Why the formal property sector can’t ignore the affordable housing crisis - P3

Are there any solutions to end the grip of the construction mafia? P2

Unscrupulous groups are targeting construction - from big sites to small micro developments. Can anything be done to stop them?

‘CONSTRUCTION Mafias’ have become a growing concern across the country, affecting large and small infrastructure and housing projects.

This is, in part, due to a diversification of the economic strategies of gangs and organised crime, among others, triggered by the impact of the Covid-19 pandemic, lockdowns and their continued economic impacts.

While construction Mafias are a nationwide phenomenon after becoming prevalent in KwaZuluNatal in 2016, Western Cape gangs are increasing their influence in the construction sector, extorting contractors and thus hindering service delivery.

Last year, the City of Cape Town warned that more than R58 million worth of transport projects were at risk due to extortion attempts.

The Western Cape government indicated that between 2018 and December 2022, more than 20 housing developments, which would house more than 21 000 people, were delayed or halted by extortion. Similar issues also manifest in other parts of the country.

It is reported that water or tanker Mafias have evolved across the country, sabotaging public water infrastructure to prolong profitable municipal contracts. They often extract water from unregulated dams and rivers, bypass essential quality controls, and thus pose serious health risks to communities.

However, while the extortion rackets targeting the human settlements sphere receive a lot of attention, it is often overlooked that extortion rackets are and have long been part of daily life for many South Africans.

Suspensions of waste collection in township areas due to extortion and attacks on workers might be the most visible community-level impact due to piles of uncollected waste.

However, residents, informal traders and small business owners in townships are often at the mercy of extortion syndicates. Informal and small businesses close as they cannot afford protection fees or fear for their safety after death threats.

Construction Mafia also target smaller township development projects, and even those building their own homes. Therefore, extortion rackets threaten community safety, livelihoods, basic services, infrastructure and housing projects and general wellbeing.

What can be done to address the pressing issue of extortion rackets, particularly the effects on

township communities?

While most responses have involved a focus on increased policing and protection of municipal workers, which appear to be bearing fruit, it is clear that a more holistic and wholeof-society approach is required.

A built environment anticorruption forum was established in 2020 comprising civil society, representatives from the built environment and various arms of the government, including the Special Investigating Unit (SIU).

However, experts have highlighted that not only must the criminal justice system be strengthened but the government must also take other measures to deal with the issue. These include increased and better engagement with communities before development projects take place, helping to isolate extortionists.

In this regard, the National Department of Public Works and Infrastructure has established a social intervention unit to “facilitate and spread awareness about construction projects in communities before they commence” and develop a method to allow communities to participate legally in construction projects.

This should be welcomed as it links to what civil society organisations have long been calling for – meaningful and deliberative engagement with communities in human settlements processes. This is so that they can participate in and take ownership of the processes and projects and also inform and

guide decision-making based on local knowledge and needs.

Experts highlight that economically excluded communities provide fertile ground for recruitment into Mafia-type organisations and the conditions to justify extortion.

Due to high levels of poverty and unemployment, taking a livelihood lens to human settlements processes and projects should therefore always be a priority and form part of a comprehensive and equitable approach to human settlements and infrastructure development.

The informal resale of state-subsidised housing, the long-established and growing importance of backyard housing as an income generator, and the intensity of small and informal businesses in townships and informal settlements highlight the important aspects of local economic development and livelihood opportunities that are integral to human settlements development processes.

These need to be enabled and supported by the state. The built environment value chain in townships and informal settlements, consisting of builders, artisans and draughtspersons, among others, should also be strengthened, as an element of broader technical and financial support for self-build housing construction.

Building community and enhancing social cohesion through various means (including area-based violence prevention initiatives) is an important

DUNOON, like many other areas within Cape Town, is affected by extreme population density. In most cases, multiple families live together on one property.

The drastic increase in population density has placed pressure on refuse collection services and the City’s indigent benefit offering, says the City of Cape Town.

Many properties have been informally subdivided over the years. This means a bin per property, as per the indigent benefit, is no longer enough to contain the waste generated by the multiple households (mainly backyarders) that share a property.

