

figure that was often in a somewhat lonely, dark, and rather melancholy space. The uncertainty and anxiety of those teen years coincide with how I was feeling when I was making art at the time. When I was having children, I noticed that I used a lot of plants and flowers that came out of these figures, which I guess kind of symbolized a more positive outlook I had in life. Perhaps I was embracing the fertility that I was feeling and my mothering and nurturing side.

I continue in a similar vein, but I am exploring some of the social expectations placed on women. The way we are depicted in my collages is from the use of very oldfashioned images. Part of the meaning that is inherent in my work is the pictures I have used, which I often don't even alter very much to get a sense of the original photo. I am exploring how women have been depicted in the past, you know as pinup models, and I am exploring ideas around the male gaze, and objectification of women.

Impact Wealth: Can you tell us more about your progress in the NFT space?

Erin McGean: I got into NFTs in 2021 and kind of stumbled into it through an artist community I was part of. I still sell physical pieces of my art and I still hold traditional exhibits, but now I'm selling my art through NF T's. I often try to pair my physical piece with the NFT so that when people buy the NFT they get a physical collage as well. Another exciting component I recently discovered through the NFT space is the use of augmented reality.

That has been the perfect kind of evolution for me because I have often made animated versions of my work. I have found applications where I can pair physical and digital art through a phone, you can hold your phone up to a still version and see the animated versions of the NFT. So, it has been a fun way to kind of bridge the traditional art and the NFT world.

Impact Wealth: For those people who aren't as familiar with the NFT financial structure, how does it benefit collectors and artists?

Erin McGean: That's a good question, for many artists it involves cutting out the middleman. We don't have to rely on galleries, or someone

The process of making something on your phone with photos that you have, or photos you can obtain, became an easy and accessible way for me to begin creating art again. I joined Instagram very early on; at that time it was a really small community. Instagram was an intimate and somewhat of an artist community.

to represent us and take a commission on our art, we are selling it directly to the collector. Another advantage is if the art resells in the future, we get a percentage of profits set by us. For example, Andy Warhol may have sold a print for $500 and today that same print sells for $5,000,000. He has never seen any of those profits. So if an artist continues in their career, and their work continues to increase in value, they will reap some of the rewards as the value of their previous work increases in value and trades hands.

Impact Wealth: Would the artist only get monetary compensation once it sells and trades hands?

Erin McGean: Yes, most artists will set a secondary market value at 10- 20%. So if someone resells it in a few years for

100 times the value, the artist will get 10-15% of the resale.

Impact Wealth: Is there ever a cap on the number of NFTs an art piece can have? How is that valued?

Erin McGean: You can compare it to an original and editions. An artist may make one NFT which is called minting (publishing a unique digital asset on a blockchain so that it can be bought, sold, and traded), they might have just one version, or they might have an addition of whatever number they want, which would reflect the value just like it does in real-world art.

Impact Wealth: How do you think artists are contributing to driving up the demand and prices of their NFTs?

Erin McGean: Part of this is done by continuing to work as a productive artist who knows that their work will grow in value because they are passionate about what they do. An NFT was meant to be more than just a JPEG file, for example, it could offer membership or come with other things. This is called unlockable content (or bonus content), this could be in the form of a studio visit, the right to the next drop that the artist releases, or perhaps you could have first dibs on collecting the artist’s work. You can attach other things to the NFT that would make it more dynamic.

Impact Wealth: There has been a lot of talk about NFTs and the Metaverse in the art world, are you involved in that as well?

Erin McGean: Yes, there are several different types of Metaverse worlds being built.

They are a good meeting place for people who cannot geographically come together. This makes art more accessible; you can hold an exhibit in the metaverse and invite people from all over the world. And you're there in 3D spaces just by looking from a screen on your computer.

You can also get VR goggles and feel like you are in there viewing the art with other people who are actually in the space with you so you can talk to them. The multiplayer metaverse is like a real-life exhibit, it is quite phenomenal.

Impact Wealth: Do you think that this will just change the future landscape for the way art is made and sold?

Erin McGean: I think it will, however, I do not think it will replace everything that exists now. But I think it will offer something different for artists, even when social media came about, that offered a new avenue for artists and that is how I started getting some success.

The ability to sell my art through Instagram and my website changed things. This could be seen as the next level of that. I also think it will affect education because as a teacher I can envision meeting other artists virtually from around the world. It is a chance to explore something new.

Impact Wealth: Which direction do you see your progression as an artist going?

Erin McGean: I want to stay true to my art and continue to make collages, however, the NFT space has opened up new possibilities and has altered my art a bit. I want to try to incorporate new technology into the meaning of the work in a way that makes sense.

Impact Wealth: Moving forward where do you see your source of inspiration? Do you see other mediums being incorporated into your work?

Erin McGean: Not yet, I am still quite tied to my old production. I think a lot of artists kind of lose sight of who they originally came in as, especially when money is involved.

Some artists shift their style to match what is popular in the space. I am trying to stay true to what I have been doing. I look at NFTs as just another way to get my art out into the world to get new collectors.

Impact Wealth: What are your plans for Art Basel, Miami?

Erin McGean: A lot of these things get planned last minute and I am involved in a lot of different communities within the space. One of them is super rare and is one of the premier platforms where the highestselling NFTs sell. I am also trying to build a community of collage artists within the

Some artists shift their style to match what is popular in the space. I am trying to stay true to what I have been doing. I look at NFTs as just another way to get my art out into the world to get new collectors.

NFT space to help elevate them, but also to help promote collages as a medium.

We have seen digital photography blow up within the last year because it is digitally native art. We are collage artists and painters and some of the traditional artists are struggling to find a way to promote or market their art to the NFT space, which is digitally focused. Working with a group of other collage artists, we're hoping to have an exhibit at Art Basel under a rare umbrella. And, I’ll probably have my work in a few exhibits in NFT NYC. I was in three or four different exhibits there, but they all happened at the very last minute.

Impact Wealth: Are there any artists who have inspired you to become an artist and a teacher?

Erin McGean: Growing up I was inspired by other female artists like Frida Kahlo, Georgia O'Keeffe, and Emily Carr, who you have probably never heard of. Emily Carr is a famous Canadian painter who was involved in the group of seven which I was inspired by. I admired how their work reflected their lives. As I got older, I began studying modern art and was moved by artists like Barbara Kruger. I also admire collage artists Hannah Höch, photographer Carol Walker, and the surrealism of visual artist Man Ray.

Impact Wealth: What projects are you working on for your next exhibition?

Erin McGean: I am pretty obsessed right now with making a series called “GIFs out of GIFs”. What I am doing is scanning several iterations of one collage, and then compiling them in Adobe and adding effects to create a moving version of the collage.

Impact Wealth: There are so many new mediums for artists and collectors. In a place like Art Basel with numerous fairs, how do you wade through all the noise and reach people?

Erin McGean: That's a tough question. You have to be consistent, and branding is important too. You must define your style so when people are walking through an exhibit and come across your work, it's immediately recognizable because there is something that sets it apart. In my experience, you must network, get to know people and get yourself out there. That is a constant struggle for any freelance artist because you need to get your voice heard and many artists tend to be introverted. So that's always a challenge but if you do the networking, build a little community and support group around yourself, you will know that they are promoting your work when you're not there.