This has contributed significantly to the prevalence of illegal dumping in the community, alongside other contributing factors such as land invasions and perceptions that littering creates or sustains jobs, says the City.

response to extortion rackets, as it reduces fear and isolation, and encourages people to share their experiences and support one another. Dialogues and conversations can be created that challenge people’s perceptions that extortion is inevitable and resistance to it futile, creating other ways of thinking.

Active community networks and initiatives can build cohesion and counter extortion.

Raising awareness and encouraging people to speak out, refuse to pay and demand action are important in achieving a collective response to tackle extortion. International examples of citizens’ liaison groups allow for a neutral alternative to reporting corruption or extortion directly and can be used as a third party to increase communication between victims, criminals and police. Building partnerships and solidarity between the government, the private sector and communities is also vital. However, trust deficits between the stakeholders would need to be addressed.

In conclusion, in addition to a strong security response, a holistic, multifaceted and whole-of-society approach is required to address the prevalence of extortion rackets that are part of daily life for many South Africans, and present a dire challenge to human settlements, infrastructure and socio-economic development in marginalised communities.

From next week, the City will collect refuse in Dunoon three times a week – on Monday, Wednesday and Friday.

The temporary change aims to test the impact of increased service frequency on levels of dumping in the area and whether increased services result in less waste affecting the downstream environment.

Dunoon’s illegal dumping, linked to extreme population density, has knock-on effects on community health and the environment.

After six months, the City will assess the impact of the services to decide if they can be continued or expanded to other areas that have similar densification challenges, says mayoral committee member for urban waste management Grant Twigg.

The City hopes that increasing the frequency of refuse collection will create a cleaner and healthier living environment in Dunoon. Improved cleanliness is more than just an aesthetic enhancement; it can foster a greater sense of pride and ownership in the community.

The intervention also aims to protect downstream environments from pollution caused by litter. The stormwater network in Dunoon connects to the Milnerton Lagoon and flows out to Lagoon Beach. Illegally dumped litter, if not intercepted by the City’s cleansing programmes, can wash into the sensitive ecosystems.

BY VIVIAN WARBY

THE big brains trust in national and local government, formal developers, micro developers and backyarders, academics, activists and NGOs are all working hard to solve the affordable housing crisis and get the mid-to-lower end of the property market to work.

The crisis, which is affecting more than half the city’s population as rapid urbanisation occurs, unemployment rises, substandard living conditions increase and the economy stagnates, has increased fears that it could lead to social unrest if left with no meaningful intervention.

Everything is being done to avert this.

“It goes beyond just being the right thing to do when there is a crisis,” says Deon van Zyl, the chairperson of the Western Cape Property Development Forum, on how finally after years of advocating, the government and corporate are thinking outside the box and engaging with topics. Rapid urbanisation Van Zyl says that getting the lower end of the property market to work and providing affordable housing in well-located areas are no longer seen as pro-social but pragmatic. “The formal property sector can’t ignore the factors – they can’t allow a social revolution or Arab Spring conditions to develop. The opportunity divide between the haves and havenots is massive and creating a perfect storm.

“Urbanisation is happening in real time … What do we do? We can’t sit it out.

“We have seen how African cities grow. Urbanisation will grow exponentially and happen faster and faster. In a developing economy, people will always seek opportunities; it’s not unique, but the speed with which it is happening right now is what is causing a crisis. Cape Town is lucky it now has a mayor who gets it and is doing what he can to prevent a disaster.

“The reality is we have a major youth unemployment crisis and people are living in substandard conditions – it is a melting pot for social upheaval. People and the government are realising it is a crisis and so everyone is working on it.”

He says the “pressure cooker” situation is in metros where infrastructure is strained and land availability scarce.

Helen Rourke, the programme director at the Development Action Group (Dag), an NGO in the housing sector, says: “We are closer than ever before to find some of the answers to these issues such as creating affordable well-located housing, to finding how we can practically do this. We know we urgently have to resolve this, so there are a lot of minds thinking about this critically.”

On affordability in the city, Rourke says there is a lot of work under way to streamline the release of well-located municipal land for social and affordable housing to incentivising inclusionary housing on privately owned land.

“Location of affordable housing is critical if we are to address a deep spatial inequality in our city, which has been reinforced and entrenched by an increasingly exclusive and profitdriven property market.”

Housing is a complex issue, but somewhere on the ladder is a property market in the lower-tomid level that for a myriad reasons is not working, says Associate Professor Francois Viruly, an economist who has been working for years to address this market. He is also working with Dag in training programmes for township micro-developers, a sector that is seen as one of the solutions to the issues at hand.

If unlocked, the lower-tomiddle-end property sector could be worth trillions of rand in the formal sector, create generational wealth, build assets and help solve a part of the affordable housing crisis. The alternative: slums and anarchy.

Capetonians living in the affluent sector – where the higherend luxury property market is booming – have had a taste of what can happen when that lower end of the property sector is not working and when housing close to economic opportunity is lacking: they’ve had people without homes make a place to live on their doorsteps, and informal settlements sprouted up alongside formal multimillion rand homes, with people seeking affordable housing close to economic opportunities.

Struggling middle class Viruly says the housing problem is moving up the housing ladder:

“Where much of the emphasis was on the lowest RDP home. We are now starting to see the problem

in the gap market (those who earn R3500 to R22 000 a month).

“The middle class is struggling. The government subsidy band has not moved upwards to reflect inflationary creep which means that more families are moving into the gap market, added to that rising building costs has made it very difficult to deliver at the lower end of the market below R600 000.

“It, once again, means that if prices are to come down to be affordable, we need to pump up supply through a reduction of development costs. For many, it would mean renting rather than ownership while a deposit is being built. We do need to find financial and other mechanisms in the private sector that allows financing for the lower rungs of the gap market,” Viruly says.

He, like others, says affordability is a major issue, with costs rising faster than people’s incomes. “Added to that millions of households do not have title deeds so can’t access the value of their homes and move up the ladder. We need to get the market functioning better.”

Title deeds are one of the big bug bears, and the government is being pushed to sort it out so that the sector can start trading and climb the property ladder, using their homes as an asset.

Title deeds

Alison Hickey Tshangana, an independent consultant working in human settlements policy and research, says millions of South Africans lack the necessary documentation to secure property rights and access the equity needed to move up the housing ladder.

“Without title deeds, people are trapped. They can’t leverage their homes to improve their lives, and that’s a significant barrier to economic mobility.”

This week, Human Settlements Minister Mmamoloko Kubayi also expressed concern about the high number of people who cannot access housing.

The minister said plans were under way to help the “missing middle” access affordable housing.

Elaborating on the gap market, the head of digital at Lightstone, Hayley Ivins-Downe, says that in

order to afford servicing a R250k bond, one needs a gross salary of R9k, For a R500k bond, R18k and for a R750k bond, R27k.

Nick Budlender, a researcher at housing activist group Ndifuna Ukwazi, says: “When one considers that roughly 75% of Cape Town households earn less than R18 000 per month, it is clear that we are in the midst of a profound housing crisis. Not only do we have a huge housing problem, it is also a segregation problem between the haves and have-nots.”

Many of these households earn money informally and in cash, making it difficult to access bank finance for a home.

Income crisis

“We have a jobs crisis, an income crisis, and that is manifesting as a housing crisis. There is, in effect, an affordability crisis,” FNB economist John Loos says.

For instance because apartheid spatial planning built townships as dormitory towns far from economic activity, it translates into too much money – about 40%, if not more – being spent on transport to get to work, leaving little for housing.

Added to that, while there has been a lot of development, it hasn’t kept pace with the rapid urbanisation.

Unfortunately, says Zama Mgwatyu, the programme manager at Dag, the problem is growing. If not addressed, it could cause homelessness and people occupying land.

He says township microdevelopments are thriving with those who seek affordable rentals to have a roof over their heads.

The micro-developers are lauded as one of the solutions to the growing housing issue.

“The crisis is asking everyone to do things differently, from banks, to the government to developers,” says Mgwatyu.

Unfortunately, “there is no silver bullet to this very complex issue”, says Professor Ivan Turok, an urban and regional economist and development planner and deputy executive director at the Human Sciences Research Council who works closely with the sector.

“The shortage of housing in

Cape Town is real and we need to really scale up. But we need multiple solutions. Land release close to job opportunities and micro-developers developing in the townships are all part of the solution, so is getting infrastructure upgrades to growing areas and title deeds to homeowners.

Infrastructure

“Infrastructure is a massive problem – where the capacity of the pipes is exceeded, there are sewage spills, breakdowns in water supply and not enough waste removal service delivery. Each plot gets one bin but these plots have grown to accommodate six to seven families, so people dump rubbish, piles of rubbish accumulate, causing problems. (See p2).

“These issues are constantly under discussion – a network of stakeholders are advocating for reform and the city itself has accepted the need for reform.”

Turok says a massive investment and a leap of faith are required to get investors on board to invest in infrastructure in informal areas.

“We worked on a paper with Dag, called Small-Scale Rental Housing: Moving from the low road to the high road. If, for instance, we took backyarding seriously, we could transform the trajectory from the low road of slums of overcrowding and no public services which we have seen emerge – a nightmare situation.

“Or the city could take a more positive road and help microdevelopers by dealing with the infrastructure upfront in areas of growth. If they do nothing, it is the low road – a route to anarchy and chaos.”

Brian Bango, the co-chairperson of the Township Developers Forum of Western Cape, echoes the concerns. He draws a parallel between the housing crisis and the Eskom debacle, where years of warnings went unheeded until the situation reached a critical point. “Now we’re warning them about affordable housing. If they don’t act, we’ll see more land occupations, increased homelessness and social unrest.”

With everyone working together, the crisis could be derailed … it is hoped.

CAPE Town’s property market kicked off the year with a bang, showcasing resilience and vigour despite economic and political uncertainties. DG Properties' managing director Alexa Horne highlights the dynamic landscape, painting a picture of a market bustling with activity and optimism.

Resilience amid uncertainty

The first half of the year has been exhilarating. The second quarter 2024 (Q2 ’24) statistics released by home loan comparison service, ooba Home Loans, reveal that the Western Cape registered the strongest growth across the first-time homebuyer (7.8% nominal increase) and repeat homebuyer (6.3%) categories and is the only region to record real (inflation-adjusted) increases in property prices.

Horne says the luxury market, particularly properties priced above R20 million, has shown robust performance.

“Cape Town’s allure for overseas investors, driven by favourable exchange rates and the valuefor-money lifestyle, continues to bolster the market.”

Semigration trends have also played a pivotal role, with the Western Cape experiencing a doubling in inbound migration rates compared to pre-2020 figures. Attractive employment

opportunities and the region’s enviable lifestyle are drawcards.

Semigration property purchases intended as main residences account for the majority, but investment and rental property interests are on the rise.

Political winds and market reactions

While the mid-tier market experienced a slowdown, the post-election period has seen a rejuvenation in activity. Horne says the high-end market remained largely unaffected, continuing its steady pace.

According to ooba’s data, an interesting development sees growing investment from homebuyers aged 18 to 31.

Buyers aged 26 to 30 registered the strongest annual price growth

in the average purchase price – 4.2%. The recurring buy-tolet trend in the Western Cape continued in Q2 ’24 - and the Western Cape has been the key driver behind the national surge in investment demand, accounting for 32.4% of all applications received for the region.

Hot spots and preferences

“Cape Town’s southern suburbs, particularly Bishopscourt and Upper Constantia, are stand-out performers. The Atlantic Seaboard remains a magnet for luxury buyers,” says Horne.

The popularity of Higgovale and Orangezicht is reflected in the impressive property sales.

DG’s Keith Anderson highlights notable transactions,

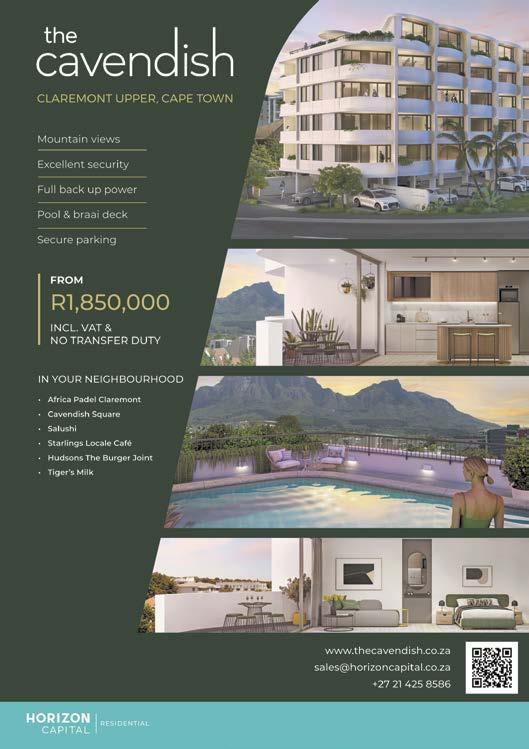

HORIZON Capital Residential is proud to present two boutique developments: The Cavendish in Claremont Upper and The Poplar in Vredehoek, both under construction.

The Cavendish, at 25 Cavendish Street, is a collection of 32 boutique apartments, perfect for students and young professionals. Nestled in a vibrant area surrounded by Cavendish Square shopping centre, Africa Padel courts and trendy coffee shops, residents will enjoy convenience and modern

comfort. The Cavendish offers a 5th floor communal roof and pool deck providing the perfect location to take in Mountain vistas. With completion anticipated for early 2026, The Cavendish promises a lifestyle of ease in one of Cape Town’s most desirable neighbourhoods.

The Poplar, at 11 Davenport Road, offers 14 high-end apartments perched on the slopes of Table Mountain. With breathtaking views of the mountain, city and sea, the apartments are a prime Airbnb

opportunity, ideal for those looking to invest in the city’s booming short-term rental market. The Poplar is set for completion by the middle of next year.

The developments reflect Horizon Capital's commitment to quality, offering a rare opportunity to invest in Cape Town's prestigious suburbs with no Transfer Duty.

Secure your slice of boutique living. For more information, visit www.horizoncapital.co.za or contact us at sales@horizoncapital.co.za or 021 425 8586.

demographic, from families and investors to international buyers and returning expatriates. European investors from the UK, Germany, Italy, the Netherlands and France, as well as African investors from Mozambique, Zimbabwe, Angola, Cameroon and Nigeria, are prominent players. The market also sees a trend towards multi-generational living arrangements.

Rental market boom

The rental market has seen rising demand and limited supply driving rental prices up. Higher interest rates and semigration have significantly increased demand.

including a sale in Orangezicht for R43m and two in Higgovale for R25m and R10.75m.

“Smaller luxury apartments and mixed-use developments near the CBD and in Sea Point are garnering significant interest. Developments such as The Fynbos are particularly noteworthy,” he says.

Buyer preferences

Horne says: “The trend towards properties that offer a blend of residential, commercial and recreational spaces is also growing, appealing to those seeking a holistic lifestyle. Outdoor spaces and security are also paramount.”

Diverse demographics

Cape Town’s property market is attracting a varied

Trends shaping the future Horne anticipates a promising second half of the year. “Stable economic indicators, cooling inflation and potentially favourable interest rate conditions bode well for the market. The influx of young professionals and the growing trend towards sustainable and smart living further enhance the prospects.”

Geopolitical instability may incentivise more investment from abroad, while improvements in electricity supply and property finance are expected to drive growth.

For more information on DG Properties, call 021 433 2580 or Alexa Horne at 082 349 7799 or visit www. dgproperties.co.za

PROPERTY MARKET’S HOPES ARE PINNED ON RATE CUTS

WHILE the past Monetary Policy Committee meeting left the repo and prime lending rates unchanged for 14-consecutive months, experts believe that fourth quarter (Q4) this year will hold a more buoyant outlook.

Gavin Lomberg, the CEO of ooba Home Loans, says that in the higher-for-longer interest rate environment, relief and intervention are needed: “A rate cut will be the key to unlocking higher volumes of activity in upcoming months.”

Lomberg says there is much speculation around a rate cut of around 25 basis points (bps) as early as next month.

“The reasons for this centres on the moderating of local inflation – notably food and petrol prices – and the easing of US inflation. As the country continues on the path towards an imminent rate cut, we anticipate a slow rise in homebuyer confidence, more competitive bids for homes and a steady return of first-time homebuyers.”

Unpacking the impact

Lomberg speculates on the positive impact rate cuts could have on the market and how these will impact the property sector:

1. On buyers and sellers

“Homebuyer confidence would increase, resulting in stronger market activity and more competitive offers on homes.”

Lomberg says it will take time.

“While a 25-basis points rate cut will not solve all our problems, it does signal the start of the rate cutting cycle and is set to bolster confidence in the market. Some homebuyers tend to take a

more cautious approach to home buying, so they might wait to see how the market plays out.”

Overall, he believes that competition among homebuyers will spell good news for sellers.

“In a prolonged buyer’s market, an upswing in demand could favour sellers in two ways: 1) more competition and more competitive bids on homes and 2) higher asking prices.”

2. On first-time homebuyers

According to ooba Home Loan’s latest data (Q2 ‘24), first-time homebuyers make up 46% of its customer base – down by 10% from its peak in May 2020 when interest rates reached a historic low of 7% and first-time buyer applications peaked at 56%.

“First-time homebuyers are feeling the effects of a higher-forlonger interest rate environment and the rising cost of living,” says Lomberg. However, should the rate cuts be implemented, he expected the trend to reverse. 3. On bank approval and pricing

“The cheaper cost of borrowing will make financing more accessible to homebuyers. The country’s key lenders are likely to continue competing for home loan business by offering attractive interest rate discounts.”

A positive trend that has emerged during the extended rate hike cycle is that of financially savvy homebuyers.

“We continue to see homebuyers prioritising deposits to reduce their monthly repayments and ‘shield’ them from the fluctuating interest rate environment.”

ELCOME to Wytham Estate, where retirement living is redefined with a blend of luxury, comfort and community. Situated in Cape Town’s southern suburbs, our estate is designed specifically for those over 60, offering an unparallelled living experience that combines elegance with practicality.

A new standard of living AT Wytham Estate, we offer a range of beautifully designed apartment-style units and mews homes, each crafted to meet the highest standards of comfort and style. Our residences feature spacious layouts, modern finishes and energy-efficient amenities, including solar power and battery storage. The elements are thoughtfully integrated to ensure your home is not only luxurious but also sustainable and cost-effective.

Each home is surrounded by meticulously landscaped

gardens, creating a serene and picturesque environment that enhances your living experience. Whether you’re enjoying a peaceful morning on your private balcony or strolling through our award-winning gardens, you’ll find that every aspect of Wytham Estate is designed to provide a tranquil and pleasant setting.

Exceptional amenities for a fulfilling lifestyle

Wytham Estate is more than just a place to live – it’s a community where you can thrive. Our estate boasts an array of amenities designed to cater to your every need and interest. The on-site restaurant and bar offer the perfect venue for socialising with friends and family, while our dedicated community spaces host a variety of events and activities that foster a vibrant and engaging atmosphere.

Health and wellness are

central to our offering. We provide tailored home-based health-care services that ensure you have access to the support you need while maintaining your independence.

Our premier security system adds an extra layer of comfort, giving you peace of mind and ensuring that you and your loved ones are safe.

A community like no other One of the most compelling features of Wytham Estate is our strong sense of community. We understand that retirement is not just about a beautiful home but also about living in a place where you feel connected and valued. Our community is designed to encourage interaction and engagement, with regular social events, clubs and activities that allow you to build lasting friendships and pursue your passions.

From fitness classes and hobby groups to

THE serene setting means residents can enjoy a peaceful morning on their private balcony or go for a stroll through the award-winning gardens.

cultural outings and social gatherings, there’s always something happening at Wytham Estate. Our residents enjoy a rich and fulfilling social life, all within the welcoming and supportive environment of our estate.

Convenience meets tranquillity Wytham Estate offers the perfect balance of tranquillity and convenience. Enjoy easy access to amenities, shopping and health-care facilities, all while being nestled in a peaceful, picturesque setting.

The prime location ensures that you have everything you need within reach, making everyday living convenient and enjoyable.

Your perfect retirement home awaits At Wytham Estate, we believe that your retirement years should be the best years of your life. With our luxurious homes, exceptional amenities and vibrant community, we provide an environment where you can live your life to the fullest.

We invite you to visit Wytham Estate and experience firsthand the exceptional living we offer. To learn more and schedule a tour, visit www.manor.life or contact us at sales@curaterealty.co.za or 063 707 2886. Discover how Wytham Estate can be the perfect setting for your next chapter. Your dream retirement lifestyle is within reach – come and make it a reality